Crypto World

IoTeX Confirms Suspicious Activity in Token Safe, Losses Contained

IoTeX, a decentralized identity protocol, is examining unusual activity tied to one of its token safes after on-chain analysts flagged a potential security incident. In a Saturday post on X, the team said it was fully engaged, working around the clock to assess and contain the situation, with early estimates suggesting losses may be lower than circulating rumors. IoTeX said it has coordinated with major exchanges and security partners to trace and freeze funds tied to the attacker, and that monitoring would continue while updates are issued to the community. The event coincided with a sharp move in its native token, IOTX, which declined more than 8% in the past 24 hours to about $0.0049, per CoinMarketCap data.

Key takeaways

- Estimated losses from the incident are around $4.3 million, according to on-chain researchers.

- A private key tied to the compromised wallet is suspected to have been exposed, enabling unauthorized withdrawals.

- The wallet reportedly held USDC (CRYPTO: USDC), USDT (CRYPTO: USDT), IoTeX’s own token (CRYPTO: IOTX), and wrapped Bitcoin (CRYPTO: WBTC).

- Stolen assets were swapped into Ether (CRYPTO: ETH) and approximately 45 ETH were bridged to Bitcoin (CRYPTO: BTC).

- IoTeX’s IOTX price moved lower, signaling a market reaction to the breach.

- Industry observers note that many projects struggle to recover from hacks due to mismanaged responses and reputational damage.

Tickers mentioned: $BTC, $ETH, $WBTC, $USDC, $USDT, $IOTX

Sentiment: Bearish

Price impact: Negative. The breach and preliminary loss estimates contributed to a material drop in IOTX, which fell about 8% over 24 hours to around $0.0049.

Market context: The IoTeX incident underscores ongoing security risks in the crypto ecosystem, where fast-moving on-chain investigations, exchange cooperation, and cross-chain tracing are increasingly central to containment and potential recovery efforts.

Why it matters

The IoTeX event highlights the fragility of hot wallets and the speed at which attackers can move funds across chains. When a private key tied to a token safe is compromised, the window for containment narrows rapidly as attackers liquidate holdings through decentralized exchanges and bridge assets across networks. The loss of roughly $4.3 million, or a substantial portion of it, can ripple through a project’s liquidity and user trust, especially for a platform focused on identity and privacy where user confidence is paramount.

Initial disclosures stress that IoTeX has engaged with major crypto exchanges and security partners to trace and potentially freeze the stolen funds. That level of collaboration is critical, given the cross-chain nature of the theft—assets were moved from a compromised wallet into other assets and then shifted across protocols. The fact that the attacker converted a portion of the stolen holdings into Ether and bridged a segment of that value to Bitcoin illustrates the classic pattern of attempting to launder proceeds while attempting to complicate recovery efforts for investigators and custodians alike.

Beyond the immediate financial impact, the incident feeds into a broader debate about resilience in crypto projects. Historically, a large share of projects impacted by hacks struggle to recover, not solely due to direct losses but as a result of damaged user trust and liquidity withdrawal. Industry observers emphasize that premature or unclear communications during the initial hours can exacerbate losses and erode confidence, even when technical fixes are ultimately deployed. The broader Web3 security community has long argued that robust incident response plans, transparent updates, and proactive fund-tracing strategies can improve outcomes, but they require organizational readiness that many teams still lack.

Analysts also point to the reputational toll. Even after funds are recovered or secured, projects can face protracted liquidity challenges and user flight. In parallel, regulators and auditors are increasingly scrutinizing protocols’ security postures, making timely disclosures and rigorous post-incident governance essential to long-term viability. These dynamics weigh on investor sentiment as the market recalibrates risk premiums for teams with evolving security practices and incident histories.

What to watch next

- IoTeX updates on the investigation, including any identified wallet addresses and the status of the compromised safe.

- Any formal announcements from involved exchanges about frozen funds or cooperation with investigators.

- On-chain tracing progress revealing whether additional assets remain at risk or have been isolated.

- Future security disclosures from IoTeX, including steps to strengthen custody and reduce exposure to private-key compromises.

- Industry commentary on lessons learned and potential shifts in cross-chain handling and wallet security practices.

Sources & verification

- IoTeX’s official X post describing the investigation and ongoing containment efforts.

- Specter Analyst’s on-chain findings outlining the suspected keys compromise, asset mix, and the $4.3 million loss.

- CoinMarketCap data showing IOTX price movement to around $0.0049 in the 24-hour window following the incident.

- Commentary from immunefi and Kerberus executives referenced in related security coverage about breach response, recovery rates, and reputational impact.

IoTeX security incident: investigators race to trace $4.3 million in losses

IoTeX’s response began with a transparent acknowledgment that an anomalous activity tied to one of its token safes warranted a full review. The company emphasized that it is “fully engaged, working around the clock to assess and contain the situation,” and it noted cooperation with major exchanges and security partners to trace and freeze funds linked to the attacker. While early estimates suggested that losses could lie below the most vocal rumors, the evolving on-chain picture pointed to a more substantial weakness in the wallet’s protection than initially anticipated.

On-chain researcher Specter outlined a sequence of events that raised alarm bells. A private key associated with the affected wallet appeared compromised, enabling the theft and rapid movement of assets. The wallet’s holdings encompassed multiple tokens, including USDC (CRYPTO: USDC), USDT (CRYPTO: USDT), IoTeX’s own token (CRYPTO: IOTX), and wrapped Bitcoin (CRYPTO: WBTC). The total value of confiscated funds was estimated at roughly $4.3 million. After extraction, the attackers reportedly swapped a portion of the loot for Ether (CRYPTO: ETH) and bridged approximately 45 ETH to BTC (CRYPTO: BTC). The credible linkage of several addresses and transaction patterns suggested an effort to obfuscate trail and cross-chain activity as funds moved through liquidity venues and bridge layers.

The public timeline included references to addresses associated with the suspected attacker and rapid interchanges across decentralized exchanges. The pattern—swift token swaps and cross-chain hops—aligns with common strategies employed by attackers seeking to minimize traceability and maximize speed to liquidity. While the exact provenance of the breach remains under investigation, the broader takeaway is clear: a private-key exposure in a single wallet can trigger a cascade of consequences across multiple assets and chains.

In parallel with the security-focused updates, market data reflected a knee-jerk reaction. IoTeX’s native token (IOTX) experienced a material price drop in the wake of the incident, underscoring how security events can translate into short-term liquidity stress and a shift in investor sentiment. The incident also placed renewed emphasis on the role of custodianship and incident-response readiness in the crypto ecosystem, particularly for projects that operate in the decentralized identity and privacy sphere where user trust is foundational.

Looking ahead, the industry will be watching how IoTeX negotiates recovery, if any, for affected users and whether the incident triggers any governance or security enhancements. The data points from this event—private-key exposure, rapid asset exfiltration, cross-chain movement, and the subsequent market reaction—will likely shape risk assessments for similar protocols and influence best practices for hot-wallet security testing and incident management in the months ahead.

Crypto World

Ethereum’s Vitalik Buterin proposes AI ‘stewards’ to help reinvent DAO governance

Ethereum cofounder Vitalik Buterin proposed a technical overhaul of decentralized autonomous organizations (DAOs), calling for the use of personal artificial intelligence agents to privately cast votes on behalf of users and help scale digital governance.

The plan, published on social media platform X one month after Buterin criticized DAOs for drifting into low participation and power centralization, aims to shift users away from delegating votes to large token holders.

Instead, individuals would deploy their own AI model, trained on their past messages and stated values, to vote on the thousands of decisions DAOs face.

“There are many thousands of decisions to make, involving many domains of expertise, and most people don’t have the time or skill to be experts in even one, let alone all of them.” Buterin wrote. “So what can we do? We use personal LLMs to solve the attention problem.”

First is privacy of content, ensuring sensitive data remains confidential. AI agents would operate within secure environments such as multi-party computation (MPC) or trusted execution environments (TEEs), enabling them to process private data without leaking it to the public blockchain.

Second is the anonymity of the participant. Buterin called for the use of zero-knowledge proofs (ZKPs), a cryptographic tool that allows users to prove they’re eligible to vote without revealing their wallet address or how they voted.

This guards against coercion, bribery, and whale watching, where smaller voters mimic the decisions of large token holders.

These AI stewards would automate routine governance participation and flag only key issues for human review.

To filter out low-quality or spammy proposals, an emerging problem as generative AI floods open forums, Buterin suggests launching prediction markets. In these, agents could bet on the likelihood that proposals would be accepted.

Good bets would earn payouts, incentivizing valuable contributions while penalizing noise.

Buterin also called for privacy-preserving tools such as multi-party computation and trusted execution environments, enabling AI agents to assess sensitive data, such as job applications or legal disputes, without exposing it on a public blockchain.

Read more: From 2016 hack to $150M Endowment: the DAO’s second act focuses on Ethereum security

Crypto World

How Much Ethereum (ETH) Does He Actually Own?

Data from Arkham shows the majority of Buterin’s wealth remains tied directly to token price swings rather than diversified holdings.

Ethereum co-founder Vitalik Buterin holds more than 240,000 ETH, currently valued at approximately $467 million, according to blockchain intelligence platform Arkham’s investigation into his on-chain holdings.

The analysis established Buterin as the largest accessible individual holder of Ethereum, though institutional players and exchange wallets dominate the top rankings of ETH ownership.

Buterin’s Portfolio Composition and Recent Transactions

The Arkham investigation, published on February 17, provided a detailed breakdown of Buterin’s known crypto assets. His Ethereum holdings have gradually declined over the years, from 662,810 ETH in December 2015, which represented 0.91% of the total supply, to the current 240,010 ETH, which now accounts for about 0.20% of all ETH in circulation.

This reduction stems from both periodic sales and the network’s inflationary supply increases over time. Beyond ETH, Buterin holds smaller positions in several tokens, including 10 billion WHITE worth about $1.16 million, 30 billion MOODENG tokens valued at about $442,000, and 869,509 KNC tokens.

His portfolio also includes roughly $11,000 in Tornado Cash’s TORN token, reflecting past usage of the privacy mixer for donations, including funds sent to Ukraine. Recent on-chain activity shows Buterin moving significant sums in alignment with his public commitments, including a 16,384 ETH withdrawal in late January 2026, worth around $43 million at current prices, to support open-source infrastructure development.

This followed his announcement that the Ethereum Foundation is entering a period of “mild austerity,” with Buterin personally assuming funding responsibilities for certain projects to ensure the Foundation’s long-term sustainability. Subsequent sales of around 2,961 ETH over three days in early February, valued at about $6.6 million, were routed through CoW Protocol using small swaps to minimize market impact.

Arkham’s assessment of the broader Ethereum holder landscape revealed that institutions and exchanges occupy the top positions. For instance, the ETH2 beacon deposit contract holds over 60% of the total supply, with Binance, BlackRock, and Coinbase ranking among the largest entities.

You may also like:

Notably, the single largest individual holder is Rain Lohmus, who possesses 250,000 ETH worth $786 million. However, these funds are inaccessible due to lost private keys, a situation Lohmus acknowledged publicly in 2023.

Wealth Trajectory and Philanthropic Focus

Buterin’s net worth has followed Ethereum’s volatile price history closely, given that ETH constitutes over 99% of his known portfolio. He briefly achieved billionaire status in 2021 when the token crossed $3,000, with his holdings peaking at $2.09 billion in November of that year.

Nonetheless, the subsequent bear market reduced his wealth by close to 75% by December 2022. In 2025, rising ETH prices again pushed his net worth above $1 billion during August’s all-time high near $5,000, though recent market corrections, which pushed ETH below $2,000, have brought valuations back to current levels.

His wealth originated primarily from the 2014 Ethereum pre-sale, where 16.53% of the initial 72 million ETH supply was allocated to founders. A $100,000 Thiel Fellowship grant that same year allowed Buterin to leave the University of Waterloo and dedicate himself fully to Ethereum development.

Unlike many crypto founders who have accumulated substantial stakes in centralized companies, Buterin’s wealth remains almost entirely liquid and tied directly to the network he helped create.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Trump’s Tariff Announcement Met With a Torrent of Criticism

The tariffs imposed by US President Donald Trump and the 10% global tariff announced by Trump on Friday have drawn critical reactions from US lawmakers, Washington, DC-based think tanks and attorneys.

US Senator Rand Paul said that the Trump tariffs are a tax increase on “working families and small businesses,” characterizing them as a net negative on the economy.

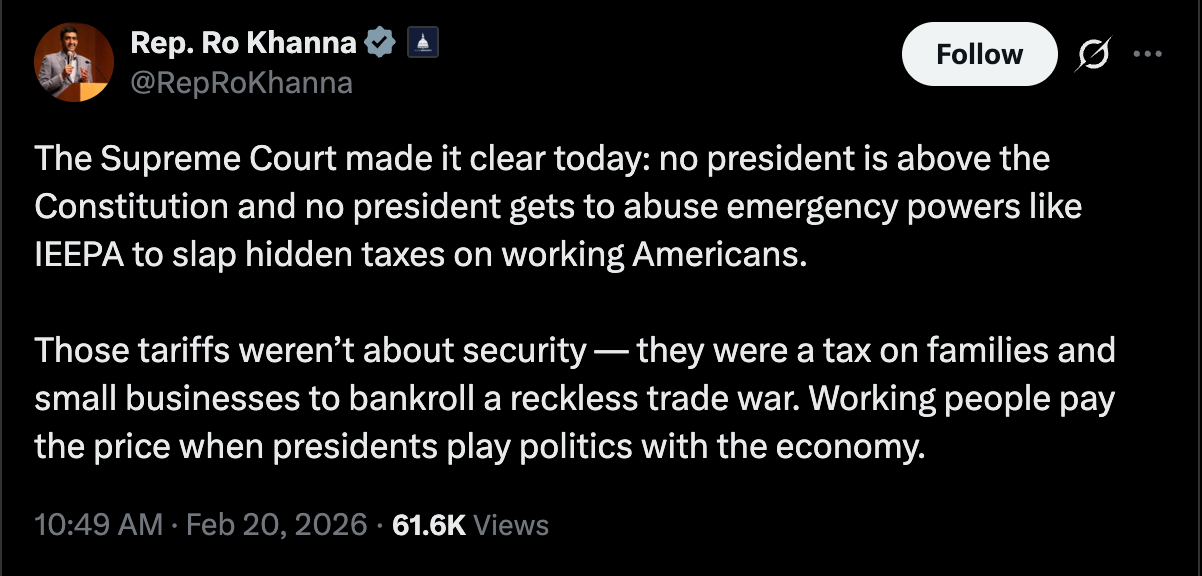

“Those tariffs weren’t about security — they were a tax on families and small businesses to bankroll a reckless trade war,” US Congressperson Ro Khanna said.

On Friday, the US Supreme Court (SCOTUS) struck down Trump’s authority to levy tariffs under the IEEPA, which Trump responded to by announcing new 10% global tariffs.

Scott Lincicome, Vice President of Cato’s Herbert A. Stiefel Center for Trade Policy Studies, a Washington DC-based think tank, was also critical of the tariffs. In comments shared with Cointelegraph, he said:

“Even without IEEPA, other US laws and the Trump administration’s repeated promises all but ensure that much higher tariffs will remain the norm, damaging the economy and foreign relations in the process.”

Trump’s tariffs typically had a negative impact on crypto markets and other risk-on assets. However, crypto prices stayed relatively stable amid the most recent round of tariffs, with Bitcoin’s (BTC) price rising by about 3% after the announcement.

Related: Bitcoin ignores US Supreme Court Trump tariff strike amid talk of $150B refund

Trump announces an additional 10% tariff, but pro-crypto attorney says legal scope is limited

“Effective immediately, all national security tariffs, Section 232, and existing Section 301 tariffs, remain in place, and in full force and effect. Today, I will sign an order to impose a 10% global tariff,” Trump announced on Friday.

The new 10% global tariff will be imposed on top of already existing tariff rates, Trump added. However, the legal statutes Trump cited are limited in scope, according to pro-crypto attorney Adam Cochran.

“The law he is using only allows this to be on countries we have a deficit with, for a set period of 150 days, and at a capped percent,” he said.

Magazine: Harris’ unrealized gains tax could ‘tank markets’: Nansen’s Alex Svanevik, X Hall of Flame

Crypto World

SBI to issue 10 billion yen onchain bond with XRP rewards for retail investors

SBI Holdings, one of Japan’s largest financial conglomerates, is launching its first blockchain-based bond aimed at individual investors, a 10 billion yen (~$64.5 million) issuance that combines traditional fixed-income features with blockchain settlement and crypto perks.

Called the SBI START Bonds, the securities are fully managed onchain using the “ibet for Fin” platform from BOOSTRY, a specialized enterprise blockchain platform for security token issuance.

These three-year bonds offer an indicative annual interest rate of 1.85% to 2.45%, paid semiannually.

XRP Rewards

The investors in these bonds can also receive rewards in XRP tokens, according to SBI.

Resident retail investors and companies that purchase more than 100,000 yen (around $650) worth and hold an account with SBI VC Trade are eligible to receive rewards in XRP in “an amount corresponding to their subscription amount.”

These bonuses, which the product page details as 200 yen in XRP per 100,000 invested yen, are to be distributed at issuance and again on each interest payment date through 2029.

The bonds are expected to begin secondary trading on March 25 via the Osaka Digital Exchange’s “START” proprietary trading system.

SBI Holdings notably formed a partnership with Ripple back in 2016, and has since then been a supporter of XRP. A subsidiary of the company has even distributed XRP directly to shareholders and supported XRP-powered remittances between Japan and the Philippines.

The company, according to its Chairman and CEO Yoshitaka Kitao, owns roughly 9% of Ripple Labs.

Kitao launched SBI Holdings in 1999 as a SoftBank subsidiary (which later separated into an independent firm in 2006) and has since seen it grow into a financial giant, generating over $8 billion in annual revenue. It first started dealing with blockchain technology through its partnership with Ripple, leading to the creation of SBI Ripple Asia.

The company has since adopted stablecoins. It has partnered with Circle to launch USDC in Japan, and signed a memorandum of understanding with Ripple to distribute its RLUSD stablecoin.

Crypto World

Uniswap Founder Slams Scam Crypto Ads After Victim Lost Everything

Uniswap founder Hayden Adams has warned users about fraudulent ads impersonating the decentralized exchange, recounting a case in which a victim reportedly lost everything. The alert arrives as January posted the largest crypto-scam losses in 11 months, underscoring persistent brand-abuse and consumer risk in the space. Adams noted that scam Uniswap apps appeared while App Store approvals were pending, a pattern that has persisted even after years of reporting. In parallel, scammers have begun buying ads on major search engines to capture users who search for “Uniswap,” presenting paid results that resemble official links. When users click through and connect wallets, attackers can drain funds with alarming ease.

Key takeaways

- Scam ads targeting Uniswap have resurfaced, leveraging paid search results to imitate the official site and misleading users who seek the platform.

- A crypto holder reporting a mid-six-figure wallet loss illustrates the real-world cost of these impersonations and social-engineering tricks.

- Uniswap previously flagged clone sites in October 2024, when scammers created lookalikes with altered UI elements to steer users toward unsafe actions.

- January’s scam and exploit losses reached about $370.3 million, marking the period as the worst month in nearly a year for fraud in crypto, according to CertiK data.

- A single social-engineering incident accounted for the majority of losses within January, underscoring how a single method can have outsized impact on users.

Sentiment: Neutral

Market context: The rise in scam-ad fraud comes as brand impersonation, social engineering, and search-ad manipulation continue to erode trust in crypto services. The broader market has seen steady attention on security hygiene, user education, and platform-level safeguards as regulators and industry groups seek better guardrails for digital-asset promotions and onboarding.

Why it matters

The incident underscores a systemic risk facing everyday users: the barrier between legitimate and counterfeit promotion is collapsing in the online search realm. When a top result for a trusted platform resembles the real site, even cautious participants can be led into granting permissions that unlock total access to their wallets. Hayden Adams’ warning highlights that fraud. Ads and clone sites are becoming more sophisticated, and the friction for fraudsters to mimic reputable brands has diminished as digital advertising costs remain accessible and search algorithms fail to fully discriminate intent in some cases.

Historically, Uniswap has faced persistent spoofing attempts. In October 2024, Cointelegraph reported on a fake Uniswap clone that exploited the platform’s branding, altering the navigation and promoting unsafe actions such as a misleading “connect” button instead of “get started,” and a “bridge” option in place of “read the docs.” That episode demonstrated the dual threat of brand impersonation and misdirection—where the user’s trust, not just their funds, is at stake. The ongoing risk reflects broader challenges in brand security for decentralized protocols that rely on open-source credibility rather than centralized verification channels.

From a security metrics perspective, January’s figures paint a stark picture. CertiK noted that crypto exploits and scams totaled $370.3 million for the month, the highest monthly tally in 11 months and roughly four times the level seen in January 2025. Of the 40 incidents recorded that month, the majority of losses stemmed from a single social-engineering attack that drained about $284 million from a solitary victim. The concentration of losses in one event amplifies the message: attackers continue to refine social-engineering playbooks, aiming for high-value targets while exploiting trust in familiar brands.

For users and builders, the implication is straightforward: brand risk in crypto remains a material threat, and defensive measures—such as stricter validation of landing pages, better authentication signals, and more robust user education—are essential. The crypto community and platform operators must balance rapid access and openness with verifiable assurances that the user is engaging with legitimate interfaces. While regulators debate standards for disclosures and promotion, practical risk-reduction steps—such as explicit warnings on search results, quick-path checks for domain legitimacy, and safer wallet-approval flows—could help reduce the odds of a successful impersonation.

As scams evolve, so too must user vigilance. The Uniswap case adds to the growing chorus of incidents that illustrate how a combination of deceptive search results, cloned UI, and social-engineering can inflict meaningful losses even on users who attempt to act prudently. The path forward is not only about better enforcement but also about empowering users with clearer signals, safer defaults, and rapid corrective action when fraud is detected.

What to watch next

- Actions by search engines and app stores to curb crypto-brand impersonation and remove counterfeit Uniswap pages promptly.

- Uniswap and other DeFi projects enhancing in-product warnings and safer onboarding flows to prevent wallet approvals on dubious sites.

- CertiK and other security firms continuing to publish monthly incident tallies and spotlightting high-impact social-engineering scams.

- Regulatory developments around crypto advertising, brand protection, and platform accountability that could shape how promotions are vetted online.

- Public awareness campaigns and educational initiatives aimed at strengthening user discernment when interacting with crypto interfaces online.

Sources & verification

- Hayden Adams’ X post warning about scam ads impersonating Uniswap and noting prior delays for App Store approvals.

- X user “Ika” describing a six-figure wallet drain and a statement: “I believe that getting drained isn’t bad luck. It’s the final consequence of a long chain of bad decisions.”

- Cointelegraph’s October 2024 report on a fake Uniswap site designed to look authentic, with altered navigation prompts.

- CertiK’s reporting on January’s $370.3 million in crypto theft and the detail that 40 incidents occurred that month, led by a single $284 million social-engineering loss.

Uniswap scam ads and the battle for trust

Hayden Adams’ warning crystallizes a broader truth about crypto security: brand integrity is a line of defense as much as cryptographic safeguards. The attacker’s toolbox increasingly blends paid search manipulation with convincing UI masquerades, creating a high-risk surface for users who may not spot the differences between legitimate pages and lookalikes. The historical episodes—from the October 2024 clone to the current wave of deceptive search results—highlight a recurring vulnerability: when a project’s name is associated with a trusted platform, the first impression can determine whether a user stays safe or exposes themselves to irrecoverable losses.

For participants building in this space, the takeaway is practical and actionable. Clear brand verification signals, domain controls, and user education should be integral to product design and incident response. The goal is to make legitimate interactions opt-in by default, with explicit confirmations before sensitive actions—especially wallet approvals—are executed. While the market contends with liquidity and macro headwinds, the quality of user onboarding and the reliability of promotional channels will increasingly influence the pace of adoption and trust in DeFi platforms.

As regulators, platform operators, and security researchers map the path forward, the industry will likely rely on a combination of technical safeguards, stronger verification ecosystems, and more transparent communication about known fraud campaigns. The losses in January serve as a reminder that even established brands in crypto must continuously adapt to a threat landscape that is evolving in real time. The resilience of the ecosystem depends on proactive risk management, rapid remediation when breaches occur, and ongoing education that helps users distinguish genuine opportunities from well-crafted scams.

Crypto World

Iran’s rial collapse mirrors Lebanon’s crisis, driving citizens to bitcoin

The rial, Iran’s official currency, has failed in 2026. Hyperinflation chews through savings every single day. Sanctions stack on top of bad decisions and endless geopolitical pressure. Every day, folks wake up to less money. Families scramble to buy basics while everything they saved disappears. This feels too familiar. Lebanon went through the exact same crisis starting in late 2019. The same kind of banking freeze, the same worthless currency slide, the same desperate search for anything that holds value. Bitcoin turned out to be that financial safe haven then. Signs point to it doing the same in Iran now.

Beirut and Tehran are trapped in the same mess

Lebanon hit the wall when banks locked accounts tight. Dollar savings got stuck, then devalued hard into a pound that kept crashing. Over 90 percent are gone. Lines at ATMs turned into fights. Protests broke out everywhere. Money sent from family abroad became the only lifeline, but even those funds struggled to come through and cost a lot in fees.

Iran deals with the same chokehold. Sanctions cut off normal trade. Inflation runs wild. Reports put crypto activity close to $8 billion in 2025. People yank Bitcoin straight to personal wallets fast. They worry about freezes or bigger drops. Even the central bank grabs stablecoins like Tether to dodge restrictions.

In Lebanon, attitudes flipped quickly. People who once ignored Bitcoin started running to it because nothing else worked. Peer-to-peer trades exploded everywhere, esp. in Telegram groups. No banks needed. Remittances landed clean. Corner stores took it for bread or gas. A whole underground economy kept running while the official one died.

The raw reality of Lebanon’s breakdown

Banks did not just slow withdrawals. They took chunks out of deposits. Promised dollars became local currency worth almost nothing. Trust vanished overnight. People who planned carefully lost retirement money, business cash and everything built over decades.

Bitcoin cut through that. It allowed holders to keep something no policy could touch or inflate away. Holding private keys on hardware wallets meant real control. Verify transactions yourself. Remittances crossed borders in minutes, no middlemen skimming. Price ups and downs happened, but long term it held up way better than the pound ever could.

Problems stayed real. Power went out constantly. The Internet dropped. Outside Beirut, liquidity stayed thin. Early on, plenty got burned by shady services because they did not know better. Groups popped up fast, though. Online chats, meetups in cafes. People taught each other: back up seeds right, run your own node, skip custodians. The crisis forced learning quickly. The clearest lesson stuck: leave Bitcoin with someone else and risk losing it to hacks, freezes, or sudden changes in the rules. True ownership means keys in your control.

What Iran can learn from Lebanon’s experience

Iran tracks a similar path. Protests show the anger boiling over. The rial keeps dropping. Onchain data makes clear that people move to self-custody to block seizures or worse inflation.

Government signals mix up. Limits on mining clash with tests using crypto for imports. For regular people, though, Bitcoin stays simple: no one stops transfers, no borders block it, value holds outside state control. Stablecoins cover day-to-day. Bitcoin is the savings.

Practices that worked in Lebanon transfer straight over. Find a reliable non-custodial wallet and back up your seed phrase. Create a network of peer-to-peer contacts for when fiat comes in or out. Those basics let the Lebanese people ride out the worst. They offer the same shot in Iran.

Sure, obstacles persist: rules flip, the internet fails in spots, prices swing. Still beats staying fully tied to a currency that keeps failing. Lebanon proved that waiting for the government to fix things rarely works. Early action saved what could be saved.

Getting control back when systems fail

Lebanon and Iran lay bare how quickly centralized finance crumbles. Overprinting, account locks and economic isolation cause innocent citizens to take the hit every time. Bitcoin switches the game: no approval required, no one else bears the risk if the keys stay yours.

The collapse in Lebanon forever changed its economy. Money moved from the into a survival tool, forcing people to learn about custody and real ownership. Iran is faced with the same lesson now: depend on failing banks or take the tool that hands power back.

The rial’s hard drop signals more than just trouble. It pushes change. Lebanon produced tougher people who learned what ownership actually means. Iran has the opening for that, too. Move before more vanishes. Check everything yourself. Build stacks. Hold the keys tight. Create real freedom. No one hands it over. You claim it back, one satoshi at a time.

Crypto World

3 forces that drove the stock market during Wall Street’s comeback week

Crypto World

Inside France’s strict conditions for selling $168 million stake of its state-owned energy cloud to U.S. bitcoin miner

France has approved the sale of a majority stake in a key data center unit of state-owned Electricité de France (EDF) to U.S.-based bitcoin miner MARA Holdings Inc., after months of national security review.

MARA, headquartered in Florida, is acquiring a 64% stake in Exaion, a subsidiary that operates high-performance computing infrastructure for digital workloads. The deal, first announced in August 2025, is valued at $168 million.

The transaction raised concerns in Paris about potential foreign control over digital infrastructure. In response, the French government imposed conditions before signing off.

NJJ Capital, an investment firm controlled by telecom billionaire Xavier Niel, will take a 10% stake in Mara France, the local entity handling the acquisition, in exchange for a requirement that a French investor step in. EDF will keep a minority stake and continue as a client of Exaion.

Finance Minister Roland Lescure called the outcome a sign that France remains open to international investment while still defending its strategic interests.

“In this operation, the State is advancing on two fronts: we are confirming France’s attractiveness for international investment, while ensuring uncompromising protection of our strategic interests and our technological sovereignty,” the Minister said. A government statement added that no sensitive EDF data will remain with Exaion following the sale.

Exaion’s board of directors will now include representatives from MARA, EDF, and NJJ.

Crypto World

Last Time This Happened, XRP Skyrocketed by 114%

If history is to repeat now, XRP could go beyond $3.00.

Ripple’s cross-border token became one of the most volatile assets in the cryptocurrency space after the 2024 presidential elections in the US, going from $0.60 to over $3.60 within less than a year, before it crashed to $1.11 earlier this month.

Following this 70% decline from July 2025 to February 2026, the token has seen its “largest on-chain realized loss spike since 2022,” said Santiment. However, this could be a blessing in disguise for token holders.

The analyst from the analytics company noted that the last time such massive realized losses were recorded, of -$1.93 billion, the underlying asset exploded by 114% in the following eight months. If such a spectacular price increase is to repeat now, it would put XRP’s valuation at over $3.00.

“Significant realized losses happen when a large number of investors sell their coins at a price lower than what they originally paid. This usually coincides with fear taking over. When traders panic and capitulate, they lock in their losses instead of holding and hoping for a rebound,” explained the company.

However, the analysts added that while this might feel negative in the short-term, it can be an important price signal for the longer run.

If the so-called weak hands have already sold, fewer sellers are left to push the asset lower. Or, as Santiment put it: “a wave of heavy realized loss can mean that much of the damage has already been done.”

Additionally, the analysis reads that such large increases in realized losses occur near market bottoms because “extreme fear tends to peak before price does.”

“Once sellers are exhausted, even a small amount of new buying pressure can push prices higher. That does not guarantee an immediate rally, but it increases the probability of a bounce. “

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP ETFs in Green For 3 Week, But Price Remains Stuck

XRP price has traded mostly flat over the past 24 hours and the past week. This sideways move shows clear market indecision. On the surface, institutional activity looks supportive. XRP spot ETFs have now recorded three straight weeks of inflows. But underneath this positive trend, a hidden weakness is quietly building.

Several technical and on-chain signals suggest XRP may be closer to a breakdown than it appears.

ETF Inflows Stay Positive, But Institutional Strength Is Rapidly Fading

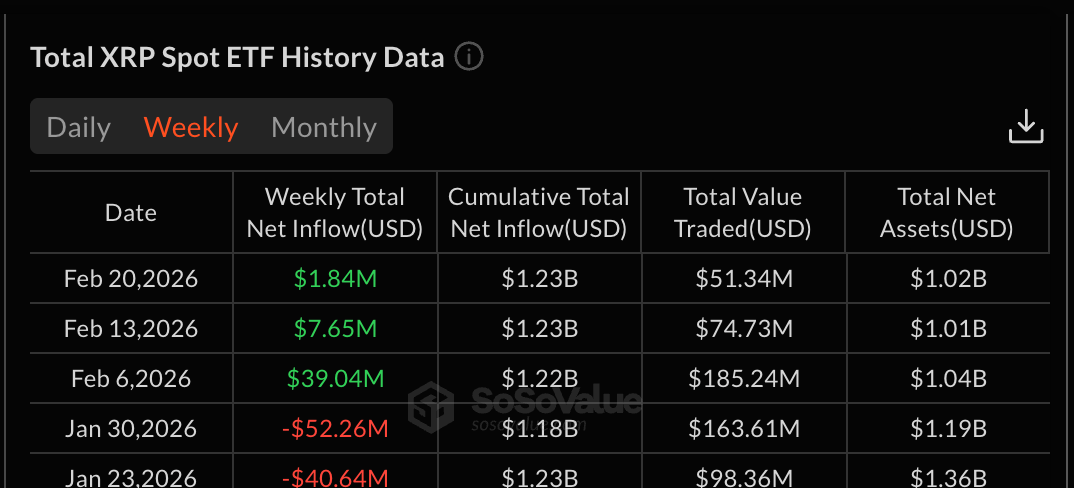

XRP spot ETFs have recorded inflows for three straight weeks. The week ending February 6 saw $36.04 million in inflows. By the week ending February 20, inflows had fallen further to just $1.84 million.

This represents a drop of nearly 95% in weekly inflows within three weeks.

ETF inflows show how much institutional money is entering an asset. Rising inflows usually signal growing confidence. But falling inflows, even if still positive, show that institutional conviction is weakening quickly.

This institutional slowdown is already visible on the chart. XRP fell below its weekly Volume Weighted Average Price, or VWAP, on February 18 and hasn’t reclaimed the line since.

VWAP represents the average price weighted by volume. It is widely used as a proxy for institutional cost basis and is referred to by big money as a benchmark.

When the price falls below VWAP, it means institutions are holding positions at a loss on average. This often reduces their willingness to buy more. The last time XRP broke its weekly VWAP, it fell nearly 26%. The correction since February 18 is also continuing.

At the same time, XRP is close to forming a hidden bearish divergence between February 6 and February 20. During this period, the XRP price seems to be printing a lower high. But the Relative Strength Index, or RSI, already formed a higher high.

RSI measures momentum. When momentum rises, but price fails to follow, it signals weakening recovery strength and a possible downtrend extension for XRP if $1.379 breaks. A clear price-specific confirmation would occur if the current XRP price fails to reach or exceed $1.439.

Together, weakening ETF inflows, VWAP loss, and bearish divergence show that institutional strength is fading despite the positive ETF streak.

Exchange Flows and Dip Buying Explain Why Price Has Not Collapsed Yet

Despite falling below the VWAP, XRP has not collapsed sharply, like earlier. On-chain data helps explain why.

One key metric is Exchange Net Position Change. This tracks whether coins are moving into or out of exchanges. Outflows usually signal buying, while falling outflows show weakening demand.

On February 18, exchange outflows peaked near 71.32 million XRP. Recently, outflows dropped to around 41.69 million XRP. This marks a decline of about 41%.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This shows that buying pressure has weakened significantly but still remains.

Another indicator shows buyers are still active. The Money Flow Index, or MFI, tracks real capital entering an asset. Between February 6 and February 19, the XRP price trended lower.

But MFI trended higher. This divergence shows dip buyers are slowly accumulating even as the price weakens.

This dip buying helps explain why XRP has remained relatively stable after losing its VWAP. Buyers are absorbing selling pressure. This has prevented an immediate collapse so far. But this support is limited. If dip buying weakens, downside risk could increase quickly.

XRP Price Faces Critical $1.25 Test as Cost Basis Cluster Becomes Final Support

Cost basis data now shows XRP approaching a critical support zone. Cost basis represents the prices at which investors previously bought XRP.

These levels often act as strong support or resistance. The most important support cluster currently sits near $1.26, hosting over 159 million XRP.

This is where a large number of holders bought XRP. As long as this level holds, the XRP price may avoid a deeper crash beyond 12% even if the immediate support zone at $1.35-$1.37 breaks.

However, if XRP falls below $1.26 ($1.259 on the chart), selling pressure could accelerate sharply. The next major downside levels would appear near $1.162 and $1.024.

On the upside, XRP must first reclaim $1.439. A stronger recovery would require moves above $1.476 and $1.549. Only a breakout above $1.670 would fully cut the bearish momentum.

For now, XRP remains stuck between weakening institutional support and steady dip buying. ETF inflows are still positive, but falling rapidly.

Technical and on-chain signals show that $1.259 is now the most important level that could determine XRP’s next major move, especially if the bearish divergence and VWAP weakness continue to play out.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech7 days ago

Tech7 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Boden – Corporette.com

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat1 day ago

NewsBeat1 day agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody