Crypto World

Can Pi Network price reclaim $0.20 after breaking a key resistance trendline?

Pi Network’s price shot up more than 50% to $0.20 earlier last week before parting with some of its gains and settling lower. Can it reclaim the key psychological figure now that it has confirmed a breakout from a multi-month trendline resistance?

Summary

- Pi Network price briefly rallied to a four-week high of $0.20 last week.

- Pi price action has confirmed a breakout from a multi-week descending trendline support on the daily chart.

According to data from crypto.news, Pi Network (PI) price rose nearly 54% to a four-week high of $0.20 on February 15 before profit taking stirred it back to $0.17 at the time of writing, though it still retains 20% gains over a seven-day period.

The PI network rally came amid investor hype surrounding the project’s upcoming key upgrades for the following months, aimed at building the ecosystem towards a more decentralized network. Notably, the upgrades for its mainnet node operators are part of its transition from version 19 to 22 of the Stellar network to accelerate its vision of decentralization while seeking to optimize performance, better security, and scalability to support long-term network growth for the project.

Another catalyst fueling this uptick is the hype surrounding the first anniversary of its mainnet launch on Feb. 20. Investors often tend to celebrate such milestones by buying more tokens, which can often drive speculative rallies.

Against this backdrop, derivatives data show that the Pi Network token’s funding rate has shifted from negative to positive at press time. This reversal suggests that traders are rotating from bearish to bullish positioning, which typically tends to uplift market sentiment surrounding the associated token.

Additionally, there is a lot of community chatter that the token could be listed on crypto exchange Kraken later this year. Getting listed on a major exchange like Kraken, which has a customer base of millions, could provide a significant boost to its price and overall liquidity.

On the daily chart, Pi Network price has confirmed a breakout of a descending trendline that had been acting as dynamic resistance since late November last year. Breaking above this long-standing pattern indicates that bulls are reclaiming market dominance and appear positioned to drive prices higher in the short term.

Evidence of a burgeoning uptrend is visible across several oscillators, with the MACD lines turning upward to indicate a positive crossover in momentum. This is typically interpreted as a sign that the period of distribution is ending and accumulation has begun.

Validating this transition, the Aroon Up at 92.86% vastly outpaces the 28.5% Down reading, confirming that the bulls have successfully seized control of the price discovery process.

Hence, Pi Network is well-positioned to see a potential rebound to its Feb. 15 high of $0.20. If bullish momentum persists, the rally could extend to its Nov. 28 high of $0.28, which lies 64% above the current price level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

New Chinese bot traffic and deepfake scams raise crypto security alarm

Binance founder Changpeng Zhao says fully transparent on-chain transactions expose salaries and business data, blocking real-world adoption of crypto payments.

Summary

- Changpeng Zhao argues that current on-chain transparency exposes corporate workflows and sensitive financial information.

- He warns that crypto payroll on public blockchains would reveal individual salaries via visible sender addresses.

- Zhao and industry voices say practical crypto payments need stronger privacy tools to win institutional adoption.

Unexplained Chinese bot traffic is colliding with a second, quieter crisis: AI‑driven forgery and identity abuse that even crypto’s most seasoned insiders now struggle to parse.

Ghost traffic and warped reality

In a recent Wired article, the author notes that over the last several months of 2025 and into 2026, small publishers, corporates, and even US agencies have watched their analytics fill up with “visitors” from Lanzhou and Singapore—sessions that rarely touch servers, leave no firewall traces, and yet dominate GA4 dashboards. As one analytics firm bluntly summarized it, these are “ghost sessions” generated by bots capable of triggering measurement calls while mimicking basic user behavior. The effect is not just technical noise: inflated sessions distort engagement metrics, ad yield, and campaign performance, especially for niche sites where a few hundred fake visits can flip a trend line.

This fog of synthetic traffic lands at the same time as a deepfake wave that is starting to outpace human intuition. Changpeng “CZ” Zhao recently admitted that an AI‑generated clip in flawless Mandarin was so accurate he “couldn’t distinguish that voice from [his] real voice,” calling the realism “scary” and warning that “even a video call verification will soon be out of the window.” His alarm follows scams where fully AI‑generated meeting participants convinced a Hong Kong finance team to wire roughly 25 million in corporate funds.

CZ’s privacy paradox

Zhao has begun to connect these threats to a deeper structural flaw in today’s internet and in public blockchains themselves. Privacy, he argues, is a “fundamental human right,” yet “current blockchains… provide too much transparency,” especially once KYC data links real‑world identities to on‑chain addresses. He has described the “lack of privacy” as “the missing link holding back crypto payment adoption,” warning that fully transparent ledgers make salaries, vendor flows, and even “ice cream preferences” trivially traceable.

The irony is brutal. On one side, overstated transparency—hyper‑indexed traffic logs, fully public transaction graphs—creates rich attack surfaces for state‑scale scrapers and commercial data brokers. On the other, AI systems now generate fake humans, fake traffic, and fake “proof” at industrial scale, eroding trust in every digital signal, from a GA4 session to a board‑level video call. When analytics can be flooded from servers routed through Singapore while GA4 “thinks” it sees Lanzhou, even basic questions (“Who visited my site?”) become non‑trivial.

Zhao’s answer is not to abandon transparency, but to harden it—pushing for privacy‑preserving tools such as zero‑knowledge proofs, and for verifiable identity rails that can flag deepfaked personas without exposing full financial lives on‑chain. In practice, that means building systems where origin, integrity, and consent can be cryptographically checked, while granular data—whether web sessions or payroll flows—remains shielded by design. The alternative is visible in today’s dashboards: a web that looks “busy,” yet is increasingly unreadable.

Markets: crypto as stress barometer

These moves comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $68,531, with a 24‑hour range between roughly $68,096 and $70,898 on about $39.4B in volume. Ethereum (ETH) changes hands near $2,053, after a 24‑hour move of about 5.5%, with trading volumes above $22.5B and recent lows under $1,910. Solana (SOL) has recently traded in the $200–$220 band, with on‑chain liquidity crossing 1B and bulls eyeing the $236–$252 zone.

For now, bots from “Lanzhou” and face‑swapped executives share a common lesson: in an AI‑saturated market, privacy and transparency are no longer opposites. They are joint prerequisites for any data stream investors can still afford to trust.

Crypto World

XRP, PI, and DOGE Tumble as BTC’s Rally Was Stopped at $70K: Market Watch

Yesterday’s gains were quickly erased in the cryptocurrency markets, with some alts, such as PI, DOGE, and XRP, marking big losses.

Bitcoin’s weekend price rally came to an end at just over $70,000, and the asset was pushed south to $68,000, where it found some support.

Most altcoins have turned red as well, with ETH going below $2,000 and XRP plummeting beneath $1.50. Dogecoin is among the worst performers in the past 24 hours.

BTC Rally Stopped Above $70K

The primary cryptocurrency went through some enhanced volatility at the start of the current month, mostly downward. The culmination took place on February 6, when it plunged to a 15-month low at $60,000 after losing $30,000 in just under two weeks.

Then came the bounce-off as BTC rocketed by $12,000 to $72,000. It was stopped there and spent the following few days trading sideways between $72,000 that $68,000. The lower boundary gave in mid-week, and bitcoin slipped to under $66,000.

The bulls finally stepped up after this point and helped prevent another leg down. Just the opposite, BTC started to gain traction at the end of the business week and jumped to over $69,000. It continued to climb above $70,000 on Saturday and Sunday before it was stopped there and driven to $68,000 on Sunday evening.

It has recovered some ground since then, but still trades below $69,000 as of press time. Its market cap is down to $1.375 trillion on CG, while its dominance over the alts stands still at 56.6%.

Alts Heading South

Ethereum was quickly rejected at $2,100 over the weekend and now struggles below the psychological $2,000 level. Ripple’s XRP skyrocketed yesterday to over $1.65 but was stopped and pushed south to under $1.50 as of press time. DOGE was the top gainer yesterday from the larger-caps, but it’s now down to $0.10 after a 9% daily drop.

Other big losers over the past day include XMR, ZEC, WLFI, and MNT. Pi Network’s native token has also faced a violent rejection. It was stopped at over $0.20 yesterday and is now down to just over $0.17 on CoinGecko.

The total crypto market cap has lost $70 billion in a day and is down to $2.425 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

I’d rather go broke than contribute to KYC’s grip on society

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Today’s traditional banking system has become too comfortable in encouraging society to overshare while underdelivering on security guarantees. Never has a financial system demanded such a sacrifice of an individual’s personal data. KYC requires legal identity, biometric data, address history, and device fingerprints, which are all bundled together and stored indefinitely by third parties.

Summary

- KYC turned privacy into collateral damage: Banks demand passports, biometrics, and device data — then store it in breach-prone databases that individuals can never truly reclaim.

- Finance has shifted from neutral infrastructure to permissioned gatekeeper: Access can be frozen, revoked, or denied — turning participation into a conditional privilege.

- Zero-knowledge tech offers a third path: Prove eligibility without surrendering identity, enabling transparency for systems and privacy for individuals.

Once that information leaves an individual’s control, it can be copied, breached, and sold to anyone. Even when companies act in good faith, the data itself becomes a liability. You cannot replace a passport the same way you can replace a lock. If we lose control of our fingerprint, address, and name, then who do we become if not a prisoner to an interdependent hive mind of capital structures that feed off the intelligence of the masses? For those who value privacy and autonomy, KYC isn’t a quality of life feature; it’s subconscious theft.

KYC: The irreversible surrender

KYC is often justified in the name of safety, but centralised safety is still a centralised risk. Large databases of sensitive information become magnets for attackers, insiders, and state actors alike. Recent incidents include Coinbase insiders exploiting customer data for extortion and Finastra, a software provider to 45 of the world’s largest 50 banks, losing 400gb of sensitive information in a data breach orchestrated by cyber criminals. History shows that no system is immune to breach, and no regulatory framework ever prevents exponential growth. What begins as ‘just for withdrawals’ quietly expands into continuous monitoring, indefinite retention, and mandatory sharing. Over time, the database itself becomes the weakest point in the system, and it rigs the world around you.

Neutrality in banking is dead

Last year, UK high street bank Lloyds was found to have used banking data from 30,000 of its own staff members to influence pay talks. This sort of treachery doesn’t just expose a dysfunctional system; it confirms that data will be used against individuals in plain sight. Blind consent can come at serious personal cost, whether implicit or explicit, and the reason it’s so alluring is that the consequence of failure rarely falls on the institution that collected the data; it falls on the individual whose lives become harder in ways that cannot be reversed.

There is also a deeper shift that happens once identity becomes a prerequisite for participation. KYC does not simply verify who someone is; it establishes permission. Someone decides who gets access, under what conditions, and with what ongoing oversight. Finance stops being neutral infrastructure and becomes a system of gates.

That change matters. A financial system built on permission inevitably reflects the values, incentives, and pressures of those who control it; accounts can be frozen, and access can be revoked. Geopolitical tensions rising across the globe, coupled with stricter KYC demands, mean that over 850 million people will soon, if not already, be excluded from digital banking systems altogether, not because they are criminals, but because they lack stable documents, stable addresses, or stable geopolitical status. For much of the world, financial access isn’t a right, but a merely temporary privilege.

This is why the claim that privacy is only for people who have something to hide has always been a toxic lie. Privacy is not about hiding wrongdoing, it is about preserving what makes each individual who they are, and protecting them from a world becoming evermore comfortable with surveillance. A society where all economic activity becomes an extension of your CV isn’t safe; it’s a surveillance state.

Privacy needs transparency to succeed

The challenge has never been choosing between privacy and transparency, but learning how to build systems that honour both equally. Transparency is essential for systems to function well. We need visibility into flows, patterns, and outcomes to detect abuse, improve infrastructure, and govern responsibly. While transparency requires visibility and authentication to be effective, it doesn’t need to see everything; it can still see movements, trends, and anomalies as a silhouette.

The rise of cryptography in recent years has seen significant breakthroughs in financial privacy technology. Zero-knowledge encryption layer 1 ecosystems such as Zcash (ZEC) and Monero (XMR) are surging as many firms are now weighing up the impact of becoming hardened by Zcash, bringing the relationship between privacy and transparency into sharper focus, as many search for a societal alternative to the normalisation of KYC practices.

Zero-knowledge encryption’s strongest asset is that it allows the general population to prove eligibility without revealing identity; selective disclosure that limits what is shared to what is strictly necessary; and user-held credentials that remove the need for centralised databases altogether. Transactions can be tracked under persistent, pseudonymous identifiers that allow systems to learn and adapt without tying activity to real-world identity. A participant can be recognised as the same actor over time, allowing for accountability, analytics, and improvement, without creating a permanent identity honeypot.

Things must get uglier before they’ll get better

Although the market is moving positively toward privacy in a world that feels more dangerous by the day, zero-knowledge encryption is still a long way from becoming the norm. This means anyone who values their privacy in 2026 will have to endure exclusion, loss, and uncertainty if they are not willing to comply with the alternative.

Every web3 breakthrough is inherently still a long-term experiment, one that intersects painfully with both financial traditionalism and conservative politics. New organisational forms are rarely elegant at the beginning, and unregulated early-stage blunders often spook the political establishment. Corporations, democracies, and public markets all went through ugly, unstable phases before they matured; decentralised systems will too.

Mistakes will be made, and scandals will happen, but infrastructure hardens over time, and what feels like a hefty compromise today becomes tomorrow’s default, and today’s gold standard will become tomorrow’s scandal. Once zero-knowledge practices are normalised, they will not contract, but expand.

After all, being at the tip of the spear means you can strike the heart first, and in time, when the world sees that the traditional banks have sold everyone’s souls down the river, the right people will be forced to pay attention.

Crypto World

Market Insights with Gary Thomson: GBP, USD, and JPY Poised for Volatility

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for insights into financial markets to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson breaks down what moved the markets last week and unpacks the strategic implications of the most critical events driving global markets.

📌 Key topics covered in this episode:

✔️ What Happened in the Markets Last Week

Japan’s election result reinforced political stability, lifting the Nikkei to record highs, while the yen unexpectedly strengthened due to positioning shifts and changing monetary policy expectations. Although the currency is supported for now, a sustained reversal in USD/JPY and EUR/JPY is not yet confirmed.

✔️ UK

Sterling has been supported by dollar weakness and relatively firm UK data, while EUR/GBP remains in correction mode. Upcoming UK unemployment data on 17 February and UK inflation on 18 February could trigger sharp moves, especially if inflation continues to exceed expectations and challenges rate-cut pricing. Would persistently high inflation force a major repricing of the Bank of England’s rate outlook and boost GBP further?

✔️ United States

The US dollar remains under pressure after its late-January sell-off, with limited fundamental support for a sustained recovery. However, the PCE Price Index on 20 Februarycould spark short-term volatility. With markets expecting the Fed to hold rates until at least June, any inflation surprise may quickly reprice policy expectations and move FX and equity markets. Could an upside surprise in PCE inflation revive dollar strength by shifting expectations for the Fed’s first rate cut?

Gain insights to strengthen your trading knowledge.

💬 Don’t forget to like, comment, and subscribe for more professional market insights every week.

Watch it now and stay updated with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Solana Price Prediction: Standard Chartered Cuts 2026 Target, Sees $2,000 by 2030

Standard Chartered just dropped a fear signal on Solana. They cut their 2026 target to $250. But then they doubled down on a bold $2,000 call by 2030.

That is a sharp contrast. Near term pressure. Long term conviction.

The bank sees Solana shifting away from pure speculation toward real utility. That kind of transition is rarely smooth. It can mean volatility now and growth later.

- Target Adjustment: 2026 prediction cut from $310 to $250, citing transitional risks.

- Long-Term Bull: 2030 target set at $2,000, driven by dominance in micropayments.

- Market Signal: Analysts see the shift from memecoins to stablecoins as a key utility driver.

What Standard Chartered’s Revised Targets Mean for Solana

Standard Chartered sees Solana at a turning point. Geoffrey Kendrick, who leads digital asset research at the bank, says SOL is shifting away from its memecoin casino image and moving toward something more serious. More infrastructure. More real finance.

That shift is not frictionless. The revised $250 target for 2026 reflects that transition. Growth is still there, but it may not look like the explosive runs from past cycles.

For retail investors, it is a trade off. The near term upside could be more measured. But the long term foundation looks stronger if real utility keeps building.

Solana Price Prediction: Breaking Down the New SOL Valuations

The roadmap is detailed. Standard Chartered trimmed the 2026 target to $250 from $310, expecting a period of consolidation as activity shifts.

But after that, the projections accelerates. $400 by 2027. $700 in 2028. $1,200 in 2029. And $2,000 by the end of 2030.

The thesis centers on network velocity. Stablecoin turnover on Solana is reportedly 2 to 3 times higher than on Ethereum, which makes it well suited for fast, low value transactions. That kind of throughput is what long term valuation models are leaning on.

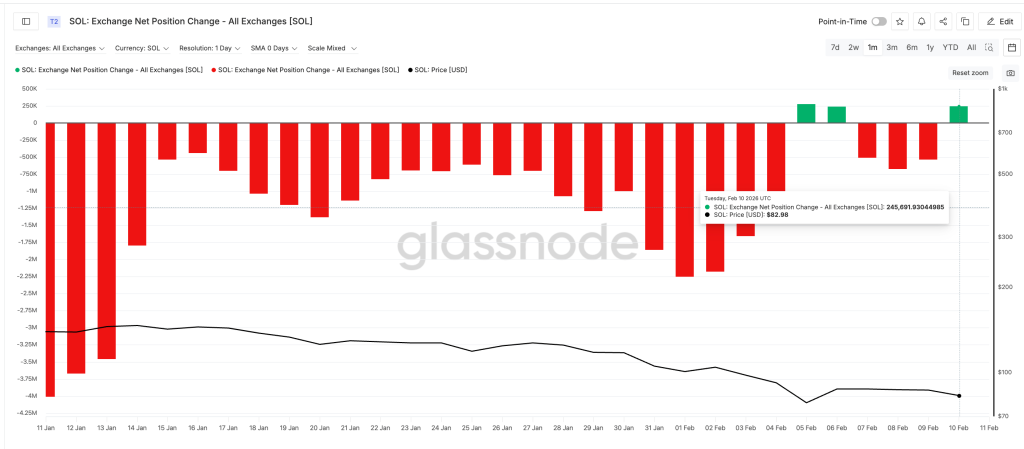

Solana coins have continued to leave exchanges. Historically, that kind of outflow points to accumulation. So even with a short-term downgrade, some players appear to be positioning for the bigger picture.

The post Solana Price Prediction: Standard Chartered Cuts 2026 Target, Sees $2,000 by 2030 appeared first on Cryptonews.

Crypto World

How Quantum Computing May Be Impacting Bitcoin’s Valuation

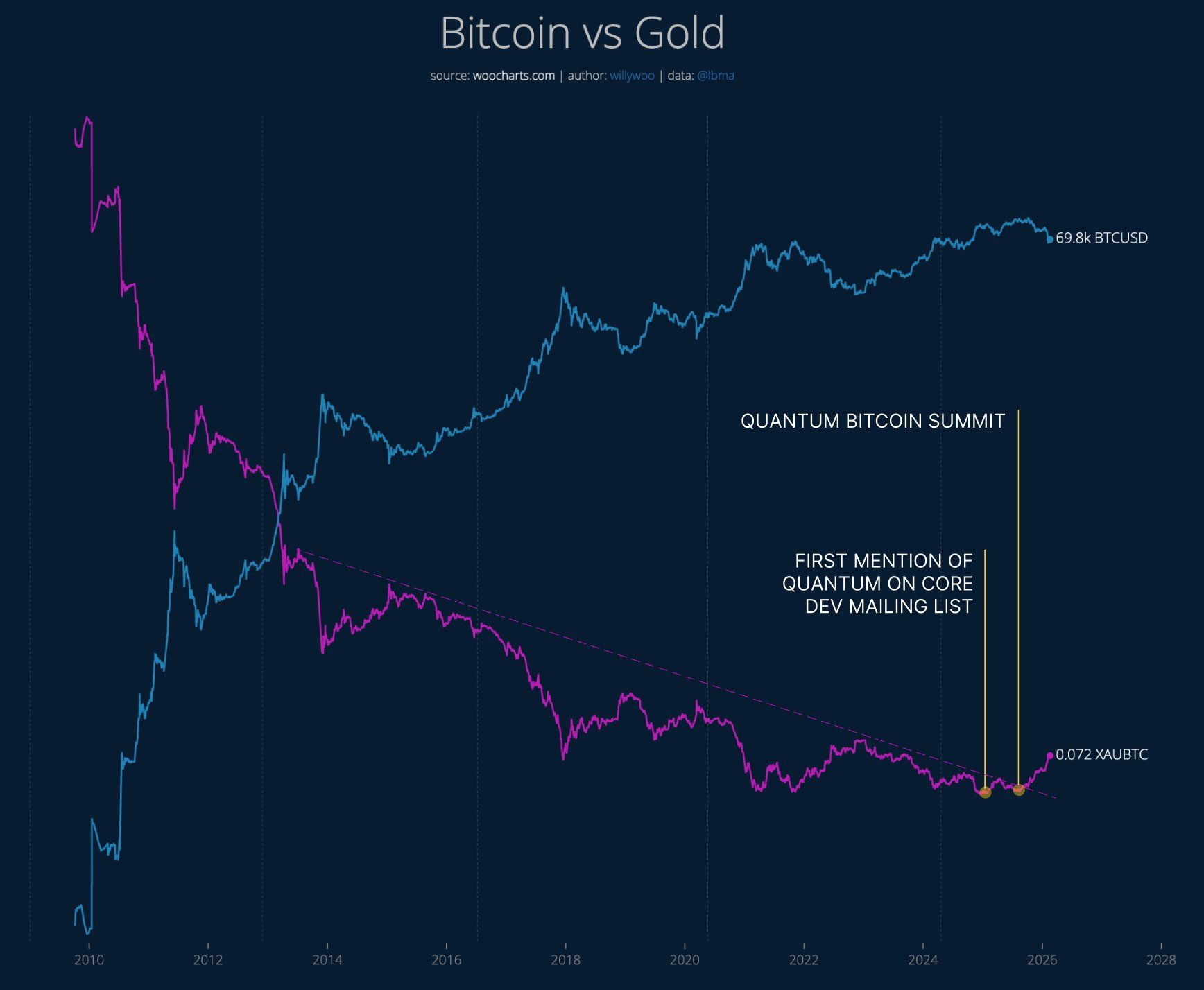

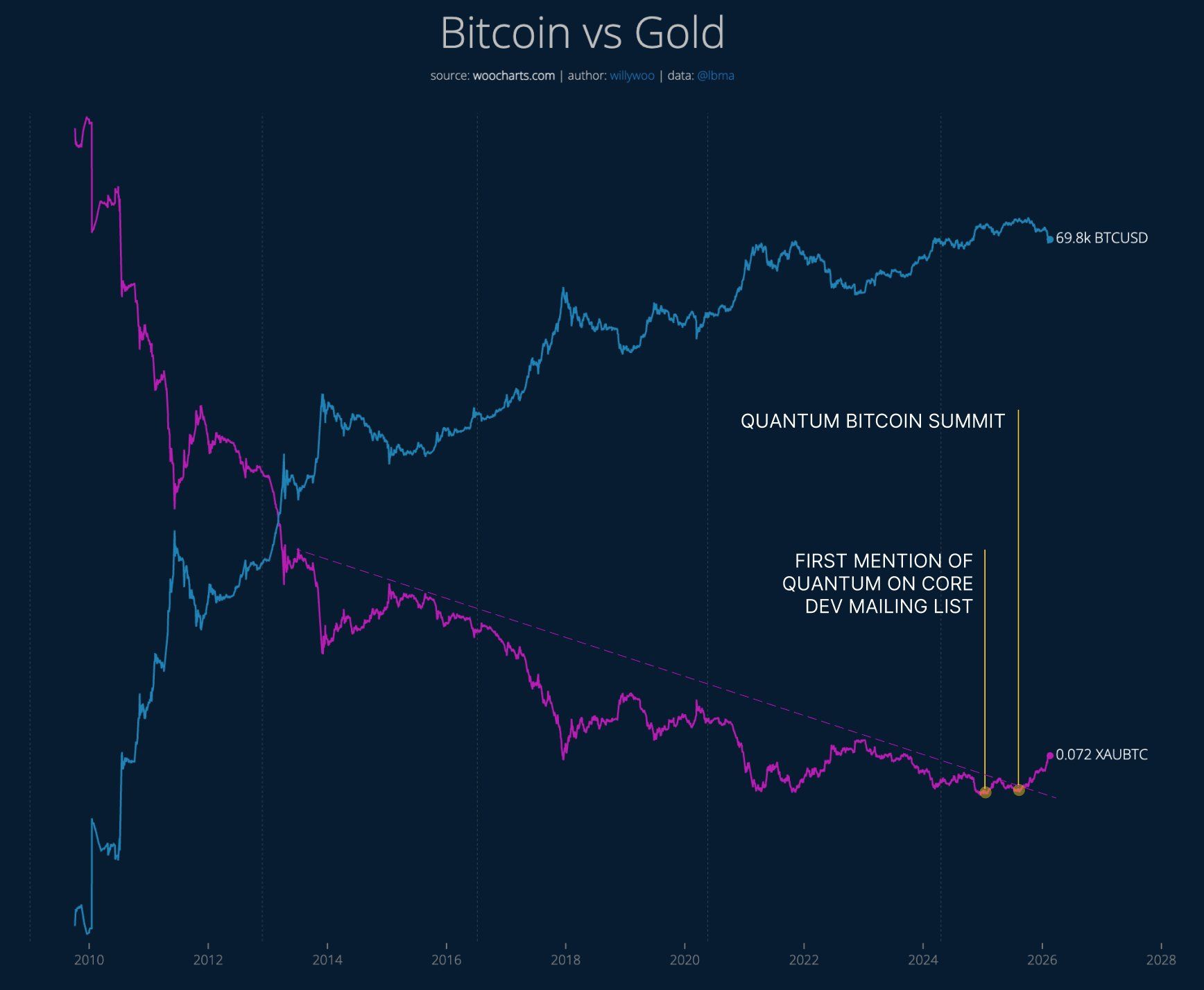

Quantum computing risks are weighing on Bitcoin’s (BTC) relative valuation against gold, according to analyst Willy Woo.

The development of quantum computing has spread concerns across the tech and financial sectors, as future breakthroughs could potentially undermine current encryption standards. Although such capabilities are not considered imminent, the long-term threat has raised questions about Bitcoin’s security model and how markets price that uncertainty.

Sponsored

Sponsored

Has Quantum Computing Entered the Bitcoin Valuation Equation?

Woo argued that Bitcoin’s 12-year outperformance relative to gold has broken, marking a significant structural shift. He pointed to the rising market awareness of quantum computing risks as a reason behind this shift.

“12 YR TREND BROKEN. BTC should be a valued a LOT HIGHER relative to gold. Should be. IT’S NOT. The valuation trend broke down once QUANTUM came into awareness,” Woo said.

Bitcoin’s security relies on elliptic curve cryptography (ECDSA over secp256k1). A sufficiently advanced, fault-tolerant quantum computer running Shor’s algorithm could theoretically derive private keys from exposed public keys and compromise funds associated with those on-chain addresses.

Such technology is not yet capable of breaking Bitcoin’s encryption. Nonetheless, a key concern, Woo argues, is the potential reactivation of an estimated 4 million “lost” BTC. If quantum breakthroughs made those coins accessible, they could re-enter circulation, effectively increasing supply.

Sponsored

Sponsored

To illustrate the scale, Woo explained that corporations following MicroStrategy’s 2020 playbook and spot Bitcoin ETFs have accumulated approximately 2.8 million BTC. The possible return of 4 million lost coins would exceed that total, equivalent to roughly eight years of enterprise-level accumulation at recent rates.

“The market has started pricing in the return of these lost coins ahead of time. This process completes once the Q-Day risk is off the table. Until then, BTCUSD will price in this risk. Q-Day is 5 to 15 years away… that’s a long time trading with a cloud over its head,” he emphasized.

He acknowledged that Bitcoin would likely adopt quantum-resistant signatures before any credible attack becomes feasible. However, upgrading cryptography would not automatically resolve the status of these coins.

“I’d say it’s 75% chance that lost coins will not be frozen by a protocol hard fork,” the analyst remarked. “Unfortunately the next 10 years is when BTC is most needed. It’s the end of the long term debt cycle, it’s where macro investors and sovereigns run to hard assets like gold to shelter from global debt deleveraging. Hence gold moons without BTC.”

Woo’s analysis does not suggest that quantum attacks are imminent. Instead, it positions quantum computing as a long-term variable factored into Bitcoin’s relative valuation, particularly in comparison to gold.

Meanwhile, Charles Edwards, founder of Capriole Investments, offered a complementary perspective on how quantum risk may be influencing market behavior. According to Edwards, concerns surrounding the quantum threat were likely a key factor that drove Bitcoin’s price lower.

The quantum threat is also shaping real portfolio moves. Jefferies strategist Christopher Wood reduced a 10% Bitcoin allocation in favor of gold and mining stocks, citing quantum concerns. This highlights that institutional investors see quantum computing as a significant risk, not a remote one.

Crypto World

Ether steadies after $540 million sell wave while altcoins lag: Crypto Markets Today

The crypto market remains under pressure on Monday despite U.S. equity futures rising by around 0.25% since midnight UTC.

Bitcoin trades at $68,710, having lost 0.1%. Altcoins such as HYPE, ZEC and XMR are down by more than 3%.

Ether is one of Monday’s outliers, rising by 0.43% since midnight as it claws its way back to $2,000 after a grueling weekend selloff was spurred by selling pressure from trader Garrett Jin.

Onchain data shows a wallet attributed to Jin deposited more than $540 million worth of ether to Binance over the weekend, leading to a disproportionate rise in sell volume compared with other exchanges.

That pressure translated into oversold conditions that ultimately set the scene for Monday’s recovery.

Gold is changing hands at $5,000 on Monday, down from its Jan. 29 peak of $5,600 but outperforming silver and crypto, which are down by 36% and 21% respectively over the same period.

U.S. markets are closed on Monday due to a public holiday.

Derivatives positioning

- The crypto futures market continues to see capital outflows, with notional open interest (OI), or the dollar value of total open or active contracts, dropping to $98 billion.

- De-risking is seen across the board, with OI falling 1% and 2.7% in bitcoin and ether futures, respectively, over 24 hours. XRP, DOGE, SUI and ADA saw declines of 6% or more.

- OI in futures tied to gold token XAUT rose 8% as traders continued to deploy capital in traditional assets.

- BTC and ETH’s 30-day implied volatility has reversed the massive pop from annualized 50% to nearly 100% earlier this month, when prices crashed. The reversal indicates a massive pricing out of volatility risks, supporting the case for price recovery.

- The spread between ether and bitcoin implied volatility indexes is beginning to widen, indicating expectations for bigger swings in ether.

- Funding rates for several alternative tokens, such as XRP, TRX, DOGE and SOL, remain negative, indicating a trader preference for bearish, short positions. If the market remains resilient, these bears may feel compelled to square off their bets, potentially leading to a “short squeeze” higher.

- SOL futures on CME show an annualized premium near zero, a sign of buy-side pressure fading fast. BTC and ETH futures are trading with slight premiums.

- On Deribit, someone paid $3 million in premium for the $75,000 strike bitcoin call option. The massive flow likely represents a bullish bet on the market.

- Still, put options tied to BTC and ETH remain pricier than calls across all time frames, a sign of lingering downside concerns.

Token talk

- The altcoin market experienced a familiar, low-liquidity drift lower on Sunday before a slight recovery on Monday morning.

- Popular memecoin is down by more than 10% in the past 24 hours but has steadied since midnight UTC, while XRP has risen by 1% by midnight despite losing 8% of its value since Sunday morning.

- Layer zero (ZRO) continues to lose momentum after its early February rally, falling by more than 34% over the past five days including a 10% drawdown in the past 24 hours. The plummet comes after the introduction of a native blockchain in collaboration with Wall Street veterans Citadel Securities and DTCC.

- The heavily bitcoin-weighted CoinDesk 5 (CD5) Index rose by 0.38% since midnight UTC while the altcoin-dominated CoinDesk 80 (CD80) lost 0.17% over the same period, demonstrating relative altcoin weakness.

Crypto World

4 Economic Triggers That Could Shake Bitcoin in Days

Bitcoin is entering a pivotal macro week as it hovers near $68,600 on February 16, 2026. After a volatile start to the year, including a sharp retracement from 2025 highs above $126,000, markets remain highly sensitive to US economic data.

Tariff tensions, sticky inflation, and the Federal Reserve’s decision to pause rate cuts have kept risk assets on edge. With US markets closed Monday for Presidents’ Day, liquidity is thinner than usual, a factor that could amplify volatility once major data begins midweek.

US Economic Data Crypto Traders Must Watch This Week

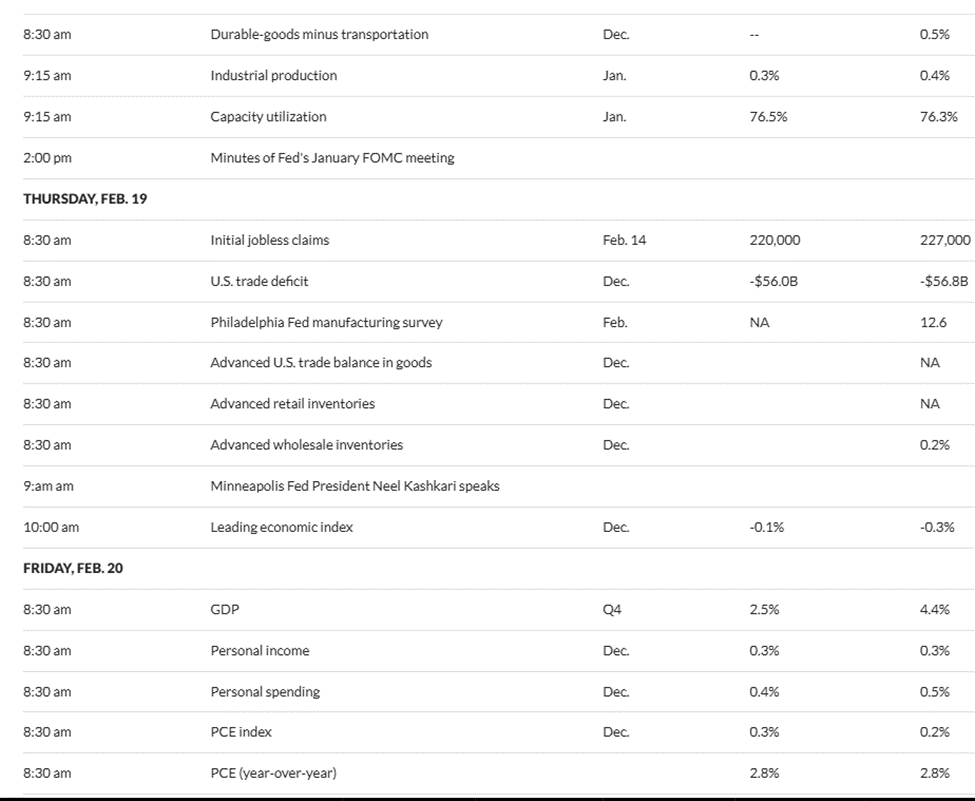

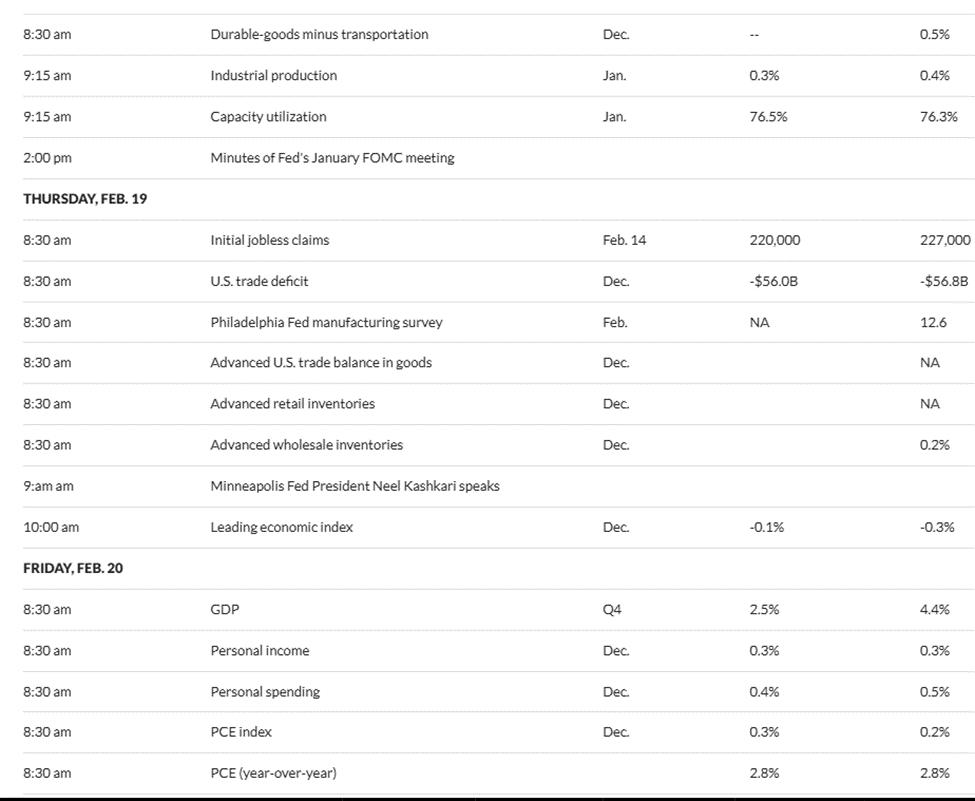

Traders are focused on four key releases: the January FOMC minutes on Wednesday, initial jobless claims on Thursday, and Friday’s Q4 GDP revision alongside December PCE inflation.

Sponsored

Sponsored

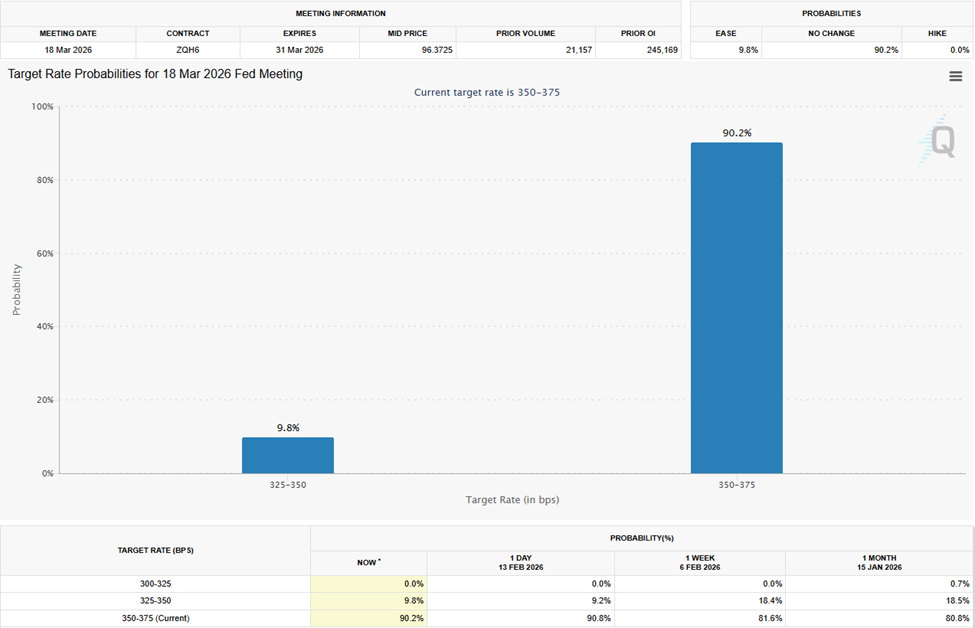

According to CME FedWatch data, markets are pricing just 9.8% odds of a March rate cut, reflecting skepticism that easing is imminent.

In this environment, even modest surprises could determine whether Bitcoin tests $70,000 resistance or revisits the $60,000 support zone.

FOMC Minutes

The release of the January FOMC (Federal Open Market Committee)minutes will likely set the week’s tone.

The Fed held rates steady at 3.50%–3.75% during its last meeting, signaling caution amid resilient growth and persistent services inflation.

FOMC minutes on Wednesday will provide deeper insight into policymakers’ internal debates, particularly around inflation risks, labor strength, and tariff-related pressures.

A hawkish tone emphasizing sticky inflation or upside risks could reinforce “higher for longer” expectations. Historically, similar signals have triggered 3–5% Bitcoin pullbacks within 24 hours as Treasury yields rise and liquidity expectations tighten.

Conversely, any language suggesting balanced risks or growing concern over slowing growth could revive rate-cut speculation.

Sponsored

Sponsored

In holiday-thinned trading conditions, even subtle dovish cues may be enough to push Bitcoin toward $70,000.

Initial Jobless Claims

Thursday’s jobless claims report offers a real-time snapshot of labor market health, a core pillar of the Fed’s dual mandate.

Consensus expects roughly 220,000 new filings for the week ending February 14, down from 227,000 previously.

A reading below 210,000 would reinforce labor resilience and reduce the likelihood of near-term easing. That outcome could pressure Bitcoin 1–3% lower as markets recalibrate rate-cut expectations.

On the other hand, claims above 230,000 would raise concerns about softening employment conditions. In past cycles, weaker labor prints have boosted risk assets on the assumption that the Fed may pivot sooner. Such a scenario could lift Bitcoin 2–4% as easing bets increase.

With BTC consolidating between $68,000 and $69,000, this release may serve as a bridge between Wednesday’s Fed insight and Friday’s inflation data.

Sponsored

Sponsored

Q4 2025 GDP (Final Revision)

Friday’s final Q4 GDP revision is expected to show +2.5% annualized growth, a significant step down from the initial +4.4% estimate.

A downside surprise below 2.3% would reinforce slowdown narratives and potentially boost Bitcoin 3–6% as markets price in earlier policy relief. Softer consumer spending, which accounts for roughly 70% of GDP, would be closely watched.

However, a print above 2.7% could complicate the outlook. Strong growth may delay easing, reinforcing “higher for longer” expectations and weighing on crypto markets.

Bitcoin remains highly correlated with equities during major macro releases. Strong growth combined with persistent inflation has historically triggered short-term BTC pullbacks.

PCE & Core PCE

The week’s most important catalyst arrives with December’s PCE inflation report, the Fed’s preferred inflation gauge.

Expectations call for +0.3% month-over-month increases in both headline and core PCE, with year-over-year readings around 2.8–2.9%.

Sponsored

Sponsored

A cooler-than-expected 0.2% MoM print would signal further disinflation progress. That outcome could meaningfully increase the probability of a rate cut and spark a 4–8% Bitcoin rally, potentially pushing prices decisively above $70,000.

But a hotter print above 0.3% would reinforce sticky inflation concerns, likely triggering 3–5% downside pressure as yields climb and easing hopes fade.

Core PCE, which strips out food and energy, will carry particular weight for policymakers and traders alike.

From Fed messaging to labor resilience, growth revisions, and inflation data, each release feeds directly into expectations for 2026 monetary policy.

With Bitcoin stabilizing near $68,600 but still well below its 2025 highs, the market remains acutely sensitive to liquidity signals.

Dovish surprises across the board could reignite risk appetite and drive a breakout toward $70,000 and beyond. Hawkish data, however, may deepen the correction toward $60,000–$65,000.

Crypto World

How Has X Money Helped DOGE Regain Momentum in February?

By mid-February, discussions about Dogecoin (DOGE) had become noticeably more active. DOGE holders expect the meme coin to stage a strong recovery after losing more than 75% of its value since last year.

Several catalysts have fueled this renewed optimism. The key question remains whether these factors are strong enough to drive a sustained price rebound.

Sponsored

Elon Musk’s Influence Over DOGE Is Making a Comeback

Data from LunarCrush, a social intelligence platform for crypto investors, show that mentions of Dogecoin increased by 33.19% over the past month compared with the previous month.

This unusually strong rise indicates that community interest in the meme coin has returned in force.

LunarCrush reports that discussions have focused on DOGE’s technical analysis, Elon Musk’s influence on the token, and the possibility of deeper integration of DOGE into X’s ecosystem.

Charts show that DOGE-related topics began trending upward after February 12. On that same day, Elon Musk revealed that X Money had entered internal testing with X employees. The company expects a limited rollout to users within the next one to two months.

Sponsored

DOGE holders expect X Money to accept DOGE for payments. Their expectations stem from Musk’s previous references to DOGE as an example for micropayments.

On February 14, Nikita Bier, Head of Product at X, announced that the platform will soon allow users to trade cryptocurrencies directly from their timelines through clickable “Smart Cashtags.”

“X is reportedly in internal testing for stock and crypto trading, sparking speculation about Dogecoin and $XRP integration. Analysts suggest Dogecoin could reach $1 or $2 quickly, with recent social posts highlighting potential price pumps and Elon Musk’s influence.” LunarCrush reported.

Price Rebounds

Although these arguments remain speculative and lack any official confirmation, DOGE’s price rebounded following these developments.

Sponsored

Data from TradingView shows that DOGE climbed from $0.09 to above $0.11 before correcting to around $0.10.

Analyst Daan Crypto Trades predicts that DOGE could reclaim the $0.16–$0.17 range in the short term. This level aligns with the 200-day moving average (MA200).

Sponsored

The recent recovery has strengthened short-term bullish sentiment. However, several structural concerns continue to cloud the long-term outlook.

Recent ETF data highlights ongoing weakness in institutional demand. The DOGE Spot ETF has recorded zero net inflows since the beginning of February. This stagnation reflects limited interest from institutional investors.

Since the launch of DOGE ETFs in the United States, total net assets across these funds have reached only $8.69 million. This figure remains modest compared to other major crypto ETFs.

Dogecoin’s unlimited supply model also presents a structural challenge. The network mints approximately 5 billion new DOGE each year. This continuous issuance raises concerns about the preservation of long-term value.

Crypto World

How to Spot and Avoid Cyber Scams During the 2026 Winter Games

Editor’s note: As the 2026 Winter Olympics attract millions of fans worldwide, cyber crooks look to exploit hype and distraction. This editorial spotlights practical, action‑or‑action guidance from Kaspersky to recognize and avoid scam attempts around tickets, merchandise and streaming. The aim is to empower readers to verify sources, keep personal data secure, and rely on official channels during the events. The content below complements the press release by summarizing key takeaways and security best practices for attending, watching or engaging with the Games online.

Key points

- Buy tickets only from official channels and confirm via the official Olympics platform.

- Stick to legitimate streaming services and trusted broadcasters; verify HTTPS and avoid unverified sites.

- Avoid counterfeit merchandise by purchasing only from official stores or partner retailers.

- Don’t click unsolicited emails, posts, texts, or ads offering free tickets or cheap streams.

- Rely on a trusted security tool such as Kaspersky Premium to block dangerous sites and card-skimming scripts.

Why this matters

During a global event that unites fans from around the world, the risk of cyber fraud rises in tandem. This guidance helps fans protect personal and payment information, avoid losing money on fake tickets, fake merch, and bogus streams, and enjoy the Games with greater confidence. By sticking to official sources and trusted channels, readers reduce exposure to fraud and support a safer online fan experience.

What to watch next

- Monitor official Olympics channels for ticket availability and official merchandise.

- Verify streaming sources and ensure secure payments on trusted platforms.

- Be cautious of unknown shops; buy only from confirmed official stores or partner retailers.

- Stay alert for phishing attempts and rely on security advisories from trusted providers.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

How to spot and avoid cyber scams during the 2026 Winter Competitions

The 2026 Winter Olympic Games are in full swing, captivating sports fans worldwide. However, the Games also serve as an opportunity for scammers to strike with different kinds of cyber fraud. Kaspersky has identified some of the key scams targeting fans right now – these are centered on fake tickets, merchandise and streaming access.

Ticket fraud

Fake ticket schemes rank among the most damaging scams hitting sports fans. With sports venues drawing huge crowds, attackers push bogus “tickets” through phishing sites that mimic official sellers to harvest payment info. Official sources stress that tickets are sold exclusively through the authorized Olympics platform, and third-party brokers or resale sites (outside any official resale channel) are fraudulent.

A fake ticket website

Bogus merchandise traps

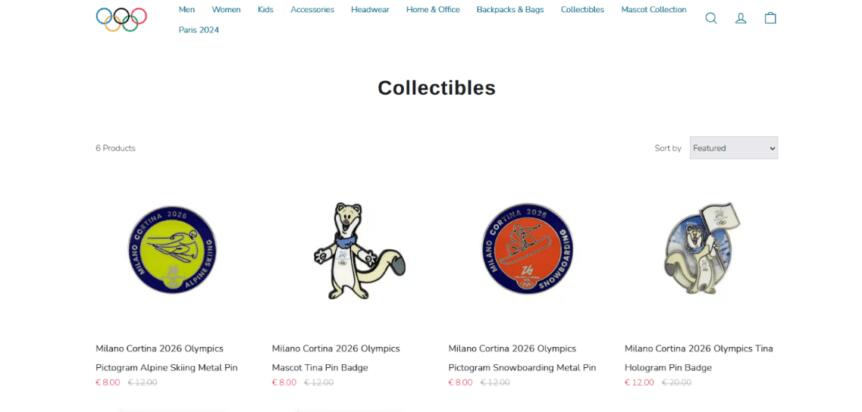

Fans rushing to buy authentic sports competition items – clothes, souvenirs or event-specific collectibles – are prime targets. Attackers launch multiple counterfeit online shops that may use official logos, post convincing photos and fabricate glowing reviews to appear legitimate. Victims pay, then get nothing – or have their card details stolen for later fraud.

Fake streaming offers

Attackers create deceptive websites imitating broadcasters, promising “cheap,” “exclusive,” or even “free” ways to catch winter competition events live – from snowboard cross to curling finals. Users pay input card details expecting instant access, only to lose their money and expose financial data for theft or redirects to more scams when they hit “play.”

Scam page of “free” streaming service

“While global competitions bring together people from different countries for the ultimate sports festival, they also draw fraudsters eager to cash in on the hype. Whether through phony ticket portals, imitation merchandise sites or bogus streaming links, these schemes are designed to look completely genuine. The best defense for sports fans is to pause, double-check every source and stick strictly to official, trusted channels before entering any personal or payment information,” notes Anton Yatsenko, web content expert at Kaspersky.

Here are the key ways to protect yourself during sports competitions:

- Purchase tickets exclusively from official channels. Skip any third-party sellers and always confirm via the official competition website.

- Stick to legitimate streaming services and trusted broadcasters. Verify HTTPS security, check reviews and never submit payment info on unverified or pop-up sites.

- Be cautious with merchandise vendors, avoid deals on “exclusive” or heavily discounted competition-branded items from unknown shops – they often deliver fakes, nothing at all or steal your details. Buy only from confirmed official stores or partner retailers.

- Don’t click on unsolicited emails, social media posts, texts or ads offering free tickets, cheap streams, special giveaways, or “urgent” competition updates.

- Rely on a trusted security tool like Kaspersky Premium, which actively blocks dangerous websites, phishing attempts, malicious ads and card-skimming scripts in real time to safeguard your information.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat18 hours ago

NewsBeat18 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat20 hours ago

NewsBeat20 hours agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show