Crypto World

Crypto Capital Shifts From Tokens to Stocks as Launches Struggle: DWF

Investor capital increasingly flows from tokens into publicly listed crypto companies as new token launches struggle, according to research and commentary from market maker DWF Labs.

Drawing on Memento Research data covering hundreds of token launches across major centralized and decentralized exchanges, the firm said more than 80% of projects have fallen below their token generation event (TGE) price. Typical drawdowns range between 50% and 70% within roughly 90 days of listing, suggesting public buyers often face immediate losses after launch.

DWF Labs managing partner Andrei Grachev told Cointelegraph that the figures reflect a consistent post-listing pattern rather than short-term market volatility. He said most tokens reach a price peak within the first month and then trend downward as selling pressure builds.

“TGE price is the exchange-listed price set before launch,” Grachev said. “This is the price the token is set to open at on the exchange, so we can see how much the price actually changes due to volatility in the first few days,” he added.

The analysis focused on structured launches tied to projects with products or protocols, rather than memecoins. Airdrops and early investor unlocks were identified as major sources of selling pressure.

Related: Kraken-backed SPAC raises $345M in upsized Nasdaq IPO

Crypto IPOs, M&A surge as capital shifts from tokens

In contrast, capital formation has strengthened in traditional markets tied to the sector. Fundraising for crypto-related initial public offerings (IPOs) reached about $14.6 billion in 2025, up sharply from the prior year, while merger and acquisition (M&A) activity surpassed $42.5 billion, the highest level in five years.

Grachev said the shift should be understood as a rotation rather than a withdrawal of capital. If capital were simply leaving crypto, you wouldn’t see IPO raises jump 48x year-over-year to $14.6 billion, M&A hit a 5-year high of over $42.5 billion, and crypto equity performance outpacing token performance,” he said.

In its report, DWF compared listed companies such as Circle, Gemini, eToro, Bullish and Figure with tokenized projects using trailing 12-month price-to-sales ratios. Public equities traded at multiples between roughly 7 and 40 times sales, compared with 2 to 16 times for comparable tokens.

The firm argued that the valuation gap is driven by accessibility. Many institutional investors, including pension funds and endowments, are restricted to regulated securities markets. Public shares can also be included in indexes and exchange-traded funds, creating automatic buying from passive investment products.

Maksym Sakharov, co-founder and group CEO of WeFi, also confirmed to Cointelegraph that there has been a capital rotation from token launches. “When risk appetite tightens, investors don’t stop craving exposure, so they start demanding cleaner ownership, clearer disclosure, and a path to enforceable rights,” he said.

Sakharov added that the money is going toward businesses that look like infrastructure because of custody, payments, settlement, brokerage, compliance and plumbing. He noted that the “equity wrapper” is attractive because it aligns with real-world adoption, enabling licensing, audits, partnerships and distribution channels.

Related: CertiK keeps IPO on the table as valuation hits $2B, CEO says

Why investors favor crypto equities over tokens?

The market is increasingly treating tokens and businesses as separate things, Sakharov said, noting that a token alone cannot replace distribution or a working product. If a project fails to generate steady users, fees, transaction volume and retention, the token ends up priced on expectations rather than real activity, which is why many launches look successful at first but later disappoint.

Listed crypto equities are not necessarily safer, but they are clearer and easier for investors to evaluate, according to Sakharov. Public companies offer reporting standards, governance and legal claims, and they fit within institutional portfolio rules, whereas holding tokens often requires custody approvals and policy changes.

Grachev described this shift as structural rather than cyclical. While tokens will remain part of crypto networks for incentives and governance, he said institutional capital increasingly prefers equity rails.

“Tokens won’t disappear, but we’re seeing a permanent bifurcation: serious protocols with real revenue will thrive, while the long tail of speculative launches faces a much harder environment,” he concluded.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Bitcoin May Rebound to $85K as CME Smart Money Slashes Shorts

Bitcoin (CRYPTO: BTC) has been signaling a potential bottom as CME futures positioning turns bullish again, a pattern that has preceded notable recoveries in prior cycles. In April 2025, non-commercial traders shifted from net short to net long, and a similar rotation is resurfacing in 2026, raising the odds of a renewed ascent in the weeks ahead. The price action sits near a key technical floor: the 200-week exponential moving average, a long-standing bear-market floor that has defined major drawdowns over the past decade; as of February, that metric hovered around $68,350, giving bulls a critical line in the sand. An oversold RSI adds to the narrative that selling pressure could be abating and a bottoming process may be underway.

Key takeaways

- The CFTC Commitment of Traders report shows non-commercial traders shifting from net short to net long, with net positions around -1,600 contracts after previously being +1,000.

- Historical analogs underscore potential upside: roughly 70% gains after similar unwind events in April 2025 and about 190% gains in 2023 under comparable conditions.

- Bitcoin’s defense of the 200-week EMA near $68,350 provides a structural support that could anchor a broader recovery rally.

- Analysts have discussed a path toward roughly $85,000 by around April if BTC clears the 100-week EMA and sustains momentum.

- Despite the favorable setup, the shift is described as a condition, not a signal; a deeper drawdown remains possible, echoing 2022’s dip below the 200-week EMA even amid oversold readings.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Positive. The unwind of net shorts into longs and the defense of the 200-week EMA support increase the odds of a near-term rebound toward higher targets, including the potential move to $85,000 if trends persist.

Market context: The current positioning sits within a broader framework of liquidity shifts and risk-on sentiment in crypto markets. Moving-average dynamics and derivatives positioning—especially around CME futures—turn into leading indicators for momentum, while macro and ETF flows continue to shape the medium-term trajectory.

Why it matters

The evolving futures posture matters because it signals a potential change in risk tolerance among large traders and institutions. If the pattern holds, it can attract additional buyers who monitor derivatives data and on-chain signals, possibly accelerating a shift from a prolonged drawdown to a more constructive price cycle. For traders, the combination of an oversold RSI, a tested floor at the 200-week EMA, and a history of outsized recoveries after similar unwind events creates a framework for positioning with defined risk and reward trade-offs.

From a market structure perspective, a sustained bounce would impact liquidity and confidence across the ecosystem, influencing miners, developers, and product teams building on Bitcoin. Observers will be watching for confirmation signals beyond the headline shifts—whether BTC can decisively clear resistance bands such as the 100-week EMA and how on-chain activity changes as price action improves. The dynamic underscores how derivatives and macro factors continue to interplay with price discovery in the longest-standing crypto market trend.

Analysts have highlighted the nuanced nature of these signals. Tom McClellan and others have noted that smart-money rotations can precede recoveries, but they do not guarantee them—echoing the caution that traders should maintain disciplined risk management as conditions evolve. The broader takeaway is a heightened awareness that the market may be shifting from a bear-market lull to a more data-driven recovery regime, dependent on how price action responds to macro inputs and on-chain signals in the weeks ahead. For those tracking the narrative, the emergence of a durable bottom would likely hinge on price staying above critical moving averages and on ongoing participation from institutional and professional traders.

What to watch next

- Next CFTC COT report release and the evolution of net futures positions on CME.

- BTC price action around the 200-week EMA (~$68,350) and a potential break above the 100-week EMA toward higher levels.

- The potential climb toward $85,000 by around April if bullish momentum persists.

- Improvements in the RSI alongside broader liquidity shifts and macro cues that could confirm a durable bottom.

Sources & verification

- CFTC Commitment of Traders (COT) report for bitcoin futures data: https://www.cftc.gov/dea/futures/deacmesf.htm

- Bitcoin historical price metric sees $122K ‘average return’ over 10 months: https://cointelegraph.com/news/bitcoin-historical-price-metric-122k-average-return-over-10-months

- Bitcoin whales sharks accumulate conditions breakout Santiment: https://cointelegraph.com/news/bitcoin-whale-sharks-accumulate-conditions-breakout-santiment

- Bitcoin crash 60k halfway point crypto bear market: https://cointelegraph.com/news/bitcoin-crash-60k-halfway-point-crypto-bear-market

Bitcoin’s rebound setup: futures positioning, EMA signals and the path to $85k

Bitcoin (CRYPTO: BTC) has been shaping a potential bottom as CME futures positioning turns bullish again, a pattern that has preceded notable recoveries in prior cycles. In April 2025, non-commercial traders shifted from net short to net long, and a similar rotation is resurfacing in 2026, raising the odds of a renewed ascent in the weeks ahead. The price action sits near a key technical floor: the 200-week exponential moving average, a long-standing bear-market floor that has defined major drawdowns over the past decade; as of February, that metric hovered around $68,350, giving bulls a critical line in the sand. An oversold RSI adds to the narrative that selling pressure could be abating and a bottoming process may be underway.

The shift in speculative positioning is detailed in the CFTC report, which shows net long exposure among non-commercial traders moving back into positive territory after a stretch of net shorts. This cadence — the turning of the tide in futures positioning — has historically preceded multi-week to multi-month reversals, particularly when price remains anchored to major moving averages like the 200-week EMA. In this cycle, the same dynamic is being cited as a setup for a potential run toward higher prices should bullish momentum sustain itself.

Analysts have pointed to historical precedents for context. In the months following similar unwind events, BTC has experienced meaningful gains: around 70% in the wake of the April 2025 shift, and on a prior cycle, as much as 190% in 2023 under comparable futures-market conditions. The emphasis on historical parallels suggests that, if the market can defend the 200-week EMA, a test of higher thresholds becomes plausible. The 200-week EMA has repeatedly served as a floor during deep drawdowns, reinforcing the idea that a durable bottom could form when prices hold above this line. The current setup also aligns with a broader pattern where smart-money participation has historically preceded price recoveries, though no outcome is guaranteed.

One caveat remains central to any bullish interpretation. McClellan and other observers emphasize that the smart-money rotation is a condition rather than a guarantee of higher prices. If the market fails to sustain the rebound, or if macro headwinds intensify, BTC could revisit downside scenarios seen in prior cycles, including a retest of lower levels or a deeper pullback. In the historical context of 2022, BTC dipped below the 200-week EMA despite oversold conditions, underscoring that downside risk can persist even when indicators suggest a potential bottom. As price hovers near the $68k area, traders are weighing the odds of a durable bottom against the risk of a renewed drawdown should momentum falter.

Market watchers are also mindful of how on-chain signals and macro factors interact with price action. A rebound would have implications for risk appetite across the ecosystem, potentially attracting institutions and retail traders alike who aim to capitalize on a multi-week uptrend. If the scenario unfolds as anticipated, a move toward the $85,000 region could materialize by spring, contingent on sustained buying pressure and continued participation from major market players. The narrative continues to be shaped by evolving data: if the RSI remains oversold but begins to turn higher, it could provide an additional layer of validation for bulls; conversely, a renewed wave of selling pressure would complicate the outlook and call into question the durability of any near-term gains.

Crypto World

XRP Ledger launches permissioned DEX, Strategy purchases $168M Bitcoin, Animoca secures Dubai license | Weekly recap

In this week’s edition of weekly recap, XRP Ledger activated a members-only decentralized exchange for regulated institutions, Strategy reported its fourth-largest Bitcoin purchase of the year and Animoca Brands obtained regulatory approval in Dubai. XRP Ledger enables institutional-only trading Strategy…

Crypto World

Everyday Investors Lost $4 Billion on Trump Meme Coins

President Donald Trump and First Lady Melania Trump launched their official cryptocurrency tokens more than a year ago. Today, those digital assets have wiped out $4.3 billion in retail wealth.

According to Cryptorank, 2 million everyday investors currently hold underwater positions, while 45 early-deployment wallets have gained a combined $1.2 billion. For every dollar insiders earned, retail investors lost $20.

Trump Coins Fall Up to 99% Amid Insider Windfall

As a result, the rapid decline of these tokens, alongside the significant gains of early insiders, has attracted much attention from industry observers.

Blockchain analytics firm CryptoRank found the TRUMP token has fallen 92% to $3.55 from its $75 all-time high. The MELANIA token dropped 99% to 11 cents from $13.05.

Although the broader cryptocurrency market shed over $1 trillion in value during the same period, researchers attributed the presidential tokens’ steeper declines to structural design rather than general market conditions.

On-chain forensics show anonymous accounts linked to the initial developers systematically drained decentralized liquidity pools.

In December 2025 alone, blockchain analyst EmberCN reported that the TRUMP token’s primary deployment address transferred $94 million in USDC into the cryptocurrency exchange Coinbase.

The developers utilized a strategy called single-sided liquidity provision on the decentralized platform Meteora.

Here, insiders deposited only TRUMP and MELANIA tokens without pairing them with dollar equivalents.

This strategy programmed the automated market maker to continuously sell their holdings to incoming retail buyers. The assets were then quietly converted into USDC

Furthermore, the threat of continued dilution looms heavily over the remaining holders.

CryptoRank data shows developers locked $2.7 billion in insider tokens inside smart contracts until 2028. Because this expiration date coincides perfectly with the end of Trump’s presidential term, it establishes a highly structured exit strategy.

This means that underwater retail holders will likely serve as exit liquidity for this final insider payout when those tokens finally hit the open market.

Crypto World

How decentralized AI is leveling the playing field

As AI infrastructure investments surge toward $300B in 2025 alone, fueled by mega-projects like the $500B Stargate initiative and hundreds of billions in Nvidia chip purchases, the decentralized AI space offers a compelling alternative to Big Tech’s centralized dominance. Now’s the time to invest in it.

In the rapidly evolving landscape of artificial intelligence, a seismic shift is underway, one that promises to redefine how we build, deploy and interact with AI. While centralized AI, dominated by tech giants like Amazon, Microsoft and Google, has driven remarkable progress, the recent shift toward agentic AI creates a unique opportunity for decentralized AI. It’s why the sector is poised to become the most exciting and critical space over the next few years.

With a global AI market projected to grow at a 35.9% CAGR through 2030, the stark valuation gap—$12 trillion for centralized AI enterprises versus ~$12 billion for decentralized AI—signals an unprecedented investment opportunity. Bridging this gap will not only yield massive financial returns but also reshape the ethical, technical and societal foundations of AI. Here’s why decentralized AI, powered by open-source principles and blockchain technology, is the future.

The valuation gap: a $15 trillion opportunity

Centralized AI, controlled by a handful of tech behemoths, commands a staggering $12 trillion~ in enterprise value, fueled by their dominance of nearly 70% of global cloud infrastructure. Yet, this concentration of power comes at a cost: stifled competition, ethical lapses, a loss of agency and control for both individual and corporate users and a one-size-fits-all approach that often stifles innovation.

Meanwhile, decentralized AI, valued at just $12 billion, is a nascent yet rapidly growing ecosystem. The blockchain AI market alone is projected to skyrocket from $6 billion in 2024 to $50 billion by 2030, reflecting a staggering 42.4% CAGR, and I don’t believe these figures will come close to the actual outcome, as the real numbers are likely to be much higher. This disparity isn’t a sign of weakness but a clarion call for investors. The next two to three years will see decentralized AI platforms—think Bittensor, Artificial Superintelligence Alliance,The Manifest Network, Venice.Ai or Morpheus—close this gap by democratizing access, fostering innovation and addressing the critical flaws of centralized systems.

And as the agentic AI age approaches, conjuring visions of hundreds of billions of independent AI agents executing instructions and transacting on behalf of individuals and companies, the case for decentralized AI becomes all the more urgent.

How can these agents be truly autonomous in a centralized model? How can we know –and prove– that they are living up to the legal definition of an “agent?” In other words, it’s a fiduciary with 100% responsibility to its owner, not to a third party (such as the platform on which it is hosted). The explosion of innovation this hyper-competitive, hyper-collaborative “Internet of AI agents” points to will only be possible if those agents are given the privacy and control they need to truly act independently. There is no “free market of ideas” without the actors in that market having their own free will. Over the past quarter, the explosion of localized AI agent frameworks built on open architectures, such as OpenClaw, has demonstrated how quickly sovereign AI can move when unshackled from centralized cloud control. By moving AI from corporate servers to local, peer-to-peer networks, users are shifting from “renting” intelligence to owning their own fully autonomous stacks. This structural re-architecture bypasses Big Tech gatekeepers, sparking a wave of innovation and privacy that centralized platforms can no longer control.

Privacy: empowering individuals over corporations

Centralized AI thrives on vast data lakes, often harvested with little regard for individual privacy. Big Tech’s history of squashing competition and skirting ethical boundaries, whether through monopolistic practices or opaque data usage, has eroded trust. Decentralized AI, by contrast, leverages blockchain’s cryptographic security to prioritize individual privacy. Users control their data, sharing it selectively via secure, transparent protocols. Platforms like Akash Network ensure that personal data remains encrypted and decentralized, preventing the kind of mass exploitation seen in centralized systems. This privacy-first approach isn’t just ethical; it’s a market differentiator in an era where 83% of enterprises are shifting workloads to private clouds to escape public cloud vulnerabilities.

But it’s not only individuals who are disadvantaged by the current centralized model. Businesses, institutions and entire industries have been forced to keep their most valuable datasets locked away. Sometimes for competitive reasons, sometimes because of fiduciary, custodial, or regulatory obligations, making sharing with centralized LLMs flatly impossible. The risk of inadvertently uploading trade secrets, proprietary R&D, sensitive customer records or regulated data into the black box of a hyperscaler has been a hard stop for meaningful enterprise-scale AI adoption.

But the deeper significance of this shift goes beyond unlocking long-dormant corporate data vaults; it redefines what enterprise trust in AI actually looks like. This is core to the mission of organizations like the Advanced AI Society, which argues that we are entering an era where enterprise customers will not merely prefer privacy-preserving infrastructure; they will demand something far stronger: proof of control. Not marketing promises, not compliance checklists, but cryptographic, verifiable assurance that the business, and only the business, controls its data, compute pathways, storage substrates, proprietary model weights and fine-tuned derivatives. In a world where AI touches regulated workflows, intellectual property and customer-sensitive operations, enterprises will insist on provable guarantees that nothing escapes their perimeter, and nothing can be silently copied, scraped or siphoned by a third party. Decentralized AI is the first architecture capable of delivering this new trust standard. It shifts the question from “Do we trust our vendor?” to “Can we verify our sovereignty?” and that inversion is the fault line upon which the next decade of enterprise AI adoption will hinge.

This is where decentralized AI and confidential computation transform the playing field. For the first time, companies can safely apply their private datasets to local or domain-specific model training without surrendering custody or visibility. Whether through encrypted compute, zero-knowledge architectures, or decentralized execution layers, the data never leaves their control. What was once an unbridgeable chasm of AI potential on one side and locked corporate data on the other can now finally be crossed.

And that unlock is enormous. Non-internet-platform companies represent the vast majority of the world’s valuable information: pharmaceutical research vaults, medical imaging archives, energy exploration data, financial pattern histories, supply chain telemetry, manufacturing QA logs and more. These troves have been sealed off from AI’s learning loops due to the inherent danger of centralized training. Decentralized, privacy-preserving AI flips that equation, turning previously inaccessible datasets into catalytic assets.

If AI is truly going to cure cancer, solve energy scarcity, overhaul logistics, accelerate drug discovery or reinvent scientific research, it cannot rely solely on whatever scraps of information Big Tech has scraped from the public internet. The great breakthroughs will come when the off-internet world—the real, industrial, scientific and institutional world—can safely contribute its data to AI models without risking exposure, theft or exploitation.

Decentralized AI is the architecture that makes that future possible. It doesn’t just empower individuals against corporations; it empowers every enterprise that has been forced to sit on the sidelines. And when those data vaults finally open on their own terms and under their own control, that will be the great unlock that propels AI from impressive novelty to civilization-scale engine.

Compute capacity: harnessing the world’s spare resources

Centralized AI’s Achilles’ heel is its insatiable demand for compute power, requiring dozens of gigawatts to train and run models like GPT-4 or Llama. Data centers strain global energy grids, raising environmental concerns and increasing consumer costs.

Decentralized AI flips this paradigm by tapping into spare compute capacity such as idle GPUs in homes, offices or even smartphones. Platforms like Targon (Bittensor Subnet 4), focused on making AI inference faster and cheaper, aggregate distributed resources to deliver scalable solutions. OAK Research highlights that Targon’s benchmarks reportedly outperform Web2 solutions in certain tasks, offering lower-cost inference with acceptable quality—a game-changer for commodification, scaling and downstream integrations. By efficiently using existing energy sources, decentralized AI aligns with a sustainable future while democratizing access to cutting-edge technology.

Blockchain as the backbone of trust and innovation

AI is moving to blockchains, and for good reason. Blockchain solves critical pain points that centralized systems sidestep or exacerbate:

- Training validation: Decentralized networks like Bittensor use consensus mechanisms (e.g., Yuma Consensus) to validate AI model outputs, ensuring quality without centralized gatekeepers.

- Copyright compliance: Blockchain’s immutable ledger tracks data and model provenance, addressing intellectual property disputes—a growing concern in AI.

- AI guardrails: Decentralized governance creates transparent, community-driven rules to prevent misuse.

- Value transactions: Tokens like those on Akash enable fair reward distribution for contributors, from miners to validators.

- Data security and privacy: Distributed storage and encryption protect sensitive data, unlike centralized clouds prone to breaches. These features empower a collaborative ecosystem where developers, users and enterprises co-create value, unhindered by Big Tech’s competitive stranglehold.

Open source: the catalyst for exponential growth

Decentralized AI thrives on open-source principles, fostering innovation at a pace centralized systems can’t match. Open-source models, like those on Bittensor for specialized tasks, invite global contributions and enable rapid iteration on use cases ranging from video analysis to predictive markets. Centralized AI, by contrast, locks models behind proprietary walls, limiting adaptability and accessibility. Open-source decentralized platforms not only accelerate innovation but also align with the growing demand for transparency in AI development—a demand Big Tech often ignores.

The investment case: why now?

The $12 trillion centralized AI market is a mature Goliath, but its growth is constrained by ethical scandals, energy demands and diminishing returns. Decentralized AI, though smaller, is a nimble $12B David, poised for exponential growth. Its ability to address privacy, leverage distributed computing and foster open innovation makes it a superior long-term bet. Investors who back platforms like Bittensor, Storj, or Akash now, while valuations are low, may stand to reap outsized returns as the blockchain AI market scales to $200 billion by 2030. The shift is already underway: enterprises are moving to private clouds, and communities are embracing decentralized governance.

The future is decentralized

Decentralized AI isn’t just a technological evolution; it’s a societal necessity. It counters Big Tech’s monopolistic grip, protects user privacy and harnesses global resources for sustainable growth. As platforms like Bittensor and Akash pioneer scalable compute markets, they pave the way for a world where AI serves the many, not the few. The delta in the valuation gap will close. Not because centralized AI will falter, but because decentralized AI’s potential is too vast to ignore. For investors, developers and visionaries, this is the most exciting space to watch, build and invest in over the next three years. The revolution is here, and it’s decentralized.

Crypto World

BlackRock’s ETHB Ethereum Staking ETF Set to Reshape Institutional Crypto Investment

TLDR:

- BlackRock plans to stake between 70% and 95% of ETH held within the ETHB trust for maximum yield.

- Investors receive 82% of staking rewards, while BlackRock and Coinbase split the remaining 18%.

- A liquidity sleeve of 5% to 30% in unstaked ETH ensures ETHB can meet investor redemptions smoothly.

- BlackRock’s spot Ethereum ETF ETHA surpassed $6 billion in assets, paving the way for the ETHB launch.

BlackRock’s upcoming iShares Staked Ethereum Trust, ticker ETHB, is drawing attention across institutional markets.

The world’s largest asset manager is preparing to launch a product that converts Ethereum into a yield-bearing asset.

With regulatory sentiment shifting in favor of staking-enabled ETFs, ETHB could mark a turning point for institutional crypto adoption in 2026.

BlackRock Structures ETHB Around Staking Yield and Liquidity

BlackRock plans to stake between 70% and 95% of the Ether held within the trust. This high staking ratio positions ETHB as a total-return product rather than a passive holding vehicle. The fund is designed to generate yield directly from Ethereum’s proof-of-stake network.

To support the 95% staking target, BlackRock will maintain a liquidity sleeve of 5% to 30% in unstaked ETH. This buffer allows the fund to meet investor redemptions even when most assets are locked in staking. It is a practical mechanism that balances yield optimization with operational flexibility.

On the revenue side, ETHB will share 82% of staking rewards with investors. The remaining 18% is divided between BlackRock and Coinbase, which serves as the fund’s prime execution agent. The trust also carries a 0.25% sponsor fee on top of the staking reward split.

An SEC filing dated December 17 confirmed that a BlackRock seed capital investor purchased 4,000 shares at $0.25 each.

This initial capital formation signals that preparations for the fund are well underway, though no official launch date has been announced yet.

Institutional Ethereum Adoption Expands Despite Market Headwinds

BlackRock’s move into Ethereum staking follows the strong performance of its spot Ethereum ETF, ETHA. That fund has already gathered over $6 billion in assets, demonstrating real institutional demand for Ethereum-based products. ETHB builds on that foundation by adding a yield component.

As Arkham noted on social media, ETHB could turn ETH from a passive holding into a yield-generating institutional product.

BlackRock currently ranks as the fourth-largest entity tracked on the Arkham Intel Platform. Its on-chain holdings exceeded $57 billion as of February 2026.

Traders monitoring ETHB should account for T+1 settlement in traditional finance. On-chain evidence of BlackRock’s ETH purchases typically appears one business day after the initial trade.

This lag is a standard feature of conventional financial infrastructure interacting with blockchain settlement.

Even as Ethereum’s price has dipped below $2,000 during the current market downturn, institutional interest in decentralized infrastructure remains active.

The expected launch of ETHB in the first half of 2026 reflects a broader regulatory shift that now permits staking rewards within exchange-traded products. That change had previously been blocked under earlier SEC guidance.

Crypto World

Vitalik’s $6.95M ETH Move: Personal Agenda or Ethereum Foundation Strategy?

TLDR:

- Vitalik Buterin withdrew 3,500 ETH worth $6.95M from Aave, resuming sales after a two-week pause.

- The Ethereum Foundation entered a period of mild austerity to balance development goals and long-term sustainability.

- Buterin personally absorbed Foundation-level responsibilities, funding open-source software, hardware, and biotech projects.

- Community observers question whether Buterin’s personal ETH-funded projects align with the Foundation’s core protocol mandate.

Vitalik Buterin’s recent withdrawal of 3,500 ETH, valued at approximately $6.95 million, from lending protocol Aave has drawn fresh scrutiny.

On-chain analytics account Lookonchain flagged the transaction, noting that 571 ETH had already been sold shortly after.

Buterin followed the activity with a lengthy public post explaining his plans. Still, the line between a personal initiative and an Ethereum Foundation strategy remains worth examining closely.

A Personal Undertaking With Foundation-Level Scope

Buterin made clear that the Ethereum Foundation is currently entering a period of reduced spending. The organization aims to balance an aggressive development roadmap with long-term financial sustainability. These two goals sit at the center of what he described as “mild austerity.”

Within that context, Buterin stated that he is personally absorbing responsibilities previously handled as the Foundation’s special projects.

This is a notable shift. It moves significant decision-making and funding away from the institutional structure and into his individual hands.

The 16,384 ETH he disclosed withdrawing will fund a broad range of open-source technology efforts. These cover areas include finance, communication, governance, operating systems, secure hardware, and biotech. The scale of these goals is far larger than what most would consider a purely personal project.

This creates a reasonable question for observers. If the Foundation is tightening its budget, and Buterin is personally funding work that falls within the Foundation’s stated mission, where does one end and the other begin? That distinction has not been fully addressed in his public statement.

Community Scrutiny Follows the On-Chain Activity

Lookonchain reported that Buterin resumed selling ETH after a two-week pause. At the time of the report, he had already moved 571 ETH worth around $1.13 million into the market. The timing, coming alongside his public explanation, drew significant attention from crypto observers.

Buterin referenced a range of existing projects to support his stated vision. These include the Vensa open-silicon initiative, the uCritter platform featuring ZK and FHE privacy tools, air-quality monitoring work, and encrypted-messaging donations. Together, they paint a consistent picture of where his focus is directed.

However, some in the community have noted that these projects span well beyond Ethereum’s core protocol development.

Supporting biotech, secure hardware, and operating systems through personal ETH sales raises questions about how these efforts connect to the Foundation’s primary mandate.

Buterin addressed this indirectly by drawing a firm line between genuine openness and commercial openness. He stated his support is for technology that is “actually open” and verifiably working for users, not systems locked behind paid APIs.

Whether that vision is a personal philosophy or a new institutional direction for Ethereum remains an open question for the community to watch.

Crypto World

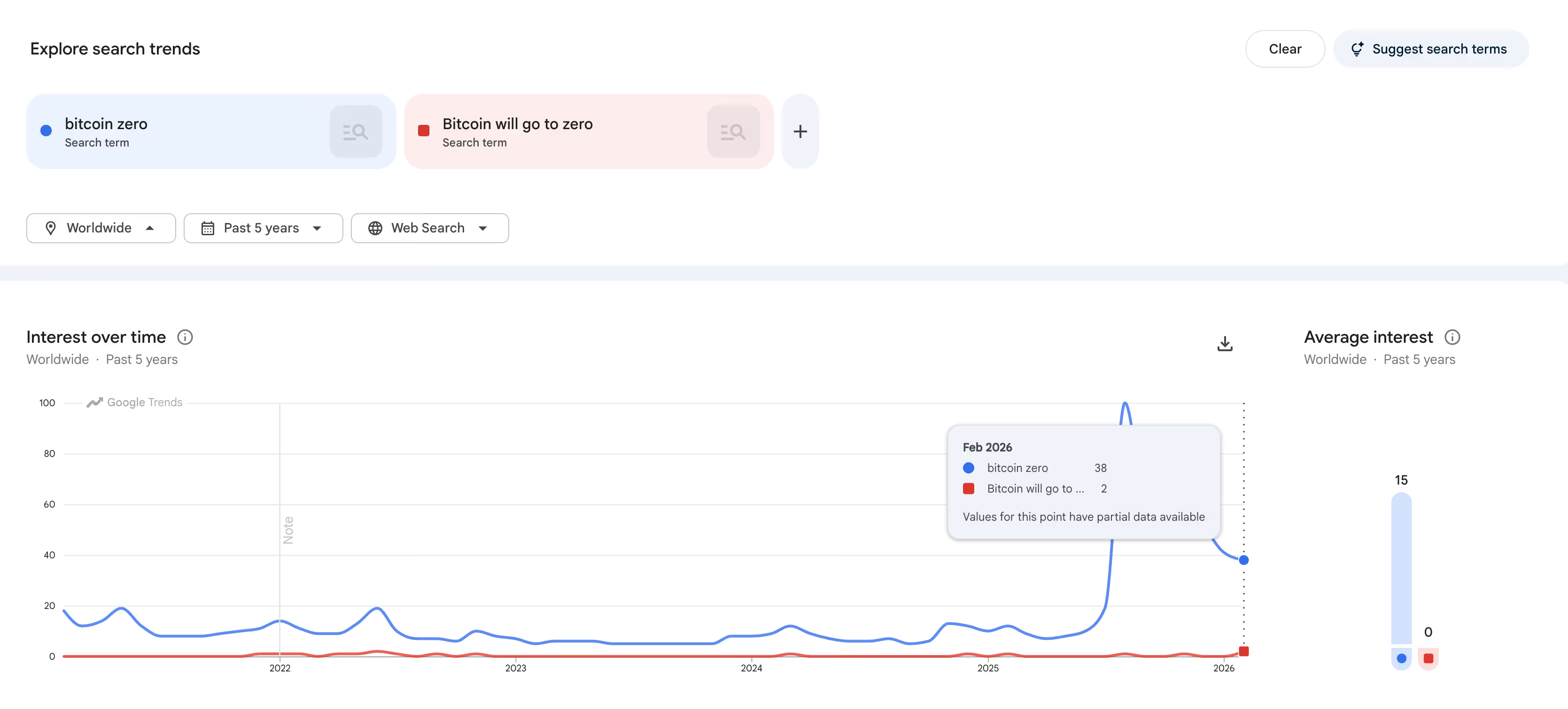

‘Bitcoin to Zero’ Hits Peak Search Interest in the U.S., yet a Clean Bottom Signal Remains Elusive

TLDR:

- U.S. searches for ‘bitcoin to zero’ hit a Google Trends score of 100 in February 2026, a record high.

- Global searches for the same term peaked in August 2025 and have since dropped to as low as 38 by February.

- Similar U.S. search spikes in 2021 and 2022 coincided with local Bitcoin price bottoms, but context has shifted.

- Google Trends measures relative interest, not raw volume, making the current spike harder to compare with past cycles.

‘Bitcoin to zero‘ searches in the U.S. surged to a record high in February 2026, as BTC slid toward $60,000. Google Trends data showed the term scored 100 on its relative interest scale this month.

The move followed a 50%-plus drawdown from Bitcoin’s October all-time high. Global searches for the same term, however, have been falling since peaking in August.

That split between domestic and worldwide data keeps the bottom signal mixed rather than conclusive.

U.S. Searches Hit Record Highs as Domestic Fear Builds

‘Bitcoin to zero’ searches in the U.S. reached their highest recorded level in February on Google Trends. The spike coincided directly with Bitcoin’s sharp decline toward the $60,000 price level.

U.S.-specific catalysts appear to be amplifying retail anxiety more than broader global sentiment. Tariff escalation, Iran tensions, and a domestic equity risk-off rotation have all weighed on investor mood.

Globally, the same search term peaked at a score of 100 back in August 2025. By February 2026, worldwide interest in the term had cooled to as low as 38.

That contrast between U.S. and global data points to fear that is regionally concentrated. Holders in Asia and Europe are navigating Bitcoin’s drawdown within an entirely different news environment.

Historically, similar U.S. search spikes in 2021 and 2022 aligned with local price bottoms. Traders familiar with those cycles have often treated elevated fear searches as a contrarian buy indicator.

However, the current environment differs from those earlier periods in meaningful ways. Bitcoin’s mainstream visibility and retail base have expanded considerably since then.

The global cooling trend complicates any straightforward bottom call based on U.S. searches alone. When worldwide fear is declining while domestic fear is rising, the signal lacks international confirmation.

That does not eliminate the possibility of a local reversal, but it reduces conviction. A mixed bottom signal requires more evidence before the case becomes compelling.

Methodology and Market Context Keep the Signal Inconclusive

Google Trends measures relative interest on a scale of 0 to 100, not raw search volume. A score of 100 simply means the term reached its own peak within the selected time window.

It does not confirm that more people searched the term in absolute terms compared to 2022. Against a much larger Bitcoin user base today, that distinction carries real analytical weight.

Bitcoin’s U.S. retail audience has grown substantially since the last major bear market cycle. A relative spike measured against a higher baseline does not carry the same weight as before.

Retail fear is clearly elevated, but elevated fear alone does not guarantee a trend reversal. Analysts recommend pairing this data with on-chain metrics before drawing firm conclusions.

The absence of a matching global fear spike keeps the contrarian case incomplete as of February. U.S. retail anxiety is real and measurable, but it remains a regional rather than a universal signal.

Prior cycles where searches and price bottoms aligned featured more synchronized global sentiment. That synchronization is currently missing from the data.

The ‘bitcoin to zero’ search spike does confirm that U.S. retail pressure is building. Whether that pressure marks a durable floor or simply reflects localized panic remains unclear.

Market participants continue watching for additional on-chain and global sentiment confirmation. Until those signals align, the bottom call stays mixed.

Crypto World

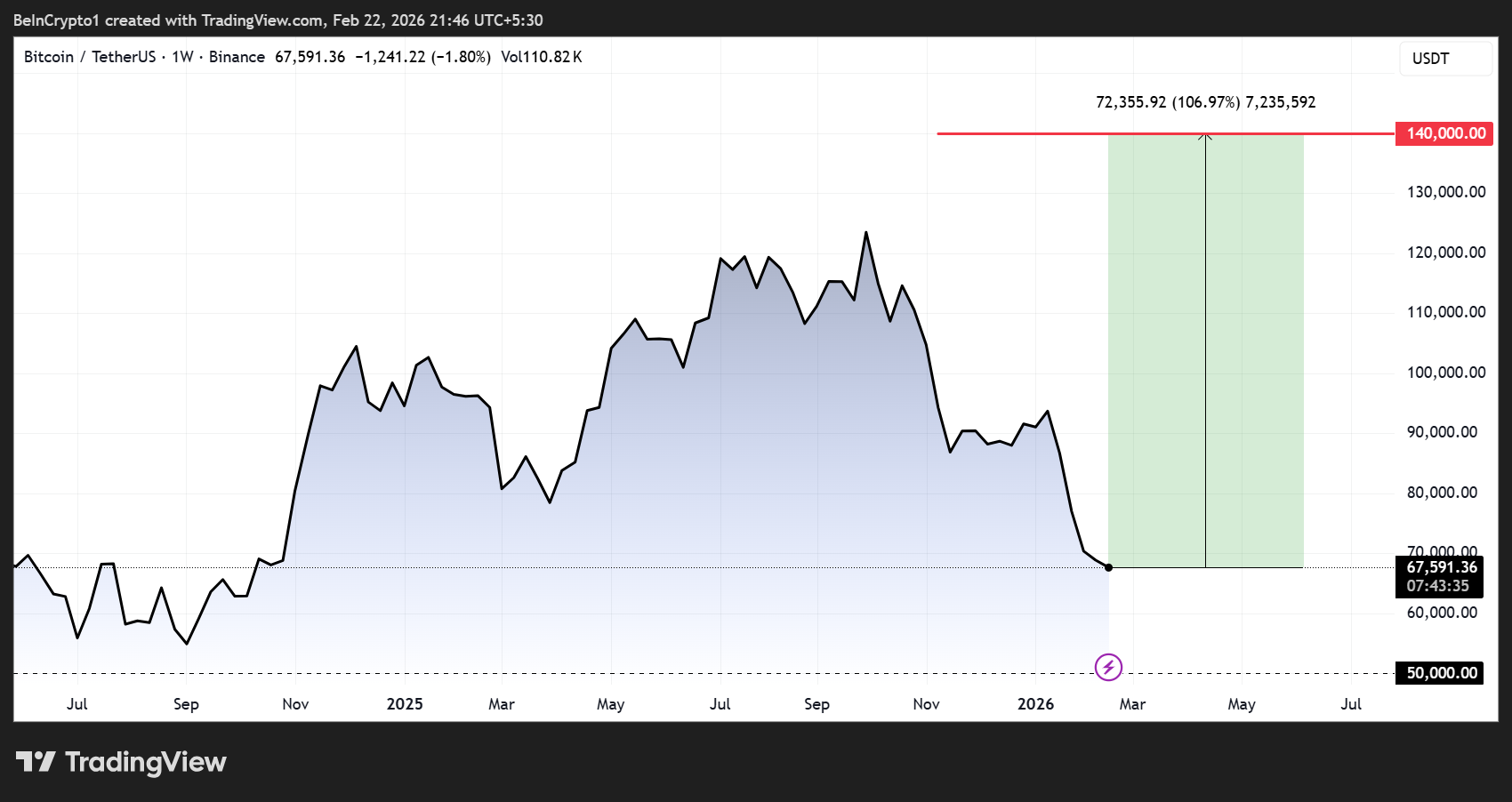

Why Bitcoin Could Hit $140,000 Soon

According to former Goldman Sachs executive and macro investor Raoul Pal, the answer depends less on sentiment and more on liquidity.

Raoul Pal says signals are beginning to align in a way that historically precedes explosive upside moves.

Is Bitcoin About to Reprice To $140,000 Far Sooner Than The Market Expects?

Raoul Pal argues that Bitcoin is currently trading at a “deep discount” to global liquidity conditions. In previous cycles, similar gaps between liquidity expansion and price have not been resolved gradually. They have closed violently.

“If that gap closes,” he suggests, Bitcoin does not grind higher — it snaps into a higher range.

At the center of Pal’s thesis is a potential liquidity inflection point in Q1 2026. Several macro forces are converging at once.

First, changes to bank regulations, particularly adjustments to the Enhanced Supplementary Leverage Ratio (ESLR). According to Pal, this may allow banks to absorb more government debt without constraining their balance sheets.

That effectively gives the US Treasury greater flexibility to monetize deficits, increasing system-wide liquidity.

Second, Treasury General Account (TGA) dynamics are in focus. Historically, when the TGA is drawn down, liquidity quickly flows back into markets. Pal believes that the process is likely to accelerate.

Layer on a weakening US dollar, often a signal of easier financial conditions, and expanding liquidity from China’s balance sheet, and the backdrop becomes more supportive for risk assets.

According to Pal, liquidity is already improving faster than markets are pricing in. His rough estimate? If Bitcoin were to realign with prevailing liquidity conditions, the price would be closer to $140,000.

“…[based on liquidity models, Bitcoin] should be closer to $140,000 [if historical relationships hold],” he said.

A move to $140,000 would represent a 106% increase in Bitcoin’s price from current levels.

Business Cycle Confirmation

Pal also points to forward-looking indicators tied to the business cycle, particularly the Institute for Supply Management (ISM). In his framework, financial conditions lead ISM by roughly nine months, with global liquidity following shortly after.

The data he tracks suggests ISM could strengthen meaningfully this year, signaling an improving growth environment. These data, listed below, could all contribute to rising confidence and lending activity.

- Fiscal stimulus

- Tax incentives for fixed asset investment

- Capital expenditure on data centers and energy infrastructure, and

- Potential mortgage rate relief

If growth expectations rise while liquidity expands, Bitcoin and other high-beta assets have historically outperformed.

The October 10 Overhang

Yet despite these improving conditions, Bitcoin has lagged. Pal traces that disconnect to the October 10 liquidation cascade, a structural event he believes damaged market plumbing.

Unlike traditional equity flash crashes, crypto lacks regulatory safeguards to cancel trades. During the cascade, forced deleveraging coincided with exchange API disruptions, temporarily removing market makers and liquidity providers. Prices fell further than fundamentals justified.

Pal speculates that exchanges may have stepped in to absorb forced selling, later unwinding positions algorithmically during peak liquidity hours.

Combined with widespread call-selling strategies clustered around the $100,000 strike, often tied to yield products, the result was sustained upside suppression.

However, he believes that the overhang is now fading.

The “Banana Zone” Setup

Pal refers to the final acceleration phase of a crypto cycle as the “Banana Zone” —a nonlinear repricing driven by liquidity, improving growth, and renewed capital inflows.

Before that phase begins, markets typically digest prior volatility and clear structural resistance levels. The $100,000 zone, he argues, is both psychological and structural. Once call-selling pressure eases and positioning remains cautious, the setup for an upside shock strengthens.

Liquidity, in Pal’s view, leads price. By the time consensus turns bullish, the move may already be underway.

If global refinancing pressures force further liquidity injections into the system, Bitcoin, which he describes as a “global liquidity sponge,” could respond quickly.

And if the gap between liquidity and price closes, $140,000 may not be a stretch target. It may simply be where the market was always headed.

Crypto World

Bitcoin May Rebound to $85K as CME ‘Smart Money’ Slashes Short Bets

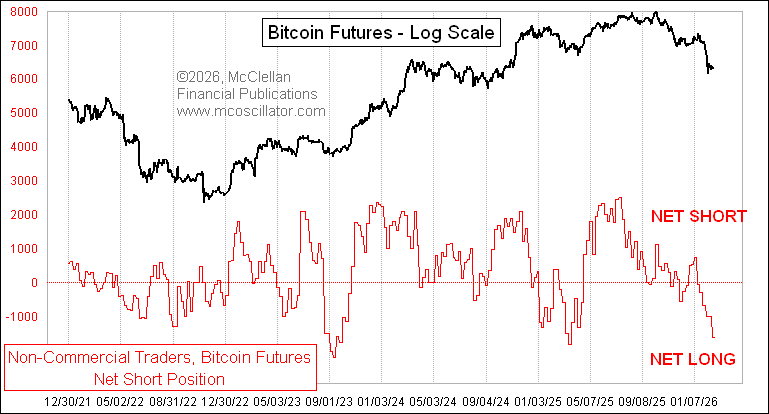

Bitcoin (BTC) bottomed after CME futures speculators turned net bullish in April 2025. A similar positioning shift is resurfacing in 2026, raising the odds of a BTC price recovery in the coming weeks.

Key takeaways:

BTC futures, technicals hint at $85,000 price target

Non-commercial Bitcoin futures traders cut their net position to about -1,600 contracts from roughly +1,000 a month earlier, according to the CFTC Commitment of Traders (COT) report published last week.

In practice, this means that large speculators, including hedge funds and similar financial institutions, have shifted from net short to long, with bulls outnumbering bears on the CME.

The rapid net-short unwind implies that “smart money” added longs “with some urgency,” said analyst Tom McClellan, while pointing to two similar past swings that preceded Bitcoin price bottoms.

For instance, BTC’s price gained around 70% after a sharp dip in CME Bitcoin futures net shorts in April 2025. In 2023, BTC price rose by over 190% under similar futures market conditions.

As of February, the smart money swing is flashing once again, just as Bitcoin defends its 200-week exponential moving average (200-week EMA, the blue line), which has acted as a bear-market floor in most major drawdowns of the last decade.

On Sunday, BTC’s 200-week EMA was hovering around near $68,350.

The last time Bitcoin traded around this moving average during deep sell-offs (in 2015, 2018 and 2020), it eventually marked the end of the downtrend and the start of a new recovery phase.

Related: Bitcoin historical price metric sees $122K ‘average return’ over 10 months

Bitcoin’s weekly relative strength index (RSI) remains in oversold territory, a sign that selling pressure is nearing exhaustion.

That further raises Bitcoin’s odds of recovering in the coming weeks. A decisive rebound from the 200-week EMA could trigger a run-up toward the 100-week EMA (the purple wave) at roughly $85,000 by April.

Bitcoin bulls aren’t out of the woods yet

McClellan cautioned that the smart money shift is “a condition, not a signal,” meaning Bitcoin could still slide from its current price levels before a durable low forms.

That may trigger the 2022 scenario, wherein BTC plunged by over 40% after breaking below its 200-week EMA despite similar oversold conditions.

A repeat of that 40% plunge in 2026 could result in BTC prices falling toward $40,000, or 60% from its record high of around $126,270.

Some analysts, including Kaiko, also see BTC potentially bottoming around $40,000–$50,000 based on its “four-year cycle” framework.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

The $23.6B Bitcoin Miscalculation: Inside Nakamoto Inc.’s Costly Treasury Collapse

TLDR:

- Nakamoto Inc. purchased 5,398 BTC near Bitcoin’s $118K peak, now sitting on $270M in unrealized losses.

- The $23.6B market cap wipeout marks one of the steepest corporate Bitcoin treasury collapses in crypto history.

- A reverse takeover structure helped launch $NAKA’s Bitcoin strategy but accelerated losses as sentiment shifted fast.

- The 99% drop in 280 days is pushing institutional investors to reconsider single large Bitcoin purchases near cycle tops.

$23.6 billion in market value has been wiped from Nakamoto Inc. ($NAKA) in just 280 days. The company purchased 5,398 Bitcoin near the asset’s all-time high of $118,000.

That single decision now carries $270 million in unrealized losses. The market capitalization collapse of 99% has stunned both retail and institutional observers.

This ranks among the most damaging corporate Bitcoin treasury bets on record.

How a Bold Bitcoin Bet Became a $23.6B Collapse

The scale of the $23.6 billion market cap erasure did not happen overnight. Nakamoto Inc. built its Bitcoin reserve strategy through a reverse takeover structure.

That approach generated early momentum and brief investor enthusiasm around the stock. As Bitcoin retreated from peak levels, however, the company’s valuation followed in dramatic fashion.

Buying 5,398 BTC at approximately $118,000 per coin left the company extremely vulnerable to any price correction. There was no phased entry, no cost-averaging approach, and no visible downside buffer in place.

When prices moved against the position, the losses compounded quickly across 280 days. The result was a near-total destruction of shareholder value.

Analyst @wiseadvicesumit captured the situation plainly, writing that “conviction is powerful” but “timing is brutal.”

The post described this as what happens when “number go up forever” meets reality. That framing resonated widely across crypto communities and financial circles. Many observers pointed to the entry price as the single most critical failure in the entire strategy.

The $270M Loss That Is Reshaping Corporate Crypto Strategy

The $270 million sitting in unrealized losses represents more than a balance sheet problem for Nakamoto Inc. It signals a broader warning for any corporate treasury considering large, concentrated Bitcoin positions.

Crypto commentator @nice_investment described the collapse as “one of the most expensive timing errors in crypto history.” That assessment is difficult to argue against, given the numbers involved.

The use of a reverse takeover to establish the Bitcoin reserve drew significant attention at launch. It positioned Nakamoto Inc. as an aggressive, conviction-driven institutional player in the crypto space.

Yet the same structure that amplified early excitement also accelerated the downside when sentiment shifted. The $23.6 billion erasure now follows that story wherever it is told.

Corporate treasury teams across the industry are watching this outcome carefully. Single large purchases near market cycle peaks have historically produced poor returns across multiple Bitcoin cycles.

This case adds a striking new data point to that pattern. Going forward, phased entry strategies and defined risk thresholds are likely to gain more favor among institutions entering the Bitcoin market.

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports6 days ago

Sports6 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics11 hours ago

Politics11 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech6 days ago

Tech6 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 days ago

Sports4 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business5 hours ago

Business5 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 hour ago

Business1 hour agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Politics3 hours ago

Politics3 hours agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World3 days ago

Crypto World3 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market