Crypto World

Hyperscale Data doubles down on Bitcoin as treasury hits 589 BTC

Hyperscale Data lifts its Bitcoin treasury to 589 BTC and targets $100m, using a strict dollar‑cost‑averaging plan as crypto remains a macro risk barometer.

Summary

- Hyperscale Data now holds 589.4502 BTC worth about $41.4m, aiming to scale its Bitcoin balance‑sheet position to $100m over time.

- The firm deploys at least 5% of allocated cash weekly into BTC via a disciplined dollar‑cost‑averaging strategy run through Sentinum and Ault Capital Group.

- Bitcoin, Ethereum, and Solana prices underscore the risk‑asset backdrop as external analyses flag elevated BTC volatility and deep drawdowns from 2025 highs.

Hyperscale Data tightens its grip on Bitcoin as treasury tops 589 BTC, sharpening a balance‑sheet bet on digital assets at a time when crypto remains the market’s rawest barometer of risk appetite.

Treasury milestone and $100m target

Hyperscale Data, Inc. said in a press release published today its Bitcoin treasury reached 589.4502 BTC as of February 8, 2026, with an implied value of roughly $41.4m at a closing Bitcoin price of $70,264. The company reiterated that its goal is to accumulate $100m worth of Bitcoin on its balance sheet over time.

Executive chairman Milton “Todd” Ault III framed the move as deliberate and incremental, stressing discipline over bravado. “We continue to demonstrate our dedication to our dollar‑cost average strategy,” he said, arguing that this approach “has allowed us to continually lower our average cost per Bitcoin and further strengthen the balance sheet and long‑term future of the Company.”

How Hyperscale is accumulating BTC

Through its subsidiaries Sentinum, Inc. and Ault Capital Group, Inc. (ACG), Hyperscale now holds 589.4502 BTC, with Sentinum controlling about 548.5903 BTC and ACG approximately 40.8994 BTC. Sentinum’s stack includes 108.3562 BTC mined in‑house and 440.2341 BTC bought in the open market, while ACG added 8.9000 BTC during the week ended February 8.

The firm plans to “fully deploy the cash allocated to its digital asset treasury (‘DAT’) strategy into Bitcoin purchases over time,” typically targeting at least 5% of allocated cash each week via daily buys, though actual deployment will flex with “market conditions and strategic considerations.” Management told investors to judge accumulation using multi‑week averages, consistent with first‑principles DCA practice common among institutional allocators.

Macro backdrop: crypto as risk gauge

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $69,095, with a recent 24‑hour range between roughly $69,319 and $70,123 and turnover anchored in deep, multi‑billion‑dollar spot and derivatives flows. Ethereum (ETH) changes hands near $2,060, down just over 2% on the session, after trading between about $2,000 and $2,150 over the last day. Solana (SOL) trades close to $83.9, slipping around 0.4% in the past 24 hours as volumes consolidate after a sharp multi‑week advance.

For readers tracking the broader context of Bitcoin’s pullback and volatility, recent analyses from outlets such as Phemex on BTC’s drawdown from its October 2025 highs, Journal du Coin’s coverage of the latest 50% correction, and XTB’s breakdown of the latest slide toward the high‑$60,000 region provide additional color on the forces shaping Hyperscale’s high‑conviction treasury strategy.

Crypto World

This Trending Meme Coin Explodes by 100% Weekly: What Comes Next?

Is this the new crypto sensation or just another scam?

The cryptocurrency market experienced a severe pullback in the past few weeks, culminating in a sharp crash on February 6.

The meme coin sector was significantly affected by the red wave, and most leading tokens in that niche have posted substantial losses. However, the lesser-known pippin (PIPPIN) defied the carnage and its valuation soared by over 100% in the past week.

Swimming Against the Tide

PIPPIN is a Solana-based meme coin that began trading in late 2024. It is themed around an AI-generated unicorn character named “Pippin,” which has become the logo of the token.

The meme coin had its glory days toward the end of 2025, when its price reached an all-time high of almost $0.60, and its market capitalization surpassed $500 million. While January was also positive, the beginning of February offered a deep correction.

In the past week, though, the asset entered another major uptrend, which contrasts with the overall bearish environment in the crypto market. As of press time, PIPPIN is worth roughly $0.38, or a 114% increase on a weekly basis.

Analysts are curious if the bull run is sustainable since there isn’t an evident catalyst driving the move north. X user ALTS GEMS Alert claimed the price has initiated a “strong bounce” from the demand zone at around $0.26, predicting that if buyers remain active, PIPPIN could soar to $0.40 and even $0.60.

Satori chipped in, too. The analyst told their over 700,000 followers on X that they have added the coin to their watchlist, arguing it has potential for much more impressive gains ahead.

You may also like:

A Ticking Time Bomb?

At the same time, some industry participants warned investors to stay away from PIPPIN, claiming its valuation is driven by pure speculation, and its utility is questionable.

X user Dippy.eth described the asset as “the largest scam of the past year,” arguing it has reached the first “take profit” zone. “0 technologies, 0 real metrics, 0 real users, 0 attention from real CT degens,” they added.

Crypto_Jobs is also pessimistic, envisioning a possible plunge to as low as $0.21. Some indicators, such as PIPPIN’s Relative Strength Index (RSI), support the bearish scenario. The technical analysis tool measures the speed and magnitude of recent price changes to help traders identify potential reversal points.

It ranges from 0 to 100, and readings above 70 suggest the valuation has risen too much in a brief period and could be due for imminent correction. Currently, the RSI stands at around 85.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

index falls 3.4% as all constituents trade lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

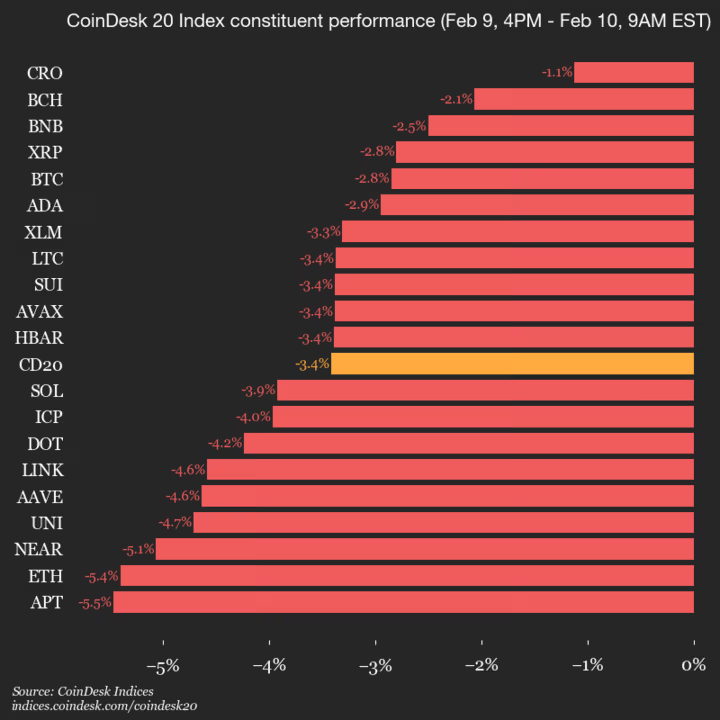

The CoinDesk 20 is currently trading at 1968.37, down 3.4% (-69.59) since 4 p.m. ET on Monday.

None of the 20 assets are trading higher.

Leaders: CRO (-1.1%) and BCH (-2.1%).

Laggards: APT (-5.5%) and ETH (-5.4%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Crypto exchange Kraken fires CFO Stephanie Lemmerman as long-awaited IPO draws closer

Kraken sacked its chief financial officer, Stephanie Lemmerman, just as the crypto exchange prepares to publicly list in the U.S. in the early part of this year, according to two people familiar with the matter.

Lemmerman joined Kraken from Dapper Labs in November 2024 and was the exchange’s CFO for one year and four months. She now has a strategic advisory role at Kraken, one of the people said.

Robert Moore, formerly VP of business expansion, has basically taken over her job, the person said. An updated leadership page on the website of Kraken’s parent company, Payward Inc., lists Moore as deputy CFO. Lemmerman does not appear.

Clearly it matters that Kraken has removed its CFO after lodging a confidential filing with U.S. regulators in November. That came just days after Kraken raised $800 million at a $20 billion valuation, including $200 million from Citadel Securities.

Other people who have been promoted to senior roles include Curtis Ting, who was made chief operating officer in December, and Kamo Asatryan was made chief data officer in January.

A second person familiar with the changes said finance at Kraken is changing to become more of a product than a back-office function.

Kraken declined to comment.

Crypto World

Michael Saylor downplays Strategy credit risk as bitcoin tumbles: ‘We’ll refinance the debt’

Strategy CEO Michael Saylor brushed off concerns about the company’s credit risk if bitcoin continues to tumble.

In fact, Saylor said he plans to keep accumulating the cryptocurrency for the company every quarter.

“If bitcoin falls 90% for the next four years, we’ll refinance the debt,” the executive said Tuesday on CNBC’s “Squawk Box.” “We’ll just roll it forward.”

Asked whether he believed banks would continue to lend to the digital asset treasury firm if bitcoin collapses, Saylor said, “Yeah, because the volatility of bitcoin is such that it’s always going to be a value.”

Bitcoin was last trading at $68,970.45, down 9% over the past five days. It has retreated as investors broadly reassess its utility, with the token tumbling 15% to $60,062.00 on Thursday — its lowest level in roughly 16 months. At its trough, the crypto was down more than 50% from its record.

Strategy has more than $8 billion in total debt on its balance sheet, in part due to its issuance of convertible notes used to buy bitcoin.

The executive also dismissed suggestions that Strategy would sell any of its digital asset holdings: “I expect we’ll be buying bitcoin every quarter forever,” Saylor said.

Strategy, 1 year

Strategy holds 714,644 bitcoins worth about $49 billion as of writing time, per its website. That makes it the largest corporate owner of the digital asset.

Saylor noted his firm has two-and-a-half years worth of cash on its balance sheet to cover dividends.

Strategy shed about 2% on Tuesday as bitcoin broke below $70,000 again. The stock has tumbled more than 40% over the past three months.

Crypto World

Vitalik Buterin outlines how the blockchain could play a key role in the future of AI

Ethereum co-founder Vitalik Buterin called for a rethink of how crypto and AI should come together, warning that a growing focus on developing artificial general intelligence (AGI) risks missing the bigger picture.

In a post on X that revisits ideas he first outlined two years ago, Buterin argues that the accelerated push toward artificial general intelligence often resembles the kind of unchecked speed and scale that Ethereum itself was created to challenge.

Rather than racing to build more powerful AI systems, he says the goal should be to guide AI development in a way that protects human freedom, spreads power more evenly and avoids both extreme AI risks and everyday security failures.

Buterin outlines a near-term vision where Ethereum plays an important — though not exclusive — role as infrastructure for AI. That includes tools to allow people to interact with AI models more privately, reducing the need to trust centralized providers. For example, running models locally, making anonymous payments for AI services and using cryptography to verify how AI systems behave.

He also describes Ethereum as a way for AI systems to coordinate economically, allowing bots to pay other bots, post security deposits, build reputations and resolve disputes without relying on a single company. Paired with AI tools that help people evaluate decisions and outcomes, Buterin argues these systems could make long-discussed ideas like decentralized governance work at real-world scale.

“To me, Ethereum, and my own view of how our civilization should do AGI, are precisely about choosing a positive direction rather than embracing undifferentiated acceleration of the arrow,” Buterin wrote on X.

Crypto World

MSTR stock eyes rebound, Strategy’s Michael Saylor: Bitcoin’s not for sale

The MSTR stock price remains in a deep bear market amid the ongoing crypto winter.

Summary

- The MSTR stock price could be on the verge of a strong bullish breakout.

- Michael Saylor insisted that Strategy will not sell Bitcoin.

- Instead, he believes that the company will keep buying Bitcoin forever.

Strategy was trading at $138 on February 10, down sharply from the all-time high of $542. Its market capitalization has slumped from a record high of over $133 billion to the current $39 billion.

Technical analysis: MSTR stock poised for rebound

The weekly timeframe chart shows that the MSTR share price has remained in a bear market in the past few months as Bitcoin (BTC) has plunged from its all-time high of $126,300 to the current $69,000.

There are signs that the stock is about to bottom. The most important sign is that the Relative Strength Index has plunged to 27, its lowest level since June 2022.

Strategy, previously known as MicroStrategy, jumped by over 2,700% the last time the RSI moved to this level. It jumped from ~$20 to a record high of $542.

The spread of the two lines of the Percentage Price Oscillator has narrowed, a sign that a bullish crossover is possible.

At the same time, the stock has settled at the 78.6% Fibonacci Retracement level, a sign that a rebound may happen soon.

If this happens, the next key target to watch will be the 61.8% Fibonacci Retracement level at $216 followed by $232, its lowest level in March and April last year.

Saylor confirms Strategy will not sell Bitcoin

Meanwhile, Saylor, the company’s founder and chairman, maintains his bullish outlook on Bitcoin, arguing that claims over whether the company would sell were unfounded and that he will continue buying.

Strategy bought 1,142 coins last week, bringing the total holdings to 714,644, which are now valued at over $49 billion. The company remains in the red, with an average cost per Bitcoin of $76,052.

Strategy’s balance sheet also has over $2.4 billion in cash, which is enough to cover dividends and debt maturities. He said:

We have two-and-a-half years’ worth of dividends in cash, our net leverage ratio is investment grade. We will not be selling. Instead, I believe we will be buying Bitcoin every quarter forever.

Saylor believes that Bitcoin will eventually bounce back as it has done in the last crypto bear markets. He also expects the coin to outperform traditional assets such as gold and the stock market.

Crypto World

Solana Historic Pattern Suggest a Recovery Rally is Incoming

Solana has spent recent sessions under heavy pressure, sliding to levels not seen in nearly two years. The sharp decline followed broader market weakness, dragging SOL well below prior support zones.

Despite the drawdown, early signs of stabilization are emerging. Historical patterns suggest Solana may be preparing for a recovery that could eventually carry the price back toward, and potentially beyond, the $100 mark.

Sponsored

Sponsored

Solana Has Seen Similar Conditions Before

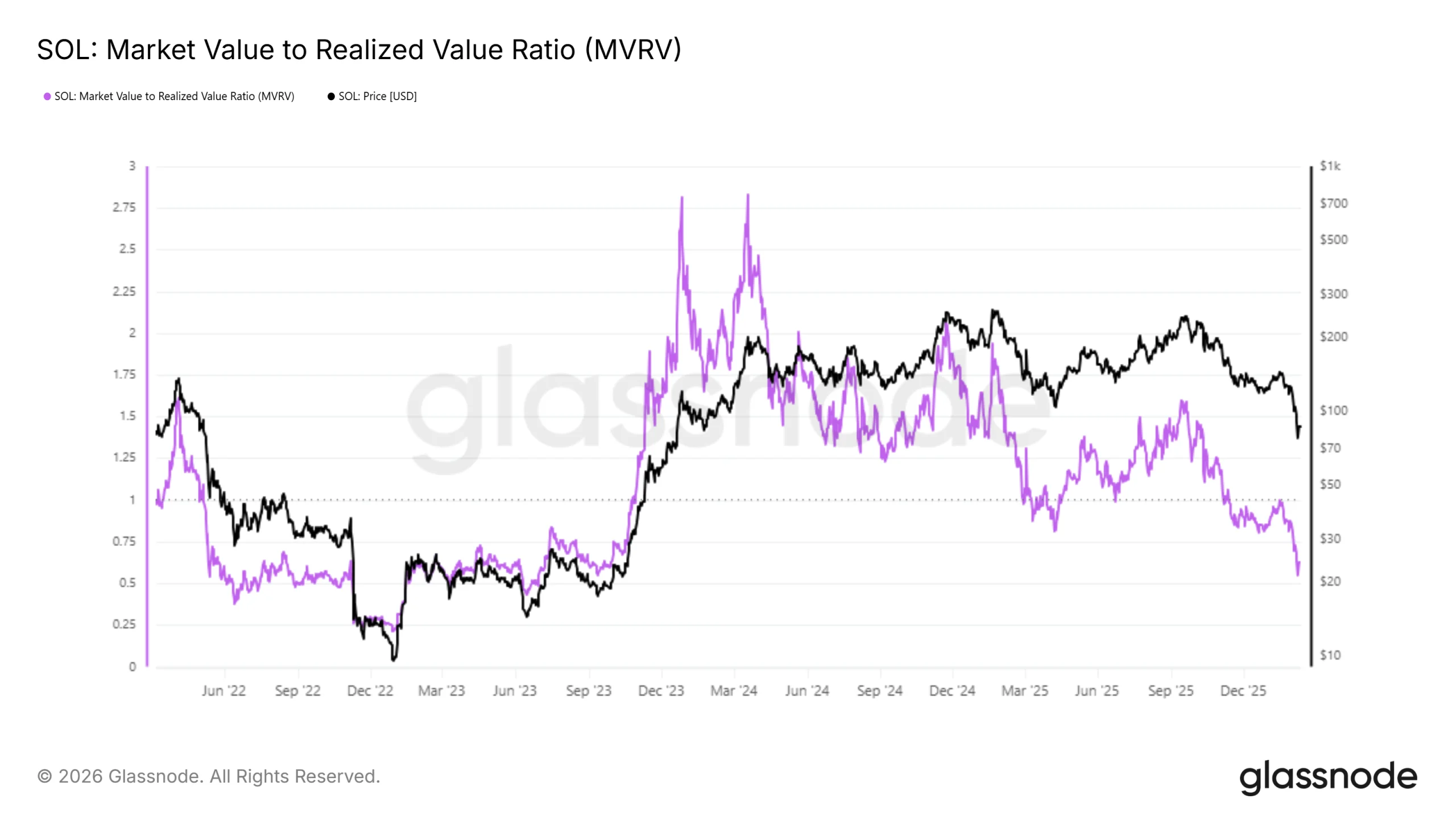

On-chain valuation metrics indicate Solana is deeply undervalued. The Market Value to Realized Value ratio has fallen to a near two-and-a-half-year low. This reading shows the market value of SOL is significantly below the aggregate cost basis of circulating tokens, reflecting widespread unrealized losses among holders.

Such conditions have historically marked late-stage corrections rather than early sell-offs. When realized value exceeds market value by this margin, selling pressure often diminishes. Investors become less inclined to exit at a loss, setting the stage for stabilization. This valuation imbalance supports the view that SOL is trading below fair value..

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Profitability data reinforces this outlook. Only 21.9% of Solana addresses are currently in profit, meaning roughly 78.1% of holders are underwater. This level of distress has historically aligned with market bottoms, as lower prices tend to attract demand from value-oriented participants.

Sponsored

Sponsored

In previous cycles, profitability dropping near or below 20% preceded notable recoveries. Reduced profit-taking limits supply, while depressed prices encourage accumulation. If history repeats, Solana could benefit from renewed interest as investors position for a rebound from deeply discounted levels.

SOL Price Bounce Back Requires Breaching This Level

Solana is trading near $86 at the time of writing, holding above the 23.6% Fibonacci retracement. This level is often described as bear market support. As long as SOL remains above it, downside risk appears contained, increasing the probability of a technical bounce.

Current stabilization suggests SOL may be forming a bottom. Any recovery will likely depend on improving capital flows. The Chaikin Money Flow indicator shows an uptick while still in negative territory. This shift suggests outflows are slowing, an early signal that selling pressure is easing.

A decisive move above $90 would place Solana on a recovery path toward $100. Confirmation would come if price flips the 61.8% Fibonacci level near $105 into support. Failure of inflows to materialize, however, could reverse progress. A drop below $81 would expose SOL to further declines toward $75 or even $70.

Crypto World

RIVER coin price bounces back 27%: analysts fear it could be a dead bounce

- RIVER coin price has surged 27% on bridge launch and new exchange listing.

- The cryptocurrency’s volume has spiked 126%, confirming strong buyer interest.

- Key support lies at $15.40, and a break below risks causing a $14.09 pullback.

RIVER coin has surged 27.4% in the past 24 hours, reaching an intraday high of $17.94.

The sudden spike comes after a period of relative stagnation, sharply outperforming a broader flat crypto market.

Traders are cautiously optimistic, but some analysts warn this could be a short-lived recovery.

The catalysts behind the rally

The primary driver of the rally was the launch of RIVER’s official cross-chain bridge.

This bridge allows seamless asset transfers between Ethereum, Base, and BNB Chain.

By enabling smoother liquidity flows, it addresses a core challenge faced by many DeFi projects.

At the same time, RIVER went live on LBank, a major centralised exchange, sparking fresh market activity.

$RIVER spot trading is live on @LBank_Exchange pic.twitter.com/U7HCPJR2dG

— River (@RiverdotInc) February 9, 2026

The exchange listing was accompanied by a $50,000 trading competition, which boosted short-term trading volume.

Combined, these events enhanced the token’s utility and made it easier for investors to access RIVER.

Volume data confirms the strength of the move, with a 126% surge in 24-hour trading volume to $83 million.

This shows that the rally was driven by genuine buying interest rather than thin order books.

The token also benefited from positive sentiment in the broader DeFi sector, which continues to attract investor attention.

RIVER coin price outlook

Analysts are watching key price levels closely to gauge the sustainability of the bounce.

If RIVER can hold above $15.40, it could attempt to reach a near-term target of $20.65.

This would represent a continuation of the current bullish momentum and strengthen confidence in the token’s recovery.

However, a break below $14.09 could signal that the rally has lost steam.

In that case, the coin may experience a pullback toward $12.50, testing lower support levels.

Traders are advised to monitor volume and bridge adoption as indicators of whether the move has lasting strength.

The rally also coincides with broader infrastructure upgrades, which could attract long-term users.

The cross-chain bridge is designed to simplify liquidity access and reduce fragmentation across networks.

Sustained adoption of this feature will be critical for supporting higher prices in the coming months.

Despite these positive factors, some analysts caution that the rebound could be a “dead mouse bounce.”

They argue that while short-term catalysts are present, the coin is still trading far below its all-time high of $87.73 that it hit at the beginning of the year 2026.

Price action remains fragile, and a failure to maintain support levels could result in another rapid decline.

Investors are therefore advised to weigh the recent gains against the risk of a correction.

The combination of technical indicators, exchange activity, and sector momentum will likely determine the next phase.

For now, the market is watching closely to see whether RIVER can convert its recent spike into a sustainable uptrend.

Crypto World

Stellar (XLM) outlook: recovery signals emerge amid long-term growth prospects

- Stellar (XLM) shows short-term recovery potential around $0.15–$0.23.

- Oversold indicators suggest a possible upward correction soon.

- Long-term adoption could drive significant value growth.

Stellar has recently shown signs of stabilising after a bearish period followed by consolidation.

The current XLM price hovers around $0.156, reflecting modest upward movement in the past 24 hours.

In addition, the token’s trading volumes remain healthy at nearly $97 million over the last day, signalling that market participants are actively engaging with the token.

Despite the ongoing volatility, the cryptocurrency is demonstrating key technical behaviours that hint at a potential recovery in the short term.

Short-term XLM recovery signals emerge

After a 31% decline in a month, the immediate support zone around $0.15 has been critical in preventing a further downside for Stellar Lumen’s XLM token.

Price action indicates that XLM is testing a make-or-break region, where sellers have been active but not dominant.

Exchange inflows data suggest that some investors are moving coins onto trading platforms, which could temporarily increase selling pressure.

However, technical indicators like the Relative Strength Index (RSI) suggest that the coin is near oversold conditions, often a precursor to upward correction.

If the upward recovery happens, the immediate short-term recovery targets range from $0.18 to $0.23 if the support holds and momentum shifts favourably.

While the XLM price is currently trading below key moving averages, reflecting a cautious outlook, the convergence of indicators points toward a possible stabilisation.

Breaking above $0.18 would signal a strengthening trend and could pave the way for a test of the $0.23 level in the coming weeks.

But until these levels are convincingly breached, bearish pressure remains a concern.

Long-term Stellar growth prospects

Beyond short-term fluctuations, Stellar’s long-term outlook remains compelling.

XLM has historically been tied to cross-border payments and financial infrastructure, which gives it real-world utility beyond speculative trading.

Analysts forecast that as adoption grows, XLM could see substantial appreciation over the next few months, with potential price levels ranging significantly higher than today.

Even modest increases in network activity, stablecoin usage, and partnerships with financial institutions could drive long-term value.

The coin’s past all-time high near $0.88 demonstrates its capacity for growth, despite the current market price being a fraction of that peak.

Stellar’s network fundamentals, combined with increasing adoption of blockchain-based payment solutions, create a foundation for sustained growth.

Investors looking at a long-term horizon may view the current price as an entry point ahead of broader adoption and utility expansion.

While short-term volatility will likely persist, the convergence of recovery signals and long-term adoption prospects creates a favourable risk-reward scenario.

Crypto World

Coca-Cola (KO) Stock Falls 4% on Weak Q4 Revenue and Sluggish 2026 Outlook

TLDR

- Coca-Cola stock fell nearly 4% in premarket trading after missing Q4 revenue expectations and issuing weak 2026 guidance

- Q4 revenue came in at $11.82 billion versus analyst estimates of $12.03 billion as soda demand weakened in North America and Asia

- Company forecasts 2026 organic revenue growth of 4-5%, below analyst expectations of 5.3% and slower than 2025’s 5% growth

- Price increases of 4% for full year 2025 helped offset higher input costs but pressured inflation-hit consumers seeking cheaper options

- Volume growth remained flat in Asia-Pacific as consumers increasingly shift to regional brands over global names

Coca-Cola shares dropped nearly 4% in premarket trading Tuesday after the beverage giant missed fourth-quarter revenue expectations and forecast slower-than-expected growth for 2026.

The Atlanta-based company reported Q4 revenue of $11.82 billion, falling short of the $12.03 billion analysts had projected. The miss came as demand for sodas weakened across key markets in North America and Asia.

The company’s 2026 organic revenue growth forecast of 4-5% came in below Wall Street’s 5.3% expectation. This also represents a deceleration from the 5% growth Coca-Cola posted in 2025.

“The forecast reads conservative, but is appropriate for the start of the year,” Jefferies analyst Kaumil Gajrawala wrote in a note. “Street likely wanted more.”

Price Hikes Pressure Consumer Demand

Coca-Cola has been raising beverage prices throughout the past year to offset higher input costs. Prices rose 4% for full-year 2025, helping to drive overall performance.

But these price increases have weighed on inflation-hit U.S. consumers who are increasingly seeking cheaper pantry options. Unit case volumes rose just 1% in the fourth quarter, matching the growth rate from the previous three months.

For the full year, volumes were flat. The company relied entirely on pricing power to drive results.

Rival PepsiCo announced last week it would cut prices on key snacks like Lay’s and Doritos. The move came after consumers pushed back on several rounds of price hikes over recent years.

The timing creates pressure on Coca-Cola as it navigates a CEO transition. Veteran executive Henrique Braun is set to take over as chief executive on March 31.

Shifting Consumer Preferences Challenge Growth

Coca-Cola adjusted earnings came in at 58 cents per share, beating analyst estimates of 56 cents. But the revenue miss highlighted ongoing challenges in key markets.

Volume growth was flat in the Asia-Pacific region during the quarter. The company faces increasing competition from regional brands in the world’s most populous continent.

Coca-Cola has been trying to adapt to changing consumer preferences. The company is leaning on zero-sugar sodas, sports drinks, and bottled teas as U.S. consumers shift to low-sugar options.

The rise of appetite-suppressing weight-loss drugs has accelerated demand for healthier beverage choices. Coca-Cola has invested in products like protein-infused Fairlife milk to capture health-conscious consumers.

The company forecast annual adjusted profit per share growth of 7-8% for 2026. This came in slightly below analyst expectations of 7.9% growth.

Despite Tuesday’s premarket decline, Coca-Cola shares have risen about 12% in 2025. The stock has outperformed PepsiCo over the past few years.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat20 hours ago

NewsBeat20 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World8 hours ago

Crypto World8 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports19 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World8 hours ago

Crypto World8 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoDriving instructor urges all learners to do 1 check before entering roundabout