Crypto World

How High Can Ripple (XRP) Go Next Week? 4AIs Make Bullish Predictions

Can XRP spike to $2 or beyond as early as next week?

While Ripple’s cross-border token crashed to almost $1.10 on February 6, bulls have since stepped in to stabilize the valuation, which currently trades around $1.55.

The question now is whether next week can deliver further gains and how high the price could go. Here’s what four of the most widely used AI-powered chatbots said on the matter.

The Bulls

ChatGPT estimated that the most probable outcome for the week ahead is for XRP to rise to roughly $1.60, which it did on Sunday, but has yet to reclaim that level. It claimed that a move north is much more plausible than a renewed crash, based on recent investor behavior.

“At the moment, XRP looks more like it’s in a stabilization phase rather than the beginning of a major breakout. The bounce from around $1.10 to $1.50 shows that buyers stepped in aggressively at lower levels, which is constructive. However, sharp rebounds are often followed by consolidation before any serious continuation higher,” its analysis reads.

The chatbot projected that an explosion to as high as $2 next week is also possible, but it would depend heavily on a major catalyst, such as a solid revival of the broader crypto market or huge news concerning Ripple and its ecosystem.

Grok – the chatbot integrated within X – agreed with ChatGPT’s assumption that XPR is most likely to surge and maintain $1.60 next week. Nonetheless, it projected that such a scenario will only be possible if the price reclaims decisively the important zone of $1.40. Grok also envisioned a jump to as high as $1.80 but expects the rally to occur toward the end of February rather than in the following seven days.

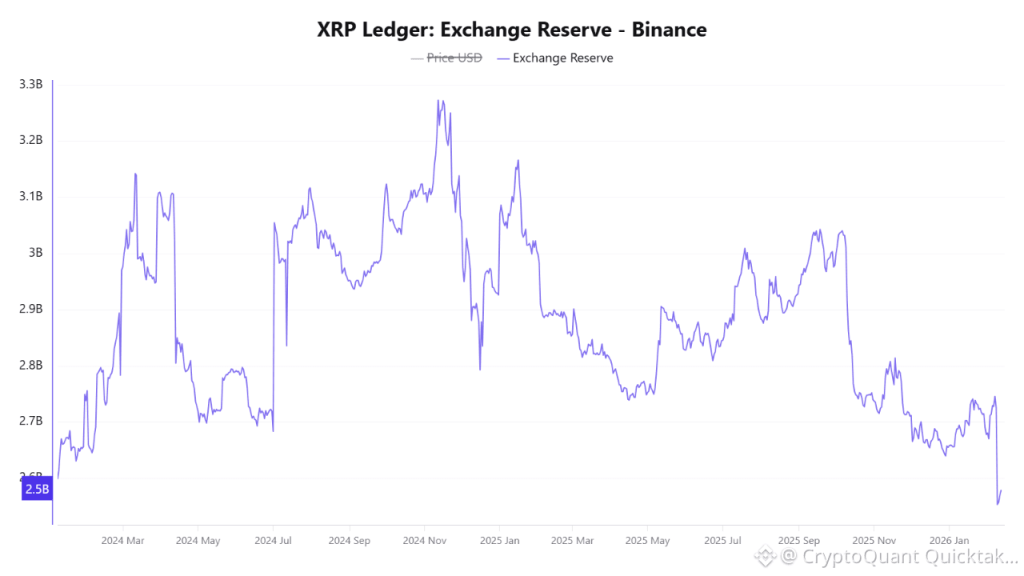

Several indicators, including the declining amount of XRP held on the largest crypto exchange, Binance, and the formation of certain technical setups, reinforce the bullish thesis.

The Bears

Unlike the aforementioned chatbots, Perplexity is pessimistic about XRP’s performance next week and expects the price to decline. It outlined that investor sentiment has been quite depressing lately, predicting that the price may drop to as low as $1.24 in the coming days.

You may also like:

Google’s Gemini also envisioned a bearish tilt in the week ahead. It noted that February has historically been a challenging month for XRP, characterizing the $1.35 – $1.40 range as “the line in the sand.”

“This level isn’t just a number – it’s the technical floor that has been holding the ‘February slide’ together. XRP is hovering right on that edge, and if it plummets below this, it could open the door to a further plunge to as low as $1,” it concluded.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

prediction markets must shift from betting

Ethereum co-founder Vitalik Buterin warned that prediction markets are sliding toward “unhealthy product market fit” by focusing on short-term cryptocurrency price bets and sports betting.

Summary

- Vitalik warns prediction markets are becoming short-term gambling tools.

- He urges a pivot toward hedging and real-world risk management uses.

- Proposes personalized prediction baskets replacing fiat stability.

Writing on X, Buterin called the trend “corposlop” and argued platforms feel pressured to embrace dopamine-driven content that lacks long-term societal value.

Buterin proposed redirecting prediction markets toward hedging use cases, including a system where personalized prediction market baskets replace fiat currency entirely.

“We do not need fiat currency at all! People can hold stocks, ETH, or whatever else to grow wealth, and personalized prediction market shares when they want stability,” he wrote.

Current model relies on traders with “dumb opinions”

Buterin identified three types of actors willing to lose money in prediction markets: naive traders with incorrect opinions, info buyers running automated market makers to learn information, and hedgers using markets as insurance to reduce risk.

The industry currently depends on naive traders and creates what Buterin called a “fundamentally cursed” dynamic.

“It gives the platform the incentive to seek out traders with dumb opinions, and create a public brand and community that encourages dumb opinions to get more people to come in. This is the slide to corposlop,” he wrote.

Personalized prediction baskets could replace stablecoins

Buterin questioned whether an “ideal stablecoin” based on decentralized global price indices is the right solution. “What if the real solution is to go a step further, and get rid of the concept of currency altogether?” he asked.

The proposed system creates price indices for all major categories of goods and services, treating physical items in different regions as separate categories.

Each user maintains a local large language model understanding their expenses, offering personalized baskets of prediction market shares representing future spending needs.

Users could hold stocks, ETH, or other assets for wealth growth while holding personalized prediction market shares for stability. The system removes fiat currency dependence while allowing customization for individual expense patterns.

Implementation needs prediction markets denominated in assets people want to hold: interest-bearing fiat, wrapped stocks, or ETH. Non-interest-bearing fiat carries opportunity costs that overwhelm hedging value.

“Both sides of the equation are likely to be long-term happy with the product that they are buying, and very large volumes of sophisticated capital will be willing to participate,” Buterin concluded.

Crypto World

Crypto Sentiment Set to Rise After CLARITY Act Passes

Passing the CLARITY crypto market structure bill could lift sentiment amid a broad downturn, according to United States Treasury Secretary Scott Bessent. In a CNBC interview, he described the bill’s stall as a drag on industry morale, noting that clarity on the framework would provide a much-needed anchor for investors and incumbents alike. He emphasized that moving the legislation forward quickly—ideally by spring, in the window between late March and late June—could set the tone for a more predictable regulatory environment as the political landscape shifts ahead of the 2026 midterm elections. Bessent warned that congressional dynamics, particularly the potential rebalancing of control in the House, will influence the odds of a deal becoming law.

“In a time when we are having one of these historically volatile sell-offs, I think some clarity on the CLARITY bill would give great comfort to the market, and we could move forward from there.”

In a time when we are having one of these historically volatile sell-offs, I think some clarity on the CLARITY bill would give great comfort to the market, and we could move forward from there.

I think if the Democrats were to take the House, which is far from my best case, then the prospects of getting a deal done will just fall apart,” Bessent continued. The Treasury secretary stressed that legislative motion on the bill should come “as soon as possible” and be sent to President Trump for signature within the spring window—an interval spanning roughly late March to late June—given the potential shift in political power during the 2026 midterms.

The broader discourse around the CLARITY Act has intersected with a series of policy conversations and industry concerns. White House officials had previously met with crypto and banking representatives to discuss stablecoins and market structure, signaling continued interest at the intersection of finance and regulation. The ongoing dialogue underscores the sensitivity of policy timing to electoral dynamics and the need for a credible legislative path to reduce uncertainty for participants across the ecosystem.

The 2026 midterm elections could throw a wrench in Trump’s crypto agenda

The balance of power in Washington often shifts during midterm years, a dynamic that former Magic Eden general counsel Joe Doll highlighted to Cointelegraph. The possibility that the House could tilt away from the current alignment injects additional risk into the policy calculus surrounding crypto-friendly reforms. Economic thinker Ray Dalio noted in January that a two-year window of political mandate could be undermined by a midterm verdict and the ensuing renegotiation of policy directions. If crypto-friendly principles are not codified into law, such political shifts could reverse the policy trajectories pursued during the administration. In the current landscape, the Republican Party holds a slim four-seat majority in the House (218-214), a distribution that means even narrow election outcomes could alter the calculus for reform.

Market watchers have also looked to prediction markets for a sense of how the midterms might unfold. Polymarket’s odds for the balance of power in 2026 project a split Congress as a plausible outcome (about 47%), with a Democratic sweep ranking at roughly 37% at the time of analysis. Those probabilities reflect the high degree of uncertainty that markets assign to policy continuity in crypto regulations, particularly if control of Congress remains contested. The numbers serve as a reminder that political risk remains a material variable for investors and firms navigating the regulatory landscape.

Sources and official references linked in coverage show that the policy conversation around the CLARITY Act is not happening in a vacuum. Reporting on the legislative posture, and the broader market implications, has drawn on remarks and analyses across major outlets and industry analyses, including coverage of the CLARITY Act’s political and market ramifications. The conversation also touches on the regulatory reception to stablecoins and market structure reforms, as seen in related reporting on White House discussions between regulators and industry participants.

As the discourse evolves, the question for market participants is how swiftly a clarified framework could be translated into enforceable rules and practical risk-management practices—without stifling innovation. A sooner movement toward clarity could reduce the anxiety that accompanies regulatory ambiguity, potentially supporting liquidity and risk appetite in a sector that has faced repeated bouts of volatility. But even with a clearer path to law, the degree to which the legislation aligns with the broader political project, and whether it endures through midterm shifts, will influence its effectiveness as a stabilizing force.

In this environment, the CLARITY bill stands out as a focal point where regulatory ambition meets political reality. The coming weeks and months will reveal whether the administration and lawmakers can reach a compromise that satisfies both investor protections and innovation-friendly constraints. The timing is tight: spring is traditionally the window for signature opportunities ahead of the new political cycle, and any delay could heighten the uncertainty that currently weighs on market sentiment.

The broader takeaway is that policy clarity matters more than ever when markets confront major volatility, and the next steps on the CLARITY Act could influence how the crypto sector allocates capital, builds infrastructure, and negotiates with traditional financial regulators. As the discussion continues, observers will be watching whether the administration can translate political will into a durable framework that supports both consumer protection and industry growth, while also accommodating the diverse interests that shape crypto policy in the United States.

What to watch next

- Progress of the CLARITY Act through congressional committees, with a focus on timing for floor action in the 2026 session.

- Any new White House statements or regulatory signals related to stablecoins and market structure reforms.

- Updates from key political actors as the 2026 midterms approach, including potential shifts in House control.

- Public commentary from major industry leaders and economists on the bill’s potential impact on liquidity and investor confidence.

- New polling or market-implied probabilities from prediction markets reflecting policy trajectory and election outcomes.

Sources & verification

- CNBC interview with Treasury Secretary Scott Bessent discussing the CLARITY bill and its potential impact (video, February 13, 2026).

- Crypto industry policy discussions and market structure debates referenced in Cointelegraph coverage on the CLARITY Act (Crypto industry split over clarity act).

- Cointelegraph reporting on White House discussions with crypto and banking reps about stablecoins and market structure (White House officials meeting market structure bill).

- Discussion of the 2026 US midterm balance of power and its implications for crypto policy (The balance of power typically shifts).

- Polymarket odds for the 2026 midterms and the likelihood of a split government (Polymarket: Balance of power 2026 midterms).

- US House data detailing party breakdown in the 118th Congress (data: pressgallery.house.gov).

Policy clarity could steer crypto markets through volatility ahead of 2026 midterms

The latest commentary from Treasury leadership underscores how regulatory clarity on the CLARITY Act is seen as a potential antidote to a period of heightened volatility in crypto markets. By framing a clear regulatory path, advocates argue it could ease caution among traders, reduce some of the overhang created by policy ambiguity, and possibly encourage more risk-taking in regulated venues. The argument is not merely about speed; it is about providing a stable, predictable framework that can accompany innovation rather than constrain it.

From a market dynamics standpoint, the timing is delicate. If the bill is advanced and signed into law ahead of the 2026 elections, industry participants hope for a period of relative policy continuity that could support capital formation and advanced product development. Conversely, a drawn-out process or a policy reversal in the wake of a midterm shift could reintroduce uncertainty, complicating executives’ investment theses and potentially altering capital flows across crypto markets and related financial instruments.

Ultimately, the CLARITY Act sits at the intersection of market structure discussions, consumer protection considerations, and the political calendar. The next steps will be telling: will policymakers align on a pragmatic framework that reduces risk without stifling innovation, or will partisan dynamics push reform onto a longer timeline? As observers weigh the odds of a spring signature, the industry remains focused on the broader trajectory of regulation, and on how that trajectory could influence liquidity, product development, and the appetite for regulated crypto ventures in a market that continues to grapple with volatility and regulatory ambiguity.

Crypto World

Hedera (HBAR) Price Breaks Out In Preparation for 60% Rally

Hedera price has surged in recent sessions, positioning HBAR for a breakout from a bullish chart pattern.

The recent move reflects improving sentiment across select altcoins. However, breakouts require follow-through buying.

Sponsored

Sponsored

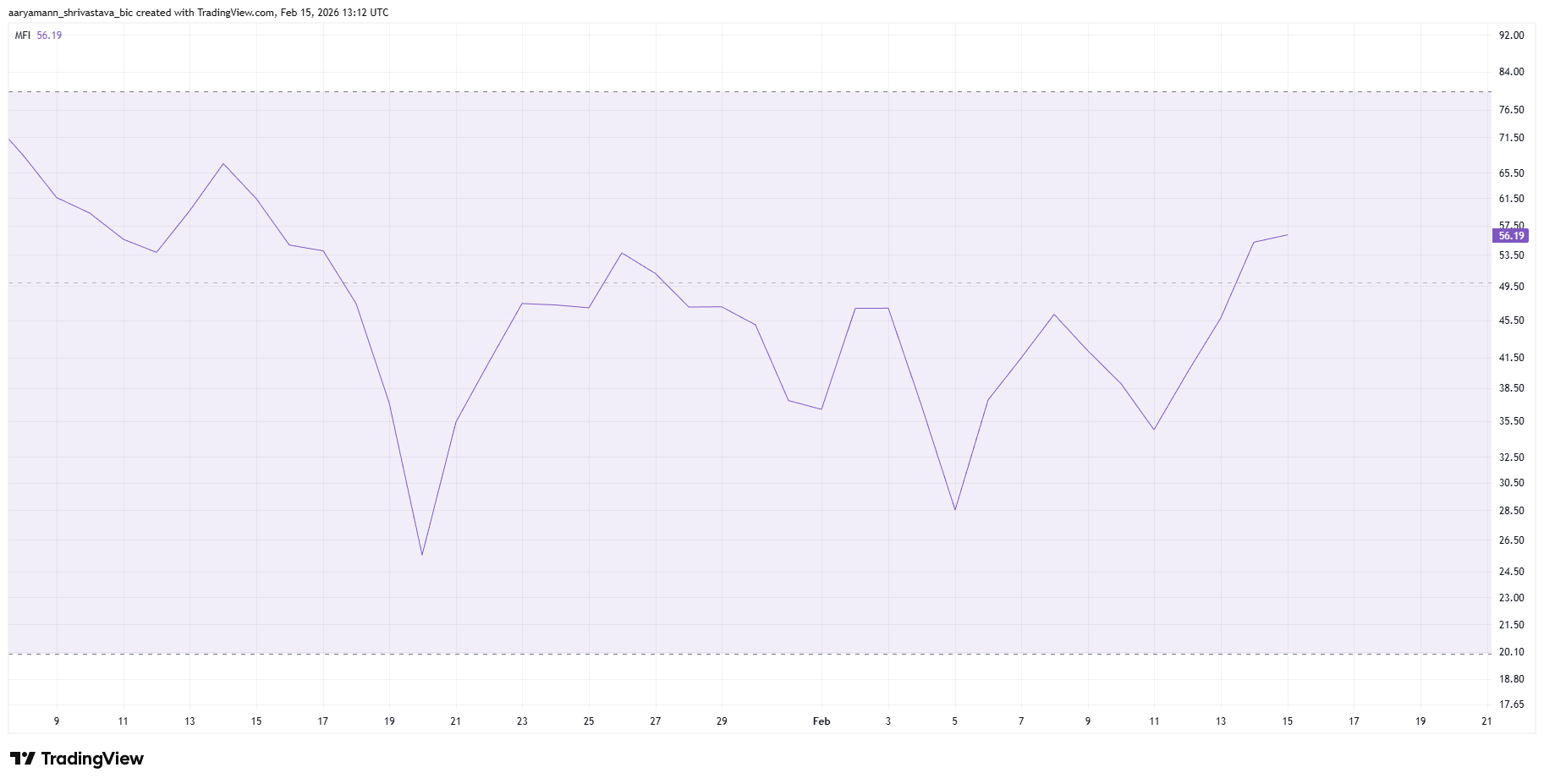

HBAR Investors Are Buying

The Money Flow Index indicates rising buying pressure for HBAR. The indicator has trended upward, signaling that capital is flowing back into the asset. Strengthening MFI readings often reflect growing demand during early recovery phases.

Investors appear to be accumulating as the price begins to climb. Increased participation provides liquidity support and reinforces bullish structure. If buying pressure continues building, HBAR could maintain upward momentum beyond near-term resistance.

The liquidation heatmap highlights $0.1084 as a critical level. Around that range, approximately $1 million worth of short positions could face forced liquidation. A move through this zone would likely accelerate upside volatility.

Short liquidations often create rapid price spikes. When bearish traders are forced to cover positions, buying pressure intensifies. For HBAR, clearing $0.1084 could serve as a catalyst for extended gains.

Sponsored

Sponsored

However, investors must sustain bullish momentum until that level is reached. Without steady accumulation, the market may struggle to generate the necessary pressure. Breakout durability depends on consistent inflows and reduced profit-taking.

HBAR Price Needs To Secure Support

HBAR price is trading at $0.1025, pressing against the $0.1030 resistance. Securing this level as support would confirm a breakout. However, a decisive close above resistance could shift sentiment toward sustained recovery.

The token has been moving within a descending broadening wedge. This formation projects a potential 57% rally upon confirmation. While that projection signals strong upside potential, a more realistic target lies near $0.1234, which would recover recent losses.

On the other hand, if investors begin booking profits prematurely, downside risk increases. A pullback toward $0.0901 support would invalidate the bullish thesis. Going forward, maintaining buying pressure remains essential for Hedera’s price to extend gains and sustain breakout momentum.

Crypto World

The Great Rotation: How Capital is Pumping Defensive Sectors While Dumping Tech Stocks

TLDR:

- Large-cap tech stocks have dumped back to September 2025 levels despite new highs in defensive sectors.

- Energy, utilities, and consumer staples pump to record levels as massive capital rotates from technology.

- Market concentration in tech means non-tech rallies cannot lift the S&P 500 without leadership change.

- Emerging markets see the highest inflows in a decade as capital rotates away from US large-cap technology.

Markets are witnessing a Great Rotation as capital flows out of technology stocks and into defensive sectors. Some stocks pump to new highs while former leaders dump to new lows.

Leadership has shifted dramatically from high-flying tech names to old economy sectors. The S&P 500 has barely moved since late October 2025 despite this massive reallocation. This pump, dump, and rotate dynamic raises questions about market direction.

Capital Reallocation Drives Historic Sector Divergence

Energy through XLE has absorbed massive capital inflows as investors rotate away from technology. Utilities experienced historic call volume on Friday during the rotation.

Industrials, materials, and consumer staples have all pumped to fresh highs. Even semiconductors have participated in gains alongside traditional sectors.

The rotation has created extreme bifurcation across markets. Large-cap tech stocks measured by MAGS have dumped back to September 2025 levels.

Software stocks tracked by IGV have declined sharply from previous peaks. This selling pressure has weighed heavily on the broader index.

Technology heavyweights act as anchors preventing the S&P 500 from advancing. Financials have also stagnated since December 2024 during this rotation phase.

The combination keeps the index flat despite pumping sectors elsewhere. Many individual names have dumped hard while others pump enough to offset losses.

Market concentration in technology remains at multi-decade highs heading into this rotation. Non-tech stocks can pump without moving market-cap weighted indexes meaningfully higher.

The dominance of large-cap tech means their performance drives overall index direction. This structure makes rotations particularly visible when leadership shifts.

Two Possible Outcomes for the Pump, Dump, Rotate Cycle

The current rotation mirrors aspects of the 2000 period when defensive sectors pumped. Risk-on technology faces pressure as capital rotates into consumer staples and utilities.

However, important structural differences exist between market environments across decades. Past patterns rarely repeat exactly despite surface similarities.

This rotation could resolve through two distinct scenarios. Technology weakness could spread and dump the broader market lower, like in 2000-2001.

Alternatively, tech could rebound from oversold levels and pump back into leadership. The second scenario appears more probable based on current conditions.

Sentiment on technology has rotated sharply in recent months. Investors previously applauded aggressive artificial intelligence spending across the sector.

Markets now question whether AI investments justify valuations as names dump. The selling has been indiscriminate across software and large-cap technology.

Capital has rotated heavily into emerging markets during this shift. EEM recorded its highest inflows in nearly a decade as money pumps international exposure.

Ex-US equity funds across all capitalizations have seen substantial increases. VEU has pumped for eight consecutive weeks during the rotation.

Put/call ratios spiked recently, suggesting elevated hedging activity. This rotation back into US tech could spark meaningful rallies if leadership shifts again.

Crypto World

Strategy Preferred Stocks Dominate US Market with $7B Issuance and Unique Tiered Structure

TLDR:

- Strategy’s $7 billion preferred issuance represented one-third of total US preferred stock market in 2025

- STRC trades $150 million daily, offering 4.5% daily liquidity versus typical illiquid preferred markets

- Yield spreads between STRF and STRD range from 2% to 5%, functioning as investor fear index for securities

- $2.25 billion USD reserve stabilized STRC near par value despite recent Bitcoin price volatility and declines

Strategy preferred stocks have emerged as a dominant force in the preferred equity market. The company issued $7 billion in preferred securities during 2025.

This volume represented one-third of all preferred stock issuances in the United States. The firm launched five distinct preferred instruments over the past year. Each security offers different risk profiles and yield characteristics for investors.

Structural Differences Drive Yield Variations Across Securities

Strategy has created a tiered preferred stock structure with notable distinctions. STRF stands as the senior-most preferred security with enhanced protective provisions.

The instrument includes dividend step-up penalties and MSTR board seat provisions. STRD shares the same 10% fixed dividend rate but ranks junior to STRF. The subordination results in fewer governance protections for STRD holders.

Market pricing reflects these structural differences through yield spreads. STRF consistently trades at 2% to 5% lower effective yield compared to STRD.

This spread serves as a fear index for Strategy’s preferred complex. When the yield difference widens to 5%, investor concern increases relative to narrower 2% spreads.

Crypto analyst Cern Basher highlighted the relationship between Strategy’s equity issuances on X. The common equity and preferred stocks work together in the capital structure.

Strategy issued $16.3 billion in common equity during 2025. This represented 6% of all US common equity issuance for the year.

STRC Brings Variable Rates and Enhanced Liquidity

STRC functions as a perpetual non-convertible preferred stock with monthly dividend resets. The initial dividend rate started at 9% upon issuance.

Strategy has increased the rate six times to reach the current 11.25% level. The security represents the largest preferred issuance with $3.37 billion outstanding.

Liquidity distinguishes Strategy’s preferred stocks from typical market offerings. STRC trades approximately $150 million daily, equating to 4.5% of total market value.

Other Strategy preferreds collectively trade between $100 million and $200 million per day. Most preferred stocks in the broader market require invitations to trade.

The variable rate structure creates different risk characteristics versus fixed-rate securities. STRD carries long duration and interest rate sensitivity.

STRC maintains short duration with minimal interest rate exposure. Market data shows STRD trades with a volatility risk premium ranging from 1.5% to 4%.

USD Reserve Reduces Volatility and Tightens Spreads

Strategy established a $1.44 billion USD reserve on December 1, 2025. The company subsequently expanded this reserve to $2.25 billion.

This cash position complements the approximately $50 billion Bitcoin treasury. The reserve creation dramatically reduced STRC volatility in the marketplace.

Recent Bitcoin price declines tested the preferred stock complex. STRC maintained trading levels near its $100 par value throughout the downturn.

The spread between STRC and STRF narrowed following the reserve announcement. Current yield differences range from nearly zero to almost 2% between these securities.

The reserve backing changed investor perception of stress risk across the preferred stack. Tighter spreads emerged as confidence in liquidity support increased.

Strategy continues issuing additional STRC securities despite Bitcoin market volatility. The seasoning process demonstrates how structural features influence relative pricing dynamics.

Crypto World

In bitcoin crash, ETF flows are down, but don’t signal investor panic

Bitcoin’s massive slump from a record price above $126,000 last October has darkened sentiment across the crypto landscape. Faith has been shaken in a trade that was viewed as a digital rival to gold as a store of value, and as a risk-on asset that would continue to boom alongside a crypto-friendly Trump administration.

Since the all-time high price last October, bitcoin has lost almost half its value and its inability to bounce back in trading is increasing fears about another “crypto winter” — a prolonged slump similar to the time of the FTX crash in 2022 when bitcoin fell from near $50,000 to as low as $15,000. In the past month alone, bitcoin is down over 25%.

But crypto investing experts on the latest CNBC “ETF Edge” say a look at the recent flows into and out of bitcoin and crypto exchange-trade funds suggests that long-term investors are not abandoning the asset class. Money has certainly moved out, but they say not to a level that suggests long-term investor panic.

Over the past three months, the iShares Bitcoin Trust (IBIT) has seen approximately $2.8 billion in net outflows. That is substantial, but over the past year, the BlackRock ETF has attracted near $21 billion in net inflows, according to VettaFi.

The broader spot bitcoin ETF category shows a similar pattern. Over the past three months, the ETF asset class has experienced roughly $5.8 billion in net outflows. Over the past year however, spot bitcoin ETFs have brought in around $14.2 billion in net inflows. Money is exiting, but the majority of assets have remained in placed, and some say the money being pulled isn’t from the long-term investor or financial advisor that have begun allocating assets to crypto.

“It’s not the ETF investors who are driving the sell off,” said Matt Hougan, Bitwise Asset Management CIO, on “ETF Edge.”

He says much of the broader pressure in bitcoin may be coming from crypto investors who accumulated positions over many years and are now trimming exposure. “It’s really a tale of two sides,” Hougan said. There are hedge funds and short-term traders who use the most liquid ETFs as tools and may pull capital quickly when momentum turns negative.

At CNBC’s Digital Finance Forum last week, Galaxy CEO Mike Novogratz said the crypto market’s “era of speculation” may be ending, and returns going forward will be more like a long-term investment holding. “It’s going to be real world assets with much lower returns,” he said at the CNBC event in New York City last Tuesday. “Retail people don’t get into crypto because they want to make 11% annualized,” he said. “They get in because they want to make 30 to one, eight to one, 10 to one.”

Financial advisors at Wall Street banks are among those adding bitcoin to investor portfolios, and adding their own branded crypto ETFs. And longer horizon investors who hold crypto as a small allocation within diversified portfolios may be willing to ride out volatility, Hougan said. If investors were capitulating across the board, the outflows over the past three months would likely approach the scale of the prior 12 months inflows.

Not that the ETF asset flow analysis makes it any easy of a period to stomach for a recent crypto investor. “It’s tough to be a bitcoin investor right now,” said Will Rhind, founder & CEO of ETF company GraniteShares on “ETF Edge.” He added that the performance of other “hard” assets, like gold, has added to the bitcoin distress. For investors who have supported the “digital gold” concept, the bitcoin price crash has been unsettling. “This is not supposed to happen,” he said of a period of time when other safe haven assets perform strongly and bitcoin continues to drop. When bitcoin is going down nearly 50%, “gold’s not supposed to go to all time highs,” he said.

Performance of the iShares Bitcoin Trust versus the SPDR Gold Shares Trust over the past year.

Sign up for our weekly newsletter that goes beyond the livestream, offering a closer look at the trends and figures shaping the ETF market.

Crypto World

Study Suggests WLFI Could Act as an Early Warning Signal for Crypto

A new Amberdata analysis suggests that a niche DeFi token linked to the Trump family may have warned markets of stress well ahead of a broader crypto downturn. The study examines activity around World Liberty Financial Token (WLFI) on Oct. 10, 2025, a day when roughly $6.93 billion in leveraged crypto positions were liquidated within an hour. On the same day, Bitcoin and Ether moved decisively lower, with smaller altcoins bearing heavier losses. At the time, Bitcoin was hovering near $121,000, showing limited immediate stress, while WLFI exhibited a pronounced decline hours before the wider market sell-off began to unfold.

The Amberdata report, available here, investigates how WLFI’s unusual price and liquidity dynamics interacted with the rest of the market as tariff news circulates in the political arena. The exploration follows a market episode in which macro headlines translated into rapid, asset-specific reactions, highlighting how a single instrument can behave as a bellwether in a highly leveraged crypto ecosystem.

“A five-hour lead time is hard to dismiss as coincidence,” said Mike Marshall, the analyst who authored the work. “That duration is what separates a genuinely actionable warning from a statistical artefact.” The study emphasizes that this signal is not a claim of insider trading but an observation about how the architecture of crypto markets can amplify the relevance of smaller, highly leveraged tokens when headline-driven stress hits liquidity chains.

WLFI anomalies before the selloff

Researchers focused on three telltale patterns that contrasted WLFI with the broader market: a surge in trading activity, a divergence from Bitcoin, and extreme leverage. WLFI’s hourly volume spiked to roughly $474 million, about 21.7 times its normal level, within minutes of tariff-related political news. At the same time, funding rates on WLFI perpetual futures climbed to about 2.87% every eight hours, translating to an annualized borrowing cost near 131%. These indicators fed into a narrative that the token was disproportionately sensitive to stress, even as the rest of the market looked comparatively placid shortly before the wave of liquidations hit.

The study does not assert insider knowledge or illicit trading; rather, it argues that the market structure can magnify the impact of asset-specific signals. One striking observation was WLFI’s holder base, which appears concentrated among politically connected participants, unlike the widely distributed ownership seen in Bitcoin. Marshall described the pattern as “instrument-specific,” with activity concentrated primarily in WLFI rather than across the crypto complex.

Timing mattered. The data show volume acceleration occurring roughly three minutes after public tariff headlines spilled into the market. Marshall notes that such rapid movement points to prepared execution rather than a collective, retail interpretation of headlines in real time. The implication, for researchers and market participants, is that under particular regulatory or geopolitical moments, an asset with high leverage and a tight, politically connected user base can become a pressure point in a broader liquidation cascade.

Another facet of the analysis ties WLFI’s stress to the mechanics of crypto collateral. In many trading venues, traders pledge a range of assets as collateral for borrowed positions. When WLFI’s price declined sharply, the value of those collateral pools fell, prompting forced liquidations of holdings like Bitcoin and Ether (CRYPTO: BTC, CRYPTO: ETH) to meet margin calls. In a market already under strain, those liquidations can amplify selling pressure across the broader ecosystem, pushing prices lower and triggering a wider selloff in a short span of time.

While WLFI’s decline appeared to precede the broader market’s weakness, Amberdata’s analysis stresses that the link is not deterministic. The report cautions against overinterpreting a single event as a predictive blueprint. Still, the authors argue that the episode offers a compelling glimpse into how leverage, asset-specific dynamics, and headline-driven liquidity shocks can interact in ways that amplify risk for other assets.

“If this were superior analysis (sophisticated participants reading the tariff headlines faster and drawing better conclusions) you’d expect to see that reflected more broadly,” Marshall said. “What we actually saw was concentrated activity in WLFI first.” The timing underscores a broader theme in crypto markets: signal concentration can precede systemic moves, at least in certain stress scenarios.

WLFI’s role in a market-wide cascade

Amberdata’s contemporaneous measurements indicate that WLFI’s realized volatility surged to levels nearly eight times those of Bitcoin during the stressed period, underscoring how sensitive highly leveraged assets can become when macro news hits. The researchers emphasize that such patterns do not necessarily predict downturns in a universal sense; instead, they can reveal how micro-architecture—structure of leverage, liquidity distribution, and collateralization—can produce early stress signals within a single instrument that eventually feeds into broader market dynamics.

From the perspective of risk managers and traders, the WLFI episode offers a cautionary note about risk concentration and cross-asset contagion. The fact that perimeter assets with concentrated ownership and high leverage can falter first means that monitoring instrument-specific signals may help identify pockets of fragility before they cascade. It also highlights the importance of robust margin and collateral frameworks that can absorb sudden shifts without triggering a rapid domino effect across correlated assets such as BTC and ETH.

Beyond the immediate market mechanics, the report sits at the intersection of policy headlines and digital asset pricing. The per-minute reaction time to tariff news illustrated how quickly information can translate into liquidity discipline—especially for assets that exist in a tight governance loop and are used as collateral in high-leverage positions. In a space where liquidity conditions can change in minutes, observers say the WLFI episode demonstrates why market participants must consider asset-level dynamics as a potential early warning tool, even if it does not guarantee predictive accuracy in every case.

Researchers acknowledge that WLFI’s linkage to the broader market depends on a confluence of factors—headline risk, macro policy signals, and the health of the DeFi ecosystem. The study’s broader implication is not that WLFI alone can forecast downturns; rather, it highlights how ecosystem fragility—driven by leverage, concentrated ownership, and instrument-specific behavior—can materialize in ways that precede shared downturns. As the crypto market continues to evolve, such signals may become an integral part of risk dashboards for sophisticated traders and institutions alike.

In a landscape where large-cap assets often dominate liquidity analyses, this episode serves as a reminder that smaller tokens with outsized leverage and targeted holder bases can temporarily steer attention toward systemic risk factors that would otherwise remain hidden. The question for market participants is whether these signals can be corroborated through additional data sets and repeated across multiple events, a task that will require more observations and longer time horizons to confirm transferability.

For now, Amberdata’s report remains a compelling case study in market microstructure: a single instrument with a distinctive balance of leverage and concentration can illuminate how stress travels through a network of collateralized positions, triggering liquidations that ripple through the broader market. As regulators and participants weigh the implications, the WLFI episode underscores the ongoing need for transparent data and robust risk controls in a crypto ecosystem that remains vulnerable to headline-driven shocks.

What to watch next

- Whether the WLFI signal can be replicated across other event windows or markets, and how often such lead times occur in future stress scenarios.

- Any regulatory or investigative developments related to WLFI, including disclosures about its holdings and governance structure.

- Shifts in liquidity provision and margin requirements on major derivative platforms amid geopolitical headlines.

- Further research from data providers validating instrument-specific stress signals and their predictive value for market-wide liquidations.

Sources & verification

- Amberdata, “coincidence or signal: did WLFI telegraph cryptos’ $6.93B meltdown?” (Oct. 2025) and related data on WLFI activity around Oct. 10, 2025.

- Cointelegraph, coverage of the Oct. 10, 2025 market crash and leveraged liquidations linked to tariff headlines.

- Senators request probe into WLFI stake and related governance questions (UAE-linked stake in WLFI).

- Reports on WLFI plans for foreign exchange and remittance platforms, highlighting the token’s evolving governance footprint.

Market signal and the WLFI episode: what it means for investors and the ecosystem

Crypto World

US Banking Giant Morgan Stanley is Hiring for Crypto Jobs

Morgan Stanley, the $9 trillion banking giant, is aggressively advancing its crypto infrastructure capabilities in DeFi and real-world assets tokenization.

The move aligns with a broader wave of traditional financial institutions seeking skilled staff to tap into the US’s current pro-crypto posture.

Morgan Stanley Ramps up DeFi and Tokenization Push

According to a job posting on LinkedIn, the Wall Street giant is seeking a senior-level engineer to direct its blockchain architecture.

Sponsored

Sponsored

Notably, the job description explicitly mentions “decentralized finance (DeFi)” alongside tokenization as a core focus area.

These two sectors have emerged as the fastest-growing verticals within the crypto economy. Data from analytics platform DeFiLlama indicates that DeFi protocols and real-world asset tokenization projects now command more than $100 billion in combined total value locked (TVL).

To capitalize on this growth, the successful candidate will be tasked with building “scalable, secure, and regulatory-compliant solutions.” These systems would be designed to bridge the gap between traditional banking requirements and the emerging digital asset industries.

The posting requires proficiency in four distinct blockchains, including Ethereum, Polygon, Hyperledger, and Canton.

This combination suggests a tiered strategy using Ethereum and Polygon to provide public network liquidity and Layer-2 scaling efficiency.

Conversely, the firm appears set to deploy Hyperledger and Canton for institutional-grade, privacy-preserving permissioned transactions.

This infrastructure build-out aligns with Morgan Stanley’s broader crypto-related roadmap.

The firm is preparing to launch a proprietary crypto trading service on its E*Trade platform in the first half of 2026. The new offering will support trading for Bitcoin, Ethereum, and Solana.

The move mirrors aggressive expansion by traditional finance (TradFi) competitors. Asset management giant BlackRock and Fidelity have already begun interacting with these sectors to tokenize institutional funds.

At the same time, there has been a noticeable surge in blockchain-related vacancies at traditional financial giants like JPMorgan Chase.

This signals that the sector is transitioning from experimental pilot programs to the development of permanent, revenue-generating digital asset products.

Crypto World

Binance XRP Reserves Drop to 2024 Lows as Traders Eye Accumulation Signal

Binance reserves have dropped to levels not seen since early 2024, and the timing is interesting. Right as liquidity thins out, price ripped 4.5% toward $1.50. That is not a coincidence the market can ignore.

On chain data shows Binance now holds only about 2.5 billion XRP. That is a noticeable squeeze on the sell side. Less supply sitting on exchanges usually means less immediate selling pressure.

And with sentiment slowly turning bullish again, this kind of liquidity drain can add fuel fast. When supply tightens and demand wakes up at the same time, things can move quicker than most expect.

- Binance XRP reserves have plummeted to roughly 2.5 billion, the lowest point since early 2024.

- Nearly 700 million coins have exited the exchange since November 2024, signaling a potential move to cold storage.

- Analysts interpret shrinking exchange balances as a classic accumulation signal that reduces selling pressure.

Is a Supply Shock Incoming?

The shift is not small. In November 2024, Binance was holding around 3.2 billion XRP. Now that number is closer to 2.5 billion. That is roughly 700 million tokens gone, about 22% of the stack wiped from exchange wallets in just over a year.

Analysts says this kind of drop usually signals tighter sell side liquidity. When coins leave exchanges, they often move into self custody. That is typically a longer term play, something institutions and whales tend to do when they are positioning, not trading.

What makes it more interesting is the timing. This reserve drain happened right after Binance rolled out full XRPL support for RLUSD. Many expected higher on chain velocity. Instead, XRP itself started flowing out.

Less supply on exchanges. Stronger price reaction. That combination is getting hard to ignore.

The Short Squeeze Scenario

What happens next comes down to funding rates. XRP funding recently hit 10 month lows, and historically that kind of reset has often come before strong upside moves.

If shorts are getting crowded while exchange supply keeps shrinking, a clean break above $1.55 could spark a sharp squeeze toward $1.80.

The setup is also getting support from improving regulatory sentiment, especially with Ripple leadership gaining more visibility in Washington.

For now, $1.45 is the key level to watch. If price holds there while reserves continue falling, that is the kind of confirmation bulls want before aiming for new highs.

The post Binance XRP Reserves Drop to 2024 Lows as Traders Eye Accumulation Signal appeared first on Cryptonews.

Crypto World

Bitcoin Volatility Subsides as Exchange Inflows Drop 90% After Peak Panic Selling

TLDR:

- Bitcoin recorded over 52% drawdown from all-time high as price fell below $60,000 on February 6

- Binance processed 25,000 BTC in panic-driven inflows before dropping threefold to 8,400 BTC recently

- Coinbase Advanced saw inflows plunge tenfold from 17,600 BTC peak to just 1,400 BTC in recent days

- Declining exchange inflows across platforms suggest selling pressure has largely subsided for now

Bitcoin volatility continues to test market participants as the leading cryptocurrency experiences a prolonged correction phase.

The digital asset dropped below $60,000 on February 6, recording a drawdown exceeding 52% from its all-time high. Exchange inflow data reveals panic-driven selling across both retail and institutional segments.

However, recent trends suggest selling pressure may be stabilizing as inflows decline substantially across major trading platforms.

Exchange Inflows Reveal Widespread Market Stress

The cryptocurrency market faced intense pressure on February 5 when Bitcoin inflows to exchanges surged dramatically.

Trading platforms recorded unusually high volumes as investors rushed to liquidate positions. This behavior reflected growing concerns about further price deterioration across the market.

Binance processed approximately 25,000 BTC in inflows during this period. The platform represents the largest global trading volume and serves a diverse user base.

The substantial flow indicated widespread selling activity across different investor categories. Market analyst Darkfost highlighted these developments in a detailed thread on the social media platform X.

Coinbase Advanced recorded 17,600 BTC in inflows on the same day. This figure represented a fivefold increase compared to early February levels.

The US-regulated platform primarily serves professional and institutional traders. The elevated activity demonstrated that sophisticated investors were not immune to market stress.

Both platforms experienced similar patterns despite serving different market segments. Retail traders and institutional participants alike moved assets onto exchanges for potential sales.

The synchronized behavior across platforms intensified downward price pressure. This dynamic created a challenging environment for all market participants attempting to navigate the correction.

Recovery Signals Emerge as Selling Pressure Subsides

Market conditions have improved considerably since the early February peak in exchange activity. Binance inflows declined to 8,400 BTC in subsequent days.

This represents a threefold reduction from the earlier surge. The decrease suggests panic selling has largely subsided among the platform’s user base.

Coinbase Advanced experienced an even more pronounced decline in inflows. The platform recorded just 1,400 BTC in recent activity.

This marks a tenfold reduction from the February 5 peak. Professional and institutional investors appear to have stabilized their positioning strategies.

The declining inflow trend indicates that forced selling has largely concluded. Market participants who needed to liquidate positions have already done so.

Remaining holders demonstrate greater conviction in their investment thesis. This shift creates conditions for potential price stabilization.

A modest recovery is already underway as selling pressure eases. The cryptocurrency has begun regaining some lost ground in recent sessions.

Sustained recovery depends on whether demand can match or exceed remaining supply. Market observers continue monitoring exchange flows for signs of renewed accumulation or distribution patterns.

-

Politics7 days ago

Politics7 days agoWhy Israel is blocking foreign journalists from entering

-

Business7 days ago

Business7 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech15 hours ago

Tech15 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

Crypto World4 days ago

Crypto World4 days agoCrypto Speculation Era Ending As Institutions Enter Market