Crypto World

Bitcoin crash risk? Kevin O’Leary flags growing quantum fears

Bitcoin has plunged nearly 50% from its all-time highs, but investor and entrepreneur Kevin O’Leary says the real story goes far beyond price action.

Summary

- Kevin O’Leary remains long Bitcoin but says institutions are increasingly cautious, limiting allocations to around 3% amid concerns over quantum computing risks.

- Bitcoin’s latest 50% correction has reinforced institutional selectivity, with capital concentrating mainly in Bitcoin and Ethereum while smaller tokens continue to be sidelined.

- Technical indicators remain weak, with Bitcoin consolidating near $68,000 as selling pressure persists and key support at $65,000–$60,000 remains in focus.

In a recent post, O’Leary argued that while sharp drawdowns are nothing new for Bitcoin (BTC), institutional behavior is evolving and a new technological threat is entering the conversation: quantum computing.

“Bitcoin just took another brutal correction… but something bigger is happening underneath,” O’Leary wrote. He pointed to the October market meltdown, when Bitcoin tumbled and much of the broader crypto market collapsed 80–90%, with many tokens never recovering.

According to O’Leary, institutions have since become more selective.

“If you want 90% of the upside and volatility in crypto, you only need Bitcoin and Ethereum,” he said, dismissing smaller tokens as “worthless” in the eyes of large capital allocators.

O’Leary maintains he is still long Bitcoin. However, he says institutional investors are hesitating due to rising concerns that future quantum computers could theoretically break cryptographic security underpinning blockchain networks. While such a threat remains speculative and likely years away, he argues it is enough to cap institutional exposure at around 3% allocations until there is greater clarity.

“They’ll stay cautious, they’ll stay disciplined, and they’ll wait,” O’Leary noted, suggesting the next major leg higher may depend as much on technological reassurance as macro conditions.

Bitcoin price analysis: Weak momentum, key levels in focus

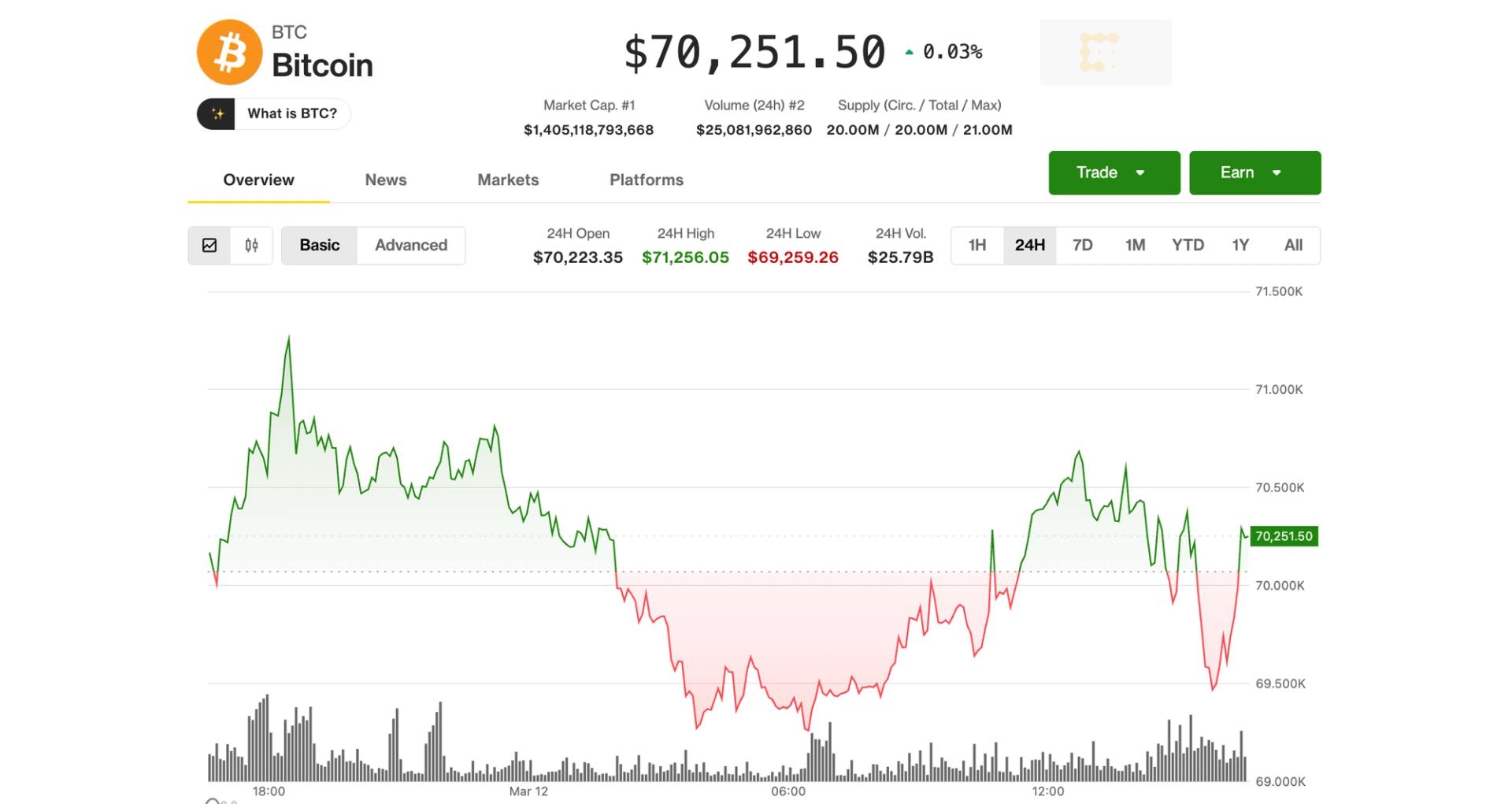

Meanwhile, the daily BTC/USDT chart shows Bitcoin trading around $68,100 after a sharp cascade from the mid-$90,000 region earlier this year.

A capitulation wick near the $60,000 zone marked a local bottom, followed by a modest relief bounce. However, price action has since stalled, moving sideways just below the $70,000 psychological level.

The Balance of Power indicator sits at -0.58, signaling sellers retain short-term control. Meanwhile, the Chaikin Money Flow (20) remains slightly negative at -0.06, indicating weak capital inflows and a lack of strong accumulation.

Immediate resistance lies near $70,000–$72,000, where recent candles have repeatedly rejected upside attempts. A break above that zone could open the door toward $75,000.

On the downside, $65,000 stands as initial support, with the $60,000 capitulation low acting as a critical structural floor. A loss of that level would likely intensify bearish pressure.

Crypto World

Bitcoin for Corporations Returns to the Bitcoin Conference

Against this backdrop, Bitcoin 2026 — now expected to surpass 40,000 attendees — is the definitive gathering for anyone serious about the future of money. With 500+ speakers, multiple world-class stages, and programming spanning Bitcoin fundamentals, enterprise adoption, mining, energy, AI, policy, and culture, the conference brings every corner of the Bitcoin ecosystem together under one roof. The BFC Symposium anchors the institutional conversation at the center of that ecosystem.

Crypto World

Optimism Developer Op Labs Cuts 20% of Staff in Effeciency Push

Op Labs’ CEO said the move was not about finances, and that the firm has “years of runway.”

The development company behind Ethereum Layer 2 network Optimism has laid off 20 employees — what appears to be approximately 20% of its team. The news was announced by OP Labs CEO and Optimism co-founder Jing Wang in an X post today, March 12, and included a screenshot of an internal Slack message Wang had sent to staff earlier in the day.

“This decision reflects a narrowing of our focus, not our runway,” Wang wrote on X.

In a Slack message to what appears to be Op Labs’ 102 employees, Wang said that the decision is “not about finances” but rather about “doing fewer things well, making decisions faster, and reducing coordination overhead.”

Op Labs’ CEO also noted in the Slack messaged that OP Labs “is well capitalized with years of runway.”

The OP token fell slightly on the news, down 2.4% in the past 24 hours, per The Defiant’s price page, while the broader market is flat today.

Last month, Coinbase’s Base — which was reportedly contributing an estimated 97% of Superchain revenue — announced it was departing the OP Stack for a self-managed codebase, sending OP down 26% in a single day. Wang acknowledged the blow but said evolving the business model was overdue.

On the product side, Optimism launched OP Enterprise in January and also passed a governance vote to direct 50% of Superchain revenue toward OP token buybacks.

This article was written with the assistance of AI workflows. All our stories are curated, edited and fact-checked by a human.

Crypto World

BTC showing safe-haven signs, holding up as stocks tumble on macro fears

Safe-haven asset?

The action is volatile, but bitcoin for the moment is continuing to hold just above the $70,000 even as other risk assets sell off across the board.

Helping to send stocks lower, crude oil prices are up more than 10% and nearing $100 per barrel amid concerns about the Hormuz Strait — a key shipping route for oil tankers.

“Stopping Iran is of more concern to me than oil prices,” said President Trump on Thursday. Meanwhile, in his first public statement since being appointed Iran’s supreme leader, Mojtaba Khamenei said the Strait of Hormuz should remain closed.

“It’s becoming clear to everyone that the Strait is far from under control and potentially impossible to control without severe concessions to Iran, boots on the ground, or huge military risks,” said Quinn Thompson, founder of Lekker Capital. “Things get dicey from here and when backs are up against the wall, volatility increases.”

Nearing the noon hour on the east coast, the Nasdaq is near session lows, down 1.6% and S&P 500 is off 1.2%.

Wiped from the front pages thanks to Iran, but still of major concern are continuing worries about a collapse in private credit. Morgan Stanley (MS) was the latest in a growing series of financial giants to cap redemptions — this one at its $8 billion North Haven Private Income Fund. Shares of Morgan Stanley were down 4% on Thursday, leading declines in the financial sector. JPMorgan, Citigroup, and Wells Fargo were lower by closer to 3%.

In private equity, KKR, Apollo Global, and Ares Management were all sporting 3% to 4% declines.

Gold, meanwhile, was down 0.6% and the 10-year U.S. Treasury yield was higher by three basis points to 4.23%.

Oil drives markets

Oil has become the main driver of crypto prices, according to CoinShares’ head of research, James Butterfill. “The dominant variable in global asset pricing is no longer the labour market. It is oil — and the geopolitical crisis underpinning it,” he said in a note. He argued that the government’s most recent U.S. payroll report, which missed expectations, would’ve normally pushed markets to price in faster rate cuts by the Federal Reserve, but the reaction was muted as investors instead focused on rising energy costs tied to the conflict in the Middle East.

Despite the pullback on Thursday, bitcoin has remained relatively resilient despite rising geopolitical tensions and broader market uncertainty, holding near the $70,000 level even as investors reassess global risks.

The reason could be that large investors are increasingly seeking more than simple exposure to bitcoin’s price, according to Dom Harz, co-founder of layer-2 blockchain BOB. “Institutions want more than exposure to bitcoin and are increasingly looking for the infrastructure designed to unlock Bitcoin’s financial utility,” he wrote in a note, pointing to growing interest in bitcoin-based financial applications that could allow users to spend, save and earn using the network.

Crypto World

Ethereum price forecast: bulls hold $2K support amid CEX outflows

- Ethereum price hovered just above $2,000 as whales moved ETH off exchanges.

- Large holder activity sees Ethereum exchange balances fall by over 74,000 ETH this week.

- Bulls could eye $2,188 and potentially $2,600 amid a technical breakout.

Ethereum’s price is holding near the $2,000 level, with bulls eyeing fresh moves above what many analysts see as a crucial psychological level.

The top altcoin traded within a tight range on Thursday, as Bitcoin showed resilience near $70,000.

However, ETH could test recent highs above the level, with whales signaling fresh confidence through notable exchange withdrawals.

ETH whales move coins off exchanges

Details shared by the smartmoney on-chain platform Lookonchain on March 12 indicate that Ethereum whale activity is picking up new momentum.

The Lookonchain X account spotlighted two of these large holder moves, with a newly created wallet address withdrawing 11,629 ETH worth about $23.7 million from Binance.

This transfer is critical as fresh wallets signal new entrants positioning for long-term appreciation.

Notably, Lookonchain also spotted a 63,324 ETH transfer by the whale address 0x8E34. According to the details, this bullish move, worth about $131.2 million, was from the crypto exchange Kraken.

Whales are buying $ETH!

Someone created a new wallet (0xfDe8) and has withdrawn 11,629 $ETH($23.71M) from #Binance in the past 2 days.

Earlier, we also reported that whale 0x8E34 withdrew 63,324 $ETH($131.2M) from #Kraken in the past 2 days.https://t.co/c0fmBE42N6… pic.twitter.com/ro8ikqlk4l

— Lookonchain (@lookonchain) March 12, 2026

What does this mean?

Whale activity had recently subsided as bears threatened to annihilate bulls amid the Iran war.

However, with analysts projecting a likely scenario where crypto rallies in the coming months, exchange outflows are on the rise again.

The two whales have, for instance, moved over 74,950 ETH worth roughly $155 million from centralised exchanges.

Such large-scale shifts can reduce sell-side pressure as fewer coins are available on CEXs compared to historical averages. This relates to an indicator called the scarcity index, which, as the data shows, has shifted positively.

The upbeat outlook for the altcoin comes as Ethereum spot exchange-traded funds recorded a second consecutive day of net inflows with over $57 million on March 11, 2026.

Net inflows increased from $12.6 million on Tuesday, ending a three-day outflow streak.

US spot ETH ETFs are also on track for another week of positive flows, with ETH price holding near the $2,000 level through this period.

Ethereum price analysis

Bulls have struggled since losing the $3,000 mark earlier in the year, and at current levels, hover about 30% down year-to-date.

Macro and geopolitical headwinds have largely allowed bears to dominate. If BTC sinks amid the Iran war sentiment, Ethereum would likely plummet alongside it.

Yet, despite overall sentiment, prices have held within the $1,800-$2,100 range in recent weeks, and $2,000 has emerged as a key short-term pivot mark.

ETH presents a bullish outlook amid its consolidation around this level, with on-chain metrics such as stablecoin inflows, ETFs, and declining exchange reserves pointing to a potential uptick.

Meanwhile, technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence strengthen this perspective.

The daily chart shows the RSI hovers near 50, neutral but trending upward. The MACD boasts a bullish outlook with the histogram bars green and expanding.

If prices climb to the channel resistance, bulls may test the 50-day moving average at $2,188. The 100-day moving average provides a dynamic supply wall just above $2,600.

However, the moving averages are trending lower. A close below $1,950 might allow for a bearish retest of $1,800 and potentially YTD lows of $1,740.

ETH changed hands at around $2,057 at the time of writing.

Crypto World

Pump.fun Is Solana First $1B Revenue App: Expansion to Ethereum Incoming

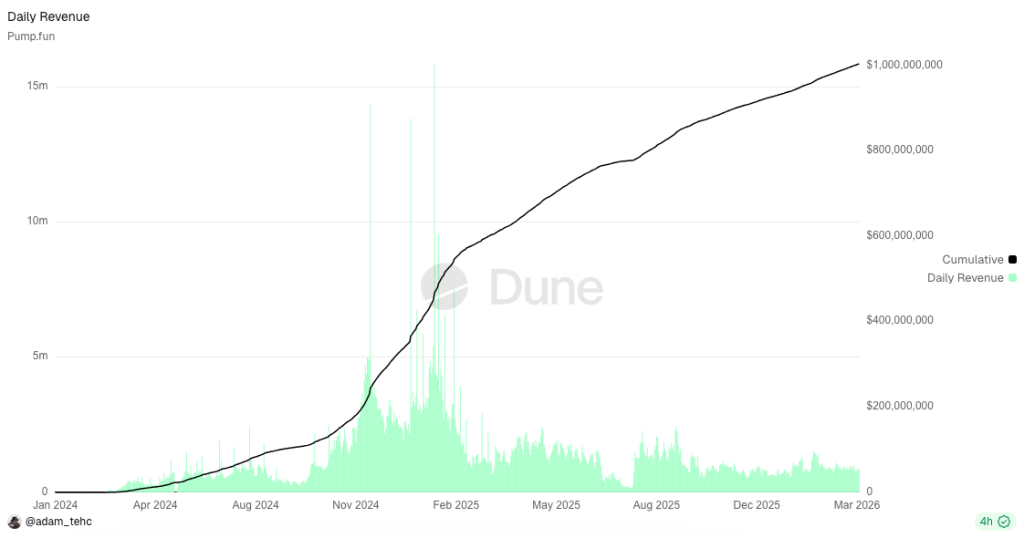

Pump.fun has officially generated over $1 billion in cumulative revenue, becoming the first application in Solana history to cross the ten-figure milestone.

