Crypto World

HBAR Bears Face $4.9 Million Squeeze as Price Direction Shifts

Hedera has posted a muted recovery in recent sessions. HBAR price remains constrained by cautious sentiment across the broader cryptocurrency market. Uncertainty in Bitcoin and macro conditions continues to cap upside attempts.

However, bearish traders may need to monitor changing signals. Derivatives positioning and capital flow indicators suggest the current balance could shift.

Sponsored

Hedera Traders Could Be In Trouble

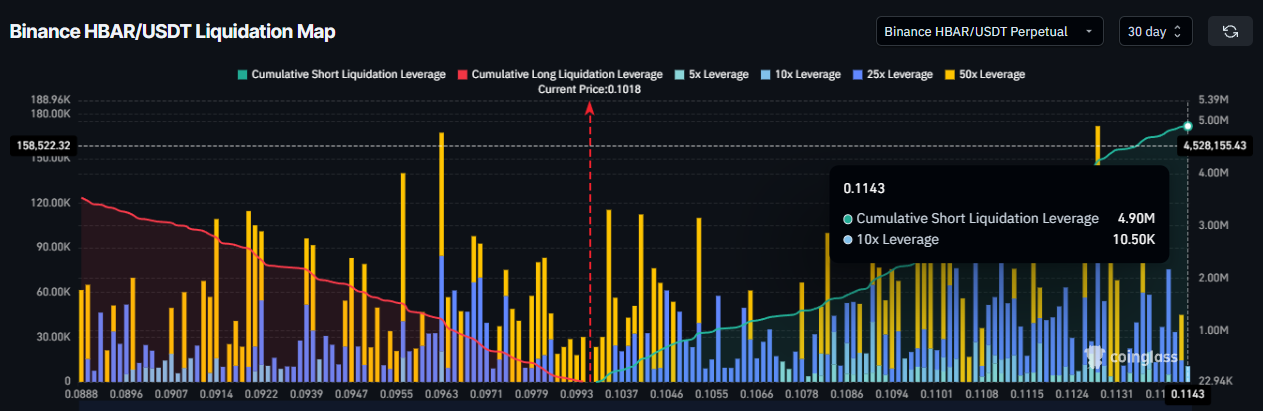

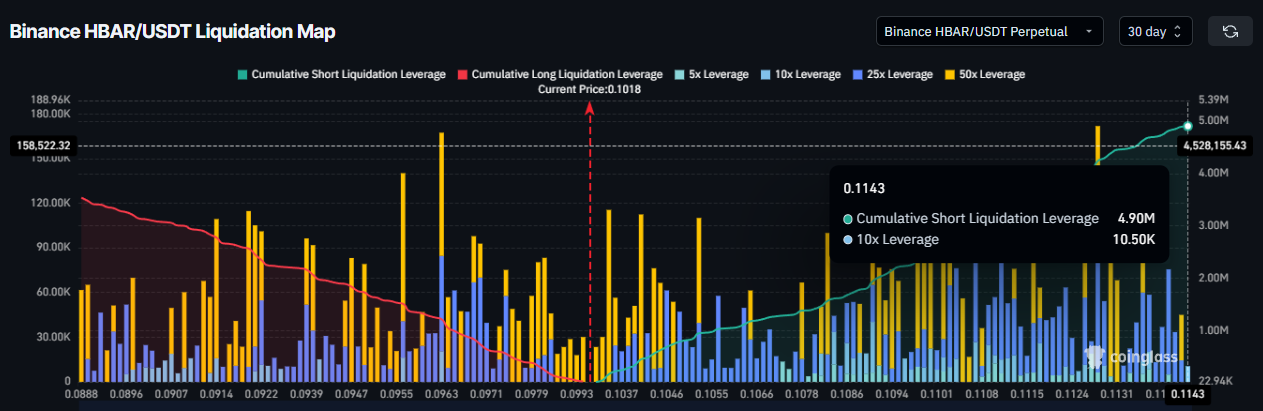

HBAR is currently experiencing strong bearish positioning in the futures market. Traders have opened a notable number of short contracts, reflecting expectations of further downside. The liquidation map highlights that positions are skewed toward bears at current levels.

Data shows that HBAR bears could face approximately $4.9 million in liquidations if the price crosses the $0.1143 mark. Such forced liquidations can trigger rapid upside volatility. When short positions unwind, buying pressure increases as traders close contracts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

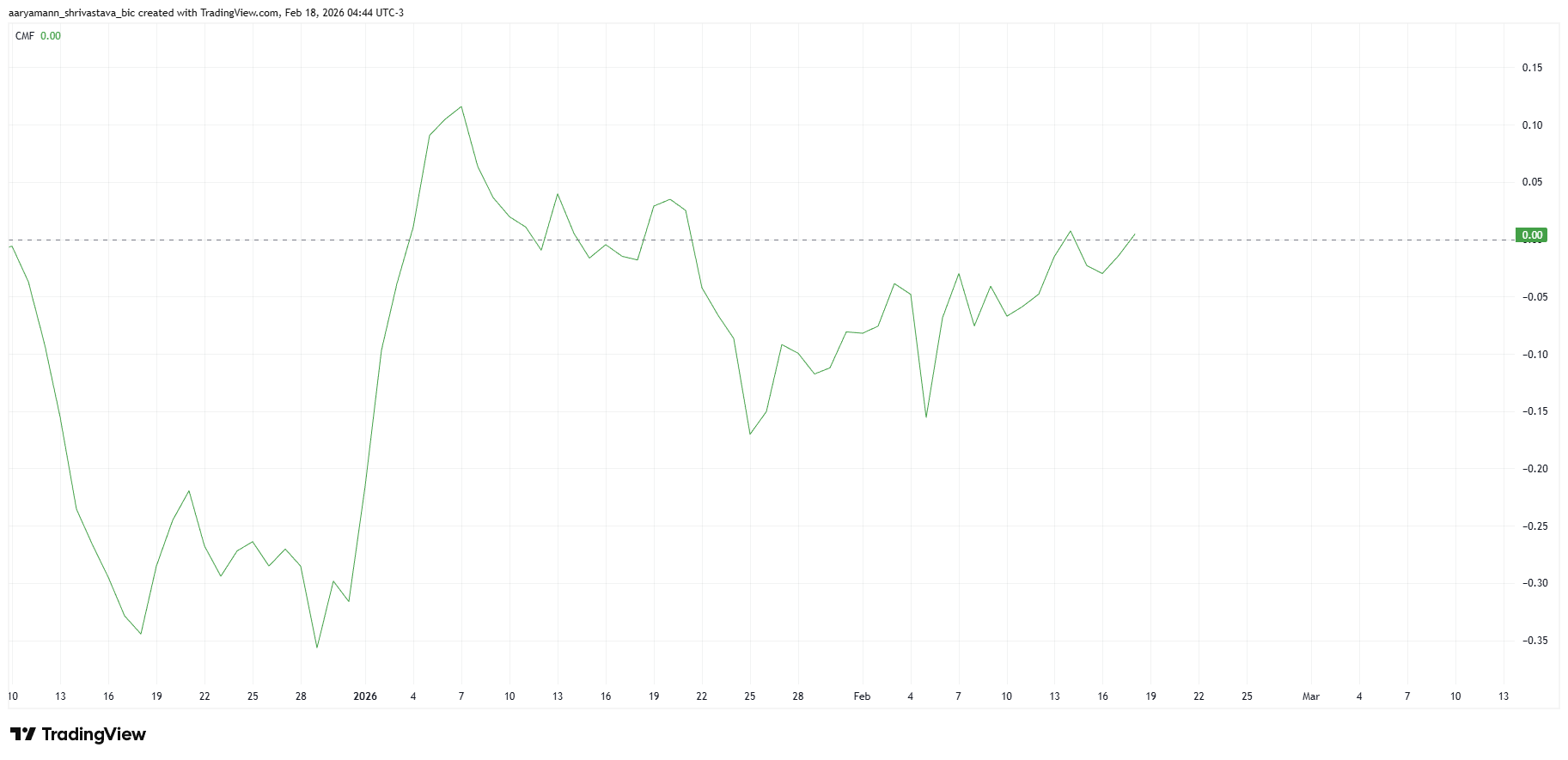

The Chaikin Money Flow indicator offers additional insight into capital movement. CMF measures inflows and outflows to assess whether buyers or sellers dominate. The indicator is currently rising, although it remains at the zero line.

Sponsored

An upward slope at zero suggests that outflows are at par with the inflows. However, the gap will likely diminish as inflows rise. Declining outflows often precede a shift toward net inflows. If this transition occurs, HBAR could gain the support needed for a short-term recovery.

Bitcoin Is Unhelpful

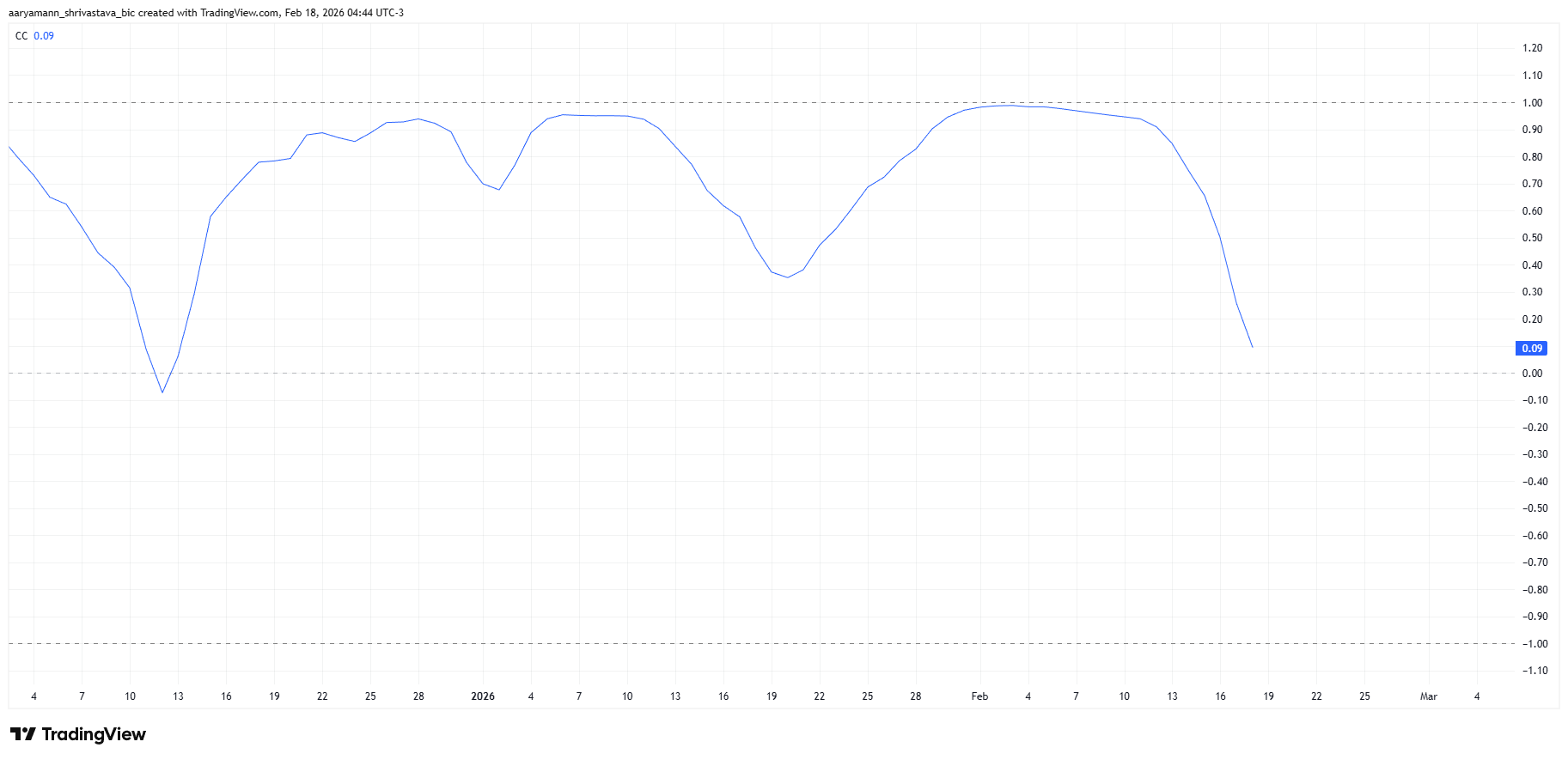

Correlation trends also support a potential shift. HBAR’s correlation with Bitcoin has declined in recent weeks. The current coefficient has dropped to 0.09, signaling weaker alignment with the crypto market leader, inching closer to completely dissociating with Bitcoin.

Sponsored

Reduced correlation can benefit altcoins during periods of Bitcoin uncertainty. If HBAR decouples further, price action may reflect investor-specific demand rather than broader market weakness. This flexibility could allow HBAR to chart an independent recovery path.

HBAR Price Has a Few Barriers To Breach

HBAR is trading at $0.1019 at the time of writing. The altcoin remains above the key $0.0961 support level at the 38.2% Fib line. However, it faces resistance at $0.1035, which aligns with the 50% Fibonacci retracement. This level currently caps upward momentum.

Sponsored

Flipping $0.1035 into support would mark a short-term breakthrough. Combined with declining outflows, this shift could fuel a recovery rally. HBAR would then target $0.1109 at the 61.8% Fibonacci.

This level is considered a critical support for an asset, and flipping it would likely trigger stronger buying among the investors, pushing the HBAR price higher.

This would bring HBAR past $0.1143, a level that threatens $4.9 million in shorts liquidations. Sustained strength could extend gains toward $0.1215 and $0.1349 eventually, helping recover year-to-date losses.

If bullish signals fail to materialize, consolidation may continue. Persistent outflows would limit breakout attempts. A breakdown below $0.0961support could expose HBAR to further downside near $0.0870. Such a move would invalidate the near-term bullish outlook and reinforce bearish control.

Crypto World

Riot stock jumps roughly 7% as Starboard pushes $1.6 billion AI data center shift

Shares of Riot Platforms (RIOT) rose nearly 9% Wednesday after activist investor Starboard Value LP released a letter pressing the company to accelerate its transition from bitcoin mining to AI infrastructure provider. The aim is for Riot to pursue high-margin artificial intelligence and high-performance computing (AI/HPC) hosting deals.

Riot’s 1.7 gigawatts of fully available power capacity make the company “well positioned to execute high-quality AI/HPC deals,” said Starboard, highlighting two of Riot’s Texas-based sites, Corsicana and Rockdale, as “premier” locations for data center development.

Starboard said that if Riot can monetize its power in line with recent transactions in the space, “it could generate more than $1.6 billion” in annual EBITDA. The group praised Riot’s recent deal with AMD, which is projected to yield $311 million over 10 years.

With a market cap of $4.25 billion, Texas-based Riot is the fifth-largest bitcoin mining company in the U.S. Its shares have risen by 19% in the past year, but remain lower by about 80% from highs hit during the 2021 bitcoin bull market. They’ve also underperformed miners like IREN, Cipher Mining, and Hut 8, which were quicker to recognize and transition to AI strategies.

Starboard was Riot’s fourth-largest shareholder as of the end of last year, and this isn’t its first push on the company. In December 2024, Starboard requested that Riot convert some of its bitcoin mining sites into data centers capable of hosting HPC machines to support big tech companies.

While Riot Platforms has built its business around bitcoin mining, the pivot toward AI infrastructure could diversify revenue as power-hungry models like OpenAI’s GPT-4o and others drive data center demand. Riot’s power access, a rare commodity in the current energy-constrained data center market, could be used to lease capacity to major AI firms.

Starboard urged CEO Jason Les and Executive Chairman Benjamin Yi to act “with urgency” and position Riot as a long-term infrastructure provider for AI workloads.

Crypto World

OpenAI Researches AI Agents Detecting Smart Contract Flaws

OpenAI has launched a new benchmark that evaluates how well different AI models detect, patch, and even exploit security vulnerabilities found in crypto smart contracts.

OpenAI released the “EVMbench: Evaluating AI Agents on Smart Contract Security” paper on Wednesday, in collaboration with crypto investment firm Paradigm and crypto security firm OtterSec, to evaluate how much the AI agents could theoretically exploit from 120 smart contract vulnerabilities.

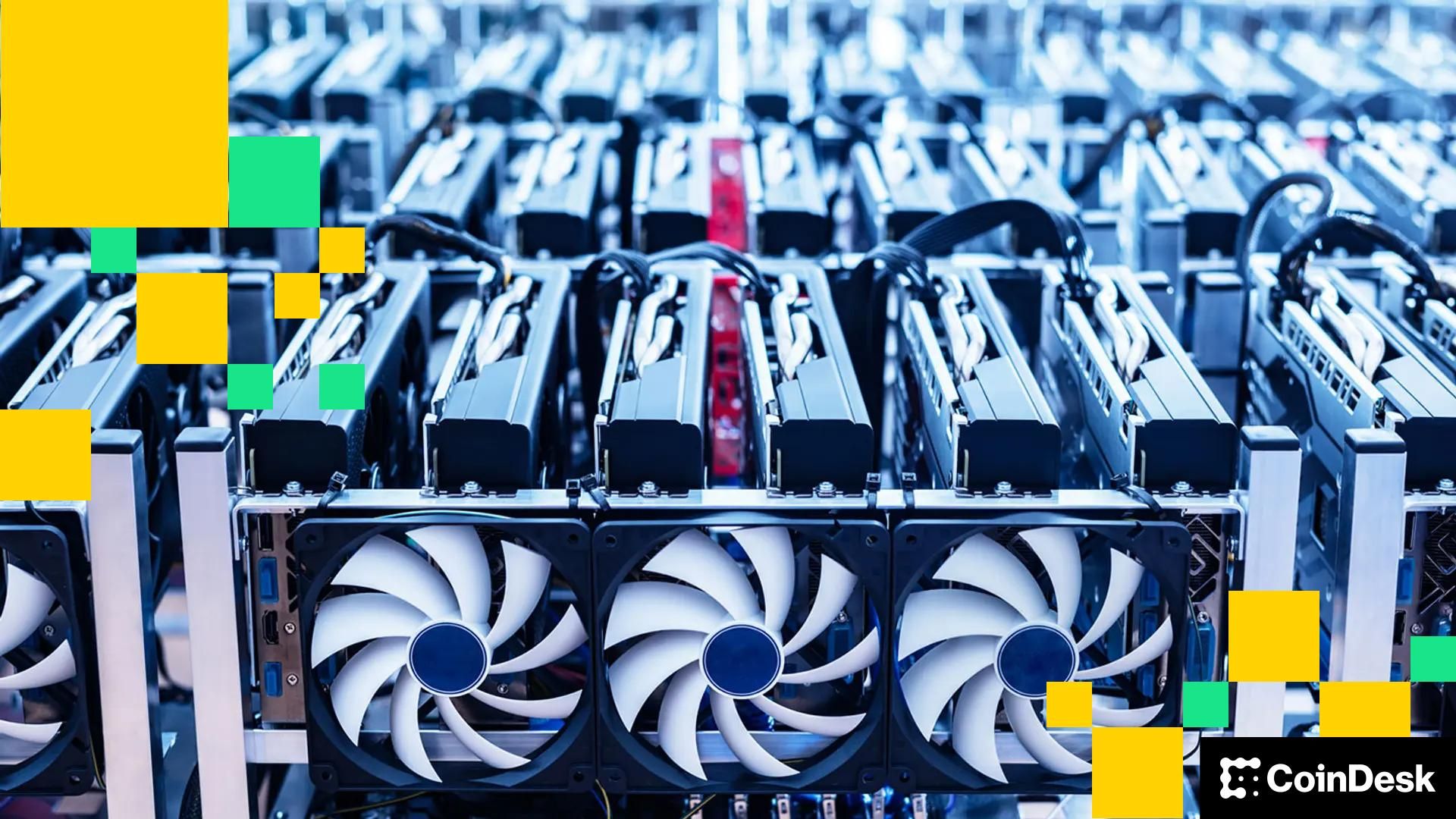

Anthropic’s Claude Opus 4.6 came out on top with an average “detect award” of $37,824, followed by OpenAI’s OC-GPT-5.2 and Google’s Gemini 3 Pro at $31,623 and $25,112, respectively.

While AI agents are becoming increasingly efficient at handling basic tasks, OpenAI said it is becoming more important to evaluate their performance in “economically meaningful environments.”

“Smart contracts secure billions of dollars in assets, and AI agents are likely to be transformative for both attackers and defenders.”

“We expect agentic stablecoin payments to grow, and help ground it in a domain of emerging practical importance,” OpenAI added.

Circle CEO Jeremy Allaire predicted on Jan. 22 that billions of AI agents will be transacting with stablecoins for everyday payments on behalf of users within five years, while former Binance boss Changpeng “CZ” Zhao also recently tipped that crypto would end up being the “native currency for AI agents.”

The need to test agentic AI performance in spotting security vulnerabilities comes as attackers stole $3.4 billion worth of crypto funds in 2025, a marginal increase from 2024.

Related: China’s AI lead will shape crypto’s future

EVMbench drew on 120 curated vulnerabilities from 40 smart contract audits, most of which were sourced from open-source audit competitions. OpenAI said it hopes the benchmark will help track AI progress in spotting and mitigating smart contract vulnerabilities at scale.

Smart contracts weren’t built for humans: Dragonfly

In a post to X on Wednesday, Dragonfly’s managing partner Haseeb Qureshi said crypto’s promise of replacing property rights and legal contracts never materialized, not because the technology failed, but because it was never designed for human intuition.

Qureshi said it still feels “terrifying” to sign large transactions, particularly with drainer wallets and other threats always present, whereas bank transfers rarely provoke the same fear.

Dragonfly’s @hosseeb explains why AI agents will use crypto rather than the traditional financial system:

“You can see it right now on Moltbook. Agents are trying to find ways to pay each other for things. It’s very primitive right now, but you can see where it’s going.”

“If I… pic.twitter.com/oWzQuuZcWN

— TBPN (@tbpn) February 18, 2026

Instead, Qureshi believes the future of crypto transactions will be facilitated by AI-intermediated, self-driving wallets, which will take care of those threats and manage complex operations on behalf of users:

“A technology often snaps into place once its complement finally arrives. GPS had to wait for the smartphone, TCP/IP had to wait for the browser. For crypto, we might just have found it in AI agents.”

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

ether.fi Migrates to Optimism’s OP Mainnet from Scroll

ether.fi, a crypto neobank, is migrating its services from the Scroll blockchain to Optimism’s OP Mainnet to leverage enhanced payment capabilities and enterprise-grade support.

ether.fi, a crypto neobank with $5.7 billion of total-value locked, said in an X post it’s migrating from the Scroll blockchain to Optimism’s OP Mainnet.

The move aims to capitalize on Optimism’s OP Enterprise to enhance global payment capabilities, access established liquidity and users, and provide enterprise-grade support, according to the company’s blog post.

The migration is significant given ether.fi’s substantial user base, boasting approximately 50,000 active cards, according to Cipher Research.

ether.fi offers a digital cash account and card product known as ether.fi Cash, which integrates DeFi features such as fiat-to-crypto flow, yield earning, and a non-custodial wallet.

Previously, ether.fi was hosted on Scroll, the 12th largest Layer 2 solution for Ethereum, with about $100 million of TVL.

Scroll’s SCROLL token is down 2.3% and Ether.fi’s ETHFi is down 3.6%.

This article was generated with the assistance of AI workflows.

Crypto World

Moonwell hit by $1.78M exploit as AI coding debate reaches DeFi

Moonwell, a decentralized finance (DeFi) lending protocol active on the Base and Optimism ecosystems, was the target of a calculated exploit that netted attackers roughly $1.78 million. The root cause centered on a pricing oracle for Coinbase Wrapped Staked ETH (cbETH) that returned an anomalously low value—about $1.12 instead of the correct price near $2,200—creating a mispricing that savvy actors could abuse to secure profits. The incident underscores the fragility of cross-chain DeFi infrastructure when price feeds are misfired and automated systems latch onto erroneous data. It also casts a spotlight on the role of AI-assisted development in smart-contract security, a topic that has become increasingly controversial as teams lean on AI-driven tools to accelerate coding and audits.

The story links a technical mispricing to governance and engineering questions that go beyond a single exploit. In the wake of the incident, Moonwell’s development activity drew scrutiny after security researcher Leonid Pashov flagged concerns on social media about AI-assisted contributions in the underlying codebase. The pull requests associated with the affected contracts show multiple commits co-authored by Claude Opus 4.6, a reference to Anthropic’s AI tooling, prompting Pashov to publicly characterize the case as an example of AI-written or AI-assisted Solidity code backfiring. The discussion is not merely about AI; it centers on whether automated code authorship was coupled with adequate safeguards.

In speaking with Cointelegraph, Pashov described how the discovery unfolded: the team had linked the case to Claude because several commits in the pull requests were attributed to Claude’s AI-assisted workflow, suggesting the developer used AI to write portions of the code. The broader implication, he argued, is not that AI itself is inherently flawed but that the process failed to implement rigorous checks and end-to-end validation. This distinction matters because it frames the incident as a cautionary tale about governance, audit discipline, and testing rigor—factors that should govern any DeFi project experimenting with AI-enabled development workflows.

Initial comments from Moonwell’s team suggested there had not been extensive testing or auditing at the outset. Later, the team asserted that unit and integration tests existed in a separate pull request and that an audit had been commissioned from Halborn. Pashov’s assessment remained that the mispricing might have been detected with a sufficiently rigorous integration test that bridged on-chain and off-chain logic, though he declined to single out any audit firm for blame. The debate touched on whether AI-generated or AI-assisted code should be treated as untrusted input, subject to stringent governance processes, version control, and multi-person review, particularly in high-risk areas such as access controls, oracle interaction, pricing logic, and upgrade pathways.

Beyond the technical particulars, the Moonwell incident has sharpened the broader conversation about AI’s role in the crypto development cycle. Fraser Edwards, co-founder and CEO of cheqd, a decentralized identity infrastructure provider, argued that the discourse on “vibe coding” masks two distinct realities in AI usage. On one hand, non-technical founders may lean on AI to draft code they cannot review; on the other, seasoned developers can leverage AI to accelerate refactors, explore patterns, and test ideas within a mature engineering discipline. Edwards stressed that AI-assisted development can be valuable at the MVP stage but should never substitute for production-ready infrastructure in capital-intensive environments like DeFi.

Edwards urged that any AI-generated smart-contract code be treated as untrusted input, requiring robust version control, clearly defined ownership, multi-person peer review, and advanced testing—especially for modules governing access controls, oracles, pricing logic, and upgrade mechanisms. He added that responsible AI integration ultimately hinges on governance and discipline, with explicit review gates and separation between code generation and validation. The goal is to ensure that deployments in adversarial environments carry latent risk that must be proactively mitigated.

Small loss, big governance questions

The Moonwell incident sits in a broader context where DeFi’s risk appetite meets evolving development practices. While the dollar figure of this exploit pales next to some of DeFi’s most infamous breaches—such as the March 2022 Ronin bridge hack that yielded more than $600 million—the episode exposes how governance decisions, testing rigor, and tooling choices can shape outcomes in real-time. The combination of AI-assisted edits, a pricing oracle misconfiguration, and an already audited codebase raises a pointed question: how should projects balance speed, innovation, and safety when AI is part of the development workflow? The lessons extend to any protocol that relies on external price feeds and complex upgrade paths, especially when those upgrades touch collateralization and liquidity risk.

As the industry weighs these factors, the Moonwell episode serves as a practical stress test for security models that attempt to scale AI-enabled development without compromising essential safeguards. It highlights that even with audits and tests in place, an end-to-end validation that encompasses on-chain and off-chain interactions remains essential. The tension between rapid iteration and exhaustive verification is unlikely to abate, particularly as more protocols explore AI-powered tooling to maintain pace with innovation while maintaining security.

“Vibe coding” vs disciplined AI use

The discourse around AI-assisted coding in crypto has shifted from a binary critique of AI vs. human developers to a nuanced debate about process. Edwards’s reflections underscore that AI can be a productive aid when integrated within a disciplined framework that emphasizes guardrails, ownership, and rigorous testing. The Moonwell case reinforces the notion that AI-generated code still requires the same level of scrutiny as hand-written code, if not more, given the elevated stakes in DeFi.

In practical terms, the incident invites a reevaluation of how AI-assisted workflows are governed within smart contract teams: who owns the AI-generated output, how changes are reviewed, and how automated tests map to real-world scenarios on the blockchain. The central takeaway is not to demonize the technology but to ensure that governance channels, audit pipelines, and on-chain validation remain robust enough to catch misconfigurations and mispricings before capital is at risk.

What to watch next

- Moonwell outlines remediation steps and governance changes in the wake of the exploit, including any changes to oracle integration and upgrade pathways.

- Auditors and the Moonwell team publish a detailed post-mortem and a revised testing framework that explicitly ties on-chain scenarios to unit and integration tests.

- Additional independent audits focus on AI-assisted development workflows and their impact on critical smart-contract components.

- On-chain monitoring and alerting enhancements are implemented to detect pricing anomalies in real-time and to trigger protective measures such as circuit breakers or pause mechanisms.

Sources & verification

- Moonwell contracts v2 pull request that exposed the mispricing issue: https://github.com/moonwell-fi/moonwell-contracts-v2/pull/578

- Public discussion by security researcher Pashov referencing AI-assisted commits in Moonwell: https://x.com/pashov/status/2023872510077616223

- Context on DeFi exploits and governance implications (Ronin bridge, Nomad bridge, etc.) referenced in related coverage: https://cointelegraph.com/news/battle-hardened-ronin-bridge-to-axie-reopens-following-600m-hack and https://cointelegraph.com/news/suspect-behind-190-million-nomad-bridge-hack-extradited-us

- Related AI in crypto governance discussions and examinations of AI-assisted development practices cited in industry discussions

AI-assisted coding, mispricing and governance in Moonwell: what it means for DeFi

Moonwell’s experience illustrates a practical tension at the intersection of AI-enabled tooling and DeFi security. An exploitable mispricing in a cbETH price feed demonstrates that even modest numeric errors in oracles can cascade into material losses when strategy and funding flows are levered through a lending protocol. The broader lesson is clear: AI-assisted development can accelerate iteration, but it does not eliminate the need for rigorous end-to-end validations that simulate real-world blockchain interactions.

In the immediate term, the incident should prompt protocol teams to revisit governance structures around codegeneration, review ownership, and the balance between automated tooling and human oversight. It also emphasizes the importance of robust integration tests that connect on-chain state changes with external data feeds, ensuring that a mispricing cannot be exploited in ways that bypass risk controls. As other projects experiment with AI-assisted workflows, Moonwell’s case will likely serve as a reference point for how to align speed with security and who bears responsibility when AI-assisted code contributes to a vulnerability.

Crypto World

New ChatGPT Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

Running a carefully structured prompt through ChatGPT can reveal some striking 2026 price outlooks for XRP, Dogecoin, and Solana.

Based on ChatGPT’s projections, all three cryptocurrencies could reach fresh all-time highs (ATHs) sooner than you think.

Below, we break down the analysis.

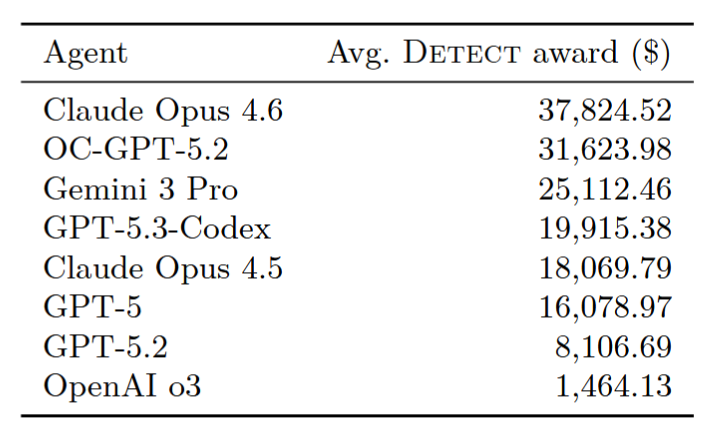

XRP ($XRP): ChatGPT Maps Out a Long-Term Route to $8

In a recent update, Ripple reiterated that XRP ($XRP) remains the core pillar of its plan to establish the XRP Ledger as a globally scalable, institution-ready payments network.

Known for fast transaction finality and minimal fees, XRPL has also emerged as a leading blockchain for two fast-growing crypto segments: stablecoins and tokenized real-world assets.

With XRP currently trading near $1.44, ChatGPT estimates that the token could climb as high as $8 by the end of 2026, implying a potential sixfold increase from current levels.

Market signals appear to reinforce this outlook. XRP’s Relative Strength Index (RSI) is uptrending at 42, a sign of renewed buying interest following an extended selloff.

Key catalysts include rising institutional inflows tied to recently approved U.S.-listed XRP exchange-traded funds, Ripple’s expanding enterprise partnerships, and the possible passage of the U.S. CLARITY bill later this year.

Dogecoin (DOGE): Could the First Meme Coin Eclipse the Doge Army’s $1 Target?

Dogecoin ($DOGE) started as a joke in 2013 but has grown into a digital asset with a market capitalization of $17 billion, accounting for over half of the $36 billion meme coin sector.

DOGE last set an all-time high of $0.7316 during the retail-driven bull market of 2021.

While Dogecoin’s $1 milestone feels far off, ChatGPT suggests a bull market could spur Dogecoin to reach that level this year.

From its current price around $0.10, reaching $1.50 would represent gains of 1,400%, or 15x.

Adoption continues to grow. Tesla accepts DOGE for select merchandise purchases, while platforms such as PayPal and Revolut support Dogecoin transactions.

Solana (SOL): ChatGPT Sees a Run Toward $450

Solana ($SOL) currently supports approximately $6.6 billion in total value locked (TVL) and holds a market capitalization near $50 billion. Increasing on-chain activity, rising developer engagement, and expanding daily users are fuelling its growth.

Momentum has also been boosted by the launch of Solana-linked exchange-traded funds from firms such as Bitwise and Grayscale, which are drawing new institutional interest.

However, after undergoing a prolonged correction in late 2025, SOL has spent much of February trading below $100.

Under ChatGPT’s most bullish projection, Solana could advance from its current price of $85 toward $450 by Christmas. Such a move would represent nearly 5x upside for current holders and comfortably surpass Solana’s prior ATH of $293, recorded in January 2025.

Solana’s long-term outlook remains strong. Asset managers including Franklin Templeton and BlackRock are actively issuing tokenized real-world assets on the network, reinforcing Solana’s position as a scalable platform for institutional-grade blockchain applications.

Maxi Doge: Step Aside Dogecoin, Maxi Enters the Meme Coin Spotlight

Finally, for investors chasing higher-risk, higher-reward opportunities, there is an abundance of opportunities among meme coin presales.

Maxi Doge ($MAXI) has quickly become one of the most discussed presales of 2026, raising $4.6 million so far during its ongoing funding round.

The project centers on Maxi Doge, a loud, gym-loving, unapologetically degen character portrayed as a distant cousin and challenger to the throne of Dogecoin, capturing the irreverent fun that fueled the 2021 meme coin boom.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a much lower environmental footprint than Dogecoin’s proof-of-work model.

Early presale buyers can currently stake MAXI tokens for yields of up to 68% APY, with returns gradually decreasing as more participants enter the staking pool.

The token is priced at $0.0002804 in the current presale phase, with automatic price increases triggered at each funding milestone. Purchases are supported through MetaMask and Best Wallet.

Maxi Doge’s the new sheriff of Memesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here.

The post New ChatGPT Predicts the Price of XRP, Dogecoin and Solana By the End of 2026 appeared first on Cryptonews.

Crypto World

Canary Capital Launches First-Ever Staked SUI ETF

Canary Capital’s introduction of the Canary Staked SUI ETF provides investors with regulated exposure to the Sui Network’s staking rewards

Canary Capital on Wednesday, Feb. 18, officially launched the Canary Staked SUI ETF (NASDAQ: SUIS).

The exchange-traded fund seeks to track the spot price of SUI while participating in the Sui Network’s proof-of-stake protocol, with net in-kind staking rewards reflected in the fund’s NAV, according to a blog post.

“The Canary Staked SUI spot ETF (SUIS) brings exposure to SUI in a registered, exchanged-traded structure, while also enabling investors to benefit from net staking rewards generated through SUI’s proof-of-stake mechanism,” said Steven McClurg, CEO at Canary Capital.

The new product aims to provide both institutional and retail investors with access to the Sui ecosystem. It also reflects a growing interest in regulated crypto investment vehicles, offering transparency and compliance with existing financial regulations.

The move is expected to attract a broader range of investors seeking diversified exposure to digital assets.

The product launch comes as Sui Network has recorded growth recently, recording over $10 billion in 30-day decentralized exchange (DEX) trading volume, 1,000 monthly active developers, and more than $200 billion in monthly stablecoin transfer volume, according to DeFiLlama and Artemis data.

This article was generated with the assistance of AI workflows.

Crypto World

OpenAI Pits AI Agents Against Each Other to Red-Team Smart Contracts

OpenAI has unveiled a benchmarking framework aimed at measuring how effectively AI agents can detect, mitigate, and even exploit security vulnerabilities in crypto smart contracts. The project, titled “EVMbench: Evaluating AI Agents on Smart Contract Security,” was released in collaboration with Paradigm and OtterSec, two organizations with deep exposure to blockchain security and investment. The study assesses AI agents against a curated set of 120 potential weaknesses drawn from 40 smart contract audits, seeking to quantify not just detection and patching capabilities but also the theoretical exploit potential of these agents in a controlled environment.

Key takeaways

- EVMbench tests AI agents against 120 vulnerabilities culled from 40 smart contract audits, emphasizing vulnerabilities sourced from open-source audit competitions.

- Among the models tested, Anthropic’s Claude Opus 4.6 led with an average detect award of $37,824, followed by OpenAI’s OC-GPT-5.2 at $31,623 and Google’s Gemini 3 Pro at $25,112.

- OpenAI frames the benchmark as a step toward measuring AI performance in “economically meaningful environments,” not just toy tasks, highlighting the real-world implications for attackers and defenders in the crypto security landscape.

- The researchers note that smart contracts secure billions of dollars in assets, underscoring the strategic value of AI-enabled tooling for both offensive and defensive activities.

- Industry observers have tied these developments to broader discussions about AI-driven payments and the role of stablecoins in everyday transactions, with major executives predicting growing agentic usage in the coming years.

- The context for such work is underscored by 2025’s crypto-security incident data, which shows a continued flow of funds through vulnerabilities and attacks, reinforcing the demand for robust AI-enabled auditing and defense mechanisms.

Detect awards for AI agents are detailed in the OpenAI PDF accompanying the study, which also describes the evaluation methodology and the scenarios used to simulate real-world smart-contract risk. The authors emphasize that while AI agents have evolved to automate a wide range of routine tasks, assessing their performance in “economically meaningful environments” is essential to understanding how they’ll perform under pressure in production systems.

“Smart contracts secure billions of dollars in assets, and AI agents are likely to be transformative for both attackers and defenders.”

OpenAI notes that it expects agentic technologies to broaden the scope of payments and settlement, including stablecoins used in automated workflows. The discussion around AI-enabled payments extends beyond security testing to the broader question of how autonomous systems will participate in daily financial activity. The company’s own projections suggest that agentic payments could become more commonplace, grounding AI capabilities in practical use cases that touch everyday consumer transactions.

In tandem with the benchmark results, Circle CEO Jeremy Allaire has publicly forecast that billions of AI agents could be transacting with stablecoins for everyday payments within the next five years. That view intersects with a recurring theme in crypto circles: the potential for crypto to become the native currency of AI agents, a narrative that has gained notable attention from industry leaders and investors alike. While such predictions remain speculative, the underlying trend is clear—AI automation is moving from the lab to the transaction layer, where it could reshape how value moves across networks.

The study arrives at a moment when crypto security continues to be a significant risk factor for investors. The data point about 2025’s assault on crypto funds—where attackers pulled roughly $3.4 billion—highlights the urgency of improved tooling and faster, more reliable patching mechanisms. The EVMbench framework is positioned, in part, as a way to measure whether AI agents can meaningfully contribute to defensive capabilities at scale, reducing exploitation opportunities and accelerating threat mitigation.

To build the benchmark, researchers drew on 120 curated vulnerabilities spanning 40 smart contract audits, with many weaknesses traced back to open-source audit challenges. OpenAI argues the benchmark will help track AI progress in recognizing and mitigating contract-level weaknesses at scale, offering a standardized way to compare future AI models as they evolve. The study also provides a lens into how AI might be applied to normalizing risk assessment across a wide range of smart-contract architectures, rather than focusing solely on isolated cases.

Smart contracts weren’t built for humans: Dragonfly

In a contemporaneous thread on X, Haseeb Qureshi, a partner at Dragonfly, argued that crypto’s promise of replacing property rights and traditional contracts never materialized not because the technology failed, but because it was never designed with human intuition in mind. He has highlighted the persistent fear associated with signing large transactions in an environment where drainer wallets and other attack vectors remain a constant threat, in stark contrast to the comparatively smoother experience of traditional bank transfers.

Qureshi contends that the next phase of crypto transactions could be enabled by AI-intermediated, self-driving wallets. Such wallets would monitor risk, manage complex operations, and autonomously respond to threats on behalf of users, potentially reducing the friction and fear that characterize large transfers today.

“A technology often snaps into place once its complement finally arrives. GPS had to wait for the smartphone, TCP/IP had to wait for the browser. For crypto, we might just have found it in AI agents.”

The broader takeaway from this thread is that AI agents may play a critical role in transforming how people interact with crypto—shifting from manual, error-prone transactions to automated, risk-aware processes that can scale with adoption. As AI agents begin to demonstrate more competence in handling security concerns, users could see improved reliability and resilience in decentralized finance workflows, even as the underlying technologies continue to mature.

What to watch next

- Publication and independent replication of the full EVMbench dataset across additional AI models and architectures.

- Broader adoption of AI-assisted auditing workflows by auditors, exchanges, and DeFi projects looking to bolster security postures.

- Explorations into agentic wallets and autonomous payment flows, including regulatory and compliance considerations for AI-managed assets.

- Follow-up benchmarks comparing more AI systems as new versions roll out, tracking improvements in detection accuracy and patching speed.

Sources & verification

- OpenAI: EVMbench: Evaluating AI Agents on Smart Contract Security — PDF: https://cdn.openai.com/evmbench/evmbench.pdf

- OpenAI: Introducing EVMbench — https://openai.com/index/introducing-evmbench/

- Crypto security losses in 2025 (reporting coverage): https://cointelegraph.com/news/crypto-3-4-billion-losses-2025-wallet-hacks

- Dragonfly: Haseeb Qureshi on AI and crypto UX (X post): https://x.com/hosseeb/status/2024136762424185208

- China’s AI lead and crypto implications (analysis): https://cointelegraph.com/news/china-ai-lead-future

- AI Eye — IronClaw and AI bot developments in Polymarket coverage: https://cointelegraph.com/magazine/ironclaw-secure-private-sounds-cooler-openclaw-ai-eye/

Key figures and next steps

The EVMbench study demonstrates that large language models and related AI agents are beginning to perform meaningful security work in the smart contract space, with clearly quantifiable differences across models. Claude Opus 4.6’s lead in average detect awards signals that certain architectures may be more adept at spotting and mitigating vulnerabilities within complex contract logic, while others trail, offering a spectrum of capabilities that researchers will likely want to refine. The inclusion of multiple industry partnerships in the project underscores the growing consensus that AI-enabled security and automated risk management could become essential to scale in decentralized environments.

As the field evolves, observers will be watching for how quickly AI agents can transition from detection to remediation, and whether these agents can operate reliably in live systems without introducing new risks. The conversation about AI-driven wallets and autonomous payments touches on a broader set of questions around security governance, user consent, and regulatory alignment. If the trajectory suggested by OpenAI and its partners continues, AI-assisted tools could become a core component of future crypto infrastructure, changing both the risk calculus and the user experience in meaningful ways. The next round of benchmarks, alongside real-world deployments, will help determine how quickly this vision materializes and what safeguards must accompany it.

Crypto World

SUI token price prediction as Grayscale Sui Staking ETF begins trading today

The launch of the new Sui-focused exchange-traded product marks another step in institutional crypto expansion. Asset manager Grayscale Investments will begin trading its Sui Staking ETF today, offering investors regulated exposure to SUI along with staking rewards.

Summary

- Grayscale Investments launches Sui Staking ETF, converting its Delaware Statutory Trust into a fully exchange-listed product that offers regulated SUI exposure and staking rewards.

- SUI trades near $0.97, well below its 50-day SMA at $1.39, with the broader trend still showing lower highs and lower lows.

- Key levels to watch: Resistance at $1.00 and $1.05; support at $0.90 and $0.85, while CMF at -0.02 signals easing but still weak capital inflows.

Grayscale’s Sui staking ETF debuts with institutional backing

This product emerged from Grayscale’s amended SEC filings, where the firm outlined plans to convert its existing Sui Trust into a fully regulated exchange-listed ETF that holds SUI tokens directly and reflects their market value.

The trust was originally formed as a Delaware Statutory Trust and now transitions into an ETF structure while retaining its focus on the Sui ecosystem.

The ETF is designed to track the price of SUI while also capturing any staking rewards that may be earned through eligible staking activities on the Sui blockchain. The structure aims to reduce the challenges of direct token custody by using institutional custodians and service providers.

Technical signals show weak momentum despite stabilization

Despite the positive headline, SUI’s price action remains cautious. On the daily chart, SUI is trading near $0.97 after a prolonged pullback from early January highs near $1.90. The broader structure shows a clear downtrend, with lower highs and lower lows dominating over the past six weeks.

The 50-day simple moving average sits at approximately $1.39 and continues to slope downward. Price remains well below this level, confirming that bearish momentum has not fully reversed.

Any sustained recovery would first need to reclaim the psychological $1.00 level and then break above $1.05, which has acted as short-term resistance during the recent consolidation.

On the downside, immediate support rests near $0.90. Below that, the early February swing low around $0.85 is the key level to watch. A break under $0.85 would likely open the door to deeper losses.

The Chaikin Money Flow indicator is currently around -0.02. This reflects slightly negative capital flows but shows improvement from the sharp outflows seen earlier this month. The gradual move toward the zero line suggests selling pressure is easing, though not yet replaced by strong accumulation.

If ETF-driven optimism attracts fresh inflows, SUI could attempt a move toward $1.20 in the coming weeks. However, confirmation requires stronger volume and a decisive break above short-term resistance.

Crypto World

Ethereum 50% staking figure by Santiment draws criticism from researchers

Ethereum has crossed a symbolic threshold, with more than half the total ether (ETH) issued now held in its proof-of-stake (PoS) contract for the first time in the network’s 11-year history, Santiment said in a post on X that has been met with criticism.

The onchain analytics firm on Tuesday said that 50.18% of all ETH issued historically is now sitting in the staking deposit contract. The figure reflects cumulative ETH that has flowed into the contract since staking was introduced ahead of the network’s 2022 transition from proof-of-work to PoS.

According to CoinDesk data, the total supply of ether is 120.69 million tokens. Bitmine, the world’s largest ether-focused treasury firm, has 4.29 million ETH, of which 2.9 million is staked. According to Arkham data, the largest holder is the Eth2 Beacon Deposit Contract with 77.1 million or over 60% of the total supply. It holds the most because it serves as the central, mandatory gateway for staking to secure the blockchain. Beacon is followed by Binance with 4.1 million ETH, BlackRock with 3.4 million and Coinbase with 2.9 million.

While the tokens are staked, they cannot be transferred or traded. Withdrawals have been enabled since the Shanghai upgrade in 2023, allowing validators to exit and return ETH to circulation.

That distinction prompted some analysts to caution against interpreting the 50% figure as a permanent supply lock.

‘Inaccurate and materially misleading’

“The post is inaccurate, or at least materially misleading,” Luke Nolan, senior research associate at CoinShares, told CoinDesk. “It references the one-way deposit contract used for ETH staking, but does not account for withdrawals. While ETH is sent into that contract when validators stake, it is not a permanent sink.”

Since withdrawals were enabled, ETH can exit the validator set and re-enter circulation, meaning that looking at the deposit contract balance alone can overstate the amount effectively staked, Nolan said.

“There is also an important nuance around the numbers being cited,” he added. “It is not correct to suggest that over 80 million ETH are currently staked. Roughly 80 million ETH have passed through the staking contract historically, but the amount actively staked today is closer to 37 million ETH, which is around 30% of the current circulating supply. That distinction materially changes the narrative.”

Aleksandr Vat, BizDev at Ethplorer.io, agreed with Nolan and provided CoinDesk with supporting data reinforcing that distinction.

The Beacon deposit contract balance on the Etherscan tracker, currently around 80.97 million ETH, reflects cumulative deposits since launch and does not decrease when validators exit. Withdrawals are processed by minting ETH back to execution-layer addresses rather than subtracting from the deposit contract itself, Vat said.

According to active staking metrics, approximately 37,253,430 ETH are presently staked, based on data from Ethplorer and CryptoQuant, implying that staking represents 30.8% of the total supply.

Santiment’s 50% figure appears to compare the cumulative Beacon contract balance to historically issued supply prior to EIP-1559 burns, Vat said. While that may be mathematically consistent depending on the denominator used, it does not represent the amount of ETH currently locked or removed from circulation, he noted.

Ethereum matures into ‘digital bond’

Even so, the milestone highlights how central staking has become to Ethereum’s economic design, Vineet Budki, partner and CEO at Sigma Capital, told CoinDesk. As participation rises, a larger share of ETH earns yield through validator rewards, reinforcing its positioning as a yield-bearing crypto asset, he said, adding he sees the development as evidence of Ethereum’s maturation into what he called a “digital bond.”

“Ethereum’s milestone of 50% staked supply marks its evolution into a digital bond, where the network’s security is fueled by long-term conviction rather than short-term speculation,” Budki said. “By locking half the total issuance in a one-way vault, the protocol has engineered a structural supply crunch.”

Budki also pointed to accelerating network activity, including a 125% year-over-year increase in daily transactions, a doubling of daily active addresses and an increase in tokenized real-world assets, much of it occurring on layer-2 networks that settle back to Ethereum’s base layer.

Nolan noted, however, that recent validator growth has been concentrated among large participants.

“A significant portion of recent validator entries has been driven by large entities such as Bitmine and U.S.-listed ETFs, which have taken up a notable share of the entry queue,” he noted.

With staking levels continuing to climb, the debate shows just how Ethereum’s supply metrics, and how they are presented, can significantly shape market narratives, Budki concluded.

Crypto World

Grayscale’s GSUI Sui Staking ETF Begins Trading on NYSE Arca

Key insights:

- GSUI ETF approved via SEC 8-A filing, begins NYSE Arca trading on February 18 with staking-based yield exposure.

- Fund charges 0.35% fee but waives it for 3 months or until $1B AUM threshold is reached.

- SUI rose by 7% after the announcement; derivatives data shows mixed sentiment despite growing institutional interest.

Grayscale Investments’ Sui Staking ETF will start trading on NYSE Arca on February 18 under the ticker GSUI after the 8-A filing became automatically effective with the U.S. Securities and Exchange Commission (SEC).

Grayscale’s 8-A Filing for Sui Staking ETF. Source: U.S. SEC

The listing gives investors regulated exposure to the SUI token and staking rewards without directly holding crypto assets, marking a significant expansion of exchange-traded products tied to alternative Layer-1 blockchains.

GSUI ETF Framework, Fees, and Key Institutional Participants

The management fee on the fund is 0.35%. Grayscale Investments Sponsors LLC has foregone the entire fee for up to 3 months or until assets under management reach $1 billion. The ETF aims to generate yield by staking SUI tokens deposited in the trust.

The key market participants include Jane Street Capital and Virtu Americas, which act as authorized participants, while JSCT, Virtu Financial Singapore, Galaxy Digital Trading Cayman, and Flowdesk will provide liquidity. Additionally, the Bank of New York Mellon serves as transfer agent and administrator, while Coinbase functions as the prime broker, and Coinbase Custody Trust Company holds the assets.

The product was previously available on OTCQX in 2025. Moving to NYSE Arca broadens access for traditional investors who want blockchain exposure without managing wallets or private keys.

SUI Market Reaction and Price Movement

SUI rose about 7% after news of the ETF surfaced, but later traded at $0.968, down 0.88% on the day. The 24-hour range stood between $0.954 and $0.987, while trading volume fell roughly 22% amid wider crypto-market uncertainty ahead of macroeconomic data, including the Federal Reserve’s FOMC minutes.

Derivatives data showed mixed sentiment. Total SUI futures open interest rose about 1% to $509 million, though short-term positions fluctuated across exchanges. In a post on X, analyst Ali suggested a potential 15% rally toward $1.16 based on a technical breakout pattern.

$SUI is breaking out of an Adam & Eve pattern, opening the door to a 15% rally toward $1.16. pic.twitter.com/2qtjppCzxw

— Ali Charts (@alicharts) February 14, 2026

GSUI Launch Signals Expansion of Staking-Based Crypto ETFs

GSUI ETF enables investors to receive staking rewards in a regulated environment, blending conventional finance with blockchain yield systems. The launch also increases institutional visibility for the Sui network, a Layer-1 blockchain designed to support high-throughput Web3 apps.

Grayscale entering into staking-based exchange-traded products is an indication of a wider trend in diversified crypto ETFs that are no longer limited to Bitcoin and Ethereum. With more adoption, analysts believe that there will be better liquidity and involvement in smaller ecosystems of digital assets.

What happens next?

GSUI will begin trading on NYSE Arca, with market participants watching early inflows and their impact on SUI liquidity and price dynamics. This indicates an expanding competition in the wider crypto ETF market.

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment13 hours ago

Entertainment13 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech17 hours ago

Tech17 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Entertainment4 hours ago

Entertainment4 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business19 hours ago

Business19 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World7 hours ago

Crypto World7 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit