Crypto World

Bitcoin Trades Like a Growth Asset, Not Digital Gold

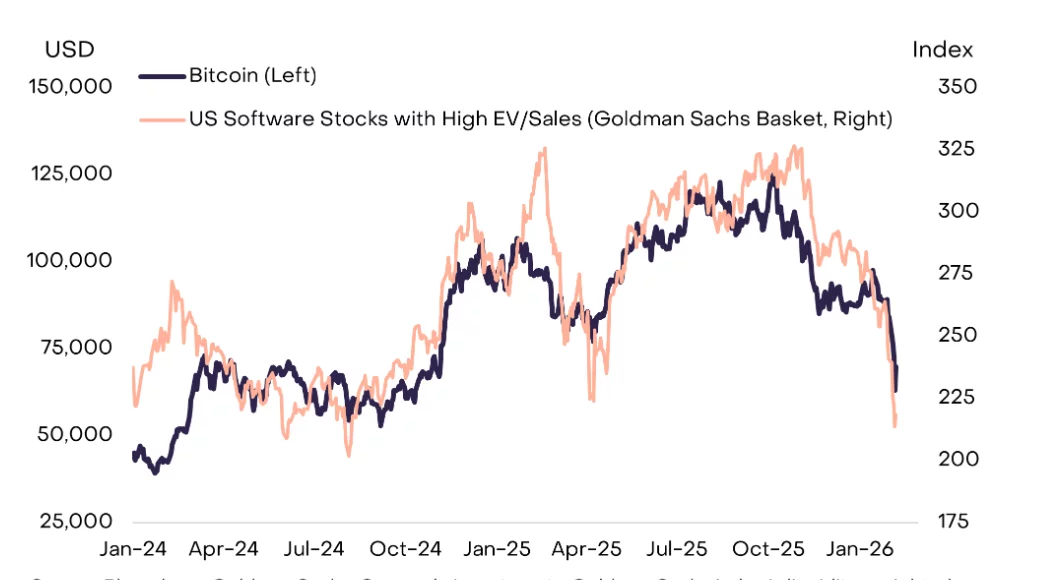

Bitcoin’s long-standing narrative as “digital gold” is under renewed scrutiny as its price action increasingly mirrors that of higher-risk growth assets rather than serving as a traditional safe-haven harbor. Grayscale’s latest Market Byte examines this shift, arguing that the asset’s role in portfolios may be evolving in ways that reflect broader participation from institutional buyers, ETF activity, and shifting macro risk sentiment. While the research maintains that Bitcoin remains a long-term store of value due to its fixed supply and independence from central banks, it cautions that near-term behavior has diverged from gold and other precious metals, opening room for a rethinking of how the market categorizes the digital asset.

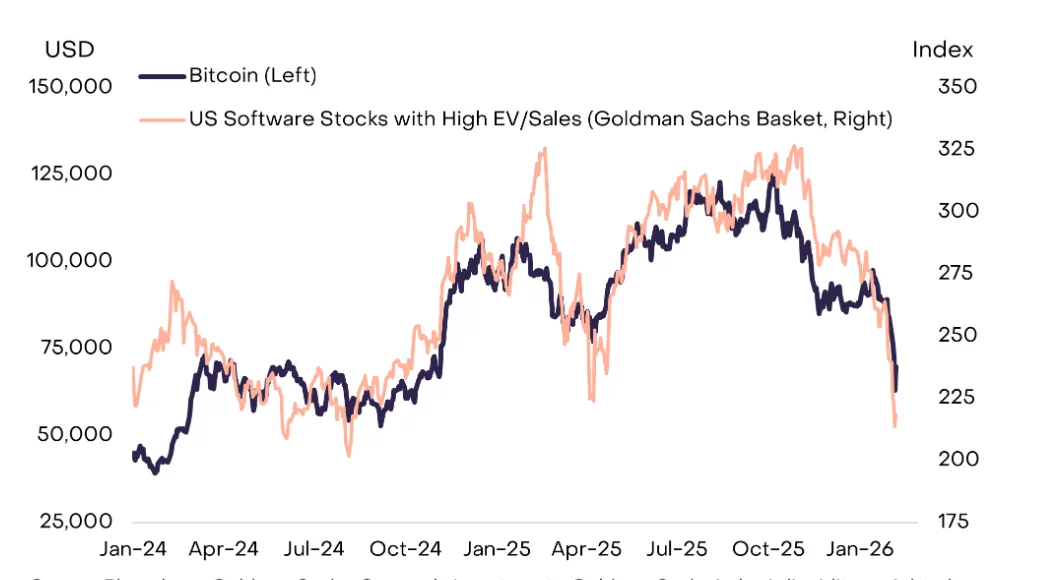

In the Grayscale analysis, the first-time reader-facing takeaway is that Bitcoin’s short-term price movements have not tracked gold’s recent rallies. The report notes that bullion and silver have surged to records even as Bitcoin has swooned, suggesting a decoupling from traditional safe-haven dynamics. Instead, Bitcoin’s price action has shown strong correlations with software equities, particularly since the start of 2024. That sector has faced sustained selling pressure amid fears that advances in artificial intelligence could disrupt or render many software services obsolete, amplifying concerns about growth equities’ durability in a high-rate environment.

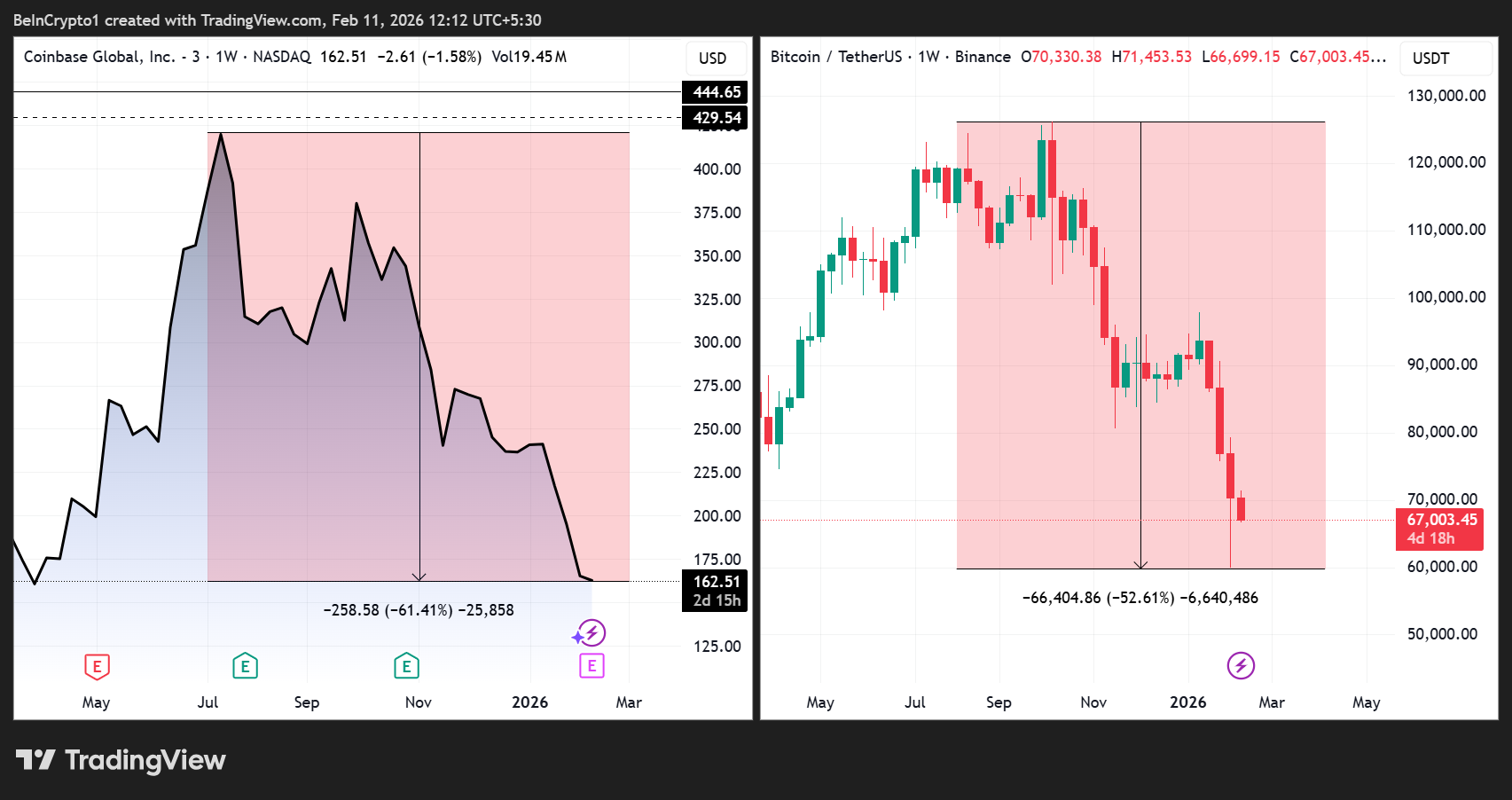

The charted narrative—one that Grayscale emphasizes with data and context—takes on added significance as the asset has logged a roughly 50% drawdown from its October peak that exceeded $126,000. The drawdown has unfolded in a string of waves, beginning with a historically large liquidation in October 2025, followed by renewed selling in late November and again in late January 2026. Grayscale highlights that persistent price discounts on major trading venues such as Coinbase reflect a broader selling impulse among U.S. participants, including “motivated” sellers who have contributed to the softer price dynamics in recent weeks. This backdrop is shaping a narrative in which Bitcoin’s path is increasingly tethered to the health of growth-oriented equities and the liquidity environment around ETFs and other traditional investment vehicles.

The Grayscale report frames these developments as part of Bitcoin’s ongoing evolution rather than a sudden policy failure of the asset’s core investment premise. Zach Pandl, the report’s author, notes that it would have been unrealistic to expect Bitcoin to supplant gold as a monetary asset in a short period of time. Gold’s long history as a monetary anchor—“used as money for thousands of years and serving as the backbone of the international monetary system until the early 1970s”—shadows Bitcoin’s current trajectory, but the author suggests that the digital asset could still contribute to monetary functions over time as the global economy digitizes further through AI, autonomous agents, and tokenized financial markets.

In broader market terms, the evolution described by Grayscale aligns with a trend toward deeper integration of digital assets into established financial markets. Institutional participation, ETF activity, and shifting risk sentiment are cited as key drivers behind Bitcoin’s greater sensitivity to equities and growth assets. The near-term outlook, therefore, hinges on the possibility of fresh capital reentering the market—whether through renewed inflows into Bitcoin-related exchange-traded products or renewed retail interest. Market watchers note that while AI-focused narratives have dominated sentiment in the meantime, a continuation of liquidity inflows could catalyze a partial rebound for crypto assets as macro conditions stabilize.

Despite the near-term softness, the report underscores a longer-term perspective. While Bitcoin’s monetary status remains a work in progress, its potential to assume a more prominent role in digital-first economies could intensify as tokenization of assets and on-chain finance expand. The analysis highlights that the ongoing transition toward tokenized markets, together with the growth of on-chain infrastructure for tokenized assets, might help Bitcoin solidify a more enduring store-of-value or medium-of-exchange function over time—even if such a shift does not materialize immediately.

From a practical standpoint, the near-term recovery hinges on capital inflows. Grayscale notes that ETF activity could serve as a meaningful catalyst should fresh inflows reappear, while retail participation—currently concentrated in AI and growth-driven equities—would need to broaden to crypto assets for a more robust upside. The research also points to ongoing market structure dynamics, including price discovery processes on major exchanges and the degree to which price gaps on venues like Coinbase reflect broader demand gaps in the crypto space. Taken together, these factors suggest Bitcoin’s path remains highly sensitive to macro risk appetite, regulatory signals, and the ebb and flow of liquidity across traditional and digital markets.

Key takeaways

- Bitcoin’s price action has shown stronger ties to growth equities, particularly software stocks, since early 2024, rather than mirroring traditional safe-haven assets like gold.

- The asset has experienced a ~50% drawdown from its October peak above $126,000, with declines unfolding in multiple waves including a major liquidation event in October 2025.

- Grayscale attributes some of the recent volatility to “motivated US sellers” and persistent price discounts on Coinbase, signaling liquidity and demand dynamics within the U.S. market.

- Institutional participation, ETF activity, and shifting macro risk sentiment are cited as factors intensifying Bitcoin’s sensitivity to the broader market environment.

- Although Bitcoin has not displaced gold as a monetary asset, its role could evolve as digital markets grow and tokenized financial systems mature.

Tickers mentioned: $BTC

Price impact: Negative. Bitcoin retraced about half of its October highs, underscoring a softer near-term price backdrop tied to risk-on selling and ETF flow dynamics.

Market context: The landscape for digital assets in 2026 is increasingly shaped by ETF inflows, institutional adoption, and a broader appetite for growth-centric equities, which can both buoy and dampen crypto markets depending on macro liquidity and risk sentiment.

Why it matters

The evolving relationship between Bitcoin and traditional financial assets matters for investors rethinking diversification in a digitizing economy. The Grayscale analysis indicates that Bitcoin remains a long-term store of value by design—its fixed supply and independence from central banking authorities still underpin its investment thesis—but the near-term price behavior reveals an asset whose risk profile is closely tied to broader market cycles. For institutions, the finding that Bitcoin correlates with growth equities adds nuance to portfolio construction, suggesting that crypto exposure may be most effective when paired with assets that can withstand higher interest-rate regimes or leveraged liquidity conditions.

From a market-building perspective, the evolution toward deeper integration with traditional finance could spur further product innovation and regulatory clarity. In a world where tokenized markets and AI-driven economies become more pervasive, Bitcoin’s potential to serve as a digital monetary component—though not guaranteed—could gain new relevance as investors seek hedges against macro uncertainties or asymmetric risk exposures. The Grayscale report highlights these dynamics without overselling the pace or inevitability of such a transition, anchoring expectations in observable market structures, ETF activity, and the behavior of major on-ramps like Coinbase.

What to watch next

- Monitor ETF inflows into Bitcoin-linked funds in the coming quarters to gauge potential liquidity-driven support.

- Track retail participation in crypto amid any renewed appetite for high-growth narratives and AI-related themes.

- Observe price action around major exchange on-ramps (e.g., Coinbase) for signs of demand normalization or persistent discounts.

- Watch for shifts in broader risk sentiment that could re-anchor Bitcoin’s correlations with growth equities rather than traditional safe havens.

- Assess regulation and institutional adoption milestones that might alter the pace of Bitcoin’s integration into mainstream portfolios.

Sources & verification

- Grayscale Market Byte on Bitcoin trading more like growth than gold, including references to Bitcoin’s correlation with software equities and macro risk sentiment.

- Historical price context, including the October 2025 liquidation event and subsequent selloffs in November 2025 and January 2026.

- Notes on price discounts at Coinbase and the role of U.S. sellers in recent weeks.

- Statements and framing around Bitcoin’s potential future monetary role amid digitalization and tokenized markets.

Bitcoin’s evolving role amid market dynamics

Bitcoin (CRYPTO: BTC) is navigating a shifting nexus where its core value proposition as a fixed-supply asset intersects with the realities of an increasingly liquid and regulated financial system. Grayscale’s analysis is careful to separate near-term price dynamics from the longer-term investment thesis. While the data show that Bitcoin has not yet displaced gold as a monetary anchor, the asset’s growing integration with institutional channels and exchange-traded products could, over time, reframe its place in diversified portfolios. The near-term backdrop remains a test of liquidity, risk appetite, and the willingness of capital to flow back into crypto as macro conditions evolve.

As markets digest these observations, industry participants will be watching whether Bitcoin can regain momentum through renewed ETF inflows or a revival of retail interest outside of AI and growth narratives. The coming months will reveal whether the current trend toward growth-equity sensitivity is a temporary anomaly or a signal of a deeper, structural revaluation of how crypto assets fit into a digitized, AI-enhanced financial ecosystem.

Ultimately, the conversation centers on duration and resilience: can Bitcoin sustain a longer-term store-of-value narrative while also fulfilling a functional role in a fast-evolving financial architecture? The Grayscale report suggests that both outcomes are possible, contingent on liquidity, regulatory clarity, and the pace at which tokenized finance expands beyond niche markets into mainstream capital allocations. The road ahead will require careful monitoring of price action, investor flow, and the health of risk markets—the triad that increasingly determines whether Bitcoin remains a sanctuary or a sophisticated, dynamic component of diversified portfolios.

Crypto World

Why Everyone’s Talking About Robinhood Q4 2025 Earnings

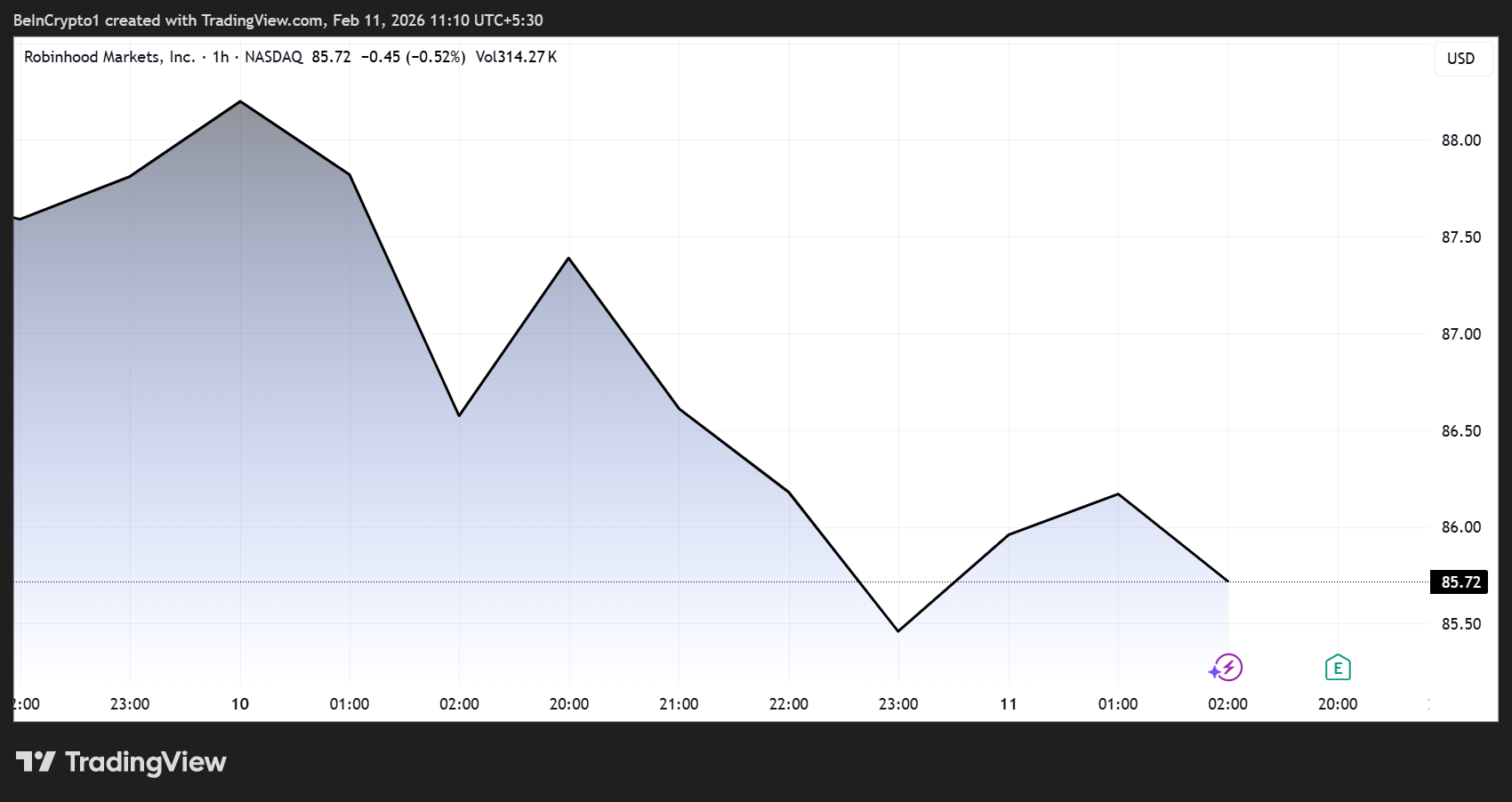

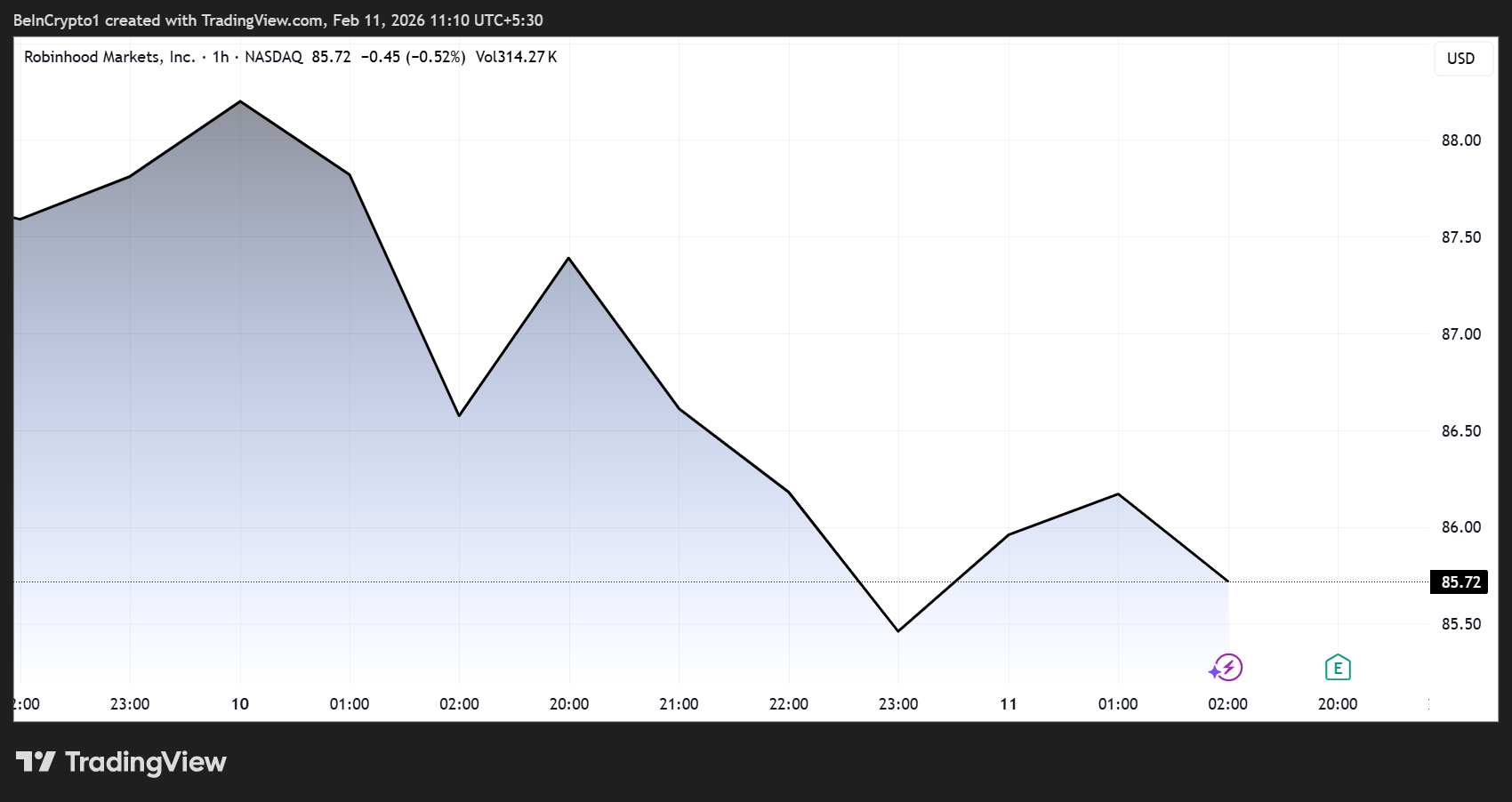

Robinhood’s Q4 2025 earnings report triggered a sharp market reaction, with the company’s stock falling roughly 8% after revenue came in below expectations.

Yet the most striking takeaway from the call was not the drop in crypto trading revenue, but the growing prominence of prediction markets and automation as pillars of the platform’s future strategy.

Robinhood Earnings Show Prediction Markets Overtaking Crypto as Key Growth Driver

Nearly one-third of analyst questions during the earnings call focused on prediction markets, reflecting how quickly the sector is moving from experimental feature to potential core business line.

Sponsored

Sponsored

“30% of $HOOD Q&A (6 of 20 questions) concerned prediction markets, by far the #1 topic,” stated Matthew Sigel, Head of Digital Assets Research at VanEck.

According to Sigel, the attention reflects fast-paced growth across the industry, with volumes now above $10 billion per month (approximately $300–400 million per day), roughly comparable to the average daily US sports betting handle.

Revenue Miss and Crypto Slowdown

Robinhood reported Q4 net revenue of $1.28 billion, below expectations of about $1.35 billion. Transaction-based revenue and crypto trading also missed forecasts, with crypto revenue coming in at approximately $221 million versus expectations closer to $248 million.

Analysts see the market reaction as largely tied to high expectations and slowing growth in key metrics rather than structural weakness in the business.

Christian Bolu, senior analyst at Autonomous Research, described the results as disappointing on the surface but constructive in outlook.

“I would say look at an expensive stock, and you know a topline miss is not helpful at all,” Bolu said, noting that some key metrics, including deposit growth, also slowed.

However, he emphasized that the longer-term outlook remains positive:

“The commentary from the management team is pretty constructive in terms of the pipeline for 2026 in terms of new business growth, and actually, transaction volumes have been very strong in January as well. So, the outlook here is actually pretty decent.”

Sponsored

Sponsored

Prediction Markets Move to Center Stage

While crypto remains an important segment, analysts increasingly see prediction markets and event contracts becoming a larger share of the business over time.

“Over time, we think things like event contracts and prediction markets will be a bigger part of the business than crypto,” Bolu added in the interview with Yahoo Finance.

The opportunity is substantial. Despite rising competition from platforms like Kalshi and Polymarket, Robinhood’s distribution advantage could prove decisive.

“The good thing about Robinhood is their value prop from a business perspective is the distribution,” Bolu said. “There aren’t many folks that can distribute or have the distribution that they do.”

Regulation Remains the Key Constraint

Even as interest grows, regulatory uncertainty remains the biggest barrier to expansion. Sigel highlighted that the issue was directly addressed during the earnings call.

“Binary yes/no contracts … can fit under CFTC event contract authority… But contracts with continuous or formula-based payouts tied to a single issuer’s financial performance could be treated as SEC ‘security-based swaps’ under Dodd-Frank.”

Sponsored

Sponsored

However, the Van Eck executive acknowledged that the lack of clarity is slowing progress:

“There’s no formal framework clarifying that boundary yet, which is why management referenced needing ‘regulatory relief.’”

AI Automation Quietly Reshaping the Business

Beyond new trading products, Robinhood is also transforming its internal operations through automation and artificial intelligence. Against this backdrop, Sigel shared one of the most striking disclosures from the call:

“AI support is really cranking. Now over 75% of our cases are solved by AI, including the complex cases that previously required licensed brokerage professionals,” he shared.

The company is also automating its engineering workflow, optimizing the entire engineering pipeline from code writing through code review to deployment and testing.

Reportedly, this is already turning into real savings and efficiency gains, estimated at over $100 million in 2025 alone.

These cost reductions could help offset cyclical revenue swings in areas like crypto and options trading.

Sponsored

Sponsored

A More Diversified Robinhood

Analysts say Robinhood today looks very different from the trading app that rose to prominence during earlier crypto and meme-stock cycles.

Bolu described the company as “a much more mature company a much more diversified company,” pointing to:

- Growing net interest income

- Retirement accounts

- Banking products, and

- Credit cards as additional revenue streams.

This diversification is one reason many analysts remain bullish despite short-term volatility. More than 80% of analysts still rate the stock a buy, according to market commentary following the results.

Robinhood’s latest earnings reinforced a key shift: crypto may no longer be the dominant narrative driving the platform.

Instead, the next phase of growth appears to be forming around prediction markets, options trading, subscriptions, and AI-driven efficiency. These segments could reduce reliance on highly cyclical crypto trading volumes.

If those trends continue, the earnings call may ultimately be remembered less for a revenue miss and more for revealing where the platform is heading next.

Crypto World

Tom Lee sees bitcoin rebound, ether bottoming below $1,800

HONG KONG — Thomas Lee, chief investment officer of Fundstrat and chairman of ether treasury firm BitMine Immersion (BMNR), said that investors should focus less on timing the exact low and start looking for entries in a keynote speech at Consensus Hong Kong 2026 on Wednesday.

“You should be thinking about opportunities here instead of selling,” Lee said.

BTC has suffered a 50% drawdown from its October record highs, its worst correction since 2022.

On Wednesday, bitcoin fell back below $67,000, giving up some of the bounce from last week’s crash lows. After managing a rapid reversal above $72,000 from $60,000 over the weekend, BTC was down 2.8% over the past 24 hours. Ethereum’s ether , meanwhile, slipped to $1,950, also around 3% lower.

‘Perfected bottom’

Lee attributed the recent weakness in crypto prices to the volatility in metals, which rippled across asset classes. Late January, gold’s market capitalization fluctuated by trillions of dollars in a single day, triggering margin calls and weighing on risk assets.

After bitcoin severely underperformed gold in 2025, he argued that the yellow metal likely has topped for this year and bitcoin is poised to outperform through 2026.

On ether , Lee said repeated 50% drawdowns since 2018 have often been followed by sharp rebounds.

Citing market technician Tom DeMark, he said ETH may need to briefly dip below $1,800 to form a “perfected bottom” before a more sustained recovery.

Read more: SkyBridge’s Scaramucci is buying the bitcoin dip, calls Trump a crypto President

Crypto World

Bitcoin trades like growth assets today, Gold tomorrow

In its latest Market Byte research note, Grayscale Investments highlights a meaningful shift in Bitcoin’s price behavior. Recent BTC trading patterns resemble growth assets more closely than safe-haven commodities like gold, challenging the long-standing “digital gold” narrative.

Summary

- Bitcoin is trading more like a growth asset than gold, with recent price action closely tracking high-growth software stocks and broader risk assets, according to Grayscale.

- Near-term BTC moves are being driven by risk sentiment, not store-of-value demand, limiting its effectiveness as a hedge during equity market drawdowns.

- Grayscale maintains a long-term bullish thesis, arguing Bitcoin could eventually evolve into a gold-like monetary asset with lower volatility and weaker equity correlations if adoption continues.

According to the report’s key takeaways, Bitcoin’s (BTC) sharp move lower in early February — where the price dipped to around $60,000 on February 5 before a modest bounce — was driven by correlation with broader risk assets rather than traditional store-of-value flows.

Grayscale’s research shows Bitcoin’s price movements have tracked high-growth software stocks closely, especially since early 2024, with both falling in sync during recent sell-offs.

This behavior ushows Bitcoin’s sensitivity to market sentiment and cyclical risk appetite, similar to technology or growth equity performance during sell-offs.

What this means for Bitcoin traders

For traders, this means treating BTC more like a beta-driven risk asset in the near term. Rather than acting as a hedge during turbulent markets, Bitcoin has recently declined alongside broader speculative assets and failed to demonstrate the safe-haven characteristics typically associated with gold.

This shift has practical implications for portfolio construction and risk management. Traditional strategies that lean on Bitcoin as a hedge against macro uncertainty or inflation may be less effective when BTC behaves in sync with growth asset risk cycles.

Grayscale stresses that Bitcoin has not yet achieved gold-like status as a monetary asset, and that gap is central to the investment thesis.

However, in a future economy shaped by AI agents, humanoid robots, and tokenized capital markets, the firm argues a digital, blockchain-based commodity like Bitcoin is better suited to become the dominant store of value than physical assets such as gold or silver.

Grayscale adds that if Bitcoin succeeds in this role over the long term, its return profile could eventually shift. Price behavior may begin to resemble gold rather than growth stocks, marked by lower volatility, weaker equity correlations, and more stable — though lower — expected returns.

Crypto World

XRP price prediction as Goldman Sachs invests $153M in XRP ETFs

Goldman Sachs has renewed institutional focus on XRP after disclosing a $153 million investment in XRP ETFs, alongside major allocations to Bitcoin, Ethereum, and Solana.

Summary

- Goldman Sachs disclosed a $153 million investment in XRP ETFs, placing the token alongside its major holdings in Bitcoin and Ethereum and reinforcing XRP’s institutional relevance.

- XRP is trading near $1.37, with technical indicators showing fragile momentum as price remains capped below key moving averages and broader market sentiment stays cautious.

- Bitcoin’s ongoing consolidation is limiting altcoin upside, making BTC’s next directional move a critical factor for XRP’s near-term breakout or breakdown.

Goldman Sachs’ XRP exposure draws attention

The disclosure, highlighted by journalist Eleanor Terrett, places the Ripple token (XRP) among a select group of digital assets held at scale by one of Wall Street’s most influential banks.

The timing of the revelation is notable. Goldman has representation at a White House meeting centered on stablecoin yield policy, underscoring its role in shaping regulatory discussions.

CEO David Solomon is also scheduled to speak at the World Liberty Financial forum next week, reinforcing the firm’s growing public engagement with digital asset markets.

While ETF exposure does not directly translate into spot demand, the move adds credibility to XRP’s institutional narrative at a time when regulatory clarity remains a key market catalyst.

XRP price analysis and near-term outlook

XRP is currently trading near $1.37, reflecting continued consolidation after a sharp sell-off earlier this month.

TradingView data shows the token struggling to reclaim key short-term moving averages, indicating that bullish momentum remains fragile. The Relative Strength Index is still positioned below the neutral 50 level, signaling muted buying pressure and cautious trader sentiment.

Price action suggests that the $1.30–$1.32 region is acting as a critical support zone. A breakdown below this area could open the door to a deeper retracement toward $1.20, where buyers may attempt to re-enter.

On the upside, XRP would need a sustained move above $1.45–$1.50 to confirm a shift in market structure and pave the way for a recovery toward the $1.60–$1.65 range.

Until a clear breakout or breakdown occurs, XRP is likely to remain range-bound, with volatility driven by external catalysts.

Meanwhile, Bitcoin (BTC) seems to be consolidating following a volatile start to the year. The lack of a decisive move in Bitcoin has capped upside momentum across altcoins, keeping XRP’s recovery attempts limited.

Crypto World

The Next Phase of Crypto Hacks May Start With a Video Call

A North Korea–nexus threat actor is enhancing its social engineering playbook. The group is integrating AI-enabled lures into crypto-focused hacks, according to a new report from Google’s Mandiant team.

The operation reflects a continued evolution in state-linked cyber activity targeting the digital asset sector, which saw a notable increase in 2025.

Sponsored

Sponsored

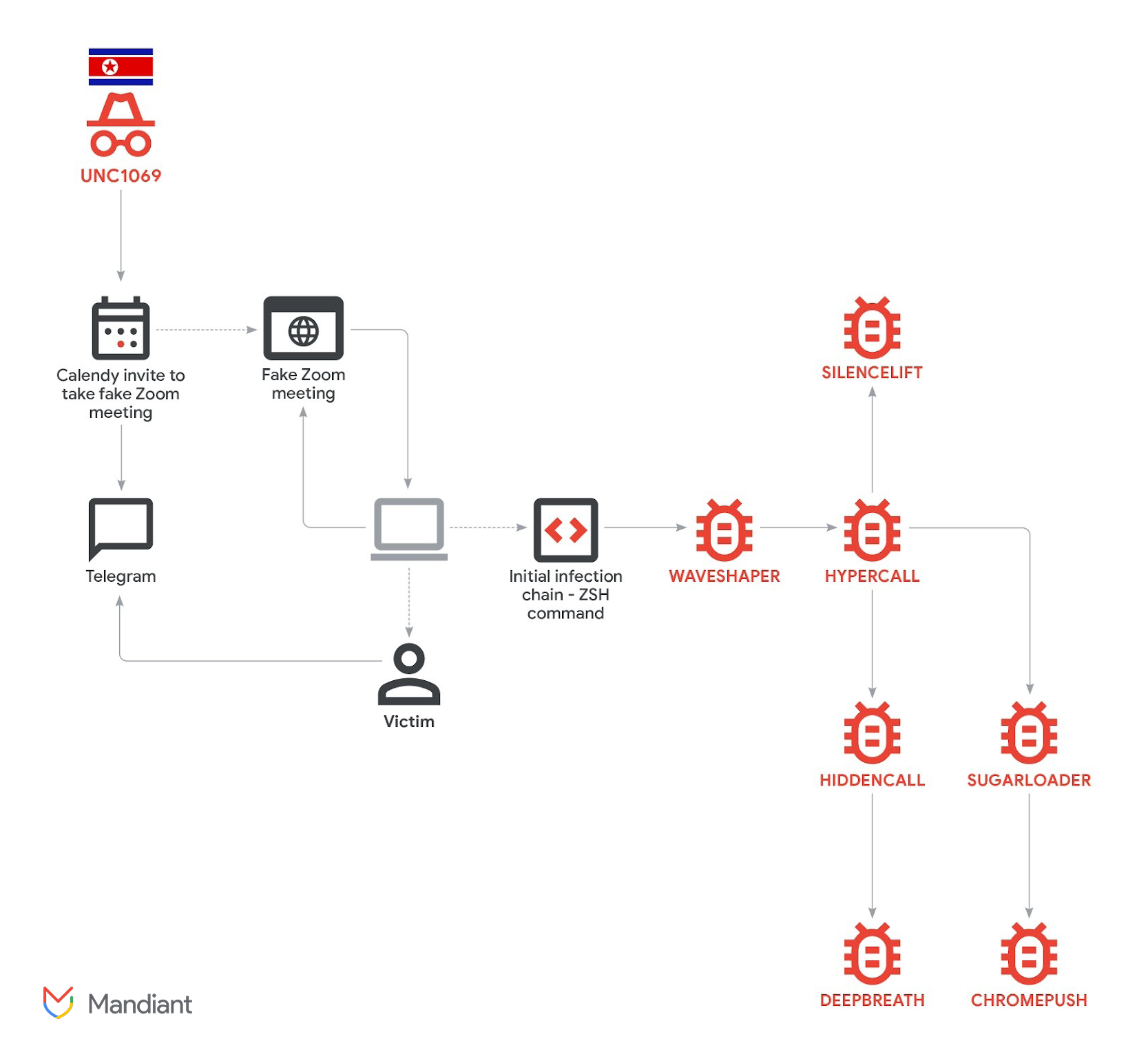

Fake Zoom Call Triggers Malware Attack on Crypto Firm

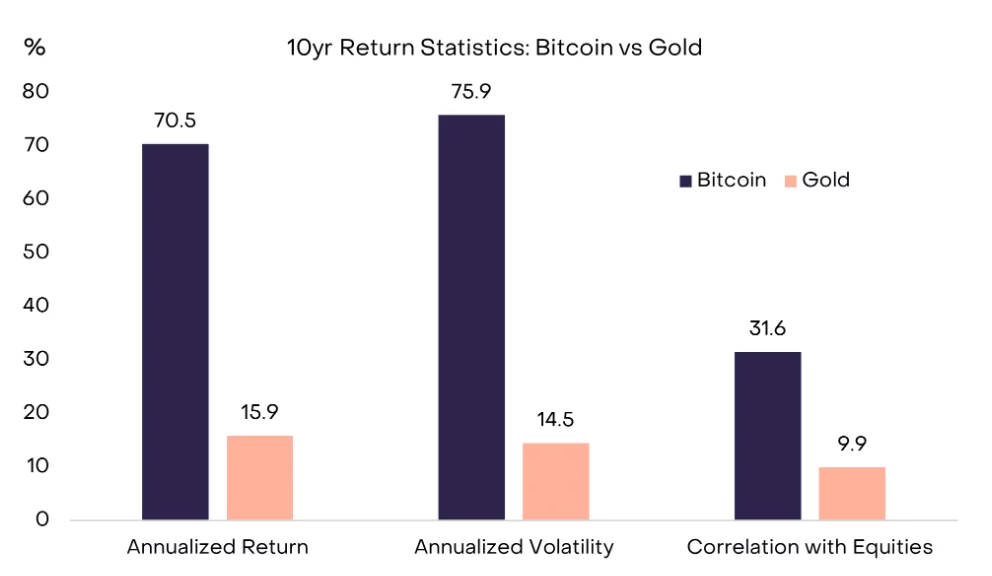

In its latest report, Mandiant detailed its investigation into an intrusion targeting a FinTech company in the cryptocurrency sector. The attack was attributed to UNC1069. It is a financially motivated threat group active since at least 2018, with links to North Korea.

“Mandiant has observed this threat actor evolve its tactics, techniques, and procedures (TTPs), tooling, and targeting. Since at least 2023, the group has shifted from spear-phishing techniques and traditional finance (TradFi) targeting towards the Web3 industry, such as centralized exchanges (CEX), software developers at financial institutions, high-technology companies, and individuals at venture capital funds,” the report read.

According to investigators, the intrusion began with a compromised Telegram account belonging to a crypto industry executive. The attackers used the hijacked profile to contact the victim. They gradually built trust before sending a Calendly invitation for a video meeting.

The meeting link directed the target to a fake Zoom domain hosted on infrastructure controlled by the threat actors. During the call, the victim reported seeing what appeared to be a deepfake video of a CEO from another cryptocurrency company.

“While Mandiant was unable to recover forensic evidence to independently verify the use of AI models in this specific instance, the reported ruse is similar to a previously publicly reported incident with similar characteristics, where deepfakes were also allegedly used,” the report added.

The attackers created the impression of audio problems in the meeting to justify the next step. They instructed the victim to run troubleshooting commands on their device.

Sponsored

Sponsored

Those commands, tailored for both macOS and Windows systems, secretly initiated the infection chain. This led to the deployment of multiple malware components.

Mandiant identified seven distinct malware families deployed during the intrusion. The tools were designed to steal Keychain credentials, extract browser cookies and login data, access Telegram session information, and collect other sensitive files.

Investigators assessed that the objective was twofold: to enable potential cryptocurrency theft and harvest data that could support future social engineering attacks.

The investigation revealed an unusually large volume of tooling dropped onto a single host. This suggested a highly targeted effort to harvest as much data as possible from the compromised individual.

The incident is part of a broader pattern rather than a standalone case. In December 2025, BeInCrypto reported that North Korean-linked actors siphoned more than $300 million by posing as trusted industry figures during fraudulent Zoom and Microsoft Teams meetings.

The scale of activity throughout the year was even more striking. In total, North Korean threat groups were responsible for $2.02 billion in stolen digital assets in 2025, a 51% increase from the previous year.

Chainalysis also revealed that scam clusters tied on-chain to AI service providers show significantly higher operational efficiency than those without such links. According to the firm, this trend suggests a future in which AI becomes a standard component of most scam operations.

With AI tools growing more accessible and advanced, creating convincing deepfakes is easier than ever. The coming time will test whether the crypto sector can adapt its security fast enough to confront these advanced threats.

Crypto World

These Altcoins Bleed Out Again as Bitcoin Dips Below $67K: Market Watch

ZRO has entered the top 100 alts after a massive surge, while most other altcoins have plunged hard yet again.

After several consecutive days of trading sideways between $68,000 and $72,000, bitcoin’s floor gave in hours ago and the asset dipped below $67,000 for the first time since Friday.

Most altcoins have joined the ride south, with ETH dumping beneath $2,000, XRP trading below $1.40, and BNB struggling to remain above $600.

BTC Slips Below $67K

It’s safe to say that the past couple of weeks have been highly unfavorable for the crypto bulls. On January 28, exactly two weeks ago, bitcoin stood tall at $90,000. However, it charted a notable price correction since then that lasted days and culminated, at least for now, last Friday.

At the time, the cryptocurrency plunged by approximately $17,000 in just over 24 hours and dumped to $60,000 on Friday morning. This became its lowest price point since before the US presidential elections in November 2024. The bulls were quick to intervene at this point and helped BTC rebound to $72,000 on that same day.

The weekend was calmer, with bitcoin trading sideways between $68,000 and $72,000. It tried to take down the upper boundary but failed on Monday and Tuesday and the subsequent rejection drove it south to under $67,000 where it currently struggles as well.

Its market capitalization has declined to $1.340 trillion on CG, while its dominance over the alts has dropped below 57%.

Alts Back in Red

Most alts have suffered even more over the past day. Ethereum has lost the $2,000 support after a 3.2% decline. A 4.1% drop from XRP has driven it to well below $1.40, while BNB is down to $600 after a 5% decrease.

SOL, ADA, HYPE, DOGE, LINK, LTC, and many other larger-cap alts are also in the red, while XMR has defied the trend today with a 3% increase to over $340.

Pi Network’s native token has charted another all-time low, while MYX is down by over 12%. BGB is next in terms of daily losses with a 9% drop. In contrast, ZRO has entered the top 100 alts after skyrocketing by 20%.

The total crypto market cap has shed over $50 billion daily and is down to $2.350 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

BTC and XRP Crash Over? Analyst Pinpoints Exact Rebound Timeline

The timeframe might be shorter than you expect.

The cryptocurrency market is bleeding out once again, led by bitcoin’s decline to under $67,000 for the first time since last Friday’s calamity.

However, one analyst believes there’s finally good news for BTC and XRP, and he even provided a more precise timing for the potential rebound.

The primary cryptocurrency has been in a free-fall state for weeks. It stood over $90,000 on January 28, but dumped by $30,000 since then to bottom out, at least for now, at $60,000 last Friday.

It tried to recover some ground since then and tapped $72,000 on a couple of occasions, but was stopped yesterday again and driven to under $67,000 as of press time.

Approximately at the time when the latest correction took place, popular analyst Ali Martinez said on X that the early TD Sequential buy signal had flashed for BTC. Moreover, he was precise with the timing of the potential rebound, claiming that it could be in the next 3-9 days.

Early TD Sequential buy signal on Bitcoin $BTC, suggesting a potential rebound could take shape over the next 3–9 days. pic.twitter.com/E1poXoOcNI

— Ali Charts (@alicharts) February 10, 2026

The metric, developed by Tom DeMark, identifies potential market reversal points, usually after a strong move in either direction. Martinez has frequently posted about the TD Sequential for several cryptocurrencies, and the indicator’s success rate has been rather impressive, especially for Ripple’s XRP.

You may also like:

Before the latest drop, the cross-border token also flashed a buy signal. Although it has since retraced by 3-4%, Martinez reminded that the TD Sequential has “perfectly timed” the local top for XRP in the past, and could signal a rapid rebound now.

The TD Sequential perfectly timed the local top on $XRP, and now it’s flashing a buy signal. pic.twitter.com/5FI3Pepsnz

— Ali Charts (@alicharts) February 10, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Drop Wipes $10 Billion From Brian Armstrong’s Net Worth

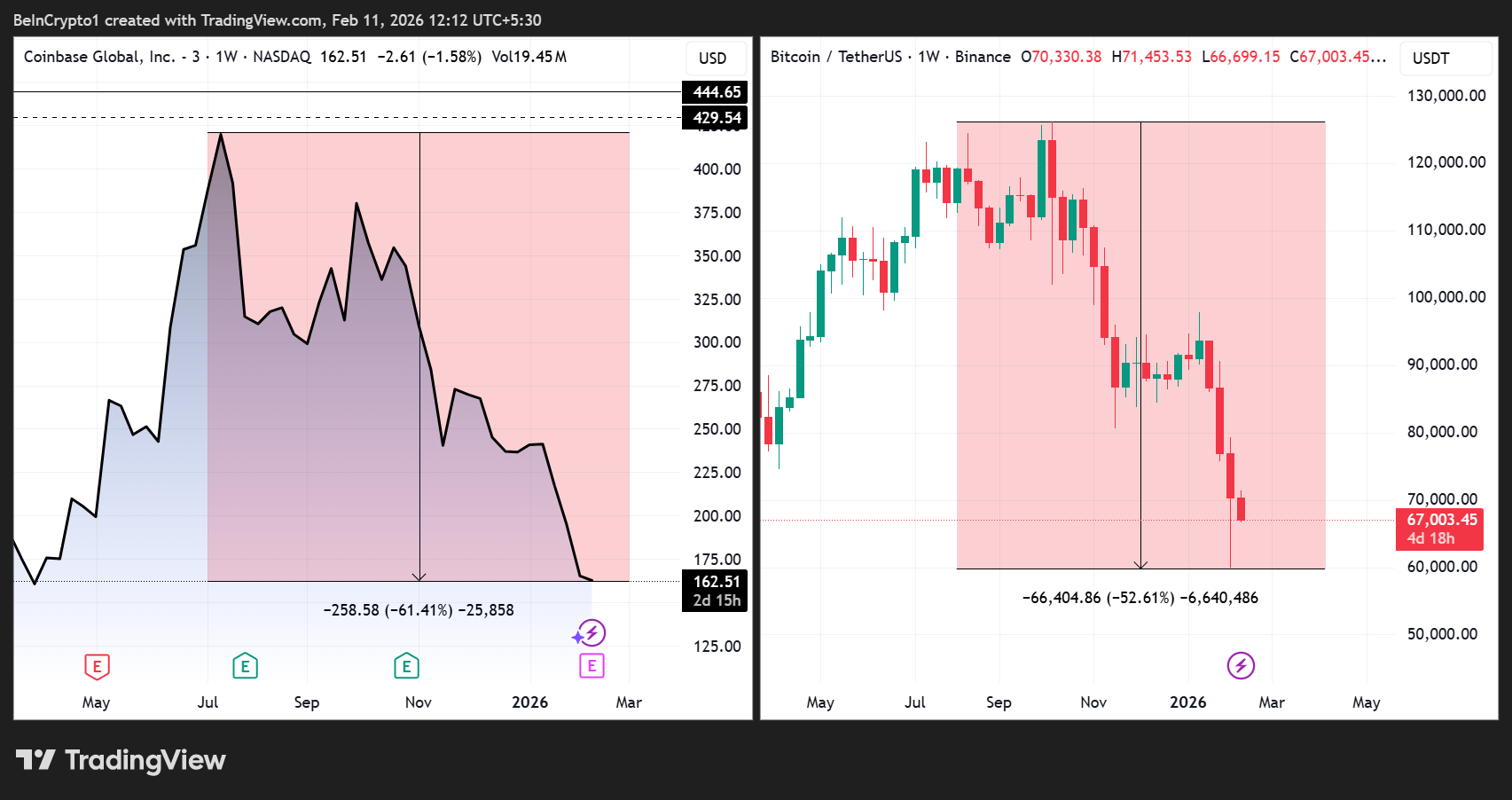

Brian Armstrong, co-founder and CEO of Coinbase, has dropped out of Bloomberg’s list of the world’s 500 richest people.

Armstrong’s net worth has fallen by more than $10 billion since July 2025. According to the Bloomberg Billionaires Index, it is down from a peak of $17.7 billion to around $7.5 billion.

Brian Armstrong’s Wealth Plummets as Coinbase Shares and Bitcoin Price Slide

The latest slide comes after JPMorgan Chase & Co. cut its price target for Coinbase stock by 27% on February 10, citing “softness in crypto prices,” declining trading volumes, and slower stablecoin adoption.

Sponsored

Sponsored

Coinbase shares have mirrored Bitcoin’s volatility, falling 60% from a July 18 high, while Bitcoin itself has dropped nearly 50% from its early October 2025 all-time high of around $126,000 to below $63,000 as of early February 2026.

Armstrong’s wealth is closely tied to his 14% stake in Coinbase, the New York-based crypto trading platform he co-founded with Fred Ehrsam in 2012.

He also holds investments in NewLimit, a biotech startup focused on longevity, and has historically sold portions of his Coinbase holdings over time.

Despite the sharp paper losses, Armstrong remains a billionaire, with his net worth estimated at approximately $7.5 billion.

The impact of the crypto slump extends beyond Armstrong. Cameron and Tyler Winklevoss, co-founders of Gemini, have seen their net worths fall to $1.9 billion each from $8.2 billion in October 2025.

Sponsored

Sponsored

Gemini recently announced plans to cut roughly 25% of its workforce and scale back some international operations.

Michael Novogratz, CEO of Galaxy Digital, saw his fortune shrink from $10.3 billion to $6.2 billion following a greater-than-expected $500 million loss in Q4 2025.

Strategy Inc. co-founder Michael Saylor also lost about two-thirds of his wealth, bringing his net worth to $3.4 billion.

Coinbase Navigates Market Headwinds While Armstrong Stays Bullish

Coinbase itself has faced operational headwinds amid the market downturn. Trading volumes have dropped sharply, and Q4 2025 transaction revenue is projected to decline 33.5% year over year.

Meanwhile, Polymarket betters see a 29% chance that Coinbase Global’s GAAP EPS for the relevant quarter will beat $0.61.

Sponsored

Sponsored

During the sell-off, the “Coinbase premium”—the price gap between BTC on Coinbase versus other exchanges—turned negative. This indicates weaker US institutional demand and potential outflows.

The exchange is further challenged by regulatory scrutiny and competition from other crypto platforms like Hyperliquid.

Despite the turbulent environment, Armstrong has maintained a bullish long-term outlook. He has publicly described crypto as “eating financial services at an incredible rate” and views market slumps as opportunities to build new products.

Sponsored

Sponsored

Armstrong has also predicted that Bitcoin could reach $1 million by 2030, framing the digital asset as a tool for wealth equalization and financial innovation.

However, while Armstrong’s net worth has been heavily impacted, his position as a founder and major shareholder could strengthen over time.

Historically, downturns have consolidated power among surviving platforms, and Coinbase may emerge leaner and more dominant if retail and institutional adoption rebounds.

Nevertheless, prolonged market weakness or a full “crypto winter” could pressure growth and test leadership strategies.

The recent wave of losses reflects the high volatility of crypto markets. While Armstrong’s exit from Bloomberg’s top 500 reflects a sharp contraction in paper wealth, long-term crypto pioneers like him have weathered multiple market cycles since 2012.

Crypto World

New Bitcoin Transfers Reported in Nancy Guthrie Ransom Account

New activity has been reported in a Bitcoin wallet tied to an alleged ransom demand in the high-profile disappearance of 84-year-old Nancy Guthrie, the mother of NBC Today co-anchor Savannah Guthrie.

Summary

- New Bitcoin activity has been detected in a wallet linked to an alleged ransom demand in the disappearance of 84-year-old Nancy Guthrie.

- The transaction marks the first reported movement in the crypto account since ransom notes demanding millions in Bitcoin were sent to media outlets earlier this month.

- Authorities have not confirmed who initiated the transfer, as the FBI continues to investigate Guthrie’s disappearance as a likely abduction.

TMZ confirmed Tuesday that for the first time since the ransom note was received, there has been “activity” in the cryptocurrency account referenced in the initial ransom demand sent to multiple media outlets, including TMZ itself.

The details of the transaction, including the amount transferred and the sender, have not been disclosed publicly. Still, the development marks a significant update in an investigation that had seen no confirmed contact from the kidnappers since earlier deadlines for ransom payments passed.

Here’s what we know about the Nancy Guthrie abduction

Nancy Guthrie was last seen at her home in Catalina Foothills, Arizona in late January and was reported missing on February 1. Law enforcement has treated her disappearance as a likely abduction after finding evidence of a struggle and DNA-matched blood at the scene.

Shortly after her disappearance, at least one ransom note demanding payment in Bitcoin (BTC) was sent to two Tucson television stations and TMZ. The note reportedly set two deadlines and demanded millions in Bitcoin for Guthrie’s safe return.

According to TMZ founder Harvey Levin, the ransom wallet tied to the first letter showed activity late Tuesday, hours after the FBI released surveillance images of a person of interest. Levin said he observed the activity “about 12 minutes” after it happened, though he declined to elaborate on the nature of the transaction.

Surveillance footage and photos of a masked person seen near Guthrie’s home early the morning she vanished, and a person of interest was detained for questioning south of Tucson earlier this week.

At present, officials have not confirmed whether the Bitcoin transaction is connected to the alleged kidnappers, the Guthrie family, law enforcement, or another party, and investigations are ongoing.

The reported Bitcoin wallet activity in the Guthrie case comes amid a wider global surge in cryptocurrency-linked kidnappings. French authorities recently arrested six suspects in a case where a magistrate and her mother were held for a crypto ransom before being rescued.

In a separate cross-border operation last year, Spanish and Danish police dismantled a gang accused of abducting and killing a crypto holder in a violent attempt to seize access to digital wallets, underscoring the growing physical security risks faced by holders of digital assets.

Crypto World

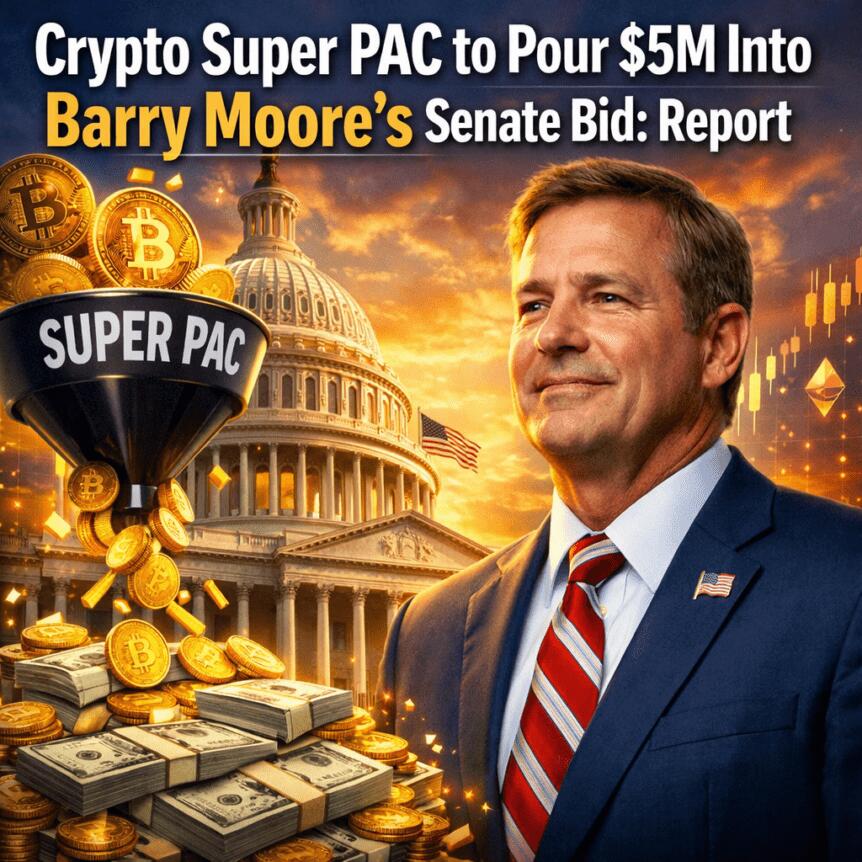

Crypto Super PAC to Pour $5M Into Barry Moore’s Senate Bid: Report

Defend American Jobs, an affiliate of the crypto-focused Fairshake PAC, is planning a $5 million push to back Alabama Senate candidate Barry Moore, according to Bloomberg. The five-week campaign, set to roll out on broadcast television and the Fox News Channel, includes a Trump endorsement as part of its messaging. The reporting cites a Fairshake statement, underscoring how crypto-aligned political committees are leaning into federal races to shape policy considerations around digital assets. The move arrives amid a broader pattern of crypto-adjacent fundraising that has become a defining feature of contemporary U.S. politics, with parties and PACs leveraging media buys to influence voters on regulatory and market issues.

Key takeaways

- Crypto-linked PACs are deploying large ad buys (millions) across major TV outlets to influence voters in Senate races where crypto policy is a live issue.

- Fairshake is backed by notable crypto industry players, signaling the depth of corporate interest behind crypto-friendly political campaigns.

- Barry Moore has a documented history of crypto-friendly positions, including past committee work and public statements endorsing a pro-crypto stance.

- Past fundraising cycles show substantial crypto-related spending, with tens of millions directed toward pro-crypto candidates and policies.

Tickers mentioned: $BTC, $COIN

Sentiment: Neutral

Price impact: Neutral. The article centers on political fundraising rather than immediate market responses.

Trading idea (Not Financial Advice): Hold. Monitor policy developments and campaign activity for potential long-term crypto-market implications.

Market context: The episode illustrates how regulatory debates and macro-fund flows intersect with political campaigns, as crypto-friendly narratives gain traction in a climate of heightened attention to digital assets and related policy clarity.

Why it matters

The funding activity highlights a strategic approach by crypto interests to influence policy at a national level. Fairshake’s $5 million expenditure, backed by high-profile crypto affiliates, shows how political spending can be concentrated around candidates perceived as sympathetic to favorable regulatory treatment. The push also underscores how partisan environments can amplify crypto policy debates, potentially shaping how lawmakers address innovation, market structure, and consumer protections in the years ahead.

Barry Moore’s profile in this narrative is notable. Elected to the U.S. House in 2020, Moore served on the Agriculture Committee and has been associated with discussions around responsible crypto regulation, including the Digital Asset Market Clarity Act. His public statements have aligned with a view of digital assets as integral to the state’s and the nation’s economic future. A December post on X appeared to reflect support for Trump’s crypto position and executive actions, reinforcing the broader pattern of crypto-leaning rhetoric among certain Republican lawmakers.

Observers point to independent assessments that rate Moore as strongly supportive of crypto, based on a track record of statements and policy positions. This kind of labeling—when aggregated by advocacy groups—helps investors and voters gauge which candidates might push for clearer rules, more predictable tax treatment, and policies that foster blockchain innovation. However, the policy landscape remains unsettled, with regulators and lawmakers weighing a range of approaches to digital assets and market infrastructure. The Alabama polling data cited in local coverage suggests a demographic segment receptive to pro-crypto messaging, even as battles over specifics persist.

What to watch next

- Watch the five-week ad schedule for Moore’s campaign, including potential follow-ups on Fox News and other broadcast outlets.

- Monitor any new statements from Fairshake or its affiliates about policy positions, as the fundraising narrative evolves ahead of the primary and general election.

- Track regulatory developments in Washington related to digital assets that could influence campaign messaging and voter concerns.

- Observe polling updates in Alabama and other states where crypto-leaning politicians are contesting elections, as shifts could alter fundraising dynamics.

Sources & verification

- Bloomberg Government reporting on Fairshake’s $5 million Alabama Senate primary ad buy and Trump endorsement.

- The Fairshake statement cited by Bloomberg outlining support for Barry Moore and the five-week media push.

- References to Fairshake’s backing by Coinbase and Ripple Labs and the broader crypto-aligned PAC ecosystem.

- Historical spending by crypto-related PACs, including a figure around $130 million in the 2024 elections.

- Alabama Daily News poll data showing initial voter preferences for Moore and Marshall in a February snapshot.

Crypto influence in Alabama politics and the midterms

Defend American Jobs’ $5 million commitment to back Barry Moore illustrates how crypto-aligned fundraising seeks to shape policy conversations ahead of the midterms. The campaign’s five-week plan, anchored in television and cable advertising, reflects a broader strategy: deploy high-impact media in key markets to foreground a crypto-friendly economic narrative. The Bloomberg report underscores that Fairshake’s approach includes support from a constellation of industry players, and it notes that the PAC’s actions are part of a wider effort to elevate crypto policy in electoral debates. The involvement of a presidential figure in the messaging—Donald Trump—also signals the high-level salience of digital-asset policy among partisans and donors as they map out policy priorities for the coming years.

Beyond the Alabama race, the story speaks to the persistence of crypto-asset policy as a political issue. Fairshake’s public positioning, supported by industry backers, demonstrates how corporate resources are deployed to influence voters’ perceptions of digital assets, market structure, and regulatory clarity. The fact that Fairshake is described as one of the most prominent crypto-related PACs—backed by major players—highlights the scale of financial flows that can accompany policy debates. As crypto advocates argue for clearer rules and more predictable frameworks, lawmakers who express supportive positions could become central figures in shaping the regulatory environment that will govern innovation, exchanges, and the broader ecosystem.

Barry Moore’s record and public statements contribute to a broader pattern in which certain members of Congress articulate a forward-looking view of crypto as economic infrastructure rather than a niche technology. From his early congressional tenure to his more recent statements, Moore has tied his messaging to the idea that crypto is part of Alabama’s—and America’s—future. The X post from December, implying alignment with Trump’s stance on crypto, reinforces this posture in a political climate where party alignment and donor influence can translate into policy signals with real-world implications for the industry’s growth and regulatory trajectory. In parallel, local polling indicates a receptivity to pro-crypto messaging among Republican voters, suggesting that fundraising narratives could gain traction as campaigns scale their outreach ahead of primary and general elections.

What to watch next

- Track the continuation of Moore’s ad campaigns as the five-week window unfolds, including potential interviews and discussions on crypto policy among campaign surrogates.

- Watch for further disclosures from Fairshake and its industry partners regarding policy positions and voting records that align with crypto-friendly approaches.

- Follow regulatory developments at the federal level that could influence campaign messaging, such as discussions around tax treatment, market structure, and consumer protections for digital assets.

https://platform.twitter.com/widgets.js

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech6 hours ago

Tech6 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World17 hours ago

Crypto World17 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition