Crypto World

DeFi Lending Platform Development Built for Serious Businesses

“If a DeFi platform cannot be explained to a board, it should not hold treasury capital.” That mindset now shapes institutional participation in DeFi lending. Serious businesses require infrastructure that behaves predictably, supports governance oversight, and aligns with long-term capital strategy.

This blog walks through the demands institutions now place on DeFi lending platform development and helps you evaluate whether a platform is built to meet those expectations in 2026.

DeFi Lending Has Entered Its Infrastructure Era

Early DeFi lending platforms were designed to prioritize:

- Permissionless access over control

- Rapid TVL growth over sustainability

- Retail-driven participation over capital discipline

That model does not translate to:

- Treasury-grade capital deployment

- Exchange-native and platform-integrated lending

- Regulated or compliance-aware operating environments

Today, DeFi lending platform development is treated as financial infrastructure, not a protocol experiment. Serious businesses now require lending platforms to be architected for reliability, governed with accountability, and operated with long-term capital and regulatory expectations in mind.

The Non-Negotiable Requirements Serious Businesses Set for DeFi Lending Platforms in 2026

In 2026, DeFi Lending Platform Development is no longer about shipping fast or maximizing short-term yield. Serious businesses assess platforms based on execution reliability, risk discipline, and architectural resilience. Anything below that baseline is simply not deployable at scale.

Demand #1: Predictable Execution Under Real Market Stress

Institutional capital does not tolerate surprises. Serious businesses demand DeFi lending platforms that:

- Behave consistently during volatility

- Maintain uptime during liquidation events

- Execute interest rate and liquidation logic predictably

In 2026, DeFi lending Platform Development must prioritize:

- Stress-tested smart contract logic

- Controlled liquidation mechanisms

- Guardrails against cascading failures

If a DeFi lending platform only works during calm market conditions, it is not production-ready.

Discuss Your DeFi Lending Platform Requirements

Demand #2: Risk Control Built Into the Protocol Layer

Risk management can no longer live off-chain. Modern DeFi lending platforms must embed:

- Loan-to-value governance

- Liquidation thresholds with policy controls

- Circuit breakers for extreme conditions

- Parameter update frameworks with audit trails

Serious businesses want explainable outcomes, systems they can justify to boards, partners, and regulators. This is where custom DeFi lending platform development services outperform protocol forks. Off-the-shelf designs rarely align with institutional risk policies or treasury mandates.

Demand #3: Compliance Awareness Without Centralization

Regulation is no longer hypothetical. While full regulatory clarity may still be evolving, businesses deploying capital in DeFi now demand:

- Audit-ready transaction records

- Governance transparency

- Optional permissioning layers

- Wallet risk screening frameworks

This does not mean abandoning decentralization. It means building DeFi lending platforms that are:

- Compliance-aware

- Governance-driven

- Capable of adapting as regulatory expectations mature

In 2026, platforms that ignore this reality will simply be excluded from institutional capital flows.

Demand #4: Architecture Designed for Capital at Scale

Scaling TVL exposes architectural weaknesses fast. Serious businesses demand DeFi lending platforms that can support:

- Large liquidity pools without degradation

- High transaction throughput

- Multi-chain asset deployment

- Upgradeability without protocol disruption

This is why modern DeFi lending platform development focuses on:

- Modular smart contract systems

- Upgrade-safe architectures

- Chain-agnostic design principles

The goal is not just launching a lending protocol, but operating it reliably for years.

Demand #5: Customization Over Forks

Forking popular lending protocols may reduce time-to-market, but it increases long-term risk. Serious businesses avoid forks because:

- They inherit architectural limitations

- Custom risk logic is hard to implement

- Governance becomes fragmented

- Upgrades become dangerous

Instead, they demand custom-built DeFi lending platforms aligned with:

- Their liquidity model

- Their treasury strategy

- Their operational workflows

This is where high-quality DeFi lending platform development services become a strategic investment, not a cost line.

Demand #6: Governance That Actually Works

Token governance alone is no longer enough. In 2026, DeFi lending platform development must support:

- Clear governance scopes

- Role-based permissions

- Transparent upgrade processes

- Emergency response mechanisms

Governance is not just about decentralization; it’s about accountability and continuity. Serious businesses deploy capital only where governance failure won’t jeopardize operations.

Demand #7: A Clear Path from MVP to Institutional Scale

Many teams get stuck between:

- Demo-ready

- Institution-ready

Serious businesses demand a development approach that supports:

- Phased deployment

- Progressive decentralization

- Measured capital onboarding

- Long-term maintainability

Professional DeFi lending platform development services address this by designing platforms that evolve without requiring full rebuilds every cycle.

Explore Institutional DeFi Lending Architecture Options

Why DeFi Lending Platform Development in 2026 Is Different

The market has matured beyond experimentation and short-term incentives. DeFi lending platform development in 2026 is shaped by hard lessons learned from volatility, protocol failures, and institutional hesitation across previous cycles. The winners are no longer the fastest movers but the most resilient builders.

In 2026:

- Yield is secondary to reliability

- Risk management outweighs aggressive growth tactics

- Predictable execution matters more than headline metrics

Growth follows trust. Trust follows infrastructure discipline. Infrastructure quality now determines long-term survival. Serious businesses understand this shift and demand DeFi lending platform development services that prioritize stability, governance, and capital protection over speed to launch.

Final Thoughts: Infrastructure Is the Signal

In 2026, serious businesses do not choose DeFi lending platforms based on features or short-term yield. They choose based on infrastructure strength, execution reliability, and the ability to handle real capital under real market stress. This is why DeFi lending platform development has become a strategic decision. Platforms that lack risk discipline, governance clarity, or scalable architecture simply do not earn institutional trust.

Antier is built for this reality. As an institutional-grade DeFi infrastructure development company, Antier delivers DeFi lending platform development services focused on stability, compliance awareness, and long-term operability. If you are ready to build a DeFi lending platform that meets institutional standards, connect with Antier for a strategic architecture discussion and move forward with confidence.

Frequently Asked Questions

01. What are the key requirements for DeFi lending platforms in 2026?

In 2026, DeFi lending platforms must prioritize predictable execution under market stress, risk control embedded in the protocol layer, and architectural resilience to meet the demands of serious businesses.

02. Why is predictable execution important for institutional capital in DeFi lending?

Predictable execution is crucial because institutional capital does not tolerate surprises; platforms must behave consistently during volatility, maintain uptime during liquidation events, and execute interest rate and liquidation logic reliably.

03. How has the focus of DeFi lending platform development changed over time?

The focus has shifted from rapid growth and permissionless access to treating DeFi lending as financial infrastructure, emphasizing reliability, governance oversight, and alignment with long-term capital and regulatory expectations.

Crypto World

Hyper-Casual Game Development as a Business Strategy

Hyper casual games are often misunderstood. It is because they look simple, launch quickly, and do not carry the cinematic depth of AAA titles. Now, as a result of their simplicity, many decision-makers assume they are small opportunities. However, behind the simplicity lies a powerful business reality.

Hyper casual games have become one of the most efficient & strategic business tools for studios, publishers, and brands looking to test ideas, acquire users, and unlock new revenue streams with lower risk.

In 2026, leading studios, publishers, and even non-gaming enterprises are not treating hyper casual games as a side experiment. They are using it as a strategic layer in their growth and monetization strategy.

For decision-makers evaluating where to allocate budgets, hyper-casual game development is no longer about chasing trends, it is about making calculated investments that produce data, insights, and scalable opportunities.

Why Hyper Casual Games Still Command Investment Attention

Many assume hyper casual peaked and declined. In reality, it evolved. Early hyper casual success relied on mass downloads and ad monetization. Today, the model is more strategic.

Hyper casual games thrive because it delivers three things businesses value most:

1. Speed

Concept-to-market timelines are dramatically shorter compared to mid-core or AAA development. This enables faster experimentation and quicker ROI evaluation.

2. Accessibility

Simple mechanics attract a broad demographic, making hyper-casual one of the most inclusive gaming categories.

3. Iteration Potential

With short development cycles, studios can test, learn, and refine rapidly.

For enterprises, this translates into agile product-market testing rather than high-risk long-term bets.

Hyper Casual Game Development as a Portfolio Strategy for Studios

Successful publishers rarely rely on a single title. They build portfolios designed to distribute risk and maximize upside. Hyper casual game development fits perfectly into this strategy Instead of investing heavily into one large project, studios launch multiple hyper casual titles to:

- Test new mechanics

- Explore genres

- Evaluate user behavior

- Identify breakout potential

A single successful hyper casual title can offset multiple experimental builds. More importantly, insights from hyper casual performance often guide larger productions. Mechanics that show traction can later evolve into hybrid-casual or mid-core games. This makes hyper casual a feeder system for future franchises.

Why Enterprises and Brands Are Entering the Space

Gaming is no longer just for gaming companies. Brands and enterprises are investing in hyper-casual games as interactive engagement tools. A well-designed hyper casual game can:

- Capture user attention in seconds

- Encourage repeat interaction

- Drive brand recall

- Support loyalty campaigns

- Promote products in a gamified format

Compared to traditional advertising, gamified engagement often yields higher retention and stronger emotional connection. For enterprises, hyper-casual becomes a customer acquisition and engagement channel, not merely entertainment.

Want to Invest in Hyper Casual Games?

Speed-to-Market as a Competitive Lever

In digital markets, timing matters. Hyper-casual development allows companies to respond quickly to:

- Cultural trends

- Seasonal events

- Viral mechanics

- Market shifts

A studio that can launch multiple titles per year learns faster than one betting on a single multi-year project. This speed reduces opportunity cost and increases adaptability. For investors and decision-makers, this agility is a serious advantage.

Monetization Beyond “Just Ads”

While ad monetization remains a pillar, modern hyper-casual games expand revenue through:

- In-app purchases

- Cosmetic upgrades

- Cross-promotion networks

- Brand collaborations

- Data-driven optimization

Portfolio-level monetization often produces stable revenue streams. The business value is not always in one viral hit, but in cumulative performance.

Data: The Hidden Asset in Hyper Casual Investment

Every hyper-casual launch generates valuable insights:

- CPI benchmarks

- Retention curves

- Session lengths

- Monetization patterns

- User behavior analytics

This data informs smarter decisions for future projects. Companies investing strategically treat each launch as a learning cycle. Instead of guessing, they build with evidence.

Risk Management Through Smaller Bets

Large game productions come with large risks. Hyper casual games spread that risk. Smaller budgets allow for multiple experiments. Multiple experiments increase the chance of finding winning formulas. This, in turn, reduces financial exposure while preserving upside. For CFOs and product leaders, this makes hyper-casual a rational investment category.

Execution Quality Makes the Difference

Not all games succeed. Execution determines outcomes. Strong hypercasual game development requires:

- Tight gameplay loops

- Rapid prototyping pipelines

- Analytics integration

- Monetization design

- Performance optimization

- Fast iteration cycles

Studios with efficient pipelines outperform those relying on slow processes.

The Role of the Right Development Partner

The overall success of the games often depends on how quickly teams can test and iterate. An experienced hyper casual game development company helps by:

- Reducing development friction

- Speeding up production

- Integrating analytics early

- Optimizing monetization

- Guiding portfolio strategy

This turns hyper-casual from trial-and-error into structured experimentation.

Long-Term Strategic Value

A hyper casual game is not always about building the next billion-dollar IP. Sometimes its value lies in:

- Market validation

- User acquisition

- Learning cycles

- Portfolio diversification

- Brand engagement

Companies that understand this extract far more value than those chasing only viral success.

Final Thoughts

Hyper casual game development is not a gamble when approached strategically. It is a business tool for:

- Testing ideas

- Reducing risk

- Accelerating learning

- Generating revenue

- Engaging audiences

Studios and enterprises that invest wisely continue to benefit from its speed & scalability.

Antier, as a trusted hyper casual game development company, works with studios and enterprises to design & deliver high-quality games optimized for fast launches, data-driven iteration, and monetization performance, helping transform simple concepts into smart business investments.

Frequently Asked Questions

01. What are hyper casual games and why are they important for businesses?

Hyper casual games are simple, quick-launch games that serve as strategic business tools for studios, publishers, and brands. They allow for testing ideas, acquiring users, and unlocking new revenue streams with lower risk, making them essential for growth and monetization strategies.

02. How do hyper casual games differ from traditional gaming models?

Unlike traditional gaming models that focus on high production values and long development cycles, hyper casual games prioritize speed, accessibility, and iteration potential, enabling faster experimentation and quicker return on investment.

03. Why should studios consider hyper casual game development as part of their portfolio strategy?

Studios should consider hyper casual game development to distribute risk and maximize potential returns by launching multiple titles. This approach allows them to test new mechanics, explore genres, and gather insights that can inform larger projects.

Crypto World

Justin Sun says ‘keep going’ on Tron Inc’s TRX buys

Crypto billionaire Justin Sun endorsed Tron Inc.’s strategy of stacking the TRX token, which has recently outperformed bitcoin , as a core treasury asset, spotlighting their latest dip buy with a simple “keep going” on X.

The Nasdaq-listed Tron Inc. announced that it acquired 175,507 TRX tokens on Wednesday at an average price of $0.28, for a fresh investment of just over $49,000 in the Tron blockchain’s native token. The latest purchase boosted its TRX stash to 679.9 million tokens ($540 million).

The company plans to further grow its TRX holdings to enhance long-term shareholder value.

Tron Inc. — formed via a reverse merger between SRM Entertainment and a Tron-related entity — is a publicly listed firm focused on blockchain-integrated treasury strategies and holding a significant amount of TRX tokens. The company is modeled on Nasdaq-listed Strategy, which pioneered the digital asset treasury narrative by starting to accumulate Bitcoin as a reserve asset in August 2020.

The nod from Sun reinforces steady accumulation amid market dips. TRX’s price peaked near 45 cents in 2024 and has since pulled back to 28 cents. But lately, it has been relatively resilient, down just 1.3% this year versus the market leader, bitcoin, which is down nearly 19%, according to CoinDesk data.

TRX’s relative outperformance amid broader crypto weakness has led some analysts to view it as a defensive haven asset.

Crypto World

ZachXBT Highlights $282M Theft of Bitcoin and Litecoin in Hardware Wallet Scam

The investigator said the attacker swapped funds into Monero and moved BTC across chains using Thorchain.

Onchain investigator ZachXBT said a victim lost more than $282 million worth of Bitcoin (BTC) and Litecoin (LTC) in a scam involving a hardware wallet earlier this month.

In a post on X, ZachXBT said the theft happened on Jan. 10, 2026, around 11 p.m. UTC, and involved about 2.05 million LTC and 1,459 BTC. He said the victim was tricked in a social engineering scam.

The theft was reported as major crypto prices were slightly higher on the day. Litecoin (LTC) was trading around $74.57, up 3.6% in the past 24 hours, while Bitcoin (BTC) traded near $95,512, up 0.2%, according to CoinGecko.

The case highlights how even hardware wallets can be risky if someone is fooled into giving up access or approving a bad transaction. These scams don’t involve breaking code; instead, they rely on tricking the victim.

According to ZachXBT, the attacker began converting the stolen BTC and LTC into Monero (XMR) through multiple instant exchanges. Monero is a privacy-focused cryptocurrency and is currently trading at $642.77, down 3.7% on the day.

He said the conversions contributed to a sharp increase in XMR’s price as the market absorbed the flow. ZachXBT also said the attacker bridged BTC to other networks, including Ethereum, Ripple, and Litecoin, using Thorchain, a cross-chain liquidity protocol.

The theft comes as security firms continue to warn that many big crypto losses come from user error and scams. PeckShield reported that total exploit losses fell to about $76 million in December 2025 from $194.3 million in November, though it said incident activity remained elevated.

Crypto World

Current Bear Market Performance Worse Than 2022: Analysts

Bitcoin’s decline into a bear market has been faster than in the past cycle, according to analysts.

“Bitcoin’s bear market is off to a weaker start than 2022,” reported on-chain analytics platform CryptoQuant on Wednesday.

Since falling below the 365-day moving average in November, Bitcoin is down 23% in just 83 days, compared to a 6% decline over the same period in early 2022, they added before stating “momentum is deteriorating faster this cycle.”

“This performance is worse than at the start of the previous bear market in January 2022.”

Bitcoin Bear Market Deepens

Bitcoin peaked at $126,000 in early October with the “Bull Score Index” at 80, but following the Oct. 10 liquidation event, the index turned bearish and has now fallen to zero while the price dumped to $71,000, “signaling broad structural weakness,” CryptoQuant reported. The platform also stated that Bitcoin “has lost key support levels” and may be targeting $70,000 to $60,000.

Bitcoin was rejected three times at the “Traders’ On-chain Realized Price,” a key on-chain support and resistance level. It also recently crossed below the lower band of this same metric, which acted as a support during the bull market.

Bitcoin’s bear market is off to a weaker start than 2022.

Since falling below the 365-day MA on Nov 12, 2025, $BTC is down 23% in 83 days, vs. just 6% over the same period in early 2022.

Momentum is deteriorating faster this cycle. pic.twitter.com/t4xD2vljVI

— CryptoQuant.com (@cryptoquant_com) February 4, 2026

Meanwhile, Santiment reported that sentiment “has turned extremely bearish toward Bitcoin and Ethereum” following the major downswing this past week.

“As we know, markets move opposite to the fear and greed of retail traders. There remains a strong argument for a short-term relief rally as long as the small-trader crowd continues to show disbelief toward cryptocurrency as a whole.”

“The BTC bear market rages on as profitability resets, realised losses rise, spot demand stays weak, and leverage unwinds,” reported Glassnode.

Meanwhile, the crypto “Fear and Greed Index” has fallen back to all-time lows around 12 as sentiment collapses and panic selling continues.

You may also like:

Crypto Market Outlook

Total capitalization has declined again today, falling 4.4% to $2.53 trillion, its lowest level since April 2025. Further losses will see it back to bear market lows from 2024.

Bitcoin dumped again, tanking below $71,000 during early trading in Asia on Thursday morning. BTC is now back at November levels and heading towards support at around $65,000.

Ether is in meltdown, crashing below $2,100 and failing to recover, also on a path to previous cycle lows.

Altcoins are not even worth mentioning, tanking even harder than the top two, with most now at 80% down from their peaks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

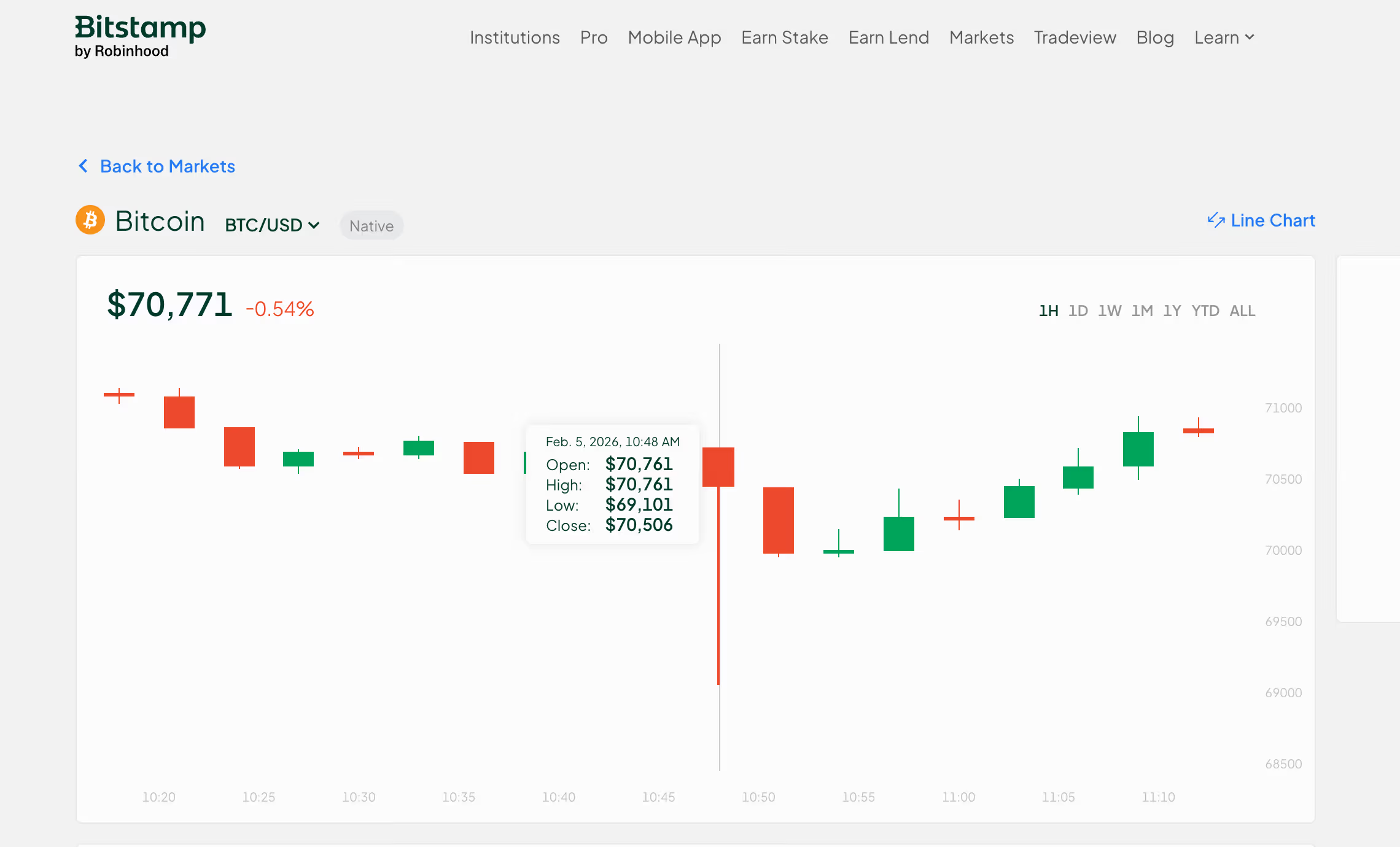

BTC tanks to $69,101 on Bitstamp

Bitcoin’s price sell-off continued Thursday, with prices breaking below the widely-tracked $70,000 level on the OG crypto exchange Bitstamp.

BTC’s dollar-denominated price slipped to $69,101 during the Asian trading hours, trading a discount to prices on other exchanges, including Coinbase, where BTC hit a low of $70,002.

The discount on Bitstamp likely stemmed from stronger selling pressure on the Robinhood-owned platform.

The global average price, tracked by CoinDesk, peaked above $126,000 in early October and has been in a downtrend since then. Some analysts expect further sell-off at least to $60,000, where prices may eventually bottom out.

Crypto World

Tether Tops 500 Million Users But USDT Peg Concerns Abound

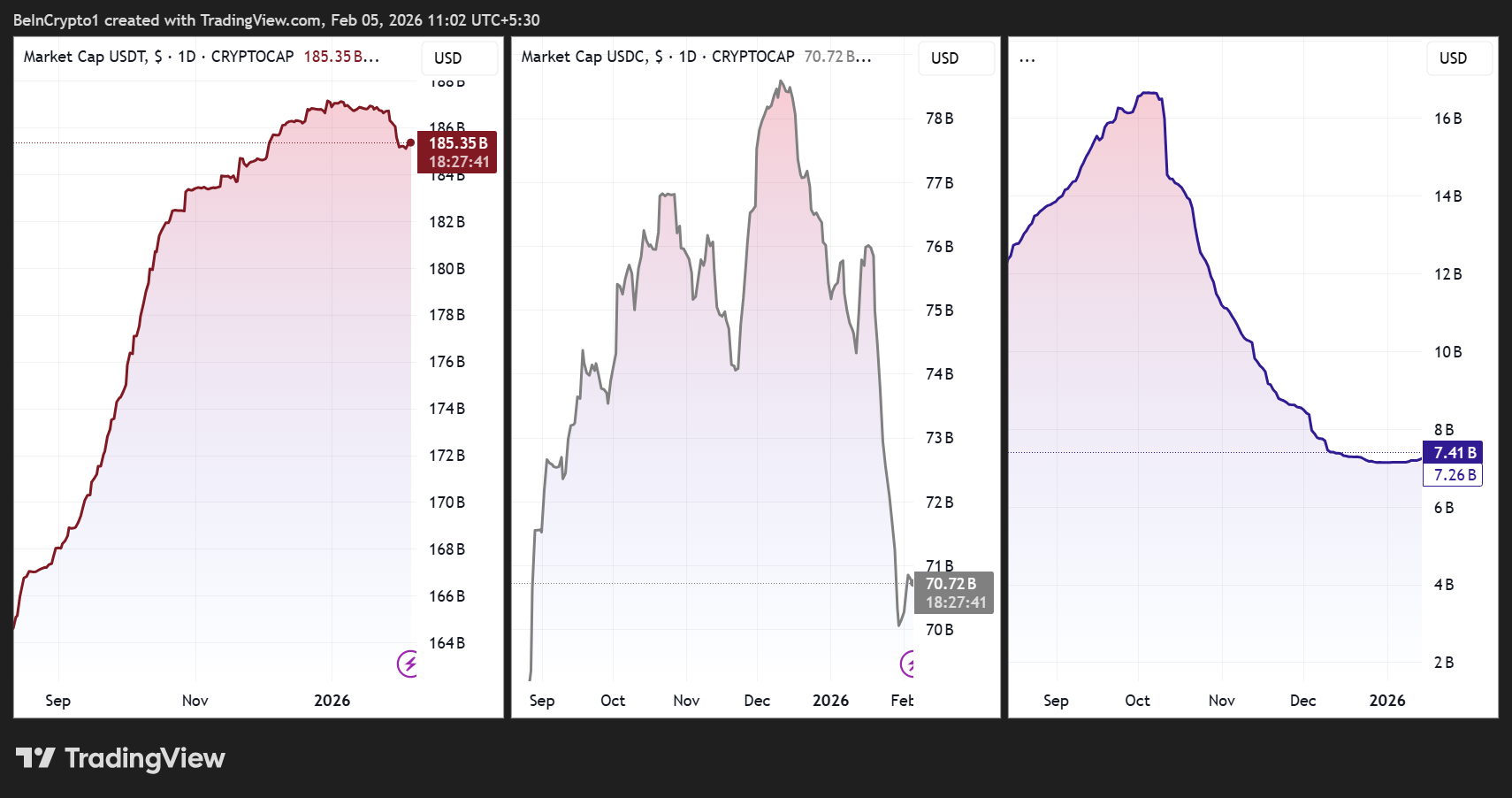

Tether’s USDT has crossed a major milestone, surpassing 534 million users, even as the broader crypto market remains under pressure following a sharp contraction that began in October 2025.

According to the company’s Q4 2025 USD₮ Market Report, the stablecoin added more than 35 million users in the quarter, marking the eighth consecutive quarter of adding over 30 million users.

Sponsored

Sponsored

USDT Expands as a Global Store of Value Even as Crypto Market Cap Contracts

The growth comes during a period of declining risk appetite. Since the October 10 liquidation cascade, the total crypto market capitalization has fallen by more than one-third (30%). Meanwhile, USDT’s supply has continued to expand modestly.

Tether reported that its market capitalization rose to $187.3 billion, up $12.4 billion in Q4, even as some competing stablecoins shrank.

Tether attributes the resilience to demand for savings, payments, and cross-border transfers rather than purely speculative trading.

On-chain metrics cited in the report show rising wallet balances among long-term holders and record transaction volumes.

However, the estimates of total users include both on-chain wallets and approximations of exchange users, making independent verification difficult.

Reserve disclosures also show continued expansion. Total reserves reached $192.9 billion, including $141.6 billion in US Treasuries, a level that would place Tether among the largest Treasury holders globally if it were a country.

Sponsored

Sponsored

The company also increased its Bitcoin holdings to 96,184 BTC and its gold reserves to 127.5 metric tons, reflecting a strategy to diversify collateral beyond cash-equivalent assets.

On-chain activity continued to grow rapidly. The number of USDT holders rose to 139.1 million, while monthly active users reached 24.8 million, both record highs.

The value transferred on-chain reached $4.4 trillion in Q4, and USDT’s share of spot trading volumes on centralized exchanges climbed to 61.5%. This highlights its role as the dominant settlement asset in crypto markets.

Sponsored

Sponsored

Minting Surge, Peg Wobbles, and Flippening Talk Highlight USDT’s Growing Systemic Role

Recent issuance activity suggests demand has carried into early 2026. On February 4, blockchain analytics account Lookonchain reported that Tether minted $1 billion in USDT, part of roughly $3 billion in stablecoins issued by Tether and Circle over three days.

Large issuances are often interpreted by traders as a signal of incoming liquidity, although newly minted tokens are not always immediately circulated.

At the same time, Tether’s growing dominance has intensified scrutiny. Market attention briefly turned to USDT’s stability after the token slipped to around $0.9980, its weakest level in more than 5 years.

While the deviation was small and short-lived, any sustained loss of confidence in the peg could have outsized consequences, given the stablecoin’s central role in trading infrastructure.

Sponsored

Sponsored

Market estimates often suggest that most crypto trading volume flows through USDT pairs, making it a critical pillar of liquidity.

The scale of Tether’s expansion has also fueled debate over its place in the crypto hierarchy. Some market observers have speculated that, if current trends continue, USDT could eventually challenge Ethereum’s position as the second-largest cryptocurrency by market capitalization, particularly during prolonged periods of risk aversion when capital rotates into stable assets.

Meanwhile, the latest data shows that USDT is expanding in terms of users, reserves, and transaction volume, even as the broader market contracts.

Yet that same growth is concentrating liquidity and systemic importance in a single instrument. The stability of Tether’s peg is increasingly tied not just to one company, but to the resilience of the crypto market itself.

Crypto World

Why Vitalik Buterin Says L2s Aren’t Scaling Ethereum Anymore

Buterin argued that many Layer 2s no longer meaningfully inherit Ethereum security.

Ethereum co-founder Vitalik Buterin said recent developments mean the original conception of Layer 2 scaling within the ETH ecosystem is no longer viable.

He said that the progress among many L2 networks has fallen short of earlier expectations, while the mainnet continues to scale directly.

Slow Progress, Low Fees

In a recent post on X, Buterin pointed to two important realities reshaping the debate. First, there is the slow and difficult progress of L2s toward “stage 2” decentralization and interoperability, and the fact that Ethereum’s mainnet has already achieved very low fees, with gas limits expected to rise significantly through 2026.

Buterin reiterated that Ethereum scaling was originally defined as expanding block space that fully inherits Ethereum’s security. This means that all activity remains valid and censorship-resistant as long as the network operates. As such, systems that rely on multisig bridges or other forms of discretionary control cannot be considered extensions of Ethereum in this sense, even if they offer high throughput.

The co-founder explained that this framing no longer holds because the blockchain no longer needs L2s to function as “branded shards,” while many L2s are either unable or unwilling to meet the security and governance requirements that such a role would imply.

Buterin observed that some projects have explicitly stated they may never move beyond stage 1, not only due to technical concerns around zero-knowledge EVM safety, but also because regulatory or customer requirements necessitate ultimate control. While he said this may be appropriate for those projects’ use cases, it means they should not be described as scaling Ethereum under the original definition.

Instead, Buterin suggested abandoning the idea that all Layer 2s should occupy the same category and be judged by the same criteria. He proposed that they be viewed as a broad spectrum of systems with varying degrees of connection to Ethereum. In this framing, some L2s may be fully backed by Ethereum’s security while others operate with more limited guarantees. This would allow users and applications to choose based on their needs.

You may also like:

He added that L2s should focus on providing distinct value beyond generic scaling, such as specialized virtual machines, application-specific efficiency, extreme throughput, non-financial use cases, low-latency sequencing, or integrated services like oracles or dispute resolution. For networks handling ETH or Ethereum-issued assets, he said reaching at least stage 1 should be a minimum standard.

ZK-EVM Precompile

From Ethereum’s perspective, Buterin said he has become increasingly convinced of the importance of a native rollup precompile that would verify ZK-EVM proofs as part of Ethereum itself. Such a system in place enables trustless interoperability and composability while allowing L2s flexibility in extending functionality.

He said that while a permissionless ecosystem will inevitably include systems with weaker or trust-dependent guarantees, Ethereum’s responsibility is to make those guarantees clear and continue strengthening the base protocol.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

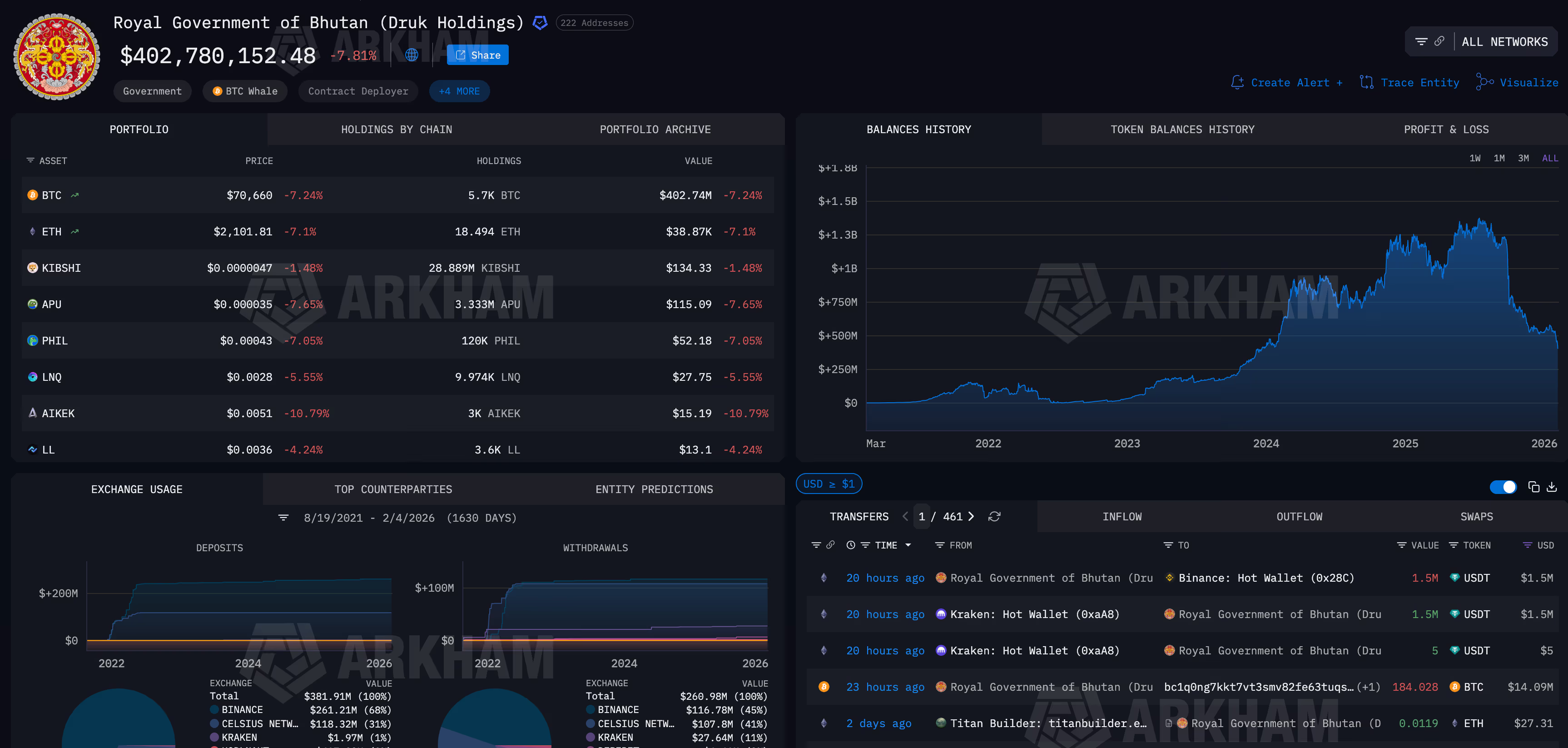

Bhutan shifts holdings after months of silence as BTC moves to $70,000

The Royal Government of Bhutan has begun moving bitcoin after months of wallet inactivity, shifting funds to trading firms, exchanges and fresh addresses as bitcoin slid below $71,000 and broader markets convulsed.

Onchain data tracked by Arkham shows Bhutan-linked wallets transferring more than 184 BTC, worth roughly $14 million, over the past 24 hours.

Some of the bitcoin was sent to new addresses, while other transfers flowed to known counterparties including QCP Capital and a Binance hot wallet, according to Arkham.

These destinations typically associated with trading, liquidity management or potential sales. CoinDesk reached out to QCP Capital via Telegram for comment.

The activity marks Bhutan’s first notable wallet movement in roughly three months and comes at a volatile moment for crypto markets. Bitcoin has fallen more than 7% in 24 hours, while silver plunged as much as 17% and global equities slid amid fears that artificial intelligence spending is undermining traditional software business models.

Bhutan has emerged over the past two years as one of the more unusual sovereign bitcoin holders, quietly building a stash through state-backed mining tied to hydropower.

Unlike corporate treasuries that trumpet accumulation strategies, Bhutan’s holdings have largely been managed out of the spotlight, making changes in wallet behavior closely watched by traders.

The latest transfers do not confirm outright selling. Coins were split across multiple destinations, including new wallets that could indicate internal reshuffling or collateral management rather than immediate liquidation.

Still, sending bitcoin to exchanges and trading firms during a sharp drawdown contrasts with the country’s otherwise long periods of inactivity.

The moves also echo a broader theme emerging in this selloff: large holders treating bitcoin less as a static reserve asset and more as a balance-sheet tool during stress.

Corporate treasuries, miners and now sovereign-linked entities are adjusting positions as liquidity tightens and price swings accelerate.

Crypto World

Bitcoin ETFs Hold On Amid Price Plunge, Analyst Says

US-based spot Bitcoin ETF holders are showing resilience despite a four-month downtrend in Bitcoin (CRYPTO: BTC), according to ETF analyst James Seyffart. In a recent post on X, he noted that the ETFs are “hanging in there pretty good,” even as the underlying asset has endured a prolonged slide. While acknowledging the pain of the current stretch—Bitcoin trading below $73,000 has left ETF holders with what he described as their largest paper losses since the January 2024 launch—the way flows have behaved contrasts with the height of the market cycle. The narrative is nuanced: inflows have cooled from peak levels, but the existing positions remain broadly intact as investors weather the drift in price.

Key takeaways

- Spot Bitcoin ETF holders are currently underwater but continuing to hold positions, signaling a degree of conviction despite the drawdown.

- Net ETF inflows had reached roughly $62.11 billion before the October downturn, and have since cooled to around $55 billion, according to preliminary data from Farside Investors.

- Bitcoin’s price trajectory has contributed to paper losses for ETF holders, with the broader market down about 24% over a 30-day window and the spot price near $70,537 at the time of reporting.

- Industry observers highlight a pattern of extended outflows, noting that three consecutive months of withdrawals marked a first in the history of higher-frequency ETF data monitoring.

- Industry voices emphasize a longer-term perspective, arguing that Bitcoin’s performance since 2022 has outpaced traditional assets in several periods, challenging the sentiment of a uniformly bearish cycle among analysts.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. ETF holders remain underwater as Bitcoin’s price decline drags on, though the net inflow dynamics offer a counterpoint to pure price Action.

Trading idea (Not Financial Advice): Hold. The combination of persistent holdings by ETF investors and improving inflows relative to peak levels suggests patience may be warranted amid ongoing price volatility.

Market context: The ETF landscape sits at the intersection of liquidity, risk appetite, and macro flows. Inflows into BTC-linked vehicles have cooled after a major cycle, while on-chain and market indicators show divergent signals about near-term momentum. The mix of price pressure and ongoing institutional participation shapes a cautious but not collapsing narrative for Bitcoin-focused ETFs.

Why it matters

The behavior of spot BTC ETFs helps illuminate a broader dynamic in crypto markets: institutional vehicles can provide a stabilizing, if not yet growth-driven, channel for price discovery. Even as price declines stretch across several weeks, the fact that ETF inflows remain sizable—albeit down from the peak—suggests that investors are maintaining exposure rather than exiting en masse. This matters for market liquidity, as ETF flows can dampen sharp price moves when buying or selling pressure intensifies, particularly in a sector as sensitive to macro headlines as crypto.

The discourse around investor sentiment is nuanced. On one hand, there is acknowledgment of substantial paper losses among ETF holders during the recent downturn, with Bitcoin navigating lower levels and volatility elevated. On the other hand, observers highlight that Bitcoin’s recovery potential remains tethered to macro risk appetite and the pace of flows into crypto vehicles. The conversation is further complicated by longer-term performance comparisons: Bitcoin has, in multiple cycles, outperformed traditional assets over extended horizons, which some argue justifies a longer view despite the near-term pain.

Analysts and researchers stress that focusing solely on near-term drawdowns can obscure the more complex picture of investor behavior and market structure. For instance, a well-known market observer suggested that Bitcoin’s strength in previous years—particularly its outsized gains through 2023 and 2024—remains a reference point for evaluating current demand. While the market may appear to be in a risk-off phase, the longer arc of Bitcoin’s price action has historically included substantial rallies following consolidation periods, underscoring the difficulty in drawing conclusions from a single quarter’s results.

Another thread in the discussion centers on the prudence of staying invested when ETF holders are effectively “underwater and collectively holding,” as some observers phrase it. This stance mirrors a broader crypto investing paradigm where conviction and time horizons matter as much as timing. In a space where episodic headlines can swing prices, the behavior of ETF holders offers a degree of reflexivity: ongoing participation from established vehicles can support price resilience, even when volatility remains elevated.

The discourse also touches on narrative risk—whether market participants are overly pessimistic about BTC’s near-term prospects. Some voices argue that evaluating Bitcoin’s performance in a post-2022 context should consider its outsized gains relative to gold and traditional assets, suggesting that the market’s recovery potential remains intact even after a difficult stretch. While sentiment among analysts fluctuates, the fact that a broad spectrum of commentators continues to discuss Bitcoin’s long-term trajectory hints at a market that is more nuanced than a straightforward bullish or bearish verdict.

The price action is clear: Bitcoin has shed nearly a quarter of its value in the last 30 days, with BTC trading around $70,537, according to CoinMarketCap. The linkage between ETF flows and price remains an evolving interplay, and investors are watching for how upcoming data and regulatory signals might shape the next leg of the cycle.

In the broader ecosystem, crypto analytics firms and market researchers have highlighted a pattern that may be drawing attention beyond immediate price moves. A widely cited analyst pointed out that the current period marks a historic phase in which consecutive outflows have occurred, raising questions about the implications for liquidity, volatility, and the resilience of BTC-linked products. Yet, this is not the first time the market has faced a testing environment, and some observers emphasize that Bitcoin’s fundamental narratives—scalability, network activity, and institutional adoption—remain central to the longer-term thesis.

Meanwhile, voices from the analytics community caution against a purely short-term lens. The market’s reaction to liquidity shifts, regulatory signals, and ETF flows can diverge from what is visible in day-to-day price movements. By examining the total inflows and outflows relative to the size of the market, investors can form a more balanced view of risk and opportunity in the BTC ETF space, rather than focusing solely on immediate losses or gains.

Eric Balchunas, a veteran ETF analyst, has emphasized that Bitcoin’s performance since 2022 has delivered outsized gains compared with gold and silver, arguing that those who judge BTC on a single year’s performance may be missing the broader arc. His comment underscores the importance of framing BTC’s story within a multiyear horizon, especially for investors considering exposure through spot BTC ETFs rather than direct spot markets. The ongoing debate about risk and return continues to shape how market participants approach BTC-focused ETFs and related products.

Ki Young Ju, CEO of CryptoQuant, summed up a meta-view that reflects a cautious mood among market participants: “every Bitcoin analyst is now bearish,” a remark that underscores the prevailing mood while leaving room for a counterpoint in a market that has historically proven contrarian at pivotal moments. The tension between bearish sentiment and the potential for a longer-term rebound remains a defining feature of BTC discourse as traders weigh the odds of a renewed upshift in price against continued macro uncertainty.

What to watch next

- Next wave of ETF flow data from Farside Investors and other researchers, which could show whether the contraction in inflows accelerates or stabilizes.

- Bitcoin price behavior over the next several weeks, particularly in response to macro cues and any regulatory developments impacting crypto markets.

- Further commentary from major ETF analysts and researchers on whether the current drawdown is a pause or the onset of a deeper correction.

- Updates on institutional participation in BTC-linked products, including any changes in flows into other crypto ETFs or related vehicles.

Sources & verification

- Preliminary net inflows data for spot BTC ETFs from Farside Investors (as cited in the article).

- Public X posts by James Seyffart discussing ETF holders’ performance and sentiment.

- Public X posts by Jim Bianco and Rand analyzing ETF holder underwater percentages and historical comparisons.

- Price data for Bitcoin from CoinMarketCap at the time of publication (BTC price around $70,537).

- Comments from Eric Balchunas regarding BTC’s performance since 2022 relative to other assets.

- Ki Young Ju’s remarks from CryptoQuant on market sentiment.

Bitcoin ETF flows and price action amid a four-month decline

US-based spot BTC ETFs are navigating a difficult phase that has stretched over several months, marked by a meaningful rally-to-correction cycle that has dragged prices lower while inflows have not collapsed as some bears expected. The conversation among analysts centers on a paradox: even as many investors sit underwater, the aggregate posture remains constructive enough to sustain a broad layer of market liquidity and investor confidence. From the vantage point of ETF market structure, the persistence of holdings and the scale of inflows before October point to a durable base of participants who view BTC exposure as a core, long-term component of a diversified portfolio rather than a speculative, short-term bet.

As price action remains volatile, the ETF community continues to balance risk and opportunity. The data show that, despite the downturn, the community of ETF holders has not rushed to exit en masse. This behavior aligns with a longer-run thesis that Bitcoin, despite reputational cycles, has established a persistent presence in institutional portfolios. The tension between near-term losses and longer-term potential remains a central theme in assessing BTC’s role within the ETF ecosystem, with analysts urging caution not to conflate short-term price dynamics with the asset’s ultimate trajectory.

In practical terms, the ongoing observation is that ETF inflows, while reduced from peak levels, still reflect a non-negligible demand for BTC exposure. The numbers suggest a market that is not capitulating, even as the price declines continue. For traders and investors, the key takeaway is that the ETF framework provides a stable, regulated channel for exposure that can influence liquidity dynamics in ways that are distinct from the spot market alone. The evolving narrative around ETF flows—alongside Bitcoin’s price path and macro signals—will continue to shape market psychology and the pace of the next leg in BTC’s cycle.

For readers who want to verify the underlying data and quotes, the linked posts and price data points in this report provide direct sources. The discussion around ETF flows, price levels, and analyst commentary reflects a broad cross-section of market voices, each contributing to a composite view of a market that remains highly reactive to both micro and macro catalysts. As regulation, classification of crypto assets, and ETF product design continue to mature, observers anticipate that flows into BTC-linked vehicles will adjust in response to evolving expectations for risk, return, and liquidity in the crypto space.

The subscription template at the end of the article is included to reflect ongoing engagement opportunities for readers seeking deeper insights into crypto market dynamics.

Notes: The coverage above preserves the factual statements and linked references as presented, while restructuring them into a professional, journalistic narrative. No promotional boilerplate from the publisher is included in this rewritten article.

Crypto World

BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100

BitMine Immersion Technologies, the Ethereum-treasury company led by Fundstrat’s Tom Lee, is facing intensifying pressure after a sharp drop in ether prices pushed the firm deep into unrealized losses. As of Feb. 5, Ethereum fell to a local low of $2,092, leaving BitMine’s holdings of roughly 4.285 million ETH with a paper loss exceeding $7 billion, -45% on its holdings.

The company pivoted from Bitcoin mining to an aggressive “Ethereum-first” treasury strategy last summer, accumulating ETH at an estimated average cost between $3,800 and $3,900. With ETH now trading more than 50% below its August 2025 all-time high of $4,946, BitMine’s once $8.4 billion portfolio is significantly underwater, placing it at the center of one of crypto’s largest single-asset corporate bets.

BitMine and Strategy Both Under Water as Bear Market Deepens

The market reaction has been swift. BMNR shares have fallen alongside ETH, reviving comparisons with Michael Saylor’s Bitcoin-focused firm, Strategy (MSTR). However, both companies are now under pressure. Strategy is currently sitting on an unrealized loss of roughly $2.70 billion on its Bitcoin holdings, based on an average purchase price of $76,052 and a current BTC price near $70,500. MSTR shares are down about 9% in the past eight hours, erasing roughly $3.7 billion in market value.

While BitMine’s losses are larger in absolute terms, analysts note that both firms highlight the risks of concentrated treasury strategies tied to volatile crypto assets.

Tom Lee Stays Bullish Despite Drawdown

Despite the “eye-watering” figures, Tom Lee remains publicly undeterred. Earlier this week, Lee described the drawdown as “a feature, not a bug,” arguing that Ethereum’s long-term fundamentals remain intact. He pointed to record daily transactions of around 2.5 million and rising active addresses as evidence that network usage is diverging from price action.

Lee attributed recent weakness to a post-October deleveraging cycle and capital rotation into precious metals. BitMine has continued to double down, recently adding another 41,000 ETH to its balance sheet, even as the Ethereum-treasury narrative faces its most severe stress test to date.

The post BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100 appeared first on Cryptonews.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech23 hours ago

Tech23 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards