Crypto World

How Crypto and US Stocks Reacted to Trump Tariffs Ban

US financial markets and cryptocurrencies moved higher after the Supreme Court struck down former President Donald Trump’s sweeping global tariffs, removing a major source of economic uncertainty.

The court ruled that Trump exceeded his authority by using emergency powers to impose broad tariffs without approval from Congress. The decision limits the president’s ability to reshape trade policy unilaterally and restores Congress as the primary authority over tariffs.

Supreme Court Restores Congress’s Control Over Tariffs

The ruling immediately reshapes the balance of power in US economic policymaking.

The tariffs, imposed under emergency authority, had targeted imports from multiple countries and generated billions in revenue.

Businesses and trade groups challenged the measures, arguing they raised costs and disrupted supply chains. The Supreme Court’s decision now blocks similar tariffs unless Congress explicitly approves them.

Stocks and Crypto Rise as Trade Uncertainty Eases

Markets reacted quickly.

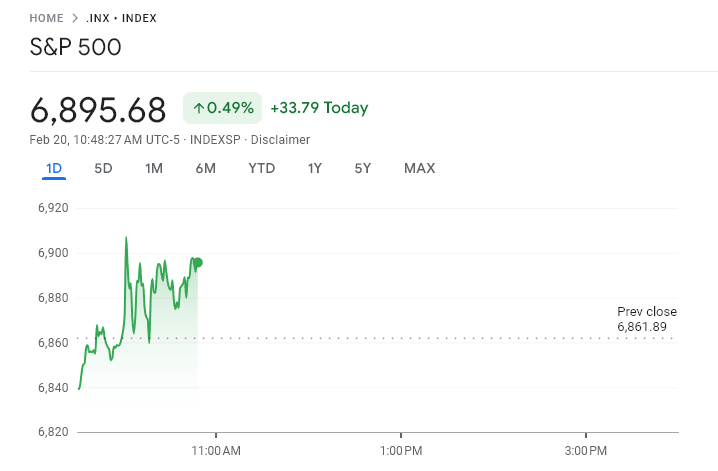

The S&P 500 rose about 0.40%, while the Nasdaq gained roughly 0.70%, signaling renewed investor confidence. Technology stocks led gains, reflecting improved expectations for economic growth and stability.

Meanwhile, the global crypto market cap climbed to about $2.38 trillion, with Bitcoin trading near $67,000 after recent volatility.

Gold briefly dipped following the decision before recovering, reflecting a shift in risk sentiment.

The market reaction reflects a key shift: reduced trade uncertainty. Tariffs often act like taxes on imports, raising prices and slowing economic activity.

Removing the threat of broad tariffs lowers inflation risks and improves liquidity expectations, both of which support risk assets.

This is particularly relevant for crypto.

Bitcoin and other digital assets are highly sensitive to global liquidity and investor confidence. When macroeconomic uncertainty declines, capital tends to flow back into riskier assets.

The recovery in crypto alongside stocks suggests investors are regaining confidence after weeks of geopolitical and economic stress.

However, the decision also highlights deeper political tensions. The ruling limits presidential authority and reinforces Congress’s constitutional control over tariffs. This could slow future trade actions but also reduce sudden policy shocks that destabilize markets.

For crypto markets, stability in global trade and economic policy is generally positive. While geopolitical risks remain, the Supreme Court’s decision removes one major macro threat.

In the near term, that shift appears to be supporting Bitcoin and the broader digital asset market.

Crypto World

Crypto Markets Tick Up Following Supreme Court Tariff Ruling

Bitcoin holds near $67,700 while investors assess Trump’s new 10% global tariff plan.

Crypto markets traded slightly higher on Friday, Feb. 20, as traders reacted to the U.S. Supreme Court ruling that struck down President Donald Trump’s emergency tariffs.

Bitcoin (BTC) is trading at $67,728, up 1.2% over the past 24 hours, while Ethereum (ETH) is at $1,970, up 1.5%. Other large-cap tokens were also mostly higher, with XRP up 1.5% to $1.43, BNB rising 3.2% to $625, and Solana (SOL) gaining 4% to $85.

Meanwhile, the total cryptocurrency market capitalization is hovering near $2.4 trillion, up 1.3% on the day. Daily trading volume stood at around $114.5 billion, according to CoinGecko.

Among top gainers, Morpho (MORPHO) climbed 11%, Ethereum Classic (ETC) rose 5.3%, and Official Trump (TRUMP) added about 5%. On the downside, Aave (AAVE) fell roughly 4.6%, Pi Network (PI) dropped about 3%, and Rain (RAIN) slipped around 2%.

Liquidations and ETF Flows

About $180 million in leveraged crypto positions were liquidated in the past 24 hours, according to CoinGlass. Long liquidations accounted for roughly $71.9 million, while shorts made up about $108 million.

Bitcoin led liquidations with $67.9 million, followed by Ethereum at around $38.3 million. More than 78,600 traders were liquidated during the period.

In the ETF space, Bitcoin spot ETFs recorded $165.76 million in outflows, while Ethereum spot ETFs experienced $130 million in outflows. In contrast, XRP spot ETFs recorded around $4 million in inflows, while Solana spot ETFs posted $5.94 million in inflows, per SoSoValue data.

Supreme Court Strikes Down Tariffs

The market uptick came amid intensifying macroeconomic uncertainty after President Donald Trump announced plans to impose a 10% global tariff. Trump’s announcement immediately followed a Supreme Court ruling that deemed his emergency tariffs illegal.

Notably, President Trump’s new tariffs could only take effect for up to 150 days unless Congress approves an extension, CNN reported.

Investors also reacted to increased geopolitical tensions after Trump said he is considering a limited military strike on Iran if nuclear negotiations do not progress soon.

In traditional markets, safe-haven assets have continued to hold steady. Gold traded at $5,092, up 1.46%, while silver climbed 6% to $84.

Meanwhile, Paul Howard, Senior Director, Wincent, said in comments shared with The Defiant that there has been a “mix of developments” over the past two days impacting price action independently of larger macro trends.

“These include speculation around the U.S. stablecoin bill, the launch of a SUI ETF on Nasdaq, and several DATs marking down their books,” Howard said. “Given the noticeable thinning of liquidity over the past month, volatility risk is currently elevated relative to levels observed over the past 12 months.”

Crypto World

Bitcoin Whales Rebuild Reserves With 236K BTC in 90-days

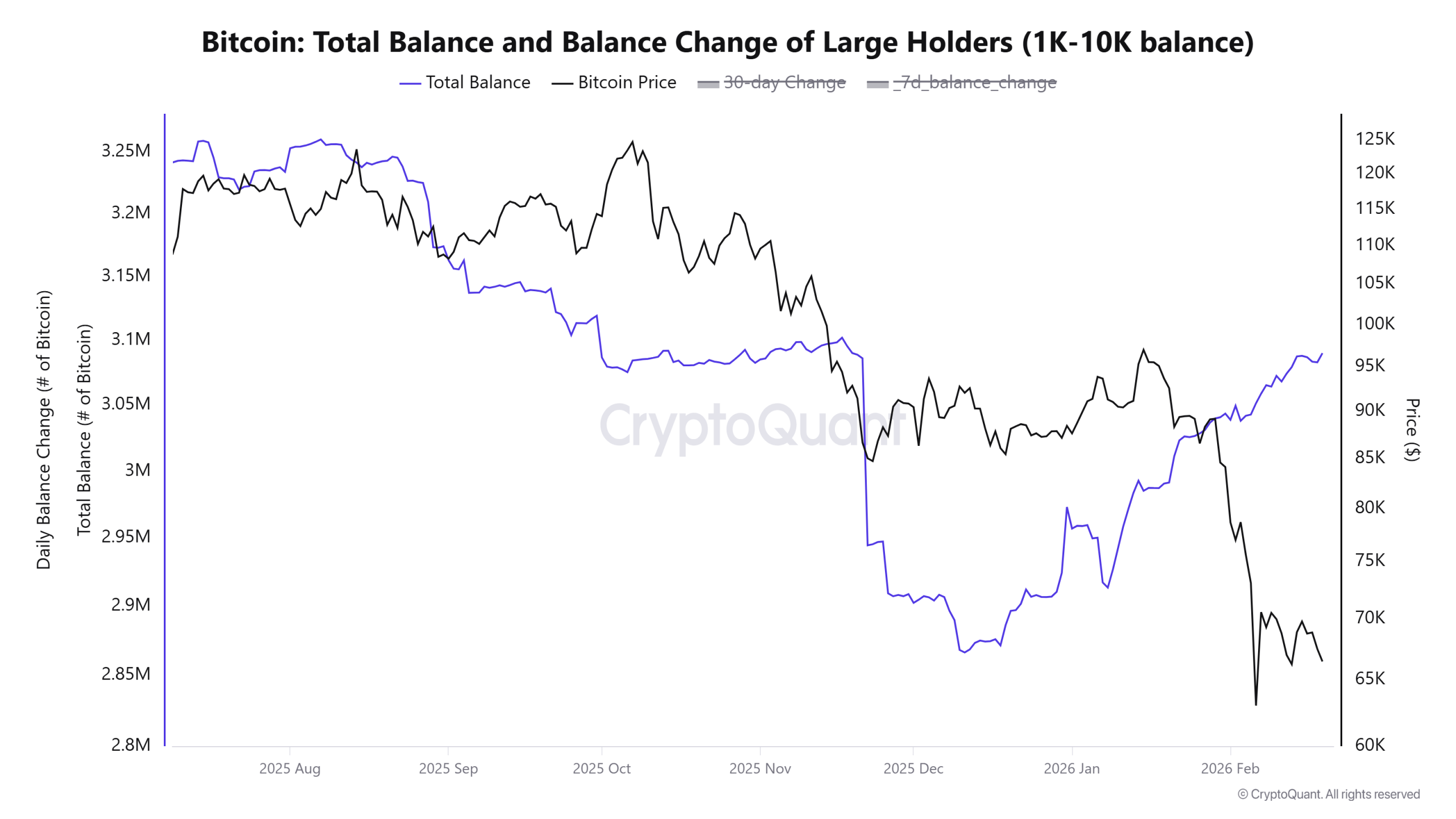

Large Bitcoin (BTC) holders have steadily increased their holdings in recent months, with the total balance climbing back to levels last seen before the October 10, 2025, market crash.

At the same time, crypto exchange data shows whale-related outflows averaging 3.5% of exchange-held BTC over a 30-day rolling period, the highest since late 2024.

BTC whale reserves return to pre-October peak

Bitcoin wallets or “whales”, holding between 1,000 and 10,000 BTC, have rebuilt reserves over the past three months. The cohorts increased their total balance to 3.09 million, from 2.86 million BTC on Dec. 10, 2025, a 230,000 BTC addition that restores their balance to pre-October 2025 levels.

Crypto analyst ‘Caueconomy’ said the full drawdown in whale reserves has been reversed over the past 30 days with the accumulation of 98,000 BTC. The broader distribution phase began in August 2025 (after BTC hit $124,000), after which Bitcoin struggled to sustain a rally significantly higher.

BTC spot market data supports the recovery. Throughout 2026, the average BTC order size has ranged between 950 BTC and 1,100 BTC, the most consistent stretch of large-ticket activity since September 2024.

Similar clusters appeared during the February–March 2025 correction. During that phase, retail orders accounted for the majority of activity, while large blocks appeared more intermittently and in smaller clusters.

Related: ‘Resilient’ Bitcoin holders defend BTC, but bear floor sits 20% lower: Glassnode

BTC exchange flows spike to 14-month highs

CryptoQuant analyst Maartunn reported $8.24 billion in whale BTC exchange flows moved into Binance over the past 30 days, marking a 14-month high. Retail flows reached $11.91 billion and have flattened over the same period. The retail-to-whale ratio now sits at 1.45, and it continues to drop as the larger-size deposits increase.

Parallel to these inflows, Glassnode data shows gross exchange whale withdrawals averaging 3.5% of total exchange-held BTC supply over a 30-day period, the strongest pace since November 2024.

Based on current exchange balances, that translates to roughly 60,000–100,000 BTC in withdrawals over the past month.

While gross inflows into exchanges have also increased, the elevated withdrawal ratio suggests that much of that incoming BTC is being offset by strong outbound transfers, leaving net exchange balances relatively stable.

Related: Quantum fears aren’t behind Bitcoin’s 46% drop, says developer

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

BTC volatility spikes as price slides from $85k to $60k

Summary

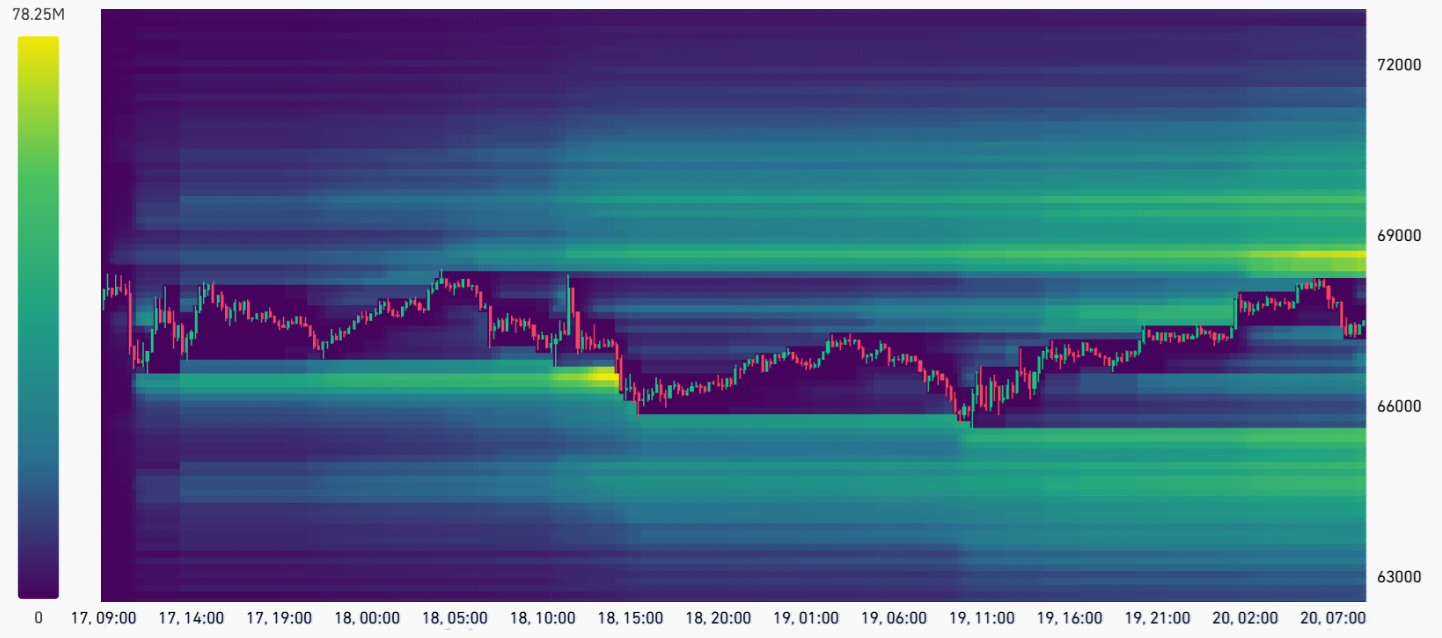

- BTC fell from about $85k to $60k before stabilizing near $66k, while March 2026 options IV spiked from just above 40% to nearly 65% then eased back toward 50%.

- Matrixport flags extreme pessimism, shrinking open interest, and persistent outflows as traders cut “tail risk” hedges and overall positioning, leaving liquidity and participation thin.

- The firm notes that high volatility, muted price sensitivity, and low liquidity have historically preceded strong upside moves in crypto, especially when macro conditions are quietly improving.

Crypto asset management company Matrixport stated in its latest research note that cryptocurrency markets are approaching a critical turning point, according to a report released by the firm.

The report indicated that a sharp decline in Bitcoin (BTC) led to a rapid increase in implied volatility in the options market, followed by a partial pullback. Bitcoin’s price briefly dropped sharply before stabilizing at a lower level, according to Matrixport’s analysis.

During the same period, the implied volatility of March 2026 expiry options climbed from approximately 40 percent to 65 percent, the report stated. The rebound indicated strong investor demand for hedging against downside risks during the decline, Matrixport noted. The subsequent drop in volatility to around 50 percent suggested that excessive “tail risk” hedges were gradually unwinding and short-term pressure had eased somewhat, according to the firm.

Matrixport stated that the market remains in a high-volatility environment. The report noted that investor sentiment is extremely pessimistic and liquidity continues to flow out of the market. Total position size has significantly decreased as traders reduce their hedging positions against collapse scenarios, weakening market participation, according to the analysis.

The report highlighted that historically, this type of combination—high volatility, low sensitivity, and decreased liquidity—has often preceded strong upward movements in cryptocurrency markets. Matrixport also noted that while there are signs of partial improvement in macroeconomic conditions, the lack of a clear reaction from cryptocurrency prices may not continue for long, according to the firm’s assessment.

Crypto World

Specialized AI detects 92% of real-world DeFi exploits

A purpose-built AI security agent detected vulnerabilities in 92% of exploited DeFi smart contracts in a new open-source benchmark.

The study, released Thursday by AI security firm Cecuro, evaluated 90 real-world smart contracts exploited between October 2024 and early 2026, representing $228 million in verified losses. The specialized system flagged vulnerabilities tied to $96.8 million in exploit value, compared with just 34% detection and $7.5 million in coverage from a baseline GPT-5.1-based coding agent.

Both systems ran on the same frontier model. The difference, according to the report, was the application layer: domain-specific methodology, structured review phases and DeFi-focused security heuristics layered on top of the model.

The findings arrive amid growing concern that AI is accelerating crypto crime. Separate research from Anthropic and OpenAI has shown that AI agents can now execute end-to-end exploits on most known vulnerable smart contracts, with exploit capability reportedly doubling roughly every 1.3 months. The average cost of an AI-powered exploit attempt is about $1.22 per contract, sharply lowering the barrier to large-scale scanning.

Previous CoinDesk coverage outlined how bad actors such as North Korea have begun using AI to scale hacking operations and automate parts of the exploit process, underscoring the widening gap between offensive and defensive capabilities.

Cecuro argues that many teams rely on general-purpose AI tools or one-off audits for security, an approach the benchmark suggests may miss high-value, complex vulnerabilities. Several contracts in the dataset had previously undergone professional audits before being exploited.

The benchmark dataset, evaluation framework and baseline agent have been open-sourced on GitHub. The company said it has not released its full security agent due to concerns that similar tooling could be repurposed for offensive use.

Crypto World

Fusaka Upgrade Fuels Record Address Poisoning on Ethereum

Lower gas costs have turned Ethereum into a playground for mass address poisoning, with scammers hitting thousands of wallets daily.

Ethereum has spent years trying to fix high fees, and recent upgrades finally made transactions cheaper. But while they solved one problem, they may have opened the door to another.

Leon Waidmann, head of research at Lisk, noted in an X post on Wednesday, Feb. 18, that network activity is booming, with stablecoin volume hitting $7.5 trillion in a single quarter while transaction fees stayed under a dollar.

“Record usage. Record cheap. At the same time. The biggest divergence between fundamentals and price in all of crypto right now,” he noted.

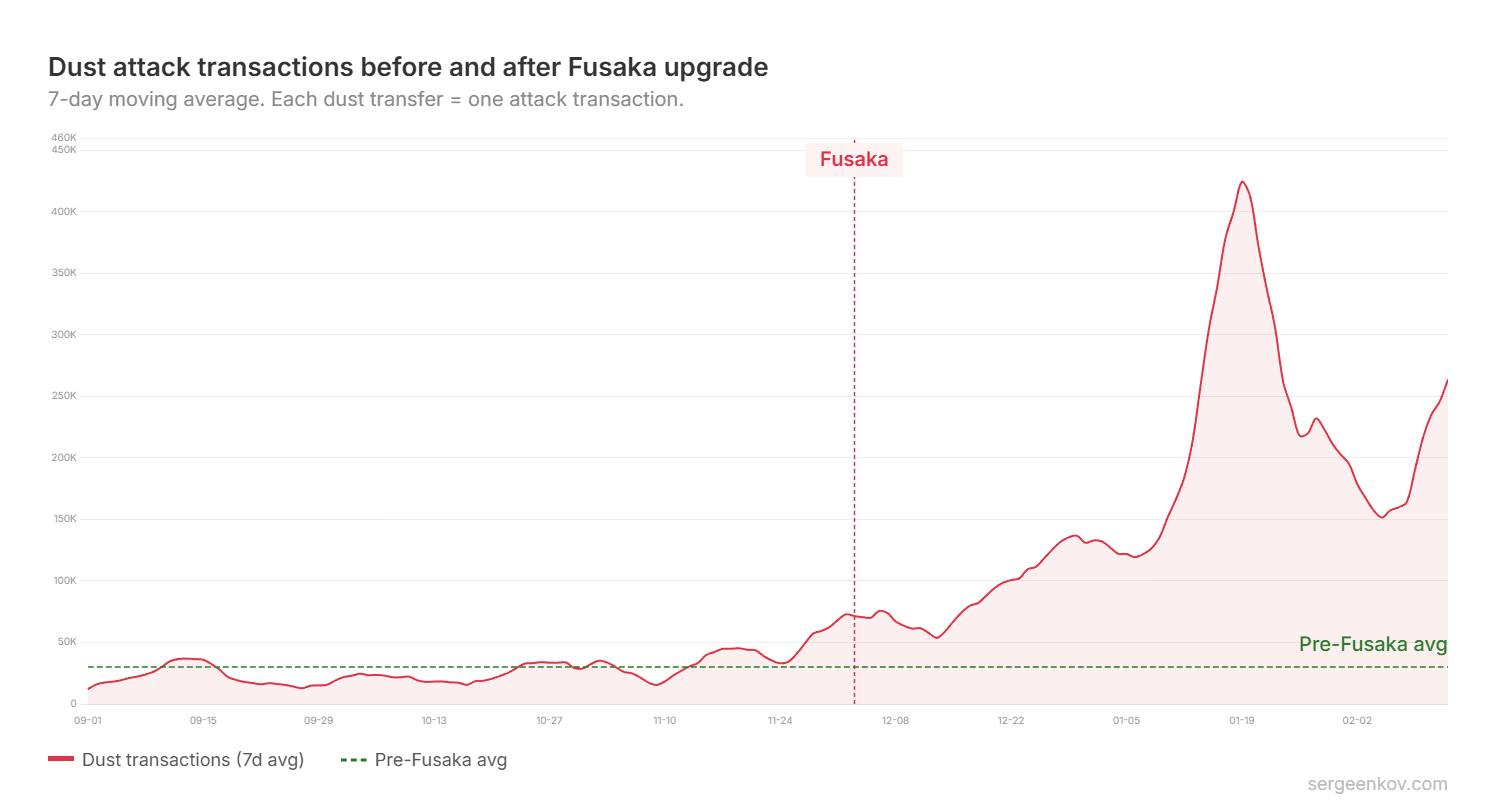

But the growth may hide a more alarming reality. A recent study by blockchain researcher Andrey Sergeenkov finds address poisoning attacks surged significantly after the December Fusaka upgrade, which cut gas fees sixfold and made spam attacks cheap enough to scale.

Address poisoning works by sending tiny transfers from addresses that look like the victim’s real contacts. If the victim copies the wrong address from their history, funds get stolen. Sergeenkov says attackers treat this like a lottery, sending millions of cheap transactions in the hope of a few big payoffs.

Unintended Consequences

Before Fusaka, attackers were sending roughly 30,000 dust transactions per day, according to Sergeenkov’s analysis of 101 tokens between Sept. 1, 2025, and Feb. 13 this year.

But after the upgrade, lower fees made mass poisoning viable in a way that wasn’t possible before, and daily dust transactions jumped to 167,000, peaking at about 510,000 in one day in January.

In just over two months after Fusaka, victims lost more than $63 million, 13 times the $4.9 million lost in a comparable prior period, the data shows.

“There is nothing wrong with lowering fees, but the security problems that cheap transactions amplify should have been addressed before the upgrade. When the Ethereum Foundation claims it is building trillion-dollar security, user safety must be the strictest priority over growth metrics,” Sergeenkov writes.

Sergeenkov noted that a single transfer accounted for a large share of the post-Fusaka losses, when attackers stole $50 million in USDT on Dec. 19, 2025. Even leaving that out, total losses still came to $13.3 million, 2.7 times higher than the pre-Fusaka period, he concluded.

Crypto World

Dutch Authorities Call on Polymarket Arm to Cease Activities

The prediction market’s Dutch arm, Adventure One, allegedly offered illegal bets, including on elections in the Netherlands.

The Netherlands Gambling Authority said it imposed a penalty on prediction markets platform Polymarket’s Dutch arm, Adventure One, for offering gambling to residents without a license.

In a Tuesday notice, Dutch authorities ordered the Polymarket company to “cease its activities immediately,” or face up to $990,000 in fines. According to authorities, Adventure One was in violation of Dutch law for offering illegal bets, including those on local elections, and the company had not responded to requests to address these activities.

”Prediction markets are on the rise, including in the Netherlands,” said the Netherlands Gambling Authority’s director of licensing and supervision, Ella Seijsener. “These types of companies offer bets that are not permitted in our market under any circumstances, not even by license holders.”

Polymarket and other platforms offering event contracts on prediction market platforms face similar scrutiny in the United States, where many individual state authorities have filed lawsuits over sports gambling. However, the chair of one of the federal financial regulators, the Commodity Futures Trading Commission, said on Tuesday that he would defend the agency’s “exclusive jurisdiction” over prediction markets, criticizing state-level action.

Related: Polymarket’s lawsuit could decide who regulates US prediction markets

Cointelegraph reached out to Polymarket for comment, but had not received a response at the time of publication. The company’s chief legal officer, Neal Kumar, said on Feb. 9 that Polymarket “welcome[s] dialogue with other states while the federal courts” consider the issue of jurisdiction in the US.

Dutch tax on crypto passes House of Representatives

The Polymarket crackdown in the Netherlands came within a week of the country’s House of Representatives advancing a proposal to introduce a 36% capital gains tax on investments that would likely include cryptocurrencies. If passed by the Dutch Senate and signed into law, it could take effect as early as 2028.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Bitcoin Rally To $70K Possible As Bears At Risk Of $600M Liquidation

Key takeaways:

-

A minor 4.3% Bitcoin price increase to $69,600 could trigger over $600 million in forced liquidations for bearish traders.

-

Rising network hashrate and the BIP-360 quantum security proposal are helping to diminish long-term technical concerns.

Bitcoin (BTC) has remained confined within a relatively tight range of $65,900 to $70,500 over the past week. This stagnation has encouraged bearish traders, particularly as other major asset classes displayed resilience. However, even if Bitcoin requires months to reclaim the $90,000 level, excessive bearish confidence could trigger a wave of forced liquidations in futures positions, rapidly shifting momentum back to the bulls.

According to CoinGlass estimates, a price rally to $69,600 would force the liquidation of over $600 million in short BTC futures. For context, when Bitcoin climbed from $60,200 to $70,560 on Feb. 6, short liquidations totaled $385 million. Currently, a mere 4.3% move upward from the $66,700 level could deliver an even more significant blow to those betting on further declines.

Bulls may also find a catalyst in weakening macroeconomic data. The US reported sluggish gross domestic product growth for the fourth quarter of 2025, with an annualized rate of 1.4% falling short of the 2.9% analysts expected, per Yahoo Finance. This slower economic activity negatively impacts corporate earnings outlooks, typically reducing investor appetite for stock market exposure.

Meanwhile, underlying US inflation rose more than anticipated in December, dampening hopes for near-term interest rate cuts. The US personal consumption expenditures price index, excluding food and energy, increased by 0.4% month over month. As the S&P 500 loses bullish steam, investors may be forced out of their comfort zones to seek higher returns in onchain markets.

Escalating Middle East tensions may prompt investors to seek alternative hedges, particularly after gold prices rallied 25% in just three months. Gold’s market capitalization has climbed to a staggering $35.2 trillion—nearly eight times larger than Nvidia (NVDA US), which sits at $4.6 trillion.

As Bitcoin trades approximately 47% below its all-time high, the risk-reward profile for the cryptocurrency may become increasingly attractive to macro traders. For now, Bitcoin bears retain control, as evidenced by the lack of demand for long positions in the futures market.

The BTC perpetual futures funding rate has failed to stay above the 6% neutral threshold over the last two weeks. More telling is the recent stretch of negative funding rate, suggesting that bears are committed to their positions even as Bitcoin retests the $66,000 support level. Regaining conviction remains a hurdle for the bulls, who witnessed $1.6 billion in liquidations during the three-day crash that started on Feb. 6.

Related: Bitcoin ETFs shed $166M as BTC heads for worst start in years

Recovering hashrate and BIP-360 progress strengthen Bitcoin network security

While some of Bitcoin’s recent weakness was attributed to network security concerns, those risks are now dissipating.

The seven-day average hashrate has recovered to 1,100 exahashes per second, matching levels from late January. Earlier fears that miners were abandoning the network to pivot toward the artificial intelligence sector have proven premature, as the industry shows remarkable resilience.

Furthermore, the introduction of BIP-360 has addressed much of the uncertainty surrounding quantum computing threats. This proposal outlines a framework for post-quantum protection through a backwards-compatible soft fork. By removing the vulnerable key-path spend found in Taproot, the proposal hides public keys onchain until the moment of spending.

This technological roadmap provides a clear path for bulls to regain the narrative, potentially forcing a short squeeze that could propel Bitcoin back above $70,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Will XRP Drop Back to $1.20? Key Support Levels Tested Amid Bearish Pressure

XRP remains under sustained bearish pressure across both its USDT and BTC pairs, with the price structure continuing to print lower highs and lower lows. Despite short-term bounces from support levels, the broader trend favors sellers as the price trades below key moving averages and within a descending structure.

Ripple Price Analysis: The USDT Pair

On the XRP/USDT chart, the price is trading inside a well-defined descending channel, consistently rejecting dynamic resistance from the midline of the channel, the upper trendline, and the 100-day and 200-day moving averages. The recent bounce from the $1.20 demand zone failed to reclaim the $1.80 supply area, reinforcing the bearish structure and confirming that rallies are still corrective in nature.

The RSI also remains below the neutral 50 level and continues to trend weakly, signaling a lack of bullish momentum. As long as XRP stays below the mid-channel resistance and the 100-day and 200-day moving averages, located near $1.90 and $2.30 levels, respectively, the downside risk toward the lower channel boundary remains elevated, with the $1.20 zone acting as critical structural support.

The BTC Pair

Against Bitcoin, XRP is also showing relative weakness, trading below both the 100-day and 200-day moving averages, which are both located above the 2,200 sats area, after failing to hold prior breakout gains. The rejection from the 2,200-2,400 sats resistance zone confirms that sellers are defending higher levels, while the price compresses near a key horizontal support band at 2,000 sats.

Momentum on the XRP/BTC pair is neutral-to-bearish, with the RSI struggling to establish sustained strength above 50. A breakdown below the current support region could open the door for further relative underperformance, while reclaiming the moving average cluster would be the first signal that XRP is beginning to regain strength versus BTC.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Trump Fires Back After SCOTUS Ruling, Announces 10% Global Tariff

The United States Supreme Court ruled on Friday that President Donald Trump could not use national emergency powers to levy tariffs during peacetime.

US President Donald Trump announced a 10% global tariff on Friday following the Supreme Court’s ruling striking down his authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA).

Trump was critical of the Supreme Court’s decision, calling the decision “ridiculous” at Friday’s press conference, and said that he will levy the tariffs under different legal methods, including the Trade Expansion Act of 1962 and the Trade Act of 1974. Trump said:

“Effective immediately. All national security tariffs under Section 232 and Section 301 tariffs remain fully in place. And in full force and effect. Today, I will sign an order to impose a 10% Global tariff under Section 122 over and above our normal tariffs already being charged.”

Trump’s tariffs have repeatedly caused severe downturns in markets considered high risk, including crypto and equities, as the threat of tariffs fuels uncertainty and shakes investor confidence.

Related: Bitcoin ignores US Supreme Court Trump tariff strike amid talk of $150B refund

The Supreme Court strikes down Trump’s authority to levy tariffs under emergency powers

Trump levied a 25% tariff on most goods coming in from Canada and Mexico, and a 10% tariff on goods coming in from China under the IEEPA, framing both tariffs as a response to national security threats.

An influx of drugs from foreign countries created a “public health crisis,” according to Trump, while trade deficits with China threatened the industrial manufacturing base in the US, he alleged.

However, the Supreme Court rejected both premises as national security threats under the IEEPA and said that the Executive Branch does not have the authority to levy tariffs under the IEEPA during peacetime.

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope,” the ruling said.

“Article I, Section 8, of the Constitution specifies that ‘The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises.’ The Framers recognized the unique importance of this taxing power,” the Supreme Court ruled on Friday.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

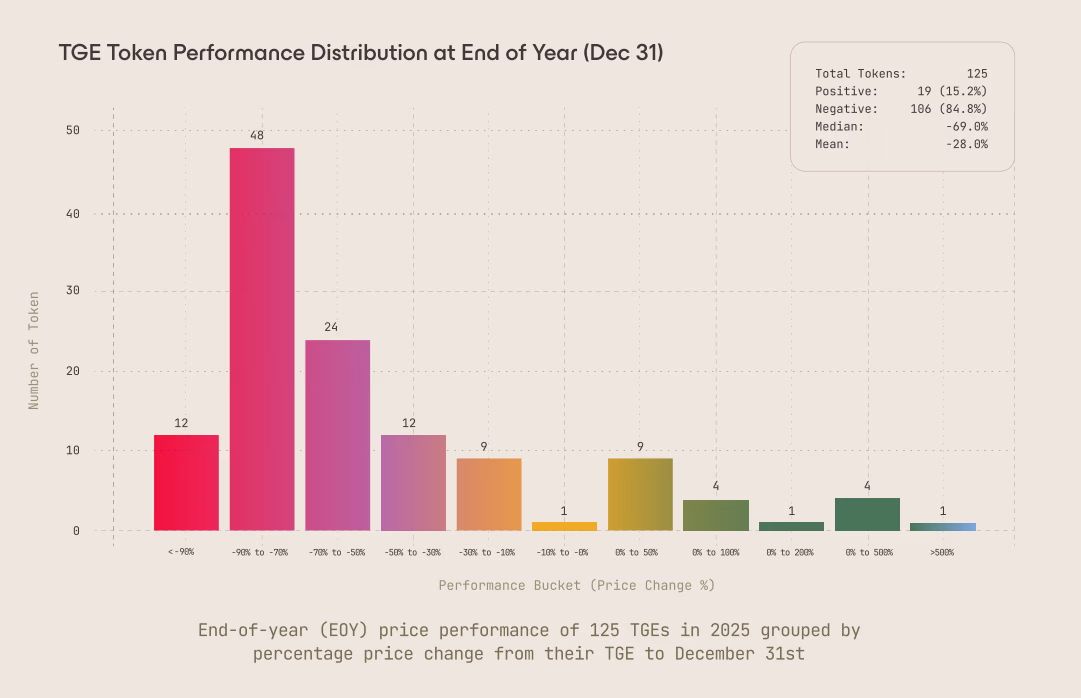

Only 1 in 10 Weak Token Launches Recovered in 2025: Arrakis

Data from more than 120 token launches shows that early sell pressure, not market timing, largely determined whether new tokens thrived in 2025.

New tokens struggled to find a floor in 2025, with early trading dynamics often setting a trajectory that proved hard to reverse as the year wore on, data shows.

An 80-page analysis by Arrakis Finance found that about 85% of tokens launched last year finished below their initial price, after reviewing 125 token generation events (TGE) and surveying more than 25 founding teams.

The data also shows that nearly two-thirds of tokens were already down within the first seven days, and only 9.4% of tokens that declined in the first week after TGE ever recovered to their launch price at any point later in the year. In most cases, early drawdowns deepened rather than reversed.

Airdrops were one of the strongest sources of immediate selling. Across multiple launches, Arrakis observed that up to 80% of airdrop recipients sold their positions on the very first day of TGE, creating concentrated sell pressure.

“The baseline assumption should be that most of an airdrop will be sold; recipients have zero cost basis and expect prices to decline, making immediate selling rational,” the report states.

Market-making structures also mattered. Arrakis says liquidity was often mispriced, prompting traders to take quick exits.

“Liquidity depth is your buyer against sell pressure. Depth needs to absorb selling from airdrops, exchange allocations, and market maker loans without catastrophic price impact,” the report notes.

Arrakis concludes that token outcomes in 2025 were largely decided by launch mechanics rather than market cycles. Early supply shocks, not macro conditions, determined whether tokens stabilized or slid, and once early confidence was lost, recovery was statistically rare.

That finding broadly aligns with separate research from Dragonfly Capital, which recently found little difference in long-term performance between tokens launched in bull versus bear markets.

As Dragonfly Capital managing partner Haseeb Qureshi explained, regardless of the timing, most tokens don’t perform well over time. Bull market launches recorded a median annualized return of about 1.3%, while bear-market launches came in at -1.3%.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video19 hours ago

Video19 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World23 hours ago

Crypto World23 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest