Crypto World

IREN and AMZ down on earnings miss, as BTC equities bounce back

IREN (IREN) earnings showed weaker than expected headline results, with the company missing consensus on both revenue and earnings per share (EPS) as it accelerates its transition from bitcoin mining to AI Cloud.

Financially, Q2 revenue declined to $184.7 million, missing expectations and down from $240.3 million in Q1, while the company reported a net loss of $155.4 million, also below consensus.

IREN secured $3.6 billion of GPU financing for its Microsoft contract which together with a $1.9 billion customer prepayment is expected to cover around 95% of GPU related capex.

Tech giant Amazon (AMZ) also missed expectations on EPS but beat on revenue, according to investing.com. Investor focus shifted to management’s plan to spend around $200 billion on capex in 2026, primarily AI related. Amazon shares are down 10%.

Pre-market update

Bitcoin rebounded from around $60,000 to $66,000, driving a broad rally across crypto exposed equities. Strategy (MSTR), the largest publicly traded holder of bitcoin, rose 7% in pre-market trading, mirroring a 7% gain for Galaxy (GLXY) and MARA Holdings (MARA) while Coinbase (COIN) increased by 6%.

Crypto World

BTC Markets Seeks ASIC Licence For RWA Trading

Australian crypto exchange BTC Markets has notified the country’s securities regulator, the Australian Securities and Investments Commission, of its intention to apply for a markets licence to offer regulated tokenized real-world assets (RWAs).

“Our plan is to obtain licensing infrastructure that enables particular types of tokenized assets to be offered and available to the public,” said BTC Markets CEO Lucas Dobbins on Monday.

The vision is a world where tokenized equities, bonds, and real-world assets will trade alongside cryptocurrencies, markets will operate continuously, and settlement will be instant, he added.

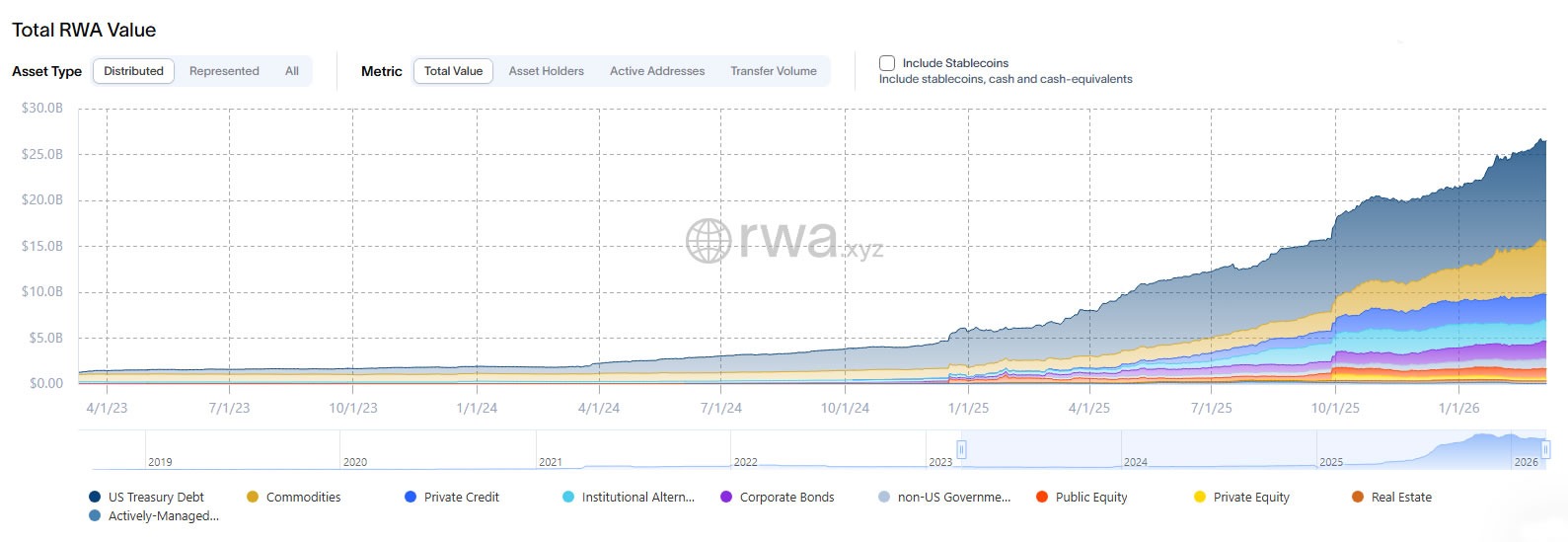

Speaking to Cointelegraph, Dobbins said “the roughly $26 billion in tokenized assets on-chain today is really just the proof of concept.”

Even conservative forecasts suggest tokenized markets could reach around $2 trillion by 2030, while others, such as the Boston Consulting Group, have estimated the opportunity as high as $16 trillion, he added.

“What’s changed is that this is no longer theoretical. Institutions like BlackRock, Goldman Sachs, and JPMorgan are already launching real products.”

BTC Markets is aiming to join the likes of Kraken and Robinhood, which began offering tokenized RWAs in 2025.

Big names in crypto and TradFi eye tokenization

American crypto exchange Kraken began offering tokenized stocks in June 2025 via a new platform called xStocks.

On March 5, the platform launched xChange, an onchain trading engine designed to facilitate trading of tokenized stocks across the Ethereum and Solana networks.

Robinhood also announced a tokenized stock trading platform for European markets in 2025.

Related: Crypto exchanges gain as tokenized commodity market climbs to $7.7B

In January, the owner of the New York Stock Exchange, Intercontinental Exchange, said it was developing a platform to support trading of tokenized securities, including stocks and ETFs.

Nasdaq has also proposed integrating tokenized versions of stocks and ETPs into its existing trading infrastructure.

Meanwhile, Coinbase announced in December that it plans to launch Coinbase Tokenize, an institutional platform designed to support the issuance and management of tokenized RWAs.

RWA tokenization opportunity in Australia

In Australia, research from the Digital Finance Cooperative Research Centre suggests tokenized markets could generate around $24 billion AUD ($16.8 billion) a year in economic gains, roughly 1% of GDP, Dobbins continued.

“On the current trajectory, we may only capture around $1 billion of that by 2030, which highlights the opportunity. Unlocking it will require licensed market infrastructure that allows tokenized assets to trade within a trusted regulatory framework,” he added.

Dobbins said that Australia also has “many of the structural drivers needed for adoption, including strong regulation, deep capital markets, and one of the largest pension systems in the world.”

“As regulatory clarity improves and infrastructure develops, Australia has the potential to play a meaningful role in the next phase of tokenized financial markets.”

“The first use cases will likely appear in areas such as private markets, infrastructure investments, and fund distribution, where tokenization can improve efficiency and access,” he said.

Tokenized RWA TVL at peak despite bear market

RWA.xyz reports that the current onchain total value of tokenized RWAs is $26.5 billion, with Ethereum commanding the largest share of the tokenized RWA market at 57.4%, not including layer-2 and EVM platforms.

Magazine: Bitcoin to outperform gold soon, FBI busts $46M crypto heist: Hodler’s Digest

Crypto World

Oil rally crushes $37 million in crypto shorts as bitcoin drops

Crude oil just had its biggest day in history, and the traders shorting or taking bearish bets on it over the weekend paid the price.

Tokenized oil perpetual contracts on Hyperliquid recorded nearly $40 million in liquidations over the past 24 hours, per Coinglass, with $36.9 million of that coming from short positions that got obliterated as crude surged roughly 30% on a dramatic escalation of the Iran conflict.

The CL-USDC contract on Hyperliquid jumped to $114.77, up nearly 20% in 24 hours. The USOIL-USDH pair hit $135, up 9% on the day after already surging earlier in the week.

The oil move dwarfed everything else in commodities. Brent and WTI are trading at levels not seen since Russia’s invasion of Ukraine in 2022, and the single-day percentage gain is on track to be the largest in the history of the oil market.

The catalyst was a weekend that went from bad to catastrophic. Iran appointed Mojtaba Khamenei as new supreme leader, replacing his father who was killed in the opening wave of strikes. Israel launched a fresh round of attacks on Iranian and Hezbollah infrastructure.

Iranian missiles and drones expanded beyond Israel to hit Saudi Arabia and Bahrain, killing two people near Riyadh and targeting energy infrastructure. Iraq’s oil output dropped roughly 60%. Kuwait and the UAE trimmed production as tanker traffic through the Strait of Hormuz collapsed.

Anyone shorting oil into that backdrop got carried out. The $36.9 million in short liquidations on the CL contract alone made oil one of the largest single-asset liquidation events on Hyperliquid outside of bitcoin and ether on Sunday.

Across the broader crypto market, CoinGlass data shows 94,058 traders were liquidated in the past 24 hours with total losses hitting $364.4 million. Bitcoin accounted for $156.67 million of that, ether contributed $70.88 million, and solana added $19.8 million.

Long liquidations outpaced shorts at $215 million versus $149 million, reflecting the broader sell-off in crypto as risk assets dropped on the escalation. The largest single liquidation was a $6.88 million BTC-USD position on Hyperliquid.

Traders are increasingly using crypto perpetual markets to express macro views on oil, metals, and currencies, drawn by 24/7 access, lower margin requirements, and the ability to trade during weekends when traditional commodity markets are closed.

When missiles start flying on a Saturday, Hyperliquid’s oil contract is one of the only places in the world where you can get leveraged crude exposure.

Open interest on the CL-USDC contract sat at $195 million with $570 million in 24-hour volume, numbers that would have been unthinkable for a tokenized commodity product a year ago. The USOIL pair carried $4.1 million in open interest with $16.2 million in volume, smaller but growing.

Crypto World

Bitcoin could face deeper downside as odds of U.S. market meltdown rise to 35%

Bitcoin is holding up better than it probably should.

The largest cryptocurrency traded at $67,378 on Monday morning, up 1.1% over the past 24 hours and essentially flat on the week, while the world around it deteriorated sharply.

Among majors, ether rose 2.3% to $1,981, hovering just below $2,000. BNB gained 1.4% to $624. Dogecoin added 1.8% to $0.09. Solana climbed 1.8% to $83.69 but remains down 1.5% on the week, still the weakest major over a seven-day basis. XRP was flat at $1.35, down 1% on the week.

S&P 500 futures fell more than 2% in Asian trading. The VIX surged to its highest level since April’s tariff turmoil. Oil is above $100. The dollar just posted its steepest weekly gain in a year.

Meanwhile, veteran strategist Ed Yardeni raised the probability of a U.S. market meltdown to 35%, up from 20%, while slashing the odds of a melt-up to just 5%.

“The US economy and stock market are stuck between Iran and a hard place,” Yardeni wrote. “If the oil shock persists, the Fed’s dual mandate would be stuck between the increasing risk of higher inflation and rising unemployment.”

In meltdown conditions, risk assets across the board tend to suffer as investors pull capital from anything with volatility and move into cash, Treasuries, or the dollar. Bitcoin has historically not been immune to that dynamic, falling alongside equities during every major risk-off episode since 2020 despite its reputation as a hedge.

Elsewhere, NYDIG’s head of research Greg Cipolaro offered a framework for understanding bitcoin’s price action compared to U.S. stocks in a Friday note.

Cipolaro argued that bitcoin’s recent parallel movement with U.S. software stocks reflects “shared exposure to the current macro regime” rather than structural convergence.

Statistically, only about 25% of bitcoin’s price movements are explained by correlation to equities. The other 75% is driven by factors outside traditional stock indices, he said.

The broader equity picture remains grim. MSCI’s global equity gauge fell 3.7% last week, with Asia bearing the worst of it. South Korea has still not fully recovered from its record two-day plunge. Hedge funds have been boosting short positions in U.S. equity ETFs. Benchmark 10-year Treasury yields jumped six basis points as traders priced in higher inflation from the oil shock.

The U.S. has fared better than most on the equity side, with the S&P 500 down only 2% last week, partly because American energy self-sufficiency insulates it more than Asian or European markets.

But the 2% drop in futures on Monday suggests that the buffer is thinning.

Crypto World

Orbital Data Center Startup to Mine Bitcoin in Space

Starcloud, an Nvidia-backed orbital data center startup, said it will start mining Bitcoin from space later this year when its second spacecraft is launched, positioning it to become the first company to mine Bitcoin off Earth.

Starcloud “will be the first to mine Bitcoin in space,” the startup’s CEO, Philip Johnston, posted to X on Saturday after revealing its Bitcoin mining ambitions in space in an interview with HyperChange on Thursday.

In the interview, Johnston said running Bitcoin application-specific integrated circuit (ASIC) miners would be “one of the most compelling use cases” of space compute due to it being significantly cheaper than GPUs.

“GPUs are about 30 times more expensive per kilowatt or per watt than ASICs,” Johnston said. “A 1-kilowatt B200 chip, it might cost $30,000. A 1-kilowatt ASIC is like $1,000.”

Clip on Bitcoin mining pic.twitter.com/WXlp1BMya1

— Philip Johnston (@PhilipJohnston) March 8, 2026

In the X post, Johnston said Bitcoin mining in space will become a “massive industry” due to how much more economical it is than mining the cryptocurrency on Earth.

“Bitcoin mining consumes about 20 GW of power continuously. It makes no sense to do this on Earth, and in the end state, all of this will be done in space.”

Starcloud was founded in early 2024 to build data centers in space as a solution to address rising energy needs for AI. In November, it launched a satellite with an NVIDIA H100 into orbit, marking the first time a GPU that powerful has ever operated in space.

Its data centers, which comprise around 88,000 satellites, are primarily powered by solar energy.

Sending Bitcoin to Mars

While Johnston’s Starcloud envisions mining Bitcoin in space, tech entrepreneurs Jose E. Puente and Carlos Puente last year came up with a solution to send it across planets.

In September, Puente told Cointelegraph that it is theoretically possible to send Bitcoin to Mars in as fast as three minutes by leveraging an optical link from NASA or Starlink and a new interplanetary timestamping system.

While someone would need to be there to receive it, the Bitcoin transaction would move through space stations — such as antennas and satellites — or even a relay around the Moon before reaching Mars.

They, however, said that mining Bitcoin on Mars would not be feasible due to the latency between the two planets.

Related: Bitcoin drops 2% as oil prices surge on energy shortage fears

Bitcoin mining profitability margins have thinned over the past few months, particularly due to Bitcoin’s (BTC) price falling nearly 48% from its $126,080 high on Oct. 6.

However, the Bitcoin mining difficulty has fallen 7% from a record 155.9 trillion units in November to 145 trillion, giving miners some much-needed breathing room for now.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Saylor hints at Strategy’s 101st Bitcoin purchase as price slips amid US-Iran tensions

Strategy may be gearing up for its 101st Bitcoin purchase, according to a cryptic post shared by co-founder Michael Saylor.

Summary

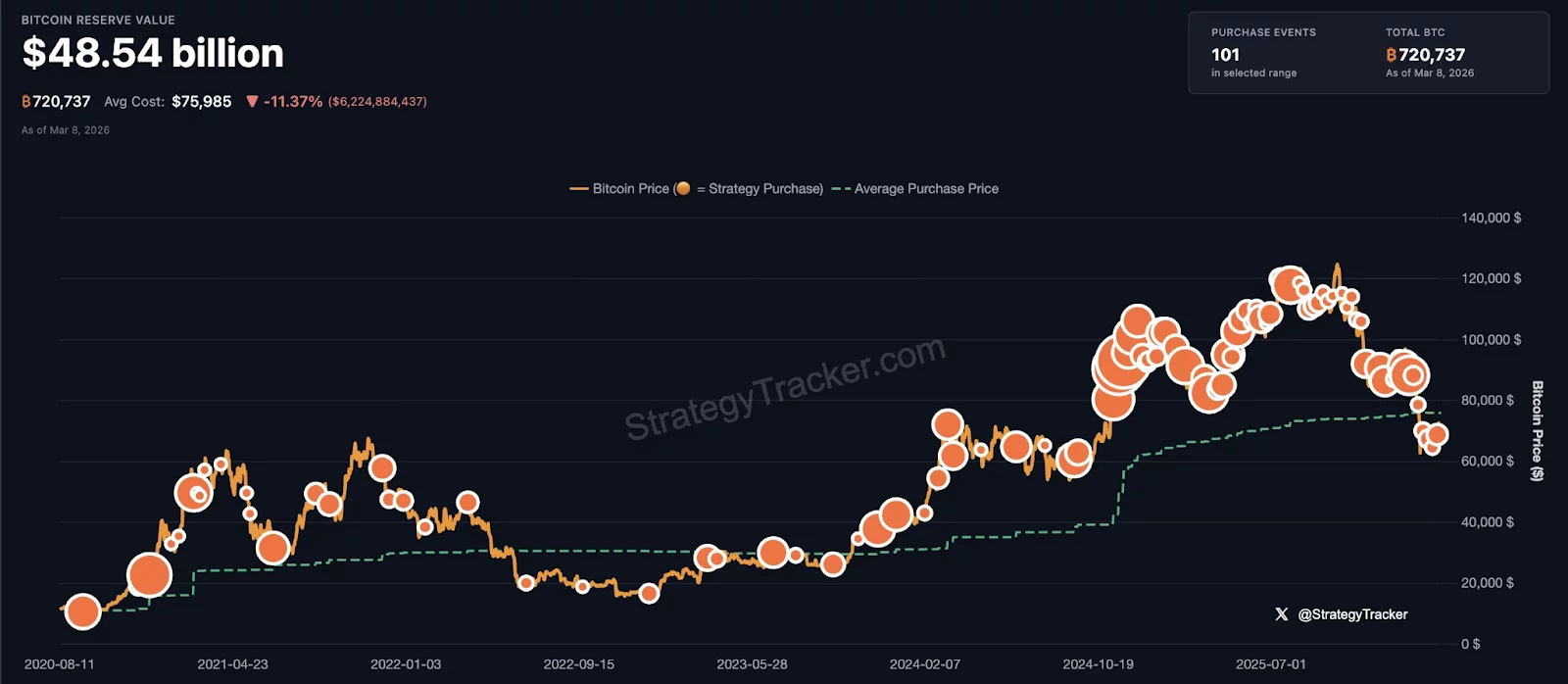

- Michael Saylor has hinted at Strategy’s 101st Bitcoin purchase.

- The company currently holds 720,737 BTC worth over $48.7 billion.

- Bitcoin was trading near $67,500, below Strategy’s average purchase cost.

As is often the case with Saylor’s posts, he shared Strategy’s Bitcoin accumulation chart, which tracks the company’s purchases since it first began buying the asset in August 2020.

“The Second Century Begins,” he wrote on X.

Strategy currently holds 720,737 Bitcoin, valued at over $48.7 billion. The company’s last purchase was executed between Feb. 23 and March 1, during which it acquired 3,015 BTC at an average price of $67,700 per coin. This batch also marked the company’s 100th Bitcoin purchase.

In the meantime, Bitcoin price has struggled to remain steady above the $70,000 mark and has repeatedly lost this key psychological support area, which has now turned into a resistance level.

Tensions between the United States and Iran have become the latest trigger that has weighed on risk sentiment across crypto markets.

As of last check, Bitcoin price was hovering around $67,500, which places it below Strategy’s average purchase cost of approximately $75,992, according to data from Bitcoin Treasuries.

Strategy’s basic NAV, which measures the value of its Bitcoin holdings relative to its market capitalization, was just below 1, which means the stock is currently trading at a discount to the value of its underlying BTC treasury.

Strategy shares closed on March 6 down roughly 4.5%, reflecting the caution among some investors as the company has continued funding its Bitcoin accumulation strategy through debt and equity financing.

Crypto World

Crypto Funding Up 50% in 12 Months Despite Fewer Deals

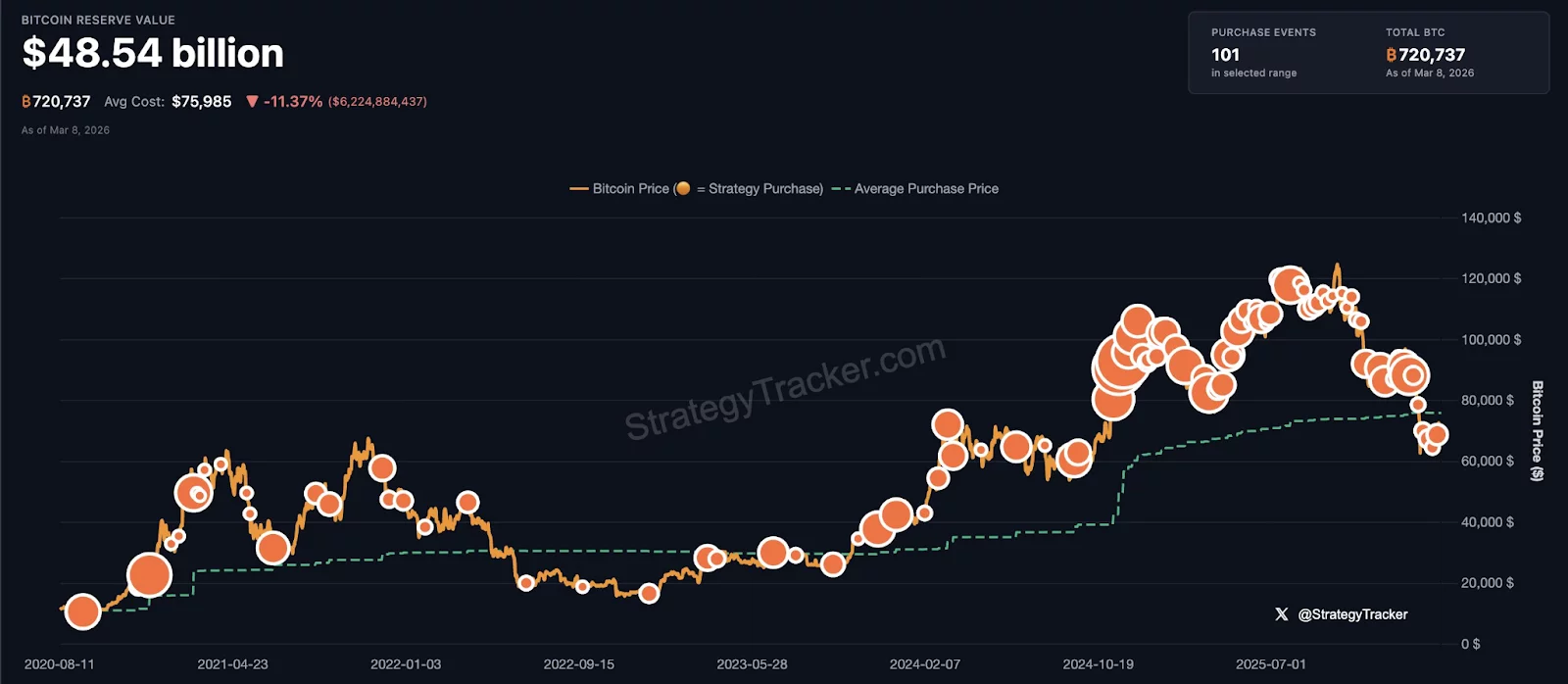

Crypto fundraising increased by almost 50% year-on-year between March 2025 and March 2026, despite the number of deals dropping 46% as VCs concentrated bets on late-stage and strategic mega-rounds.

Messari’s crypto fundraising overview shared by the company’s CEO Eric Turner on Sunday shows that the average deal size increased to $34 million in the last 12 months, up 272% from a year earlier. This came as the number of active investors fell 34.5% to 3,225.

“Capital concentration is heavily skewed by late-stage and strategic mega-rounds,” Messari said, noting that in February, just three fundraising events contributed 44% of the $795 million raised over the last month.

This included Tether’s $200 million investment into online marketplace Whop; $75 million raised for sports-focused peer-to-peer prediction market Novig in a Series B funding round led by Pantera Capital; and ARQ, a Latin American fintech app focused on stablecoins that secured $70 million in Series B funding on Wednesday, led by Sequoia Capital.

The $795 million figure marks a 65.3% fall from the previous 30 days.

Turner noted that, outside of Dragonfly Capital, no major VCs have closed new funding rounds lately, adding that “the industry needs some fresh capital.”

Meanwhile, Coinbase Ventures, QUBIC Labs, and Somnia have been the most active crypto investors over the past three months, Messari data shows.

Crypto funding nowhere near 2021-2022 levels

Monthly crypto fundraising has cooled significantly since its peaks in November 2021 and May 2022, when funding consistently hit $4 billion per month.

Since then, the $4 billion milestone has been reached only three times. Some investors have started to expand their focus toward the AI and high-performance computing sectors.

Related: Kalshi, Polymarket eye $20B valuations in potential fundraising: WSJ

While most crypto fundraising has focused on late-stage activity, Messari noted that early-stage fundraising “remains high in volume but fragmented.”

Messari pointed out that Interstate’s $1.5 million funding round on Thursday came from more than 15 participants, ranging from firms like Bloccelerate VC to individual angel investors like Sergey Gorbunov.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Questions

Crypto World

Flow Files Court Motion to Block Korean Exchange Delistings

Nonprofit organization Flow Foundation and its parent company Dapper Labs on Monday filed with the Seoul Central District Court to suspend the termination of trading support for its native token FLOW on three South Korean exchanges.

Layer-1 blockchain Flow suffered a “security incident” in December when an attacker exploited a vulnerability that allowed certain assets to be duplicated rather than minted, bypassing supply controls without accessing or draining existing user balances.

The exploit resulted in $3.9 million in duplicated tokens, but “no user funds were compromised, and all counterfeit tokens were permanently destroyed.”

Several exchanges halted FLOW token trading following the incident due to the impact of duplicate tokens on their value and the trustworthiness of the network.

Among these were major Korean exchanges Upbit, Bithumb, and Coinone, which announced on Feb. 12 that they would end FLOW trading support on March 16.

However, Flow Foundation claimed that every major global exchange has now “independently reviewed and restored full FLOW services” since the remediation efforts, and said it “remains committed to ensuring open access to FLOW in every market.”

FLOW is available on major exchanges

The Seoul Central District Court will review the application on March 9 and determine the next steps.

The Foundation stated that the token “remains fully available on major global exchanges,” including Coinbase, Kraken, OKX, Gate.io, HTX, Binance, and Bybit, with Korbit continuing to support FLOW trading in Korea.

Related: Magic Eden winds down EVM, Bitcoin NFT markets to focus on gambling

Dapper Labs, the creators of the NFT project CryptoKitties, announced the development of Flow in 2019 as a new layer-1 blockchain designed to address scalability challenges facing Web3 games and digital collectibles.

The Flow ecosystem continues to grow, said the Foundation. Disney, NBA, NFL, and Ticketmaster are all seeing success as they continue actively building on the blockchain, it added.

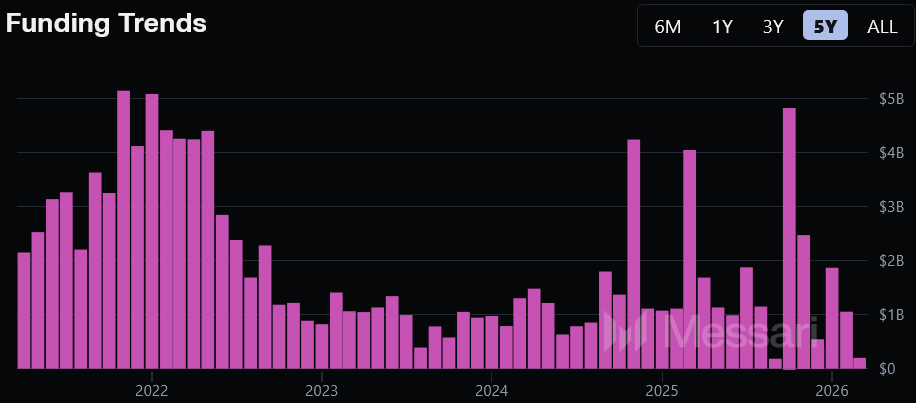

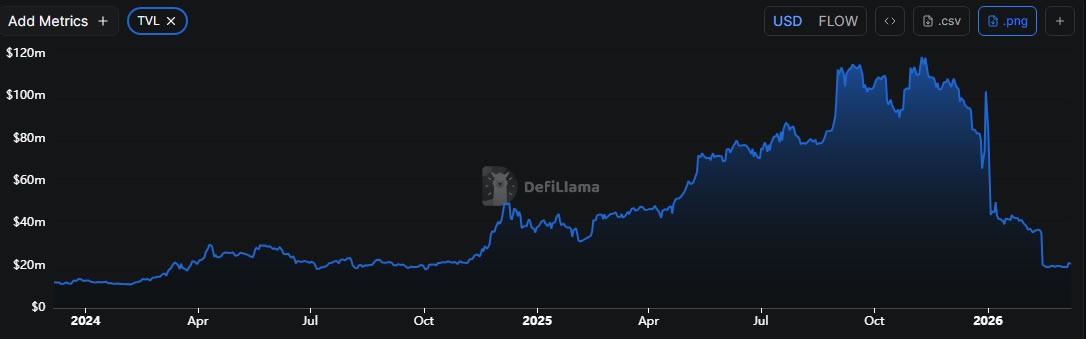

FLOW collapses from all-time high

It is not the case for the FLOW token, however.

The asset has gained marginally following the announcement, but has tanked 75% since the incident in late December, and is currently trading at $0.043.

FLOW is down 99.9% from its 2021 all-time high when it reached $42, according to CoinGecko. Total value locked on the platform is down 82% to $21 million since its November 2025 peak, reports DeFiLlama.

Meanwhile, total NFT market capitalization has declined 92% from its peak of around $17 billion in mid-2022 to roughly $1.4 billion today, according to CoinGecko.

Magazine: Bitcoin to outperform gold soon, FBI busts $46M crypto heist: Hodler’s Digest

Crypto World

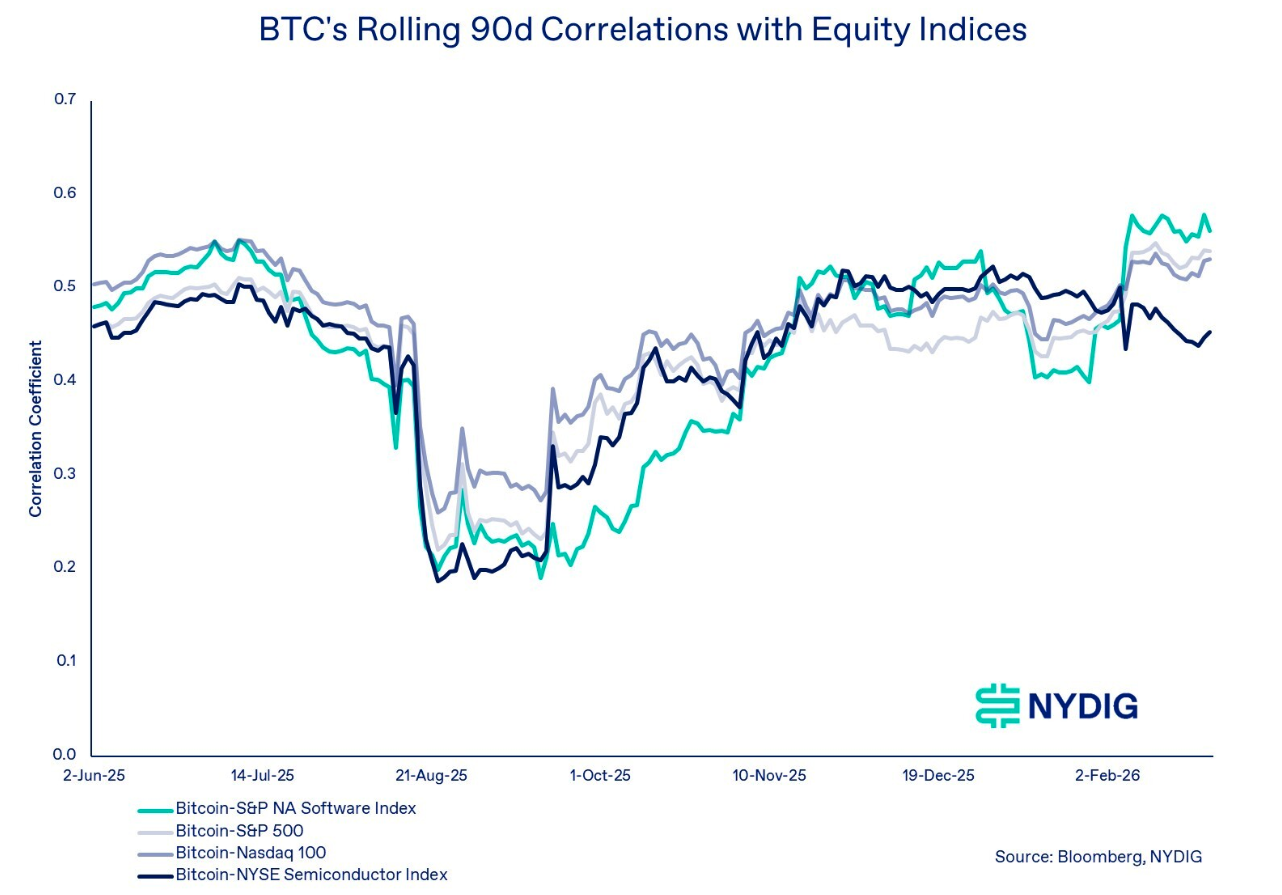

Bitcoin-Tech Stock Correlation Is Overblown, NYDIG

Bitcoin’s recent price action has traced the footsteps of US software equities, driven more by macro liquidity conditions than a lasting structural link to the tech sector. In a note issued on Friday, Greg Cipolaro, NYDIG’s head of research, argued that the visual fit between BTC and software stocks is compelling but not evidence of convergence in their underlying drivers. He cautioned that the current rally reflects shared exposure to the ongoing macro regime—namely long-duration, liquidity-sensitive risk assets—rather than a genuine alignment of Bitcoin with AI or quantum-risk themes. The backdrop remains one of ongoing volatility as traders weigh risk-on sentiment against regulatory and on-chain dynamics.

Over the past week, Bitcoin rallied alongside US software equities, inviting readers to question whether the cryptocurrency is morphing into a proxy for the sector. Cipolaro’s assessment centers on the idea that correlation does not equal causation, and that the observed co-movement is more plausibly a function of broad liquidity conditions rather than a structural re-pricing of digital assets in relation to software equities.

“While the visual fit of their indexed price is compelling, the conclusion that Bitcoin and software equities have structurally converged, or that they share common exposure to themes such as AI or quantum risk, is overstated,” Cipolaro wrote in the note. He added that the tandem rally is better explained by the macro regime’s influence on long-duration, liquidity-sensitive assets rather than an intrinsic linkage between BTC and software stocks.

Bitcoin’s price is “unexplained by equities”

Bitcoin’s correlation with software stocks has risen on a 90-day rolling basis since its all-time high above $126,000 in early October, but Cipolaro noted that its correlations with the S&P 500 and Nasdaq have also increased, suggesting that the shift is not unique to software equities. Even with such correlations in place, he argued that the majority of BTC’s price movement remains unexplained by traditional stock indices. Statistically, only about a quarter of Bitcoin’s price movements are tied to stock-market correlations, while roughly 75% are driven by factors outside the realm of equities.

He remarked that Bitcoin is not currently priced as a hedge against macroeconomic conditions, which helps explain the persistent frustration among observers that it has not fulfilled the “digital gold” narrative. Traders appear to be allocating across assets along a risk curve rather than purchasing BTC for a standalone monetary thesis. This nuance underscores how Bitcoin can diverge from gold-like behavior even as it remains subject to idiosyncratic forces.

In exploring the asymmetry between macro-driven moves and Bitcoin’s intrinsic drivers, Cipolaro pointed to Bitcoin’s on-chain activity, adoption trends, and the evolving regulatory landscape as evidence of its distinct market structure. While cross-asset correlations with equities can rise during risk-on periods, they do not dictate Bitcoin’s long-term returns. The unfolding dynamic, he suggested, reinforces Bitcoin’s role as a portfolio diversifier rather than a pure play on macro liquidity or AI narratives.

For context, a related observation has circulated in crypto media, linking Bitcoin’s price action to energy and geopolitical concerns that influence risk appetite. The broader takeaway is that BTC’s behavior sits at the intersection of macro liquidity, on-chain fundamentals, and policy developments—each contributing to its price path in different weights at different times.

Nevertheless, Cipolaro cautioned that Bitcoin’s market structure remains distinct. He cited network activity, adoption trends, and policy momentum as critical differentiators that can sustain Bitcoin as a unique financial asset even when correlations to software equities rise. The conclusion is not that Bitcoin has become a stock proxy; rather, the current co-movement reflects an overarching liquidity regime in which many asset classes move together, even as Bitcoin maintains its own, idiosyncratic underpinnings.

In sum, the market appears to be pricing BTC within a broader risk-on market framework rather than as a discrete monetary instrument. The differentiated drivers—on-chain activity, adoption, regulatory signals—remain the backbone of Bitcoin’s case as a diversifier, even as short-term correlations with equities ebb and flow.

Crypto World

Bitcoin Trading With Tech Stocks Narrative is Overstated: NYDIG

Bitcoin’s recent parallel movement with US software stocks is more of a case of shared exposure to macro events, rather than any structural convergence, according to financial services company NYDIG.

In the past week, Bitcoin (BTC) rallied alongside US software stocks, leading many to claim the cryptocurrency was a proxy for the sector, Greg Cipolaro, the head of research at NYDIG, said in a note on Friday.

“While the visual fit of their indexed price is compelling, the conclusion that Bitcoin and software equities have structurally converged, or that they share common exposure to themes such as AI or quantum risk, is overstated,” he said.

Cipolaro added the tandem rally “more plausibly reflects shared exposure to the current macro regime, specifically long-duration, liquidity-sensitive risk assets, rather than evidence of a structural convergence between Bitcoin and software equities.”

Bitcoin’s price is “unexplained by equities”

Bitcoin’s correlation with software stocks has increased on a 90-day rolling basis since its all-time high above $126,000 in early October, but Cipolaro said its correlations with the S&P 500 and Nasdaq have also recently risen, indicating that “the change is not isolated to software stocks.”

However, even with Bitcoin’s correlations to software stocks and the two indices, “the majority of Bitcoin’s price movement remains unexplained by equities,” Cipolaro added.

He said that, statistically measured, only a quarter of Bitcoin’s price movements are explained by a correlation to the stock market, while at least 75% of its movements are affected by drivers outside traditional stock indices.

Cipolaro said it appears Bitcoin is not being priced as a hedge against macroeconomic conditions, which explains “the ongoing frustration around Bitcoin’s failure to ‘act like gold’ despite the digital gold label.”

Related: Bitcoin drops 2% as oil prices surge on energy shortage fears

He added that traders appear to be allocating to assets along a risk curve, rather than buying Bitcoin for a “distinct monetary thesis.”

Cipolaro argued, however, that Bitcoin has a distinct market structure and economic drivers, pointing to its network activity and adoption trends, along with regulatory and policy developments that make it different from other assets.

“That differentiation supports bitcoin’s role as a portfolio diversifier,” he said. “While cross-asset correlations with equities are currently elevated, they remain far from determinative of bitcoin’s returns.”

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

US Banks Need Clear Crypto Rules to Stay Ahead, ex-CFTC chair says

US banks are the ones most in need of crypto regulatory clarity, according to Chris Giancarlo, former chairman of the US Commodity Futures Trading Commission, who argues that they risk falling behind the rest of the world in payment innovation.

During an episode of Scott Melker’s The Wolf Of All Streets Podcast on Sunday, Giancarlo said the crypto industry will continue to build, even if the Senate’s crypto market structure bill doesn’t pass. However, banks will be hesitant to invest in the technology without clear rules.

“The banks, however, can’t afford regulatory uncertainty. Their general counsels are telling their boards, you can’t invest billions of dollars in this… unless you’ve got regulatory certainty. The banks need this more than crypto,” he said.

“I think there’s a recognition that this is the new architecture of finance and America, our financial institutions are the world’s dominant financial institutions. We need to modernize that. We need to adopt this technology.”

US banks will fall behind if they wait too long on crypto

The crypto market structure bill, known as the CLARITY Act, has stalled in the Senate as banks, crypto firms, and lawmakers have yet to agree on crucial provisions such as whether to allow stablecoin yields.

Giancarlo warned that if US banks delay crypto adoption much longer, other countries in Asia and Europe will move ahead, leaving the American banking system behind.

“Digital rails will be built. And then the American banks will say, whoa what happened here? Our analogue identity-based, message-based system is no longer working anywhere outside the US, we need to modernize. They’ll be on the back foot,” he said.

“The banks need this clarity because they need to build this, they need to be in the forefront, not in the rear guard of this innovation,” Giancarlo added.

CLARITY Act failure could prompt workarounds

The crypto market structure bill passed the House of Representatives in July 2025 and has been referred to the Senate Committee on Banking, Housing, and Urban Affairs before a potential full Senate vote, according to Congress.

Related: Crypto industry split over CLARITY Act after Coinbase breaks ranks

If the bill passes the Senate, it will go to US President Donald Trump for signature. If it fails or is not signed, Giancarlo said SEC and CFTC leaders would likely step in to establish rules independently.

“If it doesn’t get done, I do believe that under leaders like Paul Atkins at the SEC and Mike Selig at the CFTC, they will write the kind of rules that will make this work for now. They won’t have the support of legislation that makes it work forever or at least into the next presidential cycle, but it’ll make it work for now,” he said.

“Now, does that give the industry the certainty they want? No. And who needs that certainty more than the banks? Crypto doesn’t need it. They were building even under the whip hand of Gary Gensler.”

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

Entertainment7 days ago

Entertainment7 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

News Videos7 days ago

News Videos7 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports1 day ago

Sports1 day agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business12 hours ago

Business12 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World4 days ago

Crypto World4 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3