Crypto World

In conversation with Inteliumlaw’s Elena Sadovskaya

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Elena Sadovskaya reflects on how experience and shifting crypto regulation shape Inteliumlaw’s hands-on, long-term legal approach.

Summary

- Elena’s early experience at a Big Four firm shaped a practical, hands-on approach to complex cross-border structuring and high-stakes regulatory work.

- Inteliumlaw’s growth has been driven by MiCA-era demand, with CASP licensing and EU-compliant token listings becoming core client needs in 2025.

- Elena sees crypto’s future defined by adaptation: firms that treat regulation as a strategic framework, not an obstacle, are the ones built to last.

Navigating international business structuring in today’s regulatory climate is rarely straightforward, especially for companies operating across borders and emerging sectors like crypto. To better understand how legal professionals approach this complexity in practice, we spoke to Inteliumlaw’s Elena Sadovskaya about how her early experience studying law and later working at Ernst & Young shaped her thinking. Here’s what she had to say.

Hi Elena! Can you share with us how your experience practicing law during the 2nd year of university and later working at a firm like Ernst & Young influenced the way you approach complex international business structuring today?

Elena: Spending almost 4 years at a Big 4 company, Ernst & Young (E&Y), has truly felt like the equivalent of a whole 10 years at most other consulting firms. During this period, I frequently managed multiple tax and transaction structuring projects in parallel for major international clients across a range of industries. Every time it was working with significant deals, large transactions, and high-profile cases, which all allowed me to develop a strong grasp of how large businesses work and what their legal needs are. Most importantly, however, it all sharpened my understanding of how lawyers can guide them through different situations – be it shifting laws at home base, international scaling, heightened regulator attention, or other complex challenges – with tailored solutions.

Now, for Inteliumlaw, neither “impossible” nor “unresolved” cases are part of our vocabulary. With hands-on experience as lawyers for major firms and high-profile cases, we have the necessary know-how to provide robust support for enterprises and also help small businesses eventually grow into larger organizations.

At Inteliumlaw, we uphold the highest standards of work in everything we do, based on our experience with large, sophisticated businesses and a clear understanding of the level of quality they expect and shall get from legal advisers. A core part of these standards is a genuinely responsive attitude to projects we work with, where my overtime experience at E&Y showed how far a law firm must go so that the project gets the desired quality. Today, this enables us to effectively advise on complex international business structuring and other critical legal matters.

In a recent big interview, you shared that Inteliumlaw grew from a small circle of experts to a full-fledged law firm specializing in crypto licensing and other blockchain legal services. What new services or solutions did you introduce in 2025? Which ones have become “bestsellers” among your clients in crypto?

Elena: Last year was extremely fast-paced for all of us at Inteliumlaw. As regulations continued to evolve, we expanded and diversified our legal solutions to meet the demands of modern businesses.

For the crypto sector, we introduced an opportunity to obtain a CASP license in a select few jurisdictions like Poland, the Czech Republic, Lithuania, Cyprus, and beyond. These countries’ licensing conditions went through our rigorous internal analysis and were deemed the most favorable and relevant after MiCA entered into force and replaced the legacy VASP license. In parallel, our scope has expanded to include DAO structuring in the Marshall Islands and RAK, a foundation in Panama, alongside securing a crypto license in UAE (Dubai, VARA), El Salvador, and other markets where a VASP license currently presents a meaningful opportunity. Our website is being gradually updated to reflect the complete range of services we can support you with.

When it comes to “best sellers,” it is hard to highlight something in particular as the answer largely lies in regulatory development, including newly emerged regimes, shifts in current rules, and the scale of adaptation expected from businesses. This year, it was all centered around Markets in Crypto-Assets (MiCA) regulation, and our main focus was assisting firms to adapt to this new reality. Now, Inteliumlaw advises firms on getting a CASP license and delivers end-to-end MiCA-relevant support for token issuance, exchange listings, DeFi project launch, and the preparation of MiCA-compliant white papers and the notification submission process.

Therefore, I could say that our 2025 best-seller request was securing a CASP license and listing a token in Europe with MICA-compliant white papers, where we provide end-to-end, hands-on support through every stage of the process.

Your firm positions itself as a long-term strategic partner rather than a traditional legal service provider. How do you maintain that level of involvement with clients?

Elena: What we do is not just some careless execution of the client order made on autopilot. Rather, every Inteliumlaw client receives a customized approach designed to serve their interests in the most effective way. Our goal is to build long-term relationships with our clients, not driven by “capitalist motives,” but because this is the only way we can always stay on top of their current needs and help them grow a business that will sustain in the long term. When our clients grow, so do we.

As part of our customised approach, we ensure every client has a dedicated manager for their project from day one. In this case, they always have a point of contact who coordinates the project and maintains a 24/7 insight into the client’s status and needs, allowing us to offer the right legal solution.

When maintaining continuous involvement with the client and their needs, for instance, our lawyers continuously analyze the regulations in their home base and in their target expansion markets, helping identify what they might be exposed to early, help them adapt, and advise on the alternatives if needed. Most importantly, we do not walk away when the stakes rise and never leave clients in complex cases, but are actively engaged in finding the best possible solution for them. It makes our life a little bit more complicated compared to other law firms, but it is a principle we do not compromise on.

Many crypto entrepreneurs feel that regulation kills innovation. From your perspective, is this a fair statement? What is your opinion?

Elena: In many cases, yes, though it highly depends on the jurisdiction and its regulation, where the “killing innovation” narrative often stems from authorities imposing unrealistic expectations that far outpace current realities. In some cases, regulators could have opted for a less strict approach to some aspects, which would ultimately lead to minimized conflict and a slower pace of innovation and new projects’ development.

On the other side, without regulation as it is, projects cannot exist. Yet, reacting promptly to different changes can keep the project stable and demonstrate credibility to the market. In practice, the strongest players on the market today are those who are able to adapt to the regulatory expectations; this is what defines the long-term sustainability and how a project gains trust from customers.

An unregulated industry certainly equals much more space for projects that are not reliable. So the ultimate question here is to strike a balance, a “golden mean,” which, in most cases, simply doesn’t exist, making businesses’ lives more complicated.

When a new crypto business approaches you with a request, what are the first questions you ask before even talking about jurisdictions, licenses, or other legal support?

Elena: The very first thing we discuss before everything is each project’s operational model and details of how they function, ensuring we understand the business almost as if we are the one and only founder. This is the foundation of everything: from jurisdiction-based classification of their project and the subsequent regulations applicable to which legal solution(s) we can deliver to best fit the project’s needs.

Luxury ateliers never proceed to manufacturing a tailored suit without taking precise measurements. Our approach is no different. Based on the client’s near- and long-term goals, vision, and the detailed specifics of their work, we advise on the solutions that best match their needs.

Without clear, detailed answers upfront, any discussion of how we can assist would be irrelevant. A minor oversight of a tiny detail can make a tailored suit feel suffocating. Likewise, a small nuance can completely change the course and redefine what the right solution looks like.

How do you evaluate which crypto license is optimal for a client’s business model? Especially, how does this process go for choosing an EU jurisdiction for getting a CASP license?

Elena: Long before the client reaches out, a preliminary analysis has typically been made internally. Every jurisdiction is carefully reviewed for the requirements and the regulator’s approach to issuing licenses, so we understand the level of complexity involved and identify which businesses are most likely to pass through the process.

When the client approaches us, we carry out an in-depth analysis of their setup and objectives. We explore token issuance plans, targeted markets for expansion, where the team is located, and a lot more to shape a compliant strategy. Only after assessing licensing complexity, the client’s objectives, and the budget allocated to ongoing compliance can we recommend the most suitable alternative.

MiCA has completely reshaped how crypto businesses must operate in Europe. What is the biggest misconception companies still have about this regulation?

Elena: Working with crypto firms worldwide – including those already serving EU clients or planning to enter the market – I see one misconception more than any other: many still misunderstand the difference between a VASP and a CASP, assuming they can still onboard EU customers without securing the new authorization. This is especially the case with firms registered in offshore regimes with little oversight. In fact, they can’t.

This misconception is similarly prevalent among companies previously having VASP in Poland and other EU countries. Where firms were not prepared to meet higher requirements beyond their “light-touch” setup, it is becoming hard to adapt to substance requirements, organize client workflows, and develop comprehensive documentation. For businesses already operating in tightly regulated regimes, the transition is typically smoother.

So, I would say the biggest myth now is that a business can still operate as before, targeting Europe while being registered in an unregulated jurisdiction or one known for little oversight. These times are now officially over. Even more concerning is that, in 2026, some still believe crypto is unregulated; it is regulated.

In a recent interview, you called the UAE “one of the most promising global hubs for crypto and Web.” What specific regulatory or economic features give the UAE an edge over Europe or the US?

Elena: What makes them different is their vast resources, readiness, and willingness to invest substantially in the crypto sector, all with the focus on innovation. The UAE is home to lots of corporations with a significant appetite to invest and lead in crypto, which is why there is a consistent effort to shape a regulatory environment that accelerates growth.

The UAE’s approach is truly something unique now. Where Europe tries to follow US standards with an even more stringent rule, the UAE chooses a more liberal option and approaches it more like an opportunity to strengthen the economy. The EU treats crypto much like early societies treated fire: extremely dangerous without control. That’s why the regulation is made to avoid fraud, protect customers, and reduce the room for unreliable projects.

The UAE, on the other hand, is not afraid to introduce something new. It is therefore unsurprising that they have higher adoption rates, new solutions appear faster, and central bank digital coins are being adopted much sooner than anywhere else in the world.

Imagine you can design a new “ideal” crypto jurisdiction by combining elements of 3 already-existing regimes, which would you select and why?

Elena: There is no real need to merge 3 regimes when we can choose one framework as the core and make small adjustments.

In essence, the ideal crypto jurisdiction would match the UAE innovation-first model while offering a less complex procedure to roll out in the region(s). The process of issuing authorization permits (licenses) and understanding projects’ specifics is way too overwhelming now in the UAE. Even so, however, the select few who successfully make it through the process – often after months of waiting for the regulator’s feedback, sometimes only for minor clarifications – ultimately gain access to everything the jurisdiction has to offer.

Subsequently, rationalizing this process to the extent possible would materially strengthen the jurisdiction’s reputation as a crypto-friendly hub, making it the #1 or very close to this status.

In your experience, what are the most underestimated risks when crypto businesses operate “non-compliant but profitable,” beyond fines and license revocation?

Elena: It all comes down to the severity of non-compliance. On the administrative level, there are fines of different sizes and, in the worst cases, license revocations. Yet this is not the greatest fear of most businesses.

The most horrifying skeleton in the closet is when a case turns to criminal law, and the impact goes beyond the project finances to human lives. There are numerous high-profile cases where exchange executives are arrested and prosecuted for money laundering, and this is precisely what everyone wants to avoid.

We’ve learned that you’ve designed over 50 tax-efficient and future-proof structures while also supporting multimillion-dollar deals. Which projects are you the most proud of and why?

Elena: It’s honestly difficult to single out just one project, because every structure we design at Inteliumlaw is built around a very specific business and risk profile. Each of them is its own story, and behind every “successful structure” there are months of very detailed, customized legal, tax, and regulatory work.

That said, I’m especially proud of the projects where we supported businesses from a very early stage and further during their growth into well-known brands. There’s something very rewarding about knowing you didn’t just advise on a structure but helped build the strong legal foundation that allowed the company to scale safely.

In the crypto and web3 space specifically, we’ve worked on a wide range of complex matters: from tokenization of real-world assets (including immovable property) and structuring decentralized exchange and trading infrastructure projects to token issuance and token classification, governance models, and cross-border tax and corporate setups for founders and groups. We’ve also supported projects building trading terminals, platforms, and hybrid web2/web3 models.

What I’m most proud of is not just the number of structures we’ve built, but the fact that many of them were designed to be “future-proof.”

And lastly, what regulatory developments in crypto do you anticipate in 2026? Most importantly, do you think the primary regulatory risk for crypto firms will come from new laws or from aggressive reinterpretation of rules that already exist today?

Elena: 2026 will be a very important year for regulatory consolidation in crypto, especially in Europe. First of all, we expect the expiration of the MiCA grandfathering period around mid-2026, which will force many existing VASP-style structures to either become fully licensed CASPs or exit the market. In practice, this will mean a major clean-up of the industry, with higher compliance costs but also a much clearer regulatory perimeter for serious players.

At the same time, we expect increasing global pressure on so-called “regulatory gap” jurisdictions. Many offshore and semi-offshore hubs that historically served crypto businesses precisely because of lighter regulation will likely introduce more formal crypto frameworks, licensing regimes, and substance requirements. We’re already seeing the early stages of this trend.

On the structural side, I think we’ll see more legally recognized DAOs and on-chain governance models entering the mainstream. But in parallel, decentralized and hybrid web3 projects will continue to move under closer regulatory scrutiny, especially where there is any element of custody, intermediation, token distribution, or profit expectation.

As for regulatory risk, it will likely come from both sides: new laws and aggressive reinterpretation of existing rules. In practice, enforcement and re-qualification under existing financial, securities, AML, and consumer protection regimes may be just as disruptive as brand-new legislation. The industry is maturing, but companies should plan for a tougher, more enforcement-driven environment in the near term.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

ARK Invest’s Latest Moves: Wood Increases Joby Aviation and Robinhood (HOOD) Stakes, Exits Roku (ROKU)

TLDR

- On March 6, ARK Invest liquidated 32,304 Roku shares valued at $3.17 million, extending its recent pattern of position reduction

- The investment firm acquired 289,417 Joby Aviation shares totaling $2.78 million following the electric air mobility company’s improved Q4 financial results

- ARK purchased 19,206 Robinhood Markets shares for $1.55 million, capitalizing on a 4% decline in the trading platform’s stock price

- JD Logistics received $1.48 million in new investment from ARK as the logistics stock experienced approximately 22% gains on Friday

- Portfolio reductions included Iridium Communications ($2.08 million) and 10x Genomics ($1.62 million) divestments

Cathie Wood’s ARK Invest executed multiple portfolio adjustments on Friday, March 6, 2026, as financial markets wrapped up a volatile trading week. Investor sentiment remained guarded amid escalating U.S.–Iran geopolitical tensions and fresh employment data.

The firm’s daily trading disclosures revealed strategic position changes spanning fintech, technology, and aerospace sectors.

The day’s most significant transaction involved a divestment. ARK liquidated 32,304 Roku shares distributed across several funds, generating approximately $3.17 million in proceeds. This represents a continuation of Roku sales executed earlier in the week, indicating a strategic downsizing of the streaming platform position.

Additionally, ARK divested 86,890 Iridium Communications shares for approximately $2.08 million. Despite the satellite communications provider’s presence in ARK’s investment portfolio, Friday’s transaction signals a strategic retreat from the position.

The asset manager also decreased its 10x Genomics exposure, offloading 75,007 shares worth roughly $1.62 million.

ARK Boosts Aviation and Financial Technology Holdings

Among acquisitions, Joby Aviation emerged as the headline purchase. ARK secured 289,417 shares valued at approximately $2.78 million across its ARKQ and ARKX investment vehicles. The vertical takeoff and landing aircraft developer recently unveiled Q4 2025 financial performance, reporting a per-share loss of $0.14. This represented meaningful improvement from the previous year’s $0.23 loss.

Wood has consistently accumulated Joby shares in the aftermath of these earnings disclosures.

ARK expanded its Robinhood Markets holdings through the acquisition of 19,206 shares totaling approximately $1.55 million. This strategic purchase coincided with a roughly 4% decrease in Robinhood’s share price on Friday. The transactions were distributed among ARK’s ARKK, ARKW, and ARKF investment funds.

Additional March 6 Acquisitions

JD Logistics represented another notable purchase. ARK accumulated 1,129,547 shares for approximately $1.48 million via its ARKX fund. The Chinese logistics provider’s equity surged roughly 22% during Friday’s trading session.

ARK also secured 10,600 DraftKings shares valued at around $269,876.

Supplementary acquisitions encompassed Cerus Corp, Canton Strategic Holdings, and GeneDx Holdings positions.

The firm purchased 84,004 Cerus shares for $170,948, acquired 42,500 Canton Strategic shares for $191,250, and bought 9,113 GeneDx shares for $747,266.

Standard BioTools represented another complete exit, with ARK selling 397,382 shares generating $405,329 in proceeds. ARK additionally reduced its Nextdoor Holdings stake, disposing of 23,100 shares for $38,577.

These portfolio modifications were published through ARK’s routine daily disclosure filing on March 6, 2026.

Crypto World

Bloom Energy (BE) Stock Plunges 15% as Oracle-OpenAI Texas Data Center Project Gets Scrapped

Key Takeaways

- Bloom Energy (BE) shares plummeted 15.5% following the cancellation of Oracle and OpenAI’s Texas AI data center project

- The sharp decline erased gains from the previous month, where BE had risen 11.83%

- The selloff intensified during afternoon trading after Bloomberg broke the story

- BE’s valuation metrics remain elevated with a Forward P/E of 119.41 compared to the industry’s 18.47

- Wall Street maintains a Hold rating on BE, while Q1 earnings are projected to surge 200% year-over-year

Shares of Bloom Energy experienced a dramatic selloff on March 6, 2026, tumbling 15.5% after Bloomberg published a report revealing that Oracle and OpenAI have abandoned their proposed AI data center expansion project in Texas. The announcement caught investors off guard, as many had viewed data center infrastructure growth as a critical catalyst for the fuel cell manufacturer.

The steep decline wiped out recent gains for the stock. Over the preceding month, BE had advanced 11.83%, significantly outperforming the Oils-Energy sector’s 7.17% increase and contrasting sharply with the S&P 500’s modest 0.15% decline.

Market observers noted that the bulk of selling pressure materialized during afternoon trading, indicating that Bloomberg’s report hit the wires mid-session and sparked immediate investor flight.

Prior to this development, Bloom Energy had benefited from growing enthusiasm around AI infrastructure buildout. Given the substantial power requirements of data centers, many investors viewed fuel cell technology providers like BE as prime beneficiaries of this secular trend.

The cancellation of Oracle and OpenAI’s Texas facility stripped away a significant element of this investment thesis, at least for now.

Fundamental Outlook Still Promising

Despite Thursday’s sharp price action, Bloom Energy’s near-term earnings outlook remains robust. Wall Street analysts project Q1 earnings of $0.09 per share, representing a substantial 200% increase compared to the year-ago period.

Revenue forecasts for the quarter stand at $498.11 million, reflecting 52.79% year-over-year growth. Looking at the full fiscal year, consensus estimates call for earnings of $1.38 per share on top-line revenue of $3.25 billion.

The Zacks Consensus EPS estimate has been revised 106.32% higher during the past month, signaling growing analyst confidence. Bloom Energy maintains a Zacks Rank of #3, corresponding to a Hold recommendation.

Valuation Multiples Remain Extended

Even following Thursday’s correction, Bloom Energy’s valuation remains rich by traditional metrics. The stock commands a Forward P/E multiple of 119.41, substantially above the industry benchmark of 18.47. Its PEG ratio stands at 4.78, well above the Alternative Energy sector average of 1.97.

The company’s P/S ratio of 17.12 hovers near its 10-year peak. According to GF Value analysis, fair value sits at $23.95, suggesting significant overvaluation at prevailing price levels.

Institutional investors control 84.63% of outstanding shares, while company insiders have reduced positions, offloading 268,788 shares during the past three months.

From a balance sheet perspective, the company demonstrates strong liquidity with a current ratio of 5.98 and a quick ratio of 4.95. While the debt-to-equity ratio of 3.89 indicates meaningful leverage, the Altman Z-Score of 6.88 points to financial stability.

BE’s beta coefficient of 5.34 underscores the stock’s volatile nature — Thursday’s double-digit percentage decline aligns with this high-volatility profile.

Shares closed the previous session at $159.99 before succumbing to selling pressure following the data center news on March 6.

Crypto World

February Jobs Data Shock: How a 92K Employment Drop Shifts Fed Policy Outlook

TLDR

- February nonfarm payrolls dropped by 92,000, significantly worse than the anticipated 58,000-job increase

- The unemployment rate increased to 4.4%, exceeding the 4.3% projection

- Market expectations for Federal Reserve rate cuts increased following the release, with traders pricing in several potential 2026 reductions

- Escalating Middle East tensions are driving oil prices higher, compounding inflation worries

- Federal Reserve policymakers acknowledge the challenging data while urging restraint in drawing conclusions from a single report

February’s employment report delivered a significant blow to expectations, with the Bureau of Labor Statistics revealing that 92,000 positions were eliminated across the U.S. economy. This figure stands in stark contrast to analyst predictions, which had called for approximately 58,000 new jobs to be added.

The jobless rate climbed to 4.4%, surpassing both the prior month’s 4.3% reading and Wall Street forecasts. This marks just the second time monthly employment has contracted since the pandemic-driven collapse of 2020.

Harsh winter conditions significantly impacted construction sector hiring throughout February. Additionally, a labor action involving Kaiser healthcare employees resulted in approximately 28,000 healthcare positions being subtracted from the monthly tally.

Previous employment data also underwent downward adjustments. December 2025’s initially reported 48,000-job gain was revised to show a 17,000-job loss instead. January’s numbers dropped from 130,000 to 126,000 new positions, erasing roughly 69,000 jobs from earlier estimates.

Financial markets responded swiftly to the disappointing figures. CME FedWatch data indicates March rate cut probability jumped from 2% to 4.7% following the announcement.

Prediction platforms also registered notable movement. Kalshi data reveals traders currently assign a 26% probability to exactly one rate reduction in 2026, 22% odds for two cuts, and 17% likelihood of maintaining current rates throughout the year.

Fed Officials Weigh In

Mary Daly, President of the San Francisco Federal Reserve, indicated the employment figures introduce additional challenges for upcoming policy determinations. While recognizing labor market softness, she cautioned against overinterpreting data from any single reporting period.

Daly emphasized that inflation continues running above the Fed’s 2% objective, necessitating careful policy considerations. She referenced the three rate reductions implemented in late 2025, totaling 75 basis points, as measures intended to support employment.

Neel Kashkari, Minneapolis Fed President, suggested one or two rate reductions could be warranted this year should inflation moderate. He characterized employment conditions as “steady to soft” while noting Middle East developments might warrant holding rates steady.

Retail spending figures reinforced concerns about economic momentum. Commerce Department data showed January retail sales declined 0.2%, with seven of thirteen tracked categories posting decreases.

Oil Prices Add to Inflation Pressure

Tensions between the United States and Iran have disrupted commercial shipping through the Strait of Hormuz. Extended transit routes and elevated insurance premiums are driving freight costs upward.

Brent crude oil prices pushed beyond $80 per barrel. West Texas Intermediate experienced similar increases. Qatar halted LNG shipments for the first time in three decades, potentially creating opportunities for American energy producers.

BitMEX co-founder Arthur Hayes contended that sustained Middle East instability could compel the Fed toward accommodative monetary policy, pointing to past examples.

The Federal Reserve now confronts the challenge of addressing employment weakness while inflation persists above target levels, complicated by energy price pressures stemming from geopolitical instability.

Crypto World

Ripple (XRP) Unveils Ambitious Digital Prime Broker Strategy for Institutional Adoption

TLDR

- Ripple unveiled a comprehensive whitepaper detailing its “Digital Prime Broker” framework designed for institutional and banking clients

- XRP and the XRP Ledger facilitate early settlement mechanisms through on-chain credit infrastructure

- Clients of Ripple Prime can now trade CFTC-regulated futures for Bitcoin, Ethereum, XRP, and Solana via Coinbase Derivatives with Nodal Clear settlement

- XRP Ledger’s Permissioned DEX enables institutional participation within a KYC/AML-compliant regulatory framework

- XRP currently hovers around $1.40, experiencing decline over the past 24-hour period

Ripple has introduced a comprehensive whitepaper detailing its strategy to streamline institutional access to cryptocurrency markets. At the heart of this initiative is a “Digital Prime Broker” framework, with XRP serving as a fundamental component of the system’s functionality.

Have you read Ripple’s new whitepaper in full?$XRP isn’t just payments now. They’re expanding into institutional trading infrastructure

Onchain credit lines. Prime brokerage netting Transparent funding costs

Payments was the start. This is the next layer

NEW DEMAND FOR $XRP! pic.twitter.com/S9tWuKMasz— X Finance Bull (@Xfinancebull) March 2, 2026

The primary objective addresses the currently disjointed approach institutions face when accessing digital asset markets. Presently, major financial entities navigate multiple trading partnerships, disparate credit arrangements, and substantial regulatory compliance burdens. Ripple’s proposed framework consolidates these elements into a unified access layer.

Within this architecture, a prime broker would provide on-chain credit facilities to brokers and market makers. This structure enables participants to tap into liquidity prior to standard settlement completion, accelerating transactions while improving capital efficiency.

The XRP Ledger manages settlement operations. According to Ripple, the platform supports accelerated settlement by facilitating on-chain credit lines that finance transactions before the conventional net settlement timeline concludes. Associated funding expenses are disclosed with complete transparency.

Ripple possesses existing infrastructure to support this vision. The firm’s acquisition of Hidden Road last year—now rebranded as Ripple Prime—provides an operational prime brokerage platform rather than merely a conceptual framework.

Permissioned DEX Opens Door for Regulated Institutional Trading

A recently activated Permissioned DEX on the XRP Ledger represents a crucial element of this strategic initiative. This feature enables institutional trading on-chain while maintaining control over counterparty interactions through credential-based access restrictions.

This architecture embeds KYC and AML protocols directly into the trading infrastructure. For institutions operating under stringent regulatory mandates, this integrated compliance framework proves essential.

The Permissioned DEX effectively establishes a regulated pathway within a decentralized framework, addressing what has traditionally been a significant barrier to institutional cryptocurrency adoption.

Ripple Prime Now Offers Crypto Futures on Coinbase

Ripple has further announced that Ripple Prime users can now access cryptocurrency derivatives through Coinbase Derivatives. Available products include futures contracts for Bitcoin, Ethereum, XRP, and Solana.

These contracts operate under CFTC regulation and trade continuously around the clock. Nodal Clear provides clearing services. With Ripple Prime maintaining a Futures Commission Merchant license, the platform delivers these products directly without intermediary involvement.

Coinbase additionally provides U.S. perpetual-style futures contracts, broadening the available product suite. In the previous month, Ripple Prime integrated Hyperliquid support, enabling client access to on-chain derivative products.

XRP trades near $1.40 currently, showing decline over the recent 24-hour window based on CoinMarketCap reporting.

Crypto World

How Will BTC’s Price React?

Iran also rejected Trump’s demand for unconditional surrender but apologized to its neighbors.

The war that started last Saturday between Iran on one side and the US and Israel on the other doesn’t seem to be stopping anytime soon, despite Trump’s demands for unconditional surrender.

The POTUS has made a new set of threats after Iran’s president called Trump’s request for the country’s unconditional surrender a “dream.” Nevertheless, Iran’s authorities issued a rare apology to its neighbors for its strikes against numerous sites.

The US President continued the intense topic by warning that Iran will be hit very hard today. He also threatened that areas and groups of people that were not targeted before might be “under serious consideration for complete destruction and certain death.”

TRUMP SAYS UNDER SERIOUS CONSIDERATION FOR COMPLETE DESTRUCTION AND CERTAIN DEATH, BECAUSE OF IRAN’S BAD BEHAVIOR, ARE AREAS AND GROUPS OF PEOPLE THAT WERE NOT CONSIDERED FOR TARGETING UP UNTIL THIS MOMENT IN TIME

— *Walter Bloomberg (@DeItaone) March 7, 2026

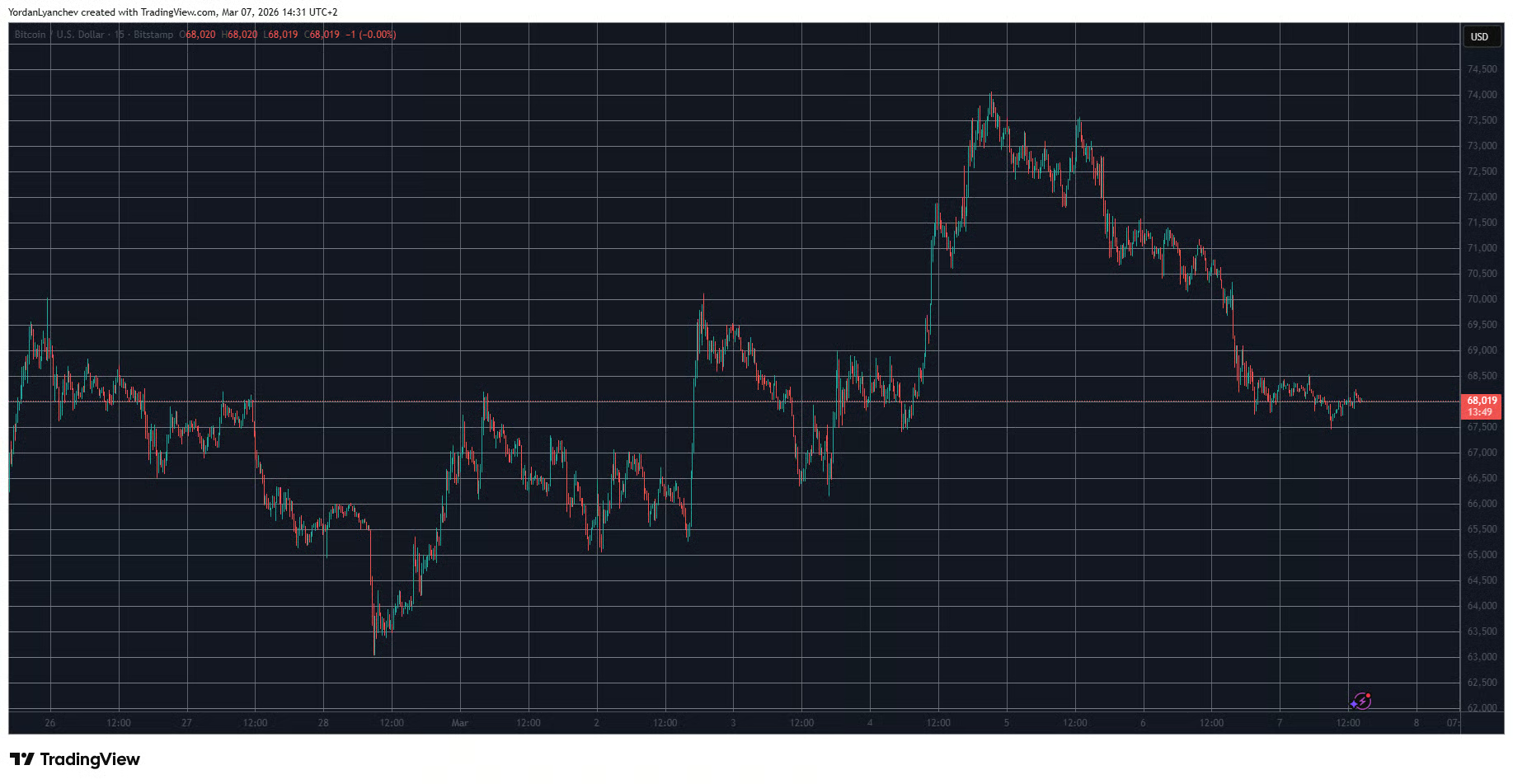

Recall that once the first strikes hit their targets last week, BTC’s price tumbled immediately from $67,000 to $63,000. However, it rebounded to $68,000 during the same day, especially after reports emerged that Iran’s Supreme Leader had been killed during the attacks.

It kept climbing mid-week as the tension grew and hit a monthly high at $74,000 on Wednesday. Nevertheless, it was rejected there, and the weak US jobs report from Friday, as well as Trump’s latest remarks on Iran and Cuba, sent it south to $68,000.

Today’s developments have left BTC unfazed as it continues to trade at around $68,000. However, more volatility might ensue if Trump’s threats become reality, especially since the crypto market is the only financial industry available for trading during the weekends.

You may also like:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

OmniPact Raises $50 Million to Power the Future of Decentralized Trust Infrastructure

TLDR:

- OmniPact raised $50M from anonymous institutional investors and family offices to advance its trust protocol.

- The funding will cover mainnet development, security audits, and a Q1 2026 testnet launch on schedule.

- Smart contracts serve as on-chain guarantors, removing all intermediaries from peer-to-peer transactions.

- OmniPact’s roadmap includes RWA integration and AI agent transaction capabilities across multiple chains.

OmniPact has secured $50 million in a private funding round to advance its decentralized trust infrastructure. The New York-based protocol is building a trust layer for peer-to-peer transactions involving both physical and digital assets.

A consortium of institutional investors and family offices backed the round, requesting anonymity. The capital will speed up mainnet development, cross-chain integration, and the launch of a decentralized arbitration module, bringing the project closer to full global deployment.

Funds to Drive Mainnet Development and Technical Expansion

A large share of the proceeds will fund the final development of OmniPact’s core contracts. Security audits of the multi-chain infrastructure are also scheduled as part of this phase.

Both steps must be completed before the protocol can advance into public deployment. This work is set to run alongside active engineering efforts on the mainnet.

OmniPact also confirmed that its testnet launch remains on schedule for Q1 2026. This milestone gives the protocol a clear timeline as it moves toward full market entry. Reaching this target would place OmniPact ahead of many competitors in the decentralized commerce sector.

Part of the capital will also go toward expanding OmniPact’s engineering team. More developers are expected to speed up real-world asset (RWA) integration across the platform. AI agent transaction capabilities are also being developed as part of this funding cycle.

Co-founder and CEO Alex Johnson commented on the raise, stating: “The funding validates our thesis that the future of commerce requires a neutral, transparent, and trustless foundation.”

Johnson added that the infrastructure “eliminates intermediaries entirely, returning power to users.” He further noted that investor confidence would allow the team to bring secure, decentralized custody to a global audience.

Smart Contracts and Decentralized Arbitration as the Trust Layer

OmniPact’s protocol is built to solve the trust problem that persists in peer-to-peer transactions. The platform deploys smart contracts as on-chain guarantors, removing reliance on any centralized platform. Two parties can therefore transact directly, with no third-party intermediary required.

Furthermore, the protocol pairs algorithmic custody with a built-in decentralized arbitration module. A reputation system operates alongside both tools, reinforcing accountability across all user activity.

Together, these mechanisms support secure and verifiable peer-to-peer asset exchange. The model also removes single points of failure common in traditional escrow services.

Cross-chain integration forms another technical pillar of OmniPact’s core architecture. The protocol is engineered to function across multiple blockchain networks at the same time. This gives the platform access to users operating across different digital asset ecosystems.

Institutional backers expressed confidence in OmniPact’s roadmap at the time of the announcement. They cited the protocol’s capacity to set new standards across both Web4 and traditional commerce.

Johnson concluded that the round gives the team the resources to “execute our roadmap” and deliver a live, fully operational protocol to a global audience.

Crypto World

European Energy Crisis: How Russia and Qatar Shocks Are Threatening EU Industrial Power

TLDR:

- Europe still imported 2 billion cubic feet per day of Russian LNG last year, half of Russia’s total exports.

- Qatar supplies 20% of global LNG and declared force majeure, with production halted for at least one month.

- The U.S. now controls over 50% of Europe’s LNG supply, giving Washington direct leverage over EU energy costs.

- Gas prices have already surged over 50% as simultaneous supply shocks strain Europe’s limited energy alternatives.

European energy crisis pressures are mounting as Russia redirects LNG exports while Qatar declares force majeure on gas. Europe replaced cheap Russian pipeline gas with costly LNG after the Ukraine war began.

Now two simultaneous supply shocks are hitting the continent at once. Gas prices have already surged over 50% in recent days.

The EU faces limited alternatives and growing concerns about a 2022-style energy crunch that could once again disrupt factories across the region.

Russia Redirects Exports as Qatar Shuts Down Production

Before the Ukraine war, Europe relied on 15 billion cubic feet per day of Russian gas. That supply kept European manufacturing costs competitive for years.

After the conflict began, Europe sourced costlier LNG from the U.S., Qatar, and other producers. The transition raised energy costs for European industry considerably.

The EU still imported 2 billion cubic feet per day of Russian LNG last year. That volume is roughly half of Russia’s total LNG exports globally. Russia has now announced it will redirect those flows to China and India.

Bull Theory stated on X: “Russia announced it will redirect part of its LNG exports away from Europe to friendly countries like China and India immediately.”

Russia’s move comes before the EU’s 2027 legal ban on Russian gas takes effect. Moscow has clear incentive to act on supply leverage before that deadline.

European policymakers now face a difficult position with limited response time. New supply chains cannot be established quickly enough to fill the gap.

Qatar’s Ras Laffan facility shutdown has added another blow to Europe’s energy position. Qatar supplies 20% of all global LNG and declared force majeure after the closure.

Normal production is not expected to resume for at least one month. Europe had relied on Qatari LNG as a central part of its post-Russia supply plan.

U.S. Leverage Grows While European Industry Faces Closures

The United States now supplies over 50% of Europe’s LNG. This gives Washington leverage over European energy costs and industrial policy.

European manufacturers must either absorb higher costs or relocate operations to North America. Bull Theory noted: “This effectively allows the U.S. to weaponize energy costs, forcing European factories to either pay a massive premium or relocate.”

Unlike China and India, Europe has not built diverse energy supply chains. Both nations secured alternatives that shielded them from current disruptions.

Europe, by contrast, faces simultaneous shocks with very few substitutes. Brussels is caught between U.S. bargaining pressure and a supply gap that diplomacy cannot quickly fill.

If the Hormuz blockade continues for weeks, a second wave of factory closures becomes likely. A similar pattern to 2022 could emerge, with permanent industrial losses for the European energy crisis.

The EU’s manufacturing standing faces direct structural pressure as a result. The outcome depends on events largely outside Europe’s control.

Russia still earns billions from the EU despite current tensions. The coming 2027 ban removes Moscow’s incentive to keep flows stable.

Europe has few tools to address a supply failure of this scale. The energy challenge now extends well beyond what Brussels can manage alone.

Crypto World

Kalshi, Polymarket Eye $20B Valuations in Potential Fundraising: WSJ

Prediction market platforms Kalshi and Polymarket are reportedly exploring new fundraising rounds that could value the companies at around $20 billion each, roughly double their most recent valuations.

Both platforms have held preliminary discussions with potential investors about raising fresh capital at the elevated valuation, the Wall Street Journal reported on Friday, citing people familiar with the matter. The report noted that the negotiations remain at an early stage and may not result in deals or secure the targeted valuation.

Kalshi currently operates in the United States and offers markets allowing users to wager on outcomes tied to sports, politics, the economy and cultural events. The company was last valued at about $11 billion in December when it raised $1 billion from investors including Paradigm and Sequoia Capital.

Founded in 2018 by Tarek Mansour and Luana Lopes Lara, Kalshi received approval from the US Commodity Futures Trading Commission in 2020 to operate as a regulated exchange for event-based markets. The platform has since expanded rapidly and recently surpassed a $1 billion revenue run rate, with some estimates placing the figure closer to $1.5 billion.

Related: Kalshi, Polymarket face trading halt in Nevada after court rulings

Polymarket plans US launch later this year

Polymarket, launched in 2020 by Shayne Coplan, remains inaccessible to US users without a virtual private network but plans to introduce a regulated domestic version of its platform later this year. The company was valued at roughly $9 billion in October after Intercontinental Exchange, the owner of the New York Stock Exchange, agreed to invest up to $2 billion.

Both platforms have drawn attention from lawmakers and regulators. As Cointelegraph reported, US Democratic lawmakers are drafting legislation to regulate prediction markets after suspiciously timed bets on the timing of US and Israeli strikes on Iran raised insider-trading concerns.

Senator Chris Murphy alleged that individuals close to the White House may have used advance knowledge of the attack to place bets, noting that several Polymarket accounts reportedly made about $1 million by wagering just hours before explosions were reported in Tehran.

Related: Kalshi founder provides update on Iran’s Khamenei market carveout

Polymarket faces insider trading suspicions

Polymarket has faced multiple insider trading allegations after several traders placed unusually well-timed bets on major events. A small group of crypto wallets recently made more than $1.2 million betting on a market tied to an onchain investigation into DeFi platform Axiom shortly before blockchain investigator ZachXBT published claims about insider trading linked to the project.

In a separate incident last month, another Polymarket account reportedly earned about $400,000 after placing a large wager on the capture of Venezuelan President Nicolás Maduro shortly before the news became public, further raising questions about whether some traders had advance information.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

USDC tops Tether as stablecoin transfers hit all-time high $1.8T

Stablecoins are delivering a liquidity surge unseen in recent cycles, with February marking a record on-chain transfer activity and signaling a shift in how capital moves through crypto markets. Allium’s data shows total stablecoin transfers climbed to $1.8 trillion in February, underscoring a robust appetite for dollar-pegged liquidity across chains. Within that, USDC accounted for roughly 70% of stablecoin activity, while USDt handled about $514 billion in transfers. The divergence—USDC’s dominance in flow despite a smaller market cap—illustrates how on-chain dynamics can outpace headline market-size metrics. The backdrop includes Circle reporting strong Q4 2025 earnings tied to rapid USDC business growth and expanded payments operations, alongside broader regulatory chatter shaping stablecoin frameworks.

Key takeaways

- February set a monthly record for stablecoin transfer volume at $1.8 trillion, according to Allium data.

- USDC comprised roughly 70% of all stablecoin transfer volume, with $1.26 trillion moved in February.

- USDt accounted for about $514 billion in stablecoin transfers in the same month, highlighting a substantial, yet smaller, slice of activity.

- USDC’s transfer volume has consistently surpassed USDt in recent months, even as USDt retains a larger market cap; Moonrock Capital’s Simon Dedic highlighted the trend on social media.

- New supply dynamics saw USDC minting accelerate in March, with Arkham data showing more than $3 billion minted in the first week of the month, while USDt’s supply remained comparatively flat.

- Broader liquidity signals—such as rising stablecoin supply on exchanges and the Stablecoin Supply Ratio’s recovery—converge with Bitcoin’s renewed price momentum, suggesting improving buying power in the market.

Tickers mentioned: $BTC, $USDC, $USDT

Sentiment: Bullish

Price impact: Positive. A higher on-chain stablecoin presence translates into greater liquidity for buyers, which can support price recoveries during risk-on periods.

Market context: The current liquidity uptick comes as crypto markets digest improved risk sentiment and a more active stablecoin ecosystem. Regulatory developments, including state-level discussions around stablecoins in places like Florida, add a layer of policy uncertainty that market participants are watching closely. These dynamics shape how liquidity profiles evolve across exchanges and DeFi protocols, influencing funding costs, slippage, and the pace of any potential rebound in broader crypto markets.

Why it matters

The February data illuminate a shift in how liquidity is sourced and deployed within the crypto ecosystem. Stablecoins are not only serving as a unit of account and settlement layer; they are becoming a primary engine for on-chain liquidity, enabling faster settlement and cross-chain movement. This has practical implications for traders, liquidity providers, and developers building on-ramp/off-ramp solutions, as larger flows can reduce slippage and improve the efficiency of executing large trades without destabilizing prices.

From an investor perspective, the observed dynamic—where USDC shows outsized transfer activity despite a smaller market cap relative to USDT—suggests that on-chain demand and real-use cases (such as payments, settlements, and cross-chain liquidity provisioning) can outpace traditional metrics. For builders and wallets, the data point to a thriving settlement layer, underscoring why stablecoins remain central to DeFi liquidity provisioning and cross-chain ecosystems. The broader regulatory context, including bills or policy proposals under consideration in jurisdictions like Florida, could influence user adoption and the pace at which institutions participate in stablecoin ecosystems, even as on-chain demand remains robust.

The market’s attention remains anchored on indicators that go beyond wallet counts or market caps and instead focus on real, on-chain activity. The Stablecoin Supply Ratio (SSR), which tracks Bitcoin’s market cap relative to stablecoin supply, has been recovering after a February dip, a signal CryptoQuant analyst Sunny Mom described as indicating “buying power returning to the market.” This sentiment aligns with a rebound in stablecoin supply on exchanges, where data indicate inflows contributing to a three-week high of roughly $66.5 billion, and with March inflows of about $5.14 billion on a single day tightening the liquidity pipeline. When sidelined capital returns to centralized and decentralized venues, it often precedes price moves in the flagship crypto assets, including Bitcoin and ether, as traders position for shifts in risk appetite.

What to watch next

- How March USDC minting evolves relative to USDT, and whether the pace sustains the early-month momentum observed by Arkham data.

- The trajectory of the SSR metric and whether rising stablecoin inflows on exchanges persist into the next quarter.

- Regulatory developments around stablecoins, including any state-level bills or federal policy steps that could affect settlement rails and cross-border payments.

- Circle’s ongoing earnings and operational updates, especially around USDC’s settlement capabilities and any further expansion of payments networks (as noted in prior earnings coverage).

- Monitoring the price action of Bitcoin and other major assets as liquidity flows and risk sentiment evolve, including shifts in funding rates and on-chain transaction activity.

Sources & verification

- Allium data on stablecoin transfer volumes, February metrics for USDC and USDt transfers.

- Arkham data on USDC minting pace in March, including the first-week minting total.

- Moonrock Capital — Simon Dedic’s observation on USDC vs USDT transfer volumes (social post).

- Cointelegraph coverage on Circle’s Q4/2025 earnings and USDC-related growth and settlement expansion.

- CryptoQuant analysis of SSR recovery and related exchange stablecoin inflows (including the March 5 figure of $5.14 billion).

- Florida Senate coverage of state-level stablecoin legislation and related regulatory considerations.

Stablecoins drive liquidity and the road ahead

The on-chain era is increasingly defined by how dollars move between wallets, scripts, and cross-chain bridges rather than by standalone token flips alone. February’s record stablecoin transfer volume, led by USDC (CRYPTO: USDC) and supported by a broad base of on-chain activity, suggests a fresh wave of liquidity is re-entering markets. While USDt (CRYPTO: USDT) remains the larger market-cap holder, its role in daily transaction flow appears to be waning relative to USDC’s immediate-use utility and cross-chain flexibility. This divergence — a rising proportion of actual transfers in USDC alongside ongoing growth of USDT’s nominal cap — highlights the complexity of today’s liquidity stack: more dollars are moving in ways that can support trades, settlements, and potentially price resilience as macro and regulatory signals evolve.

Watching the next few weeks will be instructive: will USDC sustain its elevated transfer-volume share and continue minting beyond the early March pace observed by Arkham? Will the SSR continue its ascent as more stablecoins circulate on exchanges? And how will policymakers respond to a stablecoin ecosystem that both powers practical payments and invites heightened scrutiny? The answers will shape not only the immediate liquidity environment but also the longer-term viability of stablecoins as liquidity rails for the crypto market.

//platform.twitter.com/widgets.js

Crypto World

South Korea Bars Stablecoins from Corporate Crypto Investment Guidelines Over Legal Conflict

TLDR:

- South Korea FSC excludes USDT and USDC from corporate crypto investment guidelines over legal conflicts.

- The Foreign Exchange Transactions Act does not recognize stablecoins as a valid external payment method.

- Listed companies may invest in the top 20 non-stablecoin assets, capped at 5% of their own capital.

- A pending amendment to the Foreign Exchange Act could eventually open the door for stablecoin inclusion.

Stablecoins, including USDT and USDC, are set to be excluded from South Korea’s corporate cryptocurrency investment guidelines.

South Korea’s Financial Services Commission (FSC) is preparing rules to allow listed companies to trade digital assets.

According to Herald Economy, regulators have opted to keep dollar-pegged stablecoins out of the approved investment list.

The decision stems from a conflict with the Foreign Exchange Transactions Act. This law does not currently recognize stablecoins as a legal external payment method.

Legal Conflict Shapes the Stablecoin Decision

South Korea’s Foreign Exchange Transactions Act requires external payments to go through designated foreign exchange banks. Stablecoins are not classified as external payment instruments under this law.

Allowing corporate investment in stablecoins would create a direct legal contradiction. The FSC chose to exclude stablecoins from the new corporate investment guidelines.

A partial amendment to the Foreign Exchange Transactions Act was introduced to the National Assembly in October. The amendment aims to formally recognize stablecoins as a means of payment.

The bill, however, remains under review and has not yet been passed. Until the law changes, stablecoins cannot be included in corporate investment guidelines.

Instead, the FSC plans to permit the top 20 non-stablecoin digital assets by market capitalization. Bitcoin and Ethereum are among the assets expected to be approved under these rules.

Investment amounts may also be capped at 5% of a company’s own capital. This limit is designed to reduce exposure during the early market stages.

Some listed companies with cross-border trade had requested stablecoin inclusion in the guidelines. They argued stablecoins support exchange rate hedging and fast international settlements.

The FSC, however, maintained its position and excluded stablecoins from the permitted investment list.

Corporate Stablecoin Access Remains Outside Regulated Guidelines

Even without official guidelines covering stablecoins, companies can still trade them through other channels. Personal wallets like MetaMask and overseas exchanges such as Coinbase’s OTC platform remain accessible to corporations.

These transactions, however, operate outside any officially regulated framework. The guidelines do not block companies from using stablecoins entirely.

Authorities noted that some companies already use stablecoins through personal accounts or overseas exchange platforms for trade.

These transactions occur outside formal banking channels. The FSC acknowledged this but still chose not to formalize stablecoin use in the guidelines. Regulators placed legal consistency above industry convenience in this case.

An industry insider confirmed the corporate guidelines task force has wrapped up its work. “I know that the working task force on corporate guidelines has been completed,” the insider said.

They added, “It is in line with the legislative status of the Phase 2 Digital Asset Framework Act, so we have to wait and see, but it is a knotted situation.” Progress, therefore, depends heavily on how the broader legal framework develops.

The FSC’s approach signals a cautious entry into corporate digital asset participation. By limiting access to top non-stablecoin assets, regulators aim to manage financial risk.

Companies seeking stablecoin access will likely need to wait for the Foreign Exchange Transactions Act to be amended.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business23 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion19 hours ago

Fashion19 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown