Crypto World

Inside Trump’s surreal Mar-a-Lago crypto summit

PALM BEACH, Fla. — Attending World Liberty Financial’s forum at Mar-a-Lago felt less like a high-powered summit and more like an intimate gathering — if the guest list included people who control trillions in assets and the future of finance.

Tucked beneath chandeliers and gold-painted trim, the guest list read like a who’s who of the industry’s old guard and rising disruptors. There were no name tags needed. Everyone seemed to know everyone, or at least know someone who did.

Conversations floated from the future of finance to how it might fix what’s been broken in the past — ambitious visions of tokenized assets, regulatory overhauls, and reimagined capital markets. But just as easily, the talk turned to the upcoming FIFA World Cup tournament and press-on nails, courtesy of a few unexpected names who probably had no business being there, and yet somehow made the whole thing feel even more surreal.

The event was not targeted toward an exclusively U.S. audience; attendees hailed from a number of countries. Several attendees flew from Consensus Hong Kong last week directly to Palm Beach to attend the World Liberty Forum. One attendee said they had flown in on Wednesday morning from ETHDenver, and several others said they would be flying to the Colorado conference following the forum.

‘Punitive finance’

In any other context, the event would seem to be a typical crypto conference; speakers from traditional financial backgrounds explaining how they’re using blockchain or why they’re discussing crypto to a dimly lit room.

However, the backdrop loomed: This was a conference put on by World Liberty Financial, the crypto company launched and owned in part by the family of U.S. President Donald Trump, held at his golf club Mar-a-Lago, with several attendees tied to his business interests. Binance founder Changpeng Zhao, in his first U.S. appearance since receiving a pardon from Trump, was spotted at the event. Goldman Sachs’ David Solomon joked on stage that he was there because his client had requested his presence.

Many of the panels themselves were high-level; World Liberty Financial co-founder Alex Witkoff asked U.S. Senator Ashley Moody to walk the audience through her background, or Eric Trump and Donald Trump, Jr. reiterating their past grievances with the banks.

“It was forced and maybe opportunistic but we lived a life that opened our eyes to maybe how corrupt the system was … banks [canceled our accounts] for no reason other than my father was wearing a hat that said ‘Make America Great Again,’” Eric Trump claimed. “We realized how antiquated finance was, how punitive finance was.”

Amid these sessions, some speakers walked through their arguments for the digital assets sector. Franklin Templeton CEO Jenny Johnson laid out the rationale for the U.S. dollar remaining the global reserve currency, saying the European Union was too uncoordinated for the euro to take the dollar’s place and other currencies just didn’t meet the moment.

“About 50% of trade today is done in dollars, another 30% is in the euros, [but] there’s no single European debt market. They can’t even coordinate around the euro … so that’s not going to be the next reserve,” she said.

China’s renminbi and India’s rupee are contenders, but neither is free-floating, and so that makes it unlikely either of those currencies can take on the role, she said.

“As long as people are still looking for their stablecoin to be backed by the most risk-free currency, it’s going to be the dollar,” she said.

Many of the panels nevertheless only had a passing focus on digital assets themselves. The audience reflected this, with crowds mingling outside the actual room to chat during several panels.

It wouldn’t have been a Trump gathering without the biggest real estate moguls in the room — and that’s when tokenization (putting assets on blockchain) became a topic. Hotel billionaire Barry Sternlicht, whose Starwood Capital manages over $125 million in assets under management, said the firm was ready to tokenize real-world assets such as real estate, but continues to be unable to do so given the regularity uncertainty.

Similarly, Kevin O’Leary told listeners that sovereign wealth funds, with whom he speaks regularly, won’t touch crypto because they’re afraid of the regulatory risk that comes with it in the U.S.

Glamour and celebrities

From O’Leary to Goldman Sachs CEO David Solomon to FIFA president Gianni Infantino, if the day’s lineup were ranked by celebrity status, the organizers surely saved the best for last — and probably the least relevant.

Nicki Minaj closed out the event as the final panelist, but the first that caused half the room to take out their phones to snap a picture. Her presence may not make sense in the context of finance or crypto specifically — when moderator Alex Bruesewitz informed her that people gathered to talk about a new innovation in finance, she said she “can like it” — but given her recently developed close relationship with President Donald Trump, it wasn’t entirely surprising to see her support the family’s event.

The World Liberty Forum wasn’t just a conference, it was the kind of room where fortunes are steered, not pitched, and where the side chatter was just as telling as the main agenda.

Crypto World

Only 1 in 10 Weak Token Launches Recovered in 2025: Arrakis

Data from more than 120 token launches shows that early sell pressure, not market timing, largely determined whether new tokens thrived in 2025.

New tokens struggled to find a floor in 2025, with early trading dynamics often setting a trajectory that proved hard to reverse as the year wore on, data shows.

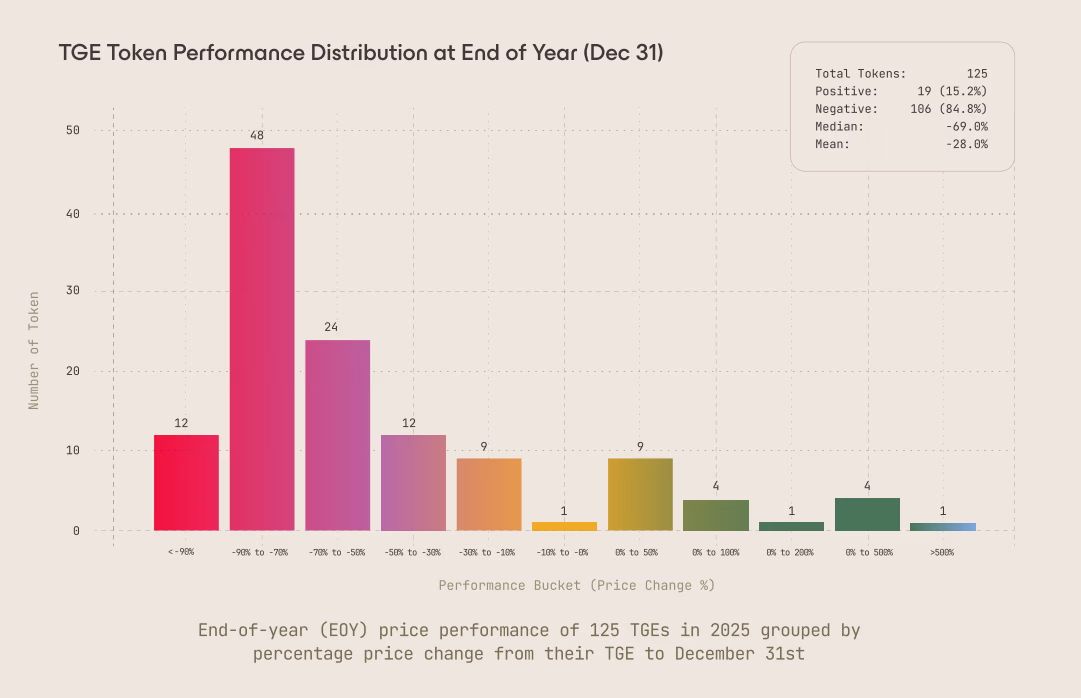

An 80-page analysis by Arrakis Finance found that about 85% of tokens launched last year finished below their initial price, after reviewing 125 token generation events (TGE) and surveying more than 25 founding teams.

The data also shows that nearly two-thirds of tokens were already down within the first seven days, and only 9.4% of tokens that declined in the first week after TGE ever recovered to their launch price at any point later in the year. In most cases, early drawdowns deepened rather than reversed.

Airdrops were one of the strongest sources of immediate selling. Across multiple launches, Arrakis observed that up to 80% of airdrop recipients sold their positions on the very first day of TGE, creating concentrated sell pressure.

“The baseline assumption should be that most of an airdrop will be sold; recipients have zero cost basis and expect prices to decline, making immediate selling rational,” the report states.

Market-making structures also mattered. Arrakis says liquidity was often mispriced, prompting traders to take quick exits.

“Liquidity depth is your buyer against sell pressure. Depth needs to absorb selling from airdrops, exchange allocations, and market maker loans without catastrophic price impact,” the report notes.

Arrakis concludes that token outcomes in 2025 were largely decided by launch mechanics rather than market cycles. Early supply shocks, not macro conditions, determined whether tokens stabilized or slid, and once early confidence was lost, recovery was statistically rare.

That finding broadly aligns with separate research from Dragonfly Capital, which recently found little difference in long-term performance between tokens launched in bull versus bear markets.

As Dragonfly Capital managing partner Haseeb Qureshi explained, regardless of the timing, most tokens don’t perform well over time. Bull market launches recorded a median annualized return of about 1.3%, while bear-market launches came in at -1.3%.

Crypto World

Supreme Court Rules Against Trump Tariffs Under IEEPA Law

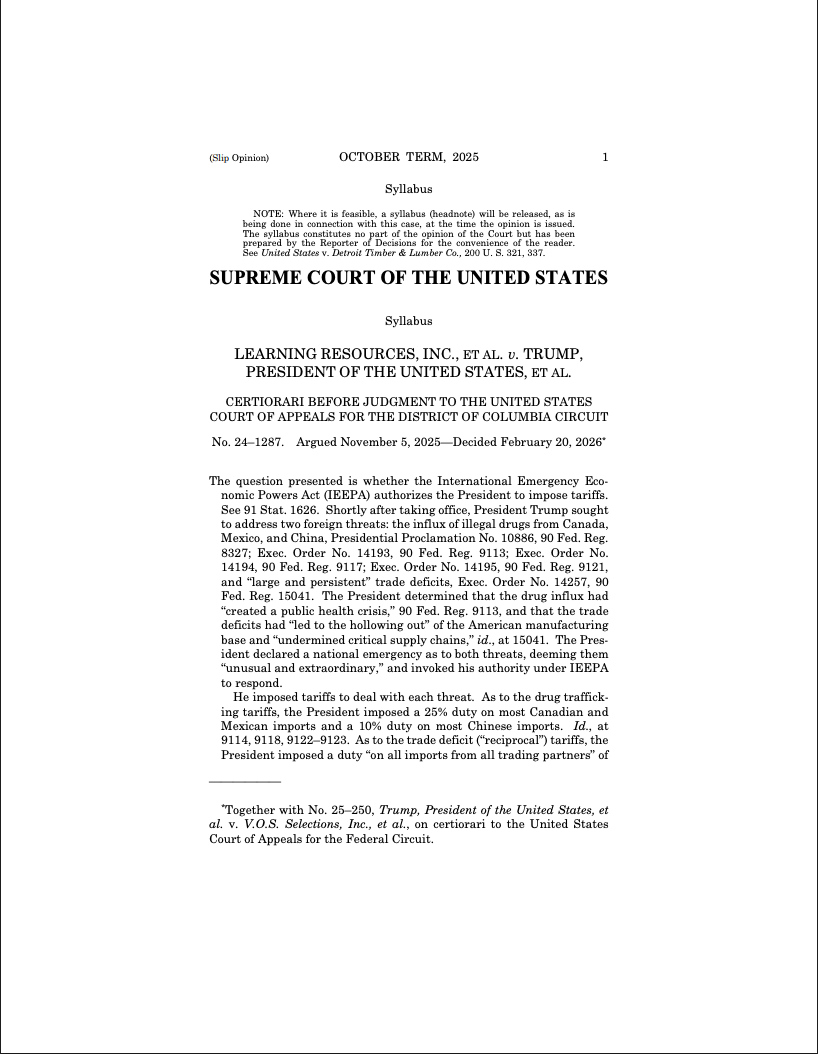

The Supreme Court of the United States (SCOTUS) issued a ruling on Friday striking down most of US President Donald Trump’s tariffs, with six of the nine Supreme Court justices ruling that the Executive Branch lacks authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA).

“IEEPA does not authorize the President to impose tariffs,” Friday’s ruling said, adding that the president has “no inherent authority” to impose tariffs during peacetime using the statutes in the IEEPA. The ruling read:

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope. That ‘lack of historical precedent,’ coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.’”

Trump claimed that the purported inflow of drugs from Canada, China and Mexico, as well as the “hollowing out” of the US industrial base, constituted a national emergency under IEEPA that justified the tariffs, which the court rejected.

Trump criticizes court, says he’ll get tariffs reinstated

In a press briefing following the decision, Trump lashed out at the justices who voted to strike down the tariffs and vowed to get them reinstated, Politico reported.

“The Supreme Court’s ruling on tariffs is deeply disappointing, and I’m ashamed of certain members of the court, absolutely ashamed, for not having the courage to do what’s right for our country,” Politico cited him as saying.

He said he would reinstate the tariffs by using “other alternatives.”

Trump’s tariffs sent shockwaves through asset markets in 2025, causing severe downturns in crypto and equities when a new round of tariffs was announced or even threatened, fueling macroeconomic uncertainty.

Related: US stocks, crypto rise after Trump pauses planned European tariffs

Trump claims tariffs could replace income tax, but crypto markets are paying the price

In October 2024, while on the campaign trail, Trump floated the idea of replacing the federal income tax with revenue generated from tariffs. Trump said the tariffs would dramatically lower the US budget deficit.

Federal taxes would be “substantially reduced” for individuals and households making less than $200,000 per year once tariff revenue started rolling in, Trump said in April 2025.

Trump announced 100% tariffs on China on Oct. 10, 2025. Within minutes, crypto markets plummeted, and the price of Bitcoin (BTC) dropped from a high of about $122,000 to about $107,000 the same day the tariffs were announced.

Analysts cited several reasons for the crash, including excessive leverage. However, traders overwhelmingly saw the 100% China tariffs as the catalyst for the crypto crash, according to market sentiment platform Santiment.

Crypto prices have yet to recover from October’s crash, and BTC remains nearly 50% below its all-time high of over $125,000 reached on October 6, despite Trump walking back his tariff policies.

Magazine: Bitcoiners are ‘all in’ on Trump since Bitcoin ’24, but it’s getting risky

Crypto World

Simon Gerovich Slams Critics of Metaplanet’s BTC Strategy

Metaplanet denied claims of hidden activity, and maintained that all Bitcoin purchases, wallet addresses, and capital deployment decisions were publicly disclosed in real time.

Metaplanet’s CEO Simon Gerovich said claims that the firm’s disclosures are insincere are “inflammatory and contrary to the facts.” He added that over the past six months, as volatility increased, the Japanese public company allocated more capital to its income business and sold put options and put spreads, which are actively managed as option positions.

The response follows accusations circulating online questioning Metaplanet’s disclosure practices and use of shareholder funds. The claims state that Bitcoin purchases were not disclosed promptly, including a large purchase made near the September price peak using proceeds from an overseas public offering, followed by a period without updates.

Gerovich’s Defense

In his latest post on X, Gerovich said part of these funds was used to purchase Bitcoin for long-term holding, and that these purchases were disclosed at the time they were made. The exec added that all BTC addresses are publicly available and can be viewed through a live dashboard, which allows shareholders to check holdings in real time. He went on to assert that Metaplanet is one of the most transparent listed companies in the world.

Metaplanet made four purchases during September and announced all of them promptly. While the month was a local peak, Gerovich stated that the company’s strategy is not about timing the market, maintaining that the focus is to accumulate Bitcoin long-term and systematically, and that every purchase is disclosed regardless of price.

On options trading, Gerovich noted the criticism stemmed from a misunderstanding of the financial statements. He said selling put options is not a bet on BTC’s price rising, but a way to acquire Bitcoin at a cost lower than the spot price through premium income. He explained that this strategy reduced effective acquisition costs in the fourth quarter. He revealed that Bitcoin per share, the company’s primary key performance indicator, increased by more than 500% in 2025.

Financial Statements And Borrowings

On financial results, Gerovich clarified that net profit is not an appropriate metric for evaluating a Bitcoin treasury company. He pointed to the operating profit of 6.2 billion yen, which indicates a growth of 1,694% year over year. According to the exec, the ordinary loss comes solely from unrealized valuation changes on long-term Bitcoin holdings that the company does not intend to sell.

Three disclosures related to borrowings were made – when the credit facility was established in October, and when funds were drawn down in November and December. Borrowing amounts, collateral details, interest rate structures, purposes, and terms were disclosed. The identity of the lender and specific interest rate levels were not disclosed at the counterparty’s request, despite the terms being favorable to Metaplanet.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

What Next After Supreme Court Strikes Down Trump Tariffs?

Washington erupted in political crossfire Friday after the Supreme Court of the United States struck down President Donald Trump’s sweeping global tariffs.

The ruling triggered sharp partisan reactions and exposed a widening divide over trade, executive power, and the country’s economic future.

Partisan Firestorm Erupts as Lawmakers Clash Over Trade, Power, and $150 Billion in Tariffs

In a 6–3 decision, the Court ruled that Trump exceeded his authority under the International Emergency Economic Powers Act (IEEPA) when he imposed broad “reciprocal” tariffs in 2025 without clear authorization from Congress.

The ruling invalidates most of those global duties, marking a major setback for a signature pillar of Trump’s second-term economic agenda.

Just like how stock and crypto markets reacted, the political reaction was immediate — and explosive.

Democrats Declare Victory

Senate Democratic Leader Chuck Schumer framed the ruling as a consumer win.

“This is a win for the wallets of every American consumer. Trump’s chaotic and illegal tariff tax made life more expensive and our economy more unstable.”

He added:

“Trump’s illegal tariff tax just collapsed — He tried to govern by decree and stuck families with the bill. Enough chaos. End the trade war.”

Similarly, Senator Elizabeth Warren emphasized the financial toll on households and small businesses.

“No Supreme Court decision can undo the massive damage that Trump’s chaotic tariffs have caused. The American people paid for these tariffs, and the American people should get their money back,” she stated.

In a broader statement, Warren argued that any refunds stemming from the ruling “should end up in the pockets of the millions of Americans and small businesses that were illegally cheated out of their hard-earned money.”

House Budget Committee Ranking Member Brendan Boyle echoed the sentiment:

“This ruling is a victory for every American family paying higher prices because of Trump’s tariff taxes. The Supreme Court rejected Trump’s attempt to impose what amounted to a national sales tax on hardworking Americans.”

Republicans Split Over Executive Power

Republican reaction, however, revealed a party divided between constitutional purists and economic nationalists.

Senator Rand Paul praised the decision as a safeguard against executive overreach.

“In defense of our Republic, the Supreme Court struck down using emergency powers to enact taxes. This ruling will also prevent a future President such as AOC from using emergency powers to enact socialism,” he said.

But Senator Bernie Moreno sharply condemned the Court’s move:

“SCOTUS’s outrageous ruling handcuffs our fight against unfair trade that has devastated American workers for decades. These tariffs protected jobs, revived manufacturing, and forced cheaters like China to pay up,” he noted.

Moreno warned that “globalists win” under the ruling and called for Republicans to codify the tariffs through reconciliation legislation.

Trump Fires Back

Trump himself reportedly responded with a single word during a White House breakfast with governors:

“Disgrace.”

The US President also signaled that his administration has a “backup plan,” hinting at possible efforts to reimpose tariffs through alternative legal authorities such as Section 301 or Section 232.

A Constitutional and Economic Flashpoint

Beyond the immediate political theater, the decision represents a rare rebuke of executive trade authority from a conservative-majority Court.

The ruling reinforces Congress’s constitutional control over taxation and trade regulation, limiting the scope of emergency economic powers under IEEPA.

At the same time, it raises practical questions about potentially billions in tariff refunds and whether lawmakers will attempt to restore elements of Trump’s trade policy through new legislation.

What began as a legal battle over tariffs has evolved into a broader confrontation over presidential power, economic nationalism, and who ultimately controls America’s trade agenda.

“The Supreme Court got it right. But they also did Trump a huge favor, as his tariffs are harming the U.S. economy and are paid by Americans. But since the tariff revenue will now stop and past revenue must be returned, the already rising U.S. budget deficit will soar. Got gold?” Peter Schiff quipped.

The fight is far from over.

Crypto World

Why Is The US Stock Market Up Today?

The US stock market recovered sharply on February 20, after the Supreme Court struck down President Trump’s tariffs in a landmark 6-3 ruling. The S&P 500 is trading around 6,890 at press time, up 0.45% from yesterday’s close, at the time of writing.

Tech (XLK) leads the rebound on tariff relief while Energy (XLE) gives back early gains despite rising oil prices. Alphabet (GOOGL) stands out, almost independently, with a 3.8% surge as it attempts to break free from a bearish pattern.

Top US Stock Market News:

Wall Street Recovers From Stagflation Scare As Tariff Ruling Sparks Relief Bounce

Wall Street faced one of its most dramatic intraday reversals on February 20, 2026. The morning opened with panic as the “data deluge” delivered a stagflation-like combination.

Advance Q4 GDP slowed sharply to 1.4% (well below the 2.8% consensus), while Core PCE accelerated to 3.0% YoY, its hottest reading since mid-2025. S&P 500 futures dropped immediately after the 8:30 AM ET release.

But the mood flipped mid-session when the Supreme Court struck down President Trump’s sweeping emergency tariffs in a landmark 6-3 ruling. Markets interpreted the decision as a major deflationary catalyst going forward.

The S&P 500 is trading at approximately 6,890 at press time, up 0.45% from yesterday’s close. Moreover, the index is now flirting with a strong zone near 6,888.

A sustained move above this level opens the path toward 6,959, and clearing that could prime the index for the psychological 7,000 milestone.

On the downside, 6,775 is the key support to watch. A break below that level would invite weakness toward 6,707.

However, upside conviction is not without risk. Experts are already flagging that the tariff ruling may not be the final word — the administration could pursue alternative tariff mechanisms, which could weigh on sentiment as the session progresses.

A move to key resistance still requires roughly a 1% push from current levels.

The Nasdaq leads the recovery, up 172 points (0.76%), and the DOW is up 68 points, at the time of writing.

The CBOE Volatility Index (VIX) dropped sharply, falling approximately 5%. The move below 20 signals that the initial stagflation panic has eased and the market is shifting back toward a cautiously optimistic posture.

The tug-of-war is clear: stagflation data pulling markets down, tariff relief pulling them up. Onto the sectors now.

Tech Rallies While Energy Dips, But Builds Bullish Case

The sector story on February 20, 2026, takes an unexpected turn. The surface numbers tell one story, but the charts tell another.

Technology (XLK) is up 0.36% at $140.72, benefiting from the Supreme Court’s tariff strike-down as lower import costs directly support hardware and semiconductor supply chains.

However, the rally faces a ceiling. XLK attempted to cross above the $141.29 resistance, but sellers stepped in. A daily close above this level is needed to open the path toward $144.78 and eventually the $149–$150 zone.

A failure to hold above $139 would flip the short-term structure bearish. The tariff relief provides the US stock market catalyst, but with Core PCE at 3.0%, reinforcing higher-for-longer rates, tech valuations remain under pressure.

Energy (XLE) tells the opposite story. The sector looked strong as US-Iran tensions pushed oil higher: WTI held above $66 and Brent above $71. But gains faded through the session, with XLE now down 1.09% since yesterday.

Yet the XLE chart tells a more constructive story underneath the red. The ETF appears to be consolidating inside a bullish flag. If the breakout confirms above $55.90, it could target $60.29 — roughly a 10% move.

The full measured move from the previous leg projects a potential 27% rally. A drop below $53.19 would invalidate the setup.

Alphabet (GOOGL) Surges As Bears Lose Grip

Alphabet (GOOGL) is the standout US stock market mover on February 20, 2026, surging approximately 3.8% to trade around $316. The stock has shown sustained buying momentum with no significant upper wick, yet, a sign that sellers have not stepped in to cap the bounce.

The move is notable because Alphabet had been trapped inside a bearish flag pattern after pulling back from its early February highs. Today’s surge is attempting to break down that bearish structure, reversing off the $296–$300 support zone and pushing toward pattern invalidation.

However, Alphabet is not out of the woods yet. A sustained move above $327 — extending to $330 — is needed to fully invalidate the bearish setup and confirm a larger bullish reversal. Until those levels are cleared, the risk of a failed breakout remains real.

On the downside, a drop back below $304 would weaken the breakout attempt and reintroduce bearish pressure. Further weakness under $296 could accelerate selling, potentially re-testing lower supports and resuming the bearish flag pattern — erasing today’s entire gain.

Within Communication Services, Alphabet is leading while Meta also posts gains, as over 51% of stocks are in the green.

While other sectors stabilize with muted moves, Alphabet’s sizable independent rally signals that dip-buyers are aggressively positioning in AI-linked growth names.

Crypto World

Wall Street Adds BMNR Stock; DeFi Lenders Are Pressured by Illiquidity

Large institutional investors continued to add exposure to crypto treasury companies over the past week, even as bear-market illiquidity forced another round of shakeouts across decentralized finance (DeFi).

The biggest corporate shareholders of Bitmine Immersion Technologies, including Morgan Stanley and Bank of America, increased exposure to the Ether (ETH) treasury company during Q4 2025 despite a broader market sell-off.

Still, ongoing bear-market illiquidity is forcing some protocols to wind down operations, with DeFi lender ZeroLend shutting down. Crypto analytics platform Parsec has also shuttered, citing crypto market volatility as the main reason.

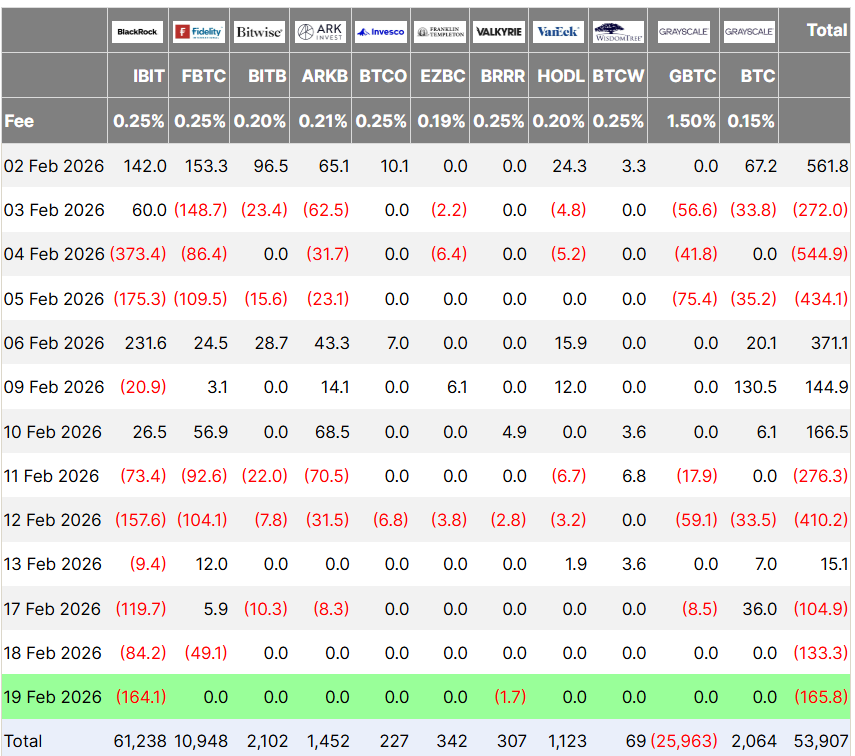

Meanwhile, Bitcoin (BTC) and ETH each rose about 2.6% during the past week, amid mounting outflows from US spot Bitcoin exchange-traded funds (ETFs), which logged three consecutive days of selling leading up to Thursday’s $165 million outflow, Farside Investors data shows.

Ether ETFs started the week with $48 million in inflows on Tuesday, but reversed to log two successive days of outflows, including $41 million in outflows on Wednesday and $130 million on Thursday.

Morgan Stanley, other top holders add Bitmine exposure amid sell-off

The largest shareholders of Bitmine Immersion Technologies (BMNR) stock increased their investments in the leading Ethereum treasury company in the fourth quarter of 2025 despite a wider crypto market crash and poor stock price performance.

Morgan Stanley, the top reported holder, increased its position by about 26% to more than 12.1 million shares, valued at $331 million at the quarter’s end, according to its Form 13F filing with the US Securities and Exchange Commission. ARK Investment Management, the second-biggest holder, increased its stake by about 27% to more than 9.4 million shares worth $256 million, its filing shows.

Several other top institutional holders also increased exposure. BlackRock increased its BMNR holdings by 166%, Goldman Sachs by 588%, Vanguard by 66% and Bank of America by 1,668%.

Wall Street adds BMNR exposure despite 48% stock slide

Each of the top 11 largest shareholders increased exposure to BMNR during Q4 of 2025, including Charles Schwab, Van Eck, Royal Bank of Canada, Citigroup and the Bank of New York Mellon Corporation, according to official filings compiled by crypto investor Collin.

The accumulation came despite a sharp drop in Bitmine’s share price. BMNR fell about 48% in the fourth quarter of 2025 and about 60% over the past six months, trading near $19.90 in premarket action Thursday, according to Google Finance.

DeFi lender ZeroLend shuts down, blames illiquid chains

Decentralized lending protocol ZeroLend said it is shutting down completely after the blockchains it operates on suffered from low user numbers and liquidity.

“After three years of building and operating the protocol, we have made the difficult decision to wind down operations,” ZeroLend’s founder, known only as “Ryker,” said in a post the protocol shared to X on Monday.

“Despite the team’s continued efforts, it has become clear that the protocol is no longer sustainable in its current form,” he added.

ZeroLend focused its services on Ethereum layer-2 blockchains, once touted by Ethereum co-founder Vitalik Buterin as a central part of the network’s plan to scale and remain competitive.

However, Buterin said earlier this month that his vision for scaling with layer 2s “no longer makes sense,” that many have failed to properly adopt Ethereum’s security, and that scaling should increasingly come from the mainnet and native rollups.

DerivaDEX debuts Bermuda-licensed derivatives DEX

DerivaDEX has launched a Bermuda-licensed crypto derivatives platform, becoming what it says is the first DAO-governed decentralized exchange to operate under formal regulatory approval.

According to a statement from the platform, the exchange received a T license from the Bermuda Monetary Authority and has begun offering crypto perpetual swaps trading to a limited number of advanced retail and institutional participants.

The BMA’s T, or test license, is issued for a digital asset business seeking to test a proof of concept.

At launch, DerivaDEX supports major crypto perpetual products and said it plans to expand into additional markets, including prediction markets and traditional securities. The company said the platform combines offchain order matching with onchain settlement to Ethereum, while allowing users to retain non-custodial control of funds.

Parsec shuts down amid ongoing crypto market volatility

Onchain analytics company Parsec is closing down after five years, as crypto trader flows and onchain activity no longer resemble their past configurations.

“Parsec is shutting down,” the company said in an X post on Thursday, while its CEO, Will Sheehan, said the “market zigged while we zagged a few too many times.”

Sheehan added that Parsec’s primary focus on decentralized finance and non-fungible tokens (NFTs) fell out of step with where the industry has now headed.

“Post FTX DeFi spot lending leverage never really came back in the same way, it changed, morphed into something we understood less,” he said, adding that onchain activity changed in a way he never understood.

NFT sales reached about $5.63 billion in 2025, a 37% drawdown from the $8.9 billion recorded in 2024. Average sale prices also declined year-on-year, falling to $96 from $124, according to CryptoSlam data.

Kraken’s xStocks tops $25 billion in volume with more than 80,000 onchain holders

Kraken’s tokenized equities platform, xStocks, has surpassed $25 billion in total transaction volume less than eight months after launch, underscoring accelerating adoption as tokenization gains traction among mainstream investors.

Kraken disclosed Thursday that the $25 billion figure includes trading across centralized exchanges and decentralized exchanges, as well as minting and redemption activity. The milestone represents a 150% increase since November, when xStocks crossed $10 billion in cumulative transaction volume.

The xStocks tokens are issued by Backed Finance, a regulated asset provider that creates 1:1 backed tokenized representations of publicly traded equities and exchange-traded funds. Kraken serves as a primary distribution and trading venue, while Backed is responsible for structuring and issuing the tokenized instruments.

When xStocks debuted in 2025, it offered more than 60 tokenized equities, including shares tied to major US technology companies like Amazon, Meta Platforms, Nvidia and Tesla.

Kraken said onchain activity has been a key growth driver since launch, with xStocks generating $3.5 billion in onchain trading volume and surpassing 80,000 unique onchain holders.

Unlike trading that occurs solely within centralized exchanges’ internal order books, onchain activity takes place directly on public blockchains, where transactions are transparent and wallets can self-custody assets.

Growing onchain participation suggests users are not only trading tokenized equities but also integrating them into broader decentralized finance (DeFi) ecosystems.

Kraken said that eight of the 11 largest tokenized equities by unique holder count are now part of the xStocks ecosystem, signaling increased market share in the emerging tokenized equities sector.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The layer-1 blockchain Kite (KITE) token rose 38% as the biggest gainer in the top 100, followed by stablecoin payment ecosystem token Stable (STABLE), up over 30% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Crypto World

Another European Country Bans Polymarket, Threatens $1M Fine

Dutch regulators have ordered crypto prediction platform Polymarket to stop operating in the Netherlands, warning it could face fines of up to €840,000 if it fails to comply.

The decision marks the latest escalation in Europe’s widening crackdown on the platform.

Polymarket is Losing the European Market

The Kansspelautoriteit (Ksa), the Dutch gambling authority, issued a formal enforcement order against Polymarket’s operator, Adventure One QSS Inc., on Friday. The regulator said Polymarket was offering illegal gambling services without a Dutch license.

Authorities imposed a penalty of €420,000 per week if Polymarket continues serving Dutch users. The fines could reach a maximum of €840,000, with additional revenue-based penalties possible later.

“In recent months, Polymarket has been in the news frequently, especially around bets on the Dutch elections. After contact with the company about the illegal activities on the Dutch market, no visible change has occurred and the offer is still available. The Gaming Authority therefore now imposes this order under penalty,” the regulator wrote.

The regulator said prediction markets qualify as gambling under Dutch law, regardless of how the platform classifies them. It also stressed that betting on elections is prohibited entirely, even for licensed operators.

Importantly, regulators highlighted Polymarket’s activity around Dutch elections as a key concern. It warned that election betting could create societal risks, including potential influence over democratic processes.

The Netherlands’ decision follows similar action in Portugal, where regulators recently blocked Polymarket nationwide.

Portuguese authorities intervened after the platform saw heavy betting tied to the latest presidential election outcomes.

Meanwhile, several other European countries have taken similar measures. Italy, Belgium, and Romania have blocked access to Polymarket, while France restricted betting functionality.

Hungary also issued a formal ban, citing illegal gambling activity.

Prediction Markets as Financial Infrastructure or Gambling Platform?

These actions reflect a growing consensus among European regulators. Authorities increasingly classify prediction markets as gambling when they operate without licenses.

However, Polymarket’s creator, Shayne Coplan, has consistently rejected that classification. He argues that prediction markets function as financial infrastructure, similar to derivatives markets, rather than gambling platforms.

Coplan maintains that prediction markets help aggregate information and forecast real-world events. Regulators across Europe disagree.

As a result, Europe has become one of the strictest regions globally for prediction market platforms. The Netherlands’ threat of direct financial penalties signals that enforcement is moving beyond access blocks toward sustained legal pressure.

Crypto World

Pakistan Goes Live With Crypto Regulatory Sandbox: Here’s What It Means for Digital Assets

TLDR:

- Pakistan’s PVARA formally launches a live crypto sandbox to test real-world virtual asset use cases under regulatory oversight.

- The sandbox framework targets stablecoins, tokenization, remittances, and on- and off-ramp infrastructure inside a supervised environment.

- PVARA Chairman Bilal bin Saqib joined global crypto and finance leaders at the World Liberty Forum in Mar-a-Lago, Florida.

- Goldman Sachs, Nasdaq, Franklin Templeton, and Coinbase participated in forum talks centered on stablecoins and financial innovation.

Pakistan launches crypto sandbox to test digital assets in a live, supervised environment built for real-world virtual asset use cases.

The Pakistan Virtual Assets Regulatory Authority formally approved the framework, marking a concrete step toward structured digital asset oversight.

The sandbox covers tokenization, stablecoins, remittances, and on- and off-ramp infrastructure. All operations run under direct PVARA supervision.

Sandbox Guidelines and the application process will be published on the PVARA website shortly, giving interested firms a clear path forward.

A Controlled Framework for Real-World Digital Asset Testing

The crypto sandbox gives companies a working environment to test virtual asset solutions within defined regulatory boundaries.

PVARA will monitor live operations and review outcomes before building broader compliance rules around them. This approach allows the authority to gather practical market data without reducing its oversight responsibilities.

Rather than regulating from theory alone, Pakistan is now working from observed, real-world results gathered inside a controlled setting.

The sandbox targets several key segments of the virtual asset market. Tokenization, stablecoins, remittance solutions, and on- and off-ramp infrastructure are all within the program’s scope.

Each use case will be tested against Pakistan’s specific financial and regulatory environment. This targeted structure ensures the framework remains focused and produces results that are directly applicable to domestic market conditions.

Firms that qualify for the sandbox can operate in a live market environment while remaining accountable to the authority.

The full Sandbox Guidelines and application details will be released on the PVARA website in the coming days. Companies working in the virtual asset space should watch the official website closely for submission deadlines and participation requirements.

PVARA Chairman Attends World Liberty Forum as Pakistan Moves Toward Global Alignment

Bilal bin Saqib, Chairman of PVARA, attended the World Liberty Forum at Mar-a-Lago in Florida earlier this week. The event brought together financial executives, crypto innovators, and policymakers from across the global financial sector.

Discussions centered on the future of finance and digital technology’s growing role in reshaping traditional systems.

Saqib shared updates from the forum directly on social media, describing it as a gathering focused on stablecoins, tokenization, and financial innovation.

Representatives from Goldman Sachs, Nasdaq, Franklin Templeton, and Coinbase were among the participants in those discussions. The forum reflected a growing global consensus around structured frameworks for digital asset development.

Pakistan’s decision to launch a crypto sandbox to test digital assets aligns with the direction taken by leading financial institutions worldwide.

The domestic framework now gives Pakistani firms a regulated channel to pursue innovations similar to those discussed at the global forum.

As countries move toward structured virtual asset oversight, Pakistan’s sandbox places it among nations actively shaping the next phase of digital finance regulation.

Crypto World

XRP Binance reserves drop 200m as holders move off exchange

XRP slips ~0.5% in 24h as 200m tokens exit Binance over ten days.

Summary

- Binance’s XRP exchange supply ratio fell from 0.027 to 0.025 in ten days, implying about 200m XRP moved off the platform into private custody.

- XRP trades near $1.43, down roughly 0.5% on the day, with about $2.2B in 24h spot volume as centralized‑exchange balances sit near multi‑year lows.

- 2025 reserve data show the current withdrawal wave has already surpassed last year’s net accumulation, reinforcing a structural trend toward self‑custody and reduced immediate sell‑side liquidity.

XRP (XRP) exchange reserves on Binance have declined over the past ten days, with approximately 200 million tokens withdrawn from the platform.

The token supply ratio on Binance, which measures the proportion of XRP’s total circulating supply held on the exchange, dropped from 0.027 to 0.025 during the period, the data showed. The metric displayed a steady downward trend rather than a single-day movement, according to the analysis.

Exchange reserve data tracks the movement of digital assets between trading platforms and private wallets. Rising reserves typically indicate holders are transferring assets to exchanges, often in preparation for selling, while declining reserves suggest withdrawals into private custody.

XRP price headwinds

The recent outflow appears to reflect user-driven movement rather than internal exchange reallocation, which cited transparency in Binance’s published custody addresses as enabling distinction between operational adjustments and organic withdrawals.

XRP has declined significantly since the beginning of 2025. Sustained exchange outflows following price corrections have historically indicated renewed investor interest at lower price levels, according to market observers.

When digital assets leave exchanges, the immediately available supply for selling on trading platforms decreases. While reduced exchange supply does not guarantee price increases, it can affect market structure if demand returns, according to market analysts.

The current level of token withdrawal has already exceeded the total accumulation seen throughout 2025, the data indicated.

Market participants continue to monitor whether the shift toward private storage will translate into price momentum or remain a structural change in holding patterns.

Crypto World

Top 3 reasons altcoins like Dogecoin, Shiba Inu Coin, XRP are rising today

Bitcoin and most altcoins, including popular names like Dogecoin, Shiba Inu Coin, and XRP, were in the green today, February 20, as investors bought the dip after some key catalysts.

Summary

- Bitcoin and most altcoins rose on Friday, with the market capitalization of all tokens rising to over $2.3 trillion.

- The rally happened after the Supreme Court ruled against Donald Trump’s tariffs.

- They also rose after the latest US GDP report, which showed that the economy slowed in Q4.

Bitcoin (BTC) jumped to $68,000, while Dogecoin (DOGE), Shiba Inu Coin (SHIB), and Ripple (XRP) rose by over 4%. The market capitalization of all tokens rose by 2.2% to over $2.3 trillion.

Dogecoin, Shiba Inu Coin, and XRP rose after the Supreme Court ruling

The main reason why altcoins like DOGE, SHIB, and XRP rose is that the Supreme Court ruled against President Donald Trump’s tariffs.

In theory, the ruling will have a positive impact on the US economy by lowering inflation. Such a move raises the possibility that the Federal Reserve will cut interest rates, especially now that the recent data showed that the headline Consumer Price Index dropped in January.

In reality, however, the decision will not have a major impact as Trump has some backup strategies that he will use to implement tariffs on key countries like China, India, and those in the European Union.

Weak US GDP data and impact on the Federal Reserve

Bitcoin and other altcoins rose after the US published a weak GDP report. According to the Bureau of Economic Analysis, the economy expanded by 1.4% in the fourth quarter, badly missing the expected 3%.

The economic growth was much lower than the 4.4% experienced in the third quarter. This slowdown was mostly because of the prolonged government shutdown that happened during the quarter.

The weak economic report is bullish for cryptocurrencies because it raises the possibility that the Fed will cut interest rates later this year.

Donald Trump gave Iran more time to reach a deal

Bitcoin and most altcoins also rose after Donald Trump gave Iranian leaders more time to reach a nuclear deal with the United States. He gave them 15 days, meaning that an attack may not happen during the weekend as some analysts were expecting.

Still, most analysts believe that he will ultimately attack the country later this year, a move that will lead to lower crypto prices. As such, there is a risk that the ongoing rebound is a dead-cat bounce, a situation where assets rise briefly and then resume the downtrend.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video17 hours ago

Video17 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World22 hours ago

Crypto World22 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics3 days ago

Politics3 days agoEurovision Announces UK Act For 2026 Song Contest