Crypto World

Coinbase posts $670M Q4 loss as it expands beyond trading

Coinbase reported a quarterly loss as it expanded into derivatives, stablecoins, and new markets to reduce reliance on spot crypto trading.

Summary

- Coinbase diversified its business through futures, global expansion, and new financial products.

- Market volatility and lower trading activity weighed on short-term performance.

- Management remains focused on long-term stability and revenue balance.

Coinbase Global, Inc. reported a net loss of $670 million in the fourth quarter of 2025, despite posting record operational metrics for the full year, according to its earnings report released on Feb. 12.

The company said its Q4 results were in line with internal expectations, even as weaker crypto market conditions in late 2025 weighed on transaction revenue and profitability.

Strong growth, weaker bottom line

In its shareholder letter, Coinbase highlighted major gains in trading activity and product adoption throughout 2025. While its crypto market share doubled to 6.4%, the total trading volume reached $5.2 trillion, up 156% year-over-year.

Revenue from subscriptions and services also reached a record $2.8 billion, indicating rising demand for non-trading products such as stablecoins, staking, and custody services. Paid Coinbase One subscribers climbed to nearly one million, tripling over the past three years.

“We drove all-time highs across our products,” said chief executive officer Brian Armstrong. “The Everything Exchange is working, and we’re well-positioned for 2026.”

Chief financial officer Alesia Haas added that the company met or exceeded its revenue and expense targets throughout the year, extending what she described as a multi-year track record of operational discipline.

However, softer market conditions in the final months of 2025 reduced trading activity and lowered asset prices, putting pressure on Coinbase’s core transaction business. According to GAAP accounting standards, these elements played a part in the quarterly net loss.

Expanding beyond spot trading

As part of its “Everything Exchange” strategy, which aims to bring various asset classes onto a single platform, Coinbase continued to grow beyond spot trading in 2025.

The company introduced 24/7 U.S. perpetual-style futures, expanded its global reach by acquiring Deribit, and launched new products like stock trading and prediction markets. At the same time, stablecoin and institutional services were further developed.

These efforts are meant to reduce dependence on traditional crypto trading and make revenue less sensitive to price swings. As a result, average USD Coin (USDC) balances on the platform climbed to $17.8 billion, while customer-held assets tripled over three years. In 2025, more than 12% of the world’s crypto was stored on Coinbase.

After the earnings report was released, Coinbase shares fell about 8% as the wider digital asset market weakened. Analysts pointed to ongoing volatility and uncertain trading volumes as major short-term risks.

Even so, the company ended 2025 with a solid financial position, holding $11.3 billion in cash and equivalents. It also bought back $1.7 billion worth of shares during the year. Early 2026 has shown signs of recovery, with about $420 million in transaction revenue recorded by early February.

Crypto World

Russia Considers Separate Stablecoin Law Amid Crypto Regulation Reforms

Key Insights

- Russia separate stablecoin law may create clear legal status for fiat-pegged tokens within the national financial system.

- Lawmakers may restrict trading on unlicensed crypto platforms under a broader exchange regulation bill.

- A ruble-pegged stablecoin approved for trade highlights Russia’s focus on cross-border blockchain payments.

Russia Plans Dedicated Stablecoin Regulation

The Russia separate stablecoin law proposal forms part of the country’s broader cryptocurrency regulatory reforms. The Ministry of Finance is considering legislation that will address fiat-pegged digital assets separately from exchange regulations.

BREAKING: 🇷🇺 Russia says it’s working on a stablecoin bill. pic.twitter.com/oEeF01Z3kg

— Crypto India (@CryptooIndia) March 5, 2026

Officials believe stablecoins serve a different function than decentralized cryptocurrencies. As a result, regulators prefer a legal framework designed specifically for these assets. The proposed Russia separate stablecoin law would define how stablecoins operate within the national financial system.

Alexey Yakovlev, director of the ministry’s Department of Financial Policy, highlighted the potential of these assets. He noted that stablecoins could play a significant role in financial infrastructure and global transactions.

At present, Russian law does not clearly define stablecoins. The planned legislation aims to clarify their legal status and regulatory classification.

Crypto Exchange Regulation Moves Forward

The Russia separate stablecoin law debate comes after advancements on wider cryptocurrency regulation. Legislators are still working on a bill that will govern crypto trading platforms nationwide.

The proposed exchange law may prohibit Russian citizens from trading digital assets on platforms that lack official permits. Regulators desire to enhance regulation and minimize risk in the crypto market.

With the proposed structure, the transactions might be conducted in the regulated institutions like banks, brokers, and stock exchanges. With the help of this structure, compliance and transparency will be enhanced.

Reports indicate lawmakers may present the exchange legislation to the State Duma during the spring session. If approved, the rules could take effect as early as July.

Stablecoins and Cross-Border Payments

Interest in the Russia separate stablecoin law reflects the country’s focus on international settlements. Policymakers view stablecoins as potential tools for cross-border financial transactions.

The Bank of Russia introduced a regulatory category called foreign digital rights. This type can involve cryptocurrencies and stablecoins that can be used in particular international applications.

An overseas trade stablecoin named A7A5 was authorized as a ruble-pegged stablecoin. Authorities approved the asset for cross-border settlements that meet regulatory requirements.

Negotiations among the central bank, the finance ministry and industry players are underway. The regulators want to come up with balanced rules to ensure financial stability and innovation.

The proposal of the Russia separate stablecoin law is indicative of the much bigger plan to modernize financial infrastructure. Well-defined policies may boost the trust in payment systems based on blockchains.

Crypto World

Binance Slams US Senate Probe over Iran as Based on Defamatory Reports

Cryptocurrency exchange Binance has officially responded to a February inquiry launched by a group of 11 US senators, largely denying facilitating transactions to Iranian entities and the narrative around employees’ terminations.

In a Friday letter to US Senators Richard Blumenthal and Ron Johnson of the Permanent Subcommittee on Investigations, Binance said that an inquiry launched in February into the exchange’s activities was based on reports that were “demonstrably false, unsupported by credible evidence, and defamatory in several material respects.”

The exchange referred to reporting from the Wall Street Journal, New York Times and Fortune, which said that Binance fired employees that reported the company had facilitated more than $1 billion in crypto transactions to entities connected to Iran, called Hexa Whale and Blessed Trust. According to Binance, the company launched an investigation in response to law enforcement inquiries, resulting in the removal of the entities from the platform.

“[T]o our knowledge, no Binance account transacted directly with an Iran-based entity,” said that exchange.

In response to the reports’ claims about the dismissal of employees who brought the investigation to the attention of executives, Binance said that some of them resigned, while another was terminated for disclosing internal user information:

“Binance takes seriously the privacy of its users and has no tolerance for employees violating that trust by sharing internal information externally. Binance also closely follows its labor and employment policies. This employment action was no different.”

The letter from the 11 senators to Treasury Secretary Scott Bessent and Attorney General Pamela Bondi asked for a response by March 13 as to whether the government officials intended to investigate Binance. As of Friday, neither Bessent nor Bondi had publicly commented on the matter.

Related: SEC ends case against Justin Sun with $10M settlement

In 2023, Binance reached a settlement with US authorities, agreeing to pay $4.3 billion to resolve violations of sanctions and Anti-Money-Laundering laws. Then-CEO Changpeng “CZ” Zhao stepped down as part of the deal and pleaded guilty to one felony charge, which later resulted in a four-month prison term.

Trump-Binance ties under scrutiny after presidential pardon

Zhao pleaded guilty and served prison time, under an agreement that he not be permitted to assume another leadership role at Binance. However, in October, US President Donald Trump issued a pardon for CZ, which legally opened the door to his return to the exchange. Zhao has publicly ruled out going back as CEO.

Before Trump announced the pardon, the administration’s ties to Binance were already under scrutiny from many lawmakers after a UAE-based company, MGX, used the USD1 stablecoin issued by World Liberty Financial to settle a $2 billion investment in the exchange. Many lawmakers have labeled the deal as corruption given that World Liberty Financial is backed by the president and his sons.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Kraken Fed Access, MARA Bitcoin Strategy, NYSE Tokenization Push

The digital asset sector took another step toward integration with traditional finance this week when Kraken secured direct access to the US Federal Reserve’s payment rails — a milestone that could reshape how crypto companies move dollars. Direct access to the Fed’s payment infrastructure could give the crypto exchange greater control over dollar flows while reducing reliance on banking partners, a longstanding challenge for the industry.

It also signals that crypto infrastructure is continuing to mature and integrate with the traditional banking system despite broader industry headwinds and a months-long market correction — one of the key themes in this week’s Crypto Biz newsletter.

Meanwhile, Bitcoin (BTC) miner MARA Holdings pushed back on speculation that it plans to dump its BTC reserves, clarifying that recent regulatory filings simply expand its treasury flexibility. Bitcoin rewards company Fold strengthened its balance sheet by eliminating $66 million in convertible debt, while analysts say a proposed New York Stock Exchange tokenization framework could open the door to greater institutional participation.

Kraken wins Fed payment access in crypto industry first

Kraken’s banking arm has secured a limited-purpose master account with the Kansas City Federal Reserve Bank, granting it direct access to the US central bank’s payment infrastructure, a first for a crypto-native company.

In a Wednesday announcement, Kraken Financial confirmed it can now use the Fed’s Fedwire system, a real-time gross settlement network that allows financial institutions to send and receive payments with the Fed. The access allows Kraken to process US dollar payments directly with the central bank instead of relying on intermediary banks.

The approval is initially granted for one year, with restrictions tailored to Kraken’s business model and risk profile.

“With a Federal Reserve master account, we can operate not as a peripheral participant in the US banking system, but as a directly connected financial institution,” said Arjun Sethi, Kraken’s co-CEO.

MARA clarifies Bitcoin treasury strategy after sell-off concerns

Bitcoin mining company MARA Holdings said recent disclosures about selling Bitcoin from its balance sheet were intended to signal flexibility — not an imminent liquidation of its holdings.

Vice president Robert Samuels said the company’s latest Form 10-K filing with the US Securities and Exchange Commission clarifies that MARA expanded its treasury strategy to allow potential Bitcoin sales if market conditions warrant. The policy also allows the company to purchase additional BTC periodically.

Some members of the crypto community interpreted the filing as authorization to sell MARA’s more than 53,000 BTC treasury, an interpretation Samuels called “factually incorrect.”

Bitcoin-focused Fold eliminates $66M in convertible debt

Bitcoin financial services company Fold said it eliminated $66.3 million in convertible debt, removing a potential source of balance-sheet pressure and shareholder dilution ahead of launching a new Bitcoin-rewards credit card.

In a recent disclosure, Fold said it retired two outstanding convertible notes — debt instruments that can be converted into equity — thereby reducing the risk of issuing additional shares in the future. The move also freed 521 Bitcoin that had previously been pledged as collateral for the debt.

The stronger balance sheet could support the rollout of Fold’s planned Bitcoin rewards credit card, which will allow users to earn BTC on everyday purchases through the Visa network.

Fold went public on the Nasdaq in February 2025 through a SPAC merger with FTAC Emerald Acquisition, becoming one of the first publicly traded Bitcoin-focused financial services companies.

TD Securities says NYSE tokenization push could attract institutions

Tokenization efforts tied to the New York Stock Exchange could accelerate institutional adoption of blockchain-based markets, according to TD Securities strategist Reid Noch.

The NYSE recently proposed tokenizing equities through an alternative trading system that would enable 24-hour trading and near-instant settlement for tokenized stocks and exchange-traded funds while operating under existing market rules.

Noch said the model resembles a “2.0” evolution of market infrastructure: Custody and settlement will remain with the Depository Trust & Clearing Corporation (DTCC), while trading will continue to follow National Best Bid and Offer (NBBO) requirements.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

Crypto World

Tether’s $7.5M bet on Bitcoin payments using USDT

As majors sell off, Tether quietly doubles down on turning Bitcoin into a $-settlement backbone via Lightning-native USDT rails.

Summary

- Tether co-leads a $7.5M round in Utexo to enable native USDT settlement on Bitcoin and Lightning.

- Utexo promises fixed, pre-confirmable fees, atomic settlement and stronger privacy anchored to Bitcoin’s security.

- Move comes as BTC trades near $68,600 and majors slide 3–5%, underscoring demand for resilient $ liquidity.

Tether has taken a calculated step to bind USDT more tightly to Bitcoin’s base layer, co-leading a $7.5M financing round for Utexo, a startup building infrastructure for native USDT settlement directly on the Bitcoin network and via the Lightning Network. While stablecoins already flow across multiple chains, this effort explicitly targets Bitcoin as a primary $-clearing rail at a time when the broader market is wobbling and liquidity quality matters more than headline valuations.

Utexo’s pitch is straightforward: use Bitcoin’s security and Lightning’s throughput to deliver pre-confirmable, fixed-fee USDT payments that settle atomically and preserve user privacy. In practice, that means traders, payment processors and exchanges could lock in fees ahead of time, reduce counterparty risk and avoid the fee volatility and congestion typical of many smart contract chains during risk-off episodes. With majors like BTC, ETH, SOL and others trading lower on the day—Bitcoin around $68,619, Ethereum near $1,976, and most large caps down roughly 3–5%—the value of predictable, high-quality $ rails becomes less abstract and more like core market plumbing.

Paolo Ardoino frames the investment as part of a broader strategy: turning Bitcoin into a global $-settlement network, not just a volatility proxy or digital gold narrative vehicle. With USDT’s circulating supply hovering around $184B, already the largest $ stablecoin float in the market, even a modest migration of settlement volume onto Bitcoin and Lightning could shift order-flow dynamics on competing L1s and sidechains. For derivatives venues, OTC desks and market makers, native USDT on Bitcoin could reduce bridging risk, compress spreads around BTC pairs and hardwire $ liquidity into the asset that anchors the entire crypto complex.

In macro terms, Tether’s Utexo play reads as a market-structure hedge: while spot prices bleed and volatility picks up, the firm is investing in the rails that will clear the next wave of leverage and settlement cycles. If Utexo delivers on atomic, private USDT settlement at scale, Bitcoin ceases to be just the risk barometer on price dashboards and becomes the neutral, censorship-resistant $ backbone underneath crypto’s fragmented liquidity stack.

Crypto World

Are Polymarket and Kalshi decentralized?

Polymarket, Kalshi, and other prediction markets have taken the world by storm and in the process seen massive support from the cryptocurrency industry.

Kalshi makes claims about “democratizing finance” while Polymarket proclaims that “using decentralized blockchain technology removes the need for a central authority in trading, which fosters fairness and open participation.”

Kalshi wasn’t originally built on a blockchain at all, however, it’s expanded into tokenized positions on Solana, claiming that “tokenization is the endgame. It is non-custodial, instant, and crypto native.”

However, that’s not how it currently functions; instead, it depends on Jupiter to “handle the off-chain actions required,” including to “open positions,” “manage positions,” and “claim winnings.”

Not exactly “non-custodial,” suggesting we’re a great distance from the “endgame.”

These prediction markets aren’t meant to be truly decentralized, unstoppable, or censorship-resistant like other crypto projects.

Instead, they maintain extraordinary control over the markets that are made available, sometimes even removing them before resolution.

Removing markets

Recently, Polymarket listed markets that resolved based on whether or not nuclear detonations occurred.

It then removed these markets following backlash from the community.

Critics felt that markets on nuclear detonation were Polymarket finding ways to profit from the possibility of history-defining calamities and destruction.

Unlike earlier attempts at prediction markets, such as Augur, Polymarket and Kalshi don’t allow any user to make a new market, instead entrusting that responsibility to the centralized actors that operate the platforms.

This is something that Polymarket is upfront with, noting in its help center that “markets are created by the markets team” and “users cannot directly create their own markets,” though it does comfort them with the notion that “they are encouraged to suggest ideas.”

Kalshi also tells users that it “love[s] community ideas for new markets.”

Interestingly, although both Polymarket and Kalshi maintain the ability to remove markets, that ability is much less advertised; it’s not mentioned in any of the “Markets” articles in Polymarket or Kalshi’s help centers.

Read more: Polymarket ends trading loophole for bitcoin quants

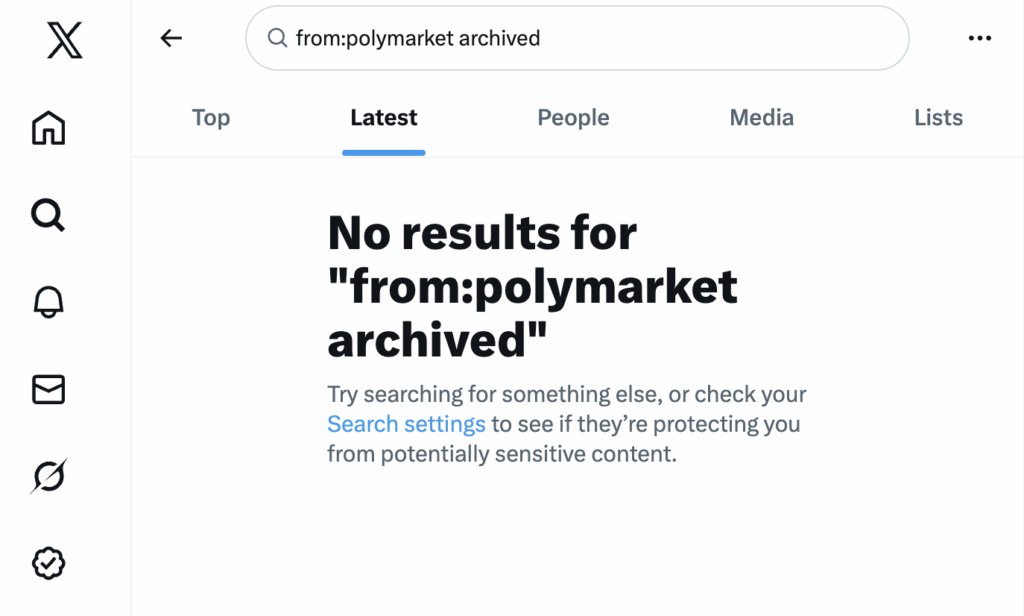

The Polymarket page for the nuclear explosion market now proclaims that market has been “archived.”

A search for “archived” in the Polymarket help center returns zero results, as does a search on X for any Polymarket posts that include the word “archived.”

When a Polymarket event is archived, it’s also no longer possible to retrieve details about the event using the Polymarket API.

The Polymarket API is meant to return the token ID, which can be used to query the smart contract for additional details.

Users in the Polymarket Discord claim that after Polymarket removed this market, they could no longer see the bet in their portfolio, with one user asking, “What happened to my money?”

Anybody who asks questions is directed to pay attention to the “#market-updates” channel in Discord, where it eventually announced that losses would be refunded.

Polymarket and Kalshi market resolution

Polymarket’s terms of service note that “the company is not involved in nor responsible for the resolution of any contracts displayed on the platform.”

The resolution on Polymarket relies on UMA, a blockchain oracle that allows tokenholders to resolve disputes about various outcomes.

Kalshi, however, doesn’t maintain the same claim, openly noting that when you “request to settle market,” that request will then go to the “markets team,” who “will thoroughly review all the settlement requests.”

Both Polymarket’s oracle-based resolution and Kalshi’s resolution mechanisms have provoked a great deal of controversy among users.

In one Polymarket controversy an Ethereum user with the Ethereum Name Service name “BornTooLate.Eth” manipulated the outcome of a Ukraine-United States mineral deal-related market by becoming one of the largest holders of the UMA token. This highlighted the governance dangers centered around the market.

Polymarket was also drawn into controversy several months ago when it launched a market that was meant to resolve based on whether or not Ukrainian President Volodymyr Zelenskyy would wear a suit before July.

Zelenskyy arrived at the NATO meeting in a non-traditional suit, meant to emulate more militaristic aesthetics, due to the ongoing Russian invasion of Ukraine.

The market was originally proposed as resolving to “yes” and ended up resolving in favor of “no,” arguing that the suit he wore didn’t meet the intent of the market resolution, which read simply, “This market will resolve to “yes” if Volodymyr Zelenskyy is is photographed or videotaped wearing a suit between May 22 and June 30, 2025 ET.”

Even the “Polymarket Intel” account on X, which has a gold check mark and the Polymarket logo, which indicates that “it’s an affiliate of @Polymarket,” posted a video with the caption “President Zelenskyy in a suit last night.”

Polymarket would subsequently try to distance itself from this account. This dispute was handled by UMA tokenholders, but that’s not always how Polymarket deals with controversial market resolutions.

The platform had listed a market that was meant to answer whether or not the so-called Department of Government Efficiency would “cut $3 billion of DEI contracts before March.”

The resolution criteria for this market was whether or not “doge-tracker.com” showed more than the $3 billion in cuts.

However, despite the resolution criteria being met, Polymarket pulled the market and refunded losses, claiming that doge-tracker.com wasn’t reliable.

Thus, markets don’t always resolve according to their resolution criteria.

Both of these cases highlight the tension between stated resolution criteria and how users and oracles expect the market to resolve.

Kalshi has also seen its fair share of controversy around market resolution.

In one case, X user “0xTyrael” claimed that they had lost money on Kalshi, as it ruled that Trump didn’t say “Mamdani” in an interview where he mangled the pronunciation of the New York mayor’s name.

More recently a market about whether or not Ayatollah Ali Khamenei would be “out” as Iranian supreme leader resolved to “no” because the resolution criteria noted that if the leader “leaves solely because they have died, the associated market will resolve and the exchange will determine the payouts…based upon the last traded price (prior to the death).”

Read more: Odds swing wildly as Polymarket bets on Iran’s successor collapse

Despite this being included in the resolution criteria, many users felt cheated, again highlighting the tension between the resolution criteria as written and as understood.

All of these various issues highlight the difficulty of creating a way to consistently resolve markets, especially in cases where resolution criteria are poorly written.

Donald Trump Jr.

Both Polymarket and Kalshi are intimately tied to the Trump regime, as both platforms have added Donald Trump Jr. as an advisor.

Additionally, Trump Jr. invested in Polymarket via the venture capital firm where he is a partner, 1789 Capital.

Additionally, Trump Media, where Trump Jr. is a director, has announced that it will launch prediction markets in cooperation with Crypto.com.

All these prediction markets have benefitted from the Commodity and Futures Trading Commission being permissive in its regulatory oversight of prediction markets under the Trump administration, and some portion of those benefits financially accrue to the Trump family.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

21Shares Launches First US Spot Polkadot ETF

21Shares has launched the first U.S. spot DOT ETF just a week after it launched one of the first spot ETFs for SUI.

21Shares has launched the first U.S. spot Polkadot ETF, known as TDOT, today, March 6, according to a press release from the firm.

The crypto exchange-traded product issuer noted that its spot ETF for Polkadot’s native asset, DOT, is registered under the Securities Act of 1933, not the Investment Company Act of 1940 — like most U.S. crypto ETPs.

Bloomberg’s senior ETF analysts, Eric Balchunas, posted about the launch on X today, noting its 0.30% fee and that “it looks like it was seeded with $11m.”

DOT Slumps on the News

Polkadot is known as a Layer 0 chain, as it consists of an ecosystem of networks with a shared base layer. With a market cap of approximately $2.4 billion, Polkadot is currently the 38th largest network, according to CoinGecko.

DOT is down about 2% over the past 24 hours, despite the ETF news, as the broader market sees a downturn on increased economic and geopolitical uncertainty.

The token saw a sharp rally last month on expectations around its upcoming halving event, as The Defiant reported.

TDOT marks the latest altcoin ETF to launch in the U.S. — a trend that accelerated notably last year. Just last week, 21Shares also issued one of the first spot ETFs for Sui (SUI), as The Defiant reported.

The first spot crypto ETF to launch in the U.S. was, fittingly, for Bitcoin. After years of attempts, 11 issuers were approved at once in a landmark decision in January 2024.

This article was generated with the assistance of AI workflows.

Crypto World

Market Insights with Gary Thomson: USD, CAD, and Commodities in Focus

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for insights into financial markets to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson breaks down what moved the markets this week and unpacks the strategic implications of the most critical events driving global markets.

👉 Key topics covered in this episode:

✔️ The most important events of recent days

Global markets have reacted sharply to escalating US–Iran tensions, with oil prices surging, stock indices falling, and the US dollar strengthening. Investors are closely monitoring the situation as uncertainty drives high market volatility.

✔️US Inflation Rate

Traders are eyeing the US inflation report on 11 March, as recent data shows slowing inflation and hints at potential Fed rate cuts. While the long-term trend may remain unchanged, the report could create short-term volatility in the US dollar and equity markets. Will the upcoming inflation data reinforce expectations for rate cuts, and how might it affect the US dollar and stock indices in the near term?

✔️Canada’s Unemployment Rate

Canada’s unemployment report on 13 March will provide insight into the labour market, which last month showed a low unemployment rate but declining employment, especially in manufacturing. While the Bank of Canada is expected to keep rates steady, the data could create short-term volatility in CAD currency pairs. Will the upcoming employment figures boost the Canadian dollar or reveal persistent weaknesses in the labour market?

✔️Multiple US Economic Releases

On 13 March, multiple key US economic indicators — including the PCE Price Index, Personal Income and Spending, Durable Goods Orders, and the second GDP estimate — will be released simultaneously. These reports could trigger short-term volatility in USD currency pairs as traders assess inflation, consumer activity, and business investment trends. How might this combined set of indicators impact the US dollar and overall market sentiment?

Gain insights to strengthen your trading knowledge.

💬 Don’t forget to like, comment, and subscribe for more market insights every week.

Watch it now and stay updated with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Bitcoin Rally Sparks Debate Over Market Strength

Bitcoin Rally Sparks Debate Over Market Strength

March 05, 2026 @ 01:43 AM (UTC)

Current Price of #Bitcoin$BTC / $USD: 💵 $72,695.95$BTC / $EUR: 💶 €62,593.26$BTC / $GBP: 💷 £54,452.83$BTC / $XAU: 🥇 14.044 oz$BTC / $XAG: 🥈 858.007 oz pic.twitter.com/69AMYA5oRD— Bitcoin (@Bitcoin) March 5, 2026

Bitcoin regained upward momentum after weeks of pressure and volatile price swings across the broader cryptocurrency market. The digital asset trades near $72,588, reflecting a strong rebound and renewed activity. However, several analysts argue that the current rise may not represent a lasting trend.

The recovery followed a period when Bitcoin lost ground due to macroeconomic pressure and market risk aversion. Global geopolitical tensions and shifting liquidity conditions also influenced trading activity. As a result, the latest surge sparked debate about whether the market entered a fresh bullish phase.

Some analysts argue that the recent gains resemble a temporary rebound after a broader decline. Meanwhile, others highlight improving sentiment across digital assets and traditional markets. The mixed outlook keeps the near-term trajectory of the asset uncertain.

Key highlights

- Bitcoin climbs above $72K after volatile weeks, yet analysts question rally strength

- Arthur Hayes links recent BTC sell-off to BlackRock’s IBIT ETF hedging activity

- Market recovery lifts Bitcoin and gold simultaneously amid global tensions

- Analysts suggest BTC may form a macro bottom near the $50K level

- Short-term Bitcoin direction remains uncertain despite strong weekly gains

Bitcoin Price Momentum And Market Structure

Bitcoin currently trades around $72,588 after gaining more than six percent within the past day. Weekly performance shows solid recovery, although the asset still records a monthly decline near seven percent. The rebound followed days of rapid swings that shaped short-term sentiment across the market.

The renewed momentum encouraged discussions about a potential continuation of the broader crypto market recovery. Many market participants interpret the rebound as a signal of renewed strength. However, several analysts emphasize that technical patterns still require confirmation.

Arthur Hayes offered a contrasting interpretation of the current price movement. He described the rally as a potential “dead cat bounce,” a term used for temporary recoveries. According to Hayes, such rebounds often appear during longer downward market phases.

Hayes argued that short bursts of upward momentum can occur even when underlying pressure remains unresolved. He explained that these moves sometimes follow sharp corrections. Therefore, he suggested that traders should treat the rally with measured expectations.

The concept reflects traditional financial market behavior where prices briefly recover before another decline. Historical examples across equities and commodities demonstrate similar patterns during volatile cycles. Consequently, the term remains widely used during uncertain market phases.

ETF Activity And Tech Market Link

$BTC

One of the reasons the rally potential was highlighted over the past weeks is that it fits well with the structural model we follow. After a three-wave decline, markets often produce a corrective rally before the broader correction continues.Under this framework, the… pic.twitter.com/ECjTe3sydn

— More Crypto Online (@Morecryptoonl) March 5, 2026

Hayes also connected the recent Bitcoin price decline to activity surrounding a major exchange-traded fund. He pointed to trading dynamics linked to BlackRock and its Bitcoin product. The product, known as the iShares Bitcoin Trust (IBIT), continues to influence market flows.

He explained that dealer hedging connected to structured products may have intensified selling pressure. Such hedging strategies often require counterparties to adjust exposure during rapid price moves. These adjustments can create short-term volatility within the underlying asset.

Market participants have already observed how large ETF flows affect liquidity and price discovery. Institutional activity expanded the market but also introduced new trading dynamics. Consequently, analysts often examine ETF behavior when assessing Bitcoin’s direction.

Hayes also stated that Bitcoin remains linked to the broader performance of technology companies. High-growth software firms often move alongside risk-oriented assets. This relationship suggests that Bitcoin still reflects wider market sentiment.

Technology stocks historically respond strongly to interest rate expectations and macroeconomic conditions. When risk appetite increases, both tech equities and digital assets often rise together. Conversely, tightening financial conditions usually reduce demand for speculative assets.

Gold Rally Adds Another Layer To Market Narrative

Another analyst, CrediBULL Crypto, shared a broader perspective on the current market structure. He suggested that Bitcoin may form a higher-timeframe bottom above the $50,000 level. However, he noted that short-term movement remains uncertain.

His analysis indicates that the asset could either begin a stronger advance or continue moving within a defined range. Price consolidation often occurs after sharp recoveries. These phases allow the market to stabilize before the next major move.

The current rally also coincides with notable gains in the gold market. The precious metal recorded strong price increases during the same trading session. This parallel movement suggests that global developments influenced multiple asset classes.

Reports also linked the gold surge to a new agreement involving the United States and Venezuela. The administration of Donald Trump announced a large gold-related transaction between the two countries. The announcement contributed to renewed activity across commodities.

When gold and Bitcoin rise simultaneously, analysts often debate the underlying drivers of demand. Some interpret the pattern as a response to geopolitical tension or financial uncertainty. Others attribute the movement to liquidity conditions and shifting global capital flows.

Bitcoin therefore stands at a critical point within the broader financial landscape. The asset regained significant ground, yet debate continues about the durability of this momentum. Market dynamics involving ETFs, technology stocks, and commodities may shape the next phase.

Crypto World

Bitcoin Price Returns to $70K Despite Growing Tension in the Middle East: Your Weekly Crypto Recap

This week saw a big investment in OKX, Kraken received a Fed Master Account, while Justin Sun reached a $10 million settlement with the SEC.

This time last Friday, the tension was building in the Middle Eastern region, but only a handful of people could have predicted how the world would change just hours later. On Saturday morning, Israel and the USA joined forces to launch a military operation against Iran, which began with air strikes.

Iran retaliated and continues to do so as the week progressed, even though its Supreme Leader was killed during the first day of the attacks. Since then, the developments on the matter have quickly escalated, with almost a dozen countries already being directly involved, while essentially every nation has felt the consequences in one form or another, especially after the Strait of Hormuz was closed and energy prices skyrocketed.

Amid all of this massive geopolitical tension, which began on an off-day for every other financial market aside from crypto, bitcoin’s price has remained stable overall. Well, that’s after the initial Saturday shock when it tumbled by $4,000 to $63,000. It quickly rebounded, recovered all losses, and even headed to new local peaks during the business week.

Although there’s no evidence that this war could end soon, BTC surged by $11,000 from its Saturday low to $74,000 on Wednesday. However, it faced an immediate rejection there and now trades around $70,000. This is still roughly 5.5% higher than its price level last week, which is rather surprising given the surging uncertainty.

Only a few larger-cap alts have performed better during this timeframe, including HYPE, NEAR, SKY, and MNT. In contrast, ADA, CC, BCH, SHIB, WLFI, and DOT are deep in the red.

Market Data

Market Cap: $2.46T | 24H Vol: $108B | BTC Dominance: 56.9%

BTC: $70,000 (+5.6%) | ETH: $2,050(+4.4%) | XRP: $1.38 (+1.4%)

You may also like:

This Week’s Crypto Headlines You Can’t Miss

Kraken Just Became the First Crypto Company With a Fed Master Account — Why It Matters. The veteran US exchange has secured access to a limited-purpose master account from the US Federal Reserve Bank of Kansas. Kraken Financial can now directly connect to the Fed’s core payment systems and bypass some of the intermediaries that exist when users are trying to deposit/withdraw.

Kazakhstan May Sell Gold to Fund $350M Crypto Purchase: Report. The governor of the country’s central bank said they plan to invest up to $350 million in cryptocurrencies or high-tech firms related to the industry. They want to use some of their current investments, such as gold and foreign exchange reserves, to do so.

NYSE Parent Company Invests in OKX at $25 Billion Valuation. Intercontinental Exchange, the behemoth behind the New York Stock Exchange, acquired a minority stake in the popular cryptocurrency trading platform, OKX. This puts the latter’s valuation at an impressive $25 billion after the latest investment round.

Ray Dalio Dismisses Bitcoin’s Safe-Haven Narrative, Rejects Comparisons to Gold. Despite BTC’s better performance since the tension in the Middle East skyrocketed, billionaire Ray Dalio dismissed its potential to serve as a safe-haven narrative and praised gold once again.

$1 Billion Floods Back Into Crypto Funds, Snapping Five-Week $4B Bleed. The previous business week snapped a five-week red streak in which investors pulled out around $4 billion from crypto-related funds. Instead, they poured around $1 billion in the span of five business days.

Justin Sun ‘Very Pleased’ With $10 Million SEC Settlement. Nearly three years after he and some of his companies were sued by the US SEC, Justin Sun announced that the claims were dismissed after he reached a $20 million settlement with the regulator.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Analyst Tells XRP Holders to Tune Out War Talk and Watch Key Price Levels

Crypto analyst EGRAG Crypto urged XRP traders to ignore geopolitical headlines and focus on long-term price structure instead.

Crypto analyst EGRAG Crypto has said that XRP traders should stop focusing on geopolitical headlines and instead pay attention to the token’s long-term price structure.

Their latest chart outlines a defined roadmap with a potential macro bottom, a nearby breakout level, and long-range targets that extend several years into the future.

Key XRP Price Levels for the Next Market Cycle

In a post on X, EGRAG shared a minimalist monthly XRP chart that focuses almost entirely on price structure. The chart spans from 2014 through a projected timeline toward 2028 and highlights three critical phases: the previous cycle bottom, the current consolidation zone, and a potential breakout stage.

The analyst argued that the most important signals are already visible in the long-term structure. According to their chart, XRP appears to be stabilizing near a major support trendline that has been rising since the 2018–2019 bear market bottom.

That trendline intersects with the most recent consolidation zone, which EGRAG highlighted as the area where the next macro bottom could be forming. The chart suggests that the final shakeout may have occurred around the $0.50 region in late 2025 before the market returned to the $1 range.

The next step in their framework centers on confirmation. EGRAG pointed to a horizontal resistance band around the $1.00 to $1.40 region that must be cleared to confirm a broader bullish expansion.

Once that level flips into support, their chart shows XRP entering a multi-year upward channel. The long-term projection lines on the chart stretch toward the 2028 timeframe and point to potential price targets above $27 during the next cycle’s expansion phase.

You may also like:

EGRAG framed the chart as a simple visual argument that long-term structure matters more than short-term news events.

The self-proclaimed XRP perma-bull had already discussed near-term technical thresholds earlier in the week, saying a weekly close above $1.55 would weaken the downward trend that has kept XRP inside a descending channel for months. Furthermore, a break above $2.20 would invalidate the bearish structure entirely.

Other market participants shared similar technical observations, with analyst Arthur writing that his custom indicator had crossed a trigger line that historically precedes fast price moves, pointing to a previous rally of about 27% within four days after a similar signal.

His counterpart, CW, noted that XRP’s decline has once again touched the lower line of its long-term ascending channel, a level that historically marks the starting point of uptrends.

XRP Price Stalls Near Key Technical Levels

Despite those signals, XRP is still stuck inside a broader corrective structure.

At the time of writing, the token was trading around the $1.40 level, down about 0.8% over the past 24 hours. Weekly performance shows an even smaller decline of 0.3%, while the monthly chart reflects a larger pullback of about 12%. On a yearly basis, XRP is still down more than 44%, highlighting the scale of the correction that followed its 2025 peak.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business3 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports23 hours ago

Sports23 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker