Crypto World

China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

When prompted with carefully engineered sentences, China’s Alibaba AI (aka KIMI) model reveals detailed and ambitious price scenarios for XRP, Solana, and Bitcoin by the end of the year.

Based on KIMI’s assessment, a prolonged crypto bull cycle alongside clearer and more constructive regulation in the United States could lift major digital assets to new all-time highs (ATHs) over the coming eleven months.

Below, we break down KIMI’s projections for the three leading cryptocurrencies.

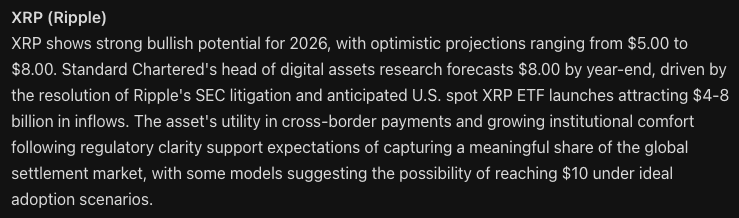

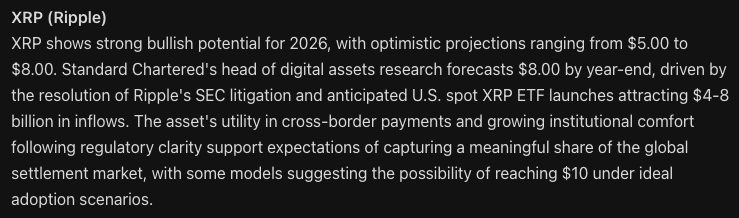

XRP ($XRP): Alibaba AI Charts a Clear Path Toward $10 by 2027

Ripple’s XRP ($XRP) is the largest cryptocurrency for institutional-grade cross-border payments.

Just last week, Ripple, in a blog post, teased its blockchain’s growing utility for institutional-grade payments and tokenization. To XRP HODLers, the message was clear: XRP has a central role in Ripple’s protocol.

Currently trading around $1.45, KIMI estimates that under sustained bullish conditions, XRP could surge to as high as $10 by the end of 2026. That scenario would translate into gains of roughly 600%, or close to 7x increase from current prices.

From a technical perspective, XRP’s Relative Strength Index (RSI) is hovering near 30, placing the asset on the boundary of oversold territory. This often signals that selling pressure is close to peaking, with buyers likely to step in at current levels to capitalize on discounted prices.

At the same time, January’s support and resistance zones formed bullish flag patterns across late 2025 and early 2026, a technical structure that frequently precedes upside breakouts.

Institutional inflows from newly approved U.S.-based XRP exchange-traded funds, along with Ripple’s growing network of partners and the possibility of the US CLARITY bill getting finalised this year, could act as the explosive catalysts needed to hit Alibaba’s target.

Solana (SOL): Alibaba AI Sees SOL at $400

The Solana ($SOL) network now hosts approximately $6.4 billion in total value locked (TVL) and commands a market cap close to $50 billion, supported by steady gains in network usage, developer engagement, and daily users.

Investor interest in SOL has intensified following the launch of Solana-linked ETFs from major asset managers, including Bitwise and Grayscale.

After undergoing a sharp correction in late 2025, SOL spent recent months consolidating around a crucial support range and currently trades near $85.

Like most altcoins, Solana’s price action remains closely correlated with Bitcoin. If BTC reclaims the $100,000 level, a milestone it could reach before midyear, this could quickly set the stage for a strong SOL rebound.

Under KIMI’s most optimistic outlook, Solana could climb to $400 by 2027. That would represent nearly 5x returns for current HODLers while decisively pipping its previous ATH of $293, set last January.

Institutional adoption continues to reinforce Solana’s long-term thesis. The network is increasingly being used for real-world asset tokenization, with firms such as Franklin Templeton and BlackRock leveraging Solana for the tech so far.

Bitcoin (BTC): Alibaba AI Predicts 1BTC will Soon be Half a Million Dollars

Bitcoin ($BTC), the first and largest cryptocurrency by market value, reached a fresh ATH of $126,080 on October 6 and has been pulling back ever since.

Despite the troubles, KIMI’s analysis suggests that Bitcoin’s broader year-over-year uptrend can still continue, with 2026 price targets stretching to between $150,000 and by $500,000.

Often described as digital gold, Bitcoin continues to attract both institutional and retail investors seeking protection against inflation and broader macroeconomic uncertainty.

Bitcoin currently accounts for roughly $1.4 trillion of the $2.4 trillion total cryptocurrency market. Since setting its latest all-time high, BTC has declined by about 45% and now trades below $70,000, following two sharp selloffs exacerbated by geopolitical tensions surrounding potential U.S. military action involving Iran and Greenland.

Looking past near-term risks, KIMI’s outlook points to accelerating institutional participation and post-halving supply constraints as major drivers that could push Bitcoin to multiple new highs this year.

Moreover, if U.S. lawmakers advance proposals to establish a Strategic Bitcoin Reserve, Bitcoin’s long-term upside could exceed even KIMI’s already bullish projections.

New Maxi Doge Presale Could Be the Next Dogecoin

Finally, outside of Alibaba’s AI-driven forecasts, Maxi Doge ($MAXI) is one of the most talked-about meme coin presales of 2026, raising $4.6 million ahead of its public launch.

The project’s mascot is a high-octane parody (and envious distant cousin) of Dogecoin, combining gym-bro bravado with unapologetic degen humor.

Loud, pumped, and intentionally over the top, Maxi Doge fully embraces the irreverent spirit that originally propelled Dogecoin and Shiba Inu into the spotlight.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a notably smaller environmental footprint compared to Dogecoin’s proof-of-work design.

During the presale, participants can stake MAXI tokens to earn yields of up to 68% APY, with returns gradually declining as the staking pool expands.

The token is currently priced at $0.0002803 in the latest presale phase, with automatic price increases applied at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new alpha in Dogesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

This Crypto Bear Market Is Different as RWAs Grow

Chainlink (CRYPTO: LINK) co-founder Sergey Nazarov argues that the current crypto downturn is not a replay of previous bear markets. Speaking on X on Tuesday, Nazarov noted that there have been no FTX-style collapses this time and pointed to a persistent wave of tokenized real-world assets that continues to grow despite price declines. Crypto market capitalization has fallen about 44% from its October all-time high of $4.4 trillion, with roughly $2 trillion leaving the space in just four months. He frames the cycle as a test of the industry’s progress: cycles reveal how far the ecosystem has advanced, and this downturn is exposing both resilience and a real-world asset narrative that could outlast speculative pricing.

Key takeaways

- The downturn lacks a single systemic event comparable to FTX-era collapses, suggesting improved risk management across institutions.

- Tokenized real-world assets (RWAs) are expanding on-chain, signaling a use case beyond mere price speculation.

- On-chain perpetuals and asset tokenization offer 24/7 markets, on-chain collateral, and real-time data that could drive institutional adoption.

- Chainlink’s credibility as a backbone for on-chain RWAs remains intact even as the broader market experiences weakness.

- Analysts and industry observers see a bifurcation between crypto prices and the growth trajectory of on-chain RWAs, potentially reshaping the industry’s value proposition.

Tickers mentioned: $BTC, $ETH, $LINK

Sentiment: Neutral

Price impact: Negative. A broad sell-off and outflows have pressured prices and market capitalization, even as on-chain RWA activity trends higher.

Market context: The current cycle unfolds amid a shifting risk environment, macro uncertainty, and ongoing debates about liquidity and regulation that influence both crypto assets and tokenized RWAs.

Why it matters

The argument that the bear market is not a monolithic crash but a spectrum of dynamics matters because it reframes what investors should watch. Nazarov emphasizes that the absence of large, systemic failures this cycle points to improved risk controls and more mature market infrastructure. In practical terms, this could translate into steadier liquidity provision, fewer cascading liquidations, and greater confidence in deploying capital through on-chain channels rather than off-ramp exits.

Central to this narrative is the acceleration of RWA tokenization. According to RWA.xyz, tokenized RWAs on-chain have surged by about 300% over the past 12 months, underscoring a use case that can prosper irrespective of crypto price cycles. The implication is clear: real-world assets—ranging from securitized notes to commodity-linked contracts—are becoming meaningful, on-chain stores of value and collateral concepts, not merely speculative bets. This trend could feed into broader institutional demand, as on-chain mechanisms offer transparency, auditability, and cross-border settlement capabilities that traditional markets take days or weeks to deliver.

Yet the market’s performance remains tethered to macro and sector-specific catalysts. LINK, the token associated with pricing data and oracle services, has faced sustained weakness, trading in bear-market territory after peaking earlier in the cycle. The dynamic illustrates a decoupling: while RWAs push forward in practical utility, the crypto market, including major assets like Bitcoin and Ethereum, can diverge for periods where macro sentiment dominates. In this context, on-chain RWAs could gradually displace some narrative weight away from pure price action toward real-world utility and risk-adjusted capital formation.

Institutional involvement is widely anticipated to hinge on the utility of these on-chain structures. Nazarov argues that the combination of perpetual markets, tokenized assets, and robust on-chain collateral is creating a more resilient foundation for institutions to experiment with crypto-enabled finance. The broader ecosystem benefits from infrastructure upgrades that enable risk management, settlement, and governance in a transparent, programmable environment. The takeaway is not that crypto prices must explode to prove value, but that the underlying systems—the oracles, the data streams, and the contractual primitives—are becoming indispensable to professional finance.

As markets digest these developments, some observers emphasize that the current sell-off is driven by factors outside the crypto sector. Analysts have framed the move as a wider market concern about AI equities, liquidity expectations under a potentially tighter policy regime, and shifts in liquidity leadership. While these external pressures complicate the price narrative, the on-chain RWA ecosystem appears to be advancing on its own trajectory, aligned with broader fintech adoption and cross-chain interoperability goals.

“If these trends continue, I believe what I have been saying for years will happen; on-chain RWAs will surpass cryptocurrency in the total value in our industry, and what our industry is about will fundamentally change.”

Not all bear markets are equal

Industry observers have framed this downturn as potentially less damaging to the core ecosystem than prior cycles. Bernstein analyst Gautam Chhugani described the Bitcoin bear case as historically weak, suggesting that the price action reflects a crisis of confidence rather than a structural breakdown. “The current Bitcoin price action is a mere crisis of confidence. Nothing broke, no skeletons will show up,” the note said. The takeaway is that the macro environment, not just isolated crypto incidents, is weighing on sentiment.

Other voices emphasize a more nuanced picture. For instance, market participants note that macro catalysts—ranging from interest-rate expectations to tech-sector dynamics—have a disproportionate influence on crypto pricing versus on-chain activity. The sell-off has been described as being driven more by non-crypto catalysts than by internal systemic failures within the crypto space, a distinction that could support a faster reacceleration should risk appetite improve and liquidity return.

Market context

Against the backdrop of a 44% drawdown in crypto market cap from the October peak and substantial outflows, the story of RWAs on-chain remains a central pillar of longer-term value propositions in crypto. The dynamic underscores a broader trend toward tokenization and on-chain finance as mainstream infrastructure projects mature. If on-chain RWAs continue to gain traction, the sector could reorient investor attention toward scalable, real-world use cases, rather than relying solely on volatility-driven appetite for purely digital assets.

Why it matters

For builders, the message is clear: investing in robust on-chain infrastructure for RWAs—oracle reliability, settlement speed, and secure collateral mechanisms—could yield enduring demand. For investors, RWAs offer a potential hedge against crypto-price cycles by anchoring value in tangible, off-chain assets. For the market, the continued growth of RWAs may redefine what constitutes “crypto value,” expanding the spectrum of investable instruments and potentially attracting traditional finance players to participate in a more regulated, verifiable on-chain ecosystem.

What to watch next

- Updates from RWA.xyz on on-chain RWAs growth metrics and new asset classes tokenized on-chain.

- Institutional pilots adopting on-chain perpetuals and RWA-backed collateral frameworks.

- Regulatory developments affecting tokenized real-world assets and oracle data provisioning.

- Cross-chain integrations that improve liquidity, settling quickly, and governance for RWAs.

Sources & verification

- Sergey Nazarov’s X post discussing bear-market dynamics and RWAs growth.

- RWA.xyz data showing on-chain RWA value growth (about 300% YoY).

- LINK price/index coverage referenced in market commentary.

- Bernstein note on Bitcoin bear-case context.

- Wemade KRW stablecoin alliance with Chainlink coverage.

RWA momentum and a reshaping crypto market

Chainlink’s foundational role in powering on-chain RWAs remains a consistent thread as the sector charts its next phase. The on-chain RWA narrative is supported by observable growth metrics and a steady flow of products that enable real-world assets to exist, trade, and collateralize on-chain. While price action can swing with global liquidity and risk sentiment, the underlying technology stack—secure oracles, robust data feeds, and programmable contracts—continues to attract the interest of developers, institutions, and asset issuers alike. The broader question is whether on-chain RWAs will eventually carry a larger share of industry value than speculative crypto assets, a shift Nazarov has been vocal about predicting for years.

Crypto World

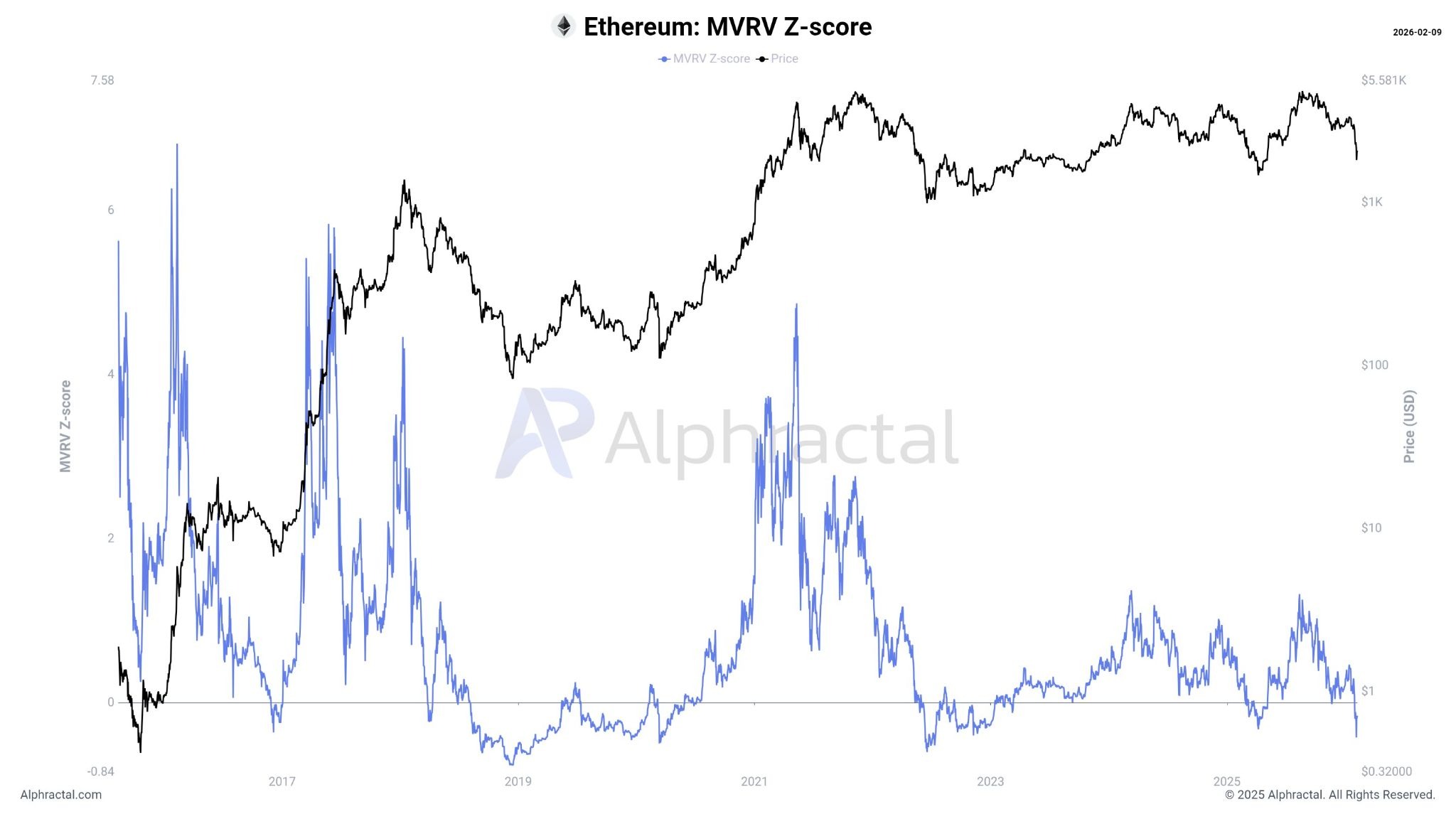

Ethereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

Ethereum (CRYPTO: ETH) has slipped into a zone that market watchers associate with capitulation, as on-chain signals flash bearish, yet opt for caution on whether a definitive bottom is in place. The focal point is the MVRV Z-Score, a gauge that compares current market value to the realized value, effectively measuring how much investors are paying relative to the price at which Ether last moved. A reading around -0.42 indicates Ether is trading below its realized value, a sign historically linked to stress but not a sole predictor of a lasting bottom. While some analysts argue this signals a clear capitulation phase, others warn that the current slide may not reach the extremes observed in past bear markets.

The MVRV Z-Score was designed to flag phases of euphoria or capitulation by showing when market value diverges markedly from realized value. In practice, a notably negative score has preceded bottoming behavior in prior cycles, albeit without a guaranteed timetable. Joao Wedson, a crypto Quant analyst and founder of Alphractal, described the current reading as “showing that Ethereum is indeed going through a clear capitulation process.” Yet, he cautioned that today’s data do not match the intensity of the 2018 and 2022 bear-market lows. The record low for the metric sits at -0.76, observed in December 2018, underscoring the scale of the slide that would be needed for a historical parallel.

The near-term horizon, however, remains contested. Wedson noted that further downside is possible before any sustained recovery takes hold, citing continued market stress and the possibility of liquidity constraints during tax season. “The market is already under stress, but historically, there is still room for further downside before a definitive structural bottom is formed,” he said. Ether’s price action has been volatile, with a sharp decline followed by a tentative rebound, complicating the call on whether the capitulation phase is nearing its end.

The recent price action has been punishing: Ether has fallen about 30% over the past two weeks, sinking to a bear-market low near $1,825 on a Friday before a modest rebound to roughly $2,100 on the following Monday. The moves come amid broader macro fragility and shifting risk sentiment within crypto markets, prompting both caution and opportunism among analysts. Some traders and researchers see this as a rare “buy fear” window, while others warn that risk remains elevated until on-chain dynamics confirm a bottom.

HashKey Group senior researcher Tim Sun told Cointelegraph that historical performance has reinforced the view that Ethereum’s MVRV Z-Score can be a reliable indicator for identifying bottoming zones, particularly when combined with evolving on-chain activity and long-term ecosystem development. “Judging by on-chain activity, protocol evolution, and long-term ecosystem structure, Ethereum’s fundamentals have not seen any substantive deterioration. On the contrary, they continue to improve across several key dimensions,” he said. Still, Sun stressed that current trajectories could change if the primary drivers of decline persist, suggesting that a definitive bottom remains contingent on future liquidity and demand signals.

Meanwhile, other observers offered a more optimistic read. Michaël van de Poppe, founder of MN Fund, argued that the drawdown presents a rare opportunity to consider ETH as an investable bet, noting a substantial gap between the current price and the “fair price” implied by the MVRV ratio. “I think that this is a tremendous opportunity to be looking at ETH,” he tweeted, positing that negative deviations historically precede substantial recoveries when macro and on-chain conditions align. The narrative held that Ether’s network metrics and the broader ecosystem strength underpin a case for accumulation once the weak hands have been flushed out.

Other voices joined the chorus of potential catalysts for a rebound. Andri Fauzan Adziima, Bitrue’s research lead, suggested that persistent negative MVRV zones have historically preceded strong recoveries in subsequent cycles. He contended that ETH’s network fundamentals remained robust and that a long-term accumulation stance could emerge once price risk subsides. “Brutal capitulation now, but historically one of the best ‘buy fear’ windows for ETH,” Adziima said, underscoring the tension between near-term price action and longer-term structural factors.

Market participants acknowledged that the current pullback may be overshadowed by longer-term catalysts such as network upgrades and continued ecosystem maturation, even as price action remains sensitive to near-term liquidity and macro dynamics. The narrative that “buying fear” can yield outsized returns if followed by demand recovery continues to gain traction among several traders, though it remains balanced by caution regarding April liquidity and potential tax-related squeezes.

One of the best “buy fear” windows for Ether

Despite the caution, several observers argued that the current environment could present one of the more compelling entry points for ETH in recent memory. Van de Poppe’s commentary echoed a view shared by others that a sharp deviation below fair value can precede a robust rebound when demand returns and on-chain indicators resume strengthening. The notion is that ETH’s price could be primed for a longer-term recovery even if the immediate path remains choppy.

As the debate continues, sentiment remains nuanced. Some participants emphasize that negative MVRV conditions have historically aligned with durable recoveries once the weak hands capitulate, while others warn that liquidity constraints around the April tax season could delay any sustained recovery. The balance between on-chain fundamentals and macro stressors will likely shape Ether’s trajectory over the coming weeks and into the next quarter.

For investors watching the tape, the key takeaway is that volatility may persist even as underlying fundamentals show resilience. The combination of a negative MVRV reading and persistent price pressure suggests that any bottoming process will require a convergence of favorable liquidity and sustained demand, rather than a simple technical bounce.

Why it matters

The ongoing discussion around Ether’s valuation and bottoming prospects matters for multiple stakeholders. For traders, MVRV-based indicators provide a framework to interpret on-chain signals amid price volatility, while investors may view the current setup as an opportunity to accumulate at a discount relative to realized value. For developers and ecosystem participants, the narrative about Ethereum’s fundamentals—network activity, upgrade timelines, and long-term growth—matters for capital allocation, governance engagement, and potential product developments that could draw renewed user interest.

From a market-wide perspective, Ethereum’s fate remains a bellwether for risk appetite in crypto markets. A clear bottom in ETH could bolster sentiment across altcoins and contribute to a broader risk-on environment, while a protracted drawdown could reinforce caution and delay recovery for other assets. In either case, the episode underscores the importance of on-chain metrics as a corroborating lens for price action, beyond headlines and short-term moves.

What to watch next

- Monitor liquidity conditions around the April tax season for potential downside or relief catalysts.

- Track on-chain indicators related to MVRV Z-Score and general network activity to assess whether a structural bottom forms.

- Watch for sustained price stabilization above recent lows and any acceleration in demand signals that could precede a rebound.

- Observe broader macro factors and crypto market flows that could influence risk sentiment and capital allocation.

Sources & verification

- On-chain MVRV Z-Score interpretation and commentary by Joao Wedson of Alphractal (tweet/status referenced in the article).

- Cointelegraph reports on Ether’s 30% decline over a two-week period and the subsequent move to around $2,100.

- HashKey Group insights from Tim Sun regarding MVRV Z-Score reliability and Ethereum fundamentals.

- Industry commentary from Michaël van de Poppe and Bitrue’s Andri Fauzan Adziima on negative MVRV zones and potential buy opportunities.

Crypto World

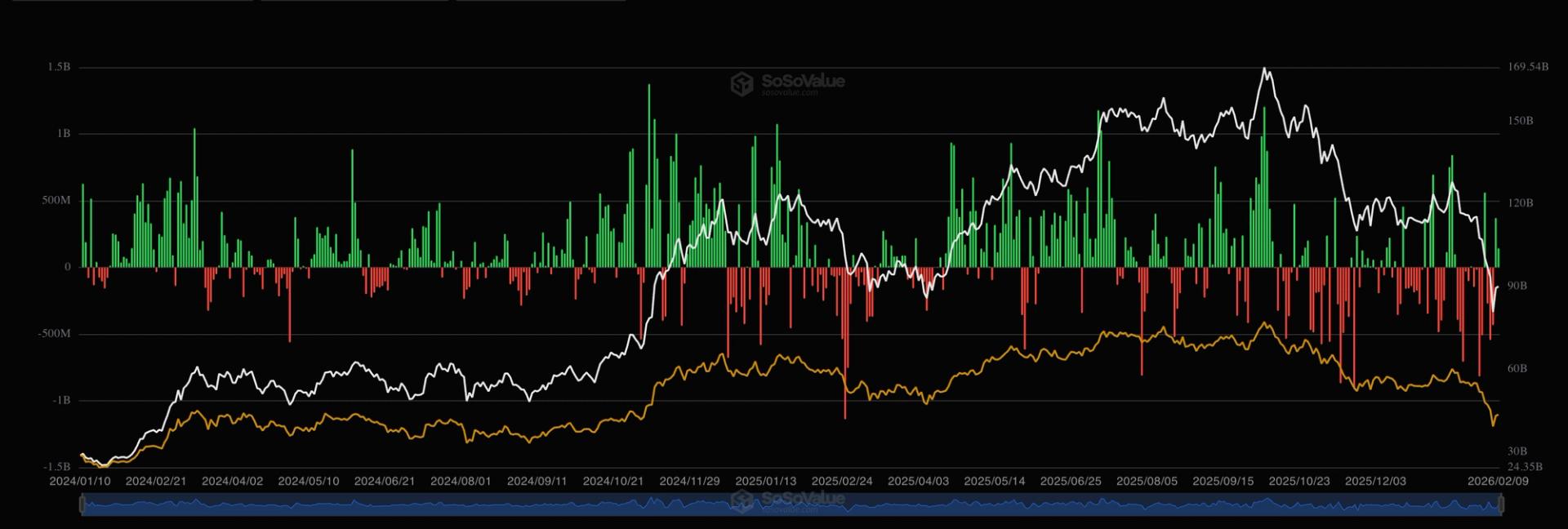

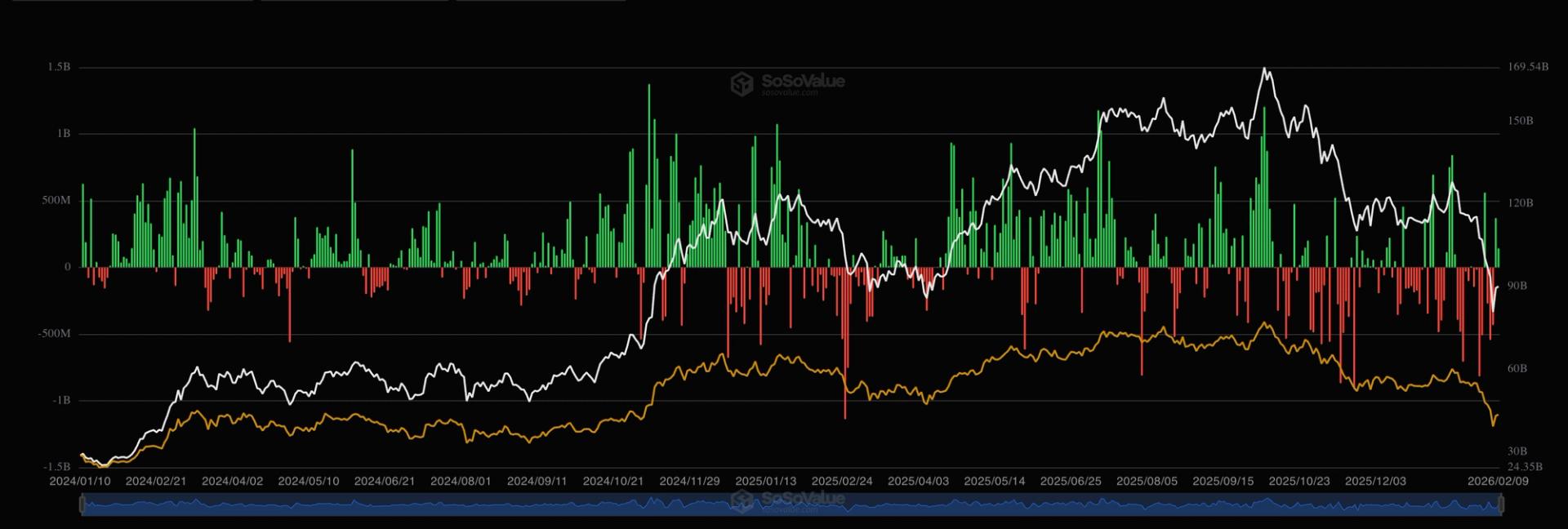

U.S. BTC ETFs register back-to-back inflows for first time in a month

For the first time in nearly a month, U.S. bitcoin exchange-traded funds (ETFs) have recorded back-to-back net inflows, snapping a redemption streak that stretched back to mid-January.

According to SoSo value data, the consecutive inflows shift began on Friday with $471.1 million in fresh capital, followed by a $144.9 million on Monday. This comes as bitcoin bounced back from Thursday’s $60,000 low to around $70,000.

In mid-January, bitcoin peaked near $98,000 after a two week rally that started at $87,000. The subsequent sell-off to $60,000 saw investors yank millions of these spot ETFs.

Broadly speaking, investors still appear confidence about the cryptocurrency’s long-term prospects, as evident from the spot ETFs’ resilient asset under management (AUM).

According to Checkonchain, the cumulative AUM of the 11 funds has only decreased by about 7% since early October, sliding from 1.37 million BTC to 1.29 million BTC. Bitcoin, meanwhile, is down over 40% since hitting record highs above 126,000 in October.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Ethereum has hit a zone typically associated with mass selling, with an MVRV Z-Score returning a score of -0.42 — though analysts are split on whether the price of Ether is close to bottoming out.

The MVRV Z-Score is a metric used to assess whether a crypto asset is overvalued or undervalued by comparing its market value to its realized value, which reflects the total value of Ether based on the price at which it was last transacted.

The metric was created to identify periods of market euphoria or capitulation when market value was considerably higher or lower than realized value.

CryptoQuant analyst and Alphractal founder and CEO, Joao Wedson, said the score “shows that Ethereum is indeed going through a clear capitulation process.”

However, the analyst said the data “does not compare to the intensity” seen at the major bottoms of the 2018 and 2022 bear markets.

The lowest value in history was -0.76, recorded in December 2018, said Wedson.

Further downsides for ETH prices possible

The analyst cautioned that further downsides could be possible before any meaningful recovery.

“The market is already under stress, but historically, there is still room for further downside before a definitive structural bottom is formed,” he said.

The price of Ether has fallen 30% over the past fortnight, reaching a bear market low of $1,825 on Friday before a minor recovery to $2,100 on Monday.

Related: Tom Lee tips lack of leverage and gold ‘vortex’ for Ether’s 21% slump

HashKey Group senior researcher Tim Sun told Cointelegraph that historically, Ethereum’s MVRV Z-Score “has proven to be a highly reliable indicator for tracking subsequent market shifts, particularly in identifying bottoming zones across multiple cycles.”

“Judging by on-chain activity, protocol evolution, and long-term ecosystem structure, Ethereum’s fundamentals have not seen any substantive deterioration. On the contrary, they continue to improve across several key dimensions,” he said.

However, it is premature to conclude that Ether has finished its bottoming process as long as the primary drivers of the current decline persist, he added.

“Given the potential liquidity constraints associated with the upcoming April tax season, the probability of further price downside remains a significant factor.”

One of the best “buy fear” windows for Ether

Other market commentators, such as MN Fund founder Michaël van de Poppe, were a little more optimistic, stating, “I think that this is a tremendous opportunity to be looking at ETH.”

“The core reason for this is that there’s a massive gap to the ‘fair price,’” he said, referring to the MVRV ratio.

Ether is currently as undervalued as it was during the April 2025 crash, the June 2022 bottom after the Terra/Luna collapse, the March 2020 Covid crash, and the December 2018 bear market bottom.

“In all of those cases, this provided a tremendous buying opportunity for this particular asset.”

Andri Fauzan Adziima, research lead at crypto trading platform Bitrue, told Cointelegraph that negative MVRV zones “have repeatedly preceded explosive recoveries in past cycles.”

“With ETH’s network metrics holding strong, it feels like a prime long-term accumulation setup once the weak hands are fully flushed,” he said.

“Brutal capitulation now, but historically one of the best ‘buy fear’ windows for ETH.”

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Bitcoin price dips below $70K as analyst calls it unpumpable

Bitcoin price slipped again on Feb. 10 after failing to stay above the $70,000 level, an area that had supported the market through much of the recent consolidation.

Summary

- Bitcoin is under pressure as capital inflows fail to translate into price expansion.

- On-chain data shows rising whale exchange deposits and steady ETF outflows.

- Technical structure continues to favor distribution over accumulation.

At press time, BTC was trading around $68,979, down 2% over the past 24 hours. The weakness extends across all major timeframes, with losses of 12% over the past week, 23% over the last month, and roughly 30% year-over-year.

The pullback has been sharp and persistent. Since reaching an all-time high of $126,080 in October 2025, Bitcoin (BTC) has fallen by nearly 45%. Rather than a single washout event, the decline has unfolded through steady selling.

At the same time, market activity has increased. Spot trading volume jumped 15.2% in the last 24 hours to $52 billion, pointing to active repositioning as traders reduce exposure or rotate capital.

Derivatives markets reflect a similar tone. CoinGlass data shows Bitcoin futures volume rising 4.97% to $70 billion, while open interest slipped 1.98% to $45 billion.

The combination suggests traders are closing positions faster than new leverage is being added, a pattern often seen during periods of distribution.

Selling pressure overwhelms inflows

Concerns around Bitcoin’s ability to stage a recovery were shared by CryptoQuant CEO Ki Young Ju. In a Feb. 9 post on X, Ju said Bitcoin is currently “not pumpable,” arguing that selling pressure is absorbing capital faster than it can translate into price gains.

Ju pointed to a sharp contrast between recent market cycles. In 2024, a $10 billion capital inflow expanded Bitcoin’s book value by $26 billion. In 2025, however, roughly $308 billion flowed into the market while total market capitalization fell by $98 billion. According to Ju, the usual multiplier effect has broken down under the weight of sustained selling.

On-chain data adds weight to that view. CryptoQuant contributor Amr Taha flagged two whale transfers of more than 5,000 BTC into Binance on Feb. 2 and Feb. 9, an uncommon event within a single week.

The first transfer aligned with Bitcoin’s slide from $77,000 to below $70,000 by Feb. 6, raising concerns that large holders may be using rallies to distribute into liquidity.

Institutional demand has also cooled. U.S. spot Bitcoin exchange-traded fund holdings peaked near 1.36 million BTC in mid-October 2025, alongside the market high. By Feb. 9, total holdings had fallen to roughly 1.27 million BTC, implying net outflows of around 90,000 BTC, or 6.6% of ETF reserves.

Bitcoin price technical analysis

From a technical perspective, losing $70,000 has altered the market structure. After several unsuccessful attempts to regain the $71,000–$73,000 range, the level now serves as resistance.

The price is still below the 50-day and 20-day moving averages, which are both limiting attempts at an upward trend. Momentum is still lacking. The relative strength index is in the 32–34 range, indicating an oversold situation without a definite bullish divergence.

After a period of compression, the price is clinging to the lower Bollinger Band as the bands begin to widen. In similar situations, failing to reclaim the mid-band often leads to further downside. Volume patterns reinforce this outlook, showing steady liquidation rather than panic selling, since sell-side spikes are not met with strong rebound activity.

A brief push toward $73,000–75,000 is feasible if Bitcoin can maintain above $68,000–69,000 and recover $71,000. A sustained close above the 50-day average near $79,000 would be needed to shift the trend.

On the downside, failure to defend $68,000 keeps pressure intact. A break below $62,800 opens the door to $60,000, with deeper liquidity waiting near $58,000.

Crypto World

U.S. sentences crypto scam mastermind to 20 years over $73M fraud

A U.S. federal court has sentenced a key figure behind a global cryptocurrency investment scam to 20 years in prison, capping one of the largest crypto-fraud prosecutions tied to so-called “pig butchering” schemes.

Summary

- U.S. court sentenced a crypto scam mastermind to 20 years over a $73M global fraud

- Defendant fled U.S. supervision and was sentenced in absentia

- Scheme used fake crypto platforms and shell companies to launder funds

The operation defrauded victims of more than $73 million, largely through fake trading platforms and online deception.

Fugitive sentenced in Absentia

The defendant, Daren Li, was sentenced in the Central District of California despite being a fugitive at the time of sentencing. Li, a dual citizen of China and St. Kitts and Nevis, removed his electronic ankle monitor and fled U.S. supervision in late 2025.

U.S. authorities said efforts are ongoing to locate and return him to serve the sentence.

Li had pleaded guilty in November 2024 to conspiracy to commit money laundering, acknowledging his role in moving fraud proceeds generated by overseas scam centers operating primarily out of Cambodia.

Inside the $73 million crypto scam

According to prosecutors, the scam relied on unsolicited social media outreach, fake cryptocurrency investment platforms, and spoofed websites designed to mimic legitimate trading services.

Victims were gradually manipulated into sending funds after building trust through fabricated personal or professional relationships.

Once funds were obtained, Li and his co-conspirators funnelled the money through shell companies and U.S. bank accounts before converting it into cryptocurrency. At least $59.8 million in victim funds passed through U.S.-based accounts as part of the laundering operation.

Eight co-conspirators have already pleaded guilty in related cases. The Justice Department said Li is the first individual directly involved in receiving stolen proceeds to be sentenced, highlighting a broader push to dismantle international crypto fraud networks and hold organizers accountable.

Crypto World

Latest Bitcoin & Ethereum News, Crypto Prices & Indexes

Ethereum (CRYPTO: ETH) has slipped into a zone that market watchers associate with capitulation, as on-chain signals flash bearish, yet opt for caution on whether a definitive bottom is in place. The focal point is the MVRV Z-Score, a gauge that compares current market value to the realized value, effectively measuring how much investors are paying relative to the price at which Ether last moved. A reading around -0.42 indicates Ether is trading below its realized value, a sign historically linked to stress but not a sole predictor of a lasting bottom. While some analysts argue this signals a clear capitulation phase, others warn that the current slide may not reach the extremes observed in past bear markets.

The MVRV Z-Score was designed to flag phases of euphoria or capitulation by showing when market value diverges markedly from realized value. In practice, a notably negative score has preceded bottoming behavior in prior cycles, albeit without a guaranteed timetable. Joao Wedson, a crypto Quant analyst and founder of Alphractal, described the current reading as “showing that Ethereum is indeed going through a clear capitulation process.” Yet, he cautioned that today’s data do not match the intensity of the 2018 and 2022 bear-market lows. The record low for the metric sits at -0.76, observed in December 2018, underscoring the scale of the slide that would be needed for a historical parallel.

The near-term horizon, however, remains contested. Wedson noted that further downside is possible before any sustained recovery takes hold, citing continued market stress and the possibility of liquidity constraints during tax season. “The market is already under stress, but historically, there is still room for further downside before a definitive structural bottom is formed,” he said. Ether’s price action has been volatile, with a sharp decline followed by a tentative rebound, complicating the call on whether the capitulation phase is nearing its end.

The recent price action has been punishing: Ether has fallen about 30% over the past two weeks, sinking to a bear-market low near $1,825 on a Friday before a modest rebound to roughly $2,100 on the following Monday. The moves come amid broader macro fragility and shifting risk sentiment within crypto markets, prompting both caution and opportunism among analysts. Some traders and researchers see this as a rare “buy fear” window, while others warn that risk remains elevated until on-chain dynamics confirm a bottom.

HashKey Group senior researcher Tim Sun told Cointelegraph that historical performance has reinforced the view that Ethereum’s MVRV Z-Score can be a reliable indicator for identifying bottoming zones, particularly when combined with evolving on-chain activity and long-term ecosystem development. “Judging by on-chain activity, protocol evolution, and long-term ecosystem structure, Ethereum’s fundamentals have not seen any substantive deterioration. On the contrary, they continue to improve across several key dimensions,” he said. Still, Sun stressed that current trajectories could change if the primary drivers of decline persist, suggesting that a definitive bottom remains contingent on future liquidity and demand signals.

Meanwhile, other observers offered a more optimistic read. Michaël van de Poppe, founder of MN Fund, argued that the drawdown presents a rare opportunity to consider ETH as an investable bet, noting a substantial gap between the current price and the “fair price” implied by the MVRV ratio. “I think that this is a tremendous opportunity to be looking at ETH,” he tweeted, positing that negative deviations historically precede substantial recoveries when macro and on-chain conditions align. The narrative held that Ether’s network metrics and the broader ecosystem strength underpin a case for accumulation once the weak hands have been flushed out.

Other voices joined the chorus of potential catalysts for a rebound. Andri Fauzan Adziima, Bitrue’s research lead, suggested that persistent negative MVRV zones have historically preceded strong recoveries in subsequent cycles. He contended that ETH’s network fundamentals remained robust and that a long-term accumulation stance could emerge once price risk subsides. “Brutal capitulation now, but historically one of the best ‘buy fear’ windows for ETH,” Adziima said, underscoring the tension between near-term price action and longer-term structural factors.

Market participants acknowledged that the current pullback may be overshadowed by longer-term catalysts such as network upgrades and continued ecosystem maturation, even as price action remains sensitive to near-term liquidity and macro dynamics. The narrative that “buying fear” can yield outsized returns if followed by demand recovery continues to gain traction among several traders, though it remains balanced by caution regarding April liquidity and potential tax-related squeezes.

One of the best “buy fear” windows for Ether

Despite the caution, several observers argued that the current environment could present one of the more compelling entry points for ETH in recent memory. Van de Poppe’s commentary echoed a view shared by others that a sharp deviation below fair value can precede a robust rebound when demand returns and on-chain indicators resume strengthening. The notion is that ETH’s price could be primed for a longer-term recovery even if the immediate path remains choppy.

As the debate continues, sentiment remains nuanced. Some participants emphasize that negative MVRV conditions have historically aligned with durable recoveries once the weak hands capitulate, while others warn that liquidity constraints around the April tax season could delay any sustained recovery. The balance between on-chain fundamentals and macro stressors will likely shape Ether’s trajectory over the coming weeks and into the next quarter.

For investors watching the tape, the key takeaway is that volatility may persist even as underlying fundamentals show resilience. The combination of a negative MVRV reading and persistent price pressure suggests that any bottoming process will require a convergence of favorable liquidity and sustained demand, rather than a simple technical bounce.

Why it matters

The ongoing discussion around Ether’s valuation and bottoming prospects matters for multiple stakeholders. For traders, MVRV-based indicators provide a framework to interpret on-chain signals amid price volatility, while investors may view the current setup as an opportunity to accumulate at a discount relative to realized value. For developers and ecosystem participants, the narrative about Ethereum’s fundamentals—network activity, upgrade timelines, and long-term growth—matters for capital allocation, governance engagement, and potential product developments that could draw renewed user interest.

From a market-wide perspective, Ethereum’s fate remains a bellwether for risk appetite in crypto markets. A clear bottom in ETH could bolster sentiment across altcoins and contribute to a broader risk-on environment, while a protracted drawdown could reinforce caution and delay recovery for other assets. In either case, the episode underscores the importance of on-chain metrics as a corroborating lens for price action, beyond headlines and short-term moves.

What to watch next

- Monitor liquidity conditions around the April tax season for potential downside or relief catalysts.

- Track on-chain indicators related to MVRV Z-Score and general network activity to assess whether a structural bottom forms.

- Watch for sustained price stabilization above recent lows and any acceleration in demand signals that could precede a rebound.

- Observe broader macro factors and crypto market flows that could influence risk sentiment and capital allocation.

Sources & verification

- On-chain MVRV Z-Score interpretation and commentary by Joao Wedson of Alphractal (tweet/status referenced in the article).

- Cointelegraph reports on Ether’s 30% decline over a two-week period and the subsequent move to around $2,100.

- HashKey Group insights from Tim Sun regarding MVRV Z-Score reliability and Ethereum fundamentals.

- Industry commentary from Michaël van de Poppe and Bitrue’s Andri Fauzan Adziima on negative MVRV zones and potential buy opportunities.

https://platform.twitter.com/widgets.js

Crypto World

Bitcoin’s Latest Drop May Be Proof the 4-Year Cycle Still Holds

Bitcoin’s (BTC) latest price correction is reinforcing, rather than undermining, the long-standing 4-year halving cycle that has historically shaped the asset’s market behavior, according to a new report from Kaiko Research.

The debate carries significant implications for traders and investors navigating Bitcoin’s volatility in early 2026.

Sponsored

Sponsored

Bitcoin Is Following Its 4-Year Cycle Amid Sharp Correction

Bitcoin fell from its cycle peak near $126,000 to the $60,000–$70,000 range in early February. This marked a drawdown of roughly 52%.

While the move rattled market sentiment, Kaiko argues the decline is fully consistent with previous post-halving bear markets and does not signal a structural break from historical patterns.

“Bitcoin’s decline from $126,000 to $60,000 confirms rather than contradicts the four-year halving cycle, which has consistently delivered 50-80% drawdowns following cycle peaks,” Kaiko’s data debrief read.

The report notes that the 2024 halving took place in April. Bitcoin topped out roughly 12–18 months later, aligning closely with prior cycles. In past instances, such peaks have typically been followed by extended bear markets lasting around a year before the next accumulation phase begins.

Kaiko says the current price action suggests Bitcoin has transitioned out of the euphoric post-halving phase and into that expected corrective period.

It is worth noting that many experts have previously challenged Bitcoin’s 4-year cycle. They argue that it no longer holds in today’s market. In October, Arthur Hayes said the 4-year Bitcoin cycle was over. He pointed instead to global liquidity as the dominant driver of price movements.

Sponsored

Sponsored

Others have argued that Bitcoin now follows a 5-year cycle rather than a 4-year one. They cite the growing influence of global liquidity conditions, institutional participation, and broader macroeconomic policy shifts.

Kaiko acknowledged that structural changes, including spot Bitcoin exchange-traded fund (ETF) adoption, greater regulatory clarity, and a more mature DeFi ecosystem, have distinguished 2024-2025 from previous cycles. Nonetheless, it said these developments have not prevented the expected post-peak retracement.

Instead, they have changed how volatility manifests. Spot Bitcoin ETFs recorded more than $2.1 billion in outflows during the recent sell-off.

This amplified downside pressure and demonstrated that institutional access increases liquidity in both directions, not just on the way up. According to Kaiko,

“While DeFi infrastructure has shown relative resilience compared to 2022, TVL declines and slowing staking flows indicate no sector is immune to bear market dynamics. Regulatory clarity has proven insufficient to decouple crypto from broader macro risk factors, with Fed uncertainty and risk-asset weakness dominating market direction.”

Kaiko also raised the key question now dominating market discussions: where is the bottom? The report explained that Bitcoin’s intraday rebound from $60,000 to $70,000 suggests initial support may be forming.

However, historical precedent shows that bear markets typically take six to 12 months and involve multiple failed rallies before a sustainable bottom is established.

Kaiko noted that stablecoin dominance stands at 10.3%, while funding rates have fallen close to zero and futures open interest has dropped by about 55%, signaling significant deleveraging across the market. Still, the firm cautioned that it remains unclear whether current conditions represent early, mid, or late-stage capitulation.

“The four-year cycle framework predicts we should be at the 30% mark. Bitcoin is doing exactly what it has done in every previous cycle, but it seems many market participants convinced themselves this time would be different,” Kaiko wrote.

As February 2026 progresses, market participants must weigh both sides of this argument. Bitcoin’s next moves will reveal whether history continues to repeat or a new market regime is taking shape.

Crypto World

Vitalik Buterin Unveils Four-Pillar Framework for Ethereum AI Integration

TLDR:

- Buterin proposes local LLM tooling and zero-knowledge payments to enable private AI interactions on-chain.

- Ethereum could serve as economic infrastructure for autonomous AI agents to coordinate and transact.

- AI models can revitalize prediction markets and quadratic voting by overcoming human attention limits.

- The framework enables cypherpunk vision where local AI verifies transactions without third-party trust.

Ethereum co-founder Vitalik Buterin has presented an updated perspective on integrating blockchain technology with artificial intelligence. The framework moves beyond abstract concepts toward practical implementations in the near term. Buterin’s approach centers on preserving human freedom while building decentralized systems that leverage AI capabilities. His vision encompasses four distinct areas where Ethereum can facilitate meaningful AI interactions without compromising security or privacy.

Privacy-Focused Infrastructure for AI Interactions

Buterin criticizes undifferentiated approaches to AI development, comparing vague directives to “work on AGI” with describing Ethereum as “working in finance” or “working on computing.” He argues such framing lacks the specificity needed for meaningful progress. Instead, his framework emphasizes choosing positive directions rather than embracing acceleration without purpose. The technical vision prioritizes human empowerment and avoiding scenarios where humans lose agency.

The proposal includes developing local large language model tooling that allows users to maintain control over their data. Zero-knowledge payment systems for API calls would prevent identity linking across different transactions. This approach addresses growing concerns about data privacy in AI applications. Additionally, ongoing cryptographic research aims to enhance AI privacy protections.

Client-side verification methods such as cryptographic proofs and trusted execution environment attestations form another component. These mechanisms mirror previous work on Ethereum privacy improvements but apply specifically to LLM interactions. The goal is creating infrastructure comparable to existing non-LLM compute privacy solutions. Buterin referenced his earlier work on Ethereum privacy roadmaps from 2024.

That foundation now extends to protecting AI-related computational processes. The technical approach maintains consistency with established blockchain privacy principles while adapting to AI-specific requirements. This continuity ensures compatibility with existing Ethereum infrastructure. The emphasis on local processing and cryptographic verification reflects broader cypherpunk values.

Economic Coordination and Enhanced Governance Systems

Ethereum can function as an economic layer facilitating AI-to-AI interactions, according to Buterin’s framework. This includes API payments, autonomous agents hiring other agents, and security deposit mechanisms. The economic infrastructure enables decentralized AI architectures rather than centralized organizational control. Smart contracts could eventually handle complex dispute resolution between AI entities.

The proposal mentions ERC-8004 and AI reputation systems as potential standards. These tools would create accountability frameworks for autonomous agents operating on-chain. Economic coordination becomes essential for scaling decentralized authority across AI systems. Without such mechanisms, AI collaboration would remain confined within single organizations.

Buterin’s vision includes revitalizing market and governance concepts previously limited by human constraints. Prediction markets, quadratic voting, combinatorial auctions, and decentralized governance structures gain new viability. Large language models can overcome the attention and decision-making bottlenecks that hampered these systems. AI assistance effectively scales human judgment across complex coordination problems.

The framework also addresses what Buterin describes as the cypherpunk “mountain man” vision of “don’t trust; verify everything.” Local AI models could propose and verify blockchain transactions without third-party interfaces. Smart contract auditing and formal verification interpretation become accessible through AI assistance. This enables the verify-everything approach that was previously impractical for individual users.

Crypto World

Vitalik Buterin Slams ‘Fake’ DeFi, Backs ETH-Based Algo Stablecoins

Buterin criticized modern DeFi as centralized in disguise, arguing USDC yield farming misses core principles.

Ethereum co-founder Vitalik Buterin has questioned the legitimacy of popular USDC yield strategies, arguing they don’t follow the principles of true decentralized finance (DeFi).

His critique was in response to crypto analyst C-node, who said that most modern DeFi focuses on speculative gains instead of building genuinely decentralized infrastructure.

Critique of Modern DeFi

C-node challenged the crypto industry on social media, saying there is little reason to use DeFi unless users hold long cryptocurrency positions and need financial services while keeping self-custody.

Buterin supported this perspective, arguing that depositing stablecoins such as USDC into lending protocols like Aave does not count as true DeFi. He dismissed such strategies, stating, “inb4 ‘muh USDC yield,’ that’s not DeFi.”

In his view, the underlying asset remains controlled by Circle, meaning the arrangement is fundamentally centralized even if the protocol itself is decentralized.

The Ethereum developer suggested two frameworks for evaluating what should qualify as real DeFi. The first, which he described as the “easy mode,” centers on ETH-backed algorithmic stablecoins. In this model, users can shift counterparty risk to market makers through collateralized debt positions (CDPs), where assets are locked to mint stablecoins.

He explained that even if 99% of the liquidity is backed by CDP holders who hold negative algorithmic dollars while holding positive ones elsewhere, the ability to offload counterparty risk to a market maker remains an important feature.

You may also like:

The second, or “hard mode,” framework allows for real-world asset (RWA) backing, but only under strict conditions. Buterin said an algorithmic stablecoin backed by RWAs could still qualify as DeFi if it is sufficiently overcollateralized and diversified to survive the failure of any single backing asset.

Under this structure, the overcollateralization ratio must be more than the maximum share of any individual asset, ensuring the system remains solvent even if one part collapses. This means that it would act as a buffer that distributes risk instead of concentrating it within centralized entities.

“I feel like that sort of thing is what we should be aiming more towards,” Buterin said, adding that the long-term goal should be moving away from the dollar as the unit of account toward a more diversified index.

Crypto Community Response

The remarks were widely supported within the X crypto community, with one user calling it a “great take” and noting that ETH-backed algorithmic stablecoins offer real risk reduction, while RWA diversification spreads it instead of eliminating it. Another commented that “True DeFi needs real risk innovation, not just USDC parking.”

However, there were also some concerns. For instance, X user Kyle DH pointed out that algorithmic stablecoins have not updated their designs to address known issues, which makes them similar to money market funds that have the same “breaking the buck” risks seen before with TerraUSD and LUNA. They added that RWA backing requires careful diversification, warning that highly correlated assets or black swan events could still cause a stablecoin to fail.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat12 hours ago

NewsBeat12 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat23 hours ago

NewsBeat23 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports11 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report