Crypto World

Bithumb accidentally gave away 2,000 BTC and crashed its market

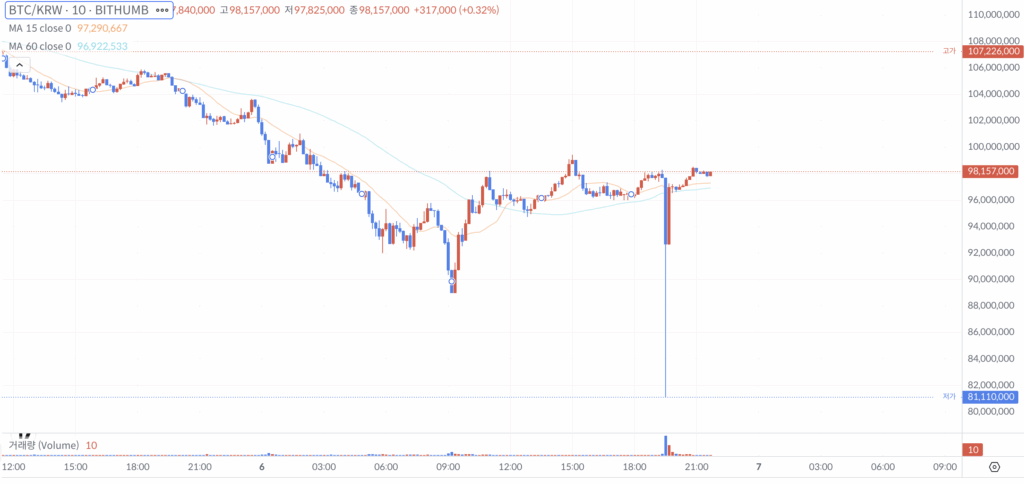

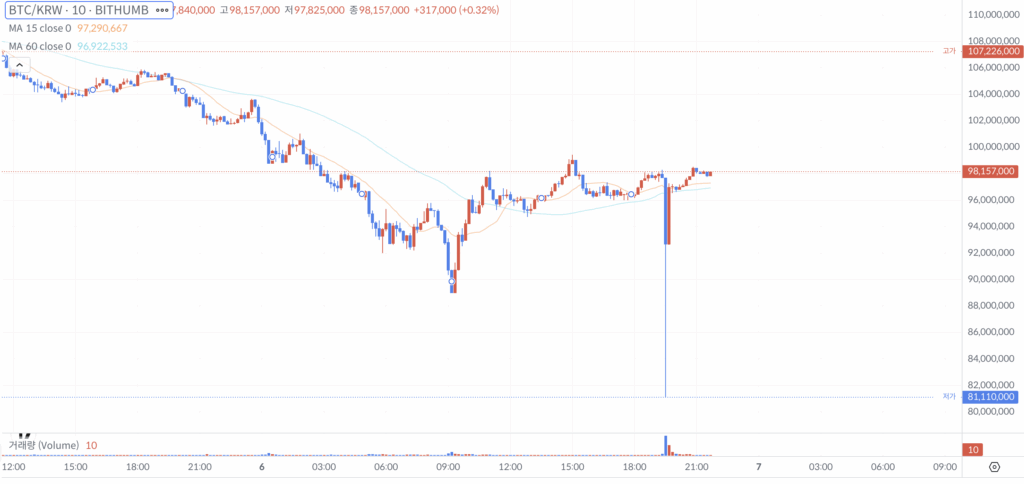

Bitcoin (BTC) has flash crashed 10% on the South Korean exchange Bithumb after a user sold 2,000 BTC that they received by mistake from a promotional airdrop.

Earlier today, X users noted that Bithumb’s listed BTC/South Korean Won (KRW) trading pair plummeted by 10% in the space of a minute before returning to its original price.

The account “Definalist,” which claims to be made up of five crypto traders based in China, noted the price drop and a “rumor” that someone dumped 2,000 BTC.

They also appeared to show a screenshot taken from the seller’s account while they were dumping the BTC, which in today’s less-than-stellar crypto markets would fetch $134 million.

Read more: Bithumb boosts security in wake of SK Telecom malware hack

Definalist later claimed that hundreds of users may have received 2,000 BTC accidentally after an employee typed BTC, instead of KRW, when sending out 2,000 KRW ($1.4) as part of a “random box prize” promotional giveaway.

Bithumb confirms it sent ‘abnormal’ sums of BTC to users

Bithumb has since confirmed some details of the incident, although it didn’t confirm the quantity of BTC nor the number of customers who received mistaken disbursements.

It admitted that an “abnormal” sum of BTC was paid to various users, and that BTC’s price “temporarily fluctuated sharply as some accounts that received the BTC sold it.”

It notes that it was able to restrict the accounts selling the BTC and added that “the market price returned to normal levels within five minutes, and the domino liquidation prevention system functioned normally, preventing chain liquidations due to the abnormal BTC price.”

“We want to make it clear that this incident is unrelated to any external hacking or security breach, and does not pose any issues with system security or customer asset management,” the exchange said.

If Bithumb did in fact send 2,000 BTC to at least 100 users, thats a minimum distribution of $13 billion.

BTC crashed almost 47% from its all-time high of $126,000 last October but has, for the time being, gradually begun to increase in price again.

The flash crash is another problem for Bithumb after South Korea’s financial competition watchdog raided its office last week over various promotions it advertised last year.

Protos has reached out to Bithumb for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Vietnam Draft Rules Propose 0.1% Tax on Crypto Transfers

Vietnam is preparing to introduce a tax framework for cryptocurrency transactions that would align digital assets with securities trading, according to a draft policy circulated by the Ministry of Finance.

Under the proposal, individuals transferring crypto assets through licensed service providers would face a 0.1% personal income tax on the value of each transaction, local outlet The Hanoi Times reported. The structure mirrors the levy currently applied to stock trades in the country.

According to the report, the draft circular, released for public consultation, classifies crypto transfers and trading as exempt from value-added tax. However, the turnover-based tax would apply to investors regardless of residency status whenever a transfer is executed.

Companies operating in Vietnam would be taxed differently. Institutional investors earning income from crypto transfers would be subject to a 20% corporate income tax, calculated on profits after deducting purchase costs and related expenses, per the report.

Related: No companies apply for Vietnam crypto pilot amid high barriers

Vietnam formally defines crypto assets

Authorities also reportedly provided a formal definition of crypto assets, describing them as digital assets that rely on cryptographic or similar technologies for issuance, storage and transfer verification.

The draft also outlines strict requirements for operators. Firms seeking to run a digital asset exchange would need at least 10 trillion Vietnamese dong (about $408 million) in charter capital, a threshold higher than that required for commercial banks and far above capital standards in many other industries. Foreign ownership would be permitted but capped at 49% of an exchange’s equity.

The proposed rules come as Vietnam began a five-year pilot program for a regulated crypto asset market launched in September 2025. On Oct. 6, 2025, Vietnam’s Ministry of Finance confirmed that no companies had applied to participate in the five-year crypto pilot at that time, citing high capital requirements and strict eligibility conditions.

Related: Vietnam central bank expects credit growth amid rapid crypto adoption

Vietnam opens licensing for crypto exchanges

Last month, Vietnam started accepting applications for licenses to operate digital asset trading platforms, marking the operational launch of its planned pilot program for a regulated crypto market.

“Applications for the aforementioned administrative procedures will be accepted beginning January 20, 2026,” the State Securities Commission of Vietnam (SSC) said, framing the move as part of a broader effort to bring crypto under formal regulatory oversight.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Top AI cryptos drop over 20% as Big Tech’s AI spending spree sparks concerns

Top AI-focused cryptos like TAO, NEAR, ICP, and RENDER faced losses surpassing 20% as investor demand in the sector fell amid concerns surrounding Big Tech’s growing bets on AI infrastructure.

Summary

- The combined market cap of all AI cryptocurrencies nosedived by over 40% on Friday.

- Concerns over massive AI-related spending by Big Tech companies have spooked investors.

According to data from CoinGecko, Bittensor (TAO), the largest AI-focused cryptocurrency with a market cap of $1.58 billion, fell 23% over the past 7 days, exchanging hands at $164 at press time. Near Protocol (NEAR) fell 25.4% while Internet Computer (ICP) and Render (RENDER) posted similar losses over the weekly period.

The entire AI crypto market has shown no signs of recovery or stabilization, recording over 42% losses in the past 24 hours alone as its total valuation fell to roughly $12 billion.

TAO and other top AI coins fell as investors remain concerned after reports from Big Tech giants like Alphabet and Amazon revealed a massive jump in AI investments for 2026, which could balloon up to $500 billion, according to recent estimates.

Investors fear that the astronomical costs of AI development will erode margins before monetization is realized, especially since recent earnings reports from these companies highlighted a significant gap between infrastructure spending and actual profit generation.

As these concerns grew louder across the broader financial markets, it triggered a sell-off in AI-linked software stocks such as Microsoft and AI chipmaking giants like AMD and Nvidia. Notably, Microsoft shares stood over 8% lower in the past five days, while chip-making giants AMD and Nvidia shares were down 18.5% and 10%, respectively, over the same period.

These chipmaking and software firms are the backbone of the hardware and processing power that is used to run the decentralized networks of most of the projects in the AI crypto space.

Notably, Bittensor relies on high-performance GPU clusters to facilitate its competitive machine learning model training, while Near Protocol is a highly scalable blockchain designed to support the intensive data demands of AI applications. Meanwhile, Internet Computer provides the sovereign cloud infrastructure required to host autonomous AI agents, and Render offers the decentralized computing power essential for complex graphical and AI rendering tasks.

Aside from the mounting anxiety over capital expenditures, AI tokens have also been weighed down by massive liquidations across the crypto market that came from Bitcoin’s dramatic plunge below multiple key support levels and a confluence of macroeconomic and geopolitical concerns that have driven risk-on sentiment away from speculative assets.

As previously reported by crypto.news, Bitcoin (BTC) price briefly fell by over 18% on Thursday as it touched nearly $60K levels, which triggered nearly $2.6 billion in liquidations across leveraged markets as market fear reached levels last seen during the collapse of the Terra blockchain nearly four years ago.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

BlackRock Bitcoin ETF Draws $231.6M Inflows After Turbulent BTC Week

BlackRock’s spot Bitcoin ETF attracted $231.6 million in inflows on Friday, signaling a tentative rebound after a week marked by pronounced volatility in cryptocurrency markets. The broader week featured outsized moves in Bitcoin-linked ETFs, with the iShares Bitcoin Trust ETF (IBIT) absorbing $548.7 million in net outflows on Wednesday and Thursday as sentiment sagged and Bitcoin briefly dipped toward $60,000, according to data cited by market observers. Preliminary figures from Farside indicate nine U.S.-based spot Bitcoin ETF products together drew $330.7 million in net inflows after a three-day stretch that saw $1.25 billion leave the sector. Bitcoin was hovering around $69,820 as the week closed, down roughly a quarter over the prior 30 days.

Key takeaways

- Friday’s inflows into BlackRock’s spot BTC ETF coincided with a bigger pullback earlier in the week, underscoring a split in the market between risk-off pressure and renewed interest in regulated Bitcoin exposure.

- Across nine U.S.-listed spot Bitcoin ETFs, inflows totaled $330.7 million after three days of heavy outflows totaling about $1.25 billion, signaling a potential shift in investor appetite or a pause in forced selling.

- The iShares Bitcoin Trust ETF (IBIT) faced a volatile week, including a 13% one-day drop on Friday—the second-worst daily decline since launch, with a 15% drop on May 8, 2024 representing the record worst day to date.

- IBIT’s price action on Friday showed a strong rebound, closing up about 9.92% on the session, as momentum in the underlying market remained volatile but constructive for some ETF holders.

- Bitcoin’s price path remains turbulent, with a 30-day decline of around 24.3% and broad price support appearing only in pockets of the market and among specific ETF inflows, rather than across the board.

Tickers mentioned: $BTC, $IBIT

Sentiment: Bearish

Price impact: Neutral. The week’s mixed inflows and outsized ETF moves did not yield a clear, sustained price direction for Bitcoin itself, though ETF prices reacted sharply in intraday moments.

Trading idea (Not Financial Advice): Hold. The data show episodic inflows and outsized volatility, suggesting the landscape remains uncertain and better suited to patience than aggressive positioning.

Market context: The week’s ETF flows illustrate how investors are evaluating regulated Bitcoin exposure as a risk-t sentiment remains sensitive to macro headlines, regulatory signals, and shifts in liquidity. Net inflows in a handful of products come as broader crypto liquidity and ETF participation continue to evolve, with flows often diverging from spot price moves.

Why it matters

The ebb and flow of ETF-based money into Bitcoin reflects more than mere trading appetite; it reveals how institutional participants are testing the waters of regulated exposure in a market that has historically traded in less centralized venues. The rebound in Friday inflows into BlackRock’s spot BTC product indicates that some investors view these listed vehicles as a credible bridge to the crypto ecosystem, offering transparency, daily liquidity, and the potential for on-exchange settlement that can align with traditional risk controls.

Yet the week’s broader narrative remains unsettled. IBIT’s swift 13% drop on Friday and its earlier record of a 15% single-day decline underscore how quickly sentiment can swing in the current regulatory environment and amid ongoing price volatility. The outflow pressures on Wednesday and Thursday, followed by the weekend’s rebound, suggest a tug-of-war: traders weighing the relative value of direct Bitcoin ownership versus regulated ETF access, while assessing the implications of liquidity and market structure on price formation.

Bitcoin itself traded near $69,820 at the time of publication, after a 30-day period marked by a roughly 24% decline. As broader market liquidity fluctuates, ETF inflows may provide temporary relief or a counterbalance to price moves driven by macro forces, miner dynamics, and persistent concerns around regulatory clarity. The data also highlight how ETF volumes can produce meaningful reflections of investor sentiment, even when spot prices remain volatile. In this context, the $10 billion daily volume record cited for IBIT on Thursday underscores that exchange-traded exposure remains a focal point for both professional and retail participants, even as price volatility persists.

On the back of Thursday’s activity, industry observers noted that the Bitcoin ETF space has not yet shown a consistent, durable upward momentum in price, even as inflows resume. ETF analyst James Seyffart pointed out that holders of Bitcoin ETFs have recorded notable paper losses since the U.S. market launched these products in January 2024, with losses around 42% when Bitcoin traded below the high-water marks of the year. Nevertheless, the latest inflows point to continued investor interest in regulated access, even as the broader price backdrop remains in flux.

What to watch next

- Monitor next week’s ETF-only inflow/outflow data to gauge whether the current rebound persists across the larger basket of spot BTC ETFs.

- Track Bitcoin’s price action in relation to key support and resistance levels to assess whether ETF flows translate into sustained price momentum.

- Watch regulatory developments and comments from market authorities that could influence the appetite for regulated Bitcoin exposure.

- Follow volume dynamics in the IBIT and other spot BTC ETFs as traders test liquidity and arbitrage opportunities in the current market environment.

- Assess new fund launches or product changes that broaden access to Bitcoin exposure through traditional market channels.

SOURCES & verification

- Farside data on net inflows across nine U.S.-based spot Bitcoin ETF products and the week’s aggregate outflows.

- Bloomberg ETF analyst Eric Balchunas’s notes on IBIT’s daily volume and price movements.

- CoinMarketCap price data for Bitcoin around the time of publication.

- Google Finance price data for IBIT and related ETF pricing behavior.

Crypto World

CZ lists a number of non-dollar stablecoins as Binance backs national currencies

CZ says Binance is working with governments to launch local-currency stablecoins, widening stablecoin options beyond dollar-pegged tokens.

Summary

- CZ says Binance is working with “more countries” on stablecoins pegged to national currencies via X post.

- Shift aims to move beyond USDT- and USDC-style dollar dominance toward a multi-fiat stablecoin landscape on-chain.

- Analysts say local stablecoins could reshape regulation and payments as banks, fintechs, and exchanges join these projects.

Binance founder Changpeng Zhao announced the cryptocurrency exchange is collaborating with multiple countries on issuing stablecoins pegged to local currencies, according to a post on the X platform.

Zhao stated the stablecoin ecosystem should not be limited to dollar-based products, writing that Binance is “working with more countries and supporting each country in issuing stablecoins pegged to their own national currency.”

The executive indicated support for multiple fiat stablecoins on blockchain networks, stating “each fiat currency should be represented on the chain,” according to the social media post.

The announcement comes amid intensifying regulatory debates in the stablecoin market, where US dollar-pegged stablecoins currently maintain dominant market positions. Dollar-based stablecoins have served as primary liquidity and transfer mechanisms in cryptocurrency markets in recent years.

Multiple nations have expressed interest in establishing digital asset infrastructure based on domestic currencies for payment systems and cross-border transfers, according to industry observers.

Cryptocurrency market analysts indicate the proliferation of local currency stablecoins could increase market diversity and influence regulatory approaches across different jurisdictions. Banks, financial technology companies, and major cryptocurrency exchanges are expected to play significant roles in this development.

The statement signals Binance’s intention to expand beyond global dollar stablecoins into projects bringing additional fiat currencies to blockchain platforms, according to Zhao’s announcement.

Crypto World

Marathon Digital moves $87m in BTC as crypto markets slide

Marathon Digital Holdings, one of the largest publicly traded Bitcoin mining companies, has recently executed a significant on-chain movement of Bitcoin worth roughly $87 million amid a broader sell-off in crypto markets.

Summary

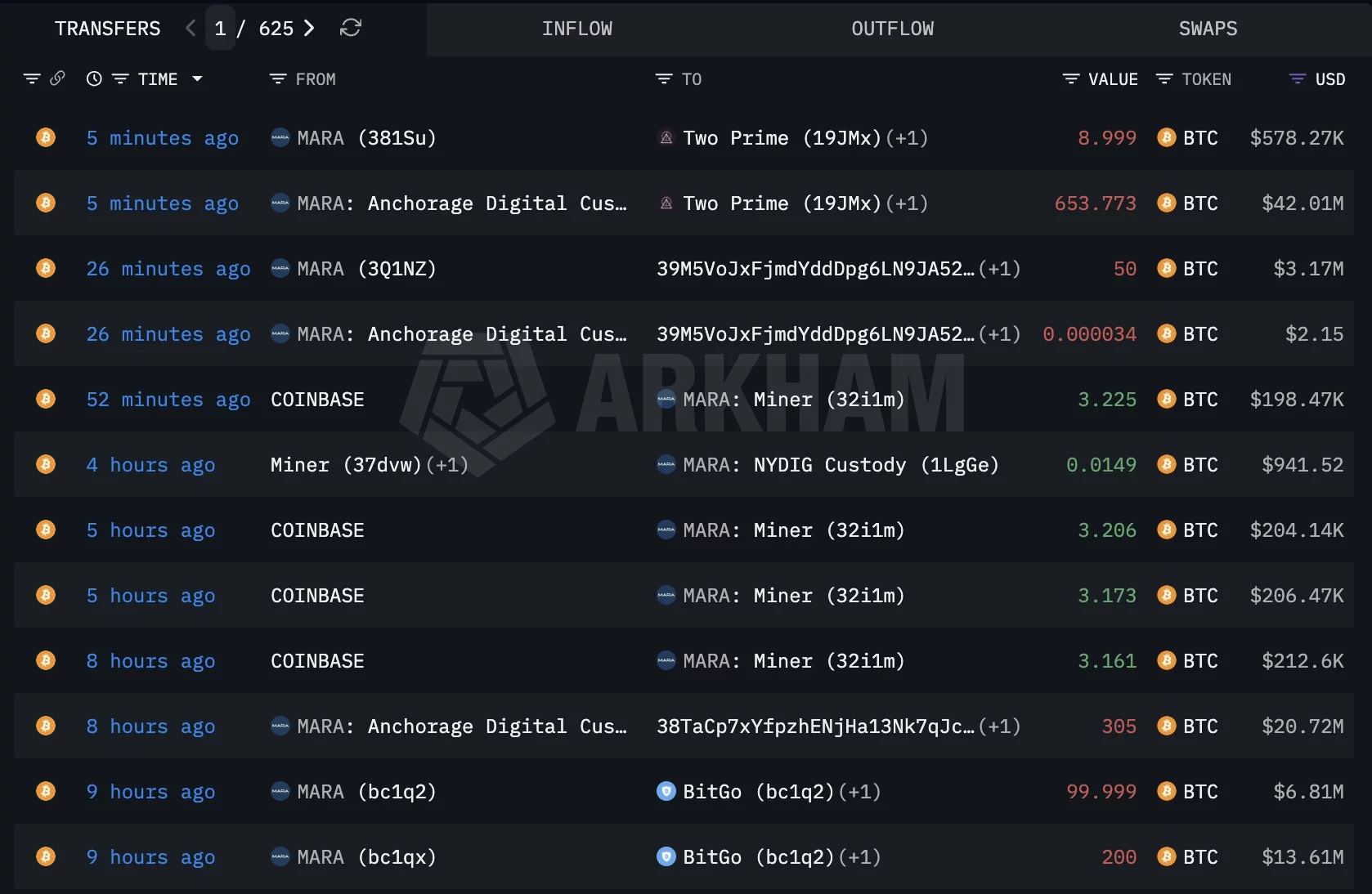

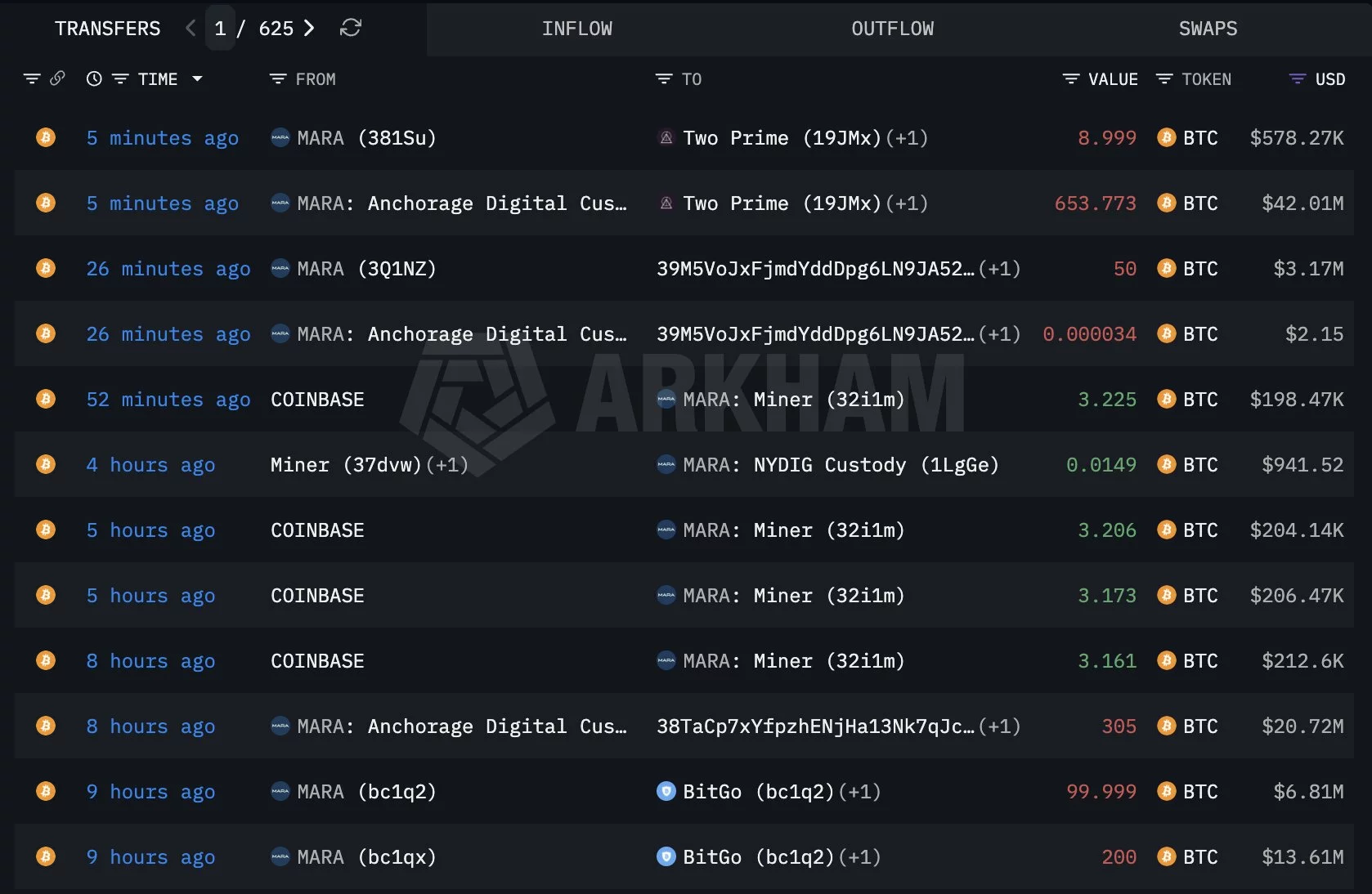

- Marathon Digital moved 1,318 BTC worth about $87 million over a 10-hour period, with funds sent to institutional counterparties, custodial wallets, and a newly created address, according to Arkham data.

- The transfers came amid a sharp pullback in Bitcoin prices, which briefly dipped toward $60,000, increasing pressure on bitcoin miners.

- The on-chain activity coincided with a nearly 19% drop in MARA shares in a single Nasdaq session, adding to investor unease across the mining sector.

The activity, captured by on-chain analytics firm Arkham, coincided with a sharp drop in Bitcoin’s (BTC) price and a steep decline in MARA’s stock.

Large BTC transfers spark market speculation

Over a roughly 10-hour period, Marathon Digital moved 1,318 BTC, valued at approximately $86.9 million at the time of transfer, from miner wallets to a mix of trading desks, custodial services, and other wallet addresses.

According to Arkham data, the largest transfer involved 653.773 BTC, worth about $42 million, sent to an address associated with institutional services provider Two Prime. Additional transfers included 200 BTC and 99.999 BTC to wallets linked to BitGo, totaling roughly $20.4 million.

Another 305 BTC, valued at about $20.7 million, was moved to a newly created wallet whose ownership remains unknown.

These on-chain moves drew attention because such large BTC movements during a market downturn are often interpreted as potential precursor actions to sales, hedging, or collateral posting.

The timing of the transfers came amid notable weakness in Bitcoin prices, which briefly dipped toward the $60,000 range before trading in the mid-$60,000s.

The on-chain activity also added to investor unease as Marathon Digital’s shares plunged. MARA stock fell nearly 19% in a single session on Nasdaq amid mounting pressure on bitcoin miners.

Though large transfers from miner wallets often trigger speculation, they don’t necessarily equate to immediate spot sales on exchanges. Institutional counterparties, lending arrangements, and collateralized trading strategies can all require BTC movements without marking direct liquidation.

Crypto World

Bitcoin investors face ‘harvest now, decrypt later’ quantum threat

IBIT’s heavy Bitcoin flows and rising institutional demand collide with growing “harvest now, decrypt later” fears and BMIC’s push for post-quantum wallet security.

Summary

- BlackRock’s iShares Bitcoin Trust now holds about 764,893 BTC, or roughly 3.64% of the eventual 21 million supply, intensifying focus on centralization and key management.

- Security researchers warn of “harvest now, decrypt later” attacks, where adversaries stockpile today’s encrypted blockchain data for future quantum decryption once ECC is broken.

- BMIC’s presale pitches a “Quantum Meta-Cloud” with ERC‑4337 smart accounts and signature‑hiding wallets that keep public keys off‑chain to mitigate future quantum attacks.

BlackRock’s iShares Bitcoin Trust recorded substantial daily trading volume, according to Nasdaq data, as digital asset security concerns related to quantum computing threats gain attention among institutional investors.

The trading volume spike occurred without a corresponding price decline, a pattern market analysts characterize as a transfer of holdings from retail investors to institutional buyers, according to industry observers. The development suggests Bitcoin’s evolving role in institutional portfolios as a macro hedge asset.

The concentration of digital asset wealth through centralized issuers has raised concerns about vulnerabilities in current cryptographic standards. Elliptic Curve Cryptography (ECC), the encryption method protecting most cryptocurrency assets, faces potential obsolescence with advances in quantum computing technology, according to cybersecurity experts.

Security researchers have identified a threat vector known as “harvest now, decrypt later,” in which encrypted data is collected for future decryption once quantum computing capabilities mature. Nation-state actors are reportedly employing this strategy, according to cybersecurity analysts.

BMIC, a blockchain security project, has positioned itself to address quantum computing threats to cryptocurrency holdings. The project has raised undisclosed funds during its presale phase, according to company announcements.

The protocol utilizes what the company describes as a “Quantum Meta-Cloud” and AI-enhanced threat detection systems designed to prevent public key exposure during transactions. Traditional cryptocurrency wallets reveal public keys when transactions are signed, creating potential vulnerabilities to future quantum algorithms, according to the project’s technical documentation.

BMIC’s architecture incorporates ERC-4337 Smart Accounts, a wallet standard that eliminates seed phrase requirements while implementing quantum-resistant cryptographic methods, according to the company. The platform offers quantum-secure staking options designed to generate yield without exposing private keys to network participants.

The project’s early funding stage has attracted capital from investors focused on blockchain infrastructure security, according to industry reports. Market observers note a growing focus on post-quantum cryptographic solutions as digital asset valuations increase.

Bitcoin’s market capitalization has reached approximately one trillion dollars, protected by cryptographic standards developed before quantum computing emerged as a practical threat. Protocols offering migration paths to post-quantum security standards may command market premiums as institutional adoption increases, according to blockchain analysts.

The cryptocurrency industry faces pressure to upgrade security infrastructure as quantum computing technology advances. Traditional encryption methods protecting blockchain assets may require replacement with quantum-resistant alternatives within the coming decade, according to estimates from technology researchers.

Cryptocurrency investments carry inherent risks, and presale investments involve additional uncertainties. Investors should conduct independent research before making investment decisions.

Crypto World

Bitcoin Core maintainers face shake-up as Gloria Zhao revokes PGP key

Bitcoin Core maintainer Gloria Zhao has revoked her signing PGP key and stepped down, ending a six-year run of mempool-focused work that reshaped transaction policy.

Summary

- Zhao confirmed on GitHub on Feb. 5 that she revoked her maintainer PGP key, formally ending her role signing Bitcoin Core releases.

- She became the first known woman Bitcoin Core maintainer in July 2022, when her key was added to the trusted-keys file alongside Pieter Wuille’s departure.

- Backed by Brink, the Human Rights Foundation and Spiral, she specialized in mempool policy, package relay (BIP 331), TRUC (BIP 431), RBF, and P2P improvements over more than six years of contributions.

Gloria Zhao has revoked her signing PGP key for Bitcoin Core, confirming her departure from the maintainer role, according to an announcement posted on her GitHub profile on February 5.

Bitcoin Core maintainers are responsible for reviewing and approving code updates and digitally signing official releases with cryptographic keys.

Zhao joined Brink, a non-profit organization supported by the Human Rights Foundation and Spiral, in January 2021. Her PGP key was added to Bitcoin Core’s trusted-keys file on July 7, 2022, making her a maintainer coinciding with Pieter Wuille’s departure. She was the first known woman in this role, appointed by community consensus, according to Bitcoin Core records.

Zhao specialized in mempool policy, transaction relay, and fee estimation. Her work included package relay (BIP 331), TRUC (BIP 431), RBF, and peer-to-peer protocol improvements designed to reduce inefficiencies and censorship vectors. She contributed hundreds of commits to Bitcoin Core, including pull request reviews and participation in the Bitcoin Core PR Review Club.

Zhao began contributing to Bitcoin Core in 2020. As of August 2025, she had made 837 contributions in the past year across Bitcoin/bitcoin and related repositories, according to GitHub data. In January 2025, Brink announced it was celebrating her four years of full-time work on Bitcoin Core.

Crypto World

Bitcoin traders face possible 70% drawdown with $38k target in play

An analyst warns Bitcoin could revisit ~$38k if past 70% drawdown patterns repeat, while others argue deeper institutional flows may cap the correction nearer 55%–60%.

Summary

- Analyst “Sherlock” maps past drawdowns of 93%, 86%, 84%, and 77% to project a roughly 70% drop this cycle, implying a Bitcoin bottom near $38,000.

- Critics on X counter that prior top‑to‑bottom moves versus bottom‑to‑top rallies suggest a shallower 55%–60% correction, arguing institutions could soften the downside.

- Sherlock replies that reflexivity can cut both ways, warning traders that trying to time a perfect bottom is risky as Bitcoin trades back to October 2024 levels.

Bitcoin (BTC) continued to trade under bearish pressure as analysts debate the potential depth of the current correction, with one market observer projecting the cryptocurrency could fall to $38,000 based on historical drawdown patterns.

Bitcoin could fall to the $38k range: analyst

The cryptocurrency has broken below key support levels and extended its decline as part of a corrective phase that began after Bitcoin reached its peak in October 2025, according to market data.

A crypto analyst known as Sherlock posted an analysis on social media platform X examining Bitcoin’s historical bear market drawdowns and their progression over time. The analysis noted that Bitcoin’s 2011 cycle experienced a drawdown of approximately 93% from peak to trough, representing the largest correction in the asset’s history to date.

Subsequent bear markets showed progressively smaller declines, according to the data cited. The 2015 cycle saw a drawdown of about 86%, followed by 84% in 2018 and approximately 77% during the 2022 bear market.

The analyst projected that if this pattern continues, the current cycle could see a drawdown of around 70% from the all-time high, which would place Bitcoin’s bottom near $38,000.

The projection generated significant engagement on X, with some market participants suggesting that increased institutional involvement and market reflexivity could limit downside risk. One response argued that when comparing prior bottom-to-top moves against top-to-bottom declines, the next drawdown should be closer to 55% or 60% rather than 70%.

Sherlock responded that reflexivity can amplify downside moves as well as rallies, cautioning traders against attempting to time purchases at specific bottom targets.

Bitcoin was trading at levels not seen since October 2024, according to data from CoinGecko. The cryptocurrency last traded around current price levels in October 2023, during the early stages of the previous bull market.

The asset has rebounded from an intraday low but remains under pressure as market participants assess whether the corrective phase has concluded.

Crypto World

“It’ll Get Worse. It’ll Get Redder.”

Cardano founder Charles Hoskinson sought to steady market sentiment during a sharp crypto sell-off, arguing that short-term price pain does not undermine the long-term case for blockchain-based financial systems.

Summary

- Cardano founder Charles Hoskinson warned that crypto markets could face further losses, telling viewers, “It’ll get worse. It’ll get redder,” as digital assets extended a broad sell-off.

- Hoskinson said he has personally lost more than $3 billion during past market cycles, arguing that his commitment to blockchain development is driven by conviction rather than profit.

- He said Cardano is entering a commercialization phase, citing full decentralization, completed governance upgrades, and upcoming initiatives such as Hydra and privacy-focused project Midnight.

Speaking during a public livestream from Tokyo, Hoskinson acknowledged worsening market conditions and warned that further volatility could lie ahead. “It’ll get worse. It’ll get redder,” he said, urging developers and investors to focus on building rather than retreating.

“I’ve lost over $3 billion”

Addressing criticism that crypto founders are insulated from downturns, Hoskinson said he has personally absorbed substantial financial losses over the years, estimating them at more than $3 billion.

“I’ve lost more money than anyone listening to this,” he said, adding that he could have exited the industry long ago but chose to remain involved out of principle rather than financial incentive.

Hoskinson emphasized that his continued participation in the sector is driven by conviction rather than profit, arguing that integrity and long-term vision matter more than short-term market cycles.

Cardano ready for commercialization

Hoskinson said Cardano (ADA) has reached a point where years of infrastructure development are beginning to translate into real-world use cases. According to him, the network is now fully decentralized, with governance mechanisms largely in place.

“The infrastructure is strong. We’re ready for commercialization,” Hoskinson said.

He highlighted Hydra, Cardano’s layer-2 scaling solution, as well as privacy-focused initiatives such as Midnight and StarStream, positioning them as key components of the ecosystem’s next phase. These projects are aimed at improving throughput, enhancing data protection, and supporting applications beyond speculative trading.

Crypto as a global economic tool

The Cardano founder also broadened his remarks to include a critique of existing financial and political systems, arguing that global economic coordination is becoming increasingly difficult under traditional frameworks.

“The only way to run a world like this is through a cryptocurrency,” Hoskinson said, contending that blockchains provide rule-based systems that reduce reliance on centralized authorities in a more interconnected global economy.

He framed blockchain adoption as a response to structural shifts driven by artificial intelligence, demographic change, and declining trust in institutions.

Looking beyond the downturn

Hoskinson closed the livestream by urging the crypto community to maintain long-term focus despite ongoing volatility. He stressed that progress should not be judged solely by token prices or short-term sentiment.

“I’ll be with you on the red days and the green days,” he said. “I ain’t going anywhere.”

Crypto World

Ripple ETF Investors Unfazed by Market Crash as XRP Price Begins Recovery

XRP went through some intense volatility but was stopped at $1.54 during its recoveyr attempt.

Unlike investors who use the spot Bitcoin and Ethereum ETFs to gain exposure to the two market leaders, those opting for the XRP funds seemed unfazed by the latest crypto crash.

Data from SoSoValue shows that the past week ended well in the green for the Ripple ETFs, even though the underlying asset’s price went through some of its darkest periods.

XRP ETFs Keep Gaining

Recall that the previous business week ended in the red for the XRP funds because of a single trading day – January 29, when investors pulled out nearly $93 million, making it the worst performance in terms of net flows since the products’ inception. The data on Monday shows a minor outflow of just over $400,000, which was rather negligible given the fact that the entire market crumbled once again during that weekend.

However, XRP ETF investors began putting funds back into the financial vehicles, with $19.46 million on Tuesday, $4.83 million on Wednesday, and $15.16 million on Friday, according to SoSoValue. For some reason, the monitoring resource has not updated the data for Thursday, but other websites and reports still show a minor net inflow.

Additionally, the cumulative net inflows for the spot XRP ETFs have grown from $1.18 billion at the end of the previous business week to $1.22 billion as of February 6, showing a net gain of around $40 million.

The spot ETH ETFs bled out around $170 million, while the BTC counterparties are down by $358 million within the same timeframe.

XRP Price Goes Nuts

The past week or so has been nothing short of a wild rollercoaster ride for the entire crypto market, but Ripple’s cross-border token was at the forefront. Last Saturday, it crashed from $1.75 to $1.50, which was already bad enough given the fact that it traded at $2.40 on January 6.

You may also like:

However, the bears were not done yet as they initiated a few consecutive leg downs, culminating in a massive plunge to $1.11 (on Bitstamp) on Friday morning. This meant that XRP had dumped by over 50% in just a month.

However, then came the big bounce as some metrics suggested so. In a matter of mere hours, the asset skyrocketed by 40% to $1.54, where it was rejected again and now struggles to remain above $1.40. The data above clearly shows that ETF investors are not to blame for these wild swings, at least not in XRP’s case.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech13 hours ago

Tech13 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports5 hours ago

Sports5 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports23 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat19 hours ago

NewsBeat19 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat6 hours ago

NewsBeat6 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”