The viral memecoin launchpad, which pioneered the bonding curve model to deter rug pulls, has now outpaced nearly every DeFi protocol in crypto by fee generation.

But the revenue record is already secondary to a potentially larger shift. Subdomain registrations for ethereum.pump.fun, base.pump.fun, and monad.pump.fun have been identified on-chain, signaling that an aggressive cross-chain expansion is imminent.

Since its launch on January 19, 2024, Pump.fun has facilitated the creation of around 12 million tokens. At the height of the memecoin frenzy in late 2024, the platform accounted for approximately 62% of all daily transactions on the Solana network.

The platform’s revenue engine is relentless. By April 2025, total fees hit 1.52 million SOL. Daily revenue consistently hovers around $1 million. This volume has made Pump.fun the de facto ‘Solana revenue’ driver, overshadowing legacy DeFi applications.

However, the metrics also reveal the extreme volatility of the product. Data suggests 98.5% of tokens launched on the platform fail to complete their bonding curve, effectively going to zero. Despite this, user retention remains high, with lifetime unique users exceeding 22 million.

Discover: The next crypto to explode

What the Subdomain Registrations Actually Reveal About Pump.fun’s Next Move

The discovery of formatted subdomains for Ethereum, Base, and Monad is not a definitive roadmap, but it is a strong signal of intent.

Expansion to the Base network represents the most logical immediate step. Base has cultivated a thriving retail user base similar to Solana’s, but currently lacks a single dominant launchpad with Pump.fun’s brand recognition.

A successful deployment here would unify the fractured memecoin liquidity currently spread across smaller forks.

The Ethereum subdomain points to a different strategy. While high gas fees historically deterred memecoin trading on mainnet, Wall Street is choosing Ethereum as the backbone of institutional DeFi, which could allow Pump.fun to tap into deeper capital markets.

How Pump.fun Expanding From Solana to Ethereum and Base Changes the Launchpad Wars

If Pump.fun successfully ports its UI and bonding curve mechanics to EVM chains, it instantly threatens native competitors.

On Base, protocols like Clanker have gained traction, but they lack the massive war chest, fueled by $1.3 billion in ICO and private funding, that Pump.fun now commands.

Security remains the primary wildcard in this expansion. The memecoin launchpad sector is notoriously fragile.

Recently, the Bonk.fun website was hijacked by a malicious actor, draining user wallets and highlighting the risks inherent in these high-velocity platforms. Expanding to new chains multiplies these attack vectors significantly.

If Pump.fun can maintain security while deploying on multiple chains, it effectively universalizes the ‘launchpad’ experience, turning it into a chain-agnostic utility rather than a feature exclusive to Solana.

Discover: The best crypto to buy now

The post Pump.fun Is Solana First $1B Revenue App: Expansion to Ethereum Incoming appeared first on Cryptonews.

Crypto World

Lido Launches Its First Stablecoin Vault

The new product, EarnUSD, lets users earn yield on their USDC and USDT.

Lido, DeFi’s largest liquid staking protocol by total value locked, has launched EarnUSD, its first stablecoin vault, according to a press release shared with The Defiant.

The new product lets users deposit and earn yield on USDC and USDT. The vault allocates capital automatically across Ethereum-based USD-denominated strategies, including on-chain lending markets, real-world asset (RWA) integrations, and structured positions, per the release.

The move marks a broader focus for the protocol, which is known for being the largest ETH staking provider, with over 8.7 million ETH currently staked.

The launch restructures Lido Earn — which the firm says has attracted almost $250 million in deposits since launching in September 2025 — into two vaults: EarnETH and EarnUSD.

EarnETH, meanwhile, accepts ETH, WETH, and stETH, and distributes deposits across major DeFi protocols including Aave, Uniswap, and Morpho.

The launch of Lido’s stablecoin vault comes as stablecoin supply on Ethereum holds out over $160 billion, per data from DefiLlama. This represents over half over total USD stablecoin supply across all networks, currently at $314.9 billion.

Regulatory momentum — namely the GENIUS Act in the U.S.— has helped drive growth in the sector over the past year.

“Stablecoins are a fundamental part of DeFi, and until now we weren’t serving those users,” said Marin Tvrdić, Earn Partnerships at the Lido Ecosystem Foundation. “That changes today with EarnUSD.”

As part of the launch, the Lido DAO has voted to allocate $5 million from its treasury into the vaults alongside users, on the same terms. If a vault suffers losses, the DAO’s position absorbs them first, according to the release.

The move follows a DAO proposal from December that outlined a $60 million budget to expand Lido’s product offering beyond liquid staking, as reported by The Defiant.

Lido currently holds around $19 billion in TVL, according to DefiLlama, making it the largest liquid staking protocol in DeFi. The vast majority of its TVL is on Ethereum.

Lido’s TVL is down over 50% from its all-time high of over $42 billion reached last August amid ETH’s rally to a new all-time high, and increased regulatory clarity.

This article was written with the assistance of AI workflows. All our stories are curated, edited and fact-checked by a human.

Crypto World

Eightco Holdings (ORBS) Stock Rallies 22% Following $125M Investment from Major Institutions

Key Highlights

- On March 12, 2026, Eightco Holdings (ORBS) announced $125 million in fresh institutional funding commitments.

- Bitmine (BMNR) is leading the round with $75 million, while ARK Invest and Payward (Kraken’s parent company) each contributed $25 million.

- Chairman Dan Ives is departing the role; Tom Lee from Bitmine will join the company’s board of directors.

- Earlier in March, ORBS deployed $52.5 million into OpenAI equity and $25 million into MrBeast’s Beast Industries.

- Shares of ORBS climbed as high as 22% during Thursday’s trading session, reaching approximately 99 cents.

On March 12, 2026, Eightco Holdings (ORBS) revealed it had secured $125 million in new institutional capital, triggering a sharp rally in its share price during early market hours.

The funding round features a substantial $75 million investment from Bitmine (BMNR), the digital asset firm led by cryptocurrency advocate Tom Lee. Additionally, ARK Invest—managed by renowned investor Cathie Wood—and Payward, which operates the Kraken cryptocurrency exchange, each pledged $25 million to the initiative.

During Thursday’s trading, ORBS shares climbed to 99 cents, marking an approximately 22% gain for the session. This represents a significant recovery for the company, whose stock had previously declined more than 90% over recent months.

The newly raised funds are designated for ORBS’ expansion efforts in artificial intelligence, blockchain technology infrastructure, and digital consumer-facing platforms.

Alongside the funding announcement, the company revealed a leadership transition. Dan Ives, the prominent technology analyst from Wedbush Securities who assumed the chairman role just last September, is relinquishing the position. Tom Lee will now occupy a board seat at ORBS.

Brett Winton, who serves as Chief Futurist at ARK Invest, has been appointed as an advisory board member.

In a public statement, Ives described the incoming leadership configuration as “the perfect team” to advance the company’s strategic objectives.

Last January, Barron’s featured a comprehensive cover investigation into Ives’s dual responsibilities and possible conflicts arising from his simultaneous roles as company chairman and equity analyst at Wedbush. When contacted Thursday, Wedbush representatives declined to provide commentary.

Strategic Capital Deployment in OpenAI and Beast Industries

Prior to Thursday’s funding announcement, ORBS had already begun deploying significant capital into strategic opportunities. On March 6, the firm invested approximately $52.5 million to obtain economic interests in OpenAI equity.

Four days later, on March 10, ORBS committed roughly $25 million to Beast Industries—the corporate entity backing internet personality MrBeast—with $7 million of that amount scheduled for funding within the next 60 days.

The company also maintains existing positions in Worldcoin, a project co-created by OpenAI’s CEO Sam Altman, as well as holdings in Ethereum.

According to company disclosures, the OpenAI and Beast Industries transactions represent ORBS’ “initial strategic investments,” indicating additional deals may be forthcoming.

Wall Street Perspective

The latest analyst assessment for ORBS stock stands at a Hold rating, accompanied by a price objective of $1.50.

Eightco currently operates with a market capitalization hovering around $160 million, while average daily trading volume reaches approximately 4.6 million shares.

Through its recent funding activities and investment deployments, the company has established simultaneous positions across OpenAI, Beast Industries, Worldcoin, and Ethereum—positioning itself at the intersection of artificial intelligence and blockchain technology.

Crypto World

Can ETH Finally Break $2,150 After Holding Key Support?

Ethereum is trying to build a base, but the general picture has not changed enough to call for a real trend reversal yet. The asset is holding above the February floor, and that matters, yet ETH is still trading beneath major overhead resistance, which leaves the market in a recovery attempt rather than a confirmed bullish phase.

Ethereum Price Analysis: The Daily Chart

The daily chart still leans bearish. ETH remains below the 100-day and 200-day moving averages, and the broader sequence from the prior months continues to reflect a market that has been making lower highs inside a descending structure. The violent selloff in early February damaged the chart significantly, and even though the panic has cooled, buyers have not done enough to repair the higher timeframe setup.

What stands out now is the market’s ability to defend the $1,800 to $1,700 demand area. That zone has become the line separating stabilization from renewed weakness. On the upside, ETH keeps running into resistance near $2,150 first, then the $2,400 supply region, while the larger bearish pivot still sits much higher near $2,800. So for now, this remains a market trying to rebound within a bigger downtrend, not one that has escaped it.

ETH/USDT 4-Hour Chart

The 4-hour chart is more constructive. ETH has been carving out a series of firmer lows since the late February bottom, and the rising trendline underneath price shows that buyers are gradually stepping in on dips instead of allowing another immediate breakdown. Momentum has also improved, with RSI recovering and staying in a healthier range compared to the weakness seen during the last leg down.

Still, the buyers have one obvious problem: they are not breaking the ceiling. The $2,150 level has repeatedly capped the upside, and until that barrier gives way, the recent advance looks more like controlled consolidation than a fresh impulsive breakout. If that level is reclaimed, ETH could quickly rotate toward the next supply band around $2,300 to $2,400. If not, the market likely remains stuck in a sideways grind above support.

On-Chain Analysis

The active addresses chart paints a more nuanced picture than pure price action. Network activity expanded aggressively into the recent period, which suggests Ethereum was still seeing solid user engagement even as the market structure weakened. That kind of divergence can be important because it shows the chain itself did not completely lose participation during the drawdown.

However, the latest drop in active addresses also shows that participation has cooled with price stress, so the metric is not giving a clean bullish signal yet. In other words, sentiment is no longer washed out, but it is not convincingly strong either. The takeaway is that underlying activity offers some support for a medium term recovery thesis, though price still needs to validate it by pushing through resistance.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Avalanche’s business chief says crypto must grow up and solve real problems

What he’s saying: Nahas told Sam Ewen on CoinDesk’s Gen C that Avalanche is a business tool, not a crypto product. He said companies want tailored blockchain infrastructure that fits compliance, geography and operational needs.

Nahas compared Avalanche’s model to WordPress, arguing businesses should be able to “spin up” a blockchain the way they spin up websites.

He said Avalanche’s strategy has shifted from broad crypto narratives toward “built for business” and embedded finance.

The goal, according to Nahas, is to help companies either make new revenue through digitization or cut costs through more efficient digital rails.

Why it matters: The discussion shows how one major crypto network is trying to distance itself from speculative token mania and pitch itself as enterprise infrastructure.

Nahas said much of crypto has been “technology for technology’s sake,” with too few products solving concrete customer problems.

He argued that businesses do not want to force their operations onto a shared general-purpose chain if they need privacy, specific fee structures or regulatory controls.

That stance reflects a broader industry push to hide the underlying blockchain and sell outcomes instead: faster payments, tokenized assets and new customer experiences.

Closer look: Nahas said Avalanche’s former “subnets” model, now rebranded as Avalanche L1s, is designed to let businesses run sovereign blockchains with their own validators and rules.

He said Avalanche has more than 70 live L1s and is targeting roughly 200 by the end of the year.

He pointed to use cases including tokenized equities, FIFA digital products, deed records in Bergen County, New Jersey, and tokenized asset programs in Japan.

Nahas said Avalanche’s combined L1 activity is processing about 40 million daily transactions, though those transactions are spread across many chains rather than concentrated on one flagship network.

Reading between the lines: Nahas was blunt that crypto’s critics are not entirely wrong. He said too much of the industry has relied on speculation, weak business models and short-term headlines.

He said “the token was the product” for many projects, which in his view is not a durable business model.

Nahas argued the sector still has not produced enough true “killer apps” that only blockchain can enable, though he suggested stablecoins may be emerging as one of them.

He also said enterprise partners are already in crypto, but often do not like what they see when projects focus more on announcements than execution.

What comes next: Nahas said clearer rules could unlock more institutional activity, even if crypto’s more libertarian wing resists regulation.

He said many companies want to build with blockchain now but will not move until they know where the legal line is.

On AI, he said blockchain-based payment rails could become important for agentic systems and micropayments, pointing to Avalanche partner Kite AI as an example.

His broader argument: the winning crypto platforms will be the ones that act less like ideology and more like dependable business infrastructure.

Crypto World

Chart Formation Signals a Potential Explosive Rally Ahead

What’s next for TAO after reaching a one-month peak?

Bittensor (TAO) has pumped by double digits over the past seven days, with some analysts expecting this could be the beginning of a much more substantial surge.

At the same time, certain indicators suggest a short-term correction is also a plausible option.

Further Gains Ahead?

As of this writing, TAO trades at around $213 (per CoinGecko), making it the top daily performer among the biggest 100 cryptocurrencies after rising 9% over the period. Its market capitalization soared past the $2 billion psychological mark, thus flipping well-known altcoins such as OKB, ASTER, and others.

The renowned analyst Ali Martinez noted TAO’s strong performance, spotting the potential formation of an Adam & Eve pattern on its price chart. It consists of two bottoms: a sharp “Adam” dip and a rounded “Eve” plunge. The structure is generally considered bullish, as it suggests sellers have lost momentum and could be replaced by buyers. Martinez estimated that in this case, TAO’s price could soar to as high as $270.

X user GalaxyTrading is also quite optimistic. Recently, they described TAO as “the clearest 10x coin for the next altcoin run phase.” The analyst argued that the asset could emerge as a dominant figure in the crypto space thanks to the development of Artificial Intelligence.

ZAYK Charts chipped in, too. Earlier this week, they assumed that Bittensor’s native token was moving within a falling channel, predicting that a breakout above roughly $200 could open the door to a possible 100% increase to almost $400.

Moving South is Also an Option

Despite the prevailing optimism among traders and analysts, some technical indicators suggest TAO’s valuation could tumble in the near future.

You may also like:

The asset’s Relative Strength Index (RSI), which measures the speed and magnitude of recent price changes, has risen above 70. This signals that the token is overbought and could be on the verge of a short-term pullback. The index runs from 0 to 100, and conversely, ratios below 30 are typically interpreted as buying opportunities.

The next factor on the list is TAO’s exchange netflow. CoinGlass’s data show that over the past few days, inflows have exceeded outflows, indicating that investors have been shifting from self-custody to centralized platforms. This is often viewed as a pre-sale step.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Business6 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos3 days ago

News Videos3 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Ann Taylor

-

Crypto World3 days ago

Crypto World3 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech1 day ago

Tech1 day agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports7 days ago

Sports7 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

Politics6 days agoTop Mamdani aide takes progressive project to the UK

-

Tech2 days ago

Tech2 days agoChatGPT will now generate interactive visuals to help you with math and science concepts

-

Business2 days ago

Business2 days agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Sports5 days ago

Sports5 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports4 days ago

Sports4 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat21 hours ago

NewsBeat21 hours agoResidents reaction as Shildon murder probe enters second day

-

NewsBeat7 days ago

NewsBeat7 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment6 days ago

Entertainment6 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business4 days ago

Business4 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business1 day ago

Business1 day agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat3 days ago

NewsBeat3 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech3 days ago

Tech3 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business3 days ago

Business3 days agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat1 day ago

NewsBeat1 day agoI Entered The Manosphere. Nothing Could Prepare Me For What I Found.

![BITCOIN & OIL: EXTREME WARNING!!!! [new Trades]](https://wordupnews.com/wp-content/uploads/2026/03/1773329631_maxresdefault-80x80.jpg)