Crypto World

Galaxy Digital shares jump 18% after company approves $200 million buyback

Shares of Galaxy Digital (GLXY) jumped 18% to $19.90 on Friday after the company approved a share repurchase program of up to $200 million, giving it authority to buy back its Class A common stock over the next 12 months.

The buybacks may be executed through the open market, privately negotiated transactions or other methods, including trading plans under Rule 10b5-1, the company said. Galaxy added that it retains the right to suspend or discontinue the program at any time, depending on market conditions and other factors.

The announcement signaled confidence from management that Galaxy’s shares are undervalued and that the firm has excess capital to deploy. Share repurchase programs often support stock prices by reducing the number of shares outstanding, which can boost earnings per share and signal balance-sheet strength. In volatile markets, buybacks can also reassure investors that management believes the company’s fundamentals remain intact.

“We are entering 2026 from a position of strength, with a strong balance sheet and continued investment in Galaxy’s growth,” said Mike Novogratz, founder and CEO of Galaxy. “That foundation gives us the flexibility to return capital to shareholders when we believe our stock doesn’t reflect the value of the business.”

The sharp move higher reflects investor approval of that message.

Galaxy reported fourth-quarter earnings earlier this week that initially weighed on the stock. The company posted a net loss of $482 million for the quarter, sending shares down initially. Despite the quarterly loss, Galaxy said it generated $426 million in adjusted gross profit for the full year and ended the year with $2.6 billion in cash and stablecoins, underscoring its liquidity position.

Other crypto stocks and major cryptocurrencies were also green no the day’s trading, with bitcoin climbing back to $70,000 and ethereum breaking $2,000 over the last 24 hours. Coinbase (COIN) had climbed over 10% to $163. In more traditional markets, the Dow Jones Industrial Average broke 50,000 for the first time.

Crypto World

AI Infrastructure as a Service (AIaaS): Enterprise AI Deployment Guide

AI Summary

- Enterprises are pivoting towards large-scale AI deployment, with a focus on robust infrastructure to support advanced AI workloads.

- As global AI spending is set to reach $2.52 trillion by 2026, organizations are investing heavily in AI foundations.

- AI Infrastructure-as-a-Service (AIaaS) emerges as a pivotal model, offering on-demand access to essential resources for building AI systems without the burden of managing complex hardware.

- AI cloud infrastructure is becoming the cornerstone of enterprise AI, providing scalable environments optimized for high-performance computing and large-scale model training.

- Key architectural components of modern AI infrastructure include high-performance compute layers, data engineering, storage layers, machine learning development environments, and MLOps frameworks.

Artificial intelligence has entered a phase where infrastructure, not algorithms, is becoming the defining factor for enterprise success. Organizations are rapidly shifting their focus from experimentation to large-scale deployment of AI solutions. However, running modern AI workloads requires massive computing power, distributed storage systems, and specialized AI development infrastructure.

Industry research shows that enterprises are dramatically increasing their investments in AI foundations. According to research from Gartner, global AI spending is projected to reach $2.52 trillion by 2026, representing a 44% increase compared to previous years. A significant portion of this spending is directed toward AI infrastructure and enterprise AI platforms.

Infrastructure is now the backbone of enterprise AI adoption. Large organizations are investing heavily in high-performance computing clusters, AI cloud infrastructure, and scalable data pipelines to support generative AI and machine learning applications.

As John-David Lovelock, Distinguished VP Analyst at Gartner, explains:

“AI adoption is fundamentally shaped by the readiness of human capital and organizational processes.”

This shift toward infrastructure-led AI adoption has accelerated the rise of AI Infrastructure as a Service (AIaaS), enabling enterprises to build intelligent systems without managing complex underlying hardware.

What Is AI Infrastructure-as-a-Service (AIaaS)? A New Operating Model for Enterprise AI

AI Infrastructure-as-a-Service is a cloud-based delivery model that provides enterprises with on-demand access to computing resources, machine learning environments, and deployment platforms required to build and scale artificial intelligence systems.

Instead of investing in expensive hardware or building AI platforms internally, organizations can leverage managed AI infrastructure services delivered through cloud-based platforms.

An enterprise-grade AI infrastructure platform typically provides:

- GPU and AI accelerator clusters for large-scale computation

- Distributed storage for large datasets

- AI development infrastructure for model training

- MLOps pipelines for lifecycle management

- AI deployment and inference environments

This service-based model enables organizations to build advanced AI applications while focusing on innovation rather than infrastructure management.

Industry analysts highlight that AI-optimized infrastructure services are becoming one of the fastest-growing segments of enterprise technology.

According to Gartner research, spending on AI-optimized Infrastructure-as-a-Service is expected to reach $37.5 billion by 2026, driven by the increasing demand for specialized computing hardware such as GPUs and AI accelerators.

The Rise of AI Cloud Infrastructure: Powering the Next Generation of AI Applications

Modern AI systems rely heavily on scalable cloud environments capable of handling massive datasets and complex machine learning workloads. As a result, AI cloud infrastructure has become the foundation of enterprise AI deployment.

Unlike traditional cloud environments, AI cloud infrastructure is optimized for high-performance computing and large-scale model training. It integrates advanced hardware components such as GPUs, tensor processing units, and AI accelerators with distributed storage and networking systems.

Key capabilities of AI cloud infrastructure include:

- Scalable GPU clusters

- Distributed computing frameworks

- High-speed networking for parallel processing

- Automated model deployment environments

These capabilities allow enterprises to train complex machine learning models, process massive datasets, and deploy AI-driven applications across global markets.

According to reports from Deloitte and Gartner, enterprise spending on AI infrastructure is accelerating as organizations scale generative AI and machine learning deployments. Major technology companies are investing hundreds of billions of dollars into data centers designed specifically for AI workloads.

This growing infrastructure ecosystem is enabling enterprises to build AI systems that can process vast amounts of data in real time.

Building Enterprise AI Infrastructure: Key Architectural Components

A modern enterprise AI infrastructure consists of multiple interconnected layers designed to support the complete lifecycle of AI development.

These layers form the foundation of AI development infrastructure used by data scientists, machine learning engineers, and enterprise technology teams.

High-Performance Compute Layer

AI workloads require specialized hardware capable of handling parallel computations. GPU clusters and AI accelerators enable organizations to train deep learning models and generative AI systems efficiently.

These compute environments are particularly critical for large language models and advanced neural networks that require thousands of parallel operations.

Data Engineering and Storage Layer

AI systems rely on vast volumes of data. Enterprise AI platforms include advanced data pipelines that support data ingestion, storage, transformation, and governance.

These systems allow organizations to process structured and unstructured data at scale while maintaining security and compliance.

Machine Learning Development Environment

AI engineers require sophisticated development environments that allow them to experiment with models, test algorithms, and collaborate across teams.

These environments are an essential component of modern AI development infrastructure.

They typically include:

- model training frameworks

- experiment tracking tools

- collaborative development environments

These capabilities accelerate innovation while ensuring consistency across AI projects.

MLOps and Model Lifecycle Management

As AI systems move into production environments, organizations must manage the entire lifecycle of machine learning models.

MLOps frameworks provide automation for:

- model deployment

- monitoring and performance tracking

- continuous model retraining

These systems ensure that AI applications remain reliable and effective over time.

The Role of AI Development Companies in Accelerating Enterprise AI

For many organizations, building AI infrastructure internally can be both technically complex and financially demanding. As a result, enterprises increasingly collaborate with specialized AI development company partners that provide expertise in building scalable AI ecosystems.

An experienced AI development company can help enterprises:

- Design scalable AI infrastructure platforms

- Implement AI cloud infrastructure environments

- Build custom AI models and data pipelines

- Deploy AI applications across enterprise systems

By combining infrastructure expertise with advanced AI engineering capabilities, these companies enable organizations to accelerate AI adoption while minimizing operational risks.

Business Advantages of AI Infrastructure-as-a-Service

Adopting AI infrastructure as a service provides multiple strategic benefits for enterprises looking to scale AI initiatives

AIaaS eliminates infrastructure bottlenecks, allowing organizations to focus on building intelligent applications rather than managing hardware.

- Scalable Computing Resources

Enterprises can dynamically scale computing resources based on demand, enabling them to handle large AI workloads efficiently.

- Reduced Capital Investment

Organizations avoid large upfront investments in specialized hardware such as GPU clusters and AI accelerators.

- Improved Operational Efficiency

Managed AI infrastructure services reduce operational complexity and simplify the management of AI environments.

- Faster Deployment of AI Applications

AIaaS platforms accelerate the development and deployment of AI solutions across enterprise systems.

Transform your Enterprise with Scalable AI Infrastructure

Emerging AI Infrastructure Trends Shaping 2025-2026

The evolution of enterprise AI infrastructure is being shaped by several transformative trends.

- Generative AI Infrastructure

The rise of generative AI has significantly increased demand for computing power and data processing capabilities. Enterprises are building infrastructure specifically designed to support large language models and multimodal AI systems.

- AI Supercomputing Clusters

Large-scale AI clusters capable of connecting thousands of GPUs are becoming the backbone of enterprise AI platforms.

Organizations are increasingly deploying AI models closer to data sources to enable real-time processing for applications such as smart manufacturing and autonomous systems.

As AI adoption grows, enterprises are implementing governance frameworks and financial operations strategies to manage the cost and performance of AI workloads.

Experts highlight that infrastructure readiness is becoming a critical factor for successful AI implementation.

Challenges Enterprises Must Address When Building AI Infrastructure

- Data Security and Compliance

Enterprises must ensure that sensitive data remains protected when deploying AI workloads in cloud environments.

Training large AI models can require significant computing resources, increasing operational expenses.

Many organizations struggle to find professionals with expertise in AI infrastructure engineering.

Relying heavily on a single AI cloud provider can create long-term operational dependencies. Addressing these challenges requires careful planning and a well-defined enterprise AI strategy.

The Future of AI Infrastructure Platforms

AI infrastructure is rapidly evolving as enterprises push the boundaries of machine learning and generative AI technologies.

Future enterprise AI platforms are expected to incorporate:

- autonomous AI operations

- distributed AI networks

- edge computing infrastructure

- AI-native cloud environments

Researchers predict that the number of AI agents and intelligent systems could increase dramatically over the next decade, placing even greater demands on global computing infrastructure.

This means that scalable AI infrastructure platforms will become essential digital foundations for the next generation of intelligent systems.

Why AIaaS is Becoming the Backbone of Enterprise AI

Artificial intelligence is transforming how organizations operate, compete, and innovate. However, the ability to scale AI initiatives depends heavily on the availability of reliable and high-performance infrastructure. AI Infrastructure-as-a-Service provides enterprises with a powerful solution for building and deploying intelligent systems without the complexity of managing hardware environments. By leveraging scalable computing environments and modern AI platforms, organizations can accelerate innovation, reduce operational complexity, and unlock new opportunities in the AI-driven economy. As AI adoption continues to expand, AIaaS will play a critical role in enabling enterprises to build the intelligent digital ecosystems of the future.

As a trusted AI Development company, Antier helps enterprises design and implement scalable AI environments that support modern AI workloads and intelligent applications. With deep expertise in enterprise AI deployment, Antier empowers organizations to transform ideas into production-ready AI solutions.

Crypto World

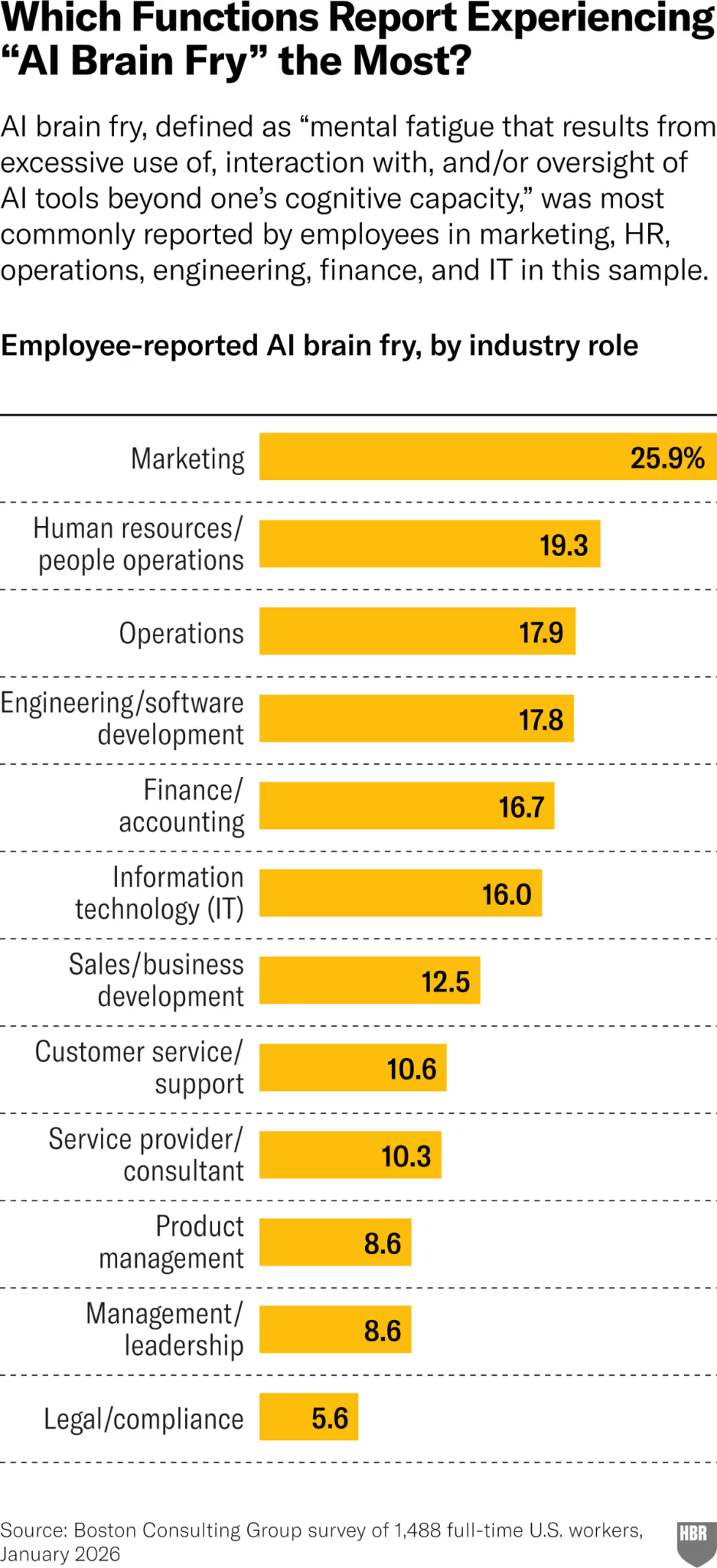

AI Use in Workplaces Causing ‘Brain Fry,’ Say Researchers

The excessive use and oversight of artificial intelligence in the workplace is giving workers “AI brain fry,” contrary to the technology’s assurance that it would ease job pressures.

Workers who are using AI tools report that the technology is “intensifying rather than simplifying work,” researchers from Boston Consulting Group and the University of California wrote in the Harvard Business Review on Friday.

A study of nearly 1,500 full-time US workers found 14% said they had experienced “mental fatigue that results from excessive use of, interaction with, and/or oversight of AI tools beyond one’s cognitive capacity,” or what the researchers called “AI brain fry.”

Respondents described having a “mental hangover” with a “fog” or “buzzing” and an inability to think clearly, along with headaches, slower decision-making, and difficulty focusing.

AI companies have pushed their products as a productivity booster, allowing workers to offload some or part of their workloads, a message that some companies have taken on and started to measure AI use as a performance metric.

Crypto exchange Coinbase CEO Brian Armstrong has said he fired engineers who didn’t want to use AI, and set a goal late last year to have AI generate half of the platform’s code.

“As enterprises use more multi-agent systems, employees find themselves toggling between more tools,” the researchers wrote. “Contrary to the promise of having more time to focus on meaningful work, juggling and multitasking can become the definitive features of working with AI.”

AI carries “significant costs,” but can improve burnout

The researchers said this AI-induced mental strain “carries significant costs in the form of increased employee errors, decision fatigue, and intention to quit.”

Study respondents who said they had brain fry experienced 33% more decision fatigue compared to those who didn’t, which researchers said could cost large companies millions of dollars a year. Those with AI brain fry were also around 40% more likely to have an active intent to quit.

Those reporting AI brain fry also self-reported making nearly 40% more major errors than those who did not, with a major error defined as one with “serious consequences, such as those that could affect safety, outcomes, or important decisions.”

The researchers found, however, that the use of AI to replace repetitive and routine tasks decreased burnout, a state of chronic workplace stress that leads to negative feelings about the job and decreased effectiveness.

Related: Anthropic reopens Pentagon talks as tech groups push Trump to drop risk tag

Respondents who used AI to reduce time spent on routine and repetitive tasks reported their levels of burnout were 15% lower than those who didn’t use AI in such a way.

The researchers said company leaders looking to reduce AI brain fry should “clearly define AI’s purpose in the organization” and explain how workloads will change with the tool.

Companies should also stick to “measurable outcomes” for AI, as “incentivizing quantity of use will lead to waste, low-quality work, and unnecessary mental strain.”

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

Crypto World

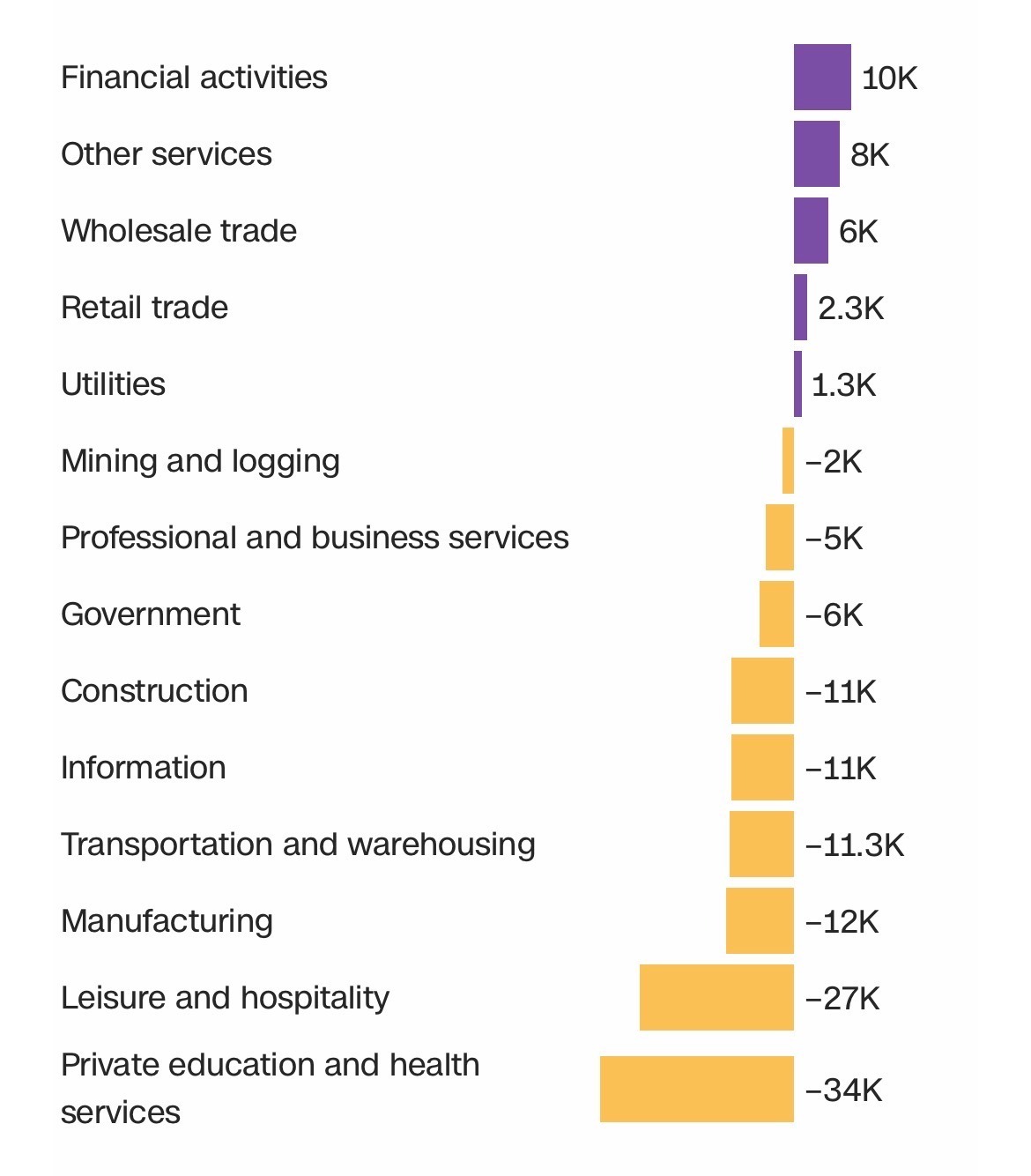

Finance Hiring Back to 2012 Levels as US Lost 92k Jobs Last Month

Finance and insurance job openings in the United States edged toward 13-year lows by the end of 2025, according to February data from the Federal Reserve Bank of St. Louis. A well-circulated analysis by The Kobeissi Letter on X warned that the industry may be bracing for more layoffs as the labor market recalibrates. The data show openings for the sector declining by 117,000 since December to 134,000 in February, with total finance and insurance listings approaching recession-era levels. The contraction is notable because it marks a swing from a peak reached in 2022 and raises questions about how the broader labor market will fare in 2026. (CRYPTO: BTC)

In a broader payroll snapshot, the February release from the US Bureau of Labor Statistics depicted a mixed picture. While the headline figure captured a net loss of 92,000 jobs for the month, the finance‑related segment posted a small gain of 10,000 positions. The healthcare sector, however, dragged on the numbers, shedding 28,000 roles in February — a consequence attributed in part to the Kaiser Permanente strike that spanned several weeks and ended late last month. The overall picture remains nuanced: a softening in certain segments coexists with pockets of resilience in others, underscoring a labor market that is anything but uniform. A CNN summary of the February report highlighted that weather conditions may have influenced the data, though the bureau noted that quantifying weather’s impact is challenging. (CNN: https://edition.cnn.com/2026/03/06/economy/us-jobs-report-february)

The discussions around these figures have fed a broader debate about the trajectory of monetary policy. A weaker payroll backdrop can tilt the balance toward rate cuts, which some market observers argue would be supportive for risk-on assets, including digital currencies. Yet the same fragility in the labor market can also push investors toward risk-off strategies as uncertainty persists, complicating the outlook for liquidity and appetite across high‑beta assets. While The Kobeissi Letter framed the sector as vulnerable to further layoffs, other data points suggest that some corners of the economy remained buoyant, creating a tug-of-war between softer hiring in finance and pockets of recovery elsewhere.

Bitcoin (CRYPTO: BTC) has traded with sensitivity to macro cues, absorbing both the caution from a softer jobs backdrop and the potential for policy shifts. The narrative around rate expectations—whether policymakers will cut sooner or hold a higher-for-longer stance—continues to shape how traders price risk, liquidity, and inflation expectations. In this context, the February numbers do not present a single storyline but rather a mosaic of forces that could influence crypto and broader markets in the weeks ahead.

The February report also touched on several sectors outside finance. The information sector, transportation and warehousing, and the federal government each lost around 11,000 jobs, contributing to the month’s mixed performance. The healthcare sector’s decline, tied to the electricity of ongoing labor actions in that space, underscored how sector-specific dynamics can travel across the broader payroll landscape. Weather, while cited as a possible contributing factor, was described by the bureau as difficult to quantify in terms of its net effect on the numbers.

Against this backdrop, market participants watched for how financial conditions might evolve as the year unfolds. The Labor Department data, coupled with independent assessments, continues to shape expectations around how aggressively the Federal Reserve might shift policy. If the data tilt toward weakness, the case for rate reductions could strengthen, potentially offering a more favorable environment for risk assets, including major crypto assets. Yet the overarching uncertainty surrounding the pace of growth and inflation means that investors remain vigilant for surprises in the coming releases.

As policymakers weigh the next steps, the market’s current mood reflects a balance between caution and opportunity. The possibility of rate relief remains a central theme for asset pricing, even as volatility persists in sectors affected by labor dynamics and sector-specific disruptions. The conversation surrounding how macro policy translates into crypto market performance is ongoing, and observers continue to parse the implications for liquidity, leverage, and investor sentiment.

Looking ahead, central bank commentary and upcoming data releases will be critical in shaping how the narrative evolves. While the February payrolls lay out a mixed landscape, the bigger question remains: will labor market softness materialize into a sustained shift in policy that catalyzes a broader risk-on rotation, or will persistent fragility push investors toward defensive positioning? The answer will likely influence the trajectory of crypto markets as traders seek clarity on the macro backdrop and the timing of potential policy pivots.

Why it matters

The February payroll data underscore a core tension in the current economic cycle: pockets of resilience exist alongside sectors that are contracting. For the crypto ecosystem, this matters because policy expectations and liquidity conditions are among the most influential drivers of price dynamics. If a softer labor market nudges the Federal Reserve toward rate cuts, it could lower the opportunity cost of holding non-yielding assets like Bitcoin and other digital currencies, potentially encouraging a broader risk-on stance among investors. Conversely, persistent hiring weakness and the possibility of renewed volatility can keep risk tolerance in check, reinforcing caution in both traditional markets and crypto trading desks.

From an investor perspective, the juxtaposition of gains in finance employment with losses in healthcare and government segments highlights the uneven nature of the recovery. The crypto market thrives on clarity—whether through clearer policy signals, stabilization in macro data, or the sustained entrance of institutional capital. The current data landscape suggests that traders should prepare for a range of outcomes, with the potential for both upside surprises and renewed downside pressure as new statistics arrive. The dynamic also reflects that macro conditions continue tooutweigh any one-harvest dataset, reinforcing the importance of a diversified approach to assessing risk and opportunity in the space.

For builders and strategists, the payroll trajectory matters in shaping how venture capital and corporate treasuries allocate liquidity in the short to mid term. The health of the labor market influences consumer demand, financial stability, and the speed at which digital asset ecosystems can scale. While the February numbers do not deliver a single roadmap, they contribute to a broader narrative in which policy direction, market liquidity, and sector-specific developments—especially in finance and healthcare—will interact with crypto-related funding, investments, and product launches as 2026 unfolds.

What to watch next

- Upcoming U.S. labor data releases (next month) to assess whether February’s softness or resilience persists across sectors.

- Federal Reserve communications and the timing of potential rate moves, including any shifts in language around inflation and growth.

- Macro liquidity trends and ETF flows that could influence risk appetite for crypto assets.

- Updates on major healthcare and labor actions that could alter sector hiring momentum in the near term.

- Monitor Bitcoin price action and volatility in response to macro news and policy signals as a gauge of risk sentiment.

Sources & verification

- Federal Reserve Bank of St. Louis data on finance and insurance job openings for February (13-year low, 134,000 openings; down 117,000 since December).

- The Kobeissi Letter posting on X summarizing the declines and comparing them to historical recession bottoms.

- US Bureau of Labor Statistics February jobs report (overall -92,000; finance activities +10,000; healthcare -28,000).

- CNN coverage of the February employment report, including discussion of weather impacts and sector contributions.

Crypto World

Surging Oil Prices and Inflation Data Will Rattle Crypto Markets This Week

A busy week lies ahead with all eyes on oil prices and key inflation reports due on the United States economic calendar.

Crypto markets saw another red Monday morning as digital assets erased last week’s gains and returned to their sideways channel.

The only thing going up at the moment is oil prices, with crypto, commodities, and US stock futures all falling on Monday morning.

President Donald Trump said oil prices “will drop rapidly” when the “Iran nuclear threat is over,” adding that it is a “very small price to pay.”

Economic Events March 9 to 13

Crude oil prices have skyrocketed to $116 per barrel as oil futures opened higher on Sunday evening. This has resulted in major volatility in stock futures and crypto markets, which are falling.

The Kobeissi Letter described it as “one of those days that will be referenced for decades to come,” with oil prices surging 25% on a Sunday, US stock market futures erasing over $2 trillion, and “20 million barrels per day of oil supply offline with no signs of deescalation,” it added.

The week ahead will add to that volatility, starting on Wednesday with February’s CPI (consumer price index) inflation data. There is only one way inflation can go with fuel prices skyrocketing.

The delayed January reading of the Federal Reserve’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, is due on Friday, adding fuel to the fire.

You may also like:

The timing is significant ahead of the Fed’s rate-setting meeting on March 18, which has a 95.5% probability of no rate changes, according to CME Group futures markets.

The PCE print is expected to show that prices increased 0.4% month-on-month in January, matching December’s pace, and would be the second consecutive “hot” reading.

Key Events This Week:

1. US Stock Market and Oil Futures Open – 6 PM ET TODAY

2. February Existing Home Sales data – Tuesday

3. February CPI Inflation data – Wednesday

4. US Q4 2025 GDP Data – Friday

5. January PCE Inflation data – Friday

6. January JOLTS Job Openings data…

— The Kobeissi Letter (@KobeissiLetter) March 8, 2026

Surging gasoline prices tied to the Middle East conflict could influence inflation expectations and consumer spending behavior, as broader markets go into selloff mode.

Crypto Market Outlook

High-risk crypto assets are particularly sensitive to geopolitical conflict, and markets have retreated $40 billion over the weekend to $2.36 trillion.

Bitcoin saw resistance at $68,000 on Sunday and tanked below $66,000 before a marginal recovery during Asian trading on Monday morning. The asset remains in the middle of its range-bound channel but is heading for the lower bands.

Ether prices saw similar declines, failing to reclaim $2,000 over the weekend and falling back to $1,960 at the time of writing. The altcoins were mostly flat over the past 24 hours.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

The US Economy Unexpectedly Lost 92,000 Jobs in February

Finance and insurance job openings toward the end of 2025 fell to 13-year lows, according to February data from the Federal Reserve Bank of St. Louis, with markets commentary outlet The Kobeissi Letter arguing on Saturday that the industry may be “bracing for more layoffs.”

In an X post, The Kobeissi Letter highlighted data showing that finance and insurance job openings have declined by 117,000 since December to hit 134,000 last month, with overall finance and insurance job listings nearing recession levels.

“Available vacancies in these sectors have dropped -410,000, or -75%, since the 2022 peak. Openings are now even lower than at the 2001 recession bottom,” The Kobeissi Letter said, adding:

“By comparison, the largest monthly decline during the 2008 Financial Crisis was -125,000. As a result, the finance and insurance job openings rate fell to 1.9%, meaning fewer than 2 out of every 100 jobs in the sector are currently vacant, the lowest since February 2010.”

Finance jobs increased despite challenges

Despite a fall in job openings in December, the finance sector was actually one of the bright spots of a US Bureau of Labor Statistics report on Friday, showing that while US unexpectedly lost 92,000 jobs in February, the “financial activities” sector posted a net employment gain of 10,000.

The bureau instead highlighted the healthcare sector as one of the key drivers behind the 92,000 net loss, following a four-week healthcare strike by Kaiser Permanente employees that ended late last month. The healthcare sector lost 28,000 jobs in the month, accounting for 30% of the total.

Meanwhile, the information sector, transportation and warehousing, and the federal government lost 11,000, 11,000, and 10,000 jobs, respectively.

CNN reported on Saturday that extreme weather conditions may have impacted the numbers, though the bureau’s report indicated that the impact of weather conditions is difficult to quantify.

Related: Crypto Fear and Greed Index falls back down to ‘extreme fear’ levels

A weak jobs market can increase the chances of the US Federal Reserve cutting interest rates to ease pressure, which could be a boon for the crypto market.

However, it can also be a double-edged sword, as the fragility could spark investors into taking risk-off strategies to weather the storm.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

U.S. isn’t really exposed to oil shocks and that might be helping bitcoin

The week-long war between Iran, the U.S., and Israel has pushed oil prices on both sides of the Atlantic past $100 a barrel, threatening to inject inflation into the global economy. Asian markets are taking a hit, bond yields are climbing, and yet bitcoin has barely budged, hovering around $67,000, where it was 24 hours ago.

A likely reason? Bitcoin’s strong links to Wall Street. Since the conflict started last week, U.S. stocks have held up relatively well compared to Asian and European equities, probably benefiting from America’s position as a net oil exporter. Bitcoin, which closely tracks U.S. tech and Nasdaq moves, seems to have caught some of that same resilience.

“The United States is not meaningfully exposed to oil from Iran, or, more broadly, the Middle East,” JP Morgan’s Executive Director Kriti Gupta and Global Investment Strategist Justin Beimann said in a note to clients Friday, noting the relative strength of the U.S. stocks.

They explained that the U.S. imports oil mostly from Canada and Mexico, and just 4% from Saudi Arabia, and that it is now the world’s largest net oil exporter. This means the U.S. is largely insulated from disruptions to oil flowing through the Strait of Hormuz, while China and other Asian countries, such as India and South Korea, are most affected.

Markets are pricing risks accordingly. Futures tied to the S&P 500 and tech-heavy index Nasdaq are down just over 3% since the conflict began on Feb. 28. Meanwhile, Asian equity indices have taken a beating. Japan’s Nikkei and India’s Nifty have dropped 10% and 5%, respectively. South Korea’s Kospi has declined by over 16%.

Though bitcoin is a decentralized asset, it has slowly evolved into a quasi–U.S. risk asset, increasingly moving in step with Wall Street, tech stocks, and even the U.S. dollar. This trend has accelerated since the debut of U.S. spot ETFs, which made it easier for institutional investors to access bitcoin directly.

The late-2024 election of Donald Trump also added to the shift, as markets reacted to his promises of looser regulations and a more crypto-friendly policy environment. Together, these developments have tethered bitcoin more closely to U.S. financial conditions, making it less of a purely global, borderless asset and more of a barometer for American risk appetite.

It shows that bitcoin is increasingly tied to U.S. financial conditions, making it less of a purely global, borderless asset and more of a barometer of Wall Street risk appetite.

Another factor likely helping bitcoin is its oversold status. The cryptocurrency had already dropped to nearly $60,000 well before the conflict began, following weeks of profit-taking and broader market jitters. That decline likely cleared out short-term sellers, leaving a relatively stable base for the digital asset.

Inflation could show up with lag

The oil price spike could hit U.S. consumers’ wallets with a lag, even though the U.S. is largely energy-independent.

“That doesn’t mean Americans are insulated from higher gasoline prices,” JPMorgan strategists Kriti Gupta and Justin Beimann noted. “Oil prices are still subject to global supply dynamics. But energy independence means there’s a lag before price increases show up at the pump, making it easier to weather short-term volatility.”

In other words, a prolonged conflict or sustained oil surge could eventually filter through to consumer prices. Still, for now, the U.S. market and bitcoin appear to be riding out the initial shock relatively unscathed.

Crypto World

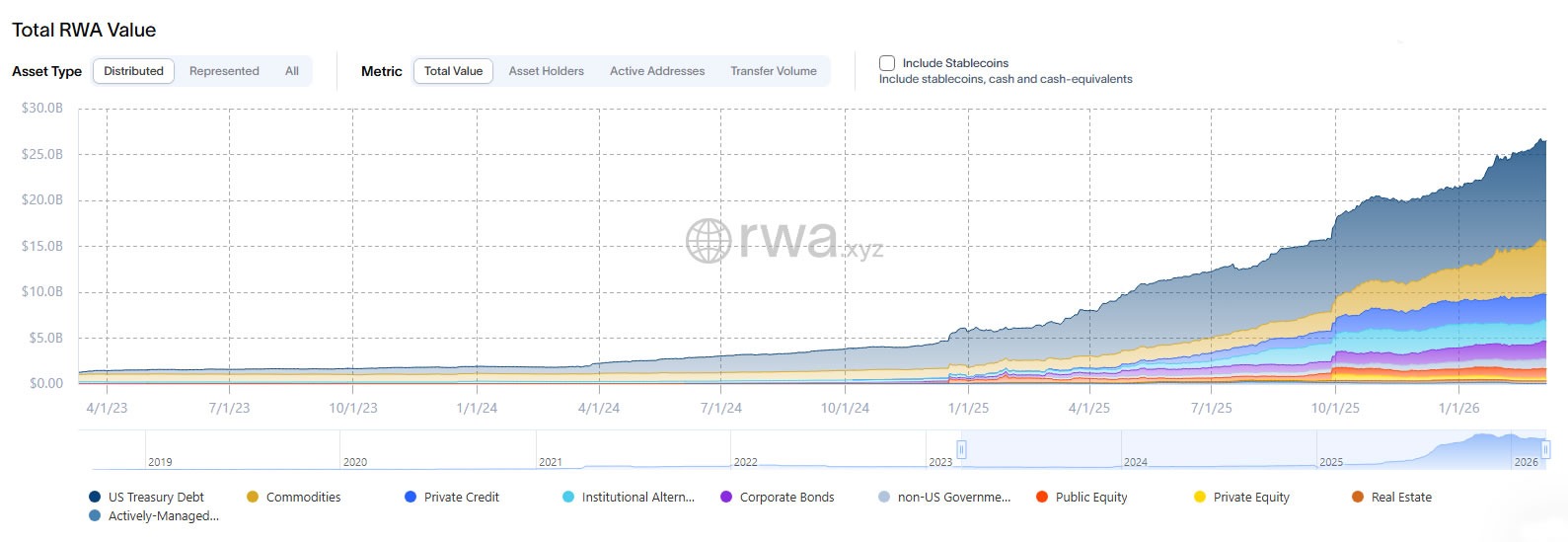

BTC Markets Seeks ASIC Licence For RWA Trading

Australian crypto exchange BTC Markets has notified the country’s securities regulator, the Australian Securities and Investments Commission, of its intention to apply for a markets licence to offer regulated tokenized real-world assets (RWAs).

“Our plan is to obtain licensing infrastructure that enables particular types of tokenized assets to be offered and available to the public,” said BTC Markets CEO Lucas Dobbins on Monday.

The vision is a world where tokenized equities, bonds, and real-world assets will trade alongside cryptocurrencies, markets will operate continuously, and settlement will be instant, he added.

Speaking to Cointelegraph, Dobbins said “the roughly $26 billion in tokenized assets on-chain today is really just the proof of concept.”

Even conservative forecasts suggest tokenized markets could reach around $2 trillion by 2030, while others, such as the Boston Consulting Group, have estimated the opportunity as high as $16 trillion, he added.

“What’s changed is that this is no longer theoretical. Institutions like BlackRock, Goldman Sachs, and JPMorgan are already launching real products.”

BTC Markets is aiming to join the likes of Kraken and Robinhood, which began offering tokenized RWAs in 2025.

Big names in crypto and TradFi eye tokenization

American crypto exchange Kraken began offering tokenized stocks in June 2025 via a new platform called xStocks.

On March 5, the platform launched xChange, an onchain trading engine designed to facilitate trading of tokenized stocks across the Ethereum and Solana networks.

Robinhood also announced a tokenized stock trading platform for European markets in 2025.

Related: Crypto exchanges gain as tokenized commodity market climbs to $7.7B

In January, the owner of the New York Stock Exchange, Intercontinental Exchange, said it was developing a platform to support trading of tokenized securities, including stocks and ETFs.

Nasdaq has also proposed integrating tokenized versions of stocks and ETPs into its existing trading infrastructure.

Meanwhile, Coinbase announced in December that it plans to launch Coinbase Tokenize, an institutional platform designed to support the issuance and management of tokenized RWAs.

RWA tokenization opportunity in Australia

In Australia, research from the Digital Finance Cooperative Research Centre suggests tokenized markets could generate around $24 billion AUD ($16.8 billion) a year in economic gains, roughly 1% of GDP, Dobbins continued.

“On the current trajectory, we may only capture around $1 billion of that by 2030, which highlights the opportunity. Unlocking it will require licensed market infrastructure that allows tokenized assets to trade within a trusted regulatory framework,” he added.

Dobbins said that Australia also has “many of the structural drivers needed for adoption, including strong regulation, deep capital markets, and one of the largest pension systems in the world.”

“As regulatory clarity improves and infrastructure develops, Australia has the potential to play a meaningful role in the next phase of tokenized financial markets.”

“The first use cases will likely appear in areas such as private markets, infrastructure investments, and fund distribution, where tokenization can improve efficiency and access,” he said.

Tokenized RWA TVL at peak despite bear market

RWA.xyz reports that the current onchain total value of tokenized RWAs is $26.5 billion, with Ethereum commanding the largest share of the tokenized RWA market at 57.4%, not including layer-2 and EVM platforms.

Magazine: Bitcoin to outperform gold soon, FBI busts $46M crypto heist: Hodler’s Digest

Crypto World

Oil rally crushes $37 million in crypto shorts as bitcoin drops

Crude oil just had its biggest day in history, and the traders shorting or taking bearish bets on it over the weekend paid the price.

Tokenized oil perpetual contracts on Hyperliquid recorded nearly $40 million in liquidations over the past 24 hours, per Coinglass, with $36.9 million of that coming from short positions that got obliterated as crude surged roughly 30% on a dramatic escalation of the Iran conflict.

The CL-USDC contract on Hyperliquid jumped to $114.77, up nearly 20% in 24 hours. The USOIL-USDH pair hit $135, up 9% on the day after already surging earlier in the week.

The oil move dwarfed everything else in commodities. Brent and WTI are trading at levels not seen since Russia’s invasion of Ukraine in 2022, and the single-day percentage gain is on track to be the largest in the history of the oil market.

The catalyst was a weekend that went from bad to catastrophic. Iran appointed Mojtaba Khamenei as new supreme leader, replacing his father who was killed in the opening wave of strikes. Israel launched a fresh round of attacks on Iranian and Hezbollah infrastructure.

Iranian missiles and drones expanded beyond Israel to hit Saudi Arabia and Bahrain, killing two people near Riyadh and targeting energy infrastructure. Iraq’s oil output dropped roughly 60%. Kuwait and the UAE trimmed production as tanker traffic through the Strait of Hormuz collapsed.

Anyone shorting oil into that backdrop got carried out. The $36.9 million in short liquidations on the CL contract alone made oil one of the largest single-asset liquidation events on Hyperliquid outside of bitcoin and ether on Sunday.

Across the broader crypto market, CoinGlass data shows 94,058 traders were liquidated in the past 24 hours with total losses hitting $364.4 million. Bitcoin accounted for $156.67 million of that, ether contributed $70.88 million, and solana added $19.8 million.

Long liquidations outpaced shorts at $215 million versus $149 million, reflecting the broader sell-off in crypto as risk assets dropped on the escalation. The largest single liquidation was a $6.88 million BTC-USD position on Hyperliquid.

Traders are increasingly using crypto perpetual markets to express macro views on oil, metals, and currencies, drawn by 24/7 access, lower margin requirements, and the ability to trade during weekends when traditional commodity markets are closed.

When missiles start flying on a Saturday, Hyperliquid’s oil contract is one of the only places in the world where you can get leveraged crude exposure.

Open interest on the CL-USDC contract sat at $195 million with $570 million in 24-hour volume, numbers that would have been unthinkable for a tokenized commodity product a year ago. The USOIL pair carried $4.1 million in open interest with $16.2 million in volume, smaller but growing.

Crypto World

Bitcoin could face deeper downside as odds of U.S. market meltdown rise to 35%

Bitcoin is holding up better than it probably should.

The largest cryptocurrency traded at $67,378 on Monday morning, up 1.1% over the past 24 hours and essentially flat on the week, while the world around it deteriorated sharply.

Among majors, ether rose 2.3% to $1,981, hovering just below $2,000. BNB gained 1.4% to $624. Dogecoin added 1.8% to $0.09. Solana climbed 1.8% to $83.69 but remains down 1.5% on the week, still the weakest major over a seven-day basis. XRP was flat at $1.35, down 1% on the week.

S&P 500 futures fell more than 2% in Asian trading. The VIX surged to its highest level since April’s tariff turmoil. Oil is above $100. The dollar just posted its steepest weekly gain in a year.

Meanwhile, veteran strategist Ed Yardeni raised the probability of a U.S. market meltdown to 35%, up from 20%, while slashing the odds of a melt-up to just 5%.

“The US economy and stock market are stuck between Iran and a hard place,” Yardeni wrote. “If the oil shock persists, the Fed’s dual mandate would be stuck between the increasing risk of higher inflation and rising unemployment.”

In meltdown conditions, risk assets across the board tend to suffer as investors pull capital from anything with volatility and move into cash, Treasuries, or the dollar. Bitcoin has historically not been immune to that dynamic, falling alongside equities during every major risk-off episode since 2020 despite its reputation as a hedge.

Elsewhere, NYDIG’s head of research Greg Cipolaro offered a framework for understanding bitcoin’s price action compared to U.S. stocks in a Friday note.

Cipolaro argued that bitcoin’s recent parallel movement with U.S. software stocks reflects “shared exposure to the current macro regime” rather than structural convergence.

Statistically, only about 25% of bitcoin’s price movements are explained by correlation to equities. The other 75% is driven by factors outside traditional stock indices, he said.

The broader equity picture remains grim. MSCI’s global equity gauge fell 3.7% last week, with Asia bearing the worst of it. South Korea has still not fully recovered from its record two-day plunge. Hedge funds have been boosting short positions in U.S. equity ETFs. Benchmark 10-year Treasury yields jumped six basis points as traders priced in higher inflation from the oil shock.

The U.S. has fared better than most on the equity side, with the S&P 500 down only 2% last week, partly because American energy self-sufficiency insulates it more than Asian or European markets.

But the 2% drop in futures on Monday suggests that the buffer is thinning.

Crypto World

Orbital Data Center Startup to Mine Bitcoin in Space

Starcloud, an Nvidia-backed orbital data center startup, said it will start mining Bitcoin from space later this year when its second spacecraft is launched, positioning it to become the first company to mine Bitcoin off Earth.

Starcloud “will be the first to mine Bitcoin in space,” the startup’s CEO, Philip Johnston, posted to X on Saturday after revealing its Bitcoin mining ambitions in space in an interview with HyperChange on Thursday.

In the interview, Johnston said running Bitcoin application-specific integrated circuit (ASIC) miners would be “one of the most compelling use cases” of space compute due to it being significantly cheaper than GPUs.

“GPUs are about 30 times more expensive per kilowatt or per watt than ASICs,” Johnston said. “A 1-kilowatt B200 chip, it might cost $30,000. A 1-kilowatt ASIC is like $1,000.”

Clip on Bitcoin mining pic.twitter.com/WXlp1BMya1

— Philip Johnston (@PhilipJohnston) March 8, 2026

In the X post, Johnston said Bitcoin mining in space will become a “massive industry” due to how much more economical it is than mining the cryptocurrency on Earth.

“Bitcoin mining consumes about 20 GW of power continuously. It makes no sense to do this on Earth, and in the end state, all of this will be done in space.”

Starcloud was founded in early 2024 to build data centers in space as a solution to address rising energy needs for AI. In November, it launched a satellite with an NVIDIA H100 into orbit, marking the first time a GPU that powerful has ever operated in space.

Its data centers, which comprise around 88,000 satellites, are primarily powered by solar energy.

Sending Bitcoin to Mars

While Johnston’s Starcloud envisions mining Bitcoin in space, tech entrepreneurs Jose E. Puente and Carlos Puente last year came up with a solution to send it across planets.

In September, Puente told Cointelegraph that it is theoretically possible to send Bitcoin to Mars in as fast as three minutes by leveraging an optical link from NASA or Starlink and a new interplanetary timestamping system.

While someone would need to be there to receive it, the Bitcoin transaction would move through space stations — such as antennas and satellites — or even a relay around the Moon before reaching Mars.

They, however, said that mining Bitcoin on Mars would not be feasible due to the latency between the two planets.

Related: Bitcoin drops 2% as oil prices surge on energy shortage fears

Bitcoin mining profitability margins have thinned over the past few months, particularly due to Bitcoin’s (BTC) price falling nearly 48% from its $126,080 high on Oct. 6.

However, the Bitcoin mining difficulty has fallen 7% from a record 155.9 trillion units in November to 145 trillion, giving miners some much-needed breathing room for now.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Entertainment7 days ago

Entertainment7 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

News Videos7 days ago

News Videos7 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports1 day ago

Sports1 day agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business13 hours ago

Business13 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World4 days ago

Crypto World4 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3