Crypto World

ICON Amsterdam Reports Record 2025 Performance and Announces Planned U.S. Expansion for 2026

[PRESS RELEASE – Amsterdam, Netherlands, February 18th, 2026]

ICON Amsterdam today announced that it closed 2025 with its strongest financial performance to date, marking a milestone year following a period of internal restructuring and operational realignment. The company also confirmed that it is preparing to explore expansion into the United States in 2026.

According to the company, 2025 revenue reached record levels compared to prior years. Leadership attributes the performance to refined product focus, tighter inventory management, improved departmental accountability, and strengthened coordination between marketing, operations, and product teams.

The milestone follows a period earlier in the decade marked by rapid scaling, rising costs, and internal coordination challenges that affected cash flow and alignment. In response, the company initiated a structured operational review instead of continuing accelerated expansion.

As part of this process, ICON updated its performance tracking systems, clarified departmental responsibilities, and introduced standardized operating procedures to support more consistent execution. According to leadership, the company adjusted its growth strategy to prioritize operational stability and the development of repeatable processes over rapid expansion.

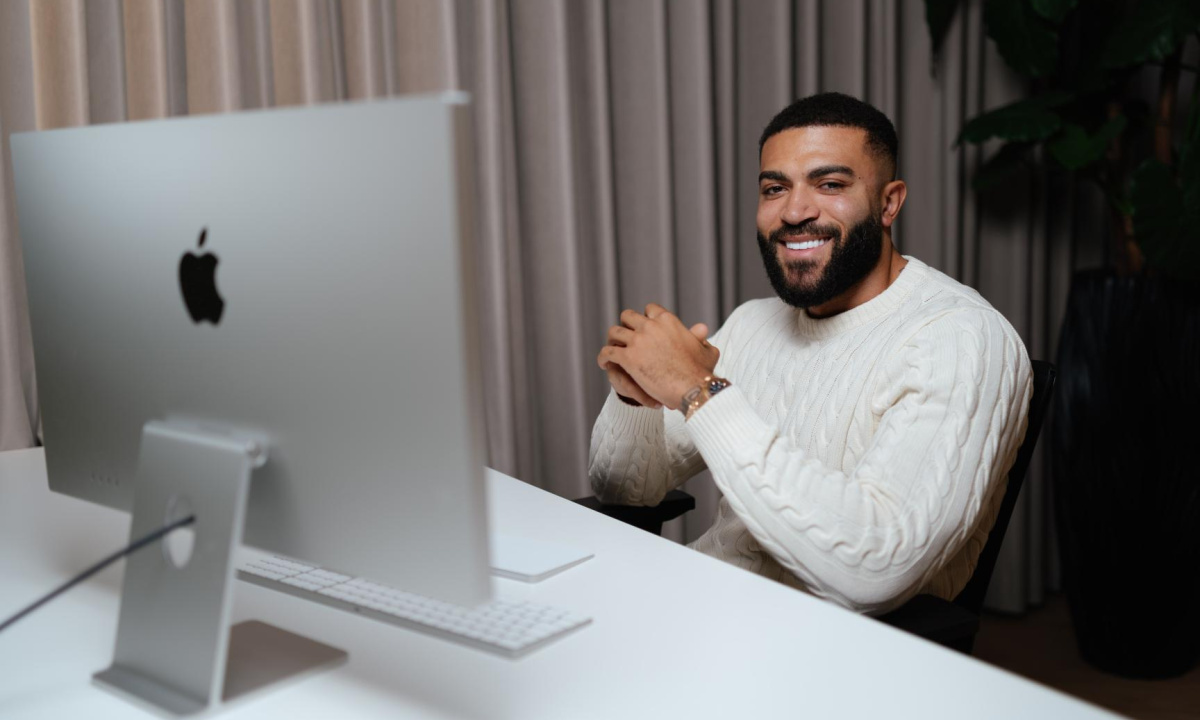

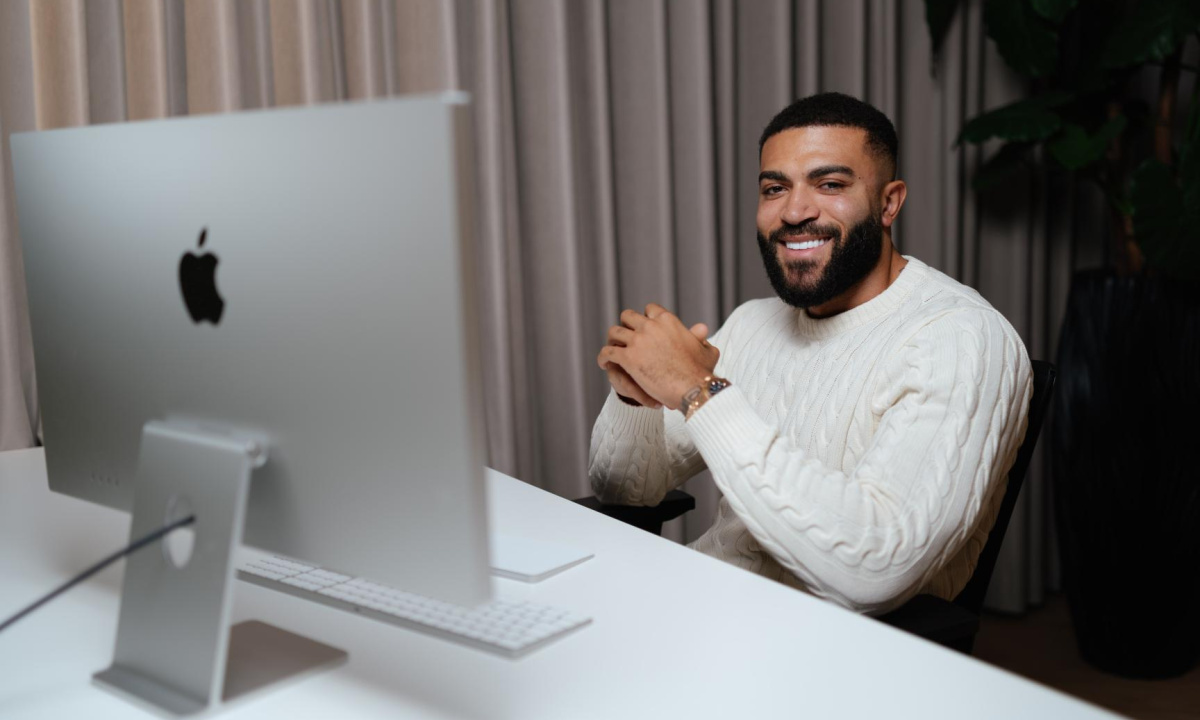

“Growth must be supported by structure,” said Samuel Onuha, Founder of ICON Amsterdam. “The focus over the past two years has been on strengthening the fundamentals of the business.”

In addition to reporting record performance for 2025, ICON confirmed it is evaluating phased entry into the U.S. market in 2026. The company indicated that any expansion would be incremental and aligned with existing operational capacity.

ICON is also preparing for the opening of its first physical retail presence in Amsterdam. While details remain under review, the initiative would represent a transition from a primarily direct-to-consumer model toward a blended retail approach.

Leadership emphasised that the company intends to maintain a measured growth strategy moving forward, prioritising operational discipline and financial sustainability.

Further updates regarding retail development and international expansion are expected to be shared in 2026.

About ICON Amsterdam

Founded in 2018, ICON Amsterdam is a Netherlands-based direct-to-consumer menswear company focused on modern tailoring and stretch-engineered apparel. The company operates primarily online and serves customers across Europe and international markets. ICON emphasises structured operations, product consistency, and disciplined growth strategy.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Solana weakens as liquidations rise and sentiment cools

- Solana (SOL) has fallen below $82 as selling pressure and risk aversion increased.

- Rising liquidations show leveraged traders are exiting positions.

- $80 support remains critical, with $75 and $90 as key levels to watch.

Solana has entered a fragile phase as selling pressure builds and confidence across the market continues to fade.

The token has slipped below the $82 area, a level that previously acted as a short-term cushion for price action.

Liquidations rise as leverage unwinds

The futures market has played a major role in amplifying Solana’s downside move.

Liquidations have increased, and long positions have been forced out as price drifts lower, creating bursts of sharp selling during the intraday declines.

Open interest across derivatives markets has also been falling, pointing to traders closing positions and stepping aside rather than betting on a fast rebound.

Funding rate has also turned negative, showing a growing dominance from short sellers who are willing to pay to maintain bearish exposure.

While leverage flushes can sometimes reset the market, there is little evidence of that shift yet.

Instead, each liquidation wave has been followed by muted buying interest.

Sentiment cools as on-chain activity slows

Beyond price and derivatives, Solana is also facing softer signals from on-chain activity.

Transaction-driven revenue has declined from recent peaks, suggesting lower demand for block space and reduced speculative activity.

A good percentage of the network usage is currently tied to short-lived trends rather than sustained growth.

That reliance leaves the network activity vulnerable as market sentiment cools.

Investor confidence has also softened as the price struggles to reclaim key resistance zones.

Repeated failures near higher levels have reinforced a wait-and-see attitude.

Even though new wallets continue to appear, overall engagement lacks momentum, especially as the hype around memecoins, which form the bulk of Solana’s engagement, fades.

This imbalance highlights the difference between long-term interest and short-term participation.

The result is a market caught between underlying potential and immediate pressure.

Solana price forecast

Traders should closely watch the $80 level as the first major line of defence in case of a further decline.

A clean break below this zone could expose the price to deeper losses.

If selling continues, the next area of interest sits between $75 and $76, which has previously acted as a stabilisation zone during corrections.

Failure there would open the door toward the low $70s, which would result in even more liquidations.

On the upside, analysts note that Solana needs to reclaim the $85-87 range to ease immediate pressure.

If SOL moves above $87, bulls will be in control, and the next target sits around $90.

A move beyond that level would be required to shift sentiment meaningfully.

Crypto World

How Is Asset Tokenization Platform Development Reshaping Film Capital Markets?

In the past few decades, the global film industry relied on a centralized capital system that has been dominated by studios, institutional financiers, and private equity syndicates. While the traditional capital structure has allowed for the creation of high production value cinematic works, it has also limited the number of independent creators who are able to produce content, while excluding many retail investors from participating in the film industry in meaningful ways. As production costs ascend and audience fragmentation continues to grow into 2026, traditional capital structures are likely to expose structural inefficiencies.

As an increasing number of investors desire greater levels of liquidity, transparency, and diversified exposure, and filmmakers desire faster access to capital as well as greater creative control, traditional funding sources, which rely heavily on intermediaries and entail opaque reporting processes, will have difficulty satisfying these modern investor and filmmaker requests.

Through the advancement of asset tokenization platform development, a massive structural solution is emerging that will allow studios and independent producers to modernize their approach to raising capital. In addition, through the use of comprehensive asset tokenization services, studios and independent producers will be able to issue tokens that comply with legal requirements, allocate revenue automatically based on contractual structures, and include a broader range of potential investors.

Key Drivers:

- Demand for alternative yield-generating asset classes

- Escalating production and distribution costs

- Investor preference for programmable financial instruments

- Regulatory evolution supporting compliant digital securities

Legacy Market Inefficiencies Holding Back Film Capital

Prior to the advent of asset tokenization platform development, the film financing industry was a closed system, relationship-based, and geographically limited in terms of capital access and structural centralization. The lack of flexible ownership distribution and investor engagement, due to the unavailability of scalable tokenization platform development infrastructure, made the system inefficient.

The lack of organized asset tokenization services made revenue sharing, cap table management, and royalty reporting highly manual and prone to errors. With the growing global need for digital content, such inefficiencies are no longer tenable.

Capital Concentration in Institutional Networks

Prior to the advent of asset tokenization platform development, the film financing industry remained a concentrated system, controlled by the film studios, and restricted access to new entrants unless they had connections with established industry insiders.

The lack of an organized tokenization platform development infrastructure made fractional ownership engagement limited and exclusive. This is now remedied by modern asset tokenization services, which provide programmable engagement mechanisms.

Impact:

- Restricted access for independent producers

- Limited cross-border capital participation

- Narrow storytelling diversity

- Overreliance on centralized approval systems

High Investment Barriers for Retail Inclusion

The traditional process of film financing involved high capital investment barriers. Without asset tokenization platform development, fractionalization structures were complex and not unified from a legal perspective.

With the development of asset tokenization platforms, film assets can be broken down into programmable units that comply with regulatory requirements. The use of integrated asset tokenization services reduces investment barriers while maintaining regulatory requirements.

Impact:

- Retail investor exclusion

- Concentrated risk exposure

- Limited portfolio diversification

- Weak alignment between audiences and financial upside

Extended Lock-In Periods and Liquidity Issues

The traditional process of film investment involves extended periods of film production and monetization. Without asset tokenization platform development, which facilitate secondary markets, investors are subject to extended capital lock-in periods.

The asset tokenization platform development embeds exit strategies into digital infrastructure.

Impact:

- Capital tied up for extended periods

- Reduced investment agility

- Elevated opportunity costs

- Lower comparative attractiveness versus liquid alternatives

Fragmented Royalty Reporting and Manual Reconciliation

The traditional revenue reporting infrastructure is based on middlemen, ranging from distributors to exhibitors and streaming services. Without development in the asset tokenization platform, it was impossible to execute smart contracts automatically.

The development of the tokenization platform incorporates programmable revenue sharing, and sophisticated asset tokenization capabilities provide audit-compliant transparency.

Impact:

- Delayed settlements

- Accounting discrepancies

- Reduced investor trust

- Administrative inefficiencies

Ready to modernize your film financing strategy through asset tokenization platform development?

The Tokenization Framework: Infrastructure-Led Resolution of Film Finance Bottlenecks

The shift in film financing in 2026 is not based on speculative digital innovation—it is based on infrastructure renewal. The development of asset tokenization platforms represents a paradigm shift in the management of intellectual property, revenue streams, and investment access. Instead of applying technology to existing infrastructure, tokenization rebuilds the financing infrastructure itself.

With robust tokenization platform development, film initiatives are created as digitally native financial systems. Ownership tokens, revenue streams, and governance rights are encoded in smart contracts, allowing for autonomous execution without the need for disparate intermediaries. Full-service asset tokenization solutions provide for regulatory compliance, secure issuance, and transparent reporting.

This infrastructure-centric strategy specifically targets the pain points enumerated above—capital concentration, lack of accessibility, illiquidity, and fragmented reporting.

Structural Digitization of Film Assets

At the core of asset tokenization platform development is the digitization of underlying rights. Film-related assets—including distribution rights, licensing agreements, streaming revenues, and profit participation models—are mapped into programmable digital tokens.

This structured conversion creates:

- Fractional ownership units tied to defined revenue streams

- Immutable records of entitlement and allocation

- Automated enforcement of contractual conditions

- Transparent cap table representation

Unlike traditional agreements stored across legal silos, digitally structured assets exist within a unified, tamper-resistant environment. This ensures clarity in ownership hierarchy and eliminates ambiguity in entitlement calculations.

Automated Revenue Allocation Through Smart Contracts

One of the most critical inefficiencies in legacy film finance lies in royalty distribution. Tokenization platform development replaces manual reconciliation with smart contract–based automation.

Under this model:

- Revenue inflows are programmatically routed to token holders

- Predefined waterfall structures execute automatically

- Distribution timelines are reduced from months to near real-time

- Administrative overhead is significantly minimized

Integrated asset tokenization services manage ongoing reconciliation across theatrical releases, streaming platforms, syndication channels, and international licensing deals. This reduces disputes, enhances transparency, and builds investor confidence through consistent reporting mechanisms.

Capital Democratization Through Programmable Fractionalization

Traditional financing structures require high minimum investment thresholds. Asset tokenization platform development resolves this through compliant fractionalization mechanisms.

By segmenting intellectual property into regulated digital units, studios can:

- Lower entry barriers while maintaining compliance

- Expand participation to geographically diverse investors

- Enable diversified exposure across multiple productions

- Align audience communities with financial participation

Well-structured tokenization platform development ensures that these fractional offerings adhere to securities classifications and jurisdictional regulations. Meanwhile, end-to-end asset tokenization services manage investor onboarding, KYC/AML verification, and governance rights distribution.

Embedded Liquidity Architecture

Liquidity constraints have historically discouraged broader participation in film investments. Infrastructure-focused asset tokenization platform development incorporates secondary trading enablement directly into the framework.

This includes:

- Regulated marketplace integrations

- Peer-to-peer transfer functionality within compliance parameters

- Automated lock-up enforcement where required

- Transparent pricing mechanisms

Through advanced tokenization platform development, liquidity is no longer an afterthought—it becomes an engineered component of the financing ecosystem. Asset tokenization services ensure these liquidity pathways remain compliant and operationally secure.

Integrated Compliance and Governance Controls

Regulatory compliance remains central to sustainable adoption. Enterprise-grade asset tokenization platform development integrates:

- Jurisdiction-specific securities rule alignment

- Automated investor accreditation validation

- Transaction monitoring systems

- Governance voting modules

Rather than relying on manual legal oversight, compliance becomes embedded within the digital architecture. Comprehensive asset tokenization services continuously update compliance frameworks in response to regulatory evolution, ensuring long-term viability.

This governance integration strengthens institutional confidence and positions tokenized film financing within mainstream capital markets rather than speculative environments.

Real-Time Transparency and Investor Intelligence

Modern investors demand visibility. Through scalable tokenization platform development, stakeholders gain access to real-time dashboards displaying:

- Revenue performance metrics

- Token distribution records

- Transaction history logs

- Forecasted payout schedules

These reporting capabilities, delivered via structured asset tokenization services, eliminate informational asymmetry between producers and investors. Transparency becomes operational rather than aspirational.

Strategic Infrastructure Impact

By embedding automation, compliance, liquidity, and transparency within the core framework, asset tokenization platform development transitions film financing from relationship-driven exclusivity to programmable scalability.

The infrastructure-led model delivers:

- Reduced fundraising cycle durations

- Diversified global capital access

- Lower operational overhead

- Enhanced investor trust

- Improved financial predictability for studios

In 2026, tokenization platform development is not simply enabling new fundraising channels—it is redefining how entertainment assets function within digital capital markets. Through structured asset tokenization services, film financing evolves into a secure, transparent, and globally accessible financial ecosystem.

Conclusion

Film financing in 2026 is transitioning from centralized gatekeeping to infrastructure-driven democratization. Asset tokenization platform development removes structural barriers while maintaining compliance integrity. Tokenization platform development introduces liquidity, automation, and operational efficiency.

Integrated asset tokenization services provide the technological backbone enabling transparent collaboration between creators and investors. By digitizing intellectual property rights into programmable financial instruments, the industry is redefining capital participation.

Film financing is no longer exclusively studio-controlled—it is increasingly infrastructure-enabled, globally accessible, and strategically programmable.

Frequently Asked Questions

01. What challenges does the traditional film financing system face?

The traditional film financing system is challenged by centralized capital structures that limit independent creators, exclude retail investors, and struggle to meet modern demands for liquidity, transparency, and faster access to capital.

02. How can asset tokenization benefit the film industry?

Asset tokenization can benefit the film industry by allowing studios and independent producers to modernize capital raising, issue compliant tokens, automate revenue allocation, and engage a broader range of investors.

03. What are the key drivers for change in film financing?

Key drivers for change in film financing include the demand for alternative yield-generating assets, rising production and distribution costs, investor preference for programmable financial instruments, and regulatory evolution supporting compliant digital securities.

Crypto World

Illicit networks accounted for $141 billion of the trillions of stablecoin volume in 2025

In 2025, illicit entities received $141 billion in stablecoins, the highest level observed in five years, according to a new report from TRM Labs. The report noted that overall stablecoin activity exceeded $1 tillion per month on several occasions last year.

Sanctions-related activity accounted for 86% of illicit crypto flows, the report said, with bad actors mostly relying on stablecoin platforms.

Of that $141 billion, $72 billion was linked to the A7A5 token, a ruble-pegged stablecoin operating within sanctions-linked networks.

Oleg Ogienko, A7A5’s director for Regulatory and Overseas Affairs, told CoinDesk that “TRM Labs tries to call all Russian external trade illicit or illegal. But this is of course a wrong statement.”

In separate comments during an interview at Consensus Hong Kong 2026, Ogienko was even more defiant, saying he was looking to debate anyone who accuses him of breaking any compliance laws through his stablecoin company.

“We are fully compliant with the regulations of Kyrgyzstan. We do not do illegal things,” he said. “We have KYC procedures, and we have AML mechanisms embedded into our infrastructure. We do not violate any Financial Action Task Force principles.”

However, Old Vector LLC and A7 LLC, A7A5’s issuing and affiliated entities, and Promsvyazbank (PSB), the bank that holds the reserves, are sanctioned by the U.S. Department of the Treasury, barring the U.S. dollar-denominated financial world from interacting with them.

Crypto World

200M XRP Pulled From Binance

Some analysts note withdrawals can reflect conviction, as traders rarely shift assets off platforms during panic phases suddenly.

XRP holders have moved approximately 200 million tokens off the Binance exchange over the past ten days, according to CryptoQuant contributor Darkfost.

The move comes with the Ripple token trading 27% lower than a month ago, suggesting some investors see current prices as an accumulation opportunity rather than an exit point.

Exchange Outflows Signal Shift in Investor Strategy

Data tracked by Darkfost shows a steady drop in XRP balances held on the world’s largest cryptocurrency exchange by volume. Per the on-chain observer, the XRP supply ratio on the platform fell from 0.027 to 0.025 over ten days, which translates to about 200 million tokens leaving Binance in the period.

Usually, when investors withdraw assets from exchanges, it reduces immediate selling pressure and points to longer-term holding strategies, as tokens moved to private custody are less accessible for quick trades.

“This dynamic therefore suggests that some investors consider current price levels to be attractive from an accumulation standpoint,” Darkfost concluded.

While some movements could reflect internal exchange reallocations, Binance tends to publish its custody addresses, allowing analysts to distinguish between operational adjustments and organic user-driven withdrawals with reasonable accuracy.

The timing of these outflows coincides with a difficult period for XRP holders. The asset has corrected roughly 40% since the start of the year, with the decline pushing it down to a 15-month low near the $1.00 level earlier in the month.

At the time of writing, the Ripple token was trading at around $1.42, down 4.5% in the last 24 hours and 27% over the past month, based on data from CoinGecko. Over a year, XRP has fallen by more than 44% and currently sits 61% below its all-time high of $3.65 reached in July 2025.

You may also like:

Still, the token has risen about 3% in the last week, outperforming the broader crypto market’s 1.4% gain in the same period. Daily trading volume has also climbed about 6% to just over $2.3 billion, a sign of increased activity even with prices slipping.

Market Sentiment Diverges From Price Action

Despite the price pressure, XRP has continued to attract attention from investors and analysts, with Grayscale recently identifying it as the second-most discussed asset in its community after Bitcoin (BTC).

The firm’s head of product and research, Rayhaneh Sharif-Askary, said during Ripple Community Day that clients frequently ask about XRP and related products tied to the Ripple ecosystem.

Additionally, a recent report from CoinShares showed XRP-linked funds drew about $33 million in inflows at a time when crypto investment products associated with heavyweights like Bitcoin and Ethereum (ETH) suffered a fourth straight week of outflows.

Nevertheless, some market observers and traditional financial institutions have tempered expectations about XRP’s performance this year. For instance, banking giant Standard Chartered slashed its year-end XRP price target by 65%, pushing down its forecast from $8.00 to $2.80, citing challenging near-term conditions across digital assets. The firm also lowered forecasts for Bitcoin, Ethereum, and Solana (SOL).

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

eBay Stock Jumps as Company Acquires Depop from Etsy for $1.2 Billion in Cash

TLDR

- eBay is buying Depop from Etsy for $1.2 billion in cash, deal expected to close Q2 2026.

- Depop hit $1 billion in gross merchandise sales in 2025, with ~60% U.S. growth year-over-year.

- eBay stock rose ~6.7% and Etsy stock surged ~16.9% after the announcement.

- eBay beat Q4 estimates: adjusted EPS of $1.41 vs. $1.35 expected; revenue $2.96B vs. $2.88B forecast.

- Etsy originally paid $1.62 billion for Depop in 2021, taking a loss on the sale.

eBay is acquiring secondhand fashion platform Depop from Etsy for $1.2 billion in cash. Both stocks moved sharply higher Wednesday following the announcement.

eBay shares climbed around 6.7% while Etsy stock surged roughly 16.9% in after-hours trading. Both boards unanimously approved the deal.

Depop is a London-based resale platform where buyers and sellers trade secondhand clothing. Nearly 90% of its 7 million active buyers are under 34, making it one of the more Gen Z-heavy platforms in the space.

The platform generated around $1 billion in gross merchandise sales in 2025, with close to 60% U.S. growth year-over-year. It has over 3 million active sellers and 56.3 million registered users.

Why eBay Wants Depop

For eBay, this is a play for a younger audience. CEO Jamie Iannone said Depop fits into the company’s fast-growing “recommerce” category and gives eBay direct access to Gen Z and Millennial shoppers it hasn’t been able to reach at scale.

Etsy is walking away from an investment it made at a higher price. The company paid $1.62 billion for Depop in 2021 as part of a broader “house of brands” push. That strategy has since been unwound, with Etsy also selling off Elo7 and Reverb in recent years.

CEO Kruti Patel Goyal framed the sale as a way to sharpen Etsy’s focus on its core marketplace, calling it “a great outcome for Etsy’s shareholders.”

eBay Q4 Earnings Beat Estimates

eBay also reported Q4 results Wednesday that topped Wall Street expectations on both lines.

Adjusted EPS came in at $1.41, ahead of the $1.35 estimate. Revenue hit $2.96 billion versus the $2.88 billion forecast — up 15% year-over-year.

Q1 guidance was also strong, with eBay projecting adjusted EPS of $1.53 to $1.59 and revenue of $3 billion to $3.05 billion, both ahead of analyst estimates.

What’s Next for Etsy

Etsy reports Q4 2025 earnings Thursday morning. Analysts are expecting EPS of $0.84, which would mark an 18.4% decline from the same quarter last year.

Wall Street holds a consensus Hold rating on Etsy stock, with an average price target of $61.58 — implying roughly 40% upside from recent levels.

The Depop transaction remains subject to regulatory approval, with both companies targeting a Q2 2026 close.

Crypto World

Polymarket’s Lawsuit Could Decide Who Regulates US Prediction Markets

Key takeaways

-

Polymarket’s federal lawsuit against Massachusetts could determine whether prediction markets are regulated solely by the CFTC or also by states.

-

The dispute centers on whether event contracts qualify as financial derivatives under the Commodity Exchange Act or as gambling under state laws.

-

The lawsuit followed state-level actions against platforms like Kalshi, with Massachusetts and Nevada moving to restrict sports-related prediction contracts.

-

A ruling in favor of Polymarket could establish uniform national oversight and prevent a patchwork of differing state regulations.

Prediction markets are platforms where people trade contracts based on the outcomes of future events. Recently, they have been in the news due to a major legal battle in the US over regulatory authority. Central to the dispute is Polymarket’s federal lawsuit against Massachusetts. The outcome of this case could determine whether these markets are regulated exclusively at the federal level or whether states can also enforce their own rules.

This article explores Polymarket’s federal lawsuit against Massachusetts. It examines the broader legal clash over whether prediction markets fall under the exclusive authority of the US Commodity Futures Trading Commission (CFTC) or under state gambling laws. It also analyzes how the case could reshape regulatory control, market access and the future of US event-based trading platforms.

A federal lawsuit with broad implications

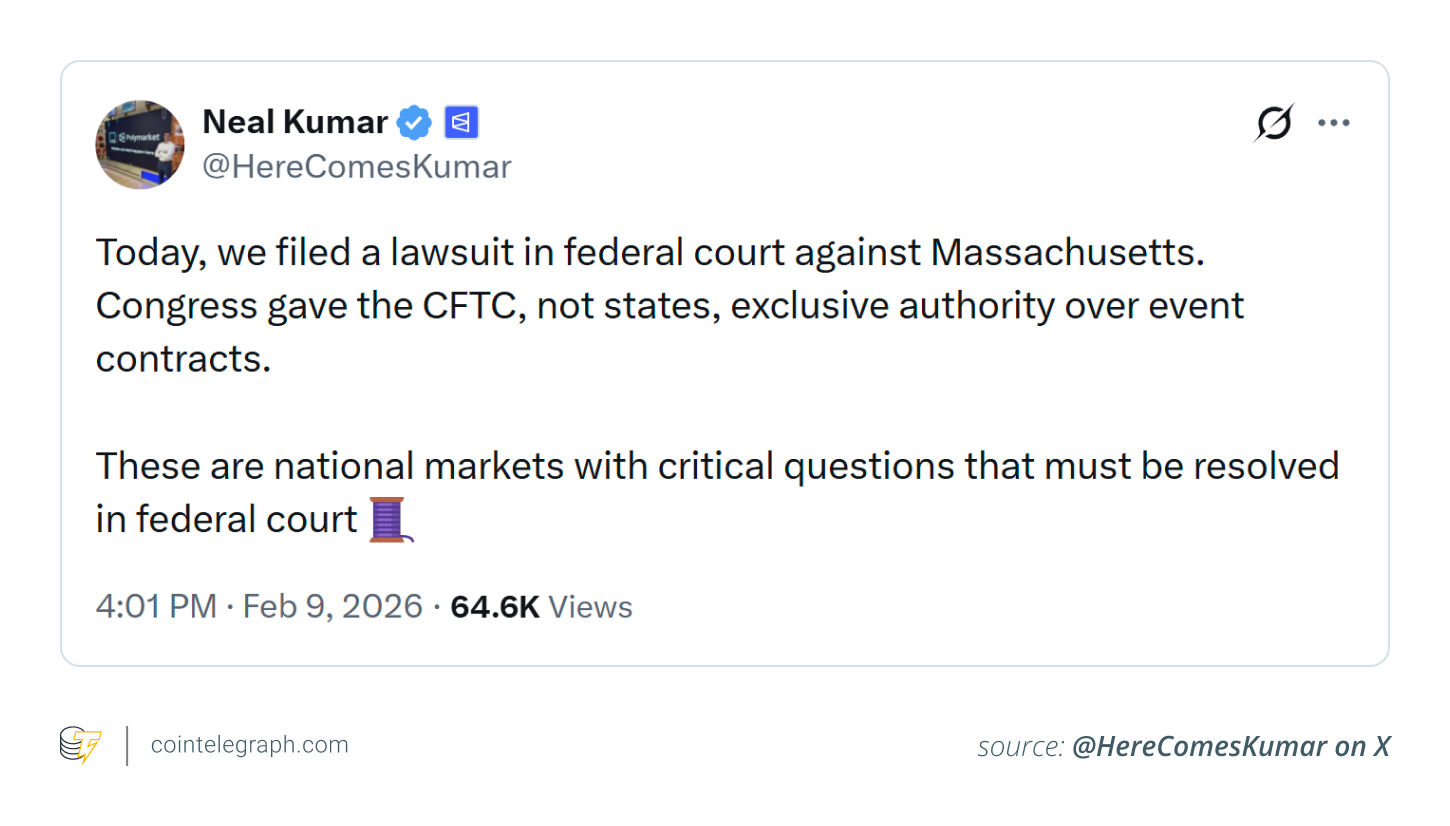

In February 2026, Polymarket filed suit in the US District Court for the District of Massachusetts to preempt enforcement by state regulators that would require it to comply with Massachusetts gambling laws. The company contends that Congress has granted exclusive authority over “event contracts,” the core products of prediction markets, to the CFTC. According to Polymarket, this renders state efforts to stop or limit its operations unlawful.

Polymarket chief legal officer Neal Kumar argues that the dispute involves national markets and that the relevant legal questions should therefore be resolved in federal court. The company opposes piecemeal enforcement by individual states. He said that restricting markets could hinder industry development.

Where it all started: State actions against Kalshi

The lawsuit’s timing was deliberate. It came shortly after Massachusetts courts acted against rival platform Kalshi, blocking sports-related contracts under state gambling laws. A judge upheld a preliminary injunction requiring Kalshi to prevent residents from accessing certain markets without a gaming license. The court directed that these markets be treated as unlicensed sports wagers.

Massachusetts’ approach to prediction markets has received support from similar state-level actions elsewhere. In Nevada, regulators obtained a temporary restraining order against Polymarket’s sports-related offerings, arguing that they violated the state’s sports betting regulatory framework.

Did you know? Corporations have used prediction markets to forecast product launches and internal project deadlines. Some companies quietly rely on employee-based markets because aggregated crowd opinions often outperform traditional executive forecasts.

What is at stake: Federal vs. state authority

The lawsuit centers on a jurisdictional dispute. Polymarket claims its event contracts, whether covering elections, economics or sports, are financial derivatives under the CFTC’s Commodity Exchange Act. In this view, federal law supersedes state gambling statutes, preventing states from independently banning or regulating these markets.

Massachusetts and other states argue that when prediction markets resemble gambling, particularly in the context of sports, they must comply with state gambling frameworks to safeguard consumers and maintain local licensing and age requirements.

If federal courts side with Polymarket, it could strengthen the case for uniform national oversight, preventing a “patchwork” of varying state-level rules or prohibitions. Conversely, upholding state authority would allow states to apply their own gambling laws to platforms operating nationwide.

Did you know? Prediction markets sometimes rival opinion polls in forecasting election outcomes. Universities have studied them for decades as tools for measuring collective intelligence and information efficiency.

Why Polymarket’s lawsuit matters

Prediction markets have experienced growth, with rising trading volumes and visibility. Data tracked by Dune showed that prediction markets recorded about $3.7 billion in trading volume in a single week in January 2026, an all-time high.

As platforms like Polymarket and Kalshi gain mainstream traction, states are pushing to apply protections comparable to those governing traditional gambling. This dynamic has prompted action by multiple states.

The CFTC’s stance has added complexity to the issue. While the federal agency has long regulated derivatives markets, including certain event contracts, it has faced pressure to stay out of specific disputes or to restrict prediction contracts involving war or terrorism.

Did you know? Prediction markets are structured using blockchain smart contracts, automatically settling trades once an outcome is verified. This automation reduces counterparty risk but raises new regulatory and oracle-related challenges.

How jurisdictional disputes are reshaping event contracts

Polymarket’s legal action represents just one element of the broader legal and regulatory disputes surrounding prediction markets across the United States. Courts in jurisdictions such as Massachusetts and Nevada are currently examining the limits of state authority, while federal officials and legislators deliberate over comprehensive guidelines. The outcomes of these proceedings will likely influence how companies structure and offer event contracts.

Whether courts ultimately uphold Polymarket’s federal argument or affirm state authority, the decision will have long-lasting implications for the growth of prediction markets. It will shape user access to these platforms and the balance regulators strike between innovation and consumer protection.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Robinhood Layer-2 Testnet Logs 4 Million Transactions in Crypto First Week

Robinhood loves crypto and really wants to get on-chain as soon as possible.

The company’s new Layer-2 testnet just processed 4 million transactions in 7 days. CEO Vlad Tenev confirmed the milestone, framing the chain as a bridge between traditional finance and on chain markets.

Built on Arbitrum, the network is designed for high throughput financial apps. And the timing is interesting. Even as crypto revenue fell 38% year over year in Q4 2025, Robinhood is doubling down on tokenization and 24/7 trading infrastructure.

They are building for the ‘next cycle’.

Key Takeaways

- Massive Throughput: The testnet logged 4 million transactions in its first week, validating initial network scalability.

- RWA Focus: Built on Arbitrum, the chain is optimizing for tokenized stocks, ETFs, and round-the-clock settlement.

- Infrastructure Pivot: Despite softer crypto revenues, Robinhood is integrating major partners like Alchemy and Chainlink to own the full stack.

Why Is This Surge Significant?

Four million transactions in one week suggests serious developer interest or deliberate stress testing of the network.

Robinhood goal is to build a dedicated lane for institutional grade finance on Ethereum. That means speed, reliability, and compliance ready design from day one.

The timing also fits a bigger pattern. Instead of chasing short term revenue, Robinhood is laying down rails for tokenized assets and round the clock trading.

If tokenization really becomes the freight train Tenev describes, this testnet is the first stretch of track.

Robinhood Built a GOOD Crypto Infrastructure

The network quietly went through six months of private testing before anyone else touched it. Now it is live on testnet. And people are already playing with it.

Developers are building tools focused on tokenized real world assets and onchain finance. Vlad Tenev hinted that the next phase of finance is moving fully onchain.

But here is where it gets interesting.

Users are testing “stock tokens” tied to names like Tesla, Amazon, and Netflix. They get testnet ETH to cover gas and try it out.

Behind the scenes, they brought in serious infrastructure. LayerZero handles interoperability. Chainlink feeds in reliable data. That part matters. Bad oracle or bridge data has wrecked DeFi protocols before. Robinhood clearly wants to avoid that mess.

Traders should expect a mainnet launch later this year, though a specific date remains unannounced. The true test will be whether Robinhood can migrate its massive retail user base onto the chain without friction.

Discover: Here are the crypto likely to explode!

The post Robinhood Layer-2 Testnet Logs 4 Million Transactions in Crypto First Week appeared first on Cryptonews.

Crypto World

Michael Saylor’s Spinal Tap ad says STRC is like a bank account — it isn’t

Michael Saylor used AI to appropriate a famous scene from the mockumentary This Is Spinal Tap to advertise STRC as a competitor to insured savings products like bank accounts and money markets.

STRC is a share of Saylor’s company Strategy (formerly MicroStrategy) that pays non-guaranteed dividends at the sole discretion of the company’s board of directors.

Unlike US bank accounts or money markets that enjoy FDIC, NCUA, or SIPC guarantees against loss, STRC offers no such assurances.

In fact, it’s fluctuated in value over the past 52 weeks from $90.52 to $100.42 — deviating substantially below its $100 par. In the past two weeks, for example, STRC has traded below $94.

In Saylor’s new promotion, a Nigel Tufnel lookalike explains to viewers that earning 0% dividends is “like a normal checking account,” or viewers could “turn it up to 3%” in a money market.

If they want “awesome” dividends, they could turn the dial to 10%, or they could choose STRC at 11%.

Concluding with a call to action and a celebratory chorus, viewers are told they can “stretch your income.”

Saylor has repeated similar comparisons across various broadcast media, even though STRC isn’t any type of insured savings product. Indeed, the brazenness of this new Spinal Tap-themed ad isn’t an anomaly.

Read more: Strategy manager wrong about BTC backing STRC

Months of likening STRC to bank accounts and money markets

“Everybody in the world would love to have a high yield bank account that yielded 10% or more,” Saylor broadcasted on national TV in reference to STRC last September.

“Or they’d love to have a money market that gave them double or triple their normal money market.”

Saylor has repeatedly likened STRC to insured savings products like FDIC-insured bank accounts or SIPC-insured money markets.

His company called STRC “Treasury credit,” even though the common understanding of US Treasury credit is literally risk-free savings bonds — redefining both terms using his ever-expanding dictionary of invented terminology.

The company went on to bury disclaimers about STRC’s “price stability” descriptions on page 90 of its latest earnings presentation where it finely admitted that STRC isn’t a money market fund.

It also admitted that although it plans to continue paying dividends and hopes to encourage traders to keep STRC near its par value, it’s actually “not required to hold any assets to back the STRC Stock.”

Saylor has called STRC his company’s “greatest feat of financial engineering to date.” He once said that Strategy could sell $10 trillion worth of the shares and similar products denominated in foreign currencies.

“They want higher yield than a money market. We designed [STRC] for them,” Saylor said in October. “Who is [STRC] targeted at? There’s $18 trillion of bank accounts.”

Read more: The many weird AI depictions of Michael Saylor

More ‘high-yield savings account’ claims

On the public record, Saylor continued, “You can see the idea of this is a high-yield savings account that just pays twice your normal savings account if you understand and if you believe in bitcoin.”

These quotes are not cherry-picked examples. There are ample, similar examples.

“How many people want a money market that pays them 10% instead of 4%? A lot of people want that. So, we just kind of created something that looks like a money market instrument,” Saylor said at another conference.

In another egregious example, Saylor likened STRC to an FDIC-insured bank account after he calculated the tax-advantaged yield equivalents of STRC’s dividend by state of residence.

“We created a bank account that pays 17-20% by combining digital capital with a digital credit instrument with a digital treasury company that issues securities to pay the dividend,” he declared.

From a stage in Dubai, Saylor said, “When designing STRC, our goal was to create a high-yield bank account-style product.”

He has repeated that claim. “Our goal is to provide you with a bank account that pays you 10% instead of your bank that pays you 4 or 3 or 2 or 0. That’s what STRC is.”

Not a bank account or money market

To be clear, despite Saylor’s promotional statements, STRC is nothing like a bank account or money market.

Indeed, it has no insurance from FDIC, NCUA, SIPC, or otherwise to guarantee its par value.

Strategy isn’t required to hold full assets to back STRC’s par value, isn’t required to maintain any particular pricing or stable value, and isn’t subject to the liquidity requirements of real money market funds.

STRC can and has lost value of its investors’ principal during periods of volatility, trading over 9% below its par value in the past.

Investors don’t have a direct redemption right with Strategy at par value, so they must hope for secondary market traders to bid for shares near par value.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Daily Market Update: Bitcoin Can’t Catch a Break as Middle East Tensions Hit Stocks and Crypto

TLDR

- Bitcoin is on track for its fifth straight weekly loss, last seen in 2022

- BTC is trading below $67,000, down around 3% this week

- Middle East tensions have pushed the U.S. dollar to 97.7 and oil to $65

- U.S. stock futures edged higher Thursday, led by Nasdaq futures up 0.3%

- Walmart reports earnings Thursday as a key read on consumer health

Bitcoin is heading toward its fifth consecutive weekly loss as rising Middle East tensions weigh on crypto markets. U.S. stock futures, meanwhile, are pointing modestly higher ahead of Walmart earnings.

As of Thursday, Bitcoin was changing hands below $67,000, down roughly 3% on the week. A close in the red would mark its longest weekly losing streak since March to May 2022.

Bitcoin peaked near $126,500 in October. It has since fallen more than 50%, with prices dropping as low as $60,000.

The monthly picture is just as bleak. Bitcoin has posted five straight monthly losses since October, making it the second-longest monthly losing streak on record. Only a six-month slide from 2018 to 2019 was longer.

Against gold, Bitcoin has now underperformed for seven consecutive months — its longest stretch on record against the precious metal.

Middle East Tensions Drive Dollar and Oil Higher

Geopolitical pressure is adding to Bitcoin’s woes. Reports say the U.S. has assembled its largest concentration of air power in the Middle East since the 2003 Iraq War.

President Trump has not made a final decision on whether to launch strikes on Iran. Prediction platform Polymarket puts the odds at 27% before the end of February.

The uncertainty has sent the U.S. dollar index to 97.7, its highest point since February 6. WTI crude oil climbed to $65 from a Wednesday low of $62.

A stronger dollar and higher oil prices tend to push risk assets like Bitcoin lower. These macro pressures are compounding an already weak technical setup for the cryptocurrency.

Stock Futures and Fed Minutes in Focus

U.S. stock futures were leaning higher Thursday morning. S&P 500 futures rose 0.2%, Nasdaq 100 futures gained 0.3%, and Dow futures were near flat.

Investors were working through minutes from the Federal Reserve’s January meeting. The minutes showed policymakers are divided, with some raising the possibility of rate hikes due to persistent inflation.

Despite that, market expectations for two rate cuts by the end of 2025 remained largely intact. Traders are also watching weekly jobless claims and pending home sales data due Thursday.

Walmart is reporting before the market opens, with investors using the results to gauge the health of the American consumer. Tariffs are also back in the spotlight after the Trump administration criticized a New York Fed report showing U.S. consumers and businesses are absorbing the cost of tariffs.

Bitcoin’s five-week losing streak, if confirmed at Friday’s close, would be one of its longest sustained downturns since the 2022 bear market.

Crypto World

Cardano (ADA) flashes technical reversal signals following Coinbase integration

- Coinbase has enabled ADA as collateral, boosting liquidity without selling.

- Inverse head-and-shoulders pattern hints at a potential bullish reversal.

- Whale accumulation strengthens confidence in ADA’s near-term outlook.

After the recent surge from around $0.24, Cardano (ADA) has struggled around the $0.27–$0.28 range for several weeks now.

However, recent developments and chart patterns signal a possible breakout.

Coinbase integration boosts ADA utility

One of the main factors driving renewed interest is the announcement that Coinbase now allows ADA to be used as collateral for loans.

This new feature allows users to borrow up to $100,000 in stablecoins without selling their ADA holdings.

Investors who want liquidity but wish to retain their ADA can now do so, thereby avoiding potential taxable events associated with selling.

This feature is especially appealing in volatile markets where traders want flexibility without exposing themselves to full downside risk.

It also underscores ADA’s growing real-world utility. Holding ADA is no longer just a speculative play; it can now serve as a financial instrument.

Large holders, often referred to as whales, may be particularly motivated by this.

Using ADA as collateral encourages them to maintain or even increase their positions.

This kind of activity often reduces supply pressure and stabilises the token in periods of uncertainty.

Moreover, as more users access these loans, the network effect could drive broader adoption across crypto platforms.

It positions ADA as a more functional and versatile asset, strengthening its market presence.

Technical signals suggest a possible reversal

At the same time, ADA’s charts are showing promising signs that a reversal may be in play.

Trading volume has sharply declined over recent months, reaching a multi-month low.

While falling volume often indicates waning interest, in this case, technical indicators suggest something more nuanced.

An inverse head-and-shoulders pattern has started to form, which is typically a bullish signal.

The Relative Strength Index (RSI) also shows divergence, suggesting that the selling pressure is easing and buyers may be stepping in.

If ADA can push above the $0.30 resistance level, it could ignite a rally toward $0.40 or even higher.

Support around $0.27 is now critical; a drop below this level could erode bullish momentum and delay any breakout.

A further slide below $0.22 would indicate that the reversal pattern has failed, potentially opening the door to extended losses.

Even with short-term uncertainty, the combination of technical patterns and Coinbase integration is creating cautious optimism among traders.

Whales are also accumulating the altcoins.

On-chain data from Santiment shows that large holders have been steadily increasing their ADA positions, often a sign that strong hands are preparing for a sustained move higher.

Historically, such accumulation tends to precede upward price momentum once market conditions improve.

The alignment of technical signals, increased utility, and investor confidence could make the coming weeks critical for ADA’s trajectory.

For traders and holders, these developments suggest that Cardano may be on the verge of breaking out from its current consolidation phase.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment24 hours ago

Entertainment24 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports9 hours ago

Sports9 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment15 hours ago

Entertainment15 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World18 hours ago

Crypto World18 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

Funding: $5.77 Billion

Funding: $5.77 Billion