Crypto World

Gold Price Climbs Above $5,000 At the Start of the Week

As shown by today’s XAU/USD chart, gold began the week on a bullish note: trading opened with a bullish gap above Friday’s high, lifting the price above the psychological $5,000 level.

The strengthening of gold has been driven by the following factors (according to media reports):

→ The US dollar, which is weakening ahead of key US economic data. The January employment report is due on Wednesday (it is expected to show signs of stabilisation in the labour market), followed by inflation data on Friday.

→ Political developments in Japan. The decisive victory of Prime Minister Sanae Takaichi has reinforced expectations of large-scale fiscal stimulus (“Sanaenomics”), which traditionally puts pressure on the yen and supports gold.

→ Demand from central banks. It has been reported that China’s central bank extended its gold purchases for the fifteenth consecutive month in January.

On 3 February, when analysing gold price fluctuations, we:

→ noted that the market was extremely oversold within the context of a long-term ascending channel;

→ suggested that a rebound from the zone of extreme oversold conditions could encounter a resistance area formed by the median of that channel and the classic Fibonacci levels (50% and 61.8%).

Indeed, on 4 February, after recovering into this area (with the formation of peak C), the market reversed lower and found support near the lower boundary of the aforementioned channel on Friday, 6 February.

Technical Analysis of the XAU/USD Chart

Price action (expanding amplitude) during the formation of low D points to aggressive demand, which may reflect the intentions of large capital.

At the same time, analysis of the market structure based on the A–B–C–D swing points suggests that, following the burst of extreme volatility at the turn of the month (highlighted by the peak in the ATR indicator), the market is searching for a new equilibrium.

It is therefore reasonable to assume that in the near term we may see a contraction in the amplitude of price fluctuations on the XAU/USD chart. It cannot be ruled out that supply and demand will find a temporary balance around the psychological $5k level.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Ripple Expands Institutional Custody Offering with New Partnerships and Capabilities

TLDR

- Ripple expands its custody services through new partnerships with Securosys and Figment.

- Ripple’s collaboration with Securosys introduces CyberVault HSM and CloudHSM.

- Ripple’s Custody now supports a wide range of HSM providers, ensuring seamless compliance across various regulatory jurisdictions.

- The partnership with Figment allows Ripple to offer staking for Proof-of-Stake networks like Ethereum and Solana directly in custody workflows.

- Ripple’s new features, including staking and enhanced security, position the company to meet growing institutional demand for digital asset services.

Ripple has announced a series of strategic partnerships to enhance Ripple Custody, reinforcing its position as a leading digital asset custody solution. New collaborations with Securosys and Figment, along with recent integrations with Chainalysis and the acquisition of Palisade, expand Ripple Custody’s functionality. These moves aim to accelerate time-to-market, simplify procurement, and provide regulated institutions with scalable solutions.

Ripple’s New Custody Capabilities for Institutional Clients

Ripple’s partnership with Securosys introduces CyberVault HSM and CloudHSM capabilities, allowing institutions to deploy hardware security modules (HSM) for custody solutions. The new offerings eliminate the complexity and high costs traditionally associated with HSM-based custody.

With both on-premise and cloud options, customers can meet their specific security needs while maintaining high levels of protection. According to Robert Rogenmoser, CEO of Securosys, the integration of CyberVault HSM with Ripple Custody provides a ready-to-deploy enterprise-grade solution.

This solution allows institutions to maintain full control over their cryptographic keys while offering scalable and cost-effective custody options. Ripple now supports one of the broadest ranges of HSM providers, ensuring compliance across various regulatory environments.

Partnership with Figment to Enhance Staking Capabilities

Ripple’s collaboration with Figment brings staking capabilities to its Custody clients, allowing institutions to offer staking for Proof-of-Stake networks like Ethereum and Solana. By integrating staking directly into custody workflows, Ripple enables banks, custodians, and regulated enterprises to provide these services without building their own validator infrastructure.

This partnership aligns Ripple with Figment’s secure, non-custodial staking platform to offer clients a seamless staking experience. Ben Spiegelman, VP at Figment, highlighted that the partnership enables Ripple’s clients to offer secure staking rewards while ensuring compliance and security.

The integration of staking allows Ripple Custody clients to expand their product offerings, maintaining the high standards of security and governance required for institutional clients. This move positions Ripple to further capitalize on the growing demand for staking services across the financial sector.

Crypto World

Damex Secures MiCA CASP Licence

Damex has announced that its Malta entity has been granted authorisation as a Crypto Asset Services Provider under the European Union’s Markets in Crypto-Assets Regulation (MiCA) by the Malta Financial Services Authority, marking a significant milestone in the company’s regulatory and institutional development.

With this authorisation, Damex joins just 148 firms across Europe approved as a CASP under the MiCA framework. Of these, only 46 are authorised to provide custody and exchange services, and only one also holds a Gibraltar licence within its group to deliver similar regulated digital asset services currently offered by Damex.

This positions Damex among Europe’s Tier-1 Digital Asset institutions.

MiCA introduces a harmonised regulatory framework designed to raise standards across the digital asset sector, establishing clear requirements around governance, operational resilience, transparency, and consumer protection.

For businesses and financial institutions, the implications are significant. Engaging with crypto providers that are not MiCA-licensed introduces regulatory exposure and operational risks without protections.

The MiCA licence places Damex within the same regulatory recognition as major institutions such as Revolut, BBVA, and Coinbase, reinforcing its role as a trusted crypto and distributed ledger technology (DLT) partner to banks and large financial institutions across Europe.

Damex has operated at the highest levels of digital asset regulation since 2017, holding a Gibraltar DLT licence and delivering regulated infrastructure for institutional clients long before MiCA’s implementation.

While the licence has now been granted, Damex is entering its final pre-operational phase under MiCA, focusing on system readiness, governance alignment, and operational controls ahead of full launch.

The company is now welcoming early engagement from institutions and businesses seeking to operate within Europe’s regulated digital asset environment.

About Damex

Damex is a regulated digital asset and payments infrastructure group of companies serving businesses and financial institutions across Europe and globally. Operating since 2017, Damex delivers compliance focused solutions for digital asset custody, exchange, payments, and treasury operations, bridging traditional finance and the digital asset economy.

Damex Digital Ltd is a limited liability company registered in Malta with registration number C110325 with registered address at MK Business Centre 115A Floor 2, Triq Il-Wied, Birkirkara, BKR 9022, Malta. Damex Digital Ltd is authorised by the Malta Financial Services Authority as a Crypto Asset Services Provider pursuant to Regulation (EU) 2023/1114 (MICAR) to provide for its clients (i) the Custody and administration of crypto assets; (ii) exchange of crypto assets for funds and other crypto assets; (iii) execution of orders for crypto assets; and (iv) providing transfer services for crypto assets.

Please visit www.damex.io/eea for further information.

Crypto World

Ethereum Price Rebounds 23%, But $1,000 Risk Still Looms

Ethereum price hit its projected breakdown target near $1,800 in early February. It even slipped to $1,740 before bouncing. Since then, ETH has rebounded almost 23%, giving traders hope that the worst may be over.

But price rebounds inside downtrends often look strong at first. The real question is whether this bounce is supported by strong buyers. Right now, charts, on-chain data, and technical metrics suggest that support remains weak. Several warning signs still point to downside risk.

The ETH Price Breakdown Worked, But the Rebound Lacks Real Strength

On February 5, Ethereum completed a major breakdown pattern on the daily chart, as predicted by BeInCrypto analysts. This pattern usually signals that sellers are taking control. The projected target was near $1,800. Ethereum price followed that path and dropped to $1,740 on February 6.

Sponsored

Sponsored

After hitting this zone, ETH rebounded about 23%. At first glance, this looks like strong dip buying as the February 6 price candle saw a large lower wick. But momentum tells a different story.

Between February 2 and February 8, the price made lower highs. At the same time, the Relative Strength Index (RSI), which tracks short-term momentum, moved higher.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This creates a hidden bearish divergence, where momentum improves but price fails to follow.

In simple terms, price is struggling to rise, even though short-term momentum looks better. That usually means sellers are still active in the background. So while the breakdown target was reached, the rebound does not yet show deep conviction.

This weak follow-through sets the stage for the next risk.

Short-Term Bounce Is Slipping Into Another Bearish Setup

Because the rebound lacks strong follow-through, the next thing to watch is the structure of the move. On the 12-hour chart, Ethereum is forming a bearish pole and flag.

First, the price dropped sharply. Then it rebounded inside a rising channel. This is a classic continuation pattern in downtrends.

Sponsored

Sponsored

It often leads to another leg lower as volume confirms the risk. On-Balance Volume, which tracks real buying and selling activity, is staying weak. It is not rising aggressively, like the price. This means fewer real buyers are supporting the rebound. Additionally, the OBV metric itself is close to breaking down its own ascending trendline. If volume breaks down, this flag structure could fail.

That would open the door to deeper losses, around 50% from the lower trendline levels. To understand whether buyers, who led the 23% rebound, can prevent that, we need to look on-chain.

Are Short-Term Traders Buying As Long-Term Holders Sell?

On-chain data shows that the recent rebound is being driven mainly by short-term traders, not long-term investors.

A key metric here is short-term Holder NUPL, which measures whether recent buyers are sitting in profit or loss.

In early February, as Ethereum dropped to $1,740, short-term holder NUPL fell to around -0.72, placing it firmly in the capitulation zone. This reflected heavy unrealized losses among recent buyers.

During the 23% rebound, however, NUPL recovered to about -0.47. That is an improvement of roughly 35% from the bottom. While it remains negative, the speed of this recovery shows that many short-term traders rushed in to buy the dip.

Sponsored

Sponsored

This pattern closely resembles past failed bottom formations.

On March 10, 2025, NUPL also rebounded to around -0.45 while ETH traded near $1,865. At that time, many traders believed a bottom had formed. A more durable bottom only appeared on April 8, 2025, when NUPL dropped close to -0.80, roughly 75% deeper than the March level. That phase marked true seller exhaustion and preceded a sustained recovery. The price was around $1,470 at the time.

Today’s structure looks much closer to March 2025 than April 2025. Losses have eased too early, suggesting that panic has not fully cleared. At the same time, long-term holders remain cautious.

The 30-day rolling Hodler Net Position Change, which tracks investors holding ETH for more than 155 days, remains negative. On February 4, outflows stood near -10,681 ETH. By February 8, they had widened to around -19,399 ETH.

This represents an increase in net selling of roughly 82% in just four days. This signals weak conviction at current levels. So the rebound is being driven mainly by short-term traders chasing a bounce, while long-term investors continue reducing exposure.

Sponsored

Sponsored

Key Ethereum Price Levels Show Why the $1,000 Risk Is Still Alive

All technical and on-chain signals now point to a weak structure. Ethereum must reclaim key resistance to stay safe. The first resistance is near $2,150.

Holding above this would ease short-term pressure. The major invalidation level is $2,780.

Only above this would the bearish structure truly break. On the downside, risk remains heavy.

Key support levels are:

- $1,990: short-term support

- $1,750: Fibonacci support

- $1,510: major retracement zone (close to the April 8, 2025 bottom)

- $1,000: bear flag projection

A daily close below $1,990 would weaken the rebound. Losing $1,750 would expose the $1,500 ETH price zone. If the bearish flag fully breaks, the projected move points toward $1,000.

That would mean a drop of nearly 50% from current levels. Right now, Ethereum is still below major resistance.

Volume is weak. Long-term holders are selling. And Short-term traders dominate activity. Until these conditions change, the risk of a much deeper Ethereum price move remains real.

Crypto World

White House Steps In With Closed-Door Meeting to Solve Crypto Market Bill Structure

TLDR

- The White House plans a closed-door meeting to resolve issues in the U.S. crypto market structure bill, focusing on stablecoin yield.

- Banks oppose yield-bearing stablecoins, fearing up to $6.6 trillion in deposit losses to crypto platforms offering higher yields.

- Crypto companies like Coinbase argue that banning stablecoin yield benefits banks and harms competition, crucial for their business.

- The House passed the CLARITY Act in July 2025, but the Senate remains divided on stablecoin yield provisions.

- White House intervention aims to break the deadlock on the yield issue, with a deadline for compromise by February 2026.

The White House is set to hold a crucial closed-door meeting tomorrow to decide the future of the U.S. crypto market structure bill. The meeting aims to resolve key issues surrounding the bill, particularly the matter of stablecoin yield. A compromise needs to be reached by the end of February 2026 to ensure progress on the legislation.

The Debate Over Stablecoin Yield

The main point of contention in the crypto market structure bill revolves around stablecoin yield. Banks view yield-bearing stablecoins as a threat to deposits, with concerns about losing up to $6.6 trillion in community bank deposits.

Bank trade groups argue that crypto platforms offering higher yields on stablecoins could lead to money moving out of traditional banks. However, crypto companies like Coinbase argue that banning stablecoin yields benefits to banks at the expense of market competition.

In Q3 2025, Coinbase made $355 million from stablecoin revenue, showing how vital this market is for them. Brian Armstrong, CEO of Coinbase, voiced strong opposition to tighter yield rules proposed in the Senate draft.

The Legislative Process and White House Intervention

The U.S. House passed the CLARITY Act in July 2025, but the Senate remains divided on stablecoin yield provisions. The Senate Banking and Senate Agriculture committees have both attempted to move forward with their versions, but the issue remains unresolved.

The White House’s involvement aims to break the deadlock by focusing solely on the yield issue, pushing for a compromise before February 2026. If a deal on stablecoin yield is reached, the bill can proceed, with both chambers needing to merge their versions.

The final version will require votes from both the Senate and the House before it can become law. Without a resolution on the yield issue, further delays could prevent the bill from advancing and leave the crypto market in a state of uncertainty.

Crypto World

Will HOOD stock rise or fall after Robinhood’s earnings on Feb. 10?

HOOD stock price rose by over 2% on Monday, continuing a recovery that started on Friday when it surged by over 13% as American equities and the crypto market bounced back.

Summary

- Robinhood share price remains in a technical bear market after crashing by 46% from its all-time high.

- The company will publish its financial results on Tuesday this week.

- Analysts are optimistic that its revenue continued growing in the fourth quarter.

Robinhood shares jumped to $84, up significantly from the year-to-date low of $72 as focus shifts to the upcoming quarterly earnings.

Robinhood to publish its Q4 earnings on Feb. 10

A key catalyst for the HOOD stock is the upcoming fourth-quarter earnings, which will shed more color on its growth and profit trajectory.

Data compiled by Yahoo Finance shows that the average estimate is that its revenue jumped by 32% in the fourth quarter to $1.34 billion, driven by the options market and its Bitstamp acquisition.

If this estimate is correct, its annual revenue will be $4.53 billion, up 53% from 2024. Its annual earnings per share is expected to come in at $2.04, up sharply from the $1.56 it made in the same period a year earlier.

Robinhood’s business has thrived in the past few years, even as competition in the trading industry has jumped, with companies like Webull and SoFi taking some market share.

The most recent results showed that its funded customers rose to over 26.8 million from 24.3 million in Q3’24. Robinhood Gold subscribers rose to 3.88 million, while total platform assets soared to $333 billion.

The company has performed well due to its strong position in the options, stocks, and crypto markets. It also benefited from ongoing innovation, which has enabled it to launch tokenized assets in its European market.

The company has also moved into the booming predictions market, which handles billions of dollars weekly.

Robinhood stock is often highly volatile after its earnings are released. For example, it dropped from $139 to $125 when it released its results in November. This retreat accelerated, pushing the stock to $102 a few weeks later.

Wall Street analysts are largely bullish on the company. Needham analysts recently reiterated their buy rating with a $135 target. Cantor Fitzgerald has a strong buy rating, while Piper Sandler has an overweight rating.

HOOD stock price technical analysis

The daily timeframe chart shows that the HOOD stock price remains in a strong downward trend, moving from a high of $154 in October to the current $82.

Robinhood remains below the 50% Fibonacci Retracement and the Supertrend indicator. Worse, the spread between the 50-day and 200-day Exponential Moving Averages has continued to narrow, suggesting it may soon form a death cross pattern.

Therefore, the most likely HOOD share price forecast is highly bearish, with the initial target to watch being at $71.40, its lowest this year. A move below that level will signal further downside, potentially to the 78.6% Fibonacci Retracement level at $60.

Crypto World

MegaETH releases mainnet as Ethereum scaling debate heats up

MegaETH, a high-performance blockchain built to make Ethereum applications feel nearly instant, debuted its public mainnet Monday, entering an ecosystem mired in a fundamental debate over how Ethereum should scale.

The project, which had pitched itself as a layer-2 “real-time blockchain” targeting more than 100,000 transactions per second (tps), would make onchain interactions feel closer to traditional web apps than today’s crypto networks. Ethereum works at less than 30 tps, according to Token Terminal.

The release caps a rapid rise that has drawn both technical curiosity and major financial backing. The project’s development arm, MegaLabs, raised a $20 million seed round in 2024 led by Dragonfly. Last October, it announced a $450 million oversubscribed token sale backed by some of the most recognizable names in crypto, including Ethereum co-founders Vitalik Buterin and Joe Lubin. The sale was one of the largest crypto fundraises of that year.

The native token, MEGA, which underpins the network’s economics, is not fully unlocked at launch. According to the team, token distribution and utility will roll out gradually, with certain unlocks tied to network usage milestones.

MegaETH’s debut comes as Ethereum’s long-standing scaling roadmap is being examined, particularly by Buterin. For years, the second-largest blockchain by market cap relied on layer-2 networks, offchain systems that batch transactions and settle them back on the base layer, to handle most of the ecosystem’s growth.

But in recent discussions, Buterin has suggested that Ethereum may need to invest more heavily in scaling the layer-1 network to reduce fragmentation and simplify the user experience.

Those comments have ignited debate across the ecosystem. Supporters of layer 2s argue that the so-called rollups remain essential and already deliver meaningful performance gains. Critics say an overreliance on them has scattered liquidity and users across dozens of networks. MegaETH’s high-speed, low-latency design lands squarely in the middle of that argument, betting that there is still strong demand for chains that push performance far beyond current norms.

Read more: MegaETH Raises $450M in Oversubscribed Token Sale Backed by Ethereum Founders

Crypto World

Bernstein Gives Bold Bitcoin Bear Market Prediction

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and take a step back from the daily price charts. Beneath the noise, some analysts believe Bitcoin’s latest downturn may be telling a very different story—one less about collapse and more about how the market itself is changing.

Crypto News of the Day: Bernstein Maintains $150,000 BTC Prediction

Bitcoin’s latest correction may feel familiar to crypto analysts, but experts at research and brokerage firm Bernstein argue that this cycle is fundamentally different from past downturns.

Sponsored

Sponsored

In a recent note to clients, the firm described the current environment as the “weakest bitcoin bear case in its history.” In their opinion, the decline reflects a crisis of confidence rather than structural damage to the ecosystem.

The analysts, led by Gautam Chhugani, reiterated a $150,000 Bitcoin price target by the end of 2026, citing:

A Bear Market Without a Crisis

Historically, Bitcoin bear markets have been triggered by systemic failures, hidden leverage, or major bankruptcies. Episodes such as the collapses of large crypto firms in previous cycles exposed structural weaknesses and triggered cascading liquidations.

Bernstein argues that none of those catalysts are present today. The analysts noted that there have been no major exchange failures, widespread balance sheet stress, or systemic breakdowns across the crypto industry, even as sentiment has deteriorated.

“What we are experiencing is the weakest Bitcoin bear case in its history,” the analysts wrote, adding that the recent sell-off reflects waning confidence rather than problems with Bitcoin’s underlying structure.

They also pointed to strong institutional alignment supporting the market, including spot Bitcoin ETF adoption, growing corporate treasury participation, and continued involvement from major asset managers.

According to the firm, these factors mark a clear departure from earlier cycles dominated by retail speculation and fragile infrastructure.

Sponsored

Sponsored

In the analysts’ view, the current market narrative is more shaped by sentiment than by fundamentals.

“Nothing blew up, no skeletons will unravel,” they wrote, arguing that concerns ranging from AI competition to quantum computing risks have contributed to a perception-driven downturn rather than a fundamental shift in Bitcoin’s value proposition.

Macro Pressures Drive Relative Weakness

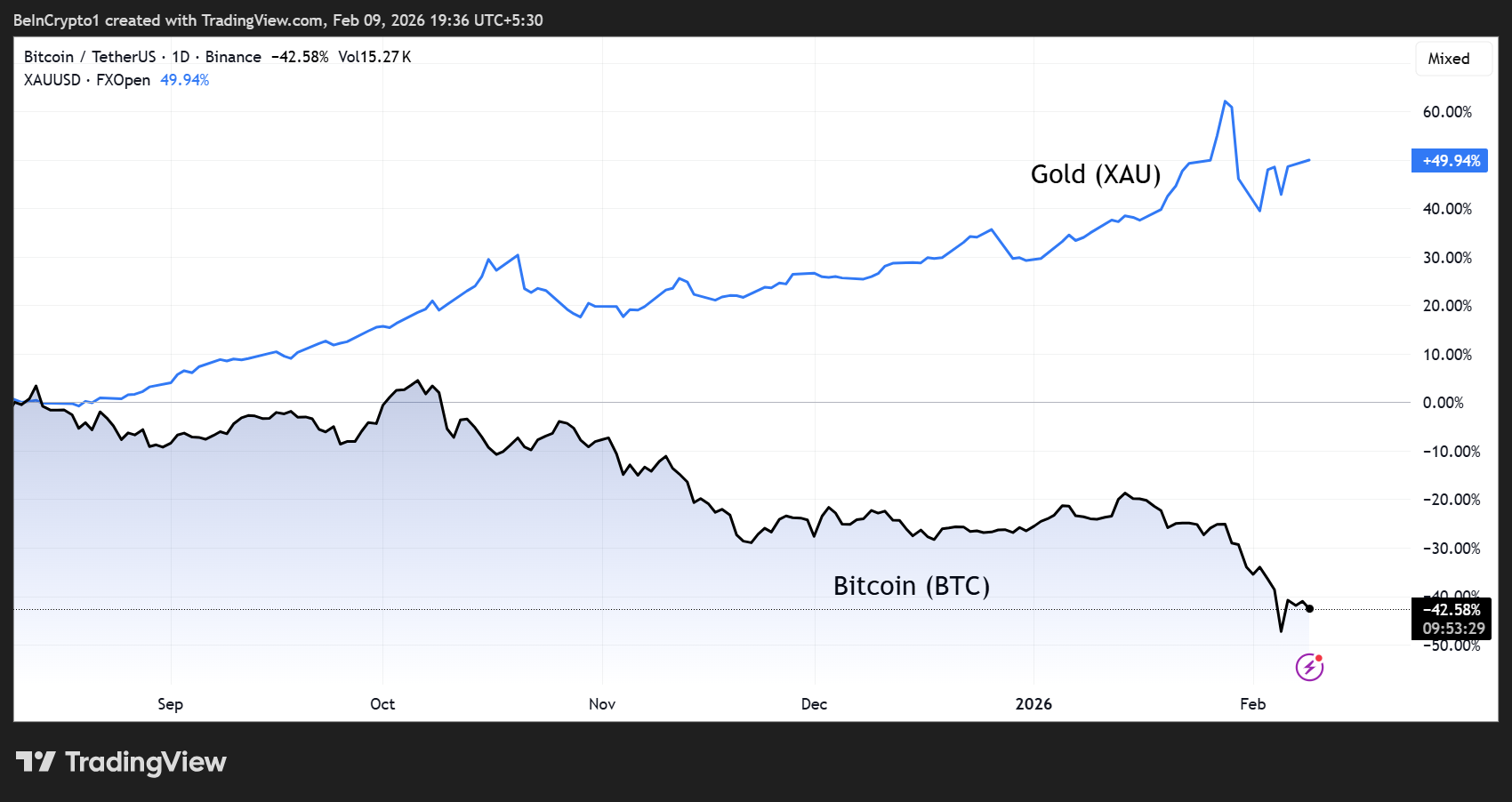

Bernstein also addressed concerns about Bitcoin’s recent underperformance relative to gold during periods of macroeconomic stress.

The analysts said this divergence reflects Bitcoin’s continued behavior as a liquidity-sensitive risk asset rather than a mature safe haven.

High interest rates and tighter financial conditions have concentrated capital flows into defensive assets such as gold and into high-growth sectors like AI.

In contrast, Bitcoin remains more sensitive to shifts in global liquidity, meaning its recovery could be closely tied to changes in monetary policy and financial conditions.

Sponsored

Sponsored

The firm expects Bitcoin’s ETF infrastructure and corporate capital-raising channels to play a significant role in absorbing new capital once liquidity conditions ease.

Structural Changes Reduce Downside Risks

Bernstein also dismissed concerns about leveraged corporate Bitcoin holdings and miner capitulation. The analysts noted that major corporate holders have structured liabilities to withstand prolonged downturns.

In one cited example, a large corporate holder, Strategy, would face balance-sheet restructuring only if Bitcoin fell to around $8,000 and remained there for several years.

Meanwhile, miners have increasingly diversified their revenue streams, including reallocating power capacity toward AI data center demand. This trend, according to the firm, has reduced pressure on mining economics and lowered the risk of forced selling during price declines.

The analysts also acknowledged the long-term risks posed by quantum computing. However, they argue that such threats are not unique to Bitcoin and would affect all critical digital and financial systems. This, the analysts say, is expected to transition to quantum-resistant standards over time.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto World

Ondo price forecast: risks remain despite gains to $0.30

- Ondo price hovered near $0.24, down around 6%.

- If there’s a breakout, ONDO could target $0.45 in the near term.

- ONDO could dive below $0.20 if bulls fail to hold onto gains.

The ONDO token climbed to nearly $0.30 as improving sentiment lifted much of the altcoin market, including the real-world asset tokenisation project.

However, selling pressure emerged near a key resistance level, with the price down about 6% over the past 24 hours at the time of writing on Monday, February 9, 2026.

As a result, despite a mildly constructive technical setup, a deeper pullback could undermine near-term upside momentum and weigh further on the price of ONDO.

Ondo price recap: bounce hits supply wall

Like several major altcoins, ONDO rebounded from the $0.20 level as cryptocurrencies recovered from the sell-off on February 5.

However, buying momentum weakened near $0.27, where selling pressure held over the weekend, establishing the area as a strong supply zone.

On Monday, the token moved lower again, falling about 6% to trade just above $0.24.

The decline was accompanied by an 8% rise in trading volume, pointing to continued seller dominance.

The weakness has come as Bitcoin struggles to regain traction around the $70,000 level, with broader market sentiment remaining negative.

On-chain data across the sector indicates sustained selling from early investors and large holders.

ONDO remains under pressure and is down about 14% over the past week, in line with similar declines across RWA-related tokens.

Ondo price outlook: up or risk of fresh pain?

The broader outlook for ONDO continues to reflect a balance between technical factors and wider macroeconomic pressures.

If a breakout materialises, ONDO could target the $0.45 level in the near term, with scope to extend toward $0.70 if momentum strengthens.

However, downside risks remain elevated.

The broader cryptocurrency market continues to trade weakly, with Bitcoin struggling below $69,000 and Ethereum facing repeated rejection near $2,000.

Sentiment remains fragile, with the CoinMarketCap Crypto Fear and Greed Index at 9, firmly in extreme fear territory.

High liquidation activity, exceeding $344 million over the past 24 hours, also points to continued market stress.

If ONDO fails to hold support at $0.21, analysts warn that a pullback toward the $0.17 level could follow.

Crypto World

Bitcoin & Ethereum News, Crypto Updates & Live Price Indexes

Binance expanded its emergency reserves again, adding 4,225 Bitcoin (CRYPTO: BTC) to its SAFU wallet, a move valued at roughly $300 million as the world’s largest crypto exchange doubles down on a Bitcoin-backed protection fund amid ongoing market pressure. The fresh purchase lifts SAFU’s Bitcoin holdings to more than $720 million at current prices, underscoring Binance’s willingness to bolster liquidity safeguards for users during a period of heightened volatility. The company had previously signaled a shift of up to $1 billion into Bitcoin and stated that the conversion would be completed within 30 days of its Jan. 30 announcement, with a rebalance back to the full $1 billion target if market swings pull the fund’s value below about $800 million.

The ongoing deployment into Bitcoin signals growing conviction in BTC as a cornerstone reserve asset for user protections, even as it binds the SAFU fund more closely to crypto price swings. Binance has emphasized that SAFU is designed to defend users in distressing conditions, yet the fund’s rising Bitcoin exposure also exposes it to downside risk if the market moves against it. The latest development was disclosed as part of Arkham’s on-chain data, which tracks wallet activity and asset inflows into SAFU’s treasury, including the 4,225 BTC addition noted above. The forward-looking goal remains to complete the BTC conversion within the 30-day window established by the January announcement.

Investors are watching Bitcoin’s price action closely. In recent sessions, the leading cryptocurrency slipped to $59,930, a level not seen since October 2024, according to TradingView data. That retreat comes amid broader market weakness and a risk-off mood among traders, who have been weighing whether a sustained rebound is in prospect or whether the correction still has legs. One market observer noted that sentiment around digital assets remains fragile, with traders clinging to historical cycles rather than relying on immediate catalysts.

Alongside the Bitcoin dynamics, industry intelligence providers have shown a tilt among the so-called smart money. Reports from Nansen indicate that traders managing significant liquidity positions tilted toward short exposure on Bitcoin and other top assets, accumulating a net short position of roughly $109 million across leading tokens. The same data set showed a notable contrast with Avalanche (CRYPTO: AVAX), which attracted a modest long bias, totaling about $7.38 million in cumulative long positions. Such positioning hints at a cautious, defensive posture among sophisticated traders even as some traders anticipate selective rebounds in select ecosystems.

Binance’s SAFU strategy traces back to its broader risk-management framework, which the exchange has repeatedly described as essential for maintaining user trust during drawdown periods. By continuing to accumulate BTC for SAFU, Binance is signaling a preference for Bitcoin-based reserves as a stabilizing buffer rather than relying solely on fiat or more traditional risk-hedge instruments. The approach aligns with the exchange’s updated risk posture as it navigates a market environment characterized by liquidity constraints, thin volume in certain segments, and a murkier regulatory backdrop that can influence how exchanges manage user protections and capital reserves.

Fragile sentiment weighs on markets

Binance’s ongoing SAFU conversion occurs against a backdrop of a broader crypto market correction, with Bitcoin’s price hovering near the $60,000 mark and sentiment described as fragile by industry observers. A chief concern cited by market participants is the lack of clear, near-term catalysts to sustain upside momentum, which can restrain upside moves and extend pullbacks. While the BTC reserve expansion may bolster confidence in risk controls, it also exposes SAFU to volatility—heightening the need for disciplined rebalancing rules if the market sours further.

Market participants eye how the SAFU fund’s size interacts with Bitcoin’s price trajectory and overall market liquidity. The balance between resilience for user protections and exposure to adverse moves will be a critical test for Binance’s risk framework in the months ahead, especially as macro conditions and on-chain activity continue to evolve.

Why it matters

The SAFU fund serves as a protective backstop intended to shield users during periods of stress. By increasing BTC holdings within SAFU, Binance demonstrates a commitment to anchoring a significant portion of its reserve assets in the most liquid, widely traded crypto asset. This approach can bolster perceived safety for users who rely on exchange-backed protections, particularly during episodes of market turbulence when liquidity and counterparty risk can become salient.

However, the strategy also concentrates a portion of SAFU’s value in Bitcoin’s price moves, potentially amplifying drawdowns if BTC undergoes further volatility. The decision to target a full $1 billion allocation within a 30-day window signals confidence in BTC’s long-run role as a reserve asset, but it requires ongoing discipline to manage risk when prices swing sharply. The narrative around SAFU’s expansion dovetails with broader industry discussions about the adequacy of exchange reserves, the role of on-chain data in verifying asset holdings, and how market participants assess the sufficiency of guarantees provided by centralized platforms.

From a market-structure perspective, the episode showcases the evolving playbook of major exchanges as they navigate a landscape of rising regulatory scrutiny, competing risk frameworks, and the fragility of short-term price trends. The interaction between on-chain activity, reserve management and investor sentiment highlights the complexity of safeguarding users while maintaining resilience in an environment characterized by rapid الأخبار changes in funding, liquidity, and risk appetite. While not a guarantee of future stability, the SAFU expansion represents a notable operational decision that could influence how other platforms think about crisis protection and capital adequacy in crypto markets.

What to watch next

- Follow-up on SAFU’s BTC accumulation and the official timeline for completing the conversion within the 30-day window.

- BTC price action around the $60,000 level and any shifts in risk sentiment as new data and catalysts emerge.

- Updates from on-chain trackers (e.g., Arkham, Nansen) confirming reserve balances and smart-money positioning.

- Any additional disclosures from Binance regarding rebalancing triggers if SAFU value moves toward or away from the $1 billion target.

Sources & verification

- Binance X post confirming continued BTC acquisitions for SAFU and the 30-day conversion target.

- Arkham on-chain data corroborating the 4,225 BTC transfer to SAFU.

- Binance’s Jan. 30 announcement about shifting up to $1 billion into Bitcoin and the $800 million floor.

- BTC price data around $59,930 from TradingView.

- Hina Sattar Joshi’s assessment of market sentiment and fragility, cited in market commentary.

- Nansen data showing smart-money positioning, including BTC net short exposure and AVAX long exposure.

Rewritten Article Body

Binance expands SAFU Bitcoin reserves as market pressure persists

Binance added 4,225 Bitcoin (CRYPTO: BTC) to its Secure Asset Fund for Users (SAFU) on Monday, increasing the safety net intended to protect client funds during downturns. The acquisition, valued at about $300 million in today’s prices, pushes SAFU’s Bitcoin reserve above the $720 million threshold, according to chain-analytics firm Arkham. The move forms part of a broader plan Binance outlined on Jan. 30 to convert up to $1 billion of user-protection assets into Bitcoin, with a 30-day target window for completing the conversion and a rebalancing clause if the fund dips below $800 million. The timing aligns with a period of renewed emphasis on reserve quality and risk-bearing capacity within the crypto exchange ecosystem.

As the market prices for Bitcoin experience volatility, Binance’s SAFU strategy illustrates a deliberate tilt toward BTC as a cornerstone reserve asset. While the fund’s BTC holdings are intended to provide a cushion for users in case of adverse conditions, the size of the reserves introduces a direct sensitivity to Bitcoin’s price movements. The Arkham data point that tracks SAFU’s evolution shows the latest inflow of 4,225 BTC, underscoring ongoing investor confidence in Bitcoin as a stabilizing component of the exchange’s emergency framework. Binance has reinforced that the conversion to BTC would be completed within 30 days of the original announcement, with a restoration path to the full $1 billion target should market volatility erode SAFU’s value below $800 million.

The immediate market response reflected in Bitcoin’s price action has been cautious. BTC retraced to around $59,930, a level not observed since October 2024, as traders reassess risk and evaluate whether macro catalysts will unlock further upside. This price backdrop has contributed to a broader sense of fragility in market sentiment, with commentators noting that traders are anchored to historical patterns rather than current catalysts. The lack of a clear near-term driver has left many investors skittish, leading to a broader risk-off stance that can weigh on asset prices and, by extension, on reserve-tracking metrics like SAFU.

Beyond BTC’s price trajectory, the activity within smart-money communities reflects a cautious tilt. Data from Nansen indicate that leveraged short positions have grown in aggregate, with traders maintaining a net short stance on Bitcoin totaling about $109 million across major assets, while Avalanche (CRYPTO: AVAX) drew a comparatively modest long exposure of $7.38 million. This divergence demonstrates that, even as some sophisticated traders seek downside protection in the current environment, others are selectively positioning for potential recoveries in particular ecosystems or tokens. The juxtaposition underscores the complexity of market dynamics in a period when reserve-building by major exchanges sits alongside a potential reallocation of capital in response to evolving risk sentiment.

At the core of Binance’s decision is a commitment to user protection that acknowledges both the benefits and risks of BTC-centered reserves. Bitcoin’s status as the most liquid cryptocurrency makes it an attractive anchor for safeguarding user funds; however, the greater the exposure to BTC price swings, the more carefully reserve managers must calibrate rebalancing rules and liquidity buffers. The SAFU program’s evolution—particularly the plan to converge toward the $1 billion target within a tight 30-day window—will be watched closely by regulators, investors, and competitors as a case study in reserve strategy and risk governance in a swiftly evolving market.

Crypto World

Why It’s Among the Leading Crypto Portfolio Trackers in 2026

Managing a crypto portfolio in 2026 is no longer a simple task. Investors often operate across centralized exchanges, on-chain wallets, DeFi protocols, NFTs, and multiple blockchains at the same time. As portfolios become more fragmented, the need for reliable, centralized tracking tools has become essential.

Among the platforms addressing this challenge, CoinStats has emerged as one of the most widely adopted solutions. With more than one million users and over $100 billion in assets tracked, CoinStats has positioned itself as a core portfolio intelligence tool for modern crypto investors.

This article takes a closer look at what CoinStats offers, how it fits into today’s crypto landscape, and why it is considered one of the leading portfolio trackers available.

A Unified View of an Increasingly Fragmented Market

One of the main issues crypto investors face today is fragmentation. Assets are spread across exchanges, wallets, Layer 1s, Layer 2s, and DeFi protocols. Tracking exposure manually quickly becomes inefficient and error-prone.

CoinStats crypto tracker addresses this problem by offering a unified dashboard where users can connect all their wallets and exchanges in one place. The platform supports more than 120 blockchains, over 300 wallets and centralized exchanges, and more than 1,000 DeFi protocols.

Popular integrations include Binance, Coinbase, MetaMask, Phantom, Trust Wallet, and many others. Once connected, balances and transactions are automatically synchronized, removing the need for manual updates.

Beyond Balances: Portfolio Analytics That Matter

While many portfolio trackers stop at balance aggregation, CoinStats goes further by providing in-depth portfolio analytics. Users can access advanced Profit and Loss analysis, historical performance tracking, and detailed portfolio breakdowns.

These insights allow investors to better understand how their strategies perform over time, which assets contribute most to returns, and where risks may be concentrated. For traders operating across multiple platforms, having this level of clarity in one interface is a significant advantage.

AI-Driven Portfolio Intelligence

CoinStats has also expanded its feature set with the introduction of a multimodel AI assistant designed for deep research and portfolio intelligence. This tool helps users analyze tokens, explore market trends, and gain contextual insights that go beyond surface-level data.

The AI assistant reflects a broader shift in crypto tooling toward data-driven decision support. While advanced research features require a paid subscription, the integration highlights CoinStats’ focus on evolving with the needs of more sophisticated users.

Risk Awareness in a Volatile Environment

Risk management remains one of the most overlooked aspects of crypto investing. CoinStats addresses this through features such as its Token Risk scanner, which helps users evaluate assets before adding them to their portfolios.

Combined with detailed asset data and AI-powered price predictions, this functionality supports more informed decision-making, particularly in fast-moving or speculative markets.

Designed for Active Users

Accessibility is another area where CoinStats stands out. The platform is available on both mobile and web, allowing users to monitor their portfolios on the go. This is especially important for active traders who need real-time visibility without being tied to a desktop setup.

As decentralized trading and on-chain activity continue to grow, mobile-first access to portfolio data is becoming a baseline expectation rather than a bonus feature.

Key Strengths at a Glance

-

Broad support across wallets, exchanges, and blockchains

-

Unified tracking for CeFi, DeFi, and NFTs

-

Advanced Profit and Loss analysis and portfolio insights

-

Multimodel AI assistant for research and intelligence

-

Token Risk scanner for asset evaluation

-

Automatic balance and transaction synchronization

-

Available on mobile and web

Limitations to Keep in Mind

Like most advanced platforms, CoinStats is not without trade-offs. Some AI-driven research features are available only through paid plans, and support for newer Layer 2 networks may occasionally lag behind major chains. However, these limitations are relatively minor when weighed against the platform’s overall functionality.

Final Thoughts

As crypto portfolios continue to span multiple ecosystems, tools that offer clarity, automation, and insight are becoming essential. CoinStats stands out not because it follows trends, but because it addresses real operational challenges faced by modern crypto investors.

With its extensive integrations, advanced analytics, and growing focus on AI-driven intelligence, CoinStats has earned its place among the leading crypto portfolio trackers in the market today.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics23 hours ago

Politics23 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat17 hours ago

NewsBeat17 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business22 hours ago

Business22 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports12 hours ago

Sports12 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat7 hours ago

NewsBeat7 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know