Crypto World

“Compromise Is in the Air”: New Details from White House Stablecoin Talks

TLDR:

- Banks accepted limited exemption language on stablecoin rewards after previously rejecting all transaction-based incentives.

- Crypto firms want broad definitions of permissible activities, while banks seek tighter limits to protect deposit structures.

- The White House urged both sides to reach a stablecoin deal before March 1 to sustain legislative momentum.

- A smaller meeting size allowed more detailed policy language discussions than earlier White House sessions.

A smaller White House meeting brought banks and crypto firms closer on stablecoin policy but stopped short of agreement.

Participants described the discussion as more detailed and more focused than earlier sessions. Officials pressed both sides to resolve disputes over rewards and account activity rules. A March 1 deadline now shapes the next phase of negotiations.

White House Stablecoin Talks Focus on Rewards and Exemptions

The meeting centered on whether crypto companies can offer rewards tied to stablecoin transactions. Banks arrived with written principles outlining limits they would accept.

One key shift emerged around conditional exemptions. Banking groups signaled openness to limited carve-outs after earlier resistance to any transaction-based rewards.

Crypto firms pushed for broad definitions of what counts as permissible account activity. Banks argued that narrower language would better protect traditional deposit models.

According to reporting by Eleanor Terrett, both sides called the session productive despite failing to reach a final compromise. Deal terms received deeper technical discussion than in prior meetings.

Ripple’s chief legal officer Stuart Alderoty said the atmosphere suggested growing willingness to bridge gaps. He also pointed to continued bipartisan momentum for crypto market structure legislation.

The White House urged participants to settle core disagreements before March 1. Officials framed the deadline as necessary to keep legislative progress on track.

Banks and Crypto Narrow Differences on Stablecoin Policy Scope

This gathering included fewer participants than the first White House session. It was led by the executive director of the President’s Crypto Council, Patrick Witt.

Crypto attendees included representatives from Coinbase, Ripple, Paxos, Andreessen Horowitz, the Blockchain Association, and the Crypto Council for Innovation.

Major banks present were Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC Bank, and U.S. Bank. Trade groups such as the ABA and ICBA also joined.

Senate Banking Committee staff attended, signaling legislative interest in the outcome of the talks. Their presence added pressure for measurable progress.

Discussion focused on defining “permissible activities” for accounts offering stablecoin rewards. Crypto firms sought flexibility to innovate, while banks stressed financial stability concerns.

Sources in the room said the tone was more constructive than earlier meetings. Participants exchanged draft language rather than general objections.

No final resolution emerged by the end of the session. However, further discussions are expected in the coming days among the same parties.

The White House continues to position itself as a mediator between financial institutions and crypto companies. Officials want an agreement that can inform broader stablecoin and market structure rules.

Crypto World

IREN deepens AI push with 50,000 Nvidia GPU order; shares fall on at-the-market offering

IREN (IREN), a data center operator focused on AI cloud infrastructure, said it agreed to buy more than 50,000 specialized processing chips from Nvidia (NVDA), expanding its capacity by about 50%.

The B300 GPUs, or graphic processing units, will take the Sydney-based company’s total AI compute fleet to about 150,000 GPUs. A GPU is a specialized chip for performing large numbers of parallel computations, enabling the training and operation of artificial intelligence models at high speed.

The company also filed for a potential at-the-market share sale of up to $6 billion as part of its broader capital management strategy. The shares dropped 5% in pre-market trading on Thursday due to potential dilution.

The additional hardware is expected to be deployed in phases through the second half of 2026 across the company’s air-cooled data centers in Mackenzie, British Columbia, and Childress, Texas. Once fully deployed, the expanded fleet is projected to support more than $3.7 billion in annualized AI cloud revenue, positioning IREN among the larger AI cloud infrastructure providers globally.

IREN said it has secured about $9.3 billion in funding over the past eight months through customer prepayments, convertible notes, GPU leasing and financing arrangements, with roughly $3.5 billion in additional capital expenditures expected for the new GPU deployments in the second half of 2026.

Crypto World

Leading AI Claude Predicts the Price of XRP, Solana and Cardano by the end of 2026

War news may have investors on edge, but when fed a careful prompt, Claude AI reveals the medium-to-long-term outlook for crypto markets is only strengthening.

Investors appear to have largely priced in geopolitical risk earlier this year, following sharp selloffs sparked by former President Trump’s comments on potential U.S. military escalation tied to Greenland and Iran.

Against that backdrop, Claude is forecasting fresh all-time highs (ATHs) in 2026 for XRP, Solana and Cardano.

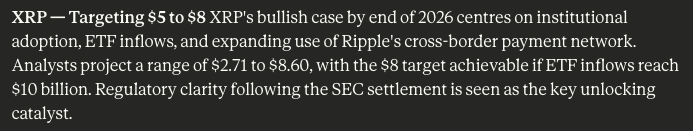

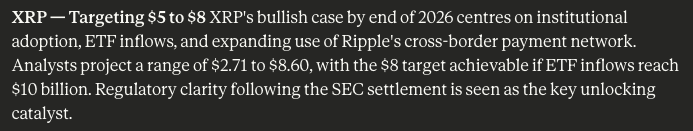

XRP ($XRP): Claude AI Sees a 6x Surge in 10 Months

In a recent statement, Ripple reiterated that XRP ($XRP) sits at the center of its strategy to position the XRP Ledger (XRPL) as a global, enterprise-grade payments network.

With near-instant settlement and extremely low transaction fees, XRPL is likely to gain an early lead in two of crypto’s fastest-expanding sectors: stablecoins and tokenized real-world assets.

XRP is currently trading around $1.40, and Claude’s projections point to a possible surge toward $8 before year-end, implying a sixfold increase from current levels.

Technical indicators support the optimistic outlook. XRP’s relative strength index (RSI) is sitting at a neautral 50, while prices have stabilized around the 30-day moving average, suggesting the prolonged consolidation phase may be over.

Additional upside drivers include growing institutional exposure following the launch of U.S.-listed XRP ETFs, Ripple’s expanding global partnerships, and the prospect of clearer regulation if the CLARITY bill advances through Congress later this year.

Solana (SOL): Could Solana Really Break Past Its Previous High This Year?

Solana ($SOL) currently secures $6.8 billion in total value locked and has a market capitalization of $52 billion.

Institutional interest accelerated after the recent rollout of Solana-based exchange-traded funds from major asset managers, including Bitwise and Grayscale.

Despite this, SOL pulled sharply back toward the end of 2025 and spent much of February trading below $100.

Under Claude’s most bullish scenario, Solana could rally from its current price near $91 to $500 by Christmas. That would represent a 5.5x gain and place Solana high above its current ATH of $293, reached in January 2025.

Strengthening the long-term case, asset managers like Franklin Templeton and BlackRock are deploying tokenized products on Solana, highlighting the network’s early lead as a scalable, institution ready blockchain.

Cardano (ADA): Claude AI Envisions Up to 1,000% Upside

Created by Charles Hoskinson, Cardano ($ADA) focuses on academic research, rigorous security standards, scalability, and long-term sustainability.

With a market value over $10 billion and more than $140 million in TVL, Cardano’s ecosystem continues to expanding in step with the industry leaders.

Claude’s outlook suggests ADA could rise by more than 1,-00%, climbing from roughly $0.28 today to nearly $3.25 by Christmas. That would surpass its previous peak of $3.09 set in 2021.

The biggest driver for Cardano’s growth would be comprehensive crypto legislation in the US. With regulatory certainty comes capital, which will allow the best altcoins to decouple from Bitcoin’s price movements.

Given the global uncertainty, further downside cannot be ruled out, including a potential drop toward $0.15 if bearish conditions intensify.

Maxi Doge: Early-Stage Meme Coin Targets Explosive Gains

Strength in XRP, Solana and Cardano will spill over into the meme coin sector, as historically seen during major bull cycles.

One emerging project attracting significant attention is Maxi Doge ($MAXI), which has already raised $4.7 million in its ongoing presale as meme coin traders speculate it could dethrone Dogecoin.

Maxi Doge brands itself as Dogecoin’s brash, gym-obsessed degen cousin, tapping into the viral, loud meme culture that defined the 2021 bull market.

Launched as an ERC-20 token on Ethereum’s proof-of-stake network, MAXI also has a smaller environmental footprint compared to Dogecoin’s proof-of-work design.

Early presale buyers can currently stake MAXI for yields of up to 67% APY, with rewards tapering as additional tokens enter the staking pool.

The token is $0.0002807 in the current presale round, with automatic price increases scheduled at each funding milestone.

Investors looking to secure tokens can visit the official website and connect a supported wallet such as Best Wallet.

Purchases can also be completed using a bank card.

Visit the Official Website Here

The post Leading AI Claude Predicts the Price of XRP, Solana and Cardano by the end of 2026 appeared first on Cryptonews.

Crypto World

Stablecoin Inflows Rebound as Yield Debate Stalls US Market Structure Bill

Weekly net stablecoin inflows rebounded last week as onchain activity picked up even while US lawmakers and banking groups sparred over whether stablecoin issuers should be allowed to pay yield, according to a new report from Messari.

Weekly net stablecoin inflows accelerated to $1.7 billion, a 414.5% increase week-on-week, according to the report published on Wednesday.

The recovery also flipped the 30-day average to a positive $162.5 million in daily inflows. Transaction volumes also rose 6.3%, while average transaction size continued to decline, reflecting renewed stablecoin issuance demand and “strengthened” onchain activity amid retail investors, the report said.

Stablecoin inflows track net new stablecoins entering circulation after accounting for redemptions.

The surge follows a weaker period earlier in the year. Messari data showed $249 million in weekly inflows two weeks earlier and $4.4 billion in net outflows over the 30 days leading up to Feb. 18.

Stablecoin yield debate stalls US market structure bill

The renewed demand comes as debate in Washington has sharpened over “yield-bearing” stablecoins. Banking groups have argued that allowing stablecoin issuers to pay yield would create a loophole that could pull deposits away from banks, and have urged lawmakers to restrict the practice as they negotiate a broader crypto market structure bill.

Related: Indiana lawmakers pass crypto rights bill banning discriminatory taxes

Initially scheduled for mid-January, the Senate Banking Committee’s markup of the bill was postponed indefinitely amid disputes over stablecoin yield.

On Tuesday, US President Donald Trump criticized banks for stalling the Senate’s bill.

“The Genius Act is being threatened and undermined by the Banks, and that is unacceptable — We are not going to allow it,” said Trump in a Tuesday post on the Truth Social platform.

Related: Tether invests in AI sleep tracking firm at a $1.5B valuation

The GENIUS Act, a federal framework for regulating stablecoin issuers, prohibits issuers from paying interest or yield solely for holding a payment stablecoin. Third-party platforms, however, can still offer rewards programs tied to stablecoin balances.

Separately, the Digital Asset Market Structure Clarity Act, known as the CLARITY Act, is designed to provide a broader regulatory framework for digital assets. The House passed the measure on July 17, 2025, and it has been under debate in the Senate.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Pi Network’s PI Steals the Show With Big Rally, Bitcoin Stopped at $74K: Market Watch

The PI token is the only double-digit price gainer from the top 100 alts today.

Bitcoin’s price resurgence over the past 24 hours has been quite impressive, as the asset surged to its highest levels in a month at $74,000, where it faced some resistance.

Most altcoins are well in the green today as well, with ETH reclaiming the $2,000 and $2,100 lines, while SOL is up to $90.

BTC Tapped $74K

It was just several days ago, on Saturday, when the primary cryptocurrency plummeted to $63,000 from $66,000 after the US and Israel joined forces to attack Iran. Although the Middle Eastern country responded immediately against numerous targets in the region and its Supreme Leader was killed, BTC didn’t continue to free fall – just the opposite, it rebounded to $68,000 on that same day.

More volatility ensued in the following couple of days, with BTC slipping to $65,200 when it surged by 5% in an hour to $70,000. It was rejected there at first, as it happened during the previous week’s attempt, but the bulls were not to be denied this time.

After they regrouped on Monday and Tuesday, they initiated a substantial leg up yesterday, driving bitcoin to its highest level since early February at $74,000. This meant that the cryptocurrency had added $11,000 since its Saturday low after the attacks began.

Although it was stopped there and now trades around $72,000, it’s still 3% up on the day. Its market cap has surged to almost $1.450 trillion on CG, while its dominance over the alts stands tall at 57.4%.

ETH Above $2.1K, PI on a Roll

Ethereum surged from under $2,000 to $2,200, where it was stopped, but still trades above $2,100 now after a 4% daily increase. SOL is back to $90, while DOGE has risen by 5% to $0.095. XRP, BNB, TRX, ADA, and LINK are also slightly in the green, while XMR is up by almost 5% to $362.

Pi Network’s native token has stolen the show once again. Perhaps driven by the overall market revival and some crucial updates to the network behind it, the PI token has surged by 13% daily and now sits above $0.195. SKY, JUP, and DCR follow suit in terms of daily gains.

The total crypto market cap has added another $60 billion in a day and now sits above $2.5 trillion on CG.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

EUR/USD and GBP/USD at Key Levels Ahead of the Nonfarm Payrolls Release

European currencies, particularly the pound and the euro, posted a sharp decline at the start of the week before shifting into a corrective rebound. However, the current move appears largely technical in nature, with the market maintaining a cautious stance ahead of the key US labour market report — Nonfarm Payrolls — due for release tomorrow.

Additional pressure on European currencies stems from the strengthening US dollar amid rising geopolitical tensions in the Middle East. The escalation of the conflict between the United States, Israel and Iran has triggered a sharp increase in energy prices. Natural gas prices in Europe have surged on concerns over potential supply disruptions, as the widening conflict has affected the Strait of Hormuz — one of the key arteries for global liquefied natural gas supplies.

Rising energy costs are increasing inflationary risks for the European economy, which has only just begun recovering from the previous energy crisis. According to analysts’ estimates, if current energy price levels persist, inflation in the euro area could rise by around 0.5 percentage points. This reinforces expectations that European central banks may keep interest rates elevated for longer, while simultaneously heightening the risk of a slowdown in economic activity.

EUR/USD

Following its decline at the beginning of the week, EUR/USD found support at 1.1530 and managed to recover above 1.1600. On the daily timeframe, a bullish harami pattern has formed, though it remains unconfirmed. If the pair fails to consolidate above 1.1650 in the coming sessions, a renewed test of recent lows in the 1.1530–1.1570 range cannot be ruled out.

Key events for EUR/USD:

- Today at 12:00 (GMT+2): Speech by Bundesbank President Joachim Nagel;

- Today at 15:30 (GMT+2): US initial jobless claims;

- Today at 15:30 (GMT+2): US non-farm productivity data.

GBP/USD

At the start of the current trading week, GBP/USD fell below 1.3300. A sharp rebound from 1.3250 led to the formation of a bullish reversal candlestick pattern; however, without a firm break above 1.3400, it is premature to expect a sustained upward correction. Should buyers fail to hold support at 1.3300, the pair may revisit the recent low at 1.3250.

Key events for GBP/USD:

- Today at 11:30 (GMT+2): UK Construction PMI;

- Tomorrow at 09:00 (GMT+2): UK Halifax House Price Index;

- Tomorrow at 15:30 (GMT+2): US Nonfarm Payrolls.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

BTC/USD Analysis: Bitcoin Price Consolidates Above $70,000

On 20 February, in the note “BTC/USD Analysis: Are the Bulls Stirring?”, we outlined a broad descending channel and highlighted early signs of increasing demand near the $65,600 level.

Subsequent price action provided further grounds to suggest that, following the dramatic decline in Bitcoin’s price from its all-time high in October 2025 to the February low around $60,000, market sentiment has begun to shift. This was reflected in the fact that two attempts by the bears to resume the downward movement (as indicated by the arrows) were unsuccessful.

It is possible that the easing of bearish pressure gave bulls greater confidence at the beginning of March, resulting in notable progress. Yesterday, Bitcoin reached its highest level in a month.

Technical Analysis of the BTC/USD Chart

As shown on the chart, the bullish impulse at the start of March led to a breakout above the QL resistance line, as well as the psychological $70,000 level.

From a bearish perspective:

→ classic indicators added to the chart are showing signs of overbought conditions;

→ the median line (M) of the previously constructed channel may act as significant resistance.

From a bullish perspective:

→ rising trading volumes (highlighted by the arrow) represent a positive signal;

→ a sequence of higher highs and higher lows allows for the construction of a local ascending channel (shown in blue);

→ Bitcoin’s price behaviour following the early February panic resembles an Accumulation phase in Wyckoff methodology. If so, the early March rally may represent a Jump Over The Creek (JOC) pattern, signalling a potential transition into the Mark-Up phase.

Considering the above, it is reasonable to expect the formation of a pullback on the Bitcoin chart — for example, a move towards testing the support zone around the psychological $70,000 level.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

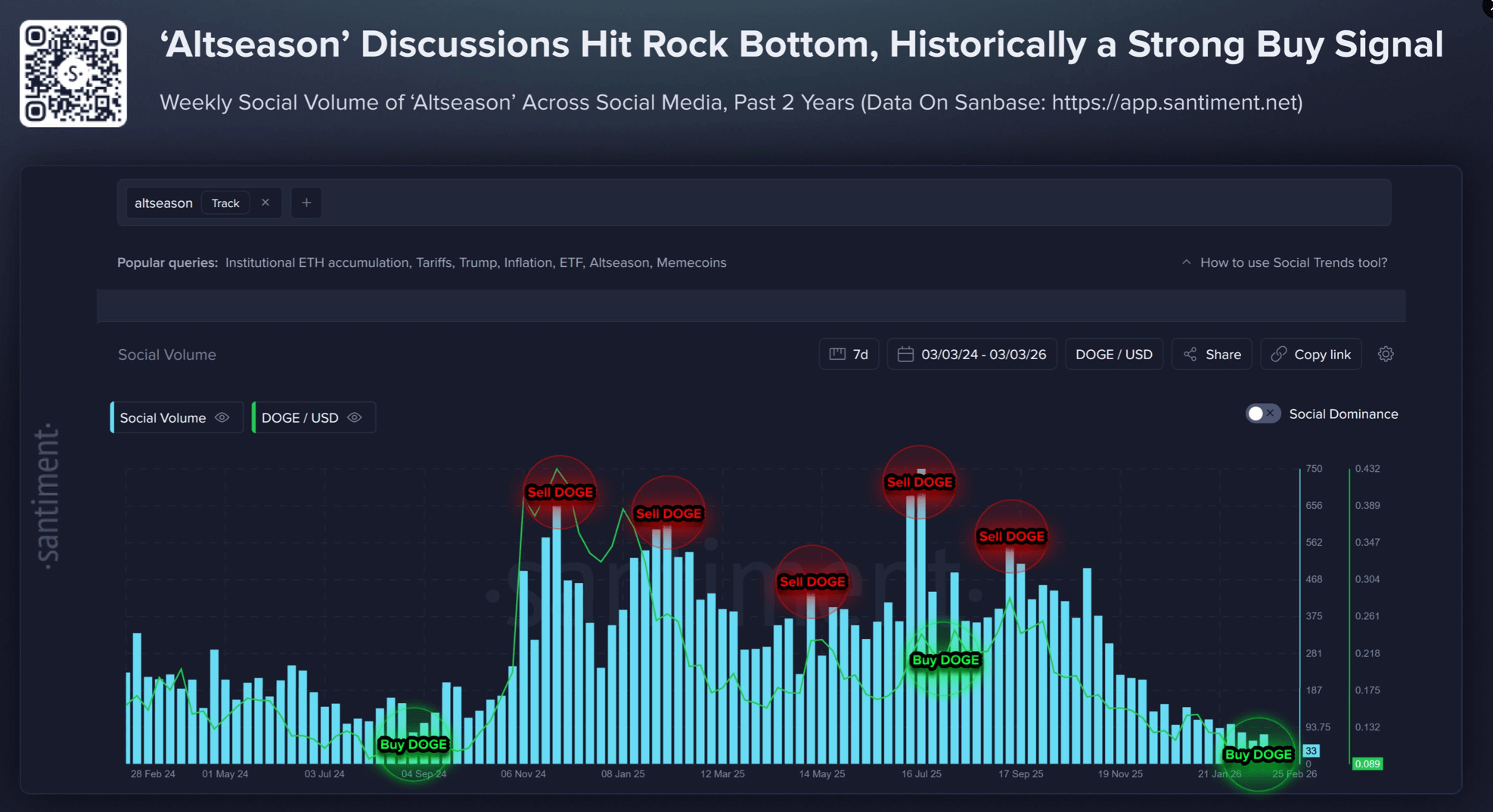

Altcoin Social Media Interest Hits 12-Month Low: Santiment

Mentions of altcoins on social media have reached their lowest level in two years, according to crypto sentiment platform Santiment, while indicators suggest that investors are focusing on Bitcoin.

Data from Santiment shows that for the week ended Feb. 27, altcoin social dominance scored 33, a sharp drop from its score of 750 in July 2025, around the time Dogecoin (DOGE) rallied 59% over 30 days.

Google worldwide search data shows a similar pattern. The term “altcoins” scored 4 out of 100 near the end of February, compared with a score of 100 during mid-August, according to Google Trends.

Santiment sees the lack of interest as a bullish signal

Santiment said the lack of interest in altcoins is a bullish signal. “Historically, however, moments like these, when social volume toward altcoin interest is at extreme lows, are around the time that rallies begin,” Santiment said in an X post on Thursday.

Other indicators also suggest that the market’s focus has been shifting from altcoins. CoinMarketCap’s Altcoin Season Index reads a “Bitcoin Season” score of 34 out of 100.

The index flips between “Altcoin Season” and “Bitcoin Season” scores based on the performance of the top 100 altcoins relative to Bitcoin over the past 90 days.

The total crypto market capitalization has fallen almost 43% since October, now sitting at $2.45 trillion.

Bitcoin jumps more than 7% in the past 24 hours

However, the crypto market has rallied over the past day, after US President Donald Trump said “the US needs to get the Market Structure done, ASAP.”

Related: Bitwise has now donated over $380K to open-source Bitcoin devs

The price of Bitcoin (BTC) surged 7.51% over the past 24 hours, with compressed volatility, strengthening ETF flows and a diminished Coinbase discount cited as catalysts for the price rise.

MN Trading Capital founder Michaël van de Poppe said that altcoins could start to take the lead once Bitcoin’s rally begins to slow.

“Great rotation, and I would assume that we’ll see altcoins take more momentum the moment Bitcoin stalls,” van de Poppe said in an X post on Thursday.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

What a Fed Master Account Could Mean for Ripple and XRP

Kraken’s latest regulatory milestone has fueled speculation across the crypto community about whether Ripple could be next in line.

While there is no official confirmation, the prospect of gaining access to the Federal Reserve’s core payment infrastructure would carry significant implications for Ripple.

Kraken’s Fed Access Draws Attention to Ripple

Yesterday, BeInCrypto reported that Kraken’s Wyoming-chartered banking arm secured access to the Federal Reserve’s core payment systems. Notably, Kraken is the first crypto firm to gain a Federal Reserve master account.

The latest milestone comes after the firm secured a Special Purpose Depository Institution (SPDI) charter from the state of Wyoming in September 2020. The following month, Kraken applied for a master account with the Federal Reserve Bank of Kansas City, which was approved yesterday.

Following the news, attention has begun to shift toward Ripple. In a recent post on X, journalist and social media personality Paul Barron argued that Ripple may be next in line for similar access. Other analysts have echoed this view.

In July 2025, the company applied for a national trust bank charter and a Federal Reserve master account. In December, BeInCrypto reported that Ripple had received conditional approval from the Office of the Comptroller of the Currency (OCC) for the charter.

Barron noted the bank charter was “the setup.” He added that direct Fed access would be the “final piece” for RLUSD to settle at full banking scale.

“The ‘CLARITY Act’ momentum is forcing the Fed’s hand. See what’s happening from DC Insiders right now – the tide is shifting. The ‘Crypto vs. Banks’ battle is over. But the war is just beginning,” he said.

Follow us on X to get the latest news as it happens

Another analyst from X Finance Bull also remarked that while the timelines may differ, the destination remains the same.

“Kraken already integrated Ripple’s RLUSD stablecoin for their payment platform. That’s not a coincidence. That’s infrastructure connecting. But why did Kraken get it first and not Ripple? Simple. Kraken applied years ago. Wyoming bank charter in 2020. Routing number in 2022. Been in line at the Fed since then. Ripple filed for the same Fed access in July 2025 through Standard Custody. National trust bank got OCC approval in December,” X Finance Bull added.

If Ripple Gains a Fed Master Account, What Could It Mean for XRP?

It is important to note that Ripple has not yet received full approval from the OCC. Additionally, Kraken’s success does not necessarily indicate that the Federal Reserve will make a similar decision regarding Ripple.

Even if the application is approved, the process could extend over several years, similar to Kraken’s lengthy timeline. Still, if Ripple were granted approval, this would place it within the core US banking settlement system.

For XRP, the development could incrementally strengthen its role as a bridge asset within Ripple’s payments network, though the extent of any real-world impact remains uncertain.

Ripple’s infrastructure uses the XRP Ledger to facilitate cross-border transactions, where XRP serves as a short-term intermediary between two fiat currencies.

Subscribe to our YouTube channel to watch leaders and journalists provide expert insights

A Fed master account would improve the fiat settlement side of that equation, allowing Ripple to move dollars faster, which could make the overall payment corridor more attractive to institutional clients.

However, it’s worth noting that the Fed’s payment rails and the XRP Ledger operate as separate systems. XRP itself would not flow through FedWire or FedNow. Thus, any efficiency gains would be indirect, improving the fiat on-ramps and off-ramps around XRP rather than upgrading the asset itself. Whether this translates into meaningfully greater XRP utility depends on factors beyond the master account alone.

The master account, if approved, would be a notable achievement for Ripple as a company. Its effect on XRP specifically could be real but secondary.

Crypto World

US Bitcoin ETFs Post $462 Million Inflows as BTC Tops $73K

US spot Bitcoin exchange-traded funds increased inflows on Wednesday, with gains distributed across most issuers, as BTC briefly surged past $73,000.

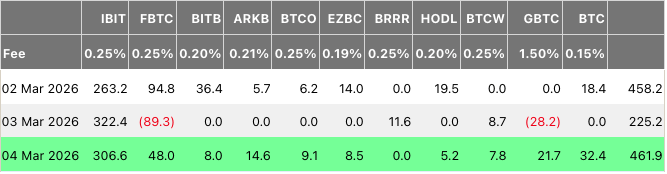

Spot Bitcoin (BTC) ETFs posted $462 million in net inflows, marking the third consecutive day of inflows and bringing the weekly total to $1.1 billion, according to Farside data.

The new gains bring year-to-date flows to about $700 million, a modest amount after the ETFs shed $3.8 billion during a five-week outflow streak.

Ether (ETH) funds shared the sentiment, drawing $169 million in inflows after seeing minor outflows of $11 million on Tuesday.

The flows highlight a potential market reversal, with analysts observing that most Bitcoin ETFs have now turned to net positive flows YTD.

All but one spot Bitcoin fund see gains

Wednesday marked a rare occasion when nearly all US spot Bitcoin funds attracted inflows, with only the CoinShares Bitcoin ETF (BRRR) recording zero inflows on the day.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) again led inflows with $307 million, followed by the Fidelity Wise Origin Bitcoin Fund (FBTC) and the Grayscale Bitcoin Mini Trust ETF (BTC) with $48 million and $32 million, respectively.

According to Bloomberg ETF analyst Eric Balchunas, almost all Bitcoin ETFs had turned net positive in year-to-date flows as of Tuesday, with only three funds still showing losses.

Those include FBTC with $1.1 billion in outflows, as well as the Grayscale Bitcoin Trust ETF (GBTC) and the ARK 21Shares Bitcoin ETF (ARKB), which have seen $648 million and $162 million in outflows, respectively.

The latest wave of gains in Bitcoin ETFs came amid a sentiment recovery attempt, with the Crypto Fear & Greed Index jumping 12 points over the past 24 hours, according to Alternative.me data.

Related: Altcoin chatter sinks to 2-year low as Bitcoin holds attention

Despite Bitcoin recovering about 20% from February’s low of $60,000, the index still stands at “extreme fear” with a score of 20.

At the time of writing, Bitcoin traded at $72,214, down about 8% over the past 30 days, according to CoinGecko.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Hire Experienced NFT Game Developers

AI Summary

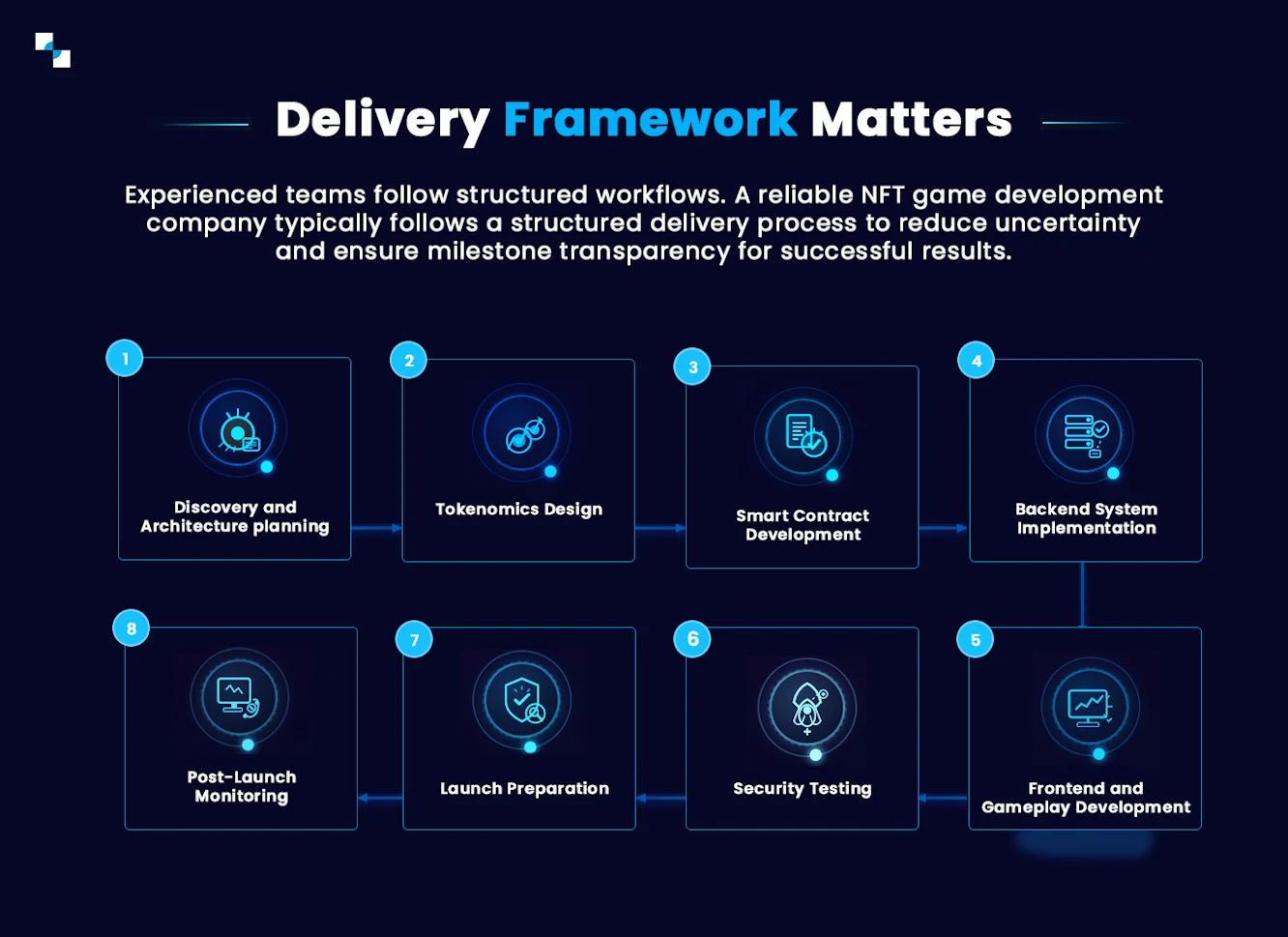

- The blog post emphasizes the importance of hiring experienced NFT game developers for building successful NFT-powered ecosystems.

- It discusses common failure points in NFT game development, the core capabilities to look for in developers, and the benefits of partnering with a specialized NFT game development company.

- The post highlights the need for expertise in blockchain engineering, game design, backend infrastructure, and security management to create sustainable NFT games.

- It also provides insights on cost considerations, long-term partnership value, and a decision framework for selecting the right development partner.

- Antier is recommended as a suitable development partner due to its expertise in gaming and understanding of technical complexity and economic sustainability in NFT game development.

The NFT gaming market is no longer experimental. Enterprises, gaming studios, & Web3 startups are building NFT-powered ecosystems that combine ownership, interoperability, and tokenized economies. However, while the opportunity is significant, failure rates remain high. The difference rarely lies in the idea. It lies in execution.

Planning to hire experienced NFT game developers is not about adding blockchain functionality to a game. It is about building secure, scalable, economy-driven digital ecosystems that can sustain users, transactions, and growth.

Before choosing a partner, enterprises must understand what truly defines experience in NFT game development and what separates a capable vendor from the best NFT game development company.

Why NFT Games Fail Without the Right Development Team

Many NFT games fail not because of market conditions, but because of technical and architectural weaknesses. Common failure points include:

- Poorly designed tokenomics

- Smart contract vulnerabilities

- Scalability bottlenecks

- Weak backend architecture

- Lack of analytics integration

- Inadequate live-ops planning

NFT games operate at the intersection of blockchain, game design, and economic modeling. A team lacking expertise in even one of these areas creates long-term instability. Enterprises that hire inexperienced NFT game developers often face post-launch issues that require expensive fixes.

What “Experienced” Really Means in NFT Game Development

Experience in NFT game development goes beyond coding smart contracts. True experience includes:

- Designing sustainable in-game economies

- Building secure NFT minting mechanisms

- Implementing gas-efficient smart contracts

- Integrating wallet systems seamlessly

- Managing multi-chain compatibility

- Planning for high transaction throughput

Experienced NFT game developers have in-depth understanding of how blockchain constraints affect gameplay. They design mechanics that account for transaction costs, confirmation delays, and network performance. This level of foresight is critical for long-term success.

Core Capabilities Enterprises Should Look For

When evaluating NFT game developers, enterprises should assess technical depth across multiple domains.

1. Blockchain Engineering Expertise

Developers should demonstrate:

- Smart contract architecture knowledge

- Multi-chain deployment experience

- Security audit readiness

- Token standard implementation expertise

- NFT marketplace integration skills

Weak blockchain engineering creates permanent vulnerabilities.

2. Game Design and Mechanics Understanding

NFT games are still games first and hence developers must understand:

- Player psychology

- Reward loops

- Progression systems

- Competitive balancing

- Retention mechanics

Without strong game design, NFT ownership alone does not drive engagement.

3. Backend Infrastructure and Scalability

A scalable NFT game requires:

- High-performance backend servers

- Real-time gameplay synchronization

- Load balancing systems

- Database optimization

- Analytics pipelines

Scalability issues damage user trust quickly.

4. Security and Risk Management

NFT games involve real asset ownership. Security cannot be optional. Teams should have:

- Smart contract security practices

- Penetration testing workflows

- Fraud prevention systems

- Anti-bot mechanisms

- Wallet security protocols

Security failures often result in irreversible damage.

Planning an NFT Game? Let’s Discuss Your Strategy

Things to Keep in Mind When Hiring NFT Game Developers

Enterprises should be cautious of:

- Teams that focus only on smart contracts

- Lack of scalable backend planning

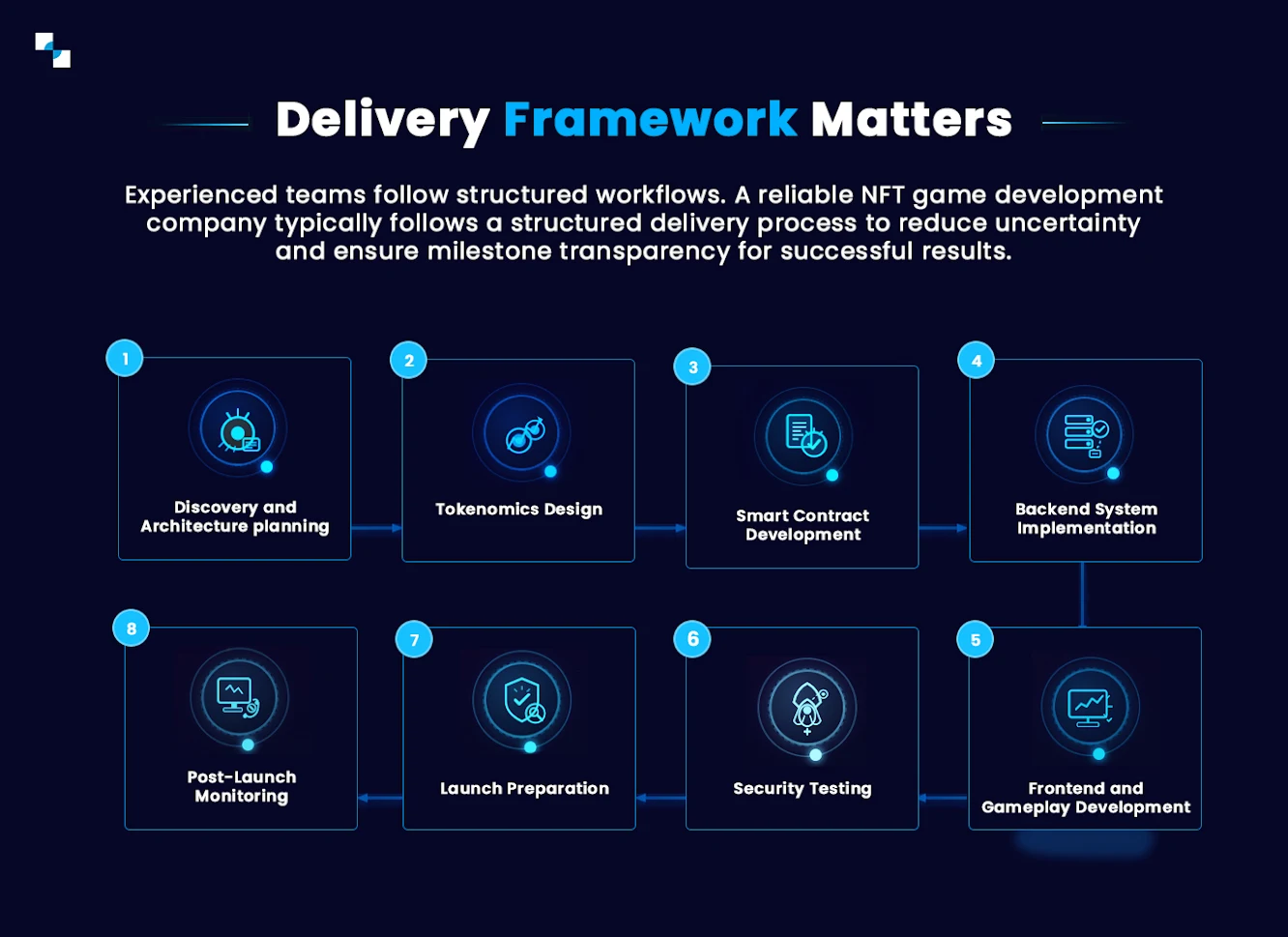

- No documented delivery process

- Unrealistic timelines

- No post-launch support strategy

A vendor that promises rapid NFT integration without discussing infrastructure and tokenomics likely lacks experience.

In-House vs Hiring a Specialized NFT Game Development Company

Some enterprises consider building internal NFT game teams. While this provides control, it introduces significant hiring and operational challenges. Building an in-house team requires:

- Blockchain engineers

- Backend developers

- Game designers

- UI/UX designers

- DevOps specialists

- Security experts

However, recruiting and coordinating such a team is expensive and time-consuming.

On the other hand, hiring a specialized NFT game development company provides:

- Cross-functional expertise

- Proven frameworks

- Faster time-to-market

- Reduced hiring risk

- Structured delivery models

For most enterprises, partnering with experienced NFT game developers reduces execution risk.

What the Best NFT Game Development Company Offers

The best NFT game development company provides more than technical services. It offers strategic guidance. This typically includes:

- Concept validation

- Tokenomics design consultation

- Architecture planning

- Blockchain selection strategy

- UX optimization

- Monetization alignment

- Compliance considerations

A true development partner aligns technical execution with business objectives.

Cost Considerations When Hiring NFT Game Developers

The cost of hiring NFT game developers tends to vary on the overall scope and complexity. Enterprise NFT games typically range from mid-five to six-figure budgets, depending on:

- Blockchain selection

- Feature depth

- Smart contract complexity

- Backend infrastructure scale

- Integration requirements

Choosing based solely on cost often results in higher long-term expenses due to rework and scalability issues. Investment should be evaluated against long-term platform sustainability.

Long-Term Partnership Value

NFT games evolve continuously. Economy tuning, feature updates, and network upgrades require ongoing technical involvement. Enterprises benefit from partners that provide:

- Continuous optimization

- Performance monitoring

- Economy balancing

- Feature expansion

- Infrastructure scaling

NFT game development is not a one-time project; it is an evolving ecosystem.

Final Decision Framework

Prior to hiring NFT game developers, enterprises should ask:

- Does the team understand both blockchain and game mechanics?

- Can they demonstrate scalable architecture experience?

- Do they provide structured delivery processes?

- Can they support long-term growth?

- Do they align technical execution with business goals?

Antier, with its high level expertise & expertise in gaming, happens to be the most suitable development partner to make sure that the NFT game becomes a sustainable ecosystem and not a short-lived experiment.

Enterprises looking forward to building secure, scalable NFT games should work with the best NFT game development company that understands both technical complexity and economic sustainability. The difference between a functioning NFT game and a thriving NFT ecosystem lies in execution, and execution begins with hiring Antier as the right development partner.

Frequently Asked Questions

01. Why do many NFT games fail despite having a good idea?

Many NFT games fail due to technical and architectural weaknesses, such as poorly designed tokenomics, smart contract vulnerabilities, and scalability bottlenecks, rather than market conditions.

02. What should enterprises look for when hiring NFT game developers?

Enterprises should seek developers with experience in designing sustainable in-game economies, building secure NFT minting mechanisms, and managing multi-chain compatibility, among other technical capabilities.

03. How does experience in NFT game development impact long-term success?

Experienced NFT game developers understand blockchain constraints and design mechanics that account for transaction costs and network performance, which is critical for creating stable and successful digital ecosystems.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Tech3 hours ago

Tech3 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes