Crypto World

Cango Offloads 4,451 BTC for $305M to Repay Loan and Fund AI

TLDR

- Cango sold 4,451 BTC, reducing Bitcoin reserves by 60% to repay a Bitcoin-collateralized loan.

- The company raised $305M, improving its financial leverage and balance sheet.

- Cango aims to pivot towards AI compute infrastructure, targeting small and medium enterprises.

- Jack Jin, former Zoom Communications leader, appointed CTO of Cango’s AI business line.

- Bitcoin’s price dropped 1.06%, while Cango saw a 3.26% after-hours rebound to $0.9500.

Cango, a Bitcoin mining company, has sold 4,451 BTC for approximately $305 million, reducing its Bitcoin reserves by 60%. The sale aims to repay a Bitcoin-collateralized loan amid recent market volatility.

Bitcoin Sale Reduces Cango’s Reserves and Strengthens Balance Sheet

The sale of 4,451 BTC represents a substantial reduction in Cango’s digital asset holdings. This move is part of a broader strategy to strengthen the company’s balance sheet and reduce financial leverage.

The $305 million raised from the sale was directly applied to partially repay a Bitcoin-backed loan, improving Cango’s financial position. The divestment comes at a time when Bitcoin prices have rebounded from a recent low.

By selling a portion of its reserves, Cango aims to maintain flexibility while funding strategic growth initiatives, including expansion into AI compute infrastructure.

Cango Shifts Focus to AI Compute Infrastructure

In addition to the sale, Cango is pivoting toward AI computing by leveraging its existing infrastructure. The company plans to offer distributed compute capacity for the AI industry, targeting small and medium-sized enterprises.

Cango’s modular approach promises faster deployment timelines compared to traditional data center models. Cango also appointed Jack Jin as CTO of its AI business line.

Jin, a former leader at Zoom Communications, brings expertise in AI/ML infrastructure and large-scale GPU systems. His experience aligns with Cango’s strategy to develop a global distributed inference platform using modular, containerized GPU compute nodes.

Bitcoin Dips 1.06% While Cango Inc. Sees After-Hours Rebound

At the time of press, CoinMarketCap data indicates that Bitcoin’s price is currently $69,983.52, down 1.06% in the last 24 hours. The price fluctuated between $69,730 and $71,000 during the day.

On the other side, Cango Inc. (CANG) closed at $0.9200, down 5.52% on the day. The stock fluctuated between $0.8840 and $0.9887. After hours, the price rose by 3.26%, reaching $0.9500.

The stock had a previous close of $0.9738. Trading volume reached 1,229,780 shares, with an average volume of 985,054. The 52-week range for Cango is between $0.8840 and $2.8750, with a market cap of $318.642 million.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

American billionaire and hedge fund manager Ray Dalio has warned that central bank digital currencies (CBDCs) are coming, which will offer benefits but also potentially allow governments to exert more control over people’s finances.

“I think it will be done,” said Dalio on CBDCs in a wide-ranging interview on the Tucker Carlson Show on Monday, which also included topics on the US debt crisis, gold prices, and even a potential civil war.

Raymond Dalio is a billionaire hedge fund manager who has been co-chief investment officer of Bridgewater Associates since 1985, after founding the firm in 1975.

During the interview, Dalio said CBDCs could be appealing due to the ease of transactions, comparing them to money market funds in functionality, but he also cautioned about their downsides.

He said there will be a debate, but CBDCs “probably won’t” offer interest, so they will not be “an effective vehicle to hold because you’ll have the depreciation [of the dollar].”

Dalio also cautioned that all CBDC transactions will be known to the government, which is good for controlling illegal activity, but also provides a great deal of control in other areas.

“There will be no privacy, and it’s a very effective controlling mechanism by the government.”

Taxation, forex controls and political debanking

A programmable digital currency will enable the government to tax directly, “they can take your money,” and establish foreign exchange controls, he said.

That will be an “increasing issue,” particularly for international holders of that currency, as the government can seize funds from nationals of sanctioned countries.

Dalio also said that you could be “shut off” from a CBDC if you were “politically disfavored.”

Related: China-led CBDC project mBridge tops $55B in cross-border payments

An American CBDC is not likely to be deployed in the near future, however, as US President Donald Trump has been vocally opposed to them.

Soon after taking office in January 2025, Trump signed an executive order prohibiting “the establishment, issuance, circulation, and use” of a US CBDC.

Only three countries have launched a CBDC

According to the Atlantic Council’s CBDC tracker, only three countries have officially launched one: Nigeria, Jamaica, and The Bahamas.

49 countries are in the pilot testing phase, including China, Russia, India, and Brazil. 20 nations have a CBDC in development, and 36 are still researching central bank digital currencies.

India’s central bank reportedly proposed an initiative in January linking BRICS CBDCs to facilitate cross-border trade and tourism payments.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Bitcoin & Ethereum News, Crypto Prices & Indexes

Coinbase’s Base App, pitched as a central piece of Coinbase’s “Everything App” strategy, is winding down its Creator Rewards program and its Farcaster-powered social feed. The move signals a shift away from social incentives toward a trading-first experience that prioritizes tradable assets. The Creator Rewards program, launched in July to foster a more social Base ecosystem, distributed roughly $450,000 to about 17,000 creators over seven months, according to an official Base App X update. That translates to an average payout of around $26 per creator. As the project evolves, the team underlined that the app’s core mission is changing, with trading taking center stage.

Base App’s creator-focused initiative will culminate with final payouts on February 18, and the program will wrap on the preceding Sunday. The decision comes alongside a broader reorientation of Base App’s social features. Founder Jesse Pollak framed the pivot by stressing simplicity and focus: “As we’ve rolled the app out, we’ve realized we need to do less, better. And by focusing on tradable assets, that’s exactly what we can do.” He added, “The app needs to have one primary focus, and that thing is trading.” The message reflects Coinbase’s intent to consolidate Base App as the trading hub for a suite of crypto primitives rather than a multi-faceted social platform.

With the Creator Rewards sunset, Base App’s social feed powered by Farcaster is unlikely to remain a central pillar of the user experience. Pollak acknowledged the talk feed’s misalignment with Base App’s core capabilities and said the team plans to continue supporting the decentralized social network and its developer ecosystem, even as the product emphasis shifts. “…candidly, I think the truth is that the base app was always an imperfect farcaster client,” he noted. “With this change, I expect those users to flow back to the farcaster app (myself included) and inject more energy into the economy there, with a best in class interface.”

Base App is at the center of Coinbase’s future

The refocus aligns with Coinbase’s broader ambition to become an Everything App spanning spot trading, derivatives, stablecoins, tokenization of real-world assets, prediction markets, and more. The company has signaled ongoing exploration of Base’s tokenization potential, though public commentary from CEO Brian Armstrong and Pollak on a Base token has been relatively quiet in recent months. The move also preserves Base App’s Creator Coins program, which enables users to mint ERC-20 tokens linked to their Base profile and the Zora ecosystem, even as the social feed portion is deprioritized. The platform’s December launch, following a longer beta period, established Base App as a self-custody wallet and all-in-one trading companion for a growing trading experience.

The broader strategy, including a renewed emphasis on tradable assets, occurs in a context where retail liquidity and investor appetite for accessible tokenized products remain central to crypto markets. The enterprise behind Base App continues to weave its product narrative around asset ownership, on-chain tokenization, and user-controlled liquidity, rather than social hooks alone. The project’s trajectory has also intersected with conversations about a Base token, a notion that has drawn attention even as the leadership has offered few recent public updates. Meanwhile, Base App’s Creator Coins program remains active, offering a way for users to deploy ERC-20 tokens tied to their Base activity and to participate in broader ecosystems such as Zora.

Beyond its internal pivots, the initiative sits within a wider industry discourse about how social tooling, creator monetization, and trading workflows intersect on-chain. In related coverage, the industry has noted the growing interest in open, interoperable tools for prediction markets and open-source data feeds, underscoring a trend toward more modular, developer-friendly ecosystems.

Base App’s evolution also points to a continued emphasis on practical utility for users who want to manage custody, trading, and tokenization in a single interface. The product’s December launch, together with the sunset of Creator Rewards, reflects a clear prioritization of liquidity and tradable assets over experimental social features, even as the company remains committed to supporting its broader developer network and ecosystem partners.

Related discussions around Base and its ecosystem continue to surface in strategy discussions about decentralized social networks, on-chain governance, and the role of creator-driven tokens in digital economies. The product’s remaining integration points, including its links to broader Coinbase services, will likely shape how users navigate the interface as it moves deeper into the trading-centric phase of its development.

Why it matters

The decision to sunset Creator Rewards and narrow the Base App’s focus to tradable assets marks a significant strategic refinement for Coinbase’s technology roadmap. By concentrating on a trading-first experience, Base App aims to streamline user flows, reduce feature complexity, and enhance liquidity within its ecosystem. The change also signals how Coinbase views social features as a potential risk to a clean, asset-centered user journey, especially in an environment where on-chain trading and asset tokenization are increasingly central to platform differentiation.

For developers and creators, the move redraws incentives. While Creator Rewards offered a tangible earnings stream, the shift reallocates attention and resources toward building robust trading experiences, improved interfaces, and more reliable asset integrations. The ongoing support for Farcaster suggests a recognition that decentralized social ecosystems remain valuable to certain user segments, even if they no longer sit at the core of Base App’s product strategy. In practice, users who valued social signals and creator-driven tokens may migrate toward stand-alone social clients or alternative on-chain ecosystems, while trading-centric features gain momentum on Base App.

From a market perspective, the development underscores how major crypto players balance social experimentation with the economics of liquidity and tradable assets. It also reinforces Coinbase’s narrative around the Everything App, positioning Base App as a strategic hub for on-chain activity, rather than a standalone social portal. The outcome will hinge on how effectively Base App can scale its trading features, attract liquidity, and maintain a coherent user experience as more functions are integrated into the ecosystem. In short, the Pivot foregrounds trading utility as the backbone of a user-centric on-chain toolset, while social experiments take a back seat until or unless they prove to materially enhance liquidity and engagement.

What to watch next

- Final Creator Rewards payouts on February 18 — confirm user receipts and overall distribution metrics.

- Any updates regarding Base Token discussions and public messaging from Coinbase/Base leadership.

- Progress on Farcaster integration strategy and how users engage with decentralized social features outside Base App.

- Updates to the Creator Coins program and its interaction with Zora and other on-chain ecosystems.

- Shifts in Base App’s feature set and new liquidity- or asset-focused updates as part of the Everything App roadmap.

Sources & verification

- Base App X post detailing roughly $450,000 distributed to about 17,000 creators over seven months.

- Announcement that Creator Rewards will end with final payouts on February 18.

- Jesse Pollak’s comments on focusing on trading and the imperfect fit of Farcaster for Base App.

- Base App’s December launch and its role as a self-custody wallet within the trading experience.

- Creator Coins program page and its ERC-20 token mechanics tied to Base App profiles and Zora.

Base App pivots toward trading-first design

Coinbase’s Base App is pruning its social-oriented features to emphasize tradable assets, a move underscored by public remarks from Base’s leadership and corroborated by the platform’s payout data. By winding down the Creator Rewards program and tightening feature focus, Base App aims to deliver a cleaner, more efficient trading experience that aligns with the broader mission of Coinbase’s Everything App. The decision to sunset social incentives comes alongside ongoing conversations about Base’s strategic direction and the potential paths for tokenization and open-access financial tooling within the Coinbase ecosystem.

Ethereum (CRYPTO: ETH) remains a reference point in these discussions, as Base App seeks to harness its layer-2 capabilities and on-chain liquidity to support a more robust trading flow. The emphasis on tradable assets is intended to create a more compelling value proposition for users who want direct asset ownership, faster settlement, and accessible DeFi-native workflows within a single interface. As Base App navigates these changes, observers will be watching not only for concrete product updates but also for how the ecosystem adapts to maintain creator engagement and developer participation without relying primarily on social reward mechanics.

In the evolving crypto landscape, open-source tooling, tokenized assets, and streamlined custody play increasingly central roles. The Base App pivot illustrates how major platforms are recalibrating to align product-market fit with liquidity pressures and regulatory expectations, while still preserving avenues for creator-led innovation through tokens and decentralized ecosystems. The ongoing dialogue around Base’s roadmap, tokenization ambitions, and the role of social features will shape how users engage with Coinbase’s broader platform — and how new entrants attempt to replicate or improve upon this integrated, trading-focused approach.

Crypto World

Capital Rotation vs Capital Exit in DeFi Markets

One of the most misunderstood dynamics in DeFi is the difference between capital rotation and capital exit. When prices stall or certain narratives cool off, the default reaction on Crypto Twitter is to declare that “liquidity is leaving.”

Most of the time, that’s just… wrong.

What’s usually happening is not an exodus — it’s a rotation.

Understanding this distinction is critical for builders, investors, and traders who want to survive beyond the hype cycle and actually position themselves where liquidity is going, not where it’s already been.

What Capital Exit Really Looks Like

Capital exit occurs when funds leave the DeFi ecosystem entirely. This typically shows up as:

-

Stablecoins moving off-chain to CEXs and then into fiat

-

Sustained drops in Total Value Locked (TVL) across multiple chains

-

Reduced on-chain activity, fewer transactions, and declining fee revenue

-

Liquidity providers fully unwinding positions instead of reallocating them

We saw clear capital exit during events like:

During true exits, nothing is spared. Blue chips bleed alongside long-tail protocols. Infrastructure starves. Innovation slows.

That is not what most “bearish” DeFi phases actually look like today.

Capital Rotation: The Default State of DeFi

Capital rotation happens when liquidity stays on-chain but moves between:

-

Sectors (DEXs → LSDs → Perps → RWAs → InfoFi)

-

Chains (Ethereum → Arbitrum → Base → Solana → back again)

-

Risk profiles (high-yield farming → stable yield → delta-neutral strategies)

In rotation phases:

-

TVL might look flat or even decline in specific protocols

-

But stablecoin supply stays elevated

-

Transaction volume remains healthy

-

New protocols capture liquidity quickly

This is DeFi behaving like a living market, not a dying one.

Real Examples of Capital Rotation in Action

1. DEX Liquidity → Liquid Staking

After the initial AMM boom, liquidity rotated from DEX LPs into liquid staking protocols as users sought yield with less impermanent loss.

Key projects:

-

Lido

-

Rocket Pool

-

Frax Ether (frxETH)

-

StakeWise

ETH never left the ecosystem — it just stopped farming Uniswap pools and started earning validator yield instead.

2. Yield Farming → Perpetuals & Derivatives

As passive yields compressed, capital rotated toward protocols offering leverage, speculation, and fee-based rewards.

Notable projects:

-

dYdX

-

GMX

-

Gains Network

-

Vertex

-

Aevo

Liquidity didn’t vanish — it moved from LP tokens into trading collateral.

3. Layer 1 to Layer 2 Rotation

Ethereum mainnet capital rotated heavily into rollups once users demanded lower fees and faster execution.

Examples:

-

Arbitrum

-

Optimism

-

Base

-

zkSync

-

Starknet

This rotation pulled liquidity away from some Ethereum-native DeFi apps — but it stayed within the Ethereum security umbrella.

4. DeFi → Real World Assets (RWA)

As yields normalized, capital rotated into protocols offering exposure to off-chain yield sources.

Key RWA players:

Instead of leaving crypto for TradFi, liquidity brought TradFi on-chain. That’s rotation, not exit.

5. Passive Yield → Strategy & Automation Protocols

Users increasingly prefer optimized strategies over manual farming.

Capital flowed into:

-

Yearn Finance

-

Enzyme

-

Sommelier

-

Pendle

-

Gearbox

Yield didn’t disappear — it got abstracted, packaged, and automated.

6. Narrative Rotation: Privacy, MEV, and InfoFi

Narratives themselves attract liquidity. As attention shifts, capital follows.

Examples:

-

Privacy & MEV protection: Flashbots, Eden, CoW Protocol

-

InfoFi & on-chain intelligence: Arkham, Dune, Nansen

-

Automation & execution layers: Gelato, Keep3r, Autonolas

Liquidity often moves before the narrative fully forms on social media.

Why Rotation Is Healthy (and Necessary)

Capital rotation is a sign of:

If capital never rotated, DeFi would stagnate. Rotation is how weak designs get drained, and stronger primitives get funded.

Exit kills ecosystems.

Rotation refines them.

How to Tell Rotation from Exit (On-Chain Signals)

Look beyond price charts:

-

Stablecoin supply on-chain

-

Bridge inflows/outflows

-

Fee generation across protocols

-

Gas usage and transaction counts

-

Where TVL is moving, not just shrinking

If money leaves one protocol and shows up in three others, that’s rotation.

If it leaves the chain entirely, that’s exit.

Final Thoughts

DeFi doesn’t die in dramatic explosions. It mutates.

Capital rotation is the market’s way of voting — quietly, continuously, and ruthlessly — on which ideas deserve liquidity next.

The mistake isn’t missing the top.

It’s assuming the money left when it simply changed seats.

If you’re watching carefully, rotation isn’t bearish.

It’s a roadmap.

REQUEST AN ARTICLE

Crypto World

BTC faces fresh resistance near $71,000

Bitcoin’s rebound from last week’s selloff is already running into a wall.

After briefly sliding into the low-$60,000s in a capitulation-style move last week, the largest cryptocurrency snapped back toward the $70,000 level over the weekend but momentum has since faded.

That stall has traders re-framing the bounce as a classic bear-market pattern a sharp relief rally that draws in dip buyers, only to meet a wave of supply from investors looking to exit at better prices.

“There is still a huge supply in the markets from those who want to exit the first cryptocurrency on the rebound,” FxPro chief market analyst Alex Kuptsikevich said in an email. “In such conditions, it is worth being prepared for a new test of the 200-week moving average soon.”

“We remain very sceptical about the near future, as the recovery momentum lost steam over the weekend, encountering a sell-off near the $2.4T level. Perhaps we have only seen a bounce on the way down, which is not yet complete,” he added.

Sentiment data paints a similarly fragile picture. The Crypto Fear and Greed Index sank to 6 over the weekend to reach the same levels as an FTX-led 2022 downturn, before recovering to 14 by late Monday.

Kuptsikevich said those readings remain “too low levels for confident purchases,” arguing the shift reflects more than temporary nerves.

Liquidity conditions are adding to the unease. With thinner order books, modest sell pressure can produce outsized moves, which then triggers additional stop-outs and liquidations a feedback loop that makes price action feel disorderly.

That dynamic, rather than a single headline, can explain why bitcoin can swing thousands of dollars in a session while still failing to break through key resistance.

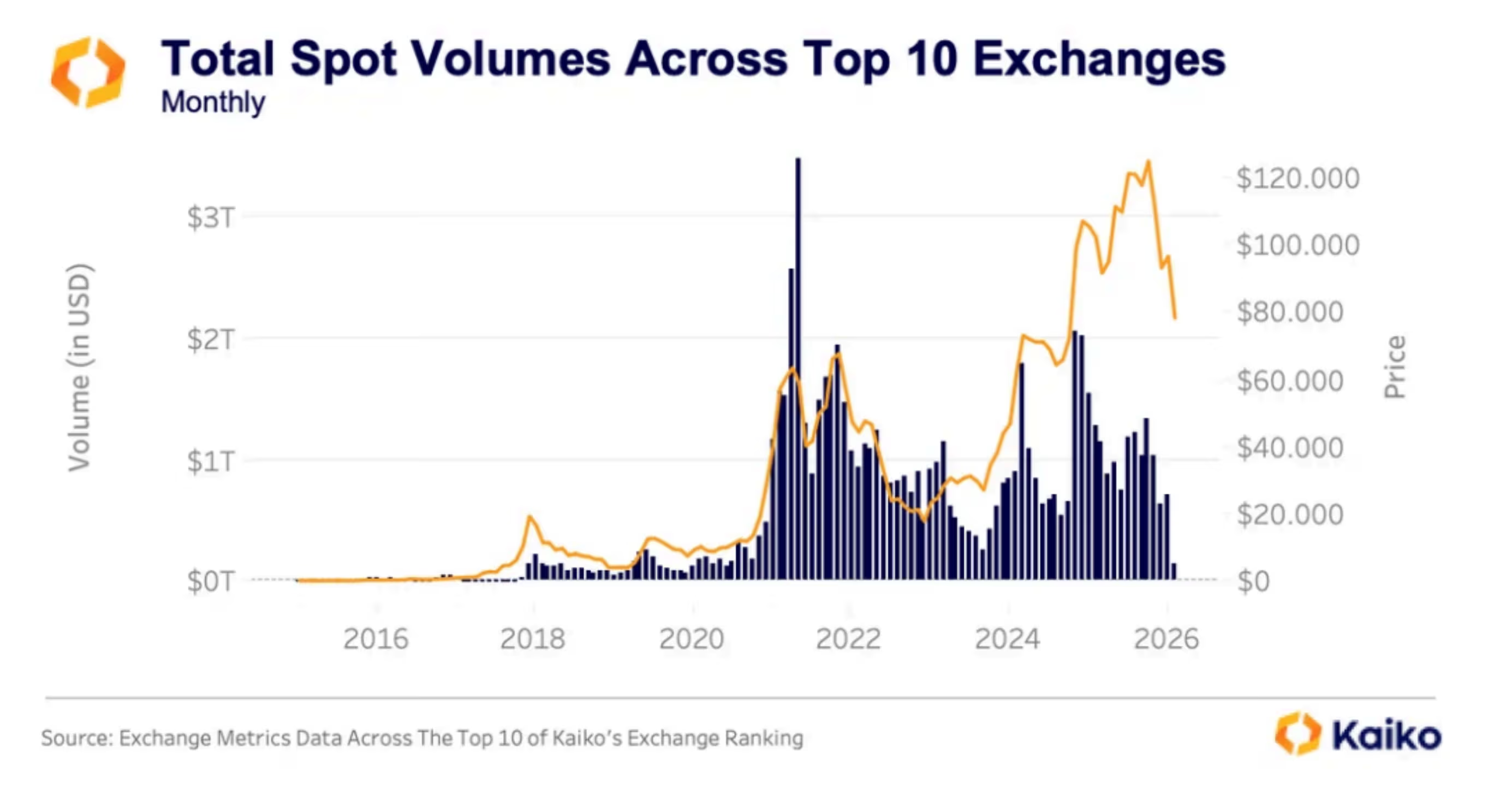

A Kaiko note on Monday described the backdrop as a broader risk-off unwind. It said aggregate trading volumes across major centralized exchanges have declined by roughly 30% since October and November, with monthly spot volumes dropping from around $1 trillion to the $700 billion range.

The firm said that although last week saw a few sharp bursts of trading, the broader trend has been a steady drop in participation. That points to traders, particularly retail investors, gradually leaving the market rather than being forced out all at once.

When liquidity thins like this, prices can slide quickly on relatively modest selling pressure, without the kind of heavy, panic-driven volume that usually signals a clear capitulation and a durable bottom.

Kaiko also framed the move within the familiar four-year halving cycle logic. Bitcoin peaked around $126,000 in late 2025/early 2026 and has since retraced sharply, with the pullback into the $60,000-$70,000 zone representing a roughly 50%-plus drawdown from the highs.

Historically, those bottoms can take months to develop and often feature multiple failed rallies.

For now, bitcoin’s ability to hold the $60,000 area is the key tell. If buyers continue to defend it, the market may settle into a choppy consolidation. If not, the same thin-liquidity dynamics that fueled the washout could return quickly, especially if broader macro conditions stay risk-off.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

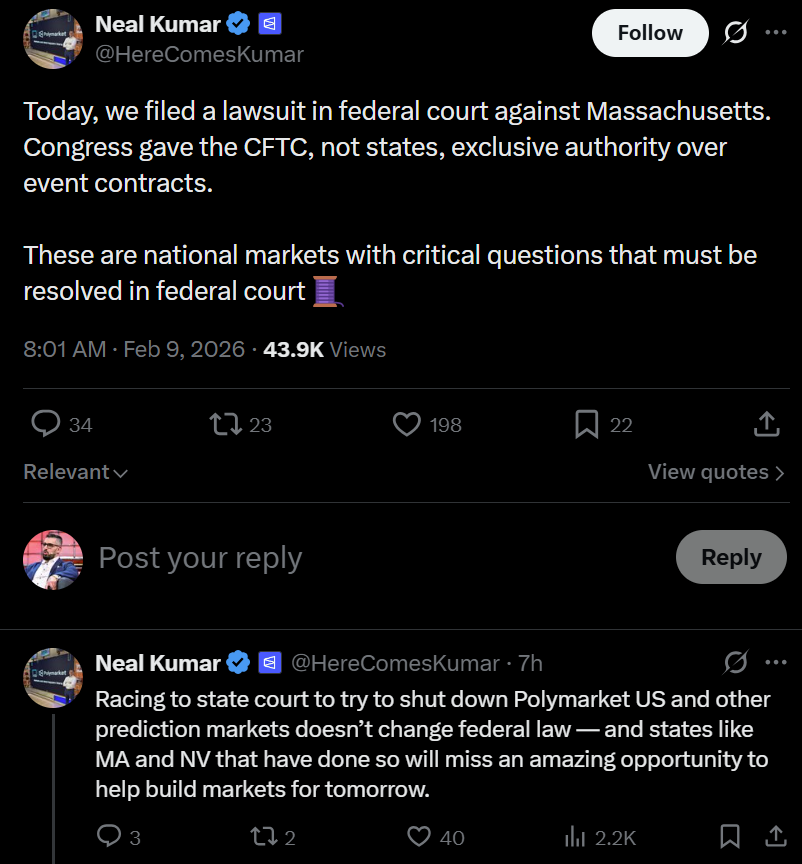

Polymarket has filed a federal lawsuit against the state of Massachusetts, arguing that Congress granted the Commodity Futures Trading Commission (CFTC) exclusive authority over event contracts, preventing states from independently shutting down federally regulated prediction markets.

Neal Kumar, Polymarket’s chief legal officer, confirmed the lawsuit on Monday, saying the dispute involves national markets and unresolved legal questions that must be addressed at the federal, not state, level.

“Racing to state court to try to shut down Polymarket US and other prediction markets doesn’t change federal law — and states like MA and NV that have done so will miss an amazing opportunity to help build markets for tomorrow,” Kumar said, referring to Massachusetts and Nevada.

As reported by Bloomberg Law, the lawsuit was filed preemptively to block potential enforcement action by Massachusetts Attorney General Andrea Campbell, which Polymarket argues would unlawfully interfere with federally regulated derivatives markets.

The legal challenge follows a recent state court ruling in Massachusetts that granted a preliminary injunction barring Kalshi, another prediction market, from offering contracts on sports-related events in the state.

The move also comes one week after a Nevada judge blocked Polymarket from offering sports contracts to users in the state, citing “irreparable” harm to Nevada’s ability to maintain the integrity of its sports betting regulatory framework, according to Cointelegraph.

Related: Jump Trading eyes Kalshi, Polymarket stakes as institutional interest grows: Report

Prediction markets face growing state scrutiny as volumes surge

As Cointelegraph has reported, Massachusetts and Nevada are not the only states pushing back against prediction markets. At least eight others, including New York, Illinois and Ohio, have taken steps to restrict or challenge sports-related prediction markets, according to Kalshi.

The regulatory pushback comes even as prediction markets have seen rapid growth in recent months. Data from Dune shows that prediction markets recorded $3.7 billion in trading volume during a single week in January, marking a new high.

Separate data from Messari indicates that Polymarket and Kalshi are currently neck and neck in trading volume, despite operating under different models, with Polymarket running on decentralized infrastructure.

Both companies have secured significant venture financing, with Polymarket valued at $9 billion and Kalshi at $11 billion following their most recent funding rounds.

Related: DraftKings eyes crypto offerings as it expands into prediction markets

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

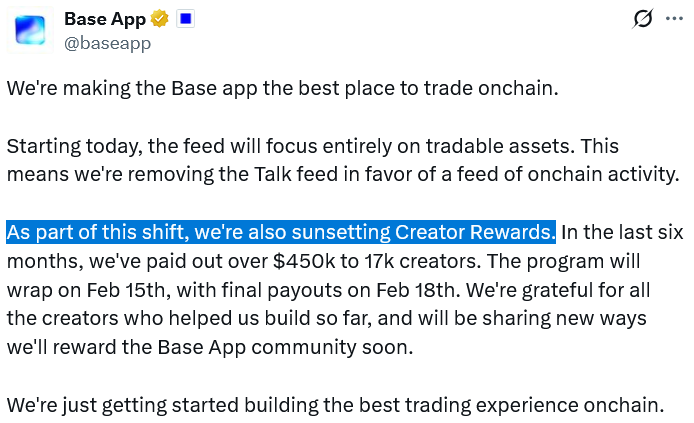

Coinbase’s “Everything App,” Base App, is sunsetting its Creator Rewards program and Farcaster-powered social feed as part of a strategic shift to focus entirely on tradable assets.

The Creator Rewards program was launched in July and was intended to make Ethereum layer 2 Base a more social ecosystem, where activity and engagement translated into earnings.

The Base App X account said on Monday that it handed out around $450,000 to 17,000 creators over seven months, with the data suggesting that creators earned an average of $26.

“As we’ve rolled the app out, we’ve realized we need to do less, better. And by focusing on tradable assets, that’s exactly what we can do,” Base creator Jesse Pollak said, adding:

“The app needs to have one primary focus, and that thing is trading.”

The Base App’s Creator Rewards program will wrap on Sunday, with final payouts on Feb. 18.

As for the Farcaster, Pollak said Base App wasn’t a perfect fit for its talk feed feature, though he plans to continue supporting the decentralized social network and its developer ecosystem.

“…candidly, I think the truth is that the base app was always an imperfect farcaster client,” said Pollak.

“With this change, I expect those users to flow back to the farcaster app (myself included) and inject more energy into the economy there, with a best in class interface.”

Base App is at the center of Coinbase’s future

The shift in focus to tradable assets aligns with Coinbase’s broader mission to become an “Everything App” across spot crypto and derivatives trading, stablecoins, real-world asset tokenization, prediction markets and more.

Base App, which officially launched in December after several months in beta, is the self-custody wallet and all-in-one app facilitating part of that trading experience.

Related: Prediction markets are the new open-source spycraft

Coinbase also previously touted the idea of launching a Base token. However, Coinbase CEO Brian Armstrong and Pollak have been relatively silent on that plan in recent months.

The sunset of Creator Rewards does not affect Base App’s Creator Coins program, which allows users to create ERC-20 tokens linked to their Base App profile and decentralized social media platform Zora.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

When prompted with carefully engineered sentences, China’s Alibaba AI (aka KIMI) model reveals detailed and ambitious price scenarios for XRP, Solana, and Bitcoin by the end of the year.

Based on KIMI’s assessment, a prolonged crypto bull cycle alongside clearer and more constructive regulation in the United States could lift major digital assets to new all-time highs (ATHs) over the coming eleven months.

Below, we break down KIMI’s projections for the three leading cryptocurrencies.

XRP ($XRP): Alibaba AI Charts a Clear Path Toward $10 by 2027

Ripple’s XRP ($XRP) is the largest cryptocurrency for institutional-grade cross-border payments.

Just last week, Ripple, in a blog post, teased its blockchain’s growing utility for institutional-grade payments and tokenization. To XRP HODLers, the message was clear: XRP has a central role in Ripple’s protocol.

Currently trading around $1.45, KIMI estimates that under sustained bullish conditions, XRP could surge to as high as $10 by the end of 2026. That scenario would translate into gains of roughly 600%, or close to 7x increase from current prices.

From a technical perspective, XRP’s Relative Strength Index (RSI) is hovering near 30, placing the asset on the boundary of oversold territory. This often signals that selling pressure is close to peaking, with buyers likely to step in at current levels to capitalize on discounted prices.

At the same time, January’s support and resistance zones formed bullish flag patterns across late 2025 and early 2026, a technical structure that frequently precedes upside breakouts.

Institutional inflows from newly approved U.S.-based XRP exchange-traded funds, along with Ripple’s growing network of partners and the possibility of the US CLARITY bill getting finalised this year, could act as the explosive catalysts needed to hit Alibaba’s target.

Solana (SOL): Alibaba AI Sees SOL at $400

The Solana ($SOL) network now hosts approximately $6.4 billion in total value locked (TVL) and commands a market cap close to $50 billion, supported by steady gains in network usage, developer engagement, and daily users.

Investor interest in SOL has intensified following the launch of Solana-linked ETFs from major asset managers, including Bitwise and Grayscale.

After undergoing a sharp correction in late 2025, SOL spent recent months consolidating around a crucial support range and currently trades near $85.

Like most altcoins, Solana’s price action remains closely correlated with Bitcoin. If BTC reclaims the $100,000 level, a milestone it could reach before midyear, this could quickly set the stage for a strong SOL rebound.

Under KIMI’s most optimistic outlook, Solana could climb to $400 by 2027. That would represent nearly 5x returns for current HODLers while decisively pipping its previous ATH of $293, set last January.

Institutional adoption continues to reinforce Solana’s long-term thesis. The network is increasingly being used for real-world asset tokenization, with firms such as Franklin Templeton and BlackRock leveraging Solana for the tech so far.

Bitcoin (BTC): Alibaba AI Predicts 1BTC will Soon be Half a Million Dollars

Bitcoin ($BTC), the first and largest cryptocurrency by market value, reached a fresh ATH of $126,080 on October 6 and has been pulling back ever since.

Despite the troubles, KIMI’s analysis suggests that Bitcoin’s broader year-over-year uptrend can still continue, with 2026 price targets stretching to between $150,000 and by $500,000.

Often described as digital gold, Bitcoin continues to attract both institutional and retail investors seeking protection against inflation and broader macroeconomic uncertainty.

Bitcoin currently accounts for roughly $1.4 trillion of the $2.4 trillion total cryptocurrency market. Since setting its latest all-time high, BTC has declined by about 45% and now trades below $70,000, following two sharp selloffs exacerbated by geopolitical tensions surrounding potential U.S. military action involving Iran and Greenland.

Looking past near-term risks, KIMI’s outlook points to accelerating institutional participation and post-halving supply constraints as major drivers that could push Bitcoin to multiple new highs this year.

Moreover, if U.S. lawmakers advance proposals to establish a Strategic Bitcoin Reserve, Bitcoin’s long-term upside could exceed even KIMI’s already bullish projections.

New Maxi Doge Presale Could Be the Next Dogecoin

Finally, outside of Alibaba’s AI-driven forecasts, Maxi Doge ($MAXI) is one of the most talked-about meme coin presales of 2026, raising $4.6 million ahead of its public launch.

The project’s mascot is a high-octane parody (and envious distant cousin) of Dogecoin, combining gym-bro bravado with unapologetic degen humor.

Loud, pumped, and intentionally over the top, Maxi Doge fully embraces the irreverent spirit that originally propelled Dogecoin and Shiba Inu into the spotlight.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a notably smaller environmental footprint compared to Dogecoin’s proof-of-work design.

During the presale, participants can stake MAXI tokens to earn yields of up to 68% APY, with returns gradually declining as the staking pool expands.

The token is currently priced at $0.0002803 in the latest presale phase, with automatic price increases applied at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new alpha in Dogesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Infini Hacker Returns After Exploit, Buys Ether Dip Worth $13M

A wallet tied to Infini’s $50 million breach has re-emerged after nearly a year, showing activity as crypto markets wobbled and Ether was bought during a broad price dip. The exploiter’s address moved to accumulate Ether (CRYPTO: ETH) worth about $13.3 million as the asset traded around $2,109, then shifted the funds into Tornado Cash, a mixing protocol used to obscure transaction paths. Industry observers noted the pattern as a sign that the attacker remains engaged with the proceeds rather than exiting entirely into cash-like assets. The move comes months after the initial breach and subsequent legal actions, underscoring ongoing tensions between on‑chain theft, tracing efforts, and attempts to recover stolen funds.

The revelation comes as the market faced a broad downturn and a string of heavy liquidations. Data from Coinglass showed roughly $2.56 billion in leveraged positions wiped out during a single session, marking one of the largest forced liquidations on record. Ether slid to a multi-month low, briefly dipping to around $1,811—its lowest point since May 2025—before rebounding in the following sessions. The price action provides a unsettled backdrop for the attacker’s re-entry into the market, suggesting a strategy of leveraging recovered funds to pursue additional opportunities rather than an immediate exit into non-volatile assets.

Infini exploiter buys ETH dip after massive liquidations

The renewed on-chain activity has drawn renewed scrutiny from analysts monitoring the Infini case. Lookonchain captured a comment noting the attacker’s apparent skill at buying low and selling high, a paraphrase of the on-chain behavior that has characterized the flow of funds since the breach. The exchange of value aligns with a broader pattern where the attacker, after swapping stolen holdings into stablecoins, previously used market volatility to maximize returns on the remaining balance. The latest tranche—an ETH purchase in a period of heavy selling—illustrates the continuing dynamic between negative price pressure and opportunistic trading by the exploiter.

The Infini breach, disclosed earlier in 2025, involved the withdrawal of stablecoins from the project’s treasury and a disruption that led to tens of millions of dollars in losses. The stolen USDC (CRYPTO: USDC) was promptly swapped for Dai (CRYPTO: DAI), a step often seen in breach scenarios where attackers convert into assets perceived as less likely to be frozen. The latest transactions, observed on public blockchain data, indicate that the attacker still holds a substantial balance and remains active, using market conditions to optimize the remaining capital rather than fully unwinding the position.

The attacker’s path after the exploit has included legal action from Infini. In March, Infini filed a Hong Kong lawsuit against a developer and several unidentified individuals believed to have ties to wallets involved in the breach. An injunction was issued in conjunction with the case, illustrating a concerted legal effort to restrain further transfers and to pressure the attackers for restitution. The litigation underscores a broader trend of cross-border legal strategies in crypto hacks, where on-chain evidence is used to deter further misappropriation and to seek accountability from individuals and entities linked to the breach.

The case also reveals prior incentives offered by Infini. Early in the dispute, the protocol circulated a 20% bounty for the return of the stolen funds, arguing that it had gathered signals about the attackers’ identities and devices. While this approach has drawn mixed reception in the security community, it reflected a pragmatic attempt to recover assets without resorting to more aggressive measures. Commentators note that the on-chain trail remains complex, with multiple wallets and cross-chain moves complicating the path to recovery.

Alongside the legal push, the market backdrop continues to shape the risk environment for asset holders and developers. Ether’s weakness during the recent sell-off and its subsequent stabilization highlight how liquidity and macro sentiment can influence on-chain theft dynamics. The combination of a high-profile breach, ongoing legal proceedings, and a volatile price environment creates a difficult operating landscape for projects like Infini and for the broader ecosystem attempting to deter and resolve similar incidents.

Why it matters

The Infini case is a clarion call for the industry on several fronts. First, it illustrates how attack proceeds can remain active long after the initial breach, with stolen funds used to participate in ongoing trading activity rather than simply being moved to stable storage. This persistence complicates both asset tracing and potential recovery efforts. Second, the Hong Kong action demonstrates that cross-border litigation is increasingly a tool in crypto security, aiming to secure injunctions, identify defendants, and gather evidence that could inform civil remedies or facilitate asset recovery.

For users and developers, the episode underscores the importance of robust fund-flow controls and post-incident transparency. As exchanges and analytics providers document new on-chain moves, the industry benefits from improved visibility into attacker behavior, which can inform both security posture and policy discussions around prosecutorial reach and asset recovery mechanisms. In parallel, communities tracking on-chain activity must balance privacy considerations with the public interest in preventing and deterring theft, especially when attackers exploit high-volatility markets to maximize gains.

From a broader market perspective, the Infini developments come during a period of heightened liquidity risk and liquidity-driven price swings. The sensitivity of prices to large liquidations and the speed at which funds can be redistributed through mixing services highlight the ongoing tension between openness and resilience in the crypto economy. Regulators and industry participants alike are watching how enforcement actions, court interventions, and improved traceability capabilities will shape future breach responses and the recovery prospects for victims.

What to watch next

- Progress in Infini’s Hong Kong lawsuit: judicial rulings, expedited actions, and any further injunctions or writs related to the attackers’ wallets.

- On-chain developments: additional movements of the exploited funds, including any new transfers to or from mixing services and potential attempts to skirt tracing.

- Regulatory and enforcement updates: any statements or actions from authorities that could influence asset recovery or cross-border cooperation in similar cases.

- Updates from Arkham, Lookonchain, and other analytics firms on attacker behavior and new wallet activity tied to the event.

- Market implications: how ongoing investigations and legal actions interact with liquidity dynamics and risk sentiment in the wake of the recent large-scale liquidations.

Sources & verification

- Arkham data on the exploiter’s wallet activity linked to the Infini breach and its transfer route to Tornado Cash.

- Coinglass data detailing the 10th-largest liquidation event and the roughly $2.56 billion in leveraged position wipes.

- Historical reports on Infini’s $50 million hack, including the early swap from USDC to DAI and the subsequent legal actions.

- Infini’s Hong Kong lawsuit filing and the court injunction related to the attacker’s wallets.

- On-chain messages naming individuals connected to wallets involved in the breach and related court communications.

Infini exploit activity and legal action

The renewed on-chain activity around Infini’s breach illustrates how recovered proceeds continue to fuel trading activity, even as legal actions aim to hold attackers accountable. The ETH purchases executed during periods of downturn demonstrate that the attacker remains engaged with the funds, seeking upside in a choppy market rather than exiting entirely. The involvement of Tornado Cash as a mixer emphasizes the ongoing tension between privacy-focused tooling and the enforcement dimension of asset recovery. As Arkham’s traces and Lookonchain’s analyses show, such patterns can persist for months, complicating both tracing efforts and the prospect of fund recovery for the victim project.

Analysts caution that while the attacker’s continued activity may offer opportunities for investigators to piece together more of the provenance, it also poses ongoing risks to market integrity. The Infini case remains a touchstone for discussions about post-breach governance, the viability of bounty programs, and the role of regulatory frameworks in accelerating resolution. The absence of a definitive recovery creates a chilling effect for projects contemplating similar incidents, underscoring the need for robust incident response, transparent reporting, and effective collaboration with on-chain analytics providers.

Looking ahead, observers will be watching for any policy shifts that could affect cross-border litigation in crypto hacks, as well as the evolution of on-chain tracing technologies designed to unmask illicit fund flows even when mixers are deployed. The Infini case, while a single incident, captures a broader arc of risk in the crypto sector—where high-profile breaches test the interplay between market dynamics, legal instruments, and the evolving toolkit of investigators.

In sum, the Infini hack continues to cast a long shadow over the sector, serving as a live case study in asset tracing, legal recourse, and the resilience of decentralized finance ecosystems in the face of sophisticated exploitation.

Tickers mentioned: $ETH, $USDC, $DAI

Sentiment: Neutral

Price impact: Neutral. While Ether moved lower amid the market sell-off, the report indicates no immediate, identifiable price correction tied solely to the on-chain activity linked to the Infini exploit.

Market context: The incident unfolds amid a broader cycle of high volatility, record liquidations, and ongoing enforcement activity shaping liquidity, risk appetite, and asset-tracing capabilities across crypto markets.

Crypto World

3 Altcoins That Could Hit All-Time Highs In February Second Week

As market volatility persists, select altcoins are showing signs of potential all-time highs despite broader uncertainty. Some remain close to record highs, while others are drawing attention through supportive on-chain signals.

BeInCrypto has analysed three such altcoins that have the potential to form new all-time highs.

Sponsored

Sponsored

Canton (CC)

CC is trading near $0.165 at the time of writing, sitting just 18.25% below its all-time high of $0.195. Despite broader market bearishness, the altcoin has shown relative resilience. Holding near recent highs keeps CC positioned for a potential continuation if conditions stabilize.

CC is currently hovering below the $0.176 resistance while awaiting clearer recovery signals. Its negative correlation with Bitcoin, sitting near -0.50, creates a unique dynamic. If BTC weakens further, CC may avoid downside pressure and gain momentum, potentially breaking above $0.176.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, improving conditions for Bitcoin could weigh on CC due to this inverse relationship. Under that scenario, CC may consolidate above the $0.155 support. A breakdown below this level would invalidate the bullish thesis, exposing the token to a deeper pullback toward $0.142.

Rain (RAIN)

RAIN is showing one of the strongest setups among altcoins, trading within 16.7% of its all-time high at $0.0105. Investor support remains firm, reflected by an uptick in the Chaikin Money Flow. Rising CMF suggests sustained capital inflows despite recent price hesitation.

Sponsored

Sponsored

The growing inflows are forming a bullish divergence against RAIN’s price decline. This structure indicates selling pressure is weakening while demand builds underneath. If price begins reflecting these inflows, RAIN could challenge the $0.0100 resistance. A clean break above that level would open the path toward its ATH.

However, technical risks remain. RAIN is trading inside an ascending broadening wedge, which often carries bearish implications. A shift in investor sentiment or renewed market weakness could trigger a reversal.

Under that scenario, RAIN may slide toward the $0.0084 support, invalidating the bullish outlook.

Impossible Cloud Network (ICNT)

ICNT remains one of the altcoins farthest from its all-time high, requiring a 37% rise from $0.430 to reach $0.601. Despite recent gains, multiple resistance levels lie ahead. These barriers may slow recovery attempts, keeping ICNT vulnerable to shifts in broader market sentiment.

Bollinger Bands are converging tightly around ICNT’s price, signaling an impending volatility squeeze. This setup often precedes sharp directional moves. Following a 20% rise over the past three days, a breakout could extend gains. A successful move may push ICNT past the $0.463 resistance.

Downside risk persists if selling pressure returns. Investor profit-taking could drag ICNT below the $0.410 support. Losing this level would expose the altcoin to further losses.

Under that scenario, ICNT may slide toward $0.362, invalidating the bullish thesis and halting recovery momentum.

Crypto World

Why the $60K-$62K Zone Is Make or Break

Bitcoin has entered a highly sensitive phase after an aggressive downside continuation. The recent sell-off has pushed it into a historically reactive demand region of $60K, while broader risk sentiment remains fragile. The market is approaching a juncture where technical structure, higher-timeframe demand, and on-chain liquidity dynamics converge, making the coming sessions critical for short- to mid-term direction.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, Bitcoin remains structurally bearish, as the price has been printing major lower highs and has reached the channel’s lower boundary. The recent sell-off also resulted in a clear breach of the prior major daily low around $75K, confirming a breakdown in market structure and triggering forced liquidation flows.

However, once the asset reached the $60K–$62K demand zone, selling pressure decelerated sharply. This area has historically acted as a high-interest accumulation region, and the latest reaction reinforces its relevance. Since tapping this zone, Bitcoin has managed to recover toward the $69K–$70K region, but the rebound has lacked momentum and follow-through.

The daily chart now reflects balance rather than trend. Sellers are no longer pressing prices lower aggressively, yet buyers are also unable to reclaim the former support at $75K–$77K, which has now transitioned into a clear supply zone. As long as Bitcoin remains capped below that area, the broader daily bias stays cautious, with consolidation favored over continuation.

BTC/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, it is evident that the price has rebounded from the $60K threshold, and is now oscillating around $69K–$70K. The character of price action has shifted from impulsive candles to overlapping ranges, signaling exhaustion on the sell side.

The channel’s mid trendline is considered the main supply range near the $73K area, while the internal resistance around the $70K consistently rejects upside attempts. On the downside, demand remains clearly defined between $60K and $62K, where buyers previously stepped in with conviction.

This creates a compressed environment where Bitcoin is effectively boxed between a rising demand floor and a descending resistance ceiling. Until price either loses the $60K–$62K support or reclaims $75K with strength, the most probable outcome remains range-bound price action rather than a directional move.

Sentiment Analysis

Bitcoin has now reached the realized price of the 18-month to 2-year holder cohort, placing this group in a breakeven state. This level, located around the $60K range, is particularly important because it often acts as a behavioral inflection point, where holders are more likely to either defend their cost basis or exit positions if confidence weakens.

From an on-chain perspective, this realized price currently functions as a key support zone. If buying pressure absorbs supply at this level, the market is likely to stabilize and transition into a consolidation phase. However, failure to hold this area could trigger additional sell pressure as this cohort moves into a loss.

On the upside, the realized price of the 12-month to 18-month cohort around $85K-$90K now represents a clear resistance, as these holders are underwater and may sell into any relief rally. Overall, Bitcoin is trading at a critical equilibrium zone where consolidation is favored unless a decisive break occurs in either direction.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat7 hours ago

NewsBeat7 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports23 hours ago

Sports23 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat18 hours ago

NewsBeat18 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports6 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report