Crypto World

Bitwise Files S-1 With SEC to Launch Uniswap-Focused ETF, UNI Token Slumps 16%

Crypto asset manager Bitwise has become the first to file with the US regulator to launch an exchange-traded fund (ETF) dedicated to Uniswap.

The fund targets exposure to Uniswap (UNI), the governance token of the leading decentralized exchange protocol. The ETF filing marks one of the pivotal moments for DeFi.

“The Trust’s investment objective is to seek to provide exposure to the value of Uniswap held by the Trust, less the expenses of the Trust’s operations and other liabilities,” the Thursday filing with the US Securities and Exchange Commission (SEC) read.

Uniswap is a decentralized exchange (DEX) built on Ethereum that offers token swaps without an intermediary. The regulatory authorities are currently reviewing the Bitwise application.

Bitwise Forms Delaware Statutory Trust for Uniswap ETF

The asset manager initially registered a Delaware statutory trust for a potential Uniswap fund on January 27, as a routine legal step that usually precedes an SEC filing.

The move positioned Bitwise to pursue a decentralized finance protocol-tied ETF to later advance to a federal filing.

The registration follows after the SEC backed off its investigation into Uniswap Labs, the Brooklyn-based company, in February 2025. The SEC charged Uniswap for operating as an unregistered securities exchange and issuing an unregistered security.

If approved by the regulator, the Coinbase Custody Trust Company would act as the custodian for the Bitwise Uniswap ETF.

Wider Crypto Market Slump Pulls UNI Token Down by Over 16%

UNI, the native token of Uniswap, has plummeted 16.59% to $3.15 in the past 24 hours, underperforming a broader market sell-off.

The drop is part of a severe crypto-wide correction. The total market cap fell 9.84% in 24 hours, with the Fear & Greed Index hitting “Extreme Fear” at 5.

Besides, a key driver was a massive $1.03 billion in Bitcoin long liquidations, which forced leveraged positions to unwind across the board. UNI is trading at $3.15 at press time, per CoinMarketCap data.

The post Bitwise Files S-1 With SEC to Launch Uniswap-Focused ETF, UNI Token Slumps 16% appeared first on Cryptonews.

Crypto World

Bitcoin tops $72,000 as ETFs pull $155 million, extending two week inflow streak

Bitcoin remained bid Thursday amid signs of persistent demand for spot exchange-traded funds (ETFs).

The leading cryptocurrency traded near $72,500 on Thursday, according to CoinDesk market data. The U.S.-listed spot ETFs pulled in another $155 million in net inflows on Wednesday, extending a recent streak of institutional buying that has helped lift prices after weeks of sluggish activity.

The fresh inflows bring total allocations to roughly $1.47 billion over the past two weeks, according to data curated by SoSoValue, marking a sharp reversal after several weeks of withdrawals earlier this year.

Institutional demand through ETFs has begun to stabilize after a difficult start to the year. Investors have poured roughly $1.7 billion into U.S. spot bitcoin ETFs since Feb. 24, according to Bloomberg Intelligence data previously reported by CoinDesk, suggesting some investors are growing more comfortable that the market may have found at least a near term floor.

Earlier this week, analysts at Bitfinex cautioned that ETF inflows do not always translate into immediate buying pressure in the spot market. Authorized participants can create and short ETF shares before sourcing the underlying bitcoin, delaying the impact of those flows on price.

Still, the spot ETF inflows and bitcoin’s recent resilience during geopolitical tensions indicates growing macro relevance of the cryptocurrency, according to some market participants.

“Bitcoin is increasingly being repriced by the market as a geopolitical hedge rather than just a risk asset,” said Livio Weng, CEO of Bitfire. “Unlike gold, bitcoin trades 24/7 and can move across borders instantly, which makes it a natural escape valve for capital during periods of geopolitical stress.”

On-chain data calls for caution

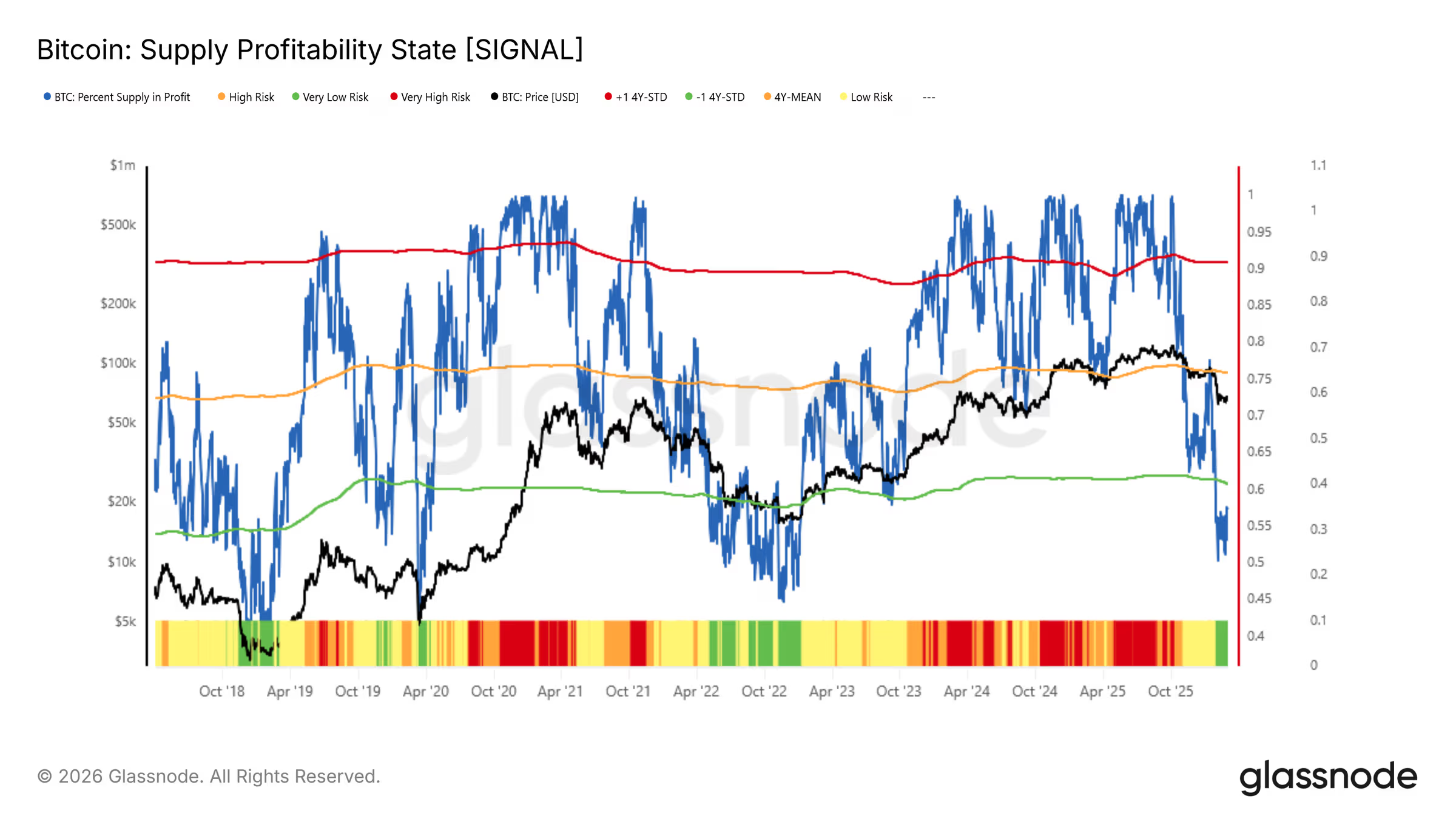

Despite the rebound in flows, underlying demand signals remain fragile, according to Glassnode. In a recent report, the firm said buy-side momentum has weakened significantly, with the 30-day moving average of realized profit falling about 63% since early February.

The share of bitcoin supply held in profit has also slipped to roughly 57%, a level historically associated with early stages of deeper bear market conditions. Glassnode added that the cost basis of short-term holders near $70,000 could act as a key behavioral ceiling, potentially turning rallies into distribution zones as traders exit positions near breakeven.

Crypto World

Banks raise alarm over Kraken’s historic Fed master account approval

The U.S. banking industry is pushing back against the Federal Reserve’s decision to grant crypto exchange Kraken direct access to its core payments infrastructure, warning the move could introduce new risks to the financial system.

Summary

- Kraken Financial became the first crypto firm to gain access to the Federal Reserve’s core payment systems through a limited-purpose master account.

- Trade groups including the Independent Community Bankers of America (ICBA) say the move could introduce risks and bypass regulatory safeguards.

- Critics warn the decision could set a precedent allowing other crypto firms to seek similar direct access to U.S. financial infrastructure.

Kraken’s Wyoming-chartered banking arm, Kraken Financial, recently secured a limited-purpose Federal Reserve “master account,” making it the first crypto-native firm to connect directly to the central bank’s payment rails.

The account allows the firm to process transactions through systems such as Fedwire without relying on intermediary banks, enabling faster fiat transfers tied to digital asset markets.

U.S. banking lobby warns of risks after Kraken gets Fed payment account

While the approval represents a milestone for the crypto industry, major banking groups have voiced strong concerns about the decision. The Independent Community Bankers of America (ICBA) said it has “deep concerns” about granting a master account to Kraken Financial, arguing that crypto-focused institutions operate under different regulatory frameworks than traditional banks.

Banking lobby groups also questioned the approval process. The Bank Policy Institute said the Kansas City Federal Reserve granted what appears to be a “limited purpose” or “skinny” master account before the Federal Reserve Board finalized the policy framework governing such access.

According to the group, the move lacked transparency and could undermine consistency across the Fed system.

Critics also point to Kraken Financial’s status as a Wyoming Special Purpose Depository Institution (SPDI), which is not federally insured like traditional banks. Banking advocates argue that allowing uninsured institutions to access the Fed’s settlement infrastructure could pose financial stability and compliance risks.

The debate highlights growing tensions between traditional financial institutions and the digital asset industry.

If upheld, Kraken’s approval could serve as a precedent for other crypto companies seeking similar integration with the U.S. banking system, potentially reshaping how digital assets interact with traditional financial infrastructure.

Crypto World

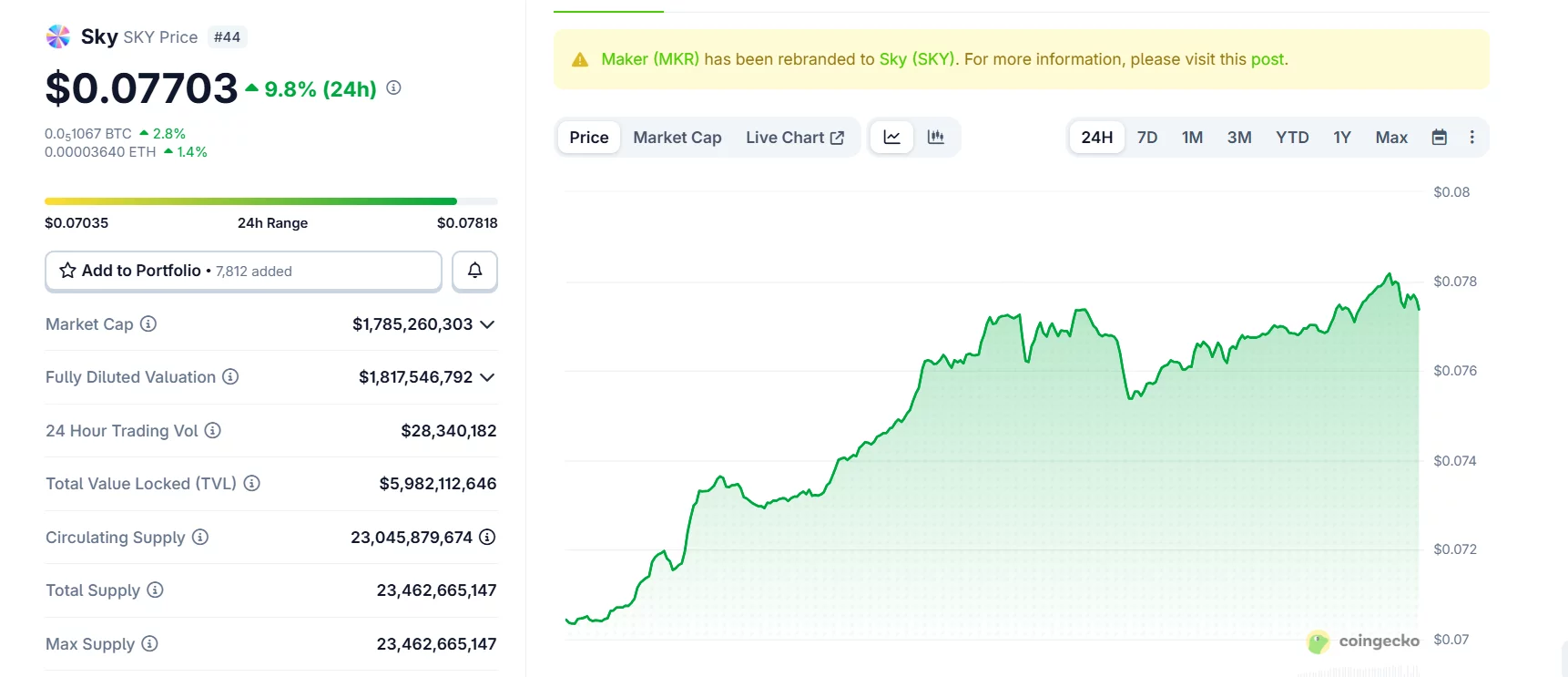

SKY token surges 10% amid aggressive buybacks and governance changes

The SKY token rallied roughly 10% over the past 24 hours as investors responded to the protocol’s ongoing token buyback program and governance updates designed to reshape its tokenomics.

Summary

- SKY gained roughly 10% in the past 24 hours, according to on-chain and market data.

- The protocol has repurchased over 1.8 billion SKY tokens through its ongoing treasury-backed buyback program.

- Recent proposals approved adjustments to staking rewards and treasury management, which could reduce token inflation.

SKY climbs double digits as protocol buybacks fuel rally

According to on-chain data, the token’s latest move comes amid renewed interest in the project’s supply reduction strategy. The Sky protocol has been actively repurchasing its native token through a treasury-backed buyback mechanism, which removes tokens from circulation and can reduce selling pressure.

Data from the protocol’s public buyback dashboard shows that more than 1.8 billion SKY tokens have already been repurchased through the program. The buybacks are funded using USDS from the project’s treasury and are executed directly on the market.

The strategy mirrors traditional corporate share buybacks, a model increasingly adopted by some decentralized finance protocols to return value to token holders and support price stability.

Momentum also appears to have been boosted by recent governance developments within the Sky ecosystem. A newly approved executive vote introduced several operational updates, including adjustments to staking rewards and treasury management functions.

One of the key changes involves the normalization of SKY staking rewards, a move that effectively slows the rate at which new tokens are issued to participants.

By reducing emissions, the protocol aims to limit inflationary pressure on the token while maintaining incentives for network participants.

The governance vote also included operational updates related to agent onboarding and settlement cycles within the protocol’s broader infrastructure.

Taken together, the buyback activity and emission adjustments have strengthened the narrative around SKY’s evolving tokenomics, which increasingly emphasize supply management and revenue-backed incentives.

The rally highlights growing market interest in DeFi projects experimenting with token value accrual models that resemble equity-style financial mechanisms.

If the buyback pace continues and governance changes further tighten supply, analysts say SKY could remain a closely watched token in the decentralized finance sector.

Crypto World

Bitwise Makes Latest Donation to Open-Source Bitcoin Devs

Crypto asset manager Bitwise has now donated a total of $383,000 to support developers who maintain and secure the Bitcoin network since 2024, with its latest $233,000 contribution announced on Wednesday.

Its second payout, funded by 10% of gross profits from its Bitwise Bitcoin ETF (BITB), adds to the $150,000 that it donated in February 2025 after BITB’s first full year.

“Bitwise is proud to donate $233,000 to support the unsung heroes maintaining and securing the Bitcoin network,” Bitwise said in a post to X on Wednesday.

Around the time of BITB’s launch in January 2024, Bitwise pledged to direct 10% of gross profits to Bitcoin developers, who play a key role in securing what has become a $1.4 trillion network.

“As $BITB continues to grow, so too does our contribution. Bitcoin is changing the world, and Bitwise will always strive to do our part to be a good steward of this incredible ecosystem.”

Bitwise said three Bitcoin-friendly non-profit organizations will allocate the funds: Bitcoin Brink, OpenSats and the Human Rights Foundation, through its Bitcoin Development Fund.

The $233,000 donation suggests Bitwise generated $2.33 million in gross profits from BITB in its second year.

Bitwise earns money from BITB by charging a 0.2% fee on BITB assets under management.

BITB is still third in total Bitcoin ETF flows

BITB has seen $2.2 billion worth of inflows since January 2024, trailing only BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), Farside Investors data shows.

However, IBIT and FBTC are far ahead, having amassed $62.4 billion and $11 billion worth of inflows, respectively.

Related: TradFi to adopt 24/7 crypto rails sooner than expected: Bitwise

Many Bitcoin ETFs have seen net inflows fall at the start of 2026 amid a broader crypto market pullback.

BITB has managed to weather that storm, however, increasing marginally from $2.17 billion to $2.21 billion across the first nine weeks of the year.

Magazine: A ‘tsunami’ of wealth is headed for crypto: Nansen’s Alex Svanevik

Crypto World

Bitcoin Outflows Hit 28,700 BTC: Is the Bitfinex Transfer Distorting the Market Signal?

TLDR:

- Bitcoin recorded its largest single-day outflow since November 2025, totaling 28,700 BTC across exchanges.

- Bitfinex alone accounted for 24,627 BTC of the total outflow, dropping reserves from 431,767 to 407,140 BTC.

- A single transaction moved 23,588 BTC to a newly created wallet, pointing to a possible internal treasury operation.

- Analysts urge caution as the outflow data may not reflect true accumulation without an official statement from Bitfinex.

Bitcoin outflows across major exchanges surged recently, reaching 28,700 BTC in a single day—the highest recorded since November 2025.

The bulk of this movement came from Bitfinex, where reserves dropped sharply within a short window. While such outflows are traditionally seen as a sign of accumulation, this event carries a distinct characteristic.

Market analysts are currently calling for caution before treating this data as a clear directional signal.

Bitcoin Outflows Reach Highest Point Since November 2025

The 28,700 BTC net outflow recorded across exchanges is not a routine figure. It marks the largest single-day outflow seen in several months.

Data shared by analyst Darkfost on X pointed to this unusual spike. The numbers quickly caught the attention of traders watching on-chain metrics.

According to Darkfost’s post, large Bitcoin outflows from exchanges often suggest accumulation behavior. Investors withdrawing BTC from platforms typically plan to hold rather than sell.

This reduces the available supply on trading venues over time. Historically, such patterns have been associated with periods of price strength.

The trend of moving Bitcoin off exchanges has appeared at various points in past market cycles. Reduced exchange reserves have often preceded upward price movement in those periods.

On-chain analysts widely reference this relationship. The pattern carries a reputation as a positive market signal.

However, this event does not fit neatly into that historical framework. The outflow was not distributed across many exchanges, as would be expected.

Instead, it was concentrated almost entirely on one platform. That concentration shifts the analysis considerably.

Single Bitfinex Transaction Raises Questions About Market Interpretation

Bitfinex saw its reserves fall from 431,767 BTC to 407,140 BTC within a very short period. That represents an outflow of roughly 24,627 BTC from the exchange alone.

This single platform accounted for the majority of the total outflow. The scale and speed of the movement stood out to on-chain analysts.

Within that movement, 23,588 BTC were transferred in a single transaction to a newly created wallet address. A single-block transfer of that size to a fresh address is uncommon in regular user activity.

Such transactions more closely resemble internal treasury operations or wallet restructuring. Exchanges carry out these moves for security or operational management purposes.

As of the time of writing, Bitfinex had issued no public statement about the transaction. Without official confirmation, analysts are working from observable on-chain data alone.

The characteristics of the transaction point more toward a platform-led operation. A newly created destination address and single-block execution are consistent with exchange-managed transfers.

Because of this, Bitcoin outflow data from this event may not reflect genuine accumulation activity. The actual market effect could be far smaller than the raw numbers suggest.

Analysts recommend waiting for further clarity before drawing any conclusions. Additional confirmation is needed before investors adjust their positions based on this data.

Crypto World

XRP Must Clear This Key Level to Invalidate Bearish Structure

Analyst EGRAG says only a weekly close above a certain level would flip XRP’s long-running descending channel bullish.

XRP is attempting to push above the 200 EMA and the $1.55 level, a move that market analyst EGRAG CRYPTO says would signal short-term strength if confirmed with a weekly close.

Despite the attempted rally, the token remains trapped inside a descending channel that has defined its price action for months, leaving the broader trend corrective until a breakout above $2.20 flips the structure bullish.

XRP Tests 200 EMA

In a post published on X on March 4, EGRAG CRYPTO said XRP is “pushing above 200 EMA” but warned that the price is still trading inside a descending channel on the weekly timeframe.

According to their breakdown, a weekly close above $1.55 would weaken the current downward trajectory, while a close above $2.20 would invalidate the bearish structure and open the path toward $2.70 to $3.60.

If XRP fails to reclaim $1.55, the analyst outlined a move toward $1.26, with a possible sweep of macro support between $0.95 and $0.85. In a separate post, they assigned a 55% to 65% probability to a deeper sweep and a 35% to 45% chance of an early breakout reclaim.

“Structure > Emotion,” they wrote, arguing that the descending channel still defines the trend. The technical standoff comes at a time when derivatives and spot activity are contracting. Analyst Amr Taha previously noted that XRP futures open interest had dropped 70% since October 2025, falling to $203 million.

Binance open interest slipped below $270 million, levels last seen in April 2025 before a major rally. Historically, such resets have coincided with local bottoms as leverage is cleared out, though they do not guarantee a rebound.

You may also like:

Price Action Reflects Fragile Recovery

At the time of writing, data from CoinGecko showed that XRP had gained about 4% in the last 24 hours and roughly 3% over the past week, bouncing from a recent low near $1.27.

Even so, the token remains down more than 12% over 30 days and about 40% across the past year. Furthermore, it is still more than 61% below its July 2025 all-time high of $3.65.

The recent rebound has occurred within a 24-hour range between $1.34 and $1.42, with market capitalization holding near $86 billion.

For now, the weekly close relative to $1.55 is the immediate focus. A decisive break above $2.20 would alter the chart structure described by EGRAG, while rejection below the 200 EMA will keep the descending channel intact and leave lower supports in play.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

SKY jumps nearly 10% after governance vote slows new token creation while buybacks tighten supply

SKY, the native token of DeFi platform Sky (formerly Maker), climbed nearly 10% after the protocol executed a governance proposal that slowed how quickly new tokens are created through staking rewards, expanded its lending system around the USDS stablecoin, and kept up a large buyback program that is pulling tokens out of the market.

The governance proposal, which passed Feb. 27 and was executed March 2, introduced several changes across the Sky Protocol, including adjustments to staking rewards and the onboarding of new credit infrastructure designed to expand the reach of its USDS stablecoin ecosystem.

One of the most closely watched changes involved staking rewards – the rate at which new coins are issued as a return for locking up existing holdings in the protocol.

Slower supply growth

The proposal “normalized” the so-called SKY staking emissions by setting the distribution at roughly 838.18 million tokens over the next 180 days, representing a reduction of about 161.82 million tokens compared with the previous schedule. Lower emissions can reduce dilution pressure, a factor traders often watch closely when evaluating governance tokens.

At the same time, the protocol has been steadily repurchasing its own token through an automated buyback program funded with USDS. According to Sky’s dashboard, the system has spent roughly $114.5 Million buying back about 1.83 billion SKY tokens so far.

The purchases occur in small transactions throughout the day, typically around $10,000 per trade, creating a steady bid in the market. In total, the program is currently removing roughly 3.6 million SKY tokens from circulation each day.

Combined with the emissions adjustment, the buybacks have tightened the token’s effective supply. Data from the protocol indicates that roughly 67% of SKY is currently staked, leaving a smaller portion actively trading in the market.

The governance proposal also approved new infrastructure to expand credit markets around the protocol. Two new “Launch Agents” were onboarded to help deploy credit and manage liquidity infrastructure connected to the USDS stablecoin system.

Industry trend

Across the crypto market, a growing number of protocols are shifting toward token models built around buybacks and lower emissions, replacing the inflation-heavy incentive systems that dominated early DeFi.

In the past, many protocols distributed large amounts of newly minted tokens to attract liquidity providers, traders, and governance participants. While those incentives helped bootstrap networks, they also created persistent selling pressure as recipients often sold rewards into the market.

More recently, protocols have begun moving in the opposite direction. Rather than issuing more tokens, some are using protocol revenue to repurchase tokens on the open market or reduce emissions altogether.

Hyperliquid offers a recent example. The decentralized exchange allocates a portion of trading fees to buy and burn its HYPE token. When trading activity surged last week, the protocol generated more than $13 Million in weekly fees, allowing roughly $9 Million worth of tokens to be burned over seven days.

Other projects are pursuing similar approaches. Solana-based Jupiter voted in February to eliminate net new emissions for its JUP token in 2026, preventing additional supply from entering circulation. Meanwhile, derivatives protocol dYdX approved a plan allocating 75% of protocol revenue toward token buybacks.

The shift reflects a broader effort to tie token demand more directly to protocol activity while limiting dilution for existing holders.

Crypto World

A16z Crypto Raises $2 Billion Fund Amid Market Downturn

Crypto venture capital giant Andreessen Horowitz is doubling down on crypto despite a major market downturn, seeking $2 billion for a new crypto fund.

A16z Crypto, the blockchain arm of venture capital firm Andreessen Horowitz, is raising a fifth fund focused on crypto with plans to close by mid-2026, according to Fortune, citing anonymous sources on Wednesday.

The latest round is significantly smaller than its previous $4.5 billion fund from 2022, but the company has shifted to a shorter fundraising cycle to remain flexible to ever-changing crypto narratives.

The move comes amid a crypto bear market that has seen more than $2 trillion wiped from total market capitalization since its peak of around $4.4 trillion in early October.

A16z crypto chief Chris Dixon’s Web3 philosophy envisioned a decentralized internet with applications built on blockchains, according to his 2024 book, “Read Write Own.”

But many of those investments have not panned out, notably decentralized X (Twitter) competitor Farcaster, which returned $180 million to investors after selling off its infrastructure in January.

Crypto VCs exploring non-crypto tech

Wall Street crypto buffs have narrowed their focus lately toward stablecoins, real-world asset tokenization, and financial products, with many venture capitalists following that shift. Others have started to look towards other areas of technology.

Co-founder of venture firm Multicoin Capital, Kyle Samani, stepped down in February to “explore new areas of technology,” such as AI, longevity, and robotics.

Meanwhile, crypto venture firm Paradigm is expanding into artificial intelligence and robotics with its latest fund seeking to raise $1.5 billion, as reported in late February.

Related: Crypto slides, but tokenized RWAs and VC push ahead

A16z raised over $15 billion in January to invest in companies and technologies it deemed critical to secure America’s future, mentioning AI and crypto and including technologies in “key areas that generate human flourishing,” such as biology, health, defense, public safety, education, and entertainment.

A16z sees opportunity in AI, crypto in 2026

A16z recently highlighted crypto and AI as major themes for 2026, stating that it expected AI to automate cybersecurity work, AI models to become app stores, privacy to become the “most important moat in crypto,” prediction markets to get “bigger, broader, and smarter,” and stablecoins to become more intertwined with traditional banking and finance.

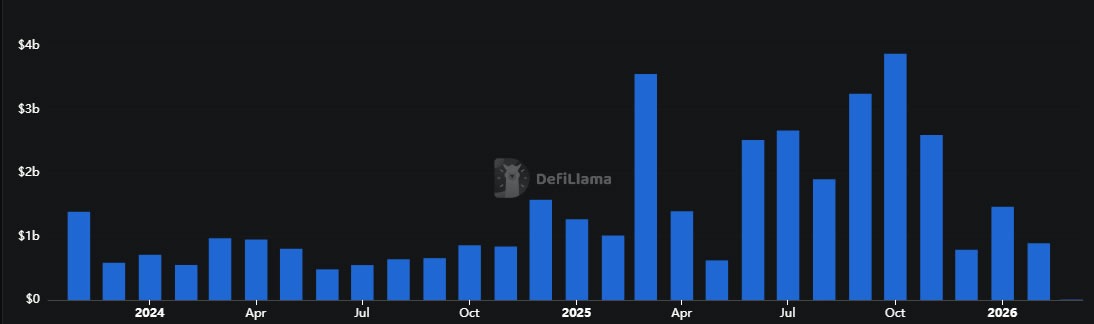

According to DeFiLlama’s fundraising aggregator, crypto startups raised $895 million in February, down almost 40% from the $1.47 billion raised the previous month and marginally less than the $1 billion raised in February 2025.

Magazine: 6 massive challenges Bitcoin faces on the road to quantum security

Crypto World

Three Reasons to Mine Crypto with ViaBTC Mining Pool in 2026

As the crypto mining industry grows rapidly in 2026, more miners are seeking to join pools that aim to improve efficiency and potential profitability. Given the number of mining pools in this industry, it can be difficult to choose the right one for your needs and strategy.

Among the many mining pools available, ViaBTC stands out as a global leader, providing miners with the tools, features, and services they need to run their operations more smoothly. Over the years, ViaBTC has become a top choice for both experienced and novice miners. It leads the industry through its strong technical support and excellent user experience. This article will outline three major reasons why you should consider mining your cryptocurrencies with ViaBTC in 2026.

1. ViaBTC’s Pool Makes Mining Profitable and Predictable

ViaBTC is a top mining pool that provides regular payouts and powerful tools to manage, track, and optimize miners’ operations. It supports PoW coins like BTC, LTC, ZEC, DOGE, and others.

As a platform that prioritizes user experience, ViaBTC’s pool function offers a full set of tools to meet miners’ needs. Its main functions can be grouped into mining, revenue management, automation, and asset control.

Here are the core functions of the ViaBTC mining pool:

Auto Conversion: As the name implies, Auto Conversion allows miners to automatically convert supported coins they mine, like BCH, LTC, etc, into another selected digital asset like BTC or USDT on an hourly basis.

This function helps miners to:

- Reduce exposure to price volatility

- Lock in profits more efficiently

- Simplify asset management, the need for exchanges

Revenue Sharing: This feature enables miners to automatically and proportionally distribute mining earnings across multiple ViaBTC accounts.

This function helps miners to:

- Manage payments efficiently for mining farms or group operations

- Split rewards fairly between miners

- Ensure transparency and timely revenue distribution

Auto Withdrawal: The Auto Withdrawal pool function automatically sends mining rewards to a designated wallet once a preset balance threshold is reached.

This function helps miners to:

- Get faster access to funds

- Improve cash-flow management

- Lower risk of keeping large balances idle

2. ViaBTC’s Mining Pool Helps Generate More Revenue

Mining profitability isn’t just about running powerful rigs; it’s also about knowing how to manage and distribute your rewards to generate more revenue or maximize income. ViaBTC provides a suite of built-in tools and payment systems that help miners get the most out of every unit of hashrate.

Flexible Payout Methods

ViaBTC supports several payout models, allowing miners to choose the one that fits their strategy.

- Pay Per Share (PPS): Provides consistent, predictable payouts even if blocks are not found immediately.

- Pay Per Share Plus (PPS+): This follows the normal PPS payout method but includes transaction fees from blocks as rewards.

- Pay Per Last N Shares (PPLNS): Rewards miners based on long-term contribution, which can yield higher payouts over time.

- Full Pay Per Share (FPPS): This pays miners per share and includes a portion of transaction fees to provide more stable earnings.

- SOLO Mining: Miners attempt blocks independently while using ViaBTC’s infrastructure.

Automated Revenue Tools

The aforementioned tools, such as Auto Withdrawal, Revenue Sharing, and Auto Conversion, help miners maximize revenue while reducing operational overhead.

Monitoring and Optimization

ViaBTC’s dashboard provides detailed insights into mining performance and profitability.

This function helps miners generate revenue by:

- Providing real-time hashrate tracking to identify underperforming machines

- Alerts for connectivity issues or drops in performance

- Profitability comparison across multiple coins.

Mining Calculator

The ViaBTC mining calculator is a powerful tool that estimates potential profits before committing resources to mining a coin. It ensures miners allocate efficiently, avoid low-profit mining, and help maximize return on investment.

3. ViaBTC’s Latest Functions Let Miners Operate More Efficiently than Ever

Mining success in 2026 now depends significantly on automation and intelligent management. ViaBTC

provides a list of new functions that help miners increase efficiency, reduce costs, and optimize operations.

Smart Mining:

ViaBTC introduced Smart Mining to automatically redeploy miners’ hashrates to higher-return mining assets based on real-time mining revenue. This reduced the need for constant manual switching.

Integrated Wallet and Asset Management:

ViaBTC’s wallet accounts allow miners to:

- Store mined assets securely

- Convert between cryptocurrencies

- Manage funds without third parties

- Trade and distribute earnings inside an ecosystem

Advanced Monitoring and Control:

ViaBTC supports:

- Performance alerts and notifications

- Multiple accounts and worker management

- Revenue sharing for partnerships.

Conclusion:

The question in 2026 is no longer whether to join a mining pool, but which pool offers the best tools and services for long-term success. ViaBTC stands out from the rest of the mining pools in the space by making mining predictable, expanding revenue opportunities with flexible payouts, and simplifying operations through its latest mining features.

Disclaimer: The opinions and views expressed in this article are for informational and educational purposes. It does not constitute any form of investment or financial advice.

Crypto World

a16z Crypto Targets $2 Billion Fund Amid Blockchain VC Shakeout

a16z crypto, the crypto-focused venture capital arm of Andreessen Horowitz, is reportedly seeking about $2 billion for its fifth crypto fund.

The raise arrives as the broader crypto market endures a downturn, with venture capital firms also facing mounting pressure.

a16z Crypto Dials Down Fund Size with Blockchain-Focused Round for 2026

According to Fortune, the firm aims to close the round by the end of the first half of 2026. This fifth fund will exclusively focus on blockchain investments.

The latest fund is significantly smaller than a16z crypto’s fourth $4.5 billion fund. BeInCrypto reported in 2022 that the fund was split into $1.5 billion for seed and $3 billion for venture investments.

However, this time, a16z crypto is opting for a shorter fundraising cycle to better capitalize on the fast-changing trends within the crypto space.

Follow us on X to get the latest news as it happens

In 2018, a16z crypto launched its first $300 million fund and has since become an active player in the market. Data from CryptoRank showed that in Q4 2025, it backed Kalshi and invested $50 million in the Solana staking protocol Jito. This year the firm invested in Babylon, Kairos, and Talos.

As a Tier 1 investor with a 22.08x retail ROI, a16z holds 187 investments averaging $10-20 million per round, building one of the most extensive portfolios in crypto venture capital.

The firm’s investment focus includes artificial intelligence (27.78%), prediction markets (16.67%), and API and developer tools (11.11% each), among other categories.

a16z is not the only firm raising capital. Just last month, Dragonfly Capital closed a $650 million fund. This showed an ongoing institutional appetite for crypto venture investing.

Crypto Venture Capital Funds Encounter ‘Identity Crisis’ Amid Market Struggles

The broader cryptocurrency market has faced challenges, continuing the decline that began in October. Bitcoin (BTC) is down by 16.7% year-to-date, despite a recent bounce-back. Other major large-cap assets have also experienced struggles.

This downturn has extended its effects to digital asset treasuries, crypto equities, and even venture capital funds. Bloomberg reported in early February that crypto-focused venture capital funds are grappling with what is described as “an identity crisis.”

According to the report, crypto-native funds were shifting their focus toward higher-performing sectors, such as stablecoin infrastructure and on-chain prediction markets. Some were also branching into adjacent industries like fintech and artificial intelligence (AI).

“Web3 as a category is largely uninvestable for now. People have moved on from NFTs, gaming, and the next incremental DeFi platform built for its own sake. Even crypto-native VCs with dry powder are pivoting hard toward fintech and stablecoin plays, and prediction markets. Everything else is struggling to get attention,” Santiago Roel Santos, founder and chief executive officer of crypto private equity firm Inversion, said.

Yet, a16z’s ongoing commitment suggests the firm believes there are opportunities for long-term value creation in the current environment.

Whether the latest efforts mark a floor for crypto venture or simply a consolidation among the sector’s most durable players, the answer will depend in large part on whether the current market downturn produces the kind of breakout companies that justify the capital committed during it.

Subscribe to our YouTube channel to watch leaders and journalists provide expert insights

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video7 days ago

Video7 days agoXii English top Selected mcq “Money Madness” Board Exam 2026, #chseodisha #hksir #mychseclass

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

UPDATE: Bitwise registers for a

UPDATE: Bitwise registers for a