Crypto World

Crypto PAC to Oppose Al Green in Texas Democratic Primary

The pro-crypto political action committee (PAC) Protect Progress will reportedly spend $1.5 million opposing Texas representative Al Green in the upcoming Democratic Party primary over his past opposition to crypto.

“As a member of the Financial Services Committee, Representative Al Green has decided to try and stop American innovation in its tracks,” Protect Progress, an affiliate of the major crypto PAC Fairshake, told The Hill on Thursday.

Green, a Democrat who has represented Texas’s 9th congressional district in the House since 2005, opposed the stablecoin regulating GENIUS Act and the CLARITY Act, two crypto-focused bills that the House passed last year.

“Texas voters can no longer sit by and have representation in Congress that is actively hostile towards a growing Texas crypto community,” Protect Progress said. “We are committed to electing new members who embrace innovation, growth and wealth creation for all Americans.”

It’s the crypto lobby’s latest attempt to influence Congress ahead of the midterm elections in November. In the 2024 elections, the crypto industry emerged as one of the largest spenders, with Fairshake alone spending roughly $130 million, resulting in an influx of pro-crypto elected officials.

Super PACs raise money through donations but can’t directly fund or coordinate with political campaigns. Instead, they purchase ads and use other methods to support specific candidates.

Advocacy group says Green against crypto

Green will face off against Christian Menefee in the Democratic primary in March for the reshaped Houston-area district.

Texas will be one of the first states to hold a primary vote on March 3, along with Arkansas and North Carolina, when each party will choose its nominee, followed by the general election on Nov. 3.

Crypto advocacy organization, Stand With Crypto, which compiles previous statements and actions to rate US politicians on their crypto stances, lists Green as “strongly against crypto” based on his voting history and statements about the technology.

Menefee supports blockchain technology

Meanwhile, Stand With Crypto rated Menefee as “strongly supports crypto” based on his answers to the organization’s questionnaire, with one of his answers expressing an interest in legislation that uses the technology for real-world problems, such as combating deed fraud by recording property records on the blockchain.

Related: Trump Bitcoin adviser David Bailey wants to create a $200M PAC

“That kind of innovation could protect working families from scams and modernize outdated government systems. I’d support or introduce bills that promote practical, public-serving blockchain use cases like this,” he said.

Another Fairshake affiliate, Defend American Jobs, announced on Tuesday that it was spending $5 million to support crypto-friendly Republican Barry Moore in his bid for the US Senate. Fairshake disclosed in January that it had gathered $193 million ahead of the midterm elections.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more

Crypto World

How Much Bitcoin Can Michael Saylor Buy via Strategy’s STRC Stock?

Michael Saylor’s Strategy may purchase more Bitcoin (BTC) in the coming weeks through the proceeds from its STRC stock sales.

Key takeaways:

What is STRC stock?

Michael Saylor’s Strategy (MSTR) owns about $50 billion in Bitcoin, the highest by any public company on record.

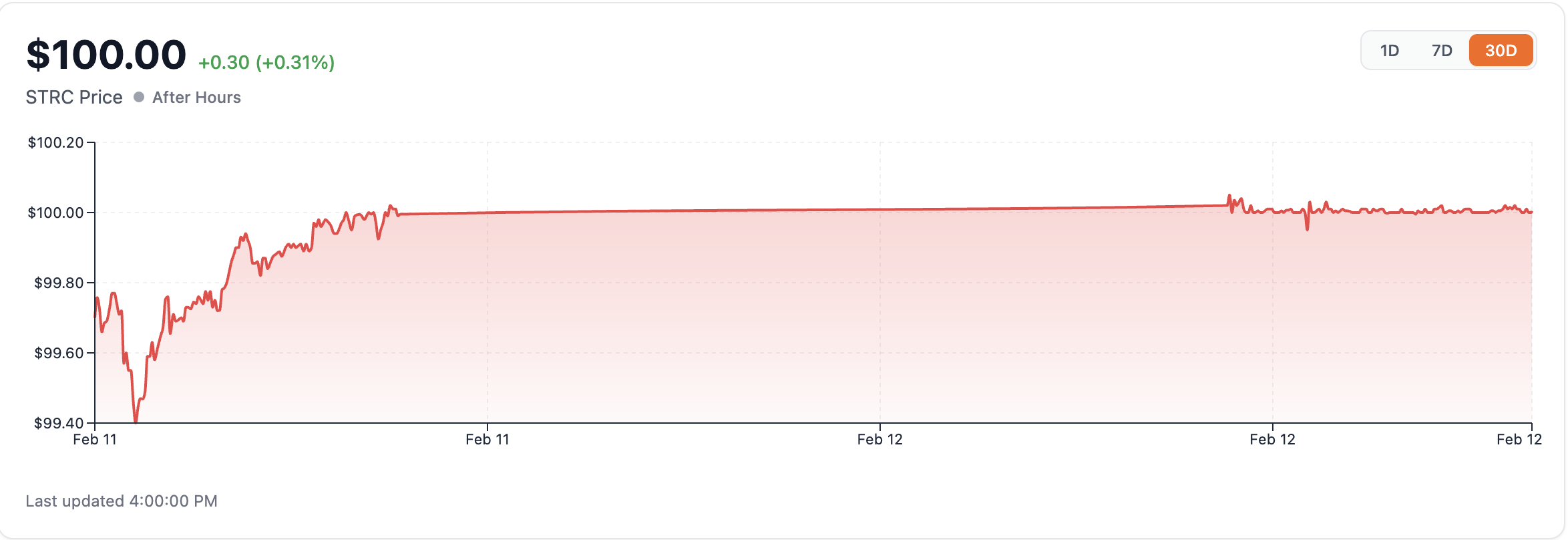

Stretch (STRC) is Strategy’s income-focused preferred stock launched in July 2025 to raise capital for its Bitcoin accumulation strategy.

In its IPO, the company raised about $2.521 billion gross and $2.474 billion net. It then used those proceeds to acquire 21,021 BTC at an average price of about $117,256.

Strategy later expanded that model by launching a $4.2 billion STRC at-the-market (ATM) program on July 31, 2025, allowing it to sell preferred shares gradually into market demand rather than all at once.

How does STRC work?

The mechanism works best when STRC trades near or above its $100 target. For that, Strategy pays a variable monthly yield to investors, adjusting it to keep the stock close to its par value.

Higher yield can support the price when it falls below par, while a lower yield can cool demand when it rises too far above it. For March 2026, the annualized STRC rate is 11.50%, or about $0.958 per share monthly.

In short, STRC turns investor demand for yield into funding for more BTC purchases.

For example, in January, Strategy sold about 1.19 million STRC shares for $119.1 million in net proceeds, alongside $1.12 billion raised through MSTR sales.

It used the combined capital to purchase 13,627 BTC for roughly $1.25 billion.

In February, STRC proceeds worth $78.4 million were used in the purchase of 2,486 BTC net.

Saylor may have $302 million in STRC proceeds

Strategy may soon raise over $300 million through sales of its STRC preferred stock, potentially giving Michael Saylor enough firepower to buy roughly 4,300 Bitcoin, according to estimates from BitcoinQuant.

The projection is based on STRC’s trading activity this week. BitcoinQuant’s model shows about $777 million in total volume, with roughly 97%, or $755 million, traded above the stock’s $100 par value.

Using a 40% capture rate, the model estimates around $302 million in net proceeds, enough to purchase about 4,334 BTC, based on average Bitcoin prices of $68,000 to $73,000 during market hours.

Friday alone saw a record $188 million in STRC trading volume, implying enough potential proceeds to fund the purchase of around 1,097 BTC, based on the same model.

Related: Michael Saylor’s Strategy buys $204M of Bitcoin in 101st purchase

The figures remain speculative for now, however. Strategy’s latest filing showed only $7.1 million in STRC sales contributing to a broader 3,015 BTC purchase.

Whether this week’s trading surge translates into a much larger Bitcoin buy should become clearer in the company’s next SEC filing, releasing on March 9.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

KnockoutStocks vs Zacks Investment Research: 2026 Stock Platform Showdown

Introduction

For decades, Zacks Investment Research has maintained its position as a leading authority in stock analysis. The company established its credibility through earnings estimate tracking, analyst revision monitoring, and its celebrated Zacks Rank methodology that evaluates stocks using earnings momentum indicators.

KnockoutStocks represents a fresh generation of AI-driven investment platforms that employs a more comprehensive methodology. It merges fundamental metrics, market indicators, and artificial intelligence capabilities within a unified system centered on the KO Score. While both services aim to guide investors toward superior stock selections, their approaches differ substantially.

Platform Overview

What Is KnockoutStocks?

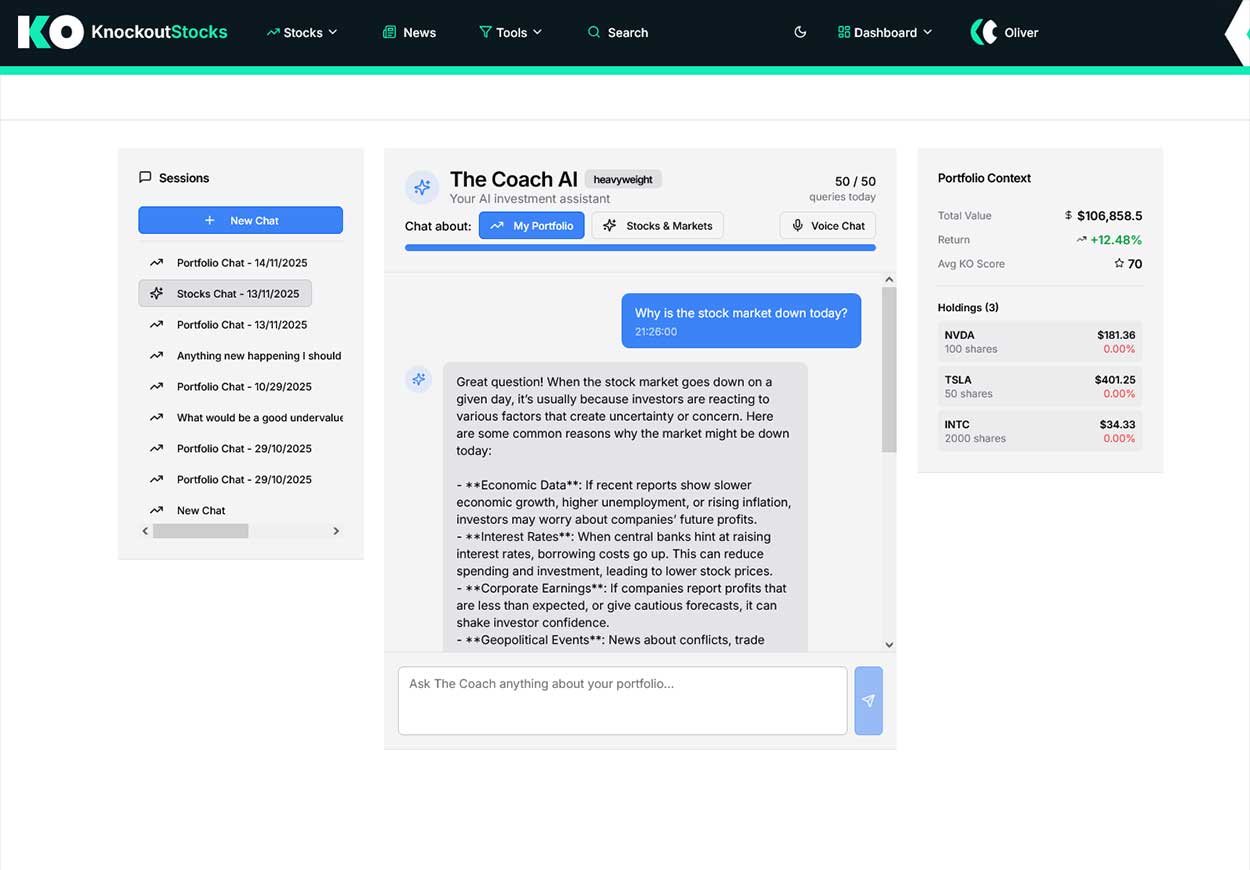

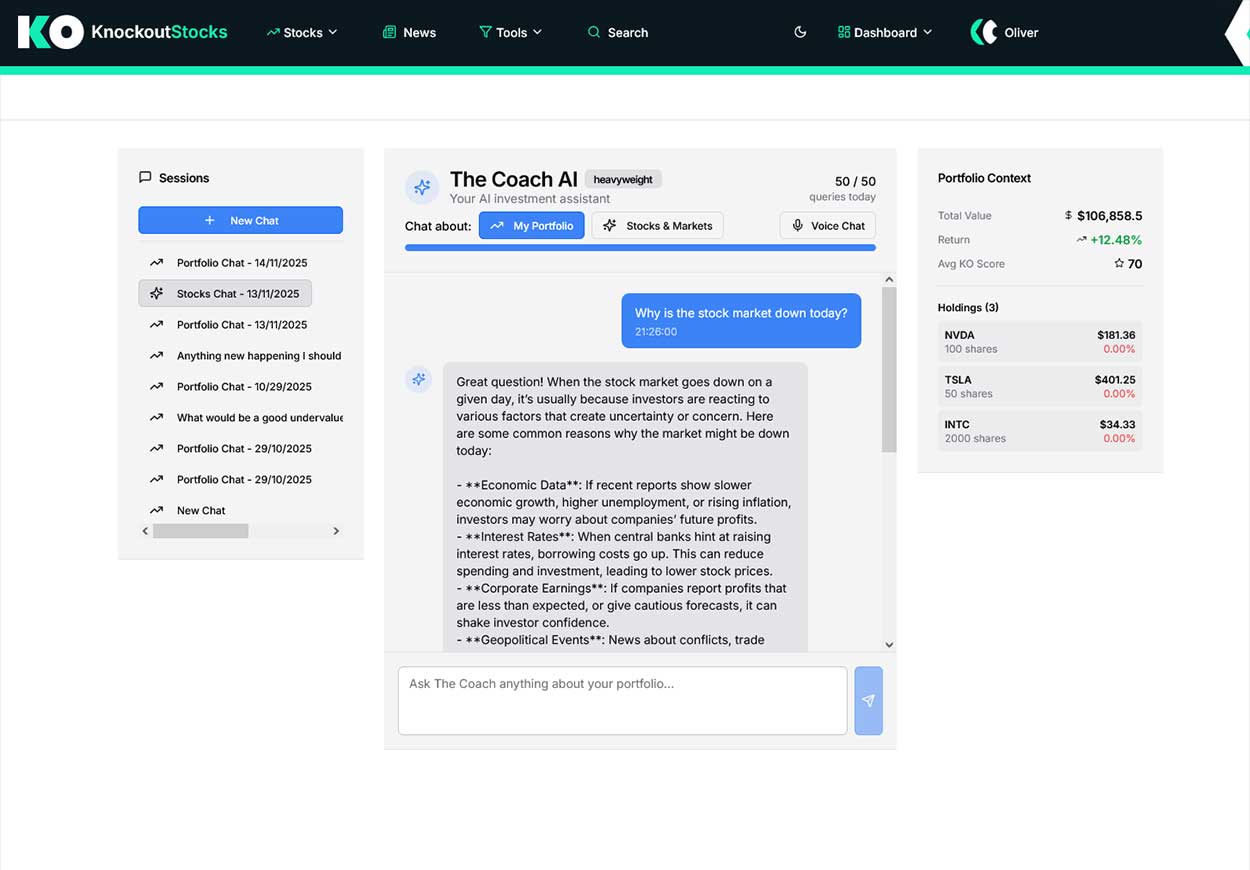

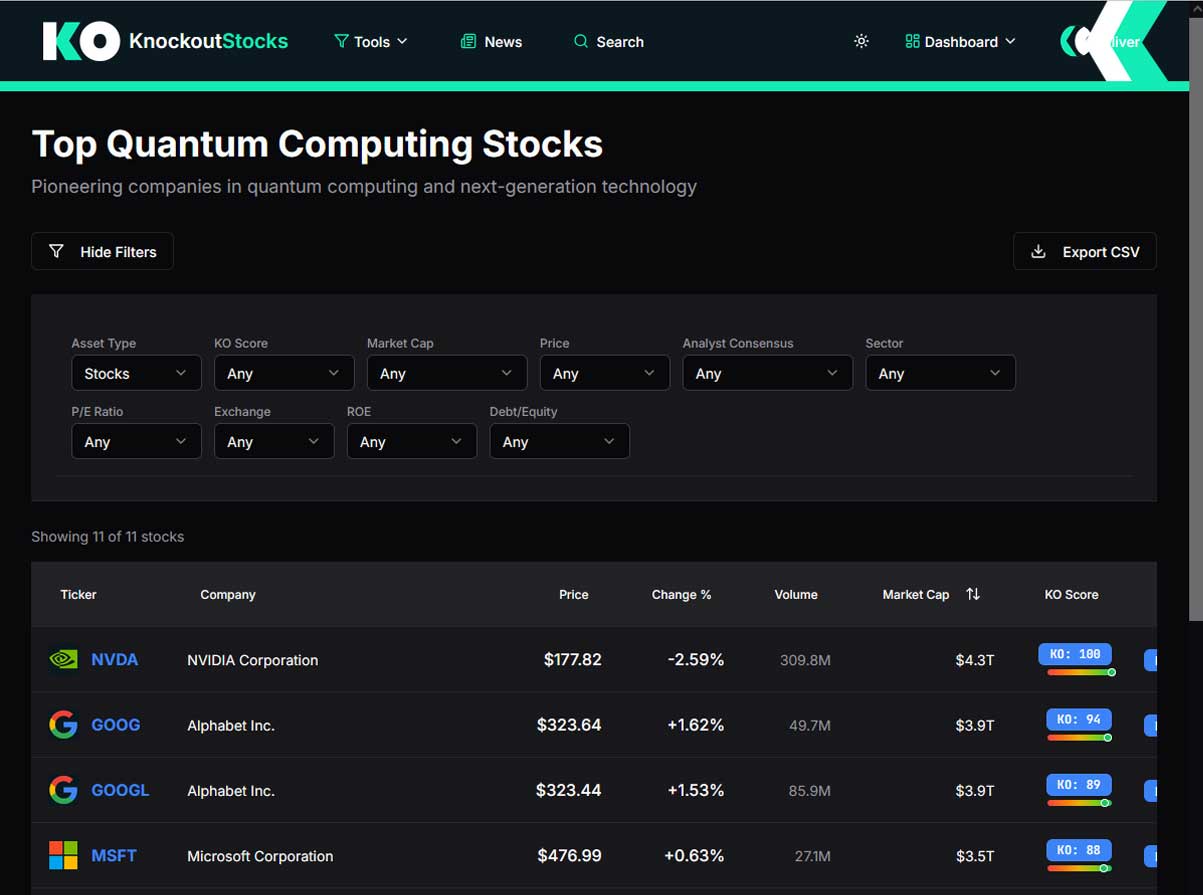

[[LINK_START_4]]KnockoutStocks[[LINK_END_4]] operates as an artificial intelligence-enhanced stock analysis platform organized around the KO Score — a specialized ranking methodology that assigns stocks numerical ratings from 0 through 100. The scoring mechanism assesses every publicly traded company using five distinct categories: profitability metrics, balance sheet strength, expansion potential, price momentum, and analyst sentiment.

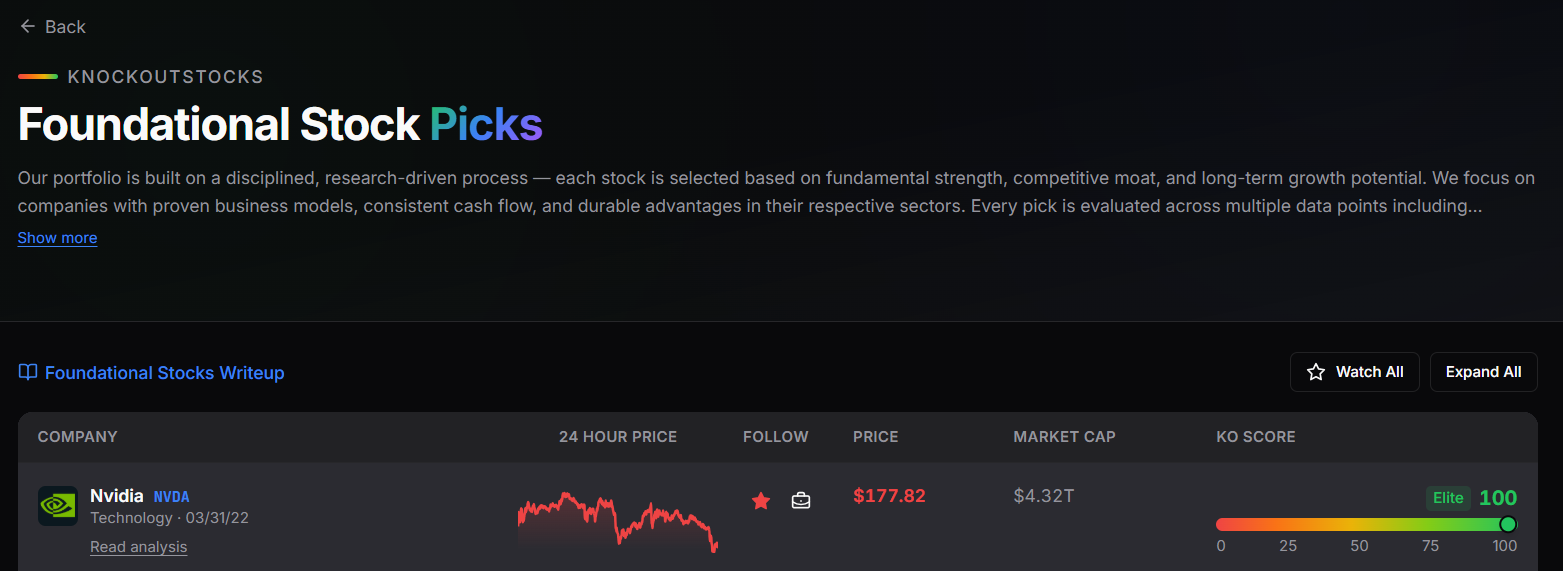

The service provides an AI-powered investment advisor, immediate AI-generated equity reports, sophisticated stock filtering tools, portfolio monitoring capabilities, and customized market intelligence. The platform delivers rapid, transparent, evidence-based investment guidance without requiring users to maintain multiple tool subscriptions or services.

What Is Zacks Investment Research?

Established in 1978, Zacks Investment Research ranks among the industry’s most enduring stock analysis organizations. The company’s primary offering is the Zacks Rank — an equity evaluation framework that assigns ratings from 1 through 5 determined by earnings projection modifications and analyst perspectives.

The service additionally features stock filtering utilities, investment research publications, portfolio management instruments, and numerous premium subscription offerings. Zacks maintains particular appeal among investors who prioritize earnings trajectory analysis and incorporate earnings revision data as a fundamental component of their investment methodology.

Feature Comparison

Stock Rankings and Ratings

The Zacks Rank forms the cornerstone of the company’s entire business model. This framework assigns scores from 1 (Strong Buy) through 5 (Strong Sell) based predominantly on earnings estimate revision patterns. The underlying principle suggests that upward analyst earnings revisions typically precede positive stock performance. This concentrated, extensively validated methodology carries substantial historical documentation.

The KO Score from KnockoutStocks adopts a more expansive evaluation framework. It synthesizes five weighted components — profitability, financial stability, growth trajectory, momentum indicators, and analyst consensus — into a single numerical rating spanning 0 to 100. Instead of concentrating exclusively on earnings revisions, it assesses overall business quality across multiple parameters. This methodology delivers a more comprehensive evaluation of a company’s fundamental strength.

AI Tools and Insights

Artificial intelligence serves as a foundational element throughout the KnockoutStocks platform. The AI advisory feature enables users to pose questions regarding specific securities, portfolio holdings, or market conditions on demand. Subscription tiers provide voice-activated AI functionality and unrestricted daily query volumes at premium levels.

Zacks has not integrated artificial intelligence capabilities into its primary platform infrastructure in any substantial capacity. The service continues operating as a data and research-focused offering built upon human analyst contributions and quantitative earnings frameworks. For investors who value AI-assisted research capabilities, KnockoutStocks maintains a decisive edge in this category.

AI-Generated Stock Reports

KnockoutStocks produces immediate AI-powered equity reports for any publicly traded security upon request. Each analysis encompasses company background, financial condition assessment, critical performance indicators, market behavior patterns, current developments, and analyst perspectives — compiled within seconds.

Zacks releases investment research documents on covered securities, authored by its analytical personnel. These publications offer thorough detail with substantial emphasis on earnings information. However, availability is restricted to stocks within Zacks’ coverage universe and reports are not produced instantaneously on demand.

Earnings Research

This category represents Zacks’ primary competitive advantage. The platform’s earnings projection data, earnings surprise historical records, and analyst revision monitoring rank among the finest resources accessible to individual investors. For those who construct investment decisions predominantly around earnings momentum and require comprehensive earnings intelligence, Zacks has constructed its complete infrastructure around this specialization.

KnockoutStocks incorporates analyst sentiment as one component within its five-pillar KO Score framework, which encompasses certain earnings and analyst perspective data. However, it does not provide the same depth of earnings estimate revision analysis and surprise history that characterizes the Zacks platform.

Stock Screener

KnockoutStocks provides an advanced filtering system featuring more than 20 criteria spanning KO Score metrics, market capitalization, price ranges, trading volume, fundamental indicators, and technical analysis parameters. Complete screener functionality is accessible through the no-cost subscription tier.

Zacks similarly offers a robust stock screening tool. The platform’s screener maintains strong industry recognition and permits filtering by Zacks Rank, earnings metrics, valuation multiples, and fundamental characteristics. However, comprehensive screener access requires premium membership, with the most sophisticated filtering capabilities reserved for higher-tier subscription packages.

Stock Picks and Investment Services

Zacks provides an extensive portfolio of premium investment advisory offerings beyond the foundational platform. These encompass curated equity recommendation portfolios, industry-specific investment ideas, and options strategy suggestions. Investors seeking a comprehensive menu of advisory services will discover abundant options.

KnockoutStocks features its proprietary Stock Picks collection — a concentrated portfolio carefully selected based on fundamental quality, competitive positioning, and sustainable growth prospects. This offering is available to Middleweight and Heavyweight subscribers. While more focused than Zacks’ extensive service range, it follows the same evidence-driven KO Score methodology.

Portfolio Tracking

KnockoutStocks delivers comprehensive portfolio monitoring with live performance metrics, profit and loss calculation, and AI-enhanced portfolio evaluation. The Heavyweight subscription accommodates up to 100 securities per portfolio with unlimited portfolio creation and AI-generated portfolio assessment reports.

Zacks offers portfolio tracking functionality that overlays Zacks Rank information and earnings data onto user holdings. The tool proves valuable for monitoring earnings-related indicators across portfolio positions but lacks AI-driven portfolio analysis capabilities or the tracking depth provided by KnockoutStocks.

Alerts and Updates

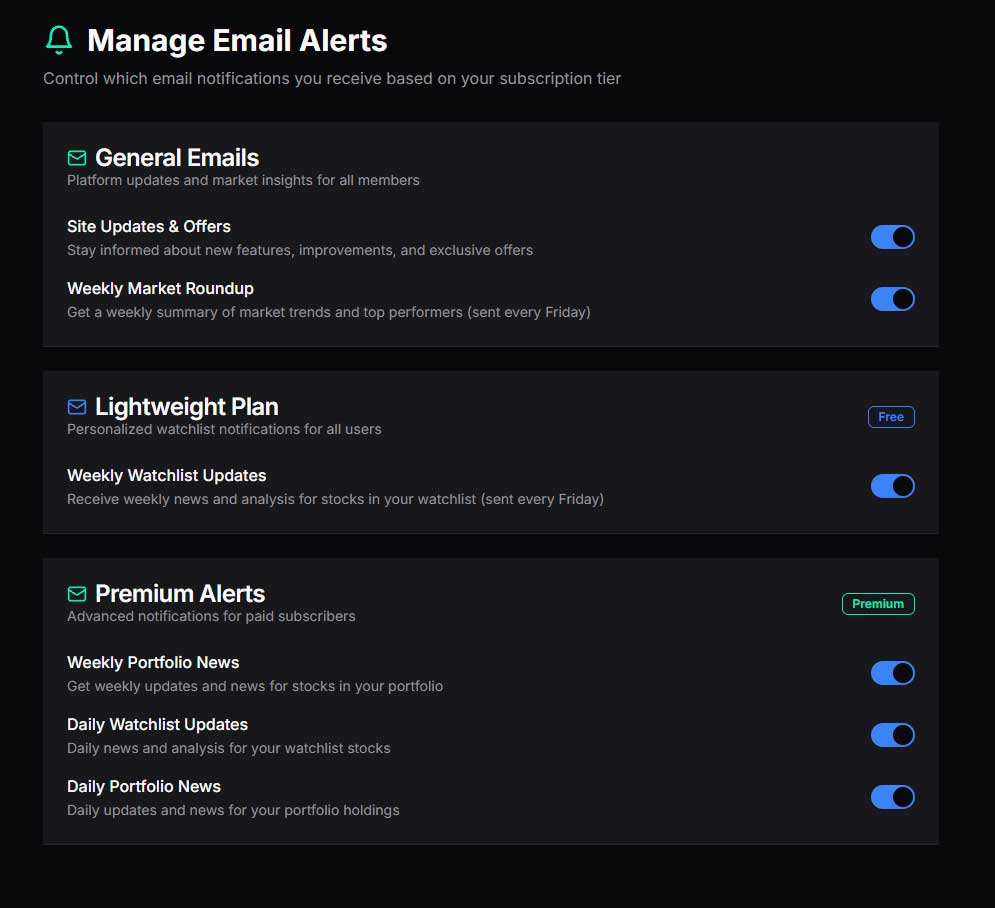

KnockoutStocks transmits customized daily or weekly email notifications covering watchlist activity, leading KO Score changes, earnings releases, analyst rating adjustments, and breaking developments customized to user holdings.

Zacks maintains a comprehensive alert infrastructure emphasizing earnings estimate modifications, Zacks Rank transitions, and analyst upgrade and downgrade activity. For investors who monitor earnings momentum closely, these notifications deliver authentic value and timeliness.

Pricing

KnockoutStocks presents three tiers. The complimentary plan includes complete screener access, single portfolio capability, five watchlist positions, one AI consultation weekly, and one AI equity report weekly. The Middleweight tier costs $19.99 monthly with 10 AI inquiries daily and 10 AI reports weekly. The Heavyweight tier runs $59.99 monthly with unlimited AI access, voice advisory services, PDF report exports, and CSV data downloads.

Zacks pricing commences with a no-cost tier providing limited Zacks Rank data access. The Zacks Premium subscription runs approximately $249 annually. Supplementary advisory services and premium portfolio offerings can substantially increase total subscription costs, positioning a comprehensive Zacks subscription among the market’s more expensive alternatives.

Pros and Cons

KnockoutStocks

Pros

- KO Score provides rapid, comprehensive quality assessment across thousands of publicly traded companies

- Integrated AI advisor for on-demand equity and portfolio inquiries

- Instantaneous AI equity reports accessible for any security at any moment

- Complete screener functionality on the complimentary subscription tier

- Robust portfolio monitoring with live data and AI evaluation

- Greater affordability across all subscription levels

- Voice-activated AI advisor accessible on premium subscription

- Comprehensive market coverage beyond earnings-focused securities

Cons

- Less comprehensive earnings estimate revision analysis compared to Zacks

- Emerging platform continuing to establish long-term performance history

- Limited premium advisory service offerings relative to Zacks

- Reduced historical earnings data comprehensiveness

Zacks Investment Research

Pros

- Zacks Rank maintains extensively documented long-term performance history

- Industry-leading earnings projection and revision intelligence

- Extensive selection of premium advisory offerings and equity recommendations

- Superior earnings surprise and estimate historical records

- Established platform with multi-decade research heritage

- Capable screener with comprehensive earnings-oriented filtering options

Cons

- Absence of dedicated AI investment advisory functionality

- No on-demand AI equity report generation

- Premium service costs can escalate rapidly

- Platform interface appears outdated relative to contemporary research tools

- Concentrated earnings emphasis results in diminished attention to other fundamentals

- Complimentary tier offers restricted meaningful functionality

Which Platform Is Best for Different Investors?

Use KnockoutStocks if you:

Prefer a rapid, comprehensive assessment of equity quality across thousands of companies utilizing one transparent scoring system. The KO Score evaluates profitability, balance sheet health, growth potential, momentum characteristics, and analyst sentiment — not merely earnings revision patterns.

Desire AI-enhanced capabilities on demand — submitting questions about securities, obtaining instant analytical reports, or evaluating your portfolio without awaiting analyst publications. KnockoutStocks incorporates this functionality throughout its core architecture.

Seek a contemporary, intuitive platform with superior portfolio monitoring and personalized notification systems at competitive pricing. The complimentary subscription tier alone delivers more functionality than Zacks’ free offering.

Aim to identify investment opportunities independently using sophisticated screening tools without encountering subscription barriers. Complete screener access on the free plan represents a meaningful competitive advantage.

Use Zacks if you:

Monitor earnings estimate revisions intensively and require the most comprehensive earnings momentum intelligence available to individual investors. Zacks has constructed decades of infrastructure around this particular data specialty.

Desire access to an extensive portfolio of premium advisory offerings, curated equity portfolios, and sector-focused recommendations beyond basic research platform functionality.

Operate as an earnings-focused investor who considers analyst estimate revisions the most reliable indicator of near-term equity performance. The Zacks Rank methodology is engineered specifically for this investment approach.

Require extensive historical earnings information and surprise history to guide your security selection methodology.

Final Verdict

Both Zacks and KnockoutStocks provide genuine investment value, though they reflect fundamentally different investing philosophies.

Zacks represents the superior solution if earnings momentum forms the central pillar of your stock selection methodology. The platform’s earnings projection data, revision monitoring, and Zacks Rank framework possess extensive historical validation and remain difficult to replicate for this particular application.

KnockoutStocks functions as the superior comprehensive platform. The KO Score methodology encompasses broader territory than the Zacks Rank, the AI capabilities introduce an on-demand intelligence dimension that Zacks completely lacks, and the portfolio tracking functionality extends considerably deeper. These advantages arrive at reduced pricing with a more accessible complimentary subscription tier.

For investors seeking a complete, contemporary research infrastructure that addresses fundamentals, market indicators, and AI-enhanced intelligence — KnockoutStocks delivers superior value in 2026. Zacks continues as a capable specialized instrument for earnings-focused investors, though as a comprehensive research platform it demonstrates its age against newer AI-powered alternatives.

Crypto World

Bitcoin purist Jack Dorsey is reluctantly giving in to stablecoin craze

Block CEO Jack Dorsey says his company will support stablecoins, despite having long argued that Bitcoin should serve as the internet’s native money protocol.

In an interview with WIRED, Dorsey acknowledged the change while making clear it reflects customer demand rather than a shift in personal belief.

“I don’t like that we’re going to support stablecoins but our customers want to use them,” he said. “I don’t think it’s wise to go from one gatekeeper to another.”

The move marks a pragmatic turn for one of Silicon Valley’s most vocal Bitcoin advocates. For years, Dorsey framed Block’s crypto strategy around Bitcoin alone, backing mining hardware development and integrating the asset into products such as Cash App.

The company first introduced the option for users to buy and sell bitcoin on the Cash App, and the company received a BitLicense from New York regulators the following year.

Block started a Bitcoin development arm and funded Bitcoin and Lightning Network developers in 2019, and started accumulating bitcoin for its corporate treasury in 2020. It currently holds 8,888.3 BTC, worth more than $600 million.

Stablecoins have surged in the meantime. Fiat currency-pegged tokens now circulate widely across crypto markets and cross-border payments, with their total market capitalization reaching $318 billion, according to CoinMarketCap data.

Competition is also intensifying. Payment companies, including Stripe and PayPal, have already integrated stablecoin infrastructure, increasing pressure on Block to offer similar options to avoid losing users, though Dorsey didn’t mention these during the interview.

This isn’t the first time Dorsey’s Block has reluctantly endorsed stablecoins.

In November last year, Block’s Cash App announced it was adding support for stablecoins, making them “interoperable with a customer’s USD cash balance.” Stablecoin deposits, the firm said, would instantly be converted into U.S. dollars in users’ balances.

That development was notable as back in 2024, when Facebook was working on its since-scrapped Libra stablecoin and the Libra Association behind it, Dorsey said with a definitive “Hell no,” that he would not be joining the crypto payments scheme.

At the time, Dorsey notably said the project “was born out of a company’s intention, and it’s not consistent with what I personally believe and what I want our company to stand for.”

In true bitcoin purist fashion, he continues to argue that Bitcoin’s decentralized design makes it the best candidate for an open financial protocol.

The comments come after the company cut its workforce by roughly 40%, citing structural changes driven by artificial intelligence. While the layoffs sparked controversy over whether the company had overhired, Dorsey brushed off the question during the WIRED interview and doubled down on the AI angle.

“These [AI] tools are presenting a future that entirely changes how a company is structured,” Dorsey said in the interview, noting that the layoffs weren’t about fixing the company’s cost and revenue per employee, because his firm was “already ahead” of all of its competitors on those metrics.

“I don’t know what the ultimate outcome is, but I do know it’s going to have a dramatic effect,” Dorsey added.

Crypto World

Binance Wins Major Legal Victory as US Court Throws Out Anti-Terrorism Lawsuit

“The court has unambiguously rejected the false and damaging narrative that Binance assisted terrorists,” commented the exchange’s General Counsel.

In a press release shared on March 7, Binance announced that a US Federal Court in the Southern District of New York had dismissed all claims brought against it under the Anti-Terrorism Act (ATA).

Eleanor Hughes, the company’s General Counsel and spokesperson on the matter, indicated that this dismissal is a “complete vindication of all false allegations.”

The case was brought up by 535 plaintiffs who alleged that the world’s largest cryptocurrency exchange had provided material support connected to 64 terrorist attacks, citing provisions under the ATA.

However, the 62-page ruling provided by the Court and Judge Jeannette Vargas officially dismissed the civil lawsuit targeting the exchange and its former CEO, Changpeng Zhao, after finding that the plaintiffs failed to establish any of their central allegations.

“The court has unambiguously rejected the false and damaging narrative that Binance assisted terrorists. We have always maintained that these claims were without merit, and today’s ruling confirms that. We will continue to defend ourselves aggressively against any litigation or reporting that misrepresents who we are and how we operate,” also commented Hughes.

The plaintiffs have 60 days to file an amended complaint in light of the recent appellate decision. However, the exchange said it’s confident that no amended pleading will be “able to cure the fundamental deficiencies the Court identified as the “underlying claims have been thoroughly examined and rejected.”

In a separate but slightly related note, 11 US Democratic Senators, led by Richard Blumenthal, urged the US DOJ and Treasury to investigate Binance for allegedly facilitating $1.7 billion in transactions to Iran-linked entities.

The exchange “strongly rejected” the allegations, indicating that it has more than 1,500 specialists worldwide to strengthen its robust compliance program.

You may also like:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Why the XRP/BTC Pair Is Flashing a Major Warning Signal

XRP continues to trade under pressure on both its USDT and BTC pairs, with the broader structure still favoring sellers despite some short-term stabilization near key support levels.

The charts suggest that buyers are trying to defend important demand zones, but the token still needs a convincing breakout above major moving averages and overhead resistance areas before any stronger recovery narrative can take shape.

Ripple Price Analysis: The USDT Pair

On the XRP/USDT chart, the asset remains trapped within a clear descending channel that has been in place for months, keeping the overall daily trend bearish. The price is currently hovering around $1.36 after failing to reclaim the mid-channel resistance and both the 100-day and 200-day moving averages, which are now acting as dynamic resistance around the $1.80 and $2.20 regions. As long as XRP stays below those levels, the structure points to continued weakness rather than a confirmed reversal.

From a support perspective, the $1.10 to $1.20 zone is the key area to watch in the short term, as it lines up with the lower boundary of the channel and has already attracted demand. If that region breaks decisively, the market could open the door for a much deeper decline.

On the upside, bulls would first need to recover the $1.80 zone before even thinking about a push toward the broader $2.40 to $2.50 resistance band. The RSI has also improved slightly and is no longer deeply oversold, but it still does not show the kind of momentum strength that would confirm a sustained bullish shift.

The BTC Pair

Against Bitcoin, XRP is also in a weak position and continues to trend lower while trading below both major moving averages. The pair is trading around 2,000 sats, with the price recently slipping back under the 2,200 to 2,400 sats resistance cluster created by the confluence of the 100-day and 200-day moving averages.

This makes the mentioned area a strong barrier for any bullish recovery attempt. The fact that XRP has failed multiple times to break and hold above that range shows that buyers still lack control.

The key support on this chart sits around 2,000 sats, and XRP is now testing that zone once again. A clean breakdown below it could expose the lower support areas around 1,500 sats and possibly even the 1,200 sats zone over time.

On the other hand, if buyers manage to defend current levels and push the pair back above 2,400 sats, the next upside target would likely be the 2,700 to 2,800 sats region, followed by the major resistance level near 3,000 sats. For now, though, the trend remains tilted to the downside, and XRP needs a clear reclaim of lost ground before the BTC pair can start looking structurally constructive again.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Top Wall Street minds see AI rotation ahead as bitcoin seeks role in new cycle

BlackRock’s Rick Rieder, UBS’s Ulrike Hoffmann-Burchardi, and hedge fund manager Daniel Loeb see a 2026 economy that may keep growing even as the market’s center of gravity shifts.

The broad message from their separate appearances at a conference in Miami last week was not that the AI boom is ending. Instead, they said, the easy phase may be over. As capital spreads beyond a handful of giant U.S. technology stocks, investors may need to think less about riding one theme and more about where growth, pricing power and disruption show up next.

That view could matter for crypto markets, particularly bitcoin . If investors move away from the crowded trades that defined the last few years, some may look harder at assets outside traditional equity sectors. Bitcoin has often traded like a high-beta technology proxy during risk-on periods, but it can also attract demand when investors seek diversification from dollar assets, long-duration growth stocks, or amid policy uncertainty.

In practice, however, bitcoin has not consistently behaved like the main hedge against dollar weakness, especially in recent months, when gold has been the dominant asset when investors move away from the dollar. But as bitcoin matures — many argue it is still a young asset compared to gold — that could change.

Rieder, BlackRock’s chief investment officer of global fixed income, said he has been broadening portfolios away from concentrated technology bets. He said he still likes parts of tech, but called the investment landscape different from last year as any he can remember in some time.

His outlook rests in part on the idea that U.S. growth could surprise to the upside even as rates move lower. Rieder said AI-driven productivity could help the economy expand while a still-soft labor market keeps inflation contained. He also argued that tariffs may matter for certain industries but have less impact at the economy-wide level because the U.S. is more dependent on services than on goods.

For bitcoin, that mix cuts both ways. Stronger growth and lower rates would usually support risk assets, including crypto. But if inflation stays contained and real economic activity improves, investors may feel less urgency to seek out alternative stores of value. In that setup, bitcoin’s case may lean less on macro fear and more on portfolio diversification and institutional adoption.

Hoffmann-Burchardi, UBS Global Wealth Management’s chief investment officer for the Americas and global head of equities, also said the macro backdrop should improve this year, pointing to fiscal stimulus in major economies and more room for U.S. rate cuts. Her bigger point, though, was that the AI trade is changing.

After three years in which markets rewarded companies enabling the AI buildout, she said investors are entering a phase in which winners and losers will separate more sharply. UBS has responded by cutting its overweight rating on technology and communication services and shifting toward industrials, electrification, and healthcare.

That rotation could also affect crypto. If equity investors become more selective on AI and digital business models, tokens tied to broad AI narratives may face more scrutiny. Bitcoin may be better placed than smaller crypto assets in that environment because its investment case is simpler. It does not depend on proving a software revenue model or winning a race for AI market share.

Loeb, founder of hedge fund Third Point, said the market is already rewarding investors who do deeper stock picking and more short selling. He described a shift away from crowded mega-cap trades toward smaller niche companies, including firms in Europe, Japan and South Korea supplying key parts of the AI buildout.

On the economy, Loeb said the U.S. is in a good place for the next six months, though he was less certain about the outlook beyond that. He also said stress in private credit, especially in loans tied to software companies, is likely to produce losses over time but not a systemic shock.

Taken together, the three investors outlined a year in which growth holds up, AI remains the dominant force, and markets become harder to navigate. For bitcoin, that may mean fewer tailwinds from simple momentum trades and a greater need to stand on its own as either a hedge, a diversifier or a liquid alternative in a more fragmented market.

Crypto World

APPL – Apple Stock Price Prediction Gets Street High $350 Target After Earnings Beat as One Crypto Project Gains Traction Pepeto

Apple just delivered one of its strongest quarters in recent memory, beating earnings estimates by a wide margin and posting 15.7% revenue growth that caught even the bulls off guard. Institutional buyers are adding to their positions, a new Street high price target has arrived, and the M5 chip cycle is still in its early stages. A small but growing number of equity investors are also beginning to diversify into digital assets for the first time, and today we will break down one specific crypto project with a very bright future.

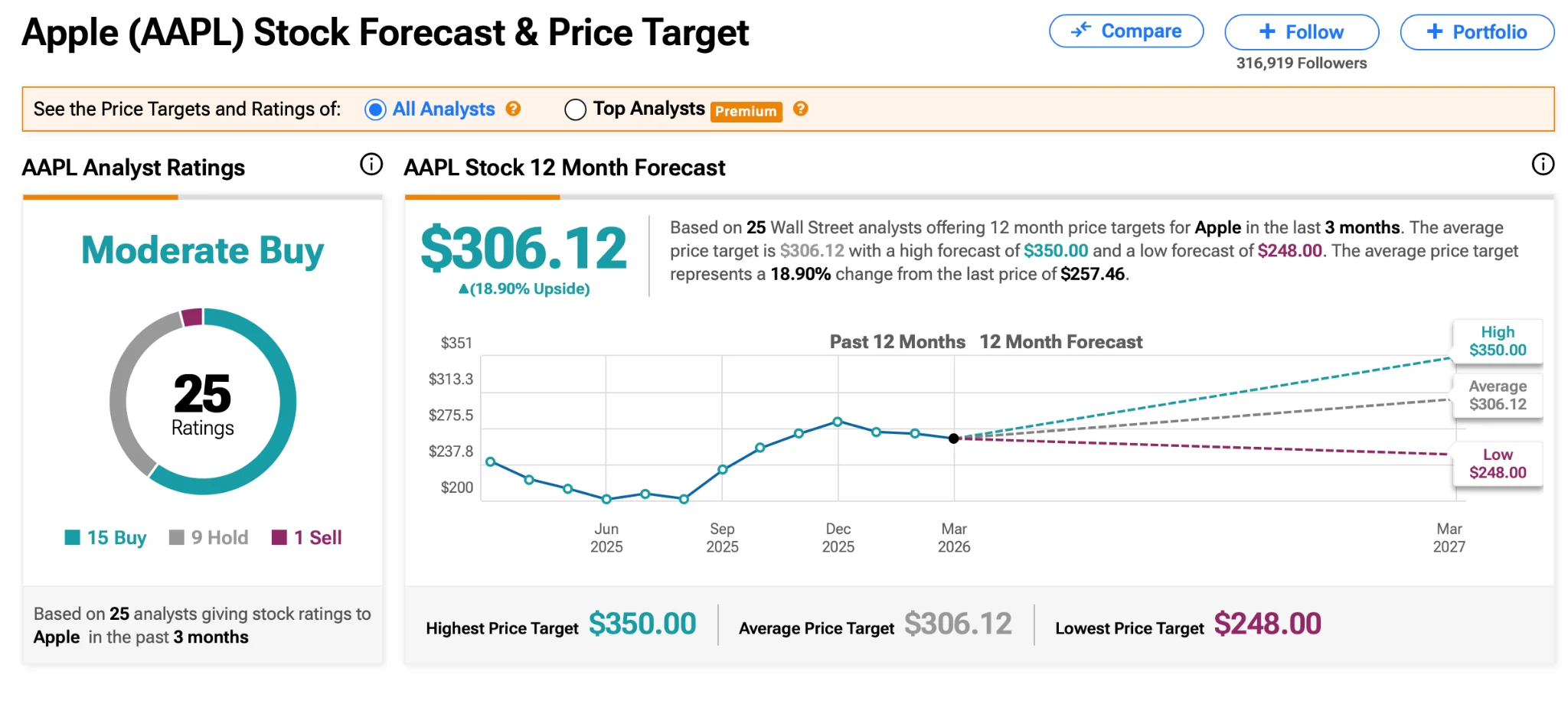

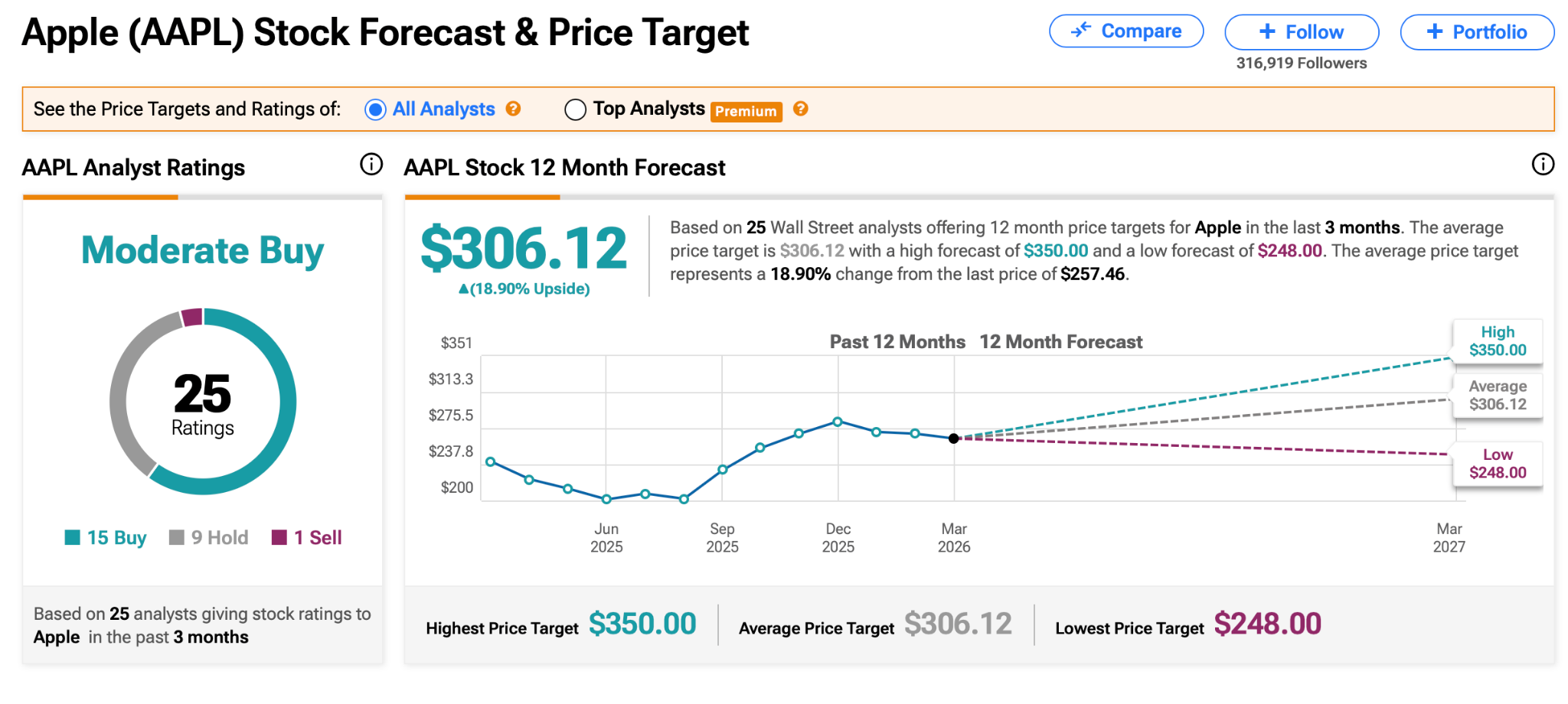

Wedbush analyst Daniel Ives raised his AAPL price target to $350, the highest on Wall Street, while keeping his Outperform rating. With Apple stock near $260, the target implies roughly 34% returns. The confidence follows a quarter where Apple posted earnings of $2.84 per share against expectations of $2.67, and revenue of $143.76 billion that topped forecasts by more than $5 billion.

Source: TIPRANKS

The M5 Mac lineup and $599 MacBook Neo are opening Apple to first time buyers, with nearly half of Mac purchasers being new to the platform. Institutions are piling in too.

Oppenheimer added 9%, Vanguard added 1.1%, and Norges Bank opened a position worth roughly $38.9 billion. The consensus sits at Moderate Buy with an average Apple stock price prediction of $306.12. That is solid for equities, but it is not the kind of return that changes your financial future.

Why AAPL Investors Are Starting to Look Beyond Traditional Equities

Apple is one of the best companies ever built, and holding AAPL long term remains smart. But the math at these valuations tells a clear story. Even hitting the Street high $350 on a stock priced at $260 delivers 34% over many months.

Wall Street is quietly moving capital into crypto infrastructure through ETFs and direct investments, and the pre-listing entries in projects with real revenue generating technology produce asymmetric returns that blue chip stocks at $3 trillion valuations cannot deliver. One project is catching attention from investors who think in P/E ratios and annual yield.

Pepeto Is Building the Digital Wall Street of the Cryptocurrency Market

Every stock you buy trades on an exchange that someone built before you arrived. The Nasdaq and NYSE are infrastructure businesses that profit from every transaction. Now imagine getting into the company building that exchange before it goes public, at a price so early that even a small position could produce returns that make the best Nasdaq stocks look like savings accounts. That is what Pepeto represents.

The project is building a full crypto trading exchange with cross chain bridge technology, essentially infrastructure connecting multiple blockchain networks the way a brokerage connects multiple exchanges. Every cryptocurrency will eventually be traded on platforms like this, and Pepeto is positioning itself as the infrastructure layer for that future.

According to Business Insider, Pepeto just announced that presale wallets will receive a permanent share of all exchange trading fees once the platform goes live. The project has raised $7.5M while each round closes quicker than the last.

Source: Markets.businessinsider

The founder already built a project to a $7 billion valuation and is starting again from day one. The SolidProof security audit was completed before raising a single dollar, the crypto equivalent of an SEC compliance review, and the Binance listing is approaching as the IPO moment. NVIDIA delivered a remarkable 10x over five years.

Pepeto’s 267x math requires only the listing valuation that exchange tokens routinely achieve, in months not half a decade. Investors who enter now also earn 204% annual yield, meaning a $10,000 position generates $20,400 per year or roughly $1,700 per month. The S&P 500 averages 10%. Treasury bonds pay 4.5%. No stock on the Nasdaq produces this yield at this entry point.

The Bottom Line

Oppenheimer, Vanguard, and Norges Bank are all adding Apple stock because institutions understand that buying quality during strong quarters builds wealth over decades. But the investors who got Amazon before it hit the Nasdaq understood something different: the biggest single returns come before the ticker goes live on the main exchange.

Pepeto’s exchange infrastructure is approaching its listing, $7.5M in presale capital proves the conviction, and the entry at six decimal zeros will not survive the moment public volume arrives. Every week the rounds close tighter and the window gets smaller.

Click To Visit Pepeto Project Official Website

FAQs

Is Apple stock or Pepeto a better buy right now?

Apple is a great hold targeting $350, but Pepeto at pre-IPO pricing with 204% annual yield offers asymmetric returns that blue chips at $3 trillion cannot produce. Visit the Pepeto official website.

Can a crypto presale beat Apple stock price prediction targets?

AAPL’s best case is 34% to the Street high. Pepeto’s listing math delivers multiples in months that equities need years to match.

Why are AAPL investors looking at crypto presales like Pepeto?

Pepeto builds crypto exchange infrastructure the way Nasdaq built stock rails. With $7.5M raised and a Binance listing approaching, stock investors see pre-IPO entry.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

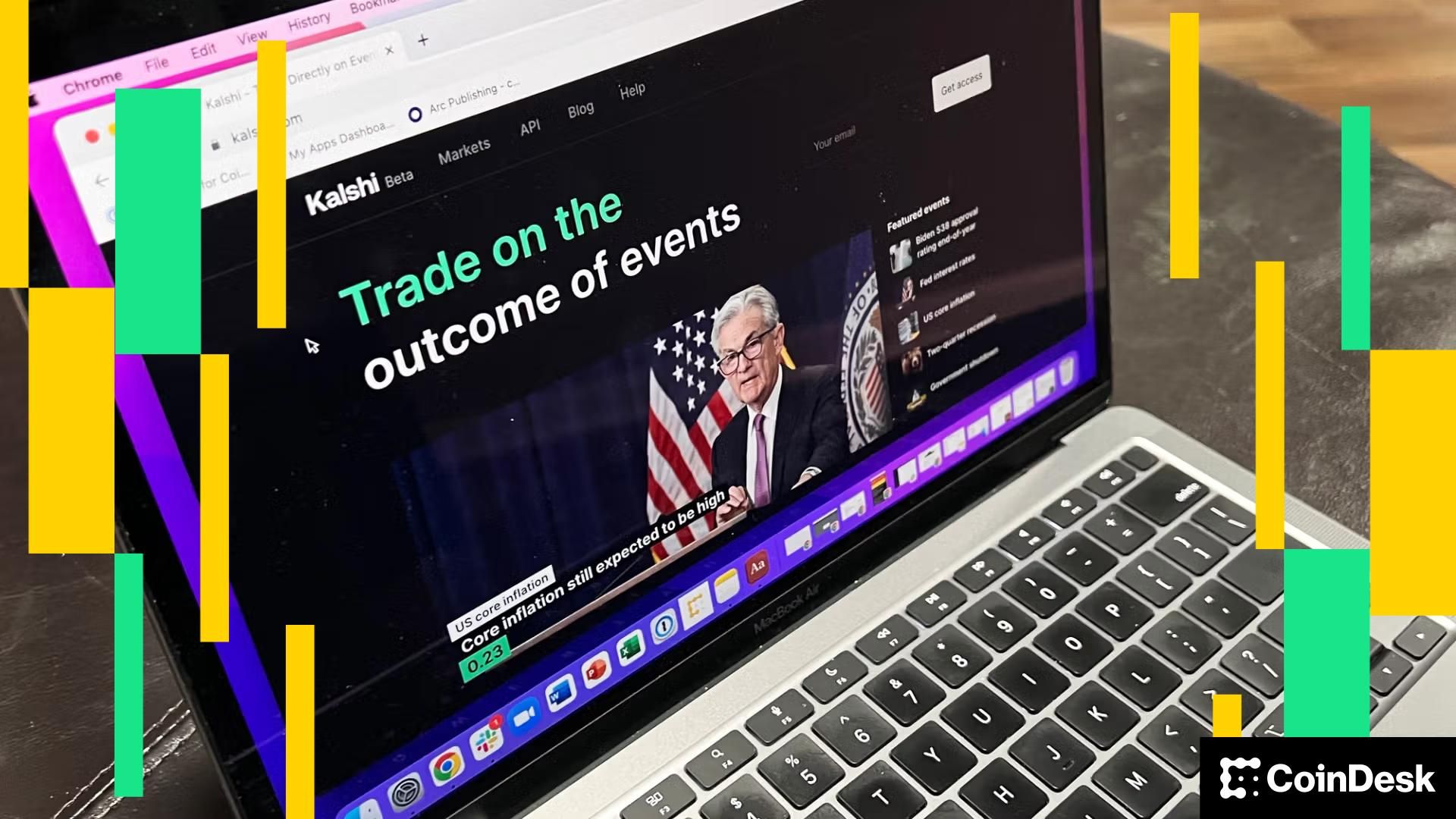

Kalshi, approved by the Commodity Futures Trading Commission, was last valued at $11 billion, while Polymarket was valued at $9 billion.

Prediction market platforms Kalshi and Polymarket are discussing potential fundraising rounds that could value each company at about $20 billion.

If completed at that level, the deals would roughly double their valuations from late 2025. The discussions remain early and may not lead to finalized investments, according to the Wall Street Journal.

Prediction markets allow users to trade contracts tied to real-world events, with categories including sports, politics, elections, and more. Traders buy and sell those contracts based on what they think will happen. Essentially, it allows users to monetize information on world events.

Kalshi already operates in the United States under approval from the Commodity Futures Trading Commission. Founded in 2018 by Tarek Mansour and Luana Lopes Lara, raised $1 billion at an $11 billion valuation in December last year.

The company recently reached an annualized revenue run rate of about $1.5 billion, according to the WSJ report citing people familiar with the business.

Polymarket, founded in 2020 by Shayne Coplan, was valued at $9 billion in October after Intercontinental Exchange agreed to invest up to $2 billion in the platform.

None of the platforms immediately responded to requests for comments from CoinDesk.

Both platforms are leading in the sector, as prediction markets have become the latest hype for traders.

According to a Dune dashboard, open interest on Kalshi is hovering over $400 million, while on Polymarket it’s at $360 million. The third-largest market, Opinion, is at $36 million.

Similarly, the weekly notional volume (total underlying value of all prediction contracts traded) on Polymarket was $1.9 billion last week, and on Kalshi, $1.87 billion, according to Dune data. Opinion saw weekly volume of $150 million, down from over $1.2 billion ahead of its token launch.

The sector has become so popular that companies, including Coinbase and Robinhood, have entered the prediction market. In fact, Wall Street giants Nasdaq and Cboe recently said they are considering rolling out yes-or-no “binary bets” for traders on the direction of traditional markets, similar to prediction-market betting.

Read more: Prediction market firms could be making $10 billion in yearly revenue by 2030, Citizens Bank says

Crypto World

Elon Musk Launches X Money Beta With Crypto Trading as Dogecoin Spikes 8%, but Rumors Are Spreading Fast That Pepeto Could Be Elon Musk’s Next Favorite Meme Coin

Elon Musk just made the biggest move in meme coin history. The X Money beta is rolling out to let users trade crypto directly from their timelines, and Dogecoin spiked 8% as its official account pushed businesses to accept DOGE instead of paying credit card fees.

But here is what the Dogecoin community is not talking about: rumors are spreading fast that Pepeto, the exchange presale that raised $7.5M from the cofounder who built Pepe to $7 billion, could be the meme coin that catches Elon Musk’s attention next.

Bloomberg reported Elon Musk confirmed X will allow users to trade stocks and digital assets directly from their timelines through the X Money payments system, while CoinDesk confirmed Dogecoin’s official account responded by encouraging businesses to accept DOGE and drop credit card fees of 2 to 3%.

When Elon Musk builds payment rails inside the world’s biggest social platform, the meme coin that combines exchange infrastructure with viral community energy is exactly the kind of project that lands on his radar.

Elon Musk, Dogecoin, and the Meme Coin Presale That Rumors Say Could Be Next

Pepeto: The Meme Coin That Elon Musk’s Community Cannot Stop Talking About

Every time Elon Musk makes a crypto move, the market scrambles to figure out what comes next. Dogecoin has always been his favorite, but the rumors spreading across Telegram and X right now are about Pepeto, the exchange presale that raised $7.5M from the person who cofounded the Pepe ecosystem and built it to $7 billion.

The reason is simple. Elon Musk has always said the crypto he supports needs to be funny, useful, and cheap to transact with. Pepeto checks every box. The zero tax engine means every trade costs nothing. The cross chain bridge connecting Ethereum, BNB Chain, and Solana moves assets in seconds. The risk scoring system checks contracts before your capital goes near them, and the SolidProof audit backs every line of code.

The community energy around Pepeto feels exactly like early Dogecoin before Elon Musk started tweeting about it, a passionate base spreading the word organically. The difference is Pepeto has exchange infrastructure Dogecoin never built, and in a market where Elon Musk builds payment rails inside X, the meme coin with real trading tools fits the vision he keeps describing.

The presale at $0.000000186 does not need Elon Musk to deliver returns, because the Binance listing creates the demand, and 209% APY staking compounds for wallets already inside while Dogecoin holders sit 87% below the all time high with zero yield. But if the rumors turn true, the entry that exists right now becomes the trade that defines the cycle.

Dogecoin Spikes 8% on X Money News but the $0.10 Resistance Keeps Blocking Recovery

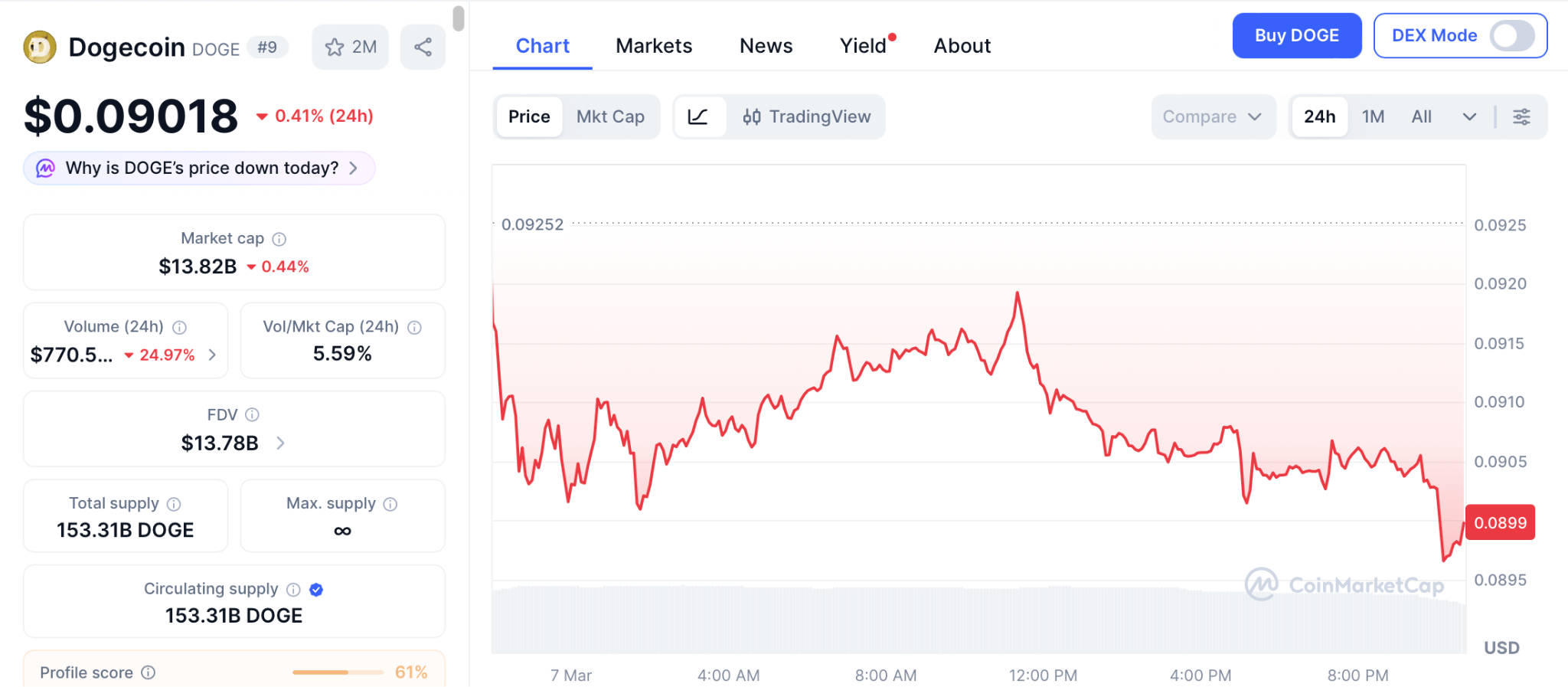

Dogecoin jumped 8% to $0.090 after Elon Musk’s X Money announcement, but the 20 day EMA at $0.10 caps the price according to CoinMarketCap.

Closing above $0.10 opens $0.11, but losing $0.09 means $0.08 then $0.06. Elon Musk keeps Dogecoin relevant, but at $12.5 billion and 87% below the all time high, even Elon Musk cannot produce the multiples a meme coin presale at six decimal zeros delivers on listing day.

The Bottom Line

Elon Musk launched X Money and Dogecoin spiked 8%, but the rumors spreading about Pepeto tell a different story about where smart money goes. The presale raised $7.5M from the $7 billion Pepe cofounder with exchange tools that match the vision Elon Musk keeps building, and the SolidProof audit and Binance listing path are the foundation Dogecoin at $12.5 billion never had.

The 209% APY compounds daily while Dogecoin holders wait for the next Elon Musk tweet, and by the time rumors become headlines, the entry at six decimal zeros will belong to the wallets that moved first.

Visit the Pepeto official website and enter the presale before the next headline drops and the entry that was available during the rumors becomes a price only early believers ever saw and acted on it, securing the highest returns of this cycle.

Click To Visit Pepeto Website To Enter The Presale

FAQs

Is Elon Musk connected to Pepeto?

Rumors are spreading fast that Pepeto could catch Elon Musk’s attention because its zero fee exchange tools and meme community energy match the vision Elon Musk keeps building. Visit the Pepeto official website.

Why did Dogecoin spike after Elon Musk’s X Money announcement?

Dogecoin jumped 8% after Elon Musk confirmed X Money will enable crypto trading from timelines, but the $0.10 resistance keeps blocking recovery while Pepeto’s presale keeps rising.

Is Dogecoin still Elon Musk’s favorite crypto?

Elon Musk confirmed Dogecoin remains his favorite, but the meme coin presale with exchange infrastructure at six decimal zeros is attracting the same energy early Dogecoin had before Elon Musk first tweeted about it.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

FL Senate Passes State Stablecoin Bill, DeSantis’ Signature Pending

Florida advanced a state-level framework for regulating payment stablecoins, moving SB 314 to Governor DeSantis’ desk for final approval. The bill, which passed the Florida Senate unanimously, would introduce consumer protections and financial oversight for stablecoin issuers operating within the state, aligning with a broader federal trend toward clearer rules for digital assets. The development comes as Florida looks to codify safeguards around payments and digital holdings while contemplating broader crypto exposure in public portfolios. The signing window is anticipated to run roughly a month, per statements from stakeholders involved in the process.

Key takeaways

- SB 314 cleared the Florida Senate with unanimous support and is headed to Governor DeSantis for signature, with a public timeline suggesting approval within about 30 days.

- The package amends Florida’s money-laundering framework to explicitly cover stablecoins, requiring issuers to comply with applicable regulations and operate under licensure, while clarifying that certain payment stablecoins are not securities.

- Issuers with activity in Florida must notify the state’s Office of Financial Regulation (OFR) before operating; oversight may fall solely to the OFR or involve joint supervision with the federal Office of the Comptroller of the Currency (OCC), depending on issuer structure.

- Incentive structures are addressed: issuers would be barred from offering interest or yields if federal rules prohibit such payments, aiming to prevent regulatory arbitrage or misleading incentives.

- Separately, Florida revisits its crypto investment posture through House Bill 183, seeking to allow up to 10% of state funds to be allocated to digital assets and crypto-related instruments, expanding beyond Bitcoin to include a wider range of assets. HB 183 is a revised form of HB 487, which was withdrawn after previous committee inaction.

Tickers mentioned: $BTC

Market context: The Florida move sits within a broader wave of state-level efforts to regulate digital assets with tailored frameworks. As federal regulatory considerations such as the GENIUS Act progress, states are actively shaping rules that balance consumer protections, financial stability, and innovation in payments and asset classes.

Why it matters

The proposed stablecoin framework marks a shift from broader, generalized crypto regulation to a state-tailored regime that can provide clearer operating parameters for issuers and clearer protection for consumers and businesses using these tokens for payments. By explicitly including stablecoins in the Money Laundering Act and defining the regulatory overlay, Florida seeks to reduce illicit use while enabling legitimate fintech activity within its borders. For issuers, the new regime points to a defined licensure pathway and a risk-management scaffold that can lower regulatory uncertainty compared with jurisdictions where rules are still evolving.

From a consumer perspective, the creation of explicit standards—such as licensing requirements, oversight responsibilities, and anti-yield incentives—offers a more predictable environment for using stablecoins in everyday payments and commerce. Meanwhile, the framework’s alignment with federal tenets, like those embedded in the GENIUS Act, signals a coordinated approach to digital-assets oversight across different levels of government. Investors in Florida-based digital assets or funds tied to state programs may eventually benefit from more transparent governance, even as issuers adapt to a more formal regulatory environment.

For Florida’s public institutions, the HB 183 plan adds another layer of potential exposure to digital assets, but with guardrails: a cap on allocations, risk parameters, and diversification considerations that could shape how state and municipal funds participate in the crypto economy. The proposal broadens the asset classes that could be included, moving beyond a BTC-centric approach to embrace a wider spectrum of crypto instruments and blockchain-enabled assets. The evolution of HB 183—being a revised version of a previous bill that stalled—will be a critical indicator of how quickly the state intends to operationalize digital-asset investments within its treasury and related entities.

What to watch next

- Governor DeSantis’ signing decision and any accompanying regulatory guidelines within the next 30 days.

- Implementation details from the OFR and any joint supervisory arrangements with the OCC, including licensure processes for stablecoin issuers and reporting requirements.

- Final language and progress of HB 183, including the scope of permissible digital-asset allocations and the timeline for any implementation.

- Federal regulatory movement around the GENIUS Act and how federal rules may influence state-by-state interpretations of stability, yields, and securities classification.

- Any subsequent clarifications or amendments as Florida regulators publish guidance on stablecoins and crypto investments.

Sources & verification

- SB 314 — Florida Senate bill history and status: https://www.flsenate.gov/Session/Bill/2026/314/?Tab=BillHistory

- Samuel Armes’ X post confirming passage and anticipated signing: https://x.com/samuelarmes/status/2029971078341067249

- GENIUS Act context and impact on stablecoins: https://cointelegraph.com/explained/what-does-the-us-genius-act-mean-for-stablecoins

- HB 487 withdrawal and related Florida stablecoin discussions: https://cointelegraph.com/news/florida-takes-strategic-bitcoin-reserve-bills-off-the-table

- Bitcoin price coverage referenced in the broader regulatory context: https://cointelegraph.com/bitcoin-price

Florida moves to regulate stablecoins and crypto investments

Florida’s legislative activity reflects a broader push to bring stablecoins into a formal regulatory framework while exploring the strategic use of digital assets within state portfolios. The consensus on SB 314—unanimous support in the Senate—underscores a bipartisan drive to codify consumer protections, licensing standards, and supervisory responsibilities that aim to prevent misuse while enabling legitimate financial innovation. At the heart of the proposal is a pragmatic recognition that stablecoins operate as a bridge between traditional payments and digital finance, requiring a robust state-level apparatus to monitor risk, ensure compliance, and preserve financial integrity.

As the bill moves toward the Governor’s desk, the interplay between state and federal rules will be critical. The GENIUS Act’s recent enactment provides a federal frame that Florida appears to be aligning with, particularly in areas touching consumer protection and oversight. Yet state-level rules also must navigate the complexities of cross-border issuance and the practicalities of supervision across multiple financial-regulatory bodies. Florida’s approach—defining licensure for issuers, clarifying which instruments are securities, and establishing oversight pathways—offers a model for how states might tailor regulation without stifling innovation.

In parallel, HB 183’s revisitation signals a broader ambition: to assess the role digital assets could play in state-managed portfolios and public funds. By contemplating a qualified exposure cap and a broader asset class slate, Florida is probing how governance, risk, and liquidity constraints can be balanced in a way that respects prudent fiduciary standards while maintaining the flexibility needed for dynamic asset classes. The evolving language and potential implementation timeline will determine whether Florida becomes a more active participant in the crypto economy or a cautious regulator that seeks to chart a measured future for public entitlements and digital finance.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion23 hours ago

Fashion23 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat2 days ago

NewsBeat2 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter