Crypto World

BTC miner sold more than half of its holdings

Bitcoin miner Cango (CANG) completed the sale 4,451 BTC over the weekend, raising roughly $305 million in USDT as it looks to reduce leverage and reposition its business around artificial intelligence infrastructure.

The company said it raised $305 million from the sale, suggesting an average sale price of about $68,524 per coin, or not far above multi-year low prices for bitcoin.

Shares are little-changed in Monday trading, but are lower by 83% on a year-over-year basis.

The company’s bitcoin sales were “based on a comprehensive assessment of current market conditions,” the firm said, as it plans to shift into AI computing infrastructure. Cango plans to deploy modular GPU units across its global network of over 40 sites to serve small and mid-sized businesses needing on-demand AI inference capacity, it said.

The company used the proceeds of its BTC sale to pay down a bitcoin-collateralized loan, bolstering its balance sheet. The company still holds 3,645 BTC worth more than $250 million, according to data from BitcoinTreasuries.

“In response to recent market conditions, we have made a treasury adjustment to strengthen balance sheet and reduce financial leverage, which provides increased capacity to fund our strategic expansion into AI compute infrastructure,” the company wrote in a letter to shareholders.

Its move into the AI sector comes as it faces what it framed as a gap between rising compute demand and existing grid capacity. Cango wrote that it’s well positioned to take advantage of that gap.

Cango is not alone. A growing group of bitcoin miners is scaling back exposure to pure mining and redirecting capital and infrastructure toward AI data centers and high-performance computing.

Bitfarms (BITF) has said it plans to exit crypto mining entirely by around 2027, and famously declared it’s no longer a bitcoin company as it shifts to high-performance computing and AI workloads.

Analysts at KBW have warned that the industry’s pivot toward AI workloads is compelling, but that the path to monetization is fraught with execution risks. That led to a downgrade not only on Bitfarms but also in Bitdeer (BTDR) and Hive Digital (HIVE).

Crypto World

Chiliz Eyes US Comeback With Fan Tokens for 2026 World Cup

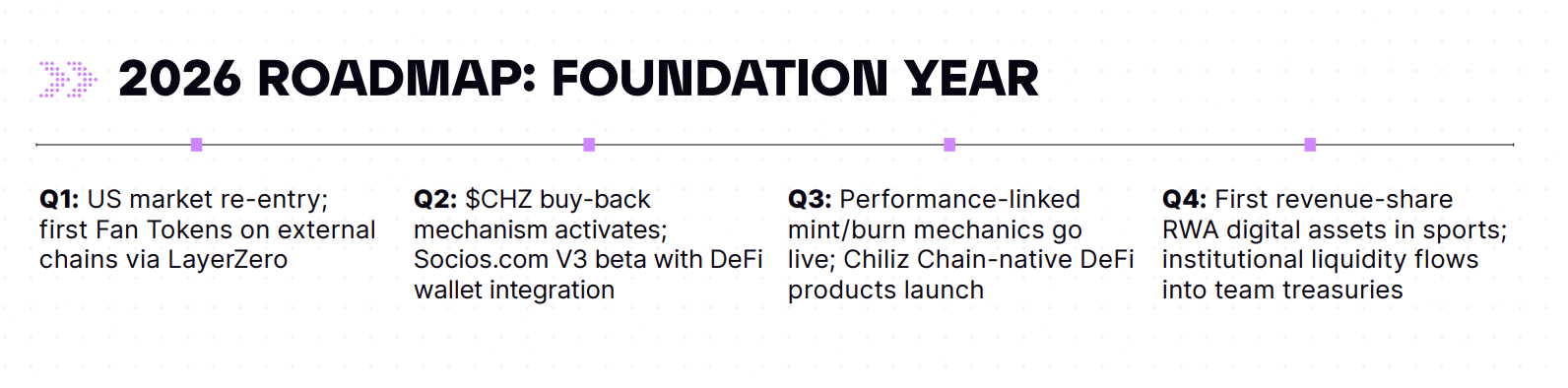

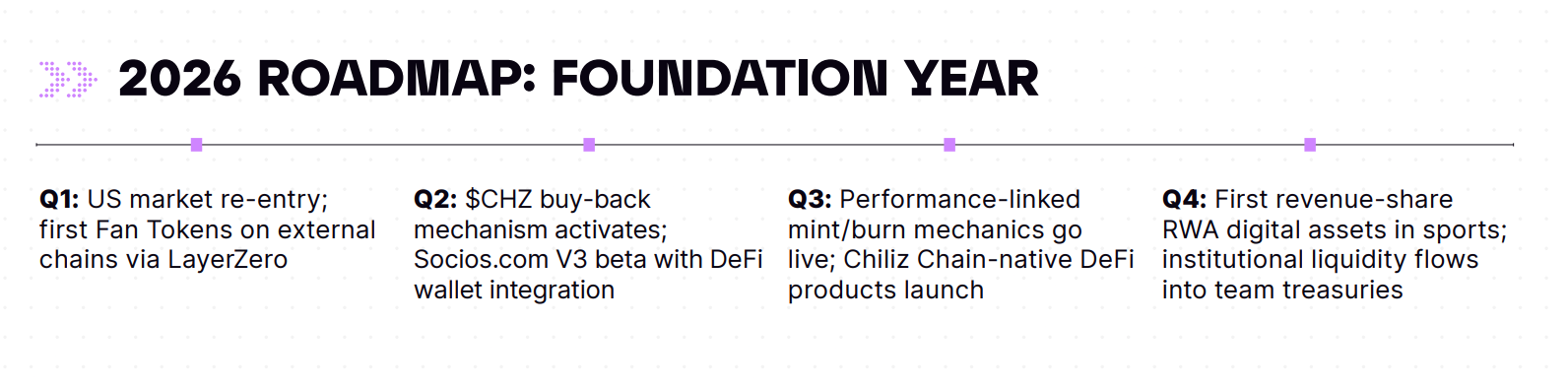

Chiliz, the sports and fan engagement blockchain, has unveiled a three-phase roadmap outlining how it plans to expand Fan Tokens ahead of the 2026 FIFA World Cup in the United States.

The project is making a big return to the US market with new Fan Token launches tied to national teams and broader blockchain expansion. Detailed in its newly released 2030 manifesto, the roadmap positions 2026 as the year Chiliz moves from experimentation to full-scale execution.

Sponsored

Regulatory Clarity Paves the US Market Re-Entry

The company says it expects to announce its first US Fan Token partnerships in Q1 2026, marking a return after several years of limited activity due to regulatory uncertainty.

In parallel, Chiliz plans to launch Fan Tokens linked to national teams in summer 2026. Unlike club-based tokens, national team Fan Tokens are designed around major tournaments and international competitions.

With the World Cup approaching, Chiliz is targeting a broader, event-driven fan base beyond traditional club supporters.

Sponsored

Omnichain Expansion to Unlock DeFi Access

Another major change arriving in 2026 is Chiliz’s move to an omnichain model. Starting in the first quarter, Fan Tokens will be bridged to external blockchains using cross-chain infrastructure.

In simple terms, this allows Fan Tokens to move outside the Chiliz ecosystem and interact with other blockchains.

The shift is designed to improve liquidity, enable cross-chain trading and arbitrage, and allow Fan Tokens to be used in decentralized finance applications beyond their native network.

Sponsored

New Tokenomics and Product Upgrades Roll Out Through 2026

In the second quarter of 2026, Chiliz plans to activate a new value-accrual mechanism for its native CHZ token.

Under the new model, 10% of all Fan Token revenues generated across the ecosystem will be used for ongoing CHZ buybacks. The company says this links CHZ demand directly to fan’s activity.

Product upgrades are also scheduled for mid-2026.

Sponsored

Socios.com, the consumer platform behind Fan Tokens, will launch a new version with DeFi wallet integration.

Later in the year, Chiliz plans to introduce performance-based token mechanics. Match results will directly affect Fan Token supply, with wins triggering token burns and losses leading to new token issuance.

Beyond 2026, Chiliz’s roadmap shifts toward tokenized real-world assets in sports. From 2027 onward, the company plans to tokenize revenue streams, intellectual property, and other traditionally illiquid sports assets.

The roadmap builds on recent developments across the Chiliz ecosystem, including revenue-linked buyback commitments and a growing focus on infrastructure over short-term price action.

With the World Cup approaching, Chiliz is betting that Fan Tokens can evolve from engagement tools into a globally traded sports asset class.

Crypto World

Bitcoin & Ethereum News, Crypto Prices & Indexes

Crypto Breaking News is a fast-growing digital media platform focused on the latest developments in cryptocurrency, blockchain, and Web3 technologies. Our goal is to provide fast, reliable, and insightful content that helps our readers stay ahead in the ever-evolving digital asset space.

Web3 Digital L.L.C-FZ

License Number: 2527596

📞 +971 50 449 2025

✉️ info@cryptobreaking.com

📍Meydan Grandstand, 6th floor, Meydan Road, Nad Al Sheba, Dubai, United Arab Emirates

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Bitcoin (BTC) pushed back above $71,000 on Monday, after market sentiment indicators across the crypto market dropped to new lows.

Some analysts believed that “extreme fear” and upside liquidity may help Bitcoin hold above its yearly-low at $60,000, but others warned that weak market conditions and bearish futures volume may push prices even lower.

Key takeaways:

-

The Crypto Fear & Greed Index dropped to a record low of 7, showing extreme fear in the market.

-

More than $5.5 billion in short liquidations above current prices may fuel a rebound.

-

Weak price trends and rising derivatives selling may still drag Bitcoin below $60,000.

Sentiment and liquidation suggeset $60,000 remains support

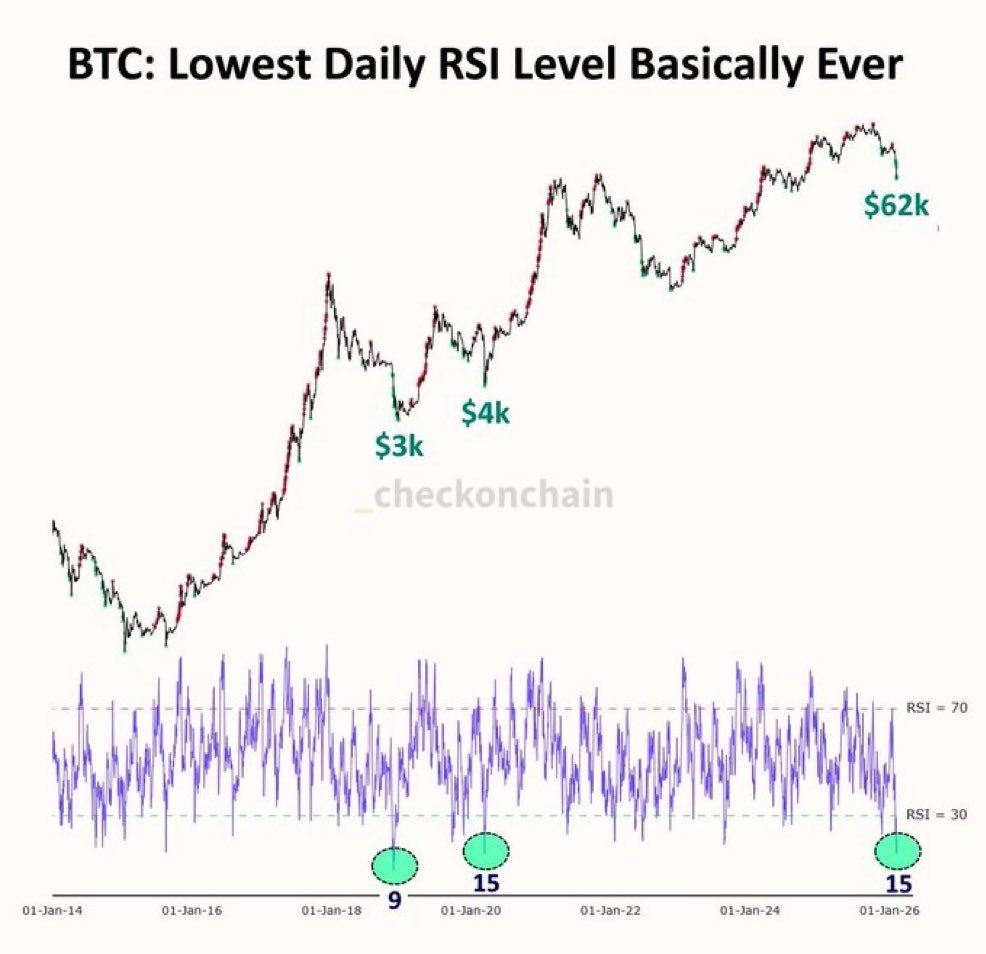

MN Capital founder Michaël van de Poppe said Bitcoin is flashing sentiment readings that have previously marked market bottoms. According to Van De Poppe, the Crypto Fear & Greed Index had dropped to 5 over the weekend (final recorded reading is 7), its lowest reading in history, while the daily relative strength index (RSI) for BTC has fallen to 15, signaling deeply oversold conditions.

These levels were last seen during the 2018 bear market and the March 2020 COVID-19 crash. Van de Poppe said such conditions may allow BTC to exhibit recovery and avoid an immediate retest of the $60,000 level.

CoinGlass data adds to the bullish case. Bitcoin’s liquidation heatmap shows over $5.45 billion in cumulative short liquidations positioned if the price moves roughly $10,000 higher, compared with $2.4 billion in liquidations on a retest of $60,000.

This imbalance suggests that an upward move may trigger forced shorts covering, leading to a BTC rally.

Related: Bitcoin circles $70K as Coinbase Premium sees first green spike in a month

BTC structural weakness keeps downside risks in focus

Data from CryptoQuant shows Bitcoin trading below its 50-day moving average near $87,000, while further below the 200-day moving average around $102,000. This wide gap reflects a corrective or “repricing” phase following the prior rally.

CryptoQuant’s Price Z-Score is also negative at -1.6, indicating BTC is trading below its statistical mean, a sign of selling pressure and trend exhaustion. Such conditions have preceded extended base-building rather than immediate rebounds.

Crypto analyst Darkfost highlighted a growing selling dominance in the derivatives markets. Monthly net taker volume has turned sharply negative at -$272 million on Sunday, while Binance’s taker buy-sell ratio has slipped below 1, signaling a strong selling pressure.

With futures volumes outweighing spot flows at the moment, stronger spot demand is needed to trigger a bullish reaction from BTC.

Adding a longer-term caution, Bitcoin investor Jelle noted that past Bitcoin bear market bottoms formed below the 0.618 Fibonacci retracement. For the current cycle, that level sits near $57,000, with deeper downside scenarios extending toward $42,000 if history repeats.

Related: Saylor’s Strategy buys $90M in Bitcoin as price trades below cost basis

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

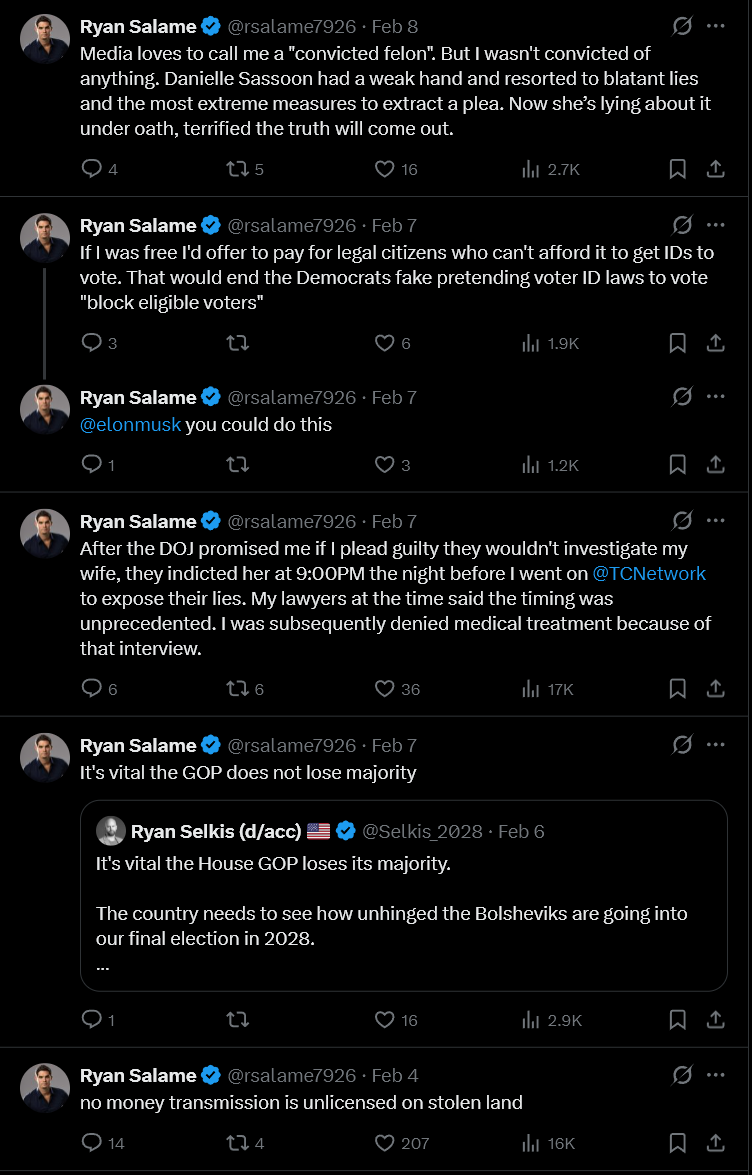

FTX’s Ryan Salame Goes Full MAGA in Bid for Trump Pardon

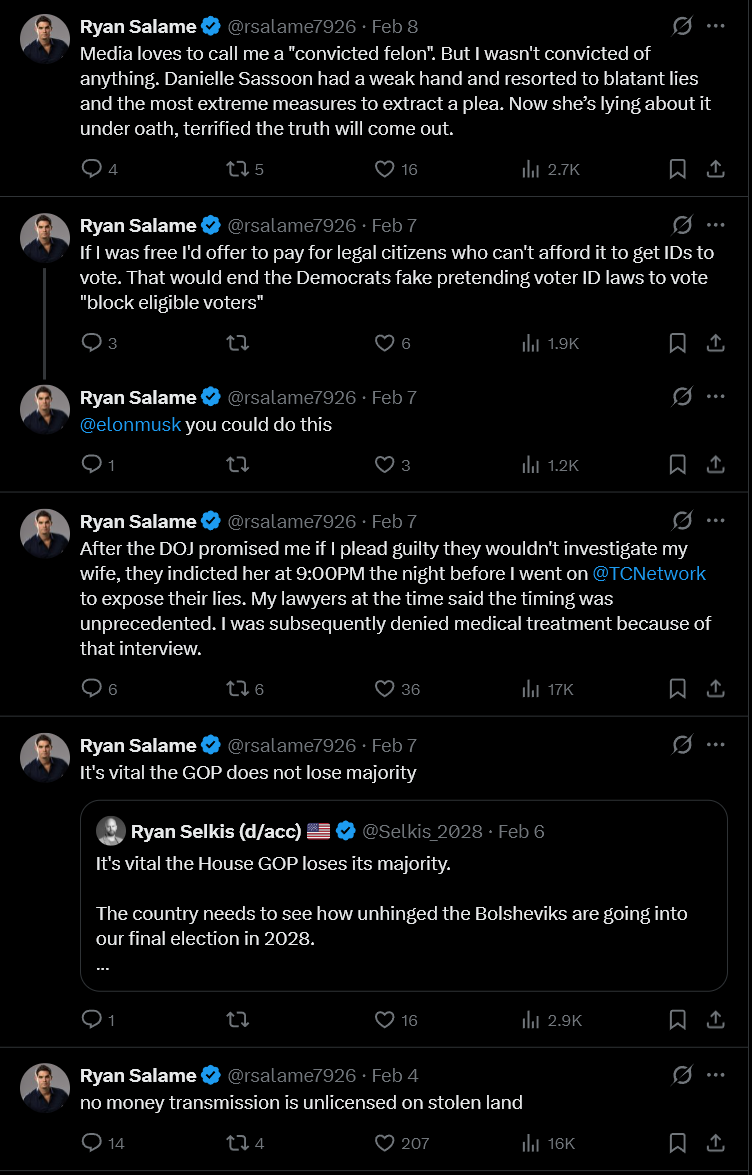

Former Ryan Salame, a onetime co-CEO of FTX, has launched a highly visible social media campaign that appears aimed at securing a presidential pardon from Donald Trump, despite currently serving a federal prison sentence.

Over recent weeks, Salame’s X account has posted a stream of politically charged messages praising Republican priorities, attacking Democrats, and aligning closely with Trump’s rhetoric on immigration enforcement and election integrity.

Sponsored

Getting on Donald Trump’s Good Side

In one post, Salame said that if granted clemency, he would “spend the remainder of my sentence working as an ICE agent,” a comment that quickly went viral.

In another, he argued voter ID laws were being misrepresented and suggested that funding IDs would “end the Democrats’ fake pretending” about voter suppression.

He is also promising to pay for legal citizens to get IDs to vote, for those who can’t afford. Only if he were free.

Sponsored

How is Salame Posting From Prison?

Salame is currently serving a 90-month federal sentence at a medium-security US Bureau of Prisons facility.

In 2023, he pleaded guilty to campaign finance violations and operating an unlicensed money-transmitting business connected to FTX.

But how is he constantly posting on X from prison? Federal inmates are prohibited from accessing social media directly.

As a result, his posts are widely understood to be published via third parties acting on his behalf, typically based on phone calls, written correspondence, or pre-approved messaging — a common workaround used by high-profile inmates.

Sponsored

Attacking Prosecutors, Echoing Trump Themes

Several posts directly attack federal prosecutors, including claims that he was coerced into a plea deal and that the Department of Justice misled him about investigations involving his wife.

Salame has repeatedly framed his prosecution as politically motivated — language that mirrors Trump’s broader criticism of the DOJ.

Sponsored

Trump’s High-Profile Pardons

Salame’s public posture comes amid Trump’s recent wave of pardons and commutations, including several tied to crypto and financial crimes.

Those moves have reshaped expectations around clemency, particularly for defendants who argue their prosecutions reflected regulatory overreach.

Trump has also intensified ICE enforcement actions and revived claims that Democrats — including President Joe Biden — undermined election integrity, themes Salame now openly amplifies.

While Salame has not explicitly requested a pardon, the messaging leaves little ambiguity.

From prison, the former FTX executive appears to be making a public case for inclusion on Trump’s clemency list. He is aligning himself with the president’s political agenda as aggressively as possible, one post at a time.

Crypto World

Dogecoin jumps as $20m whale transfer hits Robinhood

A large Dogecoin transfer to Robinhood has drawn attention amid a volatile crypto market. On Saturday, 203.6 million DOGE—worth roughly $20.1 million—was moved from an unknown wallet to the trading platform, coinciding with a 6% rebound in Dogecoin’s price.

Summary

- A large Dogecoin “whale” transfer to Robinhood—203.6 million DOGE worth about $20.1 million—coincided with a 6% price rebound.

- Nearly 278 million DOGE moved to Robinhood on February 4, signaling heightened activity by large holders during unstable market conditions.

- Whale Alert data shows this was the second major transfer in days.

The move followed several days of declines and marked a short-term reversal from a broader downward trend.

According to Whale Alert, this was not an isolated event.

Just days earlier, on February 4, nearly 278 million DOGE valued at about $29.5 million was also transferred to Robinhood. These repeated large movements suggest heightened activity by major holders during a period of market instability.

The broader cryptocurrency market has struggled since a sharp sell-off in October that eroded investor confidence. More recently, prices have been pressured by the unwinding of leveraged positions and increased volatility. Dogecoin fell for three consecutive sessions, hitting a low of $0.0799 on February 6 before rebounding to around $0.10, with losses attributed to risk-off sentiment and heavy derivatives trading.

Liquidity conditions have also weakened. Dogecoin’s market depth declined from roughly $12 million at the start of January 2026 to about $10 million in early February, a drop that can amplify price swings during turbulent periods.

Traders are closely watching key technical levels. A break below $0.07 could open the door to further downside toward $0.05, while a sustained move above the $0.106–$0.110 range may be needed to confirm a recovery. Overall, Dogecoin’s recent price action and whale activity point to ongoing uncertainty, with volatility likely to persist in the near term.

Crypto World

Trump’s Bitcoin bet? Cramer hints at $60k strategic reserve

Market commentator Jim Cramer claimed on CNBC that the Trump administration plans to purchase Bitcoin for a proposed U.S. Strategic Reserve amid ongoing market volatility.

Summary

- Cramer claimed the Trump administration may buy Bitcoin for a proposed U.S. Strategic Reserve, reportedly targeting a $60,000 entry price amid recent market volatility.

- The U.S. government currently holds 328,372 BTC (over $23 billion), with executive orders specifying that reserves come from asset forfeitures and cannot be sold; Treasury officials say public funds cannot be used to buy crypto.

- Interest in a Strategic Bitcoin Reserve is rising, with Polymarket placing the probability of establishment before 2027 at 31%, while BTC trades around $71,133, up 3% over the past 24 hours.

“I heard at $60,000 the President is gonna fill the Bitcoin Reserve,” Cramer said on Friday’s Squawk on the Street segment.

The remark coincided with a sharp Bitcoin sell-off earlier in the week, which saw BTC briefly approach $60,000 before rebounding above $70,000. If the purchase occurs at the cited price, Bitcoin would need to decline more than 15% for the administration to execute it.

What the data shows

According to Arkham data, the U.S. government currently holds 328,372 BTC, valued at over $23 billion, with no recent changes in holdings. An executive order from March 2025 specifies that BTC for the reserve would come from criminal and civil asset forfeitures, and deposits cannot be sold.

Treasury Secretary Scott Bessent has stressed that the federal government has no legal authority to bail out Bitcoin or compel banks to purchase it, reinforcing that public funds cannot be used to acquire cryptocurrency assets.

Despite these legal constraints, interest in a Strategic Bitcoin Reserve appears to be growing. Polymarket data shows the probability of such a reserve being officially established before 2027 has risen to 31%, up from 23% in early January.

At the time of reporting, Bitcoin was trading at $71,133.74, up roughly 3% over 24 hours, reflecting ongoing market volatility and investor attention on potential government involvement.

Crypto World

Pi Network (PI) Faces ‘Pyramid Scheme’ Accusations as Analyst Issues Crucial Warning

“RIP to the bags still being held. Touch some grass, seriously,” the analyst said.

Pi Network’s PI has been on a massive price decline over the past several months, causing many community members to lose patience and call the project a scam.

Meanwhile, the bearish conditions of the broader crypto market and some other important factors signal that the asset could experience a further downfall in the near future.

‘Not a Healthy Correction’

It seems rather absurd that PI was trading at around $3 nearly a year ago, given its current valuation. Last week, the token slipped to a new all-time low of approximately $0.13, and as of press time, it is worth roughly $0.14, representing a staggering 95% collapse from the historical peak.

According to X user pinetworkmembers, the decline is not “a healthy correction,” but a market pricing of the biggest issues of the controversial project behind the cryptocurrency:

“That’s not a healthy correction, that’s the market finally pricing in the obvious: no functioning mainnet after years of promises, no real-world utility beyond ‘keep the app open’, and a whole lot of mobile mining theater.”

They claimed that at first PI was sold as “revolutionary,” but eventually ended up appearing like “the longest-running pyramid scheme dressed up as Web3 empowerment for hopeful retirees and late-night scrollers.”

They opined that Pi Network users (known as Pioneers) should admit that the experiment failed and redirect their energy toward something more productive that can actually bring them profit.

“RIP to the bags still being held. Touch some grass, seriously,” the X user concluded.

This isn’t the first time the project has become the subject of criticism. Earlier this month, Pi Network’s Core Team celebrated the so-called “Moderator Appreciation Day.” The event aimed to acknowledge moderators and praise their role in building and supporting the community.

You may also like:

The statement, however, triggered significant backlash, as many members argued that the project should focus on more pressing issues, such as expediting the verification process and related tasks.

What Lies Ahead?

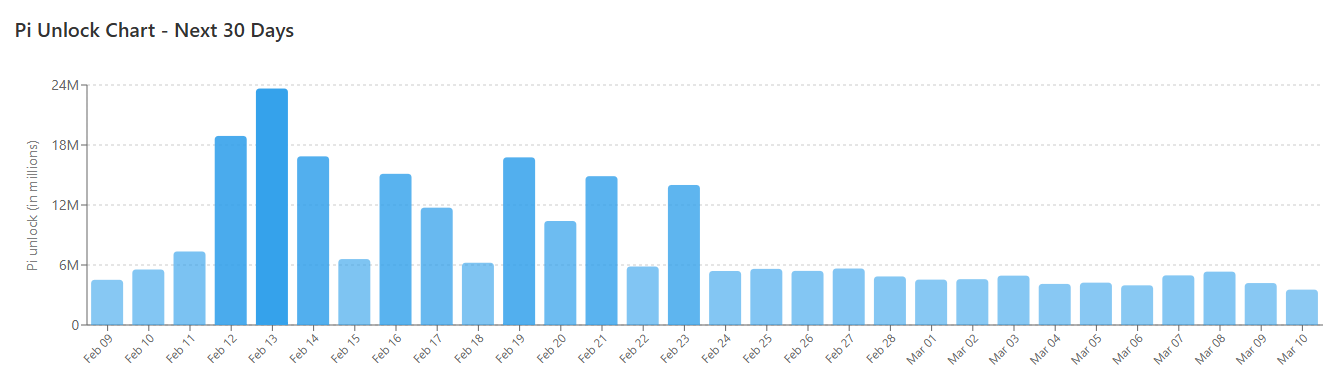

Several concerning factors, including the upcoming token unlocks, suggest PI’s price could fall further in the short term. Data shows that nearly 250 million coins will be released over the next 30 days, resulting in an average daily unlock of more than 8.3 million.

February 13 is expected to be the record day, when 23.6 million PI will be freed up. While the development doesn’t guarantee an additional price collapse, it can be considered bearish because it increases the selling pressure.

On the other hand, PI’s Relative Strength Index (RSI) signals that a rebound could also be on the horizon. The technical analysis tool measures the speed and magnitude of recent price changes and helps traders identify potential reversal points. It varies from 0 to 100, and ratios below 30 indicate that PI has entered oversold territory and may be due for a resurgence. According to RSI Hunter, the RSI currently stands at around 35.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Crypto News, Prices & Indexes

Bitcoin and Ethereum led a broad rally in risk assets as traders priced in cooling inflation and firmer macro signals, but the rebound for Ether came with a caveat: derivatives markets remained largely cautious. The on-chain picture shows a liquidity landscape that is still hunting for clear catalysts, even as Ether clears key price resistances. In short, a positive price move does not yet translate into a confident shift in momentum, with traders continuing to weigh the risk of another leg lower as macro headlines evolve.

Key takeaways

- Ethereum maintains dominance in total value locked (TVL), but scrutiny of layer-2 scaling and its subsidy model persists as investors assess long-term efficiency.

- Ether’s inflation metric rose to ~0.8% over the last 30 days as on-chain activity cooled, while macro concerns kept derivatives in a cautious, risk-off stance.

- ETH 2‑month futures traded at roughly a 3% premium to spot, below the 5% neutral threshold, signaling tepid optimism from Ether traders despite the rally.

- Year-to-date, Ether has underperformed the broader crypto market by about 9%, raising questions about where capital is flowing and how much is staying tethered to Ethereum’s core ecosystem.

- Deposits on the Ethereum base layer account for roughly 58% of the entire blockchain industry; including Base, Arbitrum, and Optimism, that figure rises to about 65%. The largest DApp on the Ethereum base layer holds more than $23 billion in TVL, underscoring Ethereum’s ongoing scale advantage over competitors like Solana, where the top DApp’s TVL remains far smaller.

Sentiment: Bearish

Price impact: Positive. Ether reclaimed the $2,100 level as the broader market rose, but the bounce remains tentative amid persistent risk-off signals in the derivatives space.

Trading idea (Not Financial Advice): Hold. The current price recovery lacks clear, durable conviction from buyers, and any sustained advance will depend on a shift in risk appetite and improved on-chain activity.

Market context: The price move comes within a broader environment of liquidity fluctuations and macro uncertainty, where flows into crypto often track traditional risk indicators and regulatory chatter as much as technical levels.

Why it matters

The Ethereum ecosystem remains the cornerstone of DeFi and NFT activity, with the base layer continuing to attract the majority of on-chain value. Even as the chain holds a commanding TVL lead, the narrative around layer-2 solutions—how they decentralize, secure, and scale applications—has grown more nuanced. Ethereum’s current stance reflects a tension between the heavy usage that has historically fueled its dynamics and the structural questions about how best to sustain growth without compromising security or centralizing risk through bridges or trusted constructs.

Data from ultrasound.money shows Ether’s supply growth accelerating to about 0.8% on an annualized basis over the last month, a sign that the burn dynamics intended to counter inflation are not as punitive as hoped when network demand softens. The built-in burn mechanism relies on base-layer data processing activity; when that activity wanes, the net effect can be a modest supply expansion, tempering the deflationary narrative some bulls have pushed. This dynamic aligns with the observed softness in on-chain activity and the tepid appetite in the derivatives market, where a 3% premium for 2‑month Ether futures sits below the 5% neutral threshold—an indication that traders are not aggressively pricing in rapid upside (Laevitas data: laevitas.ch).

On the fundamental side, the ladder of TVL metrics continues to illustrate Ethereum’s centrality. The Ethereum base layer alone accounts for the majority of blockchain deposits, while including the leading layer-2 ecosystems—Base, Arbitrum, and Optimism—pushes the share to well above two-thirds of industry activity. In contrast, Solana’s leading DApp sits far behind, a reminder that capital has not yet pursued a broad shift away from Ethereum despite competition. This shape of the market matters for developers evaluating where to build and for investors weighing the durability of Ethereum’s moat in a multi-chain era.

The pace of adoption in layer-2 networks is another focal point. Vitalik Buterin has argued that the L2 path to decentralization has proven more challenging than originally envisioned, given reliance on multisig-controlled bridges and security trade-offs. In interviews and analyses, he has signaled a pivot toward base-layer scalability while acknowledging that privacy-focused features and application-specific designs on L2s will continue to influence capital allocation patterns. The inherent tension between scalability and security is central to investors’ risk calculus as they parse long-term returns from layer-1 vs. layer-2 deployments. For context, related discussions emphasize the difference between “real DeFi” and centralized yield constructs, underscoring how policy choices and technology design shape the sustainable value proposition of Ethereum’s ecosystem (Vitalik Buterin commentary: Ethereum scaling pivot).

Another facet of the narrative is the relationship between price performance and liquidity provision. Ether’s price recovery has not yet translated into a broad-based rally in the derivatives market, where risk-off sentiment remains visible in pricing and open interest. While the disappearance of a rapid down-leg is a relief for holders, the absence of robust upside pressure suggests traders remain cautious, watching macro data and regulatory signals for any signs that capital will pivot back toward higher-yield opportunities. In this context, the chart of Ether against the overall crypto capitalization illustrates a persistent lag, with Ether’s performance this year lagging the broader market by roughly 9% as capital rotates among competing use cases and networks (TradingView: ETH/USD vs. total crypto capitalization).

Finally, the market’s attention remains split between long-term fundamental deployments and near-term price movements. The burn mechanism’s trajectory depends on on-chain activity, while the composition of TVL—especially the share captured by L2s—will influence how investors perceive Ethereum’s ability to sustain network effects. The ongoing debate about L2 security, decentralization, and throughput feeds into price dynamics and shapes the risk-reward calculus for traders and developers alike. As developers experiment with privacy-focused features and bespoke, application-specific layer designs, Ethereum’s scale narrative remains central to the crypto economy’s evolution, even as other chains strive to carve out niche advantages.

What to watch next

- Monitor Ether’s price action around the $2,200 area and whether buying pressure gains enough momentum to sustain a breakout.

- Track Vitalik Buterin’s public comments and any policy shifts from major layer-2 projects regarding decentralization and security architecture.

- Observe on-chain activity metrics and the burn rate versus supply growth using ultrasound.money data to gauge deflationary pressure.

- Watch DefiLlama for TVL movements between the Ethereum base layer and its Layer-2 ecosystem to assess flow shifts across the ecosystem.

- Keep an eye on macro indicators and central bank signals that influence liquidity and risk sentiment, as these ultimately drive derivative pricing and capital allocation.

Sources & verification

- ETH price levels and movement relative to the $2,150 threshold and recovery to $2,100+ zones.

- 2-month Ether futures annualized premium data from Laevitas as a gauge of derivatives sentiment.

- ETH supply growth metrics (0.8% annualized over the last 30 days) from ultrasound.money.

- TVL breakdowns and main chain vs. Layer-2 deposits from DefiLlama data.

- Official commentary by Vitalik Buterin on Layer-2 decentralization and the burn mechanism, including linked analyses.

What the numbers say about the market today

Market breadth has improved modestly as Ether reclaims price levels, yet the path to a sustainable rally remains uncertain. The interplay between layer-2 subsidies, base-layer scalability, and on-chain activity will continue to shape price dynamics and capital flows. Investors are watching for signals that derivatives markets finally align with price action, suggesting a broader willingness to take on risk. Until then, Ether’s leadership in TVL and ongoing L2 development will be essential barometers for the health and direction of the crypto ecosystem.

Crypto World

Bitcoin at Critical $69K-$72K Support: Death Cross Signals Deeper Correction Risk

TLDR:

- Bitcoin death cross forms on daily charts with moving averages positioned far above current price

- Weekly close below $69K-$72K support could trigger next leg down into deeper correction territory

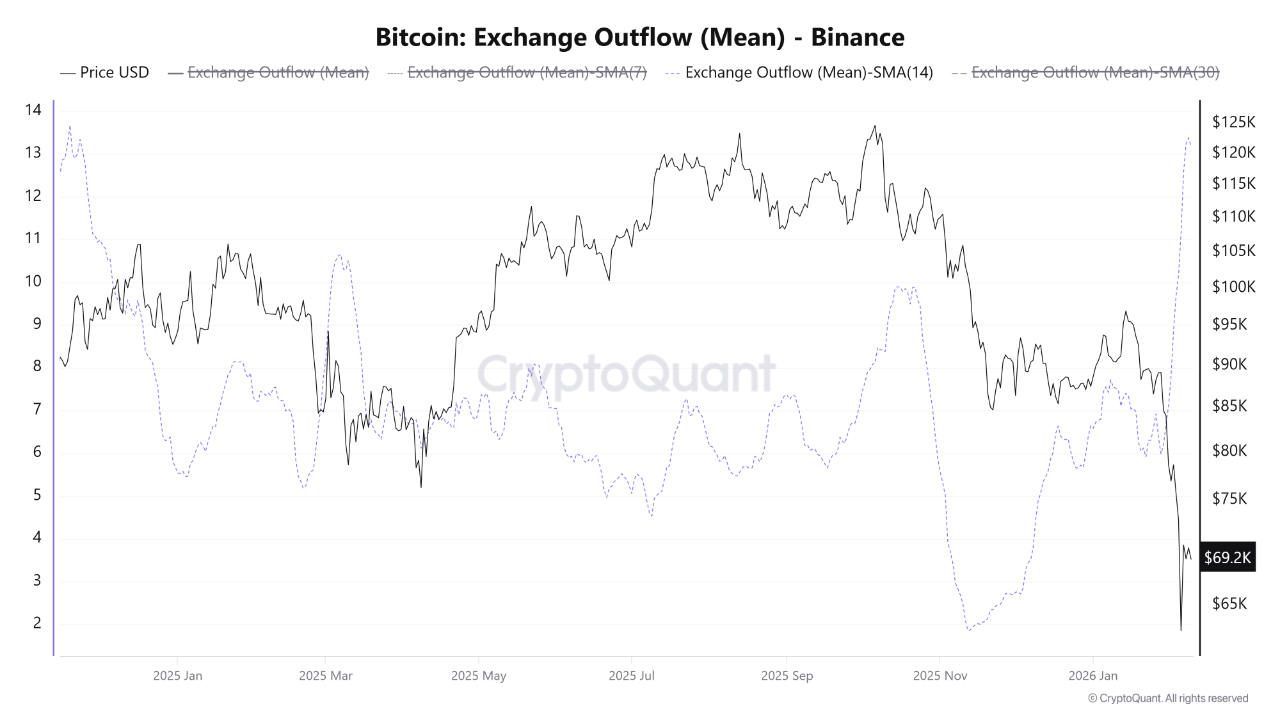

- Binance withdrawal data shows whale accumulation doubled to 13.3 BTC average since late January

- Price must reclaim $82K then mid-$90Ks to establish bottoming pattern and reverse bearish trend

Bitcoin faces a critical test as price slides into the $69,000 to $72,000 support zone amid mounting bearish technical signals.

A death cross has formed on daily charts while weekly moving averages remain far overhead. Traders warn that a clean weekly close below this range could trigger a deeper correction phase.

The current price action shows weak bounce attempts with consistent rejections at key resistance levels.

Death Cross Formation Signals Bearish Trend Structure

The technical setup has deteriorated significantly as BTC continues its descent from higher levels. Daily charts now display an active death cross with the 50-day and 200-day moving averages positioned miles above current price. This configuration represents a classic bearish trend structure where rallies meet aggressive selling pressure.

Weekly timeframes confirm the concerning technical picture. Price remains trapped below the exponential moving average ribbon with repeated rejection attempts at that level.

Any upward moves are functioning as retests rather than genuine reversals. Trader @DamiDefi emphasized that pumps are getting sold while supports face continuous stress tests.

The $69,000 to $72,000 band now represents the final line of defense. This zone determines whether the market experiences a temporary shakeout or enters a prolonged correction phase. Price behavior at this level will dictate the trajectory for coming weeks and potentially months.

A breakdown below $69,000 on a weekly closing basis would open the next leg down. The accumulation phase would become considerably more painful before any bullish momentum could rebuild.

Historical patterns suggest that losing major support zones often leads to cascading liquidations and accelerated downside movement.

Support Test Occurs Despite Whale Buying Activity

The bearish price action persists even as on-chain data reveals unusual buying patterns. Binance exchange metrics show a significant increase in average withdrawal sizes during the decline.

The 14-day simple moving average of mean outflows has doubled from approximately 6 BTC on January 28 to 13.3 BTC by February 8.

This withdrawal pattern indicates whale and institutional activity at current price levels. Large entities appear to be accumulating Bitcoin around $69,000 despite the technical deterioration.

The average outflow size represents the highest level recorded since November 2024, according to CryptoOnchain data.

However, this accumulation has not yet translated into price stability or reversal. The gap between falling prices and rising withdrawal sizes creates a divergence worth monitoring. Smart money appears to be positioning for longer-term gains while accepting near-term downside risk.

Moving coins off exchanges to cold storage traditionally reduces immediate selling pressure. Yet the current market structure suggests this effect remains insufficient to halt the decline.

Bulls need price to reclaim $82,000 first, then push back into the low-to-mid $90,000s to establish a credible bottoming range. Without holding the $69,000 to $72,000 support zone, those recovery targets become increasingly distant possibilities.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Beast Industries, the entertainment company founded by YouTuber Jimmy “MrBeast” Donaldson, is acquiring Step, a mobile banking app focused on teenagers and young adults, marking its most significant push into finance to date.

In a post to X on Monday, Donaldson said the motivation behind the acquisition was to equip young people with the tools and guidance needed to navigate personal finance from an early age.

Beast Industries CEO Jeff Housenbold said, “Financial health is fundamental to overall wellbeing, yet too many people lack access to the tools and knowledge they need to build financial security.”

The acquisition cost was not disclosed.

The YouTube channel’s expansion into finance comes after it received a $200 million investment from Ethereum treasury firm BitMine Immersion Technologies in January and a separate trademark filing for “MrBeast Financial” in October.

That trademark filing mentioned “cryptocurrency exchange services,” “cryptocurrency payment processing,” and “cryptocurrency via decentralized exchanges.”

However, it isn’t clear whether that trademark filing is related to the Step acquisition.

Cointelegraph reached out to Beast Industries for comment, but didn’t receive an immediate response.

Step scales to 6.5 million users in 8 years

The Step app aims to help Gen Z users manage money, build credit, earn rewards, and deepen their financial literacy. Spending accounts are Federal Deposit Insurance Corporation-insured through Evolve Bank & Trust.

The banking app has scaled to 6.5 million users since launching in 2018, having raised around $500 million from the likes of Steph Curry, Justin Timberlake, Will Smith, and Charli D’Amelio.

Related: Crypto PACs secure massive war chests ahead of US midterms

The MrBeast YouTube channel has 466 million subscribers, the largest channel on the video-streaming platform.

Housenbold said the Step acquisition “positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better.”

At the time of the strategic $200 million BitMine investment, its chair, Tom Lee, said the company viewed the deal as a long-term bet on the creator economy, stating:

“MrBeast and Beast Industries, in our view, is the leading content creator of our generation, with a reach and engagement unmatched with GenZ, GenAlpha and Millennials.”

Lee said that BitMine’s corporate values were “strongly aligned” with Beast Industries, but didn’t mention anything about integrating crypto at the time.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat5 hours ago

NewsBeat5 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports21 hours ago

Sports21 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat16 hours ago

NewsBeat16 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout