Crypto World

How decentralized AI is leveling the playing field

As AI infrastructure investments surge toward $300B in 2025 alone, fueled by mega-projects like the $500B Stargate initiative and hundreds of billions in Nvidia chip purchases, the decentralized AI space offers a compelling alternative to Big Tech’s centralized dominance. Now’s the time to invest in it.

In the rapidly evolving landscape of artificial intelligence, a seismic shift is underway, one that promises to redefine how we build, deploy and interact with AI. While centralized AI, dominated by tech giants like Amazon, Microsoft and Google, has driven remarkable progress, the recent shift toward agentic AI creates a unique opportunity for decentralized AI. It’s why the sector is poised to become the most exciting and critical space over the next few years.

With a global AI market projected to grow at a 35.9% CAGR through 2030, the stark valuation gap—$12 trillion for centralized AI enterprises versus ~$12 billion for decentralized AI—signals an unprecedented investment opportunity. Bridging this gap will not only yield massive financial returns but also reshape the ethical, technical and societal foundations of AI. Here’s why decentralized AI, powered by open-source principles and blockchain technology, is the future.

The valuation gap: a $15 trillion opportunity

Centralized AI, controlled by a handful of tech behemoths, commands a staggering $12 trillion~ in enterprise value, fueled by their dominance of nearly 70% of global cloud infrastructure. Yet, this concentration of power comes at a cost: stifled competition, ethical lapses, a loss of agency and control for both individual and corporate users and a one-size-fits-all approach that often stifles innovation.

Meanwhile, decentralized AI, valued at just $12 billion, is a nascent yet rapidly growing ecosystem. The blockchain AI market alone is projected to skyrocket from $6 billion in 2024 to $50 billion by 2030, reflecting a staggering 42.4% CAGR, and I don’t believe these figures will come close to the actual outcome, as the real numbers are likely to be much higher. This disparity isn’t a sign of weakness but a clarion call for investors. The next two to three years will see decentralized AI platforms—think Bittensor, Artificial Superintelligence Alliance,The Manifest Network, Venice.Ai or Morpheus—close this gap by democratizing access, fostering innovation and addressing the critical flaws of centralized systems.

And as the agentic AI age approaches, conjuring visions of hundreds of billions of independent AI agents executing instructions and transacting on behalf of individuals and companies, the case for decentralized AI becomes all the more urgent.

How can these agents be truly autonomous in a centralized model? How can we know –and prove– that they are living up to the legal definition of an “agent?” In other words, it’s a fiduciary with 100% responsibility to its owner, not to a third party (such as the platform on which it is hosted). The explosion of innovation this hyper-competitive, hyper-collaborative “Internet of AI agents” points to will only be possible if those agents are given the privacy and control they need to truly act independently. There is no “free market of ideas” without the actors in that market having their own free will. Over the past quarter, the explosion of localized AI agent frameworks built on open architectures, such as OpenClaw, has demonstrated how quickly sovereign AI can move when unshackled from centralized cloud control. By moving AI from corporate servers to local, peer-to-peer networks, users are shifting from “renting” intelligence to owning their own fully autonomous stacks. This structural re-architecture bypasses Big Tech gatekeepers, sparking a wave of innovation and privacy that centralized platforms can no longer control.

Privacy: empowering individuals over corporations

Centralized AI thrives on vast data lakes, often harvested with little regard for individual privacy. Big Tech’s history of squashing competition and skirting ethical boundaries, whether through monopolistic practices or opaque data usage, has eroded trust. Decentralized AI, by contrast, leverages blockchain’s cryptographic security to prioritize individual privacy. Users control their data, sharing it selectively via secure, transparent protocols. Platforms like Akash Network ensure that personal data remains encrypted and decentralized, preventing the kind of mass exploitation seen in centralized systems. This privacy-first approach isn’t just ethical; it’s a market differentiator in an era where 83% of enterprises are shifting workloads to private clouds to escape public cloud vulnerabilities.

But it’s not only individuals who are disadvantaged by the current centralized model. Businesses, institutions and entire industries have been forced to keep their most valuable datasets locked away. Sometimes for competitive reasons, sometimes because of fiduciary, custodial, or regulatory obligations, making sharing with centralized LLMs flatly impossible. The risk of inadvertently uploading trade secrets, proprietary R&D, sensitive customer records or regulated data into the black box of a hyperscaler has been a hard stop for meaningful enterprise-scale AI adoption.

But the deeper significance of this shift goes beyond unlocking long-dormant corporate data vaults; it redefines what enterprise trust in AI actually looks like. This is core to the mission of organizations like the Advanced AI Society, which argues that we are entering an era where enterprise customers will not merely prefer privacy-preserving infrastructure; they will demand something far stronger: proof of control. Not marketing promises, not compliance checklists, but cryptographic, verifiable assurance that the business, and only the business, controls its data, compute pathways, storage substrates, proprietary model weights and fine-tuned derivatives. In a world where AI touches regulated workflows, intellectual property and customer-sensitive operations, enterprises will insist on provable guarantees that nothing escapes their perimeter, and nothing can be silently copied, scraped or siphoned by a third party. Decentralized AI is the first architecture capable of delivering this new trust standard. It shifts the question from “Do we trust our vendor?” to “Can we verify our sovereignty?” and that inversion is the fault line upon which the next decade of enterprise AI adoption will hinge.

This is where decentralized AI and confidential computation transform the playing field. For the first time, companies can safely apply their private datasets to local or domain-specific model training without surrendering custody or visibility. Whether through encrypted compute, zero-knowledge architectures, or decentralized execution layers, the data never leaves their control. What was once an unbridgeable chasm of AI potential on one side and locked corporate data on the other can now finally be crossed.

And that unlock is enormous. Non-internet-platform companies represent the vast majority of the world’s valuable information: pharmaceutical research vaults, medical imaging archives, energy exploration data, financial pattern histories, supply chain telemetry, manufacturing QA logs and more. These troves have been sealed off from AI’s learning loops due to the inherent danger of centralized training. Decentralized, privacy-preserving AI flips that equation, turning previously inaccessible datasets into catalytic assets.

If AI is truly going to cure cancer, solve energy scarcity, overhaul logistics, accelerate drug discovery or reinvent scientific research, it cannot rely solely on whatever scraps of information Big Tech has scraped from the public internet. The great breakthroughs will come when the off-internet world—the real, industrial, scientific and institutional world—can safely contribute its data to AI models without risking exposure, theft or exploitation.

Decentralized AI is the architecture that makes that future possible. It doesn’t just empower individuals against corporations; it empowers every enterprise that has been forced to sit on the sidelines. And when those data vaults finally open on their own terms and under their own control, that will be the great unlock that propels AI from impressive novelty to civilization-scale engine.

Compute capacity: harnessing the world’s spare resources

Centralized AI’s Achilles’ heel is its insatiable demand for compute power, requiring dozens of gigawatts to train and run models like GPT-4 or Llama. Data centers strain global energy grids, raising environmental concerns and increasing consumer costs.

Decentralized AI flips this paradigm by tapping into spare compute capacity such as idle GPUs in homes, offices or even smartphones. Platforms like Targon (Bittensor Subnet 4), focused on making AI inference faster and cheaper, aggregate distributed resources to deliver scalable solutions. OAK Research highlights that Targon’s benchmarks reportedly outperform Web2 solutions in certain tasks, offering lower-cost inference with acceptable quality—a game-changer for commodification, scaling and downstream integrations. By efficiently using existing energy sources, decentralized AI aligns with a sustainable future while democratizing access to cutting-edge technology.

Blockchain as the backbone of trust and innovation

AI is moving to blockchains, and for good reason. Blockchain solves critical pain points that centralized systems sidestep or exacerbate:

- Training validation: Decentralized networks like Bittensor use consensus mechanisms (e.g., Yuma Consensus) to validate AI model outputs, ensuring quality without centralized gatekeepers.

- Copyright compliance: Blockchain’s immutable ledger tracks data and model provenance, addressing intellectual property disputes—a growing concern in AI.

- AI guardrails: Decentralized governance creates transparent, community-driven rules to prevent misuse.

- Value transactions: Tokens like those on Akash enable fair reward distribution for contributors, from miners to validators.

- Data security and privacy: Distributed storage and encryption protect sensitive data, unlike centralized clouds prone to breaches. These features empower a collaborative ecosystem where developers, users and enterprises co-create value, unhindered by Big Tech’s competitive stranglehold.

Open source: the catalyst for exponential growth

Decentralized AI thrives on open-source principles, fostering innovation at a pace centralized systems can’t match. Open-source models, like those on Bittensor for specialized tasks, invite global contributions and enable rapid iteration on use cases ranging from video analysis to predictive markets. Centralized AI, by contrast, locks models behind proprietary walls, limiting adaptability and accessibility. Open-source decentralized platforms not only accelerate innovation but also align with the growing demand for transparency in AI development—a demand Big Tech often ignores.

The investment case: why now?

The $12 trillion centralized AI market is a mature Goliath, but its growth is constrained by ethical scandals, energy demands and diminishing returns. Decentralized AI, though smaller, is a nimble $12B David, poised for exponential growth. Its ability to address privacy, leverage distributed computing and foster open innovation makes it a superior long-term bet. Investors who back platforms like Bittensor, Storj, or Akash now, while valuations are low, may stand to reap outsized returns as the blockchain AI market scales to $200 billion by 2030. The shift is already underway: enterprises are moving to private clouds, and communities are embracing decentralized governance.

The future is decentralized

Decentralized AI isn’t just a technological evolution; it’s a societal necessity. It counters Big Tech’s monopolistic grip, protects user privacy and harnesses global resources for sustainable growth. As platforms like Bittensor and Akash pioneer scalable compute markets, they pave the way for a world where AI serves the many, not the few. The delta in the valuation gap will close. Not because centralized AI will falter, but because decentralized AI’s potential is too vast to ignore. For investors, developers and visionaries, this is the most exciting space to watch, build and invest in over the next three years. The revolution is here, and it’s decentralized.

Crypto World

Dogecoin Hold Key Trendline for Sixth Day as Historical Profit Metric Hits All-Time High

TLDR:

- Dogecoin has tested a descending trendline across six consecutive daily candles without breaking below support.

- Analyst Trader Tardigrade warns that current momentum is weak and a volume spike is needed to confirm a breakout.

- Dogecoin’s Number of Days Spent at a Profit has surpassed 1,100 days, marking a first-ever reading for the asset.

- The 1,100-day metric shows most historical holders are at a loss, a level that often precedes long-term accumulation phases.

Dogecoin is drawing attention from analysts as two distinct market signals emerge simultaneously. The asset is holding a key trendline on the daily chart while posting a historic reading on a long-term cycle indicator.

Together, these developments are painting a complex picture for traders watching the market closely. The situation reflects both caution and structural interest in Dogecoin at its current price level.

Trendline Support Remains Intact but Momentum Raises Questions

Dogecoin has tested a descending trendline across six consecutive daily candles. Each test has so far resulted in the price holding above support.

Crypto analyst Trader Tardigrade noted that structure remains technically bullish under these conditions. However, the analyst also pointed out that the current price action appears to be running low on energy.

According to Trader Tardigrade, the move lacks the buyer conviction needed to confirm a genuine breakout. The analyst specifically called for a volume spike and strong conviction candles as confirmation signals.

Without those, the setup is considered more hopeful than reliable. The brakes, as the analyst described, are lightly tapped on any upward momentum.

Volume remains a critical factor in determining whether this trendline holds or breaks. Thin volume during a trendline test often leads to false signals in either direction.

Traders are advised to watch price behavior closely before committing to a directional position. A high-volume candle closing above resistance would carry more weight than multiple low-volume closes.

Until clear confirmation arrives, Dogecoin remains in a wait-and-see zone technically. The trendline holding is a positive sign, but it does not guarantee continuation.

The market requires participation from genuine buyers to shift the current dynamic. That participation has not yet shown up in a measurable way on the chart.

Historical Metric Hits Unprecedented Level for Dogecoin

On the on-chain side, Dogecoin has reached a notable milestone in a long-term cycle metric. Analyst Joao Wedson reported that Dogecoin has now accumulated more than 1,100 historical days where price traded higher than today’s level.

This is the first time the asset has reached this reading. The metric is called the Number of Days Spent at a Profit.

This indicator measures how many past trading days recorded prices above the current level. A higher reading reflects a longer history of trading at elevated prices compared to now.

It captures the aggregated positioning and memory of holders over time. This is a structural metric, not a short-term signal.

Wedson described the reading as a cycle-level development rather than a day-trading data point. It speaks to where Dogecoin sits relative to its entire price history.

More than 1,100 days of higher historical prices means a large portion of past holders are currently at a loss. That kind of data often precedes a longer-term accumulation phase in similar assets.

The combination of trendline support and this historical metric gives analysts two separate angles to monitor Dogecoin going forward.

Crypto World

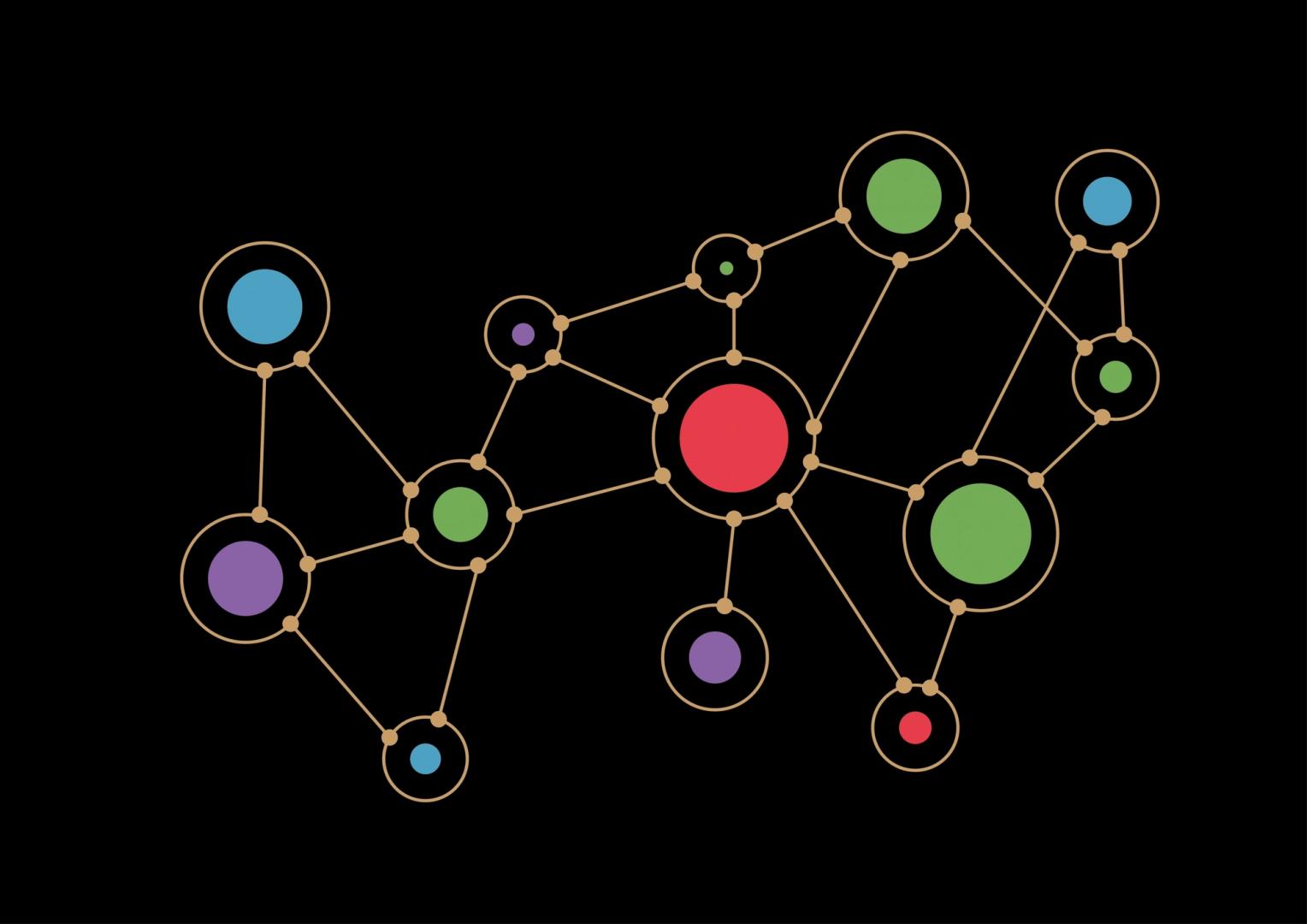

SEC Allows Broker-Dealers a 2% Haircut on Stablecoins

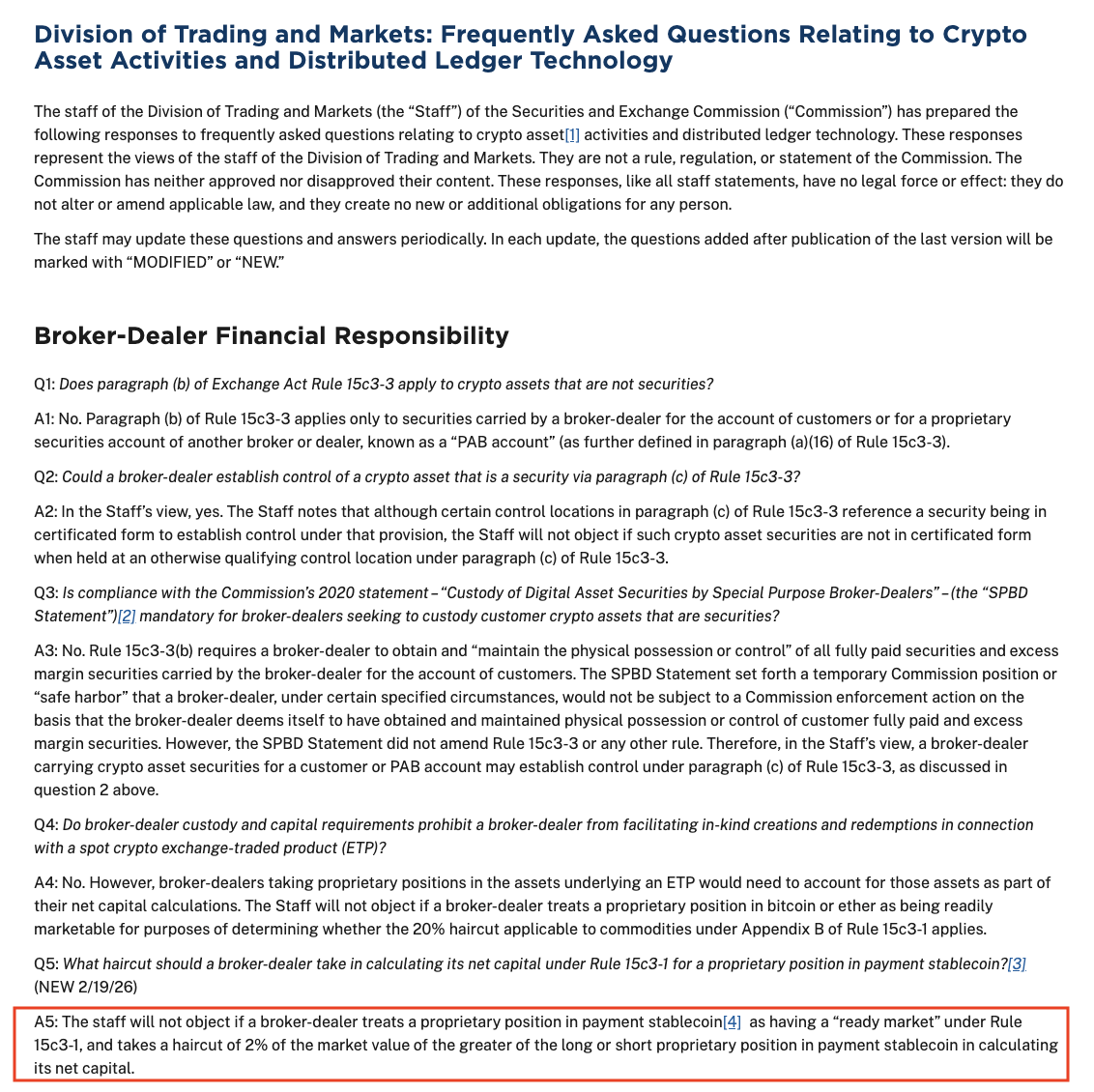

The U.S. Securities and Exchange Commission’s staff provided regulatory clarity last week on how broker-dealers can treat stablecoin holdings for net capital purposes, allowing a 2% haircut rather than applying a full 100% deduction. The guidance appeared as an official posting in the SEC’s “Frequently Asked Questions Relating to Crypto Asset Activities and Distributed Ledger Technology,” a living document used to address practical questions about handling crypto assets within traditional market infrastructure. The change comes after broker-dealers faced ambiguity about whether stablecoins—cryptocurrency tokens pegged to the US dollar—should count toward capital requirements. Commissioner Hester Peirce publicly welcomed the middle-ground approach, arguing a 100% haircut would be unduly punitive given the reserves backing these coins. The policy frames stablecoins more like cash-equivalents in balance sheets, a move that could unlock broader participation in tokenized securities and related crypto activities, without compromising the capital backbone of broker-dealers.

Key takeaways

- The SEC staff’s FAQ clarifies that broker-dealers may apply a 2% haircut to stablecoins when calculating net capital, reducing the capital impact compared with a full haircut.

- The guidance positions stablecoins closer to money-market-like instruments, linking their treatment to the reserves backing the tokens and their role in settlement rails.

- Illustratively, a broker-dealer holding $100 million in stablecoins could count $98 million toward net capital under the new guidance.

- Commissioner Peirce described the stance as measured, noting that a 100% haircut would be punitive relative to the underlying assets backing payment-stable coins.

- The development coincides with growing stablecoin traction in the United States, even as some officials question practical use cases and regulatory implications.

Tickers mentioned:

Sentiment: Neutral

Market context: The move reflects ongoing regulatory adjustments as stablecoins gain ground in US markets, spurred in part by recent legislation and ongoing debates about the role of crypto in mainstream finance.

Why it matters

The haircut clarification matters because it reduces the capital burden on broker-dealers that wish to hold and potentially utilize stablecoins in a broader set of activities, including trading and settlement of tokenized securities. By treating stablecoins more like cash equivalents, broker-dealers can allocate a portion of their stablecoin holdings toward capital requirements with a smaller drag on liquidity. That has implications for how these institutions manage risk, liquidity, and regulatory capital, potentially enabling more cost-effective participation in digital-asset markets.

From a risk-management perspective, the 2% haircut aligns with the notion that stablecoins mirror short-duration, high-quality reserve assets—the same logic used to justify the treatment of money market funds. The guidance thus reduces a prior barrier to using stablecoins for on-chain settlement and liquidity provisioning in tokenized markets. It also dovetails with industry commentary about stablecoins enabling more efficient cross-asset transactions and broader adoption of on-chain finance in mainstream trading desks.

“Stablecoins are essential to transacting on blockchain rails. Using stablecoins will make it feasible for broker-dealers to engage in a broader range of business activities relating to tokenized securities and other crypto assets.”

While the SEC clarification is a positive signal for market participants seeking clearer capital rules, it does not replace comprehensive regulatory rulemaking or policy debates. The guidance is a staff-level interpretation, not a formal amendment to net capital rules, meaning future adjustments could still occur as regulators evaluate risks, reserve adequacy, and systemic implications. Nevertheless, the response from industry observers has been to view the move as a meaningful step toward practical use-cases for stablecoins within regulated financial infrastructures.

Beyond the regulatory text, market dynamics around stablecoins have remained a focal point. Data tracked by RWA.XYZ shows a stablecoin market capitalization that has hovered in the high hundreds of billions, with fluctuations tied to sentiment, regulatory developments, and policy signals. The GENIUS stablecoin bill, signed into law in July 2025 by the US President, was widely seen as a landmark in digital-asset policy, spurring a surge in interest and activity around regulated stablecoin frameworks. The market cap climbed after the signing, reaching a reported peak above $300 billion in December 2025 and a current level around $295 billion. This trajectory illustrates how regulatory clarity and legislative actions can influence the adoption and liquidity of digital-asset primitives like stablecoins.

Yet not everyone in the policy community is sold on the immediate practical value of stablecoins. Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, has dismissed broad utility claims for crypto and stablecoins, at least in the sense of everyday financial transactions. In a public remarks sequence, he questioned what advantage stablecoins offer beyond existing payment rails, a stance that underscores the ongoing debate about the real-world use cases for digital assets in the U.S. financial system. The tension between regulation that enables innovation and skepticism about the utility of crypto assets as payment instruments continues to shape the regulatory narrative.

The weekend chatter among industry observers and crypto-analysts highlighted the significance of the SEC’s clarification for market participants seeking to align risk controls with evolving capital requirements. The reaction on social platforms and among executives underscored that the guidance, while incremental, could unlock a more expansive role for stablecoins in large financial operations, particularly as broker-dealers explore new settlement mechanisms, collateral arrangements, and asset tokenization ventures. In a market where headlines can rapidly influence liquidity and pricing, even modest shifts in capital treatment can ripple through trading desks, liquidity pools, and balance sheet strategies across the traditional-crypto interface.

What to watch next

- Whether the SEC issues additional formal guidance or rules clarifying net capital treatment for other crypto assets beyond stablecoins.

- Broker-dealer adoption: how quickly institutions incorporate the 2% haircut guidance into internal risk models and capital planning.

- Regulatory dialogues around stablecoins’ reserve assets and disclosure standards, particularly in relation to the GENIUS framework and related legislation.

- Monitoring shifts in market liquidity and settlement activity as broker-dealers experiment with stablecoins for tokenized-securities trading and other crypto-asset workflows.

- Further public commentary from policymakers, including any updates on the perspectives of central banks regarding crypto-like payments and reserve structures.

Sources & verification

- SEC staff guidance: “Frequently Asked Questions Relating to Crypto Asset Activities and Distributed Ledger Technology.” https://www.sec.gov/rules-regulations/staff-guidance/trading-markets-frequently-asked-questions/frequently-asked-questions-relating-crypto-asset-activities-distributed-ledger-technology

- SEC Commissioner Hester Peirce speech on stablecoins and capital requirements: https://www.sec.gov/newsroom/speeches-statements/peirce-stablecoin-021926-cutting-two-would-do

- SEC staff clarification page referenced in coverage: https://www.sec.gov/rules-regulations/staff-guidance/trading-markets-frequently-asked-questions/frequently-asked-questions-relating-crypto-asset-activities-distributed-ledger-technology

- RWA.XYZ stablecoins data: https://app.rwa.xyz/stablecoins

- Trump signs GENIUS stablecoin bill into law: https://cointelegraph.com/news/donald-trump-stablecoin-law-signed

- Associated Press video of the GENIUS signing: https://www.youtube.com/watch?v=FHD1G9UkCAU

- Marc Baumann LinkedIn post on the SEC guidance impact: https://www.linkedin.com/posts/marcphilippeb_%F0%9D%97%9D%F0%9D%97%A8%F0%9D%97%A6%F0%9D%97%A7-%F0%9D%97%9C%F0%9D%97%A1-the-sec-just-quietly-put-activity-7431070237011165184-oEfq?utm_source=share&utm_medium=member_desktop&rcm=ACoAAACDbMEBdyjl2O5sxzEsy9aglmivyOPP2qs

SEC clarifies 2% haircut rule for broker-dealers’ stablecoins

The publication of the SEC staff’s Frequently Asked Questions on crypto asset activities and distributed ledger technology marks a notable point in the ongoing evolution of regulatory clarity around digital assets used in traditional financial infrastructure. By allowing broker-dealers to apply a modest 2% haircut to their stablecoin holdings when calculating net capital, the staff provides a practical path forward for integrating stablecoins into regulated markets without forcing sharp, punitive reductions in capital buffers. The guidance explicitly references the Reserve- and asset-backed nature of stablecoins and positions these tokens as potential collateral and settlement assets that can support a broader spectrum of financial activities within the broker-dealer ecosystem.

In explaining the rationale, Peirce’s remarks emphasize the importance of avoiding unnecessarily punitive treatment that could hinder innovation. While the agency’s statement stops short of broad policy changes, it offers a concrete interpretive framework that market participants can incorporate into risk management, liquidity planning, and product development. The 2% haircut aligns with the conceptual approach of treating stablecoins similarly to money market instruments, which typically occupy a lower tier of capital risk in traditional finance. This alignment could lower barriers to using stablecoins as a practical tool in rapid settlement and collateralization for tokenized assets, potentially accelerating the adoption of blockchain-enabled workflows in regulated environments.

From a market perspective, the move arrives at a moment when the stablecoin sector has demonstrated resilience and growth, even as public officials debate the broader role of crypto assets in the financial system. The GENIUS law’s passage in mid-2025 and the subsequent market dynamics around stablecoins have illustrated both regulatory appetite for a clear framework and the continuing question of how these instruments will function alongside conventional payment rails. While some policymakers remain skeptical about the immediate utility of crypto-based payment methods—as reflected in cautious remarks by figures like the Federal Reserve’s Kashkari—the sector’s measured regulatory progress signals a potential for more defined, scalable usage in professional finance. As broker-dealers begin to implement and test the new haircut guidance, observers will watch for practical enrollment, risk controls, and any regulatory updates that accompany evolving supervision of digital assets.

Crypto World

Vitalik Buterin Unveils Human-Centered Crypto Security Strategy

Ethereum co-founder Vitalik Buterin has outlined a new framework for crypto security, offering practical strategies rooted in redundancy, multi-angle verification, and human-centric design.

He argues that the best way to protect users is to close the gap between their intent and system behavior.

Vitalik Buterin Explains Closing the Gap Between User Intent and System Security

Buterin’s insights, dismantling the idea of perfect security, arrive at a time when crypto platforms continue to face wallet hacks, smart contract exploits, and complex privacy risks.

By merging security with user experience, Buterin provides developers with a roadmap for balancing protection with usability.

Buterin reframes security as an effort to minimize the divergence between what users want and what systems do.

While user experience broadly addresses this gap, security specifically targets tail-risk scenarios in which adversarial behavior could lead to severe consequences.

“Perfect security is impossible—not because machines are flawed, or because humans designing them are flawed, but because the user’s intent is fundamentally an extremely complex object,” Buterin wrote.

He points out that even a seemingly simple action, like sending 1 ETH to a recipient, involves assumptions about identity, blockchain forks, and common-sense knowledge that cannot be fully encoded.

More intricate objectives, such as preserving privacy, add layers of complexity: metadata patterns, message timing, and behavioral signals can all leak sensitive information. This makes it difficult to distinguish between “trivial” and “catastrophic” losses.

The challenge mirrors early debates in AI safety, where specifying goals strongly proved notoriously difficult. In crypto, translating human intent into code faces a similar barrier.

Redundancy and Multi-Angle Verification

To compensate for these limitations, Buterin advocates redundancy: users specify intent through multiple overlapping methods. Systems act only when all specifications align.

This approach applies across Ethereum wallets, operating systems, formal verification, and hardware security.

For instance, programming type systems require developers to specify both program logic and expected data structures; mismatches prevent compilation.

Formal verification adds mathematical property checks to ensure code behaves as intended. Transaction simulations allow users to preview on-chain consequences before confirming actions.

Post-assertions require both action and expected outcomes to match. Multisig wallets and social recovery mechanisms distribute authority across multiple keys. This ensures that single-point failures do not compromise security.

The Role of AI in Security

Buterin also envisions large language models (LLMs) as a complementary tool, describing them as “a simulation of intent.”

Generic LLMs mirror human common sense, while user-fine-tuned models can detect what is normal or unusual for an individual.

“LLMs should under no circumstances be relied on as a sole determiner of intent. But they are one ‘angle’ from which a user’s intent can be approximated,” he noted.

Integrating LLMs with traditional redundancy methods could enhance mismatch detection without creating single points of failure.

Balancing Security and Usability

Critically, Buterin emphasizes that security should not translate into unnecessary friction for routine actions.

Low-risk tasks should be easy or even automated, while risky actions, such as transfers to new addresses or unusually large sums, require additional verification.

This calibrated approach ensures protection without frustrating users.

By blending redundancy, multi-angle verification, and AI-assisted insights, Buterin offers a roadmap for crypto platforms to reduce risk while maintaining usability.

Perfect security may be unattainable, but a layered, human-centered approach can safeguard users and strengthen trust in decentralized systems.

Crypto World

$1.3B Error Sparks Probe Into Weak Financial Oversight

Bithumb CEO admited past mistakes following the latest 620,000 BTC blunder which has prompting further investigations into system flaws.

South Korea’s financial authorities are facing criticism after failing to spot major flaws in Bithumb’s systems that led to an unprecedented Bitcoin error.

Despite repeated inspections by the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS), a vulnerability remained that allowed a single employee to trigger massive coin transfers without detection.

Bithumb Crypto Mishap

According to Rep. Kang Min-guk of the People Power Party, the FSC reviewed Bithumb once in 2022 and twice in 2025, while the FSS carried out three inspections during the same period. Despite this, none identified discrepancies between actual holdings and accounting records.

On February 6, a promotional event went wrong when users were mistakenly credited with 2,000 BTC each instead of coins worth 2,000 won (worth approximately $1.38). This error caused the system to register a total of 620,000 bitcoins being “distributed” to users, which is far more than the exchange’s actual holdings of about 42,800 BTC.

As reported by The Korea Times, the country’s lawmakers said the mistake exposes deeper weaknesses in internal controls, ledger management, and regulatory supervision. Rep. Han Chang-min of the Social Democratic Party questioned whether regulators’ inspections were largely procedural and noted attempts to place responsibility on Bithumb.

The FSS has extended its probe through February and is investigating potential violations involving investor protection, anti-money laundering (AML), and system flaws.

Bithumb CEO Lee Jae-won acknowledged two smaller prior errors that were recovered, which the FSS will also review.

You may also like:

Meanwhile, an emergency team from the authorities and the Digital Asset eXchange Alliance (DAXA) is reviewing asset verification and internal controls at some of the country’s other prominent exchanges, such as Upbit, Coinone, Korbit, and GOPAX. Results are expected to influence both DAXA’s self-regulatory rules and future crypto legislation.

Lost and Found

The latest setback comes a month after the Gwangju District Prosecutors’ Office reported that Bitcoin seized in a criminal case had gone missing, but authorities have now recovered all 40 billion won worth of the lost cryptocurrency. Prosecutors said the 320.8 bitcoins were returned from the hacker’s electronic wallet to the office’s wallet on February 17, apparently voluntarily, after the hacker was unable to cash them out.

The coins had originally been confiscated from the daughter of a couple arrested for operating an illegal overseas gambling site worth 390 billion won between 2018 and 2021, who had converted their criminal proceeds into Bitcoin. Officials said the BTC were lost last August when prosecutors accidentally accessed a phishing site while checking the wallet, which exposed the funds.

Authorities have been tracking the hacker and monitoring domestic and international exchanges to prevent further losses.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitwise CIO Warns the L1 Narrative May Be Dead Wrong

The idea that Layer 1 blockspace has become a commodity may be premature, according to Bitwise CIO Matt Hougan, who argues that institutional behavior tells a very different story.

Hougan pushed back on what he described as an “increasing view in crypto that L1 blockspace is a commodity.

Institutional Capital Clusters on Top-Tier Chains as On-Chain Prediction Markets Redefine Information Edge

According to the Bitwise executive, if infrastructure were truly commoditized, capital and development would be evenly distributed across chains.

Instead, the vast majority of institutional building is taking place on very few chains (Ethereum, Solana, etc.).

“…basically, zero interest in building on the twentieth largest L1,” he explained.

Networks like Ethereum and Solana continue to dominate mindshare, liquidity, and developer activity, even as newer Layer 1s compete aggressively on fees and throughput. Hougan offered a simpler explanation for today’s low-fee environment.

“Top-tier L1s built more bandwidth than the market can use at the moment, so fees are rock-bottom.”

However, he cautioned that the current equilibrium may not last.

“The real question is what happens when demand scales as stablecoins/tokenization/DeFi grow into the trillions,” he wrote. “I’m not sure we know the answer yet.”

If blockchain-based financial infrastructure expands to support trillions of dollars in tokenized assets and on-chain settlement, today’s excess capacity could quickly tighten. Such an outcome could potentially reshape the economics of leading networks.

Prediction Markets as a “Reg FD for the Internet Age,” Hougan Argues

Beyond infrastructure, Hougan also weighed in on another contentious topic: insider trading concerns surrounding crypto-based prediction markets.

“The insider trading worries about prediction markets are basically backwards,” he wrote. “Prediction markets are a markets-based extension of Reg FD, putting us all on a level playing field.”

Regulation Fair Disclosure (Reg FD) was designed to prevent selective disclosure of material information to favored investors.

Hougan argues that prediction markets extend that principle by publicly pricing probabilities around major events.

He reflected on how hedge funds historically extracted “alpha” during pivotal legislative moments in Washington, D.C., hiring lobbyists and consultants to gather private intelligence from Capitol Hill.

Today, however, retail investors can track live probabilities on platforms like Polymarket, including markets tied to the potential passage of legislation such as the Clarity Act.

“For liquid markets, those odds are probably as good or better than anything the lobbying complex can provide. It’s a more even playing field,” Hougan said.

He acknowledged that risks remain, citing the need to aggressively police insider trading in prediction markets. Still, he emphasized that the impact balance is dramatically positive and egalitarian.

Therefore, there are two debates here:

- Whether L1s are commoditized and

- Whether prediction markets enable unfair advantages

Both debates revolve around how power is distributed in financial systems. According to Matt Hougan, institutional concentration on top-tier chains reflects economic reality rather than pure commoditization.

Meanwhile, open prediction markets represent a rare instance where information asymmetry may actually be shrinking.

Crypto World

SEC Tells Broker-Dealers Stablecoins Can Count Toward Net Capital

The US Securities and Exchange Commission (SEC) staff last week clarified that broker-dealers can apply a 2% “haircut” to their stablecoin holdings without objection from the SEC.

Previously, broker-dealers were uncertain whether to apply a 100% haircut to their dollar-pegged stablecoins, meaning that they did not count the tokens toward their net capital under existing regulations.

The clarification came in the form of a posting by the staff of the SEC’s Division of Trading and Markets as a “Frequently Asked Questions Relating to Crypto Asset Activities and Distributed Ledger Technology.”

In response, Commissioner Hester Peirce said: In my view, a 100% haircut would be unnecessarily punitive given the underlying reserve assets that back payment stablecoins.”

The SEC requires broker-dealers to maintain minimum levels of net capital to meet financial obligations and absorb potential losses from market downturns and volatility, according to the staff’s clarification.

For example, if a broker-dealer holds $100 million in stablecoins, a 2% haircut allows them to count $98 million toward their net capital requirements. Celebrating the clarification as positive for the financial system, Peirce said:

“Stablecoins are essential to transacting on blockchain rails. Using stablecoins will make it feasible for broker-dealers to engage in a broader range of business activities relating to tokenized securities and other crypto assets.”

The clarification means broker-dealers can hold stablecoins without worrying about excess net capital requirements, and can treat the tokens similarly to money market funds, vehicles that hold low-risk cash equivalents like US Treasurys and certificates of deposit.

In a social media post over the weekend, Marc Baumann, CEO of crypto intelligence company 51, called the SEC staff communication “a big deal,” adding that “Wall Street can now actually hold and use stablecoins without destroying their capital ratios.”

Related: SEC leaders seek to clarify how tokenized securities interact with existing regulation

Stablecoins gain traction in the United States, but not all US officials are convinced

The stablecoin market cap recently hit a snag, falling by about $6 billion from the December 2025 peak of over $300 billion.

However, the market still has a $295 billion market cap, which has steadily grown since 2023, according to data from RWA.XYZ.

United States President Donald Trump signed the GENIUS stablecoin bill into law in July 2025, which was considered a landmark moment for the crypto industry.

The stablecoin market capitalization was just north of $252 billion at the time of signing and surged following the passage of the bill, according to data from RWA.XYZ.

Despite the meteoric surge in stablecoins and their implications for US dollar dominance in global financial markets, Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, maintains that stablecoins and crypto have no real use cases.

“I could send any one of you $5 with Venmo, or PayPal, or Zelle, so what is it that this magical stablecoin can do? ” he said on Thursday.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Yield Tsunami Bitcoin: Fed Rate Cuts Could Trigger Massive Capital Rotation Into STRC

TLDR:

- A 300bps rate drop could erase nearly $234B in annual MMF income.

- Even 5% MMF rotation may release $390B into higher-yield alternatives.

- STRC’s 11.25% yield positions it for institutional inflows during easing.

- New STRC issuance could translate into large-scale Bitcoin purchases.

Yield Tsunami Bitcoin is gaining attention after investor Adam Livingston projected a sharp capital rotation toward Bitcoin-linked yield vehicles.

In a detailed post on X, Livingston argued that ongoing Federal Reserve rate cuts could erase hundreds of billions in annual income from U.S. money market funds.

He contends that falling short-term yields may push pensions, insurers, and endowments toward higher-yielding listed structures tied to Bitcoin exposure.

Rate Cuts and the Projected $234 Billion Income Compression

Livingston stated that U.S. money market funds hold roughly $7.79 trillion as of mid-February 2026. He noted that current yields near 4.5% to 5% reflect the prior hiking cycle.

However, he argued that an additional 75 to 100 basis points of cuts could reduce front-end rates toward 3% or lower.

According to his calculations, a 300-basis-point decline across $7.79 trillion equates to about $233.7 billion in lost annual income. He described this as a large-scale compression event for conservative capital pools. As yields fall, institutions dependent on fixed income cash flows may reallocate capital.

In his tweet, Livingston called this shift a “trillion-dollar yield tsunami” moving toward Bitcoin-aligned assets. He referenced historical data from the post-2008 and 2020 easing cycles. During those periods, alternative credit and private structures experienced accelerated asset growth.

He further cited estimates suggesting that even a 5% rotation from money market funds could release nearly $390 billion. A portion of that capital, he argued, may seek liquid high-yield instruments offering double-digit returns.

STRC Structure and the Bitcoin Treasury Feedback Loop

Livingston identified Strategy’s Variable Rate Series A Perpetual Stretch Preferred Stock, trading under STRC, as a potential beneficiary.

The security reportedly pays 11.25% annualized, distributed monthly. It trades near $100 par value and includes a rules-based monthly reset feature.

He reported that STRC has a notional value of about $3.46 billion with average daily trading volume near $128 million.

According to the post, dividend coverage is supported by cash reserves and the strategy’s Bitcoin treasury. The company currently holds more than 717,000 BTC.

Livingston estimated that a 0.5% capture of projected alternative inflows could generate $2 to $4 billion in new STRC issuance.

At Bitcoin prices near $68,000, he calculated that each $1 billion raised could acquire roughly 14,700 BTC. Larger inflows would increase that figure proportionally.

He also modeled broader scenarios. A 5% rotation from money market funds with a 10% STRC capture rate could imply $39 billion in inflows.

That level, based on his figures, would represent hundreds of thousands of additional BTC purchases. Yield Tsunami Bitcoin remains central to his thesis that rate compression may indirectly expand institutional Bitcoin exposure through listed yield vehicles.

Crypto World

THORChain’s $618,000 Live Swap Puts Blockchain Transparency to the Test

TLDR:

-

- A single $618,000 BTC-to-USDC swap on THORChain exposed every transaction detail to the public in real time.

- GemWallet’s 50 basis point fee was written directly into the transaction memo, visible on-chain to anyone worldwide.

- THORChain allows users to swap assets without creating an account, submitting an ID, or seeking any permission.

- Every swap ever executed on THORChain remains permanently traceable, dating all the way back to its first transaction.

- A single $618,000 BTC-to-USDC swap on THORChain exposed every transaction detail to the public in real time.

THORChain recently showcased blockchain transparency through a live transaction on its network. A user swapped 8.99 BTC, worth roughly $67,393, for 611,637 USDC in under 17 minutes.

The swap totaled approximately $618,000 moving across chains. Every detail of this trade remained publicly visible to anyone with an internet connection.

What the Transaction Revealed About On-Chain Visibility

THORChain shared the transaction publicly, noting that every detail was traceable without any permission required.

The sending wallet address, destination address, exact amounts, fees, and processing time were all recorded permanently on a public blockchain. No compliance department or regulatory body controls access to this data.

The transaction memo also showed that GemWallet processed the swap and charged 50 basis points as a service fee.

That fee was written directly into the transaction instructions, not buried in a terms of service document. Anyone on earth could verify this at the moment it happened.

THORChain posted about the event, stating: “There is no compliance department to call, no freedom of information request to file, no company deciding what data you are allowed to see.”

This reflects a core design principle of public blockchain infrastructure. The data exists on-chain and remains accessible indefinitely.

This level of auditability extends beyond a single transaction. Every swap ever executed on THORChain traces back to the network’s first transaction, all publicly accessible without creating an account or submitting identification documents.

How THORChain Contrasts With Traditional Financial Systems

THORChain draws a direct comparison between its model and traditional finance. In conventional systems, users cannot meaningfully audit the infrastructure they trust with their money.

Access also requires clearing increasingly complex identity verification processes before any transaction can occur.

According to THORChain, opacity and gatekeeping come bundled together in traditional finance. Users are told this is simply how financial infrastructure must function. The protocol presents itself as evidence that this assumption does not hold.

The protocol operates under a model where full transparency and permissionless access coexist by default. A user can make a swap without asking anyone for permission, without creating an account, and without submitting any identification. Both features run simultaneously within the same system.

THORChain noted: “Full transparency and no gatekeepers are not mutually exclusive. They can coexist, and on a public blockchain they do by default.”

This positions the network as a functional alternative to systems where financial data remains controlled and access remains conditional. The transaction itself serves as a working example rather than a theoretical argument.

Crypto World

USDT Rare -$3B Signal Returns: Is Bitcoin Approaching Another Cycle Bottom?

TLDR:

- USDT 60-day market cap change has fallen below -$3B for only the second time in crypto market history.

- The first instance occurred in late 2022, aligning precisely with Bitcoin’s cycle bottom near the $16,000 level.

- Three single-day USDT outflows exceeding -$1B have each coincided with local bottoms or sharp Bitcoin volatility.

- Historical data shows Bitcoin entered strong recovery phases once USDT outflows stabilized after peak liquidity stress.

USDT is flashing a rare on-chain signal that has only appeared twice in crypto market history. The stablecoin’s 60-day market cap change has dropped below -$3 billion.

This level was last reached in late 2022, when Bitcoin bottomed near $16,000. That period marked one of the most severe liquidity contractions in the digital asset market.

Now, this same metric is triggering again in early 2026, with Bitcoin trading between $65,000 and $70,000.

USDT Outflows Mirror Patterns From the 2022 Cycle Bottom

The 60-day USDT market cap contraction has only breached -$3 billion on two occasions. The first came during the late 2022 market collapse, a period of forced selling and maximum fear.

The second is occurring now, in early 2026, after Bitcoin’s recent all-time high run.

On a daily basis, USDT has recorded three separate instances of single-day outflows exceeding -$1 billion. Each of those episodes lined up with either local market bottoms or sharp Bitcoin volatility clusters. That pattern is difficult to ignore given the current market conditions.

Analyst CrptosRus qouting MorenoDV_ flagged this development on X, noting the historical weight of the signal. “The 60-day Market Cap Change has dropped below -$3B, on only two occasions,” the post read. “The first occurred in late 2022, precisely as Bitcoin was carving its cycle bottom near $16K.”

Large-scale USDT redemptions at this rate typically reflect institutional or major holder exits from the broader crypto ecosystem.

Historically, these exits tend to cluster near exhaustion points rather than at the start of prolonged downtrends.

Liquidity Conditions Now Determine Bitcoin’s Next Move

Stablecoins function as the dry powder of the crypto market. When USDT supply grows, it points to fresh capital entering the ecosystem. When it contracts sharply, it reflects risk-off behavior, liquidity withdrawal, or forced redemptions.

For Bitcoin, a liquidity-sensitive asset, USDT supply trends carry measurable weight. The current 60-day contraction points to sustained capital outflows and structural tightening in crypto-native liquidity. That creates a fragile environment for price stability.

However, past cycles offer some useful context here. Once forced deleveraging completed and USDT flows stabilized, Bitcoin moved into strong medium-term recovery phases. The normalization of liquidity conditions preceded meaningful upside in prior cycles.

The current setup presents a conditional risk-reward scenario. If USDT contraction continues, downside pressure may extend further.

If flows flatten or reverse, the asymmetry shifts rapidly toward upside potential. Extreme liquidity stress has historically marked opportunity, but only once selling exhaustion is confirmed by stabilizing on-chain flows.

Crypto World

BitGo Selected To Issue FYUSD Dollar-Pegged Stablecoin

Digital asset company New Frontier Labs has partnered with BitGo Bank & Trust National Association, the entity that crypto infrastructure company BitGo will use to issue and provide custodial services for the FYUSD stablecoin, a dollar-pegged token for Insitutional investors in the Asia region.

BitGo’s announcement said FYUSD is compliant with the GENIUS Act stablecoin regulatory framework. The regulations include 1:1 backing with cash deposits held by a custodian or short-term US government debt instruments, anti-money laundering (AML) requirements and know-your-customer (KYC) checks.

The company also developed “Fypher,” a suite of stablecoin infrastructure tools that provides a “programmable settlement” layer for the FYUSD token that allows it to be used by autonomous AI agents for commercial transactions.

US Treasury Secretary Scott Bessent has touted stablecoins as a way to preserve US dollar dominance by reducing settlement times, transaction costs and democratizing access to US dollars for individuals without access to traditional banking infrastructure.

Related: 21Shares taps BitGo for expanded regulated staking, custody support across US, Europe

Stablecoins are down from the market cap peak of over $300 billion

The total market capitalization of stablecoins is over $295 billion at the time of this writing, according to RWA.XYZ, down from the peak of over $300 billion recorded in December.

Stablecoin issuer Tether, the issuer of the USDt (USDT) dollar-pegged token, is on-track for the steepest monthly drop in USDt circulating supply since the collapse of the FTX crypto exchange in 2022. At time of writing, circulating supply was 183.64 billion USDT, CoinMarketCap data showed.

While USDt remains the world’s largest stablecoin by market capitalization, its circulating supply is down $1.5 billion so far in February, data from Artemis shows. This is shaping up to be the second month of ramped up user redemptions, following a $1.2 billion drop in January.

Stablecoin redemptions could signal a broader contraction in the crypto market, as investors liquidate their positions and move their holdings off-chain, potentially into other investments.

However, spokespeople for Tether told Cointelegraph that the data represent short-term positioning, rather than a long-term trend of sustained outflows and market contraction.

Magazine: Bitcoin payments are being undermined by centralized stablecoins

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World6 days ago

Crypto World6 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports6 days ago

Sports6 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics16 hours ago

Politics16 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech6 days ago

Tech6 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video6 days ago

Video6 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech5 days ago

Tech5 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports4 days ago

Sports4 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business10 hours ago

Business10 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business6 hours ago

Business6 hours agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business5 days ago

Business5 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech5 hours ago

Tech5 hours agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

Politics6 days ago

Politics6 days agoEurovision Announces UK Act For 2026 Song Contest

-

NewsBeat4 hours ago

NewsBeat4 hours agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum