Crypto World

China’s DeepSeek AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

When fed specially crafted prompts, DeepSeek’s AI model generates details of some lofty price projections for XRP, Solana, and Bitcoin by the end of the year.

According to DeepSeek’s analysis, an extended crypto bull market combined with clearer, more supportive regulation in the United States could propel leading digital assets to fresh record highs over the next eleven months.

Below, we outline DeepSeek’s hypotheses for the three top cryptocurrencies.

XRP ($XRP): DeepSeek AI Predicts a Move Toward $10 by 2027

Ripple’s XRP ($XRP) is the biggest cryptocurrency token in the sector of institutional-grade cross-border payments. Currently trading at $1.35, DeepSeek estimates that a sustained bullish environment could push XRP as high as $10 by the end of 2026. That outcome would represent gains of around 640%, or close to 7.5x from current levels.

XRP was among the top-performing large-cap cryptocurrencies last year. In July, it recorded its first new all-time high (ATH) in seven years, surging to $3.65 after Ripple secured a decisive legal victory against the U.S. Securities and Exchange Commission.

That ruling removed a significant regulatory hurdle for XRP and eased broader concerns about the SEC going after altcoins as unlicensed securities.

From a technical standpoint, XRP’s Relative Strength Index currently sits near 20, placing it in oversold territory. This suggests the selloff is nearing exhaustion, with buyers likely stepping in at current prices to take advantage of the relative discount.

Meanwhile, XRP’s January support and resistance levels are forming an emerging bullish flag pattern, a setup that often precedes breakouts.

Additionally, institutional inflows from recently approved XRP ETFs in the US, and expectations surrounding the CLARITY bill, a comprehensive regulatory framework for crypto, could serve as catalysts for a renewed breakout.

Solana (SOL): DeepSeek AI Projects SOL at $500 or Higher

The Solana ($SOL) ecosystem now supports $7 billion in total value locked (TVL) and carries a market capitalization above $50 billion, underpinned by consistent growth in utility, developer activity, and daily users.

Interest in SOL has accelerated following the release of Solana-based ETFs from major asset managers such as Bitwise and Grayscale.

After a steep correction in late 2025, SOL spent recent months consolidating around a critical support zone and currently trades near $90. Right now, as with most cryptos, SOL is tracking Bitcoin’s price, so if Bitcoin reclaims the $100,000 level, a milestone that it could hit before midyear, then this will light the path for a quick SOL rebound.

Under DeepSeek’s most bullish scenario, Solana could climb to $500 by 2027. That would equate to nearly 500% upside from current prices and would push SOL well beyond its previous all-time high of $293, set last January.

Institutional adoption continues to strengthen Solana’s long-term narrative. The network is increasingly being used for real-world asset tokenization, with firms such as Franklin Templeton and BlackRock pointing to Solana’s expanding role within traditional financial infrastructure.

Bitcoin (BTC): DeepSeek AI Charts a Path to $250,000

Bitcoin ($BTC), the original cryptocurrency and largest by market capitalization, reached a new all-time high of $126,080 on October 6.

Despite the correction, DeepSeek indicates that Bitcoin’s broader year-over-year uptrend remains intact, with long-term price targets extending toward $250,000 by 2027.

Often referred to as digital gold, Bitcoin continues to attract institutional and retail investors seeking a potential hedge against inflation and macroeconomic volatility.

Bitcoin currently capitalizes $1.4 trillion of the $2.46 trillion total cryptocurrency market. Since hitting its ATH, BTC has fallen by around 44.5% and now trades near $70,400 following two sharp market downturns driven by global geopolitical uncertainty over potential US military action in Iran and Greenland.

Looking beyond near-term geopolitical risks, DeepSeek’s analysis highlights rising institutional participation and post-halving supply constraints as key forces that could drive Bitcoin to multiple new highs this year.

In addition, if U.S. policymakers move forward with proposals to establish a Strategic Bitcoin Reserve, Bitcoin’s long-term upside could exceed even DeepSeek’s already optimistic forecasts.

Maxi Doge (MAXI): The New Alpha in Dogesville

Finally, outside of DeepSeek’s data-driven projections, Maxi Doge ($MAXI) has become one of the most discussed meme coin presales of 2026, raising $4.6 million ahead of its public debut.

The project’s avatar is a high-energy parody (and distant cousin) of Dogecoin, blending gym-bro aesthetics with unapologetic degen humor. Loud, pumped, and intentionally outrageous, Maxi Doge leans fully into the irreverent fun that first made Dogecoin and Shiba Inu crypto sensations.

MAXI is issued as an ERC-20 token on Ethereum’s proof-of-stake network, giving it a significantly lower environmental footprint compared to Dogecoin’s proof-of-work model.

During the presale, buyers can stake MAXI tokens to earn yields of up to 68% APY, with rewards gradually decreasing as the staking pool grows. The token is currently priced at $0.0002802 in the latest presale stage, with automatic price increases applied at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new alpha in Dogesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post China’s DeepSeek AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

BOJ explores tokenized central bank money as 2026 digital yen decision looms

The Bank of Japan (BOJ) announced expansion of its blockchain experimentation for settling central bank reserves, while highlighting that efforts for a retail central bank digital currency (CBDC) are ongoing.

The BOJ rolled out a “sandbox project” to experiment settlements and bank deposits using central bank money, Governor Kazuo Ueda said on Tuesday in a speech titled “The New Financial Ecosystem and the Role of Central Banks.”

“In this experimental project, the Bank will conduct technical experimentation on settlement using central bank money in the form of current account deposits on a system that uses blockchains,” Ueda said.

The bank intends to explore “methods of connection with the existing system as well as examining use cases such as domestic interbank settlement and securities settlement,” he added. Analysts say introducing blockchain for reserves settlement would allow for instant round-the-clock settlement and reduce gridlock risk in stress events.

Ueda emphasized that the retail CBDC project is ongoing. “First, the ongoing pilot program for retail central bank digital currency (CBDC) involves the bank’s continued conduct of technical experiments, which will make it possible to provide … a digital form of cash when in demand by the wider public.”

Japan began CBDC experiments in 2021 and launched a pilot program in 2023. But the central bank has not committed to issuing a digital yen. According to a prior report, the BOJ this year will decide whether to issue a retail CBDC.

Ueda also spoke of Project Agorá,” an international experiment involving multiple central banks and major private financial institutions. He said its participants are considering “building a mechanism that would enable central banks, including the Bank of Japan, to issue central bank money as tokenized deposits on the blockchain.” If successful, he said, the effort “may bring innovation in terms of streamlining cross-border payments.”

Unlike a retail CBDC, which would function as a digital form of yen for the general public, tokenized central bank deposits would represent wholesale central bank money used by financial institutions on blockchain-based infrastructure, according to Ueda’s speech.

The move to use blockchain technology to settle reserves follows decisions in the U.K. and Hong Kong to issue sovereign debt on the blockchain.

Crypto World

Japan’s “Sanae Token” Scandal Tests Legal Limits of Political Memecoins

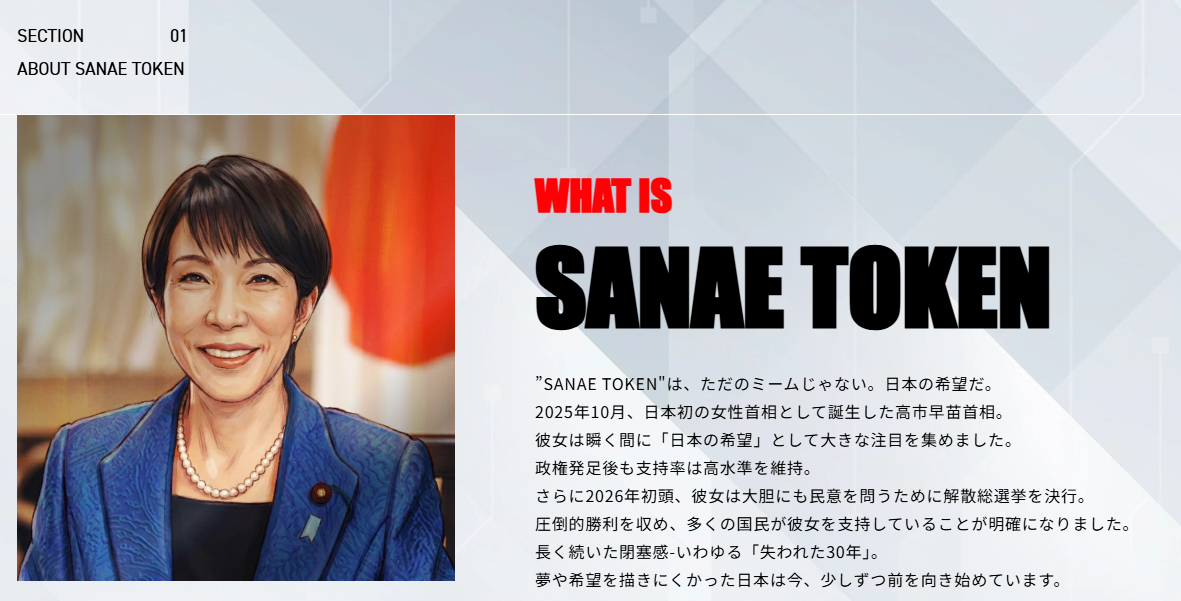

Japanese Prime Minister Sanae Takaichi publicly disavowed a cryptocurrency bearing her name and likeness. The token crashed 58% within hours, and regulators moved to investigate the issuer.

The episode is the latest in a string of political memecoins that have burned retail investors worldwide.

PM’s Denial Triggers Crash

Takaichi is Japan’s first female prime minister and one of its most popular in decades. Her LDP won 316 seats in the Feb. 8 general election, a supermajority, and her cabinet approval rating sits near 70%.

SANAE TOKEN launched on the Solana blockchain on Feb. 25 without the prime minister’s knowledge. Serial entrepreneur Yuji Mizoguchi’s NoBorder DAO community issued it as part of a “Japan is Back” initiative. The project’s website displayed Takaichi’s name and an illustrated portrait of her.

Mizoguchi had earlier stated on the YouTube show “REAL VALUE” that he was in contact with Takaichi’s side. That claim amplified speculation that the token carried some form of official backing.

On March 2, Takaichi posted on X to shut down the narrative. The post amassed over 63 million views. She said neither she nor her office knew anything about the token. She added that no approval had ever been granted.

The token’s price plunged from $0.0137 to $0.0058 almost immediately after her statement. By March 4, the market cap had cratered to roughly $62,000 with just $25,000 in liquidity.

FSA Launches Probe

Japan’s Financial Services Agency (FSA) is now investigating the token’s operators. The agency found that the issuing company lacks the required crypto exchange license.

Under Japan’s Payment Services Act, selling or exchanging crypto assets requires registration with the FSA. Violators face up to five years in prison or fines of ¥5 million.

A company called neu, led by CEO Ken Matsui, claimed responsibility for the token’s design. Matsui posted a public apology on X on March 3, saying they handled all operations.

Mizoguchi reposted Matsui’s statement and pledged cooperation with a media investigation. He wrote on X that he would not run from accountability or shift blame onto others. He said he intended to face the matter based on facts, not emotions.

Still, the gap between his earlier YouTube remarks and the prime minister’s flat denial remains unresolved.

The FSA confirmed that neu was not on its registered exchange list as of January. No subsequent application had been filed either.

The token’s structure has drawn additional scrutiny. Sixty-five percent of the total supply was reserved for operators.

Political Memecoins Under Global Spotlight

Japan’s scandal mirrors a pattern now emerging across multiple countries.

In the US, President Donald Trump launched $TRUMP on Solana in January 2025. His family and partners retained 80% of the supply and earned over $350 million in fees.

Senator Chris Murphy introduced the MEME Act to ban officials from issuing financial assets. Trump’s crypto czar, David Sacks, countered that memecoins are collectibles, not securities.

In February 2025, Argentina’s President Javier Milei promoted the $LIBRA token. It surged to a $4.5 billion market cap before crashing 89% within three hours.

Insiders allegedly extracted roughly $100 million before the collapse. Milei now faces fraud investigations and impeachment calls.

Regulatory Gap Persists

Each case exploits a similar loophole. Memecoins typically fall outside the definitions of securities in most jurisdictions.

Japan’s framework may offer a stricter path. The Payment Services Act covers crypto exchange activity regardless of token type. The FSA can act against unlicensed operators without classifying tokens as securities.

In the US, the SEC under the Trump administration has narrowed its scope of crypto enforcement. Memecoins remain largely unregulated at the federal level.

No international framework currently addresses political memecoins specifically. The gap leaves retail investors exposed to hype-driven schemes tied to public figures.

Industry observers say the SANAE TOKEN case could set a precedent. Japan’s response may shape how other regulators approach the growing trend.

Crypto World

Kalshi Partners with Luxury Watch Marketplace Bezel

The partnership with the CFTC-regulated prediction market will let users bet on luxury watch prices.

Kalshi, the largest prediction market platform by monthly spot volumes, has unveiled a strategic partnership with Bezel, a specialist in authenticated luxury watches, to let Kalshi users bet on the prices of luxury watches. Kalshi announced the move in an X post today, March 3.

The partnership with Bezel is part of Kalshi’s broader strategy to enhance its offerings in the collectibles market, Bloomberg reported today, citing executives from both firms.

Bezel’s CEO and co-founder, Quaid Walker, told Bloomberg that watches have “been viewed as a financial market for a really long period of time, but it’s also passion-driven.”

Kalshi’s previous moves into collectibles markets include a recent partnership with StockX, a platform for trading physical collectibles, from trading cards to sneakers and other apparel and accessories.

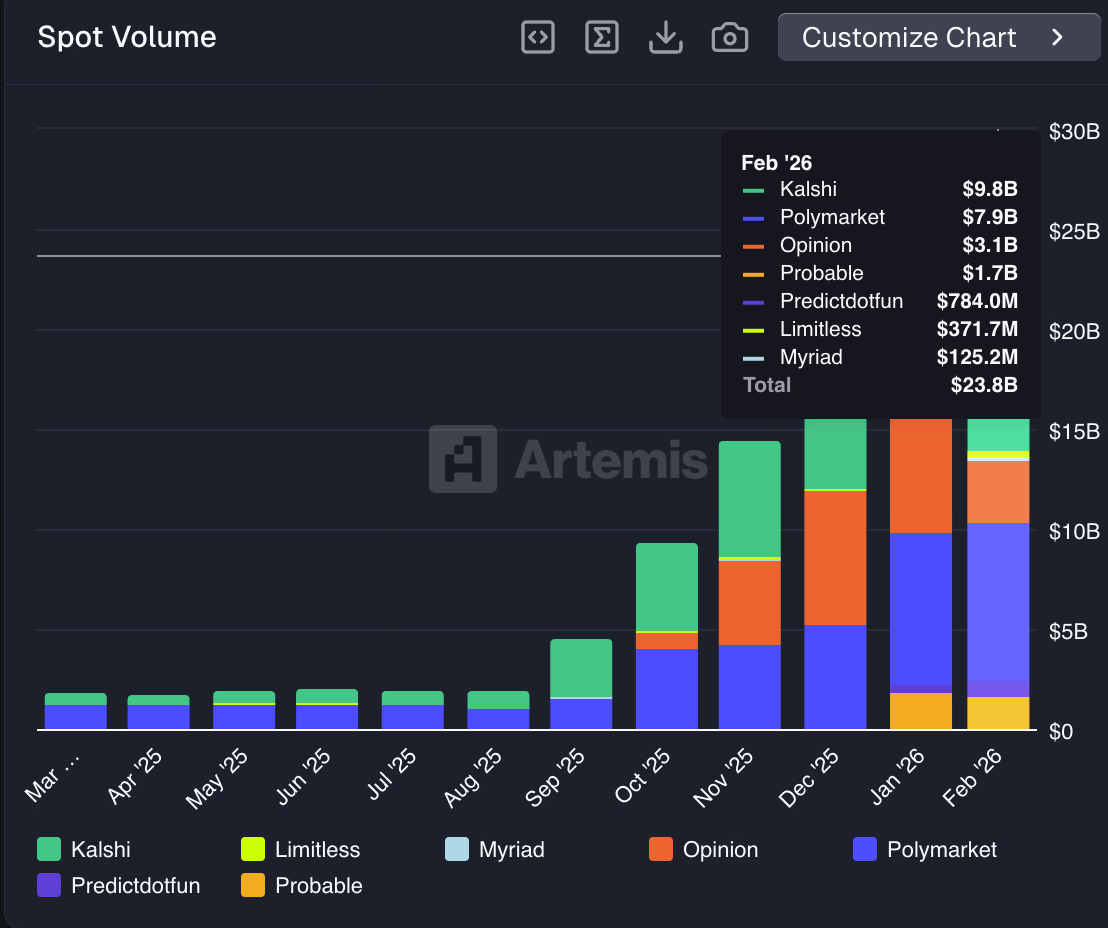

Today’s announcement comes as the hybrid on-off-chain prediction platform had its best month yet, per data from Artemis. Kalshi also surpassed on-chain prediction marketplace Polymarket in monthly trading volumes for the sixth consecutive month, with $9.8 billion in trades in February.

Polymarket saw just under $8 million last month, while total sector volume was down month over month for the first time since last August, as BNB Chain-based rival Opinion recorded a massive drop.

Kalshi and Polymarket have been neck and neck in recent months, both in terms of trading volumes and valuations, after their most recent funding rounds.

The prediction market industry is navigating complex legal landscapes, with platforms like Kalshi and Polymarket under scrutiny — including in the United States, where both platforms now operate as regulated entities under the Commodity Futures Trading Commission (CFTC).

As The Defiant reported, last month, the CFTC took a strong public stance on the issue, arguing that that the agency, not individual states, should regulate prediction market platforms.

This article was generated with the assistance of AI workflows.

Crypto World

Crypto.com Launches Blended Crypto and Stock Retirement Accounts

The CEX said its IRAs are the first crypto-native retirement accounts in the U.S. to offer crypto and traditional equities in one account.

Centralized exchange (CEX) Crypto.com has unveiled retirement account in the U.S. the let users invest in both cryptocurrency and traditional equities in a single account.

The CEX says that the IRAs are a first of its kind for a crypto native firm, according to a press release published today, March 3.

“The launch of Crypto.com IRAs is our latest significant step in providing consumers the ability to act on and invest in financial opportunity,” Kris Marszalek, co-founder and CEO of the platform said in a statement.

Per the announcement, the Crypto.com IRAs offer features such as tax-deferred or tax-free growth, contribution matches of up to 5%, and zero account fees.

The move comes just a week after the CEX announced it has received conditional approval from the Office of the Comptroller of the Currency (OCC) to establish Foris Dax National Trust Bank, positioning itself as a federally regulated qualified custodian, as The Defiant previously reported.

Founded in 2016, Crypto.com is currently ranked 10th among CEXs on CoinGecko by 24-hour trading volume and trust score, with about $2.8 billion in trades today.

In April, Fidelity launched dedicated cryptocurrency retirement accounts with exposure to several major crypto assets, as The Defiant reported. The tax-advantaged accounts from the TradFi giant, however, only offer crypto investment, while clients need to keep a separate IRA account for their traditional investments.

This article was generated with the assistance of AI workflows.

Crypto World

China’s Alibaba AI Predicts the Price of XRP, Bitcoin and Ethereum by the End of 2026

War news may be dominating headlines, but Alibaba AI believes crypto’s mid-to-long-term prospects look better than ever.

Market behavior suggests that investors may have already absorbed the impact of war-related risks earlier in the year, following selloffs triggered by former President Trump’s rhetoric around possible U.S. military escalation involving Greenland and Iran.

As such, Alibaba AI predicts sweltering new highs this year for XRP, BTC, and ETH.

XRP ($XRP): Alibaba AI Forecasts a 9x Move Over the Next 10 Months

In a recent update, Ripple reaffirmed that XRP ($XRP) is the key to positioning XRP Ledger (XRPL) as a global, enterprise-ready payments infrastructure.

With fast settlement speeds, and ultra-low transaction costs, XRPL could capture an early advantage in two of crypto’s fastest growing segments: stablecoins and tokenized real world assets.

XRP is currently trading near $1.38, and Alibaba AI predicts a potential climb toward $12 this year, a ninefold return for current holders.

Technical data adds weight to the bullish call. XRP’s relative strength index (RSI) is hovering around 43, while price action has found support near the 30-day moving average, signalling that the extended consolidation phase could be over.

Further upside catalysts include rising institutional involvement following the launch of U.S.-listed XRP ETFs, Ripple’s expanding international partnerships, and potential regulatory clarity should the CLARITY bill pass in the U.S. later this year.

Bitcoin (BTC): Alibaba AI Eyes a $155,000 New Year Target

The first and biggest crypto, Bitcoin ($BTC), reached an all-time high of $126,080 on October 6 before shedding nearly 50% of its price in the months following.

Despite recent volatility, Alibaba suggests Bitcoin remains on a long-term growth trajectory, with 2026 possibly peaking at $150,000.

Often referred to as digital gold, Bitcoin attracts risk-averse institutional and retail investors seeking diversification and protection against inflation and macroeconomic uncertainty.

Bitcoin currently represents about $1.3 trillion of the $2.4 trillion total crypto market. Much of its recent losses followed sharp pullbacks after the U.S. threatened military involvement in Iran and Greenland.

Accelerating institutional adoption and reduced supply following the latest halving event could be key drivers pushing Bitcoin to new highs this year.

If Trump delivers on his promice for a U.S. Strategic Bitcoin Reserve then BTC could even peak far higher than Alibaba suspects.

Ethereum (ETH): Alibaba AI Says ETH to Hit $6,000

Ethereum ($ETH) is the leading smart contract platform and the backbone of decentralized finance.

With a market capitalization of approximately $239 billion and $53 billion locked on chain, Ethereum is the primary settlement layer for on-chain economic activity.

Its proven security, leadership in stablecoins, and early momentum in real-world asset tokenization position Ethereum as a strong candidate for deeper institutional adoption.

That hinges on regulatory progress. Approval of the CLARITY bill by U.S. lawmakers could provide the certainty institutions need to deploy capital on Ethereum.

ETH currently trades under $2,000, with major resistance expected around $5,000 as seen by last August’s ATH of $4,946.05.

A decisive break above $5,000 has Alibaba hypothesizing $6,000 ETH by Christmas.

Maxi Doge: Early-Stage Meme Coin Targets Outsized Returns

Alibaba thinks XRP, Bitcoin, and Ethereum may offer substantial growth this year, which will ultimately be great for meme coins.

And one high upside potential new meme coin investors are piling into is Maxi Doge ($MAXI). It has raised $4.6 million in its ongoing presale as investors bet on Maxi dethroning Dogecoin.

Maxi Doge claims to be Dogecoin’s louder, degenerate, long-lost gym-bro cousin, evoking the viral energy of meme coins during the 2021 bull run.

Built as an ERC-20 token on Ethereum’s proof-of-stake network, MAXI leaves a significantly smaller environmental footprint compared to Dogecoin’s proof-of-work model.

Early presale participants can currently stake MAXI for yields of up to 67% APY, with returns gradually decreasing as more tokens enter the staking pool.

The token is $0.0002806 in the current presale phase, with automatic price increases scheduled at each funding milestone.

Investors looking to secure $HYPER can visit the official website and connect a supported wallet such as Best Wallet.

Purchases can also be made with a bank card.

Visit the Official Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Bitcoin and Ethereum by the End of 2026 appeared first on Cryptonews.

Crypto World

Coinbase CEO Says Base App SocialFi Push Fell Short

TLDR

- Coinbase CEO Brian Armstrong said the Base App SocialFi experiment did not work as expected.

- He confirmed that Coinbase has shifted the Base App focus toward trading and self-custody features.

- The company relaunched Coinbase Wallet as the Base App in July 2025 with social and trading tools combined.

- Jesse Pollak stated that the app felt overly focused on social features before the pivot.

- Base removed its Farcaster-powered social feed as part of the product changes.

Coinbase CEO Brian Armstrong said the Base App’s SocialFi features “didn’t quite work” during a recent podcast appearance. He explained that the company tested onchain social tools but later shifted focus to trading. The remarks clarify Coinbase’s strategy after relaunching its wallet as an all-in-one application in 2025.

Armstrong spoke on David Senra’s podcast and addressed the SocialFi push tied to the Base App. He said the company ran the initiative as an experiment but later changed direction. Coinbase now prioritizes trading tools and a self-custodial experience within the app.

Coinbase CEO Addresses Base App SocialFi Pivot

Coinbase relaunched its noncustodial Coinbase Wallet as the Base App in July 2025. The company positioned the product as an all-in-one platform combining trading, messaging, gaming, and social media features. However, Coinbase CEO Brian Armstrong said the social focus fell short of expectations.

“In the current incarnation, it wasn’t quite there in my view,” Armstrong said. He added, “We tried it as an experiment. It didn’t quite work.”

Armstrong said the company has since pivoted toward trading and core finance tools. He described the updated app as “more focused on trading and being a self-custodial version of the Coinbase app.” Earlier this year, Base head Jesse Pollak wrote that “the app felt overly focused on social” and would “lean into a finance-first UX.”

Soon after, Base removed its Farcaster-powered social feed following changes within the decentralized social platform. The company reduced several SocialFi elements while keeping the trading infrastructure intact.

Creator Coins and Token Performance

Jesse Pollak had promoted Creator Coin features within the Base App. The feature allowed users to double-tap posts to buy related tokens, and creators received value from activity. Armstrong said users viewed the model “as a way to reward and thank the creator.” However, most creator tokens later lost value after early trading activity slowed.

Nick Shirley launched one of the most visible creator coins through Zora. His token, $thenickshirley, reached a $15 million market cap after Armstrong promoted it. However, the token later declined sharply and failed to sustain momentum. Armstrong said “many posts” carried “thousands of dollars worth of value at the terminal end” of the experiment.

Other SocialFi efforts also faced setbacks across the sector. In January, Aave Labs spun out Lens Protocol as a separate initiative. Zora later introduced “attention markets” on Solana to let users trade social trends. Base itself now replaces parts of the OP Stack with custom components and reportedly weighs a native token launch.

Armstrong said, “I think something is going to work in SocialFi,” while noting that tokenomics “have not been quite figured out yet” and must show durability.

Crypto World

BitGo launches MiCA-compliant crypto service across EEA

TLDR

- BitGo Europe GmbH has launched its MiCA-compliant crypto as a service platform across all 30 EEA countries.

- The service enables banks and fintech firms to integrate regulated custody trading and fiat rails through a single API.

- Institutions can embed multi-asset wallets onboarding and settlement services directly into their platforms.

- Custodial wallets carry insurance coverage of up to 250 million dollars, subject to terms.

- BitGo handles trade settlement and custody through its internal regulated infrastructure.

BitGo Europe GmbH has launched its crypto-as-a-service platform across the European Economic Area under the MiCA framework. The rollout enables banks and fintech firms to integrate regulated custody, trading, and fiat services through a single API. The company confirmed that institutions in all 30 EEA countries can now access its infrastructure.

BitGo Rolls Out Regulated Infrastructure Across 30 EEA Countries

BitGo said it now offers API-based wallet, onboarding, and settlement services throughout the EEA. The company operates the service through its regulated European entity, BitGo Europe GmbH. Institutions can embed multi-asset wallets and SEPA fiat rails directly into their platforms. The platform also supports fiat on- and off-ramps under the EU’s Markets in Crypto-Assets framework.

The company stated that custodial wallets carry insurance coverage of up to $250 million, subject to terms. It also provides configurable policy controls and 24/7 operational support. Partners can enable clients to buy, sell, and hold digital assets within existing interfaces. BitGo handles trade settlement and custody through its internal infrastructure.

BitGo previously offered the service in the United States through BitGo Bank & Trust. The company confirmed that the European expansion follows MiCA’s implementation across member states. It said the framework allows institutions to formalize digital asset services under a unified licensing regime. The company has operated since 2013 and provides custody, staking, trading, financing, and settlement services globally.

BitGo went public on Jan. 22 and trades on the New York Stock Exchange under the ticker BTGO. Yahoo Finance data showed the stock at $10.20 on Tuesday, down 1.6% for the day. The data also showed the stock has declined about 20% since its listing.

Bitcoin and Ether Custody Gains Traction Under MiCA

Financial institutions across Europe have expanded digital asset custody services under MiCA rules. In July, Deutsche Bank advanced its custody plans by partnering with Bitpanda’s technology unit and the Swiss firm Taurus. The bank said it aims to integrate regulated digital asset infrastructure into its offerings. These moves align with MiCA requirements for licensed crypto services.

In September, Spain’s BBVA said it would use Ripple’s institutional custody platform. The bank confirmed that it plans to support Bitcoin and Ether trading and safekeeping. BBVA cited MiCA compliance as a key factor in its decision. The announcement outlined plans to operate under the EU’s regulatory framework.

Clearstream, part of Deutsche Börse, also confirmed the launch of new custody services for Bitcoin and Ether. The company said it will provide custody and settlement through its Swiss subsidiary, Crypto Finance AG. The service targets institutional clients seeking regulated access to digital assets. Clearstream stated that it will integrate the offering within its existing infrastructure.

In January, Standard Chartered announced plans to launch digital asset custody in Europe. The bank secured a license in Luxembourg to operate the service. It established a dedicated EU entity to deliver custody directly to clients. These developments follow MiCA’s rollout across the region.

Crypto World

Bitcoin Is ‘Money’ in Parts of Africa, Says Africa Bitcoin Corp Chair

Stafford Masie, executive chairman of Africa Bitcoin Corporation, said Tuesday that Bitcoin functions as everyday money in parts of Africa rather than primarily as a store of value.

Speaking to Natalie Brunell on the Coin Stories podcast on Tuesday, Masie said the framing of Bitcoin (BTC) differs sharply across regions.

“Where I come from, Bitcoin is money,” he told Brunell, adding that in some circular economies in Africa, merchants “won’t accept dollars — they accept satoshis.”

While investors in developed markets often emphasize its role as an inflation hedge, he described communities where satoshis circulate directly in local economies. He also pointed to the stark difference between inflation in the West and in parts of Africa.

“When you guys talk about debasement, you talk about 4% to 5% annually — we talk about 4% to 5% in an afternoon,” he said.

Masie compared the shift to the continent’s rapid adoption of mobile technology, arguing that younger populations are bypassing legacy financial systems. Rather than transitioning gradually from stable fiat currencies, he described a move from what he called “broken money” and sharp currency debasement into digital assets.

He also highlighted Africa’s youthful demographics as a key factor, noting that more than a quarter of the continent’s population is under 20. He said younger generations are embracing emerging technologies such as artificial intelligence and they “love Bitcoin.”

Masie said that in this context, Bitcoin becomes more than a passive store of value. Instead, he described it as “pristine capital;” a financial substrate that individuals and businesses can build on. He said:

In Africa, we know the age before 2008 and the age after 2008. After the Bitcoin white paper and before the Bitcoin white paper. Our lives changed, because suddenly we had something that couldn’t be debased. It was immutable, decentralized, can’t be confiscated. That to an African is life or death.”

Masie is a longtime technology executive who previously led major tech operations in South Africa.

Related: Africrypt founders back in South Africa years after platform collapse: Report

Crypto adoption in Africa

Data from blockchain analytics company Chainalysis appears to back up the shift on the continent that Masie is describing.

From July 2024 to June 2025, Sub-Saharan Africa received more than $205 billion in onchain value, up 52% year-on-year, making it the third-fastest growing crypto region globally. In March 2025 alone, monthly volume spiked to nearly $25 billion, driven largely by activity in Nigeria following a currency devaluation.

Sub-Saharan Africa has also stood out as a retail-driven crypto market. Transfers under $10,000 accounted for more than 8% of total value sent in the region during the same time period, compared with about 6% globally, according to the report released in September.

At the same time, Nigeria and South Africa showed notable institutional activity, with onchain flows indicating recurring multimillion-dollar stablecoin transfers linked to cross-border trade between Africa, the Middle East and Asia.

In January, speaking at the World Economic Forum, former UN Under-Secretary-General Vera Songwe explained how stablecoins are increasingly viewed as a cheaper remittance and settlement tool in Africa.

She said remittances have become “more important than aid” in many African economies, while traditional transfers can cost about $6 per $100 sent. With inflation exceeding 20% in about a dozen countries and an estimated 650 million people unbanked, she said stablecoins offer both a payments rail and a store of value in markets facing currency pressure.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Ray Dalio Warns Against Bitcoin as a Safe Haven

Billionaire investor Ray Dalio has warned against Bitcoin as a long-term store of value and safe-haven asset, arguing that it has little central bank support and has lingering concerns over its privacy limitations and quantum resistance.

Dalio dismissed the idea that Bitcoin (BTC) can function as a digital gold, telling the All-In Podcast on Tuesday that “there is only one gold.”

“Gold is not a precious metal that’s speculated on,” Dalio said, adding it is the “most established money” that is the second-largest reserve currency held by central banks.

Dalio added he doesn’t see why central banks would want to buy Bitcoin and hold it over the long term.

Dalio has previously said that Bitcoin has hard money characteristics and noted that it continues to “have a pretty high correlation with tech stocks.”

“So, from an ownership perspective, supply and demand can be affected if somebody gets squeezed in one area and has to sell something else they hold.”

Dalio also raised concerns about Bitcoin’s lack of privacy, stating “any transaction can be monitored,” and warned that quantum computing could threaten the network.

In July, Dalio recommended a 15% portfolio allocation into Bitcoin or gold to optimize for the “best return-to-risk ratio” in light of America’s crippling debt problem and continued currency debasement.

Related: Bitcoin dives 3% on global asset rout as $5K gold ‘smashed’ on oil fears

Between July and early October, Bitcoin and gold were both on the rise until a broader crypto market crash wiped out nearly $20 billion in leveraged positions.

The pair then decoupled in early October, with Bitcoin falling over 45% since its October peak to $68,420, while gold has continued to rally, climbing over 30% to $5,120 in that timeframe.

Dalio says the world as we know it has changed

Dalio sent a message to investors last month, warning that the “World Order,” one led by the US for the best part of a century, had “broken down,” and that investors must rethink how they protect their wealth amid rising geopolitical conflict and economic disorder.

Dalio reinforced his long-held position that stores of value, particularly gold, are the best option to preserve wealth when currencies falter and credit systems break down, while debt assets become vulnerable as uncertainty rises.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

JPMorgan CEO Jamie Dimon Pushes Bank Rules for Stablecoin Issuers

TLDR

- Jamie Dimon said stablecoin issuers that pay interest on customer balances should face the same rules as banks.

- He argued that companies holding customer funds and paying interest operate like traditional deposit-taking institutions.

- Dimon stated that such firms should comply with capital, liquidity, and anti-money laundering requirements applied to banks.

- He said banks could accept crypto platforms offering transaction-based rewards instead of interest on stored balances.

- Dimon emphasized that similar financial products should follow the same regulatory standards for fairness.

JPMorgan Chase CEO Jamie Dimon called for strict oversight of stablecoin issuers that pay interest on customer balances. He said companies offering interest should follow the same rules as traditional banks. Dimon made the remarks during a CNBC interview as lawmakers review U.S. crypto legislation.

Jamie Dimon Calls for Bank-Level Oversight on Interest-Paying Stablecoins

Jamie Dimon addressed reported tensions with Coinbase CEO Brian Armstrong during the CNBC interview. He focused on the differences between transaction rewards and interest on stored balances. He said regulators must draw a clear line between the two models.

“Rewards are the same as interest,” Dimon said during the interview. He added that firms holding balances and paying interest operate like banks. “If you are going to be holding balances and paying interest, that’s the bank,” he said.

Dimon stated that such companies should follow banking standards. He said they should meet capital and liquidity requirements. He also said they should comply with anti-money laundering rules and federal deposit insurance standards.

He explained that banks accept a compromise on transaction-based rewards. However, he said interest on stored balances changes the nature of the service. Therefore, he argued that similar products require similar oversight.

He framed the debate around fairness and safety. “Level playing field by product,” Dimon said during the interview. He warned that risks could grow outside regulated systems without equal rules.

Banks and Crypto Firms Debate Stablecoin Regulation in Washington

Lawmakers in Washington continue reviewing draft legislation on stablecoin oversight. The Senate Banking Committee had planned to vote on the proposed CLARITY Act. However, Armstrong withdrew support for the bill one day before the scheduled vote.

Armstrong has argued that banks should compete directly with crypto firms. In contrast, Dimon said regulation should follow the product structure. He maintained that companies offering bank-like services must accept bank-like supervision.

Dimon also stressed that JPMorgan supports competition within financial markets. He said the bank uses blockchain technology in its own operations. He confirmed that JPMorgan has developed a deposit token for internal use.

The bank processes payments and data transfers through distributed ledger systems. “We’re in favor of competition,” Dimon said during the interview. “But it’s got to be fair and balanced,” he added.

Dimon pointed to the compliance obligations banks follow every day. He referenced anti-money laundering checks and community lending requirements. He said regulators designed those standards to protect the financial system.

“For the safety of the system, not just the fairness of competition,” Dimon said. Meanwhile, lawmakers continue to review new draft language circulated by the White House. Industry groups have not reached an agreement on whether stablecoin issuers should offer yield on balances.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Politics18 hours ago

Politics18 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat4 days ago

NewsBeat4 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment2 days ago

Entertainment2 days agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech5 days ago

Tech5 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

NewsBeat3 days ago

NewsBeat3 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World5 days ago

Crypto World5 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat2 days ago

NewsBeat2 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech3 days ago

Tech3 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI