Crypto World

CoinShares says quantum threat to Bitcoin is real but still years away

Bitcoin faces a theoretical security risk from future quantum computers, but the threat is manageable and not imminent, according to a new research note from digital asset manager CoinShares.

Summary

- CoinShares says quantum computing poses a real but distant risk to Bitcoin, not an immediate security threat.

- Only a small share of Bitcoin’s supply, mainly in older addresses, is theoretically vulnerable to quantum attacks.

- Bitcoin can adopt quantum-resistant upgrades over time, giving the network ample room to adapt.

The firm said concerns that quantum computing could break Bitcoin’s (BTC) cryptography are often overstated, noting that the technology required to carry out such an attack remains far beyond current capabilities.

Even in the most aggressive scenarios, CoinShares estimates that a practical quantum threat to Bitcoin is likely at least a decade away.

Why quantum threat to Bitcoin matters

Bitcoin’s security relies on cryptographic tools that protect private keys and validate transactions. In theory, powerful quantum computers running algorithms such as Shor’s algorithm could one day derive private keys from public keys, allowing attackers to steal funds from certain types of Bitcoin addresses.

However, CoinShares said only a limited subset of Bitcoin is exposed. Roughly 8% of the total supply sits in older “legacy” addresses where public keys are already visible on the blockchain. Even within that group, far fewer coins would be immediately vulnerable in a way that could destabilize the network.

Bitcoin’s core hashing function, SHA-256, is also considered resilient. Quantum computers could speed up brute-force attacks, but not enough to break Bitcoin’s mining or transaction security under realistic assumptions, the report said.

Why the risk is considered manageable

CoinShares emphasized that Bitcoin is not static and has successfully upgraded its cryptography before. The network could transition to quantum-resistant signature schemes through future software upgrades if the threat becomes more concrete.

In addition, holders of older Bitcoin addresses can already protect themselves by moving funds to newer address formats that do not expose public keys until a transaction is spent.

The firm warned against rushing into drastic changes, such as premature hard forks or untested cryptographic schemes, arguing that unnecessary action could introduce bugs or weaken decentralization.

What it means for investors

For investors, CoinShares’ conclusion is straightforward: quantum computing is a long-term engineering challenge, not an existential crisis for Bitcoin today.

The report suggests the market has ample time to prepare, monitor technological progress, and implement safeguards well before quantum computers pose a realistic threat to Bitcoin’s security.

Crypto World

Bitcoin Investors Should Watch These US Economic Signals

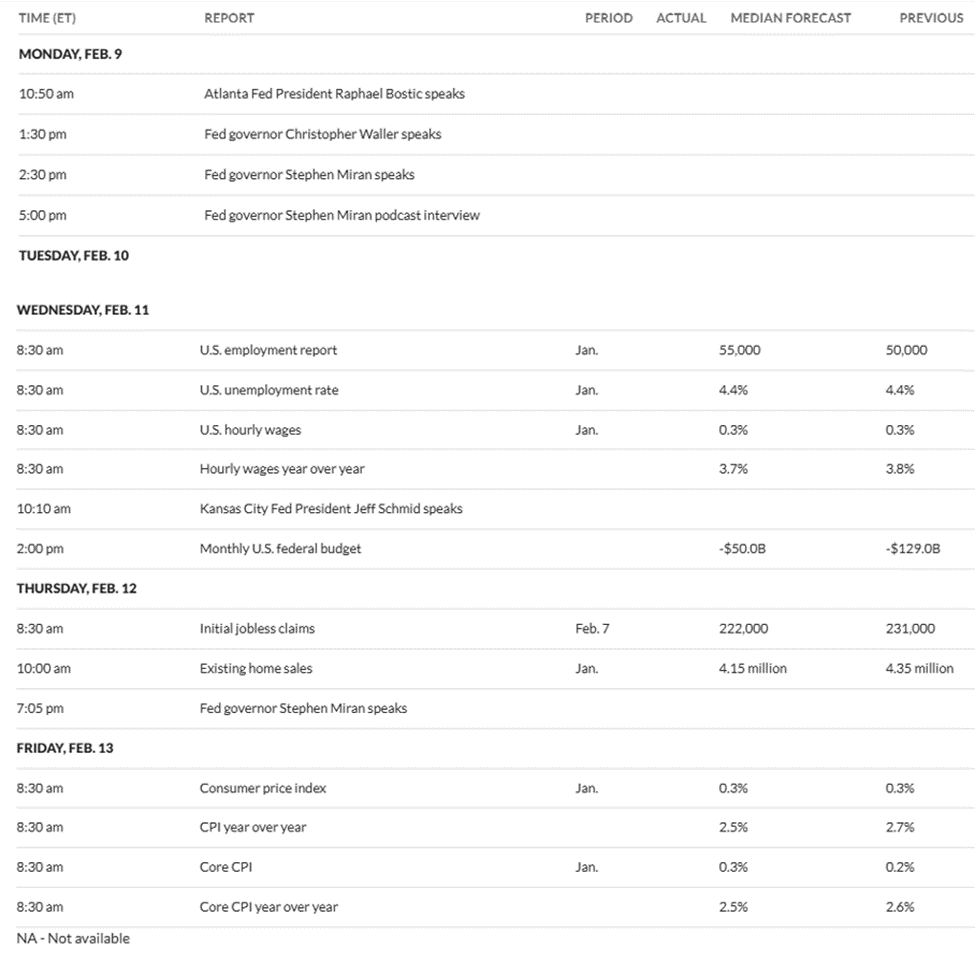

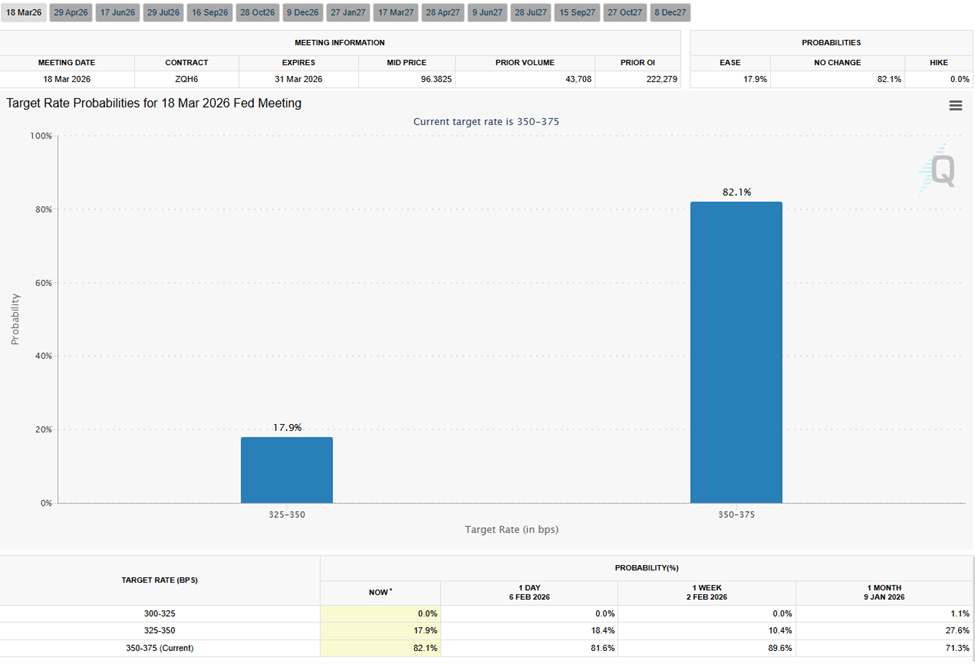

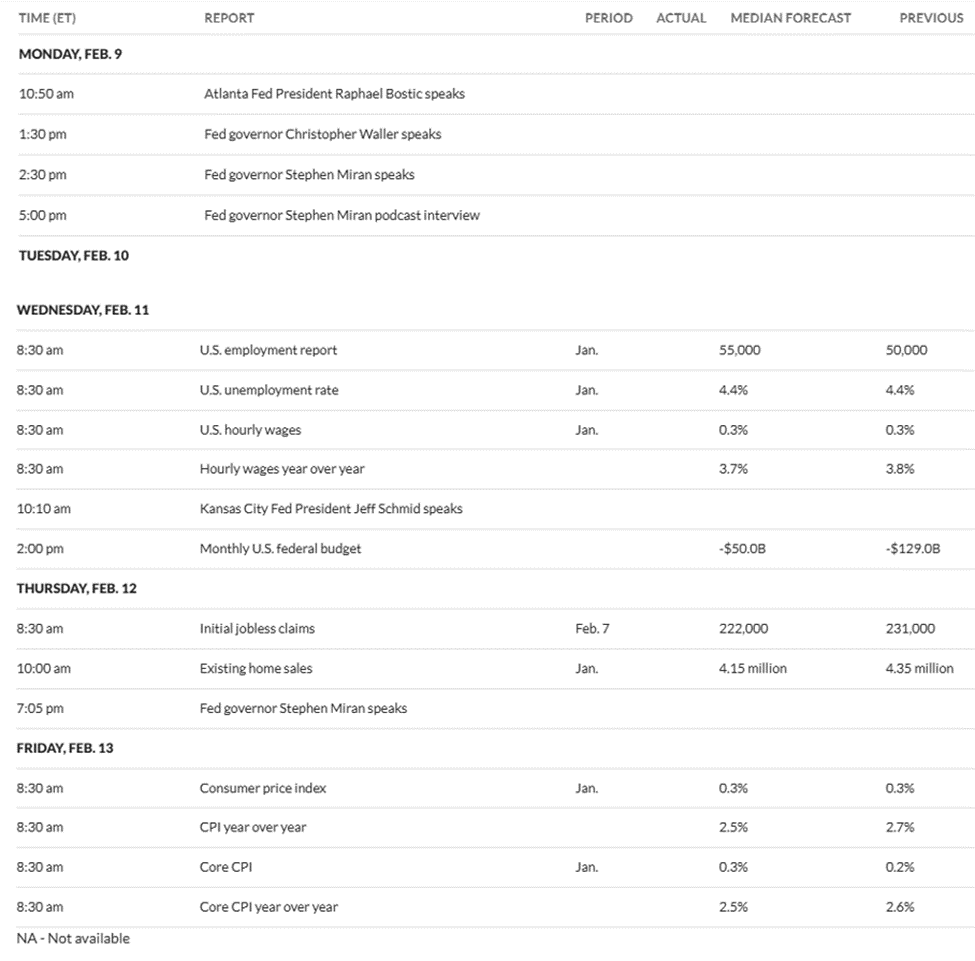

Bitcoin traders are heading into a macro-heavy week, with four US economic events expected to shape sentiment across crypto markets.

With Bitcoin trading in a volatile range and macro narratives dominating market psychology, traders are increasingly treating economic releases as short-term catalysts that can trigger sharp moves in both directions.

Which US Economic Signals Should Bitcoin and Crypto Investors Watch This Week?

A Federal Reserve (Fed) governor’s media appearance, key labor-market data, weekly unemployment claims, and January inflation figures could all influence expectations around interest rates and liquidity—two of the strongest drivers of Bitcoin’s price cycles.

Sponsored

Sponsored

Fed Governor Stephen Miran Interview in Focus

Markets will first look to comments from Federal Reserve Governor Stephen Miran, who is scheduled to appear in a podcast interview on Monday, February 9. Ahead of the 5:00 p.m. ET. appearance, there is already mixed sentiment across the crypto community, especially amid broader market caution.

Some market participants point to Miran’s relatively constructive view on stablecoins, arguing that regulatory clarity and dollar-linked digital assets could indirectly support Bitcoin by strengthening the broader crypto ecosystem and institutional participation.

Others see risk. Speculation that Miran could play a larger role in future Fed leadership has already coincided with bouts of volatility in both precious metals and crypto. This reflects fears that tighter policy could weigh on inflation-hedge narratives.

At the same time, some macro analysts have described Miran as more dovish than many of his peers, citing past arguments in favor of substantial rate cuts to support the labor market.

Any signals in that direction could lift sentiment in risk assets, particularly Bitcoin, which remains highly sensitive to liquidity expectations.

Sponsored

Sponsored

US Employment Report Could Drive “Bad News Is Good News” Narrative

Attention will shift on Wednesday, February 11, to the US employment report, one of the most closely watched indicators of economic health and monetary-policy direction.

Forecasts suggest relatively modest job growth, potentially reaching 55,000 from the previous 50,000. Weaker-than-expected data could paradoxically support Bitcoin. Cooling labor conditions would increase pressure on the Fed to ease policy, potentially improving liquidity conditions for risk assets.

Recent labor-market indicators have already pointed to signs of slowing. Reports of rising layoffs and a slowdown in hiring have strengthened expectations that rate cuts could arrive sooner than previously anticipated.

However, the employment report also carries downside risk. A sharp deterioration in job data could spark broader growth fears, prompting investors to move toward defensive positions. Such an outcome could trigger short-term selloffs in crypto, as seen during previous macro shocks.

Sponsored

Sponsored

Jobless Claims May Reinforce or Challenge the Trend

Thursday’s initial jobless claims release will provide a more immediate snapshot of labor-market conditions. As such, it could reinforce the narrative set by the employment and unemployment reports on Wednesday.

Recent spikes in claims have coincided with risk-off reactions in crypto markets, including liquidation events and rapid price swings. Some traders interpret rising claims as a signal that economic conditions are weakening enough to force monetary easing, a longer-term positive for Bitcoin.

Others warn that in the short term, deteriorating employment data can unsettle markets, especially when liquidity is thin and leverage is elevated.

That dynamic has made jobless-claims releases a growing source of volatility, even though they rarely move markets in isolation.

Sponsored

Sponsored

CPI and Core CPI Seen as the Week’s Decisive Catalyst

The most consequential data point may arrive on Friday, February 13, with the release of January’s Consumer Price Index (CPI) and Core CPI figures.

Inflation data remains the primary driver of Fed policy expectations and, therefore, a key determinant of crypto market sentiment.

Cooler-than-expected readings in recent months have supported risk assets by weakening the “higher for longer” rate narrative.

Another soft inflation print could accelerate expectations for rate cuts in 2026, potentially reinforcing bullish momentum in Bitcoin and strengthening the case for a move toward six-figure price levels over time.

However, sticky or rising inflation would likely have the opposite effect, pushing Treasury yields higher and pressuring speculative assets, including cryptocurrencies.

“If data comes in hot, rates will likely stay higher, and risk assets may struggle. If data cools, rate cut expectations could return, and markets may breathe. This week will tell us what comes next,” remarked analyst Kyle Chasse.

Taken together, the week’s events represent a concentrated test of the macro narratives currently driving Bitcoin: inflation, employment, and the timing of monetary easing.

While long-term adoption trends, such as ETF flows, institutional participation, and stablecoin growth, continue to underpin bullish projections, short-term price action remains closely tied to economic data.

Crypto World

Crypto ETP Outflows Ease as Trading Hits Record $63 Billion

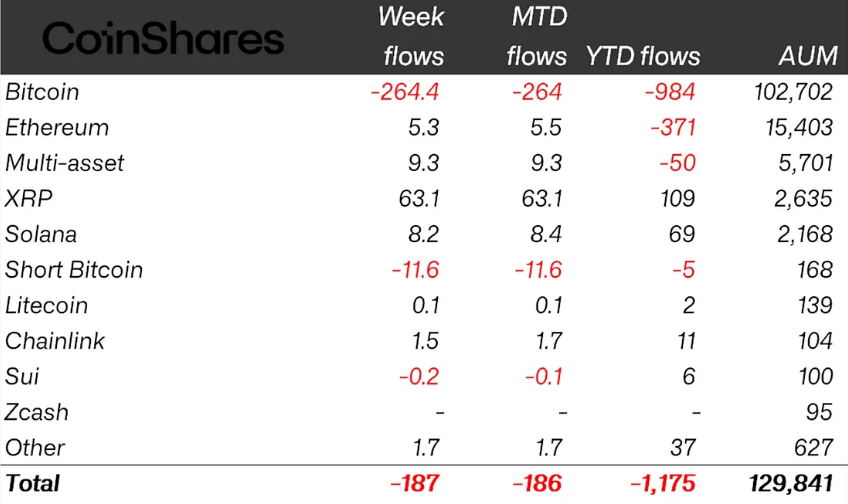

Crypto investment products logged a third straight week of outflows, though the pace of selling eased markedly as digital asset prices steadied after a sharp downturn.

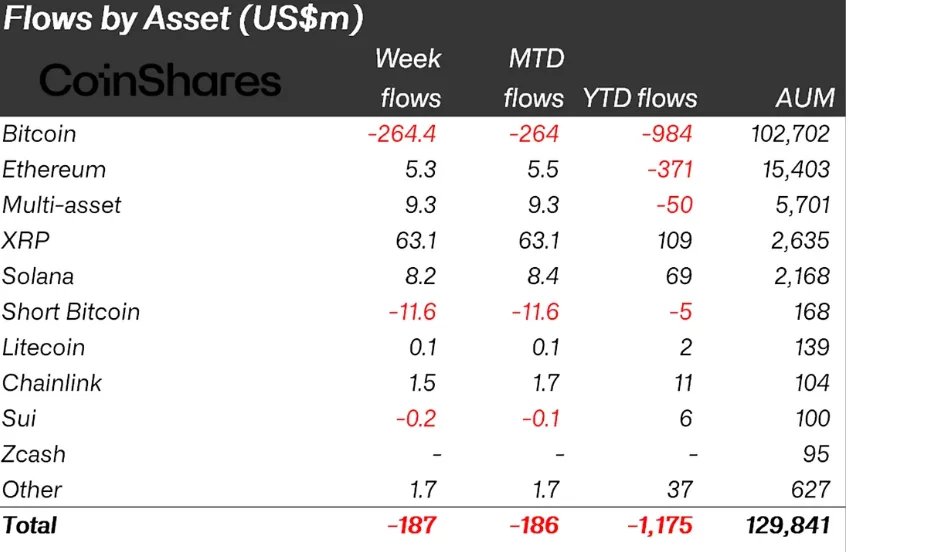

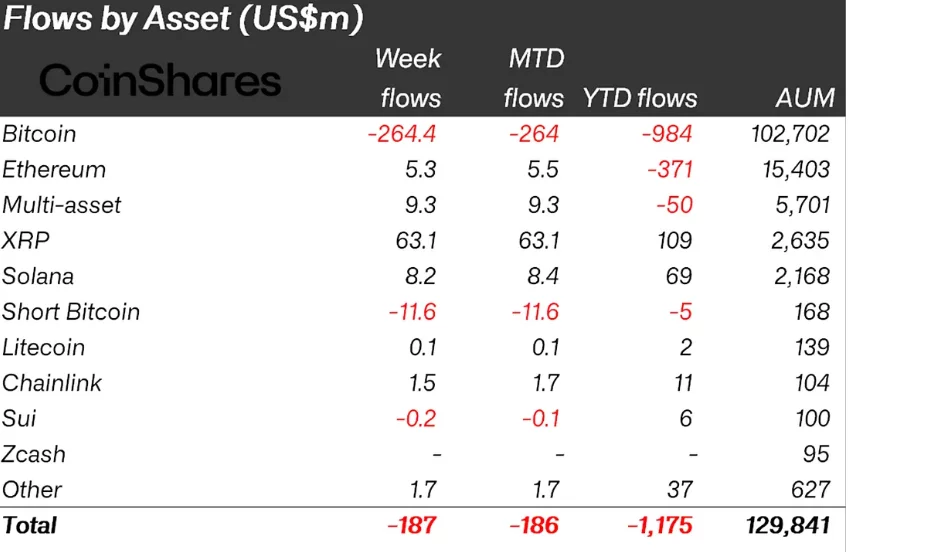

Crypto exchange-traded products (ETPs) recorded $187 million in outflows during the week, a sharp drop from the $3.43 billion seen over the previous two weeks, CoinShares reported on Monday.

The slowdown came as Bitcoin (BTC) fell to its lowest level since November 2024, with the price touching $60,000 on Coinbase last Thursday.

“While flows typically move in line with crypto prices, changes in the pace of outflows have historically been more informative, often signaling inflection points in investor sentiment,” said James Butterfill, CoinShares’ head of research.

Bitcoin ETPs only to post major losses, while XRP leads inflows

Bitcoin investment products were the only ETP group to suffer significant losses last week, with outflows totaling $264.4 million.

XRP (XRP) funds led inflows, attracting $63 million, while other altcoin ETPs, such as those tracking Ether (ETH) and Solana (SOL), posted modest gains of $5.3 million and $8.2 million, respectively.

Spot Bitcoin exchange-traded funds (ETFs) accounted for a large portion of Bitcoin ETP outflows last week, amounting to $318 million, according to SoSoValue data.

ETP volumes hit record $63 billion in weekly trading

Addressing last week’s slowdown in outflows, Butterfill suggested that a “potential market nadir may have been reached,” implying that a possible bottom could have formed for ETPs.

Despite the easing of outflows, last week marked a milestone in trading activity. According to Butterfill, ETP volumes reached a record $63.1 billion, surpassing the previous high of $56.4 billion set in October last year.

Related: BlackRock’s IBIT hits daily volume record of $10B amid Bitcoin crash

Assets under management (AUM) in Bitcoin ETPs stood at $102.7 billion by the end of the week, while ETF AUM fell below $90 billion.

Meanwhile, global crypto ETP AUM declined to $129 billion, the lowest level since March 2025, Butterfill noted.

Following three consecutive weeks of outflows, crypto ETPs have lost a total of $1.2 billion year-to-date, compared with $1.9 billion of outflows in Bitcoin ETFs.

In other industry news, major crypto fund issuer 21Shares filed last week with the US Securities and Exchange Commission for an ETF tracking Ondo (ONDO).

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

How Real Is the Threat?

Concerns that quantum computing could one day break Bitcoin’s cryptography have resurfaced. Yet, a new report by CoinShares argues that the quantum risks remain distant, with only a fraction of Bitcoin’s supply potentially vulnerable.

The report frames quantum computing as a long-term engineering challenge. It argues that Bitcoin has ample time to adapt well before quantum machines reach a cryptographically relevant scale.

Sponsored

The Quantum Threat Assessment For Bitcoin

In the report titled “Quantum Vulnerability in Bitcoin: A Manageable Risk,” CoinShares’ Bitcoin Research Lead Christopher Bendiksen explained that Bitcoin relies on elliptic-curve cryptography to secure transactions.

In theory, a sufficiently powerful quantum computer could use Shor’s algorithm to derive private keys from public keys. This could enable unauthorized spending.

However, Bendiksen noted that such an attack would require quantum machines with millions of stable, error-corrected qubits. This is far beyond today’s capabilities.

“Breaking secp256k1 within a practical amount of time (<1 year) needs 10-100,000 times the current number of logical qubits; relevant quantum tech at least 10 years off. Long-term attacks can take place over years—could become feasible within a decade; short-term (mempool attacks) need <10-min computations—infeasible in anything but the very long term (decades),” the report read.

The report also examined the scope of Bitcoin’s real exposure. According to Bendiksen, only about 1.6 million BTC, roughly 8% of the total supply, resides in legacy Pay-to-Public-Key (P2PK) addresses where public keys are already exposed. However, the true practical risk is significantly smaller.

Of that amount, the report estimated that only around 10,200 BTC could plausibly be targeted in a way that would have an impact. This represents less than 0.1% of Bitcoin’s total supply.

Sponsored

“The remaining ~1.6 million all sit in 32,607 individual, ~50 btc UTXOs, that would take millennia to unlock even in the most outlandishly optimistic scenarios of technological progression in quantum computing,” Bendiksen stated.

The remaining vulnerable coins are dispersed across tens of thousands of addresses. This distribution would make large-scale exploitation slow and operationally impractical even for advanced quantum systems, according to the analysis.

This limited exposure exists because of modern address types. Pay-to-Public-Key-Hash (P2PKH) and Pay-to-Script-Hash (P2SH) do not reveal public keys until coins are spent, sharply reducing the attack surface.

While post-quantum cryptographic proposals exist, Bendiksen cautioned against premature or forced changes. He warned they could introduce new risks, weaken decentralization, or rely on cryptographic schemes that have not yet been sufficiently tested in adversarial environments.

Sponsored

“For the perceivable future, market implications appear limited,” Bendiksen added. “The greater concern is preserving Bitcoin’s immutability and neutrality, which could be jeopardised by premature protocol changes.”

Meanwhile, this outlook aligns with views previously expressed by other industry figures, including Casa co-founder Jameson Lopp and Cardano founder Charles Hoskinson. Both of whom have argued that quantum computing poses no near-term threat to Bitcoin’s cryptography.

Quantum Risk No Longer Ignored as Investors and Developers Prepare

That said, not all market participants share this view. Some institutional investors are increasingly factoring quantum computing risk into their Bitcoin exposure rather than dismissing it as a distant concern.

BeInCrypto reported that strategist Christopher Wood reduced a 10% Bitcoin allocation from Jefferies’ model portfolio, reallocating capital toward gold and mining equities. This move came amid concerns that future advances in quantum computing could threaten Bitcoin’s security.

Sponsored

At the same time, several blockchain projects are already taking proactive steps. Coinbase, Ethereum, and Optimism have publicly outlined efforts to prepare for a post-quantum future.

Charles Edwards of Capriole Investments has also suggested that Bitcoin’s price may need to decline further before the network attracts sufficient attention to the issue of quantum security. He framed market pressure as a potential catalyst for broader technical discussion.

“$50K not that far away now. I was serious when I said last year that price would need to go lower to incentivize proper attention to Bitcoin quantum security. This is the first promising progress we have seen to date,” he said.

Edwards added that substantial work still lies ahead, warning that Bitcoin’s quantum preparedness efforts would need to accelerate in 2026.

Crypto World

South Korea Prepares to Probe Crypto Markets Under 2026 Policy Plan

South Korea’s Financial Supervisory Service is sharpening its focus on suspected crypto price manipulation, outlining a 2026 program of investigations into high-risk trading tactics. The plan contemplates a slate of probes targeting “whale”-driven swings, artificial moves that accompany exchange deposit or withdrawal suspensions, and schemes that exploit APIs and social channels to spread misinformation. Officials say automation will underpin the crackdown, using real-time anomaly detection and text-analysis tools to flag manipulation clusters and linked accounts. The initiative follows a wave of regulatory signals as Seoul readies the Digital Asset Basic Act’s second phase, signaling a shift from reactive guidance to structured oversight in a rapidly evolving market.

Key takeaways

- The FSS will pursue targeted probes into high-risk trading practices, including whale activity, with investigations slated for 2026.

- Planned inquiries will examine gating-like disruptions during exchange suspensions and coordinated trading via APIs and social media, aiming to curb market disruption.

- Automated detection will be enhanced by analyzing ultra-short-interval price movements and by flagging manipulation “sections” and related account groups, complemented by text analytics to spot coordinated misinformation.

- A dedicated task force will help implement the Digital Asset Basic Act’s second phase, focusing on disclosures, exchange oversight, and licensing standards.

- Operational incidents at domestic exchanges, including a high-profile promotional Bitcoin error, have intensified regulatory urgency and oversight actions.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The move reflects a broader push toward data-driven crypto market supervision, aligning with global trends that seek to balance investor protection with market efficiency as liquidity, risk sentiment, and regulation evolve.

Why it matters

The regulatory emphasis in South Korea matters for traders, exchanges, and investors who operate within or rely on the domestic crypto ecosystem. By centering investigations on whale-driven volatility, exchange suspensions, and API-driven manipulation, authorities aim to reduce episodes where price discovery is distorted by rapid, coordinated actions. Automated tooling for anomaly detection, combined with natural-language processing to identify misinformation, represents a shift toward scalable enforcement capable of keeping pace with fast-moving, cross-border trading strategies.

For exchange operators, the plan signals that governance and transparency will be non-negotiable prerequisites for continued growth and licensing legitimacy. The emphasis on disclosures, licensing standards, and robust internal controls could lead to tighter compliance frameworks, more rigorous surveillance programs, and clearer rules for handling market stress events. In turn, investors may benefit from improved visibility into risk controls and a more predictable regulatory environment as market participants seek to navigate this evolving landscape with greater confidence.

On a broader level, the Korean approach mirrors a regional and global trend toward harmonizing supervision as digital assets become more integrated into mainstream finance. Regulators are converging on models that combine automated market surveillance, on-chain analytics, and cross-agency cooperation to monitor both price behavior and the narratives that influence investor behavior. The outcome could influence liquidity dynamics and risk appetite across Asian markets, while also shaping how international firms design compliant product offerings and reporting frameworks for the Korean market.

What to watch next

- The Digital Asset Basic Act Phase 2 timeline, including expected disclosures and licensing guidelines for exchanges.

- Results and implications from the emergency regulator review following the Bithumb incident, with potential updates to internal-control requirements across platforms.

- Rollout and public guidance on automated detection tools, gating-related risk controls, and governance measures for API-based trading.

- Further regulatory updates around AI surveillance deployments and how they intersect with enforcement workflows.

- Any formal investigations arising from notable price movements on domestic platforms, including cross-referenced incidents and regulator cooperation with exchanges.

Sources & verification

- Yonhap News Agency report detailing FSS Governor Lee Chang-jin’s remarks and the plan to target high-risk trading practices in 2026.

- February 2, FSS expansion of AI-powered surveillance tools in crypto markets.

- Asia Business Daily report on FSC, FSS, and KoFIU emergency inspection meeting following the Bithumb incident.

- February 3, FSS review of sharp price movements in the ZKsync token during a system maintenance window on Upbit.

- Upbit operator Dunamu’s statements about internal surveillance and regulator cooperation.

Ramping up oversight: Korea’s FSS targets manipulation as AI surveillance expands

In a move that aligns with a wider global push to cement market integrity in digital assets, South Korea’s Financial Supervisory Service is unveiling an expansive plan to scrutinize pricing dynamics in crypto markets. The plan contemplates a 2026 slate of investigations into high-risk trading practices and market manipulation, with a particular emphasis on practices that distort price discovery. The scope includes large-volume moves driven by whales, as well as schemes that exploit exchange hostilities, deposit and withdrawal suspensions, and rapid-fire trading across APIs. As regulators position themselves, the emphasis is on both detection and deterrence. Bitcoin (CRYPTO: BTC) and other assets have been a focus as these dynamic conditions unfold, according to a report from Yonhap News Agency.

One of the more persistent vulnerabilities highlighted by the FSS is the so-called gating phenomenon — periods when an exchange halts deposits or withdrawals to manage risk or liquidity. Such pauses can effectively lock up supply on a platform, triggering price dislocations that do not reflect broad market sentiment. By design, gating can amplify price moves and create an artificial sense of scarcity or demand. Regulators intend to deter this practice by exposing relationships between trading bursts and system interruptions, and by mapping how such disruptions ripple across the broader crypto ecosystem.

The FSS’s surveillance playbook expands beyond mere price tracking. expanded its use of artificial intelligence-powered surveillance to monitor crypto markets, reducing the reliance on manual screening and allowing for faster pattern recognition across vast datasets. The agency says it will build tools capable of flagging manipulation “sections” — clusters of suspicious trading activity tied to specific accounts or wallets — and perform text analytics to detect coordinated misinformation campaigns that could influence investor behavior. In effect, regulators seek to fuse traditional market surveillance with on-chain analytics and natural-language processing to catch both the economic and narrative drivers of manipulation.

From a regulatory design perspective, Seoul is accelerating work on the Digital Asset Basic Act — the framework guiding how exchanges operate, how assets are classed and supervised, and how license regimes are structured. A dedicated task force has been formed to handle Phase 2 of the act, focusing on disclosure requirements, exchange oversight, and licensing standards. The aim is to create a predictable, transparent regime that can scale as market activity grows and products diversify, reducing compliance ambiguity for operators and reducing the chances of protracted enforcement disputes.

The regulatory intensification sits against a backdrop of recent operational incidents that have elevated risk awareness inside the domestic market. Bithumb disclosed that it recovered 99.7% of excess Bitcoin credited during a promotional error, an event that briefly churned prices and prompted compensation for affected users. The episode prompted regulators to convene for an emergency inspection meeting involving the Financial Services Commission, the FSS, and the Korea Financial Intelligence Unit, a meeting that Asia Business Daily described as ordering a comprehensive review of internal controls across exchanges. The episode underscored how technology-based vulnerabilities can translate into real-world customer risk and regulatory scrutiny.

Separately, the FSS said on Feb. 3 that it was reviewing sharp price movements in the ZKsync token during a system maintenance window on Upbit, signaling a willingness to escalate to formal probes if warranted. Upbit’s operator Dunamu has previously asserted that it operates internal systems to flag suspicious activity and that it can cooperate fully with regulators to provide trading data upon request. The FSS’s evolving stance suggests that market-makers, liquidity providers, and platform operators should anticipate closer watch over both their trading data and their information channels, including how they communicate with users during turbulent periods.

In sum, the current trajectory signals a maturation of South Korea’s crypto regulatory regime. The combination of automated surveillance, a formalized act, and high-profile incident responses indicates a shift from reactive guidance to proactive risk management. While the specifics of enforcement remain to be seen, the direction is clear: if the market is to expand in a compliant fashion, exchanges and participants will need to demonstrate robust governance, robust disclosure, and a willingness to collaborate transparently with the authorities.

Crypto World

Bitcoin’s (BTC) Sideways Phase Is a Trap Before a Deeper Crash (Analyst)

Bitcoin could revisit $87,000 during consolidation, but only as a chance to add shorts, and not confirmation of a trend.

Bitcoin (BTC) staged a modest recovery of almost 2% on Monday’s Asian trading hours after briefly dipping below $70,000 during the weekend. But prominent market commentators believe that the carnage is not yet over.

Doctor Profit, for one, believes that the asset is entering an extended sideways phase that is not a bullish consolidation but is a preparation for a deeper decline in the months ahead.

Sideways, Then Down

According to the analyst’s findings, Bitcoin is forming a new trading “box” between roughly $57,000 and $87,000, which represents a wide 33% range. He expects the price action to remain largely range-bound within these levels for weeks or even months.

Doctor Profit stated that this sideways behavior should not be interpreted as strength, but instead as a structural phase that typically precedes a breakdown in a broader bear market. Drawing a parallel to 2024, the analyst said BTC spent an entire year consolidating between $58,000 and $74,000 before breaking out above $100,000, and he repeatedly warned at the time that this range would later serve as a reference level during the next bear market.

That scenario is now playing out: Bitcoin is once again trading in the same price zone, but this time in a bearish context, where former consolidation areas act as structure rather than durable support. He expects that once the current sideways phase is complete, the crypto asset will break down below the box and end up targeting the $44,000-$50,000 region in the coming weeks or months.

Doctor Profit said that he is buying spot Bitcoin between $57,000 and $60,000, which he considers the local bottom of the current range, but not the final macro bottom of the bear market. He added that this area is likely to be tested multiple times during the sideways phase, which makes it suitable for range trades, while upside during this period could extend as high as $87,000, depending on market strength.

However, the analyst made it clear that $87,000 is not a guaranteed target and merely represents the upper boundary of what he expects during the consolidation. If price does approach that level, he said he would consider adding to existing short positions opened between $115,000 and $125,000, which he continues to hold in full.

You may also like:

Meanwhile, there is no immediate major downside while the market remains range-bound, as per Doctor Profit’s analysis. He described the coming period as “long and boring” while adding that the most aggressive long-term buying will only occur much lower, between the low $50,000s and the low $40,000s, where he believes Bitcoin will ultimately bottom, potentially around September or October.

“We are in a bear market. The bounces are temporary and exist to build liquidity for further downside.”

No Relief for BTC Bulls

Another pseudonymous analyst, Filbfilb, posted a Bitcoin chart on X wherein he compared the current market setup with the 2022 bear market, offering little encouragement for bulls.

His findings reveal that BTC is trading below the 50-week exponential moving average near $95,300, a level, according to the analyst, that is an important trend marker. Filbfilb suggested that losing this level leaves the crypto asset vulnerable, as recent price action resembles bear-market conditions rather than a recovery.

Market commentator BitBull also shared a similar forecast, saying that BTC’s “final capitulation hasn’t happened yet,” and that “a real bottom will form below the $50,000 level, where most of the ETF buyers will be underwater.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why Critics of Hyperliquid and Its Rivals Keep Facing Backlash

An analysis by Coinglass comparing perpetual decentralized exchange (perp DEX) data has sparked fierce debate and, in the process, highlighted rifts within the crypto derivatives sector.

The study exposed marked discrepancies in trading volumes, open interest, and liquidations across Hyperliquid, Aster, and Lighter. Users are left asking what qualifies as genuine trading activity on these platforms.

Coinglass Data Sparks Debate Over Authentic Trading on Perpetual DEXs

Coinglass is facing backlash after publishing a comparison of perp DEXs, questioning whether reported trading volumes across parts of the sector reflect genuine market activity.

Sponsored

Sponsored

A 24-hour snapshot comparing Hyperliquid, Aster, and Lighter shows that:

- Hyperliquid recorded approximately $3.76 billion in trading volume, $4.05 billion in open interest, and $122.96 million in liquidations.

- Aster posted $2.76 billion in volume, $927 million in open interest, and $7.2 million in liquidations

- Lighter reported $1.81 billion in volume, $731 million in open interest, and $3.34 million in liquidations.

According to Coinglass, such discrepancies can matter. In perpetual futures markets, high trading volume driven by leveraged positions typically correlates with open-interest dynamics and liquidation activity during price moves.

The firm suggested that, rather than organic hedging demand, the combination of high reported volume and relatively low liquidations may indicate:

- Incentive-driven trading

- Market-maker looping, or

- Points farming.

Based on this, Coinglass concludes that Hyperliquid showed stronger internal consistency across key metrics.

Sponsored

Sponsored

Meanwhile, the volume quality of some competitors warrants further validation using indicators such as funding rates, fees, order-book depth, and active trader counts.

“Conclusion…Hyperliquid shows much stronger consistency between volume, OI, and liquidations — a better signal of real activity. Meanwhile, Aster/Lighter’s volume quality needs further validation (vs fees, funding, orderbook depth, and active traders),” the analytics platform indicated.

Critics Push Back, but Coinglass Defends Its Position

However, critics argue that conclusions drawn from a single-day snapshot could be misleading. Specifically, they suggest alternative explanations for the data, including whale positioning, algorithmic differences between platforms, and variations in market structure that could influence liquidation patterns without implying inflated volume.

Others questioned whether liquidation totals alone are a reliable indicator of market health, noting that higher liquidations can also reflect aggressive leverage or volatile trading conditions.

Meanwhile, Coinglass rejects accusations that its analysis amounted to speculation or fear, uncertainty, and doubt (FUD), emphasizing that its conclusions were based on publicly available data.

Sponsored

Sponsored

“Coinglass simply highlighted a few discrepancies based on publicly available data. We didn’t expect that a neutral, data-driven observation would trigger such hostile reactions,” the firm wrote, adding that open discussion and tolerance for criticism are essential for the industry to improve.

In another response, Coinglass stressed that disagreements should be addressed with stronger evidence rather than accusations.

The firm also argued that higher leverage ceilings on some platforms could make them structurally more prone to forced liquidations. This outlook shifts the debate away from raw numbers toward exchange design and risk management.

A Pattern of Backlash in the Perp DEX Sector: What Counts as “Real” Activity?

The controversy comes amid a broader wave of disputes surrounding Hyperliquid and the perpetual DEX market.

Earlier, Kyle Samani, co-founder of Multicoin Capital, publicly criticized Hyperliquid, raising concerns about transparency, governance, and its closed-source elements.

Sponsored

Sponsored

His remarks triggered strong reactions from traders and supporters of the platform, many of whom dismissed the criticism and questioned his motives.

BitMEX co-founder Arthur Hayes further escalated the feud by proposing a $100,000 charity bet, challenging Samani to select any major altcoin with a market cap above $1 billion to compete against Hyperliquid’s HYPE token in performance over several months.

The dispute highlights a deeper issue facing crypto derivatives markets: the lack of standardized metrics for evaluating activity across DEXes.

Trading volume has long served as a headline indicator of success. However, the rise of incentive programs, airdrop campaigns, and liquidity-mining strategies has complicated the interpretation of those figures.

As new perp DEX platforms launch and competition intensifies, metrics such as open interest, liquidation patterns, leverage levels, and order-book depth are becoming central to assessing market integrity.

This Coinglass incident mirrors how data itself has become a battleground amid a sector driven by both numbers and narratives. Therefore, the debate over what those numbers truly mean is likely to intensify as the perpetual futures market continues to grow.

Crypto World

South Korea Prepares Crypto Market Probes Under 2026 Policy Plan

South Korea’s Financial Supervisory Service (FSS) said it will step up scrutiny of suspected cryptocurrency price manipulation in 2026, outlining a slate of planned investigations that target high-risk trading tactics, including “whale” activity and schemes that exploit disruptions at local exchanges, local outlet Yonhap reported Monday.

According to Yonhap News Agency, FSS Governor Lee Chang-jin said that the agency will target high-risk trading practices that undermine market order, including coordinated manipulation and schemes exploiting disruptions in exchange infrastructure.

The FSS said the probes will focus on tactics that involve large-scale trading by whales, artificial price swings during exchange deposit or withdrawal suspensions and coordinated trading mechanisms using APIs or social media to spread false information.

Under the plan, the regulator said it intends to strengthen automated detection by analyzing abnormal price movements at very short intervals and developing tools that can flag suspected manipulation “sections” and related account groups, alongside text analysis that can help identify coordinated misinformation.

Planned probes target crypto manipulation tactics

The FSS said it will investigate practices that distort price discovery, including schemes that take advantage of exchange deposit or withdrawal suspensions, a practice referred to in South Korea as “gating.”

These situations can trap supply on a platform, creating artificial movements disconnected from the broader digital asset markets.

The financial watchdog also mentioned that it will track manipulation using market-order APIs and coordinated activity aimed at amplifying false narratives on social media.

On Feb. 2, the FSS expanded its use of artificial intelligence-powered surveillance tools to monitor crypto markets, reducing reliance on manual identification of potential manipulation.

In parallel, the watchdog established a task force to prepare for the introduction of the Digital Asset Basic Act, the second phase of the country’s crypto regulatory framework.

The unit will support the implementation planning rather than enforcement, including work on disclosures, exchange oversight and licensing standards.

Related: South Korea tightens crypto licensing rules for exchanges and shareholders

Exchange incidents add urgency to oversight push

The tougher tone arrives after a series of exchange-related incidents put operational risk back in the spotlight.

On Sunday, crypto exchange Bithumb said it recovered 99.7% of excess Bitcoin (BTC) mistakenly credited to users during a promotional error.

While the exchange said no customer assets were lost, the episode briefly triggered sharp price swings and prompted compensation measures for affected users.

The incident triggered a response from regulators. According to the Asia Business Daily, the Financial Services Commission (FSC) held an emergency inspection meeting on Sunday with the FSS and the Korea Financial Intelligence Unit (KoFIU), where officials reportedly ordered a comprehensive review of internal controls across all domestic crypto exchanges.

On Feb. 3, the FSS said it was reviewing sharp price movements in the ZKsync token during a system maintenance window on Upbit. The regulator said it was analyzing the data and could escalate the review into a formal investigation depending on the findings.

Upbit operator Dunamu previously told Cointelegraph that it has internal systems that also flag suspicious activities and a process that involves cooperating with regulators.

“When regulators request information, we can provide the relevant trading data without delay,” the spokesperson told Cointelegraph.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Crypto outflows cool as investors rotate from Bitcoin to altcoins

Digital asset investment products showed early signs of stabilisation last week as crypto outflows slowed sharply to $187 million, according to the latest CoinShares weekly report, despite continued pressure on crypto prices.

Summary

- Crypto fund outflows slowed sharply to $187 million, signaling a deceleration in selling pressure despite ongoing price weakness.

- Bitcoin led weekly outflows with $264 million, while several altcoins, including XRP, Solana, and Ethereum, attracted fresh inflows.

- Elevated trading volumes and selective regional inflows, particularly in Europe, point to early signs of market stabilisation.

While fund flows often move in tandem with price action, CoinShares noted that changes in the pace of flows have historically been more telling, frequently signalling potential inflection points in investor sentiment.

The recent deceleration suggests the market may be approaching a near-term bottom.

Bitcoin sees outflows as altcoins attract interest

At the asset level, Bitcoin (BTC) remained the main source of negative sentiment, with weekly outflows of $264.4 million, extending its year-to-date outflows to $984 million. Short Bitcoin products also recorded outflows of $11.6 million, suggesting reduced demand for bearish positioning.

In contrast, several altcoins attracted fresh inflows. XRP led the pack with $63.1 million in weekly inflows, bringing its year-to-date total to $109 million. This makes the Ripple token (XRP) the strongest-performing asset on a flows basis so far this year.

Solana (SOL) and Ethereum (ETH) also saw inflows of $8.2 million and $5.3 million, respectively, while multi-asset products added $9.3 million.

Flows remained geographically uneven. European markets showed pockets of strength, with inflows into Germany ($87.1 million) and Switzerland ($30.1 million), while Canada ($21.4 million) and Brazil ($16.7 million) also recorded gains.

CoinShares said the combination of slowing outflows, elevated trading volumes, and selective inflows into altcoins and European products points to a market that may be stabilising, even as price uncertainty persists.

Assets under management fall, trading activity surges

Total assets under management (AuM) across digital asset investment products declined to $129.8 billion, the lowest level since March 2025, following the latest market correction. That period also coincided with a local low in crypto prices.

Despite the drawdown in AuM, trading activity surged. ETP trading volumes hit a record $63.1 billion for the week, surpassing the previous high of $56.4 billion recorded in October, pointing to elevated investor engagement amid market volatility.

Crypto World

Tether’s gold stash tops $23 billion as buying outpaces nation states, Jefferies says

Tether, the crypto firm behind the world’s most popular stablecoin , continued its gold hoarding over the past month, ranking within the top 30 global owners of the metal and surpassing several sovereign nations, according to a Sunday report from Wall Street investment bank Jefferies.

The stablecoin issuer’s gold reserves rose to an estimated 148 tonnes by Jan. 31, valued at roughly $23 billion, after buying about 26 tonnes in the last quarter of 2025 and adding another 6 tonnes in January, Jefferies analysts said.

Jefferies estimates show Tether’s quarterly gold buying exceeded that of most individual central banks, trailing only Poland and Brazil during that period.

At current levels, Tether’s holdings exceed those of countries such as Australia, the United Arab Emirates, Qatar, South Korea and Greece, placing the crypto firm among the top 30 holders of bullion worldwide and one of the largest non-sovereign buyers, the analysts said.

The 148 tonnes of bullion is held as reserves backing both its U.S. dollar-pegged stablecoin USDT and its gold-backed token XAUT. But the company may hold more gold than disclosed, the report added.

Because Tether is privately held, the figures represent a minimum estimate of its total gold exposure, with undisclosed additional purchases likely made on the company’s balance sheet.

According to the USDT’s fourth quarter attestation, some $17 billion of gold was in the reserves, amounting to 126 tonnes as of year-end gold prices.

XAUT’s supply grew to 712,000 tokens worth $3.2 billion by the end of January, an increase of 6 tonnes of gold backing the tokens. CEO Paolo Ardoino told CoinDesk in an October interview that the gold-back enjoyed strong retail demand mainly from emerging markets.

The accumulation coincided with a record-breaking rally in gold, topping $5,000 per ounces last month and advancing nearly 50% since September. The driving forces behind the move is central bank demand, rising long-term government bond yields and efforts by some investors to reduce reliance on the U.S. dollar.

The company’s buying spree may continue, Jefferies noted. Tether CEO Paolo Ardoino said the company plans to allocate 10%-15% of its investment portfolio to physical gold, formalizing a strategy that has already played out over several years.

Tether’s investment portfolio was valued at $20 billion as of the end of last year, CoinDesk reported.

Read more: Tether is buying up to $1 billion of gold per month and storing it in a ‘James Bond’ bunker

Crypto World

Extreme Fear continues to paralyze crypto markets heading into Monday

Crypto market sentiment collapses as CoinMarketCap’s Fear and Greed Index crashes to 9, signaling deep anxiety despite Bitcoin and majors stabilizing.

Summary

- CoinMarketCap’s Crypto Fear and Greed Index has dropped to 9, near its yearly low of 5 on Feb. 6, marking sustained “Extreme Fear” across the market.

- The index blends price momentum, BTC/ETH volatility, options positioning, stablecoin supply, and social data to frame whether sentiment is overly fearful or greedy.

- Bitcoin, Ethereum, and Solana prices have stabilized off recent lows even as sentiment stays depressed, turning the index into a context tool rather than a direct trading signal.

Crypto’s mood has flipped to panic, and CoinMarketCap’s own gauge is flashing red to prove it. The platform’s CMC Crypto Fear and Greed Index currently sits at just 9, firmly in “Extreme Fear,” down from 15 a week ago and well below the “Neutral” reading of 41 seen last month. Yesterday’s score was 8, while the yearly low hit 5 on Feb. 6, underscoring how aggressively sentiment has reset despite a still‑elevated market cap backdrop.

CoinMarket Cap’s Fear and Greed Index lowers to -9

CoinMarketCap describes the tool as “a powerful tool that analyzes market sentiment to help you make informed crypto investment decisions,” framing it as the most “trusted measure of overall crypto market sentiment” and “the number one, most cited and most trusted index of its kind” among mainstream financial outlets. The index runs on a 0–100 scale, where a lower value indicates extreme fear and a higher value “extreme greed,” effectively quantifying what many traders only feel anecdotally in price action. As the launch note put it, “this innovative index provides a wide‑ranging and quantifiable assessment of fear and greed for the entire cryptocurrency industry.”

Methodologically, the indicator pulls from five pillars: price momentum across the top 10 non‑stablecoin assets, forward‑looking volatility via BVIV and EVIV for Bitcoin and Ethereum, options put/call ratios, market composition through the stablecoin supply ratio, and CMC’s own social‑trend and engagement data. The Academy explainer stresses that “extreme fear likely indicates undervalued asset prices, while extreme greed likely indicates frothy valuations and overvalued asset prices,” echoing Warren Buffett’s maxim to “be fearful when others are greedy and greedy when others are fearful.”

In spot markets, Bitcoin (BTC) trades near $70,505 with roughly $42.8b in 24‑hour volume. Ethereum (ETH) changes hands close to $2,096, on about $20.9b in turnover. Solana (SOL) is around $87.6, after a 24‑hour range between roughly $86.2 and $88.6. That pricing backdrop lines up with a broader rebound in digital assets, with Bitcoin recently reclaiming the $71,000 area after last week’s washout and total crypto market capitalization moving back above $2.4t.

For traders, the sub‑10 print is less a trading signal than a context marker. CoinMarketCap is explicit that the Fear and Greed Index “is not a perfect indicator in itself but can provide a useful measure of the market’s sentiment,” best used alongside technicals, flows and macro drivers. In other words: quantify the fear, then decide whether you’re trading with the herd or against it.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics16 hours ago

Politics16 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat10 hours ago

NewsBeat10 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business15 hours ago

Business15 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports5 hours ago

Sports5 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics18 hours ago

Politics18 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business23 hours ago

Business23 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report