Crypto World

Binance Completes $1B SAFU Fund Shift to Bitcoin

Binance converts $1 billion SAFU fund fully into Bitcoin, buying 4,545 BTC to finish its reserve overhaul.

Binance announced on Thursday that it has finished converting its $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin, purchasing a final tranche of 4,545 BTC and bringing total holdings to 15,000 BTC.

The exchange’s decision to shift its emergency insurance reserve into BTC rather than a dollar-pegged asset reversed its position from April 2024 and placed roughly $1 billion of user protection funds directly into the cryptocurrency with the largest market cap.

Conversion Completed Within 30-Day Window

Binance executed the rebalancing in several separate purchases between February 2 and February 12, according to on-chain data monitored by Lookonchain. The final transaction of 4,545 BTC, valued at $304.5 million, brought the total worth of the holding to just over $1 billion based on Bitcoin’s current price around $67,000.

The exchange first announced the conversion plan on January 30, saying the process would conclude within 30 days. However, the completion fell nearly halfway through that window, with the SAFU wallet address, which Binance made public, now holding 15,000 BTC.

The Secure Asset Fund for Users was created in 2018 as an insurance pool to cover user losses in extreme events such as exchange hacks. In April 2024, Binance converted the fund entirely into USDC, describing the move at the time as a stability measure. The completion now marks a full reversal of that approach.

Binance said it views Bitcoin as “the premier long-term reserve asset” and framed the decision as aligning SAFU with that position. The firm also stated it will rebalance the fund if its value falls below $800 million due to price declines.

Market Context

Back when the move was announced, it drew immediate comment from market observers, with crypto commentator Garrett describing the conversion on X as “a direct capital injection into the market” and “what responsible builders do.”

You may also like:

The announcement arrived as CryptoQuant data showed Binance accounted for roughly 41% of spot trading volume among the top 10 exchanges in 2025. The exchange also maintains similarly high shares in Bitcoin perpetual futures and stablecoin reserves.

Meanwhile, at the market, the OG cryptocurrency was trading around the $67,300 level at the time of this writing, up slightly by about 0.5% in the last 24 hours, but in the red over seven days after suffering a nearly 5% dip per CoinGecko data.

The situation is the same across longer timeframes, with BTC shedding just under 24% of its value over the past fortnight and nearly 30% in the last month to keep its price more than 46% below its all-time high above $126,000 reached in October 2025.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto Stocks Rally as Trump and Regulators Push Pro-Crypto Agenda

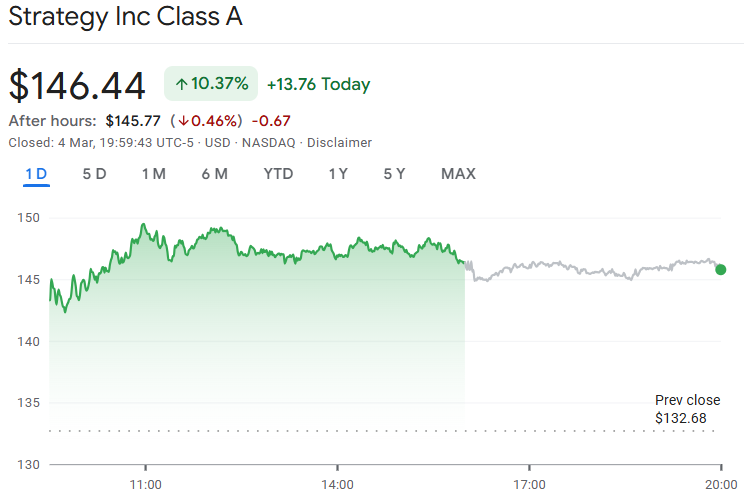

Crypto-related equities surged on Wednesday as pro-crypto commentary from Washington and expectations of a clearer regulatory path bolstered risk appetite. Bitcoin (CRYPTO: BTC) led the upward move, rising more than seven percent in the past 24 hours to the mid-72,000s, while Ether (CRYPTO: ETH) joined the rally with an about eight percent gain. Publicly traded names tied to crypto wealth and infrastructure posted standout moves: MicroStrategy (EXCHANGE: MSTR) shares jumped north of 10%, Coinbase (EXCHANGE: COIN) climbed over 14%, Hut 8 Mining (EXCHANGE: HUT) advanced about 13.89%, and American Bitcoin Corp (EXCHANGE: ABTC) rose roughly 11.65%.

Dominick John, an analyst at Zeus Research, told Cointelegraph that the rally appears linked to the prospect of clearer rules on the horizon. “Crypto equities are rallying as regulatory risk is being fundamentally redefined. With the executive branch championing a clear digital asset framework, coupled with robust spot ETF inflows and the potential passage of the Clarity Act,” he said. “The trend will persist as regulatory clarity strengthens and institutional flows accelerate. With policy risk receding and product demand expanding, crypto equities have room to reprice higher in the medium term.”

“Crypto equities are rallying as regulatory risk is being fundamentally redefined. With the executive branch championing a clear digital asset framework, coupled with robust spot ETF inflows and the potential passage of the Clarity Act,” he said.

Key takeaways

- Regulatory clarity expectations are lifting crypto equities as policymakers signal a more defined digital asset framework and as spot ETF activity strengthens.

- Major crypto-adjacent stocks posted material gains: MicroStrategy (EXCHANGE: MSTR) rose more than 10%, Coinbase (EXCHANGE: COIN) gained over 14%, Hut 8 Mining (EXCHANGE: HUT) advanced 13.89%, and American Bitcoin Corp (EXCHANGE: ABTC) climbed 11.65%.

- Regulatory moves advanced on multiple fronts: the CFTC filed for a regulatory review of prediction markets, while the SEC filed a pending application centered on Federal Securities Laws as they relate to crypto transactions.

- Political signals from the White House and supporters of crypto policy, including calls for market-structure legislation, contributed to the swing in sentiment.

- There is a caveat: the rally could cool if regulatory progress stalls or if Bitcoin retreats, underscoring the sensitivity of crypto equities to policy momentum and macro moves.

Tickers mentioned: $BTC, $ETH, $COIN, $MSTR, $HUT, $ABTC

Sentiment: Bullish

Price impact: Positive. A broad uptick in both the crypto market and related equities points to constructive liquidity and policy optimism gripping the sector.

Trading idea (Not Financial Advice): Hold. If regulatory momentum sustains and BTC maintains elevated levels, the bounce could extend; but a delay or reversal in policy progress would raise the risk of a pullback.

Market context: The move aligns with a broader risk-on tilt in crypto markets as investors price in regulatory clarity, potential ETF inflows, and evolving political support for crypto-friendly legislation, all of which can influence both spot prices and equity exposures tied to digital assets.

Why it matters

The current trajectory matters because it underscores how policy clarity can translate into tangible capital flows for both tokens and crypto-linked equities. As Washington signals a more explicit approach to digital assets, institutional interest tends to rise, creating demand not only for spot exposure but also for products and services that leverage the crypto ecosystem. The rally in MicroStrategy’s shares reflects the market’s perception that corporate treasury strategies that hoard Bitcoin may continue to benefit from price strength and demand for governance-friendly structures around holdings.

Similarly, Coinbase and other listed companies demonstrate how crypto maturity is intersecting with traditional markets. A sustained uptick in prices for BTC and ETH can lift trading activity, mining economics, and service demand for custody, lending, and staking products. The broader takeaway is that policy momentum—if it persists—could act as a catalyst for both price appreciation and the expansion of crypto-focused financial products. The prospect of a clear framework reduces policy risk, enabling more reliable forecasting for investors and incumbents alike.

Yet the landscape remains nuanced. The same catalysts driving optimism—clearer regulation, ETF flows, and favorable political rhetoric—can invert if regulatory conversations stall or if macro momentum shifts. Traders highlighted by Swyftx’s Pav Hundal warned that even a temporary setback in policy or a pullback in Bitcoin could reprice equities quickly, given the leverage that many crypto-related businesses carry and the sensitivity of their earnings to asset prices. The market’s reaction in the near term will likely hinge on the speed and specificity of policy milestones, not merely on aspirational statements from leadership.

What to watch next

- Regulatory milestones: Monitor any progress on the Clarity Act or related crypto policy bills, and timing around potential votes or committee actions.

- ETF inflows: Track fresh data on spot ETF demand and related products that could channel more fiat liquidity into the crypto ecosystem.

- Federal Securities Laws: Observe developments in the SEC’s pending application and the GRCs around crypto transactions, as described in the agency’s filings.

- Bitcoin price dynamics: Watch whether BTC can sustain levels in the low-to-mid 70,000s and how this influences risk appetite in related equities.

- Political signals: Keep an eye on White House communications and legislative activity around crypto-market structures, as these can amplify or dampen sentiment shifts.

Sources & verification

- U.S. Commodity Futures Trading Commission: regulatory review filing for prediction markets (https://www.reginfo.gov/public/do/eoDetails?rrid=1294517).

- U.S. Securities and Exchange Commission: pending filing on Federal Securities Laws and crypto governance (https://www.reginfo.gov/public/do/eoDetails?rrid=1217012).

- Bitcoin price data and market movement cited by CoinGecko (https://www.coingecko.com/en/coins/bitcoin) and Ethereum price data (https://www.coingecko.com/en/coins/ethereum).

- Company price references and tickers via Google Finance pages for MSTR, COIN, HUT, and ABTC.

- Related coverage and quotes, including comments from Dominick John of Zeus Research and Swyftx analyst Pav Hundal, as reported in Cointelegraph.

Market reaction and key details

What the announcement changes

Bitcoin (CRYPTO: BTC) breached notable intraday gains as traders chased the prospect of regulatory clarity and new product avenues. The day’s rotation into equities tied to crypto assets reflects a broader rehearsal for institutional participation, with investors looking for policy breadcrumbs and potential structural protections that could sustain longer-term demand. The initial impulse from Washington, coupled with ongoing regulatory reviews, appears to be shaping a cautious, but increasingly confident, risk environment for digital assets and the companies that hold or facilitate them. The tone of policy discourse matters as much as the price action, because credibility around a defined framework can unlock capital that has previously stayed on the sidelines for fear of regulatory ambiguity.

Why it matters (conclusion)

In sum, the current episode illustrates a market sensitive to the narrative of clarity. If regulators deliver a robust, well-communicated framework, crypto equities could reprice higher over the medium term as institutional players expand their exposure. Conversely, any disappointment or a stall in policy momentum could extinguish the current enthusiasm, given the leverage and sensitivity of crypto-related earnings to asset prices. For traders and investors, the immediate imperative is to watch policy milestones and price stability in the underlying assets, as those variables are the most direct catalysts for sustained momentum or a renewed pullback.

Sources & verification

- Official regulatory filings from the CFTC and SEC cited in the article (see links above).

- Crypto price data and market movements from CoinGecko (BTC and ETH) and Google Finance (MSTR, COIN, HUT, ABTC).

- Analysts and industry commentary referenced, including Dominick John of Zeus Research and Pav Hundal of Swyftx, as cited in the piece.

Crypto World

Crypto Stocks Soar as US Regulators Push Ahead

Crypto-related stocks surged on Wednesday as recent pro-crypto commentary from the US presidential campaign pushed Bitcoin and the broader crypto market higher.

Alongside a rise in the cryptocurrency market, the Bitcoin (BTC) treasury company Strategy spiked by more than 10%. Crypto exchange Coinbase registered a more than 14% gain, while miners Hut 8 clocked 13.89% and American Bitcoin Corp rose 11.65%.

Dominick John, an analyst at Zeus Research, told Cointelegraph the promise of clearer regulations on the near horizon could be one of the factors fueling the rally.

“Crypto equities are rallying as regulatory risk is being fundamentally redefined. With the executive branch championing a clear digital asset framework, coupled with robust spot ETF inflows and the potential passage of the Clarity Act,” he said.

“The trend will persist as regulatory clarity strengthens and institutional flows accelerate. With policy risk receding and product demand expanding, crypto equities have room to reprice higher in the medium term.”

Wall Street’s main regulators have advanced plans to oversee the industry, with the Commodity Futures Trading Commission filing a regulatory review for prediction markets and the US Securities and Exchange Commission filing a pending application on Tuesday on Federal Securities Laws and how they govern some crypto and transactions.

Trump’s statements helped buoy crypto

Pav Hundal, the lead analyst at Australian crypto platform Swyftx, told Cointelegraph that US President Donald Trump’s recent swipe at the banks and his push for the Senate’s crypto market structure bill to pass could also be playing a factor.

During a press conference at the White House, Trump also reiterated that in “crypto, we want to be dominant; we want to be dominant in everything we do,” Fox 2 Detroit reported on Wednesday.

“The market is putting a policy premium in the tape right now, and it is inflating crypto stocks,” Hundal said.

“We’ve got a double whammy of Trump pushing Congress on legislation and picking a fight with US banks for dragging their heels over the CLARITY Act. Coinbase is basically the cleanest large-cap expression of that in US equities,” he added.

Rally could still cool on bad news

The wider crypto market has also experienced a spike. Bitcoin has jumped over 7.6% in the last 24 hours to trade at $72,866, according to CoinGecko, while Ether (ETH) is up more than 8.3%, trading at $2,132.

However, Hundal cautioned that if the expected regulatory progress stalls or Bitcoin drops, the stock rally could halt and retreat as well.

Related: Trump sends pro-Bitcoin Fed chair nomination to the Senate

“Crypto stocks are obviously rallying on the expectation of political progress, and there is no reason that couldn’t continue. But things change quickly with this White House. If we see this regulatory debate go stale, or hit a wall, or Bitcoin is hit, it’s not hard to imagine a correction,” he said.

“Coinbase is pricing policy optionality, miners are pricing operating leverage on the leading asset by market capitalization in the sector. It works while BTC holds up, and can still unwind fast if this momentum hits a snag.”

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Zerohash Applies for OCC National Trust Bank Charter

Zerohash, a blockchain infrastructure provider, has applied for a National Trust Bank Charter with the Office of the Comptroller of the Currency (OCC), joining a growing list of crypto firms seeking federal licensing.

Stephen Gardner, the Chief Legal and Compliance Officer at Zerohash, noted that applying for a charter was a logical progression for the company.

Why it matters:

- A national bank trust charter allows an institution to operate as a trust bank nationwide.

- It enables fiduciary activities, asset custody, and settlement services. However, institutions with this charter cannot take deposits or issue loans, and are not covered by FDIC insurance.

- Growing OCC approvals for crypto firms signal a structural shift toward federally regulated digital asset infrastructure.

The details:

- If approved, the charter would allow Zerohash to further expand its range of services within a federal framework.

- Several digital asset firms have taken similar steps, with some already securing conditional approvals.

- Crypto.com received conditional OCC approval in late February. Ripple, Circle, Paxos, and Fidelity secured similar approvals in 2025.

- In addition, BitGo received full OCC approval in December 2025.

- World Liberty Financial‘s subsidiary filed its application in January 2026 to establish World Liberty Trust Company, National Association.

The big picture:

- Traditional banking groups have pushed back against the OCC’s issuance of trust charters to crypto firms.

- The American Bankers Association raises concerns that broadening the trust charter, especially for entities not involved in traditional fiduciary activities, could blur the lines of what it means to be a bank and open the door to potential regulatory arbitrage.

Crypto World

Goldman Sachs and Coinbase CEOs Converge on Tokenized Equities as the Next Frontier

TLDR:

- Stablecoin volume hit $30T last year, forming the blueprint Armstrong cites for tokenized equity growth.

- Over $200B in tokenized assets now live on-chain, with Ethereum holding more than 60% of that total.

- Tokenized equities could unlock 24/7 trading, fractional shares, and smart contract-based governance rules.

- Goldman Sachs CEO David Solomon confirmed tokenized equities are a major area of active strategic focus.

Wall Street attention toward tokenized equities is gaining momentum as major financial and crypto leaders discuss the concept publicly.

Goldman Sachs CEO David Solomon recently raised the topic during a discussion with Coinbase CEO Brian Armstrong.

The conversation focused on how blockchain technology could reshape global access to stock markets. The exchange also highlighted how stablecoins previously followed a similar adoption path.

Tokenized Equities Gain Attention From Goldman Sachs and Coinbase

Solomon asked Armstrong how tokenized equities could evolve within crypto markets. The discussion appeared in a video shared by Etherealize on the social platform X.

Armstrong compared the idea to early skepticism surrounding stablecoins. Many questioned the need for digital dollars when traditional digital payments already existed.

He noted that stablecoins eventually filled a gap for people without access to dollar bank accounts. Residents in high inflation economies often seek dollar exposure.

Countries such as Turkey, Argentina, and Nigeria illustrate that demand. Dollar-pegged crypto assets allow users to transact globally without traditional banking barriers.

Armstrong also referenced data showing strong stablecoin activity. Roughly $30 trillion in stablecoin payment volume occurred during the past year.

He said the same demand drivers could appear in tokenized equities. Crypto infrastructure could reduce friction in global securities trading.

Crypto Markets Push Tokenized Stocks and Global Asset Access

Armstrong outlined a simple model for tokenized equities. A traditional custodian would hold company shares while issuing equivalent tokens on-chain.

That structure could allow global investors to trade stocks without brokerage restrictions. Many people worldwide cannot easily access U.S. equity markets.

The model also introduces continuous trading. Blockchain markets operate around the clock, unlike traditional stock exchanges.

Fractional ownership could expand access further. Investors could buy small portions of companies such as Tesla or Nvidia.

Crypto markets already use perpetual futures and other derivatives. Armstrong said similar instruments could eventually extend to tokenized securities.

Smart contracts also allow programmable governance. Companies could restrict voting rights for short term shareholders through on-chain rules.

The conversation also referenced a broader tokenization trend across financial markets. Institutions now tokenize assets including Treasuries, private credit, and real estate.

Ethereum currently dominates that infrastructure. More than 60 percent of tokenized assets reside on the Ethereum network, according to Etherealize.

Those holdings exceed $200 billion in value. Institutional participants often use Ethereum because of its established compliance infrastructure.

Crypto World

Quant firm suggests a bullish BTC strategy with a key financing twist

Quant-driven trading firm TDX Strategies is pitching clients a bullish bitcoin trade with an interesting financing twist that helps offset the cost of the bet while reshaping the position’s risk profile.

The Hong Kong–based firm suggested a “bullish risk reversal” strategy on Wednesday, which involves selling a put option (insurance against a downtrend) and using the premium earned to buy bullish call options – essentially funding bullish bets with income from put writing.

This way, the trader effectively pays little or nothing upfront while remaining exposed to a bitcoin rally.

It reflects a broader shift toward more sophisticated, options‑driven positioning, as traders look to stretch their capital further and fine‑tune their risk instead of just piling into spot or straightforward bullish leveraged bets.

A call option is a contract that lets the buyer bet the price of an asset will rise above a specific level, called the strike price, by a certain date. If the price climbs above that strike, the buyer can profit; if it doesn’t, they usually just lose the small fee they paid for the option. It’s analogous to buying a lottery ticket.

A put option does the opposite. It lets the buyer set up protection against a potential drop in the asset below a specific strike price by a certain date. If it does, the put buyer stands to gain; if it doesn’t, the entity stands to lose the initial premium paid. It’s akin to buying insurance.

TDX’s suggested play combines the two in such a way that the trader becomes the seller of out‑of‑the‑money (OTM) puts (insurance) and collects the premium on one leg, then redeploys it to buy an OTM call on the other leg.

The result is a low‑cost bullish structure compared with simply buying a call outright. An out‑of‑the‑money (OTM) call is an option whose strike price is above the current market price of Bitcoin, while an OTM put is one whose strike price is below the current market price.

“The anticipated confirmation of Mojtaba Khamenei as Supreme Leader introduces an added element of risk of immediate retaliatory escalation, however, we view any headline-driven market jitters as a tactical entry point,” TDX said in a market note.

“We are looking to capitalize on temporary weakness to build upside exposure in March and April [expiry], favoring bullish risk reversals (funding OTM calls by selling OTM puts),” TDX added.

The strategy is not without risk. By selling out‑of‑the‑money puts, the trader is obligated to buy Bitcoin at the strike price if the market crashes below that level, which means he ends up acquiring the asset at a price higher than its prevailing market value.

At the same time, while the calls offer upside participation, their high strike prices mean they may expire worthless if the rally falls short of expectations. In effect, the trader trades a lower upfront cost for a more asymmetric payoff: limited upside above the call strike and meaningful downside exposure below the put strike.

The position, therefore, requires close monitoring and may not be suitable for new investors or those with limited capital and a weak grasp of options dynamics.

Crypto World

Cryptos jump 8% as bitcoin breaks $72,000

Bitcoin finally got through the door.

The largest cryptocurrency broke above $72,000 on Thursday, its highest level since before the Feb. 5 crash and the first clean move above the $70,000 ceiling that had rejected it three times in the past month.

It was trading at $72,180 in Asian afternoon hours on Thursday, up 5.9% over the past 24 hours and 5.4% on the week, as a combination of easing war anxiety, strong ETF flows, and a broader equity rebound pulled risk appetite back into the market.

The rally was broad. Ether climbed 7.5% to $2,114, reclaiming $2,000 with conviction for the first time since late February. Dogecoin surged 7.5% to $0.095. Solana added 5.3% to $89.91. XRP rose 4.2% to $1.41 and BNB gained 3% to $650. WhiteBIT Coin jumped 5.6%. The only notable laggard was Tron, up just 1.4%.

The trigger was a shift in global risk sentiment. Asian equities rallied for the first time since the Iran war broke out, with South Korea’s benchmark surging 11% after its biggest drop on record in the previous session.

Wall Street had led the way after economic data eased inflation concerns, though the recovery looked tentative with U.S. and European futures edging lower Thursday morning.

The conflict itself remains unresolved, however. Tehran is still targeting Israel and Gulf states. U.S. and Israeli forces continued striking Iran, including sinking an Iranian warship in international waters. Defense Secretary Pete Hegseth said operations could last “six, could be eight, could be three” weeks. Trump said “we’re doing very well on the war front” and that the U.S. has “great support.”

But markets have moved past the initial shock and into pricing mode. The Strait of Hormuz situation appears to be stabilizing with U.S. tanker escorts underway. Oil pared its early-week spike.

And the worst-case scenario of an uncontrolled regional escalation looks less likely with each day that passes without a dramatic widening of the conflict.

Crypto World

Trump Locks In $150M Venezuela Gold Deal While Markets Watch Iran

TLDR:

- Venezuela’s Minerven will ship up to 1,000 kg of gold to US refineries under a new Trump-brokered deal.

- Trafigura is acting as intermediary, shepherding the gold under a separate US government arrangement.

- The contract requires 98% final gold purity, with the total deal value estimated above $150 million.

- The deal marks the third reported resource extraction agreement brokered by the Trump administration in 2025.

The United States has secured a multimillion-dollar gold agreement with Venezuela, marking a shift in Washington’s resource diplomacy.

Venezuela’s state-owned mining company, Minerven, will ship up to 1,000 kilograms of gold to US refineries.

Commodity trading giant Trafigura is serving as intermediary in the arrangement. The deal, reported by Axios, carries an estimated value exceeding $150 million.

Trump’s Venezuela Gold Deal: What the $150M Minerven Contract Covers

Interior Secretary Doug Burgum traveled to Venezuela personally to finalize the agreement.

His involvement signals how seriously Washington is treating resource access as a foreign policy tool. The contract specifies a 98% final gold content standard, according to sources cited by Axios.

Trafigura’s role is to shepherd the physical gold into US refining infrastructure under a separate arrangement with the government.

The trading firm has existing logistics networks across commodity supply chains. That infrastructure makes it a natural fit for a deal of this scale and sensitivity.

Kobeissi Letter, a renowned financial markets account, flagged the deal on X, noting the US is “eyeing Venezuela’s gold.” The post attracted attention from traders and macro analysts tracking dollar-adjacent commodity flows.

This marks the third resource extraction deal the Trump administration has reportedly structured since January, when Maduro’s grip on Venezuela reportedly weakened.

US Resource Strategy Extends Beyond Venezuela Into Asia and Latin America

The Venezuela gold agreement did not emerge in isolation.

According to posts by analyst Shanaka Perera on X, the same week saw Japan and India ink a rare earth agreement in Rajasthan. India also opened the Andaman Basin to oil exploration during that same period.

A joint US-Ecuador military operation also took place within the same seven-day window, according to Perera’s account. These moves, taken together, suggest a coordinated effort to lock in resource relationships across multiple regions simultaneously.

Venezuela holds some of the world’s largest oil reserves. For years, Caracas maintained deep financial and strategic ties with Beijing. A shift toward US-aligned commodity flows represents a meaningful change in that dynamic.

Gold markets have taken note. The deal adds to existing upward pressure on gold prices, which have held near record highs in recent sessions. A 1,000-kilogram shipment, while not enormous by global standards, carries symbolic weight given its origin and the political context surrounding it.

Crypto World

Bitwise Cuts $233K Check to Bitcoin Devs Using BITB ETF Profits

TLDR:

- Bitwise donated $233K from BITB profits to Bitcoin nonprofits in its second annual giving cycle.

- BITB now manages $2.7B in assets, directly increasing the size of this year’s developer donation.

- Brink, OpenSats, and HRF’s Bitcoin Fund split the contribution across open-source development grants.

- Bitwise CIO Matt Hougan says BITB is the only ETF with an ongoing profit-share pledge to developers.

Bitwise Asset Management has donated $233,000 to three Bitcoin-focused nonprofits. The funds come directly from profits generated by its Bitwise Bitcoin ETF, ticker BITB.

This marks the second consecutive year the firm has fulfilled a pledge made at the ETF’s January 2024 launch. The commitment ties 10% of gross annual profits to open-source Bitcoin development support.

Bitwise Bitcoin ETF Profits Fund Developer Grants for Second Straight Year

Bitwise directed the donation across three organizations. Brink, OpenSats, and the Human Rights Foundation’s Bitcoin Development Fund each received a portion.

All three groups focus on funding and training developers who maintain Bitcoin’s core infrastructure. None of them operate for profit.

The pledge originated when BITB first launched in January 2024. Bitwise committed to donating 10% of gross profits annually. The first donation followed that same year. This second contribution signals the firm intends to make the practice routine.

BITB has grown considerably since its debut. The fund now manages approximately $2.7 billion in assets under management. That growth directly increased the size of this year’s donation compared to the first.

Larger assets mean larger profits, and a larger share flows to developers.

Bitwise’s Chief Investment Officer Matt Hougan pointed out that BITB stands alone among ETFs in making this type of ongoing commitment.

No other Bitcoin ETF has structured a recurring donation tied to fund profits. The observation drew attention within the Bitcoin community.

Brink, OpenSats, and HRF Bitcoin Fund Split the $233,000 Contribution

Brink focuses on supporting full-time Bitcoin protocol developers through fellowships and grants. OpenSats funds open-source contributors working on Bitcoin and related projects.

The Human Rights Foundation’s Bitcoin Development Fund supports developers in regions where financial freedom is restricted.

Each organization allocates funds independently based on its own grant criteria. Bitwise does not direct how recipients distribute the money. The structure keeps the donation at arm’s length from any product or promotional interest.

Bitwise shared the announcement publicly via its official channels. The post credited investors who chose BITB for making the donation possible. It framed the contribution as a reinvestment into the ecosystem supporting the ETF itself.

The broader Bitcoin development community responded positively. The model connects institutional capital with open-source infrastructure in a direct, measurable way. Observers noted it creates a feedback loop: more BITB investment leads to more developer funding.

Bitwise has not disclosed projections for next year’s donation. The amount will depend on BITB’s profit performance through 2025.

Crypto World

Eight Sleep Secures $50M in Funding to Build AI Sleep Agents

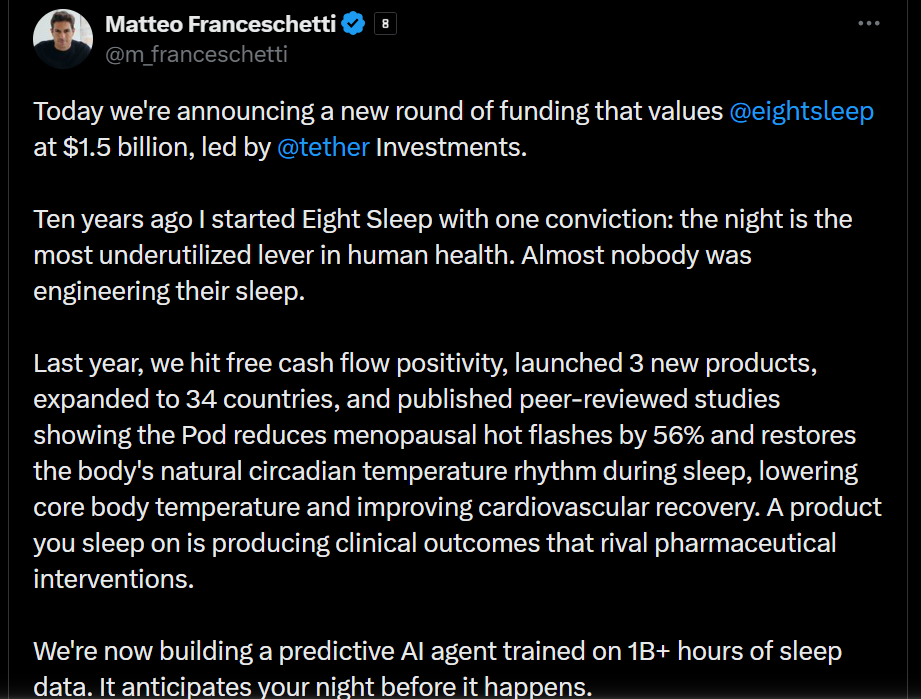

Stablecoin firm Tether has led a $50 million strategic investment round in sleep technology startup Eight Sleep, to help the company integrate artificial intelligence agents into its sleep tech products.

The latest funding round was announced on Tuesday, with Eight Sleep raising $50 million at a $1.5 billion valuation. It follows a $100 million raise last August. The firm specializes in sleep health products, primarily across bedding and supplements.

In an announcement on Tuesday, Tether expressed its strong conviction in health technology to support “longevity, performance, and disease prevention,” and will collaborate with Eight Sleep to bring artificial intelligence-based health technology products to market.

Tether has been using its capital stockpile to invest in a wide range of areas outside crypto. Its investments span the gold sector, media, biotechnology and AI. The firm has also made multiple attempts to buy professional football clubs.

“Technologies that can turn continuous health data into clear, practical insights will shape the future of consumer health and wellness,” Tether said.

“The investment is designed to empower Eight Sleep and establish a long-term collaboration to build advanced AI-driven health technology using, among others, Tether’s QVAC architecture and leveraging QVAC’s edge intelligence to enhance Eight Sleep products,” it added.

Tether’s QVAC is a privacy-focused health tech service launched in December that enables users to integrate their bio-health data from multiple services or products, like smart rings, into a single platform, supported by local on-device AI to help users with data management and health insights.

Eight Sleep has stated that it plans to build a sleep-focused AI agent to support its Pod, a sleep tech product that automatically adjusts bed temperature, elevation, and sound based on factors such as heart rate, breathing, snoring, time asleep and sleep stages.

Related: Stablecoin giving grows as ‘crypto philanthropy’ matures: Report

The Pod already has AI integrations to track sleep health data; however, Eight Sleep has said the funding will help evolve the company’s current AI tools and capabilities.

“We’ve built the most seamless AI-powered health sensing system in the world, and this partnership with Tether gives us the infrastructure to take that intelligence beyond the Pod, into every aspect of personal health,” noted Franceschetti as part of Tether’s announcement.

On X, Franceschetti provided more detail, saying that Eight Sleep is now building a predictive agent trained on over 1 billion hours of sleep data; meanwhile, it is also “advancing FDA filings for sleep apnea detection.”

“Passive. Every night. No wires, no clinic visits,” he said.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

Bitcoin tops $72,000 as ETFs pull $155 million, extending two week inflow streak

Bitcoin remained bid Thursday amid signs of persistent demand for spot exchange-traded funds (ETFs).

The leading cryptocurrency traded near $72,500 on Thursday, according to CoinDesk market data. The U.S.-listed spot ETFs pulled in another $155 million in net inflows on Wednesday, extending a recent streak of institutional buying that has helped lift prices after weeks of sluggish activity.

The fresh inflows bring total allocations to roughly $1.47 billion over the past two weeks, according to data curated by SoSoValue, marking a sharp reversal after several weeks of withdrawals earlier this year.

Institutional demand through ETFs has begun to stabilize after a difficult start to the year. Investors have poured roughly $1.7 billion into U.S. spot bitcoin ETFs since Feb. 24, according to Bloomberg Intelligence data previously reported by CoinDesk, suggesting some investors are growing more comfortable that the market may have found at least a near term floor.

Earlier this week, analysts at Bitfinex cautioned that ETF inflows do not always translate into immediate buying pressure in the spot market. Authorized participants can create and short ETF shares before sourcing the underlying bitcoin, delaying the impact of those flows on price.

Still, the spot ETF inflows and bitcoin’s recent resilience during geopolitical tensions indicates growing macro relevance of the cryptocurrency, according to some market participants.

“Bitcoin is increasingly being repriced by the market as a geopolitical hedge rather than just a risk asset,” said Livio Weng, CEO of Bitfire. “Unlike gold, bitcoin trades 24/7 and can move across borders instantly, which makes it a natural escape valve for capital during periods of geopolitical stress.”

On-chain data calls for caution

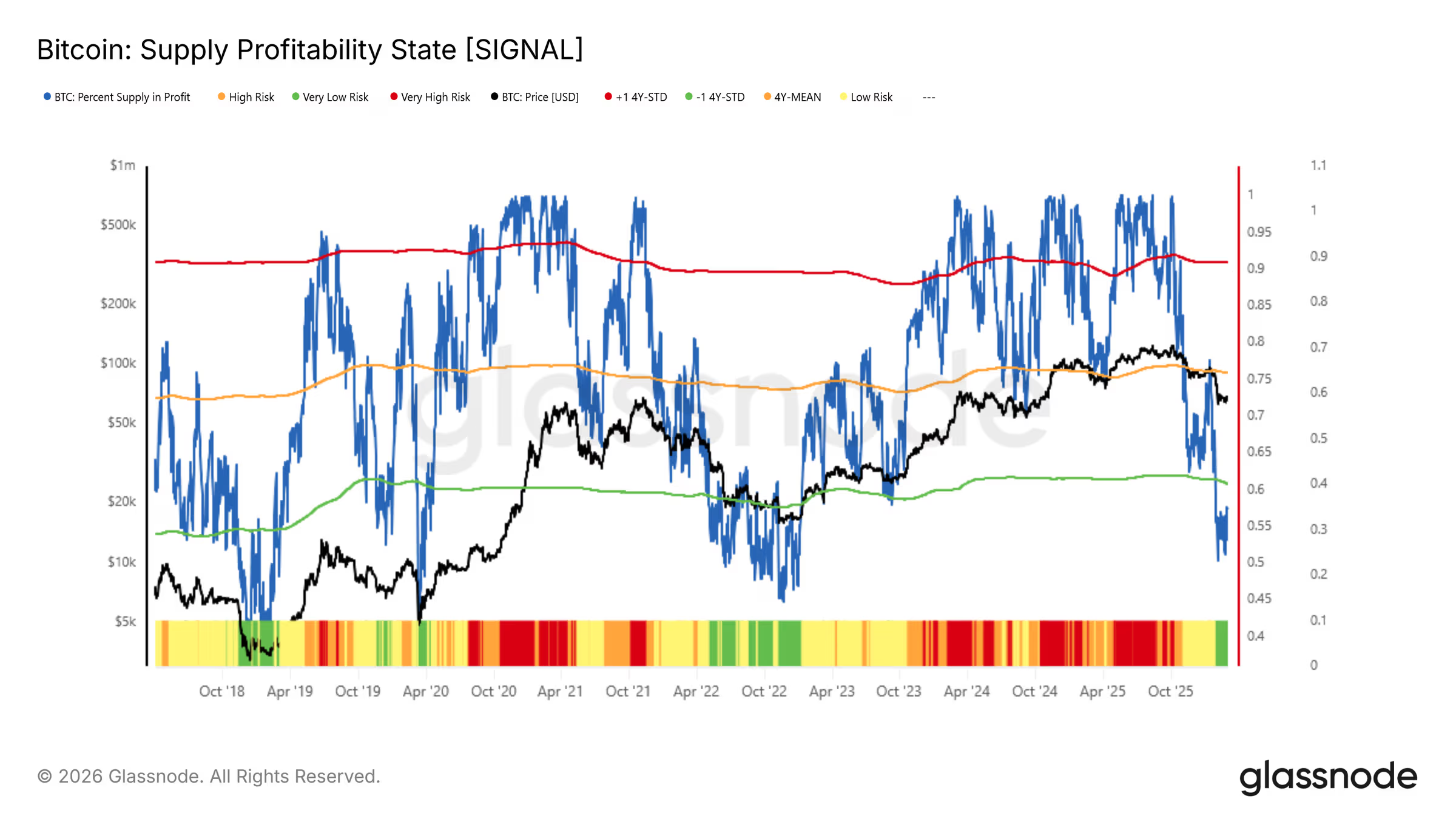

Despite the rebound in flows, underlying demand signals remain fragile, according to Glassnode. In a recent report, the firm said buy-side momentum has weakened significantly, with the 30-day moving average of realized profit falling about 63% since early February.

The share of bitcoin supply held in profit has also slipped to roughly 57%, a level historically associated with early stages of deeper bear market conditions. Glassnode added that the cost basis of short-term holders near $70,000 could act as a key behavioral ceiling, potentially turning rallies into distribution zones as traders exit positions near breakeven.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video7 days ago

Video7 days agoXii English top Selected mcq “Money Madness” Board Exam 2026, #chseodisha #hksir #mychseclass

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes