Crypto World

Bitcoin at Critical $69K-$72K Support: Death Cross Signals Deeper Correction Risk

TLDR:

- Bitcoin death cross forms on daily charts with moving averages positioned far above current price

- Weekly close below $69K-$72K support could trigger next leg down into deeper correction territory

- Binance withdrawal data shows whale accumulation doubled to 13.3 BTC average since late January

- Price must reclaim $82K then mid-$90Ks to establish bottoming pattern and reverse bearish trend

Bitcoin faces a critical test as price slides into the $69,000 to $72,000 support zone amid mounting bearish technical signals.

A death cross has formed on daily charts while weekly moving averages remain far overhead. Traders warn that a clean weekly close below this range could trigger a deeper correction phase.

The current price action shows weak bounce attempts with consistent rejections at key resistance levels.

Death Cross Formation Signals Bearish Trend Structure

The technical setup has deteriorated significantly as BTC continues its descent from higher levels. Daily charts now display an active death cross with the 50-day and 200-day moving averages positioned miles above current price. This configuration represents a classic bearish trend structure where rallies meet aggressive selling pressure.

Weekly timeframes confirm the concerning technical picture. Price remains trapped below the exponential moving average ribbon with repeated rejection attempts at that level.

Any upward moves are functioning as retests rather than genuine reversals. Trader @DamiDefi emphasized that pumps are getting sold while supports face continuous stress tests.

The $69,000 to $72,000 band now represents the final line of defense. This zone determines whether the market experiences a temporary shakeout or enters a prolonged correction phase. Price behavior at this level will dictate the trajectory for coming weeks and potentially months.

A breakdown below $69,000 on a weekly closing basis would open the next leg down. The accumulation phase would become considerably more painful before any bullish momentum could rebuild.

Historical patterns suggest that losing major support zones often leads to cascading liquidations and accelerated downside movement.

Support Test Occurs Despite Whale Buying Activity

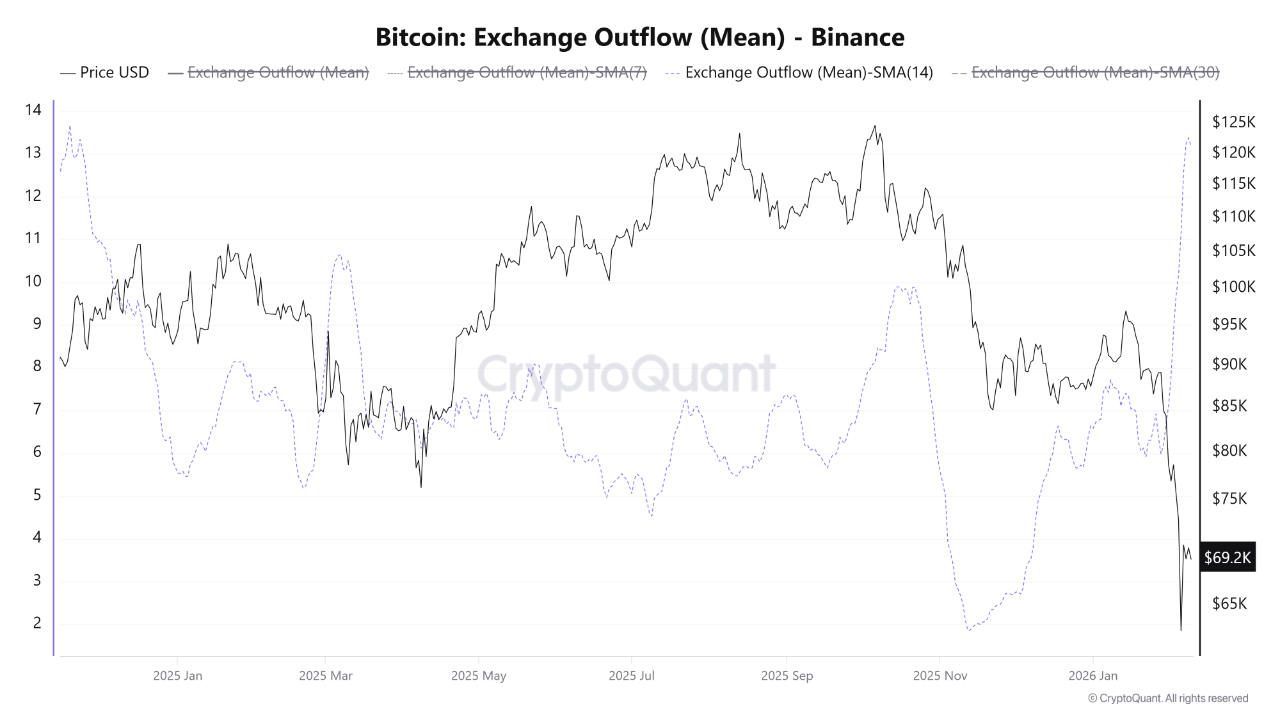

The bearish price action persists even as on-chain data reveals unusual buying patterns. Binance exchange metrics show a significant increase in average withdrawal sizes during the decline.

The 14-day simple moving average of mean outflows has doubled from approximately 6 BTC on January 28 to 13.3 BTC by February 8.

This withdrawal pattern indicates whale and institutional activity at current price levels. Large entities appear to be accumulating Bitcoin around $69,000 despite the technical deterioration.

The average outflow size represents the highest level recorded since November 2024, according to CryptoOnchain data.

However, this accumulation has not yet translated into price stability or reversal. The gap between falling prices and rising withdrawal sizes creates a divergence worth monitoring. Smart money appears to be positioning for longer-term gains while accepting near-term downside risk.

Moving coins off exchanges to cold storage traditionally reduces immediate selling pressure. Yet the current market structure suggests this effect remains insufficient to halt the decline.

Bulls need price to reclaim $82,000 first, then push back into the low-to-mid $90,000s to establish a credible bottoming range. Without holding the $69,000 to $72,000 support zone, those recovery targets become increasingly distant possibilities.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Chainlink co-founder Sergey Nazarov argues the recent crypto market downturn is unlike any previous bear market — there have been no major FTX-style collapses, and tokenized real-world asset (RWA) growth remains substantial.

Market cycles are normal, “but what is important is what those cycles reveal about how far the industry has progressed,” said Nazarov on X on Tuesday.

Crypto market capitalization has fallen 44% from its October all-time high of $4.4 trillion, with almost $2 trillion exiting the space in just four months.

Nazarov, however, did not appear concerned, highlighting two primary factors that separate this current bear market from previous ones.

Unlike previous cycles, such as the FTX and crypto-lending failures in 2022, there haven’t been major institutional collapses during this drawdown, indicating the industry can now handle volatility more reliably, he said.

“There have been no large risk management failures leading to large institutional failures or widespread systemic risks.”

RWA growth will drive institutions and infrastructure

Secondly, RWA tokenization and on-chain perpetual contracts for traditional commodities continue accelerating regardless of crypto prices, proving this innovation has standalone value beyond speculation.

Tokenized RWA onchain value has increased 300% over the past 12 months, according to RWA.xyz.

This signals that having real-world assets on-chain “is not tightly coupled to cryptocurrency prices but provides its own unique value that can grow irrespective of market pricing of Bitcoin or other crypto assets,” he said.

The surge hasn’t been reflected in the price of Chainlink (LINK), however, with the blockchain oracle and RWA-centric asset tanking 67% since its October peak and down 83% since its 2021 all-time high, trading at a bear-market low below $9 at the time of writing.

Related: Crypto VC Funding Doubled in 2025 as RWA Tokenization Took the Lead

Nazarov also sees other converging trends reshaping the future of crypto.

On-chain perps and tokenization offer unique value, such as 24/7 markets, on-chain collateral, and real-time data, which is growing steadily. Institutional adoption will be driven by this fundamental utility, and infrastructure demand will surge as complex RWAs require more sophisticated on-chain systems, the Chainlink co-founder said.

“If these trends continue, I believe what I have been saying for years will happen; on-chain RWAs will surpass cryptocurrency in the total value in our industry, and what our industry is about will fundamentally change.”

Not all bear markets are equal

Bernstein analyst Gautam Chhugani echoed the sentiment in a note on Monday, writing that we are experiencing “the weakest Bitcoin bear case in its history.”

“The current Bitcoin price action is a mere crisis of confidence. Nothing broke, no skeletons will show up,” analysts led by Chhugani said.

Jeff Mei, chief operating officer at the BTSE exchange, told Cointelegraph that this sell-off is different “in that it was caused largely by non-crypto catalysts.”

Those include fears that a faltering AI tech boom could cause stocks to crash, “compounded by the appointment of Kevin Warsh to Fed chair, who many believe will reduce liquidity in the financial system,” he said.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Bitcoin, Ethereum News & Crypto Price Indexes

Chainlink (CRYPTO: LINK) co-founder Sergey Nazarov argues that the current crypto downturn is not a replay of previous bear markets. Speaking on X on Tuesday, Nazarov noted that there have been no FTX-style collapses this time and pointed to a persistent wave of tokenized real-world assets that continues to grow despite price declines. Crypto market capitalization has fallen about 44% from its October all-time high of $4.4 trillion, with roughly $2 trillion leaving the space in just four months. He frames the cycle as a test of the industry’s progress: cycles reveal how far the ecosystem has advanced, and this downturn is exposing both resilience and a real-world asset narrative that could outlast speculative pricing.

Key takeaways

- The downturn lacks a single systemic event comparable to FTX-era collapses, suggesting improved risk management across institutions.

- Tokenized real-world assets (RWAs) are expanding on-chain, signaling a use case beyond mere price speculation.

- On-chain perpetuals and asset tokenization offer 24/7 markets, on-chain collateral, and real-time data that could drive institutional adoption.

- Chainlink’s credibility as a backbone for on-chain RWAs remains intact even as the broader market experiences weakness.

- Analysts and industry observers see a bifurcation between crypto prices and the growth trajectory of on-chain RWAs, potentially reshaping the industry’s value proposition.

Tickers mentioned: $BTC, $ETH, $LINK

Sentiment: Neutral

Price impact: Negative. A broad sell-off and outflows have pressured prices and market capitalization, even as on-chain RWA activity trends higher.

Market context: The current cycle unfolds amid a shifting risk environment, macro uncertainty, and ongoing debates about liquidity and regulation that influence both crypto assets and tokenized RWAs.

Why it matters

The argument that the bear market is not a monolithic crash but a spectrum of dynamics matters because it reframes what investors should watch. Nazarov emphasizes that the absence of large, systemic failures this cycle points to improved risk controls and more mature market infrastructure. In practical terms, this could translate into steadier liquidity provision, fewer cascading liquidations, and greater confidence in deploying capital through on-chain channels rather than off-ramp exits.

Central to this narrative is the acceleration of RWA tokenization. According to RWA.xyz, tokenized RWAs on-chain have surged by about 300% over the past 12 months, underscoring a use case that can prosper irrespective of crypto price cycles. The implication is clear: real-world assets—ranging from securitized notes to commodity-linked contracts—are becoming meaningful, on-chain stores of value and collateral concepts, not merely speculative bets. This trend could feed into broader institutional demand, as on-chain mechanisms offer transparency, auditability, and cross-border settlement capabilities that traditional markets take days or weeks to deliver.

Yet the market’s performance remains tethered to macro and sector-specific catalysts. LINK, the token associated with pricing data and oracle services, has faced sustained weakness, trading in bear-market territory after peaking earlier in the cycle. The dynamic illustrates a decoupling: while RWAs push forward in practical utility, the crypto market, including major assets like Bitcoin and Ethereum, can diverge for periods where macro sentiment dominates. In this context, on-chain RWAs could gradually displace some narrative weight away from pure price action toward real-world utility and risk-adjusted capital formation.

Institutional involvement is widely anticipated to hinge on the utility of these on-chain structures. Nazarov argues that the combination of perpetual markets, tokenized assets, and robust on-chain collateral is creating a more resilient foundation for institutions to experiment with crypto-enabled finance. The broader ecosystem benefits from infrastructure upgrades that enable risk management, settlement, and governance in a transparent, programmable environment. The takeaway is not that crypto prices must explode to prove value, but that the underlying systems—the oracles, the data streams, and the contractual primitives—are becoming indispensable to professional finance.

As markets digest these developments, some observers emphasize that the current sell-off is driven by factors outside the crypto sector. Analysts have framed the move as a wider market concern about AI equities, liquidity expectations under a potentially tighter policy regime, and shifts in liquidity leadership. While these external pressures complicate the price narrative, the on-chain RWA ecosystem appears to be advancing on its own trajectory, aligned with broader fintech adoption and cross-chain interoperability goals.

“If these trends continue, I believe what I have been saying for years will happen; on-chain RWAs will surpass cryptocurrency in the total value in our industry, and what our industry is about will fundamentally change.”

Not all bear markets are equal

Industry observers have framed this downturn as potentially less damaging to the core ecosystem than prior cycles. Bernstein analyst Gautam Chhugani described the Bitcoin bear case as historically weak, suggesting that the price action reflects a crisis of confidence rather than a structural breakdown. “The current Bitcoin price action is a mere crisis of confidence. Nothing broke, no skeletons will show up,” the note said. The takeaway is that the macro environment, not just isolated crypto incidents, is weighing on sentiment.

Other voices emphasize a more nuanced picture. For instance, market participants note that macro catalysts—ranging from interest-rate expectations to tech-sector dynamics—have a disproportionate influence on crypto pricing versus on-chain activity. The sell-off has been described as being driven more by non-crypto catalysts than by internal systemic failures within the crypto space, a distinction that could support a faster reacceleration should risk appetite improve and liquidity return.

Market context

Against the backdrop of a 44% drawdown in crypto market cap from the October peak and substantial outflows, the story of RWAs on-chain remains a central pillar of longer-term value propositions in crypto. The dynamic underscores a broader trend toward tokenization and on-chain finance as mainstream infrastructure projects mature. If on-chain RWAs continue to gain traction, the sector could reorient investor attention toward scalable, real-world use cases, rather than relying solely on volatility-driven appetite for purely digital assets.

Why it matters

For builders, the message is clear: investing in robust on-chain infrastructure for RWAs—oracle reliability, settlement speed, and secure collateral mechanisms—could yield enduring demand. For investors, RWAs offer a potential hedge against crypto-price cycles by anchoring value in tangible, off-chain assets. For the market, the continued growth of RWAs may redefine what constitutes “crypto value,” expanding the spectrum of investable instruments and potentially attracting traditional finance players to participate in a more regulated, verifiable on-chain ecosystem.

What to watch next

- Updates from RWA.xyz on on-chain RWAs growth metrics and new asset classes tokenized on-chain.

- Institutional pilots adopting on-chain perpetuals and RWA-backed collateral frameworks.

- Regulatory developments affecting tokenized real-world assets and oracle data provisioning.

- Cross-chain integrations that improve liquidity, settling quickly, and governance for RWAs.

Sources & verification

- Sergey Nazarov’s X post discussing bear-market dynamics and RWAs growth.

- RWA.xyz data showing on-chain RWA value growth (about 300% YoY).

- LINK price/index coverage referenced in market commentary.

- Bernstein note on Bitcoin bear-case context.

- Wemade KRW stablecoin alliance with Chainlink coverage.

RWA momentum and a reshaping crypto market

Chainlink’s foundational role in powering on-chain RWAs remains a consistent thread as the sector charts its next phase. The on-chain RWA narrative is supported by observable growth metrics and a steady flow of products that enable real-world assets to exist, trade, and collateralize on-chain. While price action can swing with global liquidity and risk sentiment, the underlying technology stack—secure oracles, robust data feeds, and programmable contracts—continues to attract the interest of developers, institutions, and asset issuers alike. The broader question is whether on-chain RWAs will eventually carry a larger share of industry value than speculative crypto assets, a shift Nazarov has been vocal about predicting for years.

https://platform.twitter.com/widgets.js

Crypto World

Hyperliquid beats Coinbase in 2025 notional trading volume

Hyperliquid, a decentralized perpetual futures exchange, has quietly overtaken Coinbase in total notional trading volume, marking a major shift in how crypto traders are choosing to trade.

Summary

- Hyperliquid recorded about $2.6T in notional trading volume in 2025.

- Coinbase posted roughly $1.4T over the same period.

- The gap reflects rising demand for on-chain derivatives platforms.

According to data shared on Feb. 10 by on-chain analytics platform Artemis, Hyperliquid processed about $2.6 trillion in notional trading volume in 2025. Coinbase, one of the world’s largest centralized exchanges, recorded around $1.4 trillion over the same period.

Despite Hyperliquid (HYPE) launching only a few years ago and running entirely on-chain, the numbers show that it handled almost twice Coinbase’s trading volume. The milestone has drawn attention across the crypto industry, especially as decentralized platforms continue to challenge traditional exchanges.

How hyperliquid built its lead

Hyperliquid primarily focuses on trading perpetual futures and derivatives on its proprietary Layer 1 blockchain. Active traders seeking quick execution, cheap fees, and direct access to on-chain liquidity have been drawn to it thanks to its focused approach.

The platform grew quickly throughout 2025. Daily trading occasionally increased to close to $30 billion, while monthly volumes frequently reached hundreds of billions of dollars. The total value locked increased toward $6 billion, while open interest peaked at about $16 billion.

User growth also accelerated. The platform’s active user base grew from about 300,000 to more than 1.4 million in a year, driven largely by word-of-mouth and product performance rather than heavy marketing.

Fees collected on Hyperliquid are partly used for HYPE token buybacks and burns. This model has helped support long-term interest in the ecosystem. As of early 2026, HYPE is up roughly 31.7% on the year and continues to draw increasing attention from traders.

Coinbase operates very differently. Its higher fees, stricter compliance requirements, and fully centralized model for spot and derivatives trading still make it a key entry point for retail users. However, professional traders are increasingly turning their focus toward alternatives that offer more flexibility and lower costs.

Coinbase stock is down about 27.0% so far this year, showing how much pressure traditional crypto companies are under in the current market slowdown.

What this shift means for crypto trading

The growing gap between Hyperliquid and Coinbase reflects a change in how users trade. On-chain platforms offer speed and transparency without requiring users to hand over custody, and more traders are getting comfortable using them.

With Hyperliquid, derivatives traders do not need to trust a central operator with their funds. Smart contracts are used to manage risk, and trades settle on-chain. Users who have been wary of exchanges in the past will find this appealing.

At the same time, Hyperliquid has placed a strong emphasis on user experience. Its user interface is similar to that of large centralized platforms, which makes it easier for new users to get started. Its growth has largely been attributed to this combination of usability and decentralization.

Momentum has also been boosted by recent developments. The platform is being used to test new products such as outcome-based contracts and limited-risk options. Notable industry figures, like Arthur Hayes, who recently increased the size of his own HYPE holdings, have also taken notice of it.

But there are still issues. Competition in decentralized derivatives is increasing, and regulators are paying more attention to on-chain trading activity. Aster and Lighter, two rivals, are also expanding their product lines.

Crypto World

ZachXBT Flags Phantom Chat Risk as 3.5 WBTC Is Stolen

TLDR:

- New Phantom Chat feature expands wallet social tools while unresolved address poisoning risks remain active.

- ZachXBT linked a recent 3.5 WBTC loss to spam transactions that copied trusted wallet address patterns.

- Address poisoning exploits wallet history displays and can mislead users during routine transfers.

- Social wallet features may increase exposure to scams if interface protections remain unchanged.

Phantom has announced plans to launch a new social feature called Phantom Chat in 2026. The update aims to transform the Solana wallet into a messaging and discussion hub.

Soon after the reveal, security concerns surfaced about unresolved wallet vulnerabilities. The warnings focus on address poisoning and the risk of user fund losses.

Phantom Chat feature raises address poisoning concerns

Wu Blockchain reported that Phantom unveiled Phantom Chat as part of its long-term product roadmap.

The wallet compared its vision to Telegram groups and X communities for crypto discussions. Mockup images showed emoji-based group chats designed for real-time interaction.

Phantom already introduced live chat features through its prediction markets integration with Kalshi in December 2025. The new roadmap suggests a broader move toward social tools inside the wallet. The platform currently serves more than 15 million users across its ecosystem.

On-chain investigator ZachXBT responded to the announcement, warning about unresolved address-poisoning risks. He stated that Phantom still does not filter spam transactions from user histories. This allows look-alike addresses to appear among legitimate transaction records.

According to ZachXBT, one user lost 3.5 WBTC last week after copying the wrong address from recent activity.

He traced the theft to a transaction created through spam records that mimicked the first characters of a trusted wallet address. He shared the wallet and transaction hashes publicly to document the incident.

Security risks emerge as Phantom expands wallet social tools

Address poisoning occurs when attackers send small transactions from deceptive addresses. These addresses resemble legitimate ones and appear in wallet histories. Users who copy them may unknowingly send funds to attackers.

ZachXBT argued that adding social features without fixing this issue could widen the attack surface.

He warned that chat-based activity could increase exposure to malicious links and fake addresses. His comments focused on user interface design rather than blockchain flaws.

Phantom’s announcement attracted heavy engagement from memecoin promoters and trading communities. Replies included promotional messages tied to new tokens and groups. This activity highlighted the potential for spam to blend with legitimate discussions.

Wu Blockchain noted that Phantom Chat positions the wallet as a crypto super app combining trading, social interaction, and market sentiment. The move follows a broader trend of wallets adding communication tools.

Security researchers have stressed that transaction filtering and address verification remain essential for user protection.

Crypto World

Ripple Expands Institutional Stack: Will XRP Price React?

Ripple has announced two new partnerships with Figment and Securosys to expand the capabilities of Ripple Custody, its institutional digital asset custody solution.

It is evident that Ripple is currently in an infrastructure arms race to perfect its payment, custody, and staking services for institutions. However, real-world adoption and price have yet to show signs of a breakthrough.

Sponsored

Sponsored

Ripple Expands Custody Offering With Figment and Securosys Partnerships

Ripple said the partnerships are designed to simplify procurement and support faster deployment of custody services for regulated institutions. The move comes shortly after Ripple expanded its custody stack through the acquisition of Palisade and the integration of Chainalysis’s compliance tools.

As part of the partnership with Figment, Ripple will introduce staking functionality. This will allow institutional clients to offer staking services without operating their own validator infrastructure.

The integration is aimed at banks, custodians, and regulated entities seeking exposure to Proof-of-Stake networks while maintaining institutional security and governance standards.

Through Figment’s infrastructure, Ripple Custody clients will be able to support staking on major networks such as Ethereum (ETH) and Solana (SOL).

“By combining Ripple’s enterprise‑grade custody technology with Figment’s secure, non‑custodial staking platform, we’re giving regulated institutions a way to offer staking rewards to their customers on several blockchain networks,” Ben Spiegelman, VP – Head of Partnerships & Corporate Development at Figment, stated.

Separately, Ripple has partnered with Securosys to strengthen the security layer of Ripple Custody. The collaboration adds support for CyberVault HSM and CloudHSM. This gives institutions the option to deploy HSM-based custody either on premises or in the cloud.

According to Ripple, the Securosys integration is designed to address long-standing challenges around HSM adoption. This includes cost, complexity, and slow procurement processes.

Sponsored

Sponsored

Ripple also noted that the addition of Securosys expands the range of supported HSM providers on its custody platform. This provides greater flexibility for institutions operating across multiple regulatory environments.

“By integrating our CyberVault HSM with Ripple Custody, institutions gain an out-of-the-box, enterprise-grade solution that can be deployed quickly, without added complexity, while retaining full control over their cryptographic keys,” Robert Rogenmoser, CEO of Securosys, remarked.

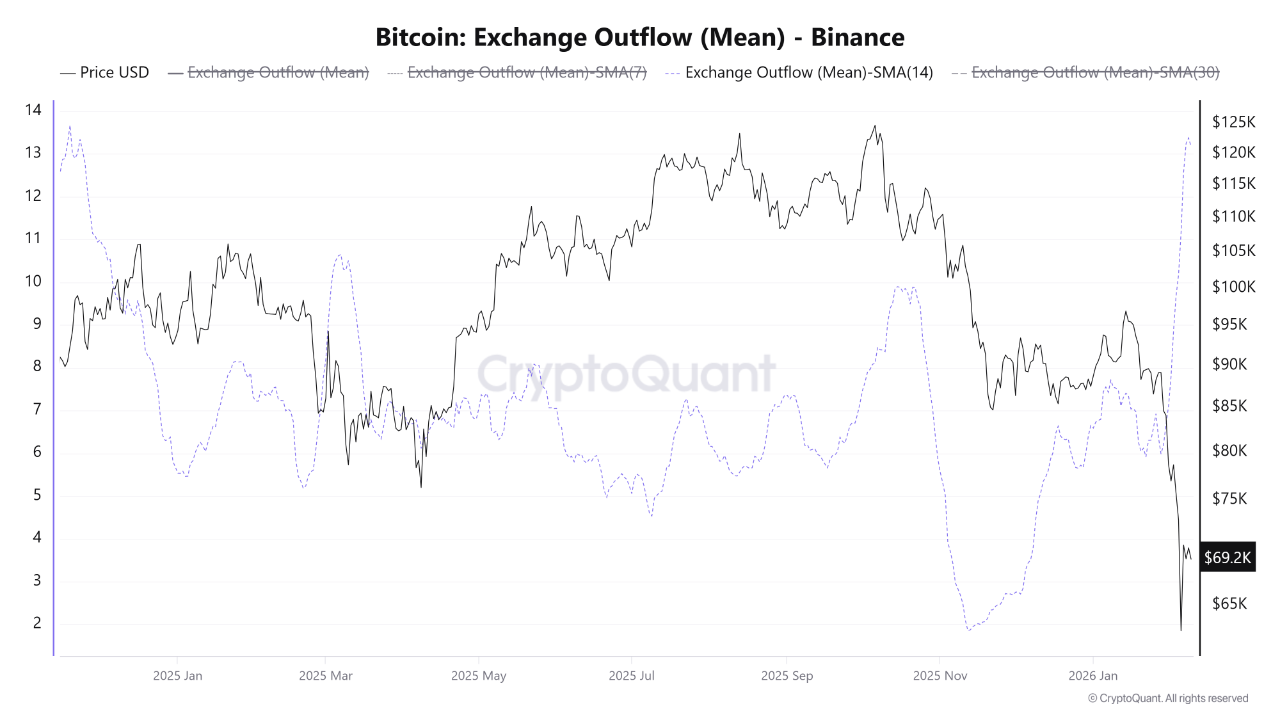

Institutional Focus Fails to Lift XRP as On-Chain Activity Cools

As Ripple continues to strengthen its institutional infrastructure, on-chain metrics from the XRP Ledger indicate that adoption remains moderate. According to data from DeFiLlama, XRPL’s total value locked declined from around $80 million in early January to approximately $49.6 million at press time, reflecting softer DeFi activity on the network.

Stablecoin data points to a similarly gradual pace. Based on DeFiLlama figures, the total stablecoin market capitalization on XRPL stands at roughly $415.85 million, suggesting steady but limited growth.

That said, much of Ripple’s institutional strategy is centered on custody, settlement, and permissioned financial use cases, which may not always be reflected in traditional DeFi metrics such as TVL.

Notably, so far, the expansion of institutional use cases has had a limited impact on XRP’s market performance.

The asset is down nearly 32% over the past month, broadly tracking the wider market downturn. At the time of writing, XRP was trading at $1.44, down 0.66% over the past day.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

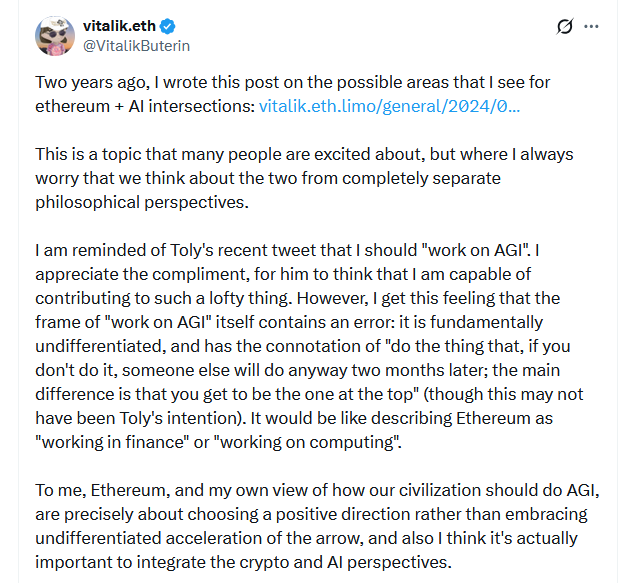

Ethereum co-founder Vitalik Buterin’s latest vision for Ethereum’s intersection with artificial intelligence sees the two working together to improve markets, financial safety and human agency.

In an X post on Monday, Buterin said his broader vision for the future of artificial intelligence (AI) sees humans being empowered by AI, rather than replaced, though he said the shorter term involves much more “ordinary” ideas.

Buterin pointed to four key areas where Ethereum and AI could intersect in the near future: enabling trustless and/or private interactions with AI, Ethereum becoming an economic layer for AI-to-AI interactions, using AI to fulfill the “mountain man” ideal by verifying everything onchain and improving market and governance efficiency.

Buterin argued that new tooling and integrations are required for AI use to be truly private, without leaking data or revealing personal identities.

Private data leaks by large language models (LLMs) have become an increasing area of concern since the rise of AI chatbots. Cointelegraph Magazine highlighted in an article last month that while ChatGPT can give you legal advice, your chat logs can be used against you in court.

He pointed to the need for tooling to support the use of LLMs locally on personal devices, utilizing zero-knowledge proofs to make API calls anonymously and improving cryptographic tech to verify work from AI, among other things.

Buterin also envisions AI becoming a user’s middleman to the blockchain, suggesting that AI agents could verify and audit every transaction, interact with decentralized apps and suggest transactions to users.

AI verification could be a major boon for crypto and other sectors, with increasingly sophisticated scammers on the rise. Address poisoning scams, just one attack vector, have seen a major uptick since December.

“Basically, take the vision that cypherpunk radicals have always dreamed of (don’t trust; verify everything), that has been nonviable in reality because humans are never actually going to verify all the code ourselves. Now, we can finally make that vision happen, with LLMs doing the hard part,” he said.

Adding to that, Buterin sees AI bots being able to “interact economically” to handle all onchain activity for users and make crypto much more accessible.

He said bots could be deployed to hire each other, handle API calls and make security deposits.

“Economies not for the sake of economies, but to enable more decentralized authority,” he said.

Related: Bitcoin miner Cango sells $305M BTC to cut leverage and fund AI pivot

Finally, Buterin thinks AI can enhance onchain governance and markets if LLMs are used to overcome the limits of human attention and decision-making capacity.

He said that while things like prediction markets and decentralized governance are “all beautiful in theory,” they are ultimately hampered by “limits to human attention and decision-making power.”

“LLMs remove that limitation, and massively scale human judgement. Hence, we can revisit all of those ideas,” he said.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

The Ethereum Foundation is sponsoring crypto security nonprofit Security Alliance (SEAL) to “track and neutralize” crypto drainers and other social engineering attackers targeting Ethereum users.

SEAL said on Monday that it launched the “Trillion Dollar Security” initiative with EF to support these efforts after reaching out to EF late last year about funding security engineers to more closely track drainer development and protect against wide-scale attacks.

The EF is now sponsoring a security engineer whose “sole mission” is to work with SEAL’s intelligence team to combat drainers targeting Ethereum users, said SEAL.

SEAL’s broader mission is to protect crypto market participants by providing collaborative tools for threat intelligence sharing and incident response while providing legal protection for its white-hat hackers.

“The Security Alliance has done important work to combat attacks and the ecosystem has benefited tremendously,” The Ethereum Foundation posted to X in response to SEAL’s announcement.

Phishing scammers and drainers often create fake websites or fraudulent emails that impersonate legitimate crypto protocols, tricking users into approving seemingly harmless wallet transactions that can result in the loss of funds.

Their tactics have become increasingly sophisticated over the years, prompting the need for improved detection and prevention mechanisms.

Crypto intelligence platform ScamSniffer estimates that these scammers have stolen nearly $1 billion in crypto over the years. However, efforts from SEAL and other crypto sleuths helped bring that tally down to $84 million in 2025, an all-time low.

Ethereum security dashboard launched to track progress

SEAL and the EF created a Trillion Dollar Security dashboard to track Ethereum’s security across six dimensions: user experience, smart contracts, infrastructure and cloud, consensus protocol, monitoring and incident response, social layer and governance.

Related: Crypto PACs secure massive war chests ahead of US midterms

Each dimension includes eight to 29 risk controls being closely monitored, along with identified “priority work” that must be addressed.

SEAL open to working with other crypto ecosystems

SEAL said the partnership with the EF is the first of many planned initiatives with other forward-thinking ecosystems, welcoming other crypto ecosystems to reach out:

“If your foundation or crypto ecosystem is interested in similar sponsorship opportunities, we’re happy to discuss how this model protects users at scale,” SEAL said.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Telegram Mini Apps Development on TON Network

Telegram is quietly transforming from a messaging app into a distribution platform for lightweight applications, games, and digital services. For enterprises watching user acquisition costs rise and app store competition intensify, Telegram mini apps represent a structural shift in how products reach audiences. The best part is that:

There are no installs

No app-store approvals

No onboarding friction

Therefore, users can conveniently access mini apps directly inside chats, often in one tap.

When combined with the TON blockchain, Telegram mini apps development can readily support payments, tokenized incentives, and ownership models, all inside a familiar interface. This is exactly the reason why these apps are no longer considered as experimental. They are becoming a serious growth channel.

To understand why, let’s examine some of the Telegram mini apps leading the TON ecosystem and what makes them successful from a business perspective.

Check Out TON Ecosystem’s Top 7 Telegram Mini Apps

1) Notcoin

Notcoin became one of the fastest-growing Telegram-native experiences by reducing gameplay to the simplest possible action that is just tapping. However, its success is not just about simplicity. Notcoin leveraged:

- Viral referral loops

- Social bragging rights

- Progress-based incentives

- Low cognitive load gameplay

It aligned perfectly with Telegram’s quick-interaction behavior. For businesses, the lesson is clear: Complex mechanics reduce adoption inside chat ecosystems.

2) Hamster Kombat

Hamster Kombat added humor, storytelling, and crypto rewards. It built a narrative-driven engagement model instead of just pure mechanics. It demonstrates that:

- Branding matters even in mini apps

- Identity-driven communities retain better

- Humor and culture drive sharing

For enterprises, this is a very clear indication that Telegram mini apps development can build brand affinity, not just usage. In this regard, if enterprises have a stricter time frame, they can launch a Hamster Combat clone script in just 7 days with the help of experts.

3) Catizen

Catizen combines community engagement with recurring reward cycles. It readily encourages habitual interaction. It proves that retention comes from:

- Community alignment

- Predictable reward schedules

- Social belonging

Hence, it is clear that Telegram mini apps can act as social ecosystems, not just tools. However, it is also possible to build a game like Catizen from scratch in 15 days when you seek the help of professional Telegram game developers.

4) Yescoin

Yescoin uses swipe-based interactions that feel natural in messaging contexts. Designing for Telegram means:

- One-handed interactions

- Short session times

- Instant feedback loops

This is worth noting here that it is UX strategy and not just design.

5) TapSwap

TapSwap introduced gamified token accumulation tied to user activity. Players respond strongly to visible progress and accumulation psychology. However, sustainability requires careful tokenomics, which happens to be a key lesson for enterprises planning to explore the field.

6) Tonkeeper Mini App Integrations

Wallet integrations like Tonkeeper show mini apps can deliver real financial utility. Utility apps build long-term value because they solve actual problems. It needs to be kept in mind that not every Telegram mini app needs to be a game. Financial tools and service apps are equally viable.

7) Fragment

Fragment enables buying and selling Telegram usernames and collectibles on TON. This shows Telegram mini apps can power real marketplaces with:

- Verified ownership

- Scarcity mechanics

- On-chain transactions

This is where mini apps cross into digital commerce infrastructure and opens up opportunities for businesses.

What Businesses Should Notice

The real takeaway for businesses is not the apps themselves. However, it is essential to note the patterns:

✔ Frictionless onboarding

✔ Native distribution

✔ Social virality

✔ Micro-session engagement

✔ Incentivized retention

✔ Integrated payments

Telegram mini apps succeed because they align with user behavior, not because they are Web3.

Want to Build Telegram Mini Apps in the TON Ecosystem?

Telegram Mini Apps & TON Ecosystem — By the Numbers

900M+ Monthly Active Users on Telegram

Telegram’s massive global user base gives mini-apps instant distribution without app-store dependency.

30%+ of Mobile Engagement Happens in Messaging Apps

Messaging platforms are now primary digital environments, making in-chat apps highly discoverable and frequently used.

120%+ Year-Over-Year Growth in TON Transactions

TON’s transaction growth reflects rising adoption and real economic activity across mini-apps and wallets.

Why TON Makes Telegram Mini Apps Viable

TON is not just a blockchain attached to Telegram; it is a purpose-built infrastructure designed to support high-frequency, low-friction digital interactions at scale.

For enterprises evaluating Telegram mini apps as business channels, the viability of the underlying blockchain is critical. Slow, expensive, or congested networks kill user experience quickly.

However, TON addresses this in several ways:

1. High Throughput for Micro-Transactions

Telegram mini apps often rely on small, frequent user actions, like reward claims, token distributions, in-app purchases, and micro-payments. TON’s architecture supports high transaction volumes with minimal latency, making it practical for real-time mini app interactions. For businesses, this ensures smoother user journeys and fewer drop-offs due to delays.

2. Low Transaction Costs

User-facing apps cannot survive on high gas fees. TON’s low-cost transaction model enables sustainable reward systems and micro-economies.

This is especially important for:

- Tap-to-earn models

- Reward distribution

- In-app asset transfers

- Marketplace transactions

Low fees allow businesses to experiment without burning capital on infrastructure costs.

3. Native Telegram Integration

TON is tightly aligned with Telegram’s ecosystem. Wallets, usernames, and mini app interactions can be linked seamlessly. This, in turn, reduces onboarding friction, which happens to be one of the biggest barriers in Web3 adoption. Here users do not feel like they are “entering crypto.” They simply feel like they are using a feature. For enterprises, this means faster adoption and lower user education costs.

4. Scalable Architecture

TON’s sharding design enables horizontal scalability. As user demand grows, the network can handle more load without congestion spikes. This matters because Telegram mini apps can scale rapidly overnight. A viral app can jump from thousands to millions of users quickly. Infrastructure that cannot scale becomes a liability.

5. Built-In Asset Logic

TON supports token creation, NFTs, and digital asset management natively. This allows businesses to design reward systems and ownership layers without building custom infrastructure from scratch. This shortens Telegram mini app development timelines and reduces technical risk.

Business Benefits for Early Movers

Timing plays a major role in emerging ecosystems. Telegram mini apps are still in a growth phase, which creates strategic advantages for early entrants.

1. Lower Competition for Attention

As the ecosystem matures, user attention becomes expensive. Early movers benefit from less crowded discovery environments and higher visibility.

This translates to:

- Faster user acquisition

- Lower marketing spend

- Higher organic reach

2. First Access to Community Loyalty

Users who adopt early platforms often develop stronger loyalty. They associate their early experiences with the brand or ecosystem that introduced them.

For businesses, this creates:

- Long-term retention

- Stronger community identity

- Higher lifetime value per user

3. Data & Learning Advantage

Early projects gain valuable behavioral data, such as what works, what retains users, what monetizes. Late entrants must rely on assumptions. Early movers rely on insights. This data advantage compounds over time.

4. Partnership & Ecosystem Opportunities

Early builders often secure stronger partnerships within the ecosystem, like wallets, marketplaces, other mini apps, and cross-promotions. Once the space matures, these partnerships become harder to secure.

5. Category Leadership Positioning

Brands that enter early often become synonymous with the category itself. This positioning is hard to replicate later. Being “one of the first” often leads to being “one of the biggest.”

Wish to Explore the Benefits of Launching Telegram Mini Apps in the TON Ecosystem?

The Hidden Complexity

From the outside, Telegram mini apps appear lightweight. However, building scalable, secure, and sustainable mini apps requires serious engineering. This is where a number of projects tend to fail.

1. Backend Infrastructure

Mini apps still require reliable servers, databases, and APIs. Handling spikes in user activity requires cloud architecture that can auto-scale. Without this, apps crash during viral growth.

2. TON Smart Contract Design

Smart contracts must be secure and efficient. Poorly designed contracts can lead to exploits, fund loss, or frozen assets. Auditing and optimization are critical.

3. Tokenomics & Reward Logic

Designing reward systems that retain users without inflating value is complex. Many mini apps fail because their token economies collapse. Economic modeling is not optional, it’s foundational.

4. Anti-Bot & Anti-Exploit Systems

Tap-to-earn and reward-based systems attract bots. Without anti-abuse mechanisms, economies break quickly. Enterprises must invest in fraud detection and behavioral monitoring.

5. UX Simplicity with Technical Depth

Mini apps must feel simple while hiding complex infrastructure. Balancing UX and blockchain logic during Telegram mini apps development is a design challenge. Users expect instant responses and zero friction.

6. Security & Compliance

Handling wallets and digital assets introduces security responsibilities. Enterprises must consider:

- Smart contract audits

- Secure wallet flows

- Regulatory awareness

Security lapses destroy trust very quickly.

Strategic Takeaway

Telegram mini apps might look easy to build. However, they are not easy to scale or sustain. The difference between a viral hit and a short-lived experiment often lies in architecture, economy design, and security readiness. This is exactly the reason why experienced Telegram mini app developers matter.

Why the Right Development Partner Matters

Successful Telegram mini apps blend:

- UX design

- Game psychology

- Blockchain logic

- Infrastructure scalability

- Economic modeling

This is multidisciplinary and a capable Telegram game development company rightly understands how these layers interact.

Antier works with startups and enterprises to build Telegram mini apps and TON-powered games that are designed for real adoption. This includes:

- Mini game design

- TON smart contract development

- Token and reward systems

- Scalable architecture

- Security-first development

It is to be kept in mind that in Telegram ecosystems, scale can happen overnight and only well-architected systems survive rapid growth.

Final Thoughts

Telegram mini apps are evolving into a major distribution channel where gaming, finance, and community intersect. They reduce friction, shorten adoption cycles, and enable creative monetization. The opportunity is real. However, success depends on execution. Businesses entering the field now are not chasing trends. Their focus is on positioning themselves in a new app ecosystem forming inside Telegram. Antier, with its sheer level of expertise as a Telegram game development company, helps businesses build scalable mini apps that not only sustain but also deliver the intended results.

Frequently Asked Questions

01. What are Telegram mini apps and how do they differ from traditional apps?

Telegram mini apps are lightweight applications that can be accessed directly within chats without the need for installations, app-store approvals, or onboarding friction, making them more convenient for users.

02. How do Telegram mini apps leverage the TON blockchain?

Telegram mini apps can utilize the TON blockchain to support payments, tokenized incentives, and ownership models, all within the familiar Telegram interface, enhancing user engagement and monetization.

03. What are some key factors that contribute to the success of Telegram mini apps?

Successful Telegram mini apps often incorporate elements like simplicity in gameplay, community engagement, branding, humor, and predictable reward systems, which align with user behavior and enhance retention.

Crypto World

The Role of AI Chatbots in Modern HR Process Automation

Human Resources has evolved from an administrative function into a strategic driver of organizational performance. Yet, despite this shift, many HR teams remain burdened by manual processes, fragmented systems, and reactive workflows that do not scale with modern workforce demands. As organizations grow across geographies, compliance frameworks, and talent models, the complexity of HR operations increases exponentially. Traditional HR automation tools, built on rigid workflows and static portals, fail to deliver the responsiveness and intelligence required today.

This is where AI chatbots in HR are redefining how organizations automate, scale, and modernize HR operations. By partnering with an experienced AI Chatbot Development Company, enterprises can implement conversational interfaces powered by artificial intelligence to unlock a new era of HR process automation – one that is proactive, context-aware, and deeply integrated into core business systems.

The Limitations of Traditional HR Automation Systems

Before understanding the impact of AI chatbots, it is critical to examine why legacy HR automation approaches fall short.

Key Challenges in Traditional HR Operations

- HR systems operate in silos (HRMS, ATS, payroll, compliance tools)

- Employees struggle to navigate complex portals for simple queries

- Most HR workflows rely on email-based approvals

- Policy interpretation remains manual and inconsistent

- HR teams spend the majority of their time on repetitive support tasks

Despite digitization, HR remains process-heavy but intelligence-light. Automation exists, but decision-making and interpretation still require human intervention. This operational gap has created the need for HR automation using AI, where systems can understand, decide, and act without constant manual oversight.

How AI Chatbots Enable HR Workflow Automation at Enterprise Scale

Unlike traditional rule-based systems that rely on fixed keywords, modern AI chatbots are built to understand how employees naturally communicate. Powered by advanced language intelligence and enterprise integrations, they play an active role in automating HR operations rather than simply responding to queries.

Key Differentiators of AI Chatbots in HR

- Intent-based understanding, not keyword matching

AI chatbots use Natural Language Processing to accurately interpret employee intent even when questions are informal, incomplete, or phrased differently. - Context-aware conversations

By retaining conversation history and employee context such as role, location, and policy eligibility, chatbots deliver consistent and personalized responses without repetition. - Direct integration with HR systems

AI chatbots connect seamlessly with HRMS, payroll, ATS, and compliance platforms to retrieve real-time data and perform actions securely. - Built-in workflow execution

Beyond answering questions, chatbots can initiate and complete HR workflows, including leave applications, approvals, and record updates. - Active participation in HR operations

These capabilities allow AI chatbots to move beyond static FAQs and function as intelligent, action-driven components of end-to-end HR process automation.

Together, these capabilities form the intelligence layer that differentiates AI-powered HR solutions from traditional, rule-based HR software.

AI Chatbots for Employee Self-Service: Redefining HR Accessibility

One of the most impactful and widely adopted use cases of AI chatbots in HR is employee self-service automation. As organizations scale, HR teams are increasingly overwhelmed by repetitive, high-volume queries that do not require human intervention but still consume significant time and resources.

The Employee Experience Challenge

Employees regularly reach out to HR for routine requests such as:

- Leave balances and approval status

- HR policy explanations and clarifications

- Payroll and salary-related questions

- Benefits eligibility and coverage details

- Tax documents and compliance information

While these queries are essential, they are largely repetitive and manual, leading to slower response times, employee frustration, and reduced HR productivity.

How AI Chatbots Enable Self-Service at Scale

When integrated with core HRMS and payroll systems, AI chatbots for employee self-service can:

- Securely authenticate employees

- Retrieve real-time, role-specific HR data

- Interpret policies contextually based on eligibility

- Deliver instant, conversational responses

This approach significantly reduces dependency on HR support tickets while ensuring employees receive accurate, consistent, and timely information—anytime they need it.

HR Workflow Automation Using AI Chatbots

The true power of AI chatbots lies in their ability to execute HR workflows, not just provide information.

Examples of Automated HR Workflows

- Leave requests and approvals

- Attendance regularization

- Shift and roster management

- Policy acknowledgment tracking

- Employee exit and clearance processes

How Workflow Automation Works

Instead of navigating forms or sending emails, employees interact naturally:

Employee: “Apply for three days of leave starting Monday.”

AI Chatbot:

- Validates leave balance

- Checks policy rules

- Routes approval to the manager

- Updates HRMS automatically

This is HR workflow automation driven by conversation, fast, accurate, and scalable.

AI Chatbots for Recruitment: Automating Talent Acquisition at Scale

Recruitment is one of the most resource-intensive HR functions, making it an ideal candidate for automation.

AI Chatbots for Recruitment and Candidate Engagement

AI chatbots assist recruitment teams by:

- Engaging candidates 24/7

- Answering role-specific queries

- Screening candidates based on predefined criteria

- Scheduling interviews automatically

- Sending follow-ups and reminders

This improves both recruiter efficiency and candidate experience.

Intelligent Candidate Screening

Chatbots can evaluate:

- Skill relevance

- Experience thresholds

- Availability and location preferences

- Role alignment

By automating early-stage screening, recruiters focus on high-quality candidates instead of manual filtering.

AI Chatbots for Onboarding: Accelerating Time-to-Productivity

Once a candidate is hired, onboarding becomes the next critical HR challenge.

How AI Chatbots Improve Onboarding

AI chatbots guide new employees through:

- Document submission and verification

- Policy walkthroughs

- IT and access requests

- Training module assignments

- First-week task coordination

This structured, guided onboarding experience improves retention, engagement, and early productivity.

Payroll and HR Compliance Automation with AI Chatbots

Payroll and compliance processes involve high risk, strict regulations, and minimal tolerance for errors.

1. Payroll Automation Use Cases

AI chatbots can:

- Explain salary structures

- Break down tax deductions

- Track reimbursements

- Answer bonus and incentive queries

2. HR Compliance Automation

Chatbots assist with:

- Labor law interpretation

- Location-specific compliance rules

- Policy enforcement consistency

- Audit-ready interaction logs

This enables payroll and HR compliance automation with reduced manual dependency and lower risk exposure.

AI Chatbots for Internal HR Support and Knowledge Management

HR knowledge often exists in scattered formats, such as PDFs, intranets, shared drives, and emails.

Centralized HR Knowledge Access

AI chatbots for internal HR support act as a unified interface that:

- Retrieves policy documents instantly

- Interprets complex policy queries

- Escalates sensitive issues appropriately

- Provides role-specific guidance to managers and employees

This transforms HR from a reactive support function into a structured, intelligent service layer.

Enterprise Architecture for AI-Powered HR Solutions

Enterprise-grade HR chatbots require a robust technical foundation.

Key Components:

- Conversational AI and LLMs

- Secure HR data retrieval (RAG pipelines)

- HRMS, ATS, and payroll integrations

- Workflow orchestration engines

- Role-based access control (RBAC)

- Compliance logging and audit trails

Because of this complexity, most enterprises partner with an experienced AI Chatbot Development Company to design, build, and maintain these systems.

Data Privacy, Security, and Compliance Considerations

HR data includes sensitive personal and financial information. Any AI-driven HR system must prioritize security.

Best Practices

- End-to-end data encryption

- On-premises or private cloud deployment

- Zero data retention for AI models

- Access control by role and hierarchy

- Compliance with GDPR and regional labor laws

Without these safeguards, HR automation introduces operational risk.

The New Standard for HR Operations

As workforce structures grow more complex and distributed, organizations must move beyond basic digitization and embrace intelligent, AI-driven automation. AI chatbots are no longer optional add-ons; they are becoming the backbone of modern HR operations and a core component of enterprise HR workflow automation solutions. By enabling employee self-service, automating recruitment and onboarding, streamlining payroll and compliance, and strengthening internal HR support, AI chatbots deliver faster execution, consistent governance, and significantly improved employee experiences. The future of HR belongs to organizations that invest early in scalable, secure, and AI-powered HR solutions, setting new benchmarks for efficiency, agility, and workforce engagement.

Antier empowers enterprises to build next-gen AI-driven HR ecosystems as a trusted AI Chatbot Development Company, delivering secure, enterprise-grade chatbot solutions tailored for complex HR environments. With deep expertise in AI, automation, and system integration, Antier helps organizations transform HR into a strategic, future-ready function.

Frequently Asked Questions

01. How have HR operations evolved in recent years?

HR operations have shifted from being purely administrative to becoming a strategic driver of organizational performance, although many teams still face challenges with manual processes and fragmented systems.

02. What are the limitations of traditional HR automation systems?

Traditional HR automation systems often operate in silos, require manual intervention for decision-making, and rely on outdated workflows, making them less responsive to modern workforce demands.

03. How do AI chatbots improve HR workflow automation?

AI chatbots enhance HR workflow automation by using Natural Language Processing to understand employee intent, enabling proactive and context-aware interactions that streamline HR operations.

Crypto World

Polymarket sues Massachusetts over prediction market rules

Polymarket has taken legal action against Massachusetts officials, seeking to block the state from restricting its prediction markets.

Summary

- Polymarket sued Massachusetts officials after a court ruling against rival Kalshi.

- The platform says federal CFTC rules override state gambling laws.

- The case could shape how prediction markets operate across the U.S.

The move comes as U.S. regulators and courts step up scrutiny of platforms that allow users to trade on real-world events, especially in sports.

On Feb. 10, Polymarket filed a lawsuit in federal court against Massachusetts Attorney General Andrea Campbell and state gaming regulators. The company said the threat of enforcement is “immediate and concrete,” following a recent ruling against rival platform Kalshi.

According to Polymarket, state intervention would disrupt its national operations, fragment its user base, and force it to choose between federal compliance and state restrictions. The company argues that its markets fall under federal oversight and should not be treated as local gambling products.

Federal authority vs. state gambling laws

At the center of the case is a dispute over who has the right to regulate prediction markets.

Polymarket says its event contracts are governed by the Commodity Futures Trading Commission. Under federal law, the CFTC oversees derivatives and futures markets, including certain types of prediction products. The company claims this authority overrides state-level gambling rules.

In its complaint, Polymarket pointed to comments made on Jan. 29 by CFTC Chairman Michael Selig, who said the agency would re-assess how it handles cases testing its jurisdiction. Shortly after, the CFTC filed an amicus brief in a related lawsuit involving Crypto.com.

Massachusetts courts have taken a different view. Last week, a state judge refused to pause a ban on Kalshi’s sports contracts, ruling that the platform must follow state gaming laws. The judge said Congress did not intend federal regulation to replace traditional state powers over gambling.

Kalshi has appealed the decision but was denied a stay. The ruling requires the company to block Massachusetts users from sports markets within 30 days.A federal judge in Nevada also recently denied Coinbase’s request for protection from a similar enforcement action, adding to the legal pressure on prediction platforms.

Robinhood, which partners with Kalshi, is now seeking its own injunction in Massachusetts to avoid state licensing requirements.

Growing pressure on prediction platforms

Polymarket’s lawsuit reflects wider tensions between fast-growing prediction markets and state regulators.

In a statement posted on social media, Polymarket chief legal officer Neal Kumar said the company is fighting “for the users.” He argued that state officials are racing to shut down innovation and ignoring federal law.

He added that Massachusetts and Nevada risk missing an opportunity to support new market models that blend finance, data, and public forecasting. State officials have so far declined to comment on the lawsuit.

The case arrives as prediction markets gain mainstream attention. Jump Trading recently made investments in Polymarket and Kalshi, two platforms that have garnered institutional support. According to recent funding rounds, Polymarket is valued at approximately $9 billion.

Supporters claim that by enabling users to trade on economic, sports, and election data, these markets enhance price discovery and public insight. Many contracts, according to critics, resemble unlicensed gambling and may put users at risk.

If Polymarket succeeds, it could limit the ability of states to regulate prediction markets and strengthen the CFTC’s role nationwide. A loss, however, may encourage more states to impose licensing rules or bans.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat9 hours ago

NewsBeat9 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat20 hours ago

NewsBeat20 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports9 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report