Crypto World

DeFi Wallets vs Centralized Wallets: Who Really Owns Your Crypto?

Imagine this: You wake up, check your exchange account, and… your funds are frozen. Or worse, gone. Meanwhile, a friend using a DeFi wallet hasn’t even touched a centralized platform—and they control every penny. This isn’t just luck. It’s the difference between true ownership and handing over your crypto to someone else.

So, who really owns your crypto?

Centralized vs. DeFi Wallets: The Basics

Centralized Wallets live on platforms like Coinbase, Binance, or Kraken. You trust these companies to store your crypto safely. The perks? Convenience, easy password recovery if you forget it, and customer support. The catch? You don’t own your private keys. That means technically, you don’t own your crypto. Exchanges can freeze, lose, or even hack your funds.

DeFi Wallets, or self-custody wallets, put private keys in your hands. Popular examples include MetaMask, Argent, and Ledger hardware wallets. You hold the keys, you hold the power. Want to interact with DeFi protocols, stake, lend, or trade directly on-chain? These wallets are the only way to do it. The downside: if you lose your keys or fall for a phishing scam, there’s no one to call for help.

Private Keys: The Soul of Crypto Ownership

Your private key isn’t just a password—it’s your financial identity. Lose it, and the crypto is gone forever. Share it carelessly, and someone else can drain your wallet in minutes.

But innovations are making this safer:

-

Smart wallets automate transaction approvals and allow social recovery.

-

Multi-signature wallets (multisig) require multiple keys to approve transactions, reducing single-point-of-failure risks.

-

Hardware wallets keep keys offline, safe from phishing and malware.

The message? Ownership is powerful—but with power comes responsibility.

Risks & Tradeoffs

Here’s the hard truth: no wallet is 100% safe.

Think of it like this: centralized wallets are like renting an apartment—you’re protected in some ways, but ultimately someone else holds the keys. DeFi wallets are like owning a house—you have freedom, but the roof collapses on you if you neglect maintenance.

Think of it like this: centralized wallets are like renting an apartment—you’re protected in some ways, but ultimately someone else holds the keys. DeFi wallets are like owning a house—you have freedom, but the roof collapses on you if you neglect maintenance.

Use Cases: When Each Makes Sense

-

Beginners or small investors: Centralized wallets for simplicity and minimal risk of mistakes.

-

Active DeFi users/yield farmers: Self-custody wallets are a must. You can stake, lend, and earn directly without middlemen.

-

Traders across multiple chains: A hybrid approach works best—hardware wallets for storage, smart wallets for daily transactions.

The Future of Wallets

Wallets are evolving fast:

-

Smart contract wallets are making UX much smoother.

-

Account abstraction and gasless transactions are lowering entry barriers.

-

Wallets as identity layers are on the rise—your wallet could become your login, reputation, and financial footprint online.

Ownership isn’t just about money anymore—it’s about digital identity and freedom.

Conclusion: Ownership Matters

Crypto promises financial sovereignty. But that promise only exists if you actually control your assets. Centralized wallets offer convenience but at the cost of control. DeFi wallets put the responsibility—and the power—in your hands.

Start small. Experiment with a self-custody wallet. Learn how to store keys safely. Once you get the hang of it, you’ll understand why ownership isn’t just about holding crypto—it’s about being in charge of your financial destiny.

Bonus Tips: Don’t Lose Your Crypto

-

Store your seed phrase offline, never online.

-

Use hardware wallets for large amounts.

-

Enable multisig for team or family wallets.

-

Double-check contracts before approving transactions.

-

Keep a small testing wallet for DeFi experiments.

REQUEST AN ARTICLE

Crypto World

Binance Says Assets Increased During Suspected Bank Run Attempt

Binance said assets on its on-chain addresses increased during what appeared to be an attempted bank run, after a wave of social media posts urged users to pull funds from the world’s biggest crypto exchange.

Co-founder He Yi described the episode on X as a coordinated withdrawal push from parts of the community. She said she still did not understand why deposits appeared to outweigh withdrawals once the campaign started, and she framed routine, large-scale withdrawals across platforms as a useful stress test for the industry.

She also urged users to slow down when moving funds, warning that mistakes on blockchain transfers are permanent once confirmed.

In the same post, she pointed users toward self-custody options, including Binance Wallet and Trust Wallet, and suggested a hardware wallet alternative for those who want added reassurance.

Binance Outage Sparks Renewed Talk Of Exchange Risk On Social Media

The comments landed after Binance briefly paused withdrawals on Tuesday, a disruption that revived familiar nerves in a market still sensitive to exchange solvency rumours.

The company first posted, “We are aware of some technical difficulties affecting withdrawals on the platform. Our team is already working on a fix, and services will resume as soon as possible.” Follow-up updates said the issue was resolved in about 20 minutes.

The short outage quickly turned into a talking point on X, with some users drawing parallels to past exchange failures, such as FTX, and framing the withdrawal push as a stress test of Binance’s plumbing.

He Yi’s message pushed back on that narrative by pointing to net inflows, not outflows, during the campaign window.

Zhao Denies Bitcoin Dump Claims Amid Weekend Selloff

On Monday, Binance co-founder Changpeng Zhao also weighed in, arguing that the market was recycling blame stories as crypto prices slid.

He called the allegations “pretty imaginative FUD” and rejected claims that Binance sold $1B of Bitcoin to trigger the weekend sell-off, saying the funds belonged to users trading on the platform.

Zhao also took aim at the idea that he could steer the market cycle through public comments. “If I had that power, I wouldn’t be on Crypto Twitter with you lot,” he wrote, after some users joked that he “canceled the supercycle” by sounding less confident about the thesis.

The back-and-forth played out as crypto traders stayed jittery and liquidity thinned across venues, conditions that tend to amplify rumours and accelerate crowd behaviour. It also revived a familiar fault line in the market, between traders who keep assets on exchanges for speed and those who see periodic withdrawals as the only credible check.

Binance has leaned on transparency reports to counter those concerns. CoinMarketCap’s Jan. 2026 exchange reserves ranking put Binance at the top with about $155.64B in total reserves, reinforcing its status as the largest liquidity hub in the sector.

The post Binance Says Assets Increased During Suspected Bank Run Attempt appeared first on Cryptonews.

Crypto World

Bhutan Quietly Sells Over $22M in Bitcoin, Triggers Speculation Over Possible Sell-Offs

The Royal Government of Bhutan has moved over $22 million in BTC out of sovereign wallets over the past week alone, drawing attention from the crypto community.

One transaction, 5 days ago, was directly sent to addresses linked to market maker QCP Capital, Arkham data revealed. The moves align with Bhutan’s periodic sales of BTC since it began mining the crypto in 2019.

“From our observations, Bhutan periodically sells BTC in clips of around $50M, with a particularly heavy period of selling around mid-late September 2025,” Arkham wrote.

Besides, the Himalayan Kingdom’s crypto portfolio has gone down more than 70% from its $1.4 billion peak to $412 million, following market depreciation.

Per Bitcoin Treasuries, Bhutan remains the seventh-largest government Bitcoin holder.

Bhutan Heavily Mined BTC in 2023 – Data

Bhutan has been mining Bitcoin since 2019 and saw more than $765 million in BTC profit.

“They mined most of their BTC before the halving in 2024, and tapered heavily after that,” said the Arkham report. “This is because the cost to mine a single Bitcoin roughly doubled, which made mining less efficient.”

Further, the nation seems to have mined 8,200 BTC in 2023 alone, making it the heaviest mining year. It approximately mined 1800 BTC in 2022 and 300 BTC in 2024.

Wallet Transfers Show No Sign of Liquidation

The BTC transfers from the government wallet in the past week come after Bitcoin has been slumping to $70,000. The largest crypto has tumbled 7.36% over the last 24 hours, outpacing the broader crypto market’s 6.39% fall.

Despite the heavy transfers, blockchain data analysts note that they are more likely to be internal reallocation or custodial arrangements rather than liquidation. The country’s wallet balances remain largely unchanged.

Bhutan has made similar mass wallet moves in the past without triggering market crashes.

The post Bhutan Quietly Sells Over $22M in Bitcoin, Triggers Speculation Over Possible Sell-Offs appeared first on Cryptonews.

Crypto World

Can XRP price hold $1.45 demand zone as key metric peaks?

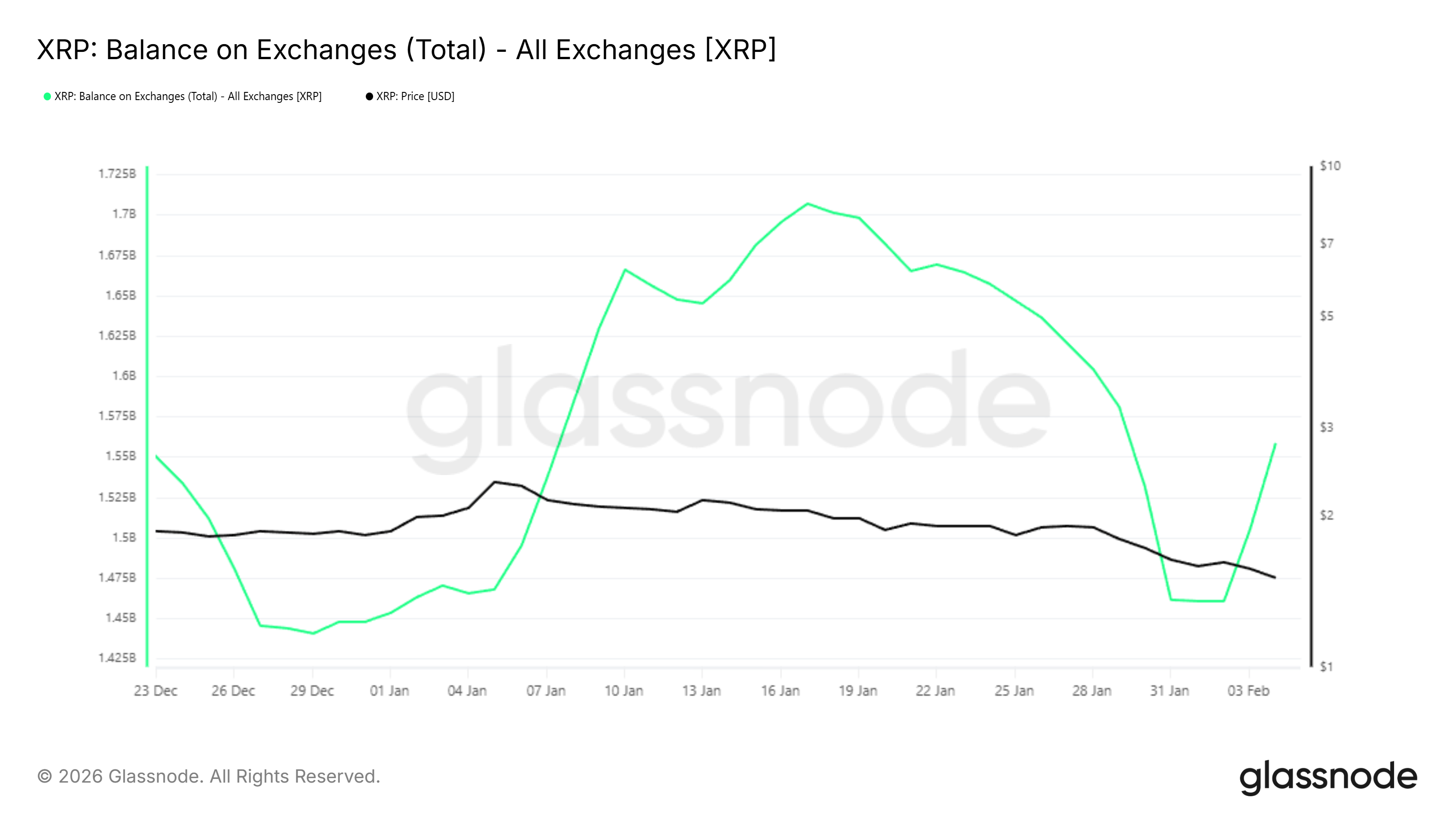

XRP price is testing a critical demand zone near $1.45 as rising on-chain velocity and falling open interest hint at a decisive move ahead.

Summary

- XRP trades near $1.44 after sharp weekly losses, with sellers still dictating short-term direction.

- On-chain velocity has surged to yearly highs, suggesting heavy re-positioning as price weakens.

- A firm hold above $1.45 could spark a short bounce, while a breakdown risks deeper losses.

XRP was trading near $1.44 at press time, down about 10% over the past 24 hours, sliding to its lowest level since November 2024. The token has weakened across all major timeframes, falling 23% over the past week and nearly 40% over the past month.

Price action over the last seven days has remained confined between $1.44 and $1.88, with sellers maintaining control. Even so, market activity has picked up. XRP (XRP) recorded $5.07 billion in trading volume in the past 24 hours, up 25%. This points to heavy participation during the sell-off.

Derivatives data show a more cautious tone. CoinGlass figures indicate futures volume rose 17% to $7.94 billion, while open interest slipped 1.8% to $2.61 billion. This mix suggests that traders reducing leverage while spot activity rises, a setup that can appear near short-term turning points.

XRP velocity spikes as supply shifts hands

A Feb. 4 analysis by CryptoQuant contributor CryptoOnchain highlighted a sharp move in XRP Ledger activity. The seven-day SMA of XRP velocity climbed to 0.013 on Feb. 3, matching the highest levels seen since January 2025.

In previous cycles, this level has appeared at key moments. During this instance, the velocity increase coincided with a price decline, suggesting rapid coin movement rather than steady accumulation. Such conditions are often linked to older holdings changing hands or aggressive short-term trading during periods of stress.

According to the analyst, when velocity reaches its upper range while price struggles, it can mark a high-friction phase in the market. Whether this activity marks late-stage selling or the early stages of stabilization depends on how the price reacts around key support.

In a separate note, CryptoOnchain pointed to a sharp drop in XRP open interest on Binance, which has fallen to $405.9 million, the lowest level since November 2024.

A market reset of this size suggests that leverage has been significantly reduced. The probability of more forced sales drops as positions are unwound. This eases the influence of derivatives on short-term price moves.

Under these conditions, if spot demand holds up, any rebound is more likely to develop in a gradual and orderly way.

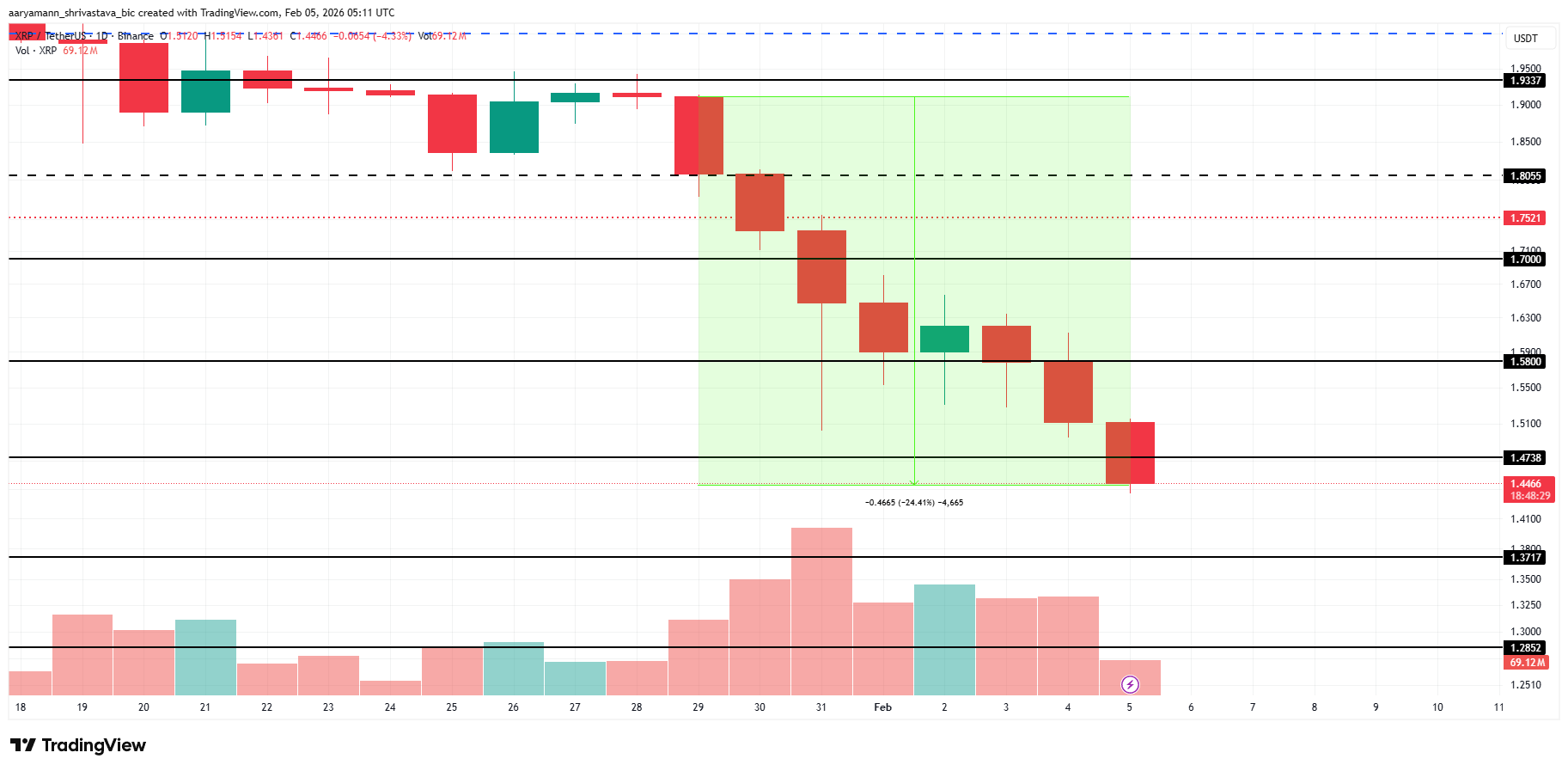

XRP price technical analysis

XRP is testing a clearly defined demand zone at $1.45, which has held during prior drops. The token is trading well below its 20-day moving average, placing the price in a stretched position.

XRP has also slipped below the lower Bollinger Band, which points to shrinking volatility. Instead of sellers running out of steam, the price action suggests heavy selling pressure pushing straight into support.

The relative strength index is in the low-30s, indicating that momentum is weak but getting closer to levels where selling pressure often slows.

Smaller bodies and longer wicks on recent candles suggest that sellers are meeting more resistance close to the current price. So far, the $1.45 level has not given way on a daily close.

If buyers continue to defend this zone, a short-term bounce toward $1.60–$1.70 becomes possible, driven by oversold conditions and reduced leverage. For the price to stabilize further, XRP would need to reclaim $1.80 and hold it.

Failure to hold $1.45 would change the picture quickly. A clean break below that level could open the door to deeper losses, as visible support becomes thinner beneath current prices.

Crypto World

Ethereum Lending Hits $28 Billion After Aave Proves DeFi’s Crisis Shield in Weekend Crash

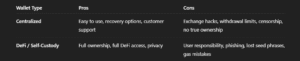

Ethereum’s on-chain lending ecosystem has reached a new milestone, with active loans surpassing $28 billion as of January 2026.

Central to this growth is Aave, the leading Ethereum-based lending protocol, which controls approximately 70% of the network’s active lending market.

Sponsored

Sponsored

Aave’s Automated Liquidations Prevent DeFi Contagion Amid Weekend Crash

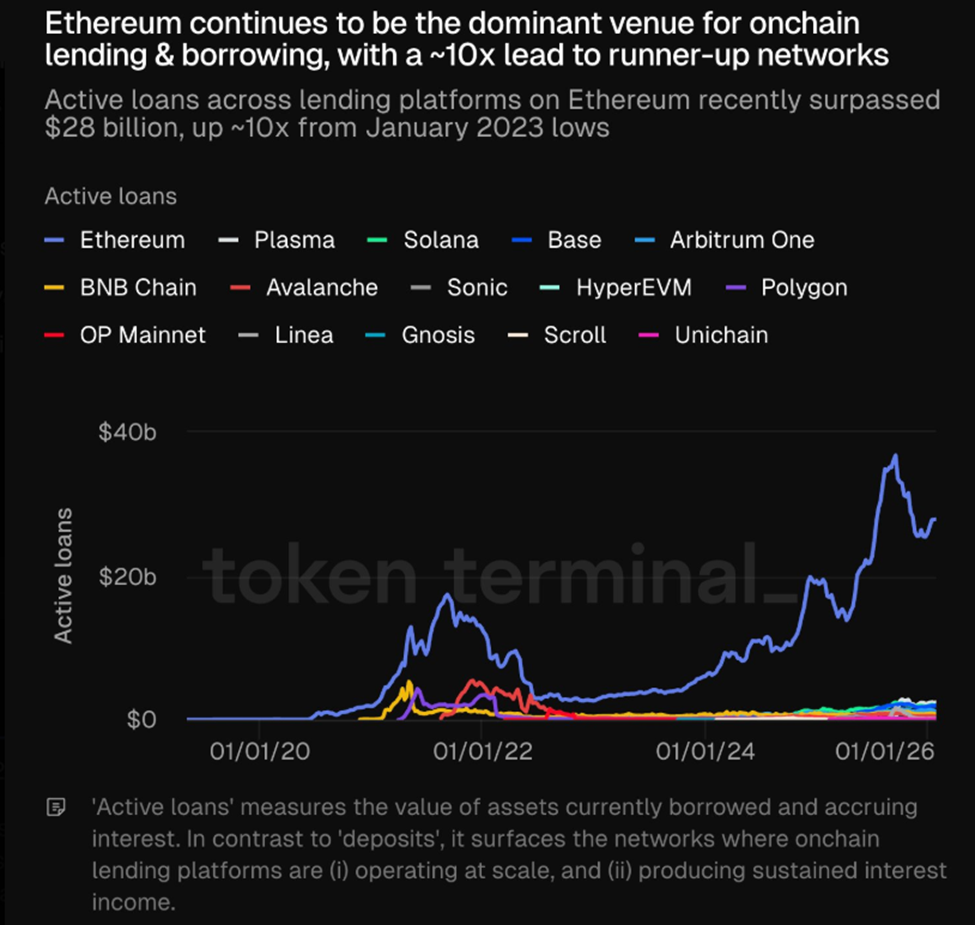

Data on Token Terminal shows that the growth in active loans across Ethereum-based lending platforms achieved a tenfold increase from January 2023 lows.

This milestone highlights Ethereum’s continued dominance in DeFi. It gives it a roughly tenfold advantage over competing networks such as Solana and Base.

The surge in lending activity, while a signal of DeFi’s expanding adoption, also raises questions about systemic risk.

In 2022, elevated loan volumes contributed to waves of liquidations that exacerbated broader market downturns. By Q3 2025, crypto lending had reached a record $73.6 billion. This represents a 38.5% quarter-over-quarter increase, and nearly tripling since the start of 2024.

According to Kobeissi analysts, this was driven largely by DeFi protocols benefiting from Bitcoin ETF approvals and a sector-wide recovery.

While leverage in DeFi remains far below that in TradFi sectors—representing just 2.1% of the $3.5 trillion digital asset market, compared to 17% in real estate—its concentration in algorithmic lending platforms like Aave amplifies the potential for rapid, automated liquidations.

Sponsored

Sponsored

Weekend Crash Highlights Aave’s Role as DeFi’s Stabilizer Amid $2.2 Billion Liquidations

The late January 2026 weekend market crash tested this system under extreme stress. Bitcoin dropped sharply from around $84,000 to below $76,000 amid:

- Thin weekend liquidity

- Geopolitical tensions in the Middle East, and

- Pressure from the US government funding uncertainties.

Over $2.2 billion in leveraged positions were liquidated across centralized and decentralized exchanges in just 24 hours.

Aave’s infrastructure played a crucial stabilizing role. The protocol processed over $140 million in automated collateral liquidations across multiple networks on January 31, 2026.

Sponsored

Sponsored

Despite high Ethereum gas fees spiking above 400 gwei, which temporarily created “zombie positions” where undercollateralized loans hovered near liquidation thresholds but could not be profitably cleared immediately, Aave handled the surge without downtime or bad debt.

Aave’s performance prevented what could have been a far more severe contagion across DeFi. Had the protocol failed, undercollateralized positions could have accumulated into bad debt. Such an outcome would trigger cascading liquidations and potential panic across the ecosystem.

Other protocols, including Compound, Morpho, and Spark, absorbed smaller liquidation volumes. However, they lacked the scale or automation to fully replace Aave.

Even large ETH holders, like Trend Research, who deleveraged by selling hundreds of millions of dollars in ETH to repay Aave loans, relied on the protocol’s efficiency to mitigate further market stress.

Sponsored

The weekend crash highlights both the opportunities and vulnerabilities inherent in Ethereum’s lending ecosystem.

While active loans and leverage are rising, Aave’s resilience signals that DeFi’s infrastructure is maturing.

The protocol’s ability to absorb large-scale liquidations without systemic failures highlights Ethereum-based lending as a stabilizing force in volatile markets. It reinforces its “flight-to-quality” reputation among both institutional and retail participants.

Despite this bullish outlook, the AAVE token is down by over 6% in the last 24 hours, and was trading for $119.42 as of this writing.

Crypto World

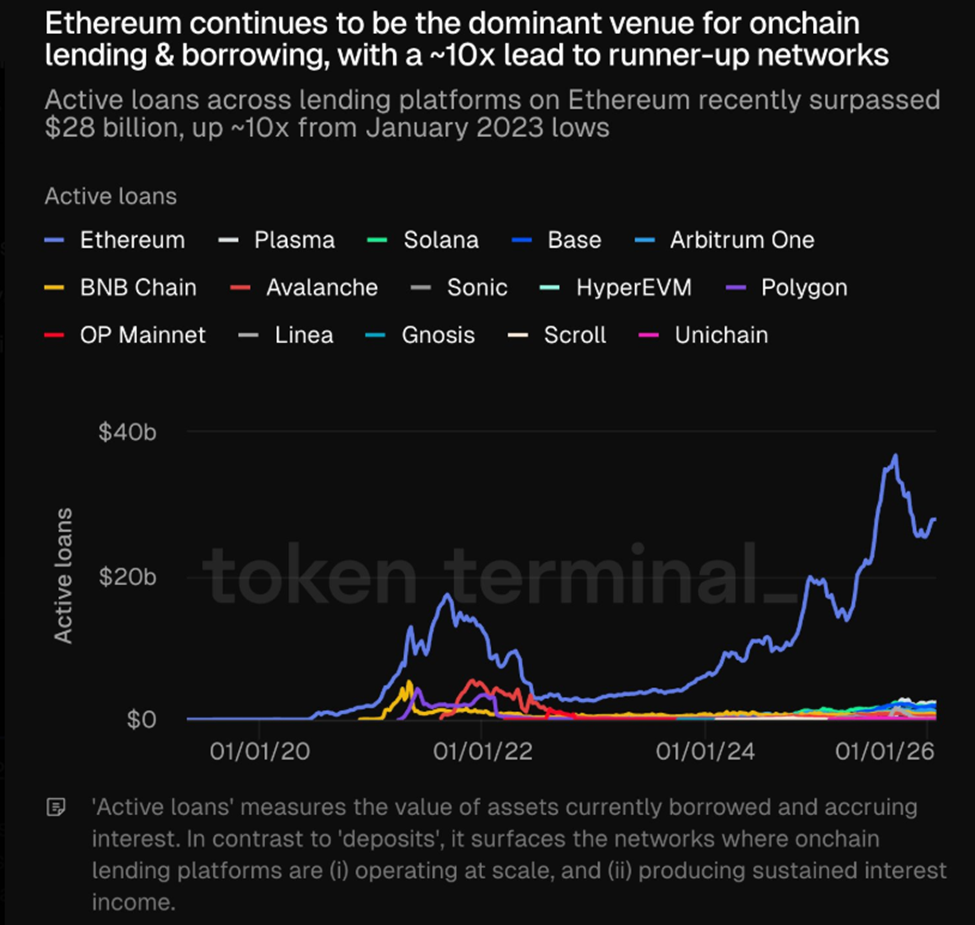

Panic Selling Clashes With Recovery Signals

XRP has faced a sharp downturn, falling 24% over the past week as selling pressure intensified across the market. The decline pushed the altcoin into a vulnerable position, breaking a pattern of past recoveries.

This sustained weakness suggests the current correction may reshape XRP’s historical price behavior if demand fails to return.

Sponsored

XRP’s Past Says Recovery Ahead

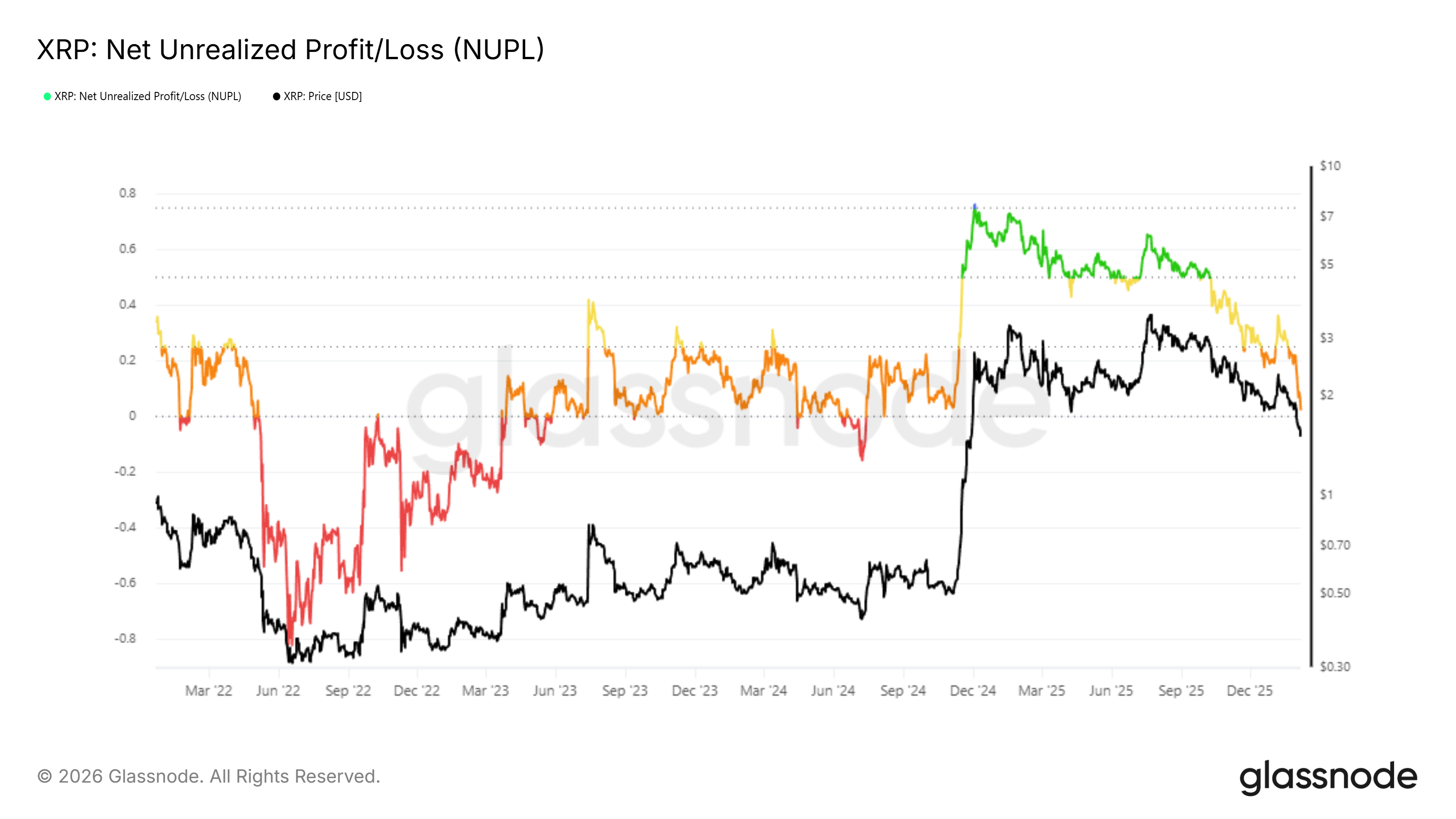

XRP’s Net Unrealized Profit and Loss is approaching the capitulation zone. At this stage, unrealized losses outweigh minor gains across the circulating supply. Historically, such conditions reduce selling incentives.

Investors often pause distribution and begin accumulating at discounted levels, which can support price stabilization.

However, XRP has not yet shown clear signs of this shift. Selling pressure remains dominant, preventing NUPL from triggering a meaningful reversal. Without accumulation replacing fear-driven exits, XRP struggles to benefit from its typical recovery cues, keeping sentiment tilted firmly toward caution.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

XRP Investors Opt to Panic For Now

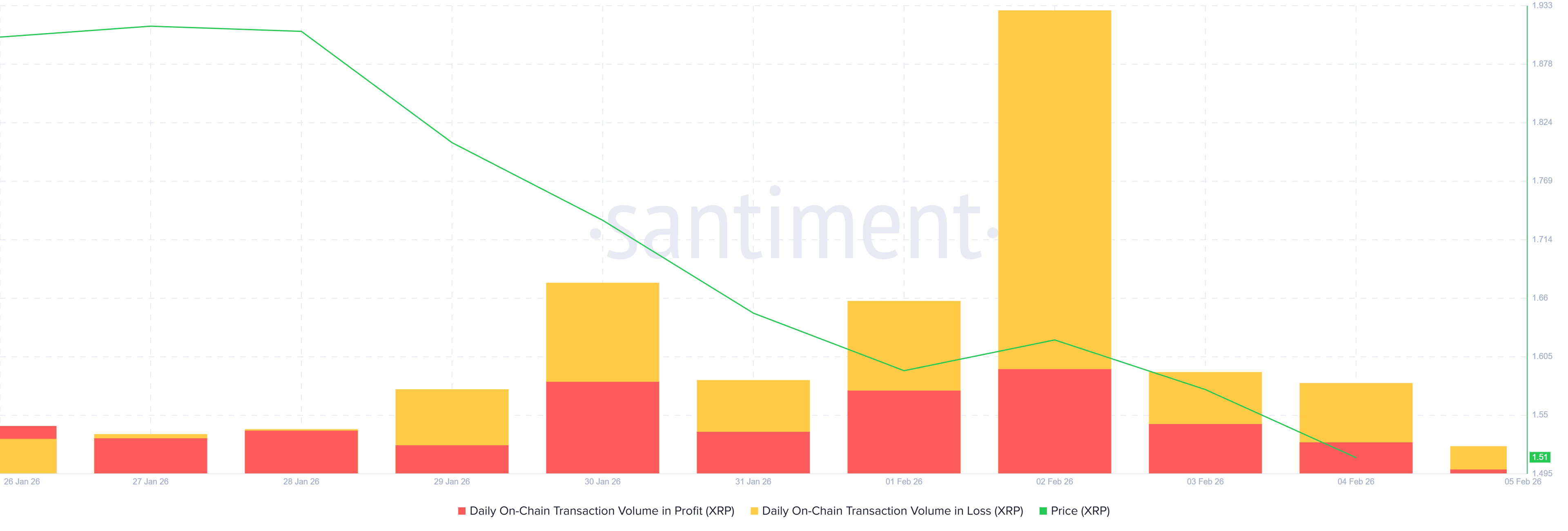

On-chain transaction data reflects sustained panic selling. Over the past week, XRP transactions executed at a loss have consistently exceeded profitable transfers.

Transaction volume on February 2 registered $2.51 billion in losses, against $567 million in profit. This imbalance highlights deteriorating confidence as holders prioritize capital preservation amid falling prices and broader market weakness.

Loss-dominated transaction volume often signals late-stage fear. While such phases can precede recovery, they also deepen drawdowns when unchecked. XRP’s inability to stabilize transaction behavior suggests momentum remains fragile, leaving the asset exposed to further downside unless sentiment improves quickly.

Sponsored

Exchange balance data reinforces bearish signals. Over the last four days, more than 97 million XRP, valued at $140 million, flowed into exchange wallets in mere three days. Rising exchange balances typically indicate intent to sell rather than long-term holding.

This surge reflects growing fear among XRP holders. As more tokens move onto exchanges, sell-side pressure intensifies. Continued inflows reduce recovery odds, as supply expansion often overwhelms short-term demand during periods of heightened uncertainty.

Sponsored

XRP Price Needs To Find Support

XRP price has declined 24.4% over the past week and trades near $1.44 at the time of writing. The asset lost the $1.47 support and is trending toward $1.37. Wednesday marked XRP’s lowest daily close since November 2024, confirming structural weakness.

If bearish conditions persist without meaningful buying interest, further downside appears likely. Losing $1.37 as support could accelerate selling pressure. Under this scenario, XRP price may slide toward $1.28 in the coming days, extending the current corrective phase.

A recovery remains possible if sentiment shifts. Reclaiming $1.58 as support would signal renewed strength. Such a move could push XRP toward $1.70. Securing that level would restore bullish confidence and help recover a portion of recent losses.

Crypto World

Hyper-Casual Game Development as a Business Strategy

Hyper casual games are often misunderstood. It is because they look simple, launch quickly, and do not carry the cinematic depth of AAA titles. Now, as a result of their simplicity, many decision-makers assume they are small opportunities. However, behind the simplicity lies a powerful business reality.

Hyper casual games have become one of the most efficient & strategic business tools for studios, publishers, and brands looking to test ideas, acquire users, and unlock new revenue streams with lower risk.

In 2026, leading studios, publishers, and even non-gaming enterprises are not treating hyper casual games as a side experiment. They are using it as a strategic layer in their growth and monetization strategy.

For decision-makers evaluating where to allocate budgets, hyper-casual game development is no longer about chasing trends, it is about making calculated investments that produce data, insights, and scalable opportunities.

Why Hyper Casual Games Still Command Investment Attention

Many assume hyper casual peaked and declined. In reality, it evolved. Early hyper casual success relied on mass downloads and ad monetization. Today, the model is more strategic.

Hyper casual games thrive because it delivers three things businesses value most:

1. Speed

Concept-to-market timelines are dramatically shorter compared to mid-core or AAA development. This enables faster experimentation and quicker ROI evaluation.

2. Accessibility

Simple mechanics attract a broad demographic, making hyper-casual one of the most inclusive gaming categories.

3. Iteration Potential

With short development cycles, studios can test, learn, and refine rapidly.

For enterprises, this translates into agile product-market testing rather than high-risk long-term bets.

Hyper Casual Game Development as a Portfolio Strategy for Studios

Successful publishers rarely rely on a single title. They build portfolios designed to distribute risk and maximize upside. Hyper casual game development fits perfectly into this strategy Instead of investing heavily into one large project, studios launch multiple hyper casual titles to:

- Test new mechanics

- Explore genres

- Evaluate user behavior

- Identify breakout potential

A single successful hyper casual title can offset multiple experimental builds. More importantly, insights from hyper casual performance often guide larger productions. Mechanics that show traction can later evolve into hybrid-casual or mid-core games. This makes hyper casual a feeder system for future franchises.

Why Enterprises and Brands Are Entering the Space

Gaming is no longer just for gaming companies. Brands and enterprises are investing in hyper-casual games as interactive engagement tools. A well-designed hyper casual game can:

- Capture user attention in seconds

- Encourage repeat interaction

- Drive brand recall

- Support loyalty campaigns

- Promote products in a gamified format

Compared to traditional advertising, gamified engagement often yields higher retention and stronger emotional connection. For enterprises, hyper-casual becomes a customer acquisition and engagement channel, not merely entertainment.

Want to Invest in Hyper Casual Games?

Speed-to-Market as a Competitive Lever

In digital markets, timing matters. Hyper-casual development allows companies to respond quickly to:

- Cultural trends

- Seasonal events

- Viral mechanics

- Market shifts

A studio that can launch multiple titles per year learns faster than one betting on a single multi-year project. This speed reduces opportunity cost and increases adaptability. For investors and decision-makers, this agility is a serious advantage.

Monetization Beyond “Just Ads”

While ad monetization remains a pillar, modern hyper-casual games expand revenue through:

- In-app purchases

- Cosmetic upgrades

- Cross-promotion networks

- Brand collaborations

- Data-driven optimization

Portfolio-level monetization often produces stable revenue streams. The business value is not always in one viral hit, but in cumulative performance.

Data: The Hidden Asset in Hyper Casual Investment

Every hyper-casual launch generates valuable insights:

- CPI benchmarks

- Retention curves

- Session lengths

- Monetization patterns

- User behavior analytics

This data informs smarter decisions for future projects. Companies investing strategically treat each launch as a learning cycle. Instead of guessing, they build with evidence.

Risk Management Through Smaller Bets

Large game productions come with large risks. Hyper casual games spread that risk. Smaller budgets allow for multiple experiments. Multiple experiments increase the chance of finding winning formulas. This, in turn, reduces financial exposure while preserving upside. For CFOs and product leaders, this makes hyper-casual a rational investment category.

Execution Quality Makes the Difference

Not all games succeed. Execution determines outcomes. Strong hypercasual game development requires:

- Tight gameplay loops

- Rapid prototyping pipelines

- Analytics integration

- Monetization design

- Performance optimization

- Fast iteration cycles

Studios with efficient pipelines outperform those relying on slow processes.

The Role of the Right Development Partner

The overall success of the games often depends on how quickly teams can test and iterate. An experienced hyper casual game development company helps by:

- Reducing development friction

- Speeding up production

- Integrating analytics early

- Optimizing monetization

- Guiding portfolio strategy

This turns hyper-casual from trial-and-error into structured experimentation.

Long-Term Strategic Value

A hyper casual game is not always about building the next billion-dollar IP. Sometimes its value lies in:

- Market validation

- User acquisition

- Learning cycles

- Portfolio diversification

- Brand engagement

Companies that understand this extract far more value than those chasing only viral success.

Final Thoughts

Hyper casual game development is not a gamble when approached strategically. It is a business tool for:

- Testing ideas

- Reducing risk

- Accelerating learning

- Generating revenue

- Engaging audiences

Studios and enterprises that invest wisely continue to benefit from its speed & scalability.

Antier, as a trusted hyper casual game development company, works with studios and enterprises to design & deliver high-quality games optimized for fast launches, data-driven iteration, and monetization performance, helping transform simple concepts into smart business investments.

Frequently Asked Questions

01. What are hyper casual games and why are they important for businesses?

Hyper casual games are simple, quick-launch games that serve as strategic business tools for studios, publishers, and brands. They allow for testing ideas, acquiring users, and unlocking new revenue streams with lower risk, making them essential for growth and monetization strategies.

02. How do hyper casual games differ from traditional gaming models?

Unlike traditional gaming models that focus on high production values and long development cycles, hyper casual games prioritize speed, accessibility, and iteration potential, enabling faster experimentation and quicker return on investment.

03. Why should studios consider hyper casual game development as part of their portfolio strategy?

Studios should consider hyper casual game development to distribute risk and maximize potential returns by launching multiple titles. This approach allows them to test new mechanics, explore genres, and gather insights that can inform larger projects.

Crypto World

Justin Sun says ‘keep going’ on Tron Inc’s TRX buys

Crypto billionaire Justin Sun endorsed Tron Inc.’s strategy of stacking the TRX token, which has recently outperformed bitcoin , as a core treasury asset, spotlighting their latest dip buy with a simple “keep going” on X.

The Nasdaq-listed Tron Inc. announced that it acquired 175,507 TRX tokens on Wednesday at an average price of $0.28, for a fresh investment of just over $49,000 in the Tron blockchain’s native token. The latest purchase boosted its TRX stash to 679.9 million tokens ($540 million).

The company plans to further grow its TRX holdings to enhance long-term shareholder value.

Tron Inc. — formed via a reverse merger between SRM Entertainment and a Tron-related entity — is a publicly listed firm focused on blockchain-integrated treasury strategies and holding a significant amount of TRX tokens. The company is modeled on Nasdaq-listed Strategy, which pioneered the digital asset treasury narrative by starting to accumulate Bitcoin as a reserve asset in August 2020.

The nod from Sun reinforces steady accumulation amid market dips. TRX’s price peaked near 45 cents in 2024 and has since pulled back to 28 cents. But lately, it has been relatively resilient, down just 1.3% this year versus the market leader, bitcoin, which is down nearly 19%, according to CoinDesk data.

TRX’s relative outperformance amid broader crypto weakness has led some analysts to view it as a defensive haven asset.

Crypto World

ZachXBT Highlights $282M Theft of Bitcoin and Litecoin in Hardware Wallet Scam

The investigator said the attacker swapped funds into Monero and moved BTC across chains using Thorchain.

Onchain investigator ZachXBT said a victim lost more than $282 million worth of Bitcoin (BTC) and Litecoin (LTC) in a scam involving a hardware wallet earlier this month.

In a post on X, ZachXBT said the theft happened on Jan. 10, 2026, around 11 p.m. UTC, and involved about 2.05 million LTC and 1,459 BTC. He said the victim was tricked in a social engineering scam.

The theft was reported as major crypto prices were slightly higher on the day. Litecoin (LTC) was trading around $74.57, up 3.6% in the past 24 hours, while Bitcoin (BTC) traded near $95,512, up 0.2%, according to CoinGecko.

The case highlights how even hardware wallets can be risky if someone is fooled into giving up access or approving a bad transaction. These scams don’t involve breaking code; instead, they rely on tricking the victim.

According to ZachXBT, the attacker began converting the stolen BTC and LTC into Monero (XMR) through multiple instant exchanges. Monero is a privacy-focused cryptocurrency and is currently trading at $642.77, down 3.7% on the day.

He said the conversions contributed to a sharp increase in XMR’s price as the market absorbed the flow. ZachXBT also said the attacker bridged BTC to other networks, including Ethereum, Ripple, and Litecoin, using Thorchain, a cross-chain liquidity protocol.

The theft comes as security firms continue to warn that many big crypto losses come from user error and scams. PeckShield reported that total exploit losses fell to about $76 million in December 2025 from $194.3 million in November, though it said incident activity remained elevated.

Crypto World

Current Bear Market Performance Worse Than 2022: Analysts

Bitcoin’s decline into a bear market has been faster than in the past cycle, according to analysts.

“Bitcoin’s bear market is off to a weaker start than 2022,” reported on-chain analytics platform CryptoQuant on Wednesday.

Since falling below the 365-day moving average in November, Bitcoin is down 23% in just 83 days, compared to a 6% decline over the same period in early 2022, they added before stating “momentum is deteriorating faster this cycle.”

“This performance is worse than at the start of the previous bear market in January 2022.”

Bitcoin Bear Market Deepens

Bitcoin peaked at $126,000 in early October with the “Bull Score Index” at 80, but following the Oct. 10 liquidation event, the index turned bearish and has now fallen to zero while the price dumped to $71,000, “signaling broad structural weakness,” CryptoQuant reported. The platform also stated that Bitcoin “has lost key support levels” and may be targeting $70,000 to $60,000.

Bitcoin was rejected three times at the “Traders’ On-chain Realized Price,” a key on-chain support and resistance level. It also recently crossed below the lower band of this same metric, which acted as a support during the bull market.

Bitcoin’s bear market is off to a weaker start than 2022.

Since falling below the 365-day MA on Nov 12, 2025, $BTC is down 23% in 83 days, vs. just 6% over the same period in early 2022.

Momentum is deteriorating faster this cycle. pic.twitter.com/t4xD2vljVI

— CryptoQuant.com (@cryptoquant_com) February 4, 2026

Meanwhile, Santiment reported that sentiment “has turned extremely bearish toward Bitcoin and Ethereum” following the major downswing this past week.

“As we know, markets move opposite to the fear and greed of retail traders. There remains a strong argument for a short-term relief rally as long as the small-trader crowd continues to show disbelief toward cryptocurrency as a whole.”

“The BTC bear market rages on as profitability resets, realised losses rise, spot demand stays weak, and leverage unwinds,” reported Glassnode.

Meanwhile, the crypto “Fear and Greed Index” has fallen back to all-time lows around 12 as sentiment collapses and panic selling continues.

You may also like:

Crypto Market Outlook

Total capitalization has declined again today, falling 4.4% to $2.53 trillion, its lowest level since April 2025. Further losses will see it back to bear market lows from 2024.

Bitcoin dumped again, tanking below $71,000 during early trading in Asia on Thursday morning. BTC is now back at November levels and heading towards support at around $65,000.

Ether is in meltdown, crashing below $2,100 and failing to recover, also on a path to previous cycle lows.

Altcoins are not even worth mentioning, tanking even harder than the top two, with most now at 80% down from their peaks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

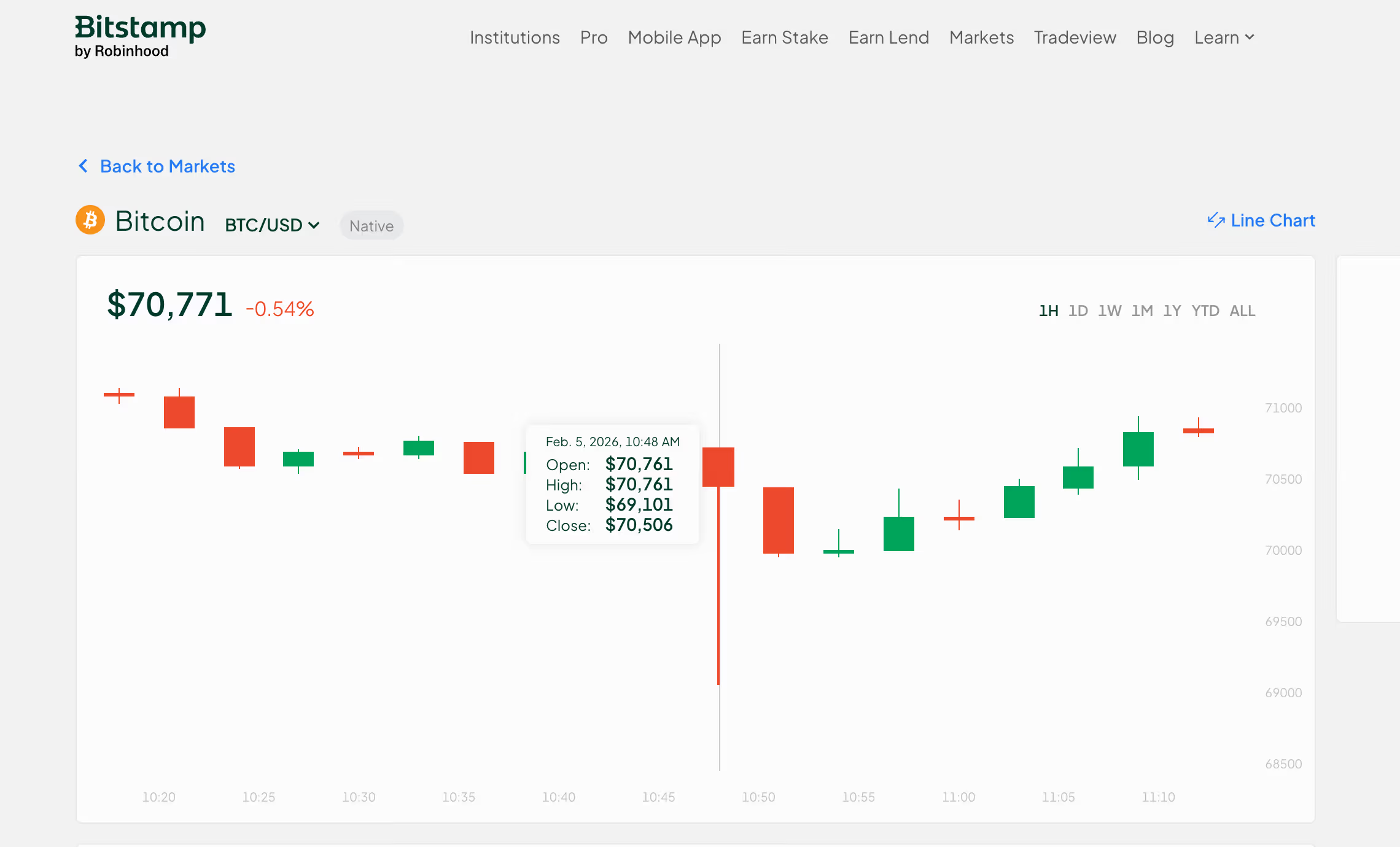

BTC tanks to $69,101 on Bitstamp

Bitcoin’s price sell-off continued Thursday, with prices breaking below the widely-tracked $70,000 level on the OG crypto exchange Bitstamp.

BTC’s dollar-denominated price slipped to $69,101 during the Asian trading hours, trading a discount to prices on other exchanges, including Coinbase, where BTC hit a low of $70,002.

The discount on Bitstamp likely stemmed from stronger selling pressure on the Robinhood-owned platform.

The global average price, tracked by CoinDesk, peaked above $126,000 in early October and has been in a downtrend since then. Some analysts expect further sell-off at least to $60,000, where prices may eventually bottom out.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech24 hours ago

Tech24 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards