Crypto World

BNP Paribas Brings Money Market Fund to Ethereum

BNP Paribas has launched a tokenized share class of a French-domiciled money market fund on the public Ethereum blockchain. The firm is the largest bank in Europe, with over $3 trillion in assets.

This marks another significant step in traditional finance’s gradual migration to distributed ledger technology.

Ethereum RWA Market Tops $15 Billion as BNP Paribas Joins Tokenization Push

The pilot project, executed through the bank’s AssetFoundry platform, allows BNP Paribas to test the integration of public blockchains into heavily regulated fund structures.

However, the bank is maintaining strict control over the digital assets.

The tokenized shares utilize a permissioned access model, meaning holdings and transfers are cryptographically restricted to a whitelist of authorized participants who meet stringent compliance standards.

“The initiative was conducted as a one‑off, limited intra‑group experiment, enabling BNP Paribas to test new end‑to‑end processes, from issuance and transfer agency to tokenisation and public blockchain connectivity, within a controlled and regulated framework,” the bank explained.

This walled-garden approach reflects a growing consensus among institutional asset managers. They clearly want to utilize the underlying settlement infrastructure of public networks like Ethereum.

However, these firms still demand the strict access controls inherent to traditional financial systems.

Notably, the initiative follows a previous BNP Paribas pilot that utilized a private blockchain in Luxembourg. This pivot signals a cautious institutional shift toward public networks to capture broader future interoperability.

Money market funds have emerged as the primary testing ground for Wall Street’s blockchain ambitions. For institutional investors, tokenizing these funds offers a regulated, yield-bearing alternative to fiat-backed stablecoins.

Furthermore, traditional fund processing relies on slow, batch-based settlement systems that can trap capital. Tokenization introduces the possibility of atomic, nearly instantaneous settlement, vastly improving capital efficiency.

“This second issuance of tokenized money market funds, this time using public blockchain infrastructure, supports our ongoing efforts to explore how tokenization can contribute to greater operational efficiency and security within a regulated framework,” Edouard Legrand, chief digital and data officer at BNP Paribas Asset Management, said in a statement.

Meanwhile, BNP Paribas joins a crowded field of incumbent heavyweights, including BlackRock, JPMorgan Chase & Co., and Fidelity Investments, all of which have deployed tokenized money market funds on Ethereum.

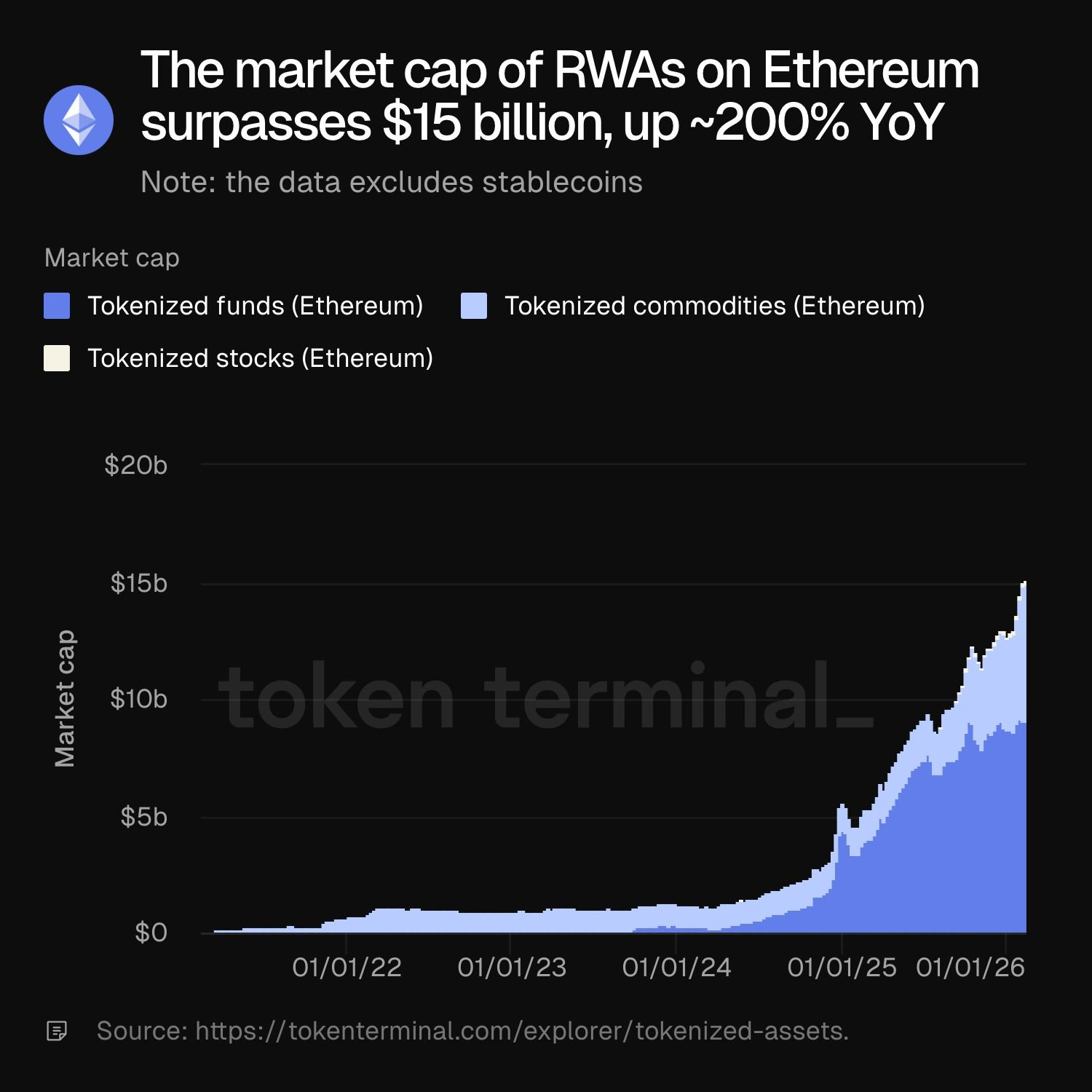

According to Token Terminal data, Ethereum currently dominates the tokenized asset market, leading in stablecoins, commodities, and tokenized funds.

The total market capitalization of real-world assets on the Ethereum ecosystem, excluding stablecoins, recently surpassed $15 billion, up roughly 200% year over year.

Crypto World

US President Trump Raises Global Tariff Rate to 15%, Crypto Doesn’t Budge

US President Donald Trump is now using alternative legal routes to levy tariffs, but critics say his authority to impose them is still limited.

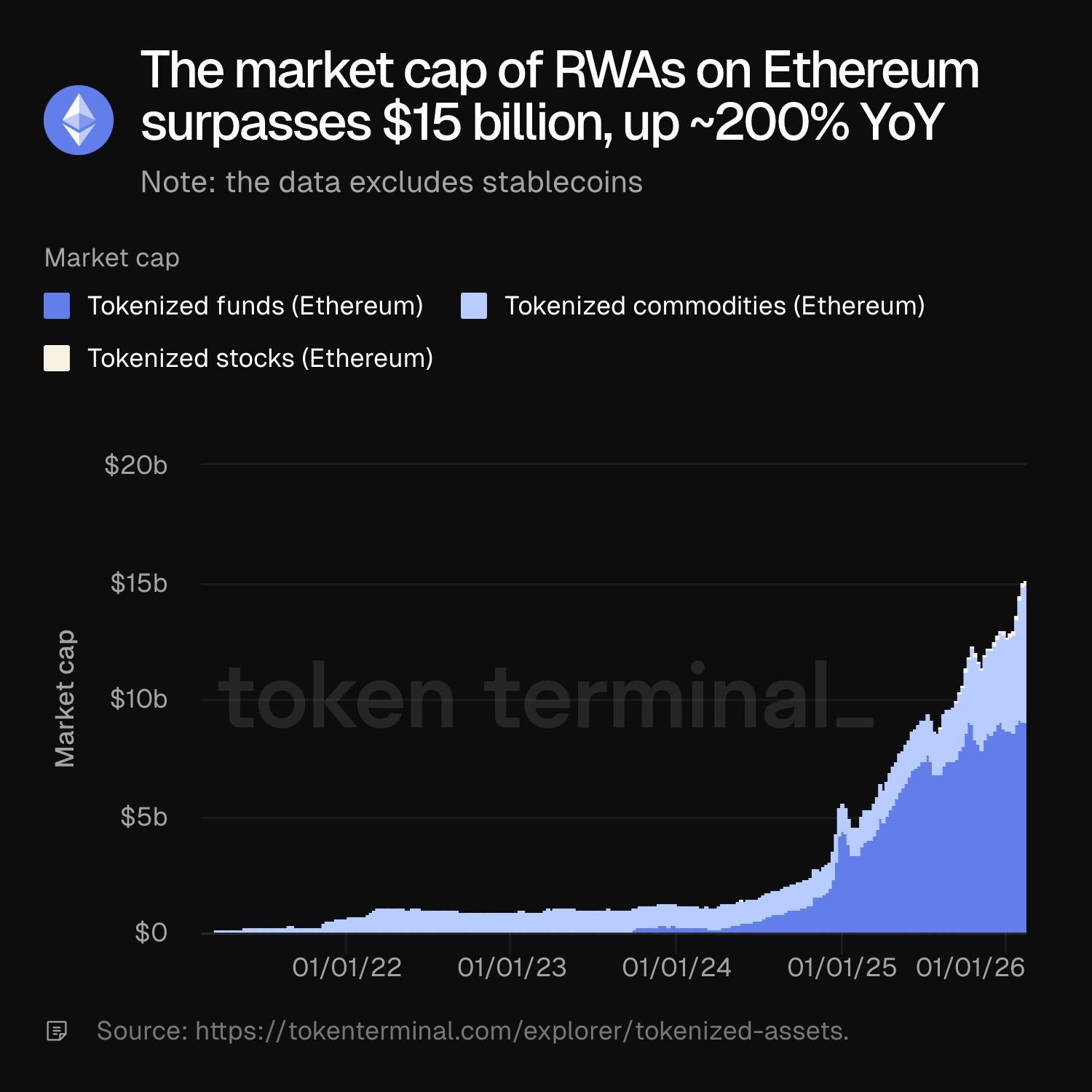

United States President Donald Trump announced on Saturday that he is raising the 10% global tariff rate announced on Friday to 15%, which will take effect immediately.

Trump reiterated his criticism of the Supreme Court’s decision to strike down his authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA). In a Saturday Truth Social post, he said:

“As President of the United States of America, I will be, effective immediately, raising the 10% worldwide tariff on countries, many of which have been ‘ripping’ the US off for decades, without retribution, until I came along, to the fully allowed, and legally tested, 15% level.”

On Friday, Trump announced a 10% global tariff rate to be added on top of already existing tariffs that remained valid after the court ruling, under alternative legal statutes outlined in the Trade Expansion Act of 1962 and the Trade Act of 1974.

However, pro-crypto attorney Adam Cochran said the scope of these laws also limits Trump’s authority to levy broad tariffs indefinitely.

“The law he is using only allows this to be on countries we have a deficit with, for a set period of 150 days, and at a capped percentage,” he said.

Each new tariff announcement from Trump caused turmoil in the crypto and stock markets, with severe downturns that negatively impacted asset prices and fueled macroeconomic uncertainty among investors.

Related: US lawmakers critical of Trump tariffs, say it will derail the economy

Crypto markets held firm in the wake of the latest tariff announcements

The crypto market, which usually experiences heavy sell-offs in response to tariff announcements, held firm in the wake of the latest tariff headlines.

The price of Bitcoin (BTC) held steady at the $68,000 level, and Ether (ETH) also remained firm, showing little to no change since Friday when the new tariffs were announced.

The Total3 indicator, which tracks the entire market capitalization of the crypto sector, excluding BTC and ETH, fell by less than 1% on Saturday and remains at about $713 billion at the time of this writing.

Magazine: ‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

Crypto World

Who Is Behind Bitcoin’s Selling Pressure? On-Chain Data Exposes the Groups Leading Capitulation

TLDR:

- Bitcoin’s capitulation hits critical levels with $643M in realized losses and 46.08% of supply underwater.

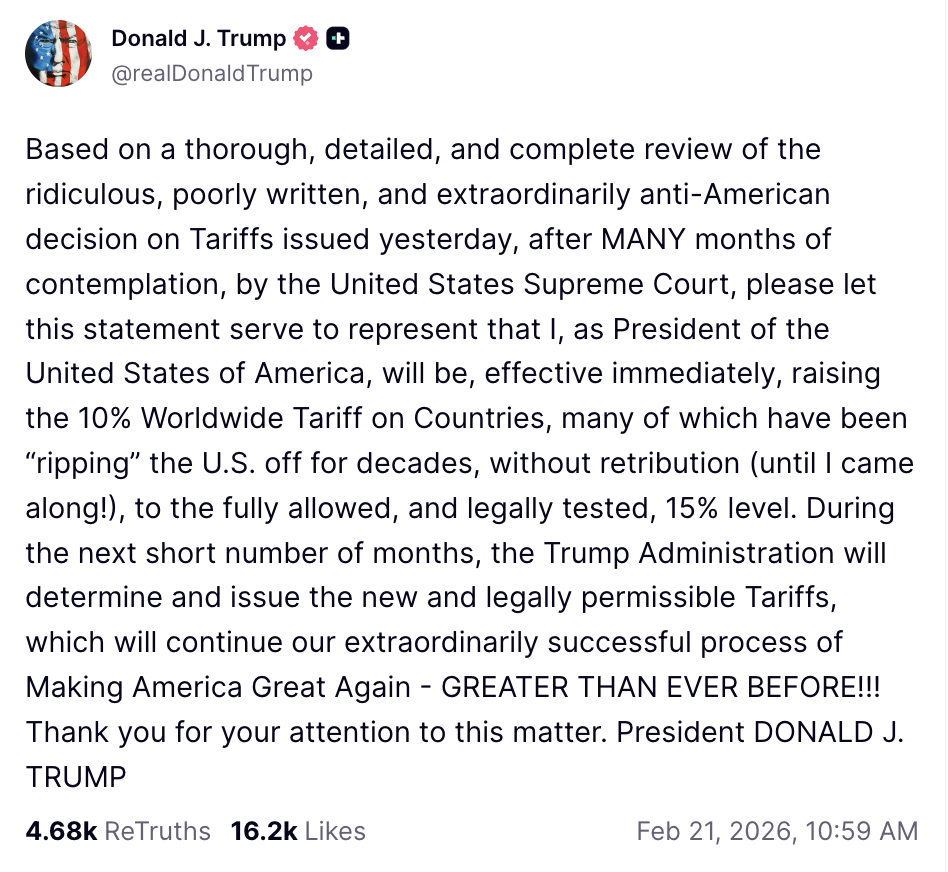

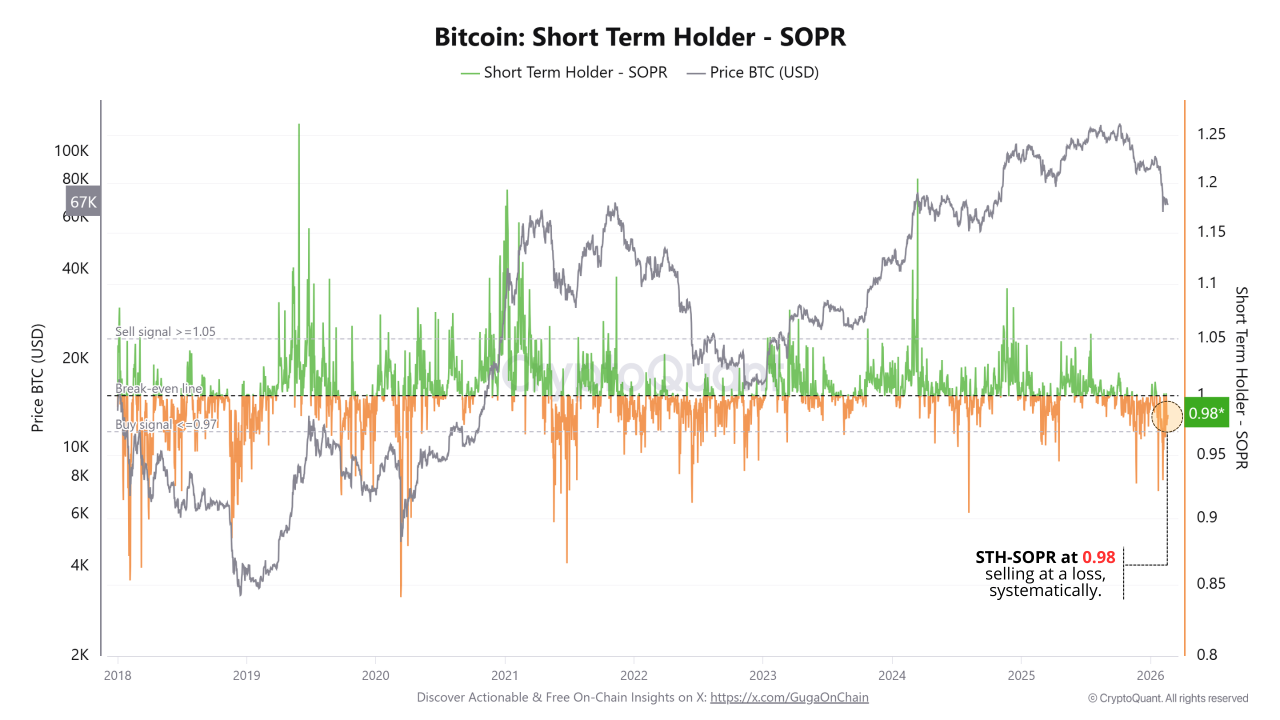

- Short-term holders with SOPR at 0.98 and MVRV at 0.73 are systematically selling BTC below entry price.

- Medium whales offloaded 91,580 BTC in 30 days while the Whale Ratio climbed to a telling 74% reading.

- Bitcoin ETFs recorded $404M in outflows Feb 17–19 as miners and retail quietly accumulated the sold supply.

Who is behind the selling pressure currently gripping the Bitcoin market? On-chain data now points to three specific groups driving the capitulation.

A total of $643 million in realized losses has been recorded, with 46.08% of the Bitcoin supply sitting underwater. The evidence is clear, this is not a broad market selloff.

Identifiable cohorts are responsible, and their behavior is trackable through on-chain metrics.

Short-Term Holders Are the Primary Source of Panic Selling

Short-term holders (STHs) sit at the center of the current capitulation. These are buyers who entered the market within the last six months, largely near cycle highs.

The STH-SOPR reading of 0.98 confirms they are selling consistently below their purchase price. Every transaction below 1.0 on this metric represents a realized loss being locked in by this group.

The STH-MVRV ratio adds further weight to this picture, currently reading at 0.73. That number reflects a cohort that is deeply underwater and actively exiting positions.

Rather than holding through the drawdown, these participants are choosing to sell at a loss. Their collective behavior is one of the clearest signs of active capitulation in the current cycle.

GugaOnChain’s on-chain analysis confirms that STH behavior is systematic, not isolated. The losses are being realized repeatedly across multiple sessions, not in a single spike.

This pattern suggests that fear, not strategy, is driving their exit decisions. It is the textbook behavior of speculative participants caught on the wrong side of the market.

Beyond the metrics, the timing of their entries matters here. Buyers from the last six months purchased Bitcoin when sentiment was elevated and prices were near local highs.

They are now facing significant paper losses that many are unwilling to hold through. That psychological pressure is directly translating into consistent sell-side volume on exchanges.

Medium Whales and ETF Institutions Are Amplifying the Pressure

Medium whales holding between 1,000 and 10,000 BTC have offloaded 91,580 BTC over the past 30 days. This is the most aggressive distribution coming from any single cohort in the current period.

Whales holding above 10,000 BTC have also reduced exposure by 22,280 BTC during the same window. Together, these two groups represent a coordinated and large-scale exit from the market.

The Whale Ratio currently sits at 74%, reinforcing that large players are routing significant volume toward exchanges.

This metric measures large transactions as a share of total exchange inflows. A reading this elevated has historically preceded continued downward price movement. It confirms that whale distribution is active and ongoing, not yet exhausted.

Institutional Bitcoin ETFs recorded $404 million in net outflows between February 17 and 19, 2026. These outflows directly translate into spot market selling pressure from regulated vehicles.

Institutions reducing exposure during periods of stress add a layer of selling that retail markets struggle to absorb. Their exit compounds the pressure already created by STHs and medium whales.

While these three groups lead the capitulation, a separate set of participants is moving in the opposite direction. Miners, small whales, and retail buyers are steadily accumulating the supply being offloaded.

This dynamic; where distressed sellers transfer coins to patient accumulators: is a recurring feature of Bitcoin’s correction phases. The identity of the sellers is now clear, and so is the identity of those stepping in to buy.

Crypto World

IoTeX Hit by Private Key Exploit, Attacker Drains Over $2 Million

A private key exploit gave an attacker control of IoTeX’s TokenSafe and MinterPool contracts on February 21. Eventually, the hackers drained an estimated $2 million in crypto assets, sending IOTX down by over 9%.

Why it matters:

- IOTX holders face direct losses as the token fell roughly 9.2% to $0.0049, according to CoinGecko data.

- The attacker used THORChain to bridge stolen ETH to Bitcoin, complicating efforts by exchanges and security partners to freeze the funds.

- IoTeX confirmed the situation is “under control,” and the exploit impact is around $2 million USD. But some on-chain analysts suggest total losses could reach $8 million.

The details:

- The attack unfolded between 7 and 9 AM UTC on February 21, giving the hacker full access to IoTeX’s TokenSafe and MinterPool contracts via a compromised private key.

- On-chain analyst Specter flagged the breach first, reporting $4.3 million drained in USDC, USDT, IoTeX (IOTX), WBTC, PAYG, and BUSD.

- The hackers swapped the Stolen funds to ETH and bridged approximately 45 ETH to Bitcoin via THORChain.

- The hacker also drained 9.3 million CCS tokens worth roughly $4.5 million, pushing total estimated losses toward $8.8 million, as per Specter.

- IoTeX co-founder Raullen Chai stated on X that exchanges are cooperating to freeze related addresses. The IoTeX chain is expected to resume in 24–48 hours.

The post IoTeX Hit by Private Key Exploit, Attacker Drains Over $2 Million appeared first on BeInCrypto.

Crypto World

IoTeX confirms $2M hack, rejects $4.3M theft claims

IoTeX reported containing a hack with losses around $2 million, disputing on-chain analyst estimates placing the theft at $4.3 million.

Summary

- IoTeX confirms $2M exploit and pauses chain for security upgrades.

- Analysts estimate $4.3M after token minting and cross-chain laundering.

- Exchanges and law enforcement work to freeze stolen funds.

The blockchain platform stated it coordinated with exchanges and law enforcement to freeze stolen funds following what it called a “long-planned attack by professional actors targeting multiple chains.”

On-chain analyst Specter posted that IoTeX’s private key may have been compromised, resulting in multiple contract assets being drained including USDC, USDT, IOTX, PAYG, WBTC, and BUSD.

The attacker swapped stolen assets for ETH and bridged 45 ETH to Bitcoin, while also minting 111 million CIOTEX tokens.

IoTeX said chain operations and deposits will resume in 24-48 hours after security upgrades are finalized.

IoTeX disputes $4.3M loss estimate with $2M confirmation

IoTeX’s initial statement acknowledged “suspicious activity involving an IoTeX token safe” and noted that “potential loss is lower than circulating rumors suggest.”

The team said it coordinated with major exchanges and security partners actively assisting in tracing and freezing the attacker’s assets.

The updated statement confirmed “the exploit impact is around $2M USD (including USDC, USDT, IOTX, and WBTC).”

Specter’s analysis showed the attacker drained multiple contract assets and executed a multi-step laundering process.

Stolen funds were swapped for ETH, with at least 45 ETH bridged to Bitcoin where tracing becomes more difficult. The minting of 111 million CIOTEX tokens shows the attacker gained control over token issuance functions.

Chain secured with 24-48 hour downtime for upgrades

IoTeX suspended chain operations following the discovery. “Our team has contained the situation and the IoTeX chain is being secured,” the platform announced.

Deposits and normal operations will resume within 24-48 hours pending completion of security upgrades.

The team works with law enforcement to investigate and recover funds. IoTeX also committed to transparent updates as the situation develops.

Crypto World

Pepeto Presale Surges Past $7M as Robinhood Tests Blockchain and Major Coins Crumble: Why Investors See a 300x Opportunity Here

Ever notice how the biggest opportunities show up when most people are too scared to look? That is exactly what is happening in crypto right now.

Robinhood just launched a blockchain testnet that processed 4 million transactions in its first week. Traditional finance is building deeper into crypto, not pulling back. At the same time, roughly $1 trillion was wiped from total crypto capitalization over recent months.

This disconnect between institutional building and retail fear creates a rare setup. And one presale is catching both crowds.

Pepeto: Investors Migrate for Utility and Explosive Upside

Traders and investors are actively moving toward projects that deliver actual usable tools instead of flashy promises. And Pepeto is at the center of that shift.

While most tokens fight to regain any kind of momentum in today’s volatile market, Pepeto offers something almost nobody else does at this stage: three working demo products. A cross chain swap, a bridge, and an exchange. Not concepts. Not wireframes. Working technology backed by dual audits from SolidProof and Coinsult.

Among these tools, the cross chain bridge stands out. Investors can move assets between blockchains without centralized intermediaries. That infrastructure turns Pepeto from a meme coin into something that could power an entire trading ecosystem.

Remember Pepecoin? It went from nothing to a $7 billion market cap. Zero products. Zero audits. Now imagine the same meme power plus working technology and a connection to the original Pepe cofounder.

Pepeto has raised over $7.258M so far at a price of $0.000000185. The presale is over 70% filled. The tokenomics carry a 0% buy and sell tax. And staking at 212% APY means a $20,000 position would generate roughly $42,400 in annual staking rewards.

But here is what really matters for investors thinking bigger. Staking is a holding bonus. The real play is what happens to your position when listings hit. If Pepeto captures even a sliver of the meme coin market that turned PEPE into a multi billion dollar token, the math on a 100x to 300x return is not wishful thinking. It is pattern recognition.

By providing real utility during a period of peak fear, Pepeto positions early investors to benefit from both adoption driven growth and price surges once market conditions flip. The presale window will not stay open much longer.

Avalanche Teases Recovery as AVAX Pushes Above $9

AVAX pushed above $9 this week, climbing from $8.63 to roughly $9.34 by February 20. Not a dramatic surge, but it hints at traders testing the waters after heavy selling.

Solana Investors Eye $100 as SOL Consolidates Around $86

Solana rose modestly from $84 to $86 as it consolidates. A push toward $100 is on investors’ radar. Many are balancing SOL positions with early stage projects offering working tools, which is why Pepeto is drawing attention.

Conclusion

While the altcoin market searches for its footing, capital is flowing toward projects that prove they can deliver. That is where Pepeto stands out. Three demo products live. Dual audits complete. A community growing fast enough to remind you of the early days of every meme coin that went on to create millionaires.

In a market that rewards function over speculation, the presale window at $0.000000185 will not last. Act while it is still open.

Visit the official website to buy into the Pepeto Presale now, and visit X for the latest community updates.

FAQs

Why is Pepeto gaining traction while bigger tokens struggle? Pepeto combines meme coin energy with working infrastructure: a swap, bridge, and exchange. That mix of culture and utility is drawing investors away from tokens that only offer speculation.

How do Pepeto’s demo products work for presale buyers? Presale participants can test the cross chain swap, bridge, and exchange demos. This gives buyers a hands on look at the technology before full public launch.

Is the 212% staking APY the main reason to invest? Staking is a holding bonus, not the primary thesis. The real opportunity is the potential price multiple when Pepeto lists on exchanges and captures meme coin market share.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

STRC Yield Play: How Fed Rate Cuts Could Drive Billions Into Strategy’s Bitcoin Machine

TLDR:

- STRC faces a major tailwind as U.S. money market funds lose $233.7 billion annually from a projected 300bps rate drop

- STRC pays 11.25% annually with $2.25 billion in cash reserves covering over 2.5 years of dividends at 5.6x overcollateralization

- A 0.5% rotation from money markets into STRC could generate $2–$4 billion, funding the purchase of up to 80,000 Bitcoin

- Strategy’s Bitcoin holdings could grow 13%–34% if STRC scales to $10–$20 billion in notional value by the year 2028

STRC, Strategy’s Variable Rate Series A Perpetual Preferred Stock, is drawing growing institutional attention as the Federal Reserve advances its rate-cutting cycle into 2026.

U.S. money market funds now hold $7.79 trillion, currently yielding between 4.5% and 5%. Analysts project yields on those funds could fall by 300 basis points.

That drop could push hundreds of billions toward high-yield alternatives. Trading near $100 par on Nasdaq and paying 11.25% annually, STRC stands positioned at that crossroads.

Fed Rate Cuts Threaten Hundreds of Billions in Annual Income

U.S. money market fund yields remain elevated from the prior rate-hiking cycle. However, the Fed has already moved 125 basis points into the current easing cycle, with markets pricing in another 75–100 basis points ahead.

Analysts expect front-end yields to compress toward 1%–2%, replicating the post-2008 and 2020 patterns.

A 300-basis-point decline across $7.79 trillion in money market assets equals roughly $233.7 billion in lost annual income.

Pensions, insurers, and corporate treasuries cannot simply absorb that loss. They are historically known to pursue higher-yielding alternatives when safe returns erode.

EPFR and McKinsey data indicate that for every 100-basis-point drop in short-term rates, alternative and high-yield vehicles see 10%–20% accelerated inflows within 12–18 months.

A 5%–10% rotation out of money markets alone could direct $390–$780 billion toward private credit, listed preferred stocks, and similar instruments.

STRC Positioned to Capture Institutional Yield Demand

STRC currently trades at $99.82 with an effective annual yield of 11.27%, paying dividends every month. Its notional value already stands at $3.458 billion. Average daily trading volume runs at approximately $128 million, reflecting growing market participation.

Analyst Adam Livingston wrote on X: “STRC sits at the perfect nexus because it’s liquid, high-yield, and structurally engineered to vacuum up the dumbest, most desperate money on Earth.”

He added that Strategy holds $2.25 billion in cash reserves, covering more than 2.5 years of dividends at 5.6 times overcollateralization.

If only 0.5% of projected capital rotation flows into STRC, that equals $2–$4 billion in new capital. At $100 par, that creates 20–40 million new shares issued. Proceeds from those shares go directly toward Strategy’s Bitcoin acquisition program.

Bitcoin Supply Could Face Pressure from STRC’s Expansion

Each $1 billion raised through STRC issuance allows Strategy to purchase approximately 14,700 Bitcoin at a $68,000 spot price.

A $4 billion capital inflow translates to roughly 58,800–80,000 additional Bitcoin removed from the open market.

Strategy currently holds 717,000 BTC. Analysts project STRC could scale to $10–$20 billion in notional value by 2028.

That growth range would add an estimated 95,000–242,000 Bitcoin to Strategy’s treasury, a 13%–34% increase in total holdings.

That accumulated buying would represent 8%–11% of annual Bitcoin issuance. Livingston noted: “Do that at scale and you’re talking supply-shock math that makes ETF inflows look quaint.”

Post-GFC private credit grew more than seven times as rate cuts redirected capital toward yield-bearing alternatives, and Bitcoin compounded sharply during each of those liquidity-driven periods.

Crypto World

Crypto Market Gives Back Nearly All Gains from 2024 and 2025 in Round Trip

The crypto market has retracted most of the gains made during the 2024-2025 pump that kicked off after the 2024 elections in the United States, and has lost about 40% of its value from the peak recorded in October 2025.

The Total3 Market Cap, a metric tracking the market capitalization of the entire crypto market, excluding Ether (ETH) and Bitcoin (BTC), surged by over 91% immediately following the outcome of the US Presidential election on November 5, reaching a high of $1.16 trillion by December 2024.

For context, the Total3 Market Cap was about $600 billion directly before the 2024 US election pump.

The market then fell to the $900 billion range, with price whipsawing until January 2025, when the Total3 briefly climbed back up to $1.13 trillion on January 18 — two days before the inauguration of Donald Trump as president of the United States.

The crypto market continued to trade sideways for much of 2025, but finally hit a new peak of about $1.19 trillion in October 2025, days before a historic market crash broke the structural uptrend of the crypto sector.

The Total3 Market Cap is about $713 billion at the time of publication, around the same level it was on November 10, 2024, with the market showing no signs of a sustained recovery.

Related: Bitcoin most ‘undervalued’ since March 2023 at $20K, BTC price metric shows

Crypto staples like Bitcoin and Ether have also retraced most gains

BTC shed over 50% of its price from peak to trough during the market downturn, falling to a low of about $60,000 before staging a limited recovery to about $68,000.

The price of ETH also plummeted by about 60% from its all-time high of nearly $5,000, reached in August 2025.

Crypto investor sentiment is also sitting at multi-year lows. The Fear and Greed Index, a sentiment tracker, is at 14 at the time of publication, indicating “extreme fear,” according to CoinMarketCap.

The indicator fell to a five on February 5. This is the lowest level recorded by the CoinMarketCap Fear & Greed Index, based on available data.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Crypto World

US Lawmakers Slam Trump Tariffs, Warn They Will Derail the Economy

Tariff politics collided with crypto markets this week after a Supreme Court decision constrained the White House’s authority to impose duties under the IEEPA, prompting President Donald Trump to unveil a new 10% global tariff. The legal setback, coming as lawmakers and think tanks weighed in on the economic impact, did little to quell debate about the proper scope of U.S. trade policy or its ripple effects on risk assets. In crypto circles, the reaction was nuanced: bitcoin and wider digital-asset markets showed resilience, with BTC gaining ground even as traditional markets wrestled with the policy signal. The episode underscores how policy shifts in traditional finance can still shape sentiment and price action in decentralized markets.

Key takeaways

- The Supreme Court struck down Trump’s authority to levy tariffs under IEEPA, creating a constitutional and legal constraint on the administration’s tariff toolbox.

- Officials nevertheless announced a new 10% global tariff, layering the fresh measure on top of existing duties and signaling a broader protectionist posture.

- Crypto markets exhibited relative stability, with bitcoin (CRYPTO: BTC) rising about 3% following the tariff news, while the broader market showed limited movement.

- Critics, including Rand Paul and Ro Khanna, described the tariffs as a tax on workers and small businesses, framing them as a costful component of a contested trade strategy.

- A pro-crypto attorney cautioned that the legal scope for global tariffs remains constrained, suggesting long-run policy risks even if immediate moves appear limited in scope.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Positive. Bitcoin rose roughly 3% in response to the tariff announcements, even as other risk-on assets showed caution.

Trading idea (Not Financial Advice): Hold. The policy environment remains uncertain, and crypto prices have shown sensitivity to headlines without committing to a sustained directional move.

Market context: The tariff developments arrive amid ongoing shifts in risk sentiment, liquidity dynamics, and regulatory scrutiny that continue to shape crypto market behavior in a macro backdrop characterized by policy flux and evolving trade talks.

Why it matters

The Supreme Court’s ruling on IEEPA limited the executive branch’s ability to unilaterally deploy tariffs, a development watched closely by policymakers and markets alike. While the court’s decision constrains authority, the administration signaled a readiness to implement a 10% global tariff, a move that critics say could intensify costs for consumers and disrupt supply chains. The divergence between judicial constraints and executive intent creates a nuanced policy landscape that investors must monitor closely, particularly for asset classes with heightened sensitivity to macro shocks and regulatory signals.

Within the crypto ecosystem, the immediate price reaction was modest but notable. Bitcoin, often viewed as a risk-on barometer in times of policy uncertainty, posted a roughly 3% uptick after the tariff news, illustrating that crypto markets can decouple from traditional equities for short stretches or interpret policy announcements through a crypto-positive lens. The broader crypto market, as tracked by aggregate indicators, showed limited dispersion, suggesting that traders were weighing longer-run implications rather than chasing sharp short-term moves. This is consistent with a market that has learned to price in policy noise without overreacting to every headline.

Reactions from lawmakers and think tanks highlighted the political fault lines surrounding tariff policy. Rand Paul framed the tariffs as a tax transfer, arguing they burden working families and small businesses to fund a broader trade conflict. Ro Khanna countered that the measures aren’t about national security but about shouldering domestic costs for political ends. These voices underscore the partisan and ideological dimensions of tariff moves, which may shape future trade negotiations and regulatory trajectories that could indirectly affect crypto markets through volatility spillovers or shifts in capital flows.

Industry observers at policy think tanks and legal circles have also weighed in on the scope of presidential authority. Scott Lincicome of the Cato Institute cautioned that even in the absence of IEEPA, other statutes and political commitments could sustain a higher-tariff regime over time, with potential knock-on effects on economic performance and foreign relations. The tension between legal constraints and political ambitions illustrates a longer-running risk for markets that rely on predictability and stable policy environments to price risk accurately. In crypto markets, such a backdrop can intensify volatility during headlines while offering a resilience story when headlines become noise rather than signal.

Beyond these developments, market participants have tracked related coverage that suggests ongoing debates about how policy shocks could influence crypto-specific mechanics. For instance, separate analyses have discussed how policy shifts interact with crypto fear and greed metrics and how any perceived refund or relief discussions could alter risk sentiment in the near term. While the immediate moves in digital assets may appear modest, the longer arc remains tied to regulatory clarity, fiscal policy, and the evolving synchronization (or lack thereof) between traditional and decentralized financial systems.

What to watch next

- Follow any formal steps or commentary detailing the 10% global tariff’s implementation timeline and scope, including affected sectors and countries.

- Monitor potential legal challenges or administrative changes that could further constrain or expand tariff authority beyond IEEPA’s current framework.

- Watch crypto market liquidity and volatility in the wake of policy signals, especially any sustained moves in bitcoin and ether (CRYPTO: ETH) as policy headlines evolve.

- Track any discussions or proposals around tariff-related refunds or relief measures that could influence investor sentiment and capital allocation to crypto assets.

- Observe policymakers’ additional statements and regulatory steps that could affect risk appetite and cross-asset correlations in the weeks ahead.

Sources & verification

- Supreme Court ruling on tariffs and the IEEPA framework: cointelegraph.com/news/scotus-strikes-trump-tariffs-alternative-plan

- Trump expands with a 10% global tariff announcement: cointelegraph.com/news/trump-10-global-tariff-scotus-ruling

- Rand Paul on tariff policies: x.com/SenRandPaul/status/2024983414110085181

- Ro Khanna’s position on tariffs: x.com/RepRoKhanna/status/2024873957296337219

- Bitcoin price context and market response: cointelegraph.com/bitcoin-price

- Total3 market-cap indicator reference: https://www.tradingview.com/chart/g7xkPkTa/?symbol=CRYPTOCAP%3ATOTAL3

- Related coverage on crypto-market reactions to tariffs and refunds: cointelegraph.com/news/bitcoin-ignores-us-supreme-court-trump-tariff-strike-amid-talk-of-150b-refund

Tariffs, the Supreme Court ruling and crypto markets: the resilience test for Bitcoin and beyond

Bitcoin (CRYPTO: BTC) and its peers are again being tested by a combination of regulatory signals and geopolitical policy moves that bleed into the risk spectrum. The Supreme Court’s decision narrows executive latitude on punitive duties, but the administration’s follow-up announcement of a 10% global tariff demonstrates a continued willingness to use trade policy as a lever. The duality—legal constraint paired with policy intent—creates a bifurcated environment for markets: one where the rule of law structures potential actions, and another where political calculations determine timing and scale.

From a price perspective, the immediate reaction in digital assets was not dramatic, but notable for its direction. Bitcoin rose by roughly 3% in the wake of the tariff news, suggesting that some participants view crypto as a hedge or at least as a diversification option amid policy uncertainty. At the same time, broader market indicators showed muted responses, with the Total3 index hovering near prior levels, indicating that the overall crypto market did not exhibit a broad, abrupt shift in risk-on or risk-off sentiment in the immediate aftermath. This decoupling—where single-asset moves diverge from the wider market—highlights the nuance of crypto market dynamics in a policy-driven environment.

Industry voices have framed the tariff moves in distinctly different terms. Rand Paul described the tariffs as a tax transfer that harms working families and small businesses, underscoring the domestic economic costs of what he characterized as a reckless trade policy. Ro Khanna offered a counterpoint, emphasizing that the measures were not focused on national security but rather on domestic fiscal calculations that may burden consumers and small enterprises. In parallel, a prominent pro-crypto attorney noted that the legal scope of the president’s authority remains constrained by statutory limits, which could temper the medium-term impact of new tariffs if challenged or narrowed in subsequent fiscal cycles.

Looking ahead, market watchers will be closely tracking whether these tariff moves translate into concrete policy actions beyond headlines. A sustained higher-tariff regime could influence corporate investment, supply chain strategies, and cross-border capital flows—factors that, in turn, feed into crypto market sentiment and liquidity. Investors should also watch for any shifts in regulatory posture or fiscal relief discussions that might dampen or amplify the observed price responses in Bitcoin and other digital assets. The story remains fluid, with policy debates continuing to shape risk tolerance and the calculus of hedging across traditional and decentralized markets.

Crypto World

Personal AI agents could solve DAO failures

Ethereum co-founder Vitalik Buterin identified limits to human attention as the core problem plaguing decentralized autonomous organizations (DAOs) and democratic governance systems.

Summary

- Buterin says limited human attention is DAOs’ core governance flaw.

- Personal AI agents could vote using user preferences and context.

- Suggestion markets and MPC may improve privacy and decisions.

Writing on X, Buterin argued that participants face thousands of decisions across multiple domains of expertise without sufficient time or skill to evaluate them properly.

The usual solution of delegation creates disempowerment where a small group controls decision-making while supporters have no influence after clicking the delegate button.

Buterin proposed personal large language models as the solution to the attention problem and shared four approaches. Personal governance agents, public conversation agents, suggestion markets, and privacy-preserving multi-party computation for sensitive decisions.

Personal LLMs can vote based on preferences

Personal governance agents would perform all necessary votes based on preferences inferred from personal writing, conversation history, and direct statements.

When the agent faces uncertainty about voting preferences and considers an issue important, it should ask the user directly while providing all relevant context.

Public conversation agents would aggregate information from many participants before giving each person or their LLM a chance to respond.

The system would summarize individual views, convert them into shareable formats without exposing private information, and identify commonalities between inputs similar to LLM-enhanced Polis systems.

Buterin noted that good decisions cannot come from “a linear process of taking people’s views that are based only on their own information, and averaging them (even quadratically).” “Processes must aggregate collective information first, then allow informed responses.

Suggestion markets could surface high-quality proposals

Governance mechanisms valuing high-quality inputs could implement prediction markets where anyone submits proposals while AI agents bet on tokens. When the mechanism accepts the input, it pays out to token holders.

The approach applies to proposals, arguments, or any conversation units the system passes along to participants. The market structure creates financial incentives for surfacing valuable contributions.

Decentralized governance fails when important decisions need secret information, Buterin argued. Organizations generally handle adversarial conflicts, internal disputes, and compensation decisions by appointing individuals with great power.

Multi-party computation using trusted execution environments could incorporate many people’s inputs without compromising privacy.

“You submit your personal LLM into a black box, the LLM sees private info, it makes a judgement based on that, and it outputs only that judgement,” Buterin explained.

Privacy protection becomes important as participants submit larger inputs containing more personal information. Anonymity needs zero-knowledge proofs, which Buterin said should be built into all governance tools.

Crypto World

Solana Growth Signals Hope Despite Woes

Data from Santiment shows new wallet creation rising even as prices slump, hinting network curiosity hasn’t faded with sentiment yet.

The price of Solana’s native SOL token is near $84, after a steep, multi-month slide that erased nearly 67% from its September 2025 all-time high, with new on-chain data and community debates pointing to a network under strain.

The mixed signals matter because they show a split between falling market sentiment and activity metrics that suggest users have not abandoned the chain.

Security Patch Delays and Infrastructure Concerns

A February 19 report from Santiment noted that a significant source of recent frustration for the Solana community stems from a critical security scare in January. Client maintainers urged validators to upgrade to Agave/Jito v3.0.14 after disclosing vulnerabilities that could crash nodes and threaten consensus integrity.

Tim Garcia of the Solana Foundation urged operators to update quickly, but reports at the time said over half of validators were still on older versions, exposing the chain to potential risks.

This operational friction resurfaced in February when a network disruption rerouted U.S. traffic through Europe and Asia. While infrastructure providers like DoubleZero noted that such rerouting is a normal part of internet networking, for validators operating a high-speed chain, milliseconds matter.

These events have forced the market to pay closer attention to how smoothly Solana’s decentralized validator set can respond to pressure, as that response directly affects uptime and the safety of funds moving through DeFi.

The uncertainty is reflecting on SOL’s price, which earlier in the month fell 25% in a week to about $96, with analysts such as Ali Martinez warning that losing the $100 zone could open a path toward $74 or even $50.

You may also like:

At the time of writing, the asset was trading around the $84 level, down about 35% over the past month and more than 51% year-on-year. Shorter time frames show mild relief, with gains near 3% in 24 hours and about 6% in seven days, per CoinGecko data.

Technical indicators remain mixed. Some traders say a breakdown near $80 confirmed a bearish chart pattern, while others see a shorter-term setup that could push prices back toward $114 if resistance clears. Santiment added that deeply negative funding rates suggest many traders are betting against SOL, a setup that sometimes comes right before short squeezes.

Activity Growth Contrasts With Fading Hype

Despite the price pressure, Santiment reported rising daily wallet creation in February. That metric tracks new addresses interacting with the network and suggests ongoing user interest even in the face of weakening sentiment.

Exchange data also shows outflows exceeding inflows in recent weeks, a sign that some holders are moving tokens off trading platforms rather than preparing to sell.

Nevertheless, the current mood contrasts with earlier cycles that defined Solana’s culture. According to Santiment, traders still reference past events such as NFT booms, meme coin launches, and exchange-related shocks that once dominated online discussion.

More recently, app builder Zora shifted a new product from Base to Solana, charging about 1 SOL per creation, which sparked debate about incentives but also signaled ongoing developer interest.

Ultimately, Solana’s is a layered picture, with prices and online attention having fallen since late 2025, yet new wallets, active builders, and crowded short positions showing that participation has not disappeared.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech7 days ago

Tech7 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Boden – Corporette.com

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat2 days ago

NewsBeat2 days agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody