Crypto World

Ethereum Price Faces 50% Breakdown Risk as DeFi TVL Slides

The Ethereum price is down more than 5% over the past few days and has now slipped below a key short-term structure. On February 10, ETH fell under $1,980 after failing to hold a narrow rebound channel. This move followed a sharp decline in DeFi activity and weakening institutional flows. Yet, despite the pressure, large holders have started adding again.

The question is simple: is this early accumulation, or just a temporary pause before another leg lower?

Pattern Break Confirms Weak ‘Big Money’ Support

Ethereum’s recent rebound from early February formed inside a bear flag. This structure acted like a short-term recovery attempt, not a trend reversal. On February 10, the price slipped below the lower boundary of the flag, triggering a pattern break with over 50% crash potential, as predicted in a previous Ethereum analysis.

Sponsored

Sponsored

This move mattered because it happened alongside weak money flow.

The Chaikin Money Flow, or CMF, measures whether capital is entering or leaving an asset using price and volume. When CMF moves above zero, it often shows large-scale institutional-style buying. When it stays below, it signals weak participation.

Between February 6 and February 9, ETH bounced, but CMF never crossed above zero. It also failed to break its descending trendline. This meant the rebound lacked strong backing from large investors.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In simple terms, the price moved up, but serious money did not follow strongly enough. When rebounds happen without strong CMF backing, they tend to fail. That is exactly what happened here. Once buying momentum stalled, sellers regained control and pushed ETH lower.

This confirms that the pattern break was not random. It was possibly supported by fading big money flows. But technical weakness alone does not explain the full picture.

DeFi TVL and Exchange Flows Reveal a Structural Problem

A deeper issue sits inside Ethereum’s DeFi activity.

Total Value Locked, or TVL, measures how much money is stored inside decentralized finance platforms. It reflects real usage, capital commitment, and long-term confidence. When TVL rises, users are locking funds. When it falls, capital is leaving.

Sponsored

Sponsored

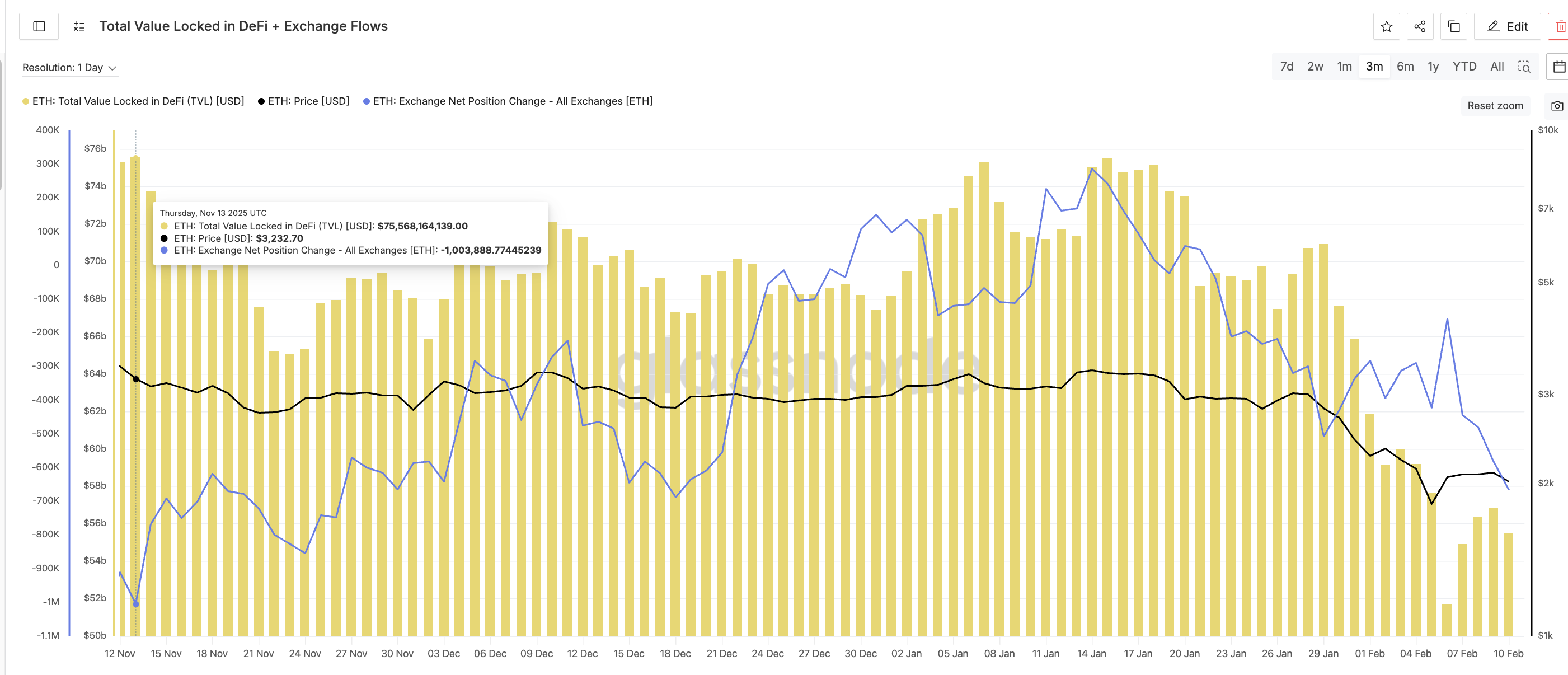

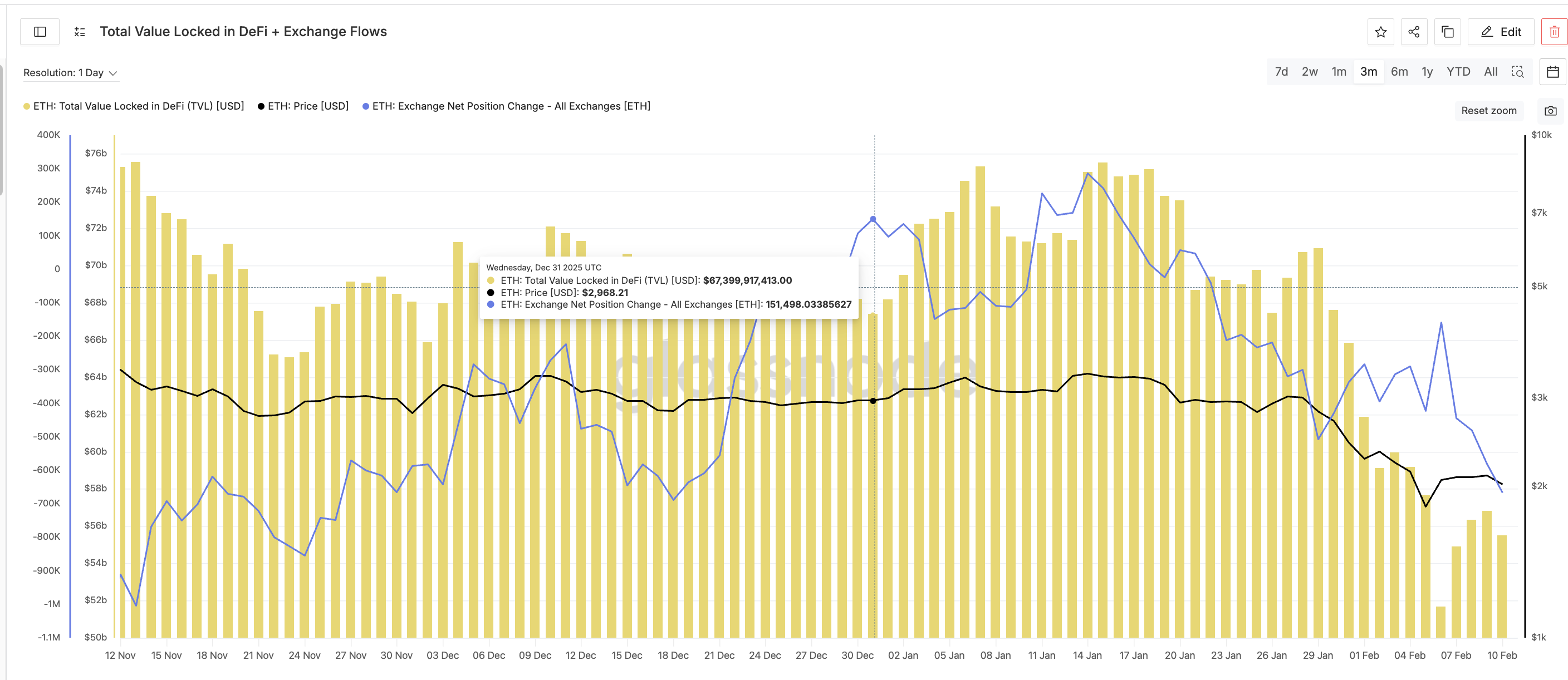

BeInCrypto analysts combined the TVL and exchange flow dashboards to show a clear pattern.

On November 13, DeFi TVL stood at $75.6 billion. At the same time, ETH traded around $3,232. The exchange net position change was strongly negative, indicating more coins were leaving exchanges than entering. Investors were possibly moving ETH into self-custody.

That was a healthy setup.

By December 31, TVL had dropped to about $67.4 billion. ETH fell to $2,968. Exchange flows flipped positive. Around 1.5 million ETH moved onto exchanges. Selling pressure increased. Now look at February.

On February 6, DeFi TVL touched a three-month low of $51.7 billion. ETH was near $2,060. Exchange outflows weakened sharply (the Net Position line reached a local peak). Even though net flows stayed slightly negative, buying pressure collapsed, as explained by the February 6 peak. This shows a repeating relationship.

When TVL falls, exchange inflows rise or outflows weaken. That means capital is shifting from long-term use toward potential selling.

Sponsored

Sponsored

As of February 10, TVL has only recovered to around $55.5 billion, down almost $20 billion from the mid-November levels. That is still close to the three-month low. Without a stronger recovery, exchange-side pressure is likely to return. So the pattern break is happening while Ethereum’s core usage remains weak.

That is a structural problem, not just a chart issue.

Whale Accumulation and Cost Basis Explain the Ethereum Price Support

Despite weak technicals and falling TVL, whales have not fully exited.

Whale supply tracks how much ETH is held by large wallets, excluding exchanges. Since February 6, whale holdings fell from about 113.91 million ETH to nearly 113.56 million. That confirmed the distribution during the breakdown. But over the past 24 hours, this trend paused.

Holdings edged back up slightly, from 113.56 million ETH to 113.62 million, showing small-scale accumulation. This suggests that whales are testing support rather than committing fully.

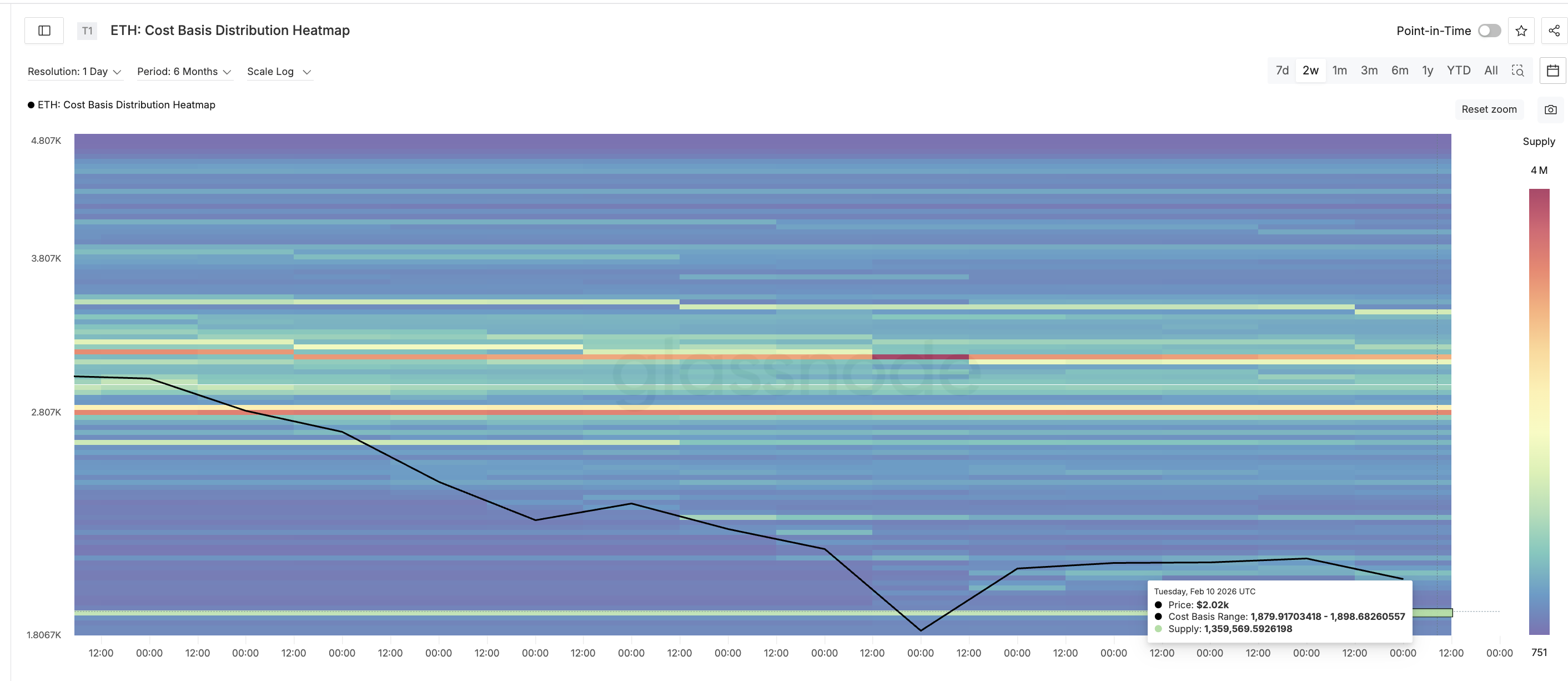

The reason becomes clear when looking at cost basis data.

Sponsored

Sponsored

Cost basis heat maps show where large groups of investors bought their coins. These zones often act as support because holders defend their entry prices. For Ethereum, a major cluster sits between $1,879 and $1,898. Around 1.36 million ETH were accumulated in this range. That makes it a strong demand zone.

The current price is hovering just above this area.

As long as ETH stays above this band, whales have an incentive to defend it. Falling below would push many holders into losses and likely trigger heavier selling. This explains the cautious buying.

Whales are not betting on a rally. They are possibly protecting a critical cost zone.

From here, the Ethereum price structure becomes clear.

Support sits near $1,960 and then $1,845. A daily close below $1,845 would break the main cost cluster and confirm deeper downside risk. If that happens, the next major downside zones sit near $1,650 and $1,500.

On the upside, ETH must reclaim $2,150 to stabilize. Only above $2,780 would the broader bearish structure weaken. Until then, rebounds remain weak.

Crypto World

Apptronik Secures $520 Million Funding to Advance Humanoid Robot Production

TLDR

- Apptronik raised $520M, bringing its Series A round to $935M for Apollo robot production.

- Apollo robots are deployed in factories and warehouses with partners like Mercedes-Benz and GXO Logistics.

- Apptronik’s robots will collaborate safely with humans for tasks like lifting, sorting, and transporting.

- The company faces competition from Tesla’s Optimus and Chinese humanoid developers like Unitree and Agility.

- Apptronik plans to expand its presence and begin fulfilling robot orders in 2027, with $1B in projected demand.

Apptronik, a robotics startup based in Austin, Texas, has raised $520 million in funding, bringing its Series A round to $935 million. The new capital will help the company refine and mass-produce its Apollo humanoid robots, aiming to lead the market ahead of competitors such as Tesla and Chinese developers.

Apollo Robots in Early Deployment

Apptronik’s Apollo robots are already deployed in several factories and warehouses under strategic partnerships with companies like Mercedes-Benz, GXO Logistics, and Jabil. These robots operate within predefined areas using sensors and light curtains to ensure safe interaction with human workers.

Today, we’re excited to announce that we’ve raised more than $935M in Series A funding with a $520M Series A-X extension round, bringing our total capital raised to nearly $1B.

This milestone is a powerful vote of confidence in our mission: building AI-powered humanoid robots…

— Apptronik (@Apptronik) February 11, 2026

The robots pause when a human crosses into their operational space, with plans for more advanced collaborative capabilities. CEO Jeff Cardenas stated that the Apollo robots will eventually be able to work alongside humans safely, performing tasks such as lifting, sorting, and transporting components.

This technology aims to make the robots more adaptable to dynamic factory environments. Apptronik believes that the versatility of humanoid robots will provide immense value by enabling a single robot to perform multiple tasks.

Apptronik AI Competition and Industry Growth

Apptronik faces stiff competition from other humanoid robot developers, including Tesla’s Optimus project and Chinese companies like Unitree and Agility Robotics. While Tesla has invested heavily in its robot development, its humanoid project remains in early-stage research.

Apptronik, however, has made strides in refining its Apollo robots, with its partnerships already demonstrating the robots’ practical applications in industrial settings. The recent funding and partnership with Google DeepMind mark major milestones for Apptronik.

Google’s Gemini Robotics AI models are now enhancing the Apollo robots’ capabilities, enabling faster, more efficient operations. Apptronik’s CEO refrained from making specific predictions about the robot’s future production timelines but indicated that they will continue refining their technology in the coming months.

The company also plans to expand its presence in Austin and open a new office in California later this year. Apptronik is focused on preparing its robots and facilities for mass production, with expectations to fulfill orders starting in 2027. B Capital’s Howard Morgan is optimistic about the future, predicting that demand for the Apollo robots will reach $1 billion in orders within a few years.

Crypto World

XRP price forecast: bulls falter amid fresh bearish sentiment

- XRP price dropped to $1.35 as selling pressure resumed.

- Bears have pushed Bitcoin back under $68k and altcoins are mirroring the decline.

- Short-term, bearish sentiment could trigger a sell-off to $1 or lower.

XRP continues to face bearish pressure as the latest attempts to establish an upside momentum stall, with prices down 14% in the past week.

In early trading on Wednesday, the Ripple cryptocurrency fell to lows of $1.35, extending its pullback from recent highs following a retest of $1.53.

The waning upside momentum suggests a potential further downside for the altcoin, whose performance mirrors the renewed selling pressure currently throttling Bitcoin and Ethereum bulls.

As of writing, market metrics showed derivatives data largely bearish, with retail traders signalling their downbeat perspective through dwindling XRP futures Open Interest.

Massive liquidations, most of which have been lopsided against longs, add to the retail indecision.

XRP price technical outlook

XRP’s struggles align with a cautious crypto environment. Bitcoin’s failure to hold above $70k means widespread selling that hasn’t spared top altcoins like XRP.

Technical indicators for XRP price, such as fading RSI, highlight potential weakness. If buyers fail to reclaim $1.50 and target $2.00, XRP risks testing key support levels near $1.22 and $1.13.

Conversely, breaking $2 might flip sentiment and allow bulls to target the $2.75 resistance level. The falling wedge pattern on the 4-hour chart signals such a breakout.

XRP price: likely bullish catalysts?

US XRP ETF demand has faded in recent weeks, while technical indicators highlight bears’ control.

Despite the gloom, several catalysts could spark a reversal for XRP holders.

Regulatory developments, particularly ongoing efforts to pass the Clarity Act, could be a key driver of crypto market sentiment.

A spike in adoption amid further regulatory clarity will cascade to XRP.

Whale accumulation also continues to ramp up as large holders add to positions.

This shows conviction and has the short-term effect of stabilizing prices ahead of what analysts see as an inevitable broader market recovery.

Stablecoin growth on the XRP Ledger adds another layer of utility, drawing institutional interest and increasing network activity.

DeFiLlama data shows that while DeFi TVL has declined, stablecoin market cap has jumped from around $331 million in early February to over $418 million as of writing.

Amid usage for XRPL, Ripple USD is also gaining traction.

Ripple has entered various partnerships aimed at tokenising traditional fund structures on the XRP Ledger, one of the moves set to accelerate growth.

Meanwhile, spot exchange-traded fund inflows have cooled in recent weeks. However, cumulative net inflows have topped $1.2 billion, and could explode when sentiment flips.

Crypto World

Sam Bankman-Fried Seeks FTX Retrial Citing Fresh Testimony

FTX founder Sam Bankman-Fried is legally challenging his 25-year sentence, filing a motion for a new trial on February 10.

The thirty-three-year-old cites “fresh testimony” that allegedly proves the defunct exchange was solvent.

The filing potentially throws a spanner in the liquidation process, with the claim that the Department of Justice suppressed critical evidence during the original proceedings.

Why Is Bankman-Fried Seeking a New FTX Trial Now?

It has been years since FTX’s November 2022 collapse wiped out $8 billion in customer funds.

Since then, self-custody has become a buzzword for retail investors, who have had to live through multiple bear markets while US regulators prepare comprehensive legislation to ensure it doesn’t happen again.

However, SBF isn’t done fighting. Serving a 25-year sentence, the disgraced mogul filed a pro se motion citing Rule 33 of the Federal Rules of Criminal Procedure.

Bankman-Fried argues that his original conviction was a miscarriage of justice because key witnesses never took the stand.

While global enforcement efforts often successfully target financial malfeasance through standard audits, SBF contends the DOJ’s rapid prosecution missed the actual financial reality of FTX.US.

He maintains that the money was “always there,” a claim he intends to support with evidence that was allegedly unavailable during his initial defense.

What the New Motion Claims

The new filing specifically hinges on declarations from Daniel Chapsky, the former head of data science at FTX.US.

According to the motion, Chapsky’s data analysis contradicts the government’s narrative regarding the $8 billion shortfall.

Bankman-Fried also points to potentially favorable testimony from former co-CEO Ryan Salame, who is currently serving a seven-and-a-half-year sentence.

In the legal documents filed Feb. 10, Bankman-Fried alleges that prosecutors intimidated witnesses and that Judge Lewis Kaplan showed “manifest prejudice” by rushing the verdict. He is demanding a new judge for any retrial, framing the original proceedings as politically motivated “lawfare”.

While the industry has largely shifted toward a compliance-focused market structure to prevent another FTX-style meltdown, SBF argues the DoJ prevented him from showing the jury data that proved solvency.

Legal experts note that Rule 33 motions face an incredibly high bar, often viewed as a “Hail Mary” in federal appeals.

What This Means for Crypto Regulation

While a retrial is statistically unlikely, the motion keeps the FTX wounds fresh for active traders and victims awaiting restitution.

The persistence of the case highlights the long-term risks of offshore exchange failures.

Regulators are likely to use this continued legal drama to justify stricter oversight. We are already seeing similar crackdowns globally, such as when Venezuela’s anti-corruption investigation shut down exchanges in a massive sweep.

For the market, this serves as a stark reminder that the legal fallout from the 2022 crash is far from over, even as prices recover.

Discover:

The post Sam Bankman-Fried Seeks FTX Retrial Citing Fresh Testimony appeared first on Cryptonews.

Crypto World

White House Stablecoin Talks Stall as Banks Push for Yield Restrictions

High-stakes negotiations between U.S. banking giants and crypto executives at the White House hit a wall yesterday, ending in an impasse over stablecoin yields.

Banks demanded restrictive “prohibition principles” on holder rewards, while crypto leaders argued such bans would suffocate innovation in the digital dollar economy.

Key Takeaways

- Banks are pushing for a broad ban on all financial and non-financial benefits tied to holding payment stablecoins.

- Crypto firms, including Coinbase and Ripple, rejected the proposals, warning they would stifle competition.

- Treasury Secretary Scott Bessent faces a hard deadline of July 2026 to finalize GENIUS Act implementation rules.

Will Banking Interests Kill the Yield?

The core friction stems from the implementation of the GENIUS Act, signed in July 2025, which aims to regulate stablecoin issuance while insulating traditional banking deposits.

Banks argue that interest-bearing stablecoins threaten their liquidity models, essentially fearing a massive deposit drain if users can earn higher yields on-chain.

This regulatory tug-of-war highlights the industry’s shift toward a compliance-focused market where regulatory pressures now dictate project viability.

The White House Crypto Policy Council is scrambling to find common ground. Yesterday’s meeting was the second this month. With lawmakers and the industry hoping to finalize rules by the midterm elections this November, the clock is ticking.

Banks are effectively trying to firewall their deposit base from digital competitors, a move that could neuter the competitive advantage of non-bank stablecoin issuers.

Discover: The next crypto to explode in 2026

Inside the Closed-Door Battle at the White House

According to a document presented by the banking side during the session, which included Goldman Sachs and JPMorgan Chase, the banks laid out strict “prohibition principles.”

These principles call for a total ban on any benefits, financial or otherwise, tied to holding or using payment stablecoins. Attendees noted that banks took a hard line, demanding enforcement measures that go well beyond the current draft of the market structure bill.

While current legislative drafts generally bar passive yield, banks want to crush even limited activity-based rewards.

Crypto stakeholders, including the Blockchain Association and Ripple, reportedly “dug in” against these demands.

The banking sector insists that exemptions for stablecoin rewards must be extremely narrow in scope, leaving little room for the types of incentive programs that drive DeFi adoption.

Discover: New cryptocurrencies to invest in today

Implications for the Market

If these restrictions hold, the U.S. risks stifling the very innovation the GENIUS Act was meant to legitimize.

Investors should watch the July deadline closely; failure to compromise could force a capital to flee to jurisdictions with clearer, pro-yield frameworks.

Just as Venezuela’s anti-corruption investigation rocked its local crypto industry with aggressive shutdowns, a heavy-handed U.S. ban on stablecoin yields could severely impact domestic liquidity.

While banks aim to protect their deposit base from disruption, the crypto market views yield as a fundamental feature, not a bug.

If the banks win this round, the utility of U.S.-regulated stablecoins could be capped at simple transaction rails, stripping them of their investment potential.

Discover: February’s best crypto presales

The post White House Stablecoin Talks Stall as Banks Push for Yield Restrictions appeared first on Cryptonews.

Crypto World

JPMorgan among those cutting price targets following Q4 miss

Robinhood (HOOD) shares slumped 10% in early trading on Wednesday after fourth-quarter revenue missed estimates, with a decline in crypto trading impacting results.

The popular trading app reported fourth-quarter earnings per share of $0.66, beating expectations of $0.63. However, revenue came in at $1.28 billion, below the $1.33 billion analysts had forecast.

A downturn in crypto trading weighed heavily on results, with crypto revenue dropping 38% year over year to $221 million.

Wall Street bank JPMorgan cut its price target on Robinhood to $113 from $130 following the softer-than-expected fourth quarter, while maintaining a neutral rating and warning that tougher 2025 comps raise the bar for 2026.

That new price target still represents potential upside of more than 50% from the current price of $76.50.

Transaction revenue of $776 million fell short, driven by a drop in crypto revenue to $221 million amid a late-year slide in digital asset markets. Net interest revenue of $411 million also missed the bank’s estimates, pressured by weaker securities lending and lower yields.

While January volumes have improved year over year, the bank’s analysts, led by Kenneth Worthington, said growth is moderating across key metrics, prompting the bank to trim top-line forecasts and lower its price target.

Compass Point’s Ed Engel took a more constructive view, though also cutting his price target to $127 from $170 while reiterating a Buy rating. He noted that Robinhood’s January KPIs showed solid momentum across all segments — including better-than-feared crypto volumes — despite the weak fourth quarter. However, a 9% EBITDA miss, driven by lower securities lending and declining take rates in crypto and options trading, weighed on results.

The most surprising detail, Engel said, was Robinhood’s 2026 operating expense guidance of 18% growth. He expects spending to fund product expansion in areas such as crypto, DeFi, and prediction markets, which could pay off in the second half of 2026. Until then, however, investors may lower EBITDA expectations.

He pointed to internalization of prediction markets, a potential Trump-related user bump, and possible mega-IPOs from SpaceX, Anthropic or OpenAI as longer-term tailwinds.

He also flagged that Robinhood’s crypto take rate declined by 3 bps quarter-over-quarter in the fourth quarter and has fallen an additional 5 bps in so far in 2026 as higher-volume traders make up a larger share of the mix.

Engel: “In the near-term, we could see investors penalize HOOD for the higher spending, but sentiment could rebound by mid-2026 as investment ROIs begin to materialize.”

Read more: Robinhood misses Q4 revenue estimates as fourth-quarter results dinged by crypto slump

Crypto World

Fragile Optimism in Crypto as ETF Flows Return

Spot Bitcoin ETFs added $145 million, Ethereum saw $57 million inflows, signaling fragile optimism after a sharp crypto sell-off.

Even though they were trading at around $68,000 and $1,980, respectively, at the time of writing, Bitcoin and Ethereum bounced yesterday after sharp sell-offs, with BTC reaching $71,000 and ETH climbing to $2,150 following the resumption of spot ETF inflows.

The rebound renewed speculation that BTC may have established a local floor, but traders are also bracing for today’s Non-Farm Payroll (NFP) report and Friday’s Consumer Price Index (CPI) release, two data points that could reset Federal Reserve rate expectations and determine whether the rally holds.

ETF Flows Turn Positive, But On-Chain Data Signals Volatility Ahead

In its latest market update, digital asset trading firm QCP noted that spot Bitcoin ETFs recorded $145 million in net inflows yesterday, building on Friday’s $371 million. Spot ETH ETFs also reversed course with $57 million in net inflows after three days of red.

The shift follows a period of intense selling pressure that recently drove BTC to around $60,000, its lowest level since before the November 2024 U.S. elections.

Despite the inflows, on-chain data suggests market participants are preparing for continued turbulence. For example, CryptoQuant contributor CryptoOnchain reported that on February 6, over 7,000 BTC moved from Binance to other spot exchanges, making it the second-highest daily volume in the past year.

At the same time, the seven-day moving average of flows from Binance to derivative exchanges spiked to 3,200 BTC, the highest level since January 2024. The analyst interpreted the migration of funds to derivative platforms as a sign that large holders are either hedging downside risk or positioning for sharp price swings.

Meanwhile, QCP market watchers revealed that the Coinbase BTC discount has narrowed from approximately 20 basis points to 9 basis points, signaling a moderation in U.S.-led selling. But the Crypto Fear & Greed Index remains at 9, deep in “extreme fear” territory, with the trading firm describing conditions as “thin ice that happens to be holding.”

You may also like:

Historical Context and On-Chain Trends

Bitcoin’s correction has drawn the broader market lower, with the OG cryptocurrency dipping below $67,000 and altcoins such as ETH, XRP, and BNB losing significant ground. The total crypto market capitalization has fallen to $2.36 trillion, shedding over $50 billion in daily value. Still, not all assets have mirrored this decline, as the likes of XMR gained 3%, while ZRO entered the top 100 following a 20% surge.

Unlike previous cycles, this downturn has avoided major systemic failures. Chainlink co-founder Sergey Nazarov pointed out on February 10 that real-world assets (RWAs) on the blockchain are expanding despite price volatility, with institutional interest sustained by technological advantages and 24/7 markets.

While the market looks for big economic changes, the increase in ETF investments provides some hope, but QCP warns that past price changes and how derivatives are set up mean traders should be careful and manage risks wisely.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why XRP Could Still Dip Below $1, Analysts Explain

XRP (CRYPTO: XRP) has retraced nearly 63% from its multi-year high of $3.66 to around $1.36 as of Wednesday, a move that market analysts say could carry bearish implications unless buyers reassert themselves. The slide comes amid a confluence of technical signals and growing on-chain activity that could either reinforce a near-term downshift or set the stage for a stubborn reversal. Traders are weighing a technical setup that points toward further pressure against a backdrop of sustained demand from spot XRP ETFs and persistent whale accumulation, painting a nuanced picture for the digital asset’s near-term trajectory. The Gaussian Channel, a charting method used to identify trends and potential support or resistance levels, places XRP at a crossroads where previous patterning has often dictated the tempo of subsequent moves.

Key takeaways

- The price action has broken below a critical zone near $1.40, aligning with a bearish setup that could extend losses toward the $0.70–$1 range if support fails.

- The Gaussian Channel shows the upper regression band near $1.16 and the middle band around $0.70, suggesting that a test of important structural levels could unfold over the coming weeks or months.

- A drop below the local low of $1.12 would validate the bearish scenario described by market technicians, potentially accelerating the downside case.

- Spot XRP ETF inflows have continued, with cumulative net inflows reaching about $1.01 billion and inflows of roughly $3.26 million on a single day, underscoring ongoing institutional interest.

- On-chain activity has picked up, with whale transactions exceeding $100,000 and active addresses surging to a six-month high, signaling that buyers remain engaged despite the price decline.

- Nevertheless, persistent ETF demand and on-chain signals could counterbalance the technical headwinds if liquidity conditions remain favorable and market sentiment improves.

Tickers mentioned: $XRP, $BTC, $ETH

Sentiment: Bearish

Price impact: Negative. A break below key supports could push XRP toward the mid-band around $0.70, extending the downside unless buyers step in.

Trading idea (Not Financial Advice): Hold. Near-term risk remains elevated if $1.12 fails, but renewals in ETF inflows and on-chain activity keep the scene cautiously balanced.

Market context: The XRP market remains closely tethered to liquidity flows from spot XRP ETFs and evolving on-chain activity. Spot XRP ETF inflows have continued, contributing to roughly $1.01 billion in cumulative net inflows and sustaining roughly $1.01 billion in assets under management, with daily inflows of millions that underscore ongoing institutional interest. At the same time, on-chain dynamics have shown resilience, with whale activity and active addresses rising even as price action remains under pressure. These factors collectively reflect a broader environment where ETF-driven demand can offset, at least temporarily, technical headwinds.

Why it matters

For investors watching XRP, the current setup matters because it juxtaposes a stubborn price decline with stubborn liquidity support. The Gaussian Channel’s readings imply that XRP could oscillate within a defined corridor before a decisive breakout or breakdown occurs. If the upper band near $1.16 acts as a temporary ceiling and the price fails to hold above the lower levels, the drawdown could extend toward the $0.70–$1 region, a zone that previously lacked robust testing for sustained support. Such a breach would be meaningful not just for XRP bulls and bears but for funds and institutions tracking the asset as part of broader crypto exposure. The dynamics of ETF flows, as observed in late-2025 through 2026, emphasize that institutional demand can create a buffer against rapid declines, but they are not a guarantee against further losses if macro conditions or sentiment deteriorate.

“The middle regression band currently ties up around $0.70, which is also a previous year-long resistance level seen back in 2023/2024, and hasn’t been backtested for support.”

On the liquidity side, the market has benefitted from a steady stream of ETF inflows. The Canary XRP ETF launch, which began late in 2025, has contributed to a trajectory of inflows that has pushed the cumulative total higher, with the latest daily inflows evidencing continued demand from institutional players. This flow is not a panacea for price declines, but it argues for a more nuanced outlook than a pure technical read would suggest. Meanwhile, on-chain metrics paint an equally important portrait. Analysts have highlighted a surge in XRP activity: whale transactions of over $100,000 and a spike in active addresses have suggested that sector participants remain engaged and are deploying capital despite adverse price movements. These signals can be precursors to a bottom or a renewed uptrend, depending on whether they align with broader market liquidity and risk appetite.

Analysts have also cited the importance of the price level around $1.12. A move below that local low could be a technical confirmation of the bearish scenario, triggering a cascade of downside protections and prompting a reevaluation of risk parity in XRP portfolios. Conversely, if ETF inflows persist and on-chain activity maintains its strength, XRP could find a foundation and attempt a staged recovery as liquidity conditions improve and risk sentiment stabilizes. The tension between price-driven momentum and liquidity-driven demand is a defining feature of XRP’s current phase, and market participants are closely watching both channels for signals of the next major move.

As the market weighs these factors, the broader crypto environment remains cautious. The behavior of BTC and ETH—often a barometer for risk sentiment—has a bearing on how XRP will respond to developing macro cues and regulatory dynamics. Although XRP has decoupled at times from the broader market, the path of least resistance in the near term could be influenced by the balance between selling pressure at technical resistance and fresh inflows that sustain institutions’ appetite for XRP exposure.

What to watch next

- Monitoring XRP’s level relative to the $1.12 local low to gauge whether the bearish scenario gains traction.

- Tracking the Gaussian Channel bands around $1.16 (upper) and $0.70 (middle) for potential testing or breakout signals.

- Observing ongoing spot XRP ETF inflows and AUM, which could widen the collision between technical resistance and liquidity-driven strength.

- Watching on-chain metrics, especially the trajectory of whale transactions and daily active addresses, for signs of renewed accumulation or distribution.

Sources & verification

- Chart Nerd’s analysis on Gaussian Channel fractals and XRP price projections referenced in a social post.

- Discussion on XRP price movement below the 1.60 level and potential downside scenarios.

- Canary XRP ETF launch and the resulting inflow data, including cumulative inflows and daily inflows feeding assets under management.

- Santiment’s reports on whale activity, large XRP transactions, and address activity as a measure of on-chain demand.

Market reaction and key details

The current XRP setup binds a bear-case price scenario to a backdrop of ongoing ETF inflows and active on-chain participation. While the price remains under pressure, the inflows into spot XRP ETFs and sustained whale engagement provide a counterbalancing force that could underpin a bottom if liquidity remains ample and risk appetite stabilizes. The path forward will likely hinge on whether XRP can stabilize above critical support levels and whether on-chain signals translate into durable buying interest.

What to watch next

- Whether XRP can hold above $1.12 on a closing basis, which would delay a deeper pullback.

- How ETF inflows trend over the next several sessions and whether AUM surpasses the $1.05–$1.10 billion range.

- Any new regulatory or product developments affecting XRP ETFs or custodial structures that could influence liquidity and investor confidence.

Crypto World

Stablecoin Conversion Costs Highest in Africa, Data Shows

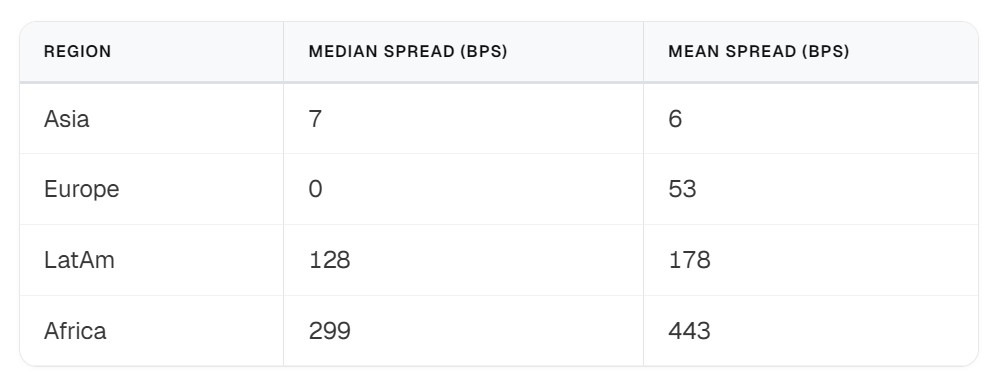

Africa recorded the highest median stablecoin-to-fiat conversion spreads among tracked regions in January, according to data observed by payments infrastructure company Borderless.xyz, covering 66 currency corridors and nearly 94,000 rate observations.

The regional median spread was 299 basis points, or about 3%, compared with roughly 1.3% in Latin America and 0.07% in Asia. In Africa, conversion costs ranged from about 1.5% in South Africa to nearly 19.5% in Botswana.

The data measures “spreads,” or the gap between a provider’s buy and sell rate for a stablecoin-to-fiat pair. Similar to a bid-ask spread in traditional markets, it reflects the execution cost paid when converting stablecoins into local fiat currency.

The findings suggest that while stablecoins are promoted as a cheaper alternative to traditional remittance rails, actual costs vary widely across African markets and appear closely tied to local provider competition and liquidity.

Competition drives pricing gaps

Borderless.xyz found that markets with several competing providers generally had conversion costs between about 1.5% and 4%. In markets with only one provider, costs often exceeded 13%.

Botswana recorded the highest median conversion cost in January at 19.4%, though pricing improved later in the month. Congo’s costs were also above 13%. By contrast, South Africa, which has a more competitive foreign exchange market, showed costs of about 1.5%.

The report suggested that these differences are driven primarily by local market conditions, such as liquidity and competition, rather than the underlying blockchain technology. In countries where multiple providers operate, conversion costs stayed closer to the regional average.

Related: Uganda opposition leader promotes Bitchat amid fears of internet blackout

Stablecoins versus traditional foreign exchange

The report also compares stablecoin mid-rates with traditional interbank foreign exchange rates, measuring what it calls the “TradFi premium.”

This metric reflects whether stablecoin exchange rates are cheaper or more expensive than traditional FX mid-market rates.

Across 33 currencies globally, the median difference between stablecoin exchange rates and traditional mid-market foreign exchange rates was about 5 basis points, or 0.05%, indicating the two were largely in line.

In Africa, the median gap was wider at roughly 119 basis points, or about 1.2%, though the difference varied significantly depending on the country.

On Jan. 24, economist Vera Songwe said at the World Economic Forum in Davos that stablecoins are helping reduce remittance costs across Africa, where traditional transfer services can charge about $6 per $100 sent.

The new data adds context, suggesting that while stablecoins offer faster settlement and potential savings compared with legacy services, conversion costs within specific corridors remain elevated.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

BTC trims losses following strong January employment report

U.S. jobs growth sizably strengthened in the first month of 2026.

There were 130,000 jobs added in January, according to a Wednesday report from the Bureau of Labor Statistics. Economist forecasts had been for 70,000 jobs added, up from jobs growth of 48,000 in December.

The unemployment rate fell to 4.3% versus forecasts for 4.4% and December’s 4.4%.

Trading in a tight range close to $69,000 for much of the week, bitcoin had dipped back to the $67,000 area in the hours prior to the report. In the immediate aftermath of the strong data, bitcoin rose to $67,500, though still down 2% over the past 24 hours.

U.S. stock index futures are continuing with modest gains, the Nasdaq 100 higher by 0.55% and S&P 500 by 0.5%. Lower earlier, the dollar is now higher on the session, and the 10-year U.S. Treasury yield has jumped five basis points to 4.20%.

After having cut rates multiple times in the second half of 2025, the Federal Reserve held policy steady at its January meeting, and members showed little inclination to resume rate cuts at the bank’s next meeting in March.

Ahead of this morning’s job numbers, interest rate traders were placing just 21% chances of a March easing, according to CME FedWatch. Just following the report, those chances had dipped to 19%.

Crypto World

Ethena-backed suiUSDe stablecoin goes live on Sui with $10 million yield vault launch

The Ethena-backed eSui Dollar (suiUSDe) has launched on Sui Mainnet, expanding the network’s stablecoin offerings and introducing the network’s first synthetic dollar to onchain trading and yield infrastructure, the Sui Foundation said in a blog post Wednesday.

The rollout also brings suiUSDe to DeepBook Margin, where it becomes the first synthetic dollar supported by the trading system.

Alongside the launch, SUI Group Holdings seeded a newly launched suiUSDe vault with $10 million, marking one of the largest initial stablecoin deployments on Sui to date.

The permissionless vault, operated by Ember Protocol and incubated by the Bluefin team, is designed to provide stablecoin-based yield to both institutional and retail participants. The vault has an initial capacity of $25 million, SUI Group said in a separate press release Thursday.

Despite broad market weakness and waves of forced liquidations across crypto, decentralized finance’s total value locked (TVL) has held up, suggesting traders continue to seek yield and passive income even as bearish sentiment weighs on the market.

Read more: Bitcoin and ether are tanking, but DeFi investors are refusing to cave to the panic

Synthetic dollars like suiUSDe are designed to function as onchain market infrastructure rather than tokenized claims on offchain cash. Unlike fiat-backed stablecoins, which typically move between venues as a neutral unit of account, synthetic dollars are built to operate natively inside trading and risk systems.

Because they are part of the market itself, synthetic dollars can integrate directly with margin engines, liquidation logic and reward mechanisms. That allows them to act as active collateral and liquidity drivers, rather than passive settlement assets.

Demand for that model has grown alongside the rise of yield and leverage-focused strategies, where users want capital efficiency and exposure in a single instrument. Ethena’s rapid growth has demonstrated that appetite, and bringing a similar structure to Sui extends it into a high-performance, programmable environment.

DeepBook Margin, unveiled last month, is a key piece of that shift. By embedding margin trading directly into the liquidity layer, it allows synthetic dollars like suiUSDe to be used natively for leveraged trading, risk management and rewards within a single execution venue.

“Launching the Ethena-backed suiUSDe was about establishing native, reliable dollar infrastructure on Sui,” said Marius Barnett, Chairman of SUI Group, in the release. “Seeding the suiUSDe Vault with $10 million is how we move that infrastructure into active use,” he added.

SuiUSDe was developed in collaboration with Ethena Labs and was first announced in the fourth quarter of 2025. With its mainnet debut, the asset is now available across multiple Sui-based protocols, including Aftermath, Bluefin, Cetus, Navi, Scallop, Suilend and others, broadening its use in trading, lending and yield strategies.

Sui is a layer-1 blockchain developed by Mysten Labs, designed to support high-throughput transactions and programmable onchain assets.

Read more: Sui Group charts new course for crypto treasuries with stablecoins and DeFi

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech11 hours ago

Tech11 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World23 hours ago

Crypto World23 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

EXCLUSIVE: SBF SEEKS NEW TRIAL, CLAIMS DOJ SILENCED DEFENSE WITNESSES AND MISLED JURY ON FTX SOLVENCY

EXCLUSIVE: SBF SEEKS NEW TRIAL, CLAIMS DOJ SILENCED DEFENSE WITNESSES AND MISLED JURY ON FTX SOLVENCY (@CarloD_Angelo)

(@CarloD_Angelo)