Crypto World

Bitcoin Everlight App Now Offering 21% APY Rewards

In early 2026, Ethereum staking continues to expand despite the sustained turbulence in prices across the broader cryptocurrency market. Participation in protocol staking remains high even as the returns compress. This reinforces Ethereum’s role as one of the core infrastructure assets while also highlighting the tradeoffs faced by long-term operators.

Within this environment, some technically experienced participants are exploring whether their knowledge can be applied to systems in which compensation is generated in Bitcoin and linked to execution-layer activity rather than token inflation.

Ethereum Staking Is Crowded, Yield Is Compressing

More than 36.9 million ETH is currently being locked on the Beacon Chain, which is around 30% of the total circulating supply. Validator participation remains high even in the face of severe price volatility. This signals long-term commitment to protocol participation.

However, that participation has come at the cost of lower returns. The Composite Ethereum Staking Rate now sits near 3.11%. Solo validators using MEV-boost strategies can still achieve higher effective rewards, averaging up to 5.69%, while operators without MEV optimization typically earn closer to 4%. The net returns for retail participants are lower once you subtract the platform fees, with Coinbase offering between 2.32% and 2.46% APY, Kraken up to 2.96%–2.98% APR, and liquid staking via stETH hovering near 3.4%.

Institutional scale has become a defining advantage in this environment. Large holders such as Bitmine Immersion Technologies, which controls over 4.3 million ETH with roughly 2.9 million staked, are able to sustain meaningful revenue despite compressed yields. At the same time, continued validator queue growth and minimal exits reinforce that while commitment remains strong, reward dilution is tightening margins for smaller and less efficient operators.

How Everlight Operates Alongside Bitcoin

Bitcoin Everlight operates as a Bitcoin-adjacent execution network designed to extend transaction handling without altering Bitcoin’s base protocol, consensus rules, or monetary policy. Bitcoin remains the authoritative settlement layer, preserving its role as the source of finality and security, while Everlight is positioned strictly at the execution layer.

Within this structure, Everlight focuses on transaction coordination tasks that Bitcoin itself is not optimized for, including routing efficiency, availability management, and rapid confirmation. Transactions are processed through a distributed set of Everlight nodes that coordinate execution activity independently of Bitcoin’s block production, allowing confirmations to occur in seconds rather than minutes.

To maintain alignment with Bitcoin’s security model, Everlight supports optional anchoring mechanisms that periodically record execution data back to the Bitcoin blockchain. This approach links high-frequency execution activity to Bitcoin’s settlement finality without modifying Bitcoin itself, allowing each layer to operate within its intended design constraints.

Converting Execution Experience Into Bitcoin Rewards

Everlight participation centers on operating execution-layer nodes that manage transaction throughput and network availability. These nodes do not validate Bitcoin blocks and do not function as Bitcoin full nodes. Their performance is continuously evaluated based on responsiveness, routing efficiency, and reliability.

Node operators commit BTCL to participate and receive Bitcoin generated from real network usage. BTC distribution scales with transaction handling volume, availability scoring, performance efficiency, and operational class across multiple node tiers. Higher tiers assume greater routing responsibility and receive proportionally larger shares of Bitcoin distributions.

Participation carries no mandatory lock period. Bitcoin accrues only while a node remains active and meets performance thresholds. Nodes that fall below required standards are deprioritized until metrics recover. Under current network parameters, estimated annualized Bitcoin rewards reach up to 21%, reflecting aggregate transaction demand and operator contribution rather than fixed emissions.

Mobile App Simplifies Control for Node Operators

The Everlight mobile app is available to node operators and provides direct visibility into participation. Operators can monitor node status, uptime consistency, routing activity, and Bitcoin earned from network usage directly from a smartphone.

Live metrics are paired with smart alerts notifying operators of uptime disruptions, performance changes, and BTC distribution events. This app-based interface reduces operational overhead while keeping execution control with the operator.

Independent technical analysis examining Everlight’s execution model and node mechanics has been published by Crypto League.

Third-Party Security Reviews Support Credibility

Bitcoin Everlight has completed independent third-party security assessments focused on smart contract logic, execution-layer behavior, and deployment risk. The SpyWolf and SolidProof audits examine transaction handling, permission structures, and edge-case failure scenarios under realistic operating conditions.

Operational accountability is reinforced through independent team identity verification conducted via SpyWolf and Vital Block, confirming the individuals responsible for development and ongoing network operations.

Token Supply and Presale Parameters

Bitcoin Everlight operates with a fixed total supply of 21,000,000,000 BTCL. Allocation is defined as 45% public presale, 20% node rewards and network incentives, 15% liquidity provisioning, 10% team allocation under vesting, and 10% reserved for ecosystem development and treasury use.

The presale follows a 20-stage structure. Phase 3 is currently active, with BTCL priced at $0.0012. Presale allocations unlock 20% at token generation, with the remaining 80% distributed linearly over six to nine months. Team allocations follow a 12-month cliff with 24 months of vesting thereafter. BTCL utility is limited to transaction routing fees, node participation thresholds, performance incentives, and anchoring operations.

Learn More About BTCL:

Website: https://bitcoineverlight.com/

Security: https://bitcoineverlight.com/security

How to Secure: https://bitcoineverlight.com/articles/how-to-buy-bitcoin-everlight-btcl

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and to do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ripple Whales Take Control of XRP Trading as Key Metric Signals Potential Rally

The transactions on the XRP Ledger has been growing lately, while one analyst explained the importance of the XRP/BTC pair.

Although it was rejected at $2.40 at the beginning of the year, crashed hard in the following month, and even its rebound attempt was halted at $1.65, XRP is still primed for upcoming gains, noted a few analysts on X.

The factors that could propel an impressive rally are whales’ behavior and the growing network usage of the XRP Ledger. Additionally, the XRP/BTC trading pair has reached a pivotal moment that could determine the future price moves of Ripple’s token.

Whales Dominate

Analyst CW indicated that the transactions on the XRP Ledger have been growing lately, which they categorized as a “positive signal” in the current macro conditions. This is because investors generally abandon the market and transactions decrease during bear phases. However, a rise in this metric now is a pattern that precedes a price rally.

Transactions on the $XRP ledger are increasing.

In general, in a bear market, investors leave market and transactions decrease.

An increase in transactions is a pattern that before a rally.

The transaction count, which had been declining since December 2024, is now increasing… pic.twitter.com/g7jkYZQWA8

— CW (@CW8900) March 7, 2026

In another post, the analyst outlined the significance of big whales in the XRP ecosystem. They noted that these large market participants continue to dominate XRP trading, maintaining a buying trend. CW added that they continue to accumulate tokens at prices below $2.40.

This is also regarded as a bullish signal for the underlying asset, as whales typically make sizeable purchases that reduce the immediate selling pressure. Moreover, retail investors tend to follow whales.

The XRP/BTC Pair

In a post titled “The Hidden Liquidity Cycle,” analyst EGRAG CRYPTO explained that the XRP/BTC pair demonstrates when “capital rotates” from the market leader to the altcoins. Historically, “XRP explodes” when this happens.

You may also like:

After noting that the green zone (in the chart below) is where XRP had become “extremely overextended” and a likely crash against BTC is coming, and the red area is the opposite, the analyst added that Ripple’s token is currently in the accumulation phase of the current cycle.

#XRP / #BTC – The Hidden Liquidity Cycle 🔄:

This chart is extremely important. 🧵1/13

Because #XRP/#BTC tells us whether #XRP will outperform #BTC, not just whether #XRP rises in #USD.

And when you zoom out… A powerful liquidity cycle begins to appear.

Let’s break it down. pic.twitter.com/LygPphS5pX

— EGRAG CRYPTO (@egragcrypto) March 7, 2026

If it breaks above the silver line, currently positioned at around 0.00003600 SAT, its rally is expected to begin. XRP/BTC is trading around 0.00002000 SAT as of press time.

EGRAG explained, though, that the XRP/BTC liquidity pair tends to move in long 7-8-year cycles, so this anticipated rally could take a while before it reignites as it did in late 2024.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

China says ‘thorough preparations’ needed ahead of Trump-Xi meeting

Chinese Foreign Minister Wang Yi attends a press conference on China’s foreign policy and external relations on the sidelines of the fourth session of the 14th National People’s Congress (NPC) on March 8, 2026 in Beijing, China.

Vcg | Visual China Group | Getty Images

BEIJING — China’s top diplomat Wang Yi underscored Sunday the benefits of interacting with the U.S., and signaled preparations are underway for a planned meeting between the two countries’ leaders amid differences over the war in Iran and trade tariffs.

“The agenda of high-level exchanges is already on the table,” Wang told reporters in Mandarin Chinese, according to an official translation. “What the two sides need to do now is make thorough preparations accordingly, create a suitable environment, manage the risks that do exist and remove unnecessary disruptions.”

“Turning our backs on each other would only lead to mutual misperception and miscalculation,” he said. “Sliding into conflict or confrontation would only drag the whole world down.”

After an in-person meeting in South Korea in the fall, Chinese President Xi Jinping and U.S. President Donald Trump indicated plans to visit each other’s countries.

Trump is scheduled to visit China from March 31 to April 2, which would be the first trip to the country by a sitting U.S. president since 2017.

However, Beijing has yet to confirm the exact dates of a Trump visit. Wang did not elaborate either, but noted the U.S. and Chinese presidents’ high-level interactions have “provided [an] important strategic safeguard for the China-U.S. relationship to improve and move forward.”

Some analysts have raised doubts over whether the trip will happen on schedule, especially since it would likely come shortly after joint U.S.-Israeli attacks on Iran that killed its Supreme Leader Ayatollah Ali Khamenei and the U.S. capture of Venezuelan leader Nicolas Maduro.

Wang did not name either individual in his remarks to the press Sunday morning but reiterated Beijing’s calls for a ceasefire in the Iran conflict.

“This is a war that should not have happened,” he said. “It is a war that does no one any good.”

Wang has held phone calls with at least seven foreign ministers — including those of Russia, Iran and Israel — since the joint U.S.-Israel strikes on Iran began on Feb. 28, according to official readouts.

He was speaking Sunday to reporters on the sidelines of China’s eight-day annual parliamentary meeting that is set to wrap Thursday. China’s top leaders, including President Xi Jinping, Premier Li Qiang and Vice Premier He Lifeng, are meeting in Beijing with delegates from across the country.

Tariffs in question

The bilateral discussions come as the U.S. and China reached a fragile truce in October for lowering tariffs on each other’s goods to below 50% for one year. The two countries had previously ratcheted up duties to well over 100% during the height of tensions last spring.

In response to a question about Trump’s casting of U.S.-China relations as a new “G2” for leading the world, Wang pushed back against the idea that two countries alone would do so, instead emphasizing multipolarity.

Without naming the U.S., Wang warned against “erecting tariff barriers and pushing [for] economic and technological decoupling.”

“This is no different from using kindling to put out a fire,” he said. “You will only get burned.”

Crypto World

Reasons behind the crypto crash with Trump as President and Paul Atkins at the SEC

The crypto crash has unfolded under Donald Trump as the president and Paul Atkins as the head of the Securities and Exchange Commission.

Summary

- The crypto market crash has happened under Donald Trump as President.

- It also tumbled despite the friendly regulations under Paul Atkins.

- Trump’s second term has been characterized by uncertainty, especially on trade.

Crypto crash has happened under Donald Trump

Bitcoin (BTC) has already erased all the gains made during the Trump presidency and is now trading at its lowest level since October 2024. Altcoins have done worse, with some notable names like Shiba Inu and Cardano hovering near their lowest levels in 2022.

The ongoing crypto crash is ironic as the industry has some major tailwinds. President Trump is the most friendly president for the industry, while Paul Atkins has embraced a different approach than Gary Gensler.

For example, Gary Gensler ended the lawsuits against top companies like Coinbase, Uniswap, and Ripple. He also embraced a more friendly approach, including not launching any lawsuits.

Washington has also enacted some friendly regulations. It passed the GENIUS Act last year, and is now working on the CLARITY Act that will separate SEC and CFTC duties.

There are a few reasons behind the crypto market crash under Trump. Analysts cite the launch of the Official Trump meme coin as a major risk in the industry as it drained vast liquidity. The meme coin initially jumped to $50 and then plunged to below $5.

At the same time, geopolitical risks have remained elevated under Trump. It started with his global tariffs to the current war in Iran that has pushed crude oil prices to the highest level in years.

His tariffs disrupted the falling inflation and pushed the Federal Reserve to be more cautious in its monetary policy. This trend may continue in the foreseeable future as inflation is expected to rise now that the crude oil and natural gas prices have jumped by over 50% this year amid the war in Iran.

Deleveraging after the huge liquidation event in October

Crypto prices have also crashed amid his ongoing deleveraging among investors, especially after the major liquidation event that happened on October 10 last year when over 1.6 million traders were wiped out.

Over $20 billion was lost on that day. Since then, the futures open interest has tumbled to below $100 billion, while the weighted funding rate has largely moved sideways. The Crypto Fear and Greed Index has remained in the red in the past few months.

The crypto crash also happened because of the gridlock in Washington about the CLARITY Act, which has stalled in the past few months. This gridlock started when Coinbase withdrew its support, citing the view that the bill made it almost impossible for crypto companies to pay stablecoin rewards.

Banks and credit unions have argued that allowing these companies to offer rewards will drain funds from their institutions, which will affect the broader economy.

Crypto World

US Court Dismisses Binance, CZ Terrorism Financing Lawsuit

Former Binance CEO Changpeng “CZ” Zhao said centralized crypto exchanges have “zero motive” to assist terrorists after a US court dismissed a lawsuit accusing the exchange of facilitating terrorist financing.

In a post on X, Zhao argued that the economics of crypto trading make such activity illogical for exchanges. “There are absolutely zero (0) motive for any CEX to have anything to do with terrorists,” Zhao wrote, adding that such actors are unlikely to generate trading revenue and may only deposit funds briefly before withdrawing them.

The comments followed a ruling by the US District Court for the Southern District of New York that dismissed claims brought by hundreds of victims and relatives of victims of terrorist attacks. The lawsuit alleged that Binance, Zhao and Binance.US operator BAM Trading Services helped terrorist groups move funds through cryptocurrency transactions.

According to the court filing, the plaintiffs represented 535 individuals linked to victims of 64 attacks carried out between 2016 and 2024. The incidents were attributed to groups including Hezbollah, Hamas, ISIS, al-Qaeda and Palestinian Islamic Jihad.

Related: Binance slams US Senate probe over Iran as based on defamatory reports

Victims seek damages from Binance

The plaintiffs argued that the attackers or affiliated organizations benefited from transactions conducted on the Binance exchange. They sought damages under the US Anti-Terrorism Act and the Justice Against Sponsors of Terrorism Act, which allows victims to pursue claims against entities accused of assisting terrorist acts.

Judge Jeannette A. Vargas dismissed the case after finding that the complaint failed to establish a sufficient connection between Binance’s operations and the attacks themselves. While the filing described alleged compliance failures and illicit activity on the platform, the court said the plaintiffs did not plausibly link the exchange’s conduct to the specific attacks that caused their injuries.

The decision effectively ended the case at the pleading stage. The judge also said that “any amended complaint shall be due within 60 days.”

Related: Binance CEO accuses WSJ of defamation over Iran sanctions report

Binance denies Iran transaction claims

The recent win for Binance comes at a time when the exchange is under growing scrutiny over transactions tied to sanctioned entities. On Friday, the exchange pushed back against allegations raised by a group of 11 US senators, rejecting claims that it facilitated transactions tied to Iranian entities.

In a letter sent Friday to Senators Richard Blumenthal and Ron Johnson, Binance said the February inquiry relied on reports that were “demonstrably false” and lacked credible evidence. The scrutiny came after media reports alleged it processed more than $1 billion in crypto transactions linked to Iranian entities Hexa Whale and Blessed Trust and fired employees who raised concerns internally.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Could a 4x Rally Follow?

Another analyst noted in the meantime that the Ethereum network activity has picked up the pace after a solid decline earlier this year.

Ethereum’s price has fought for $2,000 for a month now, but the bears have taken advantage once again after another 4% decline on a weekly scale. The macro charts are even more painful for the largest altcoin, which barely broke its 2021 all-time high in 2025, but now trades over 60% away from it.

According to a few analysts, though, the landscape around it could change soon due to the rising network activity and previous cycle moves. History has shown that ETH has posted incredible returns after it successfully defended a zone that it’s currently testing.

Can ETH Rocket by 4x Next?

Merlijn The Trader said in a Saturday post on X that “Ethereum is entering the zone that decided the last cycle.” Four years ago, it bottomed after sweeping the liquidity inside the $1.2K-$1.6K range. Technical tools like the RSI show that it’s approaching an oversold territory again, and Merlijn predicted that if it holds the $1.6K level, “buyers regain control.”

However, if it falls below the lower boundary of that range, “deeper liquidity becomes the target.” The last time this zone was tested and defended successfully, the analyst said ETH skyrocketed by 4x. A similar surge now would take it well beyond its all-time high of nearly $5,000.

In a subsequent post, Merlijn doubled down that ETH is at a “make-or-break level,” as the price has respected this rising trendline for years. It has neared the $2,000 level, and the next major move could be determined whether it will defend it or not.

ETHEREUM IS AT A MAKE-OR-BREAK LEVEL.

For years price has respected this rising trendline.

Each touch led to a major move.$ETH is testing it again near $2K.

Hold it: the bull structure stays intact.

Lose it: the macro trend breaks.Every previous touch resolved violently.… pic.twitter.com/eRauroDcrX

— Merlijn The Trader (@MerlijnTrader) March 7, 2026

Rising Network Activity

Meanwhile, fellow analyst CW noted that there’s a notable uptick in the network activity on Ethereum. The transactions peaked at over 2.5 million at the beginning of the year but quickly plunged to under 2 million. However, they have gone above that level as of the latest data.

You may also like:

Similar developments mean that investors and users are more inclined to use the network, which is generally a bullish sign for the underlying asset.

After a brief decline, $ETH network activity is increasing again.

Daily transactions are already well above last year levels. Despite the price decline, the network is becoming more active.

This indicates a bullish, not a bearish. pic.twitter.com/ZSICoVnbsO

— CW (@CW8900) March 7, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Yield-Bearing Stablecoins Expand as New DeFi Income Options Emerge

TLDR:

- Yield-bearing stablecoins now combine Treasuries, lending markets, and AI compute revenue models across DeFi platforms.

- $sUSDS leads the sector with $5.3B TVL and roughly 4% APY from lending and real-world asset strategies.

- Maple’s $syrupUSDC generates about 4.7% APY through institutional lending to crypto-native borrowers.

- Gold-backed $pmUSD reportedly delivers the highest yields, ranging between 9% and 22% via Curve liquidity pools.

Yield-bearing stablecoins are gaining traction as decentralized finance platforms compete to offer on-chain income products.

Several tokens now promise steady returns backed by different asset structures. Some rely on U.S. Treasuries, while others draw yield from institutional lending or AI infrastructure.

The expanding category shows how stablecoin design continues to evolve across the crypto market.

Yield-Bearing Stablecoins Introduce New DeFi Yield Models

The DeFi ecosystem now features several yield-bearing stablecoins with distinct backing structures. Each product relies on a separate revenue engine to generate returns.

$sUSDS currently offers roughly 4% 30-day APY and holds about $5.3 billion in total value locked. The token relies on crypto collateral and real-world assets such as treasuries.

Protocol revenue from lending and real-world asset strategies funds the yield. The structure blends traditional finance exposure with on-chain lending activity.

$syrupUSDC provides around 4.7% 30-day APY and holds roughly $1.7 billion in locked capital. The yield comes from Maple’s institutional lending pools.

According to information shared on X by Edgy from The DeFi Edge, Maple deploys the capital to institutional borrowers. Interest payments generate the returns distributed to holders.

Another model appears with $USYC. The token holds short-duration Treasuries and fixed-income instruments that drive gradual value appreciation.

Recent yields hover near 3%, while total value locked stands close to $1.9 billion. The structure allows yield to accumulate through price drift instead of explicit distributions.

Different Collateral Strategies Drive Stablecoin Yield

Several newer tokens rely on alternative revenue streams beyond traditional lending. These structures attempt to capture emerging sectors within the crypto economy.

$USDai represents a synthetic dollar backed by Treasuries and AI compute lending infrastructure. Staking into $sUSDai exposes holders to those revenue flows.

Current yields approach 6.5%, while total value locked remains near $339 million. The token links stablecoin demand with AI compute financing markets.

$coreUSDC follows a vault strategy built around automated rebalancing. Deposited USDC moves between lending platforms including Euler and Morpho.

The system adjusts allocations across protocols to capture available lending yields. Current returns average about 6.3%, according to figures shared by The DeFi Edge.

Another model appears with $pmUSD, a stablecoin minted against tokenized gold collateral. Liquidity from the token primarily flows into Curve-based strategies.

Liquidity provider strategies reportedly produce yields ranging between 9% and 22%. These returns depend on liquidity incentives and market conditions within Curve pools.

The expanding list reflects growing experimentation across the stablecoin sector. Developers now test different combinations of real-world assets, DeFi lending, and infrastructure financing.

Crypto World

Crypto prices dip as crude oil jumps to $115 ahead of US inflation report

Crypto prices continued the strong downward trend today, March 8, as the war in Iran continued, pushing crude oil prices to $115 ahead of the upcoming US consumer inflation report.

Summary

- Crypto prices continued falling today, with Bitcoin moving to $96,000.

- Crude oil prices jumped to over $115 on Hyperliquid.

- The US will publish its inflation report on Wednesday this week.

Bitcoin (BTC) price dropped to $67,000 on Sunday from last week’s high of $74,000. An index tracking the top 20 cryptocurrencies dropped by 1.29% in the last 24 hours, while the Crypto Fear and Greed Index dropped to 18.

Crypto prices dropped amid signs that the war in Iran was not about to end, which pushed crude oil prices to the highest level since 2022. The West Texas Intermediate, which ended the week at $90, soared to $115. Brent, the global benchmark, is nearing the important resistance level at $120 on Hyperliquid.

Crude oil prices soared after more countries in the Middle East slashed their production because of the closure of the Strait of Hormuz by Iran. Kuwait and the United Arab Emirates announced that they would slash production as the war continues.

Soaring oil prices has a major impact on crypto prices because of its impact on inflation. Recent macro data from the United States showed that inflation has continued falling in the past few months. Therefore, this war will change the trajectory and push inflation higher in the coming months.

Soaring inflation rate will make it hard for the Federal Reserve to cut interest rates. Indeed, data on Polymarket shows that traders have scaled down their outlook for the Federal Reserve interest rate cuts for the year.

The war in Iran is also bearish for the crypto market because Bitcoin has proven to be an unreliable hedge against inflation and geopolitical risks.

Looking ahead, crypto prices will react to the upcoming US consumer inflation report on Wednesday. Economists polled by Reuters expect the upcoming numbers to show that the headline Consumer Price Index rose to 2.5% in February from the previous 2.4%.

Core inflation, which excludes the volatile food and energy prices, is expected to come in at 2.5. US inflation expectations have continued soaring this month as the war goes on.

Traders will focus on several cryptocurrencies this week. Pi Network price will be in focus ahead of the Pi Day event that happens on Saturday this week. Similarly, Polkadot will be in focus ahead of the tokenomics upgrade on March 12.

Crypto World

Raoul Pal Sees Liquidity Surge Setting Up Crypto Market Reversal

TLDR:

- Global liquidity shows about 90% correlation with Bitcoin and nearly 97% correlation with Nasdaq since 2012.

- U.S. total liquidity rebounded from lows three months ago, historically leading crypto market movements.

- Stablecoin supply surged roughly 50% last year as blockchain transaction volumes reached trillions globally.

- Weekly and daily DeMark indicators suggest crypto markets may approach a technical trend reversal soon.

The crypto market faces deep pessimism as prices struggle and traders warn of a prolonged downturn. However, macro signals tied to global liquidity suggest conditions may soon shift.

Several financial indicators now point to expanding liquidity across major economies. Those changes could reshape the outlook for Bitcoin and broader crypto markets in the coming weeks.

Global Liquidity Signals Point to Potential Crypto Market Reversal

Macro investor Raoul Pal outlined several liquidity indicators that historically track movements in Bitcoin and technology stocks. He shared the analysis through a detailed thread on X.

Pal stated that global liquidity shows a strong correlation with Bitcoin and the Nasdaq 100. According to his data, the relationship reached about 90 percent with Bitcoin since 2012.

Liquidity growth currently runs at nearly 10% annually. Pal noted that the trend continues without signs of slowing.

Financial conditions tracked by Global Macro Investor typically lead liquidity trends by six months. According to Pal, those conditions still show easing momentum.

U.S. total liquidity was temporarily disrupted earlier this year after government shutdown effects restricted flows. Pal explained that the measure usually leads crypto markets by about three months.

Data now shows U.S. liquidity rebounding from lows reached three months ago. That rebound may feed into crypto markets if historical relationships continue.

Pal also pointed to the business cycle as another major driver of risk assets. Accelerating economic activity often lifts earnings expectations and increases investor risk appetite.

Credit Expansion, Policy Moves and Stablecoins Add Liquidity

Additional liquidity sources may strengthen the trend. Pal highlighted the enhanced Supplementary Leverage Ratio as a key banking mechanism.

The rule allows banks to expand balance sheets while absorbing Treasury issuance. According to Pal, that process increases liquidity through credit creation.

Tax refund payments also contribute to liquidity flows. When refunds land in bank accounts, they raise spending capacity and potential credit demand.

Pal also cited policy actions in China. Authorities there continue expanding the country’s central bank balance sheet.

Rate cuts in the United States represent another factor. Lower borrowing costs often increase disposable income and encourage risk taking across financial markets.

Regulatory developments may also influence flows. Pal pointed to the proposed CLARITY Act as a potential framework for banks and asset managers entering crypto markets.

Stablecoin issuance has already accelerated sharply. Pal reported that supply grew roughly fifty percent last year as transaction volumes reached trillions of dollars.

He also noted that new artificial intelligence agents interacting with blockchain systems could expand the sector’s total addressable market.

Pal added that technical indicators currently show extreme oversold conditions in crypto markets. Weekly DeMark signals could form a market base within two weeks.

Daily DeMark indicators also approach potential reversal signals. According to Pal, weaker price action may complete those setups.

Oil prices remain the main macro risk factor. Prolonged increases could tighten financial conditions and slow liquidity expansion.

Crypto World

Bitcoin Falls Below $70K Again: 3 Key Reasons

The flagship cryptocurrency has retreated from its recent momentum, slipping back into the month’s trading band beneath the $70,000 threshold after a roughly 5% decline over the past two days. Investors and traders are watching for how on-chain activity and derivatives signals align with price action, as data point to renewed selling pressure near the key level. Market participants also noted thinning spot volumes and shifting futures positioning, which together suggest a cautious stance ahead of the next price move. A four-hour view from a widely used charting platform captured the oscillation, underscoring a tussle between buyers aiming to reassert control and sellers eager to cap downside.

Key takeaways

- Short-term holders realized profits aggressively as the price rallied above $74,000, with more than 27,000 BTC moving to exchanges from short-term holder wallets in the last 24 hours.

- The profit-taking occurred predominantly from levels accumulated in the week prior, with the realized price sitting near $68,000 as selling activity intensified after the test of $70,000.

- Futures data showed a broad pattern of selling pressure, with the cumulative volume delta turning negative in both spot and perpetual markets. Specifically, spot delta reached a sizable negative read of about –$202.49 million, while perpetuals hovered around –$185.60 million.

- Coinbase-based liquidity signals showed demand cooling near critical inflection points; the Coinbase Premium Index briefly spiked above 0.08 during the rally to the $73,000–$74,000 range but faded as price retraced.

- Analysts pointed to a nearby fair value gap around $66,500 as a potential magnet for liquidity, suggesting a zone where price could pause and liquidity could rebalance if downside pressure persists.

- Market sentiment in late sessions reflected broader risk-off pressure across equities, with observers noting that Friday’s sessions often weighed on risk assets including the Nasdaq.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. A renewed wave of selling near $70k and the negative CVD readings point to softer near-term momentum.

Trading idea (Not Financial Advice): Hold. The price remains in a narrow range around key support and resistance, with near-term liquidity considerations likely to dictate direction before a clearer breakout or breakdown.

Market context: The latest price action comes as on-chain and derivatives metrics underscore a cautious mood among market participants. The combination of profit-taking from short-term holders, negative delta signals, and weakening US spot demand paints a picture of a market still determining a sustainable path above or below the $70,000 threshold, even as macro factors and risk sentiment continue to influence flows.

Why it matters

The current dynamics highlight how on-chain behavior and derivatives data can diverge from simple price movement. When more than 27,000 BTC in profit moves to exchanges from short-term holders within 24 hours, it signals a cohort that is willing to crystallize gains rather than let profits ride into further upside. That pattern, coupled with a realized price near $68,000, suggests the market could experience episodic selling pressure as traders rebalance risk in a choppy environment.

From a technical standpoint, negative delta readings across spot and perpetual futures imply that sellers have the upper hand in immediate order-flow dynamics. The negative CVDs indicate that the market’s buy-side interest is being overwhelmed by sell-side activity, which tends to coincide with price softness and a willingness to test support zones rather than push decisively toward new highs. This cadence of selling pressures can also be reinforced by liquidity dynamics around key liquidity pockets, such as the fair value gap noted near $66,500, where liquidity-minded traders expect price to revisit to re-establish balanced order books.

On the demand side, the Coinbase Premium Index’s retreat from the intraday spike above 0.08—while fleeting—highlights how demand can evaporate quickly as price moves past critical levels. The erosion of the premium suggests that the surge of Coinbase-based buying that once accompanied the move toward $74,000 did not sustain, contributing to a softer near-term outlook. Analysts have connected these micro-movements to broader risk-off impulses that have been altering how US participants approach risk assets, including equities tied to the tech-heavy Nasdaq.

Looking ahead, observers are watching whether BTC can defend the $67,000–$68,000 zone as a near-term anchor or whether selling pressure intensifies to drive the price toward the lower bound of the current consolidation range. Titan of Crypto has highlighted a nearby fair value gap around $66,500 that could act as a magnet for liquidity should selling accelerate. Such a scenario would likely require a phase of cautious accumulation by larger holders before a renewed attempt at the $70,000 threshold. For now, the mood remains mixed: buyers are present, but the momentum needed to sustain a breakout above $70,000 remains uncertain. A related discussion online raises questions about whether the move to $74,000 was a bull trap, with traders diverging on the implications for a longer-term recovery.

Visual references to the market’s price action can be found in TradingView’s BTCUSDT chart, which has been used to illustrate the four-hour dynamics during this period. The broader context continues to unfold as market participants parse on-chain signals, futures data, and spot-market activity for clues about the next major step in BTC’s path.

Related: Bitcoin price drops to near $68K as US jobs weakness fails to rescue bulls

Note: This narrative summarizes market developments and does not constitute investment advice. Market conditions can change quickly, and readers should conduct their own research before making trading or investment decisions.

https://example.com/placeholder.js

What to watch next

- Monitor BTC around the $66,500–$68,000 zone for possible liquidity-driven rebalancing.

- Watch spot and futures delta for signs of a shift toward positive accumulation or further selling pressure.

- Track Coinbase Premium Index movements to gauge whether demand from US-based participants re-accumulates near the $70k–$74k region.

- Assess the influence of US macro data and risk-on/risk-off sentiment on a potential break above or below the current range.

Sources & verification

- CryptoQuant QuickTake on STH selling pressure and profit transfers (27,000 BTC moved to exchanges in 24 hours).

- IT Tech’s analysis of CVD movements in spot and perpetual futures (negative readings: spot around –$202.49 million, perpetual around –$185.60 million).

- Coinbase Premium Index data showing decay after a brief spike near $73,000–$74,000.

- Titan of Crypto’s analysis of a nearby fair value gap near $66,500 and liquidity considerations.

- Related coverage: “Was $74K a bull trap? Bitcoin traders diverge on 2022 crash repeating.”

- TradingView BTCUSDT four-hour reference chart for price action context.

- Cointelegraph coverage referencing Bitcoin price dynamics near $68K amid US jobs data.

Bitcoin price action and near-term outlook

Bitcoin (CRYPTO: BTC) moved to test the lower end of its immediate range after failing to sustain a push above the $70,000 mark, a level that has repeatedly acted as a psychological magnet for bulls. The day’s price action reflected a tug-of-war between demand from speculators looking to re-enter momentum trades and longer-term holders who remain more comfortable booking profits at elevated levels. The substantial transfer of profits from short-term holders to exchanges underscored a cautious stance among market participants who prefer crystallizing gains rather than chasing further upside in a market that has shown fragility in the face of macro and sector-wide risk signals.

The negative delta readings in both spot and perpetual futures markets emphasize the immediate pressure that price action is facing. With bid liquidity pulling back and on-chain activity signaling profit realization, even a modest dip can invite additional selling, particularly if market participants recalibrate risk exposure in response to incoming macro data or shifting regulatory narratives. Yet the presence of liquidity in place—evidenced by the level of bids near a crucial support zone—suggests that a flush to the downside may be met with renewed accumulation rather than a wholesale capitulation, should demand return to the scene.

As the market digests these signals, a potential rebound could emerge if buyers manage to defend the $67,000–$68,000 area and push back toward the $70,000–$72,000 zone. The interplay between short-term profit-taking behavior and longer-term conviction will likely shape the next wave of liquidity provision, setting the tone for the next phase of the market’s evolution. Traders and researchers will be watching not only price levels but also the behavior of major on-chain cohorts and the evolution of sentiment across futures and spot markets, waiting for a clear sign that the current pullback is a temporary pause or the beginning of a more meaningful correction.

Crypto World

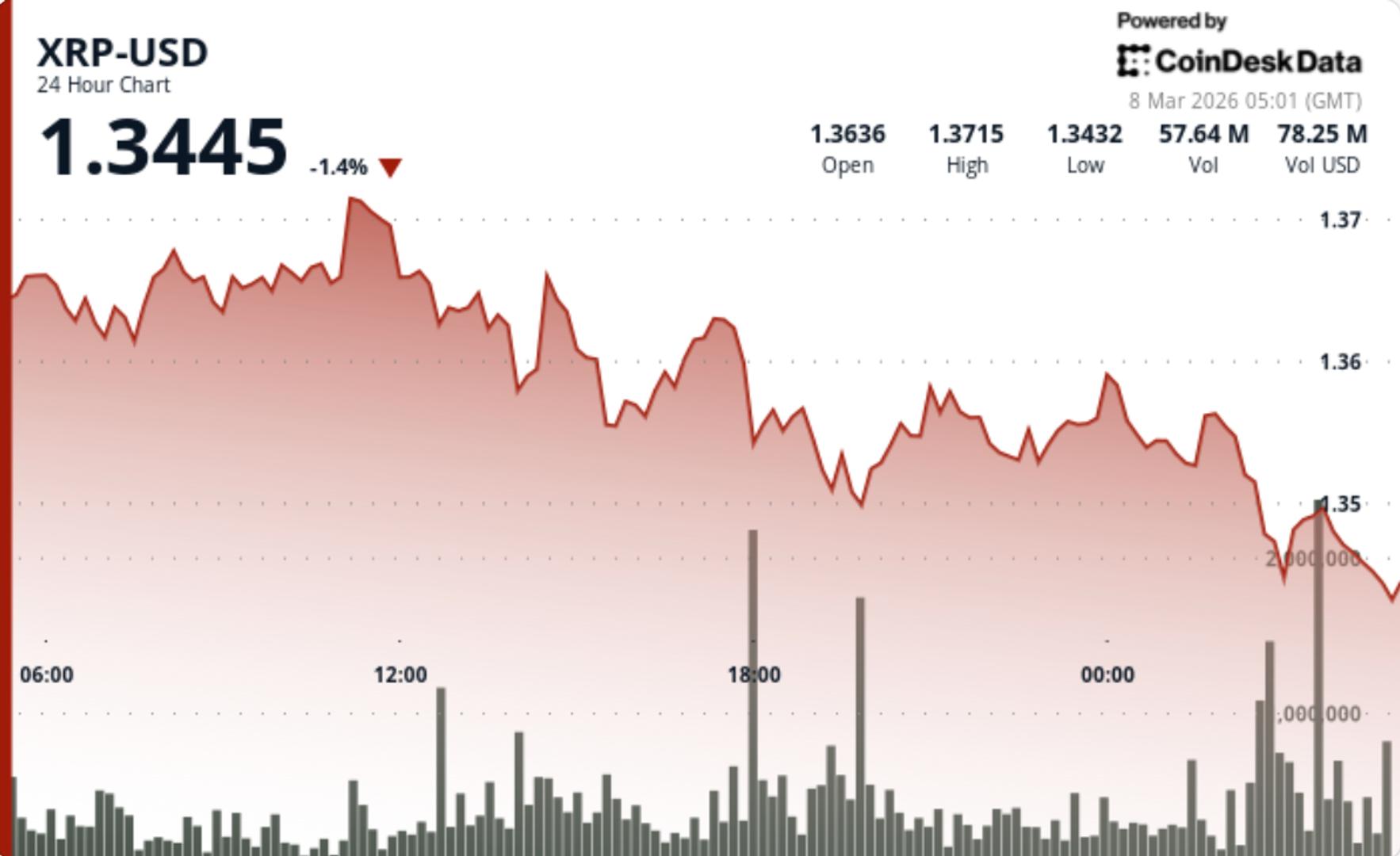

Ripple-linked token slips as traders watch $1.35 support

XRP edged lower after a technical breakdown earlier in the session, with buyers now attempting to stabilize price near the $1.35 support area.

News Background

- XRP has remained under pressure in recent sessions as the token trades within a broader corrective structure that has persisted since late February.

- Price action has largely been driven by technical positioning rather than new catalysts, with traders focusing on key support and resistance levels as the market consolidates.

- Institutional flows have been mixed during the period. XRP-linked investment products recorded moderate outflows earlier in the week while derivatives activity declined slightly, suggesting reduced speculative participation as the market digests recent volatility.

Price Action Summary

- XRP slipped from $1.3666 to $1.3554 over the 24-hour session

- The token traded within a relatively tight 1.9% range

- A sharp volume spike drove price briefly down to $1.3473

- Price later recovered toward $1.35–$1.36 as buyers stepped in

Technical Analysis

- The most notable move occurred when XRP briefly broke down toward $1.347 during a surge in trading volume, confirming selling pressure below the $1.36 area. That move reinforced $1.36–$1.37 as a short-term resistance zone after repeated rejection attempts.

- Despite the breakdown, buyers quickly defended the $1.35 region, triggering a modest rebound and forming a sequence of higher lows on shorter timeframes. This suggests dip demand remains active even as the broader trend remains weak.

- Price is now compressing between support near $1.35 and resistance around $1.36–$1.37, a tightening range that often precedes a directional move once liquidity builds.

What traders say is next?

- Market participants are focused on whether XRP can maintain support near $1.35.

- If the level holds, the token may continue consolidating before attempting another push toward $1.36–$1.37 resistance, where a breakout could reopen upside toward the $1.40 region.

- A decisive break below $1.35 would shift attention toward deeper support near $1.30–$1.32, signaling the corrective trend may extend further.

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports12 hours ago

Sports12 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Sports2 hours ago

Sports2 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Crypto World7 days ago

Crypto World7 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

Tech5 days ago

Tech5 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Video6 days ago

Video6 days agoLPP + Financial Maths + Numerical Applications | One Shot | Applied Maths | Target Board Exams 2026