Crypto World

Crypto, TradFi Execs Mingle At Trump Crypto Event

Trump family-owned Mar-a-Lago was home to traditional finance giants, US government officials and crypto executives in a crypto forum on Wednesday, hosted by the family’s sprawling crypto company.

Coinbase CEO Brian Armstrong and Binance co-founder Changpeng Zhao, who Donald Trump pardoned last year, were at the exclusive World Liberty Forum event alongside Goldman Sachs CEO David Solomon and the heads of the Nasdaq and New York Stock Exchange.

The event saw traditional finance executives and US regulators embrace crypto, with Solomon, a long-time crypto skeptic, saying on stage that he now owns “a little Bitcoin, very little,” according to one of the attendees.

“The great irony is this whole world has gone full circle,” Bloomberg reported Eric Trump as saying at the event.

“There’s people in this room that were probably on the opposite side of us, that were canceling bank accounts for us, that were kicking us out of their big banks for no reason other than the fact that my father was wearing a hat that said, ‘Make America Great Again.’”

Commodity Futures Trading Commission chair Mike Selig, the head of an agency that is pushing to regulate the crypto industry, was also in attendance, along with Republican senators Ashley Moody and Bernie Moreno.

World Liberty announces tokenization tie-up for Trump hotel

World Liberty announced at the event that it has partnered with tokenization firm Securitize, with plans to tokenize loan revenue interests in an upcoming Trump-branded resort in the Maldives.

The company said it was part of a “broader strategy to design, structure, and distribute [World Liberty]-branded tokenized real-world asset offerings.”

Related: Warren warns crypto bailout would enrich Trump family biz: Report

The Trump Organization said in November that it would tokenize the development of the project, which is being built by real estate developer DarGlobal. The resort is set to be completed in 2030 and feature 100 luxury villas.

World Liberty said that the offering will give investors “both a fixed yield and loan revenue streams” from the resort, giving exposure to “both potential income distributions and the potential for certain profits upon any future sale.”

It added that the offering is only available to eligible accredited investors in the US and would be accessed via “select third-party partners and wallets.”

Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Morgan Stanley, Top Holders Boost Bitmine Exposure Amid Sell-Off

Bitmine Immersion Technologies (BMNR) (EXCHANGE: BMNR) remains a central node in corporate crypto treasury strategies as its Q4 2025 13F filings show a broad-based uptick in holdings among the top shareholders, even as the crypto market endured a broader crash and the stock underperformed. Morgan Stanley, the largest reported holder, lifted its stake by about 26% to more than 12.1 million shares, valued at roughly $331 million at quarter-end, according to its Form 13F filing with the U.S. Securities and Exchange Commission. ARK Investment Management followed with a roughly 27% increase to over 9.4 million shares, worth around $256 million. The moves underscore a divergent dynamic in which major asset managers deploy capital into a prominent Ethereum treasury specialist even as price action remains challenging for the sector. Ether (ETH) (CRYPTO: ETH) and other treasury-driven strategies are at the forefront of this activity, illustrating how institutional players view long-term relevance amid volatility.

The momentum isn’t isolated to these two institutions. A wider cohort of blue-chip managers also expanded exposure in BMNR during the quarter. BlackRock’s stake surged by 166%, Goldman Sachs’s position jumped 588%, Vanguard increased by 66%, and Bank of America’s exposure soared by a staggering 1,668%, according to the same filings. Collectively, these moves reinforce a narrative of growing institutional curiosity toward corporate treasuries that accumulate and manage Ether holdings as a strategic reserve. The trend aligns with discussions across the market about ESG- and yield-forward treasury management, even as macro liquidity and risk sentiment oscillate.

Further reinforcing the trend, the top 11 shareholders reportedly raised exposure during Q4 2025, including names such as Charles Schwab, Van Eck, the Royal Bank of Canada, Citigroup and Bank of New York Mellon Corporation, based on official filings compiled by observers tracking 13F data. The breadth of buying activity within BMNR’s cap table points to a broad confidence among large institutions that the company’s Ether positions can endure and potentially appreciate over longer horizons, even when near-term prices have pulled back. The aggregate effect is a market where large investors appear to view BMNR as a vehicle for exposure to Ethereum treasury strategies rather than as a proxy for traditional equity beta.

BMNR’s stock, however, has not mirrored this institutional enthusiasm. The shares declined by roughly 48% in the fourth quarter of 2025 and have fallen about 60% over the preceding six months. In premarket trading, BMNR hovered near $19.90, underscoring a disconnect between the capital being deployed by incumbents and the day-to-day price action in the stock market. This divergence has prompted ongoing discussion about the company’s financing flexibility, particularly as it relates to its market net asset value, or mNAV, a metric that contrasts enterprise value with the market value of its crypto holdings. Data tracked by Bitmine monitoring services indicate that the mNAV remained above 1, a sign that the firm retains capacity to raise capital by issuing new shares if needed, supported in part by sustained institutional ownership.

Beyond the equity narrative, BMNR’s treasury strategy remains deeply anchored in Ether purchases and accumulation. In the past week, the company added 45,759 Ether for approximately $260 million, at an average cost basis of around $1,992 per ETH. This ongoing accumulation reinforces BMNR’s status as a leading corporate holder of Ether, a position publicly noted by analysts and tracked by data providers. In aggregate, the company now holds about 4.37 million Ether on its books, worth roughly $8.69 billion at current valuations, according to the StrategicEthReserve dataset. This concentration of Ether on a corporate balance sheet is characteristic of a broader trend where treasuries seek to diversify risk and inflationary pressures by maintaining sizable crypto stacks as strategic assets rather than pure speculative bets.

These developments come as the market navigates a period of heightened volatility and structural shifts in crypto liquidity and custody. While the broader sector has faced drawdowns, the continued accumulation by blue-chip institutions suggests a longer-run thesis in which Ether plays a central role in diversified treasury strategies. Bitmine’s ability to maintain an mNAV above 1—supported by strong institutional ownership—illustrates how the market is increasingly valuing the capacity to deploy capital into Ether holdings without immediate dilution or financing constraints. The data underpinning these conclusions rely on multiple sources, including 13F filings and independent trackers, which collectively provide a window into the evolving dynamics between public market perception and private treasury strategies.

For readers tracking the governance and strategic implications of Bitmine’s approach, the company’s Ether-heavy balance sheet remains a focal point. The combination of rising institutional ownership and persistent buybacks or capital raises could shape how the market evaluates Ether exposure within corporate treasuries over the coming quarters. As the market continues to digest these developments, observers will be watching how BMNR balances liquidity, financing flexibility, and the ability to sustain or adjust its Ether purchases in response to price movements, regulatory signals, and evolving investor expectations.

https://platform.twitter.com/widgets.js

Why it matters

The quarterly inflows from top-tier institutions into BMNR underscore a broader trend: major asset managers are increasingly comfortable aligning with corporate treasury strategies that emphasize Ether as an ongoing hold, not merely a speculative asset. This dynamic supports a narrative where Ether moves beyond a retail-driven hype cycle and becomes a component of risk-managed corporate portfolios. The fact that the mNAV remains above 1 suggests management can pursue additional Ether purchases or liquidity-friendly financings without necessarily triggering dilution worries, a factor that reduces external funding frictions in a volatile market.

From a market structure perspective, the concentration of Ether within a handful of corporate treasuries can influence price discovery and liquidity in the broader Ethereum ecosystem. While stock prices for BMNR have faced a substantial pullback, the ongoing accumulation by entrenched institutions indicates a differentiated view of the asset’s long-term value proposition. For investors and builders in the crypto space, the trend highlights the continued institutionalization of Ether as a treasury asset category, with governance, custody, and risk management practices likely to mature further as more firms participate.

On regulatory and policy grounds, the uptick in 13F disclosures around BMNR is part of a larger disclosure regime that provides visibility into how institutions structure their crypto exposures. This transparency helps investors assess risk, liquidity, and capital allocation strategies in a sector that remains under tight scrutiny in several jurisdictions. While the market environment remains unsettled, the clear signal from these filings is that large financial institutions see strategic merit in backing corporate treasuries that actively manage Ether holdings, even when the broader market is pressured.

What to watch next

- BMNR’s Q1 2026 13F filings to reveal whether institutions maintain or adjust their positions as Ether prices fluctuate.

- Any additional Ether purchases by BMNR and the impact on mNAV and financing options.

- Regulatory developments affecting crypto treasury strategies or corporate disclosures for digital asset holdings.

- Price action in Ether and broader Ethereum-related products that could influence treasury strategies across the sector.

Sources & verification

- Morgan Stanley 13F Q4 2025 filing confirming stake of over 12.1 million BMNR shares (EXCHANGE: BMNR) and a value near $331 million — 13f.info.

- ARK Investment Management 13F Q4 2025 filing showing a stake of about 9.4 million BMNR shares worth roughly $256 million — 13f.info.

- Bank of America 13F filing for Q4 2025, confirming exposure to BMNR — SEC filing: xslForm13F_X02/Q4202513fhr.xml.

- Bitmine tracker data indicating the mNAV remains above 1 and tracking institutional ownership — https://www.bitminetracker.io/.

- StrategicEthReserve data showing BMNR holds 4.37 million Ether (ETH) valued at approximately $8.69 billion — https://www.strategicethreserve.xyz/#.

Rewritten Article Body

Institutional bets sustain Bitmine’s Ether treasury even as price retreats

Bitmine Immersion Technologies (BMNR) (EXCHANGE: BMNR) has drawn renewed attention from the wallet of large-cap fund managers, as its Q4 2025 13F filings reveal a broad-based expansion in ownership among the top shareholders despite a crypto-market downturn and a steep slide in the stock price. Morgan Stanley, the most prominent disclosed holder, raised its stake by roughly 26% to more than 12.1 million shares, a position valued at about $331 million at quarter-end. ARK Investment Management followed with an approximately 27% increase to just over 9.4 million shares, equating to around $256 million in value. These moves, captured in the quarterly forms now on public record, signal a continued institutional tilt toward Bitmine’s Ethereum treasury positioning even as general market sentiment remains cautious. (EXCHANGE: BMNR) (CRYPTO: ETH)

Beyond these two heavyweights, a broader suite of institutions intensified their exposure to BMNR in the quarter. BlackRock’s stake surged by 166%, Goldman Sachs’s by 588%, Vanguard by 66%, and Bank of America by an astonishing 1,668%. The cluster of purchases underscores a deeper institutional conviction that Ether-based treasury strategies can function as a long-horizon component of a diversified balance sheet, particularly for entities seeking to anchor liquidity in a volatile market. The filings also show that the top 11 shareholders, including Charles Schwab, Van Eek, Royal Bank of Canada, Citigroup and Bank of New York Mellon, expanded their positions, suggesting a broad consensus among asset managers about BMNR’s strategic approach to Ether exposure and treasury management.

However, the market performance narrative remains separate from these portfolio moves. BMNR’s stock price declined about 48% in Q4 2025 and roughly 60% over the prior six months, trading near $19.90 in premarket action. The price action contrasts with the resilience implied by the mNAV, a metric that compares enterprise value to crypto holdings and can indicate financing flexibility. Bitmine-tracking services indicate the mNAV stayed above 1, a threshold that can ease the process of raising new capital through equity issuance, thereby supporting continued treasury activity without immediate dilution fears. The juxtaposition of robust institutional inflows with a declining stock price highlights a common theme in crypto corporate finance: markets can discount near-term price volatility while institutions bet on longer-term structural value in the underlying treasury strategy.

Concurrently, Bitmine intensified its Ether accumulation. In the past week alone, the company added 45,759 Ether for roughly $260 million, at an average cost basis of around $1,992 per ETH. This cadence of purchases cements Ether as a cornerstone of Bitmine’s treasury stack, aligning with its broader position as the world’s largest corporate holder of Ether—4.37 million ETH, valued at approximately $8.69 billion, according to StrategicEthReserve data. That scale places Bitmine at the vanguard of corporate custody, illustrating how large holders approach risk and revenue potential in a market that continues to rehearse inflationary and macroeconomic concerns.

The trajectory of these holdings, alongside the mosaic of 13F disclosures, points to a market where public equity dynamics and crypto treasury strategies can diverge meaningfully. Institutional confidence in BMNR’s approach appears to rest not on day-to-day price swings but on the ability to sustain a disciplined, growth-focused Ether program that could weather downside scenarios while remaining positioned for upside in a longer horizon. Observers will monitor whether this institutional appetite translates into greater liquidity, more favorable financing terms, or additional capacity to accumulate Ether in the quarters ahead, particularly as macro conditions evolve and Ethereum-specific catalysts emerge.

Crypto World

Why Humans May Not Be the Real Users of Crypto

Haseeb Qureshi, managing partner at Dragonfly, argues that crypto’s persistent friction stems from a deeper mismatch: its architecture appears better aligned with artificial intelligence (AI) agents.

In his view, many of crypto’s perceived failure modes are not design flaws but signals that humans were never the ideal primary users.

Sponsored

The Human-Crypto Disconnect

In a detailed post on X, Qureshi argued that a fundamental divide exists between human decision-making and blockchain’s deterministic architecture. He said the early vision of the industry imagined a world where smart contracts would substitute legal agreements and courts, with property rights enforced directly on-chain.

That shift, however, has not materialized. Even crypto-native firms such as Dragonfly still rely on conventional legal contracts.

“When we sign a deal to invest into a startup, we don’t sign a smart contract. We sign a legal contract. The startup does the same. Neither of us are comfortable doing the deal without a legal agreement…In fact, even in the cases where we have an on-chain vesting contract, there’s usually also a legal contract in place,” he said.

According to Qureshi, the issue is not technical failure but social misalignment. Blockchain systems function as designed, yet they are not structured around human behavior and error. He also contrasted this with traditional banking, which has evolved over centuries to account for mistakes and misuse.

“The bank, terrible as it is, was designed for humans,” he added. “The banking system was specifically architected with human foibles and failure modes in mind, refined over hundreds of years. Banking is adapted to humans. Crypto is not.”

He added that long cryptographic addresses, blind signing, immutable transactions, and automated enforcement do not align with human intuition about money.

Sponsored

“That’s why in 2026, it’s still terrifying to blind sign a transaction, to have stale approvals, or to accidentally open up a drainer. We know we should verify the contract, double-check the domain, and scan for address spoofing. We know we should do all of it, every time. But we don’t. We’re human. And that’s the tell. It’s why crypto always felt slightly misshapen for us,” the executive remarked.

AI Agents: Crypto’s True Natives?

Qureshi suggested that AI agents may be more naturally suited to crypto’s design. He explained that AI agents do not fatigue or skip verification steps.

They can analyze contract logic, simulate edge cases, and execute transactions without emotional hesitation. While humans may prefer the legal systems, AI agents may favor the determinism of code. According to him,

“In that sense, crypto is self-contained, fully legible, and completely deterministic as system of property rights around money. It’s everything an AI agent could want from a financial system. What we as humans see as rigid footguns, AI agents see as a well-written spec…Even legally, our traditional monetary system was designed for human institutions, not AIs.”

Sponsored

Qureshi forecasted that the crypto interface of the future will be a “self-driving wallet,” entirely mediated by AI. In this model, AI agents manage financial activities on behalf of users.

He also suggested that autonomous agents could transact directly with each other, positioning crypto’s always-on, permissionless infrastructure as a natural foundation for a machine-to-machine economy.

“I think it’s this: crypto’s failure modes, which always made it feel broken for humans, in retrospect were never bugs. They were simply signs that we humans were the wrong users. In 10 years, we will look back at amazement that we ever subjected humans to wrestle with crypto directly,” Qureshi stressed.

Still, he cautioned that such a shift would not occur overnight. Technological systems often require complementary breakthroughs before reaching mainstream relevance.

“GPS had to wait for the smartphone. TCP/IP had to wait for the browser,” Qureshi noted. “For crypto, we might just have found it in AI agents.”

Sponsored

Recently, Bankless founder Ryan Adams also argued that crypto adoption has stalled due to poor user experience. However, he suggested that what appears to be “bad UX” for humans may actually be optimal UX for AI agents.

Adams predicted that billions of AI agents could eventually drive crypto markets beyond $10 trillion.

“In a year or two there’ll be billions of agents, many with wallets (then a year later they’ll be trillions). The “AiFi narrative” is underground like defi was in 2019. The dry tinder is quietly collecting but at some point it will ignite. No one is paying attention to crypto now because price is down…but i believe AI agents will scale to trillions of crypto wallets. AiFi is the next frontier of DeFi,” the post read.

The machine-native crypto thesis is powerful, but real constraints remain. AI agents may transact autonomously, yet liability still ultimately rests with humans or institutions, keeping legal systems relevant.

Deterministic smart contracts reduce ambiguity but do not eliminate exploits, governance failures, or systemic risk. Lastly, an argument could also be made that if AI becomes the primary interface, crypto may fade into backend infrastructure rather than function as a parallel financial order.

Crypto World

World Liberty Financial Partners With Securitize and DarGlobal to Tokenize Trump Maldives Resort

TLDR:

- WLFI partners with Securitize and DarGlobal to tokenize Trump International Hotel & Resort, Maldives.

- The tokenized offering gives everyday investors exposure to income distributions and asset value changes.

- The initial offering will be issued on public blockchains with access via select third-party wallets.

- Eligible users can collateralize holdings and borrow through WLFI Markets where permitted by law.

World Liberty Financial (WLFI) has announced plans to tokenize Trump International Hotel & Resort, Maldives. The initiative is a three-way partnership with Securitize, Inc. and DarGlobal PLC (LSE: DAR).

This move marks the start of WLFI’s broader strategy to structure and distribute tokenized real-world asset offerings.

The resort, a luxury hospitality development scheduled for completion in 2030, will feature roughly 100 ultra-luxury beach and overwater villas.

WLFI Opens Real Estate Investment to a Broader Audience

The tokenized offering aims to give investors direct exposure to a prime Maldivian hospitality asset. Investors stand to gain from both potential income distributions and changes in asset value. The offering is structured within a regulated securities framework, adding a layer of investor protection.

WLFI co-founder Eric Trump spoke on the vision behind the announcement. He noted that the platform was built to open decentralized finance to a wider audience.

Trump said, “We built World Liberty Financial to open up decentralized finance to the world. With tokenized real estate, we’re now extending that access to what we do best.”

He further stressed the importance of retail participation in high-value assets. “For the first time, everyday investors can gain access to an iconic property like Trump International Hotel & Resort, Maldives and can be part of its success,” Trump added. He also confirmed that future tokenized offerings are in the pipeline as the platform scales.

The resort was developed by DarGlobal in collaboration with The Trump Organization. DarGlobal is listed on the London Stock Exchange and operates as an international luxury real estate developer. The Maldives property serves as the flagship asset in this initial round of tokenization.

Securitize and DarGlobal Outline the Structure of the Deal

Securitize, a leading platform for tokenizing real-world assets, is handling the compliance and governance side of the deal.

CEO Carlos Domingo acknowledged the longstanding challenge of bringing real estate on-chain. He stated, “Real estate has been one of the hardest asset classes to tokenize effectively.”

Domingo further explained the rationale behind the partnership’s design. “We believe the first scalable on-chain real estate products will be globally sought-after properties issued with compliance, governance, and market structure in mind,” he said. He confirmed that this partnership with WLFI is structured precisely to meet that standard.

DarGlobal CEO Ziad El Chaar described the collaboration as a turning point for real estate investment. He said, “Together, we are rethinking how global investors can access, trade, and ultimately gain liquidity in high-quality real estate as it is being developed.” El Chaar also pointed to WLFI’s investor network as a major advantage for expanding market participation.

The initial offering is expected to be issued on supported public blockchains. Access will be enabled through select third-party partners and wallets, subject to applicable requirements.

Additionally, the parties plan to support on-chain utilities, including the ability for eligible users to collateralize holdings and borrow through WLFI Markets, where permitted by law.

Crypto World

EUR/USD Chart Analysis: Volatility May Return to the Market

As indicated by the Bollinger Bands width indicator, the EUR/USD market remained relatively subdued in February, with the indicator twice retreating towards its lower boundary.

However, price action over the past two sessions suggests renewed activity — the range formed between 11 and 17 February has been broken to the downside by sellers.

From a fundamental perspective, this move reflects a combination of factors, including:

→ Reports that European Central Bank President Christine Lagarde is planning to step down before the end of her term in October next year. This development is viewed as a bearish factor for the euro.

→ Minutes from the FOMC meeting showing that policymakers are in no rush to cut interest rates. Opinions were divided, with some members even open to raising the Fed rate if inflation proves persistent. The prospect of a tighter Federal Reserve stance is supportive for the US dollar.

Technical Analysis of the EUR/USD Chart

The recent bearish pressure has pushed EUR/USD back towards a key support level around 1.1777. Bears attempted to break below this level on 6 February but failed, resulting in a false breakout at point B.

While bulls may attempt a rebound from this support, the broader picture suggests that sellers currently hold a slight advantage in February, reflected in the following:

→ Price action has been forming a descending channel since 11 February (shown in red).

→ High C sits roughly halfway along the A→B bearish impulse. According to Fibonacci proportions, this is consistent with a bearish market structure.

→ Bulls have been unable to secure a foothold above key psychological levels — first above 1.2000 and subsequently above 1.1900.

If selling pressure persists, a decisive break below 1.1777 cannot be ruled out, which could in turn trigger a fresh surge in volatility.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Majority of stablecoin users would use a crypto wallet issued by their bank

A majority of stablecoin users want their banks to make it easier for them to buy and spend stablecoins for regular transactions, according to a new survey compiled by YouGov.

Some 77% of the 4,658 respondents said they would open a cryptocurrency or stablecoin wallet within their banking or fintech app if one were available.

The survey, commissioned by crypto exchange Coinbase (COIN) and stablecoin infrastructure provider BVNK, also found that 71% of users would use a stablecoin-linked debit card. The survey was conducted from September to October, 2025.

Stablecoins are crypto tokens whose value is pegged to a real-world asset. The most popular, Tether’s USDT and Circle Internet’s (CRCL) USDC, are digital versions of the U.S. dollar, though other currencies are also available. The total market capitalization has grown 50% since the start of 2025, according to data tracked by DeFiLlama, and first topped $300 billion in October.

While stablecoins are widely used in trading cryptocurrencies, the results highlight how far they have penetrated into the traditional financial economy, driven especially by developments in the regulatory environment.

“Users want stablecoins to behave like money they already know,” BVNK summarized.

Stablecoin users hold an average of 35% of their annual earnings in such tokens, according to the survey, while 73% of freelancers and contractors reported an improvement in their ability to work with international clients thanks to stablecoins.

The expansion of formal regulation of stablecoins in major jurisdictions, such as the GENIUS Act in the U.S, could give banks the confidence to start offering crypto tools such as wallets.

“By codifying transparency and cybersecurity standards, the Act classifies these assets as reliable cash equivalents,” Coinbase’s Alec Lovett and John Turner said in the report. “This clarity has bolstered institutional trust while strengthening consumer protections, which we predict will supercharge adoption in the coming months and years.”

Crypto World

Crypto steadies after selloff while derivatives flash caution signals

Bitcoin and ether (ETH) both rose around 0.9% overnight while the broader altcoin market lagged on Thursday.

BTC was recently trading at $67,000 following a brief touch of $66,000 on Wednesday. Ether, at $1,970 after bouncing off $1,924, is struggling to break through the psychological $2,000 price level.

Volatility has waned since the selloff on Feb. 5. Two subsequent weeks of consolidation have left investors wondering whether this is the calm before another stormy move to the downside, or whether the market is establishing a macro low before rising back toward 2025 levels.

World Liberty Financial’s Mar-a-Lago forum on Wednesday failed to provide a bullish catalyst despite being attended by CFTC Chairman Michael Selig and executives from companies including Goldman Sachs.

From a macro perspective, bitcoin remains in a downtrend since hitting a record high of $126,600 in early October. It has notched a series of lower highs and lower lows with periods of choppy consolidation in between each major move.

Derivatives positioning

- Market dynamics have stabilized with open interest holding at $15.38 billion.

- That marks a transition from a leverage cleanup to a steady floor.

- Retail sentiment shows a subtle rebound with funding rates flipping flat to positive (Binance back at 4%), while institutional conviction remains anchored with the three-month annualized basis persisting at 3%.

- The BTC options market has reached a 50/50 volume equilibrium between calls and puts. While the one-week 25-delta skew has edged up to 12%, the implied volatility (IV) term structure remains in short-term backwardation.

- The front-end spike in the IV curve confirms that traders are still paying a “panic premium” for immediate protection, even as longer-dated tenors stabilize near 49%.

- Coinglass data shows $218 million in 24-hour liquidations, with a 77-23 split between longs and shorts. BTC ($75 million), ETH ($53 million) and others ($22 million) were the leaders in terms of notional liquidations.

- The Binance liquidation heatmap indicates $67,400 as a core liquidation level to monitor in case of a price rise.

Token talk

- The altcoin market is starting to suffer in the low-liquidity trading environment.

- Shares of lost more than 10% of their value after selling off during Wednesday’s event in a classic “sell the news” move.

- Axie Infinity (AXS) is retesting its Feb. 6 lows after falling 5.9% since midnight UTC.

- Lending platform Morpho’s native MORPHO token has now given back all of Wednesday’s gains, trading at $1.39 after shedding 4.2% of its value overnight.

- A whopping 97 of the top 100 cryptocurrencies, not including stablecoins or tokenized gold tokens, are in the red over the past 24 hours as the market remains in “extreme fear” territory.

- The fear and greed index is currently at 11/100, up from February’s low of 6/100.

Crypto World

Why BlackRock is Merging TradFi and Crypto

Before we dig into the corpses of the past, let’s clear the air on what we’re actually talking about. RWA (Real World Assets) is exactly what it says on the tin: taking physical or traditional financial assets (think real estate, gold, treasury bills, or corporate shares) and “tokenizing” them. In plain English, it’s turning a deed to a house or a share of a company into a digital token on a blockchain.

The goal? To make the “un-movable” parts of the real world as liquid and tradable as Bitcoin.

The Market Context: From “Play Money” to Infrastructure

For years, the market review of RWA was a graveyard of questionable pilots and over-hyped whitepapers.

In 2018-2019, Maecenas were the darlings of the “democratized art” movement, making headlines on CNN for tokenizing a multimillion-dollar Andy Warhol painting. The pitch was seductive: own a piece of a masterpiece for a few satoshis. Fast forward to today, and Maecenas is a digital ghost town. Its ART token has effectively flatlined to zero, and the “revolution” stalled because a flashy story couldn’t compensate for a lack of secondary market liquidity and institutional-grade legal custody.

Then there was the Freeway case of late 2022, for instance. It was the ultimate “RWA-lite” cautionary tale. The platform promised eye-watering 43% yields, claiming they were fueled by the “magic” of traditional forex markets and real-world asset management. It had all the buzzwords but zero transparency. When the $160 million ecosystem inevitably froze and its token cratered by 75% in hours, it confirmed everyone’s darkest fears: in the “Wild West” era of RWA, “real-world” was often just a marketing sticker slapped onto a black box.

To be fair, the underlying idea was never stupid. Putting real assets on-chain, making them liquid, borderless, 24/7 tradable, that’s genuinely interesting. The execution, however, was… let’s call it enthusiastic. The barrier to entry for launching an RWA project was essentially “do you have a wallet and a story?” Both requirements were consistently met by people who probably shouldn’t have been trusted with either.

The financial establishment has spent the last decade treating “tokenization” like a petulant child: loud, disruptive, and ultimately ignorable. But as we move deeper into 2026, the numbers have stopped being funny for the skeptics. According to recent projections, the asset tokenization market is hurtling toward $9.43 trillion by 2030 and reach a CAGR of 72.8% from 2025-2030.

The Great Migration: From Volatility to Utility

The irony of 2026 is that the crypto native’s greatest dream is no longer a 100x memecoin, it’s a boring 5% yield on a T-bill that actually belongs to them.

The market is currently in a state of profound exhaustion. We are over-scammed, over-sold, and frankly, bored of “magic internet money” that only trades against other “magic internet money.” There is a desperate hunger for the stability of the S&P 500, but the traditional gatekeepers haven’t made it easy.

Buying “stonks” through a legacy broker in 2026 still feels like using a fax machine. You’re trapped by:

- Geographical Redlining: Your access to the best markets depends on where you were born.

- The 9-to-5 Mirage: Markets that shut down on weekends while the world keeps turning.

- Brokerage Silos: Try moving your Apple shares from one platform to another in real-time. You can’t. They don’t exist as “assets” in your hand; they are just entries in someone else’s database.

This is the “aha!” moment for RWA. True tokenization isn’t just a new way to buy assets; it’s a technological prison break for TradFi. It’s taking the reliability of a stock and giving it the freedom of a stablecoin: self-custody, 24/7 trading, and zero borders.

Look at Tether. They didn’t print USDT, they pivoted into a massive RWA powerhouse, aggressively buying up stakes in everything from plantations 70% stake in Adecoagro, 148 tonnes of gold, and major offline corporations. They are realizing that the ultimate power move isn’t just holding dollars but owning the physical world through a digital lens.

The skepticism of the first RWA project era was justified because they were selling dreams. Today, the industry is selling infrastructure. And as it turns out, the “boring” stuff is where the next $9 trillion is hidden.

The Institutional Land Grab: Why the Giants Woke Up

If Tether is the example of a “crypto-native” moving toward the physical world, the titans of TradFi are moving even faster to colonize the digital one. The conversation has shifted from “if” to “how fast,” driven by three heavyweight examples that prove the plumbing of global finance is being rebuilt:

- BlackRock & BUIDL: With the launch of their first tokenized fund on Ethereum, the world’s largest asset manager signaled that the “petulant child” of tokenization is now the guest of honor. For BlackRock, RWA isn’t a trend; it’s a way to unlock trillions in “dead” capital by moving from slow, 48-hour settlement (T+2) cycles to near-instant, on-chain finality.

- Franklin Templeton: A century-old investment giant that moved its U.S. Government Money Market Fund (FOBXX) onto public blockchain Solana. And they are using it to offer a Treasury-backed asset that can be used as 24/7 collateral, something a traditional bank account could never dream of.

- J.P. Morgan & Kinexys Digital Assets: Through their Kinexys platform, the biggest bank in the U.S. is already processing billions in “tokenized collateral” for repo trades. They realized that by digitizing assets, they could fire the army of middlemen and automate the complex legal dance of shifting ownership with smart contracts.

This leads us to the final realization of 2026: The Infrastructure Flip.

And the big three are moving because:

- Atomic Settlement: The “T+2” delay is a relic of the era of paper certificates. In RWA, the trade is the settlement.

- Programmable Yield: You can’t program a physical plantation or a bond to automatically distribute dividends to 10,000 global investors every hour. A smart contract can.

- Efficiency over Hype: They are eliminating the “intermediary tax” and the fees paid to banks and clearers just to verify that an asset exists.

The skepticism of the Maecenas era was about the assets, because no one knew if Warhol actually existed in a vault. Today, the revolution is about access. The big players aren’t here for the 5% yield; they are here because they’ve realized that the blockchain is a better, faster, and cheaper way to run the world’s financial operating system.

The Risks: The Fine Print of the Future

Before we get too comfortable with this “upgraded” reality, we have to acknowledge that RWA brings a whole new set of failure points. We’ve traded the risk of a “rug pull” for the risk of Regulatory Seizure.

- The Oracle Problem: If a smart contract says you own the gold, but the physical vault is empty, the blockchain is just a sophisticated lie.

- Centralization Risk: If a government decides to freeze a specific RWA contract, your “self-custody” share of an Apple stock is as dead as a frozen bank account.

- Smart Contract Legal Friction: We still don’t have a global court that can “undo” an exploit on a tokenized real estate deed. When the code fails, the legal system is still too slow to catch up.

The Control Paradox: TradFi’s Trojan Horse

Crypto originally dreamed of a world without intermediaries. We wanted a peer-to-peer utopia where the code was the law and the middleman was a relic of the past.

But as the institutions move in, they’ve brought a different message: “The intermediaries are staying. We’re just upgrading our tools.”

If RWA becomes the dominant financial layer, we aren’t heading toward a decentralized nirvana. Instead, we are looking at a Hybrid Reality. Tokenization won’t destroy TradFi; it will simply re-code it. We are moving toward a system defined by:

- On-chain assets backed by off-chain legal enforcement.

- Compliance by default: Less confidentiality and more transparency when real-world monikers are involved.

- Permissioned liquidity pools: High-yield RWA vaults that only let you in once you’ve scanned your passport.

The real question isn’t whether the market will hit $10 trillion. It will. The question is: Who will own the pipes?

My bet? It won’t be the idealists who built Bitcoin in 2009. The winners will be whoever controls three things: the legal wrapper (BlackRock has armies of lawyers), the liquidity (J.P. Morgan moves $10 trillion daily), and the regulatory blessing (Franklin Templeton didn’t ask permission; they co-wrote the rules).

We called RWA a pipe dream because we thought “real world” and “blockchain” were incompatible. Turns out, they’re not. They’re just being merged by people we didn’t expect, in ways we didn’t predict, with outcomes we’re still figuring out. The revolution is here. It’s just wearing a suit.

Crypto World

$27.8B in Unrealized Losses Hit Bitcoin Self-Custody Holders as ETFs Shed $8.5B

ETF capital flight mirrors private wallet stress, suggesting institutions and individuals are reacting to the same pressure worldwide now.

A specific cohort of Bitcoin (BTC) holders practicing strict self-custody is now sitting on a collective unrealized loss of $27.89 billion, a figure that mirrors the financial bleeding seen in the U.S. institutional market, which has seen ETF exposure plummet by two-thirds since late 2024.

The data shows that the sell-side pressure crushing Bitcoin is not just a Wall Street phenomenon but a systemic event equally impacting long-term believers using cold storage.

ETFs and On-Chain Hodlers Share the Same Red

According to a detailed on-chain analysis by GugaOnChain, addresses that self-custody between 10 and 10,000 BTC with a UTXO age of 1 to 3 months are suffering a drawdown of -23.39%, translating to nearly $28 billion in paper losses.

This group, which rejects centralized exchange deposits in favor of hard wallets, has found itself in the same position as the institutional giants trading via CME futures and ETFs. Data shows those U.S. institutional products have shed $8.5 billion since October, with exposure contracting by two-thirds from the 2024 peak. GugaOnChain believes this confluence of stress validates the thesis that the market is “hostage to the same bloodbath,” whether on a trading floor or in a private vault.

Unfortunately, the macro environment suggests relief is not imminent. While three pillars of support, namely accumulators (demand of 371,900 BTC), retail (adding 6,384 BTC monthly), and miners (with an MPI of -1.11), have managed to keep the number one cryptocurrency from an immediate collapse, the analyst views these as mere delays.

Meanwhile, Bitcoin’s price data shows mixed performance across different timeframes, with the asset trading just below $67,000 at the time of writing, down about 1% in 24 hours but slightly positive for the week. The broader trend remains negative, with the asset down about 27% over 30 days and roughly 42% across six months per CoinGlass.

“The recovery? It depends on price reaction at the levels above,” stated GugaOnChain.

Whale Accumulation Meets Retail Hesitation

Despite the pervasive losses, the market is witnessing a stark divergence in behavior that adds complexity to the outlook. While short-term retail demand has cooled significantly, with Alphractal data showing the 90-day net position change for short-term holders dropping rapidly, whales are treating the dip as a fire sale.

You may also like:

Per CryptoQuant, whale holdings have gone up by approximately 200,000 BTC over the past month, climbing from 2.9 million to over 3.1 million BTC. Furthermore, the analytics firm noted that this scale of accumulation was last seen during the April 2025 correction, right before Bitcoin’s rally from $76,000 to past $126,000. This suggests that while “dumb money” may be experiencing panic, “smart money” is preparing for the long term.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Senator Elizabeth Warren Urges Fed and Treasury Not to Bail Out ‘Crypto Billionaires’

U.S. Senator Elizabeth Warren has sent a stark warning to the Federal Reserve and Treasury Department, urging them not to use taxpayer funds to bail out cryptocurrency investors as digital asset markets face renewed volatility.

Summary

- Elizabeth Warren urged the Federal Reserve and Treasury Department not to use taxpayer funds to stabilize cryptocurrency markets, warning it would amount to a bailout for “crypto billionaires.”

- Warren said any intervention could indirectly benefit a crypto venture tied to former President Donald Trump, raising potential ethical and political concerns.

- The senator pressed officials to clarify whether the government has authority to backstop crypto assets, amid heightened market volatility and political scrutiny.

Elizabeth Warren warns against federal crypto bailout

In a letter to Treasury Secretary Scott Bessent and Fed Chair Jerome Powell, Warren argued that any government intervention to stabilize the cryptocurrency market would be “deeply unpopular” and could amount to a transfer of wealth from everyday Americans to “crypto billionaires.””

Warren’s letter, sent amidst a significant downturn in Bitcoin prices, which have fallen roughly 50 % from their October highs, pushes back against pressure for federal agencies to step in to support the embattled sector.

She warned that federal intervention, such as direct asset purchases, guarantees or liquidity support, could disproportionately benefit a small group of wealthy crypto holders, and might even benefit President Donald Trump’s family-linked cryptocurrency venture, World Liberty Financial.

The letter follows questioning by lawmakers during a February 4 hearing, where Congressman Brad Sherman asked Bessent whether the Treasury had authority to bail out Bitcoin or crypto assets.

Bessent responded that the government is “retaining seized Bitcoin” referring to crypto forfeited through law enforcement actions but did not rule out broader intervention. Warren called this response a “deflection” and demanded clear assurances that taxpayer funds would not be used to support crypto markets.

Warren’s stance highlights growing political scrutiny of crypto, particularly in the context of World Liberty Financial, which has been the focus of bipartisan concern. Just days earlier, Warren and Senator Andy Kim urged the Treasury to investigate a reported $500 million investment by the United Arab Emirates in the Trump-linked company, citing potential national security implications.

The pushback against potential bailouts echoes broader debates over how government should respond to crypto market stress and bolsters calls for regulatory clarity and stronger investor protections as digital assets continue to attract mainstream attention — and political controversy.

Crypto World

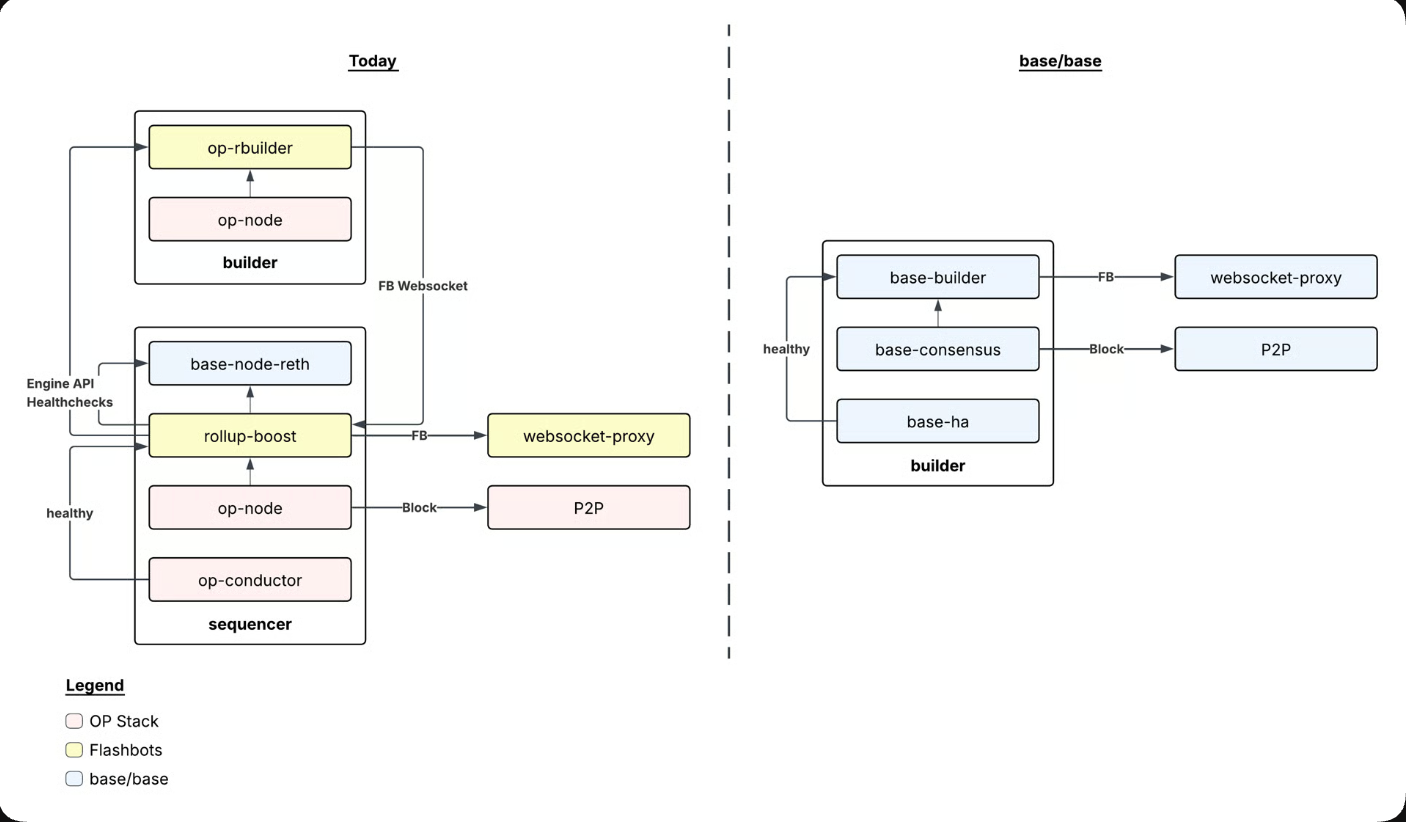

Base To Shift From Optimism Tech Stack to a ‘Unified’ Architecture

Base, the decentralized Ethereum layer-2 scaling network, said Wednesday that it is transitioning from running on Optimism’s L2 tech stack to its own unified software architecture.

Launched in 2023 as an Optimism chain, Base is shifting to its own tech stack to reduce dependence on external service providers and shorten the time to ship new upgrades, according to an announcement from Base. The team said:

“Consolidating into Base changes how Base packages and releases software for the network. We will ship one official distribution for each upgrade: a single Base binary for operating nodes on the network.”

The transition is also expected to simplify the Base network’s sequencer, which helps network validators to order transactions, the Base engineering team said.

The rollout will take place in four phases, according to the project’s roadmap, with node runners required to switch to the new Base client over the next several months for official upgrades.

Related: Base says configuration change caused transaction delays, fixes issue

Ethereum co-founder changes tune on layer-2 scaling networks

Earlier this month, Vitalik Buterin, the co-founder of the Ethereum L1 blockchain network, reversed course on scaling Ethereum through L2s.

L2s are taking longer than initially thought to transition to fully decentralized models, Buterin said, adding that the Ethereum L1 is already scaling on its own and features record-low network fees.

“The original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path,” Buterin said in February.

Buterin’s comments drew mixed reactions from L2 teams, with some agreeing that scaling networks must pivot beyond being a cheaper execution layer for Ethereum.

“It’s great to see Ethereum scaling L1 — this is a win for the entire ecosystem. Going forward, L2s can’t just be ‘Ethereum but cheaper,’” Base founder Jesse Pollak said in response.

Other L2 founders contend that scaling layers are already in alignment with the network’s long-term goals.

There are more than 128 different Ethereum L2 scaling networks at the time of publication, according to L2Beat.

Magazine: Coinbase and Base: Is crypto just becoming traditional finance 2.0?

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment22 hours ago

Entertainment22 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports8 hours ago

Sports8 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment14 hours ago

Entertainment14 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World17 hours ago

Crypto World17 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show