Crypto World

Bitcoin slides toward $70,000 as on-chain data flags bear market and traders bet Fed holds in April: Asia Morning Briefing

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin is entering the Asian trading day with on-chain data flashing full bear-market signals, as prices hover in the mid-$70,000s and global equity markets continue to search for direction.

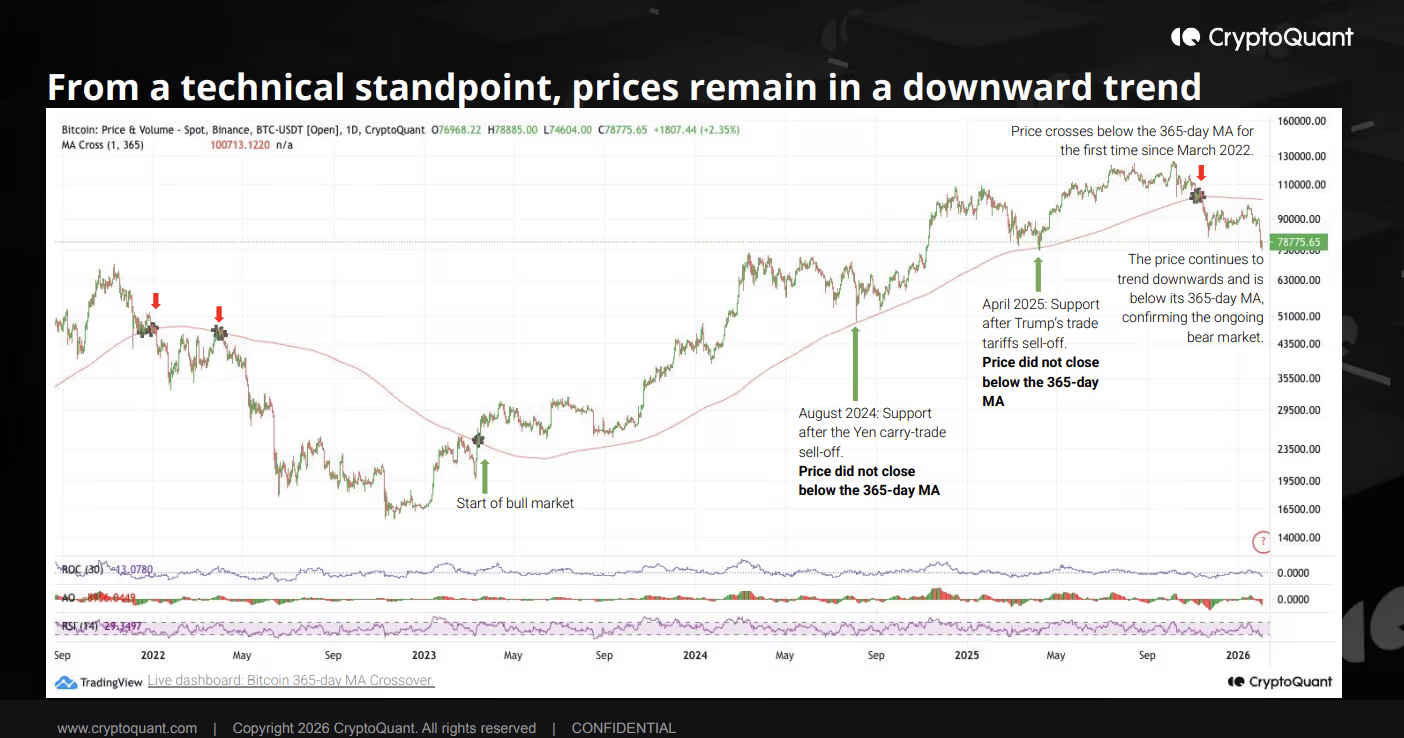

CryptoQuant’s latest weekly report frames the weakness as structural rather than cyclical, with its Bull Score Index sitting at zero while bitcoin trades far below its October peak. The report argues the market is no longer digesting gains but operating with a thinner buyer base and tightening liquidity.

Glassnode data reinforces that picture, pointing to weak spot volumes and a demand vacuum where selling pressure is not being met with sustained absorption. In effect, the issue is less panic than participation.

Institutional flows underline the shift. U.S. spot bitcoin ETFs, which were net accumulators at this time last year, have flipped into net sellers, creating a year over year demand gap measured in tens of thousands of bitcoin.

At the same time, the Coinbase premium has remained negative since October, signaling that U.S. investors are not meaningfully stepping in despite lower prices. Historically, sustained bull phases have coincided with strong U.S. spot demand. That engine is currently idling.

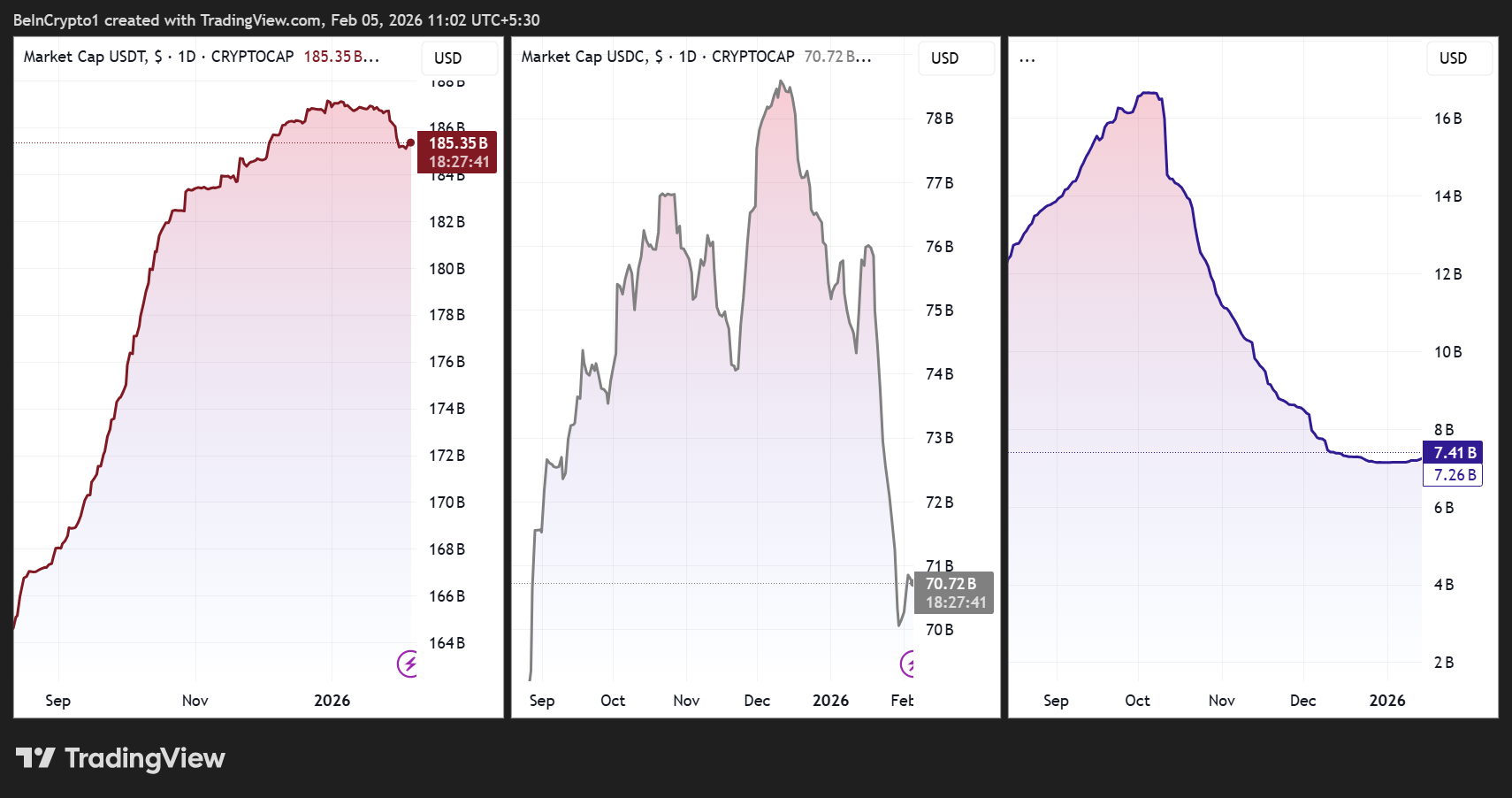

Liquidity conditions are also tightening beneath the surface. Stablecoin expansion, which typically fuels risk appetite and trading activity, has stalled, with USDT market cap growth turning negative for the first time since 2023.

Longer-term apparent demand growth has likewise collapsed from last year’s highs, suggesting this is not merely leverage being flushed but participation itself fading. Technically, bitcoin remains below its 365-day moving average, with on-chain valuation bands clustering major support in the $70,000 to $60,000 corridor.

Overlaying this is a macro backdrop where bitcoin is increasingly behaving like high-beta software rather than digital gold. Prediction markets show traders still leaning heavily toward no change at the Federal Reserve’s April meeting, with only modest expectations for a June rate cut. That hesitancy limits the prospect of near term liquidity relief.

The policy narrative is further complicated by politics. President Donald Trump recently spoke to the press about his Fed nominee Kevin Warsh and said during an interview with NBC News a Fed chair who wanted to raise rates “would not have gotten the job,” a remark that tempers earlier optimism about central bank independence.

For Asia, the result is a market defined less by shock than by absence, where bounces remain possible, but conviction remains thin.

Market Movement

BTC: Bitcoin drifted lower into the mid $70,000s after briefly testing support, with rebounds fading quickly as spot demand remained thin and tech stocks stayed under pressure.

ETH: Ether hovered just above the low $2,000s, struggling to build momentum as broader risk sentiment softened and flows remained muted across major exchanges.

Gold: Gold rebounded toward the $5,000 to $5,100 range, extending a volatile recovery driven by safe-haven buying after U.S.–Iran tensions flared and softer private payroll data offset mixed economic signals while traders reassessed the Fed outlook under Trump’s new chair pick.

Nikkei 225: Japan’s Nikkei 225 edged lower by roughly 0.3% as chip and tech heavyweights tracked Wall Street’s sell-off, though broader Japanese equities remained relatively resilient compared with regional peers.

Elsewhere in Crypto:

Crypto World

Ethereum Lending Hits $28 Billion After Aave Proves DeFi’s Crisis Shield in Weekend Crash

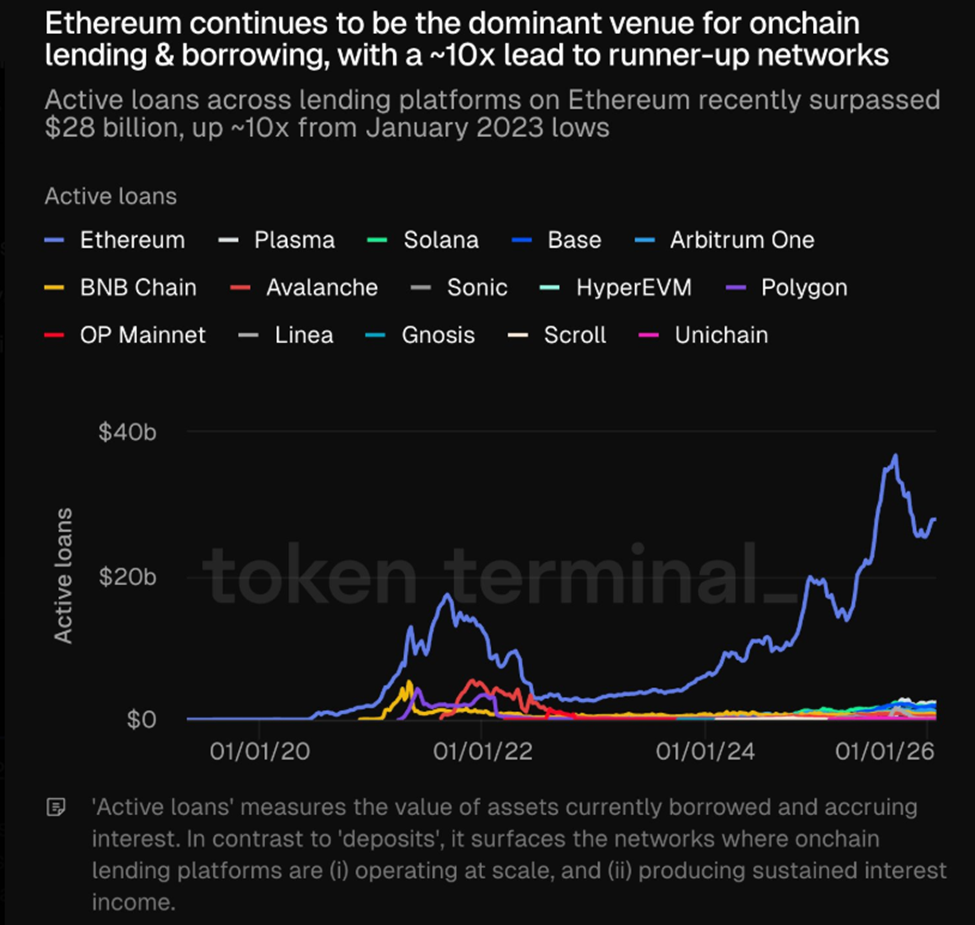

Ethereum’s on-chain lending ecosystem has reached a new milestone, with active loans surpassing $28 billion as of January 2026.

Central to this growth is Aave, the leading Ethereum-based lending protocol, which controls approximately 70% of the network’s active lending market.

Sponsored

Sponsored

Aave’s Automated Liquidations Prevent DeFi Contagion Amid Weekend Crash

Data on Token Terminal shows that the growth in active loans across Ethereum-based lending platforms achieved a tenfold increase from January 2023 lows.

This milestone highlights Ethereum’s continued dominance in DeFi. It gives it a roughly tenfold advantage over competing networks such as Solana and Base.

The surge in lending activity, while a signal of DeFi’s expanding adoption, also raises questions about systemic risk.

In 2022, elevated loan volumes contributed to waves of liquidations that exacerbated broader market downturns. By Q3 2025, crypto lending had reached a record $73.6 billion. This represents a 38.5% quarter-over-quarter increase, and nearly tripling since the start of 2024.

According to Kobeissi analysts, this was driven largely by DeFi protocols benefiting from Bitcoin ETF approvals and a sector-wide recovery.

While leverage in DeFi remains far below that in TradFi sectors—representing just 2.1% of the $3.5 trillion digital asset market, compared to 17% in real estate—its concentration in algorithmic lending platforms like Aave amplifies the potential for rapid, automated liquidations.

Sponsored

Sponsored

Weekend Crash Highlights Aave’s Role as DeFi’s Stabilizer Amid $2.2 Billion Liquidations

The late January 2026 weekend market crash tested this system under extreme stress. Bitcoin dropped sharply from around $84,000 to below $76,000 amid:

- Thin weekend liquidity

- Geopolitical tensions in the Middle East, and

- Pressure from the US government funding uncertainties.

Over $2.2 billion in leveraged positions were liquidated across centralized and decentralized exchanges in just 24 hours.

Aave’s infrastructure played a crucial stabilizing role. The protocol processed over $140 million in automated collateral liquidations across multiple networks on January 31, 2026.

Sponsored

Sponsored

Despite high Ethereum gas fees spiking above 400 gwei, which temporarily created “zombie positions” where undercollateralized loans hovered near liquidation thresholds but could not be profitably cleared immediately, Aave handled the surge without downtime or bad debt.

Aave’s performance prevented what could have been a far more severe contagion across DeFi. Had the protocol failed, undercollateralized positions could have accumulated into bad debt. Such an outcome would trigger cascading liquidations and potential panic across the ecosystem.

Other protocols, including Compound, Morpho, and Spark, absorbed smaller liquidation volumes. However, they lacked the scale or automation to fully replace Aave.

Even large ETH holders, like Trend Research, who deleveraged by selling hundreds of millions of dollars in ETH to repay Aave loans, relied on the protocol’s efficiency to mitigate further market stress.

Sponsored

The weekend crash highlights both the opportunities and vulnerabilities inherent in Ethereum’s lending ecosystem.

While active loans and leverage are rising, Aave’s resilience signals that DeFi’s infrastructure is maturing.

The protocol’s ability to absorb large-scale liquidations without systemic failures highlights Ethereum-based lending as a stabilizing force in volatile markets. It reinforces its “flight-to-quality” reputation among both institutional and retail participants.

Despite this bullish outlook, the AAVE token is down by over 6% in the last 24 hours, and was trading for $119.42 as of this writing.

Crypto World

Panic Selling Clashes With Recovery Signals

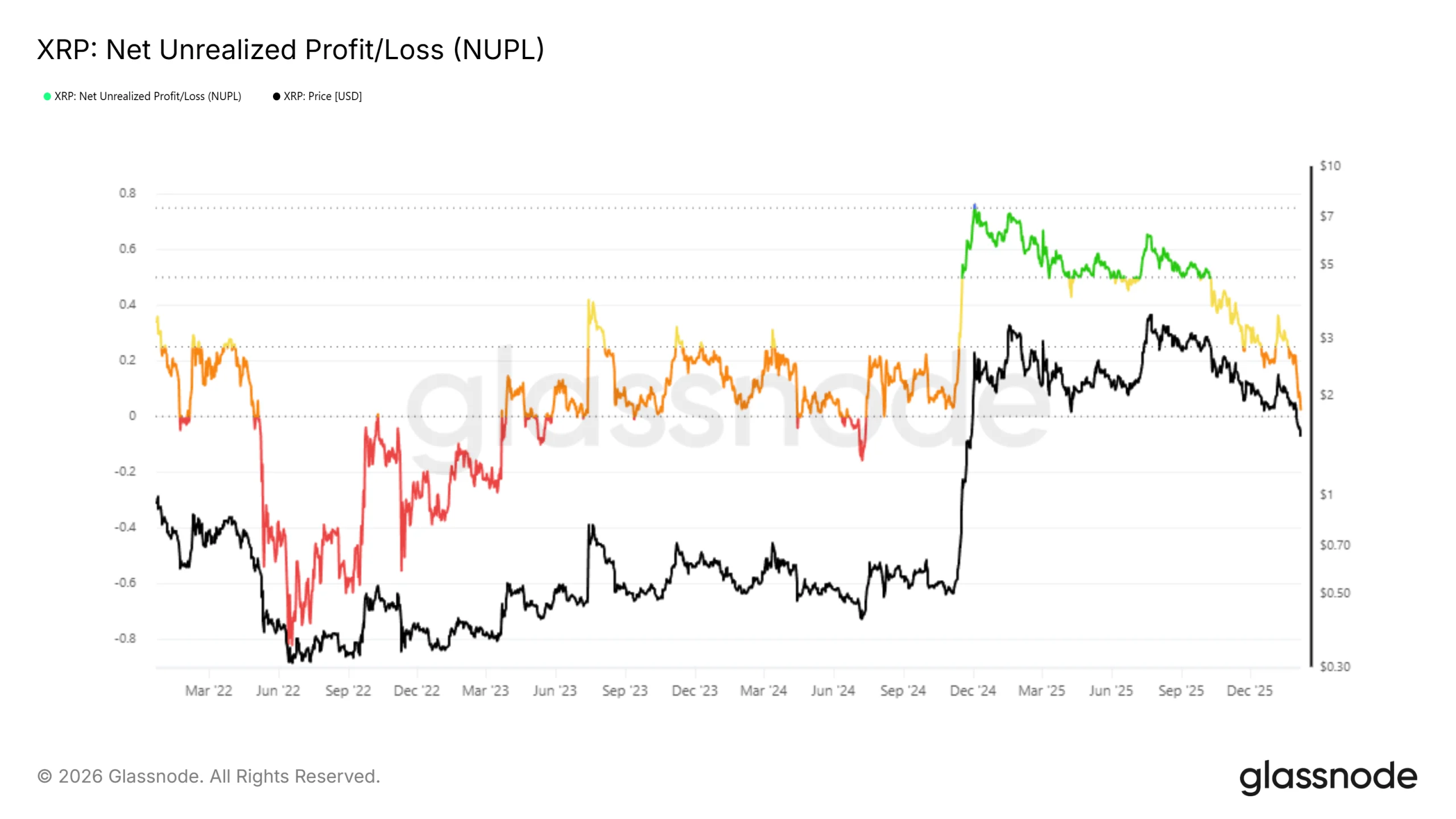

XRP has faced a sharp downturn, falling 24% over the past week as selling pressure intensified across the market. The decline pushed the altcoin into a vulnerable position, breaking a pattern of past recoveries.

This sustained weakness suggests the current correction may reshape XRP’s historical price behavior if demand fails to return.

Sponsored

XRP’s Past Says Recovery Ahead

XRP’s Net Unrealized Profit and Loss is approaching the capitulation zone. At this stage, unrealized losses outweigh minor gains across the circulating supply. Historically, such conditions reduce selling incentives.

Investors often pause distribution and begin accumulating at discounted levels, which can support price stabilization.

However, XRP has not yet shown clear signs of this shift. Selling pressure remains dominant, preventing NUPL from triggering a meaningful reversal. Without accumulation replacing fear-driven exits, XRP struggles to benefit from its typical recovery cues, keeping sentiment tilted firmly toward caution.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

XRP Investors Opt to Panic For Now

On-chain transaction data reflects sustained panic selling. Over the past week, XRP transactions executed at a loss have consistently exceeded profitable transfers.

Transaction volume on February 2 registered $2.51 billion in losses, against $567 million in profit. This imbalance highlights deteriorating confidence as holders prioritize capital preservation amid falling prices and broader market weakness.

Loss-dominated transaction volume often signals late-stage fear. While such phases can precede recovery, they also deepen drawdowns when unchecked. XRP’s inability to stabilize transaction behavior suggests momentum remains fragile, leaving the asset exposed to further downside unless sentiment improves quickly.

Sponsored

Exchange balance data reinforces bearish signals. Over the last four days, more than 97 million XRP, valued at $140 million, flowed into exchange wallets in mere three days. Rising exchange balances typically indicate intent to sell rather than long-term holding.

This surge reflects growing fear among XRP holders. As more tokens move onto exchanges, sell-side pressure intensifies. Continued inflows reduce recovery odds, as supply expansion often overwhelms short-term demand during periods of heightened uncertainty.

Sponsored

XRP Price Needs To Find Support

XRP price has declined 24.4% over the past week and trades near $1.44 at the time of writing. The asset lost the $1.47 support and is trending toward $1.37. Wednesday marked XRP’s lowest daily close since November 2024, confirming structural weakness.

If bearish conditions persist without meaningful buying interest, further downside appears likely. Losing $1.37 as support could accelerate selling pressure. Under this scenario, XRP price may slide toward $1.28 in the coming days, extending the current corrective phase.

A recovery remains possible if sentiment shifts. Reclaiming $1.58 as support would signal renewed strength. Such a move could push XRP toward $1.70. Securing that level would restore bullish confidence and help recover a portion of recent losses.

Crypto World

Hyper-Casual Game Development as a Business Strategy

Hyper casual games are often misunderstood. It is because they look simple, launch quickly, and do not carry the cinematic depth of AAA titles. Now, as a result of their simplicity, many decision-makers assume they are small opportunities. However, behind the simplicity lies a powerful business reality.

Hyper casual games have become one of the most efficient & strategic business tools for studios, publishers, and brands looking to test ideas, acquire users, and unlock new revenue streams with lower risk.

In 2026, leading studios, publishers, and even non-gaming enterprises are not treating hyper casual games as a side experiment. They are using it as a strategic layer in their growth and monetization strategy.

For decision-makers evaluating where to allocate budgets, hyper-casual game development is no longer about chasing trends, it is about making calculated investments that produce data, insights, and scalable opportunities.

Why Hyper Casual Games Still Command Investment Attention

Many assume hyper casual peaked and declined. In reality, it evolved. Early hyper casual success relied on mass downloads and ad monetization. Today, the model is more strategic.

Hyper casual games thrive because it delivers three things businesses value most:

1. Speed

Concept-to-market timelines are dramatically shorter compared to mid-core or AAA development. This enables faster experimentation and quicker ROI evaluation.

2. Accessibility

Simple mechanics attract a broad demographic, making hyper-casual one of the most inclusive gaming categories.

3. Iteration Potential

With short development cycles, studios can test, learn, and refine rapidly.

For enterprises, this translates into agile product-market testing rather than high-risk long-term bets.

Hyper Casual Game Development as a Portfolio Strategy for Studios

Successful publishers rarely rely on a single title. They build portfolios designed to distribute risk and maximize upside. Hyper casual game development fits perfectly into this strategy Instead of investing heavily into one large project, studios launch multiple hyper casual titles to:

- Test new mechanics

- Explore genres

- Evaluate user behavior

- Identify breakout potential

A single successful hyper casual title can offset multiple experimental builds. More importantly, insights from hyper casual performance often guide larger productions. Mechanics that show traction can later evolve into hybrid-casual or mid-core games. This makes hyper casual a feeder system for future franchises.

Why Enterprises and Brands Are Entering the Space

Gaming is no longer just for gaming companies. Brands and enterprises are investing in hyper-casual games as interactive engagement tools. A well-designed hyper casual game can:

- Capture user attention in seconds

- Encourage repeat interaction

- Drive brand recall

- Support loyalty campaigns

- Promote products in a gamified format

Compared to traditional advertising, gamified engagement often yields higher retention and stronger emotional connection. For enterprises, hyper-casual becomes a customer acquisition and engagement channel, not merely entertainment.

Want to Invest in Hyper Casual Games?

Speed-to-Market as a Competitive Lever

In digital markets, timing matters. Hyper-casual development allows companies to respond quickly to:

- Cultural trends

- Seasonal events

- Viral mechanics

- Market shifts

A studio that can launch multiple titles per year learns faster than one betting on a single multi-year project. This speed reduces opportunity cost and increases adaptability. For investors and decision-makers, this agility is a serious advantage.

Monetization Beyond “Just Ads”

While ad monetization remains a pillar, modern hyper-casual games expand revenue through:

- In-app purchases

- Cosmetic upgrades

- Cross-promotion networks

- Brand collaborations

- Data-driven optimization

Portfolio-level monetization often produces stable revenue streams. The business value is not always in one viral hit, but in cumulative performance.

Data: The Hidden Asset in Hyper Casual Investment

Every hyper-casual launch generates valuable insights:

- CPI benchmarks

- Retention curves

- Session lengths

- Monetization patterns

- User behavior analytics

This data informs smarter decisions for future projects. Companies investing strategically treat each launch as a learning cycle. Instead of guessing, they build with evidence.

Risk Management Through Smaller Bets

Large game productions come with large risks. Hyper casual games spread that risk. Smaller budgets allow for multiple experiments. Multiple experiments increase the chance of finding winning formulas. This, in turn, reduces financial exposure while preserving upside. For CFOs and product leaders, this makes hyper-casual a rational investment category.

Execution Quality Makes the Difference

Not all games succeed. Execution determines outcomes. Strong hypercasual game development requires:

- Tight gameplay loops

- Rapid prototyping pipelines

- Analytics integration

- Monetization design

- Performance optimization

- Fast iteration cycles

Studios with efficient pipelines outperform those relying on slow processes.

The Role of the Right Development Partner

The overall success of the games often depends on how quickly teams can test and iterate. An experienced hyper casual game development company helps by:

- Reducing development friction

- Speeding up production

- Integrating analytics early

- Optimizing monetization

- Guiding portfolio strategy

This turns hyper-casual from trial-and-error into structured experimentation.

Long-Term Strategic Value

A hyper casual game is not always about building the next billion-dollar IP. Sometimes its value lies in:

- Market validation

- User acquisition

- Learning cycles

- Portfolio diversification

- Brand engagement

Companies that understand this extract far more value than those chasing only viral success.

Final Thoughts

Hyper casual game development is not a gamble when approached strategically. It is a business tool for:

- Testing ideas

- Reducing risk

- Accelerating learning

- Generating revenue

- Engaging audiences

Studios and enterprises that invest wisely continue to benefit from its speed & scalability.

Antier, as a trusted hyper casual game development company, works with studios and enterprises to design & deliver high-quality games optimized for fast launches, data-driven iteration, and monetization performance, helping transform simple concepts into smart business investments.

Frequently Asked Questions

01. What are hyper casual games and why are they important for businesses?

Hyper casual games are simple, quick-launch games that serve as strategic business tools for studios, publishers, and brands. They allow for testing ideas, acquiring users, and unlocking new revenue streams with lower risk, making them essential for growth and monetization strategies.

02. How do hyper casual games differ from traditional gaming models?

Unlike traditional gaming models that focus on high production values and long development cycles, hyper casual games prioritize speed, accessibility, and iteration potential, enabling faster experimentation and quicker return on investment.

03. Why should studios consider hyper casual game development as part of their portfolio strategy?

Studios should consider hyper casual game development to distribute risk and maximize potential returns by launching multiple titles. This approach allows them to test new mechanics, explore genres, and gather insights that can inform larger projects.

Crypto World

Justin Sun says ‘keep going’ on Tron Inc’s TRX buys

Crypto billionaire Justin Sun endorsed Tron Inc.’s strategy of stacking the TRX token, which has recently outperformed bitcoin , as a core treasury asset, spotlighting their latest dip buy with a simple “keep going” on X.

The Nasdaq-listed Tron Inc. announced that it acquired 175,507 TRX tokens on Wednesday at an average price of $0.28, for a fresh investment of just over $49,000 in the Tron blockchain’s native token. The latest purchase boosted its TRX stash to 679.9 million tokens ($540 million).

The company plans to further grow its TRX holdings to enhance long-term shareholder value.

Tron Inc. — formed via a reverse merger between SRM Entertainment and a Tron-related entity — is a publicly listed firm focused on blockchain-integrated treasury strategies and holding a significant amount of TRX tokens. The company is modeled on Nasdaq-listed Strategy, which pioneered the digital asset treasury narrative by starting to accumulate Bitcoin as a reserve asset in August 2020.

The nod from Sun reinforces steady accumulation amid market dips. TRX’s price peaked near 45 cents in 2024 and has since pulled back to 28 cents. But lately, it has been relatively resilient, down just 1.3% this year versus the market leader, bitcoin, which is down nearly 19%, according to CoinDesk data.

TRX’s relative outperformance amid broader crypto weakness has led some analysts to view it as a defensive haven asset.

Crypto World

ZachXBT Highlights $282M Theft of Bitcoin and Litecoin in Hardware Wallet Scam

The investigator said the attacker swapped funds into Monero and moved BTC across chains using Thorchain.

Onchain investigator ZachXBT said a victim lost more than $282 million worth of Bitcoin (BTC) and Litecoin (LTC) in a scam involving a hardware wallet earlier this month.

In a post on X, ZachXBT said the theft happened on Jan. 10, 2026, around 11 p.m. UTC, and involved about 2.05 million LTC and 1,459 BTC. He said the victim was tricked in a social engineering scam.

The theft was reported as major crypto prices were slightly higher on the day. Litecoin (LTC) was trading around $74.57, up 3.6% in the past 24 hours, while Bitcoin (BTC) traded near $95,512, up 0.2%, according to CoinGecko.

The case highlights how even hardware wallets can be risky if someone is fooled into giving up access or approving a bad transaction. These scams don’t involve breaking code; instead, they rely on tricking the victim.

According to ZachXBT, the attacker began converting the stolen BTC and LTC into Monero (XMR) through multiple instant exchanges. Monero is a privacy-focused cryptocurrency and is currently trading at $642.77, down 3.7% on the day.

He said the conversions contributed to a sharp increase in XMR’s price as the market absorbed the flow. ZachXBT also said the attacker bridged BTC to other networks, including Ethereum, Ripple, and Litecoin, using Thorchain, a cross-chain liquidity protocol.

The theft comes as security firms continue to warn that many big crypto losses come from user error and scams. PeckShield reported that total exploit losses fell to about $76 million in December 2025 from $194.3 million in November, though it said incident activity remained elevated.

Crypto World

Current Bear Market Performance Worse Than 2022: Analysts

Bitcoin’s decline into a bear market has been faster than in the past cycle, according to analysts.

“Bitcoin’s bear market is off to a weaker start than 2022,” reported on-chain analytics platform CryptoQuant on Wednesday.

Since falling below the 365-day moving average in November, Bitcoin is down 23% in just 83 days, compared to a 6% decline over the same period in early 2022, they added before stating “momentum is deteriorating faster this cycle.”

“This performance is worse than at the start of the previous bear market in January 2022.”

Bitcoin Bear Market Deepens

Bitcoin peaked at $126,000 in early October with the “Bull Score Index” at 80, but following the Oct. 10 liquidation event, the index turned bearish and has now fallen to zero while the price dumped to $71,000, “signaling broad structural weakness,” CryptoQuant reported. The platform also stated that Bitcoin “has lost key support levels” and may be targeting $70,000 to $60,000.

Bitcoin was rejected three times at the “Traders’ On-chain Realized Price,” a key on-chain support and resistance level. It also recently crossed below the lower band of this same metric, which acted as a support during the bull market.

Bitcoin’s bear market is off to a weaker start than 2022.

Since falling below the 365-day MA on Nov 12, 2025, $BTC is down 23% in 83 days, vs. just 6% over the same period in early 2022.

Momentum is deteriorating faster this cycle. pic.twitter.com/t4xD2vljVI

— CryptoQuant.com (@cryptoquant_com) February 4, 2026

Meanwhile, Santiment reported that sentiment “has turned extremely bearish toward Bitcoin and Ethereum” following the major downswing this past week.

“As we know, markets move opposite to the fear and greed of retail traders. There remains a strong argument for a short-term relief rally as long as the small-trader crowd continues to show disbelief toward cryptocurrency as a whole.”

“The BTC bear market rages on as profitability resets, realised losses rise, spot demand stays weak, and leverage unwinds,” reported Glassnode.

Meanwhile, the crypto “Fear and Greed Index” has fallen back to all-time lows around 12 as sentiment collapses and panic selling continues.

You may also like:

Crypto Market Outlook

Total capitalization has declined again today, falling 4.4% to $2.53 trillion, its lowest level since April 2025. Further losses will see it back to bear market lows from 2024.

Bitcoin dumped again, tanking below $71,000 during early trading in Asia on Thursday morning. BTC is now back at November levels and heading towards support at around $65,000.

Ether is in meltdown, crashing below $2,100 and failing to recover, also on a path to previous cycle lows.

Altcoins are not even worth mentioning, tanking even harder than the top two, with most now at 80% down from their peaks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

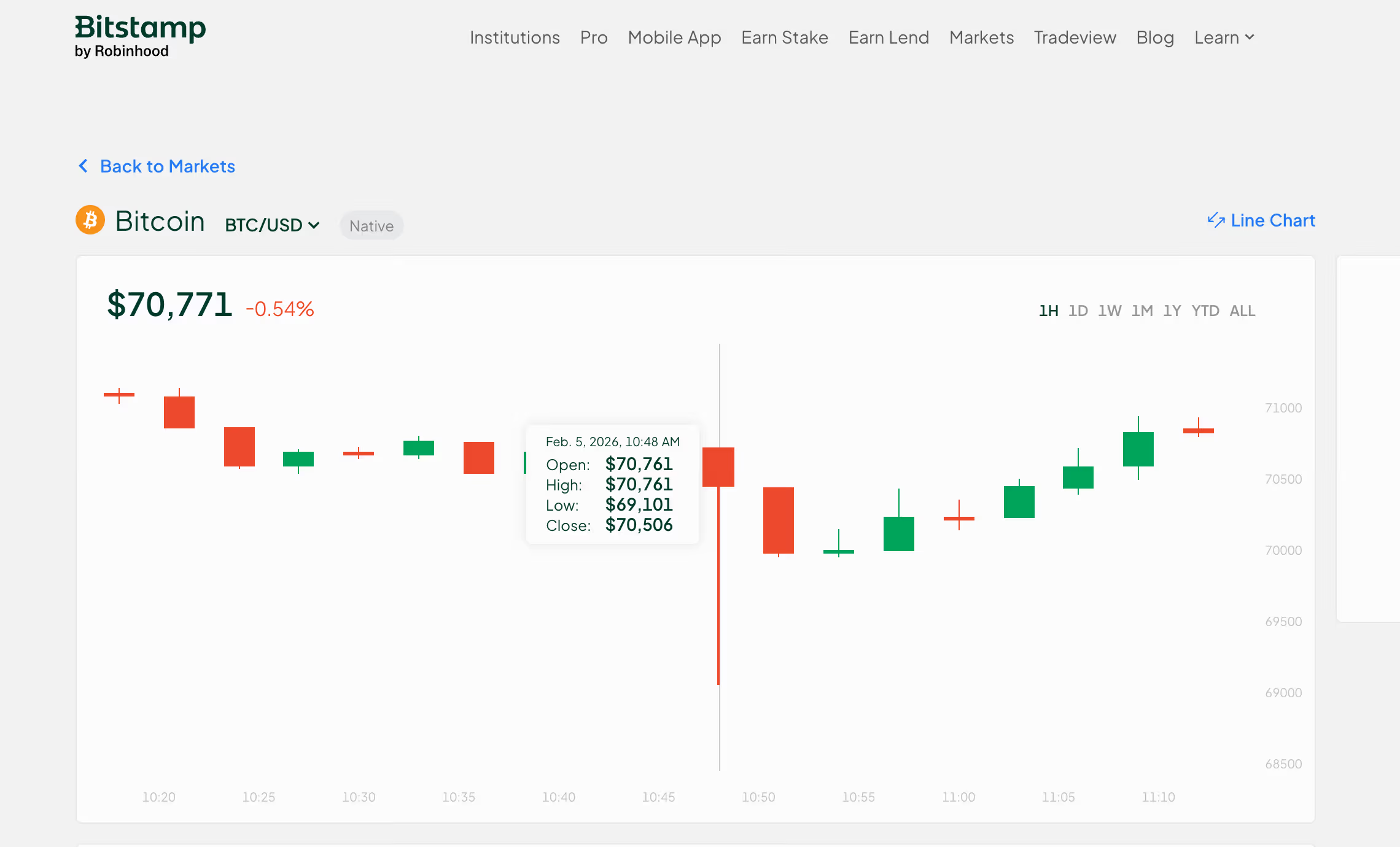

BTC tanks to $69,101 on Bitstamp

Bitcoin’s price sell-off continued Thursday, with prices breaking below the widely-tracked $70,000 level on the OG crypto exchange Bitstamp.

BTC’s dollar-denominated price slipped to $69,101 during the Asian trading hours, trading a discount to prices on other exchanges, including Coinbase, where BTC hit a low of $70,002.

The discount on Bitstamp likely stemmed from stronger selling pressure on the Robinhood-owned platform.

The global average price, tracked by CoinDesk, peaked above $126,000 in early October and has been in a downtrend since then. Some analysts expect further sell-off at least to $60,000, where prices may eventually bottom out.

Crypto World

Tether Tops 500 Million Users But USDT Peg Concerns Abound

Tether’s USDT has crossed a major milestone, surpassing 534 million users, even as the broader crypto market remains under pressure following a sharp contraction that began in October 2025.

According to the company’s Q4 2025 USD₮ Market Report, the stablecoin added more than 35 million users in the quarter, marking the eighth consecutive quarter of adding over 30 million users.

Sponsored

Sponsored

USDT Expands as a Global Store of Value Even as Crypto Market Cap Contracts

The growth comes during a period of declining risk appetite. Since the October 10 liquidation cascade, the total crypto market capitalization has fallen by more than one-third (30%). Meanwhile, USDT’s supply has continued to expand modestly.

Tether reported that its market capitalization rose to $187.3 billion, up $12.4 billion in Q4, even as some competing stablecoins shrank.

Tether attributes the resilience to demand for savings, payments, and cross-border transfers rather than purely speculative trading.

On-chain metrics cited in the report show rising wallet balances among long-term holders and record transaction volumes.

However, the estimates of total users include both on-chain wallets and approximations of exchange users, making independent verification difficult.

Reserve disclosures also show continued expansion. Total reserves reached $192.9 billion, including $141.6 billion in US Treasuries, a level that would place Tether among the largest Treasury holders globally if it were a country.

Sponsored

Sponsored

The company also increased its Bitcoin holdings to 96,184 BTC and its gold reserves to 127.5 metric tons, reflecting a strategy to diversify collateral beyond cash-equivalent assets.

On-chain activity continued to grow rapidly. The number of USDT holders rose to 139.1 million, while monthly active users reached 24.8 million, both record highs.

The value transferred on-chain reached $4.4 trillion in Q4, and USDT’s share of spot trading volumes on centralized exchanges climbed to 61.5%. This highlights its role as the dominant settlement asset in crypto markets.

Sponsored

Sponsored

Minting Surge, Peg Wobbles, and Flippening Talk Highlight USDT’s Growing Systemic Role

Recent issuance activity suggests demand has carried into early 2026. On February 4, blockchain analytics account Lookonchain reported that Tether minted $1 billion in USDT, part of roughly $3 billion in stablecoins issued by Tether and Circle over three days.

Large issuances are often interpreted by traders as a signal of incoming liquidity, although newly minted tokens are not always immediately circulated.

At the same time, Tether’s growing dominance has intensified scrutiny. Market attention briefly turned to USDT’s stability after the token slipped to around $0.9980, its weakest level in more than 5 years.

While the deviation was small and short-lived, any sustained loss of confidence in the peg could have outsized consequences, given the stablecoin’s central role in trading infrastructure.

Sponsored

Sponsored

Market estimates often suggest that most crypto trading volume flows through USDT pairs, making it a critical pillar of liquidity.

The scale of Tether’s expansion has also fueled debate over its place in the crypto hierarchy. Some market observers have speculated that, if current trends continue, USDT could eventually challenge Ethereum’s position as the second-largest cryptocurrency by market capitalization, particularly during prolonged periods of risk aversion when capital rotates into stable assets.

Meanwhile, the latest data shows that USDT is expanding in terms of users, reserves, and transaction volume, even as the broader market contracts.

Yet that same growth is concentrating liquidity and systemic importance in a single instrument. The stability of Tether’s peg is increasingly tied not just to one company, but to the resilience of the crypto market itself.

Crypto World

Why Vitalik Buterin Says L2s Aren’t Scaling Ethereum Anymore

Buterin argued that many Layer 2s no longer meaningfully inherit Ethereum security.

Ethereum co-founder Vitalik Buterin said recent developments mean the original conception of Layer 2 scaling within the ETH ecosystem is no longer viable.

He said that the progress among many L2 networks has fallen short of earlier expectations, while the mainnet continues to scale directly.

Slow Progress, Low Fees

In a recent post on X, Buterin pointed to two important realities reshaping the debate. First, there is the slow and difficult progress of L2s toward “stage 2” decentralization and interoperability, and the fact that Ethereum’s mainnet has already achieved very low fees, with gas limits expected to rise significantly through 2026.

Buterin reiterated that Ethereum scaling was originally defined as expanding block space that fully inherits Ethereum’s security. This means that all activity remains valid and censorship-resistant as long as the network operates. As such, systems that rely on multisig bridges or other forms of discretionary control cannot be considered extensions of Ethereum in this sense, even if they offer high throughput.

The co-founder explained that this framing no longer holds because the blockchain no longer needs L2s to function as “branded shards,” while many L2s are either unable or unwilling to meet the security and governance requirements that such a role would imply.

Buterin observed that some projects have explicitly stated they may never move beyond stage 1, not only due to technical concerns around zero-knowledge EVM safety, but also because regulatory or customer requirements necessitate ultimate control. While he said this may be appropriate for those projects’ use cases, it means they should not be described as scaling Ethereum under the original definition.

Instead, Buterin suggested abandoning the idea that all Layer 2s should occupy the same category and be judged by the same criteria. He proposed that they be viewed as a broad spectrum of systems with varying degrees of connection to Ethereum. In this framing, some L2s may be fully backed by Ethereum’s security while others operate with more limited guarantees. This would allow users and applications to choose based on their needs.

You may also like:

He added that L2s should focus on providing distinct value beyond generic scaling, such as specialized virtual machines, application-specific efficiency, extreme throughput, non-financial use cases, low-latency sequencing, or integrated services like oracles or dispute resolution. For networks handling ETH or Ethereum-issued assets, he said reaching at least stage 1 should be a minimum standard.

ZK-EVM Precompile

From Ethereum’s perspective, Buterin said he has become increasingly convinced of the importance of a native rollup precompile that would verify ZK-EVM proofs as part of Ethereum itself. Such a system in place enables trustless interoperability and composability while allowing L2s flexibility in extending functionality.

He said that while a permissionless ecosystem will inevitably include systems with weaker or trust-dependent guarantees, Ethereum’s responsibility is to make those guarantees clear and continue strengthening the base protocol.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

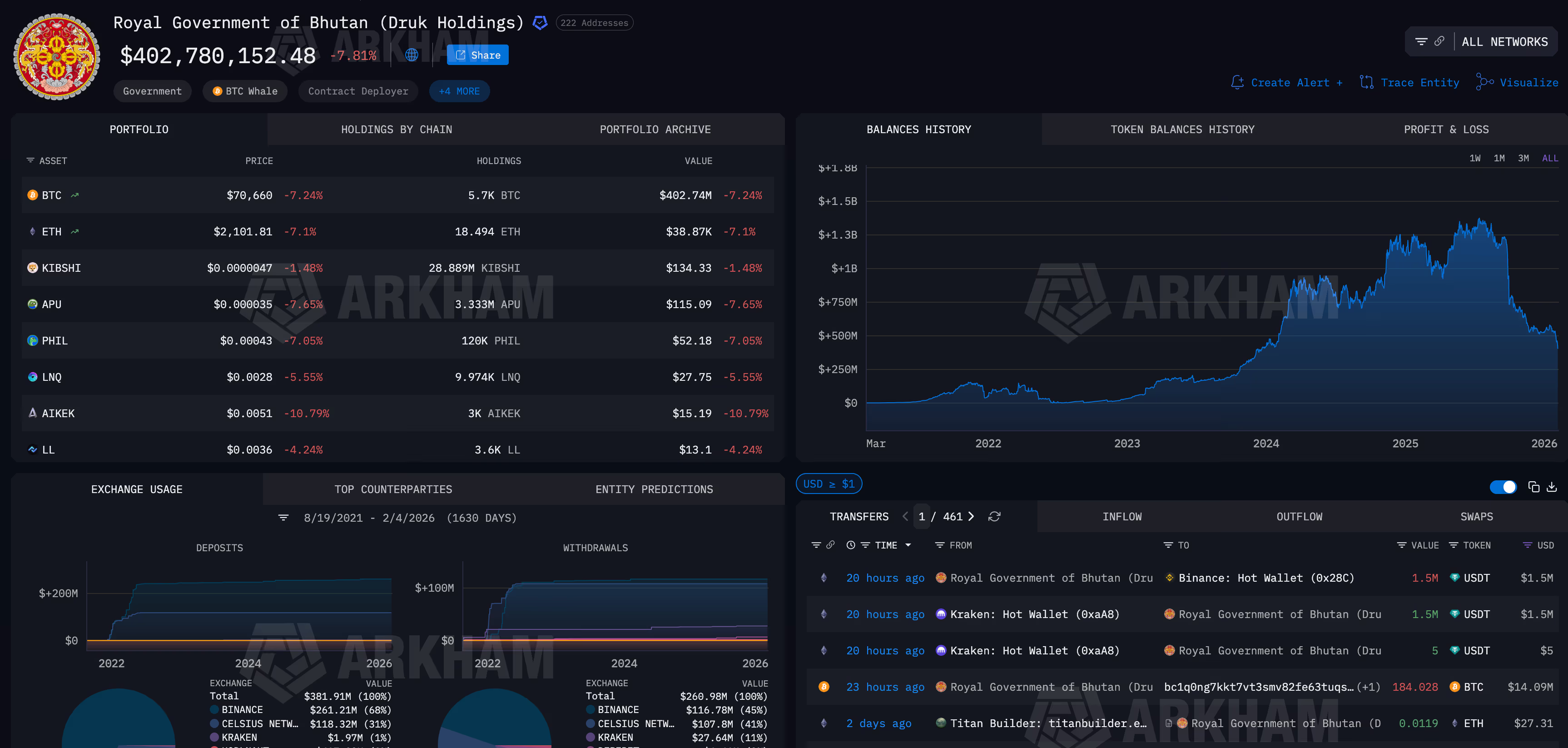

Bhutan shifts holdings after months of silence as BTC moves to $70,000

The Royal Government of Bhutan has begun moving bitcoin after months of wallet inactivity, shifting funds to trading firms, exchanges and fresh addresses as bitcoin slid below $71,000 and broader markets convulsed.

Onchain data tracked by Arkham shows Bhutan-linked wallets transferring more than 184 BTC, worth roughly $14 million, over the past 24 hours.

Some of the bitcoin was sent to new addresses, while other transfers flowed to known counterparties including QCP Capital and a Binance hot wallet, according to Arkham.

These destinations typically associated with trading, liquidity management or potential sales. CoinDesk reached out to QCP Capital via Telegram for comment.

The activity marks Bhutan’s first notable wallet movement in roughly three months and comes at a volatile moment for crypto markets. Bitcoin has fallen more than 7% in 24 hours, while silver plunged as much as 17% and global equities slid amid fears that artificial intelligence spending is undermining traditional software business models.

Bhutan has emerged over the past two years as one of the more unusual sovereign bitcoin holders, quietly building a stash through state-backed mining tied to hydropower.

Unlike corporate treasuries that trumpet accumulation strategies, Bhutan’s holdings have largely been managed out of the spotlight, making changes in wallet behavior closely watched by traders.

The latest transfers do not confirm outright selling. Coins were split across multiple destinations, including new wallets that could indicate internal reshuffling or collateral management rather than immediate liquidation.

Still, sending bitcoin to exchanges and trading firms during a sharp drawdown contrasts with the country’s otherwise long periods of inactivity.

The moves also echo a broader theme emerging in this selloff: large holders treating bitcoin less as a static reserve asset and more as a balance-sheet tool during stress.

Corporate treasuries, miners and now sovereign-linked entities are adjusting positions as liquidity tightens and price swings accelerate.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech23 hours ago

Tech23 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards