Crypto World

Coca-Cola (KO) Stock Falls 4% on Weak Q4 Revenue and Sluggish 2026 Outlook

TLDR

- Coca-Cola stock fell nearly 4% in premarket trading after missing Q4 revenue expectations and issuing weak 2026 guidance

- Q4 revenue came in at $11.82 billion versus analyst estimates of $12.03 billion as soda demand weakened in North America and Asia

- Company forecasts 2026 organic revenue growth of 4-5%, below analyst expectations of 5.3% and slower than 2025’s 5% growth

- Price increases of 4% for full year 2025 helped offset higher input costs but pressured inflation-hit consumers seeking cheaper options

- Volume growth remained flat in Asia-Pacific as consumers increasingly shift to regional brands over global names

Coca-Cola shares dropped nearly 4% in premarket trading Tuesday after the beverage giant missed fourth-quarter revenue expectations and forecast slower-than-expected growth for 2026.

The Atlanta-based company reported Q4 revenue of $11.82 billion, falling short of the $12.03 billion analysts had projected. The miss came as demand for sodas weakened across key markets in North America and Asia.

The company’s 2026 organic revenue growth forecast of 4-5% came in below Wall Street’s 5.3% expectation. This also represents a deceleration from the 5% growth Coca-Cola posted in 2025.

“The forecast reads conservative, but is appropriate for the start of the year,” Jefferies analyst Kaumil Gajrawala wrote in a note. “Street likely wanted more.”

Price Hikes Pressure Consumer Demand

Coca-Cola has been raising beverage prices throughout the past year to offset higher input costs. Prices rose 4% for full-year 2025, helping to drive overall performance.

But these price increases have weighed on inflation-hit U.S. consumers who are increasingly seeking cheaper pantry options. Unit case volumes rose just 1% in the fourth quarter, matching the growth rate from the previous three months.

For the full year, volumes were flat. The company relied entirely on pricing power to drive results.

Rival PepsiCo announced last week it would cut prices on key snacks like Lay’s and Doritos. The move came after consumers pushed back on several rounds of price hikes over recent years.

The timing creates pressure on Coca-Cola as it navigates a CEO transition. Veteran executive Henrique Braun is set to take over as chief executive on March 31.

Shifting Consumer Preferences Challenge Growth

Coca-Cola adjusted earnings came in at 58 cents per share, beating analyst estimates of 56 cents. But the revenue miss highlighted ongoing challenges in key markets.

Volume growth was flat in the Asia-Pacific region during the quarter. The company faces increasing competition from regional brands in the world’s most populous continent.

Coca-Cola has been trying to adapt to changing consumer preferences. The company is leaning on zero-sugar sodas, sports drinks, and bottled teas as U.S. consumers shift to low-sugar options.

The rise of appetite-suppressing weight-loss drugs has accelerated demand for healthier beverage choices. Coca-Cola has invested in products like protein-infused Fairlife milk to capture health-conscious consumers.

The company forecast annual adjusted profit per share growth of 7-8% for 2026. This came in slightly below analyst expectations of 7.9% growth.

Despite Tuesday’s premarket decline, Coca-Cola shares have risen about 12% in 2025. The stock has outperformed PepsiCo over the past few years.

Crypto World

Ethereum Floods Out of Exchanges in Biggest Withdrawal Wave Since October

Over 220,000 ETH have exited exchanges in the strongest withdrawal wave seen since last October.

Ethereum appears to be struggling to hold on to $2,000 following the market-wide pullback. Over the past week, the leading altcoin has shed almost 14%.

However, it just recorded its largest exchange outflows since October as traders move assets out to accumulate.

ETH Withdrawals Accelerate

ETH withdrawals from trading platforms have risen sharply. Data compiled by CryptoQuant revealed that the figure has reached its highest level since October. Recent Ethereum exchange netflow data shows a clear acceleration in outflows, which is indicative of a shift in investor behavior toward reducing the amount of ETH held on such venues.

Across all exchanges, net Ethereum outflows have surpassed 220,000 ETH over the past few days. This marks the largest wave of withdrawals since last October. Such an increase reflects a significant volume of ETH being moved from exchanges to private wallets or long-term storage protocols.

CryptoQuant stated that such movements are commonly associated with accumulation phases or with investors seeking to reduce risk by holding assets off exchanges. Binance accounted for a large share of this activity, as daily net outflows reached around 158,000 ETH on February 5.

This was the highest level of Ethereum withdrawals from Binance since last August, which implied that much of the recent exchange outflow was concentrated on the platform with the deepest liquidity.

From a price perspective, these strong outflows occurred while the crypto asset was trading in the $1,800 to $2,000 range. This means that some investors were repositioning or holding ETH at these price levels following the recent market pullback.

You may also like:

CryptoQuant further added that steady Ethereum outflows of this magnitude reduce the amount of supply readily available for selling. As a result, this trend is viewed as structurally supportive for price in the near term, particularly if market momentum stabilizes or improves.

$2,000 Level Now Under Heavy Watch

All eyes are on the $2,000 level after ETH faced rejection near higher resistance, according to market experts. Ted Pillows, for one, said ETH was rejected from the $2,100 resistance zone and identified $2,000 as the key level to hold. He warned that losing it could lead to a sweep of last week’s low. Analyst Ali Martinez also echoed the focus on this level.

Additionally, MN Capital founder Michaël van de Poppe shed light on the gap between network activity and price performance. He said that in the early stages of growth, price action often lags behind fundamentals, similar to Ethereum’s 2019 cycle, when market growth was initially limited.

Van de Poppe also explained that the asset’s price began to rise only after stablecoin transactions on the network reached their peak and observed that stablecoin transaction volumes on Ethereum are up 200% over the past 18 months, while ETH is down around 30%, which presents an opportunity for buyers.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ledger Wallet Adds OKX DEX for On-Device DeFi Swaps

Ledger, the French digital asset security company known for its hardware wallets, has integrated OKX DEX into its Wallet app, enabling users to execute multichain token swaps directly from a self-custodial environment.

According to the company, the integration provides access to OKX DEX’s liquidity aggregation from within the Ledger Wallet app, allowing users to swap tokens with the need to interact with external decentralized exchange interfaces.

Ledger said trades are routed using OKX DEX’s proprietary X-Routing technology, which aggregates liquidity across hundreds of decentralized exchanges to identify efficient execution paths. Transactions remain signed on the user’s Ledger device, with private keys never leaving the hardware wallet.

A spokesperson for Ledger told Cointelegraph that access to the OKX DEX integration is rolling out gradually, starting with availability for about 20% of Ledger Wallet users beginning today, with no device firmware or app update required.

At launch, swaps are supported on Ethereum (ETH), Arbitrum (ARB), Optimism (OP), Base (BASE), Polygon (POL) and BNB Chain (BNB), with no cross-chain or cross-seed swaps enabled.

OKX DEX is a decentralized exchange aggregator within the OKX ecosystem that routes trades across multiple onchain liquidity venues, separate from the company’s centralized exchange.

Related: Uniswap lands on OKX’s X Layer as exchange deepens DeFi strategy

Crypto IPOs expected in 2026

The integration follows reports in January that Ledger is exploring a US initial public offering that could value the company at more than $4 billion, with Goldman Sachs, Jefferies and Barclays involved in early discussions.

While Ledger would not confirm the reports, if true, it would join a growing list of crypto companies with their eyes set on public listings this year.

In January, tokenization platform Securitize advanced plans to go public through a merger with a Cantor Fitzgerald–backed blank-check company, disclosing in related filings that its revenue grew more than 840% through September 2025.

That same month, digital asset custodian Copper was reported to be exploring public listing options, though the company said it is not currently planning an IPO.

US-based crypto exchange Kraken is also expected to go public sometime in 2026. In November, Kraken said it had confidentially filed a draft registration statement with the US Securities and Exchange Commission, taking a formal step toward a potential initial public offering of its common stock.

However, on Tuesday, multiple media outlets reported that the company’s CFO, Stephanie Lemmerman, had been ousted. Her name does not appear on Kraken-parent Payward leadership page, which now lists Robert Moore, formerly VP of business expansion, as deputy CFO.

Inquiries on the change to Payward and Kraken by CoinTelegraph were not immediately replied.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

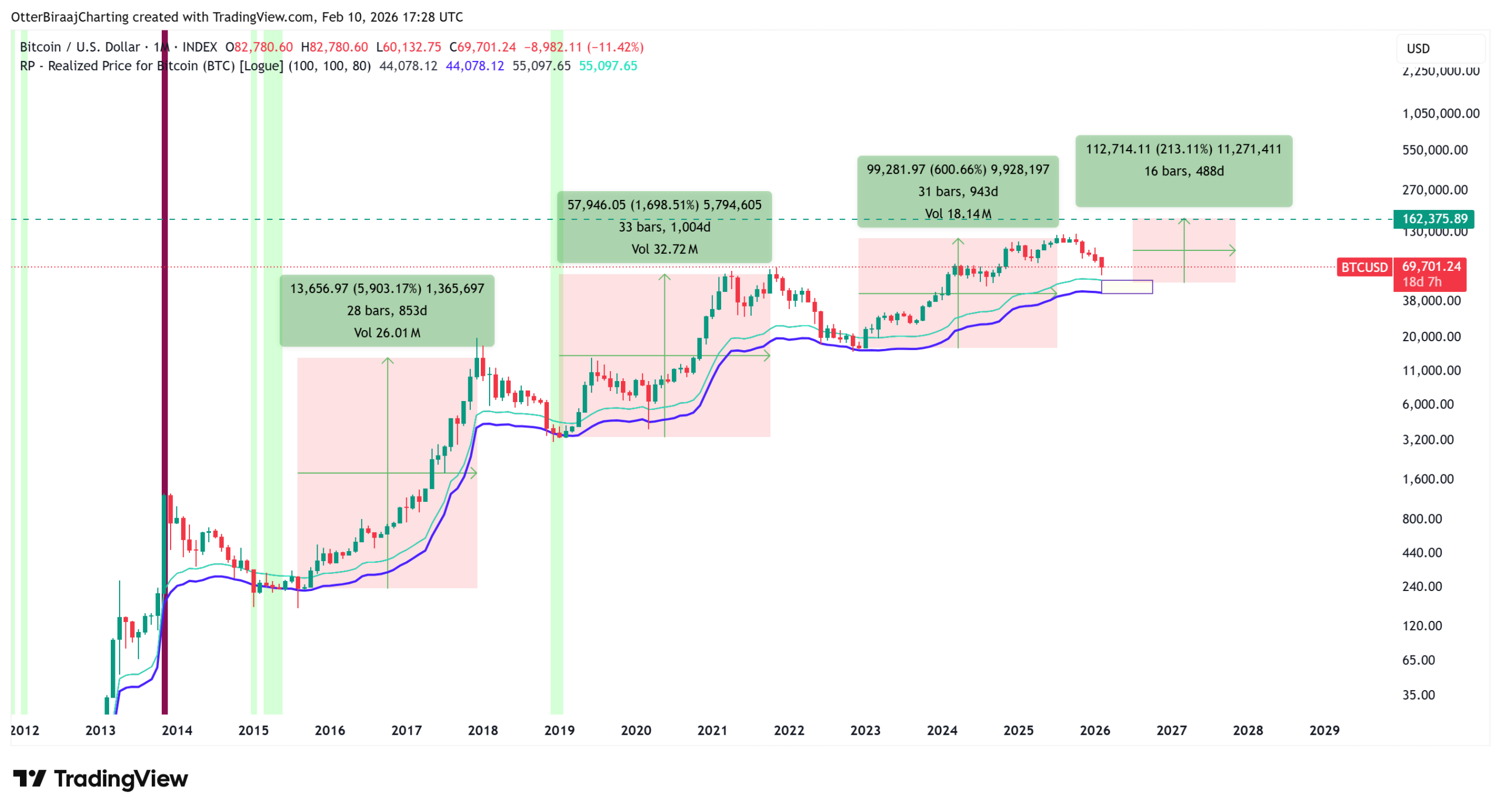

Could a 220% BTC Rally Follow?

Bitcoin has paused near recent highs, trading south of $69,000 as markets digest a period of consolidation after a volatile move that saw a dip to $60,000 followed by a rally to $72,000. Analysts note that price indicators have shifted into what some describe as a deep-value zone, prompting renewed debate about whether buyers will step in at these levels. Behind the scenes, researchers rely on two long-running metrics—realized price bands and a power-law quantile framework—that together frame the asset’s potential next leg. Taken together, these measures point to a broad, data-driven picture of accumulation forming at multiple support bands.

Key takeaways

- Bitcoin’s realized price bands align with a long-term accumulation zone that has preceded major price advances in prior cycles.

- The shifted realized price sits near $42,000 while the current realized price hovers around $55,000, signaling a structural support window roughly between $40,000 and $55,000 with potential upside if the pattern repeats.

- The power-law quantile model places BTC near the 14th percentile of its long-term log–log price corridor, suggesting a period of relative undervaluation after a cycle peak that could reach toward $210,000 in 2025 per the model.

- History shows rallies often follow a re-test of these bands, implying meaningful upside potential—roughly 170%–220%—in the next bullish phase and targets above $150,000.

- Consolidation after testing these zones has typically stretched six to eight months before the market resumes its upward trajectory toward new highs.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The current price dynamics unfold within a broader crypto environment where on-chain signals and valuation models increasingly inform timing. As liquidity ebbs and flows, accumulation zones identified by realized price bands and corroborated by long-term percentile analyses offer a framework for understanding potential inflection points, even as near-term moves remain uncertain.

Why it matters

For long-term holders and traders alike, the convergence of realized price bands with a low percentile reading from the power-law framework adds nuance to market timing. The near-term picture depicts a tug-of-war between downside risk—as implied by lower-bound scenarios in the $40k–$50k range—and the prospect of a broader upcycle should accumulation hold and demand re-emerge. This dynamic matters because it shapes risk budgeting and entry points during periods of sector-wide caution.

Beyond price, the implications ripple through market infrastructure and product design. If these bands function as gravity wells, participants in mining, staking, and decentralized finance may recalibrate risk models and deployment schedules in anticipation of a sustained rebound. The research also underscores the value of on-chain metrics that anchor sentiment, especially when macro conditions remain uncertain and with the possibility of regime shifts in liquidity and risk appetite.

Analysts emphasize that the synthesis of historical patterns with current readings still requires prudence. While the path to new highs has historically followed a phase of accumulation, each cycle contains unique catalysts and macro-tempo changes that can alter outcomes. The narrative around realized price bands and percentile positioning should therefore be viewed as one tool among many in assessing future trajectories, rather than as a guaranteed roadmap.

What to watch next

- Watch for Bitcoin price testing and holding the $55,000 area as a critical inflection point over the next several weeks.

- Monitor how often the price re-tests the realized price bands; a sustained move above the mid-$50ks would bolster the case for continued accumulation.

- Pay attention to the alignment with the power-law percentile, particularly if readings settle within the $50,000–$62,000 corridor, described as a long-term support floor in prior cycles.

- Observe any shifts in the BTC/Gold ratio or related macro indicators that could signal a risk-off or risk-on tilt, which would influence the timing of any durable bottom and subsequent rally.

Sources & verification

- On-chain realized price and shifted realized price concepts used to identify long-term accumulation zones and their historical relevance.

- The visual mapping of monthly price zones based on realized price bands, with sources cited to TradingView.

- The power-law quantile model’s positioning of BTC around the 14th percentile and its implied target near $210,000 in 2025, as discussed by the model’s proponents.

- Related discussion referencing large BTC holders and macro conditions as part of the broader context of market bottoms and pullbacks.

Market reaction and key details

Bitcoin (CRYPTO: BTC) has cooled after a volatile stretch, trading just below the $69,000 mark as market participants digest the move from a dip to $60,000 and a subsequent push back toward the $70,000 level. The retreat comes as analysts revisit two on-chain gauges that have historically framed long-run value zones. Realized price, which tracks the average cost basis of BTC the last time it moved on-chain, and its shifted counterpart, which smooths this signal forward in time, are currently signaling a broad accumulation range. In practical terms, this means that the market is tracking a price floor around the mid-$40,000s to mid-$50,000s, with the potential for outsized upside if history repeats itself and buyers re-enter the market en masse.

The current readings place realized price near $55,000 and the shifted realized price around $42,000, reinforcing the idea that a robust support base is forming amid a broader pattern of value-driven accumulation. A chart illustrating these zones, which connects monthly price action to realized-price bands, is available via the linked visualization (Cointelegraph/TradingView) and provides a historical lens on how retests of these bands have historically preceded meaningful rallies. For readers curious about the visual, the chart references BTCUSDT on TradingView.

Beyond the realized-price framework, another analytic approach gaining attention is a power-law quantile model popularized by BTC researcher Giovanni Santostasi. The latest update places BTC near the 14th percentile of a long-term log–log price corridor, suggesting a phase of relative undervaluation after a cycle peak that the model projected could reach as high as $210,000 in 2025. This confluence—price trading near realized bands and a low percentile reading on the long-term corridor—has historically coincided with recoveries, even as the structure permits the possibility of further drawdowns in the near term. The model’s $210,000 target underscores the scale of potential upside that such a framework envisions, even as the timing remains uncertain.

The discourse is not without caution. Observers such as Jelle (CryptoJelleNL) have pointed to periods where the BTC price has fallen around 31% from a prior RSI-based breakout, warning that a retracement toward the $52,000s could occur before a durable bottom takes hold. Another analyst, Sherlock, has flagged a breakdown in the BTC/Gold ratio below recent support, a condition that has previously coincided with transitions into bearish phases. In light of these signals, some analysts argue that a deeper retest—potentially into the $38,000–$40,000 region—remains plausible if historical patterns repeat. Still, the broader narrative remains that a test of the realized bands could, if met with a sustained bid, propel BTC into the next leg of its cycle.

As markets weigh these views, traders will be watching for alignment between on-chain signals and price action. The convergence of the realized-price framework with percentile positioning offers a structured lens through which to assess risk and potential catalysts, even as external factors continue to influence risk sentiment across the crypto space. The discussion around Bitcoin’s long-term value, and how that value translates into price, remains highly dependent on a delicate balance of on-chain activity, macro conditions, and investor appetite for risk.

Related: Bitcoin holders sell 245K BTC in tight macro conditions: Did the market bottom?

https://platform.twitter.com/widgets.js

Crypto World

Kaito and Polymarket Unveil ‘Attention Markets’

Kaito and Polymarket have launched ‘Attention Markets’, merging attention measurement technology with prediction market infrastructure to track cultural narratives.

Kaito and Polymarket have launched ‘Attention Markets’, an initiative that combines Kaito’s attention measurement technology with Polymarket’s prediction market infrastructure.

These markets aim to capture the dynamics of cultural narratives and emerging trends. Prediction market trading volumes have experienced a remarkable surge, growing 850% year-over-year and reaching $6.2 billion in weekly volume as of January 2026. This growth underscores the increasing relevance and influence of prediction markets in capturing collective beliefs and trends.

“As information becomes abundant, attention becomes the scarce resource. Attention Markets represent a new category within prediction markets—one that captures the dynamics of what people are paying attention to, how narratives form, and where relevance is moving next,” said Yu Hu, founder & CEO of Kaito.

A Polymarket spokesperson further elaborated on the partnership: “Polymarket has always been about turning collective beliefs into market signals. Partnering with Kaito allows us to apply that same market logic to attention itself, unlocking new ways for markets to reflect culture, trends, and shifts in public focus.”

Attention Markets will span various verticals, including AI, finance, and entertainment, and be offered on both the Polymarket and Kaito platforms.

This article was generated with the assistance of AI workflows.

Crypto World

Miami Beach House for Sale, But Only With Bitcoin?

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee—big moves are happening on the US coasts. From luxury mansions in Miami to shifts in billionaire residency, wealth is on the move, amid new patterns in finance, real estate, and crypto.

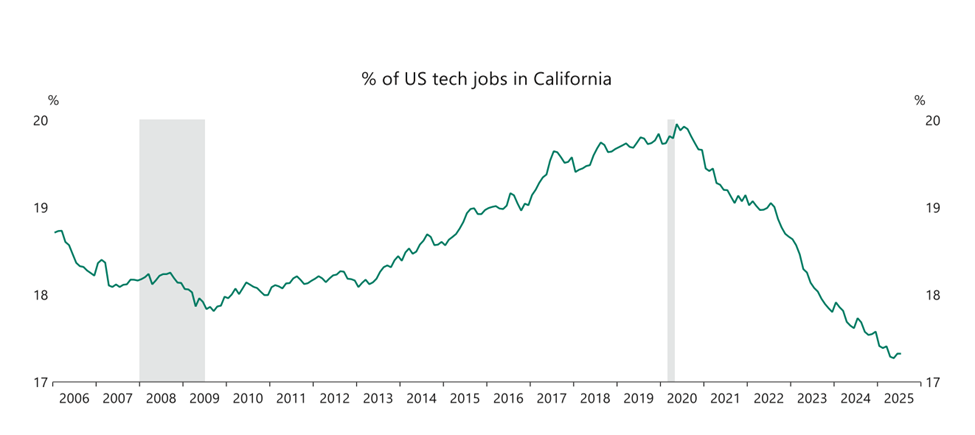

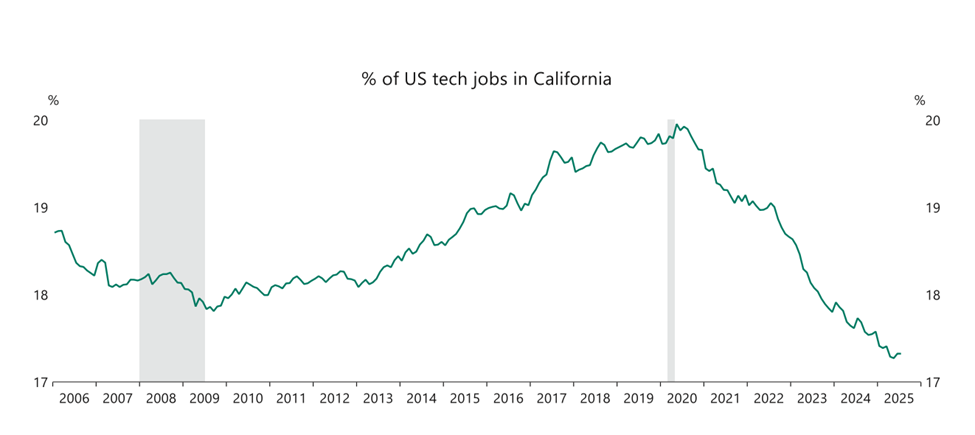

Crypto News of the Day: Florida Emerges as a Tax Haven for Tech and Crypto Wealth

California’s tech and crypto elites are increasingly eyeing Florida as a tax-friendly alternative. Grant Cardone’s recent X (Twitter) post advertising a 10,000 sq. ft., 7-bedroom Miami mansion for 700 BTC highlights the growing intersection of Bitcoin wealth and high-end real estate.

Sponsored

Sponsored

The listing coincides with a surge in relocations by high-net-worth individuals from California. Meta CEO Mark Zuckerberg and his wife, Priscilla Chan, are the latest California billionaires moving to South Florida.

Reportedly, they are purchasing a newly completed waterfront mansion in Miami’s Indian Creek neighborhood. Based on reports, the gated community is home to other high-profile figures, including Jeff Bezos, Tom Brady, and Jared Kushner/Ivanka Trump.

The seller is reportedly a limited liability company tied to Jersey Mike’s Subs founder Peter Cancro. While the deal has not been publicly confirmed as closed, WSJ, citing neighbors, estimates that Zuckerberg plans to move in by April 2026.

California Tax Fallout

The relocations come amid a proposed California billionaire tax that has sparked concern among the state’s wealthiest residents.

According to Chamath Palihapitiya, a Canadian-American VC and SPAC pioneer, California’s total taxable wealth from billionaires has fallen from over $2 trillion to under $1 trillion following announcements of high-profile departures.

Sponsored

Sponsored

Palihapitiya criticized the state’s handling of the proposed tax, arguing that the middle class will bear the fiscal burden left behind by relocating billionaires.

“These were all people who were paying 13%+ in state income tax every year with no complaints until a few weeks ago,” remarked Palihapitiya.

Against this backdrop, experts describe the billionaire tax initiative as having “backfired in the most spectacular fashion with ripple effects on local economies and corporate headquarters.

Brian Sullivan of CNBC noted that companies often follow CEOs, suggesting that Meta employees could also relocate to Florida, effectively benefiting from lower state income tax rates.

Local real estate agents report a significant uptick in demand for ultra-luxury properties. According to Danny Hertzberg, a Miami agent with Coldwell Banker Realty, interest in South Florida’s high-end market has intensified since the announcement of California’s billionaire tax.

“The 5% tax in California is really driving out people in a major way,” WSJ reported, citing Hertzberg.

Sponsored

Sponsored

Crypto’s Role in Wealth Mobility

Beyond real estate, the situation mirrors broader trends in wealth mobility and in decentralized assets. Balaji Srinivasan, former CTO of Coinbase, has warned that California’s billionaire tax could disrupt venture capital incentives, potentially reducing Silicon Valley from “one to zero” over the next decade.

He frames crypto networks and internet-native protocols as politically resilient alternatives, able to operate globally and adapt to structural risk in ways traditional tech and finance cannot.

Srinivasan likens the current moment to an extinction event: while Silicon Valley’s centralized dominance may be fragile, decentralized networks like Bitcoin are structurally positioned to thrive in a shifting political and economic playing field.

“…the intended purpose of the California wealth seizure referendum is to rob or exile everyone in tech… The goal of the Democrats is to drive tech out of California, like they did the Republicans…cryptocurrency is built to resist wealth seizures, but Silicon Valley technology sure is not… As a natural-born US citizen, he [Zuckerberg] doesn’t have the same constraints that Thiel and Elon did,” Srinivasan explained.

Sponsored

Sponsored

As Florida attracts both tech and crypto wealth, Grant Cardone’s 700 BTC mansion is emblematic of a wider trend. High-net-worth individuals are leveraging digital assets and favorable tax jurisdictions to preserve wealth, while California’s billionaire tax debate continues to reverberate across the US.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto World

Bitcoin Buy Signal Points to 220% Upside Despite Near-Term Risk

Bitcoin (BTC) is trading below $69,000 on Tuesday, confirming the view that price consolidation is the most likely course over the short term. The sell-off to $60,000 and the subsequent recovery to $72,000 resulted in many BTC price indicators falling into what analysts believe to be a deep value zone, but will buyers reach the same conclusion?

Key takeaways:

-

Bitcoin’s realized price bands have aligned with a long-term accumulation zone that preceded new BTC highs.

-

Power Law quantile models place BTC near the lower 15% of its long-term log-log price corridor, a zone that has consistently appeared after prior cycle peaks.

-

Valuation and momentum metrics are clustering around the $40,000–$55,000 region, marking a statistically significant structural support area.

BTC realized price bands outline long-term DCA zones

Bitcoin’s realized price and shifted realized price have successfully identified long-term accumulation zones since 2015.

Realized price reflects the average cost basis of all BTC last moved onchain whereas the shifted realized price smoothens this metric forward in time, capturing deeper-value zones during stronger drawdowns.

Currently, Bitcoin’s realized price sits near $55,000, while the shifted realized price is around $42,000.

Multiple years of historical data show that rallies following the re-test of these zones delivered big gains, as shown in the chart above. While returns have diminished over time, the structure still implies upside potential of 170% to 220%, aligning with targets above $150,000 in the next bullish period.

Bitcoin has typically consolidated for six to eight months after testing the realized price bands before resuming an upward trend and hitting new highs.

Power law model signals relative undervaluation for BTC

Popularized by BTC researcher Giovanni Santostasi, the updated power law quantile model places BTC near the 14th percentile of its long-term log-log price corridor, suggesting temporary undervaluation following a cycle peak that fell short of the model’s projected $210,000 high in 2025.

Confluence between price trading near realized price bands and lower power law percentiles has preceded major recoveries.

The model’s fifth (0.05) percentile previously marked long-term cycle floors and now sits between $50,000 and $62,000, overlapping with the accumulation range defined by the realized price bands.

Related: Bitcoin holders sell 245K BTC in tight macro conditions: Did the market bottom?

Analysts say Bitcoin may sell off before the next big rally occurs

Bitcoin investor Jelle noted that BTC price is currently down roughly 31% from its first weekly RSI 37 break, a level that has preceded cycle bottoms since 2014.

The drawdowns ranged between 17% and 55%, with the recent cycles bottoming closer to 40–43%, implying potential downside toward $52,000 before a durable low forms.

Crypto analyst Sherlock highlighted a breakdown in the BTC/Gold (XAU) ratio below the 15–16 level, a signal that previously marked transitions into a bearish period.

Based on this framework, Sherlock warns BTC may still see a deeper retracement toward the $38,000 to $40,000 region if history repeats.

Related: Bitcoin price punishes traders as 24-hour crypto liquidations pass $250M

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Do Super Bowl Ads Predict a Bubble? Dot-Coms, Crypto and Now AI

Advertisements for the Super Bowl — the championship game of American football — are some of the most watched and most expensive.

The game on Sunday boasted some 127 million viewers, making it the most-viewed sporting match of the year in the US, as well as the most-watched Super Bowl of all time.

Advertisers pay a premium for the limited number of commercial spots. Some companies shelled out as much as $4 million for a 30-second slot. The high sticker price, as well as the massive audience, drives companies to make their advertisements unique.

But tech industry observers have noted one particular trend in Super Bowl ads: If there’s novel tech all over the ad space, a bubble will soon pop.

Super Bowl ads and bubbles, from dot-coms to crypto

In January 2000, the dot-com boom was in full swing due to the widespread adoption of the internet. At the Super Bowl that year, which became dubbed “the dot-com bowl,” 17 different ads were about the world wide web.

One from trading platform e-Trade featured a 20-second clip of a dancing chimpanzee, followed by a screen that read, “Well, we just wasted 2 million dollars. What are you doing with your money?”

Two months later, the dot-com bubble began a steep decline that lasted until October 2002.

The same happened with the “crypto bowl” in 2022. At Super Bowl LVI, four different crypto companies aired ads: Coinbase, Crypto.com, eToro and FTX.

The now-defunct FTX aired an ad with “Seinfeld” showrunner Larry David, encouraging investors not to “miss out” on crypto. Crypto companies spent an estimated $6.5 million each per 30-second slot that year.

Just months later, the crypto market unraveled. Terra’s stablecoin ecosystem imploded in May. FTX, Celsius, Voyager Digital and BlockFi were insolvent by the year’s end. Genesis followed in January 2023.

Related: Crypto figures address connections mentioned in latest Epstein file release

The following Super Bowl, only one crypto-related ad appeared: a non-fungible token promotion related to the video game Limit Break. There were none in 2024 and 2025.

Coinbase’s sole crypto ad at Super Bowl LX missed the mark

After a two-year hiatus, one major crypto company has returned to the Super Bowl. Coinbase ran an ad in the form of a karaoke sing-along to the Backstreet Boys, which was also screened on the Sphere in Las Vegas.

Not everyone was thrilled. For many, crypto’s image has not improved since the FTX days. Political streamer Jordan Uhl posted, “From crypto to AI to Trump accounts, every Super Bowl has its own scam ad theme.”

Northwestern University’s Kellogg School of Management publishes formal ratings of Super Bowl ads and puts them in two categories: touchdowns (successful/good advertisements) or fumbles (ineffective/poor advertisements).

The Kellogg survey found that Coinbase’s 2026 ad “failed to establish a clear connection to the brand or its value proposition.” It received an “F.”

But the crypto industry now has some serious legislative victories under its belt. Coinbase’s ad may be a signal that the industry will keep promoting its brands on the largest single night for advertising in the US.

Related: Crypto PACs secure massive war chests ahead of US midterms

Do Super Bowl ads signal an end to the AI bubble?

While Crypto.com didn’t make any crypto-related advertisements, it did announce its new AI platform, imaginatively named AI.com.

A total of 10 ads at this year’s Super Bowl were about AI. Anthropic boasted its ad-free AI model, Claude. Meta showed off its AI-enabled Oakley smart glasses, and Google’s commercial featured a mother and son furnishing their home with Nano Banana Pro, the company’s AI-enabled image generator.

Amazon debuted its new Alexa+ in an ad with actor Chris Hemsworth, in which he imagines that AI is out to get him, either by closing the garage door on his head or attempting to drown him in the pool.

Svedka Vodka’s 2026 ad revived its “fembot” character that was made primarily with AI. Source: YouTube

The rapid proliferation of AI tech has coincided with eye-watering company valuations and doubt about whether firms like OpenAI will turn a profit. Now, some observers are wondering if the “AI bowl” was a harbinger of an impending bubble burst.

Gary Smith, an economics professor at Pomona College, and Jeffrey Funk, an independent consultant with Carnegie Mellon, wrote on Sunday:

“In this AI bubble, the prices of AI-dependent stocks have become untethered from realistic projections of future profits. LLM-dependent companies such as OpenAI and Anthropic are losing enormous amounts of money yet are given valuations in the hundreds of billions of dollars as if they were real companies making real profits.”

Ads focus on onboarding new users to the technology. Smith and Funk said, “In the absence of profits, the tech bros increasingly emphasize an old metric that was popular during the dot-com bubble: the number of users, with a new flavor.”

Ahead of the Super Bowl, software developer and researcher Carl Brown said, “I don’t know exactly how many AI commercials are going to be in the game this weekend. I already know there will be a lot more than it seems like there ought to be.”

E-Trade may have “wasted” $2 million in 2000, but it was still around to gloat about surviving the dot-com bust the next year. FTX and other smaller crypto platforms went under in 2022, but Coinbase and the Backstreet Boys were playing on the Vegas Sphere this time around.

The AI bubble could burst, but if past patterns point to anything, a few companies will survive — and maybe make a commercial about it.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

What It Actually Takes to Prove Someone Is Satoshi Nakamoto

Verifying Satoshi Nakamoto: A matter of math, not media

From time to time, individuals claim to be Satoshi Nakamoto, Bitcoin’s pseudonymous creator. Such announcements generate headlines, spark heated debates and trigger instant skepticism. Yet after years of assertions, lawsuits, leaked files and media interviews, no claim has been backed by definitive proof.

The reason is simple. Proving someone is Satoshi is not a matter of storytelling, credentials or courtroom victories. It is a cryptographic problem governed by unforgiving rules.

Nakamoto built Bitcoin (BTC) to function as a peer-to-peer (P2P) cryptocurrency without requiring trust in people. It is widely assumed that Satoshi Nakamoto is an adopted name rather than a real one. As a result, anyone who claims to be Satoshi, or is presented as such, must prove that identity. That proof would likely involve identity documents, historical communication records and, most critically, control of a private key associated with one of Bitcoin’s earliest addresses.

Over the years, several individuals have been speculated to be Satoshi Nakamoto, but only a few have publicly claimed to be the creator of Bitcoin.

The most prominent claimant is Craig Steven Wright, who repeatedly asserted that he was Satoshi. That claim collapsed after a UK High Court ruling explicitly determined he was not Satoshi Nakamoto and sharply criticized the credibility of his evidence.

Dorian S. Nakamoto was identified by Newsweek in 2014 as Satoshi Nakamoto, but he immediately denied any connection to Bitcoin’s creator. Early Bitcoin pioneer Hal Finney also rejected speculation that he was Satoshi Nakamoto before his passing. Nick Szabo has likewise been speculated to be Satoshi over the years and has consistently denied the claim.

What constitutes genuine proof of ownership in Bitcoin

In cryptographic systems like Bitcoin, identity is bound to private key ownership. Demonstrating control requires signing a message with that key, a process that anyone can verify publicly.

This distinction is clear:

-

Evidence can be debated, interpreted or challenged.

-

Cryptographic verification is binary; it either checks out or it does not.

Bitcoin’s verification model does not rely on authority, credentials or expert consensus. It depends on mathematics, not people, institutions or opinion.

Did you know? Early Bitcoin forum posts and the white paper used British spellings like “colour” and “favour.” This sparked theories about Satoshi’s geographic background, though linguists caution that spelling alone can be easily imitated or deliberately altered.

The gold standard: Signing with early keys

The most conclusive proof of being Satoshi would be a public message signed using a private key from one of Bitcoin’s earliest blocks, particularly those associated with Satoshi’s known mining activity in 2009.

Such a signature would be:

-

Verifiable by anyone using standard tools

-

Impossible to forge without the actual private key

-

Free from dependence on courts, media or trusted third parties.

The tools required for such proof are simple, accessible and decisive, yet no one has ever provided it.

Did you know? Satoshi gradually stepped away from public communication in 2010, just as Bitcoin started attracting developers and media attention. Their final known message suggested they had “moved on to other things,” fueling speculation about motive and timing.

Moving early coins: Even more powerful, but improbable

An even stronger demonstration would be transferring Bitcoin from an untouched Satoshi-era wallet. That single onchain action would dispel nearly all doubt.

Yet it carries massive downsides:

-

Instant worldwide scrutiny

-

Severe personal security threats

-

Potential tax, legal and regulatory fallout

-

Market disruption from anticipated dumps.

The most ironclad proof is also the most disruptive. It makes inaction a rational choice, even for the true creator.

Did you know? Blockchain researchers estimate that early mining patterns linked to Satoshi may represent roughly 1 million BTC, making those dormant wallets some of the most closely watched in crypto history.

Why documents, emails and code don’t settle the ownership

While emails, draft papers, forum posts and code contributions can support a claim, they do not constitute definitive evidence. Such materials can be forged, edited, selectively leaked or misinterpreted.

Code authorship does not prove key control. In Bitcoin, keys define identity, and everything else is secondary. Analysis of emails, draft papers and forum posts may offer intriguing correlations between an individual and Bitcoin, but it lacks certainty. The samples are limited, and styles can overlap or be mimicked.

In social settings or conventional legal disputes, identity can be supported by personal testimony or documentation. However, such evidence is irrelevant within Bitcoin’s decentralized model.

Human memory is fallible, and incentives can be misaligned. Bitcoin was designed specifically to avoid reliance on such factors. Cryptographic proof removes any human role from the verification process.

Why partial proof is not proof

Some claimants offer evidence behind closed doors. However, material shown only to select individuals, or signatures produced using later Bitcoin keys, does not meet the required standard.

To convince the world, proof must be:

-

Public: Visible to anyone

-

Reproducible: Independently verifiable

-

Direct: Tied to Satoshi-era keys.

Anything less leaves room for doubt, which is unacceptable to the Bitcoin community.

For Bitcoin to function, its creator does not need to be known or visible. On the contrary, its decentralization narrative is strengthened by the creator’s absence. There is no founder to defer to, no authority to appeal to and no identity to attack or defend.

While most organizations or projects rely on founders or management teams, Bitcoin functions precisely because identity is irrelevant.

Crypto World

Cardano price forecast: will ADA breakout or decline further from here?

- Cardano (ADA) may rebound if it breaks resistance near $0.31–$0.35.

- Leios upgrade aims to boost Cardano’s speed, security, and decentralisation.

- CME futures launch adds regulated institutional exposure to ADA.

Cardano (ADA) has struggled to regain momentum over the past year.

Currently, ADA is trading at $0.2635, with a slight 0.7% increase in the last 24 hours.

The 24-hour range spans from $0.2611 to $0.2723, reflecting modest intraday volatility.

Over the last seven days, ADA has lost about 11%, and its one-year performance remains down 62.4%.

Despite the persistent bear market, Cardano’s trading volumes over 24 hours remain significantly high at $407.8 million, indicating that the token continues to see active trading.

Market catalysts and institutional support

Cardano’s broader market outlook is influenced by the upcoming layer-1 upgrade dubbed Ouroboros Leios.

The Ouroboros Leios upgrade, confirmed at a Tokyo community event on the Midnight Japan Tour by Input Output’s Michael Smolenski and Cardano founder Charles Hoskinson, is expected to improve scalability, security, and decentralisation.

Leios will introduce parallel block processing to increase transaction throughput dramatically.

If successful, this upgrade could address the blockchain trilemma and attract more developers and users to the network.

On the institutional front, the CME Group recently launched ADA futures, including standard and micro contracts.

Cardano, Chainlink and Stellar futures are now available to trade.

Expand your trading strategy with the capital efficiency and flexibility of these new contracts, available in both larger and micro sizes.

Start trading today. ➡️https://t.co/CMksnUfZpo pic.twitter.com/19thOQHGZk

— CME Group (@CMEGroup) February 9, 2026

These futures provide regulated exposure to Cardano for professional traders and investors.

The addition of micro contracts lowers the entry barrier and may boost liquidity in the short to medium term.

Historical price data also provides context.

ADA’s all-time high was $3.09 in September 2021, while its all-time low of $0.01925 in March 2020 demonstrates the token’s extreme volatility.

Despite its current decline, ADA has grown by over 1,200% from its lowest point, showing long-term resilience.

Cardano technical outlook

From a technical standpoint, ADA faces key resistance around $0.28 to $0.31, which could define the short-term trajectory.

The Relative Strength Index (RSI) is near 33, suggesting the token is approaching oversold conditions.

The Moving Average Convergence Divergence (MACD) indicator also shows bearish momentum, although the potential for reversal exists if buyers step in.

Bollinger Bands indicate that the price is near the lower range, hinting at some room for a bounce.

On the upside, a recovery above $0.31 could open the path toward $0.35, while a failure to hold support near $0.25–$0.26 may push ADA lower.

Analysts note that an inverse head-and-shoulders pattern may be forming, signalling a potential trend reversal.

They highlight that a breakout above $0.275–$0.28 could target $0.346, representing roughly a 30% upside from current levels if the selling pressure continues to ease and trading volume confirms the move.

Ultimately, ADA’s next move will depend on whether buyers gain confidence and push the token above resistance.

Crypto World

UK Central Bank to Launch Onchain Settlement Infrastructure Pilot

The Bank of England has launched a new industry experimentation initiative to explore how tokenized assets could be settled using synchronized, atomic settlement in British pounds sterling as part of efforts to modernize the UK’s real-time gross settlement (RTGS) infrastructure.

The Synchronisation Lab initiative will allow 18 selected companies to test delivery-versus-payment and payment-versus-payment settlement between the BoE’s next-generation RTGS core ledger, known as RT2, and external distributed-ledger platforms, in a non-live environment without using real money, according to a bank statement.

The six-month pilot, scheduled to start in spring 2026, is intended to validate the central bank’s design choices for synchronized settlement, assess interoperability between central bank money and tokenized assets, and inform the development of a potential future live RTGS synchronization capability.

Originally announced in October, the initiative brings together 18 participants, including market infrastructure providers, banks, fintechs and decentralized-technology companies to test use cases spanning tokenized securities settlement, collateral optimisation, foreign exchange and digital-money issuance.

Among the Web3 participants, Chainlink and UAC Labs will test decentralized approaches to coordinating synchronized settlement between central bank money and assets issued on distributed-ledger platforms. Companies such as Ctrl Alt and Monee will focus on delivery-versus-payment settlement for tokenized gilts and other securities.

Other participants, including Tokenovate and Atumly, will test conditional margin payment workflows and digital-money issuance and redemption flows designed to coordinate with RTGS settlement. The roster also includes Swift and LSEG.

The bank said the work of the lab initiative will be used to refine the design of its RTGS synchronization capability and support further development work, with participants expected to present their use cases and findings following the conclusion of the program.

Related: UK Lords launch stablecoin inquiry as Bank of England moves to finalize rules

Global central banks expand pilots

The Bank of England is just one of a roster of central banks exploring how tokenization, programmable settlement and digital currencies could reshape their core monetary and payment systems.

In May, the Federal Reserve Bank of New York and the Bank for International Settlements published research from Project Pine examining how smart contracts could support monetary policy in tokenized financial systems, including a prototype toolkit for faster and more flexible central bank actions on programmable ledgers.

In October, the Monetary Authority of Singapore announced BLOOM, an initiative aimed at expanding settlement infrastructure to support transactions in tokenized bank liabilities and regulated stablecoins.

Beyond tokenization pilots focused on settlement and market infrastructure, central banks have also been running experiments with central bank digital currencies (CBDCs).

In Australia, the central bank launched a wholesale digital currency trial in July using stablecoins, tokenized bank deposits and a pilot CBDC.

This was followed by the United Arab Emirates completing its first government payment with a digital dirham in November, and China-led mBridge reporting in January that it had processed $55 billion in cross-border CBDC transactions across multiple jurisdictions.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat23 hours ago

NewsBeat23 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World12 hours ago

Crypto World12 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 hours ago

Crypto World3 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports23 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World12 hours ago

Crypto World12 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition