Crypto World

DOGE TD Sequential 9 Signals Seller Exhaustion Near $0.090

TLDR:

- DOGE hits TD Sequential 9, signaling sellers may be exhausted after weeks of downside.

- Price finds support near $0.090, creating a potential zone for short-term relief rallies.

- RSI and MACD show fading bearish momentum, hinting at early strength returning.

- The monthly accumulation range of $0.077–$0.055 could set up DOGE for long-term upside toward $1.

DOGE TD Sequential indicates potential trend exhaustion after a persistent downtrend. The completed nine-count setup aligns with key support near $0.090, pointing toward a likely relief bounce or sideways consolidation before the next directional move.

TD Sequential Signals Short-Term Relief

DOGE’s daily chart shows a completed TD Sequential buy setup after nine consecutive bearish closes. This occurs at the end of a clear downtrend marked by lower highs and lower closes.

TD Sequential focuses on trend fatigue rather than strength, making this setup notable. Moreover, price action around the TD 9 marker confirms selling exhaustion.

The sharp, impulsive sell-off led into the signal, followed by a small-bodied candle with long lower wicks. This indicates that bears pushed hard but failed to hold control.

Consequently, buyers entered quietly near the $0.095–$0.090 zone, coinciding with prior support levels. Additionally, momentum indicators support the TD read.

RSI rose from oversold territory into the mid-40s, showing gradual strength. Meanwhile, MACD histogram compression suggests fading bearish momentum.

Therefore, the setup favors a short-term relief bounce. Furthermore, tweets from market observers emphasize that the 4-hour TD Sequential setup confirms seller exhaustion.

Price stabilized above $0.090 instead of breaking lower, carving higher intraday lows. As a result, fresh short positions face limited potential.

Finally, completed TD 9s often precede either a multi-candle relief rally or sideways consolidation. If DOGE holds above $0.088–$0.090, it may reach $0.105–$0.112 during the next mean reversion phase.

Consequently, statistical timing indicates that downside momentum is running out rather than signaling hype-driven strength.

Macro Accumulation Zone Suggests Long-Term Upside

On the monthly chart, DOGE trades within a macro accumulation range of $0.077–$0.055. This zone follows a deep correction from its all-time high and marks a re-accumulation phase.

Down ~89% from ATH, DOGE remains in extended high-timeframe demand. Furthermore, phased accumulation is recommended over lump-sum entries.

Pullbacks into $0.077–$0.070, combined with shifts in low-timeframe structure, provide higher-probability setups. Conversely, a monthly close below $0.055 would invalidate the long-term thesis.

Additionally, liquidity targets indicate potential upside. Price could test $0.156, $0.306, $0.48, and eventually $1 if monthly support holds.

Therefore, the macro accumulation zone combined with the TD Sequential buy setup signals that the market may quietly reset for the next upward move.

Ultimately, DOGE’s short-term relief bounce aligns with longer-term accumulation dynamics. Price stabilization, improving momentum, and statistical exhaustion suggest that the current levels offer a risk-reward opportunity for both swing and long-term positions.

Crypto World

Sberbank Launches Crypto-Backed Loans for Russian Corporations Amid Growing Digital Asset Demand

TLDR:

- Sberbank completed its first crypto-backed loan to mining company Intelion Data in late 2025 as a pilot program.

- Russia’s central bank permits cryptocurrency trading but prohibits domestic payments, creating specific use cases.

- Western sanctions have accelerated cryptocurrency adoption in Russian foreign trade and corporate transactions.

- The central bank plans to finalize comprehensive crypto asset legislation by July 1, 2026, for the sector.

Sberbank, Russia’s largest lender, is preparing to expand crypto-backed lending services to corporate clients following strong market interest.

The bank completed a pilot transaction with mining company Intelion Data in late 2025. This development positions Sberbank alongside domestic competitor Sovkombank in offering cryptocurrency collateral financing.

The move reflects broader adoption of digital assets in Russia’s corporate sector amid ongoing economic pressures.

Pilot Program Marks Entry Into Digital Asset Lending

The state-controlled bank issued its first crypto-backed loan to Intelion Data, accepting mined cryptocurrency as collateral. Sberbank declined to reveal the transaction value but confirmed the pilot’s success.

The bank’s spokesperson told Reuters on Thursday that corporate demand has driven the expansion plans, citing “strong interest from corporate clients.” The institution now seeks cooperation with Russia’s central bank to develop proper regulatory frameworks.

Sovkombank previously pioneered this lending category among Russian financial institutions. However, Sberbank’s entry carries greater weight given its dominant market position.

The bank serves millions of corporate and retail customers across Russia. Its participation validates cryptocurrency’s growing role in mainstream Russian finance.

Sberbank aims to extend services beyond cryptocurrency miners to any corporation holding digital assets. This broader approach could unlock significant lending opportunities.

Many Russian companies have accumulated crypto holdings through various business operations. The bank’s willingness to accept these holdings as collateral provides new liquidity options.

Regulatory Environment Shapes Market Development

Russia’s central bank classifies cryptocurrencies as foreign exchange assets under current regulations. The regulator “permits their purchase and sale but prohibits domestic payments” using digital currencies.

This framework creates specific use cases while limiting others. The distinction allows Russians to hold crypto while preventing it from replacing the ruble.

The regulator plans to complete comprehensive crypto asset legislation by July 1, 2026. Sberbank expressed readiness to collaborate on developing these rules.

Proper regulation could accelerate institutional adoption across Russia’s banking sector. The July deadline suggests authorities recognize cryptocurrency’s economic importance.

Western sanctions have accelerated cryptocurrency adoption in Russian foreign trade and domestic business. Traditional global currency transactions face restrictions following military actions in Ukraine.

Digital assets offer alternative settlement mechanisms outside conventional banking channels. This practical necessity has transformed cryptocurrencies from speculative instruments to functional business tools.

International banks are exploring similar services despite different regulatory environments. JPMorgan is examining crypto-backed loan products for institutional clients.

Wells Fargo already offers such financing options. These parallel developments indicate global banking’s gradual embrace of cryptocurrency collateral. Sberbank’s initiative aligns Russia’s financial sector with international trends while addressing specific domestic needs.

Crypto World

Solana Surges 25% From Lows: Has SOL Found Its Bottom or Is This Just a Dead-Cat Bounce?

TLDR:

- Solana rebounded 25% from $67.69 to $85, finding support at a critical January 2024 demand zone amid extreme fear.

- Record $6.371 billion USDT exchange inflow on February 6th provides liquidity fuel for potential sustained recovery.

- Volume indicators show cooling patterns suggesting oversold exhaustion, but sustainability depends on holding $85 resistance.

- Traditional markets crossing Dow 50,000 created risk-on sentiment, though SOL must prove this isn’t a temporary bounce.

<

Solana has posted a dramatic 25% recovery in 24 hours, rebounding from $67.69 to approximately $85 amid intense debate over the sustainability of this move.

The rally coincides with Bitcoin’s climb back toward $70,000 and record inflows of stablecoins into exchanges. However, traders remain divided on whether SOL has established a genuine bottom or merely staged a temporary relief rally destined to fail.

Dead-Cat Bounce or Genuine Reversal?

The cryptocurrency community faces a critical question as Solana tests resistance levels following its sharp decline.

SOL found support at a demand zone established in January 2024, a technical level that has proven significant in past price action. Yet the velocity of the bounce has raised concerns about its durability.

Market structure suggests both scenarios remain possible at this juncture. The extreme fear reading on sentiment indicators typically accompanies major bottoms, as capitulation creates buying opportunities.

Conversely, such rapid recoveries often fail when underlying demand proves insufficient to absorb overhead supply.

Volume analysis reveals increased activity during the recovery, but questions persist about buyer commitment. Dead-cat bounces characteristically feature sharp moves on moderate volume before rolling over. The current price action bears some hallmarks of this pattern, though definitive confirmation remains elusive.

Traditional markets provided a tailwind as the Dow Jones crossed 50,000 for the first time. This risk-on environment has lifted technology assets broadly, including cryptocurrencies. The challenge lies in determining whether this support will persist or prove fleeting.

Critical Tests Ahead for Solana’s Recovery

Solana’s spot and futures volume indicators show cooling trends, suggesting the recent selloff reached exhaustion.

This data point supports the bottom formation thesis, as oversold conditions often precede sustainable reversals. However, cooling alone does not guarantee upside continuation.

The $6.371 billion USDT inflow on February 6th represents the largest liquidity injection of Q1 2026. This capital could fuel additional gains if deployed strategically into quality assets.

Alternatively, these funds may remain on the sidelines if investors lack conviction about the recovery’s legitimacy.

Technical resistance now emerges as the decisive factor in determining SOL’s trajectory. The $85 level represents a key battleground where sellers may reassert control.

A failure to break convincingly above this zone would strengthen the dead-cat bounce argument considerably.

The January 2024 demand area must hold on to any retest to validate the bottom formation. If SOL returns to the $67 range and breaks lower, the recent rally will be dismissed as a false start. Bulls need to defend this support zone while pushing the price above overhead resistance.

Market participants are scrutinizing order flow for evidence of institutional accumulation versus retail speculation. Large wallet movements and exchange withdrawal patterns will provide clues about smart money positioning. These metrics will help distinguish between a temporary squeeze and a genuine demand resurgence.

The answer to whether Solana has bottomed or merely bounced will unfold over the coming sessions. Price action around current levels holds the key to resolving this debate decisively.

Crypto World

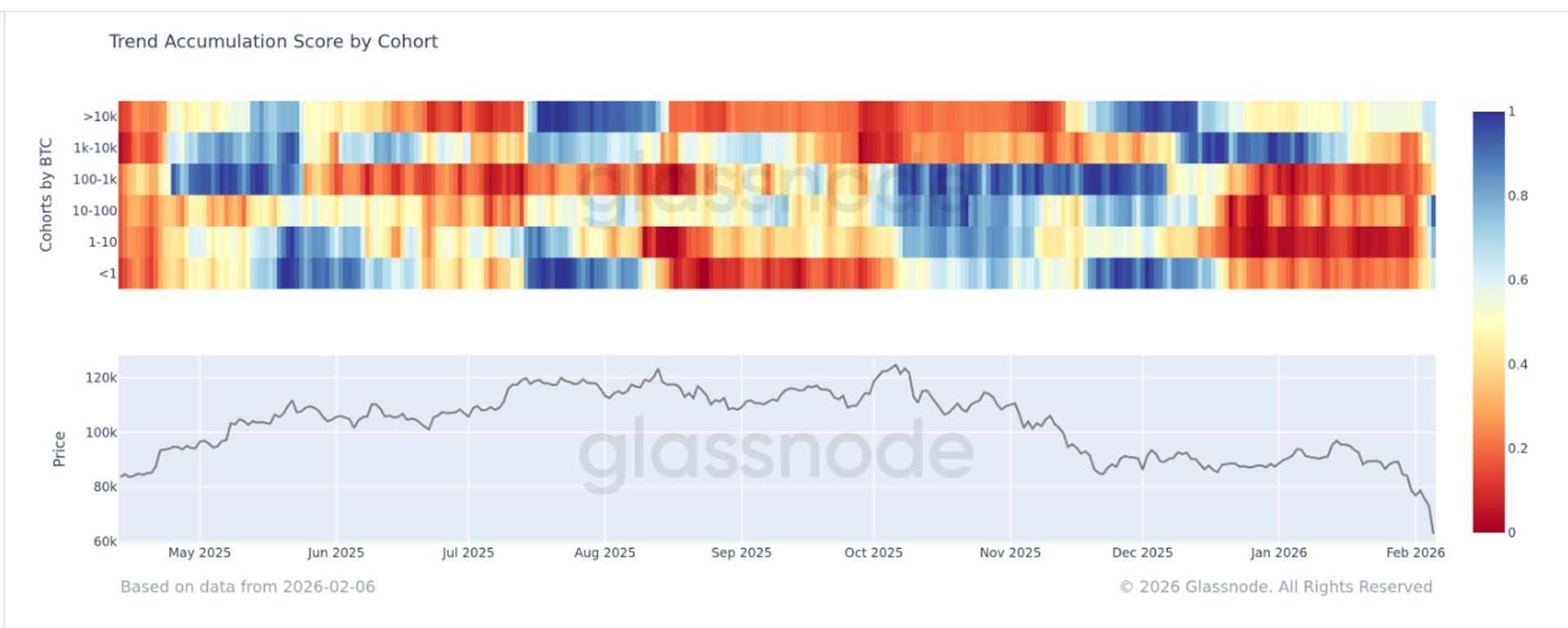

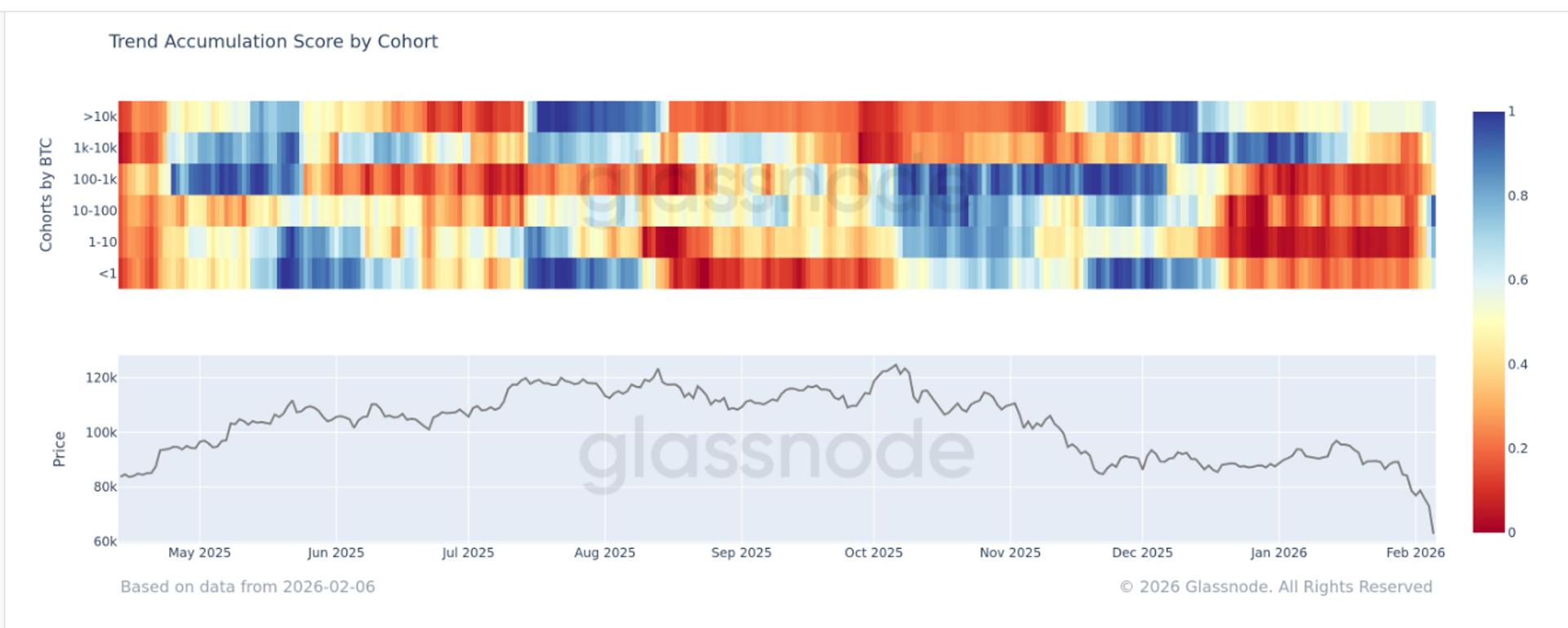

BTC is seeing accumulation across all cohorts, according to Glassnode

As February began, bitcoin was trading around $80,000, with whales dipping their toes in while retail investors were running for the exits. Just one week later, bitcoin plunged to $60,000 on Feb. 5, and the market is now showing a broad shift toward accumulation across nearly all cohorts as investors start to see value.

This change follows one of the most severe capitulation events in bitcoin’s history. Which now appears to be evolving into a more synchronized accumulation phase.

Glassnode’s Accumulation Trend Score by cohort highlights this shift in behavior. The metric measures the relative strength of accumulation across different wallet sizes by factoring in both entity size and the amount of BTC accumulated over the past 15 days. A score closer to 1 signals accumulation, while a score closer to 0 indicates distribution.

On an aggregate basis, the Accumulation Trend Score by cohort has now climbed above 0.5, reaching 0.68. This marks the first time since late November that broad-based accumulation has been observed, a period that previously coincided with bitcoin forming a local bottom near $80,000.

The cohort showing the most aggressive dip buying has been wallets holding between 10 and 100 BTC, particularly as prices fell toward $60,000

While it remains uncertain whether the ultimate bottom is in, it is evident that investors are once again finding value in bitcoin after a drawdown of more than 50% from its October all-time high.

Crypto World

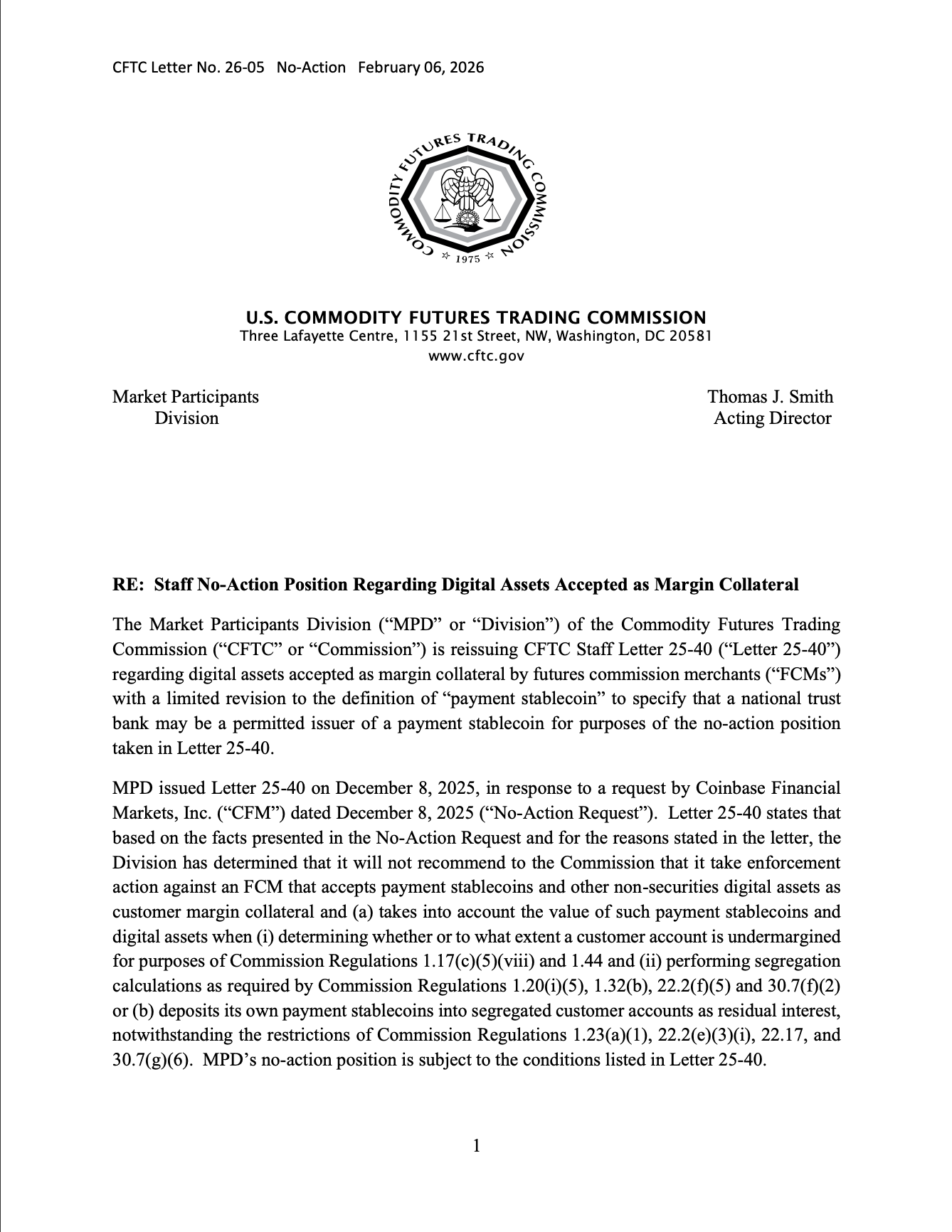

National Trust Banks Now Stablecoin Issuers

The Commodity Futures Trading Commission (CFTC) has broadened the universe of entities eligible to issue payment stablecoins, expanding the scope beyond traditional banks to include national trust banks. In a reissued staff communication, the agency clarified that national trust banks — institutions that typically provide custodial services, act as executors, and manage assets on behalf of clients rather than engaging in retail lending — can issue fiat-pegged tokens under its framework. The update, formally an amended Letter 25-40 dated December 8, 2025, signals a regulatory opening for non-retail institutions to participate in the stablecoin issuance landscape while staying within the agency’s risk controls and disclosure requirements. This move sits within a broader push to bring more clarity and supervision to U.S. dollar stablecoins as lawmakers push for a comprehensive framework.

The CFTC’s updated stance came alongside a wider regulatory environment shaped by the GENIUS Act, a flagship effort signed into law in July 2025 to establish a comprehensive regime for dollar-backed stablecoins. In parallel, the Federal Deposit Insurance Corporation (FDIC) has put forward a proposal that would allow commercial banks to issue stablecoins through a subsidiary, subject to FDIC oversight and alignment with GENIUS Act requirements. Taken together, the developments reflect a concerted push by U.S. regulators to delineate who can issue stablecoins, how reserves are managed, and what governance standards apply to ensure stability and consumer protection.

“The [Market Participants] Division did not intend to exclude national trust banks as issuers of payment stablecoins for purposes of Letter 25-40. Therefore, the division is reissuing the content of Letter 25-40, with an expanded definition of payment stablecoin.”

The evolution of guidance and policy in this space underscores the Biden-era regulatory stance on digital assets, even as political dynamics shift. A key inflection point cited by supporters and critics alike is the GENIUS Act, which aims to codify how dollar-pegged tokens are issued, backed, and redeemed in the U.S. financial system. The act envisions a framework in which stablecoins are tethered to high-quality assets—principally fiat currency deposits or short-term government securities—and prioritizes robust reserve backing over more speculative, algorithmic approaches. The law’s emphasis on 1:1 backing is central to the U.S. regulatory thesis that stablecoins should function as trusted payment rails rather than speculative instruments.

The interest in national trust banks as issuers reflects a broader attempt to harness existing financial infrastructure for stablecoin issuance while ensuring strong oversight. Custodial banks and asset managers are well-positioned to manage reserve assets and redemption mechanics, provided they meet the GENIUS Act’s criteria and the CFTC’s risk-management expectations. Yet the legal architecture remains complex: the GENIUS Act excludes algorithmic and synthetic-stablecoin models from its defined regulatory regime, signaling a deliberate preference for on-chain dollars that are backed by explicit, liquid reserves. This delineation matters for developers, exchanges, and institutions weighing whether to launch or scale stablecoin products within the U.S. market.

From a policy perspective, the FDIC’s December 2025 framework signals a parallel track for banks that want to participate in the stablecoin economy. The FDIC proposal contemplates a governance and oversight regime where a parent bank may issue stablecoins through a subsidiary, with the parent and subsidiary jointly evaluated for GENIUS Act compliance. In practical terms, banks would need clear redemption policies, transparent reserve management, and robust risk controls to withstand liquidity stress scenarios. The proposal’s emphasis on cash deposits and allocations in short-term government securities as backing underlines a risk-conscious approach to reserve management, designed to protect consumers and maintain trust in the stability mechanism.

Taken together, the CFTC, GENIUS Act, and FDIC proposals illustrate a coordinated effort to formalize who can issue stablecoins and under what safeguards. While this regulatory contour aims to reduce systemic risk and increase transparency, it also raises questions about competition, innovation, and the pace at which institutions adapt to new requirements. For market participants, the implications are twofold: potential increases in the number of credible issuers and more stringent standards for reserves and governance. The exact shape of implementation will hinge on subsequent rulemaking, agency guidance, and how firms align their compliance programs with the evolving framework.

Why it matters

First, the expansion to national trust banks widens the potential issuer base for U.S. dollar stablecoins, potentially increasing liquidity and providing new on-ramps for institutions that already manage large asset pools and custodial services. By enabling custody-focused banks to issue stablecoins, regulators acknowledge that core trust and settlement functions can be integrated with digital tokens in a controlled, audited environment. This could accelerate the adoption of digital-dollar payments for settlement, payroll, and cross-border transactions, provided these tokens remain backed by transparent reserves and subject to robust supervisory oversight.

Second, the GENIUS Act’s emphasis on 1:1 backing and the exclusion of algorithmic models create a delineated path for stablecoins to be treated as genuine state-of-the-art payment instruments rather than speculative vehicles. The act’s framework aims to minimize counterparty risk and maintain trust among users, merchants, and financial institutions. For issuers, this means that any new product entering the U.S. market will need to demonstrate verifiable reserves and clear redemption policies, which could influence how liquidity is sourced, how collateral is allocated, and how risk is modeled. Investors and traders will scrutinize reserve disclosures and governance structures more closely, knowing that regulatory compliance is a central prerequisite for broader market access.

Third, the FDIC’s proposed model for bank-issued stablecoins introduces a layered supervisory process that ties parent institutions to a dedicated subsidiary. While this structure could isolate risk and enhance accountability, it also adds a layer of administrative complexity for banks seeking to participate in the stablecoin economy. For the broader crypto ecosystem, the development signals a maturing regulatory environment in which stablecoins can function as reliable payment rails if they meet explicit, enforceable standards. This clarity could encourage more mainstream financial players to engage with digital currencies, provided the business models remain aligned with prudential risk controls.

What to watch next

- December 8, 2025 — CFTC confirms amended Letter 25-40 and expands the scope to national trust banks.

- FDIC December 2025 proposal — Banks may issue stablecoins through a subsidiary under FDIC oversight; track the Federal Register notice and subsequent rulemaking.

- GENIUS Act implementation timeline — Monitor any updates on how the regime will be phased in and how enforcement expectations will be communicated.

- Regulatory alignment — Any further CFTC or FDIC guidance clarifying reserve composition, redemption windows, and reporting obligations for issuers.

Sources & verification

- CFTC press release 9180-26 announcing the amended Letter 25-40 and inclusion of national trust banks as potential issuers of payment stablecoins.

- Federal Register notice or FDIC filing outlining the proposed framework for banks issuing stablecoins via a subsidiary and GENIUS Act alignment.

- Donald Trump stablecoin law signed in July 2025 — coverage detailing GENIUS Act context and regulatory aims.

- GENIUS Act overview — cointelegraph Learn article explaining how the act could reshape U.S. stablecoin regulation.

Regulatory expansion widens who can issue payment stablecoins

The CFTC’s decision to explicitly include national trust banks as potential issuers of payment stablecoins marks a notable shift in the agency’s interpretive posture. By reissuing Letter 25-40 with an expanded definition of “payment stablecoin,” the commission provides a clearer pathway for custodial institutions to participate in the stablecoin economy without stepping outside the boundaries of current risk management expectations. The language adopted by the Market Participants Division signals a deliberate attempt to harmonize regulatory definitions with evolving market realisms, where large custody providers and asset managers already perform core settlement and custody functions that could be extended to tokenized dollars.

At the core of the GENIUS Act is a drive to formalize stablecoins as trusted payment instruments. The act aims to curb regulatory ambiguity by outlining precise reserve requirements and governance standards, ensuring that dollars backing stablecoins are protected by transparent, high-quality assets. The law’s emphasis on 1:1 backing—whether through fiat deposits or highly liquid government securities—reflects a preference for stability over novelty. By excluding algorithmic or synthetic stablecoins from the GENIUS framework, policymakers intend to minimize complexity and counterparty risk, reducing the likelihood of sudden depegging or reserve shocks.

The FDIC’s forthcoming framework—allowing banks to issue stablecoins through a subsidiary under its oversight—complements the CFTC’s redefinition. It signals a practical progression toward integrating traditional banking structures with digital-asset processes, provided banks meet the GENIUS Act’s criteria. The proposed safeguards emphasize redemption policies, reserve adequacy, and ongoing financial health assessments, underscoring the regulators’ focus on resilience and public trust. In broad terms, the convergence of these initiatives points to a gradual, monitored expansion of the stablecoin ecosystem rather than a rapid, unbounded growth of new issuers.

Market participants should watch not only the formal issuers that emerge but also the evolving standards for disclosures, stress testing, and governance. As more entities participate in this space, the demand for clear, consistent regulatory expectations will intensify, prompting issuers to adopt rigorous compliance programs and robust risk controls. The balance regulators seek is clear: widen access to stablecoins as practical payment tools while maintaining sufficient guardrails to protect consumers, financial stability, and the integrity of settlement systems.

Crypto World

CFTC Amends Guidance, Includes National Trust Banks As Stablecoin Issuers

The Commodity Futures Trading Commission (CFTC), a US financial regulator, reissued a staff letter on Friday to expand the criteria for payment stablecoins to include national trust banks, recognizing their eligibility to issue the fiat-pegged tokens.

The CFTC amended Staff Letter 25-40, which was issued on December 8, 2025, to include national trust banks, financial institutions allowed to function in all 50 US states.

National Trust Banks typically do not provide retail banking services like lending or checking accounts. Instead, they offer custodial services, act as executors on behalf of clients and provide asset management services. The CFTC letter said:

“The [Market Participants] Division did not intend to exclude national trust banks as issuers of payment stablecoins for purposes of Letter 25-40. Therefore, the division is reissuing the content of Letter 25-40, with an expanded definition of payment stablecoin.”

The letter reflects the regulatory climate in the US toward stablecoins after US President Donald Trump signed the GENIUS stablecoin bill into law in July 2025.

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act is a comprehensive regulatory framework for US dollar stablecoins, blockchain tokens pegged to the dollar.

Related: CFTC pulls Biden-era proposal to ban sports, political prediction markets

The Federal Deposit Insurance Corporation outlines a plan for banks to issue stablecoins

In December 2025, the Federal Deposit Insurance Corporation (FDIC), a US banking regulator, proposed a framework under which commercial banks could issue stablecoins.

The proposal allows banks to issue the tokens through a subsidiary subject to oversight by the FDIC, which will gauge whether both the parent company and subsidiary are compliant with GENIUS Act requirements for issuing stablecoins.

These requirements include redemption policies, sufficient backing collateral for the stablecoin in the form of cash deposits and short-term government securities, as well as assessments of the bank and subsidiary’s overall financial health.

Under the GENIUS Act, only overcollateralized stablecoins, which are backed 1:1 with fiat currency deposits or short-term government securities, like US Treasury Bills, are recognized.

Algorithmic stablecoins and synthetic dollars, which rely on software to maintain their dollar pegs or complex market trading strategies, were excluded from the regulatory framework.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Erebor Secures First New US Bank Charter in Trump’s Second Term

The United States has granted a nationwide banking charter to a crypto-friendly startup for the first time during President Trump’s second term, signaling a rare regulatory opening for niche lenders that straddle technology and finance. The Office of the Comptroller of the Currency confirmed Erebor Bank’s charter, allowing the lender to operate across the country and serve a market long underserved after the 2023 Silicon Valley Bank collapse, according to people familiar with the matter cited by the Wall Street Journal. Erebor begins life with about $635 million in capital and a mandate to back startups, venture-backed firms, and high-net-worth clients while pursuing a differentiated set of services tailored to cutting-edge tech sectors.

The approval comes as part of a broader movement to redefine how traditional banks engage with crypto-friendly business lines, fintech models, and complex asset classes. Erebor’s launch is anchored by a roster of prominent technology investors, including Andreessen Horowitz, Founders Fund, Lux Capital, 8VC and investor Elad Gil. Palmer Luckey, Oculus co-creator and Erebor’s founder, will sit on the bank’s board but will not manage day-to-day operations, a structure described to sources close to the matter. The bank’s regulatory path has already included a deposit insurance clearance from the Federal Deposit Insurance Corporation (FDIC), underscoring a careful balance between innovation and consumer protections.

Industry observers note that Erebor is positioning itself to address a unique demand: lending to tech-forward firms whose assets, including crypto holdings or private securities, may require non-traditional collateral frameworks. The bank’s blueprint also envisions a future where blockchain-based payment rails enable rolling settlements—a feature that diverges from the conventional, business-hours timetable of many U.S. banking rails. The project’s backers have framed Erebor as a “farmers’ bank for tech,” a nod to the expertise needed to evaluate startups whose assets aren’t always easy to quantify by traditional metrics.

In late 2024, Erebor’s capital raise and strategic milestones were mirrored in the broader tech-finance press, with coverage highlighting the bank’s ambitious scope and its founders’ willingness to explore uncharted territory in U.S. banking. The Bank’s trajectory has been tied to a broader push by high-profile investors to reshape crypto banking in the United States, with conversations around regulatory alignment and product suitability for crypto-related activities continuing to unfold across the ecosystem. The project’s narrative also intersects with broader industry discussions about how banks can adapt to support frontier technologies while maintaining prudent risk controls.

As Erebor evolves, it plans to offer lending backed by crypto holdings or private securities, and to finance acquisitions of high-performance AI hardware—an area where demand has grown as generative models and specialized chips have become central to competitive advantage. The bank’s leadership argues that technical sophistication matters when assessing borrowers whose value is tied to innovation, rather than conventional asset bases. This approach could help fill a vacuum left by traditional banks that pulled back from specialized tech lending after the SVB disruptions.

Coverage over the following months tied Erebor’s story to a broader wave of crypto-native banking efforts and regulatory discussions. In related reporting, industry observers noted the ongoing conversation around how new charters might coexist with crypto custody, on-chain settlement, and risk-management frameworks designed to protect consumers and institutions alike.

Key takeaways

- The OCC granted Erebor Bank a nationwide charter, enabling operations across the United States and formalizing a crypto-friendly banking approach for a niche client base.

- The lender starts with approximately $635 million in capital and aims to serve startups, venture-backed firms, and high-net-worth clients underserved after the 2023 SVB collapse.

- Erebor’s backers include Andreessen Horowitz, Founders Fund, Lux Capital, 8VC and Elad Gil; Palmer Luckey sits on the board but will not manage daily operations.

- FDIC deposit insurance was approved, adding a layer of consumer protection to the bank’s regulatory standing.

- The bank intends to explore blockchain-based payment rails for continuous settlement and to offer credit lines backed by crypto holdings or private securities, plus financing for AI hardware purchases.

Tickers mentioned:

Market context: The Erebor charter comes amid a broader regulatory dialogue around crypto-friendly banking and fintech partnerships in the United States, reflecting ongoing efforts to reconcile innovation with safety standards and consumer protections. Regulatory attention remains focused on how specialized banks can support frontier technologies while maintaining robust risk controls in an evolving landscape.

Why it matters

For startups navigating a capital-intensive growth phase, Erebor represents a potential new channel that blends traditional banking with a deep understanding of technology-driven business models. By anchoring lending strategies to assets such as crypto holdings and private securities, the bank could provide credit facilities that are more attuned to the capital structures of venture-backed companies and cutting-edge manufacturers. This approach could help alleviate liquidity strains that some tech teams faced during the SVB downturn, offering a more diversified banking relationship beyond the conventional routes that often rely on standard collateral.

Investors and builders may view Erebor’s platform as a test case for how specialized financial services can evolve to accommodate emerging industries—defense tech, robotics, AI-driven manufacturing, and other sectors where conventional metrics do not easily capture value. The combination of a robust capital base, notable backers, and a charter that enables nationwide operations could set the stage for more banks to calibrate their risk models toward the needs of frontier tech ecosystems. Yet the model also invites scrutiny around governance, liquidity risk, and the management of crypto-related exposures, especially as ongoing debates about stablecoins, custody, and on-chain settlement unfold in regulatory circles.

In a landscape where crypto and traditional finance increasingly intersect, Erebor’s trajectory could influence competitor strategies and policy discussions about how banking products should adapt to serve technology-forward clients without compromising safety. The bank’s willingness to pursue blockchain rails and crypto-backed credit arrangements signals a broader shift in which regulated institutions experiment with novel settlement mechanisms and capital structures to support rapid innovation.

What to watch next

- The pace and scale of Erebor’s onboarding of startups and venture-backed clients as it transitions from charter approval to full-scale nationwide operations.

- Regulatory updates on risk management practices, asset collateralization standards, and any changes to how blockchain-based settlement features integrate with conventional banking rails.

- Further disclosures on the composition of loan portfolios, particularly those backed by crypto holdings or private securities, and how these exposures are hedged or liquidated if market conditions tighten.

- Details on governance and operational oversight as Luckey participates on the board, including any updates to management structure or external audits.

Sources & verification

- Wall Street Journal report on the OCC charter approval for Erebor Bank. https://www.wsj.com/finance/banking/hobbit-inspired-startup-becomes-first-new-bank-greenlighted-by-trump-2-0-0d6075ef

- FDIC press release confirming deposit insurance approval for Erebor Bank NA. https://www.fdic.gov/news/press-releases/2025/fdic-approves-deposit-insurance-application-erebor-bank-na-columbus-ohio

- Preliminary conditional approval of Erebor by the OCC. https://cointelegraph.com/news/peter-thiel-erebor-silicon-valley-bank-rival-approval

- Valuation context following a Lux Capital-led round that propelled Erebor to a multi-billion-dollar valuation. https://cointelegraph.com/news/palmer-luckey-erebor-valuation-occ-fdic-crypto-bank

Regulatory milestones redefine crypto-friendly banking in the US

Erebor’s charter marks a notable inflection point in the regulatory landscape for crypto-adjacent banking endeavors. The OCC’s decision to charter a bank expressly positioned to engage with technology-driven clients signals a pathway for growth that balances innovation with the protections expected of federally chartered lenders. The FDIC’s deposit insurance approval further certifies a structural commitment to consumer protection, a critical factor for institutions considering crypto-backed financing models or on-chain settlement capabilities.

As Erebor moves toward full-scale operations, the industry will watch how its governance and risk frameworks evolve, how the bank manages collateral volatility tied to crypto markets, and how its product suite—ranging from crypto-backed lending to blockchain settlement rails—is received by regulators, customers, and rival banks. The broader banking ecosystem is contending with questions about capital adequacy, liquidity management, and the compatibility of new tech-driven products with established supervision regimes. Erebor’s progress could influence the speed at which others pursue niche charters and crypto-friendly banking partnerships in a climate where innovation and caution must be carefully balanced.

Crypto World

BlockDag presale finally ends while Remittix sees thousands of holders join its new 300% bonus offer

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BlockDag closes $453m presale ahead of Feb 16 listing as Remittix surges with 300% bonus and growing investor demand.

Summary

- Remittix raises $28.9m and launches its crypto-to-fiat platform Feb. 9, drawing strong investor attention in 2026.

- CertiK-audited Remittix gains traction with live wallet access, real-world utility, and a limited 300% bonus offer.

- Over 703m tokens sold as Remittix positions itself as a leading PayFi project bridging crypto and fiat payments.

The crypto market is buzzing, especially with the recent conclusion of BlockDag’s presale. The project has raised a massive $453 million, and now, with its official exchange listing set for February 16th, it’s on the verge of disrupting the blockchain world. However, one project is quickly gaining more traction, offering tremendous potential for early investors: Remittix.

As BlockDag’s presale wraps up, Remittix, with its 300% bonus offer, is drawing in thousands of new investors, catching the eye of those looking for the next big crypto opportunity. With its wallet already live and a crypto-to-fiat platform launching soon, investors are racing to buy RTX tokens before the presale ends, and the next XRP-like opportunity slips away.

BlockDag’s rise amid a transforming crypto landscape

BlockDag’s presale has certainly caught the attention of the crypto community. With over 312,000 participants and a price launch target of $0.05, this project is poised to make waves in the industry. The tech behind BlockDag promises to support 15,000 transactions per second, with predictions pointing to price highs of $0.30 by February 26, $0.20 for March, and even $0.45 by April.

However, the window for massive returns in BlockDag is likely narrowing. With the presale completed, the project is now shifting to the exchange phase, where exponential growth may be limited compared to the early entry points. While it’s expected to perform well post-listing, the real opportunity has passed for presale investors. This gives rise to the perfect question: What’s next for those seeking higher returns in the ever-shifting world of crypto?

Remittix: The next major opportunity in crypto

While BlockDag has its potential, Remittix is quickly becoming the top crypto to buy now in 2026, offering something different to its community. With over $28.9 million raised through the sale of 703.7 million tokens, currently priced at $0.123 each, Remittix stands out as a project with real-world utility that’s already beginning to change the crypto landscape.

The crypto-to-fiat platform launching on February 9, 2026, is a game-changer, giving users the ability to convert crypto into fiat seamlessly. As the Remittix wallet is already available on the Apple App Store with Google Play coming soon, it is evident that Remittix is taking all the right steps to provide lasting value.

Remittix has not only raised significant funds but has also passed a rigorous CertiK security audit, further cementing its position as a safe and trustworthy investment. The 300% bonus offer, which has caught the attention of many new crypto buyers, is yet another reason why this project is attracting so much attention.

Paired with Remittix’s secure and transparent development, this incentive has already led thousands of holders to join the Remittix community. With so much value locked in the token, the 300% bonus gives buyers the chance to maximize their returns before Remittix becomes a household name in the crypto world.

Remittix is poised to become one of the top crypto assets in the world, offering the following strengths:

- Over 93% of the total token supply has already been sold, creating scarcity that could drive up the value of $RTX in the near future.

- The upcoming launch of the crypto-to-fiat platform on February 9th promises to solve one of the biggest problems in the crypto world: bridging digital assets and real-world finance.

- With its CertiK verification, transparent development process, and early-stage community support, Remittix is one of the most promising new altcoins to consider for long-term growth.

- The 300% bonus offer, exclusively available to email subscribers, creates a sense of urgency for investors to act before the opportunity is gone.

- The wallet’s already live, and Android users can expect it soon, positioning Remittix as a leader in the growing PayFi sector.

Why now is the time to act

With only a few tokens remaining, there’s no time to wait. Over 93% of the supply has already been sold, and as more listings are set to be announced, the window for securing tokens at this price is closing fast. For those searching for the best crypto to buy now in 2026, Remittix offers a rare opportunity for exponential growth.

The crypto market is volatile, but Remittix provides a clear use case and a roadmap that gives it staying power. With its upcoming crypto-to-fiat platform and PayFi ecosystem, this is a project built to thrive in the real world, not just on speculative hype. The combination of security, real-world utility, and community engagement positions Remittix as one of the best investments you can make today.

For more information, visit the official website or socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin Mining Difficulty Drops by 11% Amid Steep Market Downturn

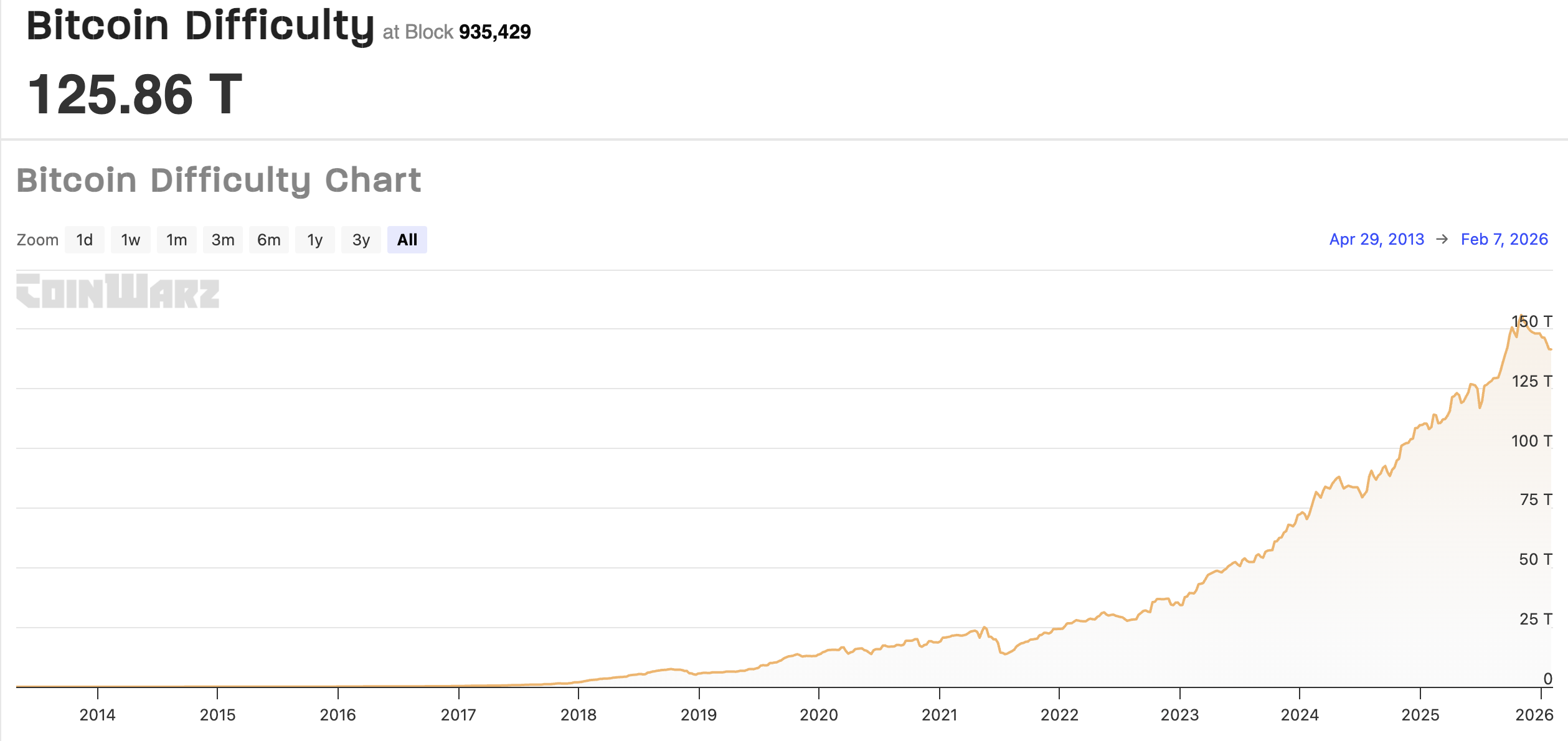

The Bitcoin network mining difficulty, a metric tracking the relative challenge of adding new blocks to the Bitcoin (BTC) ledger, fell by about 11.16% in the last 24 hours, the worst drop in a single adjustment period since China’s 2021 ban on crypto mining.

Bitcoin mining difficulty is at 125.86 T and took effect at block 935,429, data from CoinWarz shows. The average block time is over 11 minutes, overshooting the 10-minute target.

Difficulty is projected to fall again in the next adjustment on February 23 by about 10.4% to 112.7 T, according to CoinWarz.

China announced a ban on crypto mining and began enforcing a crackdown on digital assets in May 2021, resulting in several downward difficulty adjustments between May and July 2021, ranging from 12.6% to 27.9%, according to historic data from CoinWarz.

The steep downward adjustment came amid a broad crypto market downturn, which crashed the price of Bitcoin by over 50% from the all-time high of over $125,000 to a low of $60,000, and a winter storm in the US that caused temporary miner downtime.

Related: Bitcoin’s ‘miner exodus’ could push BTC price below $60K

Winter Storm Fern sweeps through the US and curtails miner hashrate

A severe winter storm swept through the United States in January, impacting 34 states across 2,000 square miles with snow, ice and freezing temperatures that disrupted electrical infrastructure.

The disruption to the power grid caused US-based Bitcoin miners to temporarily curtail their energy usage and halt operations, reducing the total network hashrate, the amount of computational power expended by miners to secure the Bitcoin protocol.

Foundry USA, a US-based mining pool and the biggest mining pool by hashrate in the world, briefly lost about 60% of its hashing power amid winter storm Fern.

The mining pool’s total hashing power declined from nearly 400 exahashes per second (EH/s) to about 198 EH/s in response to the storm.

Foundry USA’s hashrate recovered to over 354 EH/s, the mining pool’s hashing power at the time of this writing, and it still commands 29.47% of the market share, according to Hashrate Index.

However, the total Bitcoin network hashrate declined to a four-month low in January amid deteriorating crypto market conditions and miners shifting operations to AI data centers and other forms of high-performance computing.

Magazine: Bitcoin mining industry ‘going to be dead in 2 years’: Bit Digital CEO

Crypto World

2026’s Best Presale Crypto: Can IPO Genie, Ruvi AI, & Nexchain Really Compete with ZKP Crypto?

New crypto presales release every week, but what truly sets apart the heroes? If we’ve learned anything from 2025, traders find value in real-life utility, spotlighting projects like IPO Genie, Ruvi AI, and Nexchain as standout choices in Q1 2026.

IPO Genie at $0.000119 unlocks private investments from $10, promising 1000x returns on $1,000 amid $1 million raises. Ruvi AI at $0.020 powers a creator rewards super app with over $5 million secured, while Nexchain at $0.12 bridges chains for multi-chain scalability.

But, Zero Knowledge Proof (ZKP), towers above the other names as the best presale crypto of 2026. What makes this project special is that it’s self-funded over $100 million for privacy-protected AI on a ready Layer-1. Its 17-stage auction is actively targeting a record $1.7 billion accumulation. Read on to see what makes these projects special in 2026.

1. Zero Knowledge Proof (ZKP): AI & Privacy-Based Auctions Target 600x Upside

ZKP crypto or Zero Knowledge Proof (ZKP) leads 2026 presales with a ready Layer-1 blockchain, self-funded by over $100 million for robust infrastructure. This platform enables privacy-protected AI computations, letting enterprises process encrypted data without exposing sensitive details. Its focus on real technology sets it apart in a crowded market.

The presale runs as a 450-day Initial Coin Auction across 17 stages, ensuring fair and transparent pricing. Stage 2 now releases 190 million ZKP tokens daily from a 4.75 billion pool, with unallocated tokens burned permanently to enforce scarcity. Already $1.78 million raised signals accelerating interest toward a $1.7 billion target.

Stage 1 launched with 11.8 billion tokens at 200 million daily, building early momentum. Each phase reduces supply progressively, ramping up competition as buyers secure shares at uniform prices by connecting wallets. This structure creates natural demand pressure.

By Stage 17, daily releases drop 80% to just 40 million tokens, compounding tightness over time. Burns remove unsold supply daily, tightening circulation as awareness builds through 2027. Participants compete harder in later rounds for dwindling allocations.

Analysts project 100x to 600x returns from current levels. This math stems from controlled distribution and rising utility in finance, healthcare, and AI sectors. ZKP stands as the best presale crypto for blending privacy innovation with proven tokenomics.

2. IPO Genie: Democratizing Private Investments

IPO Genie revolutionizes access to private and pre-IPO deals, letting everyday investors start with just $10 using AI-driven vetting for company data, growth, and risks. The $IPO token powers platform access, voting on deals, priority entry, and participation rights. Priced at $0.000119, it has raised nearly $1 million in two months, signaling strong early traction in Q1 2026. This utility-focused model positions IPO Genie as the best presale crypto for bridging Web3 with traditional private markets.

A $1,000 investment secures 8.4 million $IPO tokens, boosted to 11.59 million with 20% welcome and 15% referral bonuses. Potential returns shine: 100x hits $138,000, 500x reaches $690,000, and 1000x yields $1.38 million. Analysts track it alongside peers for real tokenomics over hype, making early entry a calculated play on democratized wealth creation.

3. Ruvi AI: Rewarding Creators & Engagement Incentives

Ruvi AI stands out as a Web3 AI super app bundling image, video, and text generation tools, where users earn RUVI tokens for usage and content creation shared in its marketplace. At $0.020, token utility covers advanced features, payments, buying/selling, voting, and rewards distribution. Having raised over $5 million in later presale phases, it taps AI and creator economy trends, differentiating from fee-based platforms by fostering ownership. Ruvi AI earns its spot as the best presale crypto through practical utility that aligns user activity with token demand.

This reward system fuels engagement, as creators monetize directly while accessing premium AI capabilities. Analysts highlight its momentum in 2026, where AI integration meets sustainable economics, promising growth as adoption scales across content creators seeking fair compensation.

4. Nexchain: Bridging Chains

Nexchain tackles blockchain interoperability as a Layer-1 solution for seamless cross-chain communication, using AI to optimize network performance and reduce transfer costs. Priced at $0.12 per NEX, its token handles transaction fees, staking, voting, and developer tools. Long-term value hinges on developer adoption for infrastructure plays, making Nexchain the best presale crypto for builders eyeing multi-chain futures.

Analysts group it with utility peers for its focus on real-world scalability in Q1 2026. Success builds gradually as ecosystems interconnect, rewarding patient investors with staking yields and governance influence amid rising demand for unified blockchain operations.

To Summarize

Not all crypto presales are built the same, and 2026 is proving that utility-driven projects consistently outperform hype-led launches. IPO Genie, Ruvi AI, and Nexchain each solve real problems, opening private markets to retail investors, rewarding creators through AI-powered tools, and enabling seamless cross-chain scalability.

However, Zero Knowledge Proof (ZKP) clearly separates itself from the pack. Unlike early-stage concepts, ZKP launches with a fully funded Layer-1 blockchain, over $100 million in self-backed capital, and live infrastructure purpose-built for privacy-preserving AI computation. Its 17-stage Initial Coin Auction introduces enforced scarcity through daily token burns, shrinking supply by 80% by the final phase while targeting a historic $1.7 billion raise.

For traders prioritizing long-term upside, disciplined tokenomics, and enterprise-grade utility, ZKP crypto’s 600x potential stands out as the best presale crypto of 2026,

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Cardano (ADA) Make-or-Break Moment: Why $0.13 Could Trigger a 4,500% Expansion

TLDR:

- Cardano ADA trades at $0.27 within a critical higher timeframe bullish order block spanning $0.13 to $0.18

- Weekly closes above $0.13 maintain bullish structure; breaks below signal invalidation to $0.0755

- Historical pattern mirrors 2021 setup when ADA rallied 3,400% from similar accumulation zones

- Technical targets project sequential moves to $1.20, $3, $5, and $10 if current support holds firm

Cardano trades at $0.27 after a brutal 93% correction from recent highs, positioning the asset at a crossroads that could determine its entire cycle trajectory.

Technical analysis reveals a higher timeframe bullish order block between $0.18 and $0.13, where price action now consolidates.

The $0.13 level has emerged as the single most critical support, with analysts suggesting its defense or breach could unlock vastly different outcomes for ADA holders.

Critical Support Zone Holds Multi-Cycle Significance

The current price structure shows ADA testing support levels that haven’t been relevant since early accumulation phases.

After dropping 78% from the $1 local high reached six months ago, the asset now rests on multi-year support above $0.24.

This consolidation zone represents more than temporary support—it marks the battleground where cycle direction gets determined.

Crypto analyst Patel’s recent assessment emphasizes the importance of the $0.13 to $0.18 range as a higher timeframe bullish order block.

This technical zone has absorbed selling pressure while maintaining structural integrity. The key observation centers on weekly closes rather than intraday wicks, suggesting institutional participants are defending this range on meaningful timeframes.

Historical context adds weight to the current setup. During the 2021 bull run, ADA surged 3,400% to reach its all-time high of $3.10.

The subsequent bear market erased 92.89% of that value through a grinding correction lasting into 2026. Price action now sits within the same type of accumulation zone that preceded the previous explosive rally.

The distinction between a 10x cycle and continued downside rests entirely on the $0.13 threshold. Weekly closes above this level maintain the bullish structure and keep expansion targets in play.

Conversely, a confirmed break below invalidates the accumulation thesis and opens the door to deeper retracement toward the $0.0755 level, which represents the final line for high-risk positions.

Expansion Potential Hinges on Support Defense

The path forward splits into dramatically different scenarios based on how price interacts with current support. Bulls defending the $0.18 to $0.13 zone position ADA for what analysts describe as the last accumulation opportunity before parabolic movement.

The technical framework projects sequential targets that extend well beyond previous all-time highs if the base holds.

Immediate resistance appears at $0.4374, identified as the reclaim zone requiring confirmation. Breaking this level would shift momentum and validate that accumulation has concluded.

Beyond that point, the technical roadmap outlines targets at $1.20, $3, $5, and ultimately $10 during a full bull market expansion phase. These projections assume the current support structure remains intact through weekly timeframes.

The magnitude of potential upside reflects patterns observed in previous cycles. Cardano’s 2021 performance demonstrated the explosive potential when accumulation zones break into expansion phases.

The current compression from $1 down to $0.27 has created similar conditions—extended consolidation that historically precedes major directional moves.

Risk management parameters are unusually clear in this setup. The $0.13 weekly close functions as an unambiguous invalidation point for the bullish thesis. Traders can structure positions within the order block while maintaining defined exit strategies.

The asymmetric setup offers compelling upside if support holds, with downside risk clearly mapped to specific price levels that would trigger structural breakdown and force reassessment of cycle expectations.

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Tech1 day ago

Tech1 day agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports17 hours ago

Sports17 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports8 hours ago

Former Viking Enters Hall of Fame

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat1 day ago

NewsBeat1 day agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat19 hours ago

NewsBeat19 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World2 days ago

Crypto World2 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Crypto World2 days ago

Crypto World2 days agoHeads Up! Bitcoin Enters Capitulation Mode, Trades In a ‘Phase That Rewards Discipline Over Prediction’