Crypto World

Hibachi Launches FX Exchange for Stablecoin Settlement on Arc Network

TLDR:

- Stablecoin market reached $308 billion in 2025 with $46 trillion in annual transaction volume.

- Traditional FX markets still require T+2 settlement despite stablecoin instant transfer capabilities.

- Hibachi offers private orderbooks with onchain verification and self-custody options for traders.

- Circle Ventures backed Hibachi through Arc Builders Fund for sub-second finality infrastructure.

Hibachi has announced the launch of a new foreign exchange platform designed for stablecoin settlement. The platform addresses gaps in current FX markets by combining instant settlement with professional-grade execution.

Built on Circle’s Arc network, the exchange targets regulated institutions and professional traders. Stablecoin market capitalization reached $308 billion in 2025, creating demand for modern FX infrastructure.

Bridging the Gap Between Traditional and Onchain Markets

The stablecoin market processed $46 trillion in transaction volume last year. However, traditional FX markets continue operating on outdated infrastructure requiring T+2 settlement.

Banks maintain control through opacity and restricted liquidity access in the $10 trillion daily spot FX market. This creates friction as stablecoin adoption accelerates across enterprise users.

Hibachi shared its vision through a post on social media platform X. The company stated that no existing venue combines stablecoin settlement with exchange-grade execution and transparent orderbooks.

Traditional FX venues require bank intermediation and nostro accounts across multiple currencies. Centralized crypto exchanges introduce counterparty risk through custody requirements.

Current onchain venues present different challenges for institutional participants. These platforms lack privacy protections, exposing trading strategies and order flow to competitors.

Most fail to meet compliance standards that regulated firms require. The result leaves professional traders without adequate infrastructure for stablecoin-based FX operations.

The new platform aims to solve these limitations through specific design choices. Hibachi will offer instant settlement alongside tight bid-ask spreads and deep liquidity pools.

Orders and positions remain private while maintaining onchain verification capabilities. The exchange will support both self-custody and third-party custodian integrations.

Arc Network Powers Next-Generation Infrastructure

Hibachi selected Circle’s Arc network as its technical foundation. The blockchain network provides sub-second transaction finality and uses stablecoins for gas fees.

Arc also offers configurable privacy features that address institutional requirements. Circle Ventures backed Hibachi through participation in the Arc Builders Fund.

The exchange will serve spot and derivatives trading for multiple currency pairs. Professional market participants need matching speeds and uptime that rival traditional venues.

Hibachi plans to deliver these capabilities while maintaining regulatory compliance features. The platform includes reporting tools designed for regulated financial institutions.

A Deloitte survey found that 99 percent of enterprise CFOs envision using stablecoins long-term. This growing acceptance creates opportunity for specialized infrastructure providers.

Stablecoin-denominated currencies in different nations enable competition against legacy banking systems. Transparent orderbooks and broad access challenge the existing walled garden approach.

The FX market transformation reflects broader changes in digital asset utility. Stablecoins evolved from crypto-native products into mainstream payment rails over five years.

Regulatory frameworks continue developing to accommodate enterprise adoption. Hibachi positions itself to capture this market shift through purpose-built infrastructure for always-on trading.

Crypto World

SoFi Selects BitGo to Launch Bank-Issued Stablecoin SoFiUSD

SoFi Technologies has selected digital asset custodian BitGo to support the rollout of its bank-issued stablecoin, the latest sign of growing momentum around federally regulated stablecoins for payments and settlements.

Under the partnership, BitGo will provide stablecoin infrastructure services for SoFiUSD, a US dollar-pegged token issued by SoFi Bank, a nationally chartered and insured depository institution, the companies disclosed Thursday.

The arrangement will run through BitGo’s “stablecoin-as-a-service” platform, which will support the issuance of SoFiUSD and help connect the token with payment providers, market participants and cryptocurrency exchanges.

SoFi said SoFiUSD is the first stablecoin issued by a US nationally chartered and insured deposit bank on a public, permissionless blockchain.

SoFi Technologies is a publicly traded Nasdaq-listed digital finance company that offers lending, banking and investment products to nearly 14 million members. The company entered the digital asset market in 2019 by adding cryptocurrency trading through its SoFi Invest platform and later secured a national bank charter after acquiring Golden Pacific Bancorp in 2022, establishing SoFi Bank.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

US companies race to build stablecoin infrastructure

SoFi’s push into the stablecoin market comes amid a broader shift toward regulated digital dollar infrastructure in the United States, following the passage of the GENIUS Act, which establishes a federal regulatory framework for payment stablecoins and their issuers.

Against this backdrop, financial technology companies are expanding the infrastructure needed to support stablecoin payments and settlement.

As reported by Cointelegraph, payment operations platform Modern Treasury recently launched an integrated payment service that supports stablecoin rails alongside traditional banking infrastructure. The system enables businesses to settle transactions using stablecoins in addition to conventional payment methods such as ACH transfers and wire payments.

The platform currently supports several dollar-pegged tokens, including USDC (USDC), Global Dollar (USDG) and Pax Dollar (USDP).

Separately, digital asset infrastructure company Stablecore recently joined the Jack Henry Fintech Integration Network, which connects nearly 1,700 financial institutions. The integration enables banks and credit unions on the network to offer stablecoin and tokenized-asset services through their existing banking platforms.

Related: Wall Street’s crypto debate is over as banks go all-in on BTC, stablecoins, tokenized cash

Crypto World

Son of contractor managing seized crypto for U.S. Marshals arrested in France over alleged $46m theft

French authorities arrested John “Lick” Daghita, who allegedly stole tens of millions in crypto from the U.S. government.

In an X post on Thursday, FBI Director Kash Patel confirmed Daghita had been arrested on Wednesday on the island of Saint Martin in a joint FBI and French Gendarmerie operation.

In his social media post, Patel included images of Daghita handcuffed and another one of a metal suitcase filled with packs of $100 bills and several USB and what appear to be hardware crypto wallets.

“[The] FBI will continue working 24/7 with our international partners to track down, apprehend, and bring to justice those who attempt to defraud American taxpayers, no matter where they try to hide,” Patel said.

The arrest caps off a monthslong investigation by the U.S. Marshals Service into whether Daghita, the son of a government contractor tasked with managing seized crypto funds, stole over $46 million from government seizure wallets.

Brady McCarron, chief of public affairs for the USMS, told CoinDesk in late January that an investigation into allegations that Daghita had stolen cryptocurrency were underway.

The law enforcement investigation began after blockchain sleuth ZachXBT publicly alleged that Daghita, the son of CMDSS president Dean Daghita, had siphoned tens of millions of dollars in digital assets from wallets associated with U.S. government seizures.

CMDSS is a Virginia-based contractor that advertises information technology and operational support services for U.S. government agencies, including the Department of Justice and Department of Defense. The company has previously been reported to hold contracts assisting the USMS with managing and disposing of cryptocurrency seized during criminal investigations.

The investigator said he alerted authorities after identifying a wallet holding roughly 12,540 ETH, worth more than $36 million at the time, that he alleged was controlled by Daghita.

Daghita first drew attention in online circles after appearing in a recorded dispute in a Telegram group chat with another alleged threat actor in what is known as a “band for band” exchange, where participants attempt to prove control of large crypto holdings.

With Daghita now in custody, U.S. authorities are expected to pursue extradition as the investigation continues.

Crypto World

Oaktree’s Howard Marks says there’s no systemic problem with private credit

Howard Marks, co-chairman, Oaktree Capital.

Courtesy David A. Grogan | CNBC

Veteran investor Howard Marks said he doesn’t see a widespread problem brewing in private credit, but warned that the sector’s rapid expansion over the past 15 years could expose weaker lenders when markets eventually turn.

“There’s not a systemic problem with private credit,” Marks, co-chairman and co-founder of Oaktree Capital, said Thursday on CNBC’s “Money Movers.”

The noted investor said that the risk stems from the pace of expansion in direct lending, which has ballooned to a market now exceeding $1 trillion from its early development around 2011.

His comments come as sentiment toward direct lenders has soured following the collapse of auto-related borrowers Tricolor and First Brands. Much of the concern has centered on loans made to software companies as investors worry that artificial intelligence could disrupt those businesses.

“There’s a saying in the banking business that the worst of loans are made in the best of times. We’ve seen 17 years of good times. When the stuff hits the fan, or as Warren Buffett would say, when the tide goes out, we will find out whose credit analysis was discerning, who made fewer software loans to the better company,” Marks said.

The pressure has already begun to show up in fund flows. Investors pulled nearly 8% from Blackstone Inc.’s flagship private credit fund in the most recent quarter, highlighting growing caution among allocators.

Marks said it’s impossible to predict when exactly the cycle will turn.

“The things that affect the investment world so profoundly are the things that were not foreseen,” Marks said. “If they could be foreseen … anticipated and adjusted to and factored into prices, they wouldn’t have that cataclysmic effect.”

Crypto World

Ethereum Taps $2.2K as Traders Brace for a Potential Trend Change

Market analysts said Ether’s (ETH) uptrend was confirmed after the latest 25% recovery to $2,200 from its multi-year lows below $1,800.

Key takeaways:

-

Ether rose to $2,200 on Wednesday, as onchain data shows signs of returning demand.

-

ETH price support around $2,100 remains key for the bulls to hold.

Ether sellers are “losing control”

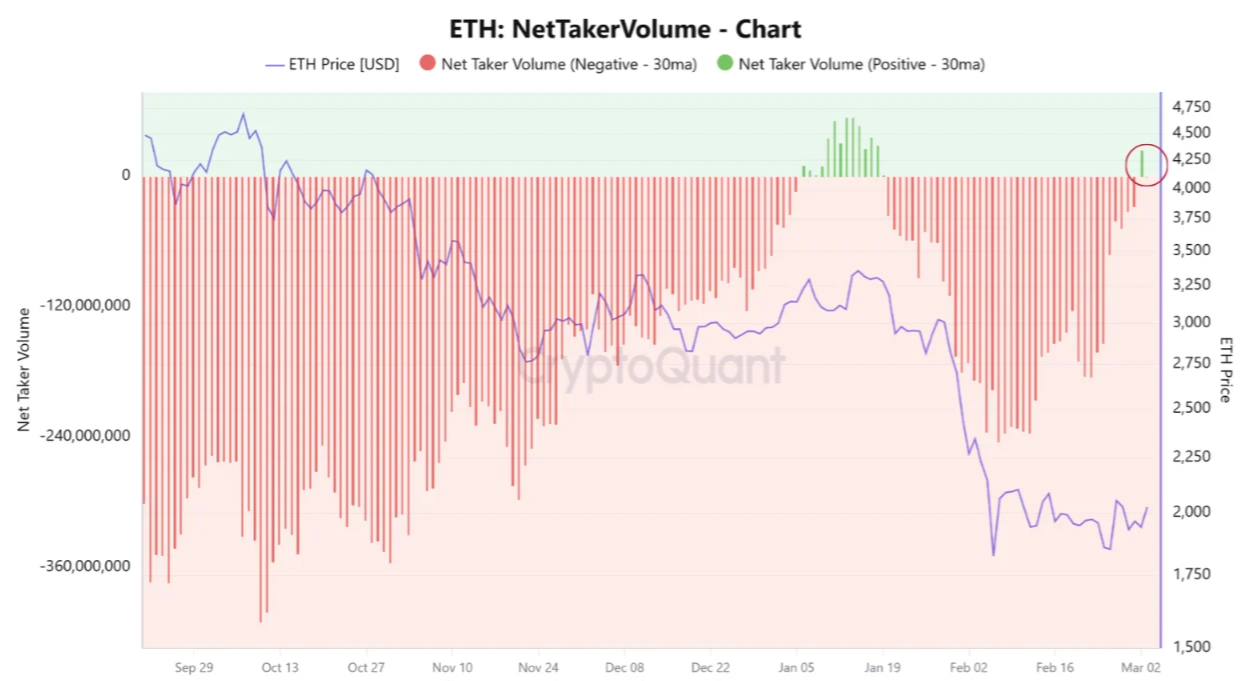

Ether’s net taker volume suggests that “sellers may be losing control” as demand for ETH derivatives returned, data from CryptoQuant shows.

Net taker volume, a metric that measures the imbalance between buyers and sellers in derivatives markets, has flipped positive after being in negative territory for nearly two months.

This negative regime coincided with the bear market drawdown, indicating sustained aggressive selling across derivatives markets.

“The latest prints show flows starting to turn positive, suggesting that seller dominance may be fading,” CryptoQuant analyst MorenoDV_ said in a recent Quicktake post, adding:

“Historically, shifts from prolonged negative taker pressure toward positive territory often precede short covering rallies and liquidity-driven rebounds, particularly after periods of forced selling.”

The return in ETH demand is also reflected by Ether’s Coinbase Premium Index, which has risen to levels last seen in December 2025.

After being negative for several months, the index has flipped positive, pointing to a return in demand from US investors, which could propel the ETH price higher.

“This indicates that US buying pressure remains positive,” CryptoQuant analyst CW8900 said, adding:

“If the Coinbase premium rises further, the rally will accelerate.”

Meanwhile, demand for spot Ether ETFs continues to recover, with these investment products recording $169.4 million in inflows on Wednesday. This shows the return of demand from institutional investors.

ETH traders anticipate a price rebound

Ether’s latest breakout must, however, not pull back below the $1,750 mark, according to analysts.

Trader and analyst Crypto Patel said that the $1,750 support must hold for “bulls to stay in control,” with the upside target set at “$2,500-$2,600.

“Lose $1,750 and bears take over again.”

Commenting on Ether’s Thursday push above $2,000, analyst Bren said a “larger bounce above $2,200 is likely.”

Meanwhile, Man of Bitcoin said that a successful retest of $2,100 support after the current retracement could open the path to $3,400 or higher.

As Cointelegraph reported, a daily candlestick close above $2,100 will revive the hopes of a recovery toward the 50-day simple moving average (SMA) at $2,381. A break above this level will mean that the corrective phase may be over.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

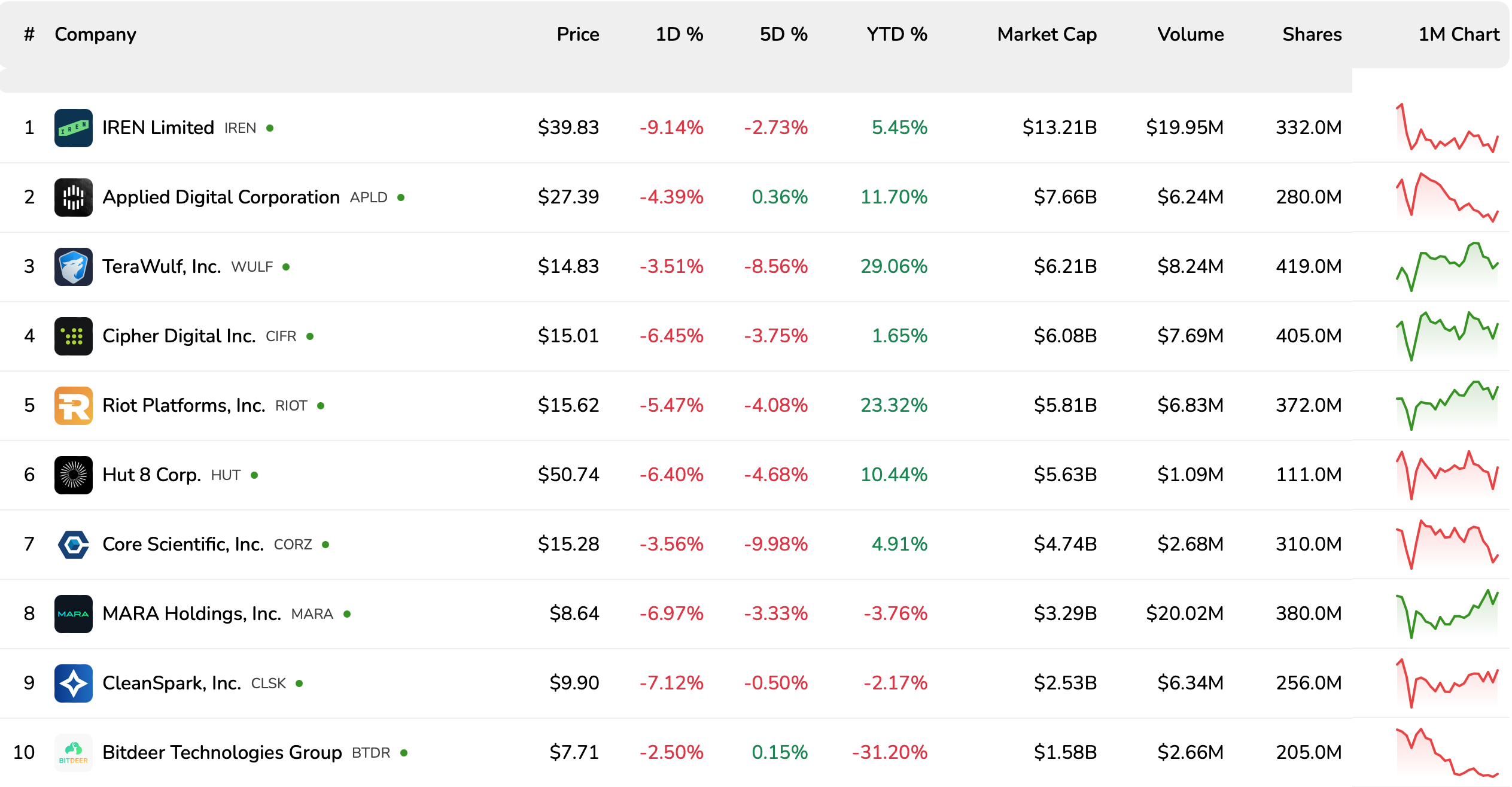

Core Scientific Lands $500M Morgan Stanley Credit Line, Expandable to $1B

Bitcoin mining and data center company Core Scientific has closed a $500 million loan facility with Morgan Stanley, with the option to expand the financing to as much as $1 billion.

According to a company announcement on Thursday, the financing may be used for general corporate purposes tied to building and expanding data center assets, including equipment purchases, real estate acquisition and securing additional power agreements.

The company operates large-scale data centers in several US states, including Texas, Georgia and North Carolina, hosting both Bitcoin (BTC) mining equipment and other high-density computing workloads.

The 364-day facility carries interest at the Secured Overnight Financing Rate (SOFR) plus 2.5% and includes an accordion feature that allows total commitments to increase by another $500 million.

Core Scientific currently derives most of its revenue from Bitcoin mining but is converting “most” of its data center footprint to support AI-related and other high-density computing workloads.

The announcement comes days after the company’s shares fell following a fourth-quarter earnings miss, as crypto mining income dropped to $42.2 million, nearly 50% lower than the same quarter a year earlier.

Related: Ex-OpenAI researcher’s hedge fund reveals big Bitcoin miner bets in new SEC filing

Core Scientific’s road to AI and HPC

Core Scientific filed for Chapter 11 bankruptcy protection in December 2022 after falling Bitcoin prices, rising energy costs and losses tied to crypto lender Celsius strained its finances. In January 2024, it emerged from bankruptcy and relisted its shares on Nasdaq after completing a court-approved restructuring.

Following the restructuring, Core Scientific began repurposing parts of its data center infrastructure to support artificial intelligence and high-performance computing (HPC) workloads alongside its Bitcoin mining operations.

That shift accelerated in June 2024, when the company signed a 12-year agreement with AI cloud provider CoreWeave to supply data center capacity for HPC.

A year later, CoreWeave sought to deepen the relationship through a proposed acquisition, agreeing in July 2025 to buy Core Scientific in an all-stock transaction valued at about $9 billion. However, the merger failed to gain sufficient shareholder approval during a vote in October and did not move forward.

Several other Bitcoin mining companies have also begun repurposing their infrastructure to support AI and HPC workloads in recent months.

In July, Hive Digital Technologies said it was expanding into HPC, building an AI infrastructure business that it expects could reach $100 million in annual revenue.

About a month later, TeraWulf signed 10-year colocation agreements with AI infrastructure company Fluidstack valued at $3.7 billion, with Google backing about $1.8 billion of the lease obligations.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Liquidity Time Preference Markets (Shadow TVL)

Reimagining DeFi Liquidity Through Time. Decentralized Finance has largely measured its strength using one metric: Total Value Locked (TVL). Billions of dollars sit inside smart contracts, signaling capital commitment, protocol confidence, and market depth. But TVL has a hidden flaw: it ignores time.

A dollar locked for 5 minutes and a dollar locked for 5 years are treated the same.

This blind spot opens the door to a new primitive in DeFi design: Liquidity Time Preference Markets, also known as Shadow TVL.

The Problem With Traditional TVL

TVL answers one question:

“How much capital is inside a protocol right now?”

But DeFi users behave very differently depending on how long they intend to stay.

Consider three liquidity providers:

| Provider | Capital | Lock Duration |

|---|---|---|

| Trader A | $1M | 30 minutes |

| Yield Farmer B | $1M | 7 days |

| DAO Treasury C | $1M | 2 years |

Traditional TVL says:

TVL = $3M

But economically, these deposits are not equal. The DAO treasury provides structural stability, while Trader A provides temporary liquidity that could vanish instantly.

This creates the concept of Shadow TVL — a deeper metric that accounts for time-weighted liquidity commitment.

What is Shadow TVL?

Shadow TVL = Liquidity adjusted by time commitment.

Instead of measuring only how much capital is present, Shadow TVL measures:

-

How long is liquidity expected to remain

-

How stable is the capital base, actually?

-

The protocol’s real economic security

Example:

| Deposit | Amount | Lock Duration | Shadow Value |

|---|---|---|---|

| $1M | 1 hour | 0.0001 weight | |

| $1M | 30 days | 0.3 weight | |

| $1M | 2 years | 1.0 weight |

Even though TVL is $3M, Shadow TVL may only equal ~$1.3M in stable liquidity.

This reveals the true durability of a protocol’s liquidity base.

Introducing Liquidity Time Preference Markets

Rather than just measuring time preference, DeFi could trade it directly.

A Liquidity Time Preference Market allows participants to buy and sell liquidity commitment durations.

Participants could trade:

-

Short-term liquidity rights

-

Long-term liquidity guarantees

-

Liquidity futures contracts

Think of it like interest rate markets, but for capital patience.

How It Could Work

Step 1 — Liquidity Commitment Tokens

When depositing liquidity, users mint a token representing their lock duration.

Example tokens:

-

LQ-1D → Liquidity locked for 1 day

-

LQ-30D → Liquidity locked for 30 days

-

LQ-365D → Liquidity locked for 1 year

These tokens represent time-bound liquidity guarantees.

Step 2 — Secondary Markets

These liquidity commitments become tradable assets.

Traders could speculate on:

-

Liquidity shortages

-

Market volatility

-

Protocol stability

Example:

If traders expect high volatility next month, 30-day liquidity tokens become more valuable, because protocols will need deeper liquidity.

Step 3 — Shadow TVL Pricing

Protocols could use market prices of these tokens to compute Shadow TVL in real time.

Instead of:

TVL = $500M

Protocols would show:

Shadow TVL = $500M capital with 87-day average commitment

This creates a liquidity durability index.

Why This Changes DeFi Economics

1. Eliminates “Mercenary Liquidity.”

Yield farmers often chase incentives and exit instantly.

Liquidity Time Markets reward long-term capital commitment, reducing unstable liquidity.

2. New Derivatives Market

Liquidity duration becomes a financial asset.

Examples:

DeFi could develop a yield curve for liquidity similar to government bond markets.

3. Predictable Protocol Stability

Protocols could price risk based on how long liquidity is expected to remain.

A DEX with:

is far more stable than one with $200M TVL but a 2-day commitment.

4. Capital Efficiency

DAOs and funds could optimize treasury deployment by selecting liquidity durations matching their risk profile.

Example:

| Strategy | Liquidity Duration |

|---|---|

| Arbitrage Funds | 1–3 days |

| Market Makers | 30–90 days |

| DAO Treasuries | 1–3 years |

Liquidity becomes programmable over time.

The Emergence of a Liquidity Yield Curve

Just like traditional finance has a bond yield curve, DeFi could develop a Liquidity Commitment Curve.

Example market rates:

| Duration | Expected Yield |

|---|---|

| 1 day | 2% APR |

| 30 days | 7% APR |

| 1 year | 18% APR |

This curve reflects market demand for liquidity stability.

During volatile markets, long-duration liquidity becomes extremely valuable.

Potential Use Cases

Stablecoin Defense

Stablecoin protocols could require a minimum liquidity duration for collateral pools.

This prevents bank-run style liquidity collapses.

MEV Protection

Validators and builders could secure blockspace liquidity guarantees, ensuring deep order books even during congestion.

DeFi Credit Markets

Lenders could issue loans backed by liquidity commitment tokens, turning liquidity guarantees into collateral.

Risks and Challenges

Despite its promise, Liquidity Time Preference Markets introduce new complexities:

Smart Contract Risk

Liquidity locks and tokenization increase protocol complexity.

Liquidity Fragmentation

Too many duration tokens could fragment capital across markets.

Speculation Loops

Traders might speculate heavily on liquidity scarcity.

However, these risks are similar to those seen in early interest rate derivatives markets in traditional finance.

Why This Idea Matters

DeFi’s biggest weakness is unstable liquidity.

TVL numbers can look impressive, but capital can disappear instantly.

Shadow TVL introduces a missing dimension: time.

Instead of measuring how much liquidity exists, DeFi could measure:

How committed is that liquidity actually?

Liquidity Time Preference Markets turn patience into a tradable financial primitive.

And once time becomes a market…

DeFi doesn’t just have liquidity.

It has predictable liquidity stability.

REQUEST AN ARTICLE

Crypto World

BTCC TradFi Hits $200M Volume and Celebrates with Zero-Fee Campaign on Gold and Silver

[PRESS RELEASE – LODZ, Poland, March 5th, 2026]

BTCC, the world’s longest-serving cryptocurrency exchange, today announced that its recently launched TradFi product has surpassed $200 million in cumulative trading volume since going live on February 10, 2026. To celebrate this milestone, BTCC is introducing a zero-fee trading campaign for the XAU and XAG pairs, where participants can earn up to 10 grams of gold through a tiered volume bonus program.

The $200 million milestone demonstrates strong demand for traditional market access among crypto traders. BTCC TradFi, launched in February 2026, enables users to trade traditional financial instruments, including forex, commodities, indices, and equities, directly on the BTCC platform using USDT as margin and settlement currency. TradFi aims to remove barriers for crypto traders to gain exposure to the global traditional financial markets.

Running from March 5 to March 19, 2026, the zero-fee campaign waives all trading fees on XAU and XAG pairs. Alongside the 0-fee promotion, users can also participate in a tiered bonus program based on the total TradFi trading volume during the campaign. Participants can earn up to 10g of gold by reaching the milestone of 5,000,000 USDT in cumulative trading volume across all TradFi pairs.

Precious metals have been among the most actively traded asset classes on BTCC’s platform. In 2025, tokenized gold on BTCC recorded $5.72 billion in trading volume, with Q4 volume surging 809% over Q1, underscoring sustained user interest in precious metals. This momentum sets the stage for the zero-fee campaign on XAU and XAG, giving both new and existing users a cost-free entry point into one of the platform’s most in-demand markets.

For traders seeking traditional market exposure without leaving the crypto ecosystem, BTCC TradFi offers a seamless platform that bridges cryptocurrency and traditional assets. The zero-fee campaign is an opportunity to explore gold and silver trading at zero trading cost on the BTCC platform. For campaign details and eligibility requirements, users may visit BTCC’s 0-fee campaign page.

About BTCC

Founded in 2011, BTCC is a leading global cryptocurrency exchange serving over 11 million users across 100+ countries. Partnered with 2023 Defensive Player of the Year and 2x NBA All-Star Jaren Jackson Jr. as global brand ambassador, BTCC delivers secure, accessible crypto trading services with an unmatched user experience.

Official website: https://www.btcc.com/en-US

X: https://x.com/BTCCexchange

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

xStocks Unveils xChange, Bringing Real-World Equity Liquidity Onchain Across Ethereum and Solana

TLDR:

- xChange is the first unified execution layer trading over 70 tokenized stocks across Ethereum and Solana onchain.

- Every xStock is backed 1:1 by underlying shares in custody, ensuring real equity exposure on the blockchain.

- Atomic settlement guarantees trades execute fully at the quoted price or not at all, eliminating partial fills.

- xStocks has surpassed $3.5 billion in onchain volume and 80,000 unique holders since launching in June 2025.

xChange, the new unified execution layer from xStocks, is now live on Ethereum and Solana. The platform enables trading of more than 70 tokenized stocks directly onchain.

Pricing is anchored to real-world public market data, while atomic settlement ensures each trade completes fully or not at all.

Since its June 2025 launch, xStocks has recorded over $3.5 billion in onchain transaction volume, marking rapid adoption of tokenized equities.

How xChange Bridges Traditional Markets and DeFi

xChange connects traditional market depth with decentralized finance infrastructure in one unified system. The platform does not rely on third-party intermediaries to process trades.

Instead, it executes transactions directly onchain across both Ethereum and Solana. This setup preserves the transparency and composability that DeFi participants expect.

Each xStock is fully collateralized and backed 1:1 by underlying shares held in custody. This structure means every onchain transaction reflects genuine equity exposure.

Atomic settlement removes the risk of partial fills entirely from the process. Trades either execute in full at the quoted price or do not go through.

Kraken announced the launch through its official X account, describing it as “the first unified execution layer for tokenized equities.” The exchange added that xChange delivers “TradFi liquidity. DeFi infrastructure. Always on.”

The platform operates 24/5, extending equity trading well beyond standard exchange hours. As a result, tokenized stocks function as always-on, programmable financial assets.

Val Gui, General Manager of xStocks, described the platform’s purpose directly. “xChange is about redefining how equities trade in a digital-first world,” Gui stated.

He added that it “brings real-world market liquidity onchain and turns tokenized stocks into fully programmable, always-on assets.” Gui noted these assets are built to “power the next generation of global financial applications.”

xStocks Records Strong Growth Metrics Since June 2025

Since launching in June 2025, xStocks has surpassed $3.5 billion in total onchain transaction volume. The platform has also crossed $25 billion in total trading volume across exchanges.

These figures reflect growing demand for tokenized equities among DeFi users and traditional finance participants. The pace of growth points to measurable market adoption across both audiences.

Over $225 million in tokenized assets are currently held onchain. More than 80,000 unique onchain holders have participated in the broader ecosystem.

Tokenized equities are gaining traction as a distinct and recognized asset class. Adoption has continued expanding across multiple chains, platforms, and applications.

xChange builds on this momentum by introducing a unified execution layer across networks. The platform connects liquidity across Ethereum and Solana while tying pricing to traditional equity markets.

This connection supports tighter spreads and improved execution quality throughout the system. Onchain settlement and transferability remain fully intact at every step.

Rather than replacing existing DeFi liquidity models, xChange functions as an added layer. It improves price alignment and execution reliability across the broader ecosystem.

The outcome is a hybrid model that combines real-world equity market depth with blockchain-based trading infrastructure. xChange positions tokenized stocks as a functional bridge connecting two distinct financial worlds.

Crypto World

Bitcoin Spot Demand Surges as War Tensions Shake Global Markets

Unleveraged buyers and ETF inflows pushed Bitcoin higher even as geopolitical uncertainty rattled global markets.

Bitcoin’s spot market demand strengthened over the weekend as rising war tensions unsettled global financial markets. The increase in spot buying helped stabilize prices after recent declines and kept BTC relatively firm during the broader market pullback.

Market data shows that this support is coming mainly from unleveraged buyers rather than derivatives activity. Analysts say the shift reduces downside risk in the near term, even as geopolitical and macroeconomic pressures persist.

Spot Buyers Step In as Bitcoin Climbs the Wall of Worry

A recent report from Bitfinex noted that spot buyers have actively supported Bitcoin since March 1. These buyers accumulated about $3.5 billion through steady purchases, mainly during late Asian and U.S. trading hours.

This wave of demand pushed BTC back above $65,000 and marked what analysts describe as a “wall of worry” phase. In it, prices climb even as uncertainty and external risks dominate market sentiment.

Meanwhile, derivatives data shows open interest moving in line with spot volumes at a balanced 1:1 ratio. The pattern suggests the rally is driven by genuine accumulation rather than leveraged trades or short-term speculation.

Further support came from the Coinbase Premium Index, which turned positive after a prolonged negative streak. The index has maintained a modest premium, signaling continued demand from U.S. market participants.

Additionally, the defense of the $60,000 support level has reinforced Bitcoin’s transition into an expansion phase. Market participation has increased, and perpetual funding rates remain moderate and well below overheated levels, indicating a balanced and sustainable environment.

You may also like:

ETF Inflows Reinforce Bitcoin’s Market Recovery

Notably, U.S. spot Bitcoin exchange-traded funds contributed significantly to the shift by reversing earlier outflows.

According to Bitfinex, strong inflows last week helped absorb selling pressure from miners and long-term holders. For context, March 4 saw $461.9 million in net flows, and week-to-date figures through March 5 have already exceeded $1.14 billion.

These inflows have reinforced key technical levels. Bitfinex highlights $77,400 as a major resistance area and $54,100 as core support based on historical cycles. They also note Bitcoin’s correlation with Nasdaq and geopolitical risks tied to the Strait of Hormuz, which could influence near-term volatility.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

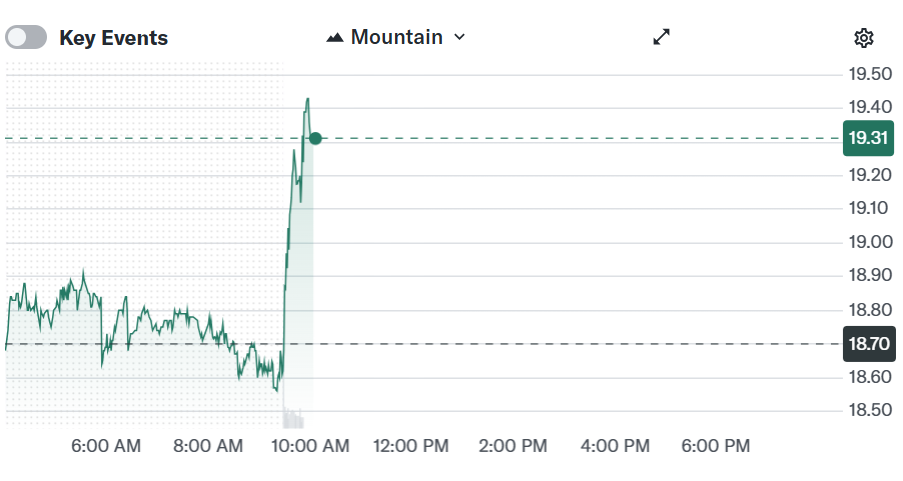

SOL Strategies Stock Climbs 21% on 691K SOL Milestone

TLDR

- SOL Strategies stock rose 20.97% to $1.50 after the company released its February business update.

- The STKESOL liquid staking platform surpassed 691,000 SOL staked within weeks of launch.

- The platform attracted 1,034 holders shortly after its rollout.

- The validator network expanded to 33,568 unique wallets in February.

- Total assets under delegation reached 3.87 million SOL, including treasury and third-party stakes.

SOL Strategies stock climbed 20.97% to $1.50 on Nasdaq after a strong February update. The company reported rapid growth in staking operations and liquid staking adoption. The update showed rising validator activity and expanding assets under delegation.

SOL Strategies Stock Jumps as Liquid Staking Gains Traction

The company said its STKESOL liquid staking platform surpassed 691,000 SOL staked within weeks of launch. It also confirmed that 1,034 holders joined the platform during the initial rollout. The figures came from its February business update, which highlighted expanding validator activity and rising delegated assets.

SOL Strategies stated that its validator network reached 33,568 unique wallets in February. That figure increased from about 31,000 wallets at the start of the month. The company said STKESOL growth supported higher validator participation and stronger network engagement.

The firm reported total assets under delegation of 3.87 million SOL in February. This total included treasury holdings and tokens delegated by third parties. Proprietary validators generated about 1,276 SOL in rewards during the month.

The company confirmed that users, delegated assets, and staking rewards all increased during February. These metrics reflect performance across validator and staking services. The company linked this expansion directly to the rollout of liquid staking services.

SOL Strategies said liquid staking allows users to earn rewards while keeping tokens liquid. It issues tokenized staking positions that users can trade or deploy elsewhere. The company described this product as an added revenue channel beyond validator services.

Revenue Growth Expands Across Staking Operations

Interim CEO Michael Hubbard said the company continues scaling infrastructure despite crypto market volatility. He stated, “The staking platform now has four revenue streams running simultaneously.” These include treasury staking, third-party delegated staking, liquid staking, and institutional staking services.

Hubbard confirmed partnerships form part of the institutional staking strategy. He cited a partnership with global asset manager VanEck as an example. The company reported that quarterly results rose 69% year on year.

Staking and validator rewards totaled 9,787 SOL during the quarter. This figure marked a 120% increase from the same quarter last year. The company linked this rise to expanded Solana-focused infrastructure operations.

SOL Strategies also reported growth in its Solana portfolio holdings. The portfolio increased to about 529,000 SOL from 139,726 previously recorded. The company attributed the rise to balance sheet growth and higher Solana exposure.

The February update included governance changes before the annual shareholder meeting on March 31. The company confirmed that Michael Hubbard will transition from interim to permanent CEO. SOL Strategies previously operated as Cypherpunk Holdings before rebranding in September 2024.

The company acquired SOL during the second quarter of 2024. It later rebranded to reflect its focus on Solana validators and staking services. SOL Strategies stock has declined 75.81% over the past six months despite the recent 21% rise.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech12 hours ago

Tech12 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial