Crypto World

Bitcoin Probably Bottomed at $77K, Analyst Says

Bitcoin’s fall of around 7% to $77,000 on Saturday might have marked the low of this cycle, according to Bitcoin analyst PlanC.

It comes as other crypto analysts continue to call for further downside for Bitcoin in the coming months.

“Decent chance this will be the deepest pullback opportunity this Bitcoin bull run,” PlanC said in an X post on Saturday.

Key takeaways

- Bitcoin slid about 7% to roughly $77,000 on Saturday, with a short-lived recovery pushing it toward $78,690 at the time of reporting, data from CoinMarketCap shows.

- From its all‑time peak of $126,100, the pullback amounts to roughly 38%, underscoring a bear‑market–like dynamic that traders have cited in past cycles.

- PlanC compared the current drawdown with previous crashes, citing 2018’s capitulation to $3,000, the March 2020 crash near $5,100, and the multi‑month dips during the FTX and Luna collapses, which briefly pushed BTC to the mid‑teens.

- The analyst warned that a major capitulation low could be forming, estimating a potential bottom in the $75,000–$80,000 range as the cycle unfolds.

- Other voices in the space emphasized caution: Rajat Soni cautioned against overreacting to weekend moves, while veteran traders laid out varied downside targets—Peter Brandt toward $60,000, and Benjamin Cowen pointing to an October‑time cycle low with intermittent rallies in the interim. Fidelity’s macro team also flagged a potential normalization in 2026 with possible dips toward mid‑$60k regions.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The abrupt weekend pullback highlighted risk-off sentiment and the potential for further price erosion in the near term.

Market context: The move comes amid a historically volatile phase for crypto markets, where macro uncertainty, liquidity shifts, and episodic capitulations have repeatedly punctuated price action. Analysts are weighing the probability of deeper retracements against pockets of resilience, often depending on how macro cues and on-chain dynamics evolve through the next several weeks.

Why it matters

For traders and long‑duration holders alike, the recent price action reinforces the notion that Bitcoin remains susceptible to swift, decisive moves, especially when macro bets tilt toward risk-off environments. The pullback echoes a pattern seen in prior cycles, where sharp declines have alternated with sharp rallies, testing the resolve of market participants and forcing recalibration of risk models. The interaction between spot price, derivatives funding, and on‑chain indicators will be watched closely as market participants attempt to gauge whether this week’s dip marks a temporary wobble or the onset of a more meaningful downcycle.

Analysts’ comments in the wake of Saturday’s swing illustrate a split, but converging, view: the downside risk appears elevated, yet a durable bottom remains contingent on broader signals. PlanC’s framing of the move as potentially the deepest pullback of this bull run invites a re‑examination of risk thresholds for traders who had positioned for renewed momentum. At the same time, voices like Rajat Soni urge restraint, warning that weekend pumps and dumps can mislead and that Bitcoin’s eventual rebound may come when sentiment has already priced in a portion of the downside.

Meanwhile, a chorus of forecasts from veteran market watchers keeps the dialogue alive. Peter Brandt has floated a target as low as $60,000 by the third quarter of 2026, a horizon that underscores a longer‑term bearish thesis in which macro and cyclical forces compress price multiple times. Benjamin Cowen has circled early October as a likely window for a cycle low, even as he anticipates several rallies on the way there. And Fidelity’s macro strategist, Jurrien Timmer, has signaled that 2026 could resemble a year off for Bitcoin, with downside potential into the mid‑$60s as the market reconciles risk premia with macro realignment.

The net takeaway is a market that remains highly sensitive to macro tempo and liquidity conditions, with a spectrum of outcomes depending on how quickly demand returns and how investors price risk in a climate of ongoing uncertainty. The chatter around potential capitulation lows reinforces the need for disciplined risk management and careful position sizing as traders navigate a landscape where both downside catalysts and relief rallies can unfold abruptly.

What to watch next

- Price action around the $75,000–$80,000 band: does BTC hold above this range, or does it break lower, inviting a deeper pullback?

- Analyst updates from prominent figures (e.g., Brandt, Cowen, Timmer) about potential bottoms and interim rallies, and how these views evolve with macro data releases.

- On‑chain indicators and capitulation signals: any spike in long‑term holder behavior or changes in liquidity metrics that precede a durable bottom?

- Macro and regulatory developments that could shape risk appetite for crypto assets, including any shifts in liquidity or institutional participation.

Sources & verification

- PlanC’s commentary on the depth of this pullback and the potential $75k–$80k bottom (X post).

- Bitcoin price data around $77,000 and $78,690 from CoinMarketCap.

- Peter Brandt’s bearish forecast for BTC toward $60,000 by Q3 2026 (Cointelegraph coverage).

- Benjamin Cowen’s expectation of a cycle low in early October with interim rallies (X post).

- Jurrien Timmer’s note that 2026 could be a “year off” for Bitcoin with a potential dip to the mid‑$60k range (Fidelity macro research).

- Investor commentary from Rajat Soni urging restraint after weekend moves (X post).

Bitcoin under pressure as capitulation risks weigh on market outlook

Bitcoin (CRYPTO: BTC) faced a sharp test this weekend as the largest crypto by market capitalization slipped about 7% to roughly $77,000, before carving a modest recovery toward $78,690 as markets sat for fresh catalysts. The price retreat comes after a period of heightened volatility that has left many onlookers pondering whether the trough of this cycle has already occurred or if a deeper retracement lies ahead. In the backdrop, Bitcoin remains down roughly 38% from its late‑2021 peak of about $126,100, a gap that many analysts see as a reminder of the cyclical nature of crypto markets and the potential for sizable downside risk before a sustainable rebound materializes.

PlanC, a well‑known voice in the crypto‑trading space, framed Saturday’s move as potentially the deepest pullback of the ongoing bull run. In a post on X, the analyst noted that there is a “decent chance” the current dip represents the cycle’s most pronounced capitulation event to date, calling attention to the fact that past crashes—from the 2018 rout that saw BTC slump to $3,000, to the March 2020 crisis around $5,100, and the distress seen during FTX and Luna collapses—produced price levels that required years to fully digest. The implication is that market psychology could be recalibrating after a period of outsized gains, with the risk of a extended bottom shaping the near‑ to mid‑term outlook.

Despite the dour undertone, there are voices that urge caution against overreaction. Rajat Soni, a respected crypto accountant, cautioned that weekend activity can be deceptive and urged traders not to overreact to momentary pumps or dumps. He suggested that Bitcoin’s eventual recovery might arrive when least expected, underlining a core market truth: price cycles often surprise participants who attempt to time them with precision. The mixed mood among market watchers—some signaling further downside, others warning against premature conclusions—highlights the ongoing tug‑of‑war between pessimism tethered to cycles and the belief that institutional participation and macro liquidity can eventually re‑accelerate demand.

Beyond PlanC’s framework, other veteran voices have laid out scenarios that keep the door open for a softer landing or more extended consolidation. Peter Brandt, a veteran chartist, has entertained the possibility of a drop as low as $60,000 by the third quarter of 2026, a projection that emphasizes how far the market could drift if macro or systemic pressures intensify. Benjamin Cowen, meanwhile, anticipates a cycle low in early October and expects multiple rallies to punctuate the path to that trough, suggesting that traders should be prepared for volatility rather than a straightforward, one‑way decline. On the macro front, Jurrien Timmer of Fidelity has signaled that 2026 could be a “year off” in which Bitcoin stalls or retests lower levels, with projections hinting at sub‑$65,000 levels in a scenario where risk appetite remains constrained.

The confluence of these viewpoints underscores a broader market reality: liquidity conditions, macro sentiment, and evolving regulatory and product‑market dynamics will continue to shape Bitcoin’s path in the months ahead. While some forecasts point to significant downside, others highlight the possibility of interim rallies that can trap late entrants or overconfident holders. For now, market participants will be watching how the price action behaves near key support zones and whether on‑chain metrics corroborate the possibility of a capitulation event or a more protracted bottoming process.

Crypto World

Bitcoin Price Falls to a New Low

As the BTC/USD chart shows, prices dropped below $74,000 yesterday. This marks the lowest level since November 2024, when the cryptocurrency was rallying on news of Trump’s election victory.

At the same time, sentiment indicators are signalling “extreme fear” across the market. This was reinforced by the break below the key April 2025 low near $74,450.

The media has been circulating increasingly alarming headlines:

→ Michael Burry, well known for his bearish calls, has suggested that a drop below the $70k level could create problems for the largest coin holder, MicroStrategy (MSTR);

→ Matt Hougan, Chief Investment Officer at Bitwise, warns that the market may be heading for a “full-blown” crypto winter rather than a simple correction.

Technical Analysis of the BTC/USD Chart

The price continues to move further away from the support level whose break we highlighted on 30 January.

At the same time, the market appears extremely oversold:

→ the price has fallen below the lower boundary of the previously drawn descending red channel;

→ the RSI indicator is forming bullish divergences.

Under these conditions, it is reasonable to assume that the market may be setting up for a technical rebound. This scenario looks particularly plausible given the scale of long position liquidations — around $2.5 billion were wiped out on 31 January alone.

If a recovery does unfold, a key test of bullish intent will be the psychological $80k area, where bears previously held clear control while breaking below the lower boundary of the descending channel.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Survey Shows Crypto Investors Favor Infrastructure Over DeFi

A survey of senior crypto investors and executives suggests capital priorities are shifting away from decentralized finance (DeFi) and toward core infrastructure, as decision-makers focus on liquidity constraints and market plumbing.

The findings come from a new report published by the digital asset conference CfC St. Moritz, based on responses from 242 attendees of its invitation-only event in January. Respondents included institutional investors, founders, C-suite executives, regulators and family office representatives.

According to the survey, 85% of respondents selected infrastructure as their top funding priority, ahead of DeFi, compliance, cybersecurity and user experience.

While expectations for revenue growth and innovation remain broadly positive, respondents flagged liquidity shortages as the industry’s most pressing risk. The results suggest that investor interest remains, but capital deployment is becoming more selective.

Infrastructure takes priority as liquidity concerns persist

Respondents pointed to market depth and settlement capacity as key bottlenecks preventing larger pools of institutional capital from entering crypto markets.

About 84% of respondents described the macroeconomic backdrop as better than neutral for crypto growth, though many said existing market infrastructure remains insufficient for large-scale capitalization.

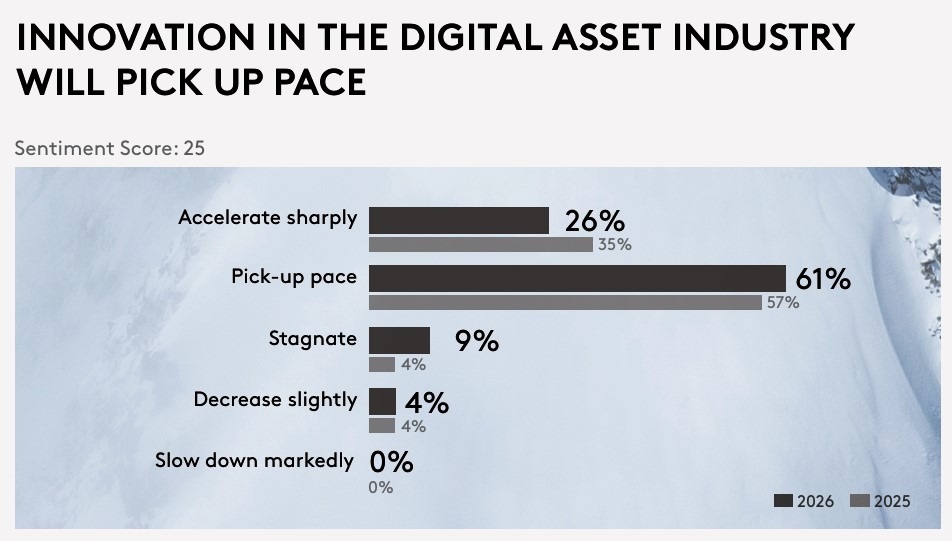

The survey also showed a change in innovation expectations. While a majority expects innovation to accelerate in 2026, fewer respondents anticipate a sharp increase compared to last year, suggesting a shift away from more speculative expectations toward execution-focused development.

This shift aligns with broader industry trends, including a focus on custody, clearing, stablecoin infrastructure and tokenization frameworks rather than consumer-facing applications.

Related: CoreWeave shows how crypto-era infrastructure quietly became AI’s backbone

US sentiment improves as IPO expectations cool

The survey found a sharp improvement in perceptions of the US regulatory environment, with respondents ranking the country as the second-most favorable jurisdiction for digital assets, behind the United Arab Emirates.

CfC St. Moritz attributed the shift to stablecoin legislation and clearer rules for banks and regulated market participants.

At the same time, expectations for crypto initial public offerings cooled after what respondents described as a record year in 2025. While most still expect listings to continue, fewer expressed high confidence, citing valuation resets and liquidity constraints.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

Bitcoin Traders Eye 200-Week Trendlines for a BTC Price Bottom

Bitcoin (BTC) traders see its ultimate support trendline coming into play as part of a new macro BTC price bottom.

Key points:

-

Bitcoin is nearing a long-term trendline retest for the first time since late 2023.

-

Weekly moving averages are on the radar as a BTC price safety net should the market fall again.

-

Market outlooks place emphasis on trader resilience despite a 40% drawdown.

BTC 200-week trend line “should be the bottom”

The latest analysis increasingly expects Bitcoin to test its 200-week exponential moving average (EMA) at $68,400.

After four straight red monthly candles, BTC price is fielding fresh downside targets, which include sub-$50,000 levels.

Despite dropping to its lowest levels since late 2024 this week, BTC/USD may be rescued by classic support trend lines in the end.

“We’re currently trading at Strategy’s cost basis & are close [to] the April lows at $74.4k. If we break below, the next key level is $70k which is just above the previous ATH of $69k,” Nic Puckrin, CEO of crypto education resource Coin Bureau, wrote in an X post Wednesday.

“Breaking below that means we head to a bear market low target. The area to watch here $55.7k – $58.2k. That’s just between the average realised price of all coins & the 200w MA. That should be the bottom.”

Puckrin referenced the 200-week simple moving average (SMA), which forms a $10,000-wide support band with the EMA equivalent, data from TradingView shows.

Trader Altcoin Sherpa, meanwhile, said that it would “make sense” for the price to drop to at least the 200-week EMA.

on 1 hand it makes sense for $BTC to tap the 200W EMA, an indicator that hasn’t been touched since 2023. This would be around 68k.

On the other, this is still an interesting level as the 2025 low.

Either way, the bottom is closer than we think imo pic.twitter.com/93DO4s4qlu

— Altcoin Sherpa (@AltcoinSherpa) February 4, 2026

“Every time Bitcoin has lost 100W EMA, it has retested the 200W EMA,” trader BitBull continued on the topic.

“Right now, 200W EMA is at $68,000 and this will most likely be retested. Once the retest happens, you could start accumulating for the long-term.”

Bitcoin investors resist full capitulation

Other market synopses are also offering hope to panicking BTC investors.

Related: BTC price heads back to 2021: Five things to know in Bitcoin this week

Fresh analysis released Tuesday by Matt Hougan, chief investment officer of crypto asset manager Bitwise, predicted that the current “crypto winter” would soon be over.

“Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while,” he argued, noting that the average “winter” lasted around 14 months.

Cointelegraph further reported on strong conviction among Bitcoin derivatives traders after enduring a drawdown of more than 40%.

The US spot Bitcoin exchange-traded funds (ETFs) have seen net outflows of $3.2 billion since mid-January — just 3% of their total assets under management.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

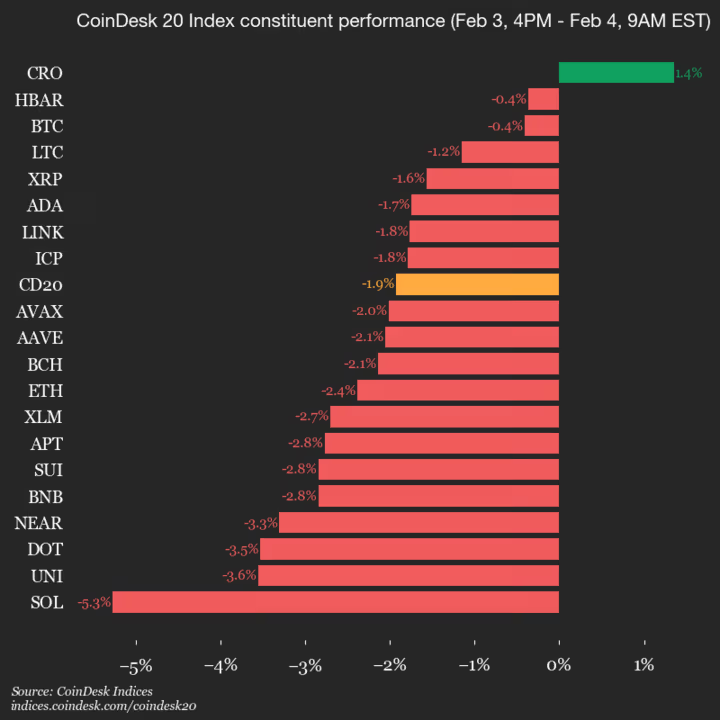

Solana (SOL) drops 5.3% as nearly all assets decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2201.13, down 1.9% (-43.33) since 4 p.m. ET on Tuesday.

One of 20 assets is trading higher.

Leaders: CRO (+1.4%) and HBAR (-0.4%).

Laggards: SOL (-5.3%) and UNI (-3.6%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Is Tesla (TSLA) Stock a Buy as Optimus Robot Production Nears?

TLDR

- Tesla stock was flat at $421.80 on Wednesday as investors awaited developments on the Optimus humanoid robot with production planned for 2026.

- An X poll showed Optimus winning as investors’ most anticipated Tesla product for the year, beating Cybercab and semi-truck options.

- Tesla is converting its Fremont Model S and Model X production space into an Optimus factory targeting one million units annually.

- The company will discontinue the Model S and Model X to make room for Optimus production lines at the California facility.

- Tesla stock trades at 259 times earnings with a $1.4 trillion market cap as the company transitions from electric vehicles to AI robotics.

Tesla stock held steady at $421.80 on Wednesday morning. The lack of movement came as investors digested recent developments around the company’s humanoid robot project.

S&P 500 and Dow futures traded higher by 0.3% and 0.2% respectively. No analyst rating changes or price target adjustments hit the stock during the session.

The most interesting development came from social media. A poll on X asked investors which Tesla product excited them most for the year ahead.

Optimus won by a landslide. The humanoid robot beat out the Cybercab, semi-truck, and stationary storage in voting. Over 16,000 votes were tallied by early Wednesday.

The poll reflects growing anticipation around Tesla’s robotics push. CEO Elon Musk has repeatedly called Optimus the company’s future.

A Factory Transformation Underway

Musk outlined specific plans during Tesla’s January 28 earnings call. The company will convert Model S and Model X production space at its Fremont, California factory.

That space will become an Optimus manufacturing facility. The long-term target is one million robot units per year from that location alone.

Production should begin in 2026. Musk said Tesla plans to unveil the third generation robot in “a few months.”

The decision to retire legacy vehicle models shows serious commitment. Model S and Model X currently represent a small portion of Tesla’s sales. But discontinuing them marks a clear pivot point for the company.

Tesla is moving resources from traditional electric vehicles to AI-powered products. This includes both Optimus and the Robotaxi ride-hailing service.

The Numbers Tell a Stretched Story

Tesla’s market cap sits at $1.4 trillion. The stock trades at $430 per share based on recent pricing.

The company finished its 2025 fiscal year with non-GAAP earnings of $1.66 per share. That puts the stock at 259 times earnings.

Analysts project earnings of $2.12 per share for 2026. They forecast $3.00 per share by 2027. Even using those future estimates, Tesla trades above 100 times earnings two years out.

Tesla stock has gained 10% over the past 12 months. But it dropped about 2% following the January earnings report.

The earnings call generated one downgrade from Battleroad Research analyst Ben Rose. He cited higher capital spending on AI projects as a concern.

Tesla plans to spend $20 billion on new plants and equipment in 2026. That’s up from less than $9 billion in 2025.

The average analyst price target rose by about $4 after earnings. That increase represents less than 1% movement.

Experts believe the humanoid robotics market could reach $5 trillion by 2050. Musk wants Tesla positioned as an early mover in that space.

Other companies are already training humanoid robots for factory work. Some industry watchers speculate Optimus could perform real-world applications later in 2026.

Tesla’s vehicle business has declined as the company shifts focus. Musk appears comfortable with this transition.

The stock reflects a loyal shareholder base willing to wait for long-term potential. Whether current prices leave room for near-term gains remains unclear.

Tesla plans to unveil the third generation Optimus robot in the coming months.

Crypto World

Enterprise Stablecoin Development in Hong Kong: HKMA Licensing Guide

Hong Kong is not waiting for consensus. The Hong Kong Monetary Authority is shifting from rulemaking to licensing, which changes the game for anyone planning a regulated stablecoin.

If you are a bank, fintech leader, or institutional issuer considering a compliant launch, this guide explains exactly what the HKMA will test, what delays or blocks approval, and how to structure stablecoin development for long-term regulatory confidence. This is written for decision-makers who want clarity, not speculation.

Why Hong Kong’s Stablecoin Licensing Framework Changes Everything

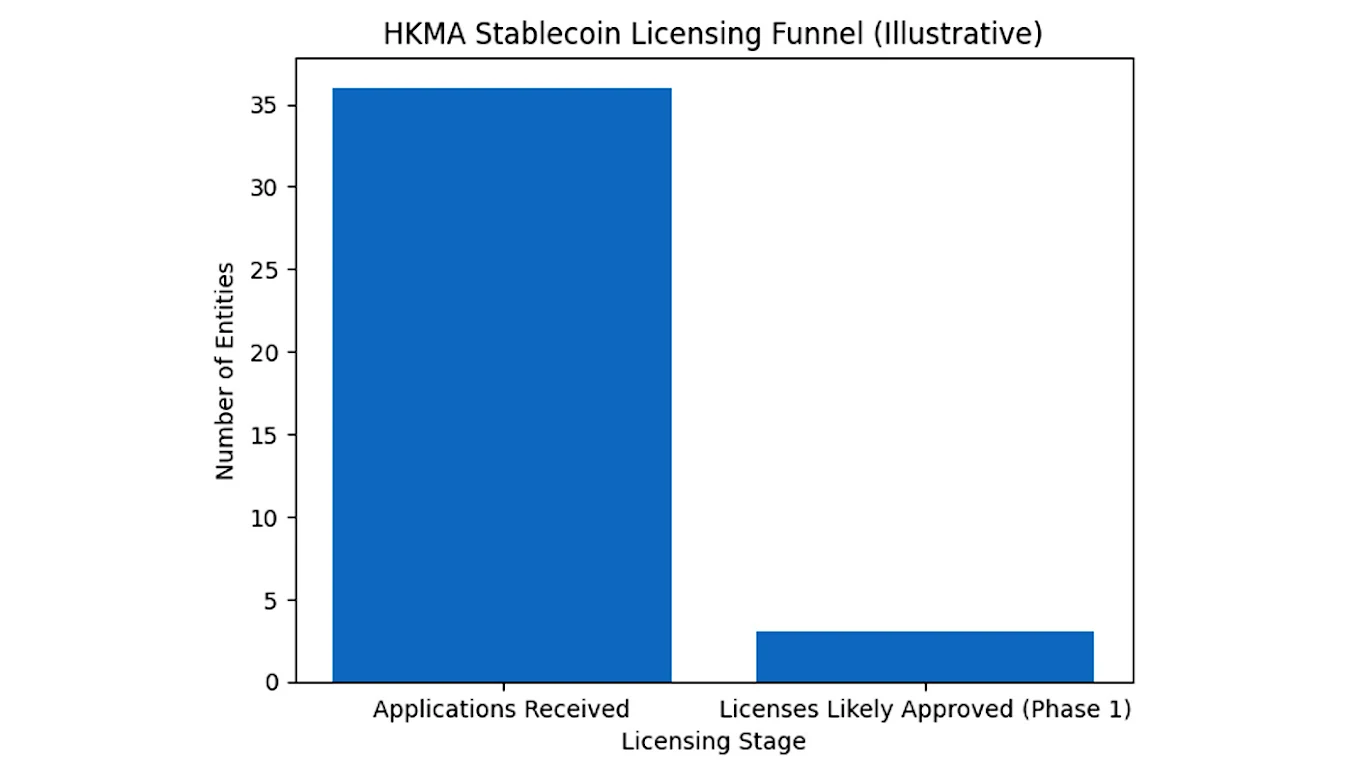

Hong Kong is moving from regulatory intent to execution. According to a recent update reported by Yahoo Finance, the Hong Kong Monetary Authority is preparing to approve its first batch of stablecoin issuer licenses, with only a limited number of applicants expected to clear the initial review. This confirms that Hong Kong is not opening the market broadly. It intentionally selects issuers that demonstrate financial resilience, governance maturity, and operational readiness.

For enterprise and institutional issuers, this is a constructive shift. A selective licensing regime reduces uncertainty, limits regulatory arbitrage, and establishes a clear standard for what qualifies as a credible stablecoin issuer. Rather than competing in an overcrowded and loosely governed market, serious players now operate in an environment designed to reward discipline and long-term viability.

The illustrative licensing funnel above highlights how this framework reshapes competition. While interest in stablecoin issuance remains strong, only issuers with robust governance structures, compliant custody arrangements, and clearly defensible reserve models are likely to progress beyond the first regulatory filter. This changes how stablecoin development must be approached. Development is no longer a technical build followed by regulatory review. Licensing expectations now influence system architecture, reserve design, custody strategy, and operational controls from the earliest planning stages.

In practical terms, Hong Kong’s framework does not just regulate stablecoins. It determines who is qualified to participate in the market at all. Understanding what regulators evaluate next is therefore essential for any issuer aiming to move forward with confidence.

Not sure if your model meets HKMA standards? Get a regulatory alignment review before formal submission.

Understanding HKMA’s Expectations: What Regulators Actually Look For

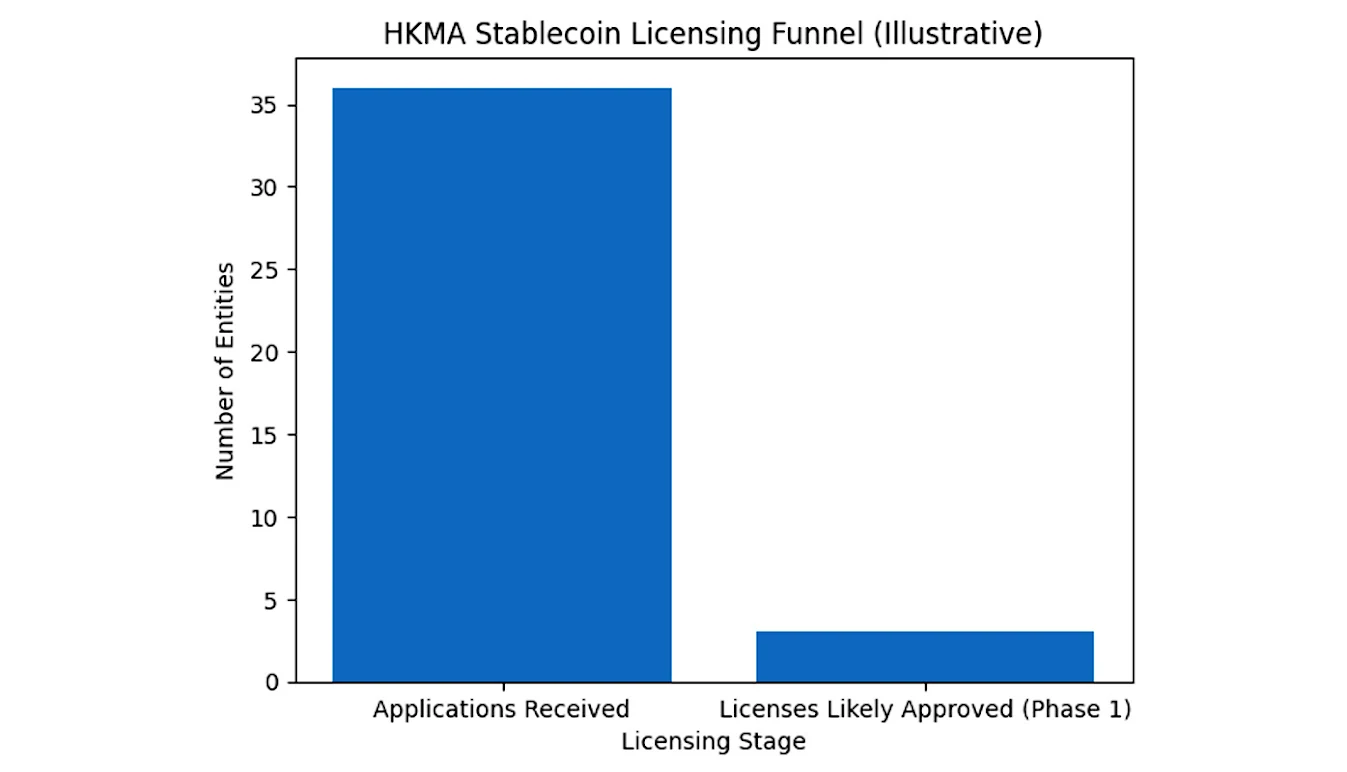

HKMA’s licensing regime is more than a badge of approval. It defines how stablecoin development must be structured, governed, and operated within a regulated financial environment.

1. Clear Licensing Requirement

From 1 August 2025, the Stablecoins Ordinance took effect in Hong Kong. The regime requires authorization for parties carrying on regulated stablecoin activities in Hong Kong and, in certain cases, for issuers of Hong Kong dollar-referenced stablecoins issued offshore. A valid license from the HKMA is required to operate without enforcement risk.

2. Governance and Accountability

Issuers must demonstrate strong corporate governance with clearly defined accountability for financial, legal, and technology risk. Boards and senior management are expected to have direct responsibility for oversight and compliance. Anonymous or loosely coordinated governance structures do not meet HKMA expectations.

3. Full Reserve Backing and Transparency

Under the HKMA’s supervisory guidelines:

- Reserve assets must at all times equal or exceed the value of stablecoins in circulation.

- Reserve holdings must be disclosed and supported by regular independent attestations or audits.

- Custody arrangements must legally segregate reserve assets and protect them from creditor claims and misuse.

These requirements ensure that stablecoins operate as financial instruments with predictable backing and certainty of redemption.

4. AML and Operational Compliance

HKMA’s AML and counter-terrorist financing guidelines apply to licensed stablecoin issuers and include travel rule and operational AML controls. Issuers are expected to demonstrate compliance readiness before launch, not after issuance.

Taken together, these expectations place stablecoin development services firmly within institutional finance, where issuers must withstand detailed regulatory scrutiny across governance, reserves, custody, and operations.

Why Custody and Reserves Are the Real Differentiators

Custody and reserves determine whether a stablecoin is trusted or questioned. From a regulatory standpoint, the central concern is the protection of user funds. Reserve assets must be legally segregated, protected from issuer insolvency, and held in a manner that allows timely redemption under all conditions. Custody arrangements must clearly define who controls reserve assets, how access is governed, and how conflicts of interest are avoided. These structures are reviewed closely because they directly impact systemic risk. This is where an experienced stablecoin development company adds value beyond code delivery. Designing compliant custody and reserve frameworks requires coordination between legal, financial, and technical teams. Errors in this layer are costly and difficult to reverse once a licensing review begins.

Key Failure Points in HKMA Stablecoin Applications

Most stablecoin applications do not fail because of weak technology. They fail because regulators identify structural and operational risks that issuers underestimate.

The most common failure points include:

- Late Regulatory Alignment: Applications stall when licensing considerations are addressed after development. HKMA expects regulatory intent to be reflected in system architecture, governance, and operating models from the outset.

- Inadequate Custody and Reserve Controls: Weak reserve segregation, unclear custodian responsibilities, or redemption mechanisms that are not stress-tested raise immediate red flags during review.

- Unclear Issuer Accountability: Applications falter when decision-making authority, risk ownership, or compliance responsibility is diffused or insufficiently documented.

- Operational Immaturity: Lack of audit readiness, untested reporting workflows, and limited incident response planning signal that the issuer is not prepared for regulated operations.

These failure points are rarely isolated issues. They are symptoms of an unclear execution strategy. For issuers pursuing regulated stablecoin development in Hong Kong, success depends on following a clear, compliance-led roadmap that aligns regulatory expectations, technical design, and operational readiness from the very beginning.

Turn this framework into an actionable plan for your team.

A Roadmap: From Concept to HKMA-Ready Stablecoin Development

Issuers that succeed in regulated markets follow a structured and disciplined roadmap. Rather than treating licensing as a post-launch task, they align strategy, compliance, and execution from the outset, often in collaboration with an experienced stablecoin development company that understands regulatory expectations.

Phase 1: Regulatory Assessment: The first step is determining whether the proposed stablecoin activity falls within HKMA’s licensing scope. This includes analyzing the token’s reference currency, distribution model, and target users, as well as identifying any cross-border implications under the Stablecoins Ordinance.

Phase 2: Compliance-Aligned Architecture: Once licensing applicability is clear, development must align with regulatory expectations. This includes smart contract logic tied to reserve controls, audit-ready reporting systems, custody workflows, and AML compliance mechanisms designed to meet HKMA standards from day one.

Phase 3: Operational Validation: Before applying for a license, issuers should conduct internal stress testing, simulate redemption scenarios, and validate reporting processes. Operational readiness is as important as technical correctness, particularly under regulatory review.

Phase 4: Licensing and Ongoing Governance: Licensing is not the end of the process. Approved issuers are expected to maintain continuous compliance, governance oversight, and transparent communication with regulators as part of ongoing supervision.

Well-designed stablecoin development solutions reduce friction across every stage of this journey, helping issuers move from concept to regulated issuance with confidence and clarity.

Choosing the Right Development Partner Matters More Than Ever

- The development partner directly impacts HKMA licensing outcomes, not just technical delivery.

- HKMA reviews governance maturity, reserve design, custody controls, and operational discipline alongside code quality.

- Partners that treat compliance as a post-build task increase approval risk and rework costs.

- A capable stablecoin development company embeds regulatory alignment into its architecture from day one.

- Experienced firms reduce licensing friction by aligning technical execution with HKMA expectations.

- The right partner helps issuers remain license-ready throughout development, regulatory review, and post-approval operations.

This makes the final decision clear. In Hong Kong’s regulated market, choosing the right partner is not a technical choice. It is a licensing decision.

Final Thought: Regulation Is the Filter, Not the Finish Line

Hong Kong’s regulatory framework makes one thing clear. Stablecoin initiatives will succeed only if they are designed for licensing, governance, and operational resilience from the start. For serious issuers, stablecoin development is no longer about speed or experimentation. It is about execution that withstands regulatory scrutiny.

This is where partnering with Antier creates a clear advantage. As a trusted stablecoin development company, Antier delivers enterprise-grade Stablecoin Development Services and stablecoin development solutions aligned with HKMA requirements, helping issuers move from concept to compliant launch with confidence.

Ready to launch an HKMA-ready stablecoin? Talk to Antier and start with clarity, compliance, and control.

Crypto World

Precise Systems of Fairness and Transparency in Crypto

Since the publication of the Bitcoin whitepaper in 2008, crypto has offered the promise of open accessibility, neutral rules, and verifiability for everyone. While crypto has continued to hold true to this mission, trading platforms have since departed from this universal truth. Hidden restrictions, inconsistent withdrawals and shifting rules have eroded trust and created a system where true ownership is no longer a guarantee.

Eighteen years later, traders have learned to understand that fairness isn’t just a selling point, rather a system that needs to be verified. The next phase of crypto depends on systems where fairness is designed into the architecture itself, not retroactively justified.

It’s this promise and verifiability that rests as the core mission of Zoomex: a global crypto exchange that’s been trusted for over five years. From day one, Zoomex was built around a simple but increasingly rare belief that fairness must be felt, consistently delivered and provable at every step of the trading journey.

When fairness is designed into the system, users don’t need to ask for trust, they can verify it.

Fairness beyond marketing

Fairness often appears in slogans, but the culture of “trust me, bro” has made efforts feel more performative than practiced. But when fairness is embedded into a platform’s system, users get an experience that’s more than just marketing.

Zoomex has built fairness into its foundation, structuring the user experience around clear trading rules, transparent asset visibility and execution logic that behaves predictably across users and market conditions. Instead of relying on discretionary decisions or hidden exceptions, the platform emphasizes consistency. Regardless of how much crypto you hold, whether you’re a new or frequent holder, or simply looking for a long-term Dollar-Cost Averaging (DCA) opportunity, the same rules apply to all users.

This matters because most trading platform failures are not based on the underlying technology. They’re systematic. Exchanges don’t collapse because orders cannot be matched, rather they fail when friction makes rules unclear, access is restricted or users lose trust in the system.

By prioritizing clarity over complexity, Zoomex positions fairness not as an abstract value, but as a systematic guarantee.

Profit as a priority

There’s no single indication of fairness bigger than withdrawals. In the wake of FTX and other exchange mishaps, users have learned to ask the difficult questions:

- “Can my profits be withdrawn?”

- “Am I an exception to this rule?

These aren’t hypothetical questions. They reflect the learned and lived experience of any crypto trader.

Zoomex’s design starts from a different assumption: Earnings belong to the user, without friction or negotiation. Withdrawals are not framed as privileges or incentives, but as a baseline right of participation. It doesn’t matter if you hold 1 BTC or 0.00001 BTC – what matters is your participation in the network.

This principle has been reinforced by independent media coverage, including user case studies documenting successful large withdrawals. On X and in the media, Zoomex users have documented real-world proof that access holds up regardless of market conditions. Fairness, in this context, is measured not by what a platform claims, but by whether users can reliably convert trading success into usable capital.

Transparency as a system, not a dashboard

When it comes to transparency on centralized exchanges, users are often left to surface-level disclosures to determine the security of their assets.Transparency on trading platforms is important to reduce information asymmetry, ensuring that users understand how their assets are traded and secured, and why conditions affect their assets.

Zoomex emphasizes transparent asset displays, traceable order execution and clear reporting of outcomes. The goal is to give the essential information to traders. Though disclosures may feel overbearing, it’s designed for intelligent market decisions, allowing traders to see their positions, execute on strategies and see their decision outcomes without ambiguity.

This approach aligns with a growing demand among experienced traders and institutional players who evaluate platforms based on structure, consistency and fairness. In this model, transparency is not a static feature, it’s a continuous system of visibility that supports informed decision-making.

Related: What “Proof Over Promises” Means in Practice

Even among institutional-grade traders, transparency needs to come with a degree of simplicity. Often complexity is mistaken for sophistication, but Zoomex understands that simplicity and sophistication are not mutually exclusive.

Zoomex’s minimalist design strips away unnecessary friction while preserving professional-grade functionality. Execution flows are streamlined, interfaces are intuitive and rules are legible. This is not about reducing capability, but instead reducing the cognitive load so both institutional and retail traders are able to clearly execute their trades with the confidence they need.

Regulatory certainty as a priority

One of the biggest hurdles of wide-spread adoption for crypto is regulatory clarity. As countries continue to evolve their legal frameworks, traders have been best supported by trading platforms that have been forward thinking about regulation, not reactive. However, there needs to be a balance of what is necessary and what is excessively cumbersome for users to make their trades with confidence. Zoomex addresses this by offering optional KYC, allowing privacy-sensitive traders to participate without unnecessary barriers while still operating within a compliant framework.

This approach reflects a broader definition of fairness: respecting different user needs rather than imposing uniform identity requirements where they are not legally required. Fair systems expand access without compromising oversight, making regulatory compliance as a feature, not a roadblock.

This framework has been battle-tested and has stood the test of time through both bear and bull markets. Zoomex has withstood five years of stable operation, regulatory licensing across multiple jurisdictions and annual security audits conducted by independent firms such as Hacken.

Privacy and compliance are more than just a marketing objective. Zoomex holds registrations including Canada Money Service Business (MSB), United States MSB and NFA and Australia AUSTRAC license, reinforcing its commitment to creating a system of precise fairness and consistency, regardless of your jurisdiction.

Related: Zoomex expands derivatives offering and launches new initiatives for European users

Trust is not just built in the bull market, but during periods of stress. Platforms like Zoomex that maintain fairness through bull and bear markets are the ones that endure.

From the first trade to the latest withdrawal, fairness on Zoomex is experienced, not explained.

Zoomex is building precise systems of fairness and transparency – cultivating partnerships, international compliance and operational decisions that consistently reinforce values of precision and fairness. The result is a platform designed not just to perform, but to hold up under scrutiny and survive in all market conditions.

As the crypto industry continues to mature, trading platforms will continue to be judged based on their integrated systems, not just their marketed promises. As fairness becomes a design requirement, and not just a press release, Zoomex is prepared to be the platform that is ready for both institutional-focused and retail traders.

Sign up on Zoomex and explore a trading system where fairness, transparency and access are built into every layer. New users can receive up to 14,000 USDT in welcome rewar

Crypto World

30% Risk Despite Tom Lee’s Theory

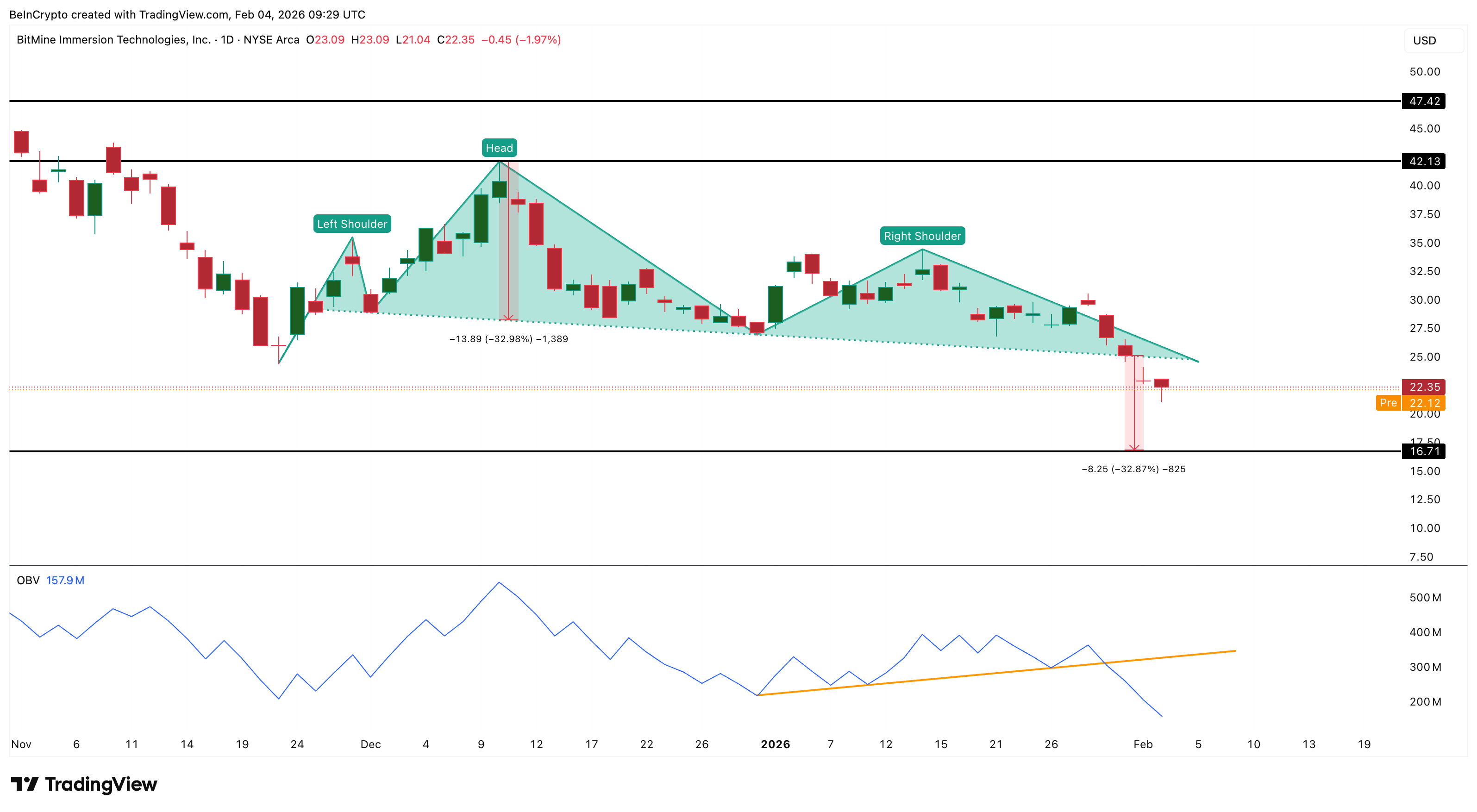

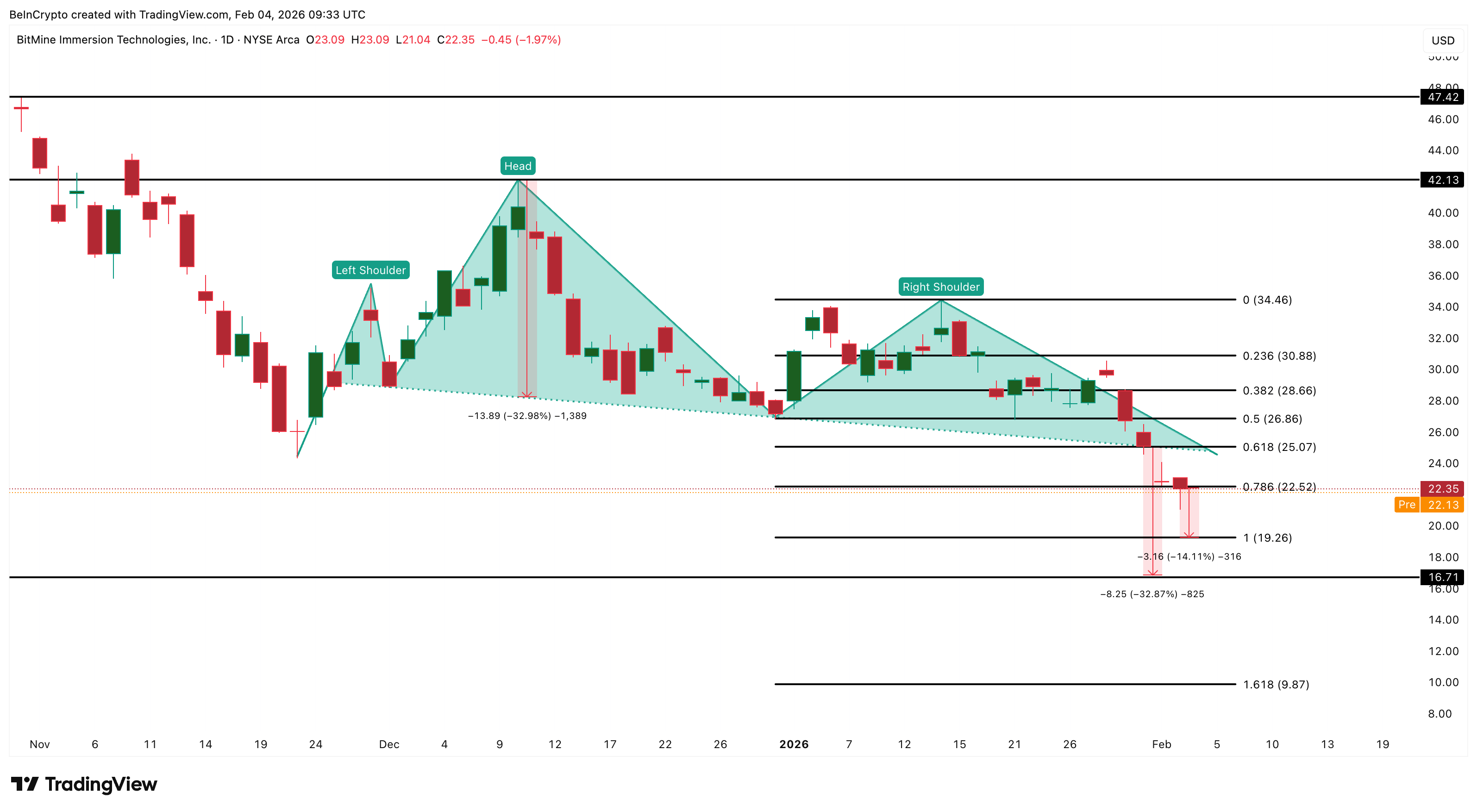

BMNR stock price remains under pressure in early February as selling continues across crypto-linked equities. The stock is down nearly 25% over five days and more than 33% over one month, trading around $22.35.

While management defended recent crypto-led paper losses as part of a long-term strategy, market data suggests technical weakness is still driving investor behavior. And increasingly driving them away, despite a novel defense from BitMine Chairman, Tom Lee.

Ethereum Treasury Losses Spark ‘Feature, Not A Bug’ Defense

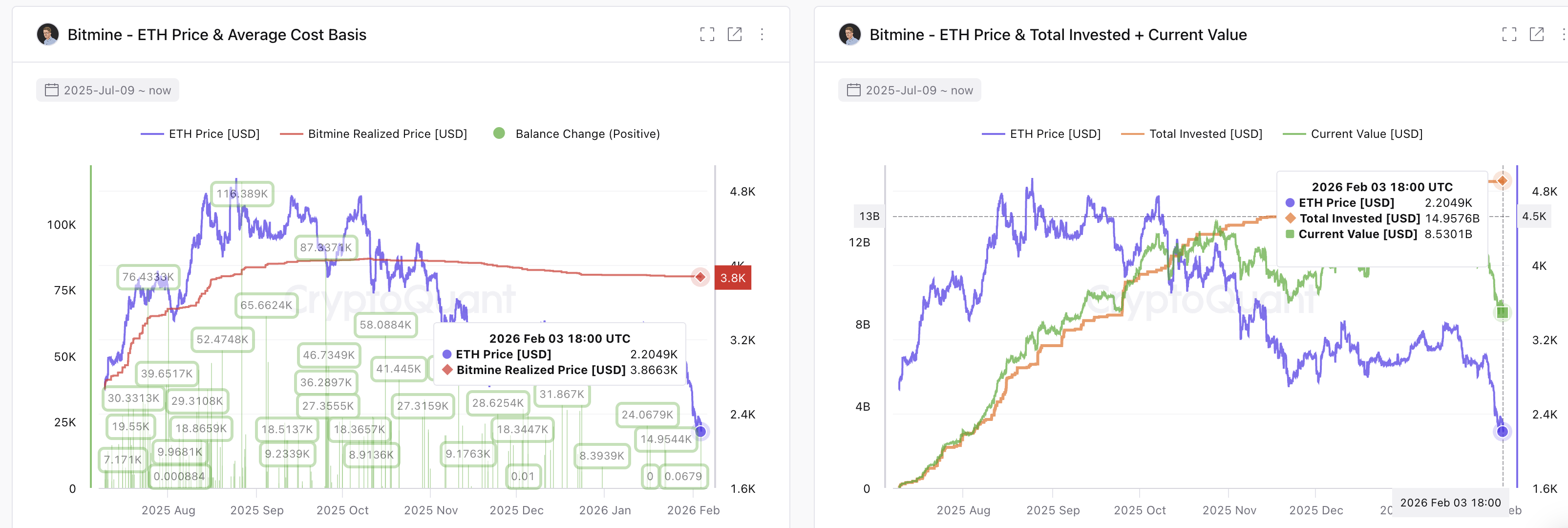

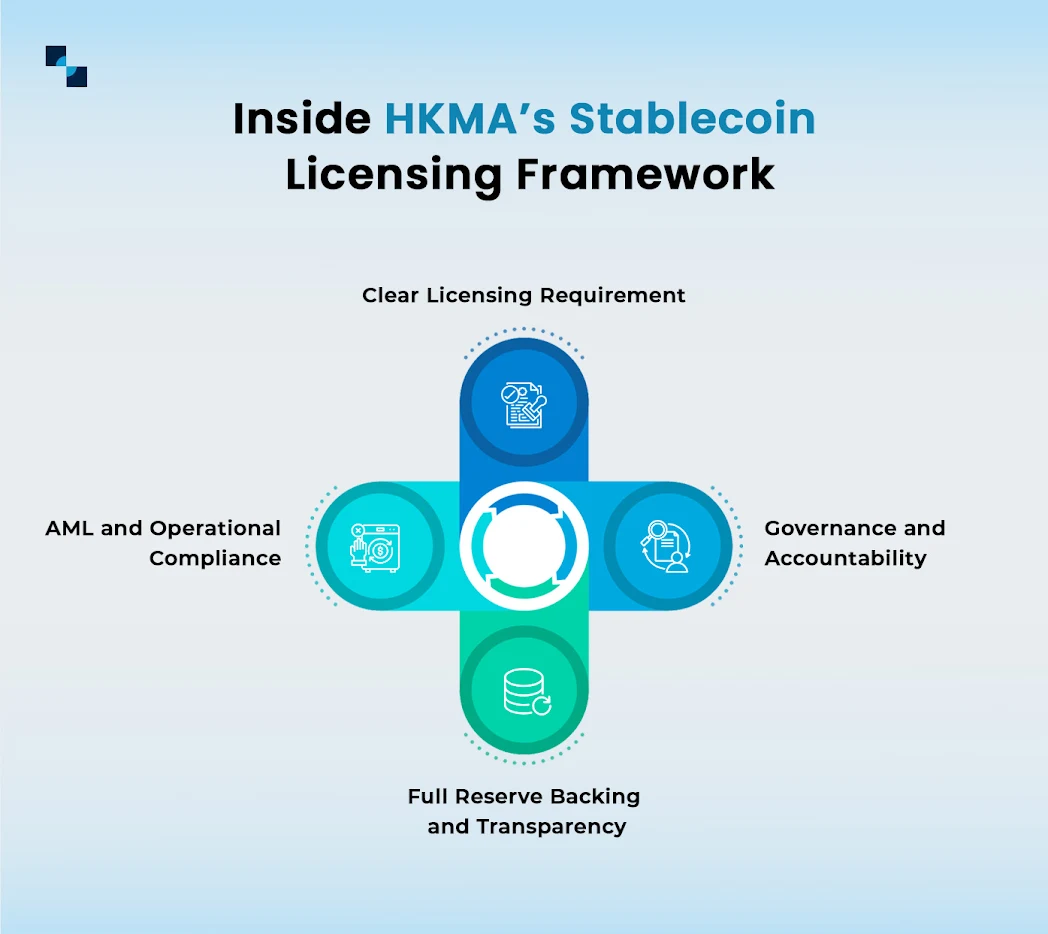

Concerns around BitMine’s balance sheet intensified after data showed heavy unrealized losses on its Ethereum treasury.

Sponsored

Sponsored

As of February 3, BitMine had invested roughly $14.95 billion into ETH holdings. However, the current market value had fallen to around $8.53 billion, implying paper losses of more than $6.4 billion.

At the same time, Ethereum was trading near $2,200, well below BitMine’s average acquisition cost of roughly $3,800. This gap highlighted how deeply underwater the company’s treasury had become.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

These figures triggered criticism from market observers, who argued that such large unrealized losses could limit future upside and pressure shareholder returns. Some warned that accumulated ETH could eventually act as a selling supply.

In response, Chairman Tom Lee defended the strategy, stating that drawdowns are “a feature, not a bug.” He argued that crypto cycles naturally involve temporary losses and that BitMine is designed to accumulate through downturns to outperform over time.

Sponsored

Sponsored

However, despite this explanation, BMNR stock failed to attract sustained buying interest after the comments.

OBV and CMF Show Buyers Stayed Away After the Breakdown

Market participation data suggests that investors began exiting even before the public debate intensified.

On-Balance Volume (OBV) tracks cumulative buying and selling pressure by adding volume on up days and subtracting it on down days. It reflects whether traders are accumulating or distributing.

From early December through late-January, OBV was forming higher lows, signaling steady accumulation. But between January 28 and 29, OBV broke below its rising trend line. This showed that possibly retail and short-term traders had started distributing shares.

Sponsored

Sponsored

After OBV weakened, institutional-style capital followed.

Chaikin Money Flow (CMF) measures whether money is flowing into or out of an asset using price and volume. Readings above zero suggest accumulation, while negative values signal capital outflows.

From January 30 onward, CMF fell sharply and remained below zero. This confirmed that large buyers were reducing exposure as the BMNR price approached key support. Both indicators aligned with the chart structure.

BMNR had been forming a head-and-shoulders pattern through December and January. When price failed near the neckline and then broke down on February 2 (gap-down formation), OBV and CMF confirmed the move.

In sequence, retail volume weakened first, large capital exited next, and prices collapsed afterward. The “feature, not a bug” ETH treasury narrative did not reverse this flow-driven sell-off.

Sponsored

Sponsored

Key BMNR Stock Price Levels Define the Next Move

After breaking the head-and-shoulders neckline and the rising trend line, the BMNR stock price resumed its broader downtrend, a projected dip of over 30%.

Several levels now define the outlook. On the downside, initial support sits near $19.26 if the BMNR stock price doesn’t reclaim $22.52 on the daily timeframe. Below $19.26, the next major level stands near $16.71, which aligns with the full technical projection of the bearish pattern.

If selling pressure accelerates, extended downside could reach toward $9.87, pushing the stock into single-digit territory. On the upside, recovery remains difficult.

The first resistance lies near $22.52. The BMNR stock price must reclaim this level to slow the decline. Above that, resistance appears near $25.07 and $28.66. These zones would need to be cleared to signal early stabilization.

A broader trend shift would require a move above $34.46, followed by confirmation near $42. For now, both OBV and CMF remain weak, showing that buyers have not returned in force. Until capital flows turn positive and key resistance is reclaimed, technical pressure is likely to dominate BMNR stock price behavior.

Crypto World

TRM Labs Completes $70M Round At $1B, Becomes Crypto Unicorn

Blockchain intelligence platform TRM Labs completed a $70 million Series C funding round, valuing it at $1 billion, becoming the latest crypto company to reach unicorn status.

The investment round was led by seed investor Blockchain Capital, with participation from Goldman Sachs, Bessemer Venture Partners, Brevan Howard Digital, Thoma Bravo, Citi Ventures and Galaxy Ventures, according to a Wednesday news release.

TRM Labs seeks to equip public and private institutions with AI solutions that combat cybercrime. The company defends against illicit activities that increasingly rely on automation.

“At TRM, we’re building AI for problems that have real consequences for public safety, financial integrity, and national security,” wrote Esteban Castaño, co-founder and CEO of TRM Labs.

“This funding allows our world-class team — and the people who will join us next — to innovate alongside institutions on the front lines of the most consequential threats, and expand the potential of AI to meaningfully improve how our critical systems are protected.”

The $70 million round shows that capital is flowing into blockchain analytics platforms seeking to stop the spread of AI-fueled scams and cyberattacks, including from large traditional institutions.

Related: Fake MetaMask 2FA security checks lure users into sharing recovery phrases

TRM Labs to expand global workforce, advance AI compliance and investigation tools

TRM is a San Francisco-headquartered company with hubs in Los Angeles, New York, Washington, London and Singapore.

It said the new capital will be used to expand its global workforce of AI researchers, data scientists, engineers and financial crime experts.

The company will also advance its AI-powered investigations to disrupt illicit activity and advance its solutions that help institutions manage financial crime risks.

Related: CZ proposes fix to address poisoning after investor loses $50M

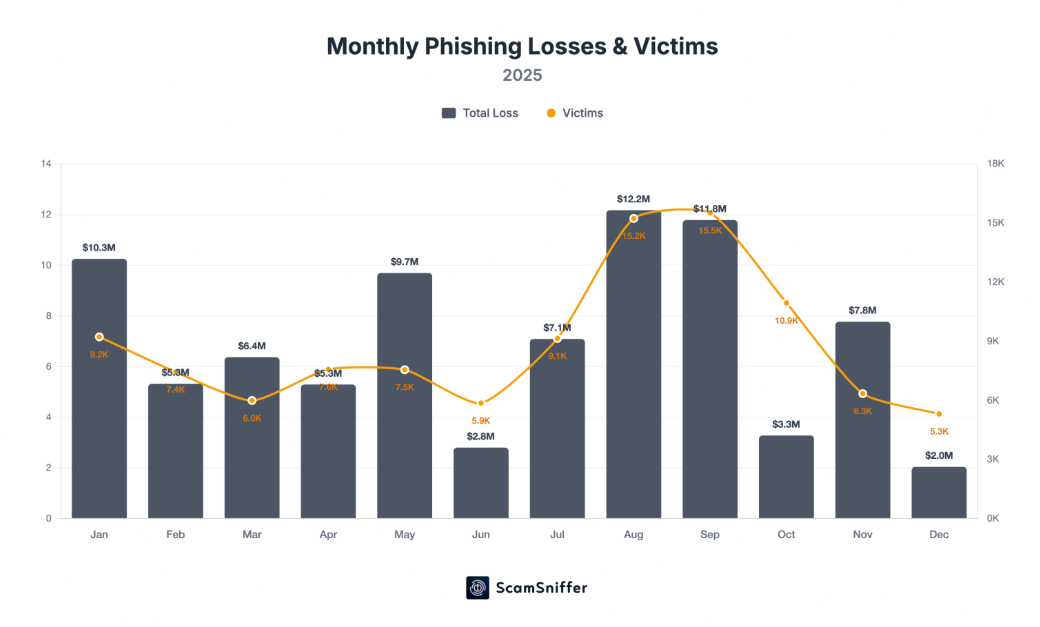

Crypto phishing scams see resurgence due to generative AI advancements

Crypto phishing scams have been a long-standing issue in the industry, which saw a resurgence following advancements in generative AI. They involve hackers sharing fraudulent links with victims to steal sensitive information, such as crypto wallet private keys.

In December, a Bitcoin (BTC) investor lost his entire retirement fund to an AI-fueled romance scam known as a “pig butchering.” In this case, the scammer used AI-generated images to emotionally manipulate the victim into sending over his Bitcoin.

Still, the falling number of incidents suggests that investors are becoming better at safeguarding their assets from attackers.

Losses to phishing scams decreased 83% year-on-year, falling to $83.3 million in 2025, from $494 million in 2024, according to a report from Web3 security tool Scam Sniffer

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

Qualcomm (QCOM) Stock: What Wall Street Expects from Earnings Today?

TLDR

- Qualcomm reports December quarter earnings today with Wall Street forecasting $12.13 billion in revenue and $3.39 EPS

- The stock trades down 15% year-to-date, creating a 44% valuation discount compared to the S&P 500

- Bernstein analyst keeps Outperform rating with $200 target despite smartphone market headwinds

- Options pricing indicates approximately 6% expected move with market bias score at -1

- Critical support sits at $146-$148 while resistance holds at $150-$152

Qualcomm unveils its December quarter financial results after today’s closing bell. Analysts project revenue of $12.13 billion with adjusted earnings per share reaching $3.39.

The mobile processor and 5G chipset manufacturer has struggled in 2026. Shares have fallen 15% while the broader semiconductor sector rallied 13%.

This underperformance reflects growing concerns about smartphone demand. Rising memory prices threaten to crimp consumer device purchases throughout the year.

Yet not everyone shares this pessimistic outlook. Bernstein analyst Stacy Rasgon maintained his Outperform rating Monday.

His $200 price target suggests substantial upside from current levels. Rasgon believes the market is overlooking Qualcomm’s fundamental strengths.

“We still believe there is value to be had under the surface [with its] objectively strong product portfolio,” the analyst wrote. He acknowledged the “general distaste of smartphones” currently weighing on sentiment.

Valuation Gap Creates Opportunity

The numbers tell an interesting story. Qualcomm’s price-to-forward earnings ratio sits 44% below the S&P 500 average.

That’s a massive discount for a market leader in wireless technology. The company dominates mobile processors and 5G chipsets globally.

Wall Street expects the current quarter to deliver $11.11 billion in revenue with $2.90 EPS. These forward estimates matter just as much as December’s results.

Options traders are pricing in roughly 6% movement following the announcement. This implied volatility doesn’t favor either direction, just expects action.

Price Action Shows Shifting Dynamics

Recent trading patterns reveal something important. Selling pressure has weakened over the past several sessions.

Downside attempts keep stalling without sustained momentum. The stock has transitioned from steady decline to choppy range-bound movement.

This shift suggests sellers are losing control. But it doesn’t confirm buyers are ready to step in aggressively either.

Key support rests between $146 and $148. Holding this zone keeps the stabilization process alive.

Breaking below $146 would hand control back to sellers. That could trigger accelerated losses.

Resistance appears at $150 to $152. Failed rallies here would confirm range behavior rather than trend reversal.

The market bias score registers -1 on a scale from -10 to +10. This reflects lingering weakness alongside fading downside momentum.

Scores near zero indicate low conviction. Neither bulls nor bears have established control heading into the report.

Qualcomm continues to trade near the bottom of its post-earnings range. The corrective phase that began after last quarter’s results remains intact.

Tonight’s report will clarify whether memory price concerns are justified. Or if the market has overreacted to temporary headwinds.

The company’s product lineup remains competitive despite market skepticism. Execution and guidance will determine the stock’s next move.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 hours ago

Tech6 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World15 hours ago

Crypto World15 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards