Crypto World

Dash Evolution Chain Integrates Zcash Orchard Privacy Pool

Dash, a layer-1 blockchain protocol with privacy-preserving features, announced on Thursday the integration of Zcash’s “Orchard” shielded pool into the Dash Evolution chain, a secondary layer on the L1 network that supports smart contract functionality. The rollout will proceed after cybersecurity audits are completed and is expected to launch in March, according to the project’s announcement. In the initial phase, Evolution will facilitate basic transfers of Zcash (ZEC) from one party to another, with subsequent upgrades planned to bring Orchard’s privacy features to tokenized real-world assets (RWAs) on the platform. The news adds a new privacy-centric rails dimension to Evolution and signals a broader push to blend shielded transactions with smart-contract enabled networks.

Key takeaways

- Dash (DASH) will integrate Zcash (ZEC)’s Orchard shielded pool into the Evolution layer, enabling private transfers on a smart-contract-capable L1.

- The launch is slated for March, pending cybersecurity audits, with initial support limited to basic ZEC transfers before privacy features for tokenized RWAs are rolled out.

- Privacy-focused tokens and on-chain privacy tooling gained renewed momentum in 2025–2026, as practitioners argue privacy is essential for practical crypto payments and for protecting sensitive business information.

- Dubai’s DFSA moved to ban privacy tokens like ZEC and XMR in January 2026, highlighting tensions between regulatory regimes and privacy tech development.

- Dash’s price action has reflected renewed interest in privacy narratives, with January 2026 seeing a surge of more than 125% and a local high near $96 on Binance before pulling back.

Tickers mentioned: $DASH, $ZEC, $XMR, $BTC

Market context: The integration arrives as the crypto market weighs the balance between privacy protections and regulatory compliance. Privacy-preserving tools are increasingly viewed as necessary for large-scale institutional use cases and for safeguarding payrolls, supplier payments, and partner disclosures from exposure, even as policy makers scrutinize anonymity features for potential misuse.

Why it matters

The Dash–Zcash collaboration underscores a broader industry push to weave shielded, privacy-forward capabilities into programmable networks. By incorporating Zcash’s Orchard shielded pool into Evolution’s smart-contract framework, Dash aims to deliver private on-chain transactions alongside the ability to deploy decentralized applications and tokenized assets. That combination could address one of the long-standing friction points in crypto payments: the need to protect transaction data while still enabling verifiable, auditable activity on a public chain. The approach also raises questions about how privacy protections interact with anti-money-laundering (AML) and know-your-customer (KYC) requirements, particularly as institutions contemplate using private rails for payroll, vendor payments, and cross-border settlements.

From a technical perspective, the Orchard integration pivots on a layered model: the base Dash network remains the settlement layer, while Evolution acts as a second layer capable of complex logic and asset tokenization. The plan to enable ZEC transfers first, followed by privacy enhancements for RWAs, suggests a measured rollout designed to test privacy-preserving mechanics in a controlled environment. For users and developers, this could open doors to more private asset issuance and private, auditable cash flows, while still leveraging the existing interoperability of Dash with other blockchains and services.

Regulatory debates frame the pace and scope of such privacy tools. Dubai’s DFSA ban on privacy tokens illustrates a regulatory hard line: while individuals may continue to hold privacy tokens, exchanges operating under its jurisdiction cannot offer them to new customers. The policy reflects a broader tension between enabling private financial activity and maintaining a measurable, compliant financial system. Advocates, including privacy researchers and industry practitioners, argue that real-world privacy needs to be addressed through a blend of regulation, culture, and code — not by siloing privacy features entirely. Critics contend that on-chain privacy can complicate enforcement and compliance, fueling a broader debate about how best to balance privacy and lawfulness in crypto ecosystems.

Amid these discussions, the narrative around privacy remains dynamic. The discourse includes prominent voices who argue that privacy is a fundamental requirement for practical adoption, especially in the context of enterprise use cases, where sensitive data such as compensation and strategic partnerships could be exposed if not shielded. Critics, meanwhile, push back on the idea that anonymity should be absolute on public networks, warning of misuse and illicit activity. The ongoing exchange of viewpoints—ranging from industry leaders to academics—continues to shape how privacy features are implemented and regulated across networks and jurisdictions.

Historical threads also color the conversation. The broader privacy discourse includes debates about anonymity, traceability, and the potential for forensic analysis to identify ownership of privacy tokens, even when on-chain data is shielded. These discussions inform the way privacy technologies are designed, tested, and deployed, as researchers seek to strike a balance between protecting user privacy and enabling legitimate oversight where needed. In parallel, researchers and practitioners increasingly emphasize that true financial privacy requires more than mere cryptographic obfuscation; it demands thoughtful regulation and governance, aligned with technical safeguards and practical use cases.

In a related vein, the debate around privacy in payments remains a central theme. Industry observers note that the lack of privacy may hinder crypto payments adoption, a concern echoed by industry leaders who argue that privacy-preserving tools are essential to shield sensitive details in business-to-business and enterprise transactions. The integration of Orchard into Evolution can be seen as part of a broader movement to embed privacy options into mainstream blockchains, rather than to keep them confined to niche use cases.

What to watch next

- March 2026: Audits complete and the initial ZEC transfers on Evolution become publicly available.

- Rollout of Orchard’s privacy features for tokenized RWAs, including governance and upgrade milestones for Evolution.

- Regulatory developments in other jurisdictions regarding privacy tokens and on-chain privacy tooling.

- Market reaction to the integration, including any shifts in Dash liquidity and trading activity on major exchanges.

Sources & verification

- Official announcements from Dash and Zcash regarding the Orchard integration and Evolution roadmap.

- Regulatory actions and statements from Dubai’s Financial Services Authority (DFSA) on privacy tokens, including ZEC and XMR.

- Historical price data for Dash (DASH) around January 2026 and associated market commentary on privacy narratives.

- Industry commentary on the role of privacy coins and the debate surrounding privacy versus regulatory compliance.

Key figures and next steps

Dash, positioned at the intersection of privacy and programmable money, is advancing a multi-phase plan to bring Orchard’s shielded capabilities to Evolution. The initial focus on basic ZEC transfers on Evolution lays the groundwork for more sophisticated privacy features tied to RWAs, potentially enabling confidential settlement and private asset issuance. If the March timeline holds post-audits, developers and users could begin testing privacy-first workflows within a familiar Dash ecosystem, while regulators and market participants watch how such integrations comport with compliance regimes around the world. The path forward will likely involve ongoing audits, governance voting on feature upgrades, and a careful articulation of privacy controls within a broader regulatory framework.

Why it matters — concluding thoughts

Privacy continues to be a critical axis for the crypto market’s maturation. The Dash–Zcash integration exemplifies how teams are attempting to reconcile the demand for private, verifiable transactions with the realities of regulatory scrutiny. For builders, it signals a roadmap for embedding privacy-by-design into smart-contract-capable networks, potentially broadening the range of use cases from payment rails to regulated asset tokenization. For users, the development could translate into more flexible privacy options without sacrificing access to a broad ecosystem of DeFi, wallets, and cross-chain services. As the regulatory landscape evolves, the ability to demonstrate privacy safeguards that align with compliance frameworks will be a decisive factor in determining how widely such technologies gain traction. In the near term, investors will be watching not just the march launch, but how the privacy feature set evolves and how this blend of shielded transactions with programmable rails resonates with real-world adoption.

What to watch next

- Audits concluding and March rollout of ZEC transfers on Evolution.

- Public validation of Orchard privacy features for tokenized RWAs on Dash.

- Regulatory updates in other jurisdictions regarding on-chain privacy tools.

Crypto World

White House favors some stablecoin rewards, tells banks it’s time to move

Limited stablecoin rewards are favored by the White House, and if bankers sign off, they’ll be in the next draft of the crypto market structure bill, according to two people familiar with the negotiation.

At a Thursday working session meant to secure common ground on stablecoin rewards between banks and the crypto industry, the White House made it clear that certain rewards programs were going to stay in the next draft of the crypto market structure bill, the people said. Representatives of Wall Street banks that attended the meeting actively worked on that language, and the White House will put together an updated draft to circulate among them, they said.

This section of the U.S. Senate’s Digital Asset Market Clarity Act — the crypto industry’s top policy aim in Washington — is one of the major fault lines for the legislation that would govern the operations of U.S. crypto markets. As it happens, the stablecoin section (404 of the draft bill) has nothing directly to do with market structure, and the revisions being discussed would actually overhaul an earlier crypto effort that became law last year, the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

This was the third White House sitdown between bankers and crypto insiders, and after the bankers dug in their heels on allowing stablecoin rewards last time, White House negotiators arrived at the table with a position that some rewards must be allowed for certain activities and transactions, but not for holdings of stablecoins that more closely resemble deposit accounts. The White House team — led by President Donald Trump’s crypto adviser, Patrick Witt — urged a quick resolution on this point that allows the legislation to move forward, the people said.

That reflects the fear expressed by bankers: that stablecoin rewards would undermine their bread-and-butter business model that depends on customers making interest-bearing deposits.

Participants at the meeting privately expressed hopes that the compromise they’ve waited for is potentially very close. Spokespeople for the White House didn’t immediately respond to a request for comment.

“Today’s meeting at the White House was a constructive step forward in resolving outstanding issues related to rewards and keeping market structure legislation on track,” Blockchain Association CEO Summer Mersinger, who has been among those at the table, said in a statement after the gathering.

If the banks decline to shake hands on limited rewards, the status quo is the GENIUS Act, which gives crypto platforms a much freer hand with rewards programs than this proposal would. If they instead give this approach a nod, their agreement would be likely to sway reluctant senators back into support.

However, this is just one of several holes in the Clarity Act that need to be filled with negotiated language. The crypto industry also remains very involved in the requests from Democratic lawmakers that the bill ramp up the protections against bad actors in crypto, especially in the decentralized finance (DeFi) space.

Also, Democratic negotiators have insisted on a couple of other points that may put them at odds with the White House. They’ve demanded a ban on senior government officials getting directly involved in the crypto industry — a position targeted most directly at President Donald Trump. They’ve also called for the White House to name a full slate of commissions at the Commodity Futures Trading Commission and the Securities and Exchange Commission, including their Democratic vacancies.

None of the Democrats’ major issues have yet been resolved. If the Senate Banking Committee moves forward with a hearing to advance the bill, as the Senate Agriculture Committee did, the outcome may again be partisan if the parties don’t find answers to those points. That won’t prevent the legislation’s advancement through the next step, but it can’t win approval from the overall Senate without significant Democratic support.

Read More: Latest White House talks on stablecoin yield make ‘progress’ with banks, no deal yet

Crypto World

XRP shorts dominate as funding drops 80% and OI falls

XRP slips below support as funding drops ~80% today on bearish leverage.

Summary

- XRP funding rate dropped nearly 80% on Thursday, signaling aggressive short bias and sustained downside positioning in derivatives markets.

- Open interest declined alongside negative funding, showing leveraged traders are de-risking as spot price trades below its short-term moving average and key Fibonacci support.

- XRP trends lower with RSI nearing oversold while crypto Fear & Greed prints “Extreme Fear” and BTC dominance climbs, pointing to rotation away from altcoins.

Daily XRP (XRP) funding rates declined nearly 80% on Thursday, February 19, according to derivatives market data, indicating continued pressure on the cryptocurrency.

Negative funding rates indicate that traders holding short positions are paying those maintaining long positions, a sign that bearish bets currently outweigh bullish exposure, according to market mechanics. The decline was accompanied by a drop in open interest, according to real-time data.

Negative funding rates suggest the market is positioned for further downside, as the metric reflects the balance between long and short traders.

Deeply negative funding can signal overcrowded positioning, according to market analysts. Historical data shows extreme short bias has sometimes preceded sharp reversals, particularly when price action stabilizes and short sellers are forced to cover positions. A prolonged negative funding environment marked a cyclical bottom for XRP in 2022 during the FTX collapse, according to historical market data.

XRP’s spot price showed a decline on the daily chart, falling below its short-term moving average and a key Fibonacci retracement level, which represents a loss of near-term support. The Relative Strength Index has fallen and is approaching oversold territory, according to technical indicators.

Market sentiment remains weak, reflected in an “Extreme Fear” reading on the Crypto Fear & Greed Index. Bitcoin dominance data suggests capital is consolidating into larger-cap assets rather than flowing into altcoins such as XRP, according to market metrics.

Technical analysts note that a recovery above the recent short-term resistance zone would signal price stabilization. Current short-term momentum favors bearish positions, as evidenced by the state of funding rates, according to derivatives market data.

Crypto World

Kraken xStocks Surpasses $25B in Tokenized Stock Volume

Kraken’s tokenized equities platform, xStocks, has surpassed $25 billion in total transaction volume less than eight months after launch, underscoring accelerating adoption as tokenization gains traction among mainstream investors.

Kraken disclosed Thursday that the $25 billion figure includes trading across centralized exchanges and decentralized exchanges, as well as minting and redemption activity. The milestone represents a 150% increase since November, when xStocks first crossed $10 billion in cumulative transaction volume.

The xStocks tokens are issued by Backed Finance, a regulated asset provider that creates 1:1 backed tokenized representations of publicly traded equities and exchange-traded funds. Kraken serves as a primary distribution and trading venue, while Backed is responsible for structuring and issuing the tokenized instruments.

When xStocks debuted in 2025, it offered more than 60 tokenized equities, including shares tied to major US technology companies like Amazon, Meta Platforms, Nvidia and Tesla.

Kraken said onchain activity has been a key growth driver since launch, with xStocks generating $3.5 billion in onchain trading volume and surpassing 80,000 unique onchain holders.

Unlike trading that occurs solely within centralized exchanges’ internal order books, onchain activity takes place directly on public blockchains, where transactions are transparent and wallets can self-custody assets.

Growing onchain participation suggests users are not only trading tokenized equities but also integrating them into broader decentralized finance (DeFi) ecosystems.

Kraken said that eight of the 11 largest tokenized equities by unique holder count are now part of the xStocks ecosystem, signaling increased market share in the emerging tokenized equities sector.

Related: Kraken launches tokenized securities trading in Europe with xStocks

Tokenized stocks mirror stablecoins’ early growth

Tokenization of real-world assets (RWAs) remains one of the fastest-growing segments of the digital asset market, even as broader crypto prices have trended lower since the start of the year.

Tokenized RWAs have increased 13.5% in total value over the last 30 days, according to industry data. By comparison, the broader crypto market shed roughly $1 trillion in market value over the same period.

Market observers say tokenized stocks may be experiencing their own “stablecoin moment,” a reference to the rapid early adoption that propelled dollar-pegged digital assets into mainstream use.

Data from Token Terminal shows tokenized stocks reached a market capitalization of $1.2 billion in December, after being virtually nonexistent six months earlier.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Crypto World

From stablecoins to CBDCs: Money is being redefined

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

To anyone who pays genuine attention to the stablecoin market, it comes as no secret that these assets have firmly entrenched themselves among the most important building blocks of the modern digital economy. By late 2025, the total stablecoin market cap had already surpassed the point of $300 billion, which tells us a lot about how much trust people are putting in them.

Summary

- Stablecoins have crossed the threshold: With $300B+ market cap and surging card usage, they’re no longer experimental — they’re becoming core payment infrastructure.

- Banks are reacting, not leading: Nearly half of banks are integrating stablecoins, while CBDCs signal central banks are adapting to rails already built by crypto.

- Liquidity is the real backbone: Yield-enhancing DeFi protocols transform idle capital into deep, 24/7 settlement infrastructure — making programmable money scalable.

Stablecoins get used so much today because they’re fast, borderless, and increasingly reliable. They move value instantly and behave predictably in ways that traditional payments increasingly don’t. It’s not really a question anymore whether stablecoins will stick around. The real question is how they will be adopted — and who will drive that adoption.

The passage of the GENIUS Act in the U.S. was a strong signal that payment stablecoins are entering a new phase. And regulation isn’t arriving just to slow the sector down; instead, it’s stepping up to give stablecoins a defined role in the broader financial system. For the first time, we’ve seen a clear path being introduced for payment stablecoins to operate alongside TradFi systems, rather than simply existing at their edges. They are actively becoming a settlement tool that can be used in practice alongside traditional financial instruments.

Adoption is already happening — but outside traditional rails

I find it important to mention that even outside any formal and large-scale integration by major payment platforms, adoption is spreading at its own pace. There is a growing number of fintechs that are building products at the intersection of crypto, stablecoins, and payments. Companies like ether.fi, Monerium, or Holyheld are already enabling real-world stablecoin usage through their financial tools and offerings. One particularly notable case of this is the exponential growth of crypto cards, utilized for everyday spending among crypto users. A study in Q3 2025 showed that a little over 60% of surveyed users already use these cards for transactions and commonplace purchases.

Meanwhile, we also have data from big names like Visa that their issuance and spending via crypto cards saw a massive rise over the course of the previous year. From January to December 2025, the total transaction volume jumped 525%, with the net spending climbing to $91 million by year-end. All of this evidence points to the rapid adoption of crypto instruments in the mainstream, and stablecoins are the primary way to power those cards.

This usage also highlights another trend that’s becoming more prominent: the growing role of non-USD stablecoins. Assets such as EURe and the more recent ZCHF are finding real demand in payment flows, especially in Europe and Switzerland, where users value on-chain settlement without taking unnecessary dollar exposure.

Euro-denominated stablecoins are rapidly developing under Markets in Crypto-Assets Regulation, and Europe now has multiple compliant euro stablecoins with real transaction volume and fintech integration. A recent report indicates that over the past several years, the total volume of euro stablecoin transactions has grown to surpass €8 billion, showing how non-USD stablecoins are increasingly gaining traction.

The role of banks in stablecoin adoption

Naturally, this shift raises questions about where traditional banks are supposed to fit into the picture. Many people assume banks will be central to stablecoin adoption going forward. And it’s true that they are paying more attention now: this asset class has grown into something large enough that they can no longer dismiss it, and public acknowledgements of their importance are becoming more common.

A recently conducted survey showed that in 2025, 49% of banks, including some Tier-1s, are already integrating stablecoins into their operations. In Switzerland, for example, over half of banks with active crypto offerings are planning to also include stablecoin-related services.

Looking ahead, I think that a much greater shift may come when central banks start introducing stablecoin-like CBDCs. Some among them, such as the European Central Bank (ECB), are already exploring this direction: particularly wholesale CBDCs intended for interbank settlements rather than retail use.

These projects involve active collaborations between central banks in France, Germany, Italy, and other countries. And if these efforts succeed and wholesale CBDCs eventually start operating on public blockchain infrastructure — potentially even platforms like Ethereum (ETH) — the impact would be tremendous. It would be a tectonic shift in what’s happening under the hood of the global financial system and how money moves across borders.

Consumers and the rise of redeemable stablecoins

Compared to banks, though, an even greater driver of specifically stablecoin adoption, to my mind, is going to be the consumer. Throughout 2025, we saw more and more use cases for redeemable stablecoins in commonplace financial activities. Major payment networks such as Visa and Mastercard are integrating these assets into their infrastructure, providing settlement solutions and merchant acceptance that extend stablecoin utility into mainstream payments.

Redeemable stablecoins give people more options for day-to-day transactions: payments, transfers, savings, and simple on-chain interactions. All without the friction of legacy systems. From the average user’s point of view, that’s a clear improvement.

Because of this, as we move deeper into 2026, I expect consumer adoption of redeemable stablecoins to be one of the main forces behind the continued growth of this market. Broadly speaking, people adopt financial tools because they work, and stablecoins do work. If a coin is easy to use, settles instantly, and can be redeemed without too much hassle, it will likely find users.

Banks may eventually integrate these tools, but as I said, in most cases, they will be responding to behavior that already exists, not initiating it.

The role of decentralized stablecoins

Alongside consumer-facing stablecoins, fully decentralized stablecoins remain essential for on-chain finance. While these assets can be used for retail payments, that’s not what they were primarily designed for. What they do in practice is power smart contracts, automated settlement, derivatives, and decentralized lending.

They form the programmable layer that allows financial logic to execute without intermediaries. In many cases, yield-enhancing protocols depend on these decentralized assets to function reliably. In other words, if consumer stablecoins expand usage, decentralized stablecoins power the infrastructure behind that usage. Together, they create a system that is both practical and resilient.

Yield-enhancing protocols: Liquidity as infrastructure

It should be noted that none of these scales has liquidity, which is the real backbone of stablecoin adoption. And this is where yield-enhancing protocols play a critical role.

Yield-generating DeFi protocols unlock idle capital and redirect it into productive use. Instead of liquidity sitting dormant, it can be deployed into automated market makers, lending pools, and cross-chain settlement layers. This creates deeper markets, tighter spreads, and more reliable execution — all of which are essential factors for payments to happen at scale.

In cross-border contexts, this matters even more. Yield-enhancing liquidity pools reduce the cost of moving value between currencies and jurisdictions. They replace fragmented correspondent banking networks with on-chain systems that are transparent, available 24/7, and economically incentivized to remain liquid. When liquidity is deep and incentives are aligned, users don’t need to worry about whether a payment will clear or whether value will be available on the other side.

What comes next

Ultimately, stablecoins are not here to replace banks overnight, and they don’t need to do it to find success, either. They have a more fundamental role to play, and that is to introduce a faster, programmable, and globally accessible financial layer. Stablecoins are meant to do what money should do in the first place: maintain value, move instantly when needed, and earn the trust of the people using them.

On all three fronts, they are evolving quickly — and in many cases, outperforming the incumbents. The digital dollar accelerates this shift, yield-enhancing protocols make it scalable, and consumer adoption makes it real. How far this can go depends only on what we build next.

Crypto World

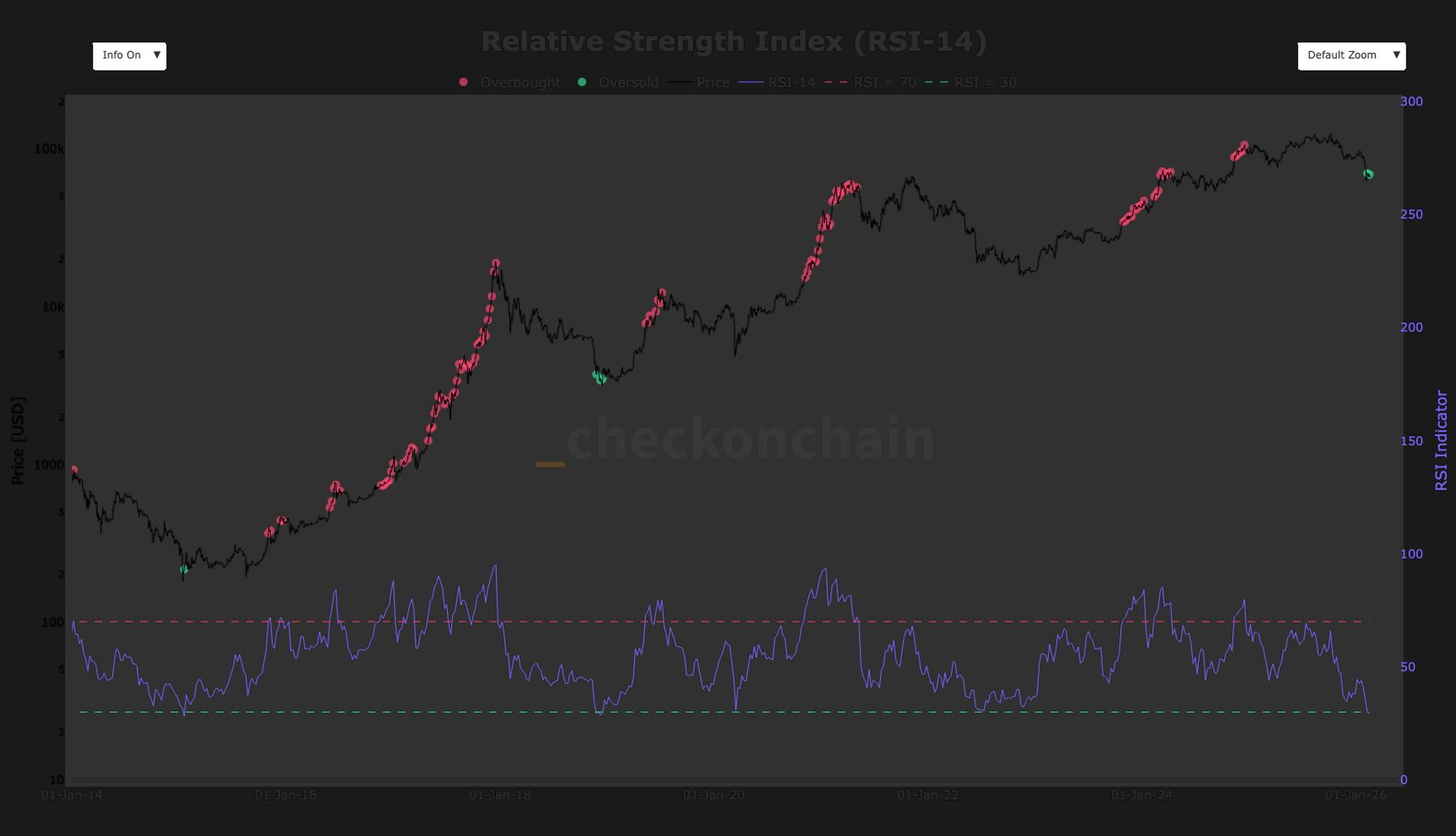

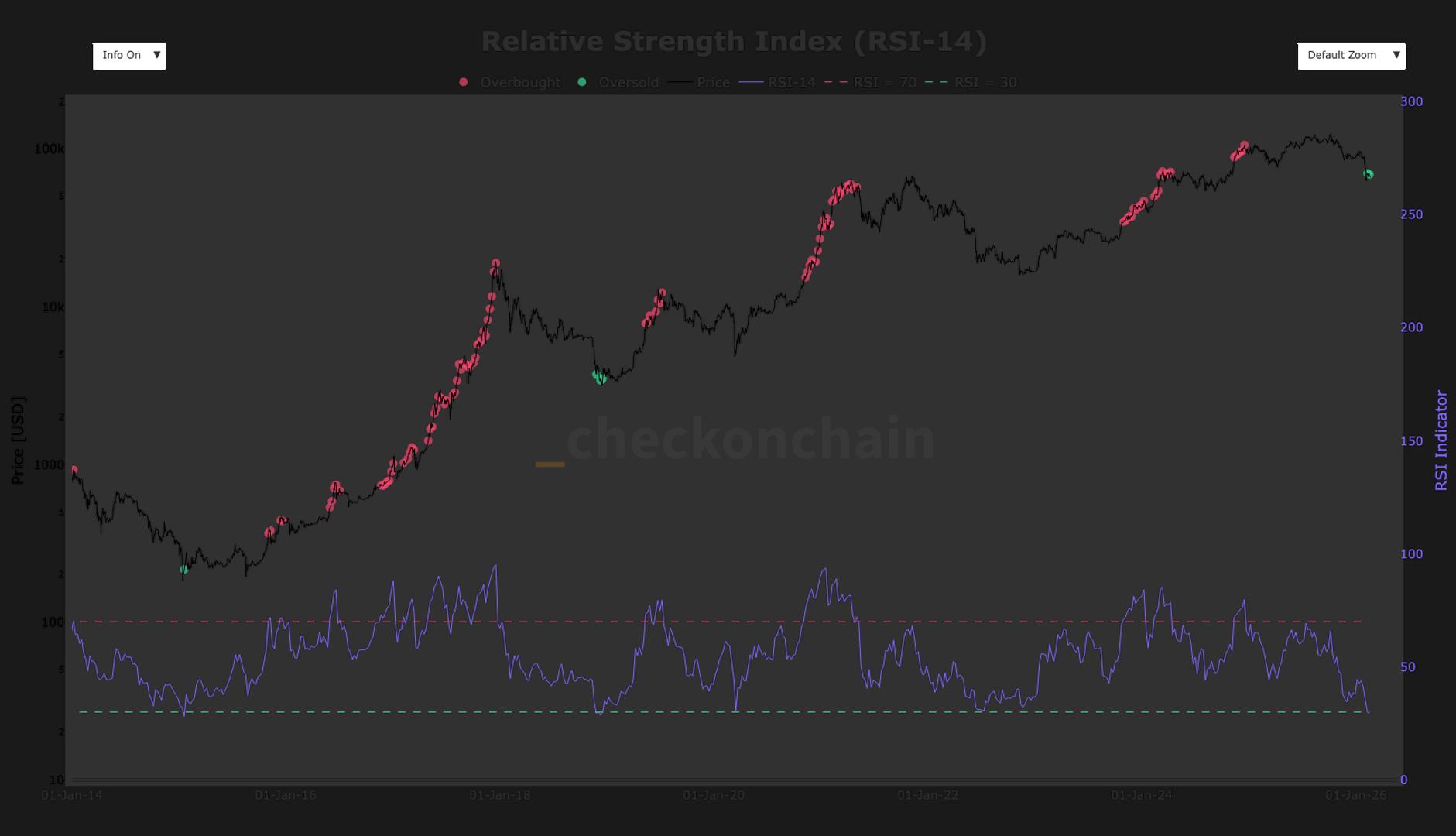

Why bitcoin’s rare oversold RSI crash signals a long, slow grind ahead

Bitcoin’s 14-day Relative Strength Index (RSI) dropped below 30 for only the third time in its history this month, according to checkonchain.

The RSI is a popular tool for detecting an asset’s momentum by measuring the speed and magnitude of recent price movements and comparing average gains and losses over a set period of 14 days.

The index produces a reading between 0 and 100, with levels above 100 generally considered overbought, while readings below 30 indicate oversold conditions, suggesting that selling may be overextended. Bitcoin’s 14-day RSI has not hit 100 since December 2024 when bitcoin first surpassed $100,000.

Previous readings below 30 marked prior cycle bottoms. In January 2015, bitcoin’s RSI fell to roughly 28 as price hovered near $200. The market then spent about eight months consolidating before a sustained recovery began. A similar pattern emerged in December 2018, when RSI dipped below 30 around $3,500. That period was followed by roughly three months of sideways accumulation before bitcoin broke higher.

BTC is trading around $66,000, with sentiment stuck in “fear” or “extreme fear” on the Crypto Fear & Greed Index for much of the past 30 days. Since peaking in October, bitcoin has shedded more than 50%, briefly falling toward $60,000.

History suggests the current move could lead to consolidation around the $60,000 region in the months ahead before the next leg upward.

Crypto World

83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

TLDR:

- 83% of altcoins on Binance are trading below the 50-week moving average, signaling a broad bear trend.

- Bitcoin has dropped to roughly 46% of its $126,000 all-time high recorded back in October 2025.

- On February 7, a new record was set with over 92% of Binance altcoins falling below a key technical level.

- Rising altcoin token supply combined with constrained liquidity continues to suppress price recovery across markets.

Altcoins are facing mounting pressure as a liquidity crunch pushes 83% of them into a bear trend. Data from Binance shows most assets, excluding Bitcoin and stablecoins, are now trading below their 50-week moving average.

Investors still holding these positions are under considerable stress. Bitcoin has been in a downtrend since October 2025, following an all-time high of $126,000. Its price currently sits at roughly 46% of that record peak.

BTC Downtrend Weighs Heavily on Altcoin Performance

Bitcoin’s decline from its all-time high has created a difficult environment for altcoins. The broader market continues to follow BTC’s direction, which has remained uncertain in recent months.

At its current level, Bitcoin trades at approximately 46% below its record high. This has left many altcoin investors with little room to recover losses.

Macro factors are adding to the pressure felt across crypto markets. Rising geopolitical tensions between the U.S. and Iran have increased uncertainty among investors.

Meanwhile, the Federal Reserve has maintained a hawkish tone in its latest FOMC minutes. These conditions make highly volatile assets like altcoins especially difficult to hold.

According to analyst Darkfost_Coc, 83% of altcoins on Binance are now below the 50-week moving average. This level is widely considered a key threshold for identifying long-term trends.

Falling below it generally signals a corrective phase for an asset. The current reading shows how broadly the bear trend has spread.

A new record was set on February 7, when over 92% of Binance altcoins traded below this level. That marked the worst reading since the bear market ended in 2023.

It stands in stark contrast to March 2024, when only 6% of altcoins sat below this threshold. December 2024 posted a similarly low reading of just 7%.

Supply Surge and Constrained Liquidity Drive Market Imbalance

The altcoin market has also been shaped by a steady rise in token supply. More projects launching means more assets competing for the same pool of capital.

When liquidity is constrained, new supply puts further downward pressure on prices. This dynamic has made it harder for most altcoins to sustain any upward momentum.

Outside of brief recovery windows, at least 50% of altcoins have remained below the 50-week moving average. This pattern differs notably from the behavior observed in the previous market cycle.

The current cycle appears structurally different, with liquidity playing a much larger role. That shift has caught many investors off guard.

Darkfost_Coc noted that outperforming in this environment requires a clear understanding of how market dynamics have evolved.

Careful asset selection and a structured investment plan are also considered essential by analysts. Without both, navigating the current conditions becomes increasingly difficult. The market rewards preparation over speculation in periods like this.

The combination of macro headwinds, rising supply, and BTC uncertainty continues to define conditions for altcoins. Investors still holding positions face an extended and challenging road ahead.

Crypto World

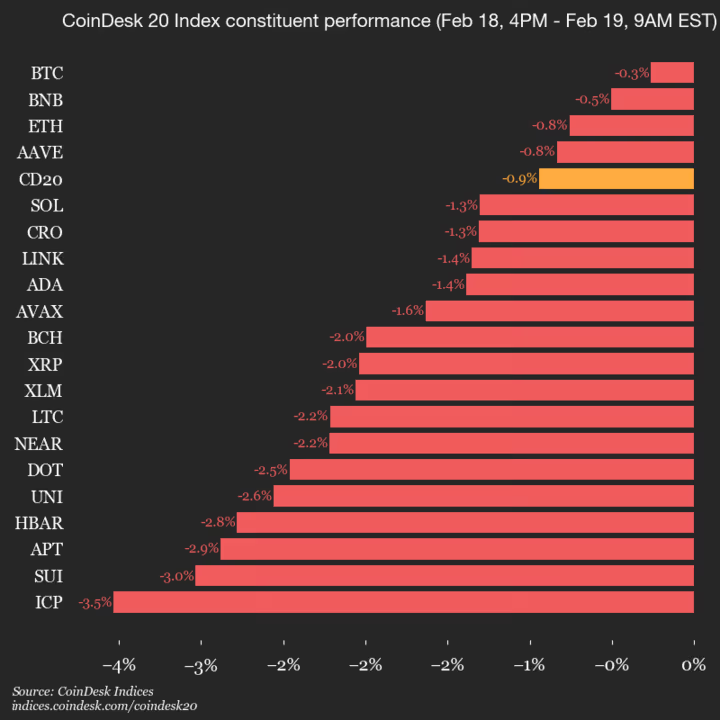

Bitcoin (BTC) Drops 0.3% as All Assets Decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1909.21, down 0.9% (-18.15) since 4 p.m. ET on Wednesday.

None of the 20 assets are trading higher.

Leaders: BTC (-0.3%) and BNB (-0.5%).

Laggards: ICP (-3.5%) and SUI (-3.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Bitcoin miner tumbles 17% on debt raise and stock sale

Bitdeer Technologies (BTDR) shares plunged on Thursday on plans to raise $300 million through a private sale of convertible senior notes, alongside a separate registered direct offering of Class A shares.

The notes, due in 2032, can convert into cash, shares or a mix of both at Bitdeer’s election. The underwriter greenshoe option is for another $45 million in notes.

The Singapore-based company also intends to sell an unspecified number of Class A shares directly to certain holders of its 5.25% convertible notes due 2029. It plans to use proceeds from both offerings to fund capped call transactions designed to limit share dilution if the new notes convert, and to repurchase a portion of the 2029 notes in private deals.

Any remaining funds will go toward expanding data centers, growing its high-performance computing and AI cloud businesses and developing ASIC-based mining rigs.

Convertible debt often puts pressure on shares because investors factor in the risk of future dilution. In simple terms, if the company’s stock rises, noteholders may convert their debt into equity, increasing the share count. Bitdeer’s use of capped calls aims to offset some of that effect, though such hedging can add volatility around pricing.

The registered direct offering depends on completion of the notes sale and related repurchases, while the notes offering can proceed on its own.

Bitdeer’s shares fell 17% in the early morning trading below $8 for the first time since April.

Crypto World

UAE sits on $344 million in BTC mining profits, Arkham says

The United Arab Emirates is sitting on roughly $344 million in unrealized profit from its bitcoin mining operations, according to onchain data from Arkham, making it one of the world’s most significant sovereign crypto plays.

Wallets tied to the UAE Royal Group currently hold roughly 6,782 BTC valued about $450 million. Excluding energy costs, Arkham estimates the position is deep in the green, reflecting the lower-than-average cost from years of industrial-scale mining compared with open-market buying.

Over the past seven days, the operation has produced some 4.2 BTC a day, suggesting the country’s mining infrastructure remains active despite bitcoin’s recent slide from late-2025 highs and broader volatility across risk assets.

The UAE’s mining push dates back to 2022, when Citadel Mining, linked to Abu Dhabi’s royal family through International Holding Company, built large facilities on Al Reem Island.

In 2023, Marathon Digital (MARA), now renamed as MARA Holdings, partnered with Abu Dhabi-based Zero Two to develop 250 megawatts of immersion-cooled mining capacity, one of the largest disclosed deployments in the region.

In August, when bitcoin traded at higher levels, Arkham estimated the UAE’s mined holdings at closer to $700 million. The latest figures reflect updated wallet tracking and lower market prices rather than major sales, with the most recent notable outflows occurring roughly four months ago.

Unlike the U.S. or U.K., whose bitcoin holdings largely stem from asset seizures, the UAE’s stash is the product of sustained mining. By holding most of what it produces, the Gulf nation is effectively converting energy and infrastructure into a strategic digital reserve that compounds over time.

In a market where many miners have been forced to sell into weakness to fund their operations, the UAE appears to be doing the opposite, steadily accumulating duing the drawdown.

Crypto World

McGlone shifts bitcoin forecast to $28,000 after critics blast $10,000 call as ‘nonsense’

Bloomberg Intelligence’s Mike McGlone appeared to walk back his $10,000 forecast for bitcoin, instead highlighting $28,000 after being challenged on social media and accused of being an alarmist whose “nonsensical” forecasts put real capital at risk.

Earlier this week, McGlone warned that collapsing crypto prices could signal broader financial stress and that bitcoin could revert toward $10,000 if U.S. equities peak and recession follows. He framed the token as a high-beta risk asset vulnerable to a breakdown in the post-2008 “buy the dip” regime.

But in a subsequent post on X, McGlone pointed to $28,000 as a more probable level based on historical price distribution, a notable shift from his earlier base case. He also said his analysis “suggests why not to buy bitcoin or most risk assets.”

His correction upward also followed being challenged to a debate by market analyst and AdLunam co-founder, Jason Fernandes on X and LinkedIn posts.

Fernandes, whose LinkedIn challenge was liked but not accepted by McGlone, told CoinDesk his broader critique still stands, even after the Bloomberg analyst revised his target. “$28K is obviously more realistic than $10K,” Fernandes said. “Proportionately fewer things need to go wrong for $28K than $10K.”

Mati Greenspan, a market analyst and the Quantum Economics founder, said $28,000 was still unlikely, “but in markets we never want to rule anything out.”

Greenspan had also called McGlone out in a post on X following his lower forecast, saying, “Mr. @mikemcglone11 would have you believe that an asset with trillions of dollars in monthly volumes could crash to a market cap of 200 billion.” He said the forecast was “literally nonsense.”

Fernandes previously estimated a more likely reset in the $40,000 to $50,000 range absent a systemic liquidity shock. He noted that $28,000 now sits closer to his lower bound than to McGlone’s original call. “It bears mentioning that he has adjusted his near-term outlook closer to my low end than his previous prediction,” Fernandes said.

At stake in the debate is more than price targets. Fernandes said that deterministic, alarmist framing can materially influence positioning and put “real capital at risk,” particularly in reflexive markets like crypto.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports18 hours ago

Sports18 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World41 minutes ago

Crypto World41 minutes ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market