Crypto World

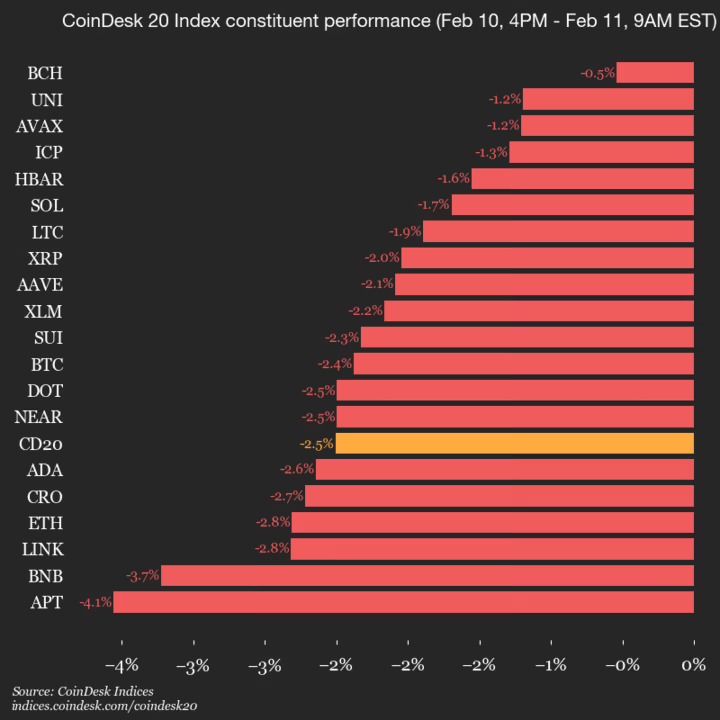

index trades 2.5% lower as all constituents decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1909.89, down 2.5% (-49.09) since 4 p.m. ET on Tuesday.

None of the 20 assets are trading higher.

Leaders: BCH (-0.5%) and UNI (-1.2%).

Laggards: APT (-4.1%) and BNB (-3.7%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Best Crypto to Buy Now: Pepeto Targets 100x Over DeepSnitch AI and ADA While Harvard and Abu Dhabi’s Mubadala Adopt Crypto ETPs

Harvard Management Company and Abu Dhabi’s Mubadala sovereign wealth fund have both adopted crypto exchange traded products according to Grayscale’s latest institutional report, and when the world’s richest university endowment and one of the Middle East’s largest sovereign funds both move into digital assets at the same time, it tells you the institutional wave is no longer a prediction, it is a fact.

The best crypto to buy now is the presale positioned to capture what follows before the listing reprices everything permanently.

Harvard and Abu Dhabi’s Mubadala Sovereign Fund Both Adopt Crypto ETPs

CoinDesk reported Grayscale’s 2026 outlook confirms Harvard Management Company and Mubadala have both adopted crypto exchange traded products, while CoinGlass data shows institutional positioning building across derivatives as pension funds and wealth managers complete their due diligence on digital assets.

When the smartest institutional money on the planet starts allocating, the best crypto to buy now is the one that gives retail traders the same infrastructure those institutions use, and Pepeto with $7.5M raised and a full exchange in development is exactly where that advantage lives.

What Is the Best Crypto to Buy Now as Institutions Flood Into Digital Assets?

Pepeto The Next 100x: The Exchange That Neutralizes the Institutional Advantage

The entry of sovereign wealth funds and university endowments into crypto highlights a critical reality: retail traders risk being outmaneuvered by institutions armed with superior data and limitless resources. Pepeto directly neutralizes this threat, which is exactly why investors call it the best crypto to buy now.

The exchange makes professional grade infrastructure available to every trader, providing the same cross chain bridging, zero fee execution, and risk scoring power that institutional desks access through expensive proprietary platforms. In simple terms, it puts every trader on the same playing field by connecting Ethereum, BNB Chain, and Solana into one liquidity layer where bridging, trading, risk scoring, and portfolio management all sit inside one interface.

The latest development milestone shows the exchange architecture is completely in development and functional, with a SolidProof audit backing every contract and a clean interface designed so both beginners and experienced traders can use it without friction.

The cofounder of the Pepe ecosystem who built a token to $7 billion leads the team, and with over $7.5M raised, the community is not just speculating, they are staking their conviction. More than 209% APY staking rewards are compounding daily, with a $10,000 position earning roughly $20,900 in yearly staking rewards, about $1,741 per month flowing into your wallet while the listing approaches and everyone else watches from the sidelines.

There is also growing confidence that Pepeto could list on major exchanges at $0.000000186, and the gap between presale pricing and listing valuation narrows every single day.

DeepSnitch AI Offers Analytics Without Exchange Scale

DeepSnitch AI positions itself as an AI powered intelligence platform with five agents for contract auditing and sentiment analysis, having raised roughly $1.8M. But the value depends on a narrow analytics niche with no exchange, no cross chain bridge, and no zero fee trading engine.

When Harvard and sovereign funds start flooding crypto with capital, traders need a platform to execute on, not just a dashboard to analyze, and the best crypto to buy now is Pepeto with the exchange infrastructure to capture that volume.

Cardano Recovers From $0.27 as Network Milestones Add Confidence

ADA is bouncing from $0.27 and attempting to reclaim $0.30 as AI price models and network milestones add confidence to the recovery thesis. But even the bullish $0.40 target is barely a 2x from current levels, and at $10 billion market cap, ADA needs sustained buying pressure for months.

The best crypto to buy now for the kind of returns that institutions are positioning for is the presale with exchange utility at a price that reprices the moment the listing arrives.

The Bottom Line

Harvard and Abu Dhabi’s sovereign fund are both in crypto now, and every time in this market’s history that the smartest institutional money moved in, the people who were already positioned before them made the kind of returns that changed everything about their financial future.

And Pepeto is that opportunity of 2026. The presale allocations are filling faster each week, the media has not even begun to cover what this exchange does, and every hour you hesitate is compounding profit flowing into wallets of people who already committed.

Visit the Pepeto official website and enter the presale before the institutional wave hits and this entry becomes the one you talk about with either pride or regret for the rest of the cycle.

Click To Visit Pepeto Website To Enter The Presale

FAQs

What is the best crypto to buy now?

The best crypto to buy now is Pepeto with exchange infrastructure in development. Visit the Pepeto official website.

Why does Harvard adopting crypto matter?

Harvard and Mubadala adopting crypto ETPs confirms institutional capital is arriving at scale, and the best crypto to buy now captures that wave before the listing reprices everything.

How does Pepeto compare to DeepSnitch AI?

Pepeto builds a complete exchange with bridging, zero fee trading, and risk scoring, while DeepSnitch AI offers analytics tools without any future adoption.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Fanatics and ZunaBet Face Off

Online gambling attracts entrants from unexpected directions. Sports merchandise empires and cryptocurrency startups both see paths forward.

Fanatics transformed sports retail dominance into gambling ambition. ZunaBet launched in 2026 with blockchain assumptions built into everything.

Two newer platforms. Two completely different visions.

The Fanatics Story

Fanatics became synonymous with sports merchandise. Licensed jerseys, collectibles, and fan gear built a retail empire.

Gambling seemed natural next. Existing sports customers already cared about games and outcomes.

Fanatics Sportsbook and Casino entered regulated American markets. State licensing determines where players access services.

The game library continues growing. Newer market entry means ongoing development.

Banking handles all transactions. Cards, transfers, e-wallets process through traditional financial systems.

Withdrawal timing follows standard patterns. Several business days covers most situations.

Welcome bonuses stay competitive. Deposit matches and credits attract new accounts.

FanCash connects gambling to merchandise. Rewards convert to spending money at Fanatics retail.

The ZunaBet Story

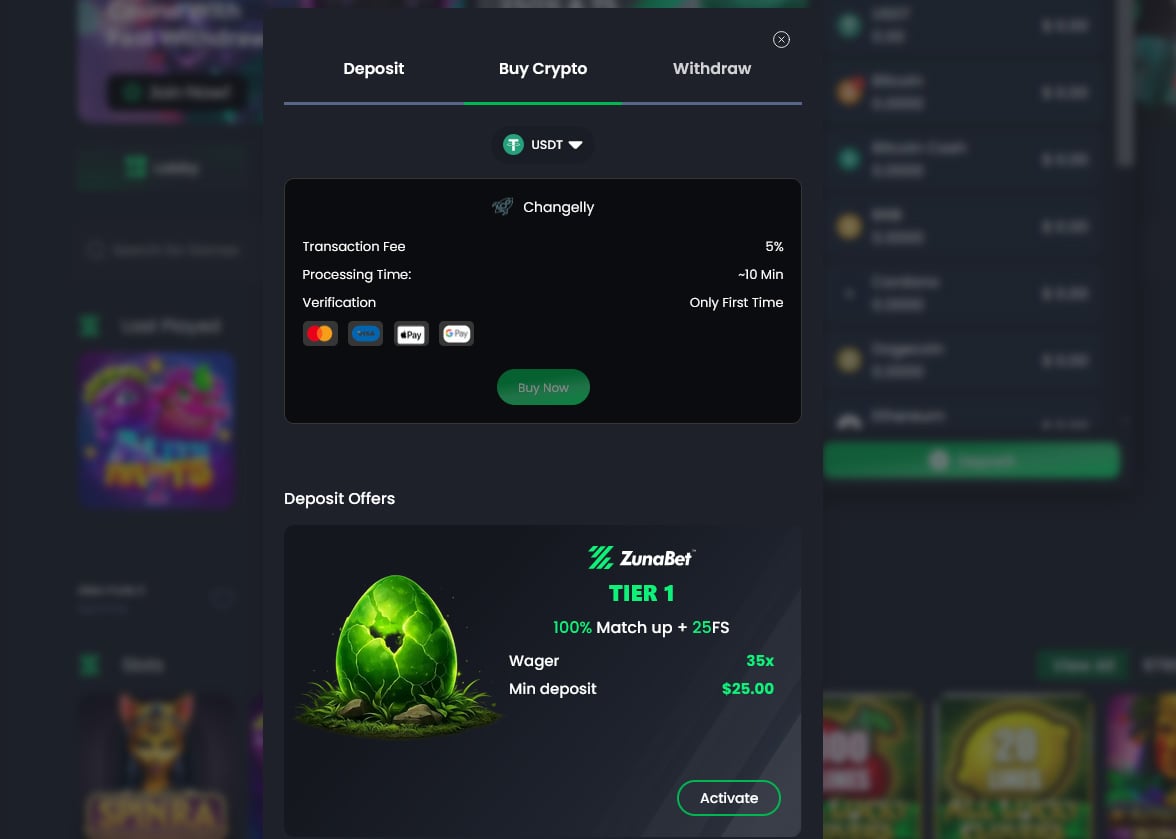

ZunaBet materialized in 2026 from different origins. Strathvale Group Ltd built specifically for cryptocurrency players.

Team experience exceeds 20 years combined. Anjouan licensing provides regulatory framework.

Game volume hit 11,000+ titles immediately. Sixty-three providers created instant depth.

Provider names include Pragmatic Play, Evolution, Hacksaw Gaming, Yggdrasil, BGaming. Recognized quality throughout.

Twenty-plus cryptocurrencies work natively. BTC, ETH, USDT, SOL, DOGE, ADA, XRP among options.

Platform fees remain zero. Withdrawal speed exceeds banking capability.

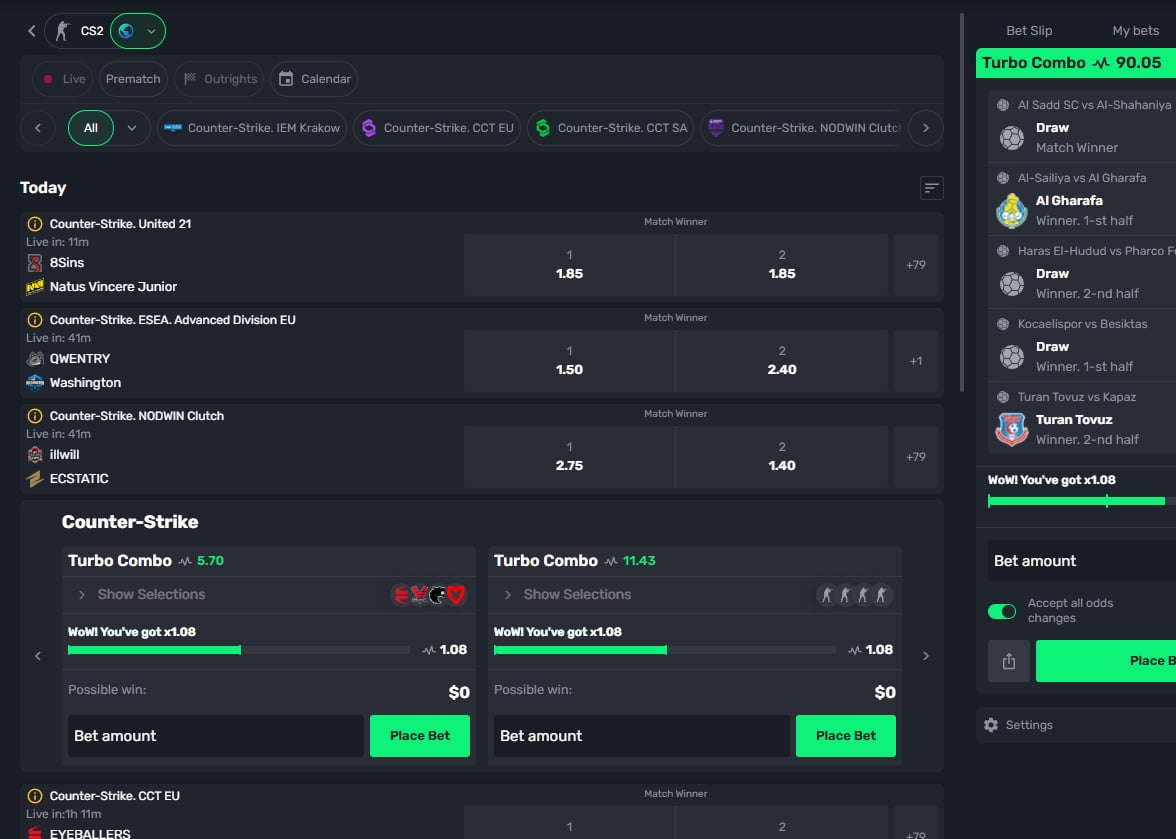

Full sportsbook runs alongside casino. Sports, esports, virtual events all active.

Breaking Down Bonuses

Fanatics competes within regulated frameworks. Welcome packages include deposit matches.

State and timing affect specifics. Checking current offers reveals details.

ZunaBet reaches $5,000 plus 75 free spins maximum. Three deposits capture everything.

First deposit gets 100% to $2,000 plus 25 spins. Second gets 50% to $1,500 plus 25 spins.

Third gets 100% to $1,500 plus 25 spins. Completion requires commitment.

Multi-deposit structure sustains engagement. Single offers often end quickly.

Terms apply everywhere. Reading conditions matters.

Contrasting Loyalty Models

Fanatics invented FanCash linking gambling and shopping. Points become merchandise spending power.

Jersey buyers and memorabilia collectors benefit naturally. Shopping rewards and gambling unite.

Players without merchandise interest gain less. Value requires retail participation.

ZunaBet engineered dragon evolution instead. Six tiers deliver increasing rakeback.

Squire begins at 1%. Warden provides 2%, Champion provides 4%.

Divine reaches 5%. Knight reaches 10%.

Ultimate peaks at 20% rakeback. Consistent play generates consistent returns.

Free spins climb to 1,000 through progression. VIP perks supplement core rewards.

Dragon mascot Zuno visualizes advancement. Progression feels like achievement.

Rakeback equals direct money. Merchandise credits require shopping.

Payment System Divide

Fanatics depends on banking entirely. Financial institutions process everything.

Cards deposit fast. Withdrawals queue behind processing.

Business hours govern timing. Weekends pause activity.

Bank statements show gambling clearly. Visibility may concern some.

ZunaBet operates outside banking. Wallets connect without intermediaries.

No bank involvement means no bank timing. Crypto speed governs.

Twenty-plus coins accepted. Multi-chain support included.

Platform fees nonexistent. Network fees only.

Privacy comes standard. Bank records untouched.

Game Selection Gap

Fanatics libraries continue development. Recent entry limits current scale.

State rules add complexity. Geographic availability varies.

Categories receive adequate attention. Slots, tables, live dealer present.

ZunaBet’s 63 providers create abundance. Eleven thousand games exist now.

Independent studios join major names. Unique titles appear.

Slots lead numerically. Tables and live complete offerings.

Evolution powers live dealing. Pragmatic powers slot volume.

Exploration takes dedication. The scale demands it.

Sports Betting Scope

Fanatics Sportsbook reflects retail DNA. American sports merchandise drives focus.

NFL, NBA, MLB, NHL dominate coverage. College sports supplement.

Brand alignment shapes priorities. Betting follows merchandising.

ZunaBet thinks globally. International coverage equals domestic.

World football alongside American leagues. Tennis, basketball, combat sports featured.

Esports goes deeper. CS2, Dota 2, League of Legends, Valorant active.

Virtual sports constant. No gaps between events.

Both unify casino and sportsbook. Single accounts serve both.

Using Each Platform

Fanatics apps cover iOS and Android. Browsers serve desktop.

Corporate sports design guides aesthetics. Functionality reliable.

ZunaBet spans iOS, Android, Windows, MacOS. Apps exceed browsers.

Dark themes look current. HTML5 speeds loading.

24/7 chat support available. Help exists constantly.

Mobile works both places. Transitions smooth.

Matching Players to Platforms

Fanatics attracts sports merchandise devotees. FanCash shoppers maximize value.

Banking users stay comfortable. Familiar methods continue.

Sports-centric bettors find brand alignment. Collecting and gambling connect.

ZunaBet attracts cryptocurrency holders. Coins integrate directly.

Bonus seekers find higher numbers. The $5,000 package leads.

Rakeback calculators should engage. Twenty percent compounds meaningfully.

Privacy seekers benefit structurally. Banks stay uninvolved.

Variety seekers discover abundance. Eleven thousand games await.

Industry Positioning

Fanatics leverages customer base enormously. Millions of retail customers exist.

Development follows compliance requirements. Growth proceeds steadily.

ZunaBet caught rising cryptocurrency waves. The 2026 timing worked.

Younger demographics own crypto. Native platforms feel right.

Dragon loyalty challenges merchandise models. Cash beats shopping credits.

Massive libraries attract curious players. Limited selection constrains.

Innovation energy flows toward crypto. Traditional builds incrementally.

Projecting Forward

Fanatics will expand gambling steadily. Resources and customers ensure continuation.

The retail connection differentiates uniquely. Jerseys plus jackpots works.

ZunaBet represents acceleration elsewhere. Crypto-first matches emerging preferences.

Eleven thousand games provides immediate depth. Twenty percent rakeback provides immediate value.

Neither suits everyone perfectly. Background determines appropriateness.

Merchandise lovers find Fanatics logical. Crypto holders find ZunaBet logical.

One merges shopping and gambling. One merges crypto and gambling.

Both newer brands compete differently. Both target different futures.

Fanatics bets on sports retail loyalty. ZunaBet bets on cryptocurrency adoption.

Current trends favor crypto trajectories. Younger players normalize it.

ZunaBet positioned accordingly. Game volume, bonus size, rakeback transparency align with generational shifts.

The question of competition resolves situationally. Different players answer differently.

For cryptocurrency believers seeking excitement, ZunaBet delivers more. Innovation and player value concentrate there.

For merchandise collectors seeking integration, Fanatics delivers more. Retail connection creates unique appeal.

Both can succeed serving different audiences. The market accommodates multiple approaches.

But momentum tells a story. Crypto-native platforms attract energy and attention.

ZunaBet exemplifies that momentum. A newer brand can absolutely compete.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

from the “unbrokeraged” to the universally invested

In today’s newsletter, Nick Ducoff, head of institutional growth at the Solana Foundation, draws a parallel between tokenization’s ability to democratize investment access and how the Internet facilitated access to banking over fifteen years ago.

Then, in Ask an Expert, the CoinDesk Research Team answers questions about stablecoin and tokenization trends from their February 2026 Stablecoins & Tokenization Assets Report. Read the full report here.

Internet capital markets: from the “unbrokeraged” to the universally invested

Fifteen years ago, over 60 million Americans were “unbanked,” shut out of basic financial services because traditional banks found them unprofitable. Then Chime, Revolut, and other fintech pioneers brought banking to smartphones, eliminating legacy barriers like minimum balances and penalty fees. Today, we face an even larger exclusion problem: billions of people are effectively “unbrokeraged,” with no access to capital markets and the investing opportunities to build generational wealth.

Enter Internet Capital Markets: global, always-on infrastructure where assets are born digital, traded mobile-first and available to anyone with a smartphone 24/7. With blockchain technology, Internet Capital Markets are poised to do for investing what fintech did for banking. And the opportunity is immense.

The scale of financial exclusion

The “unbrokeraged” encompasses two distinct but overlapping populations: those who lack brokerage accounts entirely, and international investors who can’t efficiently access high-quality U.S. dollar-denominated assets. Consider Pakistan, where, according to Bilal Bin Saqib, Chairman of the Pakistan Virtual Assets Regulatory Authority (PVARA) and CEO of the Pakistan Crypto Council, only 300,000 people hold brokerage accounts while 40 million have cryptocurrency wallets. The infrastructure exists, but financial products remain overwhelmingly inaccessible.

Even when access to U.S. markets exists through local brokers, international investors often pay significant premiums, to mention nothing of the large minimums and investor accreditation that the private markets require. These aren’t products accessible for the global middle class — they are built to serve the already-wealthy.

Tokenization expands the playing field

Blockchain tokenization transforms these dynamics by enabling fractional ownership, eliminating intermediary costs and operating 24/7 with instant settlement. The result: dramatically lower minimums and global accessibility. Consider Hamilton Lane, a leading alternative asset manager. Through Republic Crypto, investors can now access Hamilton Lane private market exposure for as little as $500. That’s a thousand-fold reduction in the entry barrier compared to traditional private fund minimums, and a signal of how internet-native market infrastructure can finally make fractional access more readily available.

The recent BitGo IPO also shows tokenization’s democratizing potential. When BitGo went public on the New York Stock Exchange, tokenized representation of BitGo stock was simultaneously tradable on Solana, allowing anyone globally with a Solana wallet to purchase BitGo stock immediately. This evolution toward real-time, global accessibility is now being validated by the world’s largest asset managers: BlackRock and Franklin Templeton have launched tokenized money market funds on public blockchains, allowing for 24/7 liquidity and transparency.

Why this infrastructure matters

Tokenization expands access rather than competing with traditional markets. The blockchain operates continuously, enabling investors in Jakarta, São Paulo, or Lagos to buy assets the moment they become available, not when their local markets open. Settlement happens instantly against stablecoins, eliminating the multi-day clearing processes and currency conversion fees that hinder retail investors outside of the U.S.

Speed and cost matter. High-performance blockchains like Solana, along with Layer 2 scaling solutions on Ethereum, can process thousands of transactions per second for fractions of a penny, making the economics of fractional ownership actually work. This is the foundation of “universal basic ownership,” where anyone with a phone can now have a stake in the global economy’s growth, even across asset classes like pre-IPO stocks and private credit, once strictly gatekept to institutions and the ultra-wealthy.

The advisor’s edge: strategy and accessibility

For financial advisors, this transition represents a strategic exposure play. Accessibility is now streamlined through regulated vehicles like spot Solana ETFs (e.g., SOEZ, QSOL, BSOL) and European ETPs, alongside user-friendly digital custody tools such as Phantom or Ledger wallets. Now, advisors can utilize sub-cent transaction costs to offer sophisticated, fractionalized portfolios to a much broader client base. This infrastructure lowers the “cost to serve,” making institutional-grade diversification available to the middle-class “mom and pop” investors through their financial advisers.

From unbrokeraged to universally invested

The fintech wave of the 2010s proved that financial exclusion is a design problem. Tokenization represents the next chapter in this story. A software developer in South Korea shouldn’t face barriers to investing in U.S. equities or accessing private credit returns. A small business owner in Argentina shouldn’t pay premium prices for the same stocks available cheaply to American investors. Sophisticated investment strategies shouldn’t remain exclusively in wealth management channels serving the top 1%.

The technology rails have been built, and regulatory pathways are becoming clearer. What remains is scaling this infrastructure and ensuring it serves its highest purpose of extending wealth-building opportunities to the billions currently locked out. While the work of banking the unbanked is far from done, it offers a blueprint for what we’re about to see: transforming the unbrokeraged into the universally invested.

– Nick Ducoff, head of institutional growth, Solana Foundation

Ask an Expert

Q: What are stablecoins and why are they important?

Stablecoins are a type of digital currency designed to maintain a stable value. This is usually achieved by “pegging” the stablecoin to a traditional asset, such as the U.S. dollar. Unlike other cryptocurrencies, such as bitcoin or ether, which may experience wide fluctuations in price, stablecoins are designed to allow users to hold or trade digital assets without exposure to price swings. Other use cases of stablecoins include serving as primary trading pairs, cross-border payments, decentralized finance (DeFi) lending and borrowing, and inflation hedging. The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), enacted in July 2025, creates a comprehensive federal regulatory framework for U.S. dollar-backed payment stablecoins.

Q: What is the current stablecoin landscape?

After rising for twenty-five consecutive months, the growth of the total stablecoin market capitalization has slowed over the past four months, though it continues to hover near its all-time high of $310 billion. CoinDesk’s latest research report indicates that as digital asset prices generally trend lower, the market dominance of stablecoins has surged. In February, Stablecoin market dominance surged to 13.3% (up from 11.2% in January), driven by the decline in price action of digital assets. Tether’s USDT continues to lead the sector with a 59.1% market share, while Circle’s USDC ranks second with 24.6%.

Q: What is the current traction for tokenized assets, and how quickly is the market for tokenized real-world assets growing?

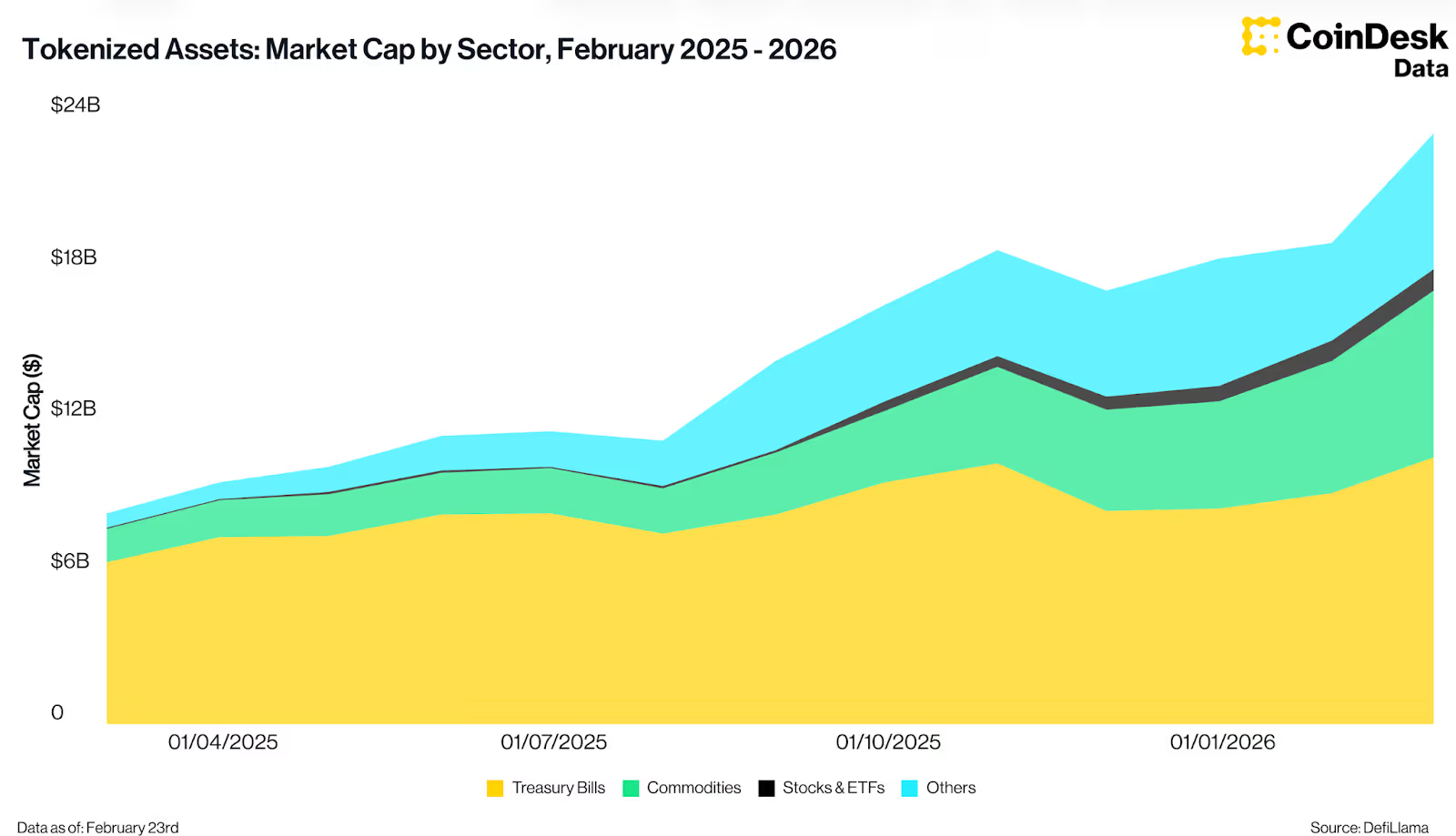

Tokenized real-world assets are continuing to gain meaningful traction in global financial markets, with the total tokenized market capitalization reaching a new all-time high of $23.4 billion by the end of February. This represents a 22.9% month-over-month increase from $19 billion in January, underscoring the accelerating pace of adoption across multiple asset classes. Much of this growth has been driven by tokenized Treasuries, which expanded 15.1% to $10.5 billion and now account for roughly 45% of the entire tokenized market. Meanwhile, tokenized commodities have emerged as a major secondary growth engine, surging 27% to $6.6 billion and representing 28.4% of the market. Other segments are also steadily developing. The Stocks & ETFs sector reached $804.7 million by late February, marking a 3.1% monthly increase and maintaining a 3.4% share of the overall tokenized ecosystem.

– Jacob Joseph, Specialist, Research, CoinDesk

Keep Reading

Crypto World

AI just bypassed the Cloudflare protection that DeFi needs

Despite launching countless branding exercises that feature the word “decentralization,” much of the crypto industry actually uses Cloudflare to defend large chunks of its user-facing infrastructure.

Indeed, Cloudflare protects crypto websites collectively processing billions of dollars worth of trades and receiving millions of visitors daily. However, this week, crypto learned that autonomous AI agents can apparently use an open-source library to walk right through several of Cloudflare’s lines of defense.

Most heard of the vulnerability from a headline about OpenClaw, an AI agent that runs on a Mac Mini or cloud server.

OpenClaws, formerly known as ClawdBots or MoltBots, can now use a free library called Scrapling to “bypass Cloudflare natively.”

“Scrape any website without getting blocked, with zero bot detection,” the developer wrote in a brief blurb on Github before releasing the code into the wild.

It soon rocketed to a #1 trending spot among Github repositories.

The age of homespun AI agents has arrived

Boasting concurrent, multi-session crawlers with realistic start/stop actions and proxy IP addresses, the Python library allows AI agents like OpenClaw and others to bypass “all types of Cloudflare’s Turnstiles and Interstitials.”

Not only that, its own benchmarks claim over 600 times the parsing speed of BeautifulSoup, a formerly impressive web crawler.

The age of homespun AI agents is here, and the traditional armor that crypto has employed to protect its websites against crawlers, spiders, Denial of Service (DoS) attacks, and hackers of all types is starting to crack.

Through the use of human-mimicking behavior and AI adaptation, an OpenClaw agent can trick sophisticated forms of bot detection. Even more devastatingly, it can operate on commodity hardware and volley attacks for a few cents.

DeFi keeps relying on Cloudflare while losing millions

Decentralized Finance (DeFi) has already learned — repeatedly and expensively — what happens when its Cloudflare-dependent front-ends fail.

Although it doesn’t have 1:1 similarity with the capabilities of Scrapling, the most obvious example of crypto’s reliance on Cloudflare remains BadgerDAO.

In December 2021, an attacker compromised a Cloudflare Workers API key.

The attacker used that key to inject a malicious script into BadgerDAO’s front-end, tricking users into signing token approvals. It drained $130 million.

Consider another example. Curve Finance suffered Domain Name System (DNS) hijacks in August 2022 and again in May 2025.

Each time, attackers accessed its registrar and redirected traffic away from Cloudflare’s nameservers to malicious clones.

The 2022 attack cost users over $500,000. The 2025 attack forced Curve to abandon its “.fi” TLD entirely and migrate to Curve.finance.

Read more: Saga becomes latest victim in DeFi hacking spree

The pattern only accelerated. In July 2024, a single DNS attack on Squarespace put 228 DeFi protocol websites at risk, including Compound and Celer Network.

Aerodrome Finance,a decentralized exchange (DEX) on Coinbase’s Base network, lost over $1 million in a November 2025 DNS hijack. OpenEden disclosed a DNS compromise on February 16, 2026. Curvance detected and blocked a front-end attack on the same day.

Every one of these attacks exploited the gap between decentralized smart contracts and the centralized web infrastructure that users actually touch: DNS records, content delivery network (CDN) scripts, and Cloudflare configurations.

Although Scrapling is too new to boast of any crypto hacks to date, there might be victims in coming days, unfortunately. Its primary intention is to scrape and download content, not hack Defi, of course. Hopefully, developers and OpenClaw users use it for its legal and intended purposes.

Scrapling lowers the Cloudflare shield

The traditional defense model assumed that bot detection, fingerprinting, and Cloudflare’s Turnstile challenges could keep automated traffic out. Scrapling breaks some of those assumptions through AI.

Its developer describes, in language probably only developers understand, about packaging TLS fingerprint spoofing, headless detection avoidance, Canvas noise generation, and WebRTC leak mitigation into a composable library.

A third party analysis noted that the core breakthrough “wasn’t a single new trick.” Instead, it was the combination of multiple AI skills to trick cybersecurity services.

Cloudflare’s own documentation warns developers to “never trust client-side validation alone.” Unfortunately, many DeFi frontends treat Cloudflare challenge widgets as sufficient, leaving backdoors open to tools that can fake a passed challenge on the client side.

The crypto industry spent five years and hundreds of millions in user losses learning that Cloudflare is a speed bump, not a wall. Scrapling just used AI to hop over again.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

here’s why the Dow Jones is crashing

The Dow Jones Index resumed its downward trend today, March 5, as the war in the Middle East continued and odds of a ceasefire happening between Iran and the United States fell on Polymarket.

Summary

- The Dow Jones Index retreated by over 500 points on Thursday.

- Traders on Polymarket believe that there will be no ceasefire any time soon.

- The index has formed a rising wedge pattern, pointing to more downside.

The Dow Jones Index, which tracks the performance of 30 large American companies, retreated by over 500 points. Similarly, the other top blue-chip indices like the S&P 500 and Nasdaq 100 fell by over 0.10%.

This retreat happened as Iran denied reports that it had reached out to the United States for talks on how to end the ongoing war. As a result, odds of a ceasefire happening this month tumbled to 27%. Similarly, the odds of a ceasefire happening in April fell by 23% to 48%.

As a result, the Fear and Greed Index continued falling, moving to the fear zone of 39. At the same time, the price of crude oil continued rising, with Brent moving to $85 and the West Texas Intermediate moving to $78.

A prolonged war in the Middle East is risky for the stock market because of the fresh supply chain shocks that will happen. It also risks stoking inflation, which will make it hard for the Federal Reserve and other central banks to cut interest rates soon.

Most companies in the Dow Jones Index were in the red, with Walmart falling by 3.90%. Merck shares fell by 3.2%, while Sherwin-Williams, Procter & Gamble, Johnson & Johnson,and Amen falling by over 2.50%.

Only four companies in the index rose today. Salesforce stock jumped by 4.46%, while IBM, Chevron, and Microsoft rose by 1.90%, 1.01%, and 0.60%. Chevron is benefiting from the ongoing crude oil and natural gas prices surge.

Dow Jones Index is at risk of falling further

The blue-chip Dow Jones Index has retreated substantially in the past few weeks. This retreat started after it moved to the psychological level of $50,000. It is common for an asset to retreat after testing such a significant level.

The stock retreated after the two lines of the rising wedge pattern neared their confluence. A rising wedge is a highly accurate reversal chart pattern.

It is now nearing the 23.6% Fibonacci Retracement level. Also, it has already moved below the 50-period moving average. Whenever an asset drops below that average, it is usually a sign that bears have prevailed.

The Average Directional Index has rebounded to 15, a sign that the sell-off is gaining momentum. Therefore, the most likely Dow Jones Index forecast is bearish, with the next key target being the 23.6% retracement level at $47,250.

Crypto World

Kraken’s xStocks Launches Unified Liquidity Layer for Tokenized Stocks

The new platform, xChange, enables cross-chain trading of over 70 tokenized stocks across Ethereum and Solana.

Kraken’s tokenized stock platform, xStocks, has unveiled xChange, a multi-chain execution layer for tokenized equity trading. The new platform enables cross-chain transactions on Ethereum and Solana, and supports over 70 tokenized stocks directly on-chain, according to an announcement from Kraken today, March 5.

By supporting cross-chain trading, xChange aims to boost liquidity and accessibility, allowing traders to operate seamlessly across two largest blockchain networks in DeFi by total value locked.

Ethereum and Solana, the two blockchains supported by xChange, have a DeFi TVL of approximately $58.6 billion and $8.2 billion, respectively, per data from DefiLlama.

The new execution layer for xStocks operates 24/5, per the announcement. Backed, the developer of xStocks, originally launched the tokenized equities alongside crypto exchange Kraken last June. By August, the platform reported $500 million in total on-chain transaction volume, while today’s announcement says that number has reached over$ 3.5 billion in total.

Kraken acquired Backed in December, as The Defiant reported. xStocks are available to traders outside of the United States, giving exposure to tokenized versions of U.S. equities that are backed 1:1 by underlying shares, today’s announcement notes.

This article was generated with the assistance of AI workflows.

Crypto World

BTC rally comes under pressure Thursday

Bitcoin’s early-week rally began to fade after U.S. markets opened Thursday, sending the cryptocurrency by nearly 2% over the past 24 hours to $71,400.

The move comes alongside declines in broad equity markets as the Iran war shows little sign of moving to a quick conclusion, sending oil higher by 5.3% to $78.70 per barrel. The Dow Jones Industrial Average is down 1.4% and S&P 500 by 0.7%.

The Nasdaq, though, is down just 0.4% as the previously battered software sector catches a major bid. The iShares Expanded Tech-Software Sector ETF (IGV) is ahead 2% and now up by about 9% over the past five sessions.

That divergence is notable, as bitcoin has been closely linked to the software sector, both tumbling in concert since October amid investor concerns over AI disruption and each bouncing from their lows in tandem in recent days.

New bull or bear market bounce?

Bitcoin “isn’t in the clear yet,” said Arthur Hayes, CIO of Maelstrom, noting that despite the rally to $74,000, the correlation with the IGV ETF remained. Whether Thursday’s decoupling will last remains to be seen, but software names pushing higher while bitcoin retreating is not what crypto bulls wanted to see. “It could be a dead cat bounce,” Hayes continued.

Traders today might also be taking some chips off the table ahead of Friday’s key U.S. jobs report for February. The economic data of late has mostly surprised to the upside, pushing down odds for a restart of Federal Reserve rate cuts.

Interest rate traders at the Chicago Mercantile Exchange now see an 88% chance that the Fed will keep rates steady not only at this month’s meeting but in April as well. A month ago, those odds were at 59%.

“We’re cautiously constructive, but the geopolitical tail risk demands humility,” said Bryan Tan, trader at Wintermute. He said improving flows into spot bitcoin exchange-traded funds (ETFs), which have recorded nearly $2 billion in inflows in the past week alone, alongside stabilizing trading volumes, are supporting the market, while muted reaction to disruptions around the Strait of Hormuz could leave room for bitcoin to climb toward the $74,000-$75,000 range.

Bitfinex analysts said there’s been a “notable increase in spot market strength,” indicating the recent move higher was driven by market buyers rather than speculative leverage.

“We consider there to be a possibility of relief over the coming weeks and months should this trend follow through,” they added.

Crypto World

NYSE Owner Invests in OKX at $25 Billion Valuation

The publicly traded parent company of NYSE, Intercontinental Exchange (ICE), is establishing a strategic partnership with the global centralized exchange.

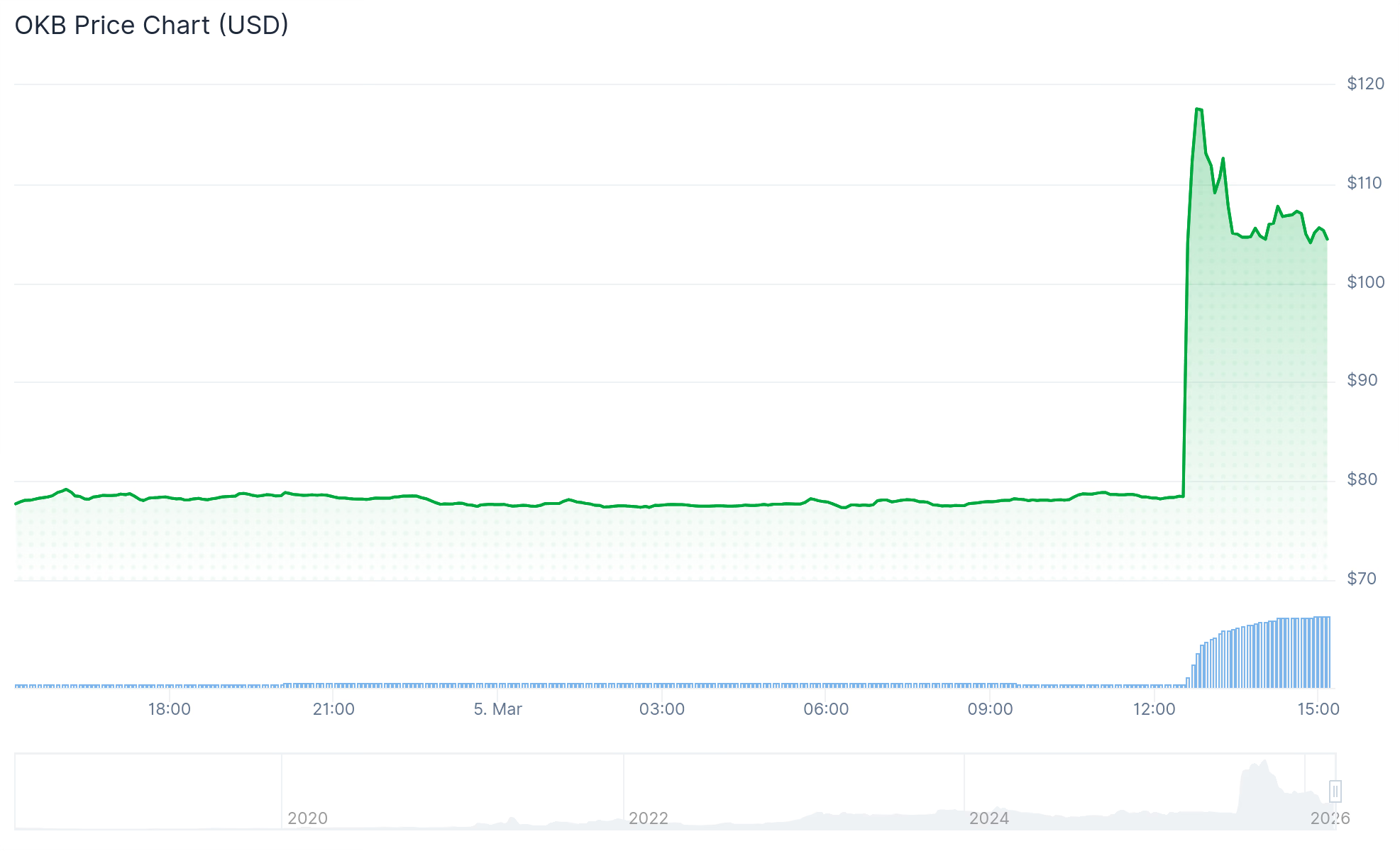

Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, has announced a strategic investment in global cryptocurrency exchange OKX, valuing the platform at $25 billion.

According to an announcement from ICE on Thursday, March 5, the collaboration is set to bolster ICE’s on-chain capabilities, while enhancing OKX’s institutional and retail offerings.

While the exact terms of the investment weren’t disclosed in the announcement, the two firms have established a strategic partnership, with plans to expand offerings from both sides.

For its part, ICE said it plans to launch regulated futures in the U.S. tied to the spot prices of cryptocurrencies on OKX, which it will license. From its side, OKX plans to offer its global retail and institutional user base access to ICE’s U.S. futures and NYSE tokenized stocks — though the announcement notes this move is pending regulatory approval.

The partnership also aims to further develop digital asset infrastructure for institutional investors, including custody and wallet solutions, as well as risk management, per the release.

Additionally, the NYSE owner will have a seat on OKX’s board. Jeffrey C. Sprecher, ICE chair and CEO, was quoted in the release, saying:

“Our strategic relationship with OKX will expand global retail access to ICE’s pre-eminent regulated markets and accelerate our plans to offer on-chain infrastructure and tokenized assets to U.S. investors.”

OKX is one of the largest centralized exchanges globally by 24-hour trading volume. Processing $2.7 billion in trades in the past day, it’s currently ranked fourth among CEXs, after Binance, with $13.3 billion, followed by Gate and Coinbase.

OKX’s founder, Star Xu, originally launched crypto exchange Okcoin in 2013, making it one of the earliest crypto exchanges, while OKX (formerly OKEx) was launched later, in 2017.

While the founding teams for Okcoin and OKX are originally from China, the platforms, which operated as independent entities for several years, quickly expanded globally and were headquartered in different countries, with Okcoin focusing on U.S. traders.

The firms consolidated and rebranded under one entity, OKX, in 2023, with regulated offerings in multiple jurisdictions.

The partnership and investment mark a significant moment for OKX’s U.S. presence and its institutional-grade offerings globally. Meanwhile, the move is Intercontinental Exchange’s latest to expand its presence in digital assets. The publicly traded financial giant launched its own crypto platform, Bakkt, back in 2018, which marked its initial foray into facilitating institutional investment in cryptocurrencies.

OKB, the OKX ecosystem’s native token, saw a sharp rally of over 30% today on the news and is currently trading around $104.

This article was generated with the assistance of AI workflows.

Crypto World

Pig butchering is creating entirely new industries

By now, most people involved in crypto are at least familiar with the concept of pig butchering, if not aware that it’s a growing problem with widespread consequences.

However, what most won’t know is that pig butchering is expanding so quickly and minting new millionaires so fast that it’s given rise to two entirely new industries: escrowing for pig butcherers and selling hostages onward from one pig butcher to another.

How does pig butchering work?

If you’re unfamiliar with what pig butchering is, it’s a diabolical and violent scam that works like this:

- An individual, usually from China, but occasionally from Eastern Europe or Southeast Asia, is lured to Southeast Asia (the biggest offenders reside in Cambodia, Laos, Thailand, and Myanmar) with promises of a job offer or modeling work.

- Once the person arrives in Southeast Asia, they’re hurriedly shuffled to a remote village or city where they’re taken hostage. Sometimes this even means they’re shackled and not allowed to go outside.

- Upon being taken hostage the individual is forced to bait Westerners into giving them crypto through romance scams, jobs offers, or other means.

- As this is happening, the hostage’s family is told that their loved one has been taken and a ransom is demanded for their freedom. The ransom is usually too large for the family to afford.

Read more: Project Brazen links KuCoin to billions in pig butchering scams

A new business is born

The pig butchering industry has grown rapidly over the past five years, with billions of dollars flowing into Southeast Asia via scam centers with thousands of hostages being held.

These massive buildings and industrial parks openly operate without threat of being shut down due to the government officials they’re able to bribe and the taxable revenue they bring in.

Most often, the leaders of these syndicates are Chinese nationals and/or members of the Triads (Chinese mafia).

However, as the industry has grown, so have its needs.

In a report from Bitrace, the ways in which pig butchering scammers have begun to rely on third parties for help in acquiring hostages is detailed along with a lucrative new side hustle of selling hostages to one another.

Guaranteed sales

The report shows examples of “guaranteed sales,” where pig butchering scammers and those who lure in hostages use a third-party escrow service so they can be assured that neither criminal enterprise will rip the other one off.

Read more: China executes four more in pig butchering scam crackdown

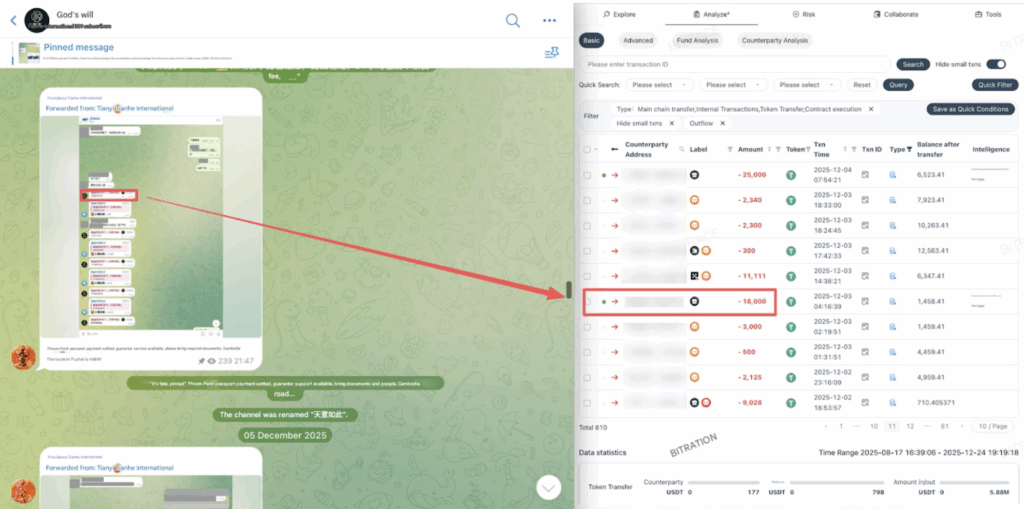

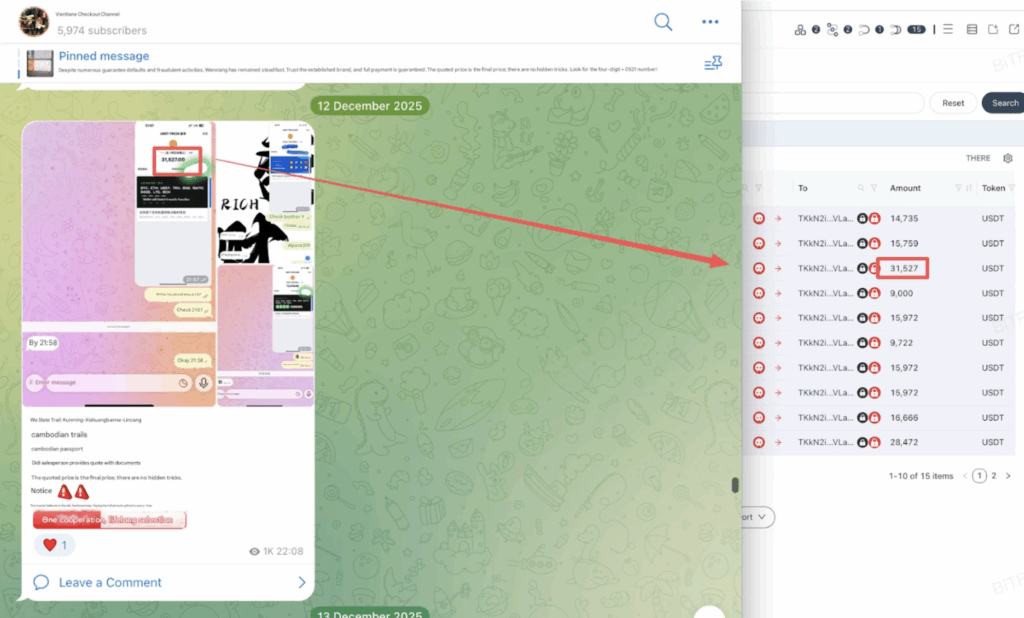

In the image above, a pig butchering group by the name of Tianhe International puts 18,000 USDT into escrow with a company called Zhencheng Guarantee.

Once the hostage exchange is completed the escrow service is able to walk away with almost $1,000 simply for holding the money for the scammers until the transaction is completed.

It’s unknown how large the scammer escrow business is within the pig butchering economy, but no doubt it’s growing, with those providing the service having to do almost nothing but hold funds and wait for the green light.

This means it’s far less risky than for those conducting the actual pig butchering or those recruiting new hostages.

Secondary sales

Another — and far more disgusting — example of how pig butcherers earn extra cash is by selling hostages forward.

The reason for the secondary sales could range from wanting extra income that month, a new individual or company spinning up a pig butchering business, or a pig butcherer winding down their business to move into other lucrative, less illegal industries like gambling or harvesting jade and rare woods for export.

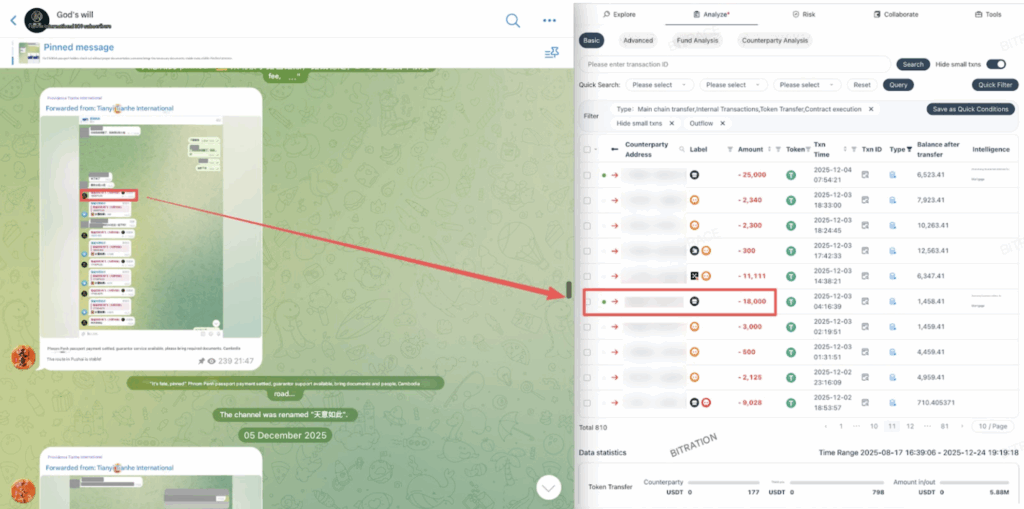

Regardless of why, there’s evidence of the secondary market having sales regularly. The below image shows evidence of Tianhe International purchasing hostages from another pig butcherer called Wanxiang Group.

Despite Chinese law enforcement putting a stop to numerous pig butchering operations and executing dozens of leaders responsible for keeping thousands of people trapped in Cambodia and Laos, the criminal activity shows no sign of slowing down.

Bitrace was able to prove that Tianhe International was earning millions and millions of dollars in revenue every month before multiple wallet addresses were frozen.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Crypto leaked by South Korean tax officials stolen a second time

A stash of crypto worth almost $5 million that was stolen after South Korean tax authorities mistakenly leaked its seed phrase has been stolen for a second time after the original thief handed it back.

The country’s National Tax Service accidentally shared a photo of the 24-word seed phrase in a press release last month. The corresponding wallet contained $4.8 million worth of a crypto called pre-retogeum (PRTG) which was stolen shortly afterwards.

This thief reportedly submitted a confession to the police on March 28 and was arrested two days later. The thief claimed they “stole the cryptocurrency out of curiosity but then returned it.”

However, officials at a police press briefing this week revealed that they’re now tracking a second thief who stole the crypto again after it was returned.

“We will investigate the additional theft as we continue to investigate the previous suspect who confessed,” police said.

According to local reports, the police haven’t identified the second thief and haven’t clarified if they’re the original owner of the cryptocurrency, who was under investigation for tax evasion.

The stolen PRTG is believed to be almost unsellable due to the token’s unpopularity.

South Korea busy dealing with crypto crime

In another odd turn of events in South Korea, a legally “dead” man apparently returned to repay victims who fell for a crypto investment scheme.

The man fled to Cambodia in 2019 after orchestrating a crypto fraud and was deported back to South Korea this January. When he fled, a “declaration of disappearance” was issued, which classified him as legally dead.

This was challenged in courts, and $60,000 worth of frozen funds have since been returned to victims.

Read more: Game developer Sillytuna reports losing $24M of crypto in UK ‘wrench’ attack

Elsewhere, a police officer in charge of crypto investigations has been jailed for six years after accepting $82,000 worth of bribes to cover up a coin consignment fraud investigation.

Another man was handed over to South Korea’s prosecution after he allegedly extorted $25,000 worth of crypto from women who wanted him to take down personal photos from his “Joo-club” Instagram account.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech10 hours ago

Tech10 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial