Crypto World

Can Artificial Intelligence Predict Crypto Prices?

As cryptocurrency markets continue to grow in size and complexity, many investors are asking whether AI can actually predict crypto prices with reliable accuracy.

Unlike traditional markets, cryptocurrencies operate around the clock, driven by human behavior, technological change, and global events.

This constant motion has made prediction nearly impossible for conventional models, but new AI-driven systems are beginning to change that reality.

The relationship between artificial intelligence and cryptocurrency represents one of the most innovative intersections in modern technology. AI’s strength lies in its ability to analyze enormous datasets in real time, identify patterns that humans cannot perceive, and transform raw information into actionable insights.

How AI Understands the Crypto Market?

Artificial intelligence uses complex models built through machine learning, a process that allows computers to learn from data, detect trends, and adapt over time. Through this process, AI can recognize how different market signals interact and evolve.

Artificial intelligence uses complex models built through machine learning, a process that allows computers to learn from data, detect trends, and adapt over time. Through this process, AI can recognize how different market signals interact and evolve.

For example, when the trading volume of a coin rises sharply while positive news spreads across major media platforms, AI models may detect a possible short-term price increase. Similarly, they can interpret negative indicators such as declining liquidity, whale sell-offs, or sharp drops in exchange inflows as early warnings of potential downturns.

By constantly comparing historical data with current conditions, AI creates improves its predictive accuracy with every new dataset.

AI-driven crypto trading bots employ several techniques to generate these predictions:

- Supervised learningtrains models using labeled data, such as past prices and market outcomes.

- Unsupervised learningexplores hidden correlations between datasets that may seem unrelated, for instance, how Twitter sentiment and blockchain congestion influence price volatility.

- Reinforcement learning, on the other hand, allows bots to learn by experience, adjusting their strategies through trial and error until they achieve optimal results.

How Can Artificial Intelligence Predict Crypto Prices More Accurately?

Data as the Core of Predictive Power

In crypto forecasting, data is everything. The more comprehensive and diverse the data sources are, the stronger the predictions become. AI systems collect and analyze multiple types of information:

- Market data: Real-time prices, trading volumes, and order books provide insights into short-term momentum.

- Blockchain data: Wallet activity, transaction frequency, and token distribution reveal network health and investor movement.

- Sentiment data: Natural language processing (NLP) tools evaluate the tone of news articles, social media posts, and forum discussions to gauge the emotional direction of the market.

- Global context: Economic indicators, government regulations, and international events often influence investor confidence in digital assets.

By combining all these factors, AI creates a multi-layered perspective of the market. For instance, a sudden increase in positive sentiment on social platforms, combined with rising transaction volume and low exchange reserves, can suggest a bullish phase.

On the contrary, when the data shows declining engagement and increasing liquidation events, it may signal a period of correction.

Unlike static models, AI constantly updates its forecasts as new information appears. This flexibility allows it to respond instantly to market shocks. It is something that even the most skilled human trader cannot achieve at the same speed or scale.

Advantages Over Traditional Forecasting

The greatest advantage of AI lies in its ability to process complexity without bias. Human traders often make emotional decisions under pressure, while AI operates purely on evidence. It can evaluate millions of variables simultaneously, providing a level of accuracy and objectivity that manual analysis cannot match.

The greatest advantage of AI lies in its ability to process complexity without bias. Human traders often make emotional decisions under pressure, while AI operates purely on evidence. It can evaluate millions of variables simultaneously, providing a level of accuracy and objectivity that manual analysis cannot match.

Another benefit is its continuous learning capability. Each inaccurate prediction becomes a lesson that sharpens future performance. Moreover, AI can identify emerging market trends far earlier than conventional models, offering traders a valuable competitive edge.

At the same time, AI supports transparency and data democratization. Retail investors now have access to tools once reserved for institutional players. By integrating AI-based bots and analytical dashboards, even smaller traders can use predictive insights that were previously available only to large financial firms.

The Limits of AI in Crypto Forecasting

Despite its impressive abilities, AI is not an oracle. Cryptocurrency markets remain influenced by unpredictable factors, geopolitical events, sudden regulatory changes, or emotional reactions from large investor groups. These “black swan” events often defy data-based logic, making any system’s prediction uncertain.

Furthermore, AI’s performance depends on the quality of the data it receives. If the input data is biased, incomplete, or manipulated, the predictions will be flawed. This is why human supervision remains essential. Traders and analysts must interpret AI results critically, using them as a decision-making tool rather than a substitute for judgment.

Another challenge lies in market manipulation. Some investors intentionally create false signals spreading misinformation or executing large coordinated trades to trigger reactions. While AI can filter noise more effectively than humans, it is still susceptible to deceptive data patterns.

The Future of AI-Driven Crypto Prediction

The collaboration between AI and blockchain technology is only beginning. As computational power grows and algorithms become more sophisticated, predictive accuracy will continue to improve.

The collaboration between AI and blockchain technology is only beginning. As computational power grows and algorithms become more sophisticated, predictive accuracy will continue to improve.

Future AI systems may integrate quantum computing, decentralized analytics, and blockchain transparency, offering nearly real-time insights into global market sentiment.

The next generation of trading bots will likely operate autonomously, learning directly from blockchain data and executing trades based on multidimensional risk analysis. However, the human role will not disappear, instead, it will evolve.

Traders will act as strategic supervisors, guiding and interpreting AI outputs to align with ethical, legal, and investment objectives.

In addition, regulatory frameworks will play a crucial role. As governments introduce clearer policies for digital assets, AI models will have access to more structured data, reducing uncertainty and improving reliability.

What AI Teaches Us About Crypto?

Artificial intelligence has made cryptocurrency markets more understandable. By transforming chaos into measurable patterns, AI helps investors see probabilities where there was once only uncertainty.

Ultimately, AI’s real contribution lies not in perfect prediction, but in understanding. It allows traders to recognize how global events, public sentiment, and digital infrastructure interact to shape the market’s direction. In doing so, it turns speculation into informed strategy.

So, can AI predict crypto prices? Not with absolute certainty, but it brings us closer to that goal than ever before. And perhaps that progress, rather than perfection, is what truly defines the future of intelligent trading.

Crypto World

Crypto Exchanges Emerge as TradFi Venues amid Tokenized Commodities Boom

Demand for tokenized commodities is increasing as investors look for safe-haven exposure through crypto-native markets that trade around the clock, rather than only during traditional market hours.

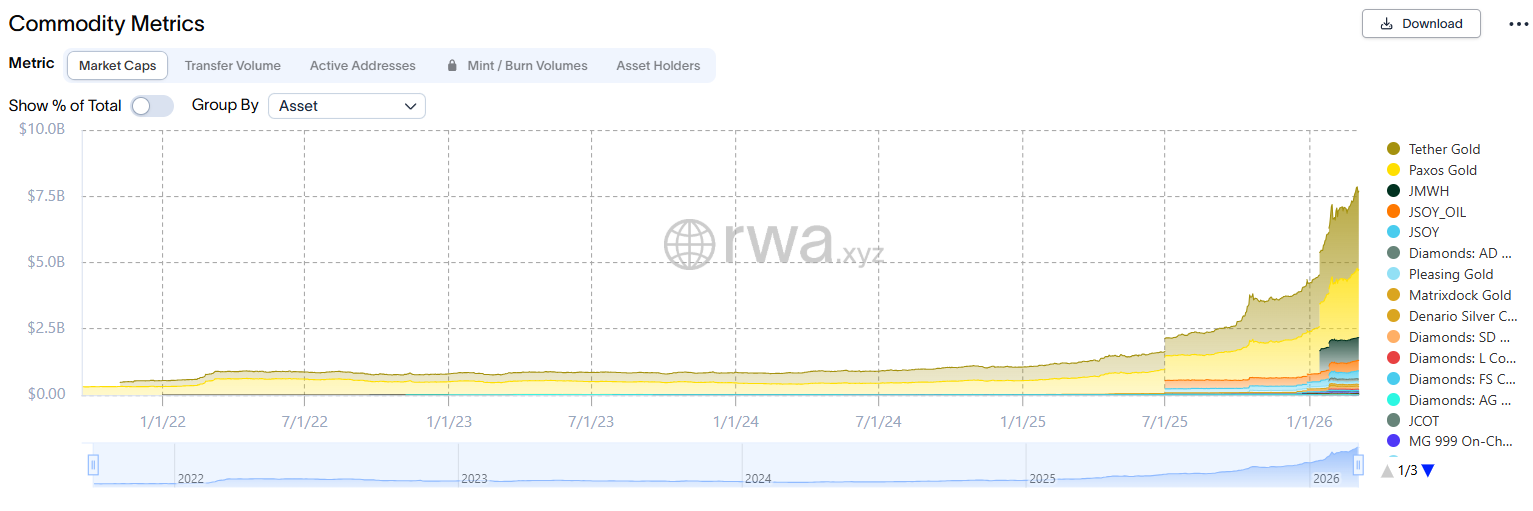

The tokenized commodities sector grew 10% over the past month to $7.69 billion in cumulative market capitalization, while holders increased by 5.8% to 189,390, according to data aggregator RWA.xyz.

Tether Gold (XAUT) makes up the lion’s share with $2.96 billion of onchain commodities, while Paxos Gold (PAXG) is second with $2.56 billion.

The growth underscores how real-world assets are becoming a larger part of crypto market activity. Tokenized commodities allow investors to gain 24/7 blockchain-based exposure to assets including gold and silver, while offering the ability to transfer and trade them through digital asset infrastructure.

Related: Crypto’s yield gap with TradFi narrows as staking, RWAs surge

Crypto exchanges emerge as new TradFi venues

At the same time, crypto exchanges are drawing more interest from traders seeking exposure to traditional assets through derivatives.

This trend is particularly visible during strong price trend periods such as the recent gold and silver rallies, according to blockchain data platform CryptoQuant.

“Activity has spiked during periods of strong precious-metal price momentum,” wrote CryptoQuant’s head of research, Julio Moreno, in a research report published on Tuesday.

He added that daily volume was overwhelmingly concentrated in gold and silver contracts, which reached $3.77 billion and $3.75 billion, respectively, on Tuesday.

Related: US financial markets ‘poised to move on-chain’ amid DTCC tokenization greenlight

Binance perpetual trading activity on the rise

Trading in those products has expanded quickly. CryptoQuant said Binance’s TradFi perpetual futures have generated more than $130 billion in cumulative trading volume and about 90 million trades since launching in January.

CryptoQuant attributed the rising demand for tokenized commodities and the precious metal rally to tariff-related uncertainty, higher interest rates and stronger safe-haven demand.

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?

Crypto World

US Jobs Miss Fails to Stop Bitcoin Erasing Its $74,000 Breakout Attempt

Bitcoin (BTC) slipped under $70,000 around Friday’s Wall Street open as weak US employment data failed to boost risk assets.

Key points:

-

Bitcoin and stocks slump in reaction to a surprise downturn in US nonfarm payrolls.

-

Fed interest-rate odds stay hawkish, with markets seeing just one cut this year.

-

BTC price action “round trips” its latest breakout attempt, continuing a 2026 trend.

Bitcoin ignores “clearly weakening” labor market

Data from TradingView showed daily BTC price downside passing 3% to hit $68,176 on Bitstamp.

US nonfarm payrolls data disappointed across the board, showing that the labor market was more under pressure than expected.

The economy lost 92,000 jobs in February, per data from the Bureau of Labor Statistics (BLS), in contrast to the predicted 58,000 increase. The unemployment rate also came in higher at 4.4%.

The print contrasted with that from January, which delivered surprisingly strong employment results.

“This marks just the 2nd monthly job loss since the 2020 pandemic,” trading resource The Kobeissi Letter wrote in a response on X.

“The US labor market is clearly weakening.”

Labor-market strain traditionally signals a tailwind for crypto and risk assets as it implies a greater chance of interest-rate cuts.

The latest data from CME Group’s FedWatch Tool nonetheless showed little chance of the Federal Reserve doing so at its next meeting on March 18. Markets also saw just one rate cut in store for 2026.

The employment result thus failed to boost risk assets, with crypto following US stocks lower. At the time of writing, the S&P 500 and Nasdaq Composite Index were down 1.5% and 1.3%, respectively.

Only gold gained, with the precious metal up 1.5% to $5,155 per ounce.

BTC price comes full circle from monthly highs

Among Bitcoin traders, frustration was apparent as BTC/USD failed to cement a breakout from its narrow local trading range.

Related: Bitcoin ‘anomalous’ outflow sees 32K BTC leave exchanges in a single day

“Deviations above the Range High keep getting sold,” J. A. Maartunn, a contributor to onchain analytics platform CryptoQuant, commented.

Maartunn flagged three such failed breakouts in recent months, with each ending up as a deviation before a retreat lower.

“The latest deviation just occurred around $71K. If history repeats, this level may again act as a trap for late longs,” he warned.

Price returned to interact with key long-term levels, notably the 200-week exponential moving average (EMA) and the old all-time high from 2021.

“Looks like $BTC is round tripping the range…again,” Keith Alan, cofounder of trading resource Material Indicators, added.

Earlier, Cointelegraph reported on existing expectations of new lows coming for Bitcoin next, despite its run to monthly highs.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

How private credit cracks at BlackRock, Blue Owl could hit crypto and DeFi markets

Cracks in the global private credit market are rattling investors, raising concerns the stress could spill into crypto markets.

Bloomberg reported Friday that BlackRock’s $26 billion private credit fund has begun limiting withdrawals amid rising redemption requests. The move follows similar stress at Blue Owl, which sold $1.4 billion in loans last month to meet withdrawals and reportedly has exposure to a collapsed U.K. property lender.

Shares of major asset managers including BlackRock (BLK), Apollo Global Management (APO), Ares Management (ARES) and KKR slid 4%-6% Friday, extending their 2026 rout.

Read more: Blue Owl liquidity crisis has investors bracing for 2008-style fallout

If redemption pressure forces private credit funds to unwind positions, it could trigger broader deleveraging across asset classes that could ripple through digital assets including bitcoin , Andreja Cobeljic, head of derivatives trading at Swiss crypto bank AMINA Bank warned in an emailed note.

Credit stress meets energy shock

U.S. banks extended nearly $300 billion in loans to private credit providers as of mid-2025 and another $285 billion to private equity funds, Cobeljic wrote, carrying risks that credit woes could extend to the banking sector

“In isolation this would be manageable,” he said. “But emerging in the middle of a broader global deleveraging event, alongside an energy shock and collapsing rate-cut expectations, it is a different conversation.”

“For risk assets, including crypto, a disorderly unwind here would represent a significant second-order shock that current pricing does not reflect,” he said.

Contagion to tokenized asset markets

A second channel of credit risk could surface directly on blockchain rails.

Tokenized private credit products — loans and funds packaged and issued on public blockchains as tokens — have grown quickly as part of the broader real-world asset (RWA) trend. According to data from rwa.xyz, the on-chain private credit market now stands at just under $5 billion. That remains tiny compared with the roughly $3.5 trillion global private credit market in 2025, estimated by the Alternative Credit Council.

But the growing presence of these assets inside decentralized finance (DeFi) means stress in the underlying loans could ripple directly to crypto markets.

“Institutions are entering crypto, but often with products that even degens and DeFi natives don’t fully grasp,” said Teddy Pornprinya, co-founder of real-world asset protocol Plume.

Real-world credit products can carry complex risks that are not always obvious to crypto investors, he said, including volatile net asset value swings and headline yields that don’t fully reflect fees or credit risk.

A recent episode shows how off-chain credit stress can spill into DeFi.

According to a report by risk advisory firm Chaos Labs, the 2025 bankruptcy of auto-parts supplier First Brands Group affected a private credit strategy run by Fasanara Capital. A tokenized version of the strategy, mF-ONE, had been issued on the Midas RWA platform and used as collateral for borrowing on the Morpho protocol.

When the underlying fund marked down exposure tied to the bankruptcy, the token’s net asset value slipped about 2%, pushing highly leveraged borrowers close to liquidation and tightening liquidity on the platform. Lenders ultimately avoided losses, but the episode highlighted how tokenized private credit used as DeFi collateral can transmit traditional credit stress into on-chain markets.

Crypto World

Russia Considers Separate Stablecoin Law Amid Crypto Regulation Reforms

Key Insights

- Russia separate stablecoin law may create clear legal status for fiat-pegged tokens within the national financial system.

- Lawmakers may restrict trading on unlicensed crypto platforms under a broader exchange regulation bill.

- A ruble-pegged stablecoin approved for trade highlights Russia’s focus on cross-border blockchain payments.

Russia Plans Dedicated Stablecoin Regulation

The Russia separate stablecoin law proposal forms part of the country’s broader cryptocurrency regulatory reforms. The Ministry of Finance is considering legislation that will address fiat-pegged digital assets separately from exchange regulations.

BREAKING: 🇷🇺 Russia says it’s working on a stablecoin bill. pic.twitter.com/oEeF01Z3kg

— Crypto India (@CryptooIndia) March 5, 2026

Officials believe stablecoins serve a different function than decentralized cryptocurrencies. As a result, regulators prefer a legal framework designed specifically for these assets. The proposed Russia separate stablecoin law would define how stablecoins operate within the national financial system.

Alexey Yakovlev, director of the ministry’s Department of Financial Policy, highlighted the potential of these assets. He noted that stablecoins could play a significant role in financial infrastructure and global transactions.

At present, Russian law does not clearly define stablecoins. The planned legislation aims to clarify their legal status and regulatory classification.

Crypto Exchange Regulation Moves Forward

The Russia separate stablecoin law debate comes after advancements on wider cryptocurrency regulation. Legislators are still working on a bill that will govern crypto trading platforms nationwide.

The proposed exchange law may prohibit Russian citizens from trading digital assets on platforms that lack official permits. Regulators desire to enhance regulation and minimize risk in the crypto market.

With the proposed structure, the transactions might be conducted in the regulated institutions like banks, brokers, and stock exchanges. With the help of this structure, compliance and transparency will be enhanced.

Reports indicate lawmakers may present the exchange legislation to the State Duma during the spring session. If approved, the rules could take effect as early as July.

Stablecoins and Cross-Border Payments

Interest in the Russia separate stablecoin law reflects the country’s focus on international settlements. Policymakers view stablecoins as potential tools for cross-border financial transactions.

The Bank of Russia introduced a regulatory category called foreign digital rights. This type can involve cryptocurrencies and stablecoins that can be used in particular international applications.

An overseas trade stablecoin named A7A5 was authorized as a ruble-pegged stablecoin. Authorities approved the asset for cross-border settlements that meet regulatory requirements.

Negotiations among the central bank, the finance ministry and industry players are underway. The regulators want to come up with balanced rules to ensure financial stability and innovation.

The proposal of the Russia separate stablecoin law is indicative of the much bigger plan to modernize financial infrastructure. Well-defined policies may boost the trust in payment systems based on blockchains.

Crypto World

Binance Slams US Senate Probe over Iran as Based on Defamatory Reports

Cryptocurrency exchange Binance has officially responded to a February inquiry launched by a group of 11 US senators, largely denying facilitating transactions to Iranian entities and the narrative around employees’ terminations.

In a Friday letter to US Senators Richard Blumenthal and Ron Johnson of the Permanent Subcommittee on Investigations, Binance said that an inquiry launched in February into the exchange’s activities was based on reports that were “demonstrably false, unsupported by credible evidence, and defamatory in several material respects.”

The exchange referred to reporting from the Wall Street Journal, New York Times and Fortune, which said that Binance fired employees that reported the company had facilitated more than $1 billion in crypto transactions to entities connected to Iran, called Hexa Whale and Blessed Trust. According to Binance, the company launched an investigation in response to law enforcement inquiries, resulting in the removal of the entities from the platform.

“[T]o our knowledge, no Binance account transacted directly with an Iran-based entity,” said that exchange.

In response to the reports’ claims about the dismissal of employees who brought the investigation to the attention of executives, Binance said that some of them resigned, while another was terminated for disclosing internal user information:

“Binance takes seriously the privacy of its users and has no tolerance for employees violating that trust by sharing internal information externally. Binance also closely follows its labor and employment policies. This employment action was no different.”

The letter from the 11 senators to Treasury Secretary Scott Bessent and Attorney General Pamela Bondi asked for a response by March 13 as to whether the government officials intended to investigate Binance. As of Friday, neither Bessent nor Bondi had publicly commented on the matter.

Related: SEC ends case against Justin Sun with $10M settlement

In 2023, Binance reached a settlement with US authorities, agreeing to pay $4.3 billion to resolve violations of sanctions and Anti-Money-Laundering laws. Then-CEO Changpeng “CZ” Zhao stepped down as part of the deal and pleaded guilty to one felony charge, which later resulted in a four-month prison term.

Trump-Binance ties under scrutiny after presidential pardon

Zhao pleaded guilty and served prison time, under an agreement that he not be permitted to assume another leadership role at Binance. However, in October, US President Donald Trump issued a pardon for CZ, which legally opened the door to his return to the exchange. Zhao has publicly ruled out going back as CEO.

Before Trump announced the pardon, the administration’s ties to Binance were already under scrutiny from many lawmakers after a UAE-based company, MGX, used the USD1 stablecoin issued by World Liberty Financial to settle a $2 billion investment in the exchange. Many lawmakers have labeled the deal as corruption given that World Liberty Financial is backed by the president and his sons.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Kraken Fed Access, MARA Bitcoin Strategy, NYSE Tokenization Push

The digital asset sector took another step toward integration with traditional finance this week when Kraken secured direct access to the US Federal Reserve’s payment rails — a milestone that could reshape how crypto companies move dollars. Direct access to the Fed’s payment infrastructure could give the crypto exchange greater control over dollar flows while reducing reliance on banking partners, a longstanding challenge for the industry.

It also signals that crypto infrastructure is continuing to mature and integrate with the traditional banking system despite broader industry headwinds and a months-long market correction — one of the key themes in this week’s Crypto Biz newsletter.

Meanwhile, Bitcoin (BTC) miner MARA Holdings pushed back on speculation that it plans to dump its BTC reserves, clarifying that recent regulatory filings simply expand its treasury flexibility. Bitcoin rewards company Fold strengthened its balance sheet by eliminating $66 million in convertible debt, while analysts say a proposed New York Stock Exchange tokenization framework could open the door to greater institutional participation.

Kraken wins Fed payment access in crypto industry first

Kraken’s banking arm has secured a limited-purpose master account with the Kansas City Federal Reserve Bank, granting it direct access to the US central bank’s payment infrastructure, a first for a crypto-native company.

In a Wednesday announcement, Kraken Financial confirmed it can now use the Fed’s Fedwire system, a real-time gross settlement network that allows financial institutions to send and receive payments with the Fed. The access allows Kraken to process US dollar payments directly with the central bank instead of relying on intermediary banks.

The approval is initially granted for one year, with restrictions tailored to Kraken’s business model and risk profile.

“With a Federal Reserve master account, we can operate not as a peripheral participant in the US banking system, but as a directly connected financial institution,” said Arjun Sethi, Kraken’s co-CEO.

MARA clarifies Bitcoin treasury strategy after sell-off concerns

Bitcoin mining company MARA Holdings said recent disclosures about selling Bitcoin from its balance sheet were intended to signal flexibility — not an imminent liquidation of its holdings.

Vice president Robert Samuels said the company’s latest Form 10-K filing with the US Securities and Exchange Commission clarifies that MARA expanded its treasury strategy to allow potential Bitcoin sales if market conditions warrant. The policy also allows the company to purchase additional BTC periodically.

Some members of the crypto community interpreted the filing as authorization to sell MARA’s more than 53,000 BTC treasury, an interpretation Samuels called “factually incorrect.”

Bitcoin-focused Fold eliminates $66M in convertible debt

Bitcoin financial services company Fold said it eliminated $66.3 million in convertible debt, removing a potential source of balance-sheet pressure and shareholder dilution ahead of launching a new Bitcoin-rewards credit card.

In a recent disclosure, Fold said it retired two outstanding convertible notes — debt instruments that can be converted into equity — thereby reducing the risk of issuing additional shares in the future. The move also freed 521 Bitcoin that had previously been pledged as collateral for the debt.

The stronger balance sheet could support the rollout of Fold’s planned Bitcoin rewards credit card, which will allow users to earn BTC on everyday purchases through the Visa network.

Fold went public on the Nasdaq in February 2025 through a SPAC merger with FTAC Emerald Acquisition, becoming one of the first publicly traded Bitcoin-focused financial services companies.

TD Securities says NYSE tokenization push could attract institutions

Tokenization efforts tied to the New York Stock Exchange could accelerate institutional adoption of blockchain-based markets, according to TD Securities strategist Reid Noch.

The NYSE recently proposed tokenizing equities through an alternative trading system that would enable 24-hour trading and near-instant settlement for tokenized stocks and exchange-traded funds while operating under existing market rules.

Noch said the model resembles a “2.0” evolution of market infrastructure: Custody and settlement will remain with the Depository Trust & Clearing Corporation (DTCC), while trading will continue to follow National Best Bid and Offer (NBBO) requirements.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

Crypto World

Tether’s $7.5M bet on Bitcoin payments using USDT

As majors sell off, Tether quietly doubles down on turning Bitcoin into a $-settlement backbone via Lightning-native USDT rails.

Summary

- Tether co-leads a $7.5M round in Utexo to enable native USDT settlement on Bitcoin and Lightning.

- Utexo promises fixed, pre-confirmable fees, atomic settlement and stronger privacy anchored to Bitcoin’s security.

- Move comes as BTC trades near $68,600 and majors slide 3–5%, underscoring demand for resilient $ liquidity.

Tether has taken a calculated step to bind USDT more tightly to Bitcoin’s base layer, co-leading a $7.5M financing round for Utexo, a startup building infrastructure for native USDT settlement directly on the Bitcoin network and via the Lightning Network. While stablecoins already flow across multiple chains, this effort explicitly targets Bitcoin as a primary $-clearing rail at a time when the broader market is wobbling and liquidity quality matters more than headline valuations.

Utexo’s pitch is straightforward: use Bitcoin’s security and Lightning’s throughput to deliver pre-confirmable, fixed-fee USDT payments that settle atomically and preserve user privacy. In practice, that means traders, payment processors and exchanges could lock in fees ahead of time, reduce counterparty risk and avoid the fee volatility and congestion typical of many smart contract chains during risk-off episodes. With majors like BTC, ETH, SOL and others trading lower on the day—Bitcoin around $68,619, Ethereum near $1,976, and most large caps down roughly 3–5%—the value of predictable, high-quality $ rails becomes less abstract and more like core market plumbing.

Paolo Ardoino frames the investment as part of a broader strategy: turning Bitcoin into a global $-settlement network, not just a volatility proxy or digital gold narrative vehicle. With USDT’s circulating supply hovering around $184B, already the largest $ stablecoin float in the market, even a modest migration of settlement volume onto Bitcoin and Lightning could shift order-flow dynamics on competing L1s and sidechains. For derivatives venues, OTC desks and market makers, native USDT on Bitcoin could reduce bridging risk, compress spreads around BTC pairs and hardwire $ liquidity into the asset that anchors the entire crypto complex.

In macro terms, Tether’s Utexo play reads as a market-structure hedge: while spot prices bleed and volatility picks up, the firm is investing in the rails that will clear the next wave of leverage and settlement cycles. If Utexo delivers on atomic, private USDT settlement at scale, Bitcoin ceases to be just the risk barometer on price dashboards and becomes the neutral, censorship-resistant $ backbone underneath crypto’s fragmented liquidity stack.

Crypto World

Are Polymarket and Kalshi decentralized?

Polymarket, Kalshi, and other prediction markets have taken the world by storm and in the process seen massive support from the cryptocurrency industry.

Kalshi makes claims about “democratizing finance” while Polymarket proclaims that “using decentralized blockchain technology removes the need for a central authority in trading, which fosters fairness and open participation.”

Kalshi wasn’t originally built on a blockchain at all, however, it’s expanded into tokenized positions on Solana, claiming that “tokenization is the endgame. It is non-custodial, instant, and crypto native.”

However, that’s not how it currently functions; instead, it depends on Jupiter to “handle the off-chain actions required,” including to “open positions,” “manage positions,” and “claim winnings.”

Not exactly “non-custodial,” suggesting we’re a great distance from the “endgame.”

These prediction markets aren’t meant to be truly decentralized, unstoppable, or censorship-resistant like other crypto projects.

Instead, they maintain extraordinary control over the markets that are made available, sometimes even removing them before resolution.

Removing markets

Recently, Polymarket listed markets that resolved based on whether or not nuclear detonations occurred.

It then removed these markets following backlash from the community.

Critics felt that markets on nuclear detonation were Polymarket finding ways to profit from the possibility of history-defining calamities and destruction.

Unlike earlier attempts at prediction markets, such as Augur, Polymarket and Kalshi don’t allow any user to make a new market, instead entrusting that responsibility to the centralized actors that operate the platforms.

This is something that Polymarket is upfront with, noting in its help center that “markets are created by the markets team” and “users cannot directly create their own markets,” though it does comfort them with the notion that “they are encouraged to suggest ideas.”

Kalshi also tells users that it “love[s] community ideas for new markets.”

Interestingly, although both Polymarket and Kalshi maintain the ability to remove markets, that ability is much less advertised; it’s not mentioned in any of the “Markets” articles in Polymarket or Kalshi’s help centers.

Read more: Polymarket ends trading loophole for bitcoin quants

The Polymarket page for the nuclear explosion market now proclaims that market has been “archived.”

A search for “archived” in the Polymarket help center returns zero results, as does a search on X for any Polymarket posts that include the word “archived.”

When a Polymarket event is archived, it’s also no longer possible to retrieve details about the event using the Polymarket API.

The Polymarket API is meant to return the token ID, which can be used to query the smart contract for additional details.

Users in the Polymarket Discord claim that after Polymarket removed this market, they could no longer see the bet in their portfolio, with one user asking, “What happened to my money?”

Anybody who asks questions is directed to pay attention to the “#market-updates” channel in Discord, where it eventually announced that losses would be refunded.

Polymarket and Kalshi market resolution

Polymarket’s terms of service note that “the company is not involved in nor responsible for the resolution of any contracts displayed on the platform.”

The resolution on Polymarket relies on UMA, a blockchain oracle that allows tokenholders to resolve disputes about various outcomes.

Kalshi, however, doesn’t maintain the same claim, openly noting that when you “request to settle market,” that request will then go to the “markets team,” who “will thoroughly review all the settlement requests.”

Both Polymarket’s oracle-based resolution and Kalshi’s resolution mechanisms have provoked a great deal of controversy among users.

In one Polymarket controversy an Ethereum user with the Ethereum Name Service name “BornTooLate.Eth” manipulated the outcome of a Ukraine-United States mineral deal-related market by becoming one of the largest holders of the UMA token. This highlighted the governance dangers centered around the market.

Polymarket was also drawn into controversy several months ago when it launched a market that was meant to resolve based on whether or not Ukrainian President Volodymyr Zelenskyy would wear a suit before July.

Zelenskyy arrived at the NATO meeting in a non-traditional suit, meant to emulate more militaristic aesthetics, due to the ongoing Russian invasion of Ukraine.

The market was originally proposed as resolving to “yes” and ended up resolving in favor of “no,” arguing that the suit he wore didn’t meet the intent of the market resolution, which read simply, “This market will resolve to “yes” if Volodymyr Zelenskyy is is photographed or videotaped wearing a suit between May 22 and June 30, 2025 ET.”

Even the “Polymarket Intel” account on X, which has a gold check mark and the Polymarket logo, which indicates that “it’s an affiliate of @Polymarket,” posted a video with the caption “President Zelenskyy in a suit last night.”

Polymarket would subsequently try to distance itself from this account. This dispute was handled by UMA tokenholders, but that’s not always how Polymarket deals with controversial market resolutions.

The platform had listed a market that was meant to answer whether or not the so-called Department of Government Efficiency would “cut $3 billion of DEI contracts before March.”

The resolution criteria for this market was whether or not “doge-tracker.com” showed more than the $3 billion in cuts.

However, despite the resolution criteria being met, Polymarket pulled the market and refunded losses, claiming that doge-tracker.com wasn’t reliable.

Thus, markets don’t always resolve according to their resolution criteria.

Both of these cases highlight the tension between stated resolution criteria and how users and oracles expect the market to resolve.

Kalshi has also seen its fair share of controversy around market resolution.

In one case, X user “0xTyrael” claimed that they had lost money on Kalshi, as it ruled that Trump didn’t say “Mamdani” in an interview where he mangled the pronunciation of the New York mayor’s name.

More recently a market about whether or not Ayatollah Ali Khamenei would be “out” as Iranian supreme leader resolved to “no” because the resolution criteria noted that if the leader “leaves solely because they have died, the associated market will resolve and the exchange will determine the payouts…based upon the last traded price (prior to the death).”

Read more: Odds swing wildly as Polymarket bets on Iran’s successor collapse

Despite this being included in the resolution criteria, many users felt cheated, again highlighting the tension between the resolution criteria as written and as understood.

All of these various issues highlight the difficulty of creating a way to consistently resolve markets, especially in cases where resolution criteria are poorly written.

Donald Trump Jr.

Both Polymarket and Kalshi are intimately tied to the Trump regime, as both platforms have added Donald Trump Jr. as an advisor.

Additionally, Trump Jr. invested in Polymarket via the venture capital firm where he is a partner, 1789 Capital.

Additionally, Trump Media, where Trump Jr. is a director, has announced that it will launch prediction markets in cooperation with Crypto.com.

All these prediction markets have benefitted from the Commodity and Futures Trading Commission being permissive in its regulatory oversight of prediction markets under the Trump administration, and some portion of those benefits financially accrue to the Trump family.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

21Shares Launches First US Spot Polkadot ETF

21Shares has launched the first U.S. spot DOT ETF just a week after it launched one of the first spot ETFs for SUI.

21Shares has launched the first U.S. spot Polkadot ETF, known as TDOT, today, March 6, according to a press release from the firm.

The crypto exchange-traded product issuer noted that its spot ETF for Polkadot’s native asset, DOT, is registered under the Securities Act of 1933, not the Investment Company Act of 1940 — like most U.S. crypto ETPs.

Bloomberg’s senior ETF analysts, Eric Balchunas, posted about the launch on X today, noting its 0.30% fee and that “it looks like it was seeded with $11m.”

DOT Slumps on the News

Polkadot is known as a Layer 0 chain, as it consists of an ecosystem of networks with a shared base layer. With a market cap of approximately $2.4 billion, Polkadot is currently the 38th largest network, according to CoinGecko.

DOT is down about 2% over the past 24 hours, despite the ETF news, as the broader market sees a downturn on increased economic and geopolitical uncertainty.

The token saw a sharp rally last month on expectations around its upcoming halving event, as The Defiant reported.

TDOT marks the latest altcoin ETF to launch in the U.S. — a trend that accelerated notably last year. Just last week, 21Shares also issued one of the first spot ETFs for Sui (SUI), as The Defiant reported.

The first spot crypto ETF to launch in the U.S. was, fittingly, for Bitcoin. After years of attempts, 11 issuers were approved at once in a landmark decision in January 2024.

This article was generated with the assistance of AI workflows.

Crypto World

Market Insights with Gary Thomson: USD, CAD, and Commodities in Focus

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for insights into financial markets to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson breaks down what moved the markets this week and unpacks the strategic implications of the most critical events driving global markets.

👉 Key topics covered in this episode:

✔️ The most important events of recent days

Global markets have reacted sharply to escalating US–Iran tensions, with oil prices surging, stock indices falling, and the US dollar strengthening. Investors are closely monitoring the situation as uncertainty drives high market volatility.

✔️US Inflation Rate

Traders are eyeing the US inflation report on 11 March, as recent data shows slowing inflation and hints at potential Fed rate cuts. While the long-term trend may remain unchanged, the report could create short-term volatility in the US dollar and equity markets. Will the upcoming inflation data reinforce expectations for rate cuts, and how might it affect the US dollar and stock indices in the near term?

✔️Canada’s Unemployment Rate

Canada’s unemployment report on 13 March will provide insight into the labour market, which last month showed a low unemployment rate but declining employment, especially in manufacturing. While the Bank of Canada is expected to keep rates steady, the data could create short-term volatility in CAD currency pairs. Will the upcoming employment figures boost the Canadian dollar or reveal persistent weaknesses in the labour market?

✔️Multiple US Economic Releases

On 13 March, multiple key US economic indicators — including the PCE Price Index, Personal Income and Spending, Durable Goods Orders, and the second GDP estimate — will be released simultaneously. These reports could trigger short-term volatility in USD currency pairs as traders assess inflation, consumer activity, and business investment trends. How might this combined set of indicators impact the US dollar and overall market sentiment?

Gain insights to strengthen your trading knowledge.

💬 Don’t forget to like, comment, and subscribe for more market insights every week.

Watch it now and stay updated with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business3 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports24 hours ago

Sports24 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker