Crypto World

If War With Iran Is Almost Certain, How Might Bitcoin Price React?

Bitcoin price is on the edge again.

Price swings are getting crazy, and it’s sitting around $67,400 like it’s not sure which way to jump. Traders are nervous. Really nervous.

On Polymarket, bettors now put the odds of a U.S. strike on Iran this month at 61%. Crypto felt it fast. Liquidations rolled in. Risk-off mode kicked on. And suddenly, everyone’s playing defense.

Key Takeaways

The Signal: Polymarket bettors price in a 61% chance of imminent US military action.

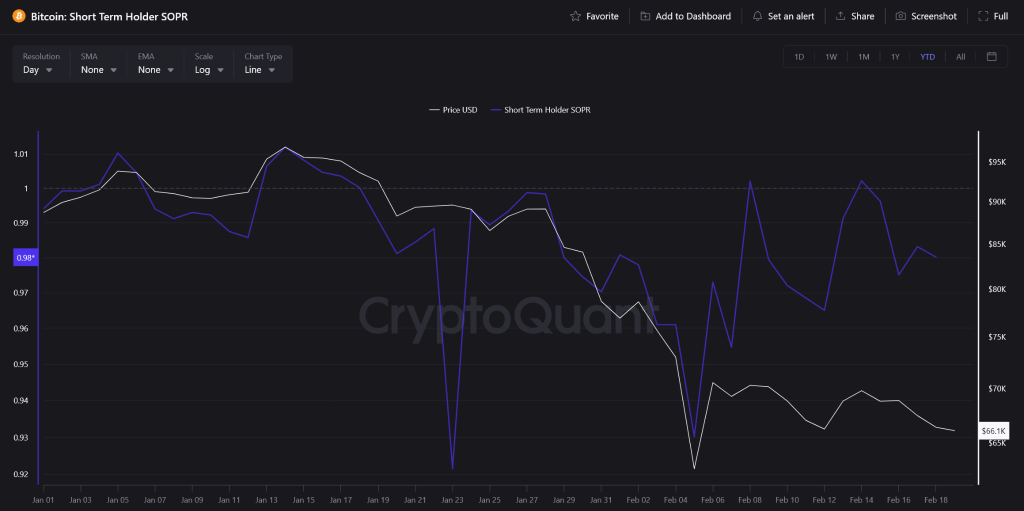

The Risk: Short-Term Holder SOPR has dipped below 1.0, indicating panic selling at a loss.

The Impact: Bitcoin risks breaking critical $65,000 support if conflict escalates this weekend.

Why Is This Happening Now?

Tensions between Washington and Tehran feels almost certain now.

Reports say the Pentagon has strike options ready after nuclear talks stalled. That kind of headline pushes investors straight into gold and cash. Risk assets get dumped first.

On chain data backs it up. The Short Term Holder SOPR is below 1. That means recent buyers are selling at a loss just to get out.

Add in uncertainty around possible Fed policy tweaks and you get a messy mix. Geopolitics plus macro pressure. While the US Iran story dominates, Bitcoin is trading like a classic risk asset, with sharp intraday drops and fragile sentiment.

What Does This Mean for Bitcoin Price?

Bitcoin is leaning hard on the $66,000 to $65,729 support zone. Lose that on a daily close and $60,000 comes into focus fast.

The short term Sharpe ratio has flipped negative, showing ugly risk adjusted returns during the panic. Nearly $80M in longs have already been wiped out since the drop from $70,000.

While retail is dumping, some political insiders are floating massive long term targets. That hints whales may see this dip as opportunity. Arthur Hayes also pointed to Treasury liquidity dynamics that could support crypto once the dust settles.

Volatility into the weekend looks guaranteed. But talks in Oman on Friday could change the tone. If tensions cool, a sharp relief rally could trap late shorts.

Discover: Here are the crypto likely to explode!

The post If War With Iran Is Almost Certain, How Might Bitcoin Price React? appeared first on Cryptonews.

Crypto World

XRP ‘Coiling’ for a Breakout? Liquidity Patterns Mirror Previous Explosive Rallies

Historical data depicts XRP rallies followed periods of tight liquidity, though sustained moves required expanding USD market depth.

XRP’s market structure is showing signs of renewed liquidity compression, as evidenced by exchange flows and on-chain liquidity conditions aligning in a way that has historically preceded increased volatility.

Data tracking Binance exchange inflows revealed that large deposits previously surged ahead of a major XRP rally, a pattern often associated with rising volatility rather than immediate selling.

Fragile Market Setup

CryptoQuant explained that while exchange inflows are commonly interpreted as potential sell-side pressure, past behavior indicates that they can also mark positioning phases before sharp price expansions. During the earlier rally period, USD liquidity, which represents the depth of capital supporting XRP markets, expanded significantly. This allowed prices to support upward momentum despite high volatility.

Current conditions, however, differ, as USD liquidity has been declining. Such a setting points to thinner market depth compared with prior expansion phases. Reduced depth typically increases sensitivity to flows and amplifies price reactions.

On the supply side, the amount of XRP actively available for trading dropped sharply ahead of the previous breakout, a period that marked the start of the rally. That same pattern is beginning to reappear, as XRP liquidity is trending lower once again. In past cycles, similar setups, where exchange inflows spiked while overall liquidity tightened, were followed by sharp increases in price volatility.

Whether those moves turned into steady trends depended largely on how much capital entered the market. Right now, exchange inflows remain relatively contained, but liquidity on both the USD and XRP side is shrinking. This points to a thinner market than during earlier expansion phases, where even modest changes in buying or selling pressure can have an outsized impact on price.

With less liquidity to absorb trades, XRP’s price may react more quickly if activity picks up, which makes market conditions even more fragile than they appear on the surface.

You may also like:

XRP Most Talked-About Asset After Bitcoin

Even against this backdrop, investor interest in the asset has not faded. As recently reported by CryptoPotato, XRP has emerged as the second-most talked-about digital asset after Bitcoin, as per Grayscale. The asset manager observed that the crypto continues to attract significant attention due to steady interest from its user base and investors, even as market sentiment remains cautious.

Speaking during Ripple Community Day, Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary, described XRP as having a large and committed community, and added that client inquiries about the token remain consistently high. Advisors at Grayscale have reported that the token frequently ranks just behind Bitcoin in terms of discussion volume.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ripple CEO Garlinghouse Predicts CLARITY Bill Has 90% Chance of Approval Soon

His remarks came after the most recent meeting in the White House.

Ripple chief executive Brad Garlinghouse said he now sees a 90% chance that the CLARITY Act will become law by April 2026. He described the outlook as stronger than before, citing steady legislative progress in Washington.

According to the CEO, the improved odds reflect recent engagement between lawmakers, the White House, crypto firms, and banking representatives. He noted that discussions have shifted from broad disagreements to resolving specific policy details.

Legislative Momentum Builds in Washington

Garlinghouse shared his updated view during an appearance on Fox Business, pointing to growing bipartisan interest in market structure legislation. He said recent meetings helped narrow differences that had previously slowed progress.

That momentum follows the CLARITY Act’s passage in the House of Representatives in 2025 with bipartisan support. Senate consideration has taken longer, though observers say the current pace signals renewed urgency.

To maintain progress, officials involved in the talks reportedly aim to settle remaining policy disputes by March 1, 2026. Supporters see the timeline as critical, given that legislative schedules often tighten ahead of midterm elections.

Stablecoins and Regulatory Clarity at the Center

The CLARITY Act, formally known as the Digital Asset Market Clarity Act, seeks to establish a unified federal framework for digital assets. It would define oversight roles by assigning assets that resemble securities to the securities regulator and commodity-like assets to the Commodity Futures Trading Commission.

Supporters argue that clearer boundaries would reduce legal uncertainty and provide consistent guidance for firms operating in the United States. They say this could lower compliance risks and support broader participation from established financial institutions.

You may also like:

Despite this support, stablecoins remain a central issue in negotiations, particularly whether issuers can offer yield-style features on reserve-backed holdings. Banking groups warn such practices could affect deposits, while crypto firms argue restrictions may push activity to other jurisdictions.

Against that backdrop, Garlinghouse said prolonged uncertainty has limited innovation, citing Ripple’s legal experience as partial but incomplete progress. He stressed that individual court outcomes cannot replace clear, industry-wide rules.

Market expectations have also shifted, with prediction platforms such as Polymarket showing rising confidence in passage within the proposed timeframe. Analysts view the coming months as a key window before political dynamics complicate the process further.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Is Blue Owl Redemption Halt an Early Alarm for Crypto Markets?

Private capital firm Blue Owl Capital, with over $307 billion in assets under management, has permanently halted investor redemptions at a retail-focused private debt fund.

The suspension has triggered concerns among economists. Furthermore, it has raised a key question about whether the private credit market could impact the broader crypto market.

Everything to Know About Blue Owl’s Redemption Changes

According to Bloomberg, the private credit firm has seen a rise in withdrawal requests in recent months. This was partly driven by investor concerns over its exposure to software companies amid the artificial intelligence surge.

FT noted that Blue Owl Capital Corp II (OBDC II) has been closed to redemptions since November. The firm had previously indicated it might reopen withdrawals later this quarter, but it has now abandoned that plan.

Earlier this week, the company revealed that quarterly redemptions would no longer be available to OBDC II investors. Instead, the firm plans to distribute cash through periodic payments tied to asset sales.

“We’re not halting redemptions, we are simply changing the method by which we’re providing redemptions,” Blue Owl co-President Craig Packer told analysts on a conference call Thursday, as per Reuters.

According to Packer, payouts to fund holders are expected to be roughly 30% of the fund’s value, up from the prior 5% cap.

“We are returning six times as much capital and returning it to all shareholders over the next 45 days. In the coming quarters we will continue to pursue this plan to return capital to OBDC II investors,” Blue Owl commented on its latest plan.

Blue Owl also moved to sell approximately $1.4 billion in assets from three of its credit funds. Bloomberg revealed that Chicago-based insurer Kuvare, the California Public Employees’ Retirement System, Ontario Municipal Employees Retirement System, and British Columbia Investment Management Corp. purchased the debt, according to people familiar with the matter. Blue Owl added that the loans were sold at 99.7% of par value.

Private Credit Market Faces Growing Strain

Market analyst Crypto Rover suggested that Blue Owl’s redemption freeze reflects mounting pressures across the $3 trillion private credit sector. He outlined several warning signs.

First, about 40% of direct lending firms now report negative free operating cash flow. Default rates among middle-market borrowers have climbed to 4.55% and continue to rise.

Notably, 30% of firms with debt due before 2027 show negative EBITDA, making refinancing challenging. Meanwhile, credit downgrades have outpaced upgrades for seven straight quarters.

“If the stress continues in the private credit market, it’ll first impact the small businesses for whom the private credit market is a critical funding source. Additionally, it’ll cause refinancing costs to go up and will result in more defaults, which will create a vicious cycle. The only way to stop this is by lowering interest rates and providing liquidity,” the analyst added.

Economist Mohamed A. El-Erian questioned whether the situation could represent an early warning signal similar to those seen in 2007 before the 2008 global financial crisis.

Implications for Crypto Markets

Stress in the private credit market does not automatically translate into direct contagion for crypto, but indirect linkages deserve attention. A recent analysis from BeInCrypto indicates Bitcoin has closely tracked US software equities.

A meaningful share of private credit is allocated to software companies, linking these markets through shared growth-risk exposure. If lending conditions tighten or refinancing risks rise, valuations in the software sector could come under pressure.

Rising defaults, widening credit spreads, and constrained capital access would likely weigh on growth stocks. Given Bitcoin’s correlation with high-growth equities during tightening cycles, sustained weakness in software could spill over into crypto markets.

That said, this remains a second-order macro effect rather than direct structural exposure. The critical variable is the broader financial response. If stress leads to tighter financial conditions, Bitcoin could face downside alongside tech.

If it triggers monetary easing or renewed liquidity support, crypto may ultimately benefit. For now, the risk is cyclical and liquidity-driven, not systemic to digital assets themselves.

Crypto World

Silver Supply Shock? Binance Hits $70B as CME Goes 24/7

While silver inventories on COMEX continue to decline, Binance’s newly launched gold and silver perpetual futures have already surpassed $70 billion in trading volume within weeks.

The sharp convergence across metals and crypto derivatives markets signals surging demand for 24/7 synthetic exposure to precious metals.

Binance recorded over $70 billion in trading volume across its XAU/USDT and XAG/USDT perpetual contracts.

It points to a strong appetite for always-on, on-chain access to gold and silver price movements. The milestone highlights how traders are increasingly turning to crypto-native platforms to gain exposure to metals without traditional market-hour constraints.

At the same time, physical silver dynamics are tightening. Silver backing futures keep falling, with the March-to-May contract roll reaching 30 million ounces per day. This pace could clear the current open interest.

“At that pace, COMEX is out of silver by February 27,” wrote investment specialist Karel Mercx, adding that from April onward, the market risks a physical shortage unless meaningful inflows arrive in the coming weeks.

The structure of the futures curve adds to the urgency. When adjusting for financing costs such as SOFR (Secured Overnight Financing Rate) and storage, the March–May spread is approaching backwardation. This condition effectively signals immediate demand for physical metal over future delivery.

In carry-adjusted terms, backwardation signals that physical silver is more valuable now than later.

Rising futures prices can intensify this dynamic, as higher forward pricing encourages speculative buying. It also prompts producers and holders to retain physical supply in anticipation of further appreciation, pulling additional metal out of the market.

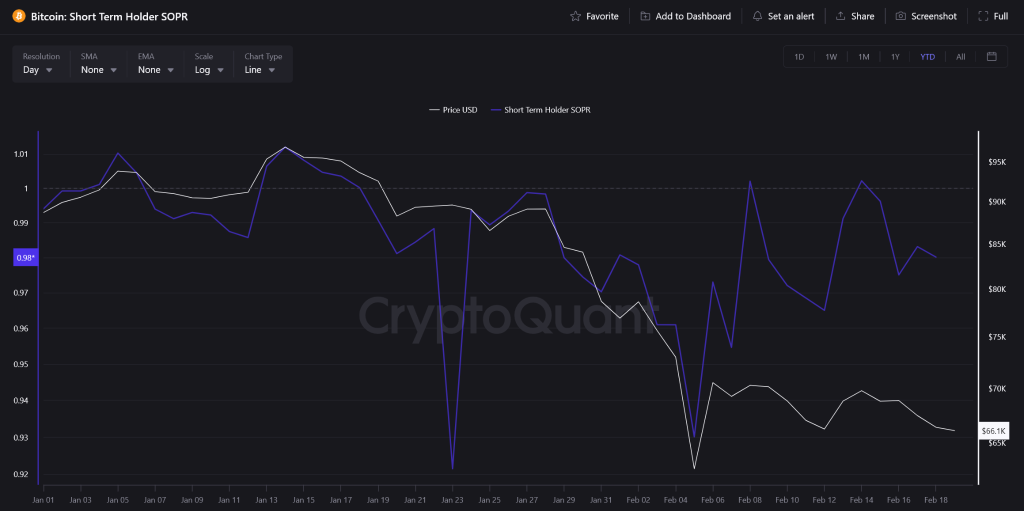

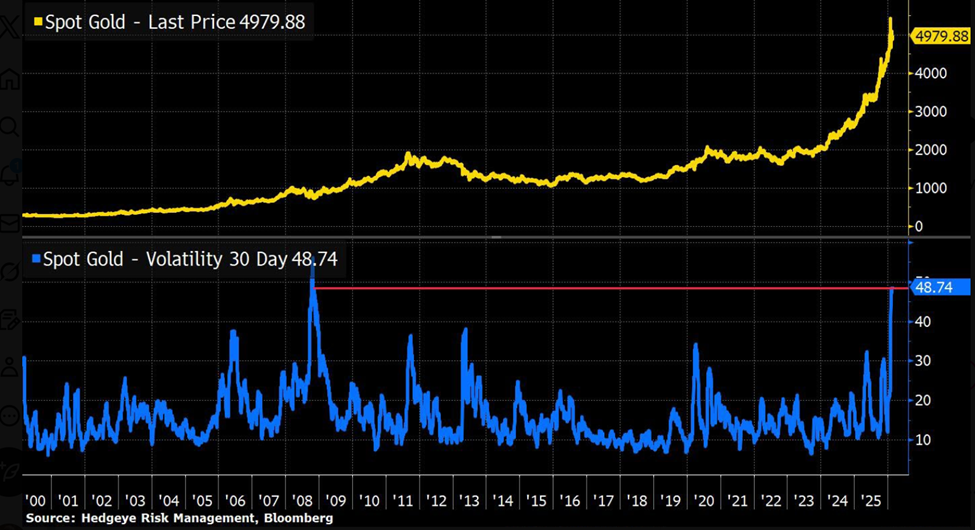

Meanwhile, gold volatility has surged, with its 30-day volatility at its highest level since 2008. The surge reflects heightened macro uncertainty and rapid shifts in positioning across derivatives markets.

The structural shift toward round-the-clock trading is not limited to crypto exchanges. CME Group announced that beginning May 29, crypto futures and options will trade 24 hours a day, seven days a week on CME Globex, pending regulatory review.

CME reported a record $3 trillion in notional volume across crypto futures and options in 2025, citing record-high demand for digital asset risk management.

Year-to-date 2026 data show average daily volume up 46% year-over-year and futures ADV up 47%, reinforcing sustained institutional participation.

The development may also reduce the risk of weekend price gaps. This would allow markets to respond instantly to geopolitical or macro shocks. Notably, the feature is already native to crypto exchanges like Binance.

Taken together, the surge in derivatives activity, accelerating silver inventory drawdowns, elevated gold volatility, and the normalization of 24/7 trading suggest markets are entering a structurally different phase.

As physical supply tightens and financial access expands, traders are positioning for potential scarcity in both metals vaults and digital order books.

Crypto World

Silver Price Breaks February Resistance Line

As seen on the XAG/USD chart, silver has today breached the upper boundary of the descending channel formed by February’s lower highs and lows.

Bullish sentiment is supported by heightened geopolitical tensions and rising demand for safe-haven assets. According to media reports:

→ On Thursday, US President Donald Trump warned Iran that it must reach an agreement on its nuclear programme, or “really bad things” would happen, setting a 10–15 day deadline.

→ In response, Tehran threatened retaliatory strikes on US bases in the region if attacked.

On 11 February, analysing the XAG/USD chart, we noted that silver was consolidating between two key levels:

→ resistance around $87.5–95

→ support near $70

Today’s bullish breakout of the channel’s upper boundary – which acted as resistance in February – can be interpreted as a move towards the $87.5–95 zone.

Confidence for bulls is further reinforced by an inverted head and shoulders (SHS) pattern. If buyers are determined, this should be confirmed by XAG/USD holding above:

→ the channel breakout level near $79

→ the psychological $80 mark.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Blockchain technology upgraded political campaign financing

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In U.S. politics, campaign finance reporting is one of the most crucially vital parts of any election. While still important, the reporting standards and practices are dated. Currently, candidates must fill out and send reports to the Federal Election Commission every three months. Which then means voters, donors, or any other campaign stakeholders have to wait months before they see vital information on campaign financing and funding. Although today, using blockchain technology, a lot of this information can reliably be delivered in real time.

Summary

- Campaign finance is stuck in batch mode: Quarterly filings delay transparency, while blockchain can deliver real-time visibility into funding flows.

- Public wallets enable live verification: Voters, journalists, and donors can independently track contributions and spending without waiting for intermediaries.

- Transparency shifts incentives: Continuous on-chain disclosure makes questionable activity easier to flag early — turning reporting into active accountability.

Real-time verification through a public wallet

During our campaign, we chose to use a public crypto wallet so donors and voters could verify activity directly. Instead of waiting for a filing window, anyone could view the wallet, check balances, and see transactions as they occurred. The ledger created a live record of campaign funds, allowing people to follow the flow of money without intermediaries interpreting or summarizing it later.

In practical terms, on-chain records show the transaction amount, the sending address, and the timestamp. Journalists, analysts, and voters can review activity themselves rather than relying on delayed reports or second-hand explanations. Expenditures can be tracked the same way, creating a permanent record of spending that remains visible over time. Anyone with basic tools can confirm activity independently, without relying on summaries released weeks later.

Public ledgers already operate at scale

There is a global rise in demand for blockchain technology as regulations and policies are opening the gates for the industry. With the CLARITY Act set to pass this year, there is a lot of momentum now within the legislative branch.

Currently, nearly 1 in 10 people own cryptocurrencies. At the same time, government and corporate interest in crypto is increasing as stablecoin regulation is advancing across more than 70 percent of major jurisdictions, and roughly 80 percent of jurisdictions have new digital asset initiatives from financial institutions.

The idea of real-time public reporting aligns with other sectors that have embraced digital auditability. Finance departments in corporations are increasingly exploring crypto workflows. A mid-2025 survey found that nearly 24 percent of North American chief financial officers expect to use digital currency in their finance operations within two years.

A practical use case for political finance

With the financial systems and the modern infrastructure already set in place, blockchain can easily be implemented in the political environment. Apart from transparency, on-chain features could prevent errors and fraud as it automatically links and timestamp transactions.

Apart from the transparency, implementing blockchain features in the campaign can prevent errors and fraud. Traditional batch reporting can lead to mistakes because it relies on manual reconciliation and delayed submission.

Meanwhile, distributed ledgers automatically link and timestamp transactions. Academic research highlights how on-chain systems can enhance traceability and trust across sectors by eliminating opaque intermediaries and enabling third parties to validate records independently.

Oversight and practical accountability

Transparency around who is funding a campaign is not only expected, it is imperative for accountability. Blockchain infrastructure modernizes how that transparency happens. Rather than relying on delayed filings and databases, on-chain systems can provide real-time visibility to funding whilst still using blockchain standards to ensure accuracy, integrity, and compliance. This is about making disclosures clearer, faster, and harder to manipulate.

Public wallets can transform campaign finance from retrospective reporting into active verification. Instead of waiting weeks or months to learn how money moved, voters can see live transactions and trust the campaign’s contributions are from legitimate sources. This can change incentives, questionable activity is flagged earlier, and accountability happens continuously, making empty promises harder to sustain. By aligning transparency with the pace of modern decision-making, blockchain restores confidence in the system and gives voters a clearer basis for choosing leaders who operate in the open.

Crypto World

Tennessee judge sides with Kalshi in ongoing sports markets battle

A federal judge in Tennessee has granted a preliminary injunction preventing state officials from enforcing gambling laws against prediction market platform Kalshi, marking a significant win for the federally regulated exchange in its escalating legal battles with state regulators.

Summary

- A Tennessee federal court granted a preliminary injunction blocking the Tennessee Sports Wagering Council from enforcing state gambling laws against Kalshi while litigation continues.

- U.S. District Judge Aleta A. Trauger signaled Kalshi is likely to succeed in arguing its sports event contracts fall under federal derivatives law regulated by the Commodity Futures Trading Commission, not state betting statutes.

- The ruling adds to a growing nationwide legal patchwork, including enforcement efforts by the Nevada Gaming Control Board, highlighting an escalating federal-versus-state regulatory clash over prediction markets.

Tennessee court halts state crackdown on Kalshi

U.S. District Judge Aleta A. Trauger ruled that Kalshi is likely to succeed in its argument that its sports-related event contracts fall under federal derivatives law, rather than state gambling statutes. The decision temporarily blocks enforcement actions by the Tennessee Sports Wagering Council while the broader lawsuit proceeds.

Kalshi operates as a designated contract market regulated by the CFTC offering event-based contracts that allow users to trade on the outcome of real-world events, including sports.

The company argues that these contracts qualify as “swaps” under the Commodity Exchange Act, placing them squarely within federal jurisdiction and preempting state-level gambling laws.

Tennessee regulators had issued cease-and-desist letters alleging that Kalshi’s sports markets constituted unlicensed sports betting. In granting the injunction, the court indicated that subjecting Kalshi to both federal derivatives oversight and state gaming regulation could undermine the uniform regulatory framework established by Congress.

The ruling adds to a growing patchwork of legal decisions nationwide. In Nevada, the Nevada Gaming Control Board has filed a civil enforcement action accusing Kalshi of offering unlawful wagering, while other states have taken mixed approaches in court.

Though temporary, the injunction underscores a broader jurisdictional clash between federal derivatives regulators and state gaming authorities. The outcome could have sweeping implications for prediction markets across the United States, potentially reshaping how sports-related event contracts are classified and regulated nationwide.

Crypto World

The 100-Day Crypto Bloodbath That’s Crushing Altcoins

According to CoinGlass, momentum gauges sit in neutral territory, reinforcing views that neither bulls nor bears dominate yet across majors.

The crypto market has lost about $730 billion in value in the past 100 days, according to data shared by on-chain analyst GugaOnChain on February 20.

The scale and speed of the drawdown point to heavy capital outflows, with smaller altcoins falling faster than large assets and traders watching for signs of stabilization.

Deepening Bearish Sentiment

According to GugaOnChain, Bitcoin’s market cap fell from $1.69 trillion on November 22, 2025, to $1.34 trillion currently, a decline of 21.62%. The top 20 cryptocurrencies, excluding Bitcoin and stablecoins, also suffered a major blow, dropping 15.17% from $1.07 trillion to $810.65 billion.

Just as vulnerable were mid- and small-cap altcoins, which plunged 20.06% from $390.38 billion to $267.63 billion over their respective 100-day windows.

Meanwhile, the selling pressure shows no sign of abating. Separate figures posted by Arab Chain show whale inflows to Binance reached a 30-day average near $8.3 billion, the highest level since 2024.

Large transfers to exchanges can signal preparation to sell or rebalance holdings, though such flows can also reflect derivatives positioning or liquidity management. The spike followed months of stable activity, which analysts often treat as a sign of changing sentiment among major holders.

Price action seems to be matching that cagey tone. At the time of writing, BTC was trading just below the $68,000 level after falling by more than 24% in the last month and roughly 30% over the past year.

You may also like:

Market-wide metrics also paint a similar picture, with total crypto capitalization standing near $2.4 trillion, up just 0.5% in 24 hours. According to CoinGlass, the average RSI sits near 45, indicating neutral momentum, and the Altcoin Season Index reads 45, also neutral.

Additionally, Bitcoin dominance holds near 57%, which signals that capital has not rotated aggressively into altcoins.

On-Chain Activity Slows

Recent data from market intelligence provider Santiment shows that network activity has also collapsed alongside prices. According to the firm, Bitcoin’s active supply stopped growing, with fewer coins moving across the network.

Per the data, there are 42% fewer unique Bitcoin addresses making transactions compared to 2021 levels, and 47% fewer new addresses are being created. Analysts describe this phenomenon as “social demotivation,” which is emotional fatigue and reduced engagement that often precedes narrative shifts.

Elsewhere, Glassnode reported that Bitcoin has broken below the “True Market Mean” and slipped into a defensive range toward the realized price of approximately $54,900. Historically, deeper bear market phases have tended to find their lower structural boundary around this level, which represents the average acquisition cost of all circulating coins.

Furthermore, the Accumulation Trend Score sits near 0.43, well short of the 1.0 level that would signal serious large-entity buying. At the same time, Spot Cumulative Volume Delta has turned negative across major exchanges, meaning sellers are still in control.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

CZ, Mar-a-Lago, & Binance’s Ties To Trump’s USD1 Stablecoin

Changpeng Zhao (CZ), the recently pardoned founder of Binance, returned to the US this week, for the first time since leaving federal prison in 2024. He attended the crypto summit hosted by the Trump family–backed World Liberty Financial (WLFI) at Mar-a-Lago.

The appearance marked a dramatic turnaround for CZ, who pleaded guilty in 2023 to anti-money laundering violations and served a four-month sentence before being granted a full presidential pardon in October 2025.

CZ Returns to US After Presidential Pardon

Reports describe the gathering as both low-key and symbolically loaded. During the event, CZ:

- Mingled with Eric Trump and Donald Trump Jr.,

- Attended panels, including one with newly appointed CFTC Chairman Michael Selig, and

- Shared space with prominent figures such as Goldman Sachs CEO David Solomon, NYSE President Lynn Martin, Coinbase founder Brian Armstrong, Senator Bernie Moreno, Kevin O’Leary, and even Nicki Minaj.

“Learned a lot,” CZ shared, emphasizing policy insights rather than political optics.

The optics of CZ’s return are striking. From federal prison and a $50 million personal fine to casually networking at the president’s club, the event signals that the legal chapter is closed.

Trump’s pardoning of CZ effectively removed long-term barriers to US travel and business activity. It allows him to rebuild influence within elite financial and regulatory circles.

Networks at Mar-a-Lago as Binance Controls 87% of Trump-Linked USD1 Stablecoin

The timing also coincides with Binance’s growing role in WLFI’s USD1 stablecoin. The exchange reportedly controls roughly 85–87% of the $5.4 billion circulating supply, strengthening a Trump-backed venture that critics have questioned for potential conflicts of interest.

While some lawmakers and commentators have raised concerns about a perceived quid pro quo between the pardon and Binance’s dominance in the stablecoin, CZ has repeatedly called such reports “not news.”

Nevertheless, Binance is reinforcing its dominance in the USD1 ecosystem with a fresh incentive push. From February 20 to March 20, the exchange will distribute 235 million WLFI tokens to USD1 holders, rewarding early adopters for providing liquidity.

Mar-a-Lago Summit Highlights Crypto-Political Convergence and USD1 Ambitions

The Mar-a-Lago summit highlighted the convergence of crypto, finance, and political influence. World Liberty’s leadership outlined ambitious plans for USD1, framing it as a “new digital Bretton Woods system” to integrate real estate, banking, and decentralized finance.

“…the work is just beginning… We are building the future, and we are doing it together,” WLFI wrote.

Attendees were urged to explore its use, while WLFI also announced upcoming tokenized investment products tied to Trump resorts.

Despite Binance remaining barred from US operations due to the 2023 settlement, CZ’s presence at a high-profile US event highlights a shift.

Engagements with policy leaders like CFTC Chairman Rostin Behnam and lobbying veterans such as Brian Armstrong suggest that figures like CZ are regaining a foothold in discussions shaping the future of digital assets.

Whether CZ’s return to the US will translate into renewed operational influence for Binance or remain a high-level networking exercise is uncertain.

What is clear, however, is the symbolism: a once-convicted crypto executive now freely attends elite US circles, at an event that blends business ambition with political connections. Meanwhile, his firm exerts unprecedented influence over a politically linked stablecoin.

Crypto World

ETH, XRP, ADA, BNB, HYPE flash mixed signals this week

ETH, XRP, ADA, BNB, HYPE sit near key levels after a choppy week of failed breakouts and fragile supports.

Summary

- TON embeds its wallet in Telegram, enabling payments, gifts, and asset transfers without traditional crypto UX, targeting over 1B users.

- CEO Max Crown says TON is “built to serve everyday users,” focusing on distribution, onboarding, and UX rather than just technical specs.

- Telegram gifts and NFT stickers have driven nine‑figure NFT volume, over 500k wallets, and rapid Toncoin (TON) account growth, signaling rising institutional and retail interest.

Ethereum (ETH) traded relatively flat over the period, with buyers maintaining key support levels as selling momentum decreased, according to technical analysts. The cryptocurrency faces resistance at higher price points, and analysts noted that recent weekly losses could precede a relief rally testing those resistance levels. Technical indicators suggest Ethereum may be completing a second downward movement in an ABC correction pattern.

Ripple closed the week with slight gains, though the advance proved insufficient to reverse bearish chart patterns. An attempt to break through resistance was rejected by sellers, a signal that the downtrend may persist, according to market observers. Analysts indicated that continued selling momentum could drive prices to lower support levels, with price reactions at nearby support expected to provide direction signals.

Cardano remained near key support levels but showed signs of weakness that could result in a breach of that level, according to technical analysis. The cryptocurrency’s price action reflected patterns similar to Ripple, with bearish momentum persisting as buyers and sellers contest support levels. Cardano has underperformed during the current year, with analysts noting that sustained gains would require reclaiming materially higher price levels.

Binance Coin (BNB) held near support levels over the past week, with selling pressure appearing to ease, though analysts cautioned the selloff may not be complete. Higher resistance levels remained untested, indicating buyer hesitation despite substantially decreased selling volume. Technical analysts stated that maintaining current support could encourage buyers to challenge resistance levels, while renewed selling pressure could push prices to lower support zones.

Hype (HYPE) closed the week lower following rejection at resistance levels. Buyers remained defensive, with analysts projecting potential further declines to key support. A loss of that support level would constitute an extremely bearish signal and could result in new yearly lows, according to market observers. Conversely, holding that level could be interpreted as a higher low formation, potentially encouraging buyer re-entry. Analysts characterized the cryptocurrency as being in a pullback phase that may extend for an indeterminate period.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video9 hours ago

Video9 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World14 hours ago

Crypto World14 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market