Crypto World

DOGE price eyes $0.20 if X, CLARITY Act spark breakout above $0.18

DOGE price slips ~1% in 24h, holding $0.09–$0.10 as traders eye X, CLARITY Act.

Summary

- DOGE price is trading around $0.098–$0.099, holding $0.09–$0.10 support but stuck below major MAs and a structural daily downtrend.

- Resistance sits near $0.104–$0.116, with $0.116 flagged as pivotal level aligning with upper Bollinger Band and 50% Fib of January’s drop.

- Base case is range‑bound; break above $0.116 could target $0.15–$0.20, while a clean loss of $0.09 risks a retest of yearly lows.

Dogecoin (DOGE) price is clinging to support just under the $0.10 mark, trading around $0.0988 as meme‑coin bulls try to turn a shaky bounce into a sustained reversal. Analysts describe the move as a “fragile recovery” after DOGE defended key support but failed to break out of its broader downtrend.

Market backdrop and key levels

Dogecoin is changing hands near $0.098–$0.099 today, marginally lower over the past 24 hours as liquidity concentrates around a tight support zone. A recent weekly analysis notes that DOGE “is currently trading at $0.099, staging a recovery attempt after successfully defending a critical support zone,” but stresses that “the daily chart confirms that Dogecoin remains in a structural downtrend.” Technicians flag resistance around $0.104–$0.116, with one wave analysis pointing to $0.1160 as “pivotal resistance,” aligning with the upper Bollinger Band and a 50% Fibonacci retracement of January’s selloff.

Crypto.news warns that the token “dropped to the important support level at $0.100, much lower than this month’s high of $0.1176,” and now trades below all major moving averages, with momentum gauges stuck in bearish territory. In parallel, bitcoin is trading near $66,879, down about 1.2% on the day, while ether changes hands around $2,466, up just under 1% over the same period, underscoring a cautious, range‑bound majors environment.

Catalysts and near‑term outlook

Sentiment hinges on two overlapping narratives: regulatory clarity and big‑tech integration. A recent outlook argues DOGE “could reach $0.20 in February 2026” if market growth, meme‑coin rotation and risk appetite align, but stresses that breaking “significant technical resistance levels” around $0.18–$0.20 with high volume is essential. Separate coverage highlights that DOGE’s recent spikes have tracked rumors around X’s crypto‑trading features and potential payment support, with one desk noting the coin “jumped 15.25% to $0.1113” following X’s trading announcement as volume surged to $1.76 billion on strong whale activity.

For now, the base case is range‑bound: DOGE holding the $0.09–$0.10 floor while facing overhead supply into the low‑$0.11s. A decisive close above $0.116 with expanding volume would open room toward $0.15, while a loss of $0.09 support risks a retest of the yearly lows. Traders watching this compressing range are effectively betting on whether the next major impulse comes from Washington’s CLARITY Act headlines or the next product move out of X.

Crypto World

XRP price breaks local bearish structure as rising volume targets $1.70

XRP price breaks local bearish market structure, shifting momentum, with price now testing a key volume support zone that could establish a higher low for higher prices.

Summary

- Local bearish structure invalidated, signaling momentum shift

- Key volume support zone being defended, favoring higher-low formation

- $1.76 resistance becomes upside target, if bullish volume confirms continuation

XRP (XRP) Price action has begun to show early signs of recovery after breaking its local bearish market structure. Following a period of sustained downside pressure, the market has transitioned back into a technically significant support region where buyers are attempting to regain control. This development suggests that the corrective phase may be nearing completion, provided key support levels continue to hold.

Markets often transition through phases of imbalance before stabilizing around high-liquidity zones. The current move back into a major volume support cluster highlights a potential shift away from bearish continuation toward rotational price behavior. Whether this develops into sustained upside momentum will depend heavily on how price reacts within this support region.

XRP price key technical points

- Local bearish market structure has been broken, signaling momentum shift

- Major volume support cluster is being tested, including POC and Fibonacci confluence

- $1.76 high-timeframe resistance becomes the upside target, if higher low confirms

XRP price has rotated back into an important technical region defined by strong volume participation. This zone includes the point of control (POC), the value area high, and the 0.618 Fibonacci retracement, creating a powerful confluence of support levels.

When multiple technical indicators align in one region, it often increases the probability of price stabilization. Such areas typically attract liquidity and institutional interest, making them ideal locations for higher lows to form during trend transitions.

The return to this volume area indicates that sellers are losing immediate dominance, while buyers are beginning to defend price more aggressively.

Establishing a higher low is critical

The most important technical requirement moving forward is the confirmation of a higher low. A higher low represents a shift in market structure from bearish to constructive and often marks the early stages of trend continuation to the upside.

For this scenario to remain valid, the value area low must continue acting as support. Acceptance below this level would weaken the bullish thesis and reopen downside risks. However, sustained holding above value strengthens the probability that accumulation is taking place.

Once a higher low is confirmed, XRP gains structural support for continuation within the newly developing trend.

Market structure transition underway

The recent break of local bearish structure is a meaningful technical event. Previously, price action was characterized by lower highs and continued weakness. That pattern has now been disrupted, indicating a transition from distribution toward potential accumulation.

Market structure shifts rarely occur instantly. Instead, they typically unfold through rotations between support and resistance levels. The current consolidation within the volume support region may represent the early phase of this transition.

As buyers defend support and absorb supply, momentum can gradually build for a larger expansion move.

Resistance at $1.76 comes into focus

If the higher low successfully forms, attention shifts toward high-timeframe resistance near $1.76. This level represents the next major technical objective and aligns with prior rejection zones within the broader trading range.

A rotational move toward resistance would confirm that the market has transitioned out of its corrective phase and into a recovery structure. However, reaching this target will require strong bullish participation.

Bullish volume is the deciding factor

While structural signals are improving, confirmation ultimately depends on bullish volume expansion. Breakouts or rotations without volume often fail, leading to renewed consolidation or reversals.

Increasing buy-side volume would validate demand returning to the market and strengthen the probability of continuation toward resistance. Without this confirmation, price may remain range-bound despite structural improvement.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, the market is attempting to transition from bearish control into a more constructive environment. The break of the local bearish structure, combined with strong volume support, suggests that a higher low may be forming.

In the near term, consolidation around the volume support zone is likely as the market searches for equilibrium. As long as the value area low holds, the probability favors a rotational move for XRP toward the $1.76 resistance level.

A decisive increase in bullish volume would confirm continuation, while failure to hold support would delay the recovery. For now, the technical landscape favors stabilization and potential upside rotation as the market attempts to establish a new structural trend.

Crypto World

The Market Priced in Cuts, the Fed Mentioned Hikes. What It Means For Bitcoin Price?

Minutes from the January meeting show rate hikes are not off the table. If inflation stalls, policymakers are ready to tighten again. That is a direct warning to risk markets.

For Bitcoin price, this flips the script. The market was leaning toward cuts. More liquidity. Easier conditions. Now the Fed is signaling the opposite.

Higher rates. Tighter liquidity. And that changes everything for crypto.

Key Takeaways

- The Signal: Fed officials discussed “upward adjustments” to rates if inflation stays above target levels.

- The Split: The vote was 10-2 to hold rates, but a significant “hawkish” contingent is pushing back against cuts.

- The Risk: Higher-for-longer rates typically drain liquidity, creating headwinds for Bitcoin and ETF inflows.

Why Does This Matter for Crypto and Bitcoin Price?

Markets were relaxed. Cuts in 2026 felt almost guaranteed. Now that confidence got shaken again.

The Fed held rates at 3.5% to 3.75%, hitting pause after three straight cuts in late 2025. But the tone was not soft. Inside the discussion, a hawkish group made it clear they are not ready to promise more easing.

Some officials even floated “upward adjustments” if inflation sticks around. That is a big shift. The market had assumed a smooth path lower. The minutes analysis say otherwise.

The Fed wants clear proof that disinflation is real before cutting again. That puts serious weight on the February CPI print. If inflation runs hot, rate hikes move from theory back to reality.

What Happens Next?

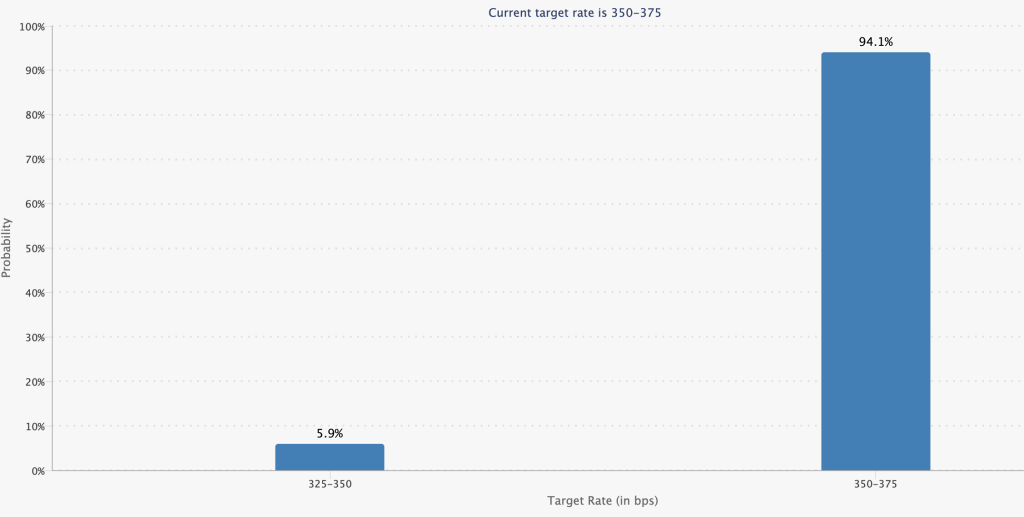

Pricing is getting messy. CME futures still show a 94% chance of a pause in March. But the hike risk is no longer zero.

Now it all comes down to inflation data. If the next print runs hot, the Fed fears get validated. If not, this scare might fade just as fast as it appeared.

Discover: Here are the crypto likely to explode!

The post The Market Priced in Cuts, the Fed Mentioned Hikes. What It Means For Bitcoin Price? appeared first on Cryptonews.

Crypto World

Banks Can’t Seem To Service Crypto, Even as It Goes Mainstream

Across the globe, it remains common for crypto users to have their bank accounts frozen and transfers blocked, even as institutional adoption rises.

Panos Mekras, co-founder and CEO of blockchain fintech Anodos Labs, began dealing with crypto in Greece in the late 2010s. Most Greek banks didn’t allow transfers to crypto exchanges back then. Mekras experienced blocked card payments until one bank finally permitted his transfers, but first, he was questioned to ensure he understood he was interacting with a “risky” counterparty.

Mekras told Cointelegraph that those early rejections are symptomatic of how banks treat digital assets as inherently high risk. That label often led to account closures or sudden freezes without explanation, ultimately pushing his business to rely solely on onchain tools and payment rails.

Public perception of crypto has since evolved. Now, crypto is undergoing an image refresh, from a speculative asset class to an infrastructure layer for future financial products. However, Mekras said he still experiences the same banking barriers, as recently as a “few months ago”:

“I tried to send money from an exchange to Revolut, and they froze my account for three weeks. I had no access to my [funds] during that time.”

The long shadow of crypto debanking

Mekras isn’t the lone crypto holder with such complaints despite banks announcing expansions into custody and blockchain initiatives.

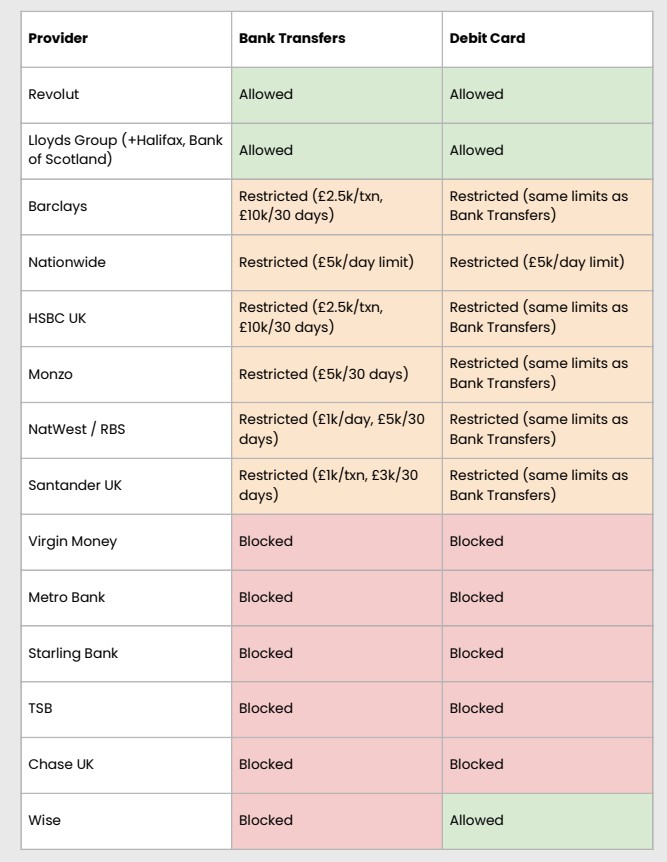

A January report from the UK Cryptoasset Business Council found that bank transfers to exchanges were being blocked or delayed, with roughly 40% of payments encountering restrictions and 80% of exchanges reporting increased friction over the past year.

The council warned that blanket bans and transaction limits are often applied without regard to the legal status of the exchange.

Revolut is one of two banks that permit both bank transfers and debit cards in the UK council’s study, and it is also the platform where Mekras claims to have experienced his recent account freeze. It operates as an authorized UK bank “with restrictions,” meaning it is currently building up its banking processes before full launch. It also holds a European Union banking license through Lithuania and offers crypto trading services in its app.

A Revolut spokesperson told Cointelegraph it treats account freezes as a “last-resort” customer protection measure in compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

“A temporary freeze may occur if our systems detect irregular activity. This could be a combination of a few factors, such as if a customer interacts with a platform frequently exploited by fraudsters, or we believe that the funds in question may be the proceeds of crime or sanctions circumvention,” the spokesperson said.

The representative added that since Oct. 1, just 0.7% of Revolut accounts where customers deposited crypto funds were restricted or frozen after investigation.

Related: How Europe’s blockchain sandbox finds innovation in regulation

When banks close doors, users move onchain

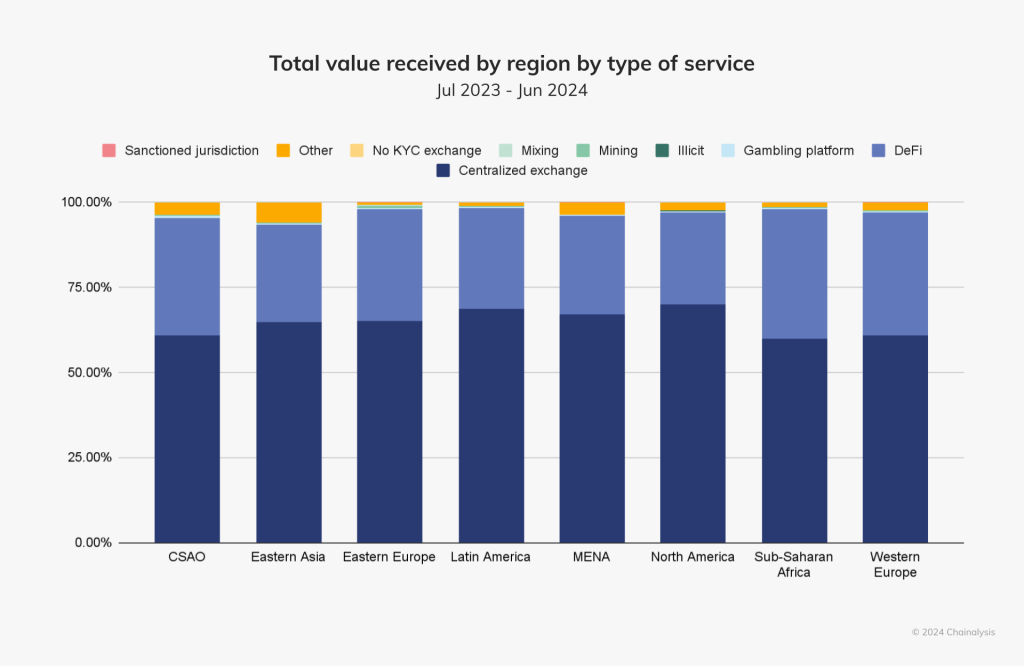

In some regions, crypto is blocked and leaves users to more extreme restrictions. Crypto on- and off-ramps are not legally possible in regions like China, so users resort to peer-to-peer (P2P) platforms or black markets to trade crypto.

While China sits on the extreme end of the spectrum, other jurisdictions have eased official and unofficial restrictions. Nigeria once banned crypto and even blocked P2P platforms. However, it formally recognized digital assets as securities in 2025.

Related: Crypto takeaways from Davos: Politics and money collide

Similar banking friction patterns also emerged in the US. Lawmakers and the industry have invoked the term “Operation Chokepoint 2.0” to describe the federal regulators’ informal guidance that discouraged banks from maintaining relationships with crypto companies.

The original “Operation Choke Point” was an initiative in which enforcement agencies were accused of pressuring banks to cut ties with politically contentious industries such as payday lenders and firearms sellers.

In January 2025, Donald Trump took office as the president of the US and has been pushing for crypto-friendly policies to position the world’s largest economy as the “crypto capital” of the world.

Crypto debanking issues have since been officially recognized. In December, the US Office of the Comptroller of the Currency (OCC) released its findings on debanking practices by nine of the country’s largest banks. The OCC also published an interpretive letter to confirm that banks may facilitate crypto transactions in a broker-like capacity.

Regardless of the positive momentum, users still complain that the banking sector won’t service accounts exposed to cryptocurrencies.

“This is still the case [and] there are still anti-crypto positions. Some have even said publicly that they are not willing to support crypto activity or engage with the industry,” said Mekras.

Mekras argued that users can consider fully detaching from the traditional banking system and moving finances onchain. It sounds viable in theory, but in reality, most businesses and users still cannot operate purely within crypto without reliable access to fiat rails.

Banking’s turn toward blockchain infrastructure

In recent years, there has been a global shift in how traditional financial institutions engage with crypto.

Major banks and financial infrastructures are increasingly building products and services tied to Web3. In the US, 60% of the top 25 banks are reportedly offering or planning Bitcoin-related services, including custody, trading and advisory solutions.

Across Europe, regulated services such as crypto custody and settlement are being introduced by legacy exchanges and financial groups under the Markets in Crypto-Assets Regulations (MiCA). In the UK, HSBC’s blockchain platform was selected to support pilot issuances of tokenized government bonds.

In that backdrop of institutional adoption, some companies working to bridge banks and blockchain claim that the challenges that lead to account freezes are linked to tooling gaps and risk frameworks inside banks.

“The problem is that there’s a huge amount of friction because traditional banks don’t really have the internal infrastructure to interpret blockchain data in a way that fits inside their existing risk and compliance frameworks,” Eyal Daskal, CEO of Crymbo — a blockchain infrastructure platform for institutions — told Cointelegraph.

He described the situation as one where banks often default to precautionary measures because they lack the ability to link onchain activity with the identity and compliance signals they rely on:

“If crypto is involved, they block the account and treat it as out of scope. It’s the simplest option for them because they don’t have the tools to assess it properly.”

Crypto is entering the financial mainstream, but for many users, access to basic banking still depends on whether a bank’s risk engine can understand what happens onchain. Until that gap closes, the industry’s institutional embrace and retail friction may continue to coexist.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Franklin Templeton, Binance Roll Out Off-Exchange Collateral

Editor’s note: In this era of digital finance, institutional collaboration between traditional asset managers and crypto exchanges is reshaping markets. The collaboration between Franklin Templeton and Binance demonstrates a practical path to bridge regulated money market products with 24/7 digital markets, using tokenized assets as collateral while preserving custody and risk controls. This editorial snapshot previews how off-exchange collateral programs can improve capital efficiency for institutions without moving assets onto exchanges.

Key points

- Off-exchange collateral using Benji tokenized money market fund shares now live on Binance.

- Custody by Ceffu minimizes counterparty risk for institutions.

- Enables yield-bearing assets to be used for trading without on-exchange parking.

- Expands Franklin Templeton and Binance’s networks of off-exchange program partners.

Why this matters

This collaboration signals growing institutional adoption of tokenized real-world assets, improving capital efficiency and risk controls in crypto markets. By tokenizing money market funds and maintaining custody off-exchange, institutions can participate in 24/7 trading with regulated protections, potentially broadening the set of assets available for collateral and fueling more stable liquidity in digital markets.

What to watch next

- Broader rollout to additional institutional clients.

- Addition of more tokenized Benji funds.

- Deeper custody and settlement integrations with Ceffu.

- Ongoing collaboration expansion across networks since the 2025 announcement.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Franklin Templeton and Binance Advance Strategic Collaboration with Institutional Off-Exchange Collateral Program

Institutions can now use Benji-issued tokenized money market funds as off-exchange collateral to trade on Binance using Ceffu’s custody layer.

SAN MATEO, CA, and ABU DHABI, UAE, February 19, 2026 — Franklin Templeton, a global investment leader, and Binance, the world’s leading cryptocurrency exchange by trading volume and users, today announced a new institutional off-exchange collateral program, making digital markets more secure and capital-efficient. Now live, eligible clients can use tokenized money market fund shares issued through Franklin Templeton’s Benji Technology Platform as off-exchange collateral when trading on Binance.

The program alleviates a long-standing pain point for institutional traders by allowing them to use traditional regulated, yield-bearing money market fund assets in digital markets without parking those assets on an exchange. Instead, the value of Benji-issued fund shares is mirrored within Binance’s trading environment, while the tokenized assets themselves remain securely held off-exchange in regulated custody. This reduces counterparty risk, letting institutional participants earn yield and support their trading activity without hedging on custody, liquidity, or regulatory protections.

“Since partnering in 2025, our work with Binance has focused on making digital finance actually work for institutions,” said Roger Bayston, Head of Digital Assets at Franklin Templeton. “Our off-exchange collateral program is just that: letting clients easily put their assets to work in regulated custody while safely earning yield in new ways. That’s the future Benji was designed for, and working with partners like Binance allows us to deliver it at scale.”

“Partnering with Franklin Templeton to offer tokenized real-world assets for off-exchange collateral settlement is a natural next step in our mission to bring digital assets and traditional finance closer together,” said Catherine Chen, Head of VIP & Institutional at Binance. “Innovating ways to use traditional financial instruments on-chain opens up new opportunities for investors and shows just how blockchain technology can make markets more efficient.”

Assets participating in the program remain held off-exchange in a regulated custody environment, with tokenized money market fund shares pledged as collateral for trading on Binance. Custody and settlement infrastructure is supported by Ceffu, Binance’s institutional crypto-native custody partner.

“Institutions increasingly require trading models that prioritize risk management without sacrificing capital efficiency,” said Ian Loh, CEO of Ceffu. “This program demonstrates how off-exchange collateral can support institutional participation in digital markets while maintaining strong custody and control.”

Launching the institutional off-exchange collateral program expands on both Franklin Templeton’s and Binance’s growing networks of off-exchange program partners and represents another effort since announcing Franklin Templeton and Binance’s strategic collaboration in September 2025.

By using Benji to bridge tokenized money market funds, Franklin Templeton is taking trusted investment products and making them work in modern markets—allowing institutions to trade, manage risk, and move capital more efficiently as digital finance becomes an everyday part of the financial system.

Offering more tokenized real-world assets on Binance meets the increasing institutional demand for stable, yield-bearing collateral that can settle 24/7. This gives investors greater choice and enhances their trading experience on the world’s largest regulated digital asset exchange.

Franklin Templeton is a pioneer in digital asset investing and blockchain innovation, combining tokenomics research, data science, and technical expertise to deliver cutting-edge solutions since 2018. Learn more at http://franklintempleton.com/investments/asset-class/digital-assets.

About Binance

Binance is a leading global blockchain ecosystem behind the world’s largest cryptocurrency exchange by trading volume and registered users. Binance is trusted by more than 300 million people in 100+ countries for its industry-leading security, transparency, trading engine speed, protections for investors, and unmatched portfolio of digital asset products and offerings from trading and finance to education, research, social good, payments, institutional services, and Web3 features. Binance is devoted to building an inclusive crypto ecosystem to increase the freedom of money and financial access for people around the world with crypto as the fundamental means.

For more information, visit https://www.binance.com.

About Ceffu

Ceffu is a compliant, institutional-grade custody platform offering custody and liquidity solutions that are ISO 27001 & 27701 certified and SOC2 Type 2 attested. Our multi-party computation (MPC) technology, combined with a customizable multi-approval scheme, provides bespoke solutions allowing institutional clients to safely store and manage their virtual assets.

For the purposes of this program, custody services for Benji-issued tokenized money market fund shares are provided by Ceffu Custody FZE, a virtual asset custodian licensed and supervised in Dubai.

About Franklin Templeton

Franklin Templeton is a trusted investment partner, delivering tailored solutions that align with clients’ strategic goals. With deep portfolio management expertise across public and private markets, we combine investment excellence with cutting-edge technology. Since our founding in 1947, we have empowered clients through strategic partnerships, forward-looking insights, and continuous innovations – providing the tools and resources to navigate change and capture opportunity.

With more than $1.7 trillion in assets under management as of January 31, 2026, Franklin Templeton operates globally in more than 35 countries.

To learn more, visit franklintempleton.com and follow us on LinkedIn.

Franklin Resources, Inc. [NYSE: BEN]

All investments, including money funds, involve risk, including loss of principal. There are risks associated with the issuance, redemption, transfer, custody, and record keeping of shares maintained and recorded primarily on a blockchain. For example, shares that are issued using blockchain technology would be subject to risks, including the following: blockchain is a rapidly-evolving regulatory landscape, which might result in security, privacy or other regulatory concerns that could require changes to the way transactions in the shares are recorded.

This is a general announcement. Products and services referred to here may not be available in your region. Terms and conditions apply.

Copyright © 2026. Franklin Templeton. All rights reserved.

Crypto World

What Is the Most Probable Next Move for BTC as Momentum Stays Weak?

Bitcoin is trading under sustained pressure after losing key higher-timeframe support levels, with the price structure showing a clear transition from distribution to a developing downtrend. Momentum remains weak, and recent rebounds appear corrective rather than impulsive, keeping downside risk elevated in the near term.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, the asset continues to respect a descending channel while trading below major moving averages, confirming bearish market structure. The rejection from the mid-range resistance zone and subsequent sharp sell-off toward the low-$60K region reinforces that sellers still control trend direction.

Momentum indicators remain subdued, with RSI holding far below neutral and failing to produce strong bullish divergence. Unless the price can reclaim the $75K–$80K resistance cluster and close above the channel midpoint, the broader bias stays tilted toward continuation lower or prolonged consolidation near the $60K support level.

BTC/USDT 4-Hour Chart

The 4-hour chart shows a steep impulsive drop followed by choppy sideways movement, typical of a bear-flag or accumulation attempt after liquidation. Lower highs continue to form beneath descending dynamic resistance, signaling that buyers have not yet regained short-term control.

Key support sits around the recent wick low near the $60K area, while immediate resistance is clustered between roughly $73K and $76K. A breakout above this range would be the first technical signal of a momentum shift, whereas a breakdown below the mentioned support zone could accelerate another leg downward and lead to another round of massive liquidations.

Sentiment Analysis

Funding rate data shows sentiment cooling significantly compared to earlier overheated conditions, with the recent deeply negative prints suggesting reduced long-side leverage. This type of reset is constructive over the medium term but does not, by itself, confirm an immediate bullish reversal.

Overall market psychology appears cautious rather than euphoric, which often precedes range formation before the next major move. For sentiment to flip decisively bullish, price strength must return alongside rising but controlled funding and improving momentum across timeframes.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Finish the job on digital asset market structure

In Washington, the safest vote is often no vote at all, and the most convenient timeline is “next session.” But when it comes to the future of banking, financial markets and financial services, inaction is unacceptable. The United States needs crypto regulatory clarity to compete and succeed in the digitally networked financial system of the 21st Century.

The Senate is today at a crossroads on market structure legislation—policy designed to bring order to digital asset innovation, an increasingly important component of global finance. Failing to codify the “rules of the road” doesn’t just stall crypto; it invites regulatory chaos that harms banks and consumers alike, saps economic dynamism and forces innovation to drift offshore. Congress must choose whether America leads the next generation of finance or watches from the sidelines.

The current stalemate centers on a perceived conflict between banks and crypto platforms regarding interest yield and rewards on stablecoins—an issue already addressed by the GENIUS Act, signed into law by President Trump last year. The law permits crypto companies to offer rewards and incentives to customers for holding and using stablecoins made available by separate providers. Banks counter that such reward structures closely resemble traditional bank savings and checking products and, if left unchecked, could shift customer balances away from insured deposits without the same prudential requirements.

Framed this way, the disagreement carries more weight than it should. Yield and rewards are questions of design within a payments framework, not questions of systemic safety or financial stability. Treating them as existential risks has delayed an otherwise straightforward resolution, stalling progress on crucial market structure issues.

If one looks past talking points, a workable compromise is already available. Congress can explicitly enable federally regulated banks—including community banks—to offer yield on payment stablecoins. Banks gain a clear, federally sanctioned revenue and customer-acquisition opportunity in the stablecoin market. They obtain a straightforward way to secure customers and funds, especially important for community banks seeking to remain competitive in a world of mega-banks and scaled payment platforms. Crypto platforms, meanwhile, retain the incentive structures their customers expect and that are available under existing law. Congress gets to move market structure legislation forward and create a bill that can pass. And, most importantly, the American consumer benefits from increased competition and the ability to share in the yield potential of their own money.

Framing crypto as an existential threat to the community bank is a rhetorical tactic, not an economic reality. A recent empirical analysis finds no statistically meaningful relationship between stablecoin adoption and deposit outflows, suggesting stablecoins function primarily as transactional instruments rather than savings substitutes. In fact, properly regulated stablecoins may provide local and community banks with a pathway to modernize their payment offerings and reach new customers.

The rewards-yield question is a design issue that can be addressed without upending progress already made. A workable compromise exists that addresses banks’ economic interests, protects crypto innovation and respects the settled law of the GENIUS Act. Advancing on that basis keeps the broader market structure package intact and provides the legal clarity that the American economy deserves.

The Senate has the tools to resolve this impasse and to follow the strong leadership displayed by the White House. Failing to do so would be a choice, not an inevitability.

Crypto World

ETH Weakness Triggers Break Down

Tom Lee’s BitMine Immersion Technologies just bought another 35,000 ETH, expanding its already massive Ethereum treasury. Normally, such aggressive accumulation would signal confidence and support the stock price. Instead, the BitMine stock price fell nearly 2% in the past 24 hours and is now down more than 8% since February 13.

This creates a strange contradiction. BitMine keeps buying Ethereum, yet its stock keeps falling. At first glance, it looks like two different stories. But underneath, it might all be the same.

Sponsored

Sponsored

BitMine Adds More Ethereum, But the Stock Breaks Down

BitMine’s latest Ethereum purchase reinforces its strategy of becoming one of the largest ETH treasury companies. Buying 35,000 ETH, in two batches, in a single day, shows long-term conviction. The purchase pushed its total holdings to 4.371 million ETH, with combined cash and crypto reserves now worth around $9.6 billion.

Want more insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Companies usually increase holdings when they expect higher future prices, not lower ones. However, the stock price reaction tells a very different story. Since February 13, BitMine stock has dropped over 8%, and the technical chart now shows a breakdown.

The stock recently fell below the lower boundary of a bear flag pattern. A bear flag forms after a sharp drop, followed by a weak recovery.

When the lower support breaks, it often signals that the prior recovery structure has weakened and the stock has entered a technically fragile zone. Based on the pattern structure, the ongoing breakdown path could extend by over 50% if the weakness persists. However, this price decline does not automatically confirm active investor selling, which we will see in the next section.

This creates a disconnect between BitMine’s strengthening treasury position and its weakening stock price, suggesting that other external factors may be influencing the move.

Sponsored

Sponsored

Retail Buying Improves, But Big Money Remains Cautious

Despite the falling price, investor behavior beneath the surface shows some early strength. One key indicator is On-Balance Volume, or OBV. This metric tracks cumulative buying and selling pressure. When OBV rises, it means investors, possibly retail, are buying. possibly retail, are accumulating, even if the price has not responded yet.

Between February 9 and February 13, BitMine’s stock price formed a lower high, showing weakening price strength. However, OBV formed a higher high during the same period. It signals that buying activity is increasing quietly. This suggests retail investors were still accumulating BitMine stock despite the falling price.

Another important indicator, the Chaikin Money Flow, or CMF, also shows improving conditions.

CMF measures whether large capital is entering or leaving a stock. The indicator has been rising recently, showing improving inflows and showing divergence similar to OBV.

Sponsored

Sponsored

However, CMF remains below the zero line, which means overall capital flow into BitMine is still negative. This suggests that large institutional investors are not fully supporting the recovery yet. Retail investors are stepping in, but institutional money remains cautious.

Together, the rising OBV and improving CMF suggest that underlying participation is stabilizing rather than collapsing. This indicates that the recent breakdown may not be driven by aggressive selling from BitMine investors. Instead, the stock’s weakness appears more closely linked to Ethereum’s own price pressure, reflecting BitMine’s growing role as a high-beta proxy for ETH rather than a stock moving independently.

Ethereum Weakness Is Dragging BitMine Stock Price Lower

The biggest reason behind BitMine’s stock decline becomes clear when comparing it with Ethereum. BitMine’s price is highly correlated with Ethereum’s price. Correlation measures how closely two assets move together. BitMine’s correlation with Ethereum has increased from 0.50 to 0.52. This means the stock is behaving more like a direct proxy for Ethereum.

Sponsored

Sponsored

At the same time, Ethereum’s futures market shows rising bearish sentiment. The Ethereum long-short ratio has dropped to extremely low levels. This ratio measures how many traders expect prices to rise compared to fall. A low ratio means most traders expect further declines.

This bearish positioning directly impacts BitMine. Because BitMine holds a massive Ethereum treasury, its stock tends to weaken when Ethereum itself faces bearish pressure.

The technical chart now shows key levels ahead. BitMine has already lost support near $19. The next major support sits near $15. If that level breaks, the stock could fall toward $12 and even $9, which would be closer to the projected bear-flag breakdown level.

On the upside, recovery would first require reclaiming $21. A stronger bullish reversal would need a move above $29.

BitMine buying more Ethereum should have been a bullish signal. Retail investors are slowly accumulating, and capital inflows are improving. However, institutional money remains cautious, and Ethereum itself is facing bearish sentiment. Because BitMine now moves closely with Ethereum, its stock direction depends heavily on Ethereum’s strength. If Ethereum remains weak, BitMine may continue facing pressure regardless of its purchases.

On the surface, BitMine buying Ethereum and BitMine stock falling look like two different events. But in reality, they reflect the same underlying force.

Crypto World

Lemonade (LMND) Stock Jumps 17% After Q4 Earnings Beat

TLDR

- Lemonade (LMND) Q4 revenue hit $228.1 million, up 53.3% year-on-year, beating estimates of $217.6 million

- Adjusted EPS loss of -$0.29 beat analyst estimates of -$0.39 by $0.10

- Net premiums earned came in at $179.5 million, an 8.3% beat and 77.4% year-on-year growth

- Q1 2026 revenue guidance of $246–$251 million tops analyst consensus of $241.6 million

- Shares jumped over 17% in pre-market trading following the results

Lemonade (NYSE: LMND) shares surged more than 17% in pre-market trading on Thursday after the company posted Q4 results that beat analyst expectations across the board.

Revenue for the quarter came in at $228.1 million, up 53.3% year-on-year and ahead of the Wall Street consensus of $217.6 million. That’s a solid beat by any measure.

The company reported an adjusted loss of $0.29 per share, compared to analyst estimates of -$0.39. That’s a $0.10 beat, or roughly 26% better than expected.

Net premiums earned — the number analysts tend to watch most closely for insurers — came in at $179.5 million. That beat estimates of $165.8 million by 8.3% and grew 77.4% compared to the same quarter last year.

Pre-tax loss for the quarter was $20.6 million, representing a -9% margin.

Strong Premium Growth Drives the Beat

Net premiums earned have grown at a 47.3% annualized rate over the last five years, well above the broader insurance industry average.

Over the past two years, that growth rate has moderated to around 30% annually — still a healthy clip, and consistent with the company’s overall revenue trajectory.

Lemonade’s revenue has compounded at roughly 50.9% annually over the last five years. The most recent two-year annualized rate of 31% shows some deceleration but still points to strong underlying demand.

Net premiums earned made up about 70.8% of total revenue over the last five years, making it the company’s primary revenue driver.

Q1 2026 Guidance Tops Estimates

Looking ahead, Lemonade guided Q1 2026 revenue to between $246 million and $251 million. The midpoint of that range, $248.5 million, comes in above the analyst consensus of $241.6 million.

That forward guidance gave investors an additional reason to bid the stock higher on Thursday morning.

Lemonade operates across renters, homeowners, pet, car, and life insurance in both the U.S. and EU markets through its AI-powered digital platform.

The company’s Giveback program, which donates unused premiums to policyholder-selected charities, remains a differentiator in its positioning — though it’s the underlying growth numbers doing the heavy lifting right now.

Lemonade held a market capitalization of $4.91 billion at the time of reporting.

The company hosted a conference call Thursday at 8:00 am Eastern to discuss results.

Shares traded up 11.1% to $73.05 immediately after the report, with pre-market gains extending above 17% as the session progressed.

Crypto World

L2 vs Sharding vs Hybrid

Choosing the right scaling architecture is one of the most critical decisions in modern crypto development. The wrong choice can lead to high fees, slow performance, security risks, and stalled adoption. The right choice can unlock growth, institutional trust, and long-term sustainability. This choice impacts system resilience and future upgrade flexibility with the support of a crypto development company.

In this guide, we break down Layer-2, Sharding, and Hybrid models to help you select the most scalable, secure, and future-ready approach for your product.

Why Scalability Is the Biggest Challenge in Crypto Development

As blockchain adoption grows, platforms face increasing pressure to handle:

- Higher transaction volumes

- Lower latency expectations

- Rising compliance standards

- Complex integrations

- Institutional security requirements

Many crypto coin development projects fail not because of weak ideas, but because their infrastructure cannot scale sustainably.

Common challenges include:

- Network congestion

- Unpredictable transaction fees

- Poor user experience

- Limited throughput

- Regulatory constraints

These issues directly affect retention, revenue, and valuation.

Discover the Best Architecture for Your Platform.

Understanding the Three Main Scaling Approaches

Selecting the right scaling model is a foundational decision in crypto development. Your choice determines performance, cost structure, compliance readiness, and long-term growth. This decision becomes a powerful growth advantage with the right strategy and expert guidance.

1. Layer-2

Layer-2 solutions process transactions outside the main blockchain while inheriting its security. Only final transaction proofs are submitted to Layer-1. This model has become the backbone of many successful crypto development platforms because it delivers scalability without sacrificing reliability.

Layer-2 Overview

| Category | Details |

|---|---|

| Processing Method | Off-chain batching with on-chain settlement |

| Security | Inherits Layer-1 security |

| Transaction Cost | Very low |

| Tooling Ecosystem | Mature |

| Wallet Support | Strong |

| Ideal Users | Startups, DeFi, Payments, Gaming |

| Main Risks | Bridge security, L1 dependency |

For most crypto coin development services, Layer-2 offers the best balance between speed, affordability, and long-term stability. With proper implementation, Layer-2 becomes a strong foundation for sustainable growth and rapid market adoption.

2. Sharding

Sharding is designed for teams building new blockchain protocols and foundational infrastructure. It focuses on scaling at the network level rather than at the application layer.

Sharding Overview

| Category | Details |

|---|---|

| Processing Method | Parallel shard execution |

| Security | Shared validator security |

| Scalability | Very high (theoretical) |

| Deployment Speed | Slow |

| Development Complexity | High |

| Ecosystem Maturity | Limited |

| Ideal Users | Layer-1 builders, infrastructure teams |

| Main Risks | Cross-shard communication, security coordination |

For crypto development company teams working on next-generation blockchain networks, sharding enables deep technical control and long-term ownership. Sharding can position teams as leaders in protocol innovation, with strong expertise and planning.

3. Hybrid Architecture

Hybrid architecture is designed for organizations that require scalability, privacy, and regulatory alignment. It combines multiple systems to balance decentralization with operational control.

Hybrid Architecture Overview

| Category | Details |

|---|---|

| Processing Method | Private networks + L2 + public settlement |

| Security | Controlled with public anchoring |

| Privacy Level | High |

| Regulatory Support | Strong |

| Deployment Speed | Medium |

| Operational Cost | High |

| Ideal Users | Banks, RWA platforms, enterprises |

| Main Risks | Governance complexity, infrastructure cost |

Hybrid systems are widely used in institutional crypto coin development because they support compliance, governance, and enterprise integration. With the right technical partner, hybrid architecture becomes a future-ready platform for large-scale adoption.

Which Scaling Model Should You Choose?

| Business Priority | Best-Fit Model |

|---|---|

| Fast Market Entry | Layer-2 |

| Low Operational Cost | Layer-2 |

| New Blockchain Development | Sharding |

| Regulatory Compliance | Hybrid |

| Enterprise Privacy | Hybrid |

Most successful crypto projects begin with a clear architecture roadmap and evolve as their user base, revenue, and regulatory exposure grow. When supported by an experienced crypto development company, scalability becomes a competitive advantage that drives long-term success.

Get Personalized Guidance for Your Crypto Growth Strategy

Common Mistakes in Scalable Crypto Development

Many projects struggle not because of weak ideas, but because of avoidable strategic and technical errors. In scalable crypto development, early decisions have long-term consequences on performance, cost, security, and investor confidence. Working with an experienced partner helps reduce these risks, but founders and technical leaders must also understand the most common pitfalls.

Avoid these costly mistakes:

1. Choosing technology before defining the business model

Selecting Layer-2, sharding, or hybrid systems without understanding user needs, revenue flows, and compliance requirements often leads to misaligned infrastructure.

2. Ignoring compliance and regulatory planning early

Delaying legal and KYC considerations can block partnerships, exchange listings, and institutional funding.

3. Underestimating long-term infrastructure and maintenance costs

Many crypto coin development projects budget only for launch, not for ongoing node operations, indexing, monitoring, and upgrades.

4. Skipping independent security audits and testing

Unreviewed smart contracts expose platforms to exploits, fund loss, and reputation damage.

5. Delaying scalability planning until growth occurs

Retrofitting scalability after user adoption is expensive, risky, and disruptive.

Many failed crypto coin development projects made these mistakes, resulting in stalled growth, lost trust, and wasted capital. Planning scalability from the beginning is essential for long-term success.

Final Words

Choosing between Layer-2, sharding, and hybrid architecture is a strategic decision that directly impacts performance, compliance, and long-term growth. While Layer-2 suits most high-growth platforms, hybrid models serve regulated enterprises, and sharding supports core protocol builders. The key to success is aligning your technology with your business goals and working with a trusted cryptocurrency development company that understands both engineering and market realities.

Antier, a leading crypto development company, delivers end-to-end solutions, from architecture design and security audits to compliance integration and infrastructure optimization. We help businesses launch faster, scale smarter, and operate with confidence. Ready to build with confidence? Book your free consultation with Antier today and get a personalized scalability roadmap for your project.

Frequently Asked Questions

01. What is the importance of choosing the right scaling architecture in crypto development?

Choosing the right scaling architecture is crucial as it affects transaction fees, performance, security, and overall adoption. The right choice can lead to growth, institutional trust, and long-term sustainability.

02. What are the common challenges faced in crypto development related to scalability?

Common challenges include network congestion, unpredictable transaction fees, poor user experience, limited throughput, and regulatory constraints, all of which can impact retention, revenue, and valuation.

03. What are the three main scaling approaches discussed in the guide?

The three main scaling approaches are Layer-2, Sharding, and Hybrid models, each offering different benefits in terms of scalability, security, and future readiness for crypto platforms.

Crypto World

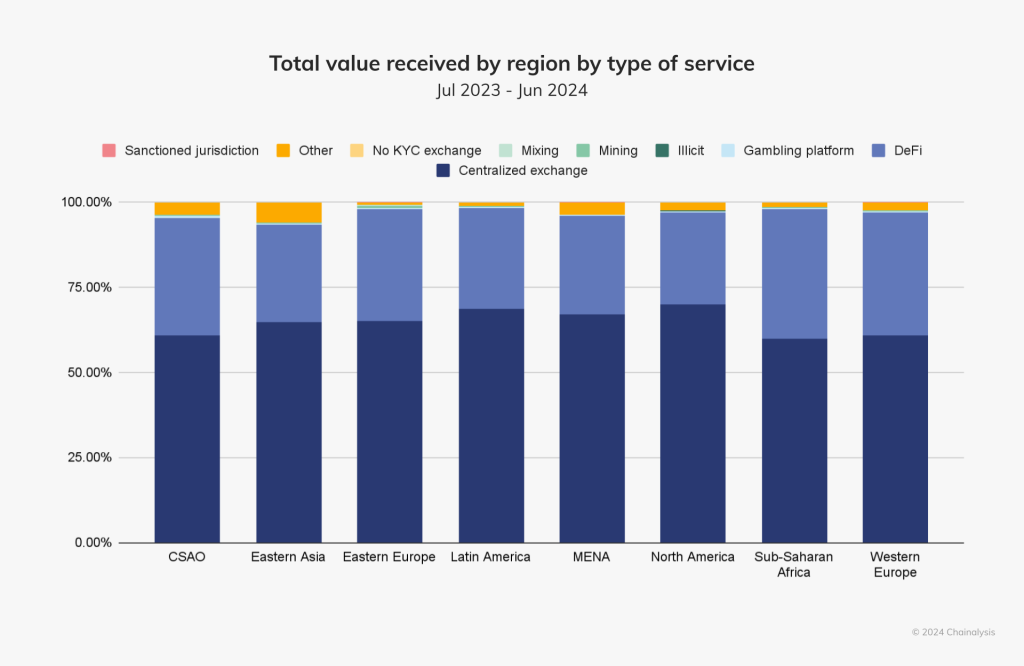

How to Build a LATAM Crypto Exchange Software That Scales Fast?

Cryptocurrency trading volumes in Latin America grew 63% and crossed $1.5 trillion between July 2024 and June 2025, establishing the region as one of the most crypto-progressive regions. In February 2026, Argentina, Brazil, and El Salvador dominated the headlines with noteworthy cryptocurrency developments. El Salvador plans a $100M tokenized investment program for localized SMEs, where Brazil considers eliminating crypto taxes and establishing a strategic Bitcoin reserve, and Argentina revokes the right to receive salaries in digital wallets. These signals demonstrate how LATAM governments and businesses are actively experimenting with new financial models.

Crypto finance group, a part of Deutsche Börse Group, entered LATAM after it sensed a “strong, concrete demand from institutions for well-structured, compliant crypto offerings”, in the words of Vander Straeten, the CEO.

If institutional capital and policy momentum are converging this fast, it is clear that LATAM crypto exchange development is commercially compelling in 2026 and beyond. However, this opportunity materializes only for platforms designed around the region’s real adoption mechanics.

What Actually Drives LATAM Digital Asset Adoption?

Crypto exchange software businesses can’t reach 200K users in LATAM by listing region-popular pairs or tokens or by increasing the leverage. The region’s digital asset adoption curve is driven by currency stability, cross-border transfer dependency, and mobile-first fintech habits.

By the end of 2025, LATAM had approximately 70 million unique crypto users, up from 73.7 million in Q3 2025 and 57.7 million earlier in the year. But the growth didn’t come from speculation but utility.

1. Inflation Hedging Via Stablecoins

Currency volatility remains the primary entry trigger in markets like Argentina, where inflation has stayed structurally high. In such markets, stablecoins function as everyday digital dollars rather than trading assets.

Stablecoins dominated more than 90% of exchange flows in Brazil, 62% in Argentina, and 48-60% region-wide. This proves that most users in the Latin American region hold balances for savings and payments, not trading.

2. Stablecoin Remittances Replacing Cash Corridors

LATAM received an estimated $165.1 billion in remittances in 2024, and another research predicted it would reach $174.4 billion by the end of 2025. Crypto has been increasingly used to bypass high-fee corridors.

Mexico, which is the second-largest corridor from the US, alone totaled $63.3 billion in remittances in 2024-25. Bitso, a leading crypto exchange software, handled over $6.5 billion in US-Mexico remittances, which totaled in 2024, representing more than 10% of the total corridor volume.

Stablecoin-based remittances cut costs by 50-80%, dropping from traditional 6-7% averages to 1-3%. High-fee LATAM corridors even benefit from 76% savings with stablecoins.

3. P2P and Social Money Behavior

Money movement in Latin America is socially mediated between families, communities, and informal networks, rather than institutionally intermediated. Crypto leads the peer-to-peer money movement in the region due to the popularity of social tipping and community payments. Many users from the region adopt wallets through contacts and not financial products.

Tron has sustained as a high-volume blockchain infrastructure supporting 78% of P2P transfers, which is an essential crypto exchange development feature for LATAM.

4. Mobile-Native Onboarding Expectations

LATAM fintech usage is mobile-centric, with 70% regional mobile penetration, and strong familiarity with chat-based payments. More users are expecting WhatsApp-style transfers and low-literacy onboarding flows with instant notifications and real-time balances in the application. So, crypto exchange software businesses in the region are competing with neobanks, not global trading apps.

In short, LATAM cryptocurrency exchange software scales when they behave like payment rails, not a trading terminal.

Essential Crypto Exchange Development Features Required to Reach 200K Users in Latin America

As stated above, the crypto adoption in LATAM comes from everyday dollar usage, social transfers, and entertainment-linked finance. The core stack, therefore, must combine payments, social, savings, custody, and engagement primitives from day 1.

1. Stablecoin-Centric Wallet Layer

The primary crypto exchange software development feature in LATAM isn’t order books but stablecoin wallets. Exchanges that nurture their in-built centralized or decentralized wallets can capture the audience that approaches crypto exchange apps as a dollar account. Here are essential crypto wallet components for LATAM exchanges:

- Multi-asset balances (USDT, USDC, crypto, and fiat)

- USD-denominated portfolio view as default

- Instant stablecoin swaps

- Near-zero-fee internal transfers

- Frictionless Onboarding

- Contact-based sending (phone / username)

2. Remittance & P2P Transfer Engine

As deduced from the statistics above, remittances create the strongest viral loop in the region. Peer-to-peer transfer engine forms another essential component for LATAM crypto exchange development. These features fetch revenues and act as customer magnets at the same time as each remittance/payment sender typically onboards 1-3 new users. So, for businesses planning to launch their digital asset exchange, the following capabilities are indispensable:

- Cross-border stablecoin transfers

- QR / phone-number payments

- P2P marketplace matching

- Chat-based or whatsapp style P2P transfers

- Local cash-out counterparties

- Corridor-specific liquidity routing

3. Local Fiat Rails

Instant and cost-efficient fiat access determines retention for crypto exchanges in LATAM. Users quickly abandon platforms that delay deposits and withdrawals beyond minutes or fail to support end-to-end money movement. For this reason, any cryptocurrency exchange software development targeting this region must implement Pix-style crypto-fiat rails as a foundational layer. These are the basic requirements:

- Brazil Pix-like instant rails

- Bank transfer APIs (SPEI-equivalent markets)

- Local PSP integrations

- Real-time deposit confirmation

- Instant fiat↔stablecoin conversion

Centralized exchanges can seamlessly be integrated with existing banking systems, leveraging APIs, and can also include fiat-stablecoin/crypto rails effortlessly. This is one of the reasons why centralized exchanges (CEXs) are the most popular crypto services in the Latin American region.

4. Social & Creator Money Layer

In countries like Latin America, where money flows socially before it flows financially, community finance features accelerate onboarding and adoption. Money movement mostly occurs within creator communities, family groups, and informal networks rather than purely financial contexts. As a result, cryptocurrency exchange software in the LATAM region increasingly functions as a social finance platform where users interact, tip, and transact around personalities and communities. Implementing creator monetization and community finance tools, along with the following features inside the exchange helps exchanges engage a wider audience.

- Creator wallets with public handles

- Stablecoin tipping & micro-payments

- Paid groups or gated channels

- Revenue split or referral distribution contracts

- Influencer referral wallets

- Community pools or shared wallets

Crypto trading platforms can also integrate Instagram-like feeds into their existing fintech platform to enhance the social effect of the platform. This way, the above-mentioned features make more sense.

5. Prediction Markets

In the LATAM region, speculative behavior is culturally linked to sports outcomes and macroeconomic events rather than traditional financial instruments. Prediction markets embedded inside crypto exchange software, therefore, attract users who may not engage with spot or derivatives trading but are comfortable with simple outcome-based participation. Cryptocurrency exchanges can create familiar entry points into digital asset usage and still generate liquidity, engagement, and revenue with the following:

- Football match outcome markets

- Election/inflation / FX outcome markets

- Simple yes/no contracts like Robinhood

- Stablecoin settlement pools

- Social rankings or leaderboards

6. Dollar Savings & Yield UX

Stablecoin savings represent one of the strongest retention drivers in inflation-prone Latin American economies, where users seek protection from local currency devaluation. Many users adopt crypto exchange wallets primarily to store digital dollars rather than to trade or transact. Crypto exchange software solutions that integrate accessible yield or savings interfaces can therefore retain liquidity and transition utility users into broader financial activity with gamification and rewards.

- One-tap stablecoin savings or vault accounts

- Transparent APY display in USD

- Recurring local-to-USD conversion

- Flexible withdrawals or redemption options

- Risk tier or yield source labeling

A LATAM exchange that reaches 200K users behaves as a dollar wallet, remittance network, social finance app with trading infrastructure and engagement layers operating in the background rather than the foreground.

Also Read>>>How To Launch Crypto Services With CNV-Ready White Label Exchange?

What are the UX Principles that Support Sustainable and Fast LATAM Crypto Exchange Software Growth?

As stated earlier, most LATAM cryptocurrency exchange software users are leveraging trading platforms for their financial needs. Exchanges that aim to scale quickly in the region must mirror familiar mobile money patterns and minimize cognitive and compliance friction at entry. Let’s again highlight the UX essentials for LATAM cryptocurrency exchange development:

1. USD-first balances as users in inflationary markets think in dollars even when transacting locally. Displaying portfolios and transaction values in USD by default aligns the app with real financial perception.

2. Simplified KYC entry and verification allow low-limit onboarding and accelerate first transactions while deferring heavier compliance steps to later stages of engagement.

3. WhatsApp-like transfers, chat-style sending, contact-based payments, and conversational confirmations reduce learning effort. Such financial experience matches how users already communicate over messaging apps.

4. Low-literacy-friendly flows can be created with icon-led actions, guided steps, and clear visual confirmations. This enables users across varied education levels to complete transfers and deposits without confusion.

5. Offline-friendly lightweight alerts, queued transaction updates, and low-bandwidth operation ensure efficient operation in environments with inconsistent connectivity.

Launch a LATAM-ready crypto exchange with Antier’s production-grade infrastructure

Closing: Why Most LATAM-Based Crypto Exchange Software Fail & How They Can Reach 200K Users in 6 Months

Many cryptocurrency exchange software launches in Latin America underperform, not because the markets lack demand, but because platforms are built around trading assumptions instead of regional money behavior. So, this is what businesses must avoid during crypto exchange development and launch;

- Launching trading before payments

- Providing USD as a secondary balance

- Slow fiat rails

- Heavy KYC at entry

- No cash-out liquidity

To make a crypto exchange software development project scale to hundreds of users in the first 180 days, crypto exchanges must primarily launch stablecoin wallets, local fiat rails, remittance loops, and social finance features.

This is why the fastest-growing LATAM cryptocurrency exchanges function less like trading terminals and more like payment networks layered with savings and social money features. Trading remains present, but it operates as a monetization layer that activates after users already rely on the app for everyday financial activity.

Antier offers LATAM-ready white label cryptocurrency exchanges and custom development solutions with the exact stack required to reach 200K users in 6 months. We support the full lifecycle from development and launch to growth and compliance. Connect today!

Frequently Asked Questions

01. What was the growth percentage of cryptocurrency trading volumes in Latin America between July 2024 and June 2025?

Cryptocurrency trading volumes in Latin America grew by 63% and crossed $1.5 trillion during that period.

02. What are some notable cryptocurrency developments in Argentina, Brazil, and El Salvador as of February 2026?

El Salvador plans a $100M tokenized investment program for SMEs, Brazil is considering eliminating crypto taxes and establishing a Bitcoin reserve, and Argentina has revoked the right to receive salaries in digital wallets.

03. What factors drive digital asset adoption in Latin America?

Digital asset adoption in LATAM is driven by currency stability, dependency on cross-border transfers, and mobile-first fintech habits, rather than speculation.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports11 hours ago

Sports11 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment17 hours ago

Entertainment17 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World20 hours ago

Crypto World20 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

(@Binansmartkid)

(@Binansmartkid)