Crypto World

How AI Predictive Analytics is Redefining Risk Management in Tokenized Asset Portfolios?

Tokenized asset portfolios are rapidly becoming a core component of modern digital finance. By converting real-world and financial assets into blockchain-based tokens, enterprises unlock greater liquidity, fractional ownership, and global market access. While these advantages are significant, they also introduce a level of complexity that traditional risk management frameworks were never designed to handle. This growing complexity has accelerated the adoption of AI-powered financial analytics to improve visibility and decision-making across digital investment ecosystems.

Unlike conventional portfolios that operate within defined market hours and centralized systems, tokenized assets function in a continuous, decentralized environment. Risk factors evolve in real time, driven by on-chain activity, secondary market behavior, protocol dependencies, and regulatory developments. In such an ecosystem, identifying risk after it has already materialized is both inefficient and costly, making advanced AI in risk management a critical requirement rather than an optional enhancement.

This reality is pushing enterprises and institutional investors toward predictive risk management. AI predictive analytics enables organizations to anticipate potential risk scenarios before they escalate, allowing for timely intervention and informed decision-making. Rather than reacting to volatility, liquidity shocks, or compliance issues, enterprises can proactively manage exposure across tokenized asset portfolios using data-driven forecasting models.

Key drivers behind the need for predictive risk management include:

- Continuous market operations: Tokenized assets trade 24/7, increasing exposure to sudden market shifts and reinforcing the need for real-time Tokenized assets risk analysis.

- Data-rich environments: Massive volumes of on-chain and off-chain data require intelligent interpretation through AI-powered financial analytics to extract meaningful risk insights.

- Dynamic portfolio exposure: Asset correlations and liquidity profiles change rapidly in tokenized ecosystems, increasing demand for AI-enhanced portfolio risk optimization.

The New Risk Landscape of Tokenized Asset Portfolios

Tokenization is changing investments and transforming how investors view risks in their portfolios. While traditional asset portfolios have mostly well-defined risks (e.g., market volatility, credit risk, macroeconomic conditions), tokenized portfolios span multiple markets and three distinct areas – financial markets, blockchain infrastructure, and digital asset performance. This convergence has elevated the role of Artificial intelligence in investment risk analysis, as manual risk models struggle to process these interconnected variables.

This convergence introduces a new and unique set of uncertainties that necessitate holistic risk assessments; therefore, risk is no longer just about asset performance, but how the technology layers, market infrastructure, and regulatory interpretations affect portfolio risk.

1. Market Risk

Risk in the tokenized marketplace is exacerbated by numerous buys and sells, speculative trading, and a speculative trading environment. Because of the short-term nature of many Tokenized Assets (TAs), their prices could be significantly misaligned with their underlying asset’s industrial value due to issues such as lack of liquidity, speculative trading behavior, and larger movements in the broader cryptocurrency market. If not monitored regularly, the volatility associated with TAs may produce large impacts to portfolio value, highlighting the importance of AI predictive analytics for forward-looking risk assessment.

2. Liquidity Risk

Liquidity for TAs is typically highly fragmented (e.g., decentralized exchanges, centralized exchanges, OTC brokerage accounts) and may appear adequate prior to periods of stress; however, when stress occurs, liquidity may be very limited. As such, it becomes essential to apply AI-enhanced portfolio risk optimization techniques to anticipate liquidity constraints when planning and executing exit strategies and allocating capital.

3. Risk with Smart Contracts

Smart contracts determine how to create, distribute and move tokenized assets from one person to another. Systemic risk can arise from improper contract logic, security holes in the contract or poor upgrade management. The risk is of a technical nature; however, financial ramifications will be direct, making automated Tokenized assets risk analysis increasingly necessary.

4. Risk due to Regulation

Tokenized assets are often used across multiple jurisdictions and have changing compliance laws and regulations. Changes to the laws surrounding compliance, reporting and asset classification will change the structure of portfolios and compiler will have participation. Predictive compliance monitoring using AI in risk management helps enterprises stay ahead of regulatory shifts.

5. Operational Risk

Reliance on oracles, custodians, blockchains and other third-party services is a potential point of failure in operations. Failure at one of these points will impact either the availability of the asset, the accuracy of its price or the completion of a transaction, reinforcing the need for AI-powered financial analytics across operational layers.

Build AI-Powered Risk Intelligence Into Your Tokenization Stack

Why Traditional Risk Models Fall Short in Tokenized Markets

Traditional risk management frameworks were developed for centralized financial systems with predictable reporting cycles and limited data sources. While effective for legacy portfolios, these models struggle to address the dynamic nature of tokenized assets, particularly when compared to modern Artificial intelligence in investment risk frameworks.

Conventional models rely heavily on historical data and assume relatively stable market behavior. Tokenized markets, however, evolve in real time and generate risk signals that require immediate analysis supported by AI predictive analytics.

Key limitations of traditional risk models include:

- Backward-looking analysis: Historical performance fails to capture emerging on-chain trends identified through Tokenized assets risk analysis.

- Static assumptions: Fixed correlations and volatility assumptions do not reflect real-time dynamics captured through AI-enhanced portfolio risk optimization.

- Delayed response cycles: Manual reviews and periodic reporting slow down decision-making in environments requiring real-time AI in risk management.

- Limited data integration: Inability to process blockchain data, smart contract activity, and decentralized liquidity metrics without AI-powered financial analytics.

As a result, risk is often identified only after losses occur, making mitigation reactive rather than preventive.

How AI Predictive Analytics Changes Risk Assessment

AI analytics is transforming the way risk is assessed and managed in a tokenized portfolio. AI predictive analytics employs machine learning, statistical modeling and real-time data to provide continuous risk assessments as conditions change, redefining AI in risk management practices.

AI models provide more than just static thresholds or historical averages for making risk assessments; they continuously evolve to reflect historical data while also incorporating live market and blockchain data. This allows for risk assessments based on future probabilities and scenarios, strengthening Artificial intelligence in investment risk strategies.

Here is how AI is changing risk assessments:

- Continuous intelligence: Real-time updates to risk metrics as new information comes in through AI-powered financial analytics.

- Pattern recognition: Machine learning recognizes correlations and patterns in data sets that a human may not be able to recognize, enabling deeper Tokenized assets risk analysis.

- Predictions based on probability: Risk is assessed based on probabilities of occurrence and impact, not historical averages, supporting AI-enhanced portfolio risk optimization.

The result is a shift for enterprises to move from traditional methods of risk reporting to anticipating future risks, thereby improving their overall resilience in managing their tokenized asset portfolios.

Key Predictive Risk Capabilities Powered by AI

AI-powered risk management platforms provide specialized capabilities that are particularly suited to tokenized asset ecosystems and enterprise-grade AI in risk management.

1. Forecasting Volatility

To determine future volatility, AI analyzes an assortment of factors including historical prices, volume of trades, depth of the order book and sentiment indicators. These insights support AI predictive analytics by allowing portfolio managers to anticipate price swings and manage exposure proactively.

2. Liquidity Stress Testing

Using simulated market stress events, predictive analytics evaluates liquidity behavior across venues. This form of Tokenized assets risk analysis is critical for large institutional exits and capital preservation.

3. Scenario Simulation & Stress Analysis

AI allows for advanced scenario modeling under regulatory changes, downturns, or macroeconomic shocks, strengthening AI-enhanced portfolio risk optimization strategies.

4. Anomaly Detection and Risk Signals

By continuously scanning transaction flows, smart contract data, and market behavior, AI systems enhance Artificial intelligence in investment risk monitoring by detecting early warning signals.

Where AI-Driven Risk Intelligence Delivers the Most Value

AI predictive analytics delivers the greatest value in tokenized portfolios that involve complex assets, long investment horizons, or regulatory oversight. Proactive AI-powered financial analytics helps preserve capital and maintain investor confidence.

High-impact application areas include:

- Tokenized real estate and infrastructure: Predictive valuation and liquidity modeling using AI in risk management

- Private credit and debt instruments: Default risk forecasting through Tokenized assets risk analysis

- Commodity-backed assets: Volatility and supply-demand forecasting enabled by AI predictive analytics

- Institutional multi-asset portfolios: Cross-asset correlation and AI-enhanced portfolio risk optimization

From Reactive Controls to Predictive Risk Management: How Antier Enables the Shift

As organizations build Tokenized asset portfolios that are larger and more complex than ever before, they require more sophisticated risk controls. Antier addresses this need by delivering enterprise-ready frameworks built on AI-powered financial analytics, AI predictive analytics, and advanced blockchain intelligence.

Antier’s AI-driven blockchain solutions enable organizations to move beyond reactive controls and embrace predictive, data-driven AI in risk management. By combining real-time on-chain data with off-chain market intelligence, Antier strengthens Artificial intelligence in investment risk capabilities across tokenized ecosystems.

By embedding predictive intelligence into tokenized asset operations, Antier enables enterprises to implement scalable AI-enhanced portfolio risk optimization, preparing portfolios for market volatility, regulatory change, and operational complexity.

Crypto World

Ethereum derivatives open interest drops 5.62% in 24-hour leverage flush

Ethereum derivatives markets saw a sharp bout of deleveraging over the past day, with total ETH contract open interest across major centralized exchanges falling 5.62% to 27.119 billion dollars, according to Coinglass data.

Summary

According to data from Coinglass, the total open interest of Ethereum (ETH) contracts across the network has contracted by 5.62% in the past 24 hours, bringing the figure down to 27.119 billion dollars.

The decline signals a decisive round of risk reduction in the derivatives market, with traders closing or being forced out of leveraged positions as conditions turn more defensive. While granular liquidation figures were not provided, the magnitude of the move suggests a mix of voluntary deleveraging and margin-driven position exits rather than a purely organic rotation.

Binance remains the largest concentration point for ETH derivatives risk, now holding 5.74 billion dollars in open interest, while Gate registers 2.866 billion dollars, Bybit 2.059 billion dollars, and OKX 1.772 billion dollars. This clustering of leverage on a handful of venues means that order book dislocations or sudden funding shifts on these exchanges can quickly bleed into spot pricing. For basis and spread traders, the reset in open interest may open up cleaner arbitrage conditions after a period of elevated speculative positioning.

Historically, single‑day pullbacks of this scale in open interest have often acted as either mid‑trend “cleanup” events or the first leg of a broader de‑risking cycle, depending on subsequent spot demand and funding dynamics. If funding normalizes and fresh spot buying emerges, the current move could be framed as a healthy clearing of excess leverage built up during prior rallies. However, if open interest continues to grind lower while spot remains under pressure, it would indicate that systematic and speculative capital are still in distribution mode.

At press time, Ethereum is trading around 2,067 dollars, down approximately 3.65% over the past 24 hours, broadly echoing the scale of the derivatives drawdown. In the near term, traders are watching the 2,000‑dollar psychological level as key support; holding that zone while open interest stabilizes would support a consolidation narrative, whereas a decisive break lower alongside further OI contraction could signal an extension of the current downside phase.

Crypto World

Web3 Foundation Refocuses on Global Advocacy as Polkadot Ecosystem Reaches Maturity

TLDR:

- Web3 Foundation has closed its General Grants Program, Decentralized Voices, and several other key initiatives.

- W3F is now focused on two pillars: global Web3 evangelism and responsible long-term asset management.

- Polkadot’s next development phase is being led by Parity Technologies and its broader builder community.

- On-chain treasury and governance tools remain active, ensuring decentralized funding continues without W3F oversight.

Web3 Foundation has announced a major strategic realignment, stepping back from its hands-on operational role.

The organization is returning to its founding purpose: championing decentralized web technologies on a global scale.

For years, W3F actively helped bootstrap networks like Polkadot and Kusama into functioning, community-driven ecosystems.

As those networks have now reached a level of maturity, the Foundation is refocusing its priorities. It will concentrate on global advocacy and disciplined long-term asset management.

Concluded Programs Mark a Shift in the Foundation’s Operational Direction

Web3 Foundation has already closed several key programs as part of this transition. These include the General Grants Program, Support, Decentralized Voices, and Decentralized Nodes.

Each of these programs played a distinct role during the ecosystem’s early growth stages. Their conclusion marks a clear shift in how W3F operates.

Over the past year, W3F undertook a thorough review of its programs and spending. Several resource-heavy bounties were closed, and spending was carefully audited throughout this period.

Clearer documentation and operational guidelines were established based on lessons learned along the way.

Moreover, several additional initiatives are being evaluated for transition to external teams. These include the JAM Prize, Polkadot Governance Support, the Polkadot Wiki, and developer documentation.

The Knowledge Base and Kusama Vision are also among the programs being considered for handover.

Despite these changes, decentralized funding mechanisms remain fully active within the ecosystem. Communities still have direct access to on-chain governance and treasury tools for funding initiatives. These pathways continue to support innovation without requiring centralized oversight from the Foundation.

Two Core Priorities Will Define the Foundation’s Long-Term Strategy

Web3 Foundation is now centering its work around two clear pillars going forward. The first involves evangelizing and advancing the decentralized web on a global scale. The second focuses on safeguarding the Foundation’s assets in alignment with its broader Web3 mission.

At the same time, Polkadot is entering a phase focused on building products with real-world utility. Parity Technologies and a wider community of builders are now driving this development stage. The Foundation’s reduced operational role is designed to complement, rather than direct, this effort.

This transition also reflects how blockchain ecosystems naturally evolve over time. As networks become self-sustaining, support structures around them must adapt accordingly.

W3F is repositioning itself as a long-term steward rather than a day-to-day operational body. This approach allows the Foundation to focus on higher-level advocacy work.

Furthermore, this realignment places greater emphasis on disciplined asset allocation going forward. Resources will be directed toward efforts with the greatest global impact.

Through advocacy and financial stewardship, the Foundation aims to strengthen the Web3 ecosystem for years to come.

Crypto World

WhiteBIT Coin ($WBT) Officially Listed on Kraken Exchange, Highlighting Its Growing Recognition

[PRESS RELEASE – Vilnius, Lithuania, March 5th, 2026]

WhiteBIT, the largest European cryptocurrency exchange by traffic, announces that its native WhiteBIT Coin (WBT) is now trading on Kraken, one of the world’s long-standing crypto platforms. WBT trading is available on WBT/EUR and WBT/USD pairs, giving more traders worldwide access to the coin and reflecting the asset’s growing recognition in the market.

The listing marks a significant milestone for WhiteBIT, following rapid growth in 2025, during which WBT surged 160%, reaching an all-time-high of $64.11 and solidifying its position as the 11th-largest cryptocurrency by market capitalization at $10.7 billion, according to CoinGecko.

“Listing WBT on Kraken represents a logical next step in the expansion of the WhiteBIT ecosystem,” said Volodymyr Nosov, Founder and President of W Group, which WhiteBIT is a part of. “It reflects the momentum we’ve built through ecosystem growth, strategic partnerships, and increasing institutional visibility. It’s another important endorsement of WBT’s value and its role in the future of digital finance.”

This momentum has been powered by the expansion of the W Group ecosystem, which WhiteBIT is a part of, including:

- High-profile partnerships, such as the collaboration with Juventus, making WhiteBIT the club’s Official Sleeve and Cryptocurrency Exchange Partner.

- Global market expansion, with new operations in South America and the United States.

- Strategic cooperation in the Middle East, including partnership with Saudi Arabia to develop blockchain infrastructure and CBDC framework.

- Institutional recognition, including WBT’s inclusion in the S&P Crypto Indices, reflecting the token’s growing liquidity and market relevance.

Launched in 2022, WhiteBIT Coin (WBT) is the native utility token of the WhiteBIT platform. It offers significant advantages within the WhiteBIT exchange ecosystem, including reduced trading fees (up to 100% discount), increased referral bonuses (up to 50%), and free daily withdrawals. Users also gain from free AML checks, staking rewards up to 22.1%, and exclusive access to new projects via the WhiteBIT Launchpad.

The addition of WBT to Kraken not only expands access for traders worldwide but also reinforces WhiteBIT’s commitment to developing a globally recognized exchange-native coin that delivers utility, liquidity, and long-term value.

About WhiteBIT

WhiteBIT is the largest European cryptocurrency exchange by traffic, offering over 900 trading pairs, 350+ assets, and supporting 8 fiat currencies. Founded in 2018, the platform is a part of W Group which serves more than 35 million customers globally. WhiteBIT collaborates with Visa, FACEIT, FC Juventus and the Ukrainian national football team. The company is dedicated to driving the widespread adoption of blockchain technology worldwide.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

SEC, Justin Sun Settle Lawsuit for $10M

The Securities and Exchange Commission has ended its long-running fraud and securities violation lawsuit against Justin Sun in a $10 million settlement.

The US Securities and Exchange Commission has ended its lawsuit against crypto entrepreneur Justin Sun with a $10 million settlement, ending a two-year legal battle over alleged fraud and securities laws violations.

The SEC said in a letter to a Manhattan federal court on Thursday that Rainberry, one of Sun’s companies, would pay a $10 million fine, and claims against Sun and his companies, the Tron Foundation and BitTorrent Foundation would be dropped.

Related: Rep Waters demands SEC oversight hearing about its approach to crypto

The lawsuit, first filed in March 2023, accused Sun and his companies of selling unregistered securities via the Tronix (TRX) and BitTorrent (BTT) tokens and allegedly wash trading TRX.

Magazine: SEC’s U-turn on crypto leaves key questions unanswered

This is a developing story, and further information will be added as it becomes available.

Crypto World

SEC Closes Justin Sun Case with $10M Settlement

The U.S. Securities and Exchange Commission has closed a high-profile civil action against crypto entrepreneur Justin Sun, announcing a resolution that ends a two-year dispute over allegations of fraud and securities violations. In a letter filed with a Manhattan federal court, Rainberry, one of Sun’s companies, will pay a $10 million penalty, and the SEC said that the claims against Sun along with the Tron Foundation and BitTorrent Foundation would be dropped. The suit, filed in March 2023, alleged that Sun and his affiliated entities offered securities or investment-like instruments tied to the Tron and BitTorrent ecosystems and engaged in trading activity accused of wash trading. The settlement wraps up the government’s action, while Sun’s other ventures continue to operate in a regulated, growing environment.

Key takeaways

- The SEC has settled with Rainberry for $10 million, ending litigation against Justin Sun and dropping charges against the Tron Foundation and BitTorrent Foundation.

- The case, filed in March 2023, centered on allegations of unregistered securities and wash trading involving the Tronix and BitTorrent tokens.

- The resolution signals continued regulatory risk and scrutiny for token-based projects, even as some cases are resolved without a broader ruling on asset classification.

- The settlement follows a wave of enforcement activity in the crypto sector and occurs amid ongoing questions about how token offerings fit securities laws.

- Regulators’ attention to token ecosystems remains high, with lawmakers and watchdogs calling for oversight and clearer rules around crypto projects.

Tickers mentioned: $TRX, $BTT

Sentiment: Neutral

Price impact: Neutral. The settlement does not indicate an immediate price reaction for related assets as no public market move is documented in the filing.

Market context: The settlement arrives as crypto enforcement remains active and markets weigh regulatory signals on token sales, security classifications, and disclosure requirements amid rising institutional interest and ETF considerations.

Why it matters

The resolution matters for the broader crypto ecosystem because it provides a concrete example of how regulators view token-related activities tied to established blockchain ecosystems. While the Rainberry settlement carries a monetary penalty and results in the dismissal of claims against Justin Sun and the Tron Foundation and BitTorrent Foundation, the SEC maintained that certain token arrangements can fall under securities laws when investment-like features or registration requirements are involved. The decision underscores the continuing debate over the boundary between securities and non-securities in token projects, a topic that has shaped enforcement priorities and policy discussions for years. For builders and investors, the message is clear: thorough disclosures and careful consideration of registration and compliance can influence both risk and opportunity in token-enabled ecosystems. The case also highlights that settlements can end protracted litigation while still leaving room for regulatory interpretation to evolve in future actions.

Beyond the immediate parties, the development feeds into a broader regulatory narrative surrounding token issuance, trading practices, and how authorities scrutinize market manipulation allegations such as wash trading. The outcome does not end regulatory interest in these topics; rather, it demonstrates that settlements can resolve specific cases while regulators continue to refine their approach to crypto-assets and the securities-versus-non-securities question that underpins much of the policy debate in Washington and abroad.

Market participants should monitor how similar cases evolve and whether additional settlements or guidance will emerge that clarify registration requirements for token offerings tied to major ecosystems. The case also serves as a reference point for exchanges, issuers, and developers seeking to understand how enforcement actions align with current legislative discussions about crypto oversight and investor protection.

What to watch next

- A formal court entry detailing the settlement terms and confirming Rainberry’s payment timeline.

- An official SEC statement clarifying the scope of the dropped claims and the regulatory reasoning behind the resolution.

- Reactions from Sun and the Tron/BitTorrent communities, including any statements from the related foundations.

- Regulatory guidance or policy proposals addressing token offerings and securities classification in the near term.

- Subsequent filings or communications in the case that illuminate how the agency interprets token-based securities going forward.

Sources & verification

Settlement ends SEC v. Sun case and sets tone for crypto enforcement

The filing language and subsequent statements indicate a precise and bounded resolution. Rainberry’s $10 million payment closes a chapter that began when the SEC charged Justin Sun and his affiliated entities with moving securities-like instruments without appropriate registration and with market practices that allegedly included wash trading around the Tron ecosystem. The commission’s reference to Tronix (TRX) (CRYPTO: TRX) and BitTorrent (BTT) (CRYPTO: BTT) tokens underscores how regulators continue to scrutinize token offerings that may carry investment contracts or other securities characteristics. The inclusion of these tokens in the allegations highlighted ongoing tensions between innovation in decentralized ecosystems and the securities framework that governs traditional asset offerings, a tension that remains at the core of many enforcement discussions.

The settlement makes Rainberry the sole financial obligation in this case, while the claims against Justin Sun and the affiliated foundations are dismissed. This outcome signals that enforceable penalties can be levied even as broader questions about token-based securities persist. The timing aligns with a period of heightened regulatory attention on crypto assets and ongoing policy debates about how to classify and regulate tokens used to coordinate decentralized networks and fundraising activities. The case, therefore, stands as a practical example of how settlements can resolve specific enforcement actions while leaving open questions about the definitive boundaries of securities laws in the rapidly evolving token economy.

For observers tracking regulatory signals, the decision adds a data point in the broader context of enforcement strategy that seeks to balance investor protection with the continued growth of blockchain-based ecosystems. It also reinforces the notion that settlement terms can provide a clear path forward for involved projects while regulators continue to pursue further clarity on how token issuances should be structured and disclosed. As the market digests this outcome, market participants will look for guidance on disclosures, registration considerations where applicable, and how future actions might delineate the permissible scope of token-related activities within established ecosystems.

Crypto World

Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Ethereum and Dogecoin by the End of 2026

When you plug in a special prompt into AI chatbots, KIMI AI reveals some frankly unbelievable 2026 price projections for top cryptocurrencies.

Markets seem unfazed by the US/Iran war news, a sign that much of the geopolitical risk was absorbed earlier in the year, following aggressive sell-offs triggered by comments from former President Trump regarding possible U.S. military actions linked to Greenland and Iran.

While it’s still early days, crypto’s recovery may actually be on a firm footing.

Here’s why KIMI AI believes XRP, Ethereum and Dogecoin will gain the most.

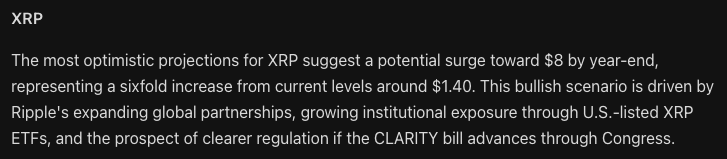

XRP ($XRP): KIMI AI Forecasts a 6x Move Within 10 Months

In a recent update, Ripple reaffirmed XRP ($XRP) remains central to its vision of establishing the XRP Ledger (XRPL) as a global, enterprise-grade payments infrastructure.

Thanks to near-instant transaction finality and minimal fees, XRPL could secure an early foothold in two of crypto’s fastest-growing verticals: stablecoins and tokenized real-world assets.

XRP is currently trading near $1.41, and KIMI predicts a potential rally toward $8 by New Year, representing a sixfold gain from current levels.

XRP’s relative strength index (RSI) is holding close to a neutral 50, while price action has converged with the 30-day moving average, indicating the downturn may be exhausted.

Hitting $8 depends on rising institutional participation following the rollout of U.S.-listed XRP ETFs, Ripple’s expanding international partnerships, and the passage of the CLARITY Act through Congress later this year.

Ethereum (ETH): KIMI AI Sees ETH at $7.500

Ethereum ($ETH) remains the foundation of decentralized finance thanks to an early lead in sophisticated smart contracts.

With a market capitalization of $251 billion and roughly $53 billion locked on chain, Ethereum is the primary settlement layer for blockchain economic activity.

Its strong security record, leadership in stablecoin issuance, and early traction in real-world asset tokenization position Ethereum for increased institutional adoption post-CLARITY.

Regulatory clarity remains a key variable. Institutions require it to deploy larger allocations on Ethereum.

ETH is currently trading below $2,000, with significant resistance expected near $5,000, close to its all-time high of $4,946.05 last August.

KIMI’s scenario suggests that a confirmed breakout above $5,000 could open the door to $7,500 ETH before Christmas.

Dogecoin (DOGE): DOGE to $1? KIMI AI Thinks the Real Target is 3x That!

Originally launched as a joke in 2013, Dogecoin ($DOGE) is now a mature digital asset with a market capitalization around $14 billion, accounting for nearly half of the $32 billion meme coin sector.

DOGE last set an all-time high of $0.7316 during the retail-driven bull market of 2021.

The $1 milestone has long been a psychological target for the Dogecoin community, and KIMI’s outlook suggests that a strong bull cycle could push DOGE close to, or beyond, that level.

From its current price just under $0.10, a move toward $2.80 or higher would represent a 28x return, or 2,700%.

Adoption and utility continue to grow.

Tesla accepts DOGE for select merchandise, while major fintech platforms including PayPal and Revolut now support Dogecoin transactions, reinforcing its real-world utility.

SUBBD (SUBBD): If Altseason is Here, then SUBBD is KING

If the above cryptos follow KIMI’s projected course, then one new token that presale watchers expect will surge alongside them is SUBBD ($SUBBD), an AI-integrated content platform likely to disrupt the $85 billion creator economy.

SUBBD empowers creators with better revenue tools while offering fans more meaningful engagement.

Unlike traditional subscription platforms, which often charge creators up to 20% in fees while limiting community control, SUBBD eliminates intermediaries.

This decentralized approach has already sparked interest, raising $1.5 million during its ongoing presale.

Fans also benefit from an exclusive access ecosystem, including token-gated content, early releases, and member-only discounts, all fostering deeper connections between creators and their supporters.

To stay updated, you can follow SUBBD across X, Telegram, and Instagram, or join the ongoing presale directly through their website.

Visit the Official SUBBD Website Here

The post Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Ethereum and Dogecoin by the End of 2026 appeared first on Cryptonews.

Crypto World

Ripple’s RLUSD Stablecoin Expands DeFi Reach With New Morpho Vault

TLDR:

- RLUSD’s market cap has more than doubled in six months, per Sentora’s announcement this week.

- The Sentora vault on Morpho accepts five collateral types: cbBTC, weETH, wstETH, sUSDe, SyrupUSDC.

- Morpho runs as a permissionless lending network, letting curators set their own risk parameters.

- The RLUSD vault is live on Ethereum, with Sentora acting as the designated vault curator.

Ripple’s RLUSD stablecoin now has a dedicated lending vault on Morpho. Sentora, a DeFi vault curator, launched the product this week.

The vault allows users to supply RLUSD and earn yield through curated lending markets. It marks another step in pushing RLUSD deeper into on-chain financial infrastructure.

Sentora Builds Curated Lending Market Around RLUSD on Morpho

RLUSD has grown steadily since its launch. Its market cap has more than doubled over the past six months, according to Sentora. Much of that growth ties directly to expanding its presence across DeFi protocols and multichain deployments.

The new Morpho vault adds a structured lending venue to that effort. Users deposit RLUSD into the vault. Borrowers can then access that liquidity by posting approved collateral through Morpho’s lending markets.

Sentora controls the risk parameters of the vault. That includes selecting which collateral assets qualify and setting the associated lending terms.

The vault currently accepts five collateral types: cbBTC, weETH, wstETH, sUSDe, and SyrupUSDC. This spread gives borrowers flexibility while maintaining a diversified collateral base for the vault.

Morpho’s Permissionless Design Draws Institutional-Grade Activity

Morpho operates as a permissionless, non-custodial lending network. Developers and institutions can build customized lending markets directly on top of its protocol. Rather than relying on shared liquidity pools, the protocol supports curated vaults with configurable risk settings.

That design has driven fast growth. Morpho has become one of the more active lending infrastructures in DeFi, according to Sentora’s announcement.

For RLUSD, the structure offers a clean fit. Sentora manages risk. Morpho handles the underlying infrastructure. Suppliers access yield. Borrowers access stablecoin liquidity.

The vault is now live on Ethereum. Sentora published the contract address and a direct link to the Morpho app interface in its announcement posted on X.

Morpho also flagged the launch on its own X account, describing it as new utility for RLUSD and calling attention to Sentora’s role as curator.

The move signals continued momentum for RLUSD beyond its original issuance role. Stablecoins increasingly function as active settlement assets within DeFi, not just passive stores of value. The Sentora vault adds a concrete use case to that trend.

Crypto World

Kraken xStocks launches xChange for on-chain stock trading

Kraken-backed xStocks has launched a new on-chain trading engine designed to connect traditional equity liquidity with decentralized finance infrastructure.

Summary

- xStocks introduced xChange, an on-chain trading engine for tokenized stocks.

- Users can trade 70+ tokenized equities across Ethereum and Solana.

- The platform has already recorded $3.5B on-chain volume, $25B total trading volume, and 80,000 holders.

In a March 5 announcement, Kraken said its tokenized equity platform xStocks has introduced xChange, an execution layer that allows users to trade tokenized stocks directly on-chain across Ethereum (ETH) and Solana (SOL).

xChange allows trading of more than 70 tokenized equities on-chain while keeping prices aligned with real-world public market data.

On-chain trading engine connects liquidity across Ethereum and Solana

Each tokenized stock on xChange is fully collateralized and backed 1:1 by underlying shares held in custody, ensuring transactions represent actual equity exposure rather than synthetic derivatives.

The system introduces atomic settlement, meaning every trade either executes completely at the quoted price or does not execute at all. Partial fills are avoided, giving traders predictable execution similar to traditional market infrastructure.

The trading engine also connects on-chain markets with traditional equity liquidity. Real-time pricing mechanisms link tokenized equities to public market depth, which can tighten spreads and improve execution quality while keeping settlement on the blockchain.

Tokenized equities adoption grows across DeFi platforms

xChange builds on the growth of tokenized equities since the launch of xStocks in June 2025. According to the company, the platform has recorded over $3.5 billion in on-chain transaction volume, alongside $25 billion in total trading volume across exchanges.

Tokenized assets on-chain now exceed $225 million, with more than 80,000 unique on-chain holders interacting with the ecosystem.

The new execution layer operates 24 hours a day, five days a week, allowing tokenized stock trading beyond traditional exchange hours. This extended availability gives DeFi applications and global users access to equities even when traditional stock markets are closed.

Val Gui, general manager of xStocks, said the system brings traditional market liquidity onto blockchain infrastructure while turning tokenized equities into programmable digital assets that can be integrated into DeFi applications.

The approach combines public market pricing with blockchain settlement, allowing tokenized stocks to move across decentralized applications while maintaining exposure to underlying equities.

Crypto World

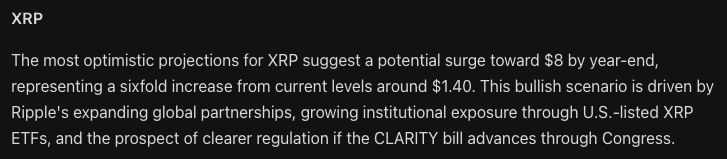

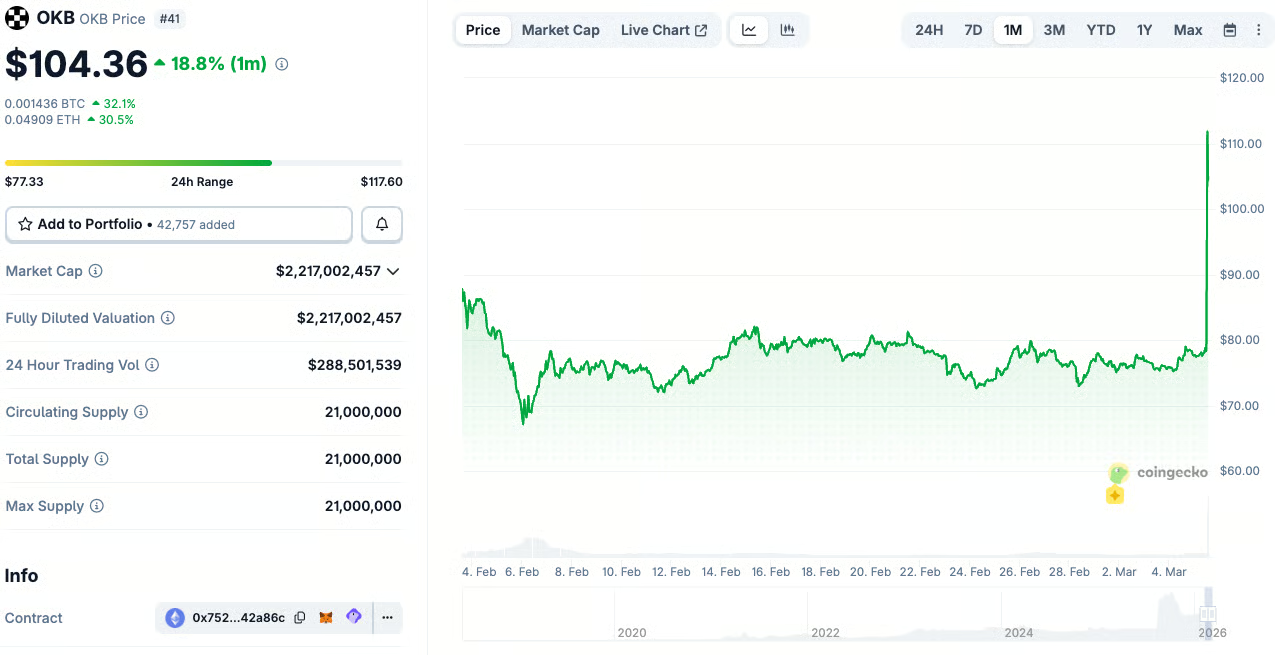

NYSE Parent Company Invests in OKX at $25 Billion Valuation

OKX is now valued at $25 billion following an investment from NYSE’s parent company.

One of the world’s most popular cryptocurrency exchanges, OKX, was valued at a whopping $25 billion following its latest round of investments.

According to reports, the Intercontinental Exchange, which is the parent company of the New York Stock Exchange, acquired a minority stake in the crypto trading firm.

It also places OKX well above recent market entrants such as Bullish and Gemini, currently sitting at $5.39 billion and $1 billion, respectively.

As soon as the news broke out, the price of OKB (the native cryptocurrency of the OKX ecosystem) went vertical. It skyrocketed by a whopping 37% in a matter of minutes.

The move is the last in a series of deepening institutional involvements in the cryptocurrency industry. As CryptoPotato reported earlier, Morgan Stanley also filed for its own Bitcoin Trust ETF, while Kraken – a US-based crypto exchange, became the first to receive a Fed Master Account.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

US SEC Proposes Guidelines on How Securities Laws Can be Applied to Crypto

Like the SEC, the derivatives trading regulator, the CFTC, is also working to regulate prediction markets.

The United States Securities and Exchange Commission (SEC) has inched closer to creating guardrails to ascertain how cryptocurrencies are regulated.

In a recent commission-level guidance submitted to the White House’s Office of Information and Regulatory Affairs (OIRA), the SEC outlined how securities laws can be applied to crypto. If followed, the new guidelines could affect how crypto-focused companies register and operate their businesses in the country.

New Guidelines for Crypto Market

According to the OIRA’s website, the guidance was labeled as the “Application of the Federal Securities Laws to Certain Types of Crypto Assets and Certain Transactions Involving Crypto Assets.”

The website shared sparse details about the SEC’s proposal. Still, an SEC spokesperson informed Bloomberg that the financial agency “will consider interpretive guidance around a token taxonomy for crypto assets.” This means that factors such as a crypto’s inherent properties, behavior, and use cases would be considered to determine whether securities laws apply or not.

With these guidelines in place, crypto firms would know how to proceed with registration, operations, and investor engagement. It is worth noting that commission-level guidance has more power than staff-level guidance. Still, it falls short of the requirements to become a rule, which include processes such as public notice and comment.

The latest move aligns with Paul Atkins’ goal of bringing crypto-friendliness to the country since he became the SEC chairman. A few weeks ago, he hinted at the agency’s commitment to establishing structural crypto regulations despite falling cryptocurrency prices.

CFTC Calls for Regulation of Prediction Markets

The SEC is not the only Wall Street regulator advocating for a crypto-friendly regulatory framework. On March 2nd, the Commodity Futures Trading Commission (CFTC) submitted a measure to the White House’s OIRA on prediction markets.

You may also like:

Michael Selig, the CFTC chairman, shed some light on the prediction markets’ measure, saying:

“We’re going to be setting very clear standards as to what can be self-certified in our markets and what cannot and how to evaluate the different products that are offered in the space.”

The CFTC’s latest move comes amid heightened attention investors give to prediction markets, popularized by leading platforms Polymarket and Kalshi.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech17 hours ago

Tech17 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports6 hours ago

Sports6 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed