Crypto World

Crypto Google Searches Plummet to 1-Year Lows Amid Market Crash

Google worldwide search volume for “crypto” is hovering near a one-year low as investor sentiment cools amid a broad market downturn that has trimmed the crypto market’s total capitalization from a peak above $4.2 trillion to roughly $2.4 trillion. The global Google Trends reading for crypto sits at 30 out of 100, with the 12-month high of 100 last reached in August 2025 when market fervor and valuations were at their peak. In the United States, the pattern mirrors the wider trend but with its own rhythm: after a July high of 100, US search interest dipped below 37 in January and then rebounded to 56 in the first week of February. Taken together, these metrics paint a cautious mood among retail and institutional participants alike.

Google search data has long been used by market observers as a proxy for investor interest and potential turning points, aligning with sentiment gauges such as the Crypto Fear & Greed Index. As liquidity has cooled and volatility has persisted, traders and long-term holders have faced a challenging environment where on-chain activity and capital flows tighten alongside waning enthusiasm for risk-on bets in the crypto space. The juxtaposition of dwindling searches with continuing headlines about market stress underscores a market that remains sensitive to macro headlines, policy signals, and evolving risk appetites.

Google search data is often used as a gauge of investor sentiment and corroborates other indicators that track crowd psychology across the crypto market. As the broader market contends with macro headwinds, retail chatter and social signals continue to reflect a cautious stance, even as some pockets of volatility persist.

Investor sentiment craters as Fear & Greed Index hits record lows

The Crypto Fear & Greed Index plunged to a record low of 5 on Thursday, before ticking up to 8 by Sunday, according to CoinMarketCap. Both readings sit in the “extreme fear” territory, signaling widespread risk aversion among market participants. The latest readings echo sentiment conditions observed during past downturns, including periods that followed the Terra ecosystem collapse and the associated de-pegging event in 2022. CoinMarketCap notes that extreme fear can coexist with abrupt bursts of selling pressure, creating environments where short squeezes and liquidity gaps become more pronounced.

In broader terms, sentiment has moved in lockstep with price action and liquidity constraints. The market’s mood now resembles the climate seen after the Terra collapse, when contagion fears and leverage-induced liquidations amplified downside pressure. The Terra incident, which destabilized the Terra ecosystem and its dollar-pegged stablecoin, remains a reference point for how quickly confidence can erode in a highly correlated sector. The event set in motion cascading liquidations that helped accelerate a protracted bear phase in 2022, a period that many participants say still informs risk management and portfolio construction today.

The dialogue around sentiment is also fed by data-driven signals from analysts tracking social conversations and on-chain indicators. Santiment has highlighted a sharp decline in positive versus negative commentary, with crowd sentiment skewing heavily negative as traders search for a bottom to time their entries. While some investors seek capitulation points as an opportunity to accumulate, others remain wary of premature bets in an environment where liquidity can tighten quickly and price swings remain pronounced.

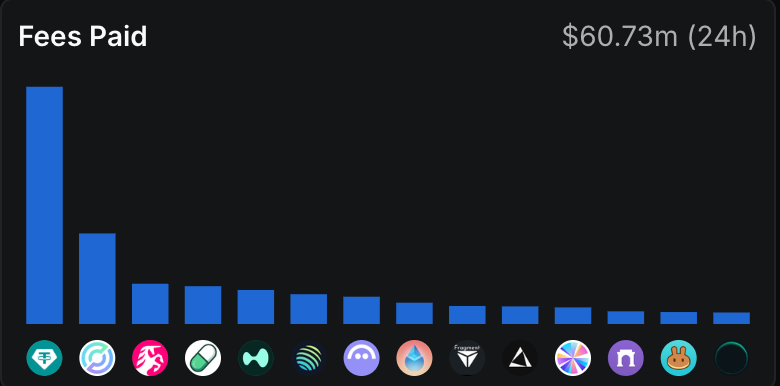

The broader mood is reinforced by market structure data: daily aggregate crypto trading volume has fallen markedly from a high near $153 billion on Jan. 14 to around $87.5 billion most recently, underscoring the retreat in participation and the challenge of sustaining momentum in a risk-off regime. These shifts in activity, combined with sentiment indicators, paint a picture of a market that remains fragile and sensitive to macro catalysts and policy developments. Investors are paying closer attention to how institutions and retail players reposition their risk budgets in the face of ongoing volatility and mixed fundamentals.

Why it matters

At a fundamental level, the convergence of weak search interest, suppressed trading volumes, and extreme fear in sentiment indices matters for participants across the crypto ecosystem. For traders, the current environment reinforces the importance of risk controls, liquidity considerations, and disciplined position sizing, given the potential for rapid shifts if macro catalysts improve or if liquidity flows reaccelerate. For builders and developers, the mood underscores the need for clarity around use cases, real-world utility, and user acquisition strategies that can drive sustained engagement even when markets are challenged.

From a retail vantage point, the data suggest that casual interest is not being replaced by immediate price upside; rather, attention remains episodic, with bursts around major headlines and then a reversion to the mean. This dynamic can affect onboarding curves for new users and the cadence of education and tooling that platforms rely on to convert curiosity into participation. Meanwhile, for institutions, the subdued atmosphere might translate into more selective allocations, tighter diligence, and a wait-and-see posture as they gauge how the regulatory and macro landscapes unfold in the coming quarters.

The Terra episode remains a salient reminder of how quickly sentiment can flip when confidence erodes and liquidity drains. In such environments, risk models that emphasize stress-testing, collateral management, and scenario planning can be more valuable than outright exposure bets. Investors should remain mindful of the connections between search behavior, sentiment, and price action, recognizing that public interest can act as a leading indicator of potential market inflection—but not a reliable predictor on its own.

What to watch next

- Continuing Google Trends updates on crypto search interest (worldwide and US) to spot any turning points in public curiosity.

- Monitoring the Crypto Fear & Greed Index and related sentiment metrics on CoinMarketCap and comparable aggregators.

- Observing developments around Terra’s ecosystem and the future trajectory of LUNA, as well as any regulatory or governance signals affecting stablecoins and cross-chain liquidity.

- Watching liquidity dynamics and macro flows, including ETF-related product activity and institutional risk appetites, to gauge potential shifts in market participation.

Sources & verification

- Google Trends data for Crypto worldwide and US searches (Google Trends links in the article).

- CoinMarketCap Fear & Greed Index page for sentiment data.

- CoinMarketCap charts page for market volume trends.

- Terra ecosystem collapse coverage and its impact on market psychology and liquidity (2022 references cited in the article).

- Santiment research and weekly summaries on crowd sentiment and social signals.

Market reaction and key details

What the data collectively suggest is a crypto market that remains highly sensitive to macro dynamics, liquidity conditions, and high-profile narrative events. The decline from a peak market cap above $4.2 trillion to roughly $2.4 trillion reflects not only price moves but also a broad retrenchment in risk appetite and a retreat by weaker hands who fueled the late-2021 to mid-2025 hype cycle. The rebound in US search interest in early February indicates that public attention can snap back, but whether that translates into durable capital inflows remains uncertain. As one anchor of the ecosystem, Bitcoin (CRYPTO: BTC) continues to lead price discovery, even as broader market participation ebbs and flows in response to evolving fundamentals and sentiment.

Terra’s collapse and the subsequent liquidity shock provided a stark reminder of how correlated risk exposures can be, particularly when leverage is high and confidence deteriorates. The reverberations from that event still inform risk controls, governance discussions, and the pace at which new products attempt to attract capital in a cautious environment. In the near term, the market will likely hinge on macro signals, regulatory clarity, and the interplay between sentiment indicators and actual on-chain activity.

Why it matters (expanded)

For users and investors, the current climate underscores the importance of diversification, prudent risk management, and clear investment objectives. It also highlights the value of staying informed through reliable data sources and avoiding overreliance on short-term sentiment alone. For builders in the space, the message is to emphasize tangible use cases, security, and user-friendly tooling that can withstand periods of market stress. For the market as a whole, the ongoing scrutiny around liquidity, regulatory development, and institutional participation will shape the trajectory of adoption and the resilience of the sector to shocks.

Ultimately, the story is one of a maturing market that continues to wrestle with volatility, narrative risk, and the pace of innovation. As investors weigh risk-adjusted returns in a downbeat environment, the data offer a sober reminder: interest can surface quickly, but sustained participation requires credibility, resilience, and real-world utility that transcends cycles.

What to watch next

- Weekly updates on Google Trends for crypto and related terms to identify shifts in public interest.

- Monitoring the Fear & Greed Index for potential signals that market psychology is shifting toward a more constructive phase.

- Tracking Terra-related developments and the performance of its associated assets, including governance updates and liquidity restoration efforts.

Sources & verification

Crypto World

Gear Up for the Fed’s ‘Gradual Print’ Strategy

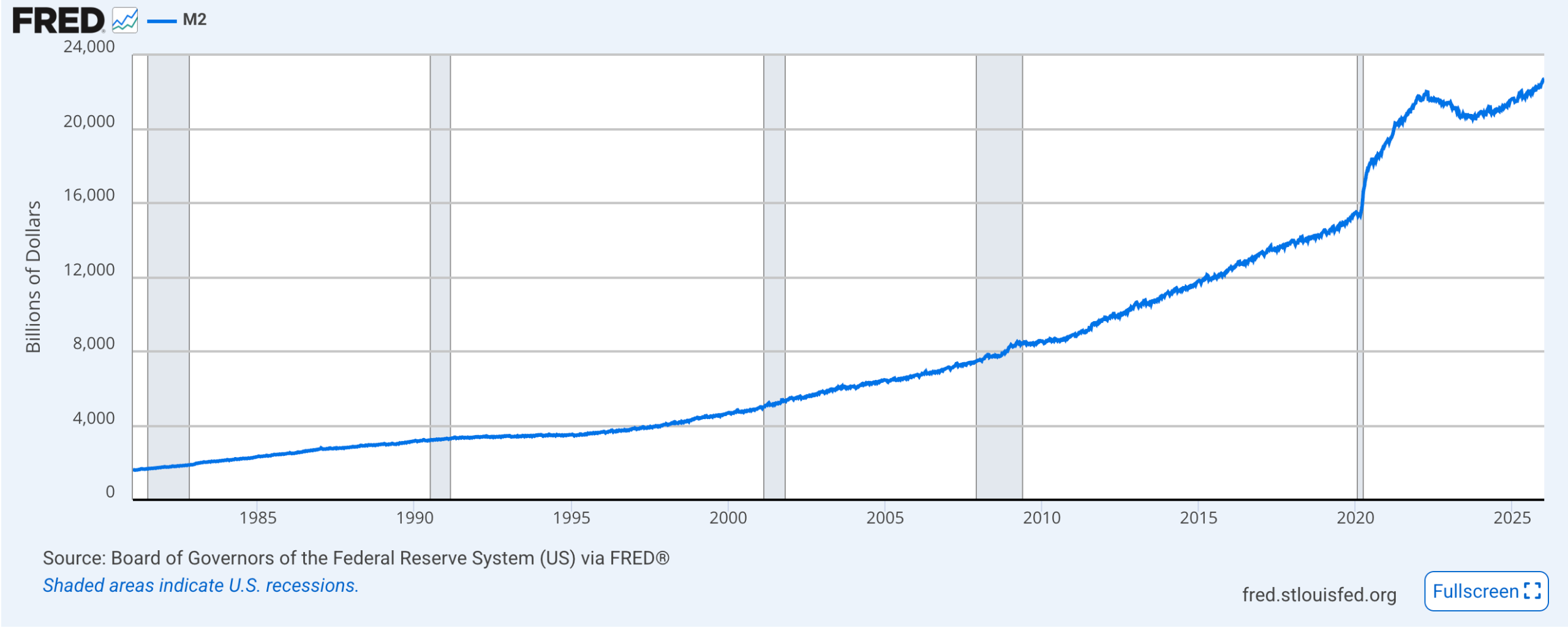

As the Federal Reserve navigates a gradual path of monetary expansion, investors increasingly view crypto markets through a macro lens. In a view echoed by Lyn Alden, a respected economist and Bitcoin advocate, the current regime is likely to spur asset prices in a measured way—enough to lift high-quality assets while avoiding the explosive rallies some on-chain enthusiasts once forecast. Alden argues the Fed’s balance sheet will grow roughly in proportion to nominal GDP, a framework that, she contends, supports a cautious reallocation toward scarce, resilient assets and away from crowded speculative bets. In this environment, Bitcoin (CRYPTO: BTC) remains a focal point for traders weighing how policy will ripple through liquidity and risk appetite.

The strategist’s stance sits against a backdrop of political and regulatory uncertainty shaping the Fed’s next moves. Alden’s February 2026 investment strategy newsletter suggests a continued emphasis on “high-quality scarce assets,” coupled with a strategic rebalance away from euphoric sectors toward areas that are under-owned but structurally robust. The broader context includes the ongoing debate about who will lead the Fed next, with market participants parsing how a potential chairmanship—whether Kevin Warsh or another figure—might tilt policy toward hawkish or dovish tendencies. The macro narrative is essential for crypto traders because interest-rate trajectories and liquidity cycles are historically linked to crypto price dynamics.

Historically, market outcomes hinge on the direction of credit and money supply. When policymakers expand credit by increasing the money supply, many assets—crypto included—tend to benefit in the near term. Conversely, a contractionist stance manifested through higher rates can dampen risk assets and compress prices. This duality informs current expectations: central banks have signaled a cautious, data-dependent approach, but investors remain vigilant for any signs that the balance sheet will outpace or merely keep pace with monitored economic growth. In late 2025, Powell pointed to a nuanced policy path, describing inflation and employment risks as two sides of a balancing act, and underscoring that policy carries no risk-free shortcut.

“Interest rate policy can influence crypto prices,” an established principle that investors continuously test. The flow of credit and the liquidity environment shape risk sentiment, and crypto markets—while diverse—are not insulated from such macro moves. The relationship between liquidity provision and asset prices remains central to how traders structure portfolios in the months ahead. Earlier this year, crypto observers noted how shifts in policy expectations could reprice risk, particularly for assets that benefited from prior rounds of monetary stimulus. A related analysis outlined how lingering policy ambiguity—especially around rate paths and balance-sheet expansion—can sustain volatility in the space.

Market observers have been tracking forward guidance and rate-path probabilities with particular attention to the upcoming FOMC decision window. Early signals suggested that a March rate cut was no sure thing, with traders estimating a roughly 20% probability of a cut at the next meeting, down from a prior reading near 23%. This shift reflects a broader re-pricing of risk as investors weigh the possibility that the Fed may remain cautious about inflation momentum and labor-market dynamics. The CME FedWatch tool has become a barometer for these expectations, showing a move toward pricing in steadier policy rather than aggressive easing.

At the same time, the policy backdrop remains unsettled. Powell, who leads the Federal Reserve, has faced questions about the speed and scale of future rate adjustments. Following the December FOMC meeting, he acknowledged that inflation risks appeared skewed to the upside in the near term, even as employment remained robust. With Powell’s term set to expire and Warsh’s confirmation still awaited by the Senate, investors must factor in the possibility that the committee’s consensus could shift as new data arrives. In such an environment, crypto traders increasingly view Bitcoin not merely as a speculative asset but as a potential hedge or cycle-levered instrument whose performance is tied to macro liquidity dynamics and the policy stance around money creation.

In the broader conversation about how policy affects asset prices, several interconnected themes emerge. First, the pace of balance-sheet expansion remains a critical variable; if the Fed continues to grow the monetary base in step with nominal GDP, the implication could be a gradual upward drift in risk assets, including crypto. Second, the market’s sensitivity to the chair’s temperament and the committee’s tightening or easing cadence means that any signals about policy discipline, inflation expectations, or financial-stability concerns can translate into intensified price movements across digital assets. Finally, the crypto space continues to wrestle with regulatory clarity and institution-building, which amplifies the impact of macro shifts on liquidity and diversification choices for investors.

Key takeaways

- The Fed is anticipated to maintain a gradual expansion of its balance sheet, aiming to grow in proportion to nominal GDP, a framework that could support broad asset prices without triggering extreme liquidity surges.

- Lyn Alden cautions that investors should rebalance away from euphoric sectors toward high-quality scarce assets, signaling a selective, value-oriented strategy for crypto holders.

- Market pricing for a March rate cut sits around 20%, down from prior levels, reflecting uncertainty about how inflation and employment data will unfold in the near term.

- Policy uncertainty, including the potential shift in leadership at the Fed, adds a layer of risk to crypto liquidity and risk sentiment in 2026.

- Crypto-price respond to money-supply signals, making Bitcoin a barometer for macro liquidity and policy expectations in the current cycle.

Tickers mentioned: $BTC

Market context: The macro backdrop remains characterized by ongoing liquidity considerations, policy guidance, and the broader risk-on/risk-off dynamic that has been shaping crypto markets as investors reassess long-term growth prospects and the trajectory of central-bank balance sheets.

Sentiment: Neutral

Price impact: Neutral. The policy path is seen as supportive for risk assets in a gradual way, but expectations for aggressive liquidity expansion have cooled, keeping volatility in check but not eliminating it.

Why it matters

For investors, the evolving policy framework matters because it defines the liquidity environment in which crypto markets operate. If the Fed sustains a measured expansion of its balance sheet alongside steady GDP growth, high-quality assets—often those with scarce supply or strong fundamentals—could outperform in a backdrop of resilient demand. Bitcoin, as the most mature cryptocurrency with significant liquidity and institutional interest, often reacts to shifts in money supply and policy expectations. The current outlook suggests a world where disciplined, data-driven decisions—rather than rapid-fire stimulus—could guide asset price trajectories, with crypto portfolios needing to adapt to changing risk premia and macro signals.

Builders and developers in the crypto space may also take cues from this macro environment. A more predictable policy path could reduce some downside macro risk, enabling longer-term experimentation and product development in decentralized finance, layer-1 ecosystems, and institutional-grade custody and liquidity solutions. Yet, the absence of a clear, easing-driven bull case could maintain a careful stance among investors who prize resilience and yield stability over speculative exuberance. In this setting, projects with robust on-chain economics, real-world utility, and sustainable governance could attract more durable capital, while speculative plays may experience more episodic volatility as market probabilities shift.

From a regulatory and institutional perspective, the interplay between central-bank signaling and crypto-market liquidity remains a focal point. If policymakers continue to emphasize cautious growth and gradual easing, the path of least friction for crypto institutions could involve deeper integration with traditional financial rails, enhanced risk controls, and clearer frameworks for custody, settlement, and reporting. The story remains dynamic, with policy, macro data, and market sentiment converging to shape the next phase of crypto adoption and price discovery.

What to watch next

- March FOMC outcome and the probability of a rate move, as reflected by CME FedWatch.

- Any new signals from the Fed about the pace of balance-sheet expansion and its relationship to nominal GDP growth.

- Nominal GDP growth data and inflation readings that could influence the committee’s guidance.

- Status of Kevin Warsh’s confirmation as Fed Chair and how leadership could influence policy tilt.

- Bitcoin price action in response to macro liquidity shifts and any notable shifts in institutional participation.

Sources & verification

- Lyn Alden’s February 2026 investment strategy newsletter (link to the original newsletter).

- Federal Reserve policy commentary and remarks by Chair Jerome Powell, including December FOMC statements.

- Market expectations for rates compiled by CME Group’s FedWatch tool.

- Related analyses on the impact of fed interest rates on crypto holders and investor sentiment pieces.

Fed policy signals, Alden’s outlook, and Bitcoin posture

Bitcoin (CRYPTO: BTC) sits at an intersection of macro policy and crypto market dynamics. Alden’s framework—favoring high-quality scarce assets and a measured reallocation away from speculative corners—suggests a patient, risk-aware stance for crypto investors. The notion that the Fed will pursue balance-sheet growth in line with nominal GDP implies a lingering but controlled liquidity environment, one that can support gradual asset price appreciation without igniting runaway inflation fears. In this context, BTC may benefit more from a steady money-supply backdrop than from sudden, outsized stimulus, aligning with a broader market preference for resilience and fundamentals. Readers can monitor the evolving policy narrative through linked discussions on Bitcoin’s price movements and broader crypto-market responses to rate expectations.

Powell’s cautionary framing—emphasizing no risk-free path for policy—highlights the asymmetry in policy outcomes. As the Senate weighs Warsh’s nomination, investors must weigh the likelihood of a hawkish tilt against the potential for cooler inflation readings later in the year. This balance matters for crypto liquidity, as a more cautious stance could prompt a shift in risk appetite, favoring assets with clearer on-chain utility and governance structures over more speculative bets. Taken together, the macro backdrop underscores the need for disciplined positioning, selective exposure, and ongoing scrutiny of liquidity signals as crypto traders navigate a landscape defined by gradual monetary expansion rather than rapid-fire stimulus.

Crypto World

Crypto VC Explodes in Q4 2025: $8.5B Floods Later-Stage Startups

US-headquartered companies captured 55% of Q4 crypto VC capital.

Crypto and blockchain venture capital witnessed a sharp rebound in Q4 2025, driven predominantly by large late-stage deals. Galaxy Digital’s report, authored by Alex Thorn, Head of Firmwide Research, found that venture capitalists deployed $8.5 billion across 425 deals in the quarter – an 84% increase in capital invested and a 2.6% rise in deal count compared to Q3 2025.

This represents the strongest quarterly investment in the sector since Q2 2022, although deal counts remain well below 2021-2022 levels.

Crypto VC Surge in Q4

Thorn reported that later-stage companies captured 56% of total capital invested, while earlier-stage startups accounted for the remaining 44%, a proportion unchanged from the previous quarter.

Eleven deals in Q4 raised over $100 million each, which collectively represented $7.3 billion, or roughly 85% of the quarterly total. The largest raises included Revolut at $3 billion, Touareg Group at $1 billion, and Kraken at $800 million.

Other prominent transactions included Ripple and Tempo at $500 million each, Erebor at $350 million, MegaHoot at $300 million, Rain at $250 million, EXUGlobal and TradeAlgo at $120 million each, and RedotPay at $107 million. Across 2025, venture capitalists invested a total of $20 billion into crypto and blockchain startups through 1,660 deals, making it the largest annual investment since 2022 and more than double 2023’s total.

The Trading/Exchange/Investing/Lending category remained the largest recipient of venture capital as it drew over $5 billion, led by Revolut and Kraken, while sectors including stablecoins, AI, and blockchain infrastructure also attracted notable investment.

Pre-seed deal counts remained healthy at 23% of total deals, which means continued entrepreneurial activity, while later-stage deal share has steadily increased as the sector matured. During this quarter, median pre-money valuations climbed to $70 million, and the median deal size reached $4 million. Valuation data existed for just 10% of deals, biased toward bigger, later-stage companies.

You may also like:

Global Crypto VC

Geographically, 55% of capital went to US-headquartered companies, followed by the United Kingdom at 33%, Singapore at 2%, and Hong Kong at 1.7%. A similar pattern was seen across deal counts as well, with 43% completed by US companies, 6% in the UK, and 4% in Hong Kong.

Fundraising for crypto-focused venture funds reached $1.98 billion across 11 funds in Q4, which contributed to $8.75 billion raised for the full year, the largest since 2022. Average fund size rose to $167 million, with a median of $46 million.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

MegaETH Joins Chainlink Scale Program With $14B in DeFi Assets at Launch

TLDR:

- MegaETH launched with Chainlink integration, enabling immediate access to $14B in DeFi assets and protocols.

- Chainlink’s oracle infrastructure powers 70% of DeFi markets with over $27 trillion in transaction value.

- CCIP enables cross-chain liquidity for Lombard and Lido assets across MegaETH and other blockchain networks.

- Aave and GMX protocols are now available on MegaETH through Chainlink’s data and interoperability standards.

MegaETH has joined the Chainlink Scale program and integrated Chainlink’s data and interoperability infrastructure at launch.

The collaboration provides immediate access to leading DeFi protocols, including Aave and GMX. Users can now interact with nearly $14 billion in flagship assets such as Lido’s wstETH and Lombard’s BTC.b and LBTC.

The integration went live on Monday, marking a strategic partnership between the real-time blockchain platform and the oracle network.

Chainlink Infrastructure Powers MegaETH’s DeFi Ecosystem

The integration brings Chainlink Data Feeds, Data Streams, and Cross-Chain Interoperability Protocol (CCIP) to MegaETH. These services enable developers to build high-performance decentralized applications on the platform.

The oracle infrastructure has facilitated over $27 trillion in onchain transaction value across the industry. Currently, Chainlink powers approximately 70% of existing DeFi markets globally.

MegaETH users gain access to multiple DeFi protocols through this partnership. Aave and GMX are among the prominent platforms now available on the network.

Additionally, HelloTrade and Avon have joined the ecosystem at launch. The integration creates opportunities for lending protocols, derivatives markets, and decentralized exchanges to operate efficiently.

The platform features a custom integration designed to deliver fast market data. This setup supports MegaETH’s objective of becoming the first real-time blockchain.

Developers can now build applications requiring accurate price feeds and reliable data sources. The infrastructure ensures consistency across various financial products and services.

CCIP enables secure cross-chain asset transfers for MegaETH users. Asset issuers like Lombard and Lido can provide liquidity across multiple blockchain networks.

The protocol offers compliance-enabled interoperability for developers building composable applications. This functionality extends MegaETH’s reach beyond its native ecosystem into broader multi-chain environments.

Scale Program Benefits and Industry Adoption

The Chainlink Scale program provides MegaETH developers with low-cost oracle services. Institutions building on the platform receive access to secure data infrastructure from day one.

Oracle nodes supply trusted information to support both traditional and decentralized finance applications. The program reduces barriers for teams developing on MegaETH.

Johann Eid, Chief Business Officer at Chainlink Labs, commented on the partnership’s scope. “MegaETH joining Chainlink Scale and adopting the Chainlink data and interoperability standards is a major moment for our ecosystem,” Eid stated.

He added that the infrastructure has enabled tens of trillions in onchain transaction value. The integration brings users access to protocols like Aave and GMX alongside key DeFi assets.

Stani Kulechov, Founder of Aave Labs, addressed the upcoming Aave launch on MegaETH. “The upcoming Aave launch on MegaETH with Chainlink live from day one will give users access to the high-quality data,” Kulechov explained.

He noted that Chainlink’s standards have been foundational to Aave’s multi-ecosystem growth. The integration enables seamless extension onto MegaETH’s next-generation blockchain platform.

Lei Yang, Co-Founder and CTO of MegaETH, outlined the strategic rationale behind joining Chainlink Scale. “Joining Chainlink Scale ensures that our developers have access to high-quality data and secure interoperability,” Yang said.

He emphasized the importance of providing developers with necessary tools from day one. The partnership supports MegaETH’s goal of becoming the leading blockchain platform in the industry.

Crypto World

Get Ready for the Federal Reserve’s ‘Gradual Print’

Whether the Federal Reserve is engaging in quantitative easing is purely semantic, according to Alden, who says all roads lead to debasement.

The US Federal Reserve is entering into a “gradual” era of money printing that will stimulate asset prices “mildly” but will not be as dramatic as the “big print” that many in the Bitcoin (BTC) community anticipated, according to economist and Bitcoin advocate Lyn Alden.

“My base case is roughly in line with what the Fed expects: to grow its balance sheet approximately at the same proportional pace as total bank assets or nominal gross-domestic product (GDP),” Alden said in her Feb. 8 investment strategy newsletter, adding:

“Overall, it means I continue to want to own high-quality scarce assets, with a tendency to rebalance away from extremely euphoric areas and toward under-owned areas.”

The comments followed US President Donald Trump’s nomination of Kevin Warsh to be the next Federal Reserve Chairman, which caused a furor among market traders, who perceived Warsh as more hawkish on interest rates than other potential Fed picks.

Interest rate policy can influence crypto prices. Expanding credit by increasing the money supply is typically seen as bullish for assets, and a contraction of the money supply through higher interest rates typically leads to economic slowdown and lower prices.

Related: Bitcoin investor sentiment cools amid US shutdown fears, Fed policy jitters

No rate cut expected at next FOMC meeting

Some 19.9% of traders expect an interest rate cut at the next Federal Open Market Committee (FOMC) meeting in March, down from Saturday, when CME Fedwatch showed 23% of respondents forecast a rate cut.

Current Federal Reserve Chairman Jerome Powell has repeatedly issued mixed forward guidance about interest rate policy despite slashing rates several times in 2025.

“In the near term, risks to inflation are tilted to the upside and risks to employment to the downside, a challenging situation. There is no risk-free path for policy,” Powell said following the December FOMC meeting.

Powell’s term as Federal Reserve chairman expires in May 2025, and Warsh has yet to be confirmed as the next chairman by the US Senate, fueling investor uncertainty about the direction of interest rate policies in 2026.

Magazine: TradFi fans ignored Lyn Alden’s BTC tip — Now she says it’ll hit 7 figures: X Hall of Flame

Crypto World

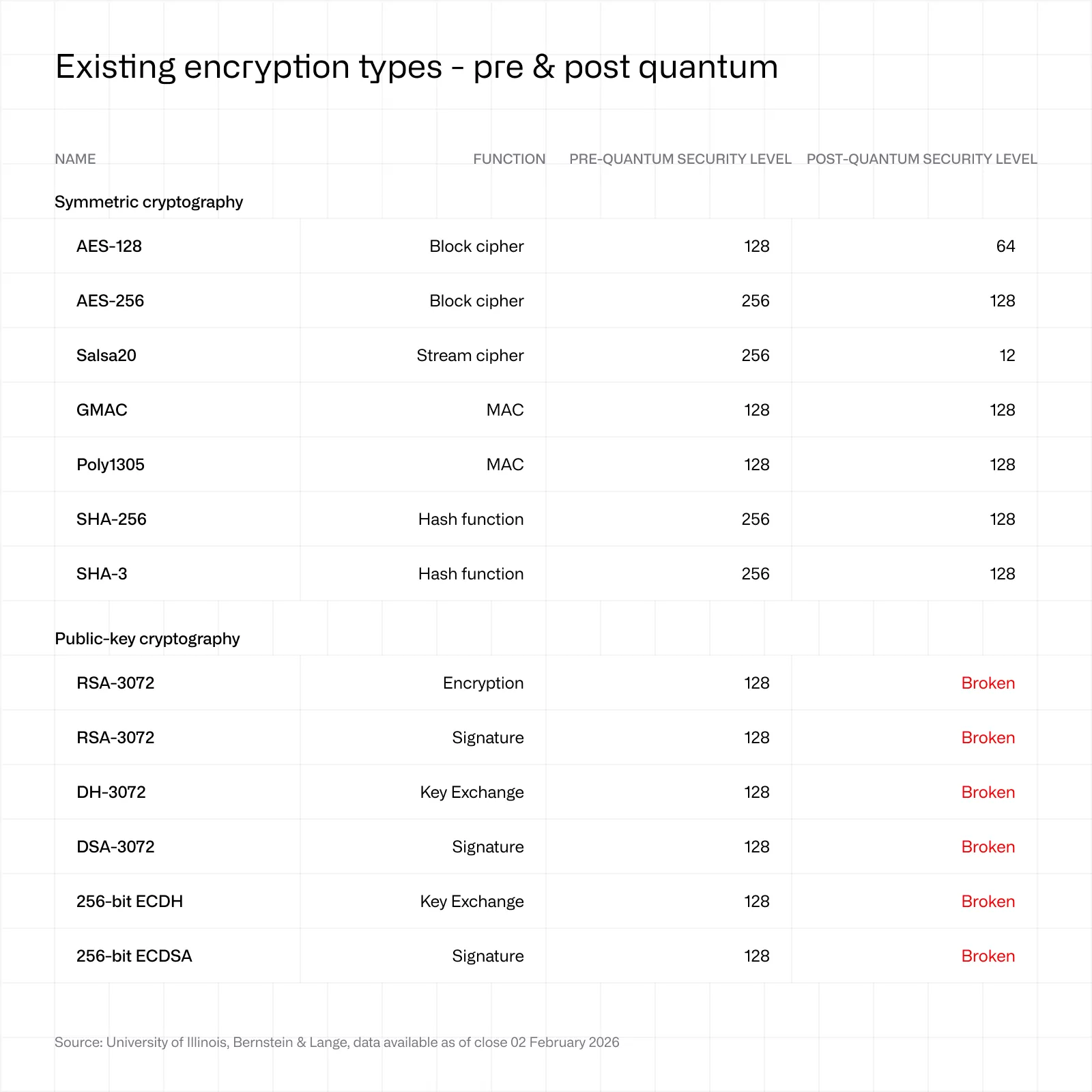

Quantum Computers Need Millions More Qubits to Break Bitcoin, CoinShares Reports

TLDR:

- Breaking Bitcoin encryption requires quantum computers 100,000 times more powerful than today’s technology

- Only 10,200 BTC in legacy addresses could cause market disruption if suddenly compromised by quantum attack

- Cryptographically relevant quantum computers unlikely to emerge before 2030s, according to CoinShares analysis

- Bitcoin can adopt post-quantum signatures through soft forks while maintaining defensive adaptability

Quantum computing poses no immediate threat to Bitcoin’s security infrastructure, according to digital asset manager CoinShares.

The firm’s latest analysis dismisses concerns about near-term vulnerabilities in the cryptocurrency’s cryptographic foundation.

Current quantum technology remains decades away from breaking Bitcoin’s encryption protocols. CoinShares estimates only 1.7 million BTC faces potential exposure, representing 8% of total supply.

The research suggests institutional investors should view quantum risks as manageable engineering considerations rather than existential crises.

Technology Requires Decades Before Becoming Cryptographically Relevant

CoinShares’ analysis reveals breaking Bitcoin’s secp256k1 encryption demands quantum systems with millions of logical qubits.

Current quantum computers operate at approximately 105 qubits, falling dramatically short of required thresholds.

Source: CoinShares

Researchers estimate attackers would need machines 100,000 times more powerful than today’s largest quantum systems.

Reversing a public key within one day requires 13 million physical qubits and fault tolerance levels not yet achieved.

Breaking encryption within one hour would demand quantum computers 3 million times more advanced than current capabilities.

Each additional qubit makes maintaining system coherence exponentially more difficult, according to technical experts.

Cybersecurity firm Ledger’s Chief Technology Officer Charles Guillemet provided expert perspective on the technical challenges facing quantum development.

Speaking to CoinShares, Guillemet emphasized the massive scale required for cryptographic attacks. “To break current asymmetric cryptography, one would need something in the order of millions of qubits. Willow, Google’s current computer, is 105 qubits. And as soon as you add one more qubit, it becomes exponentially more difficult to maintain the coherence system,” Guillemet confirmed.

CoinShares projects cryptographically relevant quantum computers may not emerge until the 2030s or beyond. Long-term attacks on vulnerable addresses could take years to complete even after technology matures.

Short-term mempool attacks would require computations finishing in under 10 minutes, remaining infeasible for decades ahead.

Limited Vulnerability Concentrates in Legacy Address Formats

The digital asset manager’s research identifies exposure primarily in legacy Pay-to-Public-Key addresses holding roughly 1.6 million BTC.

Modern address formats including Pay-to-Public-Key-Hash and Pay-to-Script-Hash conceal public keys behind cryptographic hashes. These contemporary formats maintain security until owners actively spend their funds.

CoinShares determined only 10,200 BTC sit in outputs potentially causing market disruption if compromised suddenly.

Source: CoinShares

The remaining vulnerable coins distribute across 32,607 individual outputs of approximately 50 BTC each. Breaking into these addresses would require millennia even under optimistic quantum advancement scenarios.

Bitcoin’s security framework relies on elliptic curve algorithms for authorization and SHA-256 hashing for protection.

Quantum algorithms cannot alter Bitcoin’s fixed 21 million supply cap or bypass proof-of-work validation requirements.

Grover’s algorithm reduces SHA-256 security effectively but brute-force attacks remain computationally impractical.

Renowned cryptographer Dr. Adam Back addressed Bitcoin’s capacity for defensive evolution in response to future quantum threats.

The Blockstream CEO and Bitcoin contributor explained the network’s adaptability to CoinShares. “Bitcoin can adopt post-quantum signatures. Schnorr signatures paved the way for more upgrades, and Bitcoin can continue evolving defensively,” Back told CoinShares.

Users retain sufficient time to migrate funds voluntarily to quantum-resistant addresses. Market impact appears minimal, with vulnerable coins likely resembling routine transactions rather than systemic shocks.

Crypto World

Are Non-Financial Use Cases in Blockchain Dead?

Prominent crypto venture capitalists are clashing online about whether non-financial use cases in crypto, Web3, and blockchain have failed due to a lack of investor demand and product-market fit or if the best days for non-financial applications still lay ahead.

The debate started on Friday when Chris Dixon, a managing partner at venture capital firm a16z crypto, published an article arguing that years of “scams, extractive behavior and regulatory attacks” were the reason that non-financial use cases in crypto have not taken off.

These use cases include decentralized social media, digital identity management, decentralized media streaming platforms, digital rights platforms, Web3 video games and more.

“Non-financial use cases for crypto have failed because no one wants them,” Haseeb Quereshi, a managing partner at crypto venture firm Dragonfly, said in a response on Sunday. He added:

“Let’s just admit it. They were bad products. They failed the market test. It was not Gensler or Sam Bankman-Fried (SBF) or Terra that caused these things to fail; it was that no one wanted any of it. Pretending otherwise is coping.”

Dixon said that as a16z crypto’s funds are managed with at least a 10-year time horizon, “building new industries takes time.”

“You don’t have the luxury of ‘waiting to be right’ in VC,” Nic Carter, the founding partner of venture firm Castle Island Ventures, said in a reply to Quereshi. “You need to be right about a market during the 2-3 year fund deployment period,” he said.

The debate follows a surge of VC investment into crypto projects in 2025, which mostly flowed to tokenized real-world assets (RWAs), physical or traditional financial assets represented onchain by digital tokens.

Related: Web3 revenue shifts from blockchains to wallets and DeFi apps

Different approaches to portfolio building

Dragonfly’s portfolio is built around financial use cases and blockchain infrastructure that helps move value and risk through the onchain financial system.

Some of the firm’s investments include the Agora stablecoin and payments platform, payments infrastructure provider Rain, synthetic dollar issuer Ethena, and the Monad layer-1 blockchain network.

As for a16z, the firm’s crypto portfolio includes many financial use cases like Coinbase and decentralized crypto exchange Uniswap, but also features a much wider range of Web3 sectors like community building, gaming and media streaming.

These projects include the community building club Friends With Benefits, digital identity provider World and Web3 gaming platform Yield Guild Games.

Magazine: Web3 games shuttered, Axie Infinity founder warns more will ‘die’: Web3 Gamer

Crypto World

Vitalik Buterin Says Most DeFi Is Fake

Ethereum co-founder Vitalik Buterin and crypto analyst c-node have reignited the debate over the true purpose of Decentralized Finance (DeFi).

Together, the two industry experts challenge the booming industry to rethink its priorities.

Sponsored

Experts Clash Over What Counts as “Real” DeFi

The underlying issue, according to the experts, is that much of today’s DeFi hype is superficial, serving speculative interests rather than advancing genuinely DeFi infrastructure.

“There is no reason to use DeFi unless you have longs on cryptocurrencies and want access to financial services while preserving self-custody,” c-node wrote.

They dismissed common yield-generating strategies—like depositing USDC into lending protocols—as “cargo cults,” suggesting they mimic DeFi’s success without embodying its original ethos.

The analyst further emphasized that non-Ethereum chains may struggle to replicate Ethereum’s DeFi boom, noting that early ETH participants were ideologically committed to self-custody. Meanwhile, newer ecosystems are dominated by venture capital funds using institutional custodians.

Buterin’s reply offered both a counterpoint and a broader framework for what counts as “real” DeFi. The Russo-Canadian innovator argued that algorithmic stablecoins, particularly when overcollateralized or structured to decentralize counterparty risk, qualify as genuinely decentralized.

“Even if 99% of the liquidity is backed by CDP holders who hold negative algo-dollars and separately positive dollars elsewhere, the fact that you have the ability to punt the counterparty risk to a market maker is still a big feature,” Buterin wrote.

Sponsored

DeFi’s Ideological Divide and the Push for Decentralized Risk

The Ethereum co-founder also criticized popular USDC-based strategies, noting that simply depositing centralized stablecoins into lending protocols fails to meet the criteria for DeFi.

Beyond technical definitions, he articulated a long-term vision: moving away from dollar-denominated systems toward diversified units of account backed by decentralized collateral structures.

The discussion highlights a deeper ideological divide within crypto:

Sponsored

- On one side, DeFi is seen as a tool for speculative capital efficiency—leveraging positions and generating yields without relinquishing custody.

- On the other hand, it is viewed as a foundational financial system capable of reshaping the global monetary sector through decentralization and risk distribution.

Subsequent replies in the thread reinforced this tension. Some argued that using DeFi with centralized assets still reduces intermediaries, potentially lowering systemic risk.

Others, however, sided with c-node’s purist view, predicting that market forces will favor self-custody-driven protocols over hybrid or fiat-backed systems.

This debate may shape the next phase of crypto innovation. Ethereum’s dominance in DeFi, fueled by ideological early adopters, contrasts sharply with other chains, where venture-backed investors prioritize convenience over decentralization.

Meanwhile, Buterin’s push for overcollateralized algorithmic stablecoins and diversified indices points to a possible evolution beyond current dollar-pegged structures.

Sponsored

As DeFi approaches its second decade, these discussions show that the sector is no longer just about yields and liquidity.

Instead, the conversation is turning toward the very principles that define it—custody, decentralization, and risk distribution.

This raises questions about whether DeFi can truly offer an alternative to TradFi systems or remains a sophisticated tool for crypto speculators.

Crypto World

Tom Lee’s BitMine Adds $42 Million to its Ethereum Hoard

BitMine, the largest corporate holder of Ethereum, has capitalized on the digital asset’s recent price volatility to expand its treasury holdings.

On February 7, blockchain analysis platform Lookonchain reported the transaction, citing data from Arkham Intelligence. The firm acquired approximately 20,000 ETH for a total capital outlay of $41.98 million.

Sponsored

Sponsored

BitMine Chair Defends Aggressive Buying Amid Crash

Notably, this latest tranche moves the firm significantly closer to its long-term objective of controlling 5% of Ethereum’s total circulating supply. Data from Strategic ETH Reserve shows it has achieved over 70% of that goal with its 4.29 million ETH holdings.

Meanwhile, BitMine’s latest ETH purchase comes at a moment of extreme market fragility.

Ethereum prices have collapsed roughly 31% over the past 30 days, trading around $2,117 as of press time. Over the past week, the asset traded for as low as $1,824, its lowest level since May 2025.

Still, BitMine remain committed to the crypto token, with the firm’s chairman Tom Lee arguing that “Ethereum is the future of finance.”

Consequently, Lee has dismissed concerns regarding the firm’s deepening unrealized losses.

Sponsored

Sponsored

In a recent statement, Lee argued that the current volatility is “a feature, not a bug.” According to him, Ethereum has weathered drawdowns of 60% or worse on seven occasions since 2018.

So, despite the “Crypto Winter” optics exacerbated by the nomination of Kevin Warsh to the Federal Reserve and geopolitical tensions following the Greenland incident, the Ethereum network’s fundamental usage remains robust.

Moreover, BitMine has been evolving beyond a simple “buy-and-hold” treasury strategy.

To outperform the cycle and mitigate the drag of falling spot prices, the company is pivoting toward what it describes as “accretive acquisitions” and high-risk capital deployment.

This includes publicized “moonshot” allocations into smaller-cap tokens like Orbs and investments in media outlets like Mr Beast.

Additionally, BitMine continues to leverage its massive stack for yield, staking nearly 3 million ETH.

These efforts are designed to offset the heavy pressure of a macro environment that has turned sharply risk-off.

Crypto World

PBOC Bans Unapproved Yuan-Pegged Stablecoins in China

The People’s Bank of China (PBOC) and seven regulatory agencies issued a joint statement on Friday prohibiting the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs). The directive applies to both onshore and offshore issuers, underscoring Beijing’s intent to keep financial instrumentation closely aligned with state policy while continuing to push the domestic CBDC ecosystem forward. The announcement, signed by the PBOC alongside the Ministry of Industry and Information Technology and the China Securities Regulatory Commission, reiterates a posture that private crypto activities remain outside the formal financial system unless they receive explicit clearance. A translated version of the statement framed the policy as a guardrail against stablecoins that imitate fiat currency functions during circulation and use.

“Stablecoins pegged to fiat currencies perform some of the functions of fiat currencies in disguise during circulation and use. No unit or individual at home or abroad may issue RMB-linked stablecoins without the consent of relevant departments.”

Winston Ma, an adjunct professor at New York University (NYU) Law School and a former Managing Director at CIC, China’s sovereign wealth fund, weighed in on the development, indicating the ban covers both onshore and offshore RMB variants. He noted that the policy applies to CNH and CNY alike, reflecting a comprehensive approach to RMB-related markets. CNH, the offshore version of the yuan, is designed to maintain currency flexibility in international markets while preserving capital controls, Ma explained.

The overarching narrative here is clear: Beijing intends to quarantine speculative crypto activity from the formal financial system even as it accelerates the broader rollout of e-CNY, the sovereign CBDC managed by state authorities. The policy positions digital yuan usage as the preferred channel for digital financial innovation while signaling a hard boundary against RMB-pegged instruments that could replicate traditional money-like functions outside of official oversight.

The move comes on the heels of China’s broader digital currency strategy. Just ahead of the announcement, officials approved commercial banks to share interest with clients holding the digital yuan, a development designed to make the CBDC more attractive to investors and everyday users alike. This aligns with a consistente trajectory: expand the practical utility of the digital yuan while constraining parallel ecosystems that could siphon demand or create regulatory ambiguity.

Within the policy landscape, China has repeatedly signaled a preference for harnessing digital currency tools under state supervision. A more permissive stance toward yuan-backed private tokens would complicate capital controls and challenge risks management frameworks, while the digital yuan remains a controlled instrument for domestic monetary policy and financial stability. The new directive reinforces the idea that the regime will tolerate innovation only within the boundaries of regulatory approval and centralized oversight.

Chinese government briefly considered yuan-pegged stables, but focused on CBDC instead

Earlier reporting in August 2025 suggested that China’s leadership was weighing a potential pivot toward allowing private companies to issue yuan-pegged stablecoins to facilitate global currency usage. Those discussions, however, did not translate into policy change. By September that year, regulators moved to pause or halt stablecoin trials until further notice, indicating that the government remained wary of private instruments that could undermine monetary sovereignty or complicate enforcement. The sequence illustrates a careful balancing act: while China explores financial innovation, it remains disciplined about the channels through which that innovation can reach the broader market.

In a broader context, China has shown a consistent preference for the centralized digital yuan over private stablecoins. The January 2026 policy to allow interest payments on digital yuan wallets is part of a long-run strategy to elevate the CBDC’s appeal and to test new incentive structures within a tightly regulated framework. The shift mirrors ongoing debates in other major economies about how to reconcile crypto innovation with financial stability and national monetary sovereignty, but China’s approach remains notably centralized and policy-driven.

In parallel coverage, the digital yuan story has been a recurring theme in the crypto-policy discourse, with broader examinations of CBDCs and their implications for cross-border payments and domestic finance. The conversations around stablecoins, RWAs, and the CBDC ecosystem continue to be closely watched as regulators in Beijing refine the balance between innovation and oversight.

Market context

The cross-currents in China’s crypto policy reflect a broader, global tension between digital asset innovation and regulatory control. The latest ban reinforces a risk-off stance toward private tokens and tokenized assets within a framework designed to preserve financial stability while promoting the government’s CBDC agenda. Investors and project developers watching RMB-linked instruments will likely reassess their onshore and offshore strategies in light of the explicit permission regime now underscored by multiple ministries and commissions.

Why it matters

For market participants, the joint statement clarifies that the Chinese authorities intend to keep RMB-related financial engineering firmly under state supervision. This has direct implications for any entity seeking to issue stablecoins pegged to the Renminbi or to tokenize real-world assets in a way that could bypass regulatory channels. The onshore/offshore consistency implied by the ban signals a regime-wide approach—no loopholes for RMB-backed tokens operating in the gray zones of global finance.

For issuers and platforms, the development serves as a clear reminder that regulatory clearance is a prerequisite for RMB-linked products. The alignment among the PBOC, MIIT, and CSRC indicates a shared risk assessment across monetary policy, information technology, and securities oversight. As China’s CBDC ecosystem matures, providers will likely pivot toward products and services anchored in the official digital yuan rather than those that attempt to replicate fiat-like functionality through private tokens.

From a policy perspective, the episode underscores Beijing’s dual posture: promote digital currency adoption domestically, while limiting the permissibility of private tokens that could complicate capital controls or blur the lines between currency and asset. The tension between innovation and sovereignty remains a defining feature of the Chinese crypto regulatory landscape and may shape global attitudes toward RMB-linked financial instruments and tokenized assets in the near term.

What to watch next

- Whether the regulators issue further guidance on RMB-linked tokens and tokenized RWAs, including definitions of what constitutes an “unapproved” issuance and potential penalties.

- Any enforcement actions against noncompliant issuers, both domestic and foreign, that attempt to issue RMB-linked instruments without consent.

- The ongoing rollout and uptake of the digital yuan wallet, particularly any changes to interest-bearing features or user incentives.

- Reactions from financial institutions, stablecoin operators, and tokenized-RWA platforms regarding the enforceability of the ban and its implications for cross-border activity.

- Regulatory developments related to CNH cross-border use and how offshore RMB markets will adapt to the policy, given the policy’s emphasis on RMB-related markets across borders.

Sources & verification

- Official statement: People’s Bank of China and seven agencies joint release (PBOC site) – https://www.pbc.gov.cn/tiaofasi/144941/3581332/2026020619591971323/index.html

- Overview of China’s digital yuan

- What are CBDCs? A beginner’s guide to central bank digital currencies

- China digital yuan pressure on US stablecoins

- China tech giants halt Hong Kong stablecoin plans

- China digital yuan interest wallets 2026

- China considering yuan-backed stablecoins global currency usage

Introduction

The People’s Bank of China (PBOC) and seven major regulators issued a joint directive on Friday that bars the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs). The measure targets both domestic and international issuers, signaling Beijing’s intent to curb private, crypto-style instruments in favor of tightly controlled monetary tools. The statement—co-signed by the PBOC, the Ministry of Industry and Information Technology, and the China Securities Regulatory Commission—frames RMB-linked stablecoins as devices that mimic fiat currency during circulation unless they secure explicit authorization. A translated section of the release emphasizes that no unit or individual may issue RMB-linked stablecoins without the consent of relevant departments.

Why it matters – The long arc of China’s digital finance policy

The policy is not an isolated move; it fits within a multi-year effort to keep speculative crypto activity outside of the formal financial system while promoting the digital yuan’s broader adoption. In this context, China’s approach is to constrain private tokens that could bypass capital controls or undermine monetary policy, even as it experiments with CBDC-based financial tools. The announcement arrived alongside other developments, including a 2026 push to offer interest on digital yuan wallets, designed to make the CBDC more attractive to users and investors alike. The stance also reflects a broader regional and global debate about how CBDCs will interact with private stablecoins and tokenized assets in a rapidly evolving digital economy.

The commentary from Winston Ma, an adjunct professor at NYU Law, underscores the breadth of the enforcement scope. He notes that the ban spans onshore and offshore RMB variants (CNH and CNY), reinforcing a centralized policy that seeks to keep RMB-related markets within a clearly defined regulatory perimeter. The policy’s emphasis on consent and authorization echoes long-standing Chinese priorities: maintain currency sovereignty, assure financial stability, and accelerate the domestic CBDC agenda without inviting parallel private infrastructures that could complicate policy transmission or risk management.

Looking ahead, the policy invites a clearer delineation of which digital assets and tokenized products may proceed under regulatory oversight. It also suggests that the ongoing policy dialogue around the digital yuan, CBDCs, and tokenized RWAs will continue to shape the global crypto regulatory landscape, affecting how international players approach RMB-linked products and cross-border digital finance in the years to come.

In the coming months, observers will watch for explicit enforcement guidelines, any adjustments to CBDC wallet incentives, and the extent to which offshore RMB markets adapt to a more stringent regime. The balance Beijing seeks—between innovation and control—will likely influence both domestic fintech deployments and cross-border financial engineering involving RMB-denominated instruments.

Crypto World

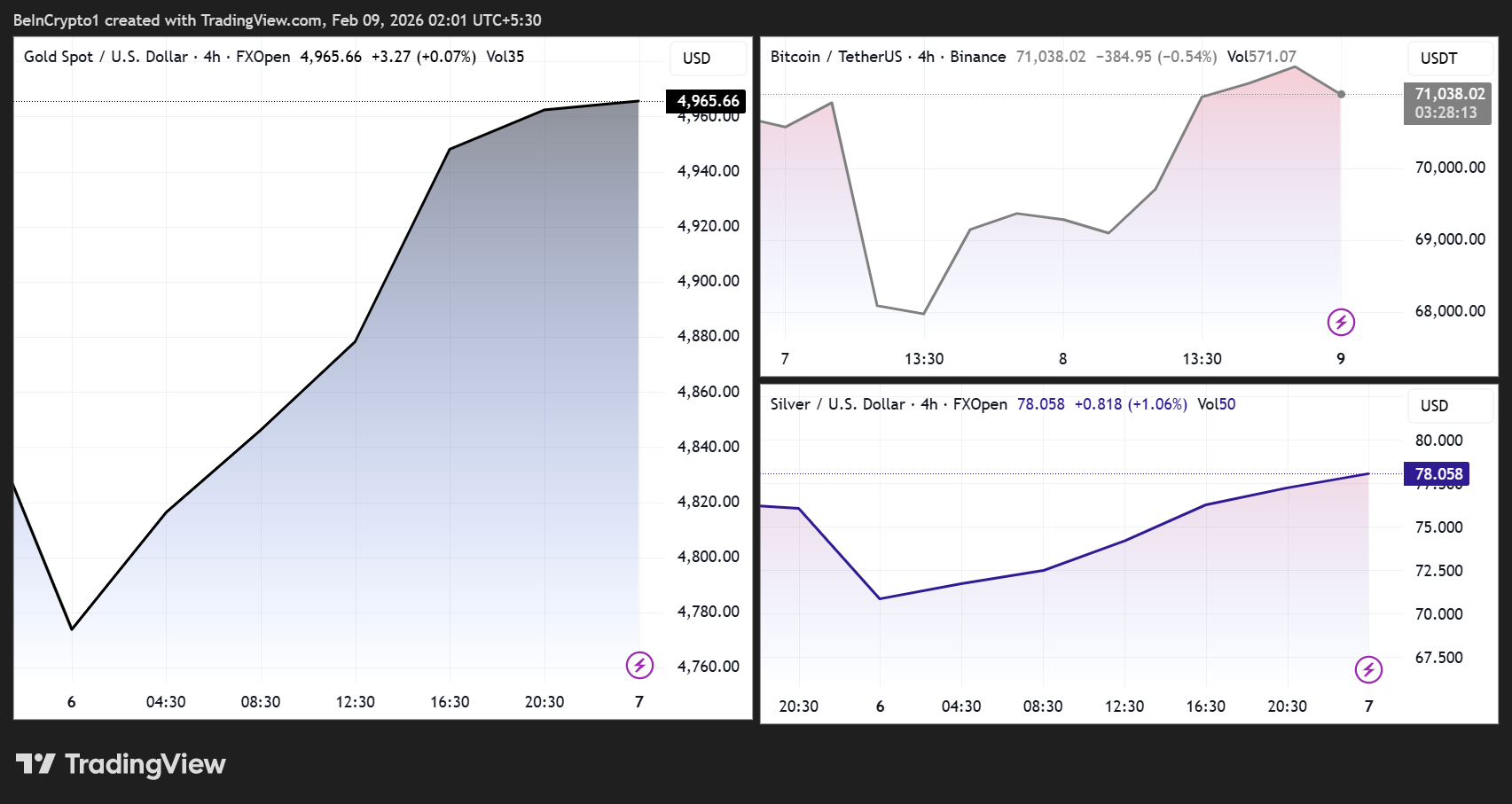

BTC, Gold & Silver Exposed?

Global markets may be entering a new phase of volatility after Goldman Sachs warned that systematic funds could offload tens of billions of dollars in equities in the coming weeks.

This wave of selling could ripple into Bitcoin, gold, and silver as liquidity conditions deteriorate.

Sponsored

Goldman Warns CTA Selling Could Accelerate as Liquidity Thins

According to Goldman’s trading desk, trend-following funds known as Commodity Trading Advisers (CTAs) have already triggered sell signals in the S&P 500. What’s more, they are expected to remain net sellers in the near term, regardless of whether markets stabilize or continue falling.

The bank estimates that roughly $33 billion in equities could be sold within a week if markets weaken further.

More significantly, Goldman’s models suggest that as much as $80 billion in additional systematic selling could be triggered over the next month if the S&P 500 continues to decline or breaches key technical levels.

Market conditions are already fragile. Goldman analysts noted that liquidity has deteriorated and options positioning has shifted in ways that may amplify price swings.

When dealers are positioned “short gamma,” they are often forced to sell into falling markets and buy into rising ones, intensifying volatility and accelerating intraday moves.

Sponsored

Goldman also highlighted those other systematic strategies—including risk-parity and volatility-control funds—still have room to reduce exposure if volatility continues to rise. That means selling pressure may not be limited to CTAs alone.

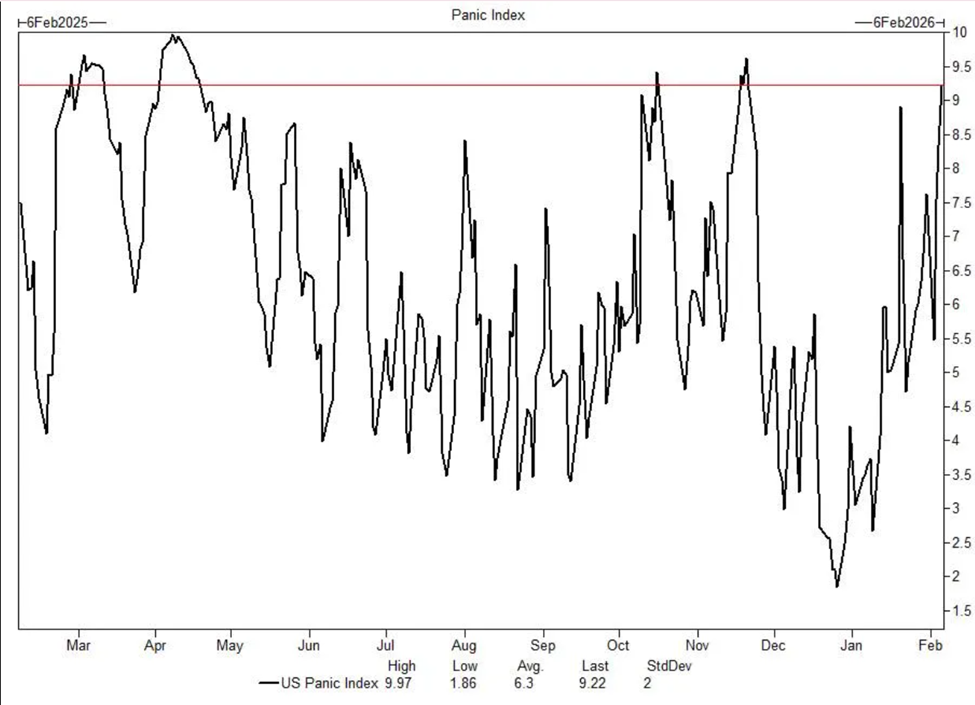

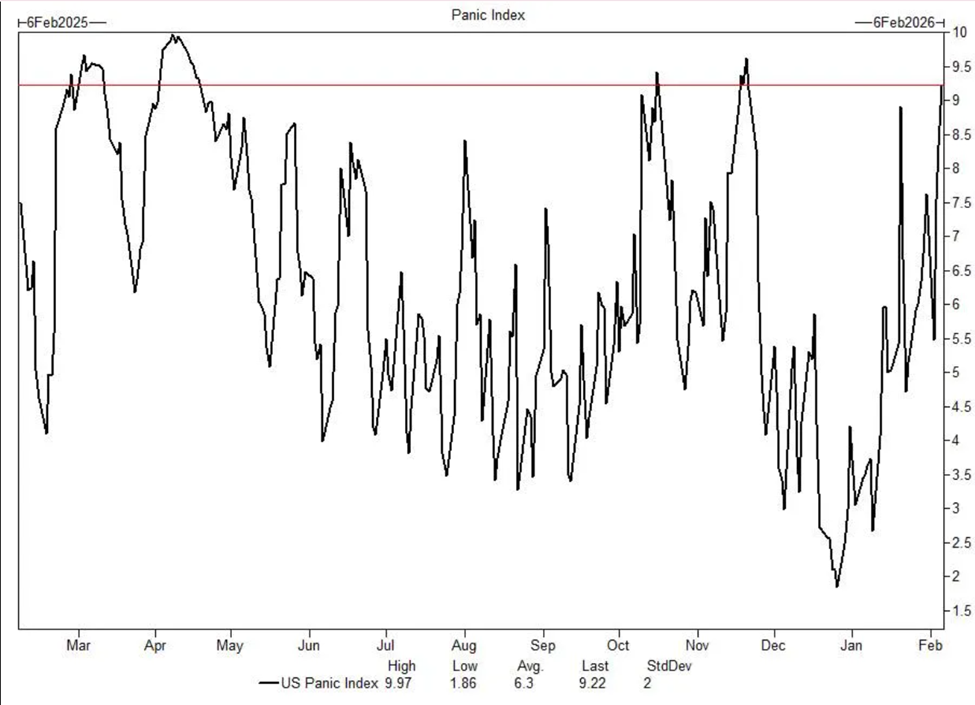

Investor sentiment is also showing signs of strain. Goldman’s internal Panic Index recently approached levels associated with extreme stress.

Meanwhile, retail investors, after a year of aggressively buying dips, are beginning to show fatigue. Recent flows indicate net selling rather than buying.

Sponsored

Although Goldman’s analysis focused primarily on equities, the implications extend beyond stock markets.

Historically, large, flow-driven equity sell-offs and tightening liquidity conditions have increased volatility across macro-sensitive assets, including crypto.

Bitcoin, which has increasingly traded in line with broader risk sentiment during periods of liquidity stress, could face renewed volatility if forced selling in equities accelerates.

Crypto-linked equities and retail-favored speculative trades have already shown sensitivity to recent market swings, suggesting positioning remains fragile.

Sponsored

At the same time, turbulence in equities can trigger complex cross-asset flows. While risk-off conditions can pressure commodities, precious metals such as gold and silver can also attract safe-haven demand during periods of heightened uncertainty, leading to sharp moves in either direction depending on broader liquidity trends and the dollar’s strength.

In the meantime, the key variable remains liquidity. With systematic funds deleveraging, volatility rising, and seasonal market weakness approaching, markets may remain unstable in the weeks ahead.

If Goldman’s projections materialize, the coming month could test equities, with a spillover effect on Bitcoin and precious metals.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics6 hours ago

Politics6 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business5 hours ago

Business5 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics8 hours ago

Politics8 hours agoThe Health Dangers Of Browning Your Food

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business12 hours ago

Business12 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report