Crypto World

Ethereum’s Big ZK Reveal Tomorrow: What to Expect

Tomorrow, February 11, 2026, the first L1-zkEVM workshop will give a first look at a new system that could make block validation faster, cheaper, and more accessible for everyone.

Instead of re-executing every transaction in a block, Ethereum may soon rely on zero-knowledge (ZK) proofs, enabling validators to verify correctness through cryptographic proofs.

Sponsored

Sponsored

Why Ethereum’s Shift to ZK Proofs Could Redefine Block Validation

Ethereum Foundation researcher Ladislaus.eth called it “arguably one of the more consequential” upgrades in the network’s history.

The change is part of the L1-zkEVM 2026 roadmap and focuses on the EIP-8025 (Optional Execution Proofs) feature. This allows certain validators, called zkAttesters, to confirm blocks using cryptographic proofs instead of checking every transaction themselves.

The shift is optional, meaning no one is forced to upgrade, and all existing nodes continue to work as they do today. However, for those who adopt it, the benefits may be significant.

“The first L1-zkEVM breakout call is scheduled for February 11, 2026, 15:00 UTC,” wrote Ladislaus.eth.

Today, validating a block requires re-executing every transaction, which takes more time and resources as the network grows.

ZK proofs enable zkAttesters to verify a block almost instantly without storing the entire blockchain.

This is not just about speed. By lowering the hardware, storage, and bandwidth requirements, Ethereum becomes far more accessible.

Sponsored

Sponsored

Solo stakers and home validators can participate fully using regular consumer hardware. This keeps the network decentralized and true to the “don’t trust, verify” philosophy.

Higher gas limits and faster execution can also be achieved without pushing smaller participants out of the system.

EIP-8025 emphasizes flexibility and security. Proofs from multiple clients are shared across the network, and validators accept a block once enough independent proofs have been verified (currently proposed to be three out of five).

This approach preserves diversity among client software while keeping the network safe, inclusive, and resistant to centralization.

Sponsored

Sponsored

Institutional Momentum and Tomorrow’s Workshop Signal a New Era for Ethereum Validation

The timing could not be more relevant. Ethereum’s institutional adoption is surging in 2026, with Fidelity Digital Assets, Morgan Stanley, Grayscale, BlackRock, and Standard Chartered actively building or investing in the network.

“2026 is off to a fast start on Ethereum…One month in. Should be a fun year,” remarked David Walsh, head of enterprise at the Ethereum Foundation.

Tokenized assets, stablecoins, and staking products continue to expand, while projects like the Glamsterdam hard fork (featuring enshrined proposer-builder separation, ePBS) support the practical implementation of ZK proof generation on L1.

L1-zkEVM development also benefits Layer 2 rollups and zkVM vendors such as ZisK, openVM, and RISC Zero, who are already proving Ethereum blocks today. Standardizing the execution witness and ZK VM APIs creates shared infrastructure, enabling both L1 validators and L2 protocols to leverage the same proofs.

The February 11 workshop will cover six core sub-themes:

Sponsored

Sponsored

- Execution witness and guest program standardization

- zkVM-guest API standardization

- Consensus layer integration

- Prover infrastructure

- Benchmarking, and

- Formal verification for security.

It marks the official kickoff of Ethereum’s 2026 roadmap to make block validation optional, proof-driven, and far more efficient.

If adoption grows, EIP-8025 could make full-verifying nodes viable on laptops again and scale Ethereum’s base layer without sacrificing decentralization or security.

For validators, developers, and users alike, this may be the moment Ethereum’s block validation truly enters a new era.

Tomorrow’s L1-zkEVM workshop promises a first glimpse at what could become Ethereum’s most transformative architectural leap since The Merge.

Crypto World

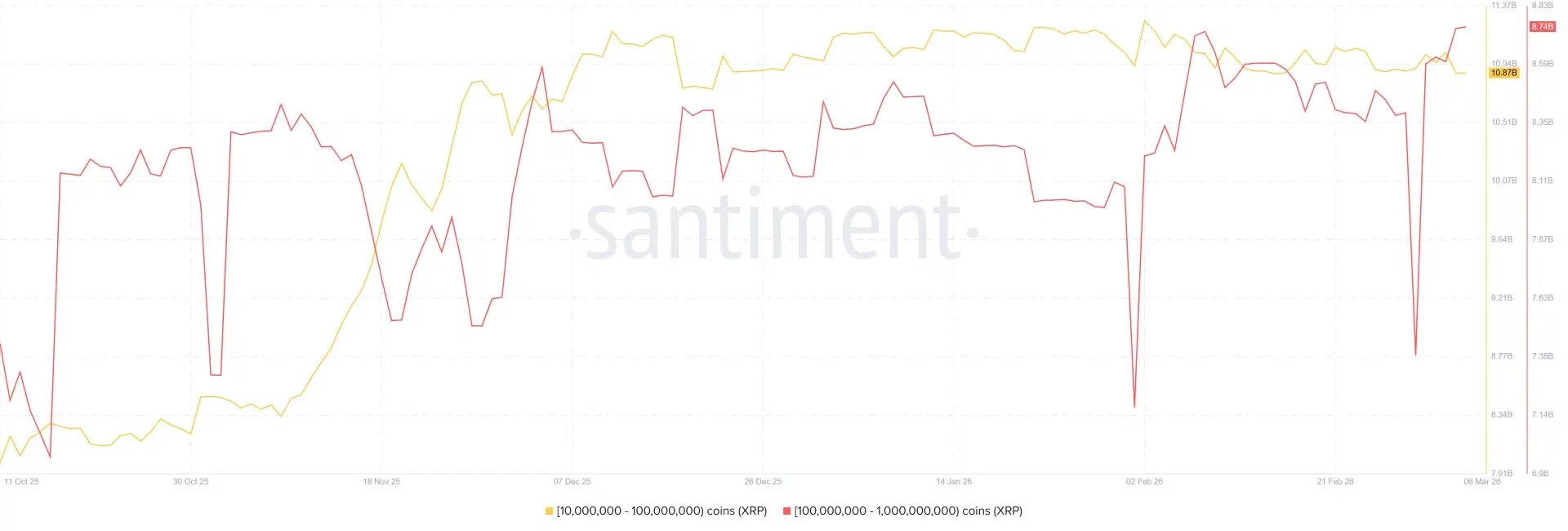

Vancouver Mayor Ken Sim’s BTC reserves proposal blocked by city, provincial law

Vancouver Mayor Ken Sim’s plan to invest city reserves in bitcoin is not permitted under the Vancouver Charter and British Columbia’s Municipal Finance Authority Act, a staff report says.

The briefing released ahead of a March council meeting recommends closing a 2024 motion to make Vancouver a “bitcoin-friendly city,” after staff determined the plan violates municipal investment rules embedded in the city’s charger. Staff wrote they “conclusively determined that under the Vancouver Charter, bitcoin is not an allowable investment asset for the City.”

The conclusion reflects the highly restrictive framework governing how Canadian municipalities can invest public funds. Section 201 of the Vancouver Charter allows the city to invest idle funds only in a narrow set of instruments, such as federal or provincial government securities, government-guaranteed bonds, municipal debt, bank-guaranteed investments, credit union deposits and certain pooled investment vehicles.

British Columbia’s Municipal Finance Authority Act reinforces the restriction.

Municipal investment pools are limited to conservative assets such as government bonds, municipal securities, bank deposits and highly rated commercial paper.

The law defines eligible securities as bonds, debentures, deposit certificates and promissory notes, reflecting a framework built around fixed income and cash equivalents. Stocks, commodities and cryptocurrencies are not included.

A narrower question remains unresolved: whether Vancouver could still pursue the softer branding goal embedded in the motion by accepting bitcoin for taxes or fees, provided the cryptocurrency is immediately converted into Canadian dollars.

While the charter regulates how city funds are invested, it does not necessarily govern how payments are processed.

Crypto World

Major whales scoop up 4.18B XRP since the 10/10 market crash

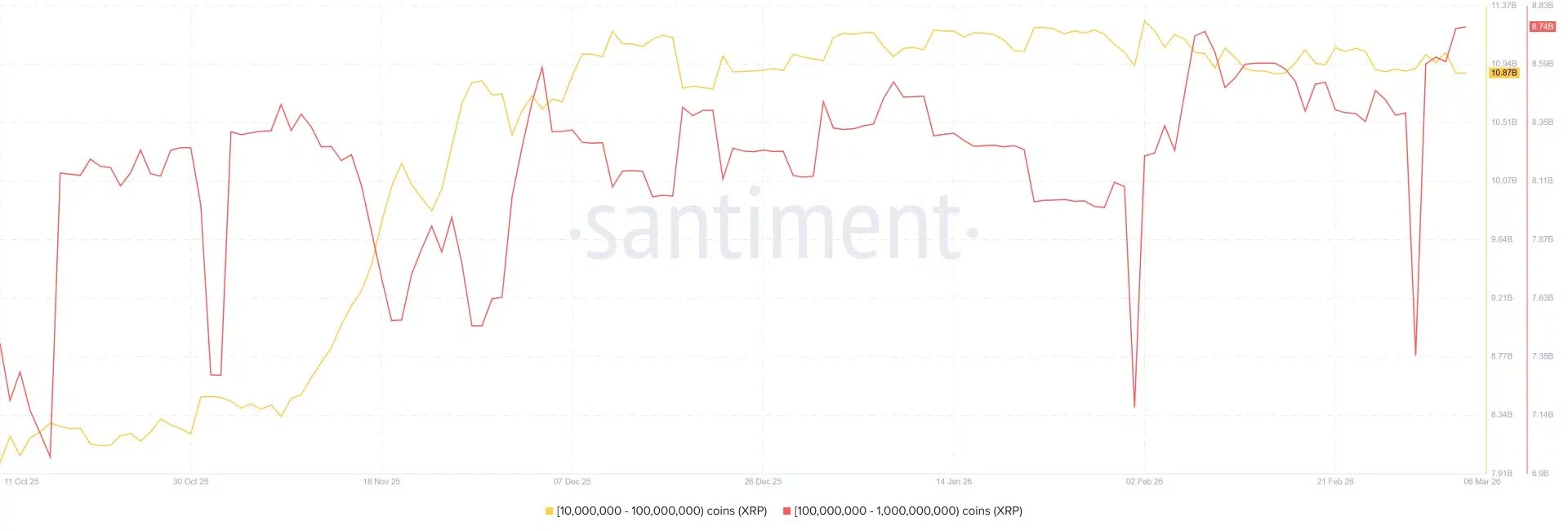

Large XRP holders have significantly increased their positions in recent months, accumulating billions of tokens following the sharp market downturn that began around October 10.

Summary

- Large XRP holders accumulated 4.18 billion tokens following the Oct. 10 market crash, according to Santiment data.

- Wallets holding 10M–100M XRP now control roughly 10.87B tokens, signaling sustained whale accumulation.

- XRP is currently consolidating near $1.40, with key support at $1.35 and resistance around $1.50–$1.60.

The broader crypto market experienced a notable correction during that period, with several major assets retracing after a strong rally earlier in the year. The Ripple token (XRP) was among the tokens affected, sliding from above the $2.30 region and entering a prolonged downtrend that lasted through early 2026.

However, the sell-off appears to have created an accumulation opportunity for large investors.

Data from Santiment shows that wallets holding between 10 million and 100 million XRP have steadily increased their balances since the October crash. These addresses collectively added roughly 4.18 billion XRP over the period, pushing their combined holdings to about 10.87 billion XRP.

Meanwhile, the largest whale cohort, wallets holding 100 million to 1 billion XRP, have also maintained elevated holdings, with balances recently climbing toward 8.74 billion XRP.

The sustained rise in these wallet balances suggests that major investors have been quietly accumulating during the market pullback rather than exiting positions, a pattern that historically precedes stronger market moves once broader sentiment improves.

XRP price analysis

At press time, XRP is trading near $1.40, stabilizing after weeks of sideways price action following the earlier decline from the $2.20 region.

The daily chart shows XRP forming a consolidation range between roughly $1.35 and $1.50, indicating a potential base-building phase as volatility continues to compress.

Momentum indicators remain neutral. The Relative Strength Index (RSI) is hovering around 45, suggesting that the asset is neither oversold nor overbought. This typically reflects a market waiting for a stronger directional catalyst.

Meanwhile, the Chaikin Money Flow (CMF) indicator is slightly negative near -0.11, indicating mild capital outflows despite the ongoing whale accumulation.

Key technical levels to watch include support around $1.35, which has held multiple times in recent weeks. A breakdown below this level could open the door toward $1.20.

On the upside, resistance sits near $1.50, with a stronger barrier around $1.60. A decisive breakout above this zone could signal renewed bullish momentum if whale accumulation continues.

Crypto World

Vancouver Staff Say Bitcoin Cannot Be Held in City Reserves

Vancouver city staff said Bitcoin cannot be held in municipal reserves and recommended that the city council drop a proposal to create a Bitcoin reserve.

City staff, led by Colin Knight, general manager of the Finance and Supply Chain Management department, “conclusively determined” that Bitcoin (BTC) is not an “allowable investment” for the city under the Vancouver Charter, according to a motions update report dated March 2.

Staff recommended merging the motion with other related initiatives to reprioritize resources, with a final decision pending a council vote at a meeting on March 10.

The proposal to create a Vancouver Bitcoin reserve was originally introduced in late 2024 by Mayor Ken Sim as part of a motion titled “Preserving the City’s Purchasing Power Through Diversification of Financial Reserves — Becoming a Bitcoin-Friendly City.”

The council passed the motion with six votes in favor and two opposed. However, the latest developments could stall the proposal entirely.

Bitcoin’s inflation hedge argument fades amid bear market

Introducing the proposal in 2024, Mayor Sim said the motion was partly aimed at helping the city hedge against inflation using Bitcoin, which has often been described as “digital gold” because of its fixed supply capped at 21 million coins.

“As an open, decentralized, and secure digital asset, Bitcoin has been recognized by many financial experts and analysts as a potential hedge against inflation and currency debasement,” the motion reads.

Related: Bitcoin is forming a bottom as the 4-year cycle ends: VanEck CEO

The argument that Bitcoin acts as an inflation hedge has weakened recently as the cryptocurrency’s price declined sharply. Bitcoin has fallen about 50% from its October 2025 peak of above $126,000, returning to late-2024 levels and briefly touching lows near $60,000.

Despite skepticism from some analysts who argue Bitcoin does not behave like digital gold, macroeconomists such as Lyn Alden remain bullish on the digital asset relative to gold in the near term.

“If I had to bet Bitcoin versus gold over the next two to three years, I would bet Bitcoin,” Alden said on the New Era Finance podcast on Wednesday.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

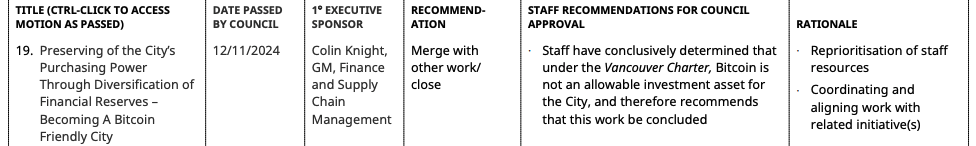

Solana (SOL) ETFs Continue Attracting Institutional Money Despite 57% Price Drop

Key Takeaways

- SOL has declined 57% since US-based Solana ETFs debuted in July, currently trading around $88

- Despite price weakness, Solana ETFs have attracted $1.5 billion in net inflows with minimal redemptions

- Institutional investors account for 50% of total ETF capital inflows

- February 2026 saw Solana process a record-breaking $650 billion in stablecoin transactions

- The network now ranks second only to Ethereum in USDC supply across all blockchains

While Solana’s token price has experienced significant pressure since its exchange-traded fund launch in the US, underlying network metrics and capital flows paint a different picture.

The SOL token currently hovers around $88, representing a 57% decline from the July ETF launch price. The token has also retreated 70% from its January 2025 peak of $293, which occurred during a speculative memecoin trading frenzy.

Yet despite this substantial price deterioration, Solana-focused ETFs have accumulated $1.5 billion in net capital and retained nearly all of it, according to Bloomberg’s ETF specialist Eric Balchunas.

In a Thursday analysis, Balchunas highlighted that institutional investors represent 50% of total inflows, characterizing this as a “serious investor base.”

He emphasized that ETF products launching during such severe market downturns typically struggle to attract any capital whatsoever, and most funds would collapse if their underlying asset lost 57% of its value within the first six months of trading.

When normalized for relative market capitalization, Solana ETFs have effectively pulled in the equivalent of $54 billion in Bitcoin-adjusted terms—approximately double the comparative flow Bitcoin ETFs experienced at the same stage post-launch.

On Thursday, Solana ETFs experienced their first net redemption day in more than a month, with $6 million exiting the six available products. This followed a $19 million net inflow recorded Wednesday, based on CoinGlass tracking data.

Network Processes Unprecedented Stablecoin Activity

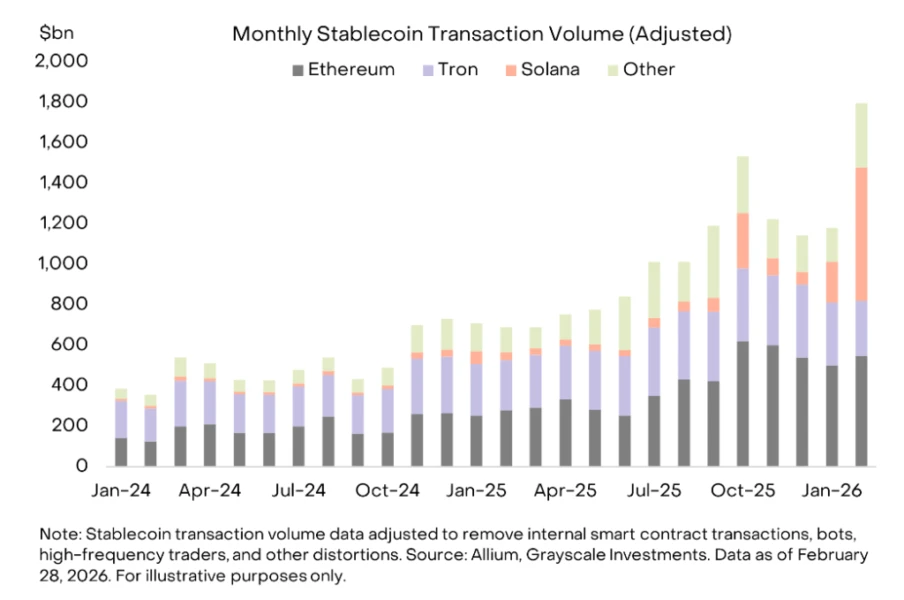

Beyond price movements, Solana’s blockchain infrastructure achieved a milestone $650 billion in stablecoin transaction volume throughout February 2026, as detailed in a Grayscale Investments research report.

This represents the highest monthly stablecoin transaction volume ever documented on any blockchain network, accomplished within just 28 days. The figure more than doubled the previous record established merely four months prior in October 2025.

According to Grayscale’s analysis, this volume stemmed primarily from SOL-stablecoin trading activity and genuine payment transactions, rather than speculative memecoin speculation.

Solana’s minimal transaction costs have enabled economically viable small-value transfers, attracting developers creating payment infrastructure and micropayment applications that would be economically unfeasible on networks with higher fee structures.

Climbing the Stablecoin Ecosystem Rankings

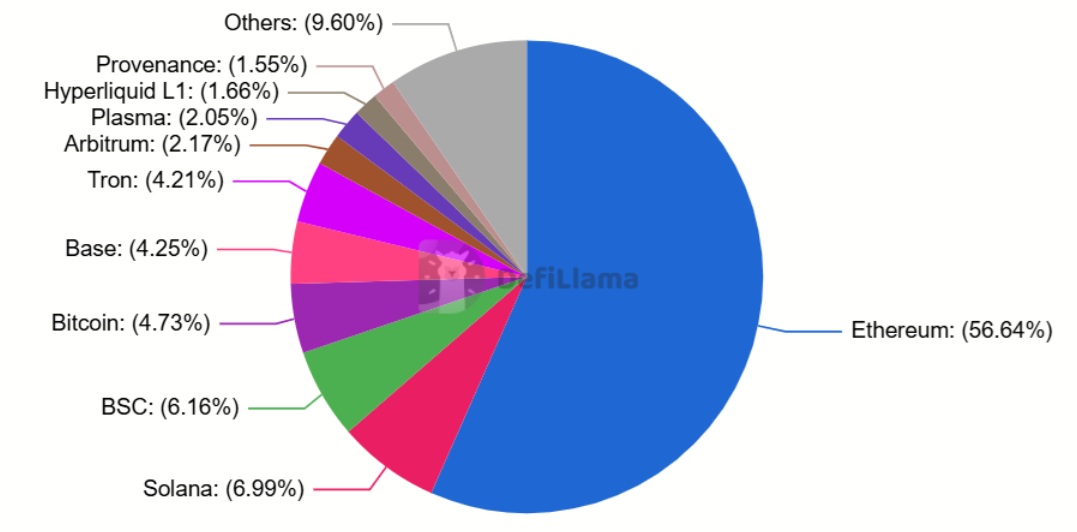

Solana currently maintains the fourth-largest total stablecoin supply among all blockchain networks. When examining USDC exclusively, it holds the second position, trailing only Ethereum.

Given USDC’s preference among institutional market participants, Solana’s runner-up status in this specific category represents a significant indicator for market observers.

Ethereum continues dominating tokenized real-world assets, processing $15.57 billion over the trailing 30-day period compared to Solana’s $2 billion, based on rwa.xyz analytics.

SOL has declined 2.7% in the past 24 hours and 11% over the past 30 days, according to CoinGecko data. The token last changed hands at approximately $88.40.

Crypto World

Pi Network’s PI Surges Past $0.20 Ahead of Key March 12 Deadline: Details

The March 12 deadline comes just days after the protocol was updated to the v19.9. Here’s what’s next.

Pi Network’s native token continues to defy the overall market moves, as the asset has charted gains even in the past 24 hours when bitcoin and most other altcoins have posted losses.

The most probable reason behind this disparity could be linked to the recent updates announced by the team, including a deadline for the next big one.

PI Rockets Above $0.20

It was less than a month ago, on February 11, when Pi Network’s token was digging new lows almost daily. The broader market’s crash pushed PI south hard, but it finally bottomed on that day at $0.1312. This meant that it had lost roughly 95% of its value since its all-time high marked on February 26, 2025.

However, PI reacted well to this crash and quickly jumped past $0.20. That level was too strong for the PI bulls, and it slipped back down to $0.16. Another leg up followed that culminated earlier today as the token skyrocketed to over $0.20 once again, charting a new three-week high. As of now, it trades over 50% above its all-time low seen less than a month ago.

Its market capitalization has climbed to well over $1.9 billion, which makes it the 44th-largest cryptocurrency by that metric. However, it’s worth noting that there are some worrying signs about its future price performance that could jeopardize its rally. Some of those include the massive number of tokens scheduled to be unlocked tomorrow and the RSI, which is now within an ‘oversold’ territory.

New Deadline Approaches

PI has demonstrated in the past that it tends to move mostly in line with some big announcements or updates from the team. Just earlier this week, it jumped by 9% daily after the implementation of the v19.9 protocol update. Now, they have set their sight to the next one, which they claim is currently in progress and could be the driver of PI’s latest gains.

At first, the team said they wanted to complete the v20.2 update by Pi Day 2026 (March 14), but they have moved up the timeline to March 12.

You may also like:

Protocol upgrades in progress (Step 3 – Deadline: March 12): The Pi Mainnet blockchain protocol continues to undergo a series of upgrades. All Mainnet Nodes are required to complete this step before the deadline to remain connected to the network. Details here:…

— Pi Network (@PiCoreTeam) March 5, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Arthur Hayes Predicts Fed Money Printing From US-Iran Tensions Could Propel Bitcoin (BTC) Higher

Key Takeaways

- Arthur Hayes, BitMEX co-founder, believes extended US-Iran military engagement may compel the Federal Reserve to reduce interest rates and expand monetary supply.

- Historical precedent shows the Fed has injected liquidity during previous US military operations, according to Hayes.

- Escalating oil prices resulting from regional tensions could drive 10-year Treasury yields upward, potentially prompting Fed intervention.

- Bitcoin dropped from approximately $66,000 to $63,000 when tensions intensified but has since rebounded to the $73,000 level.

- Market observers identify $70,685 as crucial Bitcoin support, with near-term price objectives ranging from $75,000 to $80,000.

Arthur Hayes, who co-founded BitMEX and currently serves as chief investment officer at Maelstrom, believes the escalating US-Iran tensions may initiate a sequence of events culminating in Federal Reserve monetary expansion — potentially benefiting Bitcoin prices.

In analysis published Monday on his blog, Hayes explained how prolonged US military operations in Middle Eastern regions have historically compelled the Federal Reserve to implement rate reductions and inject market liquidity. He cited the 1990 Gulf War, post-9/11 global counterterrorism efforts, and the 2009 Afghanistan troop surge as illustrative examples.

“The cure, as always, is cheaper and more plentiful money,” Hayes noted in his analysis.

In a March 6 post on X, Hayes cautioned that sustained increases in Brent crude prices stemming from US-Iran hostilities could cause 10-year Treasury yields to surge dramatically. Such market turbulence would elevate the MOVE Index — which tracks US bond market volatility — creating what Hayes considers a “prerequisite” for Federal Reserve monetary intervention.

Brent crude has climbed approximately 20% since conflict intensification began, fueled by concerns about Middle Eastern supply constraints. Nevertheless, oil prices declined over 1% Thursday to approximately $80 per barrel following Trump administration announcements of price stabilization measures, including a 30-day exemption permitting India to maintain Russian oil purchases.

Implications for Bitcoin Markets

Hayes contends that Federal Reserve rate reductions or balance sheet growth would increase market liquidity, historically providing positive momentum for Bitcoin and comparable risk assets.

Bitcoin’s response to the military tensions has shown volatility. Prices declined from roughly $66,000 to $63,000 immediately following hostilities escalation. Subsequently, the cryptocurrency has recovered and recently reached a one-month peak of $73,000.

Hayes recommends awaiting definitive indications of Fed policy adjustments — either interest rate cuts or balance sheet expansion — before initiating Bitcoin or altcoin purchases. He has not advocated for immediate market entry.

Probability of a rate reduction at the Federal Reserve’s March 17–18 policy meeting remains minimal. CME Group’s FedWatch tool indicates merely 2.7% odds of a cut at that gathering. Most market observers anticipate the Fed will maintain rates within the 3.50% to 3.75% range.

Expert Technical Analysis

Cryptocurrency analyst Ali Martinez has pinpointed $70,685 as a critical Bitcoin support threshold. Maintaining that price level could facilitate a near-term advance toward $75,000–$80,000, according to market technicians.

Inflation pressures represent an additional consideration. Should inflation remain persistent, the Federal Reserve may possess limited flexibility for rate cuts, potentially constraining any immediate rally in risk assets like Bitcoin.

Hayes has offered comparable forecasts repeatedly in recent months. In January, he suggested potential US military operations in Venezuela as a probable catalyst for Fed monetary easing. Last month, he indicated an AI-driven financial crisis as the subsequent trigger.

In December, Hayes forecasted Bitcoin would reach $200,000 this month, referencing reserve management acquisitions announced by the Fed during that period.

Currently, Bitcoin maintains trading activity within the $70,000–$73,000 corridor, with markets monitoring both Federal Reserve communications and Middle Eastern geopolitical developments.

Remember: Preserve all tokens like [[EMBED_0]], [[IMG_0]], [[LINK_START_0]], [[LINK_END_0]], [[SCRIPT_0]], [[FIGURE_0]] etc. exactly as they appear. These are placeholders for embeds, images, and links that must not be changed.

Crypto World

Solv Protocol exploit drains $2.7M in SolvBTC, 10% bounty offered

Bitcoin-focused Solv Protocol was exploited on Thursday, resulting in roughly $2.7 million worth of funds drained from one of its token vaults. The project has offered a 10% bounty to the attackers.

Summary

- Solv Protocol lost about $2.7 million after an exploit drained 38 SolvBTC from one of its Bitcoin Reserve Offering vaults, with fewer than 10 users affected.

- Security researchers estimate that the attacker abused a double-minting flaw in a BitcoinReserveOffering contract.

- The project has offered a 10% bounty for the return of the funds.

Solv Protocol is a DeFi platform that allows users to stake Bitcoin through its Staking Abstraction Layer.

According to a post incident update, roughly 38 Solv Protocol BTC (SolvBTC), which the project uses for yield-generating and lending activities across its ecosystem, was drained from one of its structured yield vaults called Bitcoin Reserve Offerings (BRO).

Solv Protocol said that the incident impacted fewer than 10 users and added that it would compensate for the loss of 38.05 SolvBTC, which amounts to roughly $2.7 million.

While a full post-mortem of the incident is yet to be published, third-party security analysts believe the attacker was able to abuse a double-minting flaw in a BitcoinReserveOffering contract.

Per security firm Decurity’s automated bot, the exploiter was able to trigger the vulnerability 22 times, which allowed them to inflate 135 BRO into roughly 567 million BRO tokens before converting the funds into SolvBTC.

Meanwhile, a pseudonymous crypto researcher identified as Pyro described the incident as a reentrancy attack, a common exploit where repeated calls to a smart contract allow attackers to manipulate internal accounting before balances are properly updated.

In the meantime, Solv Protocol has offered a 10% bounty if the attackers return the funds to the designated address. Further, the project claims to be working with its security partners to patch the vulnerability.

At the time of publication, the attackers have yet to indicate whether they intend to return the stolen funds.

This is one of the several attacks that have targeted DeFi protocols of late.

Earlier in the week, Curve Finance’s sDOLA LlamaLend markets were exploited through a vulnerability tied to the pool’s oracle configuration, and the attacker reportedly made about $240,000 by manipulating the pricing mechanism using a flash loan to trigger liquidations.

In early February, the cross-chain liquidity protocol CrossCurve also lost roughly $3 million after attackers exploited a flaw in its smart contract that allowed spoofed cross-chain messages to bypass gateway validation and unlock funds from the PortalV2 contract.

Crypto World

Will Bitcoin price drop below $70K as $2.2B BTC options expiry looms?

Bitcoin price fell to near $70,000 on Friday following a sharp rebound the previous day. A looming BTC options expiry event is now keeping investors on edge as the market anticipates potential volatility.

Summary

- Bitcoin price has given up a portion of its gains from this week.

- Over $2.22 billion worth of options set to expire today have spurred concerns around volatility.

- Bitcoin technicals remain bullish despite the current drawdown.

According to data from crypto.news, Bitcoin (BTC) price fell 4.5% to an intraday low of $70,177 on Friday morning Asian time before stabilizing around $70,400 at press time. The bellwether pulled back after facing rejection around $74,000, a key resistance level it had failed to break for over a month.

Bitcoin price fell as investors began booking profits after climbing over 15% in the past 5 days.

This came amid a broader risk-off environment triggered by the ongoing war between the U.S. and Iran, which has led energy prices to soar to multi-month highs. The military escalation has also triggered capital rotation into traditional safe-haven assets, which have seen relatively better performance amid the geopolitical uncertainty.

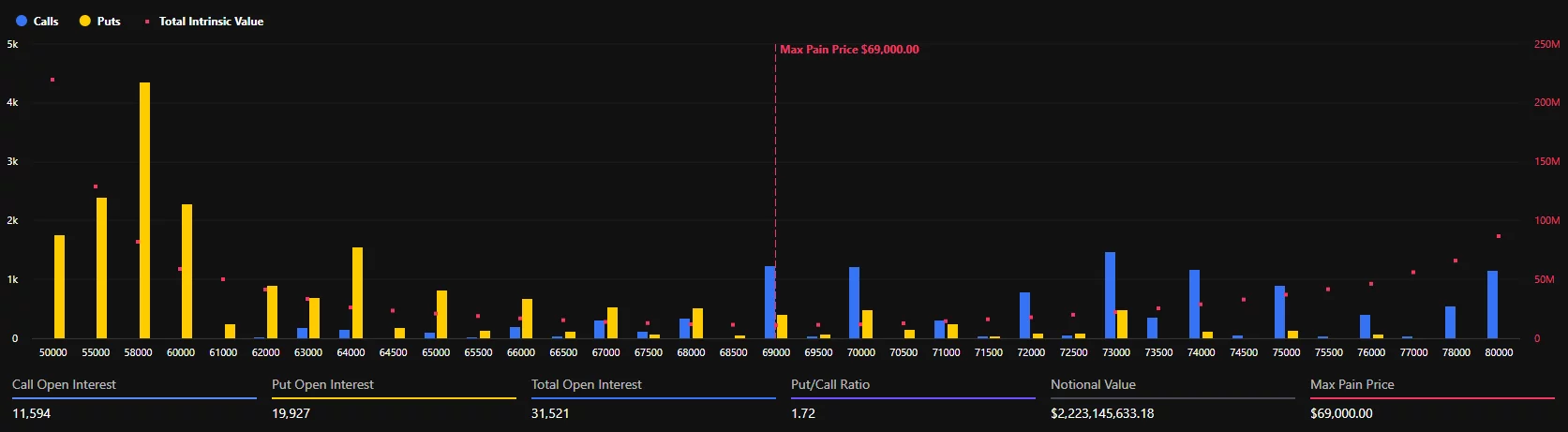

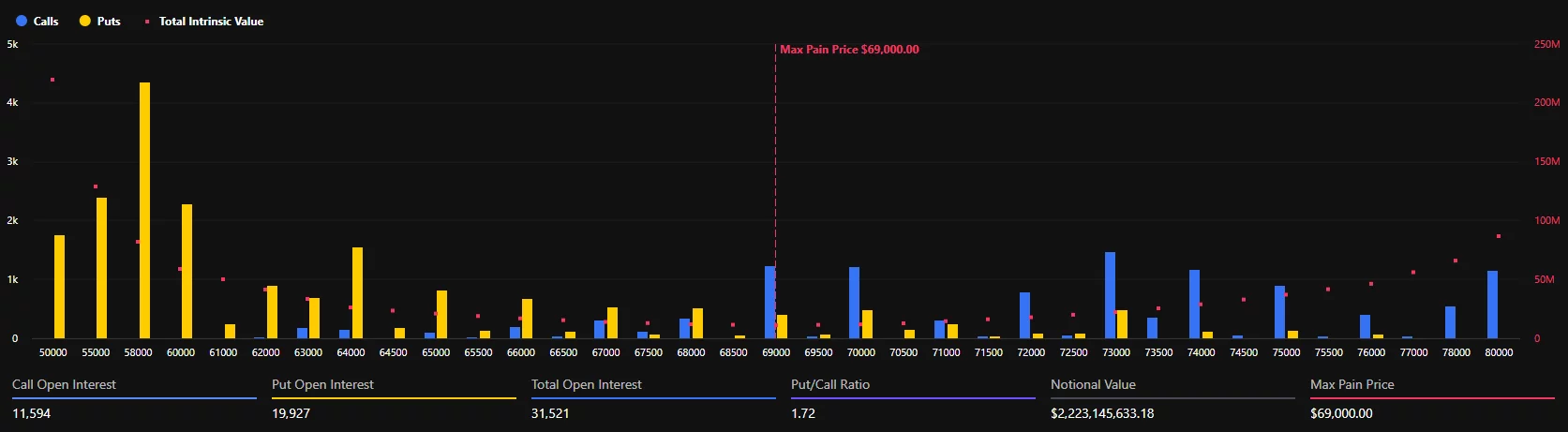

Today, investor sentiment is being kept in check as $2.22 billion worth of Bitcoin option expiry is set to be settled on the Deribit exchange at 8:00 a.m. UTC. Over 31,500 Bitcoin open contracts are set to expire.

At press time, the put-to-call ratio was at 1.72, meaning put options or traders betting on Bitcoin to go lower far surpass the calls that are betting on a rise. The maximum pain level for BTC or the price at which most option contracts expire worthless stood at $69,000, just $1,400 short of the current spot price.

The maximum pain level, also known as the strike price, tends to pull spot prices towards the center around expiry. Therefore, there remains a high risk that Bitcoin price could pull back towards the $69,000 mark as options reach expiry.

Bitcoin has failed to hold above $70,000 six times since the start of February, and losing this key psychological support once again could spook short-term traders who were betting on the current recovery rally.

Despite the concerns surrounding the massive options expiry today, BTC price charts have not yet shown signs of a breakdown.

On the Bitcoin/USDT 24-hour chart, momentum indicators still portrayed a positive outlook at least in the short term.

Notably, the MACD line was pointing upwards, suggesting growing buying pressure for the bulls in comparison to the selling pressure exerted by bears. At the same time, the Relative Strength Index has also formed a bullish divergence with the price action.

For now, bulls will be eyeing $72,000 as the next major resistance level to claim, a break above which could likely end its downtrend today.

On the contrary, a move below the $70,000 support could pull BTC price to $69,000 and successively as low as $60,000 as the broader structure remains confined within a bearish flag pattern, which is considered one of the most negative formations in technical analysis.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Ethereum (ETH) Price Struggles Below $2,200 Amid Macro Headwinds and ETF Outflows

Key Takeaways

- Ethereum declined 6% following a brief rally to $2,200, pressured by US equity market weakness and geopolitical tensions

- Options market skew reached 7%, indicating institutional traders are positioning for potential downside

- US spot Ethereum ETFs experienced combined net outflows totaling $91 million on March 5

- The validator entry queue expanded to 3.4 million ETH, while exit queue contracted to only 58,944 ETH

- Ethereum commands 65% of aggregate blockchain TVL across layer-1 and layer-2 networks, with $55.4B on mainnet

Ethereum is currently exchanging hands near $2,080 following its inability to sustain momentum beyond the $2,200 threshold this week. The pullback occurred amid deteriorating global market conditions, influenced by escalating Middle East tensions and a US judicial decision mandating government repayment exceeding $130 billion in tariff refunds to domestic enterprises.

The second-largest cryptocurrency had mounted an impressive 22% recovery from its February nadir of $1,800, but upward momentum dissipated rapidly. Wednesday’s temporary breach of $2,200 was swiftly followed by a 6% retracement, echoing broader risk-asset selloffs across US markets.

Futures market indicators paint a cautious picture. The 30-day annualized premium for ETH futures contracts remains significantly below the 5% neutral benchmark, suggesting limited appetite for leveraged bullish positions among derivatives traders.

The put-call skew for ETH options expanded to 7% on Thursday. Historical patterns indicate that readings exceeding 6% generally reflect heightened demand for downside protection among sophisticated market participants.

Liquidation data from CoinGlass reveals that ETH traders absorbed $58 million in forced position closures over a 24-hour period, with long positions accounting for $35.7 million of that total.

Institutional Flows and Staking Dynamics

The price deterioration coincided with unfavorable institutional flow data. March 5 witnessed US spot Ethereum ETF products recording aggregate net redemptions of $91 million, signaling a temporary retreat in institutional demand.

This outflow represented a sharp reversal from the more constructive inflows observed during earlier trading sessions in the week, underscoring how rapidly institutional sentiment responds to changing market dynamics.

Meanwhile, network staking metrics present a contrasting narrative. The validator activation queue has ballooned to approximately 3.4 million ETH, while the corresponding exit queue has diminished to merely 58,944 ETH. Prospective validators now face wait times approaching 57 days.

These figures indicate that substantial holders are preferring to stake their ETH for yield generation rather than liquidating positions during market turbulence.

Onchain Metrics and Ecosystem Dominance

Decentralized exchange activity on Ethereum has cooled considerably. Weekly DEX trading volumes contracted to $12.6 billion from $20.2 billion recorded one month prior. Decentralized application revenues similarly declined to $14.1 million over the trailing seven days, representing a 47% month-over-month decrease.

Solana experienced comparable trends, with DEX volumes contracting by 50% across the identical 30-day measurement period.

Notwithstanding reduced network activity metrics, Ethereum maintains its commanding position in value locked across the blockchain ecosystem. When accounting for layer-2 scaling solutions, the Ethereum infrastructure captures approximately 65% of total blockchain TVL. The mainnet alone secures $55.4 billion, substantially exceeding Solana’s $6.8 billion.

Technical analysis identifies immediate resistance at the $2,108 level on daily timeframes. A decisive close above this threshold could facilitate a move toward $2,388. Conversely, should support at $1,741 fail to hold, subsequent downside targets emerge at $1,524 and $1,404.

Analysts have identified $1,826 as the lower boundary of the current range structure, representing the next technical attractor should selling pressure intensify in the near term.

Crypto World

Cardano price prediction as ADA accepted at 137 Spar stores in Switzerland

Cardano’s native token ADA is drawing renewed attention after the Cardano Foundation announced that the cryptocurrency can now be used for payments at Spar supermarkets across Switzerland, marking a real-world adoption milestone for the blockchain network.

Summary

- Cardano Foundation announced that Cardano can now be used at 137 stores of SPAR in Switzerland, expanding real-world crypto payment adoption.

- ADA is trading near $0.27 after weeks of consolidation following a broader downtrend from the $0.40 region earlier this year.

- Technical indicators show weak accumulation and slightly bearish momentum, with key support around $0.26 and resistance near $0.30.

According to the foundation, customers can now pay with the Cardano token (ADA) using a crypto payment integration powered by the OpenCryptoPay gateway, allowing seamless checkout transactions in participating stores.

The rollout makes the Swiss branch of the global retail chain one of the largest supermarket networks in Europe to accept ADA payments.

The initiative reflects Cardano’s broader push toward everyday payment use cases and could help strengthen the network’s reputation as a practical blockchain ecosystem beyond decentralized finance and token speculation.

Retail adoption has historically been a positive sentiment driver for cryptocurrencies, as it signals growing real-world utility. However, the impact on price tends to depend on broader market conditions and investor demand rather than adoption announcements alone.

At press time, ADA is trading near $0.27, showing modest stabilization after a prolonged downtrend that began in early January.

Cardano price prediction after ADA payment rollout across Spar stores

The daily chart shows that Cardano has been trading in a tight consolidation range between $0.26 and $0.30 over the past few weeks following a steep decline from the $0.40 region earlier in the year.

Price is currently hovering around $0.269, with the market forming smaller candles and reduced volatility — a pattern that often precedes a breakout move.

The Accumulation/Distribution indicator, sitting near 50.66B, has been trending slightly downward, suggesting that buying pressure remains limited and that large investors have not yet begun aggressive accumulation.

Meanwhile, the Balance of Power (BOP) indicator remains marginally negative at -0.0097, indicating that sellers still hold a slight advantage in the short term.

Key levels to watch include support near $0.26, which has held multiple times since mid-February. A breakdown below this level could expose ADA to further downside toward $0.24.

On the upside, resistance sits around $0.30, with a stronger barrier near $0.32. A sustained break above these levels could signal the start of a recovery rally if bullish momentum returns to the broader crypto market.

For now, ADA appears to be in a consolidation phase, with traders watching for a catalyst — such as increased adoption or broader market strength — to determine the token’s next major move.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports15 hours ago

Sports15 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker