Crypto World

BingX Rolls Out Copy Trading Plaza and Enhanced Lead Trader Homepage in Major Upgrade to Copy Trading Suite

PANAMA CITY, February 11, 2026 – BingX, a leading cryptocurrency exchange and Web3-AI company, announced the upcoming launch of an array of enhancements to its copy trading suite, including the all-new Copy Trading Plaza and an upgraded Lead Trader Homepage. This major overhaul redefines BingX’s copy trading experience with a refreshed experience, smarter discovery, and deeper data transparency, aimed at significantly increasing visibility and engagement across its copy trading ecosystem.

The new Copy Trading Plaza consolidates discovery, evaluation, and execution into a single, intuitive destination designed to help users identify top strategies faster and with greater confidence:

- Intelligent Discovery: Discover both real traders and AI-driven strategies tailored to your trading preference on the BingX mobile app

- Centralized Copy Trading Hub: One-stop access to curated trader lists and strategy insights to improve overall copy trading efficiency

- Professional-Grade Metrics: Select trading strategies with advanced ranking and filtering powered by professional risk and performance metrics

The revamped Lead Trader Homepage offers a variety of advancements:

- Multidimensional Data: A fully revamped personal page with multidimensional performance data, offering copiers greater transparency and Lead Traders more opportunities

- Enhanced Transparency: Deep dives into trading behavior, risk profile, and historical performance, allowing traders to implement new trading strategies with greater confidence

- New Set of Tools: Integrated tools to help Lead Traders build credibility, grow visibility, and manage copiers more effectively

As the first exchange to offer copy trading in Web3, BingX operates one of the industry’s largest and most active copy trading communities. To date, the platform has recorded over 1.3 billion cumulative copy trading orders and $580 billion in cumulative trading volume, underscoring its scale, liquidity, and long-standing user trust.

“This overhaul is a structural leap forward for copy trading on BingX,” said Vivien Lin, Chief Product Officer at BingX. “By unifying smarter discovery, professional-grade metrics, and enhanced trader profiles, we’re enabling users to make faster, better-informed decisions while empowering Lead Traders to build influence and long-term value.”

To celebrate the launch, BingX is rolling out a limited-time campaign, offering users who complete their first copy trade or apply to become a lead trader and place their first trade by February 28 via the new homepage will be entered into a lucky draw, with the top prize reaching up to 9,999 USDT.

About BingX

Founded in 2018, BingX is a leading crypto exchange and Web3-AI company, serving over 40 million users worldwide. Ranked among the top five global crypto derivatives exchanges and a pioneer of crypto copy trading, BingX addresses the evolving needs of users across all experience levels.

Powered by a comprehensive suite of AI-driven products and services, including futures, spot, copy trading, and TradFi offerings, BingX empowers users with innovative tools designed to enhance performance, confidence, and efficiency.

BingX has been the principal partner of Chelsea FC since 2024, and became the first official crypto exchange partner of Scuderia Ferrari HP in 2026.

For media inquiries, please contact: media@bingx.com

For more information, please visit: https://bingx.com/

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

BTC and stocks stabilize. The bond market isn’t convinced

Bitcoin and global equity markets have stabilized after an early-week sell-off and oil price spike that was triggered by the outbreak of military conflict between the U.S., Israel, and Iran. Bond markets, however, are signaling caution, as rising yields signal renewed inflation concerns and dwindling bets on Fed rate cuts.

BTC, the leading cryptocurrency by market value, traded above $70,000 Friday, up nearly 10% for the week. Prices briefly climbed to nearly $74,000 Wednesday after dropping to around $65,000 over the weekend as geopolitical tensions rattled markets.

The rebound has been mirrored in equity futures. Contracts tied to the S&P 500 slid to a multi-week low of 6,718 points Tuesday before recovering to around 6,840 as of writing.

The initial risk-off move came as oil prices surged following reports that Iran had blocked oil tankers transiting through the Strait of Hormuz, a critical chokepoint for global crude supplies. Markets stabilized after the U.S. moved quickly to calm fears, promising naval escorts and political risk insurance for oil and gas tankers traveling through the strait.

Still, the bond market remains uneasy.

The yield on the 10-year U.S. Treasury note has risen for four consecutive days, climbing from 3.93% to 4.15%. Bond prices move inversely to yields. Meanwhile, the two-year yield, which is more sensitive to interest rate expectations, has jumped from 3.37% to nearly 3.60%.

The move higher in yields suggests traders are reassessing the outlook for monetary policy as the conflict-driven spike in energy prices threatens to rekindle inflation pressures.

According to CME Fed funds futures, investors now see less than a 50-50 chance of two 25-basis-point Fed rate cuts this year, down from nearly 80% before the onset of the conflict.

“The rates market is revealing the tension in this rally,” Bryan Tan, trader at leading digital asset market maker Wintermute, said in an email, noting the rise in yields.

“The conflict between a resilient economy (ISM Services at 56.1, ADP at +63K vs +50K expected) and an inflationary energy shock is historically the kind of setup that keeps the Fed frozen for longer. The Warsh nomination officially hitting the Senate this week adds another layer of hawkish uncertainty,” Tan added.

Some observers note that the inflationary impact of oil shocks typically unfolds gradually across the global economy, suggesting yields could remain elevated in the weeks ahead and potentially cap upside in risk assets such as stocks and cryptocurrencies.

“After major geopolitical shocks, oil prices usually rise gradually for weeks. The average pattern shows oil typically climbing 20–30% within ~60 days after the shock,” analyst Jack Prandelli explained on X. “Markets often underprice the first phase of supply risk. The real move tends to happen once physical disruptions start showing up in flows and inventories.”

Recent strong economic data in the U.S. has also contributed to the rise in yields and the scaling back of rate-cut expectations. Data released Tuesday showed economic activity in the U.S. services sector continued to expand in February, with the ISM index rising to 56.1. The ADP private payrolls report showed 63,000 job creations in February, the strongest reading since July 2025.

Attention now turns to Friday’s nonfarm payrolls report and wage growth figures. A hotter-than-expected print could further weaken expectations for Fed rate cuts and inject fresh volatility into financial markets.

Crypto World

Trader offers 10% bounty after claiming violent $24M crypto robbery

A cryptocurrency holder has claimed that attackers stole roughly $24 million in a crypto robbery following a violent assault, with blockchain security analysts now tracking the movement of the funds on-chain.

Summary

- A crypto user known as “Silly Tuna” claims attackers used violence and threats to steal roughly $24 million in digital assets.

- Blockchain security firm PeckShield said the funds were drained in an address poisoning attack and partially moved to staging wallets.

- Around $20 million in DAI is reportedly sitting in two wallets, while small portions have already been bridged to Arbitrum.

$24M crypto robbery linked to address poisoning

In a series of posts on X, a user operating under the handle “Silly Tuna” alleged that the theft occurred during a physical attack that involved weapons and threats of kidnapping and sexual violence. The user said police have been contacted and described the incident as a “violent assault and theft,” adding that the attackers targeted their crypto holdings.

“Still have limbs, phew,” the user wrote, claiming they were held down while attackers threatened them with axes and forced the transfer of funds.

The victim said the stolen assets were moved to an Ethereum wallet beginning with 0x6fe0…0322 and offered a 10% bounty on any recovered funds. The user also called on blockchain investigators to help trace the transactions.

Blockchain security firm PeckShield later reported that an address linked to the victim had been drained of approximately $24 million worth of aEthUSDC, describing the incident as an address poisoning attack.

According to the firm, about $20 million in DAI linked to the exploit is currently sitting in two attacker-controlled staging wallets, each holding roughly $10 million. These wallets have not yet been mixed, suggesting the funds remain traceable for now.

PeckShield also said the attacker has begun bridging small amounts of the stolen assets to the layer-2 network Arbitrum, a move often used by attackers attempting to fragment or obscure transaction trails.

The incident highlights the growing risk of physical attacks targeting cryptocurrency holders, sometimes referred to as “wrench attacks,” where criminals use coercion or violence to force victims to hand over private keys or execute transfers.

It remains unclear whether any of the stolen funds have been recovered at press time.

Crypto World

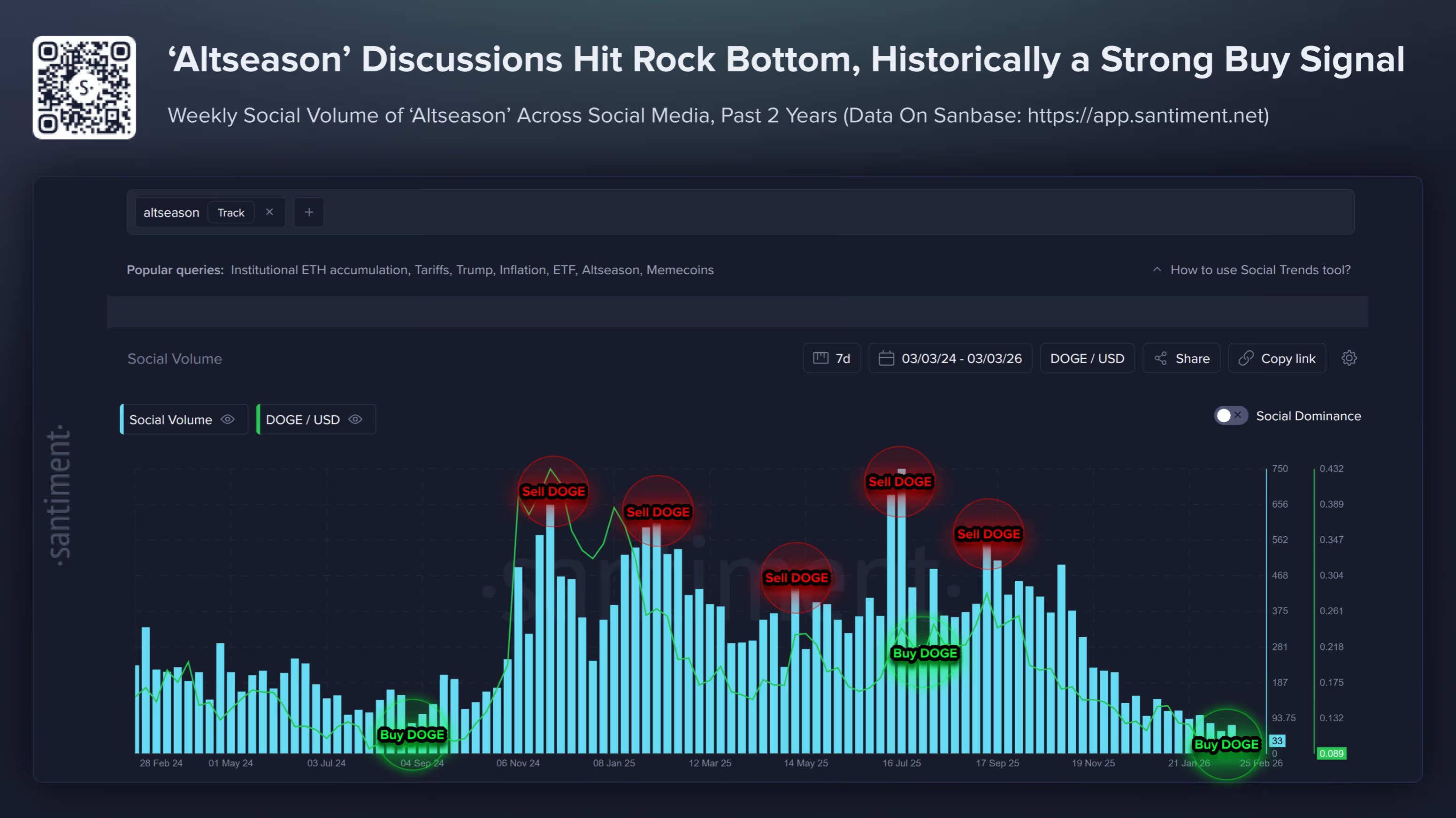

Altseason chatter collapses as dogecoin correlation hints at rebound

The crypto crowd has given up on altcoins. And that might be the most bullish thing about them right now.

Santiment’s social volume tracker shows weekly mentions of “altseason” across social media have fallen to rock bottom, the lowest reading in at least two years.

The term is essentially a proxy for retail greed and speculation. When everyone’s talking about altseason, it usually marks a top. When nobody’s talking about it, large holders have historically started accumulating.

Every major spike in altseason chatter over the past two years coincided with a local top in DOGE. Every period of silence was followed by a rally. The pattern isn’t perfect, but the correlation between crowd disinterest and subsequent price recoveries is hard to ignore across multiple cycles.

The current apathy is earned. Altcoins have been brutalized since October’s crash. Dogecoin is down roughly 75% from its cycle peak. Solana has shed over 60%. Cardano has lost more than 70%.

The broader altcoin market has been bleeding against bitcoin for months, with capital rotating into BTC and stablecoins rather than chasing lower-cap tokens. There’s simply nothing left to be excited about if you’ve been holding alts through this drawdown.

Other sentiment indicators confirm the exhaustion. The Crypto Fear and Greed Index has spent most of February and March oscillating between “fear” and “extreme fear.”

The Coinbase Premium Index stayed negative for over 40 consecutive days through February, signaling that U.S. retail interest was absent even from bitcoin, let alone more speculative assets. Google Trends data for terms like “best crypto to buy” have flatlined while searches of “bitcoin to zero” hit a U.S. record earlier in the month.

Meanwhile, the on-chain picture has been quietly diverging from sentiment. Bitcoin wallets holding 100+ BTC approached 20,000 for the first time in late February, suggesting large holders were accumulating the dip.

The data does not directly mean a rally is imminent; however, with the ongoing Iran conflict pressuring financial markets all over the world. The altcoin market needs bitcoin to stabilize before it can rotate lower on the risk curve.

The conditions for an altseason aren’t here yet, but the sentiment setup is.

Crypto World

US SEC drops Justin Sun lawsuit with $10M settlement from Rainberry

Justin has secured a $10 million settlement in a multi-year lawsuit filed by the United States Securities and Exchange Commission that accused the crypto entrepreneur of alleged fraud and securities violations.

Summary

- Justin Sun settled the SEC’s long-running lawsuit with a $10 million payment from Rainberry, bringing an end to allegations tied to TRX and BTT token sales and trading practices.

- The case, originally filed in 2023 under former SEC Chair Gary Gensler, accused Sun and affiliated entities of unregistered securities sales.

A letter from the SEC made public on Feb. 5 confirmed that neither Sun nor any of his companies involved in the case had admitted or denied the allegations, but the claims would be dropped following the payment of the fine.

With this, the SEC has wrapped up a three-year-long case that was filed under the leadership of former SEC Chair Gary Gensler, who was widely known for his regulation-by-enforcement approach.

Sun, along with affiliated entities including the Tron Foundation, BitTorrent Foundation, and Rainberry, was accused of selling unregistered securities involving TRX and BTT tokens. Further, the SEC alleged that Sun engaged in “manipulative wash trading” of TRX and paid celebrities like Akon, Lindsay Lohan, and Jake Paul to promote BTT without disclosing their compensation.

Sun has reiterated that the SEC’s complaints “lacks merit.”

Rainberry has agreed to pay a $10 million fine as part of the latest settlement.

“Today’s resolution brings closure, but I never stopped building. I will continue to focus on accelerating innovation in the United States and around the world, and look forward to working with the SEC to develop guidance and regulations for crypto going forward,” Sun wrote in a recent X post.

The dismissal comes as no surprise because under President Donald Trump’s administration, the commission has taken a markedly pro-crypto stance and has dropped multiple enforcement actions that were previously brought against major industry players like Coinbase.

However, the decision to drop Sun’s case has also drawn scrutiny from some lawmakers, who believe the move may have been motivated by Sun’s financial ties to Trump-linked crypto ventures.

Soon after Trump’s election, Sun acquired $30 million worth of tokens linked to World Liberty Financial, which has direct links to the president’s family.

Democratic lawmakers, including Representatives Maxine Waters, Ritchie Torres, and Stephen Lynch, have argued that the circumstances surrounding the settlement warrant closer scrutiny and have requested the SEC to reopen the case.

Crypto World

Protocol Bankruptcy Courts – Smart Liquidity Research

How DeFi Could Handle Failure Without Chaos Decentralized finance has mastered many things: permissionless trading, algorithmic lending, automated market making. But one problem still sits awkwardly in the background — what happens when a protocol fails?

In traditional finance, companies that collapse enter structured legal processes like Chapter 11 bankruptcy, where courts coordinate creditors, restructure debt, and distribute remaining assets fairly. In DeFi, the equivalent often looks more like Twitter threads, governance drama, and panic withdrawals.

What if blockchains had their own Protocol Bankruptcy Courts?

The Missing Layer in DeFi: Orderly Failure

Protocols fail for many reasons:

-

Smart contract exploits

-

Insolvent lending pools

-

Governance attacks

-

Market collapses

-

Oracle manipulation

Events such as the collapse of Terra and the liquidation cascades across Celsius Network and FTX showed how chaotic unwinding can be when billions of dollars in digital assets are involved.

Unlike traditional companies, most DeFi protocols lack a formal mechanism to restructure obligations when something breaks.

Instead, we see:

-

Emergency governance votes

-

Ad-hoc treasury bailouts

-

Community-driven compensation plans

-

Legal interventions outside the chain

A Protocol Bankruptcy Court would aim to solve this by embedding structured crisis resolution directly into smart contracts and governance systems.

What Is a Protocol Bankruptcy Court?

A Protocol Bankruptcy Court (PBC) is a decentralized system that activates when a protocol becomes insolvent or unable to fulfill obligations.

Instead of shutting down chaotically, the protocol enters a structured recovery phase governed by predefined rules.

Think of it as a smart-contract-powered restructuring process.

Key functions could include:

1. Automatic Insolvency Detection

Smart contracts continuously monitor protocol health metrics:

-

Collateral ratios

-

Liquidity reserves

-

Treasury solvency

-

Withdrawal pressure

If thresholds are breached, the protocol automatically triggers Bankruptcy Mode.

2. Creditor Registry

All stakeholders are mapped on-chain:

-

Depositors

-

Liquidity providers

-

Token holders

-

Bond markets

-

DAO treasury claims

The court system creates a transparent creditor registry so everyone knows who is owed what.

No hidden liabilities. No off-chain spreadsheets.

3. Claim Prioritization

A core function of bankruptcy is deciding who gets paid first.

Protocols could encode priority layers such as:

-

User deposits

-

Secured collateral lenders

-

Liquidity providers

-

Governance token holders

This hierarchy could be voted on beforehand through DAO governance.

4. On-Chain Restructuring Proposals

Instead of chaotic community debates, restructuring proposals are submitted through a structured system.

Examples:

-

Treasury-backed compensation plans

-

Tokenized debt issuance

-

Recovery tokens (similar to post-crisis IOUs)

-

Liquidity lock extensions

Voting would determine which recovery plan becomes active.

5. Asset Liquidation Engines

Remaining assets could be distributed through:

Everything happens transparently on-chain.

The Concept of Recovery Tokens

A common tool in restructuring is the issuance of recovery tokens.

After a protocol collapse, affected users receive tokens representing their claim on future revenue.

These tokens could:

-

Earn a portion of protocol fees

-

Be tradable on secondary markets

-

Appreciate it if the protocol recovers

This approach transforms losses into long-term claims instead of instant write-offs.

Why DeFi Needs This

DeFi’s biggest weakness isn’t innovation — it’s crisis management.

Traditional finance has centuries of legal infrastructure for handling insolvency. Blockchains do not.

Protocol Bankruptcy Courts could:

-

Prevent panic bank runs

-

Provide fair creditor coordination

-

Reduce legal uncertainty

-

Preserve the surviving protocol value

-

Turn catastrophic collapses into structured recoveries

Instead of “rug → chaos → lawsuits,” the process becomes “failure → restructuring → recovery.”

The Governance Challenge

Who should run these courts?

Possible models include:

DAO Jury System

Randomly selected token holders review restructuring proposals.

Delegated Arbitration

Specialized governance delegates evaluate claims.

Automated Rules

Smart contracts execute pre-programmed recovery paths.

In reality, a hybrid system is likely.

Risks and Limitations

Protocol Bankruptcy Courts are not a perfect solution.

Challenges include:

-

Governance manipulation during crises

-

Disputes about creditor priority

-

Smart contract rigidity

-

Legal conflicts with real-world jurisdictions

Still, even an imperfect on-chain restructuring process could be far better than today’s improvisation.

A Future Where Protocols Can Fail Safely

Failure is inevitable in experimental financial systems.

The question isn’t whether protocols will collapse, but how they collapse.

If DeFi wants to mature into global financial infrastructure, it needs systems not just for growth, but for orderly failure.

Protocol Bankruptcy Courts could become one of the most important missing layers in decentralized finance — transforming collapse from a chaotic event into a managed, transparent restructuring process.

In a world where code governs capital, perhaps even bankruptcy should be programmable.

REQUEST AN ARTICLE

Crypto World

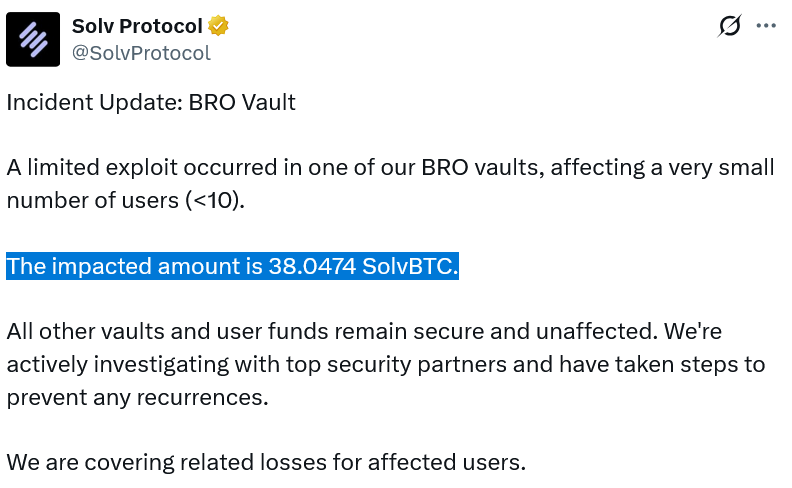

Solv Protocol Offers 10% Bounty After $2.7M Hack

Security researchers say a bug in Solv Protocol’s smart contracts allowed an attacker to mint an outsized amount of a Bitcoin-backed token and swap it for SolvBTC, the Bitcoin-pegged asset on the Solv network. In total, the incident is estimated at $2.7 million in losses, while the attacker minted 38.05 Solv Protocol BTC (SolvBTC) tokens before converting the bulk into a position on SolvBTC. Solv said fewer than ten users were affected and that it has deployed mitigations and engaged multiple security firms to investigate the exploit. The incident underscores ongoing security challenges in DeFi vaults that rely on cross-chain assets and minting logic.

Bitcoin-based DeFi platforms continue to attract attention for the financial leverage they offer across chains, but this episode shows how a single vulnerability can ripple through a broader ecosystem. The attacker’s maneuver involved 22 separate minting events, culminating in a swap that moved most of the minted tokens into just over 38 SolvBTC, a token pegged to Bitcoin. Pseudonymous researchers described the vulnerability as a re-entrancy-like flaw, a class of attack that has repeatedly exposed weaknesses in smart contracts where external inputs can provoke unintended minting or asset creation. While the precise chain of events remains under audit, the core insight is clear: minting controls on DeFi assets tied to real-world reserves demand robust, multi-layered safeguards.

Solv Protocol has been forthright about its response. In a public post on X, the team explained that they have put measures in place to prevent a recurrence and are collaborating with security firms Hypernative Labs, SlowMist, and CertiK to conduct a comprehensive review. A 10% bounty was offered to the attacker in exchange for returning the stolen funds, a strategy designed to recover value while maintaining a channel for dialogue. So far, there has been no confirmed on-chain communication from the attacker to the bounty address, according to Etherscan data, complicating any near-term recovery plan.

Solv Protocol’s model hinges on Bitcoin deposits backing Solv Protocol BTC, enabling users to lend, borrow, or stake across interconnected blockchains. The project has stressed that it possesses a substantial on-chain Bitcoin reserve—reported at roughly 24,226 BTC, valued at more than $1.7 billion at the time of reporting. This scale underscores the potential systemic impact of the breach, even if the immediate exposure to users appears limited. The event also places a spotlight on the resilience of liquidity providers across cross-chain ecosystems, where smart contract design, reserve accounting, and user protection mechanisms must align to prevent similar exploits in the future.

Initial assessments point to a flaw within a Solv smart contract that allowed excessive minting of a token used within the protocol. Security researchers describe this as a re-entrancy vulnerability, a persistent threat in DeFi that takes advantage of unexpected inputs to force asset creation beyond intended limits. The discourse around the incident has touched on broader lessons for DeFi—namely, the importance of formal verification, rigorous contract auditing, and robust guardrails for minting functions tied to real-world assets. The Solv incident joins a growing catalog of DeFi security episodes that encourage protocols to bake in stronger checks and consensus-driven escalation paths before minting or locking value.

Solv has provided a public wallet address in its update to encourage the attacker to participate in the bounty program. Yet, as of the latest blockchain checks, no on-chain message had arrived at that address. The lack of a reply is a reminder that, even with incentives, adversaries may delay or avoid engagement, leaving affected users and the ecosystem in a state of limbo as investigators map the full scope of the breach. The situation continues to evolve as security firms parse call traces, contract states, and token movements to determine whether additional exploits are possible or if the incident has crossed a boundary into a recoverable event.

The broader crypto community is watching how Solv and its security partners respond to this breach. The cross-chain nature of Solv’s products, coupled with the size of its Bitcoin-backed reserve, makes this incident more than an isolated hack; it tests the durability of risk controls, incident response, and incentive-driven remediation in DeFi’s Bitcoin-linked layer. While the immediate loss is tangible, the longer-term implications hinge on how effectively Solv can close the vulnerability, reassure participants, and demonstrate that cross-chain lending and staking platforms can withstand sophisticated, multi-stage exploits without eroding confidence in the underlying mechanics of wrap-and-bridge systems.

The event also highlights the tension between open, incentive-aligned security practices and the risk of misaligned incentives when large sums are at stake. As Solv and its partners conduct their audits and implement additional safeguards, observers will look for a clear roadmap outlining contract upgrades, formal verification steps, and a revised risk framework for minting and reserve management across Bitcoin-backed tokens. In an ecosystem where liquidity is a prized asset, the balance between rapid response and thorough, verifiable remediation remains the defining challenge for DeFi builders and auditors alike.

Why it matters

From a technical perspective, the Solv Protocol breach underscores how minting controls in DeFi products tied to real assets require exceptionally robust safeguards. A single bug in a contract that governs token creation can unlock outsized supply, enabling attackers to siphon value before guardrails activate. For users, the incident raises questions about the reliability of Bitcoin-backed DeFi vaults and the timeline for remediation—factors that influence whether liquidity remains available and secure across connected chains.

From a market perspective, the breach occurs against a backdrop of ongoing scrutiny of DeFi security practices, audit standards, and bug-bounty programs. The involvement of established security firms signals a serious investigative effort, but the absence of a public attacker-led recovery also underscores the fragility of trust when large on-chain reserves are at stake. For builders, the episode reinforces the need to implement multi-sig governance, formal verifications, and fail-safes that prevent minting beyond predefined caps, especially in systems that bridge Bitcoin to other networks.

For investors and users, the incident serves as a reminder to assess not only the yield or liquidity benefits of cross-chain DeFi products but also the depth and rigor of their security programs. The deployment of independent audits, transparent incident timelines, and concrete upgrade roadmaps will be critical in restoring confidence as the ecosystem weighs the trade-offs between innovation and safety in complex, asset-backed DeFi architectures.

What to watch next

- Updates from Hypernative Labs, SlowMist, and CertiK on the ongoing audit findings and patch implementations.

- Any further on-chain movements of the minted tokens or the SolvBTC asset, including potential recoveries or additional seizures.

- New governance or contract upgrades that address minting guards, emergency pause mechanisms, and reserve reporting.

- Public communications from Solv Protocol about timelines for remediation and user restitution, if applicable.

Sources & verification

- Solv Protocol’s official X posts detailing the incident and bounty offer.

- On-chain data and the transaction reference 0x44e637c7d85190d376a52d89ca75f2d208089bb02b7c4708ad2aaae3a97a958d.

- Public comments from security researchers (Hypernative Labs, SlowMist, CertiK) as cited in related updates.

- The reported figure of 24,226 BTC in Solv’s Bitcoin reserve and the broader context of SolvBTC as a Bitcoin-backed token.

Solv Protocol breach exposes risk in Bitcoin-backed DeFi vaults

Crypto World

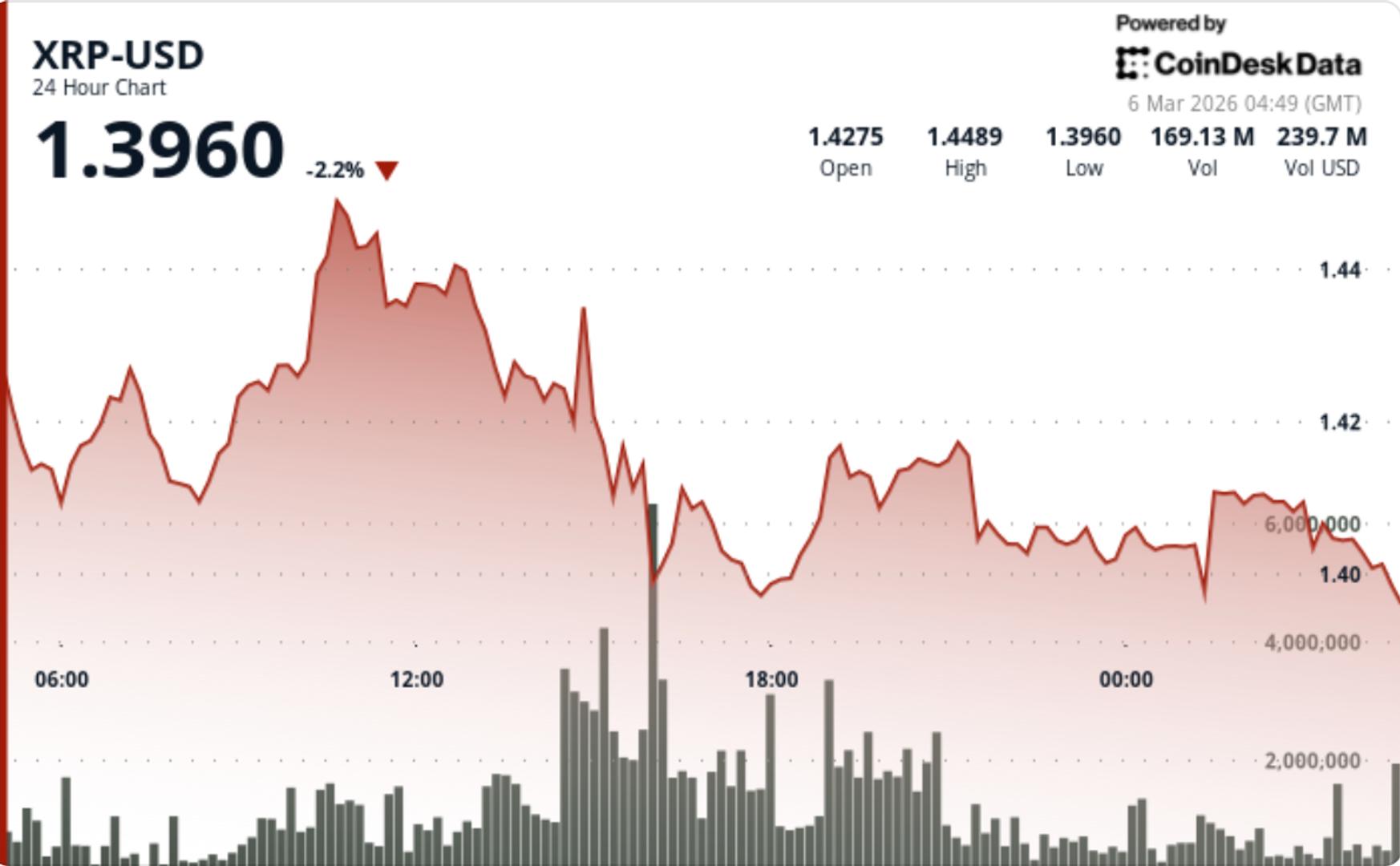

What next for Ripple-linked token as it fails to break above $1.45

XRP moved lower after another rejection near resistance, with rising volume confirming sellers remain in control of the short-term trend.

News Background

- XRP has struggled to regain momentum since its July 2025 peak, continuing to trade within a broader corrective structure. The token remains roughly 60% below that high as market participants debate whether the current consolidation represents accumulation or continuation of the downtrend.

- Institutional positioning has offered mixed signals. Spot XRP ETFs have accumulated roughly $1.24 billion in inflows over the past four months, while on-chain data shows large wallets adding to positions during recent dips.

- At the same time, derivatives activity has cooled significantly, with open interest declining sharply since late 2025 as leverage unwinds across crypto markets.

- Ripple’s supply dynamics also remain steady. The company re-locked 700 million XRP into escrow on March 1 as part of its routine supply management cycle.

Price Action Summary

- XRP declined 3.3%, falling from $1.4588 to $1.4108

- Price repeatedly failed to hold above the $1.43–$1.45 resistance zone

- Volume surged 74% above average during the main selloff

- A late-session break below $1.411 confirmed downside momentum

Technical Analysis

- The key technical event was the rejection from the $1.43–$1.45 resistance band, which triggered a sequence of lower highs and reinforced the prevailing descending channel structure.

- Once $1.411 support gave way on elevated volume, downside momentum accelerated, pushing XRP toward the $1.40 area. Short-term structure now favors sellers while price remains below the prior support zone.

- Despite the weakness, the broader chart shows compression forming between downward resistance and rising support, with a potential triangle structure approaching its apex. This suggests the market may be nearing a larger directional move once current consolidation resolves.

- Key levels now cluster around $1.40 support and $1.43–$1.45 resistance.

What traders say is next?

- Traders are closely watching whether XRP can stabilize above $1.40.

- Holding this level could allow the token to consolidate before attempting another move toward $1.45 and eventually $1.55, which analysts view as the first level that would weaken the broader bearish structure.

- A break below $1.40, however, would likely shift focus toward deeper support around $1.33, with some analysts pointing to the $1.00 zone as a potential longer-term reset area if selling pressure accelerates.

Crypto World

Hacker Steals $2.7M From Solv’s Bitcoin Yield Platform

Crypto security researchers say the hacker exploited a bug allowing them to mint tokens, before swapping the freely-gained tokens for another tied to Bitcoin.

Bitcoin-based decentralized finance platform Solv Protocol says one of its token vaults was exploited for $2.7 million and has offered the attacker a 10% bounty in exchange for returning the stolen funds.

Solv said in an X post on Thursday that less than 10 of its users were impacted, but it would cover the loss of 38.05 Solv Protocol BTC (SolvBTC), a token pegged to Bitcoin (BTC).

The project added that it had implemented measures to prevent the same attack from recurring and was investigating the exploit with crypto security firms Hypernative Labs, SlowMist and CertiK.

Solv allows users to deposit Bitcoin for Solv Protocol BTC, which they can then use to lend, borrow or stake on other blockchains. The project has 24,226 Bitcoin worth over $1.7 billion and claims it is the largest on-chain Bitcoin reserve.

Solv hasn’t confirmed how the exploit happened, but two crypto security researchers attributed it to a vulnerability in one of Solv’s smart contracts that allowed the hacker to excessively mint a token used on the protocol.

Related: Mt. Gox’s former CEO floats hard fork to recover 80K hacked Bitcoin

The hacker exploited this vulnerability 22 times before swapping hundreds of millions of the tokens for a little over 38 SolvBTC, CD Security co-founder Chris Dior said.

Pseudonymous crypto researcher “Pyro” described the exploit as a re-entrancy attack, where unexpected inputs expose gaps in smart contracts, a popular attack that has plagued multiple DeFi protocols for years.

Solv shared an Ethereum wallet address in its X post to encourage the hacker into accepting a 10% bounty.

However, the hacker has not yet sent an on-chain message to the address, according to Ethereum block explorer Etherscan.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

What next for BTC as it slides under $71,000

Bitcoin got to $74,000 and ran out of further buying pressure.

The largest cryptocurrency pulled back to $70,987 by Friday’s Asian session, down 2.2% over the past 24 hours after Thursday’s surge carried it to its highest level since early February. The rally from Saturday’s war-driven low near $64,000 to Thursday’s $74,000 peak amounted to roughly 15% in five days, but the retreat since has given back about a third of that move.

Chart watchers such as FxPro chief analyst Alex Kuptsikevich pointed to the rejection coincided with the 61.8% Fibonacci retracement and just below the 50-day moving average, two technical barriers that tend to attract sellers in bear market rallies.

Fibonacci retracement levels are derived from a mathematical sequence that traders use to identify where a bounce is likely to stall. The idea is that after a large move down, prices tend to retrace a predictable percentage of that drop before resuming the trend. The 61.8% level is the most closely watched because it represents the point where a recovery has retraced roughly two-thirds of its losses, far enough to feel convincing but historically where bear market rallies tend to die.

The 50-day moving average, meanwhile, is simply the average closing price over the past 50 days. It acts as a moving line of resistance during downtrends because it represents the price at which the average recent buyer breaks even, giving them an incentive to sell rather than hold. Bitcoin hitting both at the same time makes $74,000 a technically crowded level.

Kuptsikevich noted that “the bulls still have to convince the community that the bear market is over,” adding that the magnitude of the move was driven by a short squeeze from bears who “pulled their stops too close to the market price.”

Bitunix analysts flagged a similar read on the microstructure. The push to $74,000 triggered concentrated short liquidations, while long leverage liquidation clusters sit around $70,000. Secondary liquidity pools are near $64,000. That creates a defined range for the next move, with the floor and ceiling both visible on the liquidation heat map.

The weekly numbers still look strong for majors. Bitcoin is up 5.4% over seven days. Ether gained 2.7% to $2,080. BNB added 3.1% to $648. Solana rose 2.1% to $88.39. The laggards were dogecoin, down 3.7% on the week, and XRP, essentially flat with a 0.2% decline.

The macro picture heading into the weekend is messy, however.

Asia’s benchmark stock index has dropped 6.4% since the Iran war broke out, with MSCI’s regional gauge heading for its worst week since March 2020. The dollar is on pace for its best week since November 2024. Oil is posting its biggest weekly surge since 2022. Those are not the conditions that typically sustain a crypto rally.

Friday brought some tentative relief. Asian equities erased early losses as the dollar weakened and crude prices dipped on reports that the U.S. was weighing options to address the energy cost spike.

But the war isn’t over. The Senate failed to block Trump’s continued military actions against Iran, leaving conflict costs and energy disruption as open variables. Defense Secretary Hegseth has said operations could last three to eight weeks. The Strait of Hormuz remains effectively disrupted.

The $70,000 level that was resistance for a month is now the first test of support. Holding it would suggest the breakout is real. Losing it puts the $64,000 floor back in play.

Crypto World

Can Ethereum price reclaim $2,400 as it eyes a bullish reversal amid market recovery?

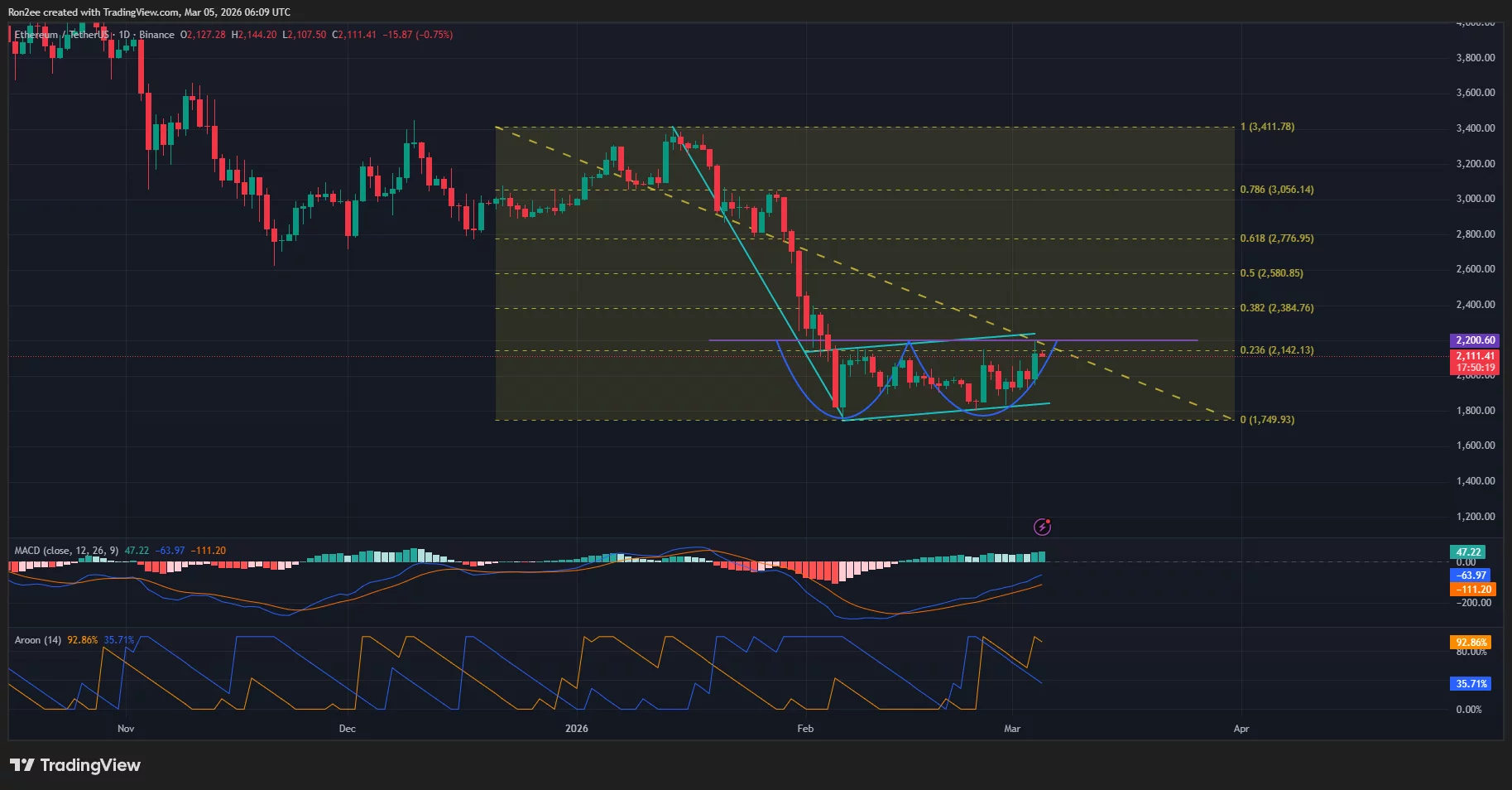

Ethereum bulls pushed its price to nearly $2,200 on Thursday amid a market-wide recovery.

Summary

- Ethereum price rebounded to a 4-week high on Friday amid increased demand from institutional traders and a surge in short liquidations.

- ETH has formed a double bottom pattern on the daily chart.

According to data from crypto.news, Ethereum (ETH) price rallied over 11% to a 4-week high of $2,192.

Ethereum price rallied amid a broader market recovery led by Bitcoin. The bellwether reclaimed the $73,000 mark for the first time since early February as reports emerged that the U.S. and Iran could be negotiating a deal to end their military confrontation.

As ETH price rose, it triggered a short squeeze of traders with highly leveraged bearish bets in the derivatives market. Data from CoinGlass show over $133 million in short positions were liquidated in the past 24 hours, compared to only $21.5 million in long positions.

A return of inflows into spot Ethereum ETFs also seems to suggest that institutional investors had played a significant part in the recovery. Per data compiled by Farside Investors, spot Ethereum ETFs drew in $169.4 million yesterday.

Simultaneously, Ethereum’s open interest shot up nearly 15%, which is a sign of increased derivatives market activity after multiple days of stagnation. While the weighted funding rate remains negative at press time, if it continues to climb, a shift toward positive funding rates could signal a return of bullish sentiment.

This surge in activity suggests that traders are once again aggressively positioning themselves, potentially setting the stage for more volatility if the price breaks key resistance levels.

On the daily chart, Ethereum price has formed a double bottom pattern, a major bullish reversal pattern formed of two consecutive troughs. The neckline of the pattern lies at the $2,200 psychological resistance level.

A breakout from the neckline could push Ethereum to $2,400, which aligns with the 38.2% Fibonacci retracement level that is often seen as a critical target for a trend reversal.

It should also be noted that a successful reclaiming of the $2,400 mark would invalidate a larger bearish flag pattern forming on the chart.

Key technical indicators seem to suggest that bulls are already on the move. Notably, the MACD lines have formed a bullish crossover and were pointing upwards, while the Aroon Up showed a reading of 92.86%, far above the bearish indicator at 35.71%.

For now, traders are eyeing $2,142, the 23.6% Fibonacci retracement level, as a key resistance. ETH was trading at $2,117 when writing, just 1.1% below that mark.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech23 hours ago

Tech23 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports11 hours ago

Sports11 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker