Crypto World

BTC Price Analysis All But Guarantees Bitcoin Higher by Early 2027

Bitcoin past performance gave 88% odds of higher prices by early 2027, the latest in a series of new bullish BTC price predictions.

Bitcoin (BTC) at $122,000 in ten months could be an “average return” if history repeats itself.

Key points:

-

An “informal” Bitcoin price metric gives 88% odds of BTC/USD trading higher by early 2027.

-

$122,000 per coin would mark an “average return” based on prior performance.

-

Bullish BTC price predictions remain in place despite the current low sentiment.

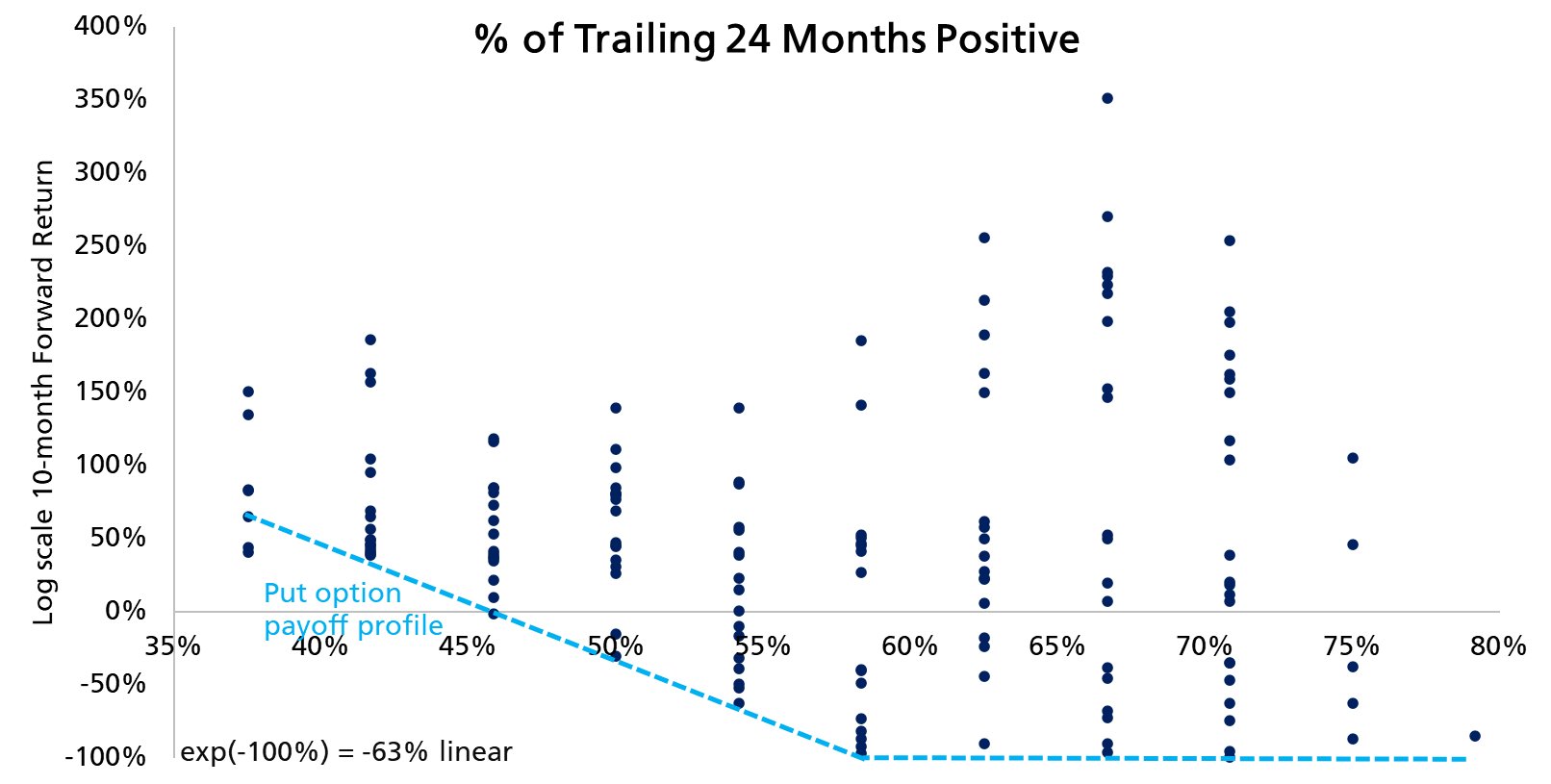

BTC price ended half of past 24 months higher

New analysis from network economist Timothy Peterson gives almost 90% odds of a BTC price being higher by early 2027.

Bitcoin’s underperformance since Q4 2025 has not removed every bullish BTC price prediction that leverages historical data.

For Peterson, monthly price action over the past two years points to a recovery through the rest of the year.

“50% of the past 24 months have been positive. This implies a 88% chance that Bitcoin will be higher 10 months from now,” he reported on X.

“The average return is exp(60%)-1 = 82% => $122,000. Data goes back to 2011.”

In a previous post, Peterson acknowledged that trailing price performance is more useful for identifying trend “inflection points” than price targets.

“This metric measures frequency, not magnitude. So Bitcoin could trend sideways for months and this metric could still go down. But it is still very useful for identifying inflection points,” he wrote, calling the tool “informal.”

A survey conducted by Peterson on Sunday, meanwhile, underscored existing bearish crypto market sentiment.

Bitcoin bulls double down

As Cointelegraph reported, other market sources continue to beat on a major BTC price recovery in 2026.

Related: Bitcoin whales participate in V-shaped accumulation, offsetting 230K BTC sell-off

Among them is an analysis from Bernstein, which this month offered a $150,000 target, calling Bitcoin’s comedown its “weakest bear case” in history.

US banking giant Wells Fargo additionally sees $150 billion in capital inflows into Bitcoin and stocks by the end of March.

“Speculation picks up with bigger savings…we expect YOLO to return,” analyst Ohsung Kwon wrote in a note last week.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Elliptic flags crypto exchanges aiding Russia

Crypto exchanges maintaining operational or financial connections with Russia continue aiding circumvention of international sanctions, according to an Elliptic report.

Summary

- Elliptic says some exchanges help Russia bypass sanctions via crypto.

- Wallet rotation and P2P ruble trades obscure sanctioned flows.

- Shared custody links Exmo global and Russia-facing platforms.

The platforms provide transaction routes allowing Russian entities to make cross-border payments shielded from traditional banking oversight through ruble-to-crypto conversions.

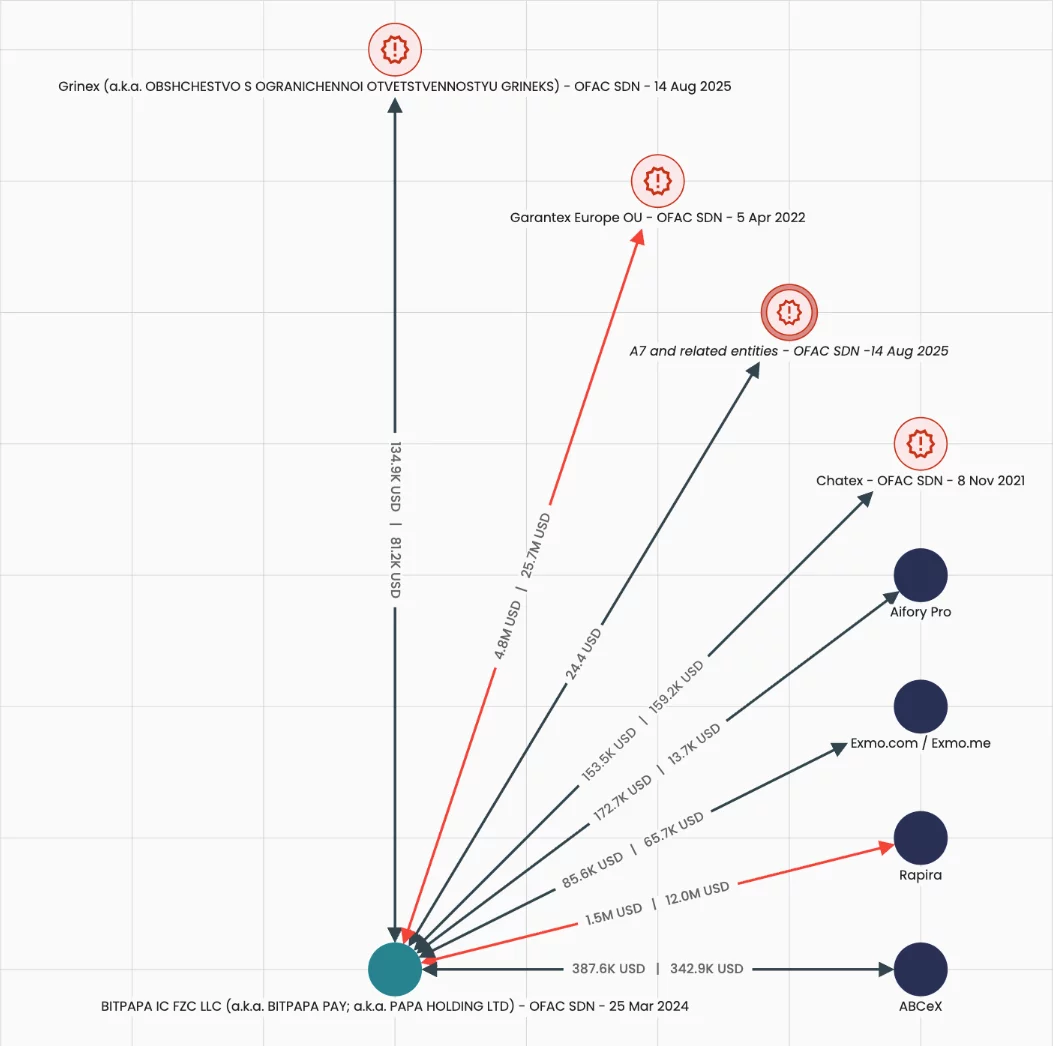

Bitpapa, sanctioned by the U.S. Office of Foreign Assets Control in March 2024, sends approximately 9.7% of outgoing crypto funds to OFAC-sanctioned targets, including 5% to the sanctioned exchange Garantex.

ABCeX has processed at least $11 billion in crypto from its Moscow Federation Tower office, previously occupied by Garantex.

Exmo claims to have exited the Russian market but continues sharing custodial wallet infrastructure between its Western-facing and Russian-facing platforms. They conduct over $19.5 million in direct transactions with sanctioned entities.

Bitpapa and ABCeX use crypto wallet rotation to evade tracking

Bitpapa, a peer-to-peer exchange with corporate registrations in the UAE, primarily targets Russian users allowing rubles to be exchanged for crypto.

Blockchain analysis shows the platform manages wallets to evade sanctions enforcement by constantly rotating addresses.

This prevents transaction monitoring systems from identifying Bitpapa as a counterparty and hiding Russian fund origins.

ABCeX operates both order-book and P2P ruble-to-crypto trading from Moscow’s Federation Tower.

The exchange uses wallet-hiding strategies to prevent crypto transactions from being linked to the service. ABCeX has sent amounts to Garantex and Aifory Pro, which specializes in cash-to-crypto services.

Fiat currencies including rubles are converted into crypto through these services before being transferred across borders without passing through intermediaries.

The assets can then be converted to local currency through overseas crypto brokers or exchanges. Many exchanges maintain nominal registrations outside Russia while helping in high volumes of trading linked to sanctioned entities.

Exmo shares wallet infrastructure between separate platforms

Exmo claimed to exit the Russian market following the 2022 invasion of Ukraine by selling its regional business to Exmo.me.

Blockchain analysis contradicts this geographic operational separation, showing Exmo.com and Exmo.me continue sharing identical custodial wallet infrastructure.

Crypto deposited into either platform is pooled into the same hot wallet addresses, while withdrawals for both platforms are issued from matching addresses.

The shared infrastructure shows no real operational separation and allows funds from the Russian-facing platform to co-mingle with the Western-facing entity. Exmo has transacted with Garantex, Grinex, and Chatex.

Rapira, a Georgia-incorporated exchange with a Moscow office, helps in ruble-based trading and has engaged in direct crypto transactions with Grinex totaling over $72 million.

Moscow authorities reportedly raided Rapira’s offices as part of a capital flight investigation to Dubai.

Aifory Pro operates in Moscow, Dubai, and Turkey, serving as a “Foreign Economic Activity Payment Agent” for international trade between Russia and China.

Crypto World

How to Earn SOL When the Market Corrects

SOL corrects. Charts become volatile. The crypto community starts discussing “cycle bottoms” and “the end of growth.” Some sell. Some lock in losses. Others postpone decisions “until better times.”

And Vladika?

Vladika continues producing blocks. Maintaining uptime. Supporting the network with the same infrastructure stability as before.

A validator on Solana does not operate according to candle patterns. It operates according to epochs, blocks, and infrastructure reliability.

When the Market Falls, Commitment Becomes Visible

Corrections are not only about price. They are stress tests for network participants.

During turbulence, some operators reduce infrastructure costs. Some adjust commission structures. Others become less transparent.

And there is another category — those who remain consistent.

Vladika belongs to the latter.

The economic model does not change depending on market phase:

- 0% commission on base staking rewards

- 100% of MEV rewards distributed to delegators

No hidden mechanisms.

No temporary campaigns.

No sudden commission increases after several epochs.

If you delegate SOL through Vladika, you receive the full rewards generated by the network for your participation.

What Happens to Staking When Price Declines?

It is critical to separate two variables: market price and network yield.

Yes, SOL may correct.

But staking mechanics continue operating. Blocks are produced. Consensus is maintained. Rewards are distributed.

The average staking yield for Vladika currently stands at approximately 6.42% annually.

This is not speculative yield.

It is structural compensation for securing the network.

During corrections, this number becomes more meaningful.

While part of the market reacts emotionally, staking remains a discipline tool.

You do not sell the asset.

You do not remove it from the ecosystem.

You allow it to generate additional SOL.

Important: You Do Not Transfer Your Funds

For many holders, this is fundamental.

When staking on Solana, tokens remain in your wallet.

You do not transfer them to the validator.

You delegate voting rights only.

You retain full custody.

You can undelegate at any time.

After the standard unlock period (one epoch), SOL becomes fully liquid again.

Staking is not asset transfer.

It is infrastructure participation.

Validator Behavior During Volatility Is the Key Metric

Selecting a validator during bullish phases is easy.

Evaluating performance during difficult periods is far more telling.

Key indicators:

- uptime stability

- commission history

- MEV transparency

- participation in official network programs

Vladika holds SFDP Approved status under the Solana Foundation Delegation Program.

https://solana.org/sfdp-validators/A23LfQn6khffj2hGhGfXr6P52W2pxrVcCaHVQLYQgiX2

This confirms compliance with Solana Foundation technical standards.

Additionally, the validator is marked as “Honest” on analytics platforms tracking operator behavior and MEV transparency — indicating no hidden redistribution mechanisms.

These parameters become especially relevant during market instability.

Stability Is a Position

In bull markets, yield discussions are easy.

In corrections, only consistency remains.

Vladika does not alter its structure based on market sentiment.

It does not modify economics under pressure.

It does not experiment with commission levels.

Infrastructure must remain stable regardless of cycle phase.

If You Already Hold SOL

If SOL is already in your wallet, the primary question is efficiency.

An average yield of ~6.42% annually allows you to increase SOL holdings without additional market exposure and without surrendering control.

Staking enables you to:

- support network decentralization

- accumulate additional SOL

- maintain full asset control

- participate in Solana infrastructure long term

Markets fluctuate. That is their nature.

A validator built for stability continues operating.

Vladika remains online — with uptime, transparent economics, and structural consistency.

Detailed validator information, staking conditions, and technical specifications are available at:

https://vladika.love/

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

XRP Drops 69% From ATH and Tests Key Support Zone; Is a Reversal Coming?

TLDR:

- XRP has dropped 69% from its recent all-time high of $3.66 and is currently trading around $1.39.

- The $0.66 price level is a critical support threshold — a weekly close below it invalidates the bullish outlook.

- Santiment data recorded $1.93B in weekly realized losses, the largest spike for XRP since November 2022.

- Analysts cite upside targets of $2, $3, $5, and $10-plus if XRP holds above its key accumulation zone.

XRP is trading around $1.39 after recording a 69% correction from its recent all-time high of $3.66. The asset has posted a -3.76% decline in the last 24 hours and an -8.78% drop over the past seven days.

Trading volume stands at approximately $1.43 billion within the same 24-hour window. The token is currently testing a historically significant demand zone that analysts say previously served as a multi-year accumulation area.

XRP Retests Multi-Year Accumulation Zone After Sharp Decline

The current price action places XRP at a technically important level. The token broke below the $2 support zone and is now retesting what analysts describe as a high-timeframe demand area.

This zone previously acted as the upper boundary of a multi-year accumulation range before the 835% rally.

Crypto analyst Crypto Patel noted on social media that the current structure mirrors a classic breakout-retest setup. The price tested this same support region before the prior explosive move. That historical parallel has drawn attention from traders watching the $0.86–$0.66 range closely.

According to the analysis, the $0.66 level acts as the key line for bullish continuation. A weekly close below that price would technically invalidate the bullish outlook. For now, XRP remains above that threshold while sentiment stays cautious.

The confluence of the multi-year breakout retest and the accumulation zone creates what analysts see as a strong demand area. Whether price holds or breaks lower from here will likely set the tone for the next major move.

On-Chain Data Shows Largest Realized Loss Spike Since November 2022

On-chain data from Santiment recorded $1.93 billion in weekly realized losses among XRP holders. This marks the largest spike of this kind since November 2022. The data point reflects a notable capitulation event among market participants.

Crypto Patel referenced the Santiment figures in a post on X, pointing out that extreme capitulation events have historically coincided with local price bottoms.

The November 2022 comparison is relevant because that period also preceded a recovery phase for many digital assets.

Realized losses occur when holders sell at prices lower than their cost basis. A spike of this size shows that a large portion of the market exited positions at a loss. Such behavior often marks a shift from weak hands to stronger holders.

Upside targets cited in the analysis range from $2 to $3, extending further to $5 and beyond $10 from the accumulation zone.

These levels represent potential resistance points if buyers step in and the price recovers. The next major confirmation will come from how XRP closes on a weekly basis near current levels.

Crypto World

Bitcoin May Rebound to $85K as CME Smart Money Slashes Shorts

Bitcoin (CRYPTO: BTC) has been signaling a potential bottom as CME futures positioning turns bullish again, a pattern that has preceded notable recoveries in prior cycles. In April 2025, non-commercial traders shifted from net short to net long, and a similar rotation is resurfacing in 2026, raising the odds of a renewed ascent in the weeks ahead. The price action sits near a key technical floor: the 200-week exponential moving average, a long-standing bear-market floor that has defined major drawdowns over the past decade; as of February, that metric hovered around $68,350, giving bulls a critical line in the sand. An oversold RSI adds to the narrative that selling pressure could be abating and a bottoming process may be underway.

Key takeaways

- The CFTC Commitment of Traders report shows non-commercial traders shifting from net short to net long, with net positions around -1,600 contracts after previously being +1,000.

- Historical analogs underscore potential upside: roughly 70% gains after similar unwind events in April 2025 and about 190% gains in 2023 under comparable conditions.

- Bitcoin’s defense of the 200-week EMA near $68,350 provides a structural support that could anchor a broader recovery rally.

- Analysts have discussed a path toward roughly $85,000 by around April if BTC clears the 100-week EMA and sustains momentum.

- Despite the favorable setup, the shift is described as a condition, not a signal; a deeper drawdown remains possible, echoing 2022’s dip below the 200-week EMA even amid oversold readings.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Positive. The unwind of net shorts into longs and the defense of the 200-week EMA support increase the odds of a near-term rebound toward higher targets, including the potential move to $85,000 if trends persist.

Market context: The current positioning sits within a broader framework of liquidity shifts and risk-on sentiment in crypto markets. Moving-average dynamics and derivatives positioning—especially around CME futures—turn into leading indicators for momentum, while macro and ETF flows continue to shape the medium-term trajectory.

Why it matters

The evolving futures posture matters because it signals a potential change in risk tolerance among large traders and institutions. If the pattern holds, it can attract additional buyers who monitor derivatives data and on-chain signals, possibly accelerating a shift from a prolonged drawdown to a more constructive price cycle. For traders, the combination of an oversold RSI, a tested floor at the 200-week EMA, and a history of outsized recoveries after similar unwind events creates a framework for positioning with defined risk and reward trade-offs.

From a market structure perspective, a sustained bounce would impact liquidity and confidence across the ecosystem, influencing miners, developers, and product teams building on Bitcoin. Observers will be watching for confirmation signals beyond the headline shifts—whether BTC can decisively clear resistance bands such as the 100-week EMA and how on-chain activity changes as price action improves. The dynamic underscores how derivatives and macro factors continue to interplay with price discovery in the longest-standing crypto market trend.

Analysts have highlighted the nuanced nature of these signals. Tom McClellan and others have noted that smart-money rotations can precede recoveries, but they do not guarantee them—echoing the caution that traders should maintain disciplined risk management as conditions evolve. The broader takeaway is a heightened awareness that the market may be shifting from a bear-market lull to a more data-driven recovery regime, dependent on how price action responds to macro inputs and on-chain signals in the weeks ahead. For those tracking the narrative, the emergence of a durable bottom would likely hinge on price staying above critical moving averages and on ongoing participation from institutional and professional traders.

What to watch next

- Next CFTC COT report release and the evolution of net futures positions on CME.

- BTC price action around the 200-week EMA (~$68,350) and a potential break above the 100-week EMA toward higher levels.

- The potential climb toward $85,000 by around April if bullish momentum persists.

- Improvements in the RSI alongside broader liquidity shifts and macro cues that could confirm a durable bottom.

Sources & verification

- CFTC Commitment of Traders (COT) report for bitcoin futures data: https://www.cftc.gov/dea/futures/deacmesf.htm

- Bitcoin historical price metric sees $122K ‘average return’ over 10 months: https://cointelegraph.com/news/bitcoin-historical-price-metric-122k-average-return-over-10-months

- Bitcoin whales sharks accumulate conditions breakout Santiment: https://cointelegraph.com/news/bitcoin-whale-sharks-accumulate-conditions-breakout-santiment

- Bitcoin crash 60k halfway point crypto bear market: https://cointelegraph.com/news/bitcoin-crash-60k-halfway-point-crypto-bear-market

Bitcoin’s rebound setup: futures positioning, EMA signals and the path to $85k

Bitcoin (CRYPTO: BTC) has been shaping a potential bottom as CME futures positioning turns bullish again, a pattern that has preceded notable recoveries in prior cycles. In April 2025, non-commercial traders shifted from net short to net long, and a similar rotation is resurfacing in 2026, raising the odds of a renewed ascent in the weeks ahead. The price action sits near a key technical floor: the 200-week exponential moving average, a long-standing bear-market floor that has defined major drawdowns over the past decade; as of February, that metric hovered around $68,350, giving bulls a critical line in the sand. An oversold RSI adds to the narrative that selling pressure could be abating and a bottoming process may be underway.

The shift in speculative positioning is detailed in the CFTC report, which shows net long exposure among non-commercial traders moving back into positive territory after a stretch of net shorts. This cadence — the turning of the tide in futures positioning — has historically preceded multi-week to multi-month reversals, particularly when price remains anchored to major moving averages like the 200-week EMA. In this cycle, the same dynamic is being cited as a setup for a potential run toward higher prices should bullish momentum sustain itself.

Analysts have pointed to historical precedents for context. In the months following similar unwind events, BTC has experienced meaningful gains: around 70% in the wake of the April 2025 shift, and on a prior cycle, as much as 190% in 2023 under comparable futures-market conditions. The emphasis on historical parallels suggests that, if the market can defend the 200-week EMA, a test of higher thresholds becomes plausible. The 200-week EMA has repeatedly served as a floor during deep drawdowns, reinforcing the idea that a durable bottom could form when prices hold above this line. The current setup also aligns with a broader pattern where smart-money participation has historically preceded price recoveries, though no outcome is guaranteed.

One caveat remains central to any bullish interpretation. McClellan and other observers emphasize that the smart-money rotation is a condition rather than a guarantee of higher prices. If the market fails to sustain the rebound, or if macro headwinds intensify, BTC could revisit downside scenarios seen in prior cycles, including a retest of lower levels or a deeper pullback. In the historical context of 2022, BTC dipped below the 200-week EMA despite oversold conditions, underscoring that downside risk can persist even when indicators suggest a potential bottom. As price hovers near the $68k area, traders are weighing the odds of a durable bottom against the risk of a renewed drawdown should momentum falter.

Market watchers are also mindful of how on-chain signals and macro factors interact with price action. A rebound would have implications for risk appetite across the ecosystem, potentially attracting institutions and retail traders alike who aim to capitalize on a multi-week uptrend. If the scenario unfolds as anticipated, a move toward the $85,000 region could materialize by spring, contingent on sustained buying pressure and continued participation from major market players. The narrative continues to be shaped by evolving data: if the RSI remains oversold but begins to turn higher, it could provide an additional layer of validation for bulls; conversely, a renewed wave of selling pressure would complicate the outlook and call into question the durability of any near-term gains.

Crypto World

XRP Ledger launches permissioned DEX, Strategy purchases $168M Bitcoin, Animoca secures Dubai license | Weekly recap

In this week’s edition of weekly recap, XRP Ledger activated a members-only decentralized exchange for regulated institutions, Strategy reported its fourth-largest Bitcoin purchase of the year and Animoca Brands obtained regulatory approval in Dubai. XRP Ledger enables institutional-only trading Strategy…

Crypto World

Everyday Investors Lost $4 Billion on Trump Meme Coins

President Donald Trump and First Lady Melania Trump launched their official cryptocurrency tokens more than a year ago. Today, those digital assets have wiped out $4.3 billion in retail wealth.

According to Cryptorank, 2 million everyday investors currently hold underwater positions, while 45 early-deployment wallets have gained a combined $1.2 billion. For every dollar insiders earned, retail investors lost $20.

Trump Coins Fall Up to 99% Amid Insider Windfall

As a result, the rapid decline of these tokens, alongside the significant gains of early insiders, has attracted much attention from industry observers.

Blockchain analytics firm CryptoRank found the TRUMP token has fallen 92% to $3.55 from its $75 all-time high. The MELANIA token dropped 99% to 11 cents from $13.05.

Although the broader cryptocurrency market shed over $1 trillion in value during the same period, researchers attributed the presidential tokens’ steeper declines to structural design rather than general market conditions.

On-chain forensics show anonymous accounts linked to the initial developers systematically drained decentralized liquidity pools.

In December 2025 alone, blockchain analyst EmberCN reported that the TRUMP token’s primary deployment address transferred $94 million in USDC into the cryptocurrency exchange Coinbase.

The developers utilized a strategy called single-sided liquidity provision on the decentralized platform Meteora.

Here, insiders deposited only TRUMP and MELANIA tokens without pairing them with dollar equivalents.

This strategy programmed the automated market maker to continuously sell their holdings to incoming retail buyers. The assets were then quietly converted into USDC

Furthermore, the threat of continued dilution looms heavily over the remaining holders.

CryptoRank data shows developers locked $2.7 billion in insider tokens inside smart contracts until 2028. Because this expiration date coincides perfectly with the end of Trump’s presidential term, it establishes a highly structured exit strategy.

This means that underwater retail holders will likely serve as exit liquidity for this final insider payout when those tokens finally hit the open market.

Crypto World

How decentralized AI is leveling the playing field

As AI infrastructure investments surge toward $300B in 2025 alone, fueled by mega-projects like the $500B Stargate initiative and hundreds of billions in Nvidia chip purchases, the decentralized AI space offers a compelling alternative to Big Tech’s centralized dominance. Now’s the time to invest in it.

In the rapidly evolving landscape of artificial intelligence, a seismic shift is underway, one that promises to redefine how we build, deploy and interact with AI. While centralized AI, dominated by tech giants like Amazon, Microsoft and Google, has driven remarkable progress, the recent shift toward agentic AI creates a unique opportunity for decentralized AI. It’s why the sector is poised to become the most exciting and critical space over the next few years.

With a global AI market projected to grow at a 35.9% CAGR through 2030, the stark valuation gap—$12 trillion for centralized AI enterprises versus ~$12 billion for decentralized AI—signals an unprecedented investment opportunity. Bridging this gap will not only yield massive financial returns but also reshape the ethical, technical and societal foundations of AI. Here’s why decentralized AI, powered by open-source principles and blockchain technology, is the future.

The valuation gap: a $15 trillion opportunity

Centralized AI, controlled by a handful of tech behemoths, commands a staggering $12 trillion~ in enterprise value, fueled by their dominance of nearly 70% of global cloud infrastructure. Yet, this concentration of power comes at a cost: stifled competition, ethical lapses, a loss of agency and control for both individual and corporate users and a one-size-fits-all approach that often stifles innovation.

Meanwhile, decentralized AI, valued at just $12 billion, is a nascent yet rapidly growing ecosystem. The blockchain AI market alone is projected to skyrocket from $6 billion in 2024 to $50 billion by 2030, reflecting a staggering 42.4% CAGR, and I don’t believe these figures will come close to the actual outcome, as the real numbers are likely to be much higher. This disparity isn’t a sign of weakness but a clarion call for investors. The next two to three years will see decentralized AI platforms—think Bittensor, Artificial Superintelligence Alliance,The Manifest Network, Venice.Ai or Morpheus—close this gap by democratizing access, fostering innovation and addressing the critical flaws of centralized systems.

And as the agentic AI age approaches, conjuring visions of hundreds of billions of independent AI agents executing instructions and transacting on behalf of individuals and companies, the case for decentralized AI becomes all the more urgent.

How can these agents be truly autonomous in a centralized model? How can we know –and prove– that they are living up to the legal definition of an “agent?” In other words, it’s a fiduciary with 100% responsibility to its owner, not to a third party (such as the platform on which it is hosted). The explosion of innovation this hyper-competitive, hyper-collaborative “Internet of AI agents” points to will only be possible if those agents are given the privacy and control they need to truly act independently. There is no “free market of ideas” without the actors in that market having their own free will. Over the past quarter, the explosion of localized AI agent frameworks built on open architectures, such as OpenClaw, has demonstrated how quickly sovereign AI can move when unshackled from centralized cloud control. By moving AI from corporate servers to local, peer-to-peer networks, users are shifting from “renting” intelligence to owning their own fully autonomous stacks. This structural re-architecture bypasses Big Tech gatekeepers, sparking a wave of innovation and privacy that centralized platforms can no longer control.

Privacy: empowering individuals over corporations

Centralized AI thrives on vast data lakes, often harvested with little regard for individual privacy. Big Tech’s history of squashing competition and skirting ethical boundaries, whether through monopolistic practices or opaque data usage, has eroded trust. Decentralized AI, by contrast, leverages blockchain’s cryptographic security to prioritize individual privacy. Users control their data, sharing it selectively via secure, transparent protocols. Platforms like Akash Network ensure that personal data remains encrypted and decentralized, preventing the kind of mass exploitation seen in centralized systems. This privacy-first approach isn’t just ethical; it’s a market differentiator in an era where 83% of enterprises are shifting workloads to private clouds to escape public cloud vulnerabilities.

But it’s not only individuals who are disadvantaged by the current centralized model. Businesses, institutions and entire industries have been forced to keep their most valuable datasets locked away. Sometimes for competitive reasons, sometimes because of fiduciary, custodial, or regulatory obligations, making sharing with centralized LLMs flatly impossible. The risk of inadvertently uploading trade secrets, proprietary R&D, sensitive customer records or regulated data into the black box of a hyperscaler has been a hard stop for meaningful enterprise-scale AI adoption.

But the deeper significance of this shift goes beyond unlocking long-dormant corporate data vaults; it redefines what enterprise trust in AI actually looks like. This is core to the mission of organizations like the Advanced AI Society, which argues that we are entering an era where enterprise customers will not merely prefer privacy-preserving infrastructure; they will demand something far stronger: proof of control. Not marketing promises, not compliance checklists, but cryptographic, verifiable assurance that the business, and only the business, controls its data, compute pathways, storage substrates, proprietary model weights and fine-tuned derivatives. In a world where AI touches regulated workflows, intellectual property and customer-sensitive operations, enterprises will insist on provable guarantees that nothing escapes their perimeter, and nothing can be silently copied, scraped or siphoned by a third party. Decentralized AI is the first architecture capable of delivering this new trust standard. It shifts the question from “Do we trust our vendor?” to “Can we verify our sovereignty?” and that inversion is the fault line upon which the next decade of enterprise AI adoption will hinge.

This is where decentralized AI and confidential computation transform the playing field. For the first time, companies can safely apply their private datasets to local or domain-specific model training without surrendering custody or visibility. Whether through encrypted compute, zero-knowledge architectures, or decentralized execution layers, the data never leaves their control. What was once an unbridgeable chasm of AI potential on one side and locked corporate data on the other can now finally be crossed.

And that unlock is enormous. Non-internet-platform companies represent the vast majority of the world’s valuable information: pharmaceutical research vaults, medical imaging archives, energy exploration data, financial pattern histories, supply chain telemetry, manufacturing QA logs and more. These troves have been sealed off from AI’s learning loops due to the inherent danger of centralized training. Decentralized, privacy-preserving AI flips that equation, turning previously inaccessible datasets into catalytic assets.

If AI is truly going to cure cancer, solve energy scarcity, overhaul logistics, accelerate drug discovery or reinvent scientific research, it cannot rely solely on whatever scraps of information Big Tech has scraped from the public internet. The great breakthroughs will come when the off-internet world—the real, industrial, scientific and institutional world—can safely contribute its data to AI models without risking exposure, theft or exploitation.

Decentralized AI is the architecture that makes that future possible. It doesn’t just empower individuals against corporations; it empowers every enterprise that has been forced to sit on the sidelines. And when those data vaults finally open on their own terms and under their own control, that will be the great unlock that propels AI from impressive novelty to civilization-scale engine.

Compute capacity: harnessing the world’s spare resources

Centralized AI’s Achilles’ heel is its insatiable demand for compute power, requiring dozens of gigawatts to train and run models like GPT-4 or Llama. Data centers strain global energy grids, raising environmental concerns and increasing consumer costs.

Decentralized AI flips this paradigm by tapping into spare compute capacity such as idle GPUs in homes, offices or even smartphones. Platforms like Targon (Bittensor Subnet 4), focused on making AI inference faster and cheaper, aggregate distributed resources to deliver scalable solutions. OAK Research highlights that Targon’s benchmarks reportedly outperform Web2 solutions in certain tasks, offering lower-cost inference with acceptable quality—a game-changer for commodification, scaling and downstream integrations. By efficiently using existing energy sources, decentralized AI aligns with a sustainable future while democratizing access to cutting-edge technology.

Blockchain as the backbone of trust and innovation

AI is moving to blockchains, and for good reason. Blockchain solves critical pain points that centralized systems sidestep or exacerbate:

- Training validation: Decentralized networks like Bittensor use consensus mechanisms (e.g., Yuma Consensus) to validate AI model outputs, ensuring quality without centralized gatekeepers.

- Copyright compliance: Blockchain’s immutable ledger tracks data and model provenance, addressing intellectual property disputes—a growing concern in AI.

- AI guardrails: Decentralized governance creates transparent, community-driven rules to prevent misuse.

- Value transactions: Tokens like those on Akash enable fair reward distribution for contributors, from miners to validators.

- Data security and privacy: Distributed storage and encryption protect sensitive data, unlike centralized clouds prone to breaches. These features empower a collaborative ecosystem where developers, users and enterprises co-create value, unhindered by Big Tech’s competitive stranglehold.

Open source: the catalyst for exponential growth

Decentralized AI thrives on open-source principles, fostering innovation at a pace centralized systems can’t match. Open-source models, like those on Bittensor for specialized tasks, invite global contributions and enable rapid iteration on use cases ranging from video analysis to predictive markets. Centralized AI, by contrast, locks models behind proprietary walls, limiting adaptability and accessibility. Open-source decentralized platforms not only accelerate innovation but also align with the growing demand for transparency in AI development—a demand Big Tech often ignores.

The investment case: why now?

The $12 trillion centralized AI market is a mature Goliath, but its growth is constrained by ethical scandals, energy demands and diminishing returns. Decentralized AI, though smaller, is a nimble $12B David, poised for exponential growth. Its ability to address privacy, leverage distributed computing and foster open innovation makes it a superior long-term bet. Investors who back platforms like Bittensor, Storj, or Akash now, while valuations are low, may stand to reap outsized returns as the blockchain AI market scales to $200 billion by 2030. The shift is already underway: enterprises are moving to private clouds, and communities are embracing decentralized governance.

The future is decentralized

Decentralized AI isn’t just a technological evolution; it’s a societal necessity. It counters Big Tech’s monopolistic grip, protects user privacy and harnesses global resources for sustainable growth. As platforms like Bittensor and Akash pioneer scalable compute markets, they pave the way for a world where AI serves the many, not the few. The delta in the valuation gap will close. Not because centralized AI will falter, but because decentralized AI’s potential is too vast to ignore. For investors, developers and visionaries, this is the most exciting space to watch, build and invest in over the next three years. The revolution is here, and it’s decentralized.

Crypto World

BlackRock’s ETHB Ethereum Staking ETF Set to Reshape Institutional Crypto Investment

TLDR:

- BlackRock plans to stake between 70% and 95% of ETH held within the ETHB trust for maximum yield.

- Investors receive 82% of staking rewards, while BlackRock and Coinbase split the remaining 18%.

- A liquidity sleeve of 5% to 30% in unstaked ETH ensures ETHB can meet investor redemptions smoothly.

- BlackRock’s spot Ethereum ETF ETHA surpassed $6 billion in assets, paving the way for the ETHB launch.

BlackRock’s upcoming iShares Staked Ethereum Trust, ticker ETHB, is drawing attention across institutional markets.

The world’s largest asset manager is preparing to launch a product that converts Ethereum into a yield-bearing asset.

With regulatory sentiment shifting in favor of staking-enabled ETFs, ETHB could mark a turning point for institutional crypto adoption in 2026.

BlackRock Structures ETHB Around Staking Yield and Liquidity

BlackRock plans to stake between 70% and 95% of the Ether held within the trust. This high staking ratio positions ETHB as a total-return product rather than a passive holding vehicle. The fund is designed to generate yield directly from Ethereum’s proof-of-stake network.

To support the 95% staking target, BlackRock will maintain a liquidity sleeve of 5% to 30% in unstaked ETH. This buffer allows the fund to meet investor redemptions even when most assets are locked in staking. It is a practical mechanism that balances yield optimization with operational flexibility.

On the revenue side, ETHB will share 82% of staking rewards with investors. The remaining 18% is divided between BlackRock and Coinbase, which serves as the fund’s prime execution agent. The trust also carries a 0.25% sponsor fee on top of the staking reward split.

An SEC filing dated December 17 confirmed that a BlackRock seed capital investor purchased 4,000 shares at $0.25 each.

This initial capital formation signals that preparations for the fund are well underway, though no official launch date has been announced yet.

Institutional Ethereum Adoption Expands Despite Market Headwinds

BlackRock’s move into Ethereum staking follows the strong performance of its spot Ethereum ETF, ETHA. That fund has already gathered over $6 billion in assets, demonstrating real institutional demand for Ethereum-based products. ETHB builds on that foundation by adding a yield component.

As Arkham noted on social media, ETHB could turn ETH from a passive holding into a yield-generating institutional product.

BlackRock currently ranks as the fourth-largest entity tracked on the Arkham Intel Platform. Its on-chain holdings exceeded $57 billion as of February 2026.

Traders monitoring ETHB should account for T+1 settlement in traditional finance. On-chain evidence of BlackRock’s ETH purchases typically appears one business day after the initial trade.

This lag is a standard feature of conventional financial infrastructure interacting with blockchain settlement.

Even as Ethereum’s price has dipped below $2,000 during the current market downturn, institutional interest in decentralized infrastructure remains active.

The expected launch of ETHB in the first half of 2026 reflects a broader regulatory shift that now permits staking rewards within exchange-traded products. That change had previously been blocked under earlier SEC guidance.

Crypto World

Vitalik’s $6.95M ETH Move: Personal Agenda or Ethereum Foundation Strategy?

TLDR:

- Vitalik Buterin withdrew 3,500 ETH worth $6.95M from Aave, resuming sales after a two-week pause.

- The Ethereum Foundation entered a period of mild austerity to balance development goals and long-term sustainability.

- Buterin personally absorbed Foundation-level responsibilities, funding open-source software, hardware, and biotech projects.

- Community observers question whether Buterin’s personal ETH-funded projects align with the Foundation’s core protocol mandate.

Vitalik Buterin’s recent withdrawal of 3,500 ETH, valued at approximately $6.95 million, from lending protocol Aave has drawn fresh scrutiny.

On-chain analytics account Lookonchain flagged the transaction, noting that 571 ETH had already been sold shortly after.

Buterin followed the activity with a lengthy public post explaining his plans. Still, the line between a personal initiative and an Ethereum Foundation strategy remains worth examining closely.

A Personal Undertaking With Foundation-Level Scope

Buterin made clear that the Ethereum Foundation is currently entering a period of reduced spending. The organization aims to balance an aggressive development roadmap with long-term financial sustainability. These two goals sit at the center of what he described as “mild austerity.”

Within that context, Buterin stated that he is personally absorbing responsibilities previously handled as the Foundation’s special projects.

This is a notable shift. It moves significant decision-making and funding away from the institutional structure and into his individual hands.

The 16,384 ETH he disclosed withdrawing will fund a broad range of open-source technology efforts. These cover areas include finance, communication, governance, operating systems, secure hardware, and biotech. The scale of these goals is far larger than what most would consider a purely personal project.

This creates a reasonable question for observers. If the Foundation is tightening its budget, and Buterin is personally funding work that falls within the Foundation’s stated mission, where does one end and the other begin? That distinction has not been fully addressed in his public statement.

Community Scrutiny Follows the On-Chain Activity

Lookonchain reported that Buterin resumed selling ETH after a two-week pause. At the time of the report, he had already moved 571 ETH worth around $1.13 million into the market. The timing, coming alongside his public explanation, drew significant attention from crypto observers.

Buterin referenced a range of existing projects to support his stated vision. These include the Vensa open-silicon initiative, the uCritter platform featuring ZK and FHE privacy tools, air-quality monitoring work, and encrypted-messaging donations. Together, they paint a consistent picture of where his focus is directed.

However, some in the community have noted that these projects span well beyond Ethereum’s core protocol development.

Supporting biotech, secure hardware, and operating systems through personal ETH sales raises questions about how these efforts connect to the Foundation’s primary mandate.

Buterin addressed this indirectly by drawing a firm line between genuine openness and commercial openness. He stated his support is for technology that is “actually open” and verifiably working for users, not systems locked behind paid APIs.

Whether that vision is a personal philosophy or a new institutional direction for Ethereum remains an open question for the community to watch.

Crypto World

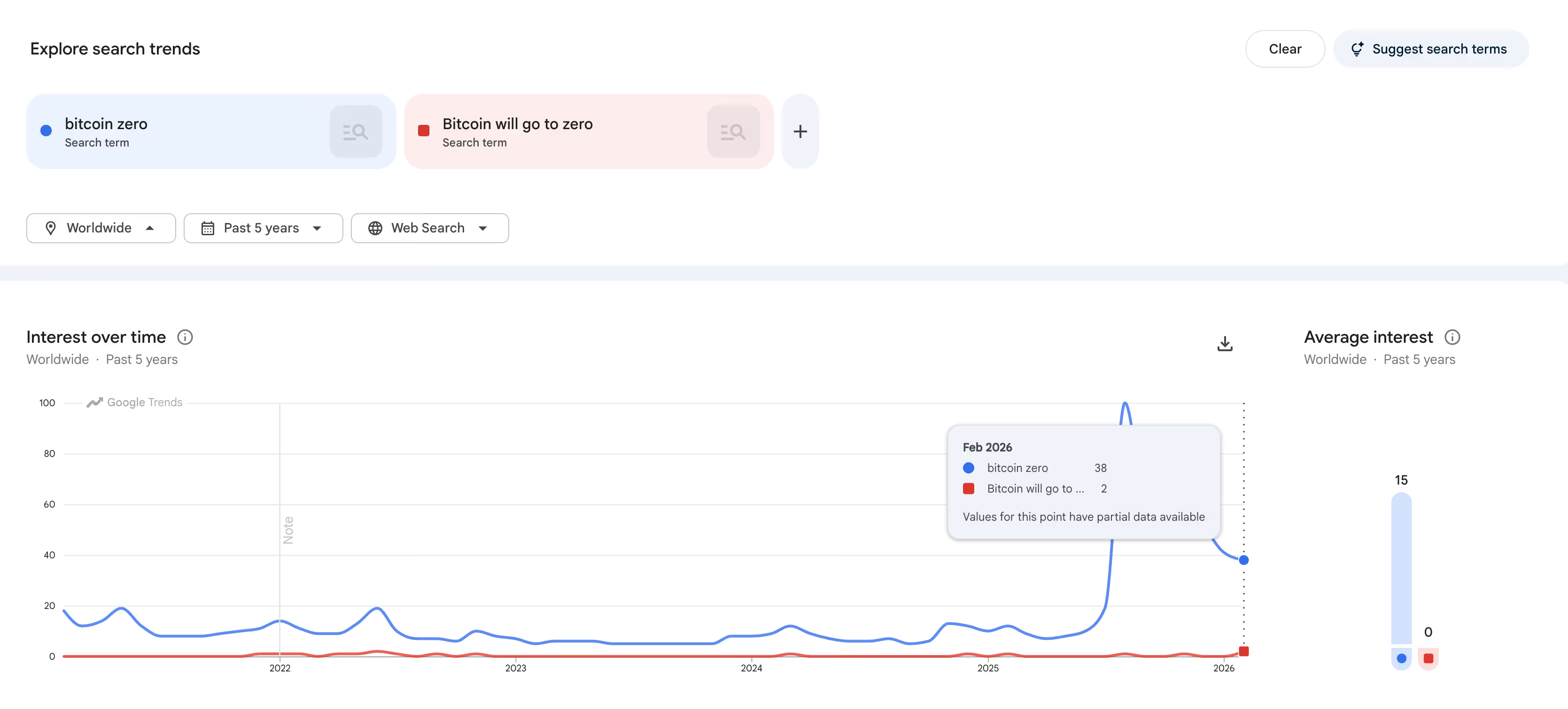

‘Bitcoin to Zero’ Hits Peak Search Interest in the U.S., yet a Clean Bottom Signal Remains Elusive

TLDR:

- U.S. searches for ‘bitcoin to zero’ hit a Google Trends score of 100 in February 2026, a record high.

- Global searches for the same term peaked in August 2025 and have since dropped to as low as 38 by February.

- Similar U.S. search spikes in 2021 and 2022 coincided with local Bitcoin price bottoms, but context has shifted.

- Google Trends measures relative interest, not raw volume, making the current spike harder to compare with past cycles.

‘Bitcoin to zero‘ searches in the U.S. surged to a record high in February 2026, as BTC slid toward $60,000. Google Trends data showed the term scored 100 on its relative interest scale this month.

The move followed a 50%-plus drawdown from Bitcoin’s October all-time high. Global searches for the same term, however, have been falling since peaking in August.

That split between domestic and worldwide data keeps the bottom signal mixed rather than conclusive.

U.S. Searches Hit Record Highs as Domestic Fear Builds

‘Bitcoin to zero’ searches in the U.S. reached their highest recorded level in February on Google Trends. The spike coincided directly with Bitcoin’s sharp decline toward the $60,000 price level.

U.S.-specific catalysts appear to be amplifying retail anxiety more than broader global sentiment. Tariff escalation, Iran tensions, and a domestic equity risk-off rotation have all weighed on investor mood.

Globally, the same search term peaked at a score of 100 back in August 2025. By February 2026, worldwide interest in the term had cooled to as low as 38.

That contrast between U.S. and global data points to fear that is regionally concentrated. Holders in Asia and Europe are navigating Bitcoin’s drawdown within an entirely different news environment.

Historically, similar U.S. search spikes in 2021 and 2022 aligned with local price bottoms. Traders familiar with those cycles have often treated elevated fear searches as a contrarian buy indicator.

However, the current environment differs from those earlier periods in meaningful ways. Bitcoin’s mainstream visibility and retail base have expanded considerably since then.

The global cooling trend complicates any straightforward bottom call based on U.S. searches alone. When worldwide fear is declining while domestic fear is rising, the signal lacks international confirmation.

That does not eliminate the possibility of a local reversal, but it reduces conviction. A mixed bottom signal requires more evidence before the case becomes compelling.

Methodology and Market Context Keep the Signal Inconclusive

Google Trends measures relative interest on a scale of 0 to 100, not raw search volume. A score of 100 simply means the term reached its own peak within the selected time window.

It does not confirm that more people searched the term in absolute terms compared to 2022. Against a much larger Bitcoin user base today, that distinction carries real analytical weight.

Bitcoin’s U.S. retail audience has grown substantially since the last major bear market cycle. A relative spike measured against a higher baseline does not carry the same weight as before.

Retail fear is clearly elevated, but elevated fear alone does not guarantee a trend reversal. Analysts recommend pairing this data with on-chain metrics before drawing firm conclusions.

The absence of a matching global fear spike keeps the contrarian case incomplete as of February. U.S. retail anxiety is real and measurable, but it remains a regional rather than a universal signal.

Prior cycles where searches and price bottoms aligned featured more synchronized global sentiment. That synchronization is currently missing from the data.

The ‘bitcoin to zero’ search spike does confirm that U.S. retail pressure is building. Whether that pressure marks a durable floor or simply reflects localized panic remains unclear.

Market participants continue watching for additional on-chain and global sentiment confirmation. Until those signals align, the bottom call stays mixed.

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports6 days ago

Sports6 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics12 hours ago

Politics12 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech6 days ago

Tech6 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 days ago

Sports4 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business6 hours ago

Business6 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 hours ago

Business2 hours agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Tech1 hour ago

Tech1 hour agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Politics4 hours ago

Politics4 hours agoMaine has a long track record of electing moderates. Enter Graham Platner.