Crypto World

Coinbase Reports $667M Q4 Loss as Crypto Market Downturn Hits Revenues

Coinbase earnings just broke its streak, and not in a good way. After eight straight winning quarters, it posted a brutal $667 million net loss in Q4 2025. That is a punch to the face.

As crypto prices slid from their yearly highs, the exchange completely missed Wall Street revenue expectations.

Revenue came in at $1.78 billion. Sounds big, but it was below the $1.85 billion analysts expected. Transaction revenue was the real damage. Down 37% to $982.7 million.

That tells you everything about trader activity right now.

Key Takeaways

- Coinbase reported a $667 million net loss, its first profit miss since Q3 2023.

- Revenue fell 21.5% YoY to $1.78 billion, missing analyst expectations.

- Transaction fees plummeted 37% as retail traders exited the market.

- Shares (COIN) dipped 7.9% intraday but rebounded nearly 3% after hours.

Is the Bull Market Officially Over? How Coinbase Can Survive It

That $667 million loss is not just a bad quarter. It screams deeper cycle weakness. A big chunk of it came from unrealized losses on Coinbase own crypto holdings after prices collapsed from the October 2025 highs.

When Bitcoin falls from nearly $126,000 to the mid $60k range, nobody walks away clean. Not even the exchanges.

This kind of volatility feels similar to the uncertainty during the FTX fallout days. Brian Armstrong is still calling this downturn psychological.

Retail traders are barely active. Transaction revenue, which is the core engine of the business, dried up as volume vanished.

Casual money is staying on the sidelines. And that is the last thing Coinbase needed.

Discover: The best crypto to diversify your portfolio

COIN Stock Resilience or Dead Cat Bounce?

Even after that ugly earnings report, COIN stock actually climbed 2.9% in after-hours, sitting near $145. Sounds crazy, right?

But the stock had already dropped 7.9% during the regular session. Traders probably priced in the disaster before the numbers even hit.

Still, the outlook is not exactly comforting. Subscription and services revenue was the only real bright spot, up 13% to $727.4 million.

That helped soften the blow. But management is already guiding lower for Q1 2026, expecting that figure to fall into the $550 to $630 million range. That is not small.

If even the so-called stable revenue starts shrinking, the safety cushion gets thin fast. And if that happens, a retest of the $139 zone, near the 52-week lows, would not be surprising at all.

Discover: What is the next crypto to explode?

The post Coinbase Reports $667M Q4 Loss as Crypto Market Downturn Hits Revenues appeared first on Cryptonews.

Crypto World

BlackRock’s Former Head of Crypto Explains How He Pitches ETH to Wall Street

TLDR:

- BlackRock’s former Head of Crypto, Joseph Chalom now leads Sharplink, a $1.5 billion Ethereum treasury company.

- Stablecoins at $310 billion and tokenized assets at $32 billion are both projected to grow into the trillions.

- Chalom pitches ETH as a trust commodity, grounded in fundamentals, with no short-term price predictions made.

- Chalom firmly separates ETH from Bitcoin, arguing Ether holds intrinsic value tied to global financial infrastructure.

BlackRock’s former Head of Crypto is now making a direct case for Ethereum to institutional investors. Joseph Chalom, who once led crypto strategy at the world’s largest asset manager, now serves as CEO of Sharplink.

Sharplink is a $1.5 billion Ethereum treasury company focused on digital assets. Drawing from his Wall Street background, Chalom has built a structured method for pitching ETH.

His approach centers on Ethereum’s long-term role in global finance, avoiding short-term price predictions entirely.

How Chalom Opens the ETH Conversation With Institutions

Coming from BlackRock, Chalom understands exactly how institutional investors think and evaluate assets. He uses that background to frame the Ethereum opportunity before touching on ETH as an asset.

He points out that stablecoins currently stand at around $310 billion in total market value. That market, he argues, is heading into the trillions in the coming years. Tokenized assets sit at roughly $32 billion today and are on a similar growth trajectory.

Beyond stablecoins and tokenized assets, institutional DeFi adoption is also accelerating at a rapid pace. Chalom further raises agentic finance as another layer of the broader Ethereum opportunity.

These combined trends build a case for Ethereum as core infrastructure for global finance. Institutional investors, he notes, tend to agree with this framing once it is laid out clearly.

Chalom captured this view directly, stating: “The Ethereum ecosystem is going to be the future settlement layer for finance.”

That framing shifts the conversation away from speculation and toward structural financial transformation. Rather than positioning Ethereum as a crypto asset, his pitch presents it as an emerging financial backbone. That foundation, he explains, is where every institutional conversation must begin.

Why Chalom Separates ETH From Bitcoin in Every Pitch

With the ecosystem case established, Chalom then turns the focus to ETH as a stand-alone asset. He draws on his BlackRock experience to steer institutions away from common misconceptions about Ether.

He explains that as the Ethereum network grows, more Ether is needed to secure and settle transactions. This creates a direct link between ecosystem expansion and rising structural demand for ETH.

Chalom elaborated on this positioning, saying: “As the Ethereum ecosystem grows, you need more Ether to secure and settle these transactions. Therefore, Ether ends up becoming a trust commodity.”

He added that the pitch stays grounded in principles and fundamentals at all times. “What we don’t do is make up numbers and talk about short-term price predictions for Ether,” he said.

That discipline keeps institutional conversations anchored in long-term structural value rather than market noise.

Chalom also makes a deliberate point of separating ETH from Bitcoin in every conversation. He firmly rejects the idea that Ethereum is simply a “little brother” running as a coefficient of Bitcoin’s value.

“ETH is not a derivative of Bitcoin,” he stated, noting it holds intrinsic value to the future of the financial system. He reinforced this by saying:

“The number one thing to do is not make up numbers. And number two, Ethereum has intrinsic value to the future of the financial system.” That distinction, rooted in his Wall Street experience, is central to how he earns institutional confidence in ETH.

Crypto World

CAAT Pension Plan Fires CEO Derek Dobson Over $1.6 Million Vacation Payout

TLDR:

- CAAT CEO Derek Dobson resigned immediately after a $1.6M vacation payout triggered public outrage in 2026.

- A settlement agreement requires Dobson to repay the controversial 2025 vacation payout to the plan fully.

- Acting CEO Kevin Fahey appointed five internal senior leaders to restore stability and stakeholder trust.

- CAAT remains financially strong, with a funded status of 124%, holding over $23 billion in total plan assets.

The CAAT Pension Plan has announced the immediate departure of CEO Derek Dobson after a $1.6 million vacation payout triggered widespread public backlash.

The Toronto-based organization reached a settlement requiring his resignation and full repayment of the 2025 vacation payment.

A new senior leadership team has since been appointed to lead the plan. CAAT manages over $23 billion in assets and remains one of Canada’s most well-funded pension organizations.

Settlement Agreement Closes Dobson’s Chapter at CAAT

The CAAT Board of Trustees confirmed that Dobson’s departure took effect immediately under a formal settlement. He agreed to resign and repay the full $1.6 million vacation payout received for 2025.

Both parties acknowledged the importance of moving forward to support the plan’s long-term health. The agreement brings closure to a period that raised serious governance concerns.

CTV News first reported the controversy, revealing the payout Dobson received as part of his 2025 compensation. The report quickly drew public attention and sparked debate about executive pay at pension funds.

Many questioned whether such a payment was appropriate for a public-facing pension organization. The board responded swiftly, settling shortly after the story surfaced.

Reactions spread across social media as the story gained traction online. One widely shared comment captured the public mood: “He thought taking a $1.6 million vacation payment was a good use of funds?” That response reflected growing frustration over accountability at pension institutions. The board’s quick action was broadly seen as a necessary step toward rebuilding trust.

The Financial Services Regulatory Authority of Ontario also engaged constructively with the plan throughout this process. CAAT thanked the regulator for its role in helping strengthen governance and oversight practices.

Their involvement reflected broader scrutiny of pension fund management across the sector. It also reinforced the board’s commitment to acting in the best interests of all members.

New Leadership Team Steps In to Drive Stability and Trust

Acting CEO Kevin Fahey, who also serves as Chief Investment Officer, now leads CAAT’s day-to-day operations. Five senior leaders from within the organization were appointed to report directly to Fahey.

Addressing the appointments, Fahey stated: “I am proud that these five senior leaders are all existing CAAT employees who will drive stability and institutional continuity.“ He added that their internal relationships would help teams better serve members every day.

John Baiocco was appointed Senior Vice President of Funding and Sustainability, while Stephen Hewitt became Senior Director of Communications.

Laura Foster was named interim Chief Financial Officer, Jillian Kennedy took on the role of Chief Operating Officer, and James Fera was appointed Chief Legal Officer and General Counsel.

The board expressed confidence in the team’s ability to engage staff and serve members throughout the transition. A search for a Chief Human Resources Officer remains ongoing at this time.

Board Chair Audrey Wubbenhorst praised Fahey for the progress made since his appointment as acting CEO. She said: “The Board continues to focus on its work in the best interests of members.”

Wubbenhorst also expressed gratitude to all stakeholders for their “ongoing trust and confidence in the Plan.” Restoring the plan’s reputation stands as a clear priority as new leadership takes hold.

CAAT reported a funded status of 124%, holding $1.24 for every $1 of promised pension benefits. The plan also carries over $6 billion in funding reserves to guard against market volatility and demographic risks.

These figures provide a layer of stability as the organization navigates this leadership change. The plan’s financial foundation remains solid as it enters this new phase.

Crypto World

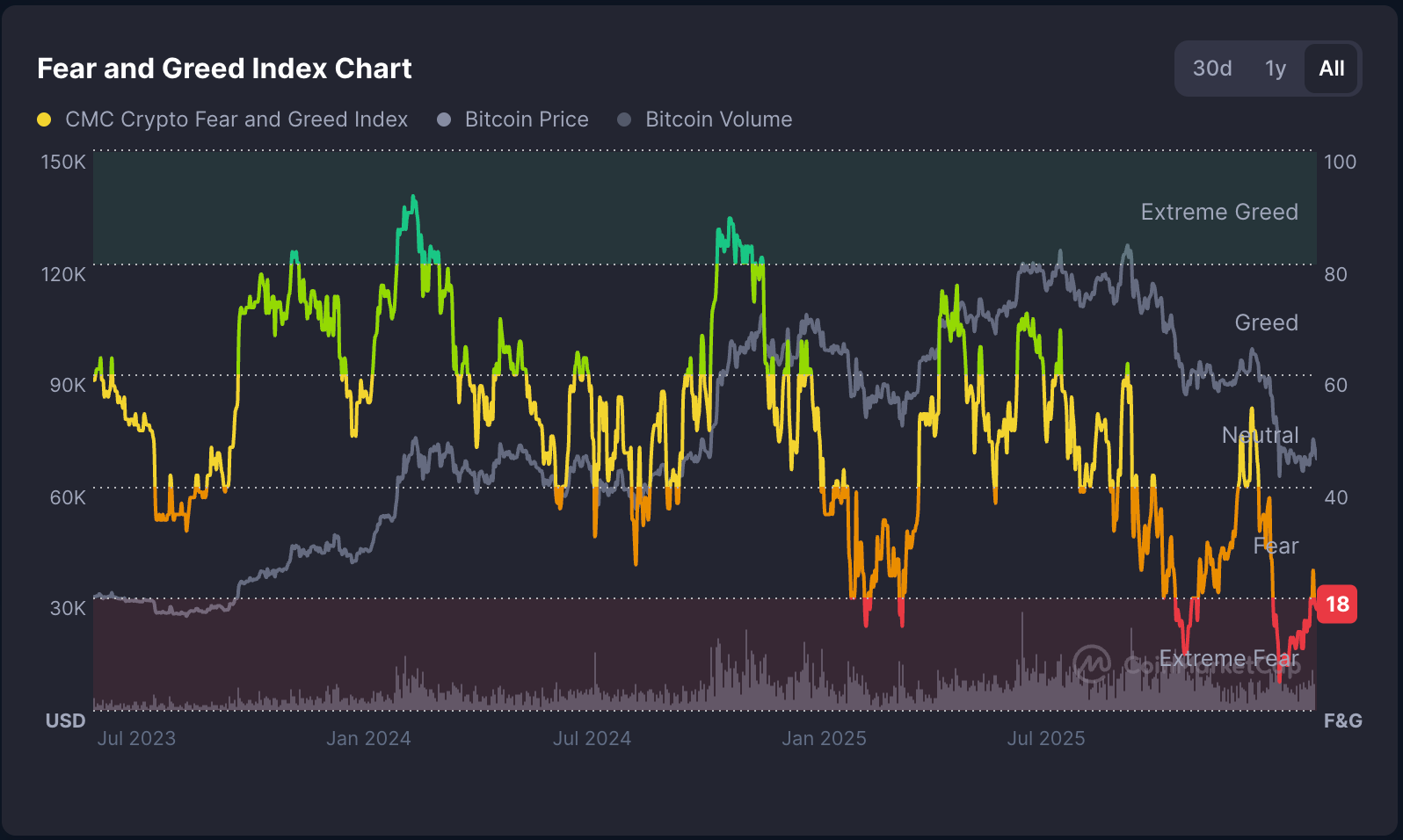

Crypto Fear and Greed Index Stumbles Back to ‘Extreme Fear’ Territory

The Crypto Fear and Greed Index, one of the most widely used gauges of crypto investor sentiment, has fallen back down to “extreme fear” levels after briefly recovering on Wednesday.

The Crypto Fear and Greed Index is at 18 at the time of this writing, down from the 20 recorded on Friday, according to CoinMarketCap. 20 signals “fear,” an atmosphere of caution among investors, but an improvement over rock-bottom market sentiment.

Sentiment briefly spiked to 25 on Wednesday, but contracted as geopolitical tensions between the US, Israel and Iran continue to erode risk appetite and increase macroeconomic uncertainty among market participants.

The index hit a yearly low of 5 in February amid the crypto market downturn and several headwinds, including renewed geopolitical tensions and macroeconomic concerns, such as uncertainty over interest rate policy, liquidity levels and rising US government debt.

Crypto assets have been in a bear market since the October 2025 crash, which slashed the price of Bitcoin (BTC) by over 50% from its all-time high, before BTC staged a limited recovery, and erased hundreds of billions of dollars in value from the altcoin market.

Related: Bitcoin sentiment hits record low as contrarian investors say $60K was BTC’s bottom

Alts suffer the most as sentiment craters

38% of altcoins are hovering near all-time low prices, which is more severe than the aftermath of the FTX collapse, according to CryptoQuant analyst Darkfost.

The price collapse was accompanied by about a 50% reduction in crypto trading volume, Darkfost told Cointelegraph.

“Altcoins remain the last sector of the crypto market where liquidity typically flows, so this situation is not surprising, given the geopolitical and macroeconomic deterioration observed over the past several months,” he said.

Mentions of altcoins on social media platforms sank to their lowest level in two years, according to crypto market sentiment analysis platform Santiment.

In February 2026, worldwide Google search volume for “Bitcoin going to zero” also hit its highest level since 2022, according to data from Google Trends, corroborating the low investor confidence measured by other sentiment indicators.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Crypto World

Gold Should Have Exploded When the Iran War Started: Here’s Why It Did Not

TLDR:

- Gold spiked to $5,390 on February 28 but dropped 4% by March 4, settling at $5,093 after strikes.

- Oil surged 13% and jet fuel jumped 140% while gold gained only 2.3% since the Iran war began.

- Dollar strength from inflation expectations historically outbids gold in phase one of energy crises.

- Goldman Sachs targets $6,300 gold by end-2026, leaving a $1,207 gap the market has not yet priced.

Gold should have exploded when the Iran war started, but it did not. That unexpected restraint is now the central question driving institutional analysis worldwide.

Since US-Israeli strikes on February 28 killed Iran’s Supreme Leader and closed the Strait of Hormuz, gold gained only 2.3 percent.

Brent crude surged 13 percent. Jet fuel jumped 140 percent. For seasoned market watchers, understanding why gold held back matters far more than the price itself.

Why Gold Stayed Quiet While Every Other Crisis Asset Moved

The war began with dramatic force. US-Israeli strikes destroyed twenty Iranian warships within 48 hours and closed a critical global shipping lane.

Gold briefly spiked to $5,390 intraday on February 28. Yet by March 4, just six days into the largest Middle East military campaign since the Gulf War, gold had dropped roughly 4 percent in a single session.

The answer to gold’s restraint sits in the dollar. An oil spike does not immediately trigger a safe-haven gold bid. Instead, it activates the inflation expectation channel, which strengthens the dollar and tightens real yields. That is the one macro environment where gold historically underperforms other assets.

Analyst Shanaka Anslem Perera framed it plainly in a widely circulated post. “This is not gold failing,” he wrote, describing gold as being temporarily outbid by the dollar during an inflation shock’s opening phase. The dollar roared following the oil move, and gold waited. That sequence is not random — it is structural.

The Fed now faces three competing pressures at once. Oil-driven inflation calls for rate hikes. A war-related growth shock calls for cuts. War financing calls for monetization.

Markets read the inflation signal first and bought dollars instead of gold. That is why the numbers look the way they do today.

Understanding the Two-Phase Pattern That Explains What Comes Next

Every major energy-driven geopolitical crisis in modern history has followed the same two-phase sequence. Phase one sees the dollar strengthen on inflation expectations, leaving gold behind.

Phase two begins when sustained economic damage becomes visible, recession probability rises, and markets shift from pricing inflation to pricing monetary debasement.

In 1973, that second phase took about six months and delivered gold gains of 73 percent. The 2022 Russia-Ukraine war compressed the timeline because the conflict stayed geographically contained. In 2026, the duration of Hormuz disruption determines when and whether phase two arrives.

Goldman Sachs has already moved its end-2026 gold target to $6,300, conditioned on prolonged Hormuz closure. Gold sits at $5,093 today. That leaves a $1,207 gap the market has not yet priced.

According to Perera, that gap exists because the market is still betting on a short war while the evidence points toward a longer one.

The $5,000 support level is the technical number every trader is now watching. The Fed’s March 18 meeting and the UN Security Council session on March 10 are the next key events.

If support holds through both, the base for phase two remains intact. Gold did not explode when the Iran war started — but the structure building beneath it suggests the delay, not the direction, is what analysts got wrong.

Crypto World

Bank of Canada issues Canada’s first tokenized bond in a pilot

Canada has wrapped up a formal test of distributed ledger technology in its debt markets, marking a milestone with the issuance of the country’s first tokenized bond. The Bank of Canada announced on a recent Friday that Project Samara brought together the central bank, Export Development Canada, Royal Bank of Canada, and TD Bank Group to explore whether a blockchain-inspired infrastructure could streamline the lifecycle of bonds—from issuance to settlement. The pilot involved a CAD 100 million instrument maturing in under three months, issued to a closed group of investors, and settled using wholesale central bank deposits rather than traditional commercial bank money. The platform, built on Hyperledger Fabric, linked separate cash and bond ledgers to enable near-instant settlement and end-to-end lifecycle management, including issuance, bidding, coupon payments, redemption, and secondary trading.

Key takeaways

- The pilot issued a CAD 100 million tokenized bond with a maturity of less than three months to a select group of investors, representing a tangible step toward tokenized government-like debt in Canada.

- Settlement relied on wholesale central bank deposits rather than conventional bank money, underscoring a shift in how payment rails could interact with tokenized securities.

- Hyperledger Fabric served as the core platform, integrating separate ledgers for cash and bonds to support a full lifecycle from issuance to trading with near-instant settlement.

- Participants tested a comprehensive workflow—issuance, bidding, coupon payments, redemption, and secondary trading—highlighting both operational gains and governance or regulatory hurdles.

- Early results point to improved data integrity and operational efficiency, while signaling that broader uptake will hinge on governance, regulatory alignment, and integration with existing financial infrastructures.

Sentiment: Neutral

Market context: The Canadian pilot sits within a growing global wave of experiments where governments and financial institutions explore tokenized and blockchain-enabled bonds. Notable precedents include the World Bank’s Bond-i issuance in 2018, which is widely cited as the first bond whose lifecycle was managed on a blockchain, and Singapore’s 2022 introduction of Project Guardian to study digital-asset use in wholesale markets. Hong Kong’s tokenized green bond program launched in 2023, with subsequent expansions in 2024 and 2025, and the World Bank’s 2024 collaboration with Swiss National Bank and SIX Digital Exchange illustrate a broader push toward digital settlement rails for traditional assets.

Why it matters

The Canadian experiment adds momentum to the concept that distributed ledger technology can streamline bond issuance, trading, and settlement by harmonizing disparate ledgers and enabling faster, more transparent post-trade processing. In theory, tokenized bonds promise reduced counterparty risk and improved data integrity, because the lifecycle—issuance, auction, coupon payments, and redemption—can be captured on an auditable, shared ledger with restricted access controls. The use of wholesale central bank deposits for payments further signals a potential evolution of settlement rails that aligns with central bank objectives for digital currency and streamlined settlement finality.

Yet the pilot also exposes real-world frictions. Governance structures and regulatory regimes must adapt to tokenized asset workflows, encompassing disclosure, investor protection, and cross-ledger interoperability. The need to integrate a distributed system with established financial infrastructures—clearing, custodial practices, and risk management frameworks—presents a non-trivial hurdle for scale. In addition, the transition from pilot to live, broad-based issuance requires careful calibration of operational risk, access rights, and oversight to ensure that security, privacy, and settlement finality meet both market and regulatory expectations.

Beyond Canada, the trend toward tokenized debt is not simply a technology story; it reflects evolving market architecture preferences. The World Bank’s historic Bond-i project demonstrated the feasibility of recording bond lifecycles on a blockchain platform, while MAS’s Project Guardian has driven industry exploration into digital-asset tokenization in wholesale markets. The Hong Kong Monetary Authority’s tokenized-bond initiatives show strategic regulatory support for digitalized debt, and Switzerland’s engagement with SIX Digital Exchange to settle a Swiss-franc digital bond highlights a growing ecosystem of cross-border experimentation. Taken together, these efforts illustrate how tokenization and distributed ledgers could eventually broaden access to capital markets, reduce settlement risk, and enable more granular post-trade data analytics—though each jurisdiction faces its own governance and technical integration challenges.

In this context, Canada’s test represents a proof-of-concept that a traditional debt instrument can be issued, traded, and settled on a ledger that mirrors wholesale central-bank-ready infrastructures. It also demonstrates a collaborative model among a government authority, a crown corporation, and large domestic banks, which could serve as a blueprint for future pilots or potential live deployments in other markets. The emphasis on end-to-end lifecycle management—issuance through secondary trading—addresses a longstanding pain point in bond markets: friction and latency in post-trade processes. While the initiative does not imply immediate disruption to conventional bond markets, it signals a path toward more efficient settlement, tighter data governance, and potentially new forms of investor access, should scale and regulatory support align in the coming years.

For participants and observers, the key takeaway is not that a single tokenized bond will disrupt the market but that a working, production-grade, distributed-ledger environment validated by major financial institutions can execute a bond’s lifecycle with high degrees of automation and near-instant settlement. The learnings—benefits in operational clarity and data integrity, paired with governance and integration challenges—will inform both policy considerations and private-sector decisions about the role of blockchain-inspired architectures in the capital markets ecosystem. As central banks and regulators monitor live pilots, the Canadian example reinforces the proposition that tokenized assets can be more than a speculative concept; they can be engineered into functional components of a broader, digitized financial infrastructure.

The Bank of Canada’s announcement and accompanying materials provide a window into how pilots like Project Samara are shaping practical experimentation. The release notes that the bond issuance and settlement occurred on a distributed ledger platform, with payments routed through wholesale central bank deposits. For more granular details on the official pilot, see the Bank of Canada’s announcement here: Bank of Canada, Export Development Canada, RBC, TD successfully complete bond issuance experiment using distributed ledger technology.

As the data set from this pilot becomes more concrete, observers will be watching for how governance structures evolve, how regulators respond to cross-jurisdictional interoperability considerations, and whether subsequent pilots scale to larger debt issues or longer maturities. The path from a single trial to a broader adoption hinges not only on technical feasibility but on the alignment of risk controls, settlement finality guarantees, and fiscal-technical harmonization across institutions and regulatory bodies. In that sense, Project Samara is less about the immediate utility of the CAD 100 million note and more about demonstrating that a coordinated, ledger-based approach can support end-to-end bond management in a way that resonates with evolving central-bank digital currency and digital-asset policy discussions.

What to watch next

- whether Canada expands the pilot to include larger issues or longer tenors within the same framework

- regulatory guidance or updates that address governance and interoperability for tokenized fixed income in Canada

- additional participants from the private sector or other Canadian provinces contemplating similar experiments

- technical refinements to the ledger architecture that improve scalability and cross-ledger reconciliation

- potential live deployments or cross-border pilots tied to wholesale settlement rails

Sources & verification

- Bank of Canada, Export Development Canada, Royal Bank of Canada, and TD Bank announce successful bond-issuance experiment using distributed ledger technology (March 2026): https://www.bankofcanada.ca/2026/03/bank-canada-export-development-canada-rbc-td-successfully-complete-bond-issuance-experiment-distributed-ledger-technology/

- World Bank: Bond-i—the first global blockchain bond issuance (2018): https://www.worldbank.org/en/news/press-release/2018/08/23/world-bank-prices-first-global-blockchain-bond-raising-a110-million

- Monetary Authority of Singapore: Project Guardian and wholesale digital-asset initiatives (2022): https://www.mas.gov.sg/news/media-releases/2022/mas-partners-the-industry-to-pilot-use-cases-in-digital-assets

- Hong Kong Monetary Authority: tokenized green bond issuance and program updates (2023–2025): https://www.hkma.gov.hk/eng/news-and-media/press-releases/2023/02/20230216-3, https://www.hkma.gov.hk/eng/news-and-media/press-releases/2024/02/20240207-6

- World Bank: partnership with Swiss National Bank and SIX Digital Exchange to advance digitalization in capital markets (2024): https://www.worldbank.org/en/news/press-release/2024/05/15/world-bank-partners-with-swiss-national-bank-and-six-digital-exchange-to-advance-digitalization-in-capital-markets

Tokenized bonds in Canada: outcomes, mechanics, and implications

Canada’s tokenized-bond pilot under Project Samara represents a deliberate, methodical step toward reimagining debt markets through distributed ledger technology. The collaboration among the Bank of Canada, Export Development Canada, and two of the country’s largest banks demonstrates a practical, governance-conscious approach to testing a full lifecycle on a shared ledger. The CAD 100 million instrument with a sub-three-month maturity illustrates how tokenization can be deployed for relatively short-duration debt in a controlled setting, providing a limited but meaningful data point for how such assets might behave in real markets.

The mechanics of the Pilot Samara platform—built on Hyperledger Fabric and featuring integrated cash and bond ledgers—address a core challenge in traditional bond markets: the latency and risk associated with post-trade processing. By enabling issuance, bidding, coupon settlement, redemption, and secondary trading on a single ledger, and by processing payments through wholesale central bank deposits, the pilot pushes the envelope on settlement efficiency and inter-ledger coherence. The approach also offers a blueprint for potential future interoperability with central bank digital currencies and wholesale payment rails, a topic of growing interest among policymakers around the world.

However, the pilot also makes clear that technology alone is not a panacea. Governance structures, cross-border data agreements, and regulatory requirements remain critical to the viability of broader adoption. The institutions involved acknowledged that while operational improvements were evident, so too were governance and integration hurdles—issues that would need to be resolved before any large-scale rollout. As the market grows more comfortable with the idea of tokenized assets and as central banks continue to refine their digital-currency frameworks, pilots like Samara provide a concrete, observable test of how tokenized debt could function within a regulated, institutionally trusted ecosystem.

In the broader context, Canada’s experiment sits at the intersection of technological capability and policy design. It reflects a systematic, risk-conscious approach to exploring new settlement paradigms while preserving market integrity and investor protection. The results contribute to a landscape in which tokenized bonds are no longer a speculative curiosity but a potential instrument for more efficient settlement and improved data governance. Investors, financial institutions, and policymakers will be watching closely for how Canada translates pilot insights into scalable solutions that could reshape the structure and speed of debt markets in the years ahead.

Crypto World

Circle and Stripe Race to Replace Credit Cards With Stablecoin Payments for AI Agents

TLDR:

-

- Circle launched Arc blockchain and nanopayments, cutting transaction costs to fractions of a penny for AI agents.

- Stripe and Paradigm built Tempo blockchain, raising $500M at a $5B valuation for stablecoin payment rails.

- Credit card fees make microtransactions unworkable, giving stablecoins a structural edge in machine-to-machine commerce.

- Coinbase’s x402 recorded just $24M in volume, exposing a wide gap between agentic payment ambition and adoption.

- Circle launched Arc blockchain and nanopayments, cutting transaction costs to fractions of a penny for AI agents.

Circle Internet Group and Stripe are locked in a race to build payment systems for a world that does not yet exist. Both companies are developing infrastructure designed for autonomous AI agents that settle transactions in stablecoins.

The goal is to replace the traditional credit card swipe with programmable, machine-driven payments. Investors are watching closely, with Stripe reaching a $159 billion valuation and Circle shares climbing nearly 30% since the start of 2026. The competition is already reshaping how the payments industry thinks about the future.

Two Companies, One Vision, Different Approaches

Circle is moving fast on the infrastructure side. The company launched Arc, a new blockchain built specifically for stablecoin payments.

It also began testing “nanopayments,” a capability that lets autonomous agents hold balances and transact across networks.

Costs run at fractions of a penny per transaction, making high-frequency machine-to-machine commerce economically practical for the first time.

Stripe is taking a different but equally aggressive path. Together with crypto venture firm Paradigm, it is building Tempo, a blockchain designed from the ground up for stablecoin settlement.

The project raised $500 million at a $5 billion valuation, with Visa, Mastercard, UBS, and Shopify signing on as partners.

Stripe has also spent more than $1.1 billion acquiring stablecoin infrastructure, including the 2025 purchase of Bridge.

The two companies are effectively building parallel highways toward the same destination. Circle is focused on the settlement layer and the nanopayment capability.

Stripe is focused on merchant integration and blockchain rails. Together, their investments represent the most serious institutional bet yet that stablecoins will power the next generation of commerce.

Why Credit Cards Cannot Compete in an Agent-Driven World

The structural argument against credit cards is straightforward. Traditional card networks charge fixed fees and percentage-based pricing on every transaction.

That model works for a consumer buying a $50 item but breaks down entirely when a software agent pays cents for a data request or an API call.

Circle CEO Jeremy Allaire framed the opportunity clearly on the company’s February 25 earnings call. He described a future where AI agents consume services from one another at scale.

A legal skills agent, for instance, might field thousands of micro-requests from external agents daily. Each transaction might be worth only a fraction of a dollar, making card fees prohibitive.

Analyst Mark Palmer of Benchmark-StoneX reinforced that point. “Microtransactions are a poor fit for traditional rails in terms of cost, latency and programmability,” he said.

Stablecoins embedded directly into software workflows, he added, remove the settlement delays and cost structures that make cards unworkable at that scale.

The Road Between Ambition and Adoption

Despite the infrastructure race, real-world volume tells a more cautious story. Coinbase’s x402, an open standard built for agentic payments, reported just $24 million in total volume over the past 30 days.

That figure sits against a global e-commerce market projected to reach $6.88 trillion this year. The gap between the two numbers is difficult to overlook.

Merchant adoption presents another hurdle. Chris Donat of BWG Global noted that merchants follow consumer demand.

“They aren’t going to bother accepting something unless they are asked by a meaningful number of consumers to do it,” he said. Right now, consumers are not asking for stablecoin payments in significant numbers.

Stablecoin transactions also lack the fraud protection, dispute resolution, and credit extension built into every card payment.

A practical near-term path may involve AI agents using virtual cards that settle on the back end through stablecoin rails.

That model would allow card networks and stablecoin infrastructure to coexist, rather than forcing an immediate winner-takes-all outcome.

Allaire himself acknowledged that the timeline for meaningful agentic transaction volume remains uncertain, even as the race to build the pipes intensifies.

Crypto World

Crypto Investor Says Attackers Stole $24M in Violent Robbery

The victim offered a 10% bounty for any recovered funds and asked exchanges and investigators to help trace the transfers.

A crypto holder known online as Sillytuna said on March 5 that attackers stole about $24 million worth of tokens after threatening him with violence during a real-world robbery.

The incident has renewed concern about so-called “wrench attacks,” a form of crime where perpetrators use physical threats to force victims to hand over control of their crypto wallets instead of attempting to hack them.

Victim Describes Violent Coercion

In several posts on X, Sillytuna said the theft involved armed attackers who threatened severe violence unless he transferred control of his holdings. He wrote that the group used weapons and issued threats of kidnapping and sexual assault, adding that police in the United Kingdom were already involved.

“$24 million dollar theft of AUSD from 0x6fe0fab2164d8e0d03ad6a628e2af78624060322 Involved violence, weapons, kidnap and rape threats. Obvs police involved,” he tweeted.

Blockchain analytics platforms soon began tracking the movement of the stolen assets, with Arkham sharing data showing the attackers taking about $23.6 million in aEthUSDC linked to an address associated with Sillytuna.

The firm’s analysis established that most of the funds were quickly converted into other tokens and spread across several wallets. About $20 million was swapped into DAI and placed in two Ethereum addresses. The attackers also bridged smaller portions of the funds to other networks.

Roughly $2.48 million was transferred to the Arbitrum network, where the funds were routed through multiple Wagyu accounts. Those accounts were then used to purchase Monero, a privacy-focused cryptocurrency that makes transaction tracing significantly more difficult.

Arkham also reported that approximately $1.1 million was moved to the Bitcoin network through a bridging service, with part of that amount potentially sent to a mixing service.

You may also like:

Security firm PeckShield initially described the incident as a possible address-poisoning attack, but Sillytuna rejected that explanation, insisting that the funds were taken through direct physical intimidation rather than a wallet exploit.

The victim offered a 10% bounty for any funds recovered, even if returned by the perpetrators themselves. Additionally, he asked exchanges and blockchain investigators to help block or trace the transfers.

Community Tracking Effort

Soon after Sillytuna shared his ordeal, members of the crypto community began examining the transactions in detail, with security researcher Tay Vano flagging multiple addresses connected to the theft and confirming that Wagyu was being used to launder funds to the privacy coin Monero.

PerpetualCow, the developer behind Wagyu, later responded, saying that the platform does not freeze user funds as a matter of policy. However, they claimed they would have stopped the transactions from going through in the first place, but they had been asleep when the transfers happened.

Nevertheless, they pointed out that compliance systems eventually flagged the suspicious transactions, preventing additional transfers from passing through.

While some members of the community focused on tracing the stolen funds, others reacted in different ways. For example, a group within the Solana ecosystem launched a meme token linked to Sillytuna’s name and said trading fees would be directed toward helping offset the losses.

Sillytuna’s case is not an isolated event but part of a documented increase in wrench attacks. Some of the more well-known incidents include the January 2025 kidnapping of Ledger co-founder David Balland from his home in France, with attackers severing one of his fingers to pressure associates into paying a ransom.

In another case, a U.S. resident visiting London was drugged and lost approximately $122,000 in crypto after being tricked into smoking a cigarette laced with scopolamine.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Coinbase (COIN) says new U.S. tax-reporting rules for crypto are cluttered, confusing

Cryptocurrency trading giant Coinbase (COIN) said new U.S. tax reporting requirements are overly onerous for many crypto holders and add unnecessary clutter to the country’s taxation system.

While the idea is that taxable activity on crypto should be reported in the same way as with equities, for example, the rules require reporting transactions in stablecoins — whose value, by definition, doesn’t change — and the tiny amounts spent on the network fees known as gas.

The Nasdaq-listed exchange is currently sending millions of American crypto holders the new 1099-DA forms designed to bring crypto in line with the rest of finance. While all Coinbase’s customers will be affected to some extent, it’s the very large group of retail customers who are being hit with an unnecessary administrative burden on what amounts to small transaction flows, said Lawrence Zlatkin, the company’s VP of tax.

“Frankly, [small retail] transactional flow is so small, I just don’t know why we’re spending efforts as a country focused on them,” Zlatkin said in an interview. “I just think it just does a disservice to people when you’re trading 50 bucks, let’s say, that you get a form like this and you have to report gains or losses. That’s just not what the tax system is supposed to be about.”

For trading platforms, the new system means sharing details of customers’ digital asset transactions with the IRS. Customers are copied in using the form, so they can voluntarily reconcile their gains and losses with the tax authority.

As is often the case when trying to align crypto with traditional finance, however, there are challenges.

This year, Coinbase will provide the IRS only with the gross proceeds of digital asset sales, and not the net value or cost basis. As a result, the onus is on the trader to add what’s missing regarding their crypto acquisition costs and actual tax basis. (Coinbase will begin calculating cost basis on behalf of its customers starting next tax year.)

This will cause some degree of confusion, particularly among people who have never owned assets like stocks. And crypto brings its own level of complexity, given how holdings can be shunted between platforms and swapped in and out of various coins and tokens.

There are other obvious over-reporting wrinkles in the system that need to be ironed out, Zlatkin said, such as the need to report stablecoin holdings, whose value, by design, is fixed.

“People should pay taxes where they have income,” Zlatkin said. “Do you have income on USDC? No, you don’t. So why are we reporting USDC transactions? And we’re reporting those on our exchange as there’s no blanket exemption for USDC. That, to me, clutters the system.”

Gas fees, the small crypto transactions used to pay blockchain costs, just add to the reporting clutter, Zlatkin said.

“Gas fees might be 50 cents, a buck — do we have to disclose that? Is that a valuable use of resources to collect revenue? And I would posit that the answer is no,” he said. “We should focus on where there’s real income to get people to voluntarily comply. But not where there’s no income, such as in stablecoins or in tiny, tiny transactions that are mostly network fees.”

Coinbase’s goal is to educate and, moving forward, to create tools that help make the sometimes onerous task of calculating cost basis on crypto easier, said Ian Unger, the exchange’s director of tax reporting information.

When an equities investor sells stocks or moves their shares between brokers, those transactions come with transfer statements, so the cost basis transfers with it, he pointed out.

“That’s not the world we live in today for crypto assets,’ Unger said in an interview. “There could be a world where some of this does get easier for those who buy and sell on one exchange and want to move to another exchange. But we’re not there yet, and so until we get there, there’ll be a lot of confusion.”

Crypto World

Kuwait Oil Production Cut Begins as Strait of Hormuz Closure Fills Storage Tanks to Capacity

TLDR:

- Kuwait declared force majeure on day 18 as onshore tanks hit full capacity with no export route available.

- Seven insurance letters from London closed the Strait, not Iranian strikes on Kuwait’s oil production facilities.

- JPMorgan warns total Gulf shut-ins could reach nearly 5 million barrels per day if Hormuz stays closed.

- Forced well shut-ins risk 10 to 30 percent permanent recovery loss, turning disruption into long-term supply destruction.

Kuwait oil production has been curtailed after onshore storage tanks reached full capacity. This occurred on day 18 of the Strait of Hormuz closure to commercial shipping.

The Gulf nation was producing 2.8 million barrels per day before February 28. Since that date, no tankers have loaded at Kuwaiti export terminals.

Oil continued flowing from wells into storage with no route to market. Kuwait declared force majeure and began reducing output in response.

Insurance Withdrawal, Not Missiles, Closed the Strait

Analyst Shanaka Anslem Perera raised the root cause of the shutdown in a post on X. He noted that seven letters from London-based insurance companies effectively closed the Strait of Hormuz.

Without shipping insurance, commercial vessels could not legally transit the waterway. Those letters, rather than missiles, triggered Kuwait’s oil production cuts.

Iran fired missiles at military bases and the US embassy in Kuwait. However, zero confirmed strikes landed on any oil production or export facility.

Kuwait’s refineries and export terminals remained physically intact throughout the conflict. The shutdown was driven entirely by the logistics breakdown downstream of the wells.

JPMorgan had estimated Kuwait held an 18-day storage runway following the closure. That estimate proved accurate as tanks reached capacity on schedule.

Iraq had already cut 1.5 million barrels per day the prior week for identical reasons. The same storage arithmetic is now counting down in Saudi Arabia, the UAE, and Qatar.

JPMorgan further warned that continued closure could push total Gulf shut-ins to nearly 5 million barrels per day. That figure represents roughly 5 percent of global oil supply.

The cuts would stem from storage limits, not from any attack on production infrastructure.

Reservoir Damage Could Make Kuwait Oil Production Cuts Partially Permanent

Kuwait oil production shut-ins carry a second concern beyond immediate volume loss. Forced well closures under reservoir pressure can cause lasting formation damage.

Asphaltene precipitation, fines migration, clay swelling, and pressure depletion are the primary risks. These factors can reduce long-term recovery rates by 10 to 30 percent even after wells restart.

The Society of Petroleum Engineers has documented this pattern across decades of forced shut-ins. During the 1991 Gulf War, some Kuwaiti fields lost 15 to 25 percent of long-term recovery capacity.

Mitigation options exist, including chemical inhibitors and controlled shut-in procedures. However, these measures require planning time that an insurance-driven closure did not provide.

Kuwait had roughly 18 days of warning before the storage crisis peaked. Whether that window was sufficient to protect thousands of producing wells remains an open question.

Post-restart treatments may limit damage if applied promptly. The outcome will determine whether the production cut proves temporary or partially permanent.

Markets are currently pricing a supply disruption. Reservoir physics, however, may be signaling supply destruction.

The gap between those two outcomes could equal 10 to 30 percent of Kuwait’s long-term output. That distinction is the central question the energy market has yet to fully price in.

Crypto World

Prediction Market Kalshi Sued Over Khamenei Trade Carveout

A federal class-action suit targets prediction platform Kalshi, accusing the company of failing to clearly disclose a death carveout tied to a market that forecast the fate of Iran’s former supreme leader. The case centers on the “Ali Khamenei out as Supreme Leader” market, which was halted after the death of Ayatollah Ali Khamenei was confirmed, leaving won bets unsettled in a way the plaintiffs say was not anticipated by users. The plaintiffs contend that the death carveout policy was never incorporated into the user-facing rules summary and was not presented in a way that would alert a reasonable consumer. Kalshi’s co-founder has acknowledged that earlier disclosures were grammatically ambiguous, though the company maintains it did not profit from such markets. The lawsuit also highlights disputes over payouts and reimbursements to traders who were affected.

Key takeaways

- The class-action alleges Kalshi concealed a death carveout in a major political market and failed to disclose how payouts would be handled when a death outcome was involved.

- Trading was halted and positions were voided after the death was confirmed, meaning the market did not resolve to a definitive “yes.”

- Kalshi maintains it does not list death-related markets and asserts the policy is stated in market rules; co-founder Tarek Mansour says no money was made from the market and losses were reimbursed out of pocket.

- Plaintiffs criticize the reimbursement method, arguing the last-traded-price approach and the exact timestamps used to compute it were not disclosed or transparent.

- The suit arrives as prediction-market volumes on Kalshi and peers rose to record levels in 2026, underscoring growing interest in off-exchange forecasting tools.

- The dispute spotlights ongoing scrutiny of how market-design rules are conveyed and enforced in politically sensitive event markets.

Sentiment: Neutral

Market context: The dispute sits at a time when prediction-market platforms have drawn heightened attention as volumes surge in 2026. Regulators and market participants are increasingly weighing how disclosures, rule wording, and risk-management practices shape user trust in event-based forecasts.

Why it matters

For users, the case underscores the importance of transparent disclosures when markets hinge on sensitive outcomes such as political leadership and life-and-death scenarios. The reimbursement mechanism—meant to mitigate losses when outcomes are blocked or unsettled—will come under greater scrutiny if procedural details remain opaque. For Kalshi and the broader prediction-market sector, the suit tests how clearly rules must be communicated within user interfaces and whether policies prohibiting certain outcomes can withstand legal challenges if not explicitly explained. The outcome could influence how platforms design carveouts, disclosures, and payout methodologies when markets intersect with real-world, high-stakes events.

Beyond Kalshi, the dispute feeds into a broader conversation about governance and consumer protection in the burgeoning forecasting economy. As platforms compete for liquidity and user engagement, the balance between creative market design and clear, auditable rules becomes a growing focal point for investors, policymakers, and users alike. The case also arrives amid visible pushback over how reimbursements are determined, raising questions about standardization across operators and the expectations set for participants in this niche trading space.

What to watch next

- Legal filings and court rulings in Risch v. Kalshi LLC, including any motions to dismiss or for class certification.

- Kalshi’s public updates to its market rules or disclaimers regarding death-related markets and any changes to the carveout policy.

- Public disclosure of the precise methodology and timestamps used to calculate last-traded prices for reimbursed trades.

- Any settlements or additional disclosures arising from related enforcement actions or disclosures in 2026 trading-volume activity.

- Follow-up reporting on how prediction-market operators adjust governance and risk controls in response to high-profile outcomes.

Sources & verification

- Court Listener docket for Risch v. Kalshi LLC, detailing the class-action complaint and filings.

- Public statements from Kalshi co-founder Tarek Mansour on X addressing the death-market carveout and reimbursements.

- Cointelegraph coverage on Kalshi’s response to the carveout and the reimbursement policy.

- Cointelegraph reporting on related Kalshi developments, including policy enforcement and market dynamics in 2026.

Market reaction and regulatory considerations surrounding Kalshi’s death-market carveout

A class-action alleging disclosure gaps around Kalshi’s death carveout has put the platform’s governance under a sharp lens. The complaint centers on the “Ali Khamenei out as Supreme Leader” market, which was voided after the death of the Iranian leader was confirmed, leaving a scenario where winners did not receive a payout and losers did not simply absorb gains. Plaintiffs emphasize that the carveout policy was not clearly present in the user-facing rules summary, and they point to statements from Kalshi acknowledging earlier disclosures were ambiguous rather than intentionally misleading.

“With an American naval armada amassed on Iran’s doorstep and military conflict not merely foreseeable but widely anticipated, consumers understood that the most likely, and in many cases the only realistic, mechanism by which an 85-year-old autocratic leader would ‘leave office’ was through his death. Defendants understood this as well.”

Kalshi’s co-founder, in defending the firm’s approach, reiterated that the company does not list markets directly tied to death and that the policy to avoid profit from such outcomes is embedded in the rules. He asserted that Kalshi did not profit from the market and that all losses were reimbursed out of pocket, a claim designed to counter arguments that the platform benefited from a misleading disclosure regime. The company’s stance aligns with a broader commitment it has publicly stated—that death-related markets are not listed and that the policy is clearly articulated within the market’s governance framework.

The debate over the reimbursed trades centers on the method used to determine compensation. Kalshi’s team has explained that reimbursements were calculated using the last traded price once the death confirmation occurred, a methodology designed to cap potential losses for participants while avoiding windfall profits. Critics, however, argue that the process and its exact timestamps should be transparent and auditable to ensure confidence in the remedy. The plaintiffs contend precisely that transparency is lacking, arguing that traders deserve a clear, reproducible account of how reimbursements were computed.

Trading activity in prediction markets continued to climb in 2026, with volumes reaching new highs even as legal questions surrounding rule disclosures and payout mechanics persist. The ongoing scrutiny reflects a maturing market where participants increasingly demand clarity on risk controls, governance, and the boundary between ambition in market design and consumer protection. In parallel, Kalshi has faced other regulatory and governance questions, including episodes related to insider trading and broader policy enforcement within its platform ecosystem.

As the case advances, observers will watch not only the court’s handling of disclosure questions but also whether Kalshi, and the wider ecosystem, respond with more explicit UI disclosures or refinements to how sensitive outcomes are treated in live markets. The outcome could influence how other platforms articulate carveouts and payout rules, shaping a more predictable framework for participants who use event-driven markets to hedge risk or speculate on real-world events.

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Ann Taylor

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech7 days ago

Tech7 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Sports3 hours ago

Sports3 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat2 days ago

NewsBeat2 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

(@coinbase)

(@coinbase